Use these links to rapidly review the document

TABLE OF CONTENTS

Item 8. CONSOLIDATED FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | |

ý |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended January 28, 2012

|

Commission File Number 0-21915

COLDWATER CREEK INC.

(Exact name of registrant as specified in its charter)

| | |

DELAWARE

(State or other jurisdiction of

incorporation or organization) | | 82-0419266

(I.R.S. Employer

Identification No.) |

ONE COLDWATER CREEK DRIVE, SANDPOINT, IDAHO 83864

(Address of principal executive offices)

(208) 263-2266

(Registrant's telephone number)

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

|---|

| Common Stock $0.01 par value | | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES o NO ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ý NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ý NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act (Check one):

| | | | | | |

| Large accelerated filer o | | Accelerated filer ý | | Non-accelerated filer o

(Do not check if a

smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES o NO ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on July 30, 2011, the last business day of the registrant's most recently completed second fiscal quarter, based on the last reported trading price of the registrant's common stock on the NASDAQ was approximately $116,787,636.

There were 121,693,553 shares of the registrant's $0.01 par value common stock outstanding on March 12, 2012.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's proxy statement to be filed with the Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Form are incorporated by reference into Part III of this Form 10-K.

Table of Contents

Coldwater Creek Inc.

Annual Report on Form 10-K

For the Fiscal Year Ended January 28, 2012

Table of Contents

| | | | | | | |

| | PART I | | | | | | |

| | Item 1. | | Business | | | 3 | |

| | Item 1A. | | Risk Factors | | | 8 | |

| | Item 1B. | | Unresolved Staff Comments | | | 17 | |

| | Item 2. | | Properties | | | 17 | |

| | Item 3. | | Legal Proceedings | | | 18 | |

| | Item 4. | | Mine Safety Disclosures | | | 18 | |

| | PART II | | | | | | |

| | Item 5. | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | | 18 | |

| | Item 6. | | Selected Financial Data | | | 19 | |

| | Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | | 21 | |

| | Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | | 36 | |

| | Item 8. | | Financial Statements and Supplementary Data | | | 37 | |

| | Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | | 69 | |

| | Item 9A. | | Controls and Procedures | | | 69 | |

| | Item 9B. | | Other Information | | | 71 | |

| | PART III | | | | | | |

| | Item 10. | | Directors, Executive Officers and Corporate Governance | | | 71 | |

| | Item 11. | | Executive Compensation | | | 71 | |

| | Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | | 71 | |

| | Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | | 71 | |

| | Item 14. | | Principal Accounting Fees and Services | | | 71 | |

| | PART IV | | | | | | |

| | Item 15. | | Exhibits and Financial Statement Schedules | | | 72 | |

"We," "us," "our," "Company" and "Coldwater Creek," unless the context otherwise requires, means Coldwater Creek Inc. and its wholly-owned subsidiaries.

2

Table of Contents

PART I

Item 1. BUSINESS

The following discussion contains various statements regarding our current strategies, financial position, results of operations, cash flows, operating and financial trends and uncertainties, as well as certain forward-looking statements regarding our future expectations. When used in this discussion, words such as "anticipate," "believe," "estimate," "expect," "could," "may," "will," "should," "plan," "predict," "potential," and similar expressions are intended to identify such forward-looking statements. Our forward-looking statements are based on our current expectations and are subject to numerous risks and uncertainties. As such, our actual future results, performance or achievements may differ materially from the results expressed in, or implied by, our forward-looking statements. Refer to our "Risk Factors" in this Annual Report on Form 10-K. We assume no future obligation to update our forward-looking statements or to provide periodic updates or guidance.

General

Coldwater Creek Inc. is a specialty retailer of women's apparel, accessories, jewelry, and gift items. Founded in 1984 as a catalog company, today we are a multi-channel specialty retailer. Our proprietary merchandise assortment reflects a sophisticated yet relaxed and casual lifestyle. A commitment to providing superior customer service is manifest in all aspects of our business. Our mission is to become one of the premier specialty retailers for women 35 years of age and older by offering our customers a compelling merchandise assortment with superior customer service through all of our sales channels.

References to a fiscal year refer to the calendar year in which the fiscal year begins. Our fiscal year ends on the Saturday nearest January 31st. This reporting schedule is followed by many national retail companies and typically results in 13-week fiscal quarters and a 52-week fiscal year, but occasionally will contain an additional week resulting in a 14-week fiscal fourth quarter and a 53-week fiscal year.

Our Multi-Channel Approach

Since the opening of our first premium retail store in November 1999, we have evolved from a direct marketer to a multi-channel specialty retailer. Our merchandise is offered through two distinct operating segments: retail and direct. The retail segment consists of our premium retail stores, outlet stores and day spas. The direct segment consists of sales generated through our e-commerce website and from orders taken from customers over the phone and through the mail. Our catalogs are prominently displayed in each premium retail store to encourage customers to continue shopping with us even after they have left our stores. This multi-channel approach also allows us to cross-promote our brand and provides customers with convenient access to our merchandise, regardless of their preferred shopping method. As part of our commitment to superior customer service, we accept returns virtually at any time and for any reason through any channel regardless of the initial point of purchase.

Information regarding segment performance is included in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations," in this Annual Report on Form 10-K. Additionally, selected financial data for our segments is presented in Note 15,Segment Reporting, to our consolidated financial statements.

Retail Segment

As of January 28, 2012, we operated 363 premium retail stores throughout the United States at an average size of approximately 5,900 square feet per store. We conduct periodic seasonal sales events in our premium retail stores and, beginning in October 2010, we dedicated a full-time sales section within our premium retail stores to clear excess merchandise. Approximately 40 percent of these stores are located in traditional malls, 55 percent in lifestyle centers and 5 percent in street locations. During

3

Table of Contents

fiscal 2011 we opened five new stores and closed 15 stores. Approval of new store locations or changes in existing store leases is conducted upon presentation of a collaborative analysis involving our real estate, business intelligence and finance departments. Our real estate department uses its experience and current market knowledge to identify potential locations based upon an overall market plan. Our business intelligence department then analyzes each location by extracting data and information from our own extensive customer database and combining it with external demographic information. Our finance department analyzes, among other things, a store's historical and projected performance trends such as store earnings and cash flows. This comprehensive analysis includes such information as projected sales, average consumer age and income level, buying habits and the retail location of competitors within the same trade area.

As of January 28, 2012, we operated 38 outlet stores at an average size of approximately 6,800 square feet per store. We use outlets to manage excess merchandise transferred from our premium retail stores and to sell products made solely for this channel.

We also operate ourColdwater Creek ~ The Spa concept in nine locations. These day spas offer a complete menu of spa treatments, including massages, facials, body treatments, manicures and pedicures. In addition to spa treatments, the day spas carry an assortment of relevant apparel as well as lines of personal care products. Our day spas are staffed with experienced professionals in all treatment areas.

Direct Segment

Our direct segment began with the mailing of our first catalog in 1985 and was expanded in 1999 to include our e-commerce business. We use our e-commerce website, www.coldwatercreek.com, to cost-effectively expand our customer base and provide another convenient shopping alternative for customers. The website features the entire full-price merchandise offering found in our catalogs and also serves as an efficient promotional vehicle for the clearance of excess inventory. We continue to take orders from customers over the phone and through the mail using our customer contact center located in Coeur d'Alene, Idaho.

Marketing

Customers are driven to all channels primarily by catalogs, television advertising, e-mail campaigns, online advertising, and loyalty programs. We have an extensive proprietary database of customer information, including customer demographics, purchasing history, and geographic proximity to an existing or planned premium retail store. We believe our ability to effectively design and manage our marketing and promotional programs is enhanced by this source of information, allowing us to adjust the frequency, timing and content of each marketing program to maximize its benefits.

We seek to present a consistent brand image throughout all of our marketing and promotion activities. Our merchandise is offered through one core catalog title:Coldwater Creek. We continue to evaluate our marketing programs to ensure that we are reaching the greatest number of customers in the most effective and efficient manner possible. We also use national magazine advertising and postcards targeting specific markets to drive traffic while promoting overall brand awareness. In addition, we participate in cost-per-click search and revenue share-based affiliate programs whereby numerous popular Internet search engines and consumer websites provide direct access to our website.

We offer customer loyalty programs such asonecreek and our co-branded credit card program. Theonecreek program benefits include sneak peeks at upcoming trends and new merchandise,onecreek customer service specialists, exclusiveonecreek savings and promotions, free shipping on returns, and a special birthday gift. The co-branded credit card program is operated through a third party. Customers who participate in our credit card reward program earn points on purchases made with the credit card at Coldwater Creek and at other businesses where the card is accepted. Cardholders who accumulate

4

Table of Contents

the requisite number of points are issued a coupon that is valid towards the purchase of our merchandise. In addition to earning points, all participants in the co-branded credit card program receive exclusive offers throughout the year. These offers have included special discounts, invitations to our shopping events, and periodic opportunities to earn double and triple points.

Merchandise Design and Procurement

We design and develop the majority of our apparel either in-house or through collaboration with independent designers. To ensure our designers stay abreast of trends in styles and fabrics, we operate a design center in New York City. Our New York design team merges the latest fashion trends with our customers' preferences to build an overall vision that guides the design and development of our seasonal merchandise assortment.

Our product development team translates the overall vision for each season into various product designs, fabrics and prints, indicating the construction and exact specifications for each item. Our team seeks inspiration from their extensive travels, fashion shows, and our direct sourcing team, which provides new fabrics and novelty prints along with product samples from various manufacturers. Our direct sourcing team assists in identifying the appropriate manufacturers to supply each item and in negotiating price and delivery terms.

Once our merchandise assortment is selected, our inventory planning team determines the quantities of each item to purchase in order to meet anticipated demand. This determination is made through the analysis of information such as historical sales, planned merchandise presentation, scheduled store openings, and sales and margin projections. This process culminates in the issuance of various purchase orders. Coordinating with the direct sourcing department, quality assurance and quality compliance personnel monitor the production process to verify the merchandise is produced to exact specifications and within the designated timeline.

We alter the composition, magnitude and timing of merchandise offerings based upon an understanding of prevailing consumer demand, preferences and trends. The timing of merchandise offerings may be further impacted by, among other factors, the performance of various third parties on which we are dependent. Additionally, the net sales we realize from a particular merchandise offering may impact more than one fiscal quarter and year and the amount and pattern of the sales realization may differ from that realized by a similar merchandise offering in a prior fiscal quarter or year. We continually review inventory to identify excess and slow moving merchandise and clear this merchandise through markdown and other promotional offerings. We also dispose of excess and slow moving inventory internally through our full-time sales section within our premium retail stores, outlets and website, and we have on occasion used a third party liquidator.

Our apparel is purchased through both domestic importers who procure the merchandise on our behalf and international manufacturers through our direct sourcing program. During fiscal 2011, we had approximately 240 active vendors and our largest individual vendor represented less than 10 percent of our merchandise purchases. We have sourcing offices in Hong Kong and India to assist with product development and production management, as well as monitoring compliance with our code of conduct and monitoring program.

For fiscal 2011, we were the importer of record for approximately 65 percent of our total units of apparel purchased. We believe direct sourcing provides us with more control over the production, quality and transportation logistics of our apparel and results in faster speed to market and lower merchandise costs. Domestic importers will remain, however, a crucial component of our overall sourcing strategy, providing unique industry and marketplace knowledge along with product design and development capabilities.

5

Table of Contents

We are committed to sourcing our products in a responsible manner, respecting both the countries in which we have a business presence and the business partners that manufacture our products. We have a code of conduct and monitoring program that applies to all factories contracted in the production of merchandise for Coldwater Creek. Within this code, we recognize that local customs and laws vary from one region of the world to another; however, we strongly believe the issues of business ethics, human rights, health, safety and environmental stewardship transcend geographical boundaries. The intention of this code is to communicate our expectations to each of our business partners.

Distribution Center

We lease a 960,000 square-foot distribution center in Mineral Wells, West Virginia, which fulfills merchandise needs for our retail locations and merchandise sold through our direct channel. We believe that our distribution facility is adequate to provide the capacity required for the foreseeable future.

Seasonality

Our quarterly results and cash flows can fluctuate significantly depending on a number of factors including the particular seasonal fashion lines and customer response to our merchandise offerings, shifts in the timing of certain holidays, including Valentine's Day, Easter, Mother's Day, Thanksgiving and Christmas, and weather related influences.

Competition

The women's retail apparel market is highly competitive. Competitors range from specialty apparel retail companies such as Chico's FAS, Inc. ("Chico's"), The Talbots, Inc. ("Talbots"), Christopher & Banks Corporation ("Christopher & Banks") and ANN INC., to small single channel catalog, e-commerce and retail store companies. We also compete with national department store chains such as Macy's, Inc., Nordstrom, Inc., Dillard's, Inc. and J.C. Penney Company, Inc., along with discount retailers that offer women's apparel and accessories, such as Kohl's Corporation and Target Corporation.

We believe that we compete principally on the basis of our high-quality, distinctive merchandise selection and exceptional customer service. We also believe that an integrated, multi-channel sales strategy enhances our ability to compete in the marketplace by providing convenient access to our merchandise, regardless of our customers' preferred shopping method.

Employees

As of January 28, 2012, we had approximately 2,600 full-time employees and 4,300 part-time employees. During our peak selling season, which includes the months of November and December, we utilize a substantial number of temporary employees. None of our employees are covered by collective bargaining agreements.

Trademarks

Our registered trademarks include Coldwater Creek®, Coldwater Creek The Spa® and the stylized Coldwater Creek logo. We believe that our registered and common law trademarks have significant value and are instrumental to our ability to market and sustain demand for our merchandise and brand.

Available Information

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and therefore file periodic reports and other information with the Securities and

6

Table of Contents

Exchange Commission ("SEC"). These reports may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Washington, D.C. 20549, or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet website at www.sec.gov that contains reports, proxy information statements and other information regarding issuers that file electronically.

Our filings under the Exchange Act, including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to these reports, are also available free of charge on the investor relations portion of our website at www.coldwatercreek.com. These reports are available as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. The reference to our website address does not constitute incorporation by reference of the information contained on the website, and the information contained on the website is not part of this document.

Executive Officers of the Registrant

The table below sets forth the name, age and position of our executive officers as of March 12, 2012:

| | | | | |

Name | | Age | | Positions Held |

|---|

Dennis C. Pence | | | 62 | | Chairman of the Board of Directors, President and Chief Executive Officer |

Jill Brown Dean | | | 55 | | President, Chief Merchandising Officer |

Jerome Jessup | | | 51 | | President, Chief Creative Officer |

James A. Bell | | | 44 | | Executive Vice President, Chief Operating Officer and Chief Financial Officer |

John E. Hayes III | | | 49 | | Senior Vice President, Human Resources and General Counsel |

Mark A. Haley | | | 44 | | Vice President, Chief Accounting Officer |

Executive Officers

Dennis C. Pence co-founded Coldwater Creek in 1984 and has served as a Director since our incorporation in 1988, serving as the Board of Director's Chairman since July 1999 and as its Vice-Chairman prior to that. Mr. Pence has served as our Chief Executive Officer since September 2009, and previously from September 2002 through October 2007 and from 1984 through December 2000. Mr. Pence has also served as our President since September 2009 and from 1984 through 2000. From June 2002 to September 2002, he provided us with his executive management services. From January 2002 to June 2002, Mr. Pence served as our interim Chief Financial Officer and Treasurer. From January 2001 to January 2002, Mr. Pence was semi-retired. Mr. Pence has also served as Chairman of the Board of Director's Executive Committee since its formation in May 2000, a member of the Succession Planning and Management Development committee since November 2007, and as Secretary from July 1998 to February 2009. From April 1999 to December 2000, he was also the President of our Internet Commerce Division. Prior to co-founding Coldwater Creek, Mr. Pence was employed by Sony Corp. of America, a subsidiary of Sony Corporation, a publicly held manufacturer of audio, video, communication, and information technology products, from 1975 to 1983, where his final position was National Marketing Manager—Consumer Video Products.

Jill Brown Dean has served as President and Chief Merchandising Officer since February 2011. Prior to joining Coldwater Creek, Ms. Dean served as President of the Limited Too division of Tween Brands from October 2006 to April 2008. Prior to that, Ms. Dean spent 18 years with Limited Brands, serving as Executive Vice President, General Manager for Victoria's Secret flagship stores from July 2003 to October 2006, as well as President and Chief Executive Officer of Lane Bryant from June 1994 to October 2001. Ms. Dean began her career at Limited Brands in merchandising for the Express division.

7

Table of Contents

Jerome Jessup has served as President and Chief Creative Officer since February 2011, having joined the Company in August 2009 as Executive Vice President, Creative Director. Prior to joining Coldwater Creek, Mr. Jessup ran his own fashion collection and consulting practice for four years. Prior to that, he was the Senior Executive Vice President of Design and Merchandising for ANN INC. Mr. Jessup also spent ten years with The Gap, Inc. ("The Gap"), leading the design and product development functions for Banana Republic, as well as for The Gap, GapKids, babyGap and GapBody divisions.

James A. Bell was appointed Executive Vice President and Chief Operating Officer in January 2012 and continues to serve as Chief Financial Officer. Upon joining the Company, Mr. Bell served as Divisional Vice President of Financial Planning from September 2009 until December 2009. From December 2009 to April 2010, Mr. Bell served as Vice President of Financial Planning. From April 2010 to January 2012, Mr. Bell served as Senior Vice President and Chief Financial Officer. Prior to joining Coldwater Creek, Mr. Bell served from April 2007 to June 2009 as Senior Vice President, Finance and Planning for Harry and David Holdings, Inc. From October 2002 to April 2007, Mr. Bell was Senior Director, Finance at The Gap. Prior to his role at The Gap, Mr. Bell served in various senior finance roles at SmartPipes, Inc., a software company, and in Piper Jaffray's Investment Banking group. Prior to his role at Piper Jaffray, Mr. Bell served in the U.S. Navy for nine years on active duty as a Naval Flight Officer.

John E. Hayes III has served as Senior Vice President, Human Resources and General Counsel since April 2010, having joined the Company in February 2009 as Senior Vice President, General Counsel. In addition, Mr. Hayes served as the Company's interim Chief Financial Officer from November 2009 to April 2010. Prior to joining Coldwater Creek, Mr. Hayes was engaged for 17 years in private law practice, most recently as a partner with Hogan & Hartson, LLP, from March 2003 to February 2009. While in private practice, Mr. Hayes served as our outside corporate and securities law counsel from 1999 until joining us. Prior to his legal career, Mr. Hayes practiced as an accountant with KPMG LLP.

Mark A. Haley has served as Vice President and Chief Accounting Officer since October 2011. Upon joining the Company, Mr. Haley served as Vice President and Controller from September 2010 until October 2011. Prior to joining the Company, Mr. Haley served from December 2007 to September 2010 as Senior Director of Financial Reporting for SUPERVALU Inc. From July 1991 through December 2007, Mr. Haley was with Deloitte & Touche LLP, where he served in various roles, including Director, Assurance Services beginning in September 2006.

Item 1A. RISK FACTORS

In addition to the other information set forth in this report, you should carefully consider the following risk factors which could materially affect our business, financial condition or future results of operations. The risks described below are not the only risks we face. Additional risks and uncertainties not currently known or deemed immaterial may also adversely affect our business, financial condition, or future results of operations.

We must successfully gauge fashion trends and changing consumer preferences or our sales and results of operations will be adversely affected.

Forecasting consumer demand for our merchandise is difficult given the nature of changing fashion trends and consumer preferences. The specialty retail business fluctuates according to changes in consumer preferences dictated, in part, by fashion and season. In addition, our merchandise assortment differs in each seasonal flow and at any given time our assortment may not resonate with our customers. On average, we begin the design process for apparel nine to ten months before merchandise is available to consumers, and we typically begin to make purchase commitments four to eight months in advance. These lead times make it difficult for us to respond quickly to changes in demand for our products. To the extent we misjudge the market for our merchandise or the products suitable for local

8

Table of Contents

markets, our sales will be adversely affected and the markdowns required to move the resulting excess inventory will adversely affect our results of operations.

We continue to update our style orientation and reinvigorate our brand, which includes improving the balance of our assortment to address more aspects of our customers' lifestyle and rebuilding our underperforming categories. If these changes do not resonate with our customers, our sales, gross margins and results of operations will be adversely affected.

Our inventory levels and merchandise assortments fluctuate seasonally, and at certain times of the year, such as during the holiday season, we maintain higher inventory levels and are particularly susceptible to risks related to demand for our merchandise. If the demand for our merchandise were to be lower than expected, causing us to hold excess inventory, we could be forced to further discount merchandise, which reduces our gross margins and negatively impacts results of operations and operating cash flows. If we were to carry low levels of inventory and demand is stronger than we anticipate, we may not be able to reorder merchandise on a timely basis to meet demand, which may adversely affect sales and customer satisfaction.

We may be unable to improve the value of our brand and our failure to do so may adversely affect our business.

Our success is driven by the value of theColdwater Creek brand. We are implementing a comprehensive marketing campaign, which includes television, national magazine advertising, and online media initiatives, to restore Coldwater Creek's brand value and to increase traffic to all channels. This campaign is designed to increase brand engagement and brand trial with a focus on expanding the reach to a broader segment of our target demographic. The value of our brand is largely dependent on the success of our design, merchandise assortment, and marketing efforts and our ability to provide a consistent, high quality customer experience. If we are not able to improve our brand perception, we may not fully realize the benefits of any improvements to our merchandise assortment and customer experience. If we are not able to improve the value of our brand, our business and results of operations may be adversely affected.

Continued material operating losses may require that we obtain additional financing from the capital markets to execute our business plan.

We believe we have sufficient cash and liquidity, including our revolving line of credit that we may continue to draw on from time to time, to fund our operations through the next 12 months. However, we have had recurring operating losses and if our future operating performance is below our expectations, or our revolving line of credit is not fully available to us, our cash and liquidity could be adversely impacted. Constraints on liquidity make us vulnerable to further downturns in our business or the general economy and a shortfall would have serious consequences for our business, such as forcing us to curtail our operations. Additionally, lack of capital could restrict our ability to react to changes in our business or to take advantage of opportunities as they arise, including opportunities designed to accelerate our turnaround. For these reasons we may access the capital markets for additional debt or equity financing. If we borrow additional amounts under our revolving line of credit or incur other debt, our interest expense will increase and we may be subject to additional covenants that could restrict our operations. The sale of additional equity securities or convertible debt securities could result in significant dilution to our current stockholders, particularly given our low stock price in recent periods. Newly issued securities may have rights, preferences and privileges that are senior or otherwise superior to those of our common stock. There is no assurance that debt or equity financing will be available in amounts or on terms acceptable to us.

9

Table of Contents

Our revolving line of credit contains borrowing base and other provisions that may restrict our ability to access it, which could impact our ability to access capital when needed.

Historically, we have relied on our cash resources and cash flows from operations to fund our operations. We have also used our revolving line of credit to secure trade letters of credit and from time to time for borrowings, both of which reduce the amount available for borrowing. The actual amount of credit that is available from time to time under our revolving line of credit fluctuates greatly and is limited to a borrowing base amount that is determined according to, among other things, a percentage of the value of eligible inventory plus a percentage of the value of eligible credit card receivables, as reduced by certain reserve amounts that may be determined at the discretion of the lender. Consequently, it is possible that, should we need to access any additional funds from our revolving line of credit, the amount needed may not be available in full. Additionally, our revolving line of credit contains covenants related to capital expenditure levels and minimum inventory book value, and other customary matters. Our failure to comply with the covenants, terms and conditions could cause the revolving line of credit not to be available to us. As of January 28, 2012, the revolving line of credit was limited to a borrowing base of $68.8 million and we had $21.9 million in letters of credit issued and $15.0 million borrowed on our revolving line of credit, resulting in $31.9 million available for borrowing under our revolving line of credit.

We may be unable to successfully realize the benefits of our store optimization program.

We continue to believe that retail expansion will be a key driver for our long term growth. However, due to our business performance and our focus on improving financial results, we are executing a store optimization program based on an ongoing review of the performance of our premium stores. As a result, we closed 15 premium stores in fiscal 2011 and expect to close approximately 20 to 30 additional underperforming stores prior to the end of fiscal 2013. The optimization program will be achieved through a staged approach based primarily on natural lease expirations and early termination rights. In total, when the program is completed, we expect these actions to generate approximately $15 to $20 million in annualized expense reductions and approximately $8 to $12 million in annualized improvement in pretax operating results. However, there can be no assurance that the store optimization program will realize the expected benefits and we may incur delays and unexpected costs in its execution. Any miscalculations or shortcomings we may make in the planning and implementation of the store optimization program may adversely affect our financial position, results of operations and cash flows.

Economic conditions have impacted consumer spending and may adversely affect our financial position and results of operations.

Consumer spending patterns are highly sensitive to the economic climate and consumer spending continues to be impacted by the high levels of unemployment, foreclosures and declines in home values, stock market volatility, restrictions on the availability of credit, volatile energy and food costs, and other negative economic conditions, nationally and regionally. We continue to be affected by challenging macroeconomic conditions which are evidenced in our business by a highly competitive retail selling environment and low retail store traffic. We believe these conditions will continue for the foreseeable future. If consumer spending on apparel and accessories continues to decline and demand for our products decreases further, we may be forced to further discount our merchandise or sell it at a loss, which would adversely affect our results of operations. In addition, higher costs for transportation, raw materials, labor, insurance and healthcare, and other negative economic factors may adversely affect our results of operations.

10

Table of Contents

We have incurred substantial financial commitments and fixed costs related to our retail stores that we will not be able to recover if our stores are not successful.

The success of an individual store location is dependent on the success of the lifestyle center, shopping mall or outlet center where the store is located, and may be influenced by changing customer demographic and consumer spending patterns. These factors cannot be predicted with accuracy. Because we enter into long-term financial commitments when leasing retail store locations and incur substantial fixed costs for each store's design, leasehold improvements, fixtures and management information systems, it would be costly for us to close a store that does not prove successful.

The testing of our retail stores' long-lived assets for impairment requires us to make significant estimates about our future performance and cash flows that are inherently uncertain. These estimates can be affected by numerous factors, including changes in economic conditions, our results of operations, and competitive conditions in the industry. These factors, along with fluctuations and changes from estimates in sales, gross margins, operating cash flows and earnings, may affect the timing and the fair value estimates used in our testing of long-lived assets, which may result in impairment charges.

We are subject to potentially adverse outcomes in litigation matters, which could adversely affect our business.

We are, from time to time, involved in various legal proceedings incidental to the conduct of our business. Actions which may be filed against us include commercial, intellectual property infringement, customer and employment claims, including class action lawsuits alleging that we have violated federal and state wage and hour and other laws. These issues arise primarily in the ordinary course of business but could raise complex factual and legal issues, which are subject to multiple risks and uncertainties and could require significant management time and costs to defend. We believe that our current litigation issues will not have a material adverse effect on our results of operations or financial condition. However, our assessment of current litigation could change in light of the discovery of facts not presently known to us with respect to pending legal actions, or adverse determinations by judges, juries or other finders of fact. Moreover, additional litigation that is not currently pending may adversely affect our results of operations or financial condition.

Our results of operations fluctuate and may be negatively impacted by seasonal influences, particularly during the holiday season.

Our net sales, results of operations, liquidity and cash flows have fluctuated, and will continue to fluctuate, on a quarterly basis, as well as on an annual basis, as a result of a number of factors, including, but not limited to, the following:

- •

- the composition, size and timing of various merchandise offerings;

- •

- the timing and number of premium retail store openings and closings;

- •

- the timing and number of promotions;

- •

- the timing and number of catalog mailings;

- •

- the ability to accurately estimate and accrue for merchandise returns and the costs of inventory disposition;

- •

- the timing of merchandise shipping and receiving, including any delays resulting from labor strikes or slowdowns, adverse weather conditions, health epidemics or national security measures; and

11

Table of Contents

- •

- shifts in the timing of important holiday selling seasons relative to our fiscal quarters, including Valentine's Day, Easter, Mother's Day, Thanksgiving and Christmas, and the day of the week on which certain important holidays fall.

Our results continue to depend materially on sales and profits from the November and December holiday shopping season. In anticipation of traditionally increased holiday sales activity, we incur certain significant incremental expenses, including the hiring of a substantial number of temporary employees to supplement the existing workforce. If, for any reason, we were to realize lower-than-expected sales or profits during the November and December holiday selling season, our financial condition, results of operations, including related gross margins, and cash flows for the entire fiscal year may be adversely affected.

We may be unable to manage the complexities of our multi-channel business model, which could adversely affect our results of operations.

The complexity of our multi-channel business model requires a level of expertise to successfully manage operations. As we continue to tightly control expenses, we may experience an increase in demands on our managerial, operational and administrative resources, as well as our control environment. If we do not manage these demands, we may not realize the full benefits of our multi-channel business model, which may adversely affect our results of operations.

We are subject to significant risks associated with our management information systems, which, if not working properly, could adversely affect our results of operations.

We have a number of complex management information systems that are critical to our operations, including systems such as accounting, human resources, inventory purchasing and management, financial planning, direct segment order processing, and retail segment point-of-sale systems. Installing new systems or maintaining and upgrading existing systems carries substantial risk, including potential loss of data or information, cost overruns, implementation delays, disruption of operations, lower customer satisfaction resulting in lost customers, inability to deliver merchandise to our stores or our customers and our potential inability to meet SEC reporting requirements, any of which would harm our business and may adversely affect our results of operations.

Compromises of our data security could adversely affect our results of operations.

In the ordinary course of our business, we collect and store certain personal information from our customers, employees and vendors, and we process customer payments using payment information. In addition, business is primarily conducted over the Internet for our direct segment. In order to reduce our vulnerability to computer viruses, physical and electronic break-ins, and similar disruptions, we have taken steps designed to secure our computer systems, which include network firewalls, two-factor authentication and access technology, encryption, and intrusion detection and prevention devices to provide security for processing, transmission and storage of confidential information. Nevertheless, there can be no assurance that we will not suffer a data compromise. Attempts to penetrate our computer system could result in misappropriation of personal information, payment information or confidential business information. In addition, an employee, contractor or other third party with whom we do business may attempt to circumvent our security measures in order to obtain such information, and may purposefully or inadvertently cause a breach involving such information. We may not have the resources or technical sophistication to anticipate or prevent rapidly evolving types of cyber attacks. Risks of attacks may cause us to incur increasing costs, including costs to deploy additional personnel and protection technologies, train employees, and engage third party specialists. Any compromise of our data security and loss of personal or business information could disrupt our operations, damage our reputation and customer confidence, and subject us to additional costs and liabilities, which could adversely affect our business and results of operations.

12

Table of Contents

We are required to maintain compliance with Payment Card Industry Data Security Standards ("PCI Standards"), which are common standards for protecting cardholder data. As part of an overall security program and to meet PCI Standards, we undergo frequent external vulnerability scans and we are reviewed by a third party security assessor. As PCI Standards change, we may be required to implement additional security measures. Failure to maintain compliance could violate agreements with major credit card companies and result in significant fines or a loss of credit processing capabilities.

We depend on key vendors for timely and effective sourcing and delivery of our merchandise. If these vendors are unable to timely fill orders or meet quality standards, we may lose customer sales and our reputation may suffer.

We may experience difficulties in obtaining sufficient manufacturing capacity from our vendors. We generally maintain non-exclusive relationships with multiple vendors that manufacture our merchandise. However, we have no contractual assurances of continued supply, pricing or access to new products, and any vendor could discontinue selling to us at any time. Moreover, a key vendor may not be able to supply our inventory needs due to capacity constraints, financial instability, or other factors beyond our control, or we could decide to stop using a vendor due to quality or other issues. If we were required to change vendors or if a key vendor were unable to supply desired merchandise in sufficient quantities on acceptable terms, particularly in light of current global economic conditions, we could experience delays in filling customer orders or delivering inventory to stores until alternative supply arrangements are secured. These delays could result in lost sales and a decline in customer satisfaction. The inability of key vendors to access credit and liquidity, or the insolvency of key vendors, could lead to their failure to deliver our merchandise, which could result in lost sales and lower customer satisfaction. It is also possible that the inability of our vendors to access credit or concerns vendors or their lenders may have with our creditworthiness may cause them to extend less favorable terms to us, which could adversely affect our cash flows, margins and financial condition, as well as limit the availability under our revolving line of credit. Additionally, delays by our vendors in supplying our inventory needs could cause us to incur more expensive air freight charges, which may adversely affect our margins.

Our reliance on foreign vendors subjects us to uncertainties that could impact our costs to source merchandise, delay or prevent merchandise shipments, which could adversely affect our business.

We continue to source apparel directly from foreign vendors, particularly those located in Asia, India and Central America. We were the importer of record for approximately 65 percent of the total apparel units purchased during fiscal 2011. Irrespective of our direct sourcing from foreign vendors, substantially all of our merchandise, including that which we buy from domestic vendors, is manufactured overseas. This exposes us to risks and uncertainties which could substantially impact our ability to realize any perceived cost savings. These risks include, among other things:

- •

- burdens associated with doing business overseas, including the imposition of, or increases in, tariffs or import duties, or import/export controls or regulations, as well as credit assurances we are required to provide to foreign vendors;

- •

- declines in the relative value of the U.S. dollar to foreign currencies;

- •

- volatile labor, fuel, energy and raw material costs, such as recent increases in the cost of cotton;

- •

- failure of vendors to adhere to our quality assurance standards, code of conduct and other environmental, labor, health, and safety standards for the benefit of workers;

- •

- financial instability of a vendor or vendors, including their potential inability to obtain credit to manufacture the merchandise they produce for us;

- •

- the potential inability of our vendors to meet our production needs due to raw material or labor shortages;

13

Table of Contents

- •

- changing, uncertain or negative economic conditions, political uncertainties or unrest, or epidemics or other health or weather-related events in foreign countries resulting in the disruption of trade from exporting countries; and

- •

- restrictions on the transfer of funds or transportation delays or interruptions.

We face substantial competition from other retailers in the women's apparel industry and if we are unable to compete effectively, our business could be adversely affected.

We face substantial competition from other specialty retailers in the women's apparel industry and our net sales may decline or grow more slowly if we are unable to differentiate our merchandise and shopping experience from those of other retailers. In addition, the retail apparel industry has experienced significant price deflation over the past several years largely due to the downward pressure on retail prices caused by discount retailers and, more recently, by declining consumer spending, resulting in increased promotional and competitive activity. This competitive environment may make it more difficult to pass on product cost increases to our customers and to compete with retailers that have greater purchasing power, which may result in lower gross margins.

We may be unable to efficiently fill customer orders in our direct segment, which could adversely affect customer satisfaction, our reputation and our business.

If we are unable to efficiently process and fill customer orders, customers may cancel or refuse to accept orders, and customer satisfaction could be harmed. We are subject to, among other things:

- •

- failures in the efficient and uninterrupted operation of our customer contact center or our distribution center, including system failures caused by telecommunications systems providers, order volumes that exceed our present telephone or Internet system capabilities, computer viruses, electrical outages, mechanical problems, and human error;

- •

- delays or failures in the performance of third parties, such as vendors who supply our merchandise, shipping companies and the U.S. postal and customs services, including delays associated with labor strikes or slowdowns, adverse weather conditions, or health epidemics; and

- •

- disruptions or slowdowns in our order processing or fulfillment systems resulting from increased security measures implemented by U.S. customs or from homeland security measures, fire, natural disasters or comparable events.

We have a liberal merchandise return policy and if we experience a greater number of returns than anticipated, our results of operations could be adversely affected.

As part of our commitment to superior customer service, we accept returns virtually at any time and for any reason through any channel regardless of initial point of purchase. We make allowances in our financial statements for anticipated merchandise returns based on historical return rates and future expectations. These allowances may be exceeded, however, by actual merchandise returns as a result of many factors, including changes in the merchandise mix, size and fit, actual or perceived quality, differences between the actual product and its presentation in catalogs or on the website, timeliness of delivery, competitive offerings and consumer preferences or confidence. Any significant increase in merchandise returns that exceed our estimates would result in adjustments to revenue and to cost of sales and may adversely affect our financial condition, results of operations and cash flows.

We may be unable to manage significant increases in the costs associated with our catalog business, which could adversely impact our business.

We incur substantial costs associated with catalog mailings, including paper, postage, merchandise acquisition and human resource costs associated with catalog layout and design, production and

14

Table of Contents

circulation and increased inventories. Significant increases in U.S. Postal Service rates and the cost of telecommunications services, paper and catalog production could significantly increase catalog production costs and result in lower profits for the catalog business. Most of our catalog-related costs are incurred prior to mailing, and as such we are not able to adjust the costs of a particular catalog mailing to reflect the actual subsequent performance of the catalog. Moreover, customer response rates have been volatile in recent years, particularly for mailings to prospective customers. Any performance shortcomings experienced by the catalog business may adversely affect our overall business, financial condition, results of operations and cash flows.

Our success is dependent upon key personnel and our ability to attract and retain qualified employees.

Our future success depends largely on the contributions and abilities of key executives and other employees. The loss of any of our key employees may adversely affect our business. Furthermore, the current economic conditions or the location of our corporate headquarters in Sandpoint, Idaho, may make it more difficult or costly to attract qualified employees for key positions.

Our multi-channel business model may expose us to assessments for unpaid taxes, penalties and interest, which could be substantial.

Our multi-channel business model subjects us to taxes in numerous jurisdictions, including state and local income, franchise, payroll, and sales and use tax. We collect and remit these taxes in any jurisdiction in which we have a physical presence. While we believe we have appropriately paid or accrued for all taxes based on our interpretation of applicable law, tax laws are complex and interpretations differ from state to state. In the past, some taxing jurisdictions have assessed additional taxes and penalties on us, asserting either an error in our calculation or an interpretation of the law that differed from our own. It is possible that taxing authorities may make additional assessments in the future. In addition to taxes, penalties and interest, these assessments could cause us to incur legal fees associated with resolving disputes with taxing authorities.

Additionally, changes in state and local tax laws, such as temporary changes associated with "tax holidays" and other programs, require us to make continual changes to our collection and reporting systems that may relate to only one taxing jurisdiction. If we fail to update our collection and reporting systems in response to these changes, any over collection or under collection of taxes could subject us to interest and penalties, as well as private lawsuits and damage to our reputation.

The day spa concept may not be successful and may be abandoned at any time, which could adversely affect our operating results.

We operate theColdwater Creek ~ The Spa concept in nine locations. To date, our day spas have had a negative impact on our earnings, as we experiment with marketing approaches and gather data regarding the spa business and, in particular, our spa customer. We have no plans to build additional day spas. There is no assurance that the day spa concept will ever be successful.

If we were to abandon the day spa concept, we would be required to write off any remaining net capitalized costs and may incur lease termination costs, which may adversely affect results of operations. Additionally, we may incur impairment charges related to our day spas if there were a continued deterioration in the spas' results of operations.

If we are unable to protect our trademarks from infringement, our business may be adversely affected.

Our registered trademarks, which include Coldwater Creek® and the stylized Coldwater Creek logo, are important to our success. Even though we register and protect our trademarks and other intellectual property rights, there is no assurance that our actions will protect us from others infringing upon our trademarks and proprietary rights or seeking to block sales of our products as infringements of their

15

Table of Contents

trademarks and proprietary rights. If we cannot adequately protect our trademarks or prevent infringement of them, our business and results of operations may be adversely affected.

Because the majority of our cash and cash equivalents are concentrated with one financial institution, we may experience losses on our deposits.

We maintain the majority of our cash and cash equivalents with one major financial institution in the United States, in the form of demand deposits, money market accounts and other short-term investments. Deposits in this institution may exceed the amounts of insurance provided on such deposits. With the current financial environment and the instability of financial institutions, we cannot be assured that we will not experience losses on our deposits.

Our stock price has fluctuated and may continue to fluctuate widely.

The market price for our common stock has fluctuated and will continue to be significantly affected by, among other factors, quarterly operating results, changes in any earnings estimates publicly announced by us or by analysts, customer response to merchandise offerings, and timing of retail store openings and closings. In addition, stock markets generally have experienced a high level of price and volume volatility and market prices for the stock of many companies, including ours, have experienced wide price fluctuations not necessarily related to their operating performance. The reported high and low closing prices of our common stock during fiscal 2011 were $3.07 per share and $0.82 per share, respectively. The current price of our common stock may not be indicative of future market prices. The fluctuation of the market price of our common stock may have a negative impact on our liquidity and access to capital. In addition, price volatility of our common stock may expose us to stockholder litigation which may adversely affect our financial condition, results of operations and cash flows.

We may not be able to maintain our listing on the NASDAQ, which may limit the ability of our stockholders to sell shares of our common stock.

Our common stock is currently listed on the NASDAQ Global Select Market and we are required to meet specified financial requirements to maintain this listing, one of which is that we maintain a minimum closing price of at least $1.00 per share for our common stock. Our common stock has recently traded below $1.00 per share. If we fail to maintain the $1.00 minimum closing price for 30 consecutive business days, we may be at risk of delisting. We cannot be assured that we can maintain or would be successful in regaining compliance with the minimum price requirements in the future. Delisting, or even the issuance of a notice of potential delisting, could have a material adverse effect on the price of our shares and our ability to issue additional securities or secure financing. In the event of delisting, trading of our common stock would most likely be conducted in the over the counter market on an electronic bulletin board established for unlisted securities, which would adversely affect the market liquidity of our common stock, security analysts' coverage of us could be reduced and customer, investor, supplier and employee confidence may be diminished.

Our largest stockholders may exert influence over our business regardless of the opposition of other stockholders or the desire of other stockholders to pursue an alternate course of action.

Dennis Pence, our Chairman of the Board of Directors, CEO and co-founder, beneficially owns, directly and indirectly, 18.6% of our outstanding common stock. Ann Pence, our co-founder, beneficially owns, directly and indirectly, 14.9% of our outstanding common stock. Either Dennis Pence or Ann Pence acting independently would have significant influence over, and should they act together, could effectively control the outcome of, any matters submitted to stockholders, including the election of directors and approval of business combinations, and could delay, deter or prevent a change of control of the Company, which may adversely affect the market price of our common stock. The interests of these stockholders may not always coincide with the interests of other stockholders.

16

Table of Contents

Provisions in our charter documents and Delaware law may inhibit a takeover and discourage, delay or prevent stockholders from replacing or removing current directors or management.

Provisions in our Certificate of Incorporation and Bylaws may have the effect of delaying or preventing a merger with or acquisition of us, even where the stockholders may consider it to be favorable. These provisions could also prevent or hinder an attempt by stockholders to replace current directors and include:

- •

- providing for a classified Board of Directors with staggered, three-year terms;

- •

- prohibiting cumulative voting in the election of directors;

- •

- authorizing the Board of Directors to designate and issue "blank check" preferred stock;

- •

- limiting persons who can call special meetings of the Board of Directors or stockholders;

- •

- prohibiting stockholder action by written consent; and

- •

- establishing advance notice requirements for nominations for election to the Board of Directors or for proposing matters that can be acted on by stockholders at a stockholders meeting.

Because the Board of Directors appoints management, any inability to effect a change in the Board of Directors may also result in the entrenchment of management.

We are also subject to Section 203 of the Delaware General Corporation Law, which, subject to exceptions, prohibits a Delaware corporation from engaging in any business combination with an interested stockholder for a period of three years following the date that the stockholder became an interested stockholder. The preceding provisions of our Certificate of Incorporation and Bylaws, as well as Section 203 of the Delaware General Corporation Law, could discourage potential acquisition proposals, delay or prevent a change of control and prevent changes in our management.

Item 1B. UNRESOLVED STAFF COMMENTS

None.

Item 2. PROPERTIES

The general location, use and approximate size of our principal properties as of January 28, 2012 are as follows:

| | | | | | | | |

Facility | | Address | | Owned/

Leased | | Approximate Size | |

|---|

Corporate Offices(a) | | Sandpoint, Idaho | | Owned | | | 250,000 sq. ft. | |

Distribution Center | | Mineral Wells, West Virginia | | Leased | | | 960,000 sq. ft. | |

Customer Contact Center | | Coeur d'Alene, Idaho | | Leased | | | 69,000 sq. ft. | |

Foreign Sourcing Offices | | Hong Kong and Delhi, India | | Leased | | | 17,000 sq. ft. | |

New York Design Studio | | New York City, New York | | Leased | | | 20,000 sq. ft. | |

363 Premium Retail Stores(b) | | Various U.S. locations | | Leased | | | 2,165,000 sq. ft. | |

38 Outlet Stores(c) | | Various U.S. locations | | Leased | | | 259,000 sq. ft. | |

9 Day Spas(d) | | Various U.S. locations | | Leased | | | 49,000 sq. ft. | |

- (a)

- Our corporate offices include approximately 156,000 square feet of administrative office space and approximately 94,000 square feet occupied by our employee fitness center, spa, virtual retail stores, photo studio, and employee training center.

17

Table of Contents

- (b)

- Our premium retail stores average approximately 5,900 square feet in size per store. The base term of our premium retail store leases is generally ten years. Store count includes 362 premium retail stores and one flagship store located in Manhattan, New York.

- (c)

- Our outlet stores average approximately 6,800 square feet in size per store. The base term of our outlet store leases is generally five years.

- (d)

- Our day spas average approximately 5,400 square feet in size per spa. The base term of our day spa leases is generally ten years.

We believe that our corporate offices, distribution center and customer contact center will meet our operational needs for the foreseeable future.

Item 3. LEGAL PROCEEDINGS

See Note 13,Commitments and Contingencies, to our consolidated financial statements.

Item 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

Item 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Price Range of Common Stock and Dividend Policy

Our common stock has been quoted on the NASDAQ Stock Market under the symbol "CWTR" since our initial public offering on January 29, 1997. On March 12, 2012, we had 6,395 stockholders of record and 121,693,553 shares of common stock, $0.01 par value per share, outstanding.

The following table sets forth the high and low sales prices for our common stock for the periods indicated:

| | | | | | | |

| | Price Range of

Common Stock | |

|---|

| | High | | Low | |

|---|

Fiscal 2011: | | | | | | | |

First Quarter | | $ | 3.11 | | $ | 2.28 | |

Second Quarter | | $ | 3.07 | | $ | 1.21 | |

Third Quarter | | $ | 1.83 | | $ | 0.80 | |

Fourth Quarter | | $ | 1.21 | | $ | 0.81 | |

Fiscal 2010: | | | | | | | |

First Quarter | | $ | 8.75 | | $ | 4.22 | |

Second Quarter | | $ | 7.37 | | $ | 3.13 | |

Third Quarter | | $ | 5.89 | | $ | 3.27 | |

Fourth Quarter | | $ | 3.58 | | $ | 2.71 | |

We have never paid a cash dividend on our common stock nor do we expect to declare a cash dividend in the foreseeable future. In addition, the payment of dividends is subject to certain restrictions under our Amended and Restated Credit Agreement.

18

Table of Contents

Performance Graph

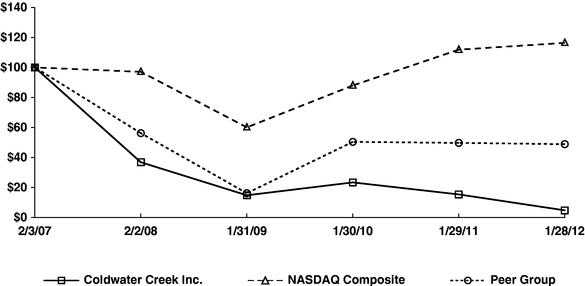

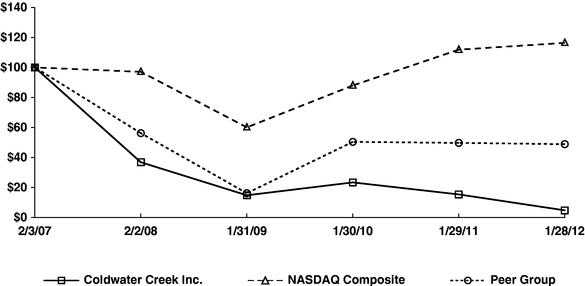

The following graph compares the cumulative five-year total return to stockholders on Coldwater Creek Inc.'s common stock to the cumulative total returns of the NASDAQ Composite Index and a customized peer group of the following four companies: Chico's, Talbots, Christopher & Banks, and ANN INC. The stock price performance shown below is not necessarily indicative of future performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Coldwater Creek Inc., the NASDAQ Composite Index, and a Peer Group

- *

- $100 invested on 2/3/07 in stock or 1/31/07 in index, including reinvestment of dividends.

Index calculated on month-end basis.

| | | | | | | | | | | | | | | | | | | |

| | Base

Period | | Indexed Returns for the Fiscal Years Ended | |

|---|

| | February 3,

2007 | | February 2,

2008 | | January 31,

2009 | | January 30,

2010 | | January 29,

2011 | | January 28,

2012 | |

|---|

Company/Index: | | | | | | | | | | | | | | | | | | | |

Coldwater Creek Inc. | | $ | 100.00 | | $ | 36.77 | | $ | 14.75 | | $ | 23.33 | | $ | 15.32 | | $ | 4.71 | |

NASDAQ Composite | | $ | 100.00 | | $ | 97.07 | | $ | 60.02 | | $ | 87.95 | | $ | 111.84 | | $ | 116.36 | |

Peer Group | | $ | 100.00 | | $ | 56.17 | | $ | 16.13 | | $ | 50.36 | | $ | 49.68 | | $ | 48.82 | |

The information required by this item concerning equity compensation plans is incorporated by reference to "Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters" in this Annual Report on Form 10-K.

Item 6. SELECTED FINANCIAL DATA

The information presented below should be read in conjunction with Management's Discussion and Analysis of Financial Condition and Results of Operations and our consolidated financial statements and related notes included elsewhere in this Annual Report on Form 10-K. Historical data is not

19

Table of Contents

necessarily indicative of the Company's future results of operations or financial condition. Refer to our "Risk Factors" included elsewhere in this Annual Report on Form 10-K.

| | | | | | | | | | | | | | | | |

| | Fiscal Year Ended | |

|---|

| | January 28,

2012(a)(b) | | January 29,

2011 | | January 30,

2010(c) | | January 31,

2009 | | February 2,

2008 | |

|---|

| | (52 weeks)

| | (52 weeks)

| | (52 weeks)

| | (52 weeks)

| | (52 weeks)

| |

|---|

| | (in thousands except per share, average square feet per store

and store count data)

| |

|---|

Statement of Operations Data: | | | | | | | | | | | | | | | | |

Net sales | | $ | 773,021 | | $ | 981,101 | | $ | 1,038,581 | | $ | 1,024,221 | | $ | 1,151,472 | |

Gross profit | | $ | 229,328 | | $ | 307,285 | | $ | 334,281 | | $ | 350,560 | | $ | 450,183 | |

Net loss | | $ | (99,694 | ) | $ | (44,111 | ) | $ | (56,132 | ) | $ | (25,963 | ) | $ | (2,488 | ) |

Net loss per common share—Basic and diluted | | $ | (0.99 | ) | $ | (0.48 | ) | $ | (0.61 | ) | $ | (0.29 | ) | $ | (0.03 | ) |

Weighted average common shares outstanding—Basic and diluted | | | 100,261 | | | 92,316 | | | 91,597 | | | 91,037 | | | 92,801 | |

Cash dividends declared per common share | | | — | | | — | | | — | | | — | | | — | |

Selected Segment Data: | | | | | | | | | | | | | | | | |

Net sales: | | | | | | | | | | | | | | | | |

Retail | | $ | 595,192 | | $ | 732,430 | | $ | 782,429 | | $ | 751,352 | | $ | 775,082 | |

Direct | | $ | 177,829 | | $ | 248,671 | | $ | 256,152 | | $ | 272,869 | | $ | 376,390 | |

Segment operating income (loss): | | | | | | | | | | | | | | | | |

Retail | | $ | (1,797 | ) | $ | 27,083 | | $ | 37,479 | | $ | 30,396 | | $ | 76,585 | |

Direct | | | 24,017 | | | 40,483 | | | 41,837 | | | 42,108 | | | 55,878 | |

| | | | | | | | | | | | |

Total segment operating income | | | 22,220 | | | 67,566 | | | 79,316 | | | 72,504 | | | 132,463 | |

Unallocated corporate and other | | | (118,380 | ) | | (110,945 | ) | | (124,494 | ) | | (118,716 | ) | | (143,132 | ) |

| | | | | | | | | | | | |

Loss from operations | | $ | (96,160 | ) | $ | (43,379 | ) | $ | (45,178 | ) | $ | (46,212 | ) | $ | (10,669 | ) |

| | | | | | | | | | | | |

Selected Operating Data: | | | | | | | | | | | | | | | | |

Total catalogs mailed | | | 58,757 | | | 83,125 | | | 91,365 | | | 85,950 | | | 128,551 | |

Average premium retail store size in square feet | | | 5,900 | | | 5,900 | | | 5,900 | | | 5,900 | | | 5,800 | |

Balance Sheet Data: | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 51,365 | | $ | 51,613 | | $ | 84,650 | | $ | 81,230 | | $ | 62,479 | |

Inventory | | $ | 131,975 | | $ | 156,481 | | $ | 161,546 | | $ | 135,376 | | $ | 139,993 | |

Working capital | | $ | 54,222 | | $ | 81,846 | | $ | 98,885 | | $ | 92,989 | | $ | 115,750 | |

Total assets | | $ | 413,115 | | $ | 506,723 | | $ | 583,523 | | $ | 628,627 | | $ | 624,259 | |

Total debt and capital lease obligations | | $ | 42,310 | | $ | 13,037 | | $ | 13,338 | | $ | 15,040 | | $ | 15,408 | |

Stockholders' equity | | $ | 116,413 | | $ | 193,009 | | $ | 235,561 | | $ | 282,496 | | $ | 301,863 | |

Premium Retail Store Count: | | | | | | | | | | | | | | | | |

Beginning of the fiscal year. | | | 373 | | | 356 | | | 348 | | | 306 | | | 240 | |

Opened during the period | | | 5 | | | 19 | | | 8 | | | 42 | | | 66 | |

Closed during the period | | | 15 | | | 2 | | | — | | | — | | | — | |

| | | | | | | | | | | | |

End of the fiscal year | | | 363 | | | 373 | | | 356 | | | 348 | | | 306 | |

| | | | | | | | | | | | |

- (a)

- Net sales for fiscal 2011 included $11.8 million of a cumulative one-time adjustment reflecting a change in our estimate of gift card breakage as we began to recognize income from gift card breakage when the likelihood of redemption is considered remote and for the estimated non-escheatable amount. Prior to fiscal 2011, we only recognized income from the non-escheated

20

Table of Contents

portion of unredeemed gift cards after the filing of the corresponding escheatment to the relevant jurisdictions.

- (b)

- On October 24, 2011, we completed an underwritten public offering of 28.9 million shares of our common stock. We received net proceeds from the offering of $22.9 million after deducting underwriting discounts and commissions and offering expenses.

- (c)

- During fiscal 2009, we recorded a $24.4 million non-cash income tax charge, or $0.27 per share, related to a valuation allowance against net deferred tax assets. U.S. GAAP requires that we assess whether a valuation allowance should be established against our deferred tax assets based on the consideration of all available evidence using a "more-likely-than-not" standard. In making such judgments, significant weight is given to evidence that can be objectively verified. Current or previous losses are given more weight than projected future performance. Consequently, based on available evidence, in particular our historical cumulative losses, we recorded a valuation allowance against our net deferred tax asset. The recording of a valuation allowance does not preclude us from utilizing the full amount of the deferred tax asset in future profitable periods.

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion contains various statements regarding our current initiatives, financial position, results of operations, cash flows, operating and financial trends and uncertainties, as well as certain forward-looking statements regarding our future expectations. When used in this discussion, words such as "anticipate," "believe," "estimate," "expect," "could," "may," "will," "should," "plan," "predict," "potential," and similar expressions are intended to identify such forward-looking statements. Our forward-looking statements are based on our current expectations and are subject to numerous risks and uncertainties. As such, our actual future results, performance or achievements may differ materially from the results expressed in, or implied by, our forward-looking statements. Refer to our "Risk Factors" elsewhere in this Annual Report on Form 10-K. The forward-looking statements in this Annual Report are as of the date such report is filed with the SEC, and we assume no obligation to update our forward-looking statements or to provide periodic updates or guidance.

Overview

We encourage you to read this Management's Discussion and Analysis of Financial Condition and Results of Operations in conjunction with the accompanying consolidated financial statements and related notes. References to a fiscal year refer to the calendar year in which the fiscal year begins. Our fiscal year ends on the Saturday nearest January 31st. This reporting schedule is followed by many national retail companies and typically results in a 52-week fiscal year, but occasionally will contain an additional week resulting in a 53-week fiscal year. Fiscal 2011, fiscal 2010 and fiscal 2009 each consisted of 52 weeks.

21

Table of Contents

Executive Summary

Net sales decreased to $773.0 million for fiscal 2011 compared to $981.1 million for fiscal 2010. This 21.2 percent decrease in net sales was primarily driven by a 22.5 percent decrease in comparable premium retail store sales(1) in our retail segment and a decrease of 28.9 percent in our direct segment net sales, offset by $11.8 million of a cumulative one-time adjustment reflecting a change in our estimate of gift card breakage.

Gross profit for fiscal 2011 was $229.3 million, or 29.7 percent of net sales, compared to $307.3 million, or 31.3 percent of net sales, for fiscal 2010. The decline in gross profit margin was primarily due to the deleveraging of fixed expenses given the lower sales, partially offset by higher merchandise margins and the benefit resulting from the cumulative one-time adjustment for gift card breakage income.

Selling, general and administrative expenses ("SG&A") for fiscal 2011 were $320.3 million, or 42.1 percent of net sales, compared to $346.7 million, or 35.3 percent of net sales, for fiscal 2010. The decrease in SG&A dollars was primarily due to lower employee related expenses, occupancy expenses, and variable and fixed operating expenses, partially offset by higher marketing expenses.