QuickLinks -- Click here to rapidly navigate through this document

Exhibit 99.1

RISK FACTORS

Our retail store rollout strategy is subject to a number of risks and uncertainties.

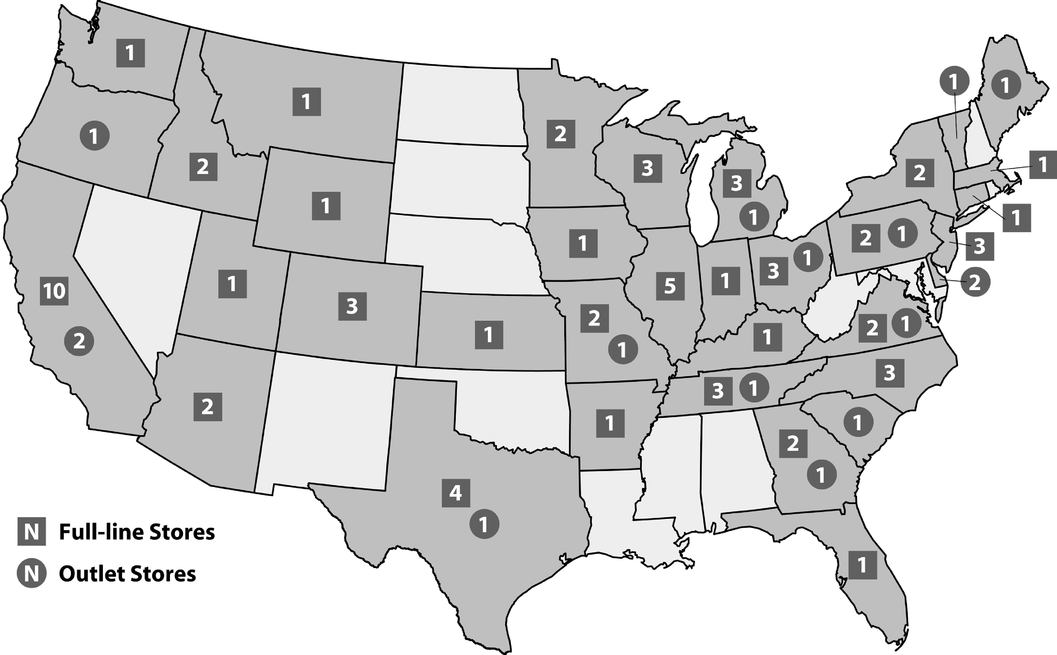

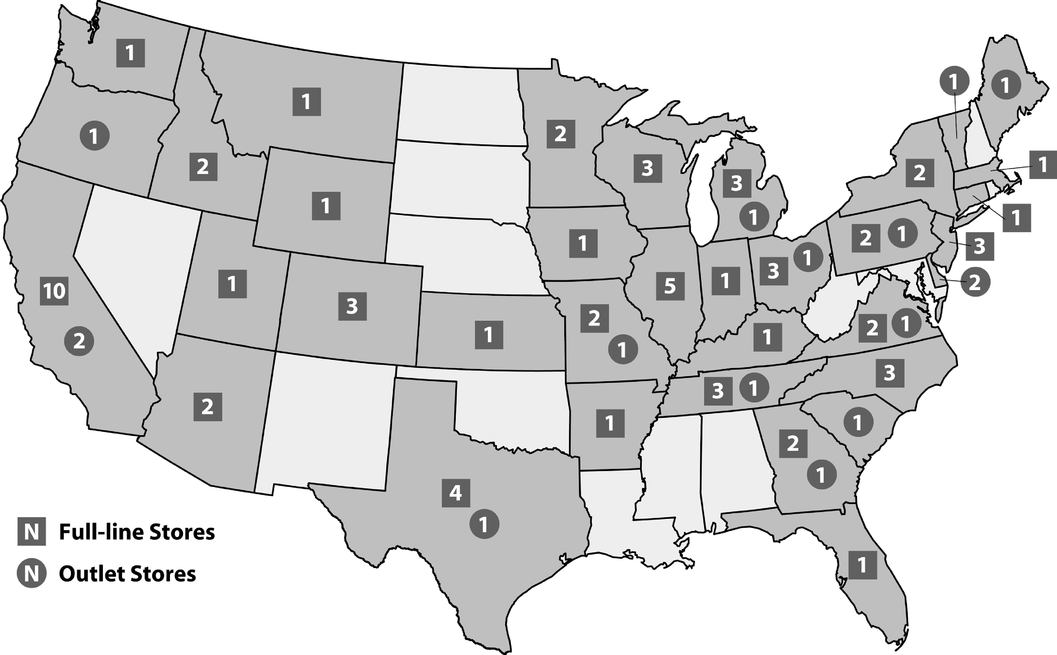

The key driver of our growth strategy is our retail store expansion. In the 12 months ended November 1, 2003, our retail business accounted for 33.0% of total net sales. We began our retail expansion in 1999, and as of November 1, 2003, we had 63 full-line retail stores, 22 of which were opened in fiscal 2003, two resort stores and 17 merchandise clearance outlet stores in 51 markets. We opened an additional three full-line retail stores in November 2003 and currently plan to open 40 to 50 new stores in each of fiscal 2004 and fiscal 2005. There can be no assurance that these stores will be opened, will be opened in a timely manner, or, if opened, that these stores will be profitable. Our ability to open new retail stores depends on a number of factors, many of which are beyond our control, including the following:

- •

- We face competition for premium retail space, and if we encounter difficulty in identifying or securing these sites our expansion may be delayed;

- •

- We may encounter delays in negotiating site leases or be unable to obtain favorable lease terms for the retail store locations we identify;

- •

- We may experience construction delays and cost overruns in connection with the build-out of new stores;

- •

- We may be unable to hire and retain qualified retail sales and management personnel in the areas where our stores are located;

- •

- We are required to make long-term financial commitments when leasing retail store locations, which would make it more costly for us to close or relocate stores;

- •

- The success of our individual stores may depend on the success of the shopping malls or lifestyle centers in which they are located; and

- •

- The demographic and other marketing data we rely on in determining the location of our stores cannot predict future consumer preferences and buying trends with complete accuracy.

We have made numerous refinements in our retail store format since our first full-line store opening in 1999. Our retail model may undergo further refinements as we gain experience operating more stores. In addition, retail store operations entail substantial fixed costs, including costs associated with maintaining inventory levels, leasehold improvements, fixtures, store design, and information and management systems, and we must continue to make these investments to maintain our stores. There can be no assurance that our retail expansion will be successful or that we will be able to address the risks associated with this rapidly expanding portion of our business. Any miscalculations in our retail strategies, shortcomings in our planning, implementation, management and control, or our inability to sufficiently leverage incremental costs could require us to write off significant costs.

We may be unable to manage the costs associated with our catalog business.

We incur substantial costs associated with our catalog mailings, including paper, postage, merchandise acquisition and human resource costs associated with catalog layout and design, production and circulation and increased inventories. Most of these costs are incurred prior to mailing. As a result, we are not able to adjust the costs of a particular catalog mailing to reflect the actual subsequent performance of the catalog. In addition, increases in U.S. Postal Service rates and the cost of paper could significantly increase our catalog production costs and result in lower profits for our catalog business to the extent we are unable to pass these costs onto our customers or implement more cost effective printing, mailing or distribution systems. Because our catalog business accounts for a significant portion of total net sales, any performance shortcomings experienced by our catalog business

would likely have a material adverse effect on our overall business, financial condition, results of operations and cash flows.

Response rates to our catalogs could decline, which would negatively impact our net sales and results of operations.

Response rates to our catalog mailings and, as a result, the net sales generated by each catalog mailing, can be affected by factors beyond our control such as changing consumer preferences, willingness to purchase goods through catalogs, weak economic conditions and uncertainty, and unseasonable weather in key geographic markets. Additionally, a portion of our catalog mailings are to prospective customers. These mailings involve risks not present in mailings to our existing customers, including lower and less predictable response rates. Additionally, it has become more difficult for us and other direct retailers to obtain quality prospecting mailing lists, which may limit our ability to maintain the size of our active catalog customer list. Lower response rates could result in lower-than-expected full-price sales and higher-than-expected clearance sales at substantially reduced margins.

Our e-commerce business is subject to a number of risks that are beyond our control.

Our e-commerce business is vulnerable to a number of factors that are beyond our control, including the following:

- •

- Buying trends related to Internet usage and other risks associated with Internet usage, including consumer privacy concerns, changes in applicable federal and state regulation and security breaches;

- •

- Software filters installed by Internet service providers and businesses that may inhibit our ability to send e-mail messages to our customers; and

- •

- Failures in our website network infrastructure or the systems of third parties.

Any one or more of these factors could result in a reduction in our net sales as well as increased administrative and order processing costs.

Our catalog business depends on the timely mailing of our catalogs.

The timely mailing of our catalogs is critical to the success of our direct business, particularly during our peak holiday selling seasons, and requires the involvement of many different groups within our organization as well as outside vendors. Consequently, we are subject to potential delays at multiple points throughout the process of producing a catalog, many of which we may be unable to prevent. Any delay in mailing a catalog could cause customers to forego or defer purchases from us.

We may be unable to manage expanding operations and the complexities of our multi-channel strategy.

During the past few years, with the implementation of our multi-channel business model, our overall business has become substantially more complex. This increasing complexity has resulted in increased demands on our managerial, operational and administrative resources and has forced us to develop new expertise. For example, as a result of opening retail stores in numerous jurisdictions, we are required to deal with an increasing number of state and local tax authorities with respect to all of our channels. We also face new risks and uncertainties, such as the possibility that some of our direct customers may shift to our retail segment as we open more stores, which may cause our direct sales to

2

decline. In order to manage currently anticipated levels of future demand, we will be required to continue, among other things, to:

- •

- improve and integrate our management information systems and controls, including installing and integrating a new inventory management system;

- •

- expand our distribution capabilities;

- •

- attract, train and retain qualified personnel, including middle and senior management, and manage an increasing number of employees; and

- •

- obtain sufficient manufacturing capacity from vendors to produce our merchandise on a timely basis.

Our continued growth could strain our management, financial, merchandising, marketing, distribution and other resources. Any failure to manage growth effectively could harm our financial condition, results of operations and cash flows.

We may be unable to anticipate changing customer preferences and to respond in a timely manner by adjusting our merchandise offerings, which could result in lower sales.

Our future success will depend on our ability to continually select the right merchandise assortment, maintain appropriate inventory levels and creatively present merchandise in a way that is appealing to our customers. Consumer preferences cannot be predicted with certainty, as they continually change and vary from region to region. On average, we begin the design process for our apparel nine to ten months before merchandise is available to our customers, and we typically begin to make purchase commitments four to six months in advance. These lead times make it difficult for us to respond quickly to changing consumer preferences and amplify the consequences of any misjudgments we might make in anticipating customer preferences. Consequently, if we misjudge our customers' merchandise preferences or purchasing habits, our sales may decline significantly, and we may be required to mark down certain products to significantly lower prices to sell excess inventory, which would result in lower margins.

We depend on key vendors for timely and effective sourcing and delivery of our merchandise.

Our direct business depends largely on our ability to fulfill orders on a timely basis, and our direct and retail businesses largely depend on our ability to keep appropriate levels of inventory in our distribution center and our stores. As we grow our retail business, we may experience difficulties in obtaining sufficient manufacturing capacity from vendors to produce our merchandise. We generally maintain non-exclusive relationships with multiple vendors that manufacture our merchandise. However, we have no contractual assurances of continued supply, pricing or access to new products, and any vendor could discontinue selling to us at any time. If we were required to change vendors or if a key vendor were unable to supply desired merchandise in sufficient quantities on acceptable terms, we may experience delays in filling customer orders or delivering inventory to our stores until alternative supply arrangements are secured, which could result in lost sales and a decline in customer satisfaction. Furthermore, products from alternative sources, if any, may be of a lesser quality and/or more expensive than those we currently purchase.

3

Our increasing reliance on foreign vendors will subject us to a variety of risks and uncertainties.

As we expand our retail stores and our merchandise volume requirements increase, we expect to source merchandise directly from foreign vendors, particularly those located in Asia, which will expose us to new and greater risks and uncertainties, including:

- •

- burdens associated with doing business overseas, including the imposition of, or increases in, tariffs or import duties, or import/export controls or regulation, and the availability of quotas, as well as credit assurances we are required to provide to foreign vendors in connection with our private label merchandise;

- •

- difficulty in identifying and supervising suppliers in foreign countries;

- •

- requirements that we make purchase commitments to foreign vendors earlier than required for domestic vendors, which may prevent us from using a portion of our working capital for other purposes;

- •

- declines in the relative value of the U.S. dollar to other foreign currencies, which could negatively affect the profitability and business prospects of one or more of our foreign vendors and their ability to provide merchandise to us at favorable prices, or at all; and

- •

- changing or uncertain economic conditions in foreign countries resulting in the disruption of trade from exporting countries, restrictions on the transfer of funds or transportation delays or interruptions.

In addition, in certain countries, political uncertainties or unrest, including work stoppages, foreign government regulations, wars and fears of war or political unrest, epidemics or other health risks or weather-related problems may disrupt the ability of foreign vendors to supply merchandise to us in a timely manner. The occurrence of any or all of these factors could substantially increase our costs to source merchandise through foreign vendors. Consequently, there is no assurance that we will be able to achieve any perceived cost savings. Furthermore, although we have fair labor agreements with all of our domestic importers, as we increase our direct imports, we will need to implement additional policies and procedures to ensure vendors comply with our standards. If one or more of our foreign vendors do not adhere to our quality assurance standards or our standards for conducting business (including, for example, fair labor standards and the prohibition on child labor), we could lose customer goodwill.

We may be unable to fill customer orders efficiently, which could harm customer satisfaction.

Our ability to efficiently process and fill customer orders is critical to our business and is subject to a number of risks, many of which are beyond our control:

- •

- failures in the efficient and uninterrupted operation of our customer service call centers or our sole distribution center in Mineral Wells, West Virginia, including system failures caused by telecommunications systems providers and order volumes that exceed our present telephone or Internet system capabilities;

- •

- delays or failures in the performance of third parties, such as shipping companies and the U.S. postal and customs services, including delays associated with labor disputes, labor union activity, inclement weather, natural disasters, health epidemics and possible acts of terrorism; and

- •

- disruptions or slowdowns in our order processing or fulfillment systems resulting from the recently increased security measures implemented by U.S. customs, or from homeland security measures, telephone or Internet down times, system failures, computer viruses, electrical outages, mechanical problems, human error or accidents, fire, natural disasters or comparable events.

4

These events could cause delays in our ability to receive and distribute orders and may cause orders to be lost or to be shipped or delivered late. As a result, customers may cancel or refuse to accept orders, and customer satisfaction could be harmed. Additionally, delays in shipping merchandise to our retail stores could cause us to lose sales if sufficient inventory is not available in stores at the time customers want to purchase the merchandise.

We may be unable to provide adequate levels of customer service, which could result in lost sales.

We believe that our success to date has been largely based on our reputation for superior customer service, and any damage to our customer service reputation could result in reduced sales and harm our operating results. Our ability to provide superior customer service depends, among other things, on our ability to do the following:

- •

- maintain high call response rates in our call centers;

- •

- manage inventory levels to ensure merchandise is available in our stores in the most popular styles, colors and sizes;

- •

- ship merchandise purchased through our catalogs or over the Internet in a timely manner;

- •

- ensure adherence to our strict quality assurance standards by vendors as our merchandise volume requirements grow; and

- •

- hire and train qualified, friendly call center and retail store associates.

Our ability to do these things will be even more difficult as we open more geographically dispersed retail stores. Any failure on our part to successfully manage and perform these activities could harm customer service and reduce our net sales.

We have a liberal merchandise return policy, and we may experience a greater number of returns than we anticipate.

As part of our customer service commitment, we maintain a liberal merchandise return policy that allows customers to return any merchandise, virtually at any time and for any reason, and regardless of condition. We make allowances in our financial statements for anticipated merchandise returns based on historical return rates and our future expectations. These allowances may be exceeded, however, by actual merchandise returns as a result of many factors, including changes in the merchandise mix or consumer preferences or confidence. Any significant increase in merchandise returns or merchandise returns that exceed our allowances could materially adversely affect our financial condition, results of operations and cash flows.

Our quarterly results of operations fluctuate and are impacted by our ability to predict sales trends and by seasonal influences.

As with many apparel retailers, our net sales, operating results, liquidity and cash flows have fluctuated, and will continue to fluctuate, on a quarterly basis, as well as an annual basis, as a result of a number of factors, including, but not limited to, the following:

- •

- the composition, size and timing of our various merchandise offerings, including when we recognize related sales and costs;

- •

- the number and timing of our full-line retail store openings;

- •

- the timing of our catalog mailings and the number of catalogs we mail;

- •

- customer response to merchandise offerings, including the impact of economic and weather-related influences, the actions of our competitors and similar factors;

5

- •

- our ability to accurately estimate and accrue for merchandise returns and the costs of obsolete inventory disposition;

- •

- overall merchandise return rates, including the impact of actual or perceived service and quality issues;

- •

- market price fluctuations in critical materials and services, including paper, production, postage and telecommunications costs;

- •

- the timing of merchandise receiving and shipping, including any delays resulting from labor strikes or slowdowns, adverse weather conditions, health epidemics or national security measures; and

- •

- shifts in the timing of important holiday selling seasons relative to our fiscal quarters, including Valentine's Day, Easter, Mother's Day, Thanksgiving and Christmas, and the day of the week on which certain important holidays fall.

Our results continue to depend materially on sales and profits from the November and December holiday shopping season. In anticipation of traditionally increased holiday sales activity, we incur certain significant incremental expenses, including the hiring of a substantial number of temporary employees to supplement our existing workforce. If, for any reason, we were to realize lower-than-expected sales or profits during the November and December holiday selling season, our financial condition, results of operations, including related gross margins, and cash flows for the entire fiscal year would be materially adversely affected.

We face substantial competition from discount retailers in the women's apparel industry.

We believe our customers are willing to pay slightly higher prices for our unique merchandise and superior customer service. However, we face substantial competition from discount retailers, such as Kohl's and Target, for basic elements in our merchandise lines, and our net sales may decline if we are unable to differentiate our merchandise and shopping experience from these discount retailers. In addition, the retail apparel industry has experienced significant price deflation over the past several years largely due to the downward pressure on retail prices caused by discount retailers. This price deflation may make it more difficult for us to maintain our gross margins and to compete with retailers that have greater purchasing power than we have. Furthermore, because we currently source a significant percentage of our merchandise through intermediaries and from suppliers and manufacturers located in the United States and Canada, where labor and production costs, on average, tend to be higher, our gross margins may be lower than those of competing retailers.

Our success is dependent upon our senior management team.

Our future success depends largely on the efforts of Dennis Pence, Chairman and Chief Executive Officer; Georgia Shonk-Simmons, President and Chief Merchandising Officer; and Dan Griesemer, Senior Vice President of Retail. The loss of any of these individuals or other key personnel could have a material adverse effect on our business. Furthermore, the location of our corporate headquarters in Sandpoint, Idaho may make it more difficult to replace key employees who leave us, or to add qualified employees we will need to manage our further growth.

Prior to joining our company, Melvin Dick, our Executive Vice President and Chief Financial Officer, served as the lead engagement partner for Arthur Andersen's audit of WorldCom's consolidated financial statements for the fiscal year ended December 31, 2001, and its subsequent review of WorldCom's condensed consolidated financial statements for the fiscal quarter ended March 31, 2002. The ongoing investigation of the WorldCom matter may require Mr. Dick's attention, which may impair his ability to devote his full time and attention to our company. Further, Mr. Dick's

6

association with the WorldCom matter may adversely affect customers' or investors' perception of our company.

Lower demand for our merchandise could reduce our gross margins and cause us to slow our retail expansion.

Our merchandise is comprised primarily of discretionary items, and demand for our merchandise is affected by a number of factors that influence consumer spending. Lower demand may cause us to move more full-price merchandise to clearance, which would reduce our gross margins, and could adversely affect our liquidity (including compliance with our debt covenants) and, therefore, slow the pace of our retail expansion. We have maintained conservative inventory levels, which we believe will make us less vulnerable to sales shortfalls. However, low inventory levels also carry the risk that, if demand is stronger than we anticipate, we will be forced to backorder merchandise, which may result in lost sales and lower customer satisfaction.

Our sales tax collection policy may expose us to the risk that we may be assessed for unpaid taxes.

Many states have attempted to require that out-of-state direct marketers and e-commerce retailers whose only contact with the taxing state are solicitations and delivery of purchased products through the mail or the Internet collect sales taxes on sales of products shipped to their residents. The U.S. Supreme Court has held that these states, absent congressional legislation, may not impose tax collection obligations on an out-of-state mail order or Internet company. Although we believe that we have collected sales tax where we are required to do so under existing law, state tax authorities may disagree, and we could be subject to assessments for uncollected sales taxes, as well as penalties and interest and demands for prospective collection of such taxes. Furthermore, if Congress enacts legislation permitting states to impose sales tax collection obligations on out-of-state catalog or e-commerce businesses, or if we are otherwise required to collect additional sales taxes, such tax collection obligations may negatively affect customer response and could have a material adverse effect on our financial position, results of operations and cash flows. In addition, as we open more retail stores, our tax collection obligations will increase significantly and complying with the greater number of state and local tax regulations to which we will be subject may strain our resources.

Our stock price has fluctuated and may continue to fluctuate widely.

The market price for our common stock has fluctuated and has been and will continue to be significantly affected by, among other factors, our quarterly operating results, changes in any earnings estimates publicly announced by us or by analysts, customer response to our merchandise offerings, the size of our catalog mailings, the timing of our retail store openings or of important holiday seasons relative to our fiscal periods, seasonal effects on sales and various factors affecting the economy in general. The reported high and low closing sale prices of our common stock were $11.36 per share and $5.37 per share, respectively, during the fiscal year ended February 1, 2003, and were $13.10 per share and $5.86 per share, respectively, during the first nine months of our 2003 fiscal year. In addition, the Nasdaq National Market has experienced a high level of price and volume volatility and market prices for the stock of many companies have experienced wide price fluctuations not necessarily related to the operating performance of such companies.

7

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

We encourage you to read this Management's Discussion and Analysis of Financial Condition and Results of Operations in conjunction with our accompanying consolidated financial statements and their related notes. Our discussion of our results of operations and financial condition includes various forward-looking statements about our markets, the demand for our products and services and our future results. We based these statements on assumptions that we consider reasonable. Actual results may differ materially from those suggested by our forward-looking statements for various reasons including those discussed in the "Risk Factors" included elsewhere in this report.

When we refer to a fiscal year, we mean the calendar year in which the fiscal year begins. On December 16, 2002, our Board of Directors approved a change in our fiscal year end from the Saturday nearest February 28 to the Saturday nearest January 31, effective February 1, 2003. Accordingly, our 2002 fiscal year consisted of an 11-month transition period. We made this decision to align our financial reporting schedule with the majority of other national retail companies.

We currently operate in two reportable segments, our direct segment and our retail segment. Beginning in the quarter ended May 3, 2003, we reclassified our outlet store business and phone and Internet orders that originate in our retail stores from our direct segment to our retail segment. We made these reclassifications to reflect the manner in which our segments are currently managed. We have reclassified prior period financial statements on a consistent basis for fiscal years 2002, 2001 and 2000. These reclassifications had no impact on our consolidated net sales, net income, retained earnings or cash flows for any period. Due to information systems limitations, we did not reclassify periods prior to fiscal 2000 because it was not practicable for us to do so. In addition, management believes that the reclassification of these prior periods would be immaterial.

Unless otherwise indicated, the common stock outstanding, retained earnings and net income per share amounts appearing in this report and the financial statements included herein reflect two 50% stock dividends, each having the effect of a 3-for-2 stock split, declared by our Board of Directors on December 19, 2002 and August 4, 2003, respectively. These stock dividends have the combined effect of a 2.25-for-1 stock split.

Coldwater Creek Profile

Coldwater Creek is a multi-channel, specialty retailer of women's apparel, accessories, jewelry and gift items. Our unique, proprietary merchandise assortment and our retail stores, catalogs and e-commerce website are designed to appeal to women between the ages of 30 and 60, with household incomes in excess of $50,000. We reach our customers through our direct segment, which consists of our catalog and e-commerce businesses, and our rapidly expanding base of retail stores.

Our catalog business is a significant sales channel and acts as an efficient marketing platform to cross-promote our website and retail stores. During the 12 months ended November 1, 2003, we mailed 140.8 million catalogs. We launched our full-scale e-commerce website,www.coldwatercreek.com, in 1999 to cost-effectively expand our customer base and provide another convenient shopping alternative for our customers. We currently have a database of over 2.0 million e-mail addresses to which we regularly send customized e-mails.

Our retail channel is our fastest growing sales channel and represented 33.0% of our total net sales in the 12 months ended November 1, 2003. We expect our retail business to be the key driver of our growth strategy. As of November 1, 2003, we operated 63 full-line retail stores, 22 of which were opened in fiscal 2003, as well as two resort stores and 17 merchandise clearance outlet stores in 51 markets. We opened three additional stores in November 2003 and currently plan to open 40 to 50 new stores in each of fiscal 2004 and fiscal 2005. We closed one outlet store in December 2003. Over the

8

past four years, we have been refining our retail store model and have taken the following steps to support the growth of our retail business and realize the benefits of our multi-channel model:

- •

- testing and developing a scaleable retail store model for national rollout;

- •

- deepening the management team, particularly in our retail segment, by hiring key members of management with extensive retail experience;

- •

- focusing our merchandise offering by refining our product assortment and increasing our investment in key items; and

- •

- integrating our retail and direct merchandise planning and inventory management functions to maintain fashion continuity and brand integrity across all channels.

Direct Segment Operations

Our direct segment includes our catalog and e-commerce businesses. Our direct channel generated $351.5 million in net sales, or approximately 67.0% of our total net sales, for the 12 months ended November 1, 2003. As we continue to rollout our retail stores, we expect our direct segment to decrease as a percentage of total net sales over time. However, we expect our direct segment to continue to be a core component of our operations and brand identity and an important vehicle to promote each of our channels and provide cash flow to support our retail store expansion.

For the 12 months ended November 1, 2003, our catalog business generated $201.4 million in net sales, or 38.4% of total net sales. Historically, we used three catalogs,Northcountry, Spirit andElements, to feature our entire line of full-price merchandise with different assortments for each title to target separate sub-groups of our core demographic. In November 2003, we announced our intention to combine our two smaller catalogs,Spirit andElements, and to re-introduce the combined catalog under theSpirit title in January 2004. Additionally, each year we assemble selected merchandise from the most popular items in our primary merchandise lines and feature them in a festiveGifts-to-Go holiday catalog and on our website.

Since 2000, in an effort to increase the productivity of our direct business and reduce costs, we have reduced our catalog circulation and have been actively promoting the migration of our customers from our catalogs to our more cost-efficient e-commerce website. We have also focused on decreasing the number of mailings to prospective customers because they increasingly produce lower response rates and contribute fewer sales than mailings to active customers. In fiscal 2003, we mailed 117.8 million catalogs, down 35.8% from our peak mailings of 183.6 million catalogs in 2000. We expect to continue to reduce our catalog circulation, particularly to prospective customers, which we believe will continue to have a positive impact on our selling, general and administrative expenses. Although we anticipate losing some potential prospect sales, we believe that optimizing the level of our prospect mailings will have an overall positive impact on our net income.

We launched our full-scale e-commerce website,www.coldwatercreek.com, in July of 1999 to offer a convenient, user-friendly and secure online shopping option for our customers. The website features our entire full-price merchandise offering found in our catalogs and retail stores. It also serves as an efficient promotional vehicle for the disposition of excess inventory.

In the 12 months ended November 1, 2003, online net sales were $150.1 million and represented 28.6% of total net sales. As of November 1, 2003, we had over 2.0 million opt-in e-mail addresses to which we regularly send customized e-mails to drive sales through our website and our other channels.

9

We also participate in a net sales commission-based program whereby numerous popular Internet search engines and consumer and charitable websites provide hotlink access to our website. This affiliate program serves as an effective tool in prospecting for new customers.

Retail Segment Operations

Our retail segment includes our retail and outlet stores and catalog and Internet sales that originate in our retail stores. Our retail channel is our fastest growing sales channel and generated $172.8 million in net sales, or 33.0% of total net sales, for the 12 months ended November 1, 2003.

We opened our first full-line retail store in November 1999 and have since tested and refined our store format and reduced capital expenditures required for build-out. We currently plan to open 40 to 50 new stores in each of fiscal 2004 and fiscal 2005 and believe there is an opportunity to grow to 400 to 500 stores in up to 275 identified markets nationwide over the next six to eight years. The pace, scope and size of our retail store expansion will be influenced by the economic environment, available working capital, our ability to identify and obtain favorable terms on suitable locations for our stores and, if necessary, external financing.

Our core new store model, which we introduced in the second half of 2002, consists of 5,000 to 6,000 square foot stores. These stores reflect improvements in our construction processes, materials and fixtures, merchandise layout and store design and have reduced our initial capital investment per store compared to previously opened stores. This model assumes an average initial net investment per store of approximately $560,000 and anticipates net sales per square foot of approximately $500 in the third year of operations. For the 12 months ended November 1, 2003, our 37 full-line stores that had been open at least 13 months averaged 7,269 square feet and net sales per square foot of $467. Most of these stores have been open for one to two years.

We are also testing a smaller store model of 3,000 to 4,000 square foot stores. We have designed these stores to access smaller markets and to increase our presence in larger metropolitan markets. This model assumes an average initial net investment per store of approximately $400,000 and anticipates net sales per square foot of approximately $600 in the third year of operations. We currently have six stores open in this model, none of which has been open for a full year.

We currently operate 16 outlet stores where we sell excess inventory. We plan to open an additional three outlet stores in fiscal 2004. We generally locate the outlets within clusters of our retail stores to efficiently manage our inventory and clearance activities, but far enough away to avoid significantly diminishing our full-line store sales. Unlike many other apparel retailers, we use our outlet stores only to sell overstocked premium items from our full-line retail stores and do not have merchandise produced directly for them.

10

Results of Operations

The following table sets forth certain information regarding our costs and expenses expressed as a percentage of consolidated net sales:

| | Fiscal Year Ended

| | Nine Months Ended

| | Three Months Ended

| |

|---|

| | March 3,

2001

(53 weeks)

| | March 2,

2002

(52 weeks)

| | Feb. 1,

2003

(48 weeks)

| | November 2,

2002

| | November 1,

2003

| | November 2,

2002

| | November 1,

2003

| |

|---|

| Net sales | | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % |

| Cost of sales | | 55.7 | | 58.8 | | 60.1 | | 58.6 | | 60.9 | | 57.2 | | 58.8 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Gross profit | | 44.3 | | 41.2 | | 39.9 | | 41.4 | | 39.1 | | 42.8 | | 41.2 | |

| Selling, general and administrative expenses | | 39.9 | | 40.7 | | 36.6 | | 39.3 | | 36.3 | | 36.7 | | 34.7 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Income (loss) from operations | | 4.5 | | 0.5 | | 3.3 | | 2.1 | | 2.8 | | 6.1 | | 6.5 | |

| Interest, net, and other | | 0.2 | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | (0.1 | ) | 0.0 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Income (loss) before provision for income taxes | | 4.7 | | 0.6 | | 3.3 | | 2.1 | | 2.8 | | 6.0 | | 6.5 | |

| Income tax (benefit) provision | | 1.8 | | 0.2 | | 1.3 | | 0.8 | | 1.0 | | 2.3 | | 2.4 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Net income (loss) | | 2.9 | % | 0.4 | % | 2.0 | % | 1.3 | % | 1.7 | % | 3.8 | % | 4.1 | % |

| | |

| |

| |

| |

| |

| |

| |

| |

Comparison of the Three- and Nine-Month Periods Ended November 1, 2003 with the Three- and Nine-Month Periods Ended November 2, 2002

Net Sales. Our consolidated net sales in the fiscal 2003 third quarter and first nine months increased by $9.3 million and $22.8 million, respectively. The increase was due primarily to our retail expansion, increased clearance sales and, to a lesser extent, improved full-line retail store performance. For the fiscal 2003 third quarter, our retail segment net sales increased $17.1 million, or 45.9%. Our full-line retail store expansion accounted for 73.1% of this sales growth, with the balance from our clearance outlets and existing full-line retail stores. For the first nine months of fiscal 2003, our retail segment net sales increased $38.5 million, or 43.0%. Our full-line retail store expansion accounted for 70.9% of this sales growth with the balance from our clearance outlets and existing full-line retail stores. These increases were partially offset by decreased net sales from our catalog and e-commerce businesses of $7.8 million, or 8.5%, and $15.7 million, or 6.6%, for the fiscal 2003 third quarter and first nine months, respectively. Please refer to our discussions titled"Three- and Nine-Month Operating Segment Results" below for further details.

Gross Profit. Our consolidated gross profit dollars for the fiscal 2003 third quarter and first nine months increased by $1.7 million, or 3.2%, to $56.9 million, and by $1.2 million, or 0.9%, to $136.7 million, respectively. The increase was primarily due to the increase in our consolidated net sales. Our consolidated gross profit rate for the fiscal 2003 third quarter and first nine months decreased to 41.2% and 39.1%, respectively. The decrease was due primarily to a reduction in merchandise margins of 3.4 percentage points and 3.2 percentage points for the fiscal 2003 third quarter and the first nine months, respectively, on full-price sales from our catalog and e-commerce businesses as we undertook promotional campaigns to reactivate customers and increase average units per order. Our consolidated gross profit was also negatively impacted by direct segment clearance sales, which increased $1.9 million, or 10.8%, at a 0.5 percentage point lower margin in the three months ended November 1, 2003 than in the three months ended November 2, 2002. Our direct segment clearance sales increased $10.6 million, or 25.4%, in the first nine months of fiscal 2003 from the same period in the prior year. We have discontinued many of our promotional campaigns in our direct

11

segment. Additionally, we believe that our inventory levels are now aligned with our retail store growth strategy and do not anticipate disposition activities beyond those typically encountered by retailers. Consequently, we expect that our gross profit rate will stabilize.

These negative impacts on our gross profit rate were partially offset by improved leveraging of full-line retail store occupancy costs and, to a lesser extent, by improved merchandise margins on full-price sales from our retail segment and by improved direct segment sales returns. Our margin was positively impacted by an improvement of 1.4 percentage points and 0.9 percentage points, respectively, in the leveraging of our full-line retail store occupancy costs. We were able to leverage our retail store occupancy costs primarily due to improved net sales at our retail stores. Our margin was also positively impacted by a 1.5 percentage point and 1.8 percentage point improvement in our merchandise margins on full-price sales from our retail segment for the fiscal 2003 third quarter and first nine months, respectively. We attribute our improved margins on full-price retail sales to our decision to reduce the number of days merchandise is discounted before it is moved to our outlet stores. In addition, for the fiscal 2003 third quarter and first nine months, direct segment returns declined as a percentage of sales by 3.4 percentage points and 3.0 percentage points, respectively.

Additionally, we recognized $0.2 million of vendor rebates during the three months ended November 1, 2003 versus $1.1 million in the three months ended November 2, 2002. We recognized $1.5 million of vendor rebates during the first nine months of fiscal 2003 versus $1.1 million in the first nine months of fiscal 2002. These rebates were credited to cost of sales as the related merchandise was sold.

Selling, General and Administrative Expenses. Selling, general and administrative expenses in the fiscal 2003 third quarter were $48.0 million, an increase of $0.7 million over the three-month period ended November 2, 2002, and were $126.9 million in the first nine months of fiscal 2003, a decrease of $1.8 million over the nine month period ended November 2, 2002.

Selling, general and administrative expenses in the fiscal 2003 third quarter and the first nine months of fiscal 2003 were positively impacted by reduced costs associated with catalog mailings of approximately $3.1 million and $7.3 million, respectively. We decreased our catalog mailings by 4.8%, to 92.1 million in the first nine months of fiscal 2003 from 96.7 million in the first nine months of fiscal 2002. We increased our catalog mailings by 3.0 million, or 7.6%, to 42.7 million in the three months ended November 1, 2003 from 39.7 million in the three months ended November 2, 2002. However, the number of catalogs mailed in the three- and nine-month periods ended November 1, 2003, includes our first holiday catalog of the year, which totaled approximately 11.0 million catalogs, and which was timed to arrive in homes during the final three days of the third quarter. The revenues and costs associated with this catalog mailing will, for the most part, be recognized in the fiscal 2003 fourth quarter. In the prior year, this same catalog was sent in the fourth quarter of fiscal 2002. Excluding the 11.0 million holiday catalogs, we mailed approximately 8.0 million, or 20.0%, fewer catalogs in the three months ended November 1, 2003 than in the three months ended November 2, 2002 and approximately 15.7 million, or 16.2%, fewer catalogs in the fiscal 2003 first nine months than in the nine months ended November 2, 2002.

Additionally, we mailed more catalogs to our house file relative to the total catalog mailings in the fiscal 2003 third quarter compared with the three months ended November 2, 2002. We generally realize better response rates to our house file mailings than to our prospecting catalog mailings and have observed falling response rates to our prospecting catalog mailings. The percentage of mailings to our house file increased 7.1 percentage points and 4.9 percentage points in the fiscal 2003 third quarter and first nine months, respectively.

Offsetting the positive impacts of our reduced catalog mailings were increased personnel costs associated with our retail expansion and, to a lesser extent, an accrual of approximately $1.4 million (pre-tax) for expected sales tax liabilities. Personnel costs associated with our retail expansion increased

12

$2.3 million, or 17.6%, for the fiscal 2003 third quarter, and $5.8 million, or 16.3%, for the fiscal 2003 first nine months. The personnel costs primarily included store employee wages, administrative and technical support salaries, related taxes and employee benefits. The majority of the $1.4 million (pre-tax) sales tax accrual resulted from an error in our Canadian tax returns related to refunds of the Canadian Goods and Services Tax, known as the GST. Canada allows refunds for GST paid by retailers, as it imposes a value-added tax that is collected from the consumer or user of the goods and services purchased. During the fiscal 2003 third quarter, we discovered we included Canadian provincial sales tax in our GST refund claims. The provincial sales taxes we were including are not refundable. Since discovering this, we have properly filed our current GST refund claims and we have accrued the amount of taxes we estimate we will need to pay back to Canada. Also, we accrued for sales taxes we estimate are payable to certain counties in one state in which we have a retail presence but did not collect sufficient sales taxes from our customers. This accrual is included in the $1.4 million (pre-tax) amount.

Other Operating Data. Our mailing list grew to 14.9 million names at November 1, 2003 from 14.0 million names at February 1, 2003. Also, our proprietary e-mail address database consisted of 2.1 million names at November 1, 2003 compared with 1.8 million names at February 1, 2003. Our active customers declined slightly to 2.6 million at November 1, 2003 from 2.7 million at February 1, 2003. Our active customers are those customers who have purchased merchandise from us through any of our three sales channels during the preceding 12 months. Active customers do not include retail customers who have not provided identifying information to us.

Income Tax Rate. Our effective income tax rate was 37.3% in the three months ended November 1, 2003 compared with 38.0% in the three months ended November 2, 2002. Our effective income tax rate was 37.4% in the first nine months of fiscal 2003 compared with 39.3% in the first nine months of fiscal 2002. The current year's rate for both the fiscal 2003 third quarter and first nine months was lower because we reversed an accrual for approximately $0.2 million related to certain income taxes. Also, the rate for the fiscal 2002 first nine months was higher than the rate for the fiscal 2003 first nine months because it included the impact of the non-deductibility for tax purposes of the imputed salaries of $0.2 million for Dennis Pence and Ann Pence.

13

Net Sales. The following table summarizes our net sales by segment (in thousands):

| | Three Months Ended

| |

|---|

| |

| |

| |

| |

| | Change

| |

|---|

| | November 2, 2002

| | % of Total

| | November 1, 2003

| | % of Total

| |

|---|

| | $

| | %

| |

|---|

| Catalog | | $ | 52,232 | | 40.5 | % | $ | 44,749 | | 32.4 | % | $ | (7,483 | ) | (14.3 | )% |

| Internet | | | 39,368 | | 30.6 | % | | 39,081 | | 28.3 | % | | (287 | ) | (0.7 | )% |

| | |

| |

| |

| |

| |

| | | |

| | Direct | | | 91,600 | | 71.1 | % | | 83,830 | | 60.7 | % | | (7,770 | ) | (8.5 | )% |

| Retail | | | 37,230 | | 28.9 | % | | 54,322 | | 39.3 | % | | 17,092 | | 45.9 | % |

| | |

| |

| |

| |

| |

| | | |

| Total | | $ | 128,830 | | 100.0 | % | $ | 138,152 | | 100.0 | % | $ | 9,322 | | 7.2 | % |

| | |

| |

| |

| |

| |

| | | |

| | Nine Months Ended

| |

|---|

| |

| |

| |

| |

| | Change

| |

|---|

| | November 2, 2002

| | % of Total

| | November 1, 2003

| | % of Total

| |

|---|

| | $

| | %

| |

|---|

| Catalog | | $ | 133,881 | | 40.9 | % | $ | 123,138 | | 35.2 | % | $ | (10,743 | ) | (8.0 | )% |

| Internet | | | 103,644 | | 31.7 | % | | 98,648 | | 28.2 | % | | (4,996 | ) | (4.8 | )% |

| | |

| |

| |

| |

| |

| | | |

| | Direct | | | 237,525 | | 72.6 | % | | 221,786 | | 63.4 | % | | (15,739 | ) | (6.6 | )% |

| Retail | | | 89,690 | | 27.4 | % | | 128,224 | | 36.6 | % | | 38,534 | | 43.0 | % |

| | |

| |

| |

| |

| |

| | | |

| Total | | $ | 327,215 | | 100.0 | % | $ | 350,010 | | 100.0 | % | $ | 22,795 | | 7.0 | % |

| | |

| |

| |

| |

| |

| | | |

Our direct segment's net sales decreased in both fiscal 2003 periods primarily due to our decision to mail approximately 8.0 million, or 20.0%, fewer catalogs in the fiscal 2003 third quarter and approximately 15.7 million, or 16.2%, fewer catalogs in the fiscal 2003 first nine months, excluding the 11.0 million catalogs sent to arrive in homes in the last three days of the fiscal 2003 third quarter. The revenues and costs associated with this catalog mailing will, for the most part, be recognized in the fiscal 2003 fourth quarter. Also, we believe that our direct segment has been adversely impacted by a continuing softness in the direct mail business.

We believe that our catalog business did not decrease proportionally with the decrease in catalogs mailed due a higher percentage of mailings to our existing customers. We believe that our e-commerce business's net sales were not as severely impacted by the decrease in catalog mailings primarily due to our continued efforts to promote the migration of our customers from our catalogs to our website. For example, we continued to participate in a net sales commission-based "affiliate" website program in which numerous popular search engines and consumer and charitable websites provide hotlink access to our website.

The increase in our retail segment net sales for the three- and nine-month periods in fiscal 2003 primarily reflects incremental sales from the addition of 25 full-line retail stores and five outlet stores since November 2, 2002.

14

Operating Contribution. The following table summarizes our operating contribution by segment (in thousands):

| | Three Months Ended

| |

|---|

| |

| |

| |

| |

| | Change

| |

|---|

| | Nov. 2

2002

| |

| | Nov. 1

2003

| |

| |

|---|

| | %

| | %

| | $

| | %

| |

|---|

| Direct | | $ | 16,477 | | 18.0 | %(1) | $ | 13,208 | | 15.8 | %(1) | $ | (3,269 | ) | (19.8 | )% |

| Retail | | | 4,642 | | 12.5 | %(2) | | 9,262 | | 17.1 | %(2) | | 4,620 | | 99.5 | % |

| Corporate and Other | | | (13,227 | ) | (10.3) | %(3) | | (13,525 | ) | (9.8) | %(3) | | (298 | ) | 2.3 | % |

| | |

| | | |

| | | |

| | | |

| Consolidated income from operations | | $ | 7,892 | | 6.1 | %(3) | $ | 8,945 | | 6.5 | %(3) | $ | 1,053 | | 13.3 | % |

| | |

| | | |

| | | |

| | | |

| | Nine Months Ended

| |

|---|

| |

| |

| |

| |

| | Change

| |

|---|

| | Nov. 2

2002

| |

| | Nov. 1

2003

| |

| |

|---|

| | %

| | %

| | $

| | %

| |

|---|

| Direct | | $ | 39,576 | | 16.7 | %(1) | $ | 33,274 | | 15.0 | %(1) | $ | (6,302 | ) | (15.9 | )% |

| Retail | | | 4,396 | | 4.9 | %(2) | | 13,512 | | 10.5 | %(2) | | 9,116 | | 207.4 | % |

| Corporate and other | | | (37,152 | ) | (11.4 | )%(3) | | (36,923 | ) | (10.5 | )%(3) | | 229 | | (0.6 | )% |

| | |

| | | |

| | | |

| | | |

| Consolidated income from operations | | $ | 6,820 | | 2.1 | %(3) | $ | 9,863 | | 2.8 | %(3) | $ | 3,043 | | 44.6 | % |

| | |

| | | |

| | | |

| | | |

- (1)

- Direct segment operating contribution expressed as a percentage of direct segment net sales.

- (2)

- Retail segment operating contribution expressed as a percentage of retail segment net sales.

- (3)

- Corporate and other segment operating contribution and consolidated income from operations expressed as a percentage of consolidated net sales.

Our direct segment's operating contribution for the fiscal 2003 third quarter was $13.2 million compared with $16.5 million for the three months ended November 2, 2002. Our direct segment's operating contribution for the first nine months of fiscal 2003 was $33.3 million compared with $39.6 million for the nine months ended November 2, 2002. For both fiscal 2003 periods, we primarily attribute the decreases to diminished merchandise margins realized by our full-price catalog and e-commerce businesses of 3.4 percentage points and 3.2 percentage points for the fiscal 2003 third quarter and first nine months, respectively. For the fiscal 2003 first nine months, a 15.1% increase in direct segment clearance activity at a 1.9 percentage point reduced margin also contributed to the decrease in our direct segment's operating contribution. In addition, direct segment sales returns for the fiscal 2003 third quarter and first nine months declined as a percentage of sales by 3.4 percentage points and 3.0 percentage points, respectively.

Our retail segment's operating contribution for the fiscal 2003 third quarter was $9.3 million as compared with $4.6 million for the three months ended November 2, 2002. Our retail segment's operating contribution for the first nine months of fiscal 2003 was $13.5 million as compared with $4.4 million for the nine months ended November 2, 2002. We primarily attribute these increases to the opening of new stores, to improved leveraging of full-line retail store occupancy costs and, to a lesser extent, to increased merchandise margins on our full-price retail sales. For the fiscal 2003 third quarter and first nine months, we experienced an improvement of 1.4 percentage points and 0.9 percentage points, respectively, in the leveraging of our full-line retail store occupancy costs. During these same periods, merchandise margins on full-price sales from our retail segment improved by 1.5 percentage points and 1.8 percentage points, respectively.

Partially offsetting these positive impacts were increased outlet store clearance activity and, to a lesser extent, increased personnel costs associated with our retail expansion. The personnel costs primarily included administrative and technical support salaries, store employee wages, and related

15

taxes and employee benefits. For the fiscal 2003 third quarter and first nine months, outlet store clearance activity increased 56.4% and 48.5%, respectively, primarily because of the increase in the number of our retail stores, and personnel costs associated with our retail expansion increased $2.3 million, or 17.6%, and $5.8 million, or 16.3%, respectively.

Our corporate and other segment's operating contribution for the three months ended November 1, 2003 was $(13.5) million as compared with $(13.2) million for the three months ended November 2, 2002. Our corporate and other segment's operating contribution for the first nine months of fiscal 2003 was $(36.9) million as compared with $(37.2) million for the the nine months ended November 2, 2002. Both the three- and nine-month periods in fiscal 2003 include the accrual of $1.4 million for expected sales tax liabilities. This amount was partially offset in the fiscal 2003 third quarter and entirely offset in the fiscal 2003 first nine months by decreases in other corporate expenses.

Fiscal 2002 Compared with Fiscal 2001:

The following discussions compare an 11-month fiscal year 2002 with a 12-month fiscal year 2001. Fiscal year 2002 is an 11-month transition period attributable to the change in our fiscal year end as of February 1, 2003.

The following table, which sets forth our unaudited results of operations for the one-month and 12-month periods ended March 2, 2002 and the 11-month periods ended February 2, 2002 and February 2, 2003, is provided to assist the reader in assessing differences in our overall fiscal 2001 and 2002 performance.

| | 11 Months

Ended

February 2, 2002

| | One Month

Ended

March 2, 2002

| | 12 Months

Ended

March 2, 2002

| | 11 Months

Ended

February 1, 2003

|

|---|

| | (in thousands)

|

|---|

| Net sales | | $ | 435,741 | | $ | 28,283 | | $ | 464,024 | | $ | 473,172 |

| Cost of sales | | | 254,554 | | | 18,111 | | | 272,665 | | | 284,406 |

| | |

| |

| |

| |

|

| Gross profit | | | 181,187 | | | 10,172 | | | 191,359 | | | 188,766 |

| Selling, general and administrative expenses | | | 176,285 | | | 12,617 | | | 188,902 | | | 173,330 |

| | |

| |

| |

| |

|

| Income (loss) from operations | | | 4,902 | | | (2,445 | ) | | 2,457 | | | 15,436 |

| Interest, net, and other | | | 465 | | | 18 | | | 483 | | | 170 |

| | |

| |

| |

| |

|

| Income (loss) before provision for income taxes | | | 5,367 | | | (2,427 | ) | | 2,940 | | | 15,606 |

| Income tax (benefit) provision | | | 2,079 | | | (939 | ) | | 1,140 | | | 6,249 |

| | |

| |

| |

| |

|

| Net income (loss) | | $ | 3,288 | | $ | (1,488 | ) | $ | 1,800 | | $ | 9,357 |

| | |

| |

| |

| |

|

Our consolidated net sales for fiscal 2002 were $473.2 million, an increase of $9.1 million, or 2.0%, compared with consolidated net sales of $464.0 million during fiscal 2001. Our consolidated net sales increased $37.4 million, or 8.6%, from consolidated net sales of $435.7 in the comparable 11-month period in the prior year. This increase is primarily due to incremental sales of $53.8 million contributed by our retail expansion. These positive impacts were partially offset by a decrease of $28.8 million, or 11.8%, in full-price sales by our direct segment's catalog business.

Our consolidated cost of sales for fiscal 2002 were $284.4 million, an increase of $11.7 million, or 4.3%, from $272.7 million in fiscal 2001. Our consolidated gross profit decreased by $2.6 million, or 1.4%, to $188.8 million for fiscal 2002 from $191.4 million for fiscal 2001, and our consolidated gross margin decreased to 39.9% for fiscal 2002 from 41.2% for fiscal 2001.

16

The decrease in our consolidated gross profit dollars was primarily attributable to a decrease of $10.2 million, or 5.3%, in net sales from there being one less month in fiscal 2002 than in fiscal 2001, partially offset by the increase in consolidated net sales. To a lesser extent, the decrease was mitigated by rebates received from merchandise vendors. These rebates, which were credited to cost of sales as the related merchandise was sold, totaled $2.0 million in fiscal 2002 versus $0.8 million in fiscal 2001.

The decrease in gross profit percentage was primarily attributable to our decision in the fiscal 2002 fourth quarter to conduct a concentrated effort to clear obsolete inventory through our website. Our e-commerce clearance sales increased 3.6% at a 20.6 percentage point reduced margin. Our gross profit rate was also negatively impacted by a 2.3 percentage point decrease in the leveraging of our full-line retail store occupancy costs. These negative impacts were partially offset by a 4.4 percentage point improvement on margins from full-price sales in our retail segment.

Our consolidated selling, general and administrative expenses for fiscal 2002 were $173.3 million, a decrease of $15.6 million, or 8.2%, from $188.9 million for fiscal 2001. Our consolidated selling, general and administrative expenses as a percentage of our consolidated net sales decreased to 36.6% for fiscal 2002 from 40.7% for fiscal 2001.

For fiscal 2002, our selling, general and administrative expenses were positively affected by a $13.9 million decrease in catalog cost amortization, due to our mailing of 24.8 million, or 15.4%, fewer catalogs. Additionally, our selling, general and administrative expenses were approximately $12.6 million lower due to there being one less month in fiscal 2002 compared with fiscal 2001. These positive impacts were partially offset by an increase of $7.1 million, or 45.6%, in personnel-related costs incurred in connection with the continued development and expansion of our retail segment. These costs primarily included administrative and technical support salaries, store employee wages, and related taxes and employee benefits. Additionally, our fiscal 2002 selling, general and administrative expenses were negatively affected by costs of approximately $0.9 million associated with settling a dispute with a former merchandise vendor. Our selling, general and administrative expenses as a percentage of net sales were positively impacted principally by improved response rates to catalogs mailed to our house file of approximately 1.8%. To a lesser extent, we believe our selling, general and administrative expense rate was positively affected by our leveraging of reduced catalog production costs. These positive impacts were partially offset by increased mailings to prospective customers of 3.0 million catalogs, or 6.8%, which resulted in lower customer response rates and lower average order dollars.

We maintained a conservative circulation strategy during fiscal 2002, as we did during fiscal 2001, pending indications of a sustained recovery of the U.S. economy. As a result, our fiscal 2002 catalog mailings were 136.2 million, a decrease of 24.8 million catalogs, or 15.4%, from our 161.0 million catalog mailings in fiscal 2001. Although curtailed, our fiscal 2002 catalog mailings resulted in our proprietary catalog mailing list growing to 14.0 million names at February 1, 2003 from 12.5 million names at March 2, 2002. Our active customers increased slightly to 2.7 million at February 1, 2003 from 2.6 million at March 2, 2002.

As a result of the foregoing, our consolidated income from operations was $15.4 million for fiscal 2002, an increase of $13.0 million, or 528.2%, compared with consolidated income from operations of $2.5 million for fiscal 2001. Expressed as a percentage of net sales, our consolidated income from operations was 3.3% for fiscal 2002 compared with 0.5% for fiscal 2001.

Our consolidated net interest and other income was minimal during both fiscal 2002 and fiscal 2001 as we continued to utilize excess working capital to fund the continued expansion of our retail segment.

For fiscal 2002 our consolidated provision for income taxes was $6.3 million, an increase of $5.1 million, or 448.2%, compared with a consolidated provision for income taxes of $1.1 million for

17

fiscal 2001. Our effective income tax rate for fiscal 2002 increased to 40.0% from 38.8% for fiscal 2001. The increase in our income tax expense was primarily the result of higher pre-tax income. The increase in our effective income tax rate was primarily the result of a 1.0 percentage point increase in our federal statutory rate and a 0.2 percentage point increase in our state income tax rate, net of federal benefits. We attribute the increase in our state income tax rate to our retail segment's expansion into and within states with higher corporate income tax rates. To a lesser extent, the non-deductibility for tax purposes of the fair market value of the imputed salaries of Dennis Pence and Ann Pence also negatively impacted our effective income tax rate.

We completed fiscal 2002 realizing consolidated net income of $9.4 million (net income per basic and diluted share of $0.39) as compared with consolidated net income of $1.8 million (net income per basic and diluted share of $.08 and $.07, respectively) in fiscal 2001, an increase of $7.6 million or 419.8%.

Operating Segment Results

The following table, which sets forth the unaudited impact on net sales by business channel of the one-month and 12-month periods ended March 2, 2002 and the 11-month periods ended February 2, 2002 and February 2, 2003, is provided to assist the reader in assessing differences in our net sales by business channel.

| | 11 Months

Ended

February 2, 2002

| | One Month

Ended

March 2, 2002

| | 12 Months

Ended

March 2, 2002

| | 11 Months

Ended

February 1, 2003

|

|---|

| | (in thousands)

|

|---|

| Catalog | | $ | 234,061 | | $ | 11,988 | | $ | 246,048 | | $ | 200,157 |

| Internet | | | 131,649 | | | 10,224 | | | 141,873 | | | 144,838 |

| | |

| |

| |

| |

|

| | Direct | | | 365,709 | | | 22,212 | | | 387,921 | | | 344,995 |

| | |

| |

| |

| |

|

| Retail | | | 70,032 | | | 6,071 | | | 76,103 | | | 128,177 |

| | |

| |

| |

| |

|

| Total | | $ | 435,741 | | $ | 28,283 | | $ | 464,024 | | $ | 473,172 |

| | |

| |

| |

| |

|

Our direct segment contributed $345.0 million in net sales for fiscal 2002, a decrease of $42.9 million, or 11.1%, from the $387.9 million contributed in fiscal 2001. Our direct segment constituted 72.9% and 83.6% of our consolidated net sales for fiscal 2002 and 2001, respectively.

Our direct segment's catalog business, on a stand-alone basis, contributed $200.2 million in net sales for fiscal 2002, a decrease of $45.9 million, or 18.7%, from the $246.0 million contributed in fiscal 2001. Our catalog business constituted 42.3% and 53.0% of our consolidated net sales, and 58.0% and 63.4% of our direct segment's net sales, for fiscal 2002 and 2001, respectively.

The above decreases in catalog and outlet store net sales primarily reflect significantly lower full-price catalog sales. We attribute the decrease primarily to our mailing of 24.8 million, or 15.4%, fewer catalogs in 2002 than we did in 2001, and soft consumer demand for women's apparel stemming from the generally weak U.S. economy. Additionally, $10.2 million of the decrease is attributable to there being one less month in fiscal 2002 than in fiscal 2001.

We attribute a measure of the above decrease in catalog and outlet store net sales to our migration of full-price merchandise orders out of our catalog sales channel and into our e-commerce sales channel. Our ongoing efforts to promote our website in all of our catalogs and stores is intended to encourage this migration, as our e-commerce business is an efficient and cost-effective sales channel.

Our direct segment's e-commerce business, on a stand-alone basis, contributed $144.8 million in net sales for fiscal 2002, an increase of $3.0 million, or 2.0%, from the $141.9 million in net sales

18

contributed in fiscal 2001. Our e-commerce business constituted 30.6% and 30.6% of our consolidated net sales, and 42.0% and 36.6% of our direct segment's net sales, for fiscal 2002 and 2001, respectively.

We primarily attribute the above increase in e-commerce net sales to new customers obtained through our affiliate website program. Our affiliate website program contributed approximately $19.0 million in sales in fiscal 2002 compared with $6.3 million in fiscal 2001. We believe that our ongoing e-mail promotional efforts with existing customers also contributed to the increase, as did the migration of catalog customers to our e-commerce site. Further, we believe that our e-commerce business is increasingly realizing sales from customers initially obtained through our retail store openings. Another factor contributing to the increase in e-commerce net sales was e-commerce clearance sales, which increased $1.1 million, or 3.6%, in fiscal 2002 as compared with fiscal 2001. Additionally, e-commerce sales returns declined by 1.6% in fiscal 2002 over fiscal 2001. Our mailing of 24.8 million, or 15.4%, fewer catalogs in fiscal 2002 than in fiscal 2001 mitigated the increase in sales, as did our shorter fiscal year in 2002, which we believe had the effect of decreasing our fiscal 2002 e-commerce net sales by approximately $6.2 million. Our proprietary e-mail address database consisted of 1.8 million names at February 1, 2003 compared with 1.5 million names at March 2, 2002.

Our retail segment contributed $128.2 million in net sales for fiscal 2002, an increase of $52.1 million, or 68.4%, from the $76.1 million contributed in fiscal 2001. Our retail segment constituted 27.1% and 16.4% of our consolidated net sales for fiscal 2002 and 2001, respectively.

The above increase in retail net sales primarily reflects incremental sales of $53.8 million contributed by our retail expansion. This increase was mitigated by our shorter fiscal year in 2002, which we believe had the effect of decreasing our fiscal 2002 retail net sales by approximately $5.4 million.

The following table summarizes our operating contribution by segment (in thousands):

| |

| |

| |

| |

| | Change

| |

|---|

| | 11 Months

Ended

Feb. 1, 2003

| |

| | 12 Months

Ended

Mar. 2, 2002

| |

| |

|---|

| | %

| | %

| | $

| | %

| |

|---|

| Direct | | $ | 52,134 | | 15.1 | %(1) | $ | 52,426 | | 13.5 | %(1) | $ | (292 | ) | (0.6 | )% |

| Retail | | | 8,292 | | 6.5 | %(2) | | (6,047 | ) | (7.9 | )%(2) | | 14,339 | | (237.1 | )% |

| Corporate and other | | | (44,990 | ) | (9.5 | )%(3) | | (43,922 | ) | (9.5 | )%(3) | | (1,068 | ) | 2.4 | % |

| | |

| | | |

| | | |

| | | |

| Consolidated income from operations | | $ | 15,436 | | 3.3 | %(3) | $ | 2,457 | | 0.5 | %(3) | $ | 2,979 | | 528.2 | % |

| | |

| | | |

| | | |

| | | |

- (1)

- Direct segment operating contribution expressed as a percentage of direct segment net sales.

- (2)

- Retail segment operating contribution expressed as a percentage of retail segment net sales.

- (3)

- Corporate and other segment operating contribution and consolidated income from operations expressed as a percentage of consolidated net sales.

Our direct segment's operating contribution for fiscal 2002 was $52.1 million as compared with $52.4 million for fiscal 2001. We attribute the slight decrease in our direct segment's operating contribution primarily to a 3.6% increase in e-commerce clearance sales at a margin that was 20.6 percentage points lower than in 2001. To a lesser extent, we attribute the decrease to decreased full-price net sales, as a result of our mailing 24.8 million, or 15.4%, fewer catalogs in fiscal 2002 than in fiscal 2001. The ratio of full-price sales to total sales in our direct segment decreased 1.2 percentage points from fiscal 2001 to fiscal 2002. These negative impacts were partially offset by reduced catalog marketing expenses of approximately $13.9 million related to the mailing of 24.8 million fewer catalogs. Additionally, our catalog and e-commerce sales returns declined by 1.2 percentage points in fiscal 2002 over fiscal 2001.

19

Our retail segment's operating contribution for fiscal 2002 was $8.3 million as compared with $(6.0) million for fiscal 2001. We primarily attribute the improvement in our retail segment's operating contribution to an improvement of 4.4 percentage points in the margins on our full-price retail segment sales and, to a lesser extent, a decrease of $1.6 million in retail store pre-opening expenses. The decrease in retail store pre-opening expenses was due to our opening 14 stores in fiscal 2002 compared with 19 stores in fiscal 2001, combined with overall cost savings in the store pre-opening process. These positive factors were partially offset by a 2.3 percentage point decrease in our leveraging of our full-line retail segment's occupancy costs.

Our corporate and other segment's operating contribution for fiscal 2002 was $(45.0) million as compared with $(43.9) million for fiscal 2001. We primarily attribute the decrease in our corporate and other segment's operating contribution to an increase of $2.1 million in brand marketing expenses and an accrual for $0.9 million to settle a dispute with a former merchandise vendor. Partially offsetting these negative factors was a decrease of $2.5 million, or 13.6%, in employee expenses of which approximately $1.5 million related to the twelfth month of fiscal 2001.

Fiscal 2001 Compared with Fiscal 2000:

Our consolidated net sales for fiscal 2001 were $464.0 million, an increase of $5.6 million, or 1.2%, from $458.4 million in fiscal 2000. Excluding consolidated net sales of approximately $8.1 million attributable to the additional fifty-third week in fiscal 2000, our consolidated net sales for fiscal 2001 increased by $13.7 million, or 3.0%. On a comparative fifty-two week basis, the fiscal 2001 increase in our consolidated net sales primarily was attributable to increased full-price sales in our retail segment of $34.0 million, or 107.3%, and, to a lesser extent, our increased full-price sales of $15.4 million, or 19.2%, in our direct segment's e-commerce business. Increased clearance sales of $8.5 million, or 41.0%, by our e-commerce business also contributed to the overall increase, although at diminished gross margins. These sales increases were substantially offset by a decrease of $49.3 million, or 19.7%, in full-price sales from our direct segment's catalog business and by a decrease of $3.6 million, or 12.0% in clearance sales by our catalog business and outlet stores.

Our consolidated cost of sales for fiscal 2001 was $272.7 million, an increase of $17.5 million, or 6.8%, from $255.2 million in fiscal 2000. Our consolidated gross profit decreased by $11.9 million, or 5.9%, to $191.4 million for fiscal 2001 from $203.3 million in fiscal 2000, and our consolidated gross margin decreased to 41.2% for fiscal 2001 from 44.3% in fiscal 2000. The fiscal 2001 decreases in our consolidated gross profit dollars and margin primarily were attributable to an increase of 41.0% in clearance sales in our e-commerce business at a margin that was 3.8 percentage points higher than in fiscal 2000. The increase in e-commerce clearance sales was the result of our efforts to maintain our conservative inventory position. To a lesser extent, a 1.7 percentage point decrease on merchandise margins realized on full-price sales in our e-commerce business negatively impacted our gross profit dollars and margin. Partially offsetting these negative impacts was an 11.5% decrease in clearance sales made by our outlet stores and clearance catalog.

Our consolidated selling, general and administrative expenses for fiscal 2001 were $188.9 million, an increase of $6.1 million, or 3.4%, from $182.8 million in fiscal 2000. Our consolidated selling, general and administrative expenses as a percentage of consolidated net sales increased to 40.7% for fiscal 2001 from 39.9% in fiscal 2000. The fiscal 2001 increase in our consolidated selling, general and administrative expenses and rate was primarily due a 3.0 percentage point increase in the ratio of catalog marketing expenses to catalog sales. This reduced leveraging of our catalog marketing expenses is discussed more fully in the paragraph below. To a lesser extent, the fiscal 2001 increase in our consolidated selling, general and administrative expenses and rate was also attributable to an increase of $8.5 million, or 25.7%, in personnel costs, and an increase of $1.6 million, or 14.7%, in

20

infrastructure costs, which were incurred in connection with the continued development and expansion of our retail segment and, to a significantly lesser extent, our direct segment's e-commerce business. The associated personnel costs primarily included administrative and technical support salaries, store wages, and related taxes and employee benefits. The associated infrastructure costs primarily consisted of depreciation and other costs associated with incremental administrative support facilities and hardware and software technology. Partially offsetting these incremental costs was a decrease of approximately $12.4 million in catalog marketing expenses, as we mailed 22.6 million, or 12.3%, fewer catalogs in fiscal 2001 than in fiscal 2000. In 2001 we also experienced decreases of $2.4 million, or 65.4%, in incentive-based compensation, $1.4 million, or 13.3%, in direct segment wages, and $1.0 million, or 88.4%, in education and training. Our fiscal 2001 selling, general and administrative expenses also reflect a $0.3 million charge for asset write-downs and outside service costs incurred in connection with our fiscal 2001 fourth quarter decision to close our Sandpoint distribution center. Additionally, the selling, general and administrative expenses reflect a $0.8 million charge for asset write-offs relating to obsolete Internet e-commerce software that was recorded in the fiscal 2001 fourth quarter. We also recorded a $0.2 million charge related to executive severance during the fiscal 2001 fourth quarter.