UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | |

ý |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended January 31, 2009

Commission File Number 0-21915

COLDWATER CREEK INC.

(Exact name of registrant as specified in its charter)

| | |

DELAWARE

(State of other jurisdiction of

incorporation or organization) | | 82-0419266

(I.R.S. Employer

Identification No.) |

ONE COLDWATER CREEK DRIVE, SANDPOINT, IDAHO 83864

(Address of principal executive offices)

(208) 263-2266

(Registrant's telephone number)

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

|---|

| Common Stock $0.01 par value | | NASDAQ Global Select

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES o NO ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO ý

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

YES ý NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant's knowledge, in a definitive proxy or information statement incorporated by reference to Part III of this Form 10-K or any amendment to this Form 10-K o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "accelerated filer", "large accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act (Check one):

| | | | | | |

| Large accelerated filero | | Accelerated filerý | | Non-accelerated filero

(Do not check if a smaller reporting company) | | Smaller reporting companyo |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) YES o NO ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on August 2, 2008, the last business day of the registrant's most recently completed second fiscal quarter, based on the last reported trading price of the registrant's common stock on the NASDAQ was approximately $377,399,000

There were 91,255,700 shares of the registrant's $0.01 par value common stock outstanding on March 27, 2009.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's proxy statement to be filed with the Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Form are incorporated by reference into Part III of this Form 10-K.

Table of Contents

Coldwater Creek Inc.

Annual Report on Form 10-K

For the Fiscal Year Ended January 31, 2009

Table of Contents

| | | | |

PART I | | | | |

Item 1. | | Business | |

3 |

Item 1A. | | Risk Factors | | 10 |

Item 1B. | | Unresolved Staff Comments | | 19 |

Item 2. | | Properties | | 20 |

Item 3. | | Legal Proceedings | | 22 |

Item 4. | | Submission of Matters to a Vote of Security Holders | | 22 |

PART II | | | | |

Item 5. | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

24 |

Item 6. | | Selected Financial Data | | 26 |

Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | 27 |

Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | 47 |

Item 8. | | Consolidated Financial Statements and Supplementary Data | | 48 |

Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 82 |

Item 9A. | | Controls and Procedures | | 82 |

Item 9B. | | Other Information | | 84 |

PART III | | | | |

Item 10. | | Directors, Executive Officers and Corporate Governance | |

85 |

Item 11. | | Executive Compensation | | 85 |

Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 85 |

Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | 85 |

Item 14. | | Principal Accountant Fees and Services | | 85 |

PART IV | | | | |

Item 15. | | Exhibits and Financial Statement Schedules | |

86 |

"We", "us", "our", "Company" and "Coldwater" unless the context otherwise requires means Coldwater Creek Inc. and its subsidiaries.

2

Table of Contents

PART I

Item 1. BUSINESS

The following discussion contains various statements regarding our current strategies, financial position, results of operations, cash flows, operating and financial trends and uncertainties, as well as certain forward-looking statements regarding our future expectations. When used in this discussion, words such as "anticipate," "believe," "estimate," "expect," "could," "may," "will," "should," "plan," "predict," "potential," and similar expressions are intended to identify such forward-looking statements. Our forward-looking statements are based on our current expectations and are subject to numerous risks and uncertainties. As such, our actual future results, performance or achievements may differ materially from the results expressed in, or implied by, our forward-looking statements. Please refer to our "Risk Factors" in this Annual Report on Form 10-K. We assume no future obligation to update our forward-looking statements or to provide periodic updates or guidance.

We maintain an Internet web site at www.coldwatercreek.com. (This web site address is for informational purposes only and is not intended to provide an active link or to incorporate any information contained on the web site by its reference in this document.) We make available, free of charge, through our web site our annual report on Form 10-K, our quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such reports have been electronically filed with the SEC.

General

We are a specialty retailer of women's apparel, accessories, jewelry and gift items. Founded in 1984 as a catalog company, today we are a multi-channel specialty retailer generating $1.0 billion in net sales in fiscal 2008. Our proprietary merchandise assortment reflects a sophisticated yet relaxed and casual lifestyle. A commitment to providing superior customer service is manifest in all aspects of our business. We serve our customers through our retail and direct segments. Our merchandise assortment, retail stores, catalogs and e-commerce web site are designed to appeal to women who are 35 years of age and older with average annual household incomes in excess of $75,000. Our mission is to become one of the premier specialty retailers for women 35 years of age and older in the United States by offering our customers a compelling merchandise assortment with superior customer service.

Coldwater Creek Brand

The Coldwater Creek brand is synonymous with a sophisticated yet relaxed and casual lifestyle. To maintain and strengthen this brand image we focus our merchandising efforts on the design and development of unique, colorful items with an emphasis on comfort and quality fabrics that provide easy care. Our merchandise is fashionable but not trendy and includes clothing for each aspect of our customer's lifestyle, including soft career, casual weekend wear and special occasion.

We seek to present a consistent brand image throughout all of our marketing and promotion activities. In recent years, we used a broad based marketing strategy of national magazine advertising and catalog circulation to attract new customers while building overall brand awareness. During fiscal 2008 we shifted to a more point-of-sale, in-store focus by concentrating our efforts on maintaining our best customers through programs such as personal shopper. We also continue to attract new customers through select advertising placement. In addition, we are developing traffic drivers through innovative e-mail campaigns, retail mailers and newspaper ads as well as through our loyalty programs (see "Customer Loyalty Programs" below for further discussion).

As a direct-to-consumer retailer we have been able to create an extensive proprietary database of customer information including customer demographics, purchasing history, and geographic proximity to an existing or planned premium retail store. We believe our ability to effectively design and manage

3

Table of Contents

our marketing and promotional programs is enhanced by this rich source of information, allowing us to adjust the frequency, timing and content of each program to maximize its benefits.

Customer service has always been a hallmark of the Coldwater Creek brand. We seek to hire associates who are understanding of our customer's needs and relate well to our brand. To ensure that our customer receives the same level of exceptional customer service, ongoing training is provided for all store and customer contact center personnel. The training is focused on company culture, customer service methods and expectations, and product knowledge. To ensure we are providing the level of service customers have come to expect, we monitor customer shopping survey scores, customer comments, conversion rates and other operational metrics on a daily basis. In addition, our customer service programs are designed to facilitate our multi-channel approach. We accept returns through any channel regardless of the initial point of purchase. We also provide in-store web kiosks and assist customers in ordering items through our web site if the desired merchandise is unavailable at their local premium retail store.

Our Multi-Channel Approach

Since the opening of our first premium retail store in November 1999, we have gradually evolved from a direct marketer to a multi-channel specialty retailer. Our merchandise is offered through two distinct operating segments, retail and direct. Our retail segment includes an expanding base of premium retail stores and outlet stores along with our day spa locations, while the direct segment encompasses our direct-to-consumer business through e-commerce and phone and mail operations. Our catalogs are prominently displayed in each premium retail store to encourage customers to continue shopping with us even after they have left our stores. This multi-channel approach also allows us to cross-promote the brand and provides customers with convenient access to our merchandise, regardless of their preferred shopping method.

Information regarding segment performance is included in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations," of this Annual Report on Form 10-K under the heading "Results of Operations—Segment Results." Additionally, selected financial data for our segments is presented in Note 17 to our consolidated financial statements.

Retail Segment

Our retail stores are designed to reflect the brand's focus on a casual, unhurried lifestyle, encouraging customers to relax and enjoy their shopping experience. Our prominent storefront display windows and logo signage provide an inviting atmosphere to our shoppers. Store interiors combine an appealing mix of wood décor, stone accents, and other natural materials and colors. Thoughtfully designed merchandise fixtures, water features and leather chairs also help to create a warm, comfortable environment. We also promote and market our retail stores through the use of our catalogs.

We continue to conduct four key seasonal sales events per year in the premium retail stores. Excess merchandise is cleared primarily through our 35 merchandise clearance outlet stores and our e-commerce channel. Unlike many other retailers that specifically develop and produce items for sale through their outlet locations, we use outlets exclusively to manage overstocked premium merchandise.

The key driver of our growth strategy continues to be the retail expansion. We believe there is an opportunity for us to grow our premium retail store base to between 500 to 550 stores in more than 280 identified markets nationwide. In fiscal 2008, we opened 42 premium retail stores, increasing our total premium store count to 348, covering 201 markets. Approximately 42.5 percent of these stores are located in traditional malls, 52.6 percent in lifestyle centers and 4.9 percent in street locations. In addition to our 348 premium retail stores we also had 35 merchandise clearance outlets in operation at the end of fiscal 2008.

4

Table of Contents

Each new store location is identified, analyzed and presented for approval through a collaborative process between our real estate and business intelligence departments. The real estate department uses its experience and current market knowledge to identify potential locations based upon an overall market plan. The business intelligence department then analyzes each location by extracting data and information from our own extensive customer database and combining it with external demographic information. This comprehensive analysis includes such information as projected sales, average consumer age and income level, buying habits and the retail location of competitors within the same trade area.

Based on current macroeconomic conditions, we determined during the third quarter of fiscal 2008 to significantly decrease our store rollout plans for fiscal 2009, and it is our present intention to open no more than ten retail stores during fiscal 2009, the majority of which are planned for opening in the first half of the year. New premium retail stores will average approximately 6,100 square feet. As of March 27, 2009, one store has been opened in the first quarter of fiscal 2009, for a premium retail total store count of 349.

We also operate ourColdwater Creek ~ The Spa concept in nine locations. These day spas offer a complete menu of spa treatments, including massages, facials, body treatments, manicures and pedicures. In addition to spa treatments, the day spas carry an assortment of relevant apparel as well as lines of personal care products for women. Our day spas are staffed with experienced professionals in all treatment areas.

Direct Segment

The direct segment consists of sales generated through our e-commerce web site and from orders taken from customers over the phone or though the mail. The direct segment began with the mailing of our first catalog in 1985 and was expanded in 1999 to include our e-commerce business. Our e-commerce web site and catalogs feature full color photographs, graphics and artwork. Utilizing a proprietary process, we primarily present our apparel "off-figure," leaving the customer to decide if an item of merchandise or ensemble is right for her based upon its inherent style and design. All web site and catalog pages are designed by an in-house team of artists, copywriters and editors to ensure a consistent presentation of the Coldwater Creek brand.

Our Web Site. We use the e-commerce web site, www.coldwatercreek.com, to cost-effectively expand our customer base and provide another convenient shopping alternative for customers. The web site features the entire full-price merchandise offering found in our catalogs. It also serves as an efficient promotional vehicle for the disposition of excess inventory. Customers are driven to the web site primarily by our catalogs, e-mail campaigns and online advertising. In addition, we participate in cost-per-click search and revenue share-based affiliate programs whereby numerous popular Internet search engines and consumer and charitable web sites provide direct access to our web site.

Our Catalogs. During fiscal 2008, our merchandise was offered through two core catalog titles:Northcountry andColdwater Creek, which differentiate the merchandise assortment offered in each title to cater to the various lifestyles of our core customer.Northcountry represents the broadest product assortment, mixing apparel with jewelry, fashion accessories, gift items and home-related hard goods. TheColdwater Creek catalog is designed to drive traffic to our premium retail stores, primarily featuring merchandise that can be found in these stores. We continue to evaluate our catalogs to ensure that we are reaching the greatest number of customers in the most effective and efficient manner possible. As a result, we began offering our merchandise under a single catalog title during late fiscal 2008 and expect to continue to operate under one catalog title during fiscal 2009.

Customer Contact Centers. We have three customer contact centers located in Coeur d'Alene, Idaho, Mineral Wells, West Virginia, and Sandpoint, Idaho. Customer contact center personnel receive

5

Table of Contents

comprehensive, ongoing training on the Coldwater Creek culture, expectations of exceptional customer service, and product knowledge. Certain personnel receive more extensive product training and are available to respond to customer inquiries. These Product Specialists can be quickly patched into a three-way call with individual customers and contact center agents to answer highly specific questions about any of the merchandise we offer.

If customers visiting our e-commerce web site have questions about products, web site navigation or order placement they can request assistance from a knowledgeable customer contact center agent through the online instant help option. Requests or questions sent via e-mail receive a personalized reply, rather than an automated response, within an average of fifteen minutes. For customers who prefer to place orders over the phone, the customer contact center phone system is designed to ensure customer calls are answered immediately.

Merchandise

We design and develop all of our apparel either in-house or through collaboration with independent designers. To ensure our designers stay abreast of trends in styles and fabrics, we opened our New York design studio during fiscal 2004. Our New York design team merges the latest fashion trends with our customers' preferences to build an overall vision that guides the design and development of our seasonal merchandise assortment. During the fourth quarter of fiscal 2008, we made some changes to our merchandising team and its structure. These changes have enabled us to better integrate our merchandise design and product development teams, which we believe will enable us to offer a more compelling product and enhance efficiency.

Our product development team translates the overall vision for each season into various product designs, fabrics and prints, indicating the construction and exact specifications for each item. Our team seeks inspiration from their extensive travels, fashion shows, and from our direct sourcing team which provides new fabrics and novelty prints along with product samples from various manufacturers. Our direct sourcing team also assists in identifying the appropriate manufacturers to manufacture each item and in negotiating both price and delivery terms.

Once our merchandise assortment is selected, our inventory planning team determines the exact quantities of each item to purchase in order to meet anticipated demand. This determination is made through the analysis of information such as historical sales, planned merchandise presentation, scheduled store openings and sales projections. This process culminates in the issuance of various purchase orders. Coordinating with the direct sourcing department, quality assurance and quality compliance personnel monitor the production process to verify the merchandise is produced to exact specifications and within the designated timeline.

Direct Sourcing

Our apparel has historically been purchased primarily through domestic importers who procured the merchandise on our behalf. Over the past four years, however, we have worked directly with foreign manufacturers, launching our direct sourcing initiative in the third quarter of fiscal 2004. The benefits of direct sourcing include improved control over the production, quality and transportation logistics of our apparel. We believe these benefits result in faster speed to market, improved quality and lower merchandise costs.

To support this initiative we opened a sourcing office in Hong Kong in the fourth quarter of fiscal 2005 and an office in India in the first quarter of fiscal 2006. These sourcing offices work closely with direct sourcing personnel located at our corporate headquarters. The primary functions of these offices are product development and production management as well as ensuring compliance with our code of conduct and monitoring program. Foreign office personnel are involved in selecting foreign manufacturers, ensuring adequate factory capacity and negotiating prices and delivery terms. Our

6

Table of Contents

sourcing offices also provide samples of fabrics, colors and prints that are being developed in their region. Once a purchase order is issued, production management personnel work directly with foreign manufacturers to ensure merchandise is produced according to our exact specifications, including fabric quality and color, fit and design. The opportunity to verify conformance to these specifications throughout the manufacturing process provides more control over the quality of our end product. Personnel also oversee the timeliness of the production process, from the initial receipt of fabric to merchandise shipment, resulting in improvements in inventory planning and control.

Approximately 15 percent of our apparel was purchased directly from manufacturers in fiscal 2005. During fiscal 2006, this percentage increased to approximately 30 percent. During fiscal 2007, this percentage increased to approximately 50 percent. For fiscal 2008 we have reached our goal of sourcing approximately 60 percent of the apparel units purchased, and we believe there is opportunity to slightly increase our direct sourcing during fiscal 2009. This expansion of our direct sourcing is a multi-year initiative which we expect will ultimately result in approximately 65 to 70 percent of our inventory being sourced directly. As we have increased the percentage of total apparel that is purchased directly from manufacturers, the number of domestic importers with whom we contract has decreased. Domestic importers will remain, however, a crucial component of our overall sourcing strategy, providing unique industry and marketplace knowledge along with product design and development capabilities.

Customer Loyalty Programs

In September 2007, we launchedonecreek, a unique new loyalty program designed to further enhance service and reward our most valuable customers. Benefits of program participation include unparalleled service, sneak peeks at upcoming trends and new merchandise,onecreek customer service specialists, a personal shopper, exclusiveonecreek savings and promotions, free shipping on returns, and a special gift to help celebrate her birthday. Using our existing customer database we identified and initially enrolled approximately 250,000 of our very best customers inonecreek, which we expanded to over 600,000 customers during fiscal 2008.

In the second quarter of fiscal 2005, we introduced our co-branded credit card program. To encourage pre-approved customers to apply for and accept the credit card, we provide a discount to customers on their first Coldwater Creek purchase made with the co-branded credit card. Once a customer is approved to receive a co-branded credit card and the credit card is activated, they become eligible to participate in our credit card reward program. Under this program, points are earned on purchases made with the credit card at Coldwater Creek and at other businesses where our card is accepted. Cardholders who accumulate the requisite number of points are issued a coupon that is valid towards the purchase of Coldwater Creek merchandise. In addition to earning points, all participants in the co-branded credit card program receive exclusive offers throughout the year. These offers have included special discounts, invitations to Coldwater Creek shopping events, and periodic opportunities to earn double and triple points.

Competition

The women's retail apparel market is highly competitive. Competitors range from specialty apparel retail companies such as Chico's, Talbots, Christopher & Banks and Ann Taylor to small single channel catalog, e-commerce and retail store companies. We also compete with national department store chains such as Macy's, Nordstrom, Dillard's and JC Penney, along with discount retailers that offer women's apparel and accessories, such as Kohl's and Target.

We believe that we compete principally on the basis of our high-quality, distinctive merchandise selection and exceptional customer service. We also believe that an integrated, multi-channel sales

7

Table of Contents

strategy enhances our ability to compete in the marketplace by providing convenient access to our merchandise, regardless of our customer's preferred shopping method.

Social and Environmental Responsibility

We are committed to sourcing our products in a responsible manner, respecting both the countries in which we have a business presence, and the business partners that manufacture our products.

As a part of this commitment, in fiscal 2005, we implemented a comprehensive code of conduct and monitoring program that applies to all factories contracted in the production of merchandise for Coldwater Creek. Within this code, we recognize that local customs and laws vary from one region of the world to another; however, we strongly believe the issues of business ethics, human rights, health, safety and environmental stewardship transcend geographical boundaries. The intention of this code is to communicate our expectations to each of our business partners.

To ensure our business partners adhere to our code of conduct, we monitor each of their business practices through an annual on-site factory inspection and compliance audit. These audits are performed by an accredited compliance firm and focus on areas such as compliance with local laws and regulations, child and forced labor conditions, working hours, health and safety programs, freedom of association and the environment. Random audits are conducted as needed.

If deficiencies are discovered, personnel in each region are empowered to work with the respective business partner to correct those deficiencies. The goal of this process is to not only immediately correct the deficiencies, but to also educate individuals, build strategic relationships and improve business practices over the long-term. Business relationships are severed with partners who do not make the necessary improvements in a timely manner.

In addition, we have joined Business for Social Responsibility, a global organization that assists member companies in the achievement of success in ways that respect ethical values, people, communities and the environment. Through the many tools offered by this organization, and the collaboration with other member companies, we will continue to develop and strengthen our social compliance program. As a member of Business for Social Responsibility, we, along with nine other internationally known brands, became charter members of the Sustainable Water Group. Water is a natural resource that can be significantly impacted by the apparel manufacturing process. The focus of this group is the development of a single set of standards for monitoring and improving water quality in the production of apparel.

In 2008, we completed our fourth year as a national sponsor for the Susan G. Komen Race for the Cure® for breast cancer awareness and research. We also sponsor various local community organizations and events and encourage our employees to be actively involved in their communities, as evidenced by our Adopt-a-School program which we implemented during 2007. Under this program, Coldwater Creek associates partner with local elementary schools, volunteering their personal time and energy to provide classroom assistance. In addition, we have implemented LEED (Leadership in Energy and Environmental Design) Green Building Rating System for Commercial Interiors in selected stores which is in keeping with Coldwater Creek's goals of reducing our impact on the environment and creating healthy surroundings for our employees and customers.

Government Regulation

The direct business is subject to the Merchandise Mail Order Rule and related regulations promulgated by the Federal Trade Commission. While we believe we are in material compliance with these regulations, no assurance can be given that new laws or regulations will not be enacted or adopted which might adversely affect operations.

8

Table of Contents

Our multi-channel business model subjects us to state and local taxes in numerous jurisdictions, including state income, franchise, and sales and use tax. We collect these taxes in any jurisdiction in which we have a physical presence. While we believe we have paid or accrued for all taxes based on our interpretation of applicable law, tax laws are complex and interpretations differ from state to state. In the past, some taxing jurisdictions have assessed additional taxes and penalties on us, asserting either an error in our calculation or an interpretation of the law that differed from our own. It is possible that taxing authorities may make additional assessments in the future. In addition to taxes, penalties and interest, these assessments could cause us to incur legal fees associated with resolving disputes with taxing authorities.

Additionally, changes in state and local tax laws, such as temporary changes associated with "tax holidays" and other programs, require us to make continual changes to our collection and reporting systems that may relate to only one taxing jurisdiction. If we fail to update our collection and reporting systems in response to these changes, any over collection or under collection of sales taxes could subject us to interest and penalties, as well as private lawsuits and damage to our reputation.

Various states have attempted to collect back sales and use taxes from direct marketers whose only contacts with the taxing state are solicitations through the mail or the Internet, and whose subsequent delivery of purchased goods is by mail or interstate common carriers. We may be subject to these attempts in jurisdictions in which we currently have or previously had no physical presence. However, the United States Supreme Court has held that these states, absent congressional legislation, may not impose tax collection obligations on an out-of-state mail order or Internet company. During fiscal 2008, certain state legislation has been enacted that requires certain Internet and/or mail order retailers to collect and remit sales tax from customers resident in that jurisdiction. This legislation was enacted on a prospective basis and does not impact our current sales tax collection and remittance processes. We anticipate that any further legislative changes regarding direct marketers, if adopted, would also be applied only on a prospective basis.

Many of our products are manufactured outside the United States and are subject to existing or potential duties, tariffs or quotas that may limit the quantity of products we are allowed to import or increase the cost of such products. For example, the United States and the European Union have historically imposed trade quotas on certain apparel and textile categories from the Peoples Republic of China. Effective January 1, 2009, apparel and textile quotas that were outlined in the memorandum of understanding between the United States and The Peoples Republic of China expired and are no longer applicable. To date, we have not been restricted by quotas in the operation of the business, and customs duties have not comprised a material portion of the total cost of most of our products. As we expand retail operations and begin to source more merchandise overseas, business may be impacted by quotas and the imposition of customs duties or tariffs. We are also subject to foreign governmental regulation and trade restrictions, including U.S. regulations prohibiting certain foreign activities, with respect to our product sourcing.

Employees

As of January 31, 2009, we had 2,800 full-time employees and 8,400 part-time employees. During our peak selling season, which includes the months of November and December, we utilize a substantial number of temporary employees. None of our employees are covered by collective bargaining agreements.

Trademarks

Our registered trademarks include Coldwater Creek®, Coldwater Creek The Spa® and the stylized Coldwater Creek logo. We believe that our registered and common law trademarks have significant value and are instrumental to our ability to market and sustain demand for our merchandise and brand.

9

Table of Contents

Available Information

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the Exchange Act), and therefore file periodic reports and other information with the Securities and Exchange Commission (SEC). These reports may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Washington, D.C. 20549, or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet web site atwww.sec.gov that contains reports, proxy information statements and other information regarding issuers that file electronically.

Our filings under the Exchange Act (including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to these reports) are also available free of charge on the investor relations portion of our web site atwww.coldwatercreek.com. These reports are available as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. The reference to our web site address does not constitute incorporation by reference of the information contained on the web site, and the information contained on the web site is not part of this document.

Item 1A. Risk Factors

In addition to the other information set forth in this report, you should carefully consider the following risk factors which could materially affect our business, financial condition or future results. The risks described below are not the only risks facing the Company. Additional risks and uncertainties not currently known or that are currently deemed immaterial may also adversely affect the business, financial condition, and/or operating results of the Company.

General economic conditions have impacted consumer spending and may adversely affect our financial position.

Consumer spending patterns are highly sensitive to the general economic climate, the consumer's level of disposable income, consumer debt, and overall consumer confidence. Consumer spending has been impacted recently by the current recession, volatile energy and food costs, greater levels of unemployment, higher levels of consumer debt, declines in home values and in the value of consumers' investments and savings, restrictions on the availability of credit and other negative economic conditions, nationally and regionally. We continue to be affected by challenging macroeconomic conditions which are evidenced in our business by a highly competitive retail selling environment, low retail store traffic levels and a shift in customer purchasing toward more value priced merchandise. These conditions, which have continued into the first quarter of fiscal 2009, had a negative impact on our revenues, gross margins, operating cashflows and earnings in fiscals 2008 and 2007. We believe these conditions, in particular the highly competitive selling environment, low retail store traffic levels and the shift in customer purchasing toward more value priced merchandise, will continue throughout fiscal 2009 and the foreseeable future. If consumer spending on apparel and accessories continues to decline and demand for our products decreases further, we may be forced to discount our merchandise or sell it at a loss, which would reduce our revenues, gross margins, operating cash flows and earnings. In addition, continued declines in our profitability could result in a charge to earnings for the impairment of our stores, which would not affect our cash flow but could decrease our earnings or increase our losses, and our stock price could be adversely affected. In addition, higher transportation costs, higher costs of labor, insurance and healthcare, and other negative economic factors may increase our cost of sales and operating expenses.

10

Table of Contents

Recent disruptions in the credit and financial markets could affect our liquidity and harm our financial performance.

The recent distress in the financial markets has resulted in extreme volatility in securities prices and diminished liquidity and credit availability, which may affect our liquidity. Although we currently do not have any borrowings under our $70 million secured credit facility, tightening of the credit markets could make it more difficult for us to access funds, enter into agreements for new indebtedness or obtain funding through the issuance of our securities. Additionally, if the macroeconomic environment were to continue to deteriorate, it is possible that consumer spending could decline further and impact our cash flows, which may require us to borrow under our credit facility. The actual amount of credit that is available from time to time under our credit facility is limited to a borrowing base amount that is determined according to, among other things, a percentage of the value of eligible inventory plus a percentage of the value of eligible credit card receivables, as reduced by certain reserve amounts that may be determined in the discretion of the lender. Consequently, it is possible that, should we need to access our credit facility, it may not be available in full. Additionally, our credit facility contains covenants related to capital expenditure levels and minimum inventory book value, and other customary matters. Our failure to comply with the covenants, terms and conditions of our credit facility could cause the facility not to be available to us.

In addition, the current credit crisis is having a significant negative impact on businesses around the world, and the impact of this crisis on our major suppliers cannot be predicted. The inability of key vendors to access liquidity, or the insolvency of key vendors, could lead to their failure to deliver our merchandise, which would result in lost sales and lower customer satisfaction. It is also possible that the inability of our vendors to access liquidity will cause them to extend less favorable terms to us, which could negatively affect our margins and financial condition.

Demand for our merchandise is difficult to gauge and our inability to predict consumer spending patterns and consumer preferences may reduce our revenues, gross margins and earnings.

Forecasting consumer demand for our merchandise is difficult given the nature of changing fashion trends and consumer preferences, which can vary by season and from one geographic region to another and be affected by general economic conditions that are difficult to predict. On average, we begin the design process for apparel nine to ten months before merchandise is available to consumers, and we typically begin to make purchase commitments four to eight months in advance. These lead times make it difficult for us to respond quickly to changes in demand for our products and amplify the consequences of any misjudgments we might make.

Our inventory levels fluctuate seasonally, and at certain times of the year, such as during the holiday season, we maintain higher inventory levels and are particularly susceptible to risks related to demand for our merchandise. If we elect to carry relatively low levels of inventory and demand is stronger than we anticipated, we may be forced to backorder merchandise in our direct channels or not have merchandise available for sale in our retail stores, which may result in lost sales and lower customer satisfaction.

In addition, during our 2008 fiscal year, our business was negatively impacted as we navigated through an over-assortment of merchandise that did not differentiate us enough from our competitors. We have recently implemented changes to our business strategy that we expect over time will both increase the appeal of our merchandise to customers and reduce the impact of discounting and promotions. However, these initiatives will take time to be fully implemented. They may not be successful, have any positive effect on our operating results or offset declining consumer spending due to adverse economic conditions. If the demand for our merchandise is lower than expected we will be forced to discount more merchandise, which reduces our gross margins and earnings.

11

Table of Contents

Our cost savings initiatives may have a negative impact on our operations and inhibit our long-term growth plans.

During 2008, through our cost-cutting efforts, we reduced operating expenses and we expect to achieve further reductions in 2009. Much of these savings have been achieved through decreased marketing expenditures and headcount reductions. We believe these measures were necessary and appropriate to ensure the long-term health of our business in response to current economic conditions. However, our cost-cutting measures may also have negative effects on some aspects of our operations. For example, our reduced marketing plans may make it difficult for us to respond quickly to any improvement in economic conditions, and thereby inhibit our long-term growth. We may also experience deterioration of our customer base due to lower levels of marketing and advertising. We could also experience low employee morale and an inability to retain key employees due to recent headcount reductions and other cost savings initiatives.

The retail store model requires us to incur substantial financial commitments and fixed costs that we will not be able to recover if a store is not successful.

The success of an individual store location depends largely on the success of the lifestyle center or shopping mall where the store is located, and may be influenced by changing customer demographic and consumer spending patterns. These factors cannot be predicted with complete accuracy. Because we are required to make long-term financial commitments when leasing retail store locations, and to incur substantial fixed costs for each store's design, leasehold improvements, fixtures and information and management systems, it would be costly for us to close a store that does not prove successful. The current economic environment may also adversely affect the ability of developers or landlords to meet commitments to us to pay for certain tenant improvement expenses we incur in connection with building out new retail store locations.

The deterioration of the financial, credit, and housing markets has had a severe impact on consumer confidence and discretionary spending. These market conditions have had a negative effect on our business. Though we believe no impairment of our long-lived assets exists as of January 31, 2009, we concluded to take an impairment charge in the second quarter of 2008 as a result of continuing losses related to our day spa concept. If market conditions were to continue to deteriorate for an extended period of time, it is reasonably possible that we could record additional impairments of these or other long-lived assets in the future.

We are subject to potentially adverse outcomes in litigation matters.

We are, from time to time, involved in various legal proceedings incidental to the conduct of our business. Actions which may be filed against us include commercial, intellectual property infringement, customer and employment claims, including class action lawsuits alleging that we have violated federal and state wage and hour and other laws. These issues arise primarily in the ordinary course of business but could raise complex factual and legal issues, which are subject to multiple risks and uncertainties and could require significant management time. We believe that our current litigation issues will not have a material adverse effect on our results of operations or financial condition. However, our assessment of current litigation could change in light of the discovery of facts not presently known to us with respect to pending legal actions, or adverse determinations by judges, juries or other finders of fact. Moreover, additional litigation that is not currently pending could have a significant impact on our results or operations or financial condition.

The majority of our cash and cash equivalents are concentrated with one financial institution.

We maintain the majority of our cash and cash equivalents with one major financial institution in the United States of America, in the form of demand deposits, money market accounts and other

12

Table of Contents

short-term investments. Deposits in this institution may exceed the amounts of insurance provided on such deposits. With the current financial environment and the instability of financial institutions, we cannot be assured that we will not experience losses on our deposits.

Quarterly results of operations fluctuate and may be negatively impacted by seasonal influences.

Net sales, operating results, liquidity and cash flows have fluctuated, and will continue to fluctuate, on a quarterly basis, as well as on an annual basis, as a result of a number of factors, including, but not limited to, the following:

- •

- the number and timing of premium retail store openings;

- •

- the timing and number of e-mails delivered;

- •

- the timing of catalog mailings and the number of catalogs we mail;

- •

- the ability to accurately estimate and accrue for merchandise returns and the costs of obsolete inventory disposition;

- •

- the timing of merchandise receiving and shipping, including any delays resulting from labor strikes or slowdowns, adverse weather conditions, health epidemics or national security measures; and

- •

- shifts in the timing of important holiday selling seasons relative to our fiscal quarters, including Valentine's Day, Easter, Mother's Day, Thanksgiving and Christmas, and the day of the week on which certain important holidays fall.

Our results continue to depend materially on sales and profits from the November and December holiday shopping season. In anticipation of traditionally increased holiday sales activity, we incur certain significant incremental expenses, including the hiring of a substantial number of temporary employees to supplement the existing workforce. If, for any reason, we were to realize lower-than-expected sales or profits during the November and December holiday selling season, as we did in fiscal years 2008 and 2007, our financial condition, results of operations, including related gross margins, and cash flows for the entire fiscal year would be materially adversely affected.

We may be unable to manage expanding operations and the complexities of our multi-channel strategy, which could harm our results of operations.

During the past few years, with the implementation of a multi-channel business model, our overall business has become substantially more complex. This increasing complexity has resulted and is expected to continue to result in increased demands on our managerial, operational and administrative resources and has forced us to develop new expertise. In order to manage our complex multi-channel strategy, we will be required to, among other things:

- •

- successfully integrate improvements to our management information systems and controls;

- •

- efficiently manage the upgrade of certain equipment at our distribution center; and

- •

- attract, train and retain qualified personnel, including middle and senior management, and manage an increasing number of employees.

If we do not meet these demands or develop required expertise, we may be unable to fully achieve our growth strategies or realize the full benefits of a multi-channel strategy, which may harm our results of operations.

13

Table of Contents

We are subject to significant risks associated with our ongoing implementation of major changes to our management information systems.

To support our increasingly complex business processes, we are replacing a number of our management information systems that are critical to our operations, including systems such as accounting, human resources, inventory purchasing and management, financial planning, direct segment order processing, and retail segment point-of-sale systems. Currently, we are installing a core merchandising system which is a central component affecting many aspects of our business. Installing and integrating vital components of our management information systems carries substantial risk, including potential loss of data or information, cost overruns, implementation delays, disruption of operations, and our potential inability to meet reporting requirements, any of which would harm our business and could impair our results of operations.

We depend on key vendors for timely and effective sourcing and delivery of our merchandise. If these vendors are unable to timely fill orders or meet quality standards, we may lose customer sales and our reputation may suffer.

The direct business depends largely on our ability to fulfill orders on a timely basis, and the direct and retail businesses depend largely on our ability to keep appropriate levels of inventory in the distribution center and stores. We may experience difficulties in obtaining sufficient manufacturing capacity from vendors to produce merchandise. We generally maintain non-exclusive relationships with multiple vendors that manufacture our merchandise. However, we have no contractual assurances of continued supply, pricing or access to new products, and any vendor could discontinue selling to us at any time. Moreover, a key vendor may become unable to supply our inventory needs due to capacity constraints, financial instability, or other factors beyond our control, or we could decide to stop using a vendor due to quality or other issues. If we were required to change vendors or if a key vendor was unable to supply desired merchandise in sufficient quantities on acceptable terms, particularly in light of current global economic conditions, we could experience delays in filling customer orders or delivering inventory to stores until alternative supply arrangements were secured. These delays could result in lost sales and a decline in customer satisfaction. Additionally, delays by our vendors in supplying our inventory needs could cause us to incur expensive air freight charges, which would negatively impact our margins.

We face substantial competition from discount retailers in the women's apparel industry.

We face substantial competition from discount retailers, such as Kohl's and Target, for basic elements in our merchandise lines, and net sales may decline or grow more slowly if we are unable to differentiate our merchandise and shopping experience from these discount retailers. In addition, the retail apparel industry has experienced significant price deflation over the past several years largely due to the downward pressure on retail prices caused by discount retailers and, more recently, by declining consumer spending, resulting in increased promotional and competitive activity. We expect this price deflation to continue as a result of the recent expiration of quota restrictions on the importing of apparel into the United States from foreign countries that are members of the World Trade Organization. This price deflation may make it more difficult for us to maintain gross margins and to compete with retailers that have greater purchasing power than we have. Furthermore, because we continue to source a significant percentage of our merchandise through intermediaries and from suppliers and manufacturers located in the United States and Canada, where labor and production costs, on average, tend to be higher, our gross margins may be lower than those of competing retailers.

14

Table of Contents

Consumer concerns about purchasing items via the Internet as well as external or internal infrastructure system failures could negatively impact our e-commerce sales or cause us to incur additional costs.

The e-commerce business is vulnerable to consumer privacy concerns relating to purchasing items over the Internet, security breaches, and failures of Internet infrastructure and communications systems. If consumer confidence in making purchases over the Internet declines as a result of privacy or other concerns, e-commerce net sales could decline. We may be required to incur increased costs to address or remedy any system failures or security breaches or any actual or perceived consumer privacy concerns.

We may be unable to fill customer orders efficiently, which could harm customer satisfaction.

If we are unable to efficiently process and fill customer orders, customers may cancel or refuse to accept orders, and customer satisfaction could be harmed. We are subject to, among other things:

- •

- failures in the efficient and uninterrupted operation of our customer contact centers or our sole distribution center in Mineral Wells, West Virginia, including system failures caused by telecommunications systems providers and order volumes that exceed our present telephone or Internet system capabilities;

- •

- delays or failures in the performance of third parties, such as vendors who supply our merchandise, shipping companies and the U.S. postal and customs services, including delays associated with labor disputes, labor union activity, inclement weather, natural disasters, health epidemics and possible acts of terrorism; and

- •

- disruptions or slowdowns in our order processing or fulfillment systems resulting from increased security measures implemented by U.S. customs, or from homeland security measures, telephone or Internet down times, system failures, computer viruses, electrical outages, mechanical problems, human error or accidents, fire, natural disasters or comparable events.

We have a liberal merchandise return policy, and we may experience a greater number of returns than we anticipate.

As part of our customer service commitment, we maintain a liberal merchandise return policy that allows customers to return any merchandise, virtually at any time and for any reason, regardless of condition. We make allowances in financial statements for anticipated merchandise returns based on historical return rates and future expectations. These allowances may be exceeded, however, by actual merchandise returns as a result of many factors, including changes in the merchandise mix, size and fit, actual or perceived quality, differences between the actual product and its presentation in catalogs or on the web site, timeliness of delivery, competitive offerings and consumer preferences or confidence. Any significant increase in merchandise returns or merchandise returns that exceed our expectations would result in adjustments to the sales return accrual and to cost of sales and could have a material and adverse affect on financial condition, results of operations and cash flows.

We may be unable to manage significant increases in the costs associated with the catalog business, which could affect results of operations.

We incur substantial costs associated with catalog mailings, including paper, postage, merchandise acquisition and human resource costs associated with catalog layout and design, production and circulation and increased inventories. Significant increases in U.S. Postal Service rates and the cost of telecommunications services, paper and catalog production could significantly increase catalog production costs and result in lower profits for the catalog business. Most of our catalog-related costs are incurred prior to mailing, and as such we are not able to adjust the costs of a particular catalog

15

Table of Contents

mailing to reflect the actual subsequent performance of the catalog. Moreover, customer response rates have been unpredictable in recent years, particularly for mailings to prospective customers. Because the catalog business accounts for a significant portion of total net sales, any performance shortcomings experienced by the catalog business would likely have a material adverse effect on our overall business, financial condition, results of operations and cash flows.

Our success is dependent upon key personnel.

Our future success depends largely on the contributions and abilities of key executives and other employees. The loss of any of our key employees could have a material adverse effect on the business. Furthermore, the location of our corporate headquarters in Sandpoint, Idaho, may make it more difficult or costly to replace key employees who leave us, or to add qualified employees we will need to manage our further growth.

Our multi-channel model may expose us to the risk that we may be assessed for unpaid taxes.

Our multi-channel business model subjects us to state and local taxes in numerous jurisdictions, including state income, franchise, and sales and use tax. We collect these taxes in any jurisdiction in which we have a physical presence. While we believe we have paid or accrued for all taxes based on our interpretation of applicable law, tax laws are complex and interpretations differ from state to state. In the past, some taxing jurisdictions have assessed additional taxes and penalties on us, asserting either an error in our calculation or an interpretation of the law that differed from our own. It is possible that taxing authorities may make additional assessments in the future. In addition to taxes, penalties and interest, these assessments could cause us to incur legal fees associated with resolving disputes with taxing authorities.

Additionally, changes in state and local tax laws, such as temporary changes associated with "tax holidays" and other programs, require us to make continual changes to our collection and reporting systems that may relate to only one taxing jurisdiction. If we fail to update our collection and reporting systems in response to these changes, any over collection or under collection of sales taxes could subject us to interest and penalties, as well as private lawsuits and damage to our reputation.

Any determination that we have a material weakness in our internal control over financial reporting could have a negative impact on our investor perceptions.

Our system of internal controls over financial reporting is designed to provide reasonable assurance that the objectives of an effective control system are met. However, any system of internal controls is subject to inherent limitations and the design of our controls does not provide absolute assurance that all of our objectives will be met. This includes the possibility that controls may be inappropriately circumvented or overridden, that judgments in decision-making can be faulty and that misstatements due to errors or fraud may not be prevented or detected. Any failure in the effectiveness of internal control over financial reporting could have a material effect on financial reporting or cause us to fail to meet reporting obligations, and could negatively impact investor perceptions.

The stock price has fluctuated and may continue to fluctuate widely.

The market price for our common stock has fluctuated and has been and will continue to be significantly affected by, among other factors, quarterly operating results, changes in any earnings estimates publicly announced by us or by analysts, customer response to merchandise offerings, the size of catalog mailings, the timing of retail store openings or of important holiday seasons relative to our fiscal periods, seasonal effects on sales and various factors affecting the economy in general. The reported high and low closing sale prices of our common stock were $7.92 per share and $1.05 per share, respectively, during fiscal 2008. In addition, stock markets generally have experienced a high

16

Table of Contents

level of price and volume volatility and market prices for the stock of many companies have experienced wide price fluctuations not necessarily related to their operating performance.

The largest stockholders may exert influence over our business regardless of the opposition of other stockholders or the desire of other stockholders to pursue an alternate course of action.

Dennis Pence, our Chairman of the Board of Directors, may be deemed to beneficially own directly and indirectly approximately 17.1 percent of our outstanding common stock as of March 27, 2009. Ann Pence, our former Vice Chairman, may be deemed to beneficially own, directly and indirectly, approximately 19.9 percent of our outstanding common stock as of March 27, 2009. Either Dennis Pence or Ann Pence acting independently, could have significant influence over any matters submitted to stockholders, including the election of directors and approval of business combinations, and could delay, deter or prevent a change of control of the company, which may adversely affect the market price of common stock. The interests of these stockholders may not always coincide with the interests of other stockholders.

Provisions in the charter documents and Delaware law may inhibit a takeover and discourage, delay or prevent stockholders from replacing or removing current directors or management.

Provisions in our Certificate of Incorporation and Bylaws may have the effect of delaying or preventing a merger with or acquisition of us, even where the stockholders may consider it to be favorable. These provisions could also prevent or hinder an attempt by stockholders to replace current directors and include:

- •

- providing for a classified Board of Directors with staggered, three-year terms;

- •

- prohibiting cumulative voting in the election of directors;

- •

- authorizing the Board to designate and issue "blank check" preferred stock;

- •

- limiting persons who can call special meetings of the Board of Directors or stockholders;

- •

- prohibiting stockholder action by written consent; and

- •

- establishing advance notice requirements for nominations for election to the Board of Directors or for proposing matters that can be acted on by stockholders at a stockholders meeting.

Because the Board of Directors appoints management, any inability to effect a change in the Board of Directors may also result in the entrenchment of management.

We are also subject to Section 203 of the Delaware General Corporation Law, which, subject to exceptions, prohibits a Delaware corporation from engaging in any business combination with an interested stockholder for a period of three years following the date that the stockholder became an interested stockholder. The preceding provisions of our Certificate of Incorporation and Bylaws, as well as Section 203 of the Delaware General Corporation Law, could discourage potential acquisition proposals, delay or prevent a change of control and prevent changes in our management.

The day spa concept may not be successful and may be abandoned at any time.

We operate theColdwater Creek ~ The Spa concept in nine locations. To date, our day spa has had a negative impact on our earnings, as we experiment with marketing approaches and gather data regarding the spa business and, in particular, our spa customer. During the three months ended August 2, 2008, we determined that the carrying amount of certain assets at certain day spa locations will not be recovered. Consequently, we recorded an impairment charge of $1.5 million related to the day spa concept in the second quarter of fiscal 2008.

17

Table of Contents

We have not formed a conclusion as to the long-term prospects of this concept, although we have no plan to build additional day spas. There is no assurance that the day spa concept will ever be successful or that we will develop future spas. Factors that could cause us to abandon the day spa concept include:

- •

- unexpected or increased costs or delays in the concept's development;

- •

- the potential demands on management resources in developing this new concept and the need to focus these resources on other strategic priorities for our business;

- •

- legal and regulatory constraints;

- •

- the inherent difficulty in forecasting consumer tastes and trends through market research, and the possibility that we will determine through the performance of our day spas that demand does not meet our expectations; and

- •

- our inability to fund our day spa concept or its expansion with operating cash as a result of either lower sales from our retail and direct businesses or higher than anticipated costs, or both.

If we were to abandon the day spa concept, we would be required to write off any costs we have capitalized and may incur lease termination costs, which would have a material and adverse effect on results of operations, particularly for the quarter in which a write off is recognized. Additionally, there is no assurance that we will not incur additional impairment charges related to our day spa concept, in particular, if there were a continued deterioration in macroeconomic conditions.

We may be unable to successfully implement our retail store rollout strategy, which could result in significantly lower revenue growth.

The key driver of our growth strategy continues to be the retail store expansion. As of January 31, 2009, we operated 348 premium retail stores. We have since opened one additional store in the first quarter of fiscal 2009 for a total of 349 premium retail stores currently in operation. We believe we have the potential to grow our retail business to a total of 500 to 550 premium retail stores. However, there can be no assurance that these stores will be opened, will be opened in a timely manner, or, if opened, that these stores will be profitable. The ability to open our planned retail stores depends on our ability to successfully:

- •

- identify or secure premium retail space;

- •

- negotiate site leases on favorable lease terms for the retail store locations we identify; and

- •

- prevent construction delays and cost overruns in connection with the build-out of new stores.

Any miscalculations or shortcomings we may make in the planning and control of the retail growth strategy could materially impact our results of operations and financial condition. In addition, recent macroeconomic conditions including the ongoing credit crisis could result in an inability on the part of real estate developers to obtain retail property in preferred locations.

Based on current macroeconomic conditions, we determined during the third quarter of fiscal 2008 to significantly decrease our store rollout plans for fiscal 2009, and it is our present intention to open no more than ten new retail stores in fiscal 2009. We do not maintain a specific rollout plan beyond a one-year horizon. We continually reassess store rollout plans based on the overall retail environment, the performance of the retail business, our access to working capital and external financing and the availability of suitable store locations. For example, it is possible that in any year we will increase planned store openings, particularly if we experience strong retail sales and have access to the necessary working capital or external financing. Likewise, we would be inclined to further curtail our store rollout if we were to continue to experience weaker retail sales or if we did not have adequate working capital or access to financing, or as a part of a cost containment initiative.

18

Table of Contents

Increasing reliance on foreign vendors will subject us to uncertainties that could impact our cost to source merchandise and delay or prevent merchandise shipments.

We expect to continue to expand our direct sourcing program and to source more apparel directly from foreign vendors, particularly those located in Asia as well as those located in India and Central America. During fiscal 2008 we were the importer of record for approximately 60 percent of total apparel purchases. We believe there is opportunity to increase our direct sourcing slightly more during fiscal 2009, with the ultimate target being 65 to 70 percent. This exposes us to risks and uncertainties, which could substantially impact our ability to source apparel through foreign vendors and to realize any perceived cost savings. These risks include, among other things:

- •

- burdens associated with doing business overseas, including the imposition of, or increases in, tariffs or import duties, or import/export controls or regulation, as well as credit assurances we are required to provide to foreign vendors;

- •

- declines in the relative value of the U.S. dollar to foreign currencies;

- •

- volatile fuel and energy costs;

- •

- failure of foreign vendors to adhere to our quality assurance standards or our standards for conducting business;

- •

- financial instability of a vendor or vendors;

- •

- changing, uncertain or negative economic conditions, political uncertainties or unrest, or epidemics or other health or weather-related events in foreign countries resulting in the disruption of trade from exporting countries; and

- •

- restrictions on the transfer of funds or transportation delays or interruptions.

Irrespective of our direct sourcing initiative, substantially all of our merchandise, including that which we buy from domestic vendors, is manufactured overseas. Consequently, regardless of how we source our merchandise, we are exposed to the uncertainties of relying on foreign vendors.

We cannot predict whether any of the foreign countries in which our merchandise is manufactured, or in which our merchandise may be manufactured in the future, will be subject to import restrictions by the U.S. government. The United States and the European Union have historically imposed trade quotas on certain apparel and textile categories from the Peoples Republic of China. Effective January 1, 2009, apparel and textile quotas that were outlined in the memorandum of understanding between the United States and the Peoples Republic of China expired and are no longer applicable. Any new imposition of trade restrictions, such as increased tariffs or more restrictive quotas, on apparel or other items exported from the Peoples Republic of China or elsewhere could however affect the import of such merchandise and could increase the cost or reduce the supply of merchandise available to us and adversely affect our business, financial condition, results of operations and liquidity. Our sourcing strategy is designed to allow us to adjust to such potential shifts in availability of apparel and any new imposition of quotas for apparel and textiles exported from the Peoples Republic of China or elsewhere. However, sourcing operations may nevertheless be adversely affected by trade limits, political and/or financial instability resulting in the disruption of trade from exporting countries, significant fluctuation in the value of the U.S. dollar against foreign currencies, and/or other trade disruptions.

Item 1B. Unresolved Staff Comments

None.

19

Table of Contents

Item 2. PROPERTIES

Stores, Distribution Center and Corporate Facility

Our principal executive and administrative offices are located at One Coldwater Creek Drive, Sandpoint, Idaho 83864. Our telephone number is (208) 263-2266. The general location, use and approximate size of our principal properties as of January 31, 2009 are set forth below:

| | | | | | | | |

Facility | | Address | | Owned/ Leased | | Approximate Size | |

|---|

Corporate Offices(a) | | One Coldwater Creek Drive

Sandpoint, Idaho | | Owned | | | 270,000 sq. ft. | |

East Coast Operations Center, including Distribution and Customer Contact Center | | 100 Coldwater Creek Drive

Mineral Wells, West Virginia | | Leased | | |

960,000 sq. ft. | |

Coeur d'Alene, Idaho Customer Contact Center | | 751 West Hanley Avenue

Coeur d'Alene, Idaho | | Leased | | |

69,000 sq. ft. | |

Foreign sourcing offices | | Various foreign locations | | Leased | | |

17,000 sq. ft. | |

New York Design Studio | | New York City, NY | | Leased | | |

9,000 sq. ft. | |

348 Premium Retail Stores(b)(d) | | Various U.S. locations | | Leased | | |

2,050,000 sq. ft. | |

35 Outlet Stores(c) | | Various U.S. locations | | Leased | | |

247,000 sq. ft. | |

9 Day Spas(e) | | Various U.S. locations | | Leased | | |

49,000 sq. ft. | |

- (a)

- Our corporate offices include approximately 176,000 square feet of administrative office space and approximately 94,000 square feet occupied by our employee fitness center, spa, virtual retail stores, photo studio, employee training center and various corporate departments.

- (b)

- As of January 31, 2009 our premium retail stores averaged approximately 5,900 square feet in size per store. The lease base terms of our premium retail stores are generally ten years.

- (c)

- As of January 31, 2009 our outlet stores averaged approximately 7,000 square feet in size. The lease base terms of our outlet stores are generally five years.

- (d)

- Includes 347 premium retail stores and one flagship store located in Manhattan, New York. During the first quarter of fiscal 2007 we began classifying our resort store as a premium retail store.

- (e)

- As of January 31, 2009 our day spas average approximately 5,400 square feet in size. The lease base terms of our day spas are generally ten years.

We believe that our corporate offices, distribution center and customer contact centers will meet our operational needs for the foreseeable future.

20

Table of Contents

The following table summarizes the geographic location of our stores at the end of fiscal 2008 and fiscal 2007:

| | | | | | | | | | | | | | | | | | | |

| | As of

January 31, 2009 | | As of

February 2, 2008 | |

|---|

| | Premium

Retail Stores | | Outlet Stores | | Day

Spas | | Premium

Retail Stores | | Resort and

Outlet Stores | | Day

Spas | |

|---|

Alabama | | | 7 | | | 1 | | | — | | | 7 | | | 1 | | | — | |

Arizona | | | 10 | | | — | | | — | | | 9 | | | — | | | — | |

Arkansas | | | 4 | | | — | | | — | | | 3 | | | — | | | — | |

California | | | 31 | | | 3 | | | 3 | | | 26 | | | 2 | | | 3 | |

Colorado | | | 8 | | | 1 | | | 1 | | | 7 | | | 1 | | | 1 | |

Connecticut | | | 7 | | | — | | | — | | | 7 | | | — | | | — | |

Delaware | | | — | | | 2 | | | — | | | — | | | 2 | | | — | |

Florida | | | 24 | | | 2 | | | 1 | | | 17 | | | — | | | 1 | |

Georgia | | | 12 | | | 1 | | | — | | | 10 | | | 1 | | | — | |

Idaho | | | 2 | | | — | | | — | | | 2 | | | — | | | — | |

Illinois | | | 17 | | | 1 | | | 1 | | | 16 | | | 1 | | | 1 | |

Indiana | | | 7 | | | 2 | | | — | | | 6 | | | 2 | | | — | |

Iowa | | | 4 | | | 1 | | | — | | | 4 | | | 1 | | | — | |

Kansas | | | 2 | | | — | | | — | | | 2 | | | — | | | — | |

Kentucky | | | 3 | | | — | | | — | | | 3 | | | — | | | — | |

Louisiana | | | 4 | | | — | | | — | | | 4 | | | — | | | — | |

Maine | | | 2 | | | 1 | | | — | | | 1 | | | 1 | | | — | |

Maryland | | | 5 | | | — | | | — | | | 4 | | | — | | | — | |

Massachusetts | | | 9 | | | — | | | — | | | 9 | | | — | | | — | |

Michigan | | | 11 | | | 1 | | | — | | | 11 | | | 1 | | | — | |

Minnesota | | | 10 | | | 1 | | | — | | | 9 | | | — | | | — | |

Mississippi | | | 2 | | | — | | | — | | | 1 | | | — | | | — | |

Missouri | | | 9 | | | 1 | | | — | | | 8 | | | 1 | | | — | |

Montana | | | 3 | | | — | | | — | | | 3 | | | — | | | — | |

Nebraska | | | 3 | | | — | | | — | | | 3 | | | — | | | — | |

Nevada | | | 3 | | | — | | | — | | | 3 | | | — | | | — | |

New Hampshire | | | 2 | | | — | | | — | | | 2 | | | — | | | — | |

New Jersey | | | 13 | | | — | | | — | | | 10 | | | — | | | — | |

New Mexico | | | 2 | | | — | | | — | | | 2 | | | — | | | — | |

New York | | | 11 | | | 2 | | | — | | | 11 | | | 2 | | | — | |

North Carolina | | | 11 | | | — | | | — | | | 10 | | | — | | | — | |

North Dakota | | | 2 | | | — | | | — | | | 1 | | | — | | | — | |

Ohio | | | 15 | | | 1 | | | — | | | 14 | | | 1 | | | — | |

Oklahoma | | | 3 | | | — | | | — | | | 2 | | | — | | | — | |

Oregon | | | 6 | | | 1 | | | 1 | | | 6 | | | 1 | | | 1 | |

Pennsylvania | | | 14 | | | 2 | | | — | | | 11 | | | 2 | | | — | |

Rhode Island | | | 2 | | | — | | | — | | | 1 | | | — | | | — | |

South Carolina | | | 6 | | | 1 | | | — | | | 5 | | | 1 | | | — | |

South Dakota | | | 1 | | | — | | | — | | | 1 | | | — | | | — | |

Tennessee | | | 8 | | | 1 | | | — | | | 7 | | | 1 | | | — | |

Texas | | | 28 | | | 2 | | | 2 | | | 25 | | | 1 | | | 2 | |

Utah | | | 2 | | | — | | | — | | | 2 | | | — | | | — | |

Vermont | | | 1 | | | 1 | | | — | | | 1 | | | 1 | | | — | |

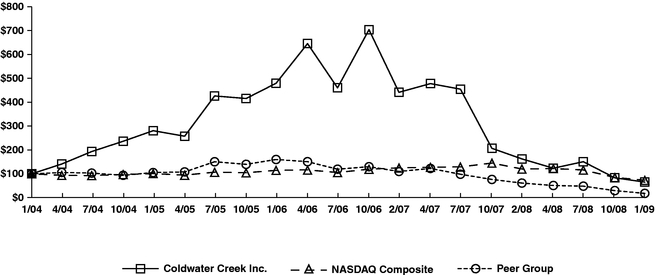

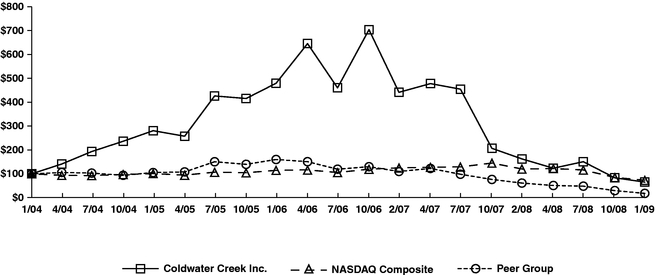

Virginia | | | 7 | | | 2 | | | — | | | 6 | | | 2 | | | — | |