SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary proxy statement |

| x | Definitive proxy statement |

| ¨ | Confidential, for use of the Commission only as permitted by Rule 14a-6(e)(2) |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

Coldwater Creek Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee previously paid with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing party: |

| 4) | Date filed: |

One Coldwater Creek Drive

Sandpoint, Idaho 83864

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 10, 2006

To our Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of COLDWATER CREEK INC. (the “Company”), a Delaware corporation, which will be held at the Company’s corporate headquarters at One Coldwater Creek Drive, Sandpoint, Idaho 83864, at 9:30 a.m. Pacific Time on June 10, 2006 for the following purposes:

| 1. | To elect two Class III directors to the Company’s Board of Directors (the “Board”); |

| 2. | To consider and vote upon a proposal to approve the 2006 Employee Stock Purchase Plan (the “ESPP”) and the reservation of 1,800,000 shares of the Company’s common stock, $0.01 par value per share (the “Common Stock”), for issuance under the ESPP; |

| 3. | To consider and vote upon a proposal to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation that will increase the number of authorized shares of Common Stock from 150,000,000 to 300,000,000 shares; |

| 4. | To consider and vote upon a proposal to ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending February 3, 2007; and |

| 5. | To act upon such other business as may properly come before the meeting or any adjournment or postponement thereof. |

These matters are more fully described in the Proxy Statement accompanying this Notice.

The Board has fixed the close of business on April 19, 2006 as the record date for determining those stockholders who will be entitled to vote at the meeting.

Representation of at least a majority of the shares of Common Stock of the Company entitled to vote, whether present in person or represented by proxy, is required to constitute a quorum. Accordingly, it is important that your shares be represented at the meeting. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT IN THE ENCLOSED ENVELOPE. You may revoke your proxy at any time prior to the time it is voted. You may also revoke your proxy by attending the meeting and voting in person.

Please read the proxy material carefully. Your vote is important, and the Company appreciates your cooperation in considering and acting on the matters presented.

Very truly yours,

Dennis C. Pence

Chairman of the Board of Directors,

Chief Executive Officer and Secretary

Sandpoint, Idaho

May 8, 2006

Stockholders Should Read the Entire Proxy Statement

Carefully Prior to Returning the Proxy

PROXY STATEMENT

FOR THE

ANNUAL MEETING OF STOCKHOLDERS OF

COLDWATER CREEK INC.

To Be Held June 10, 2006

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of COLDWATER CREEK INC. (“Coldwater Creek” or the “Company”) of proxies to be voted at the 2006 Annual Meeting of Stockholders (“Annual Meeting”) which will be held at 9:30 a.m. Pacific Time on June 10, 2006 at the Company’s corporate headquarters at One Coldwater Creek Drive, Sandpoint, Idaho 83864 or at any adjournments or postponements thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders (“Notice”). This Proxy Statement and the proxy card were first mailed to stockholders on or about May 8, 2006.

VOTING RIGHTS AND SOLICITATION

The close of business on April 19, 2006 is the record date for stockholders entitled to notice of and to vote at the Annual Meeting. As of that date, 92,359,252 shares of the Company’s common stock, $.01 par value per share (the “Common Stock”), were issued and outstanding. All of the shares of the Common Stock outstanding on the record date are entitled to vote at the Annual Meeting. Stockholders of record entitled to vote at the Annual Meeting will have one vote on the matters to be voted upon for each share of Common Stock so held.

Common Stock represented by proxies in the accompanying form which are properly executed and returned to Coldwater Creek will be voted at the Annual Meeting in accordance with the stockholder’s instructions contained therein. In the absence of contrary instructions, Common Stock represented by such proxies will be voted:

| 1. | FOR the election of two Class III directors as described herein under “Proposal 1-Election of Directors;” |

| 2. | FOR the approval of the 2006 Employee Stock Purchase Plan and the reservation of 1,800,000 shares of Common Stock for issuance thereunder as described herein under “Proposal 2-Approval of the Company’s 2006 Employee Stock Purchase Plan;” |

| 3. | FOR the approval of an amendment to the Company’s Amended and Restated Certificate of Incorporation that will increase the number of authorized shares of Common Stock from 150,000,000 to 300,000,000 shares as described herein under “Proposal 3-Approval of an Amendment to the Company’s Amended and Restated Certificate of Incorporation;” and |

| 4. | FOR ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending February 3, 2007 as described herein under “Proposal 4-Ratification of Selection of the Company’s Independent Registered Public Accounting Firm.” |

Management is not aware of any matters to be presented at this Annual Meeting other than those set forth in this Proxy Statement and accompanying Notice. If any other matters should properly come before the Annual Meeting, the proxy holders will vote on such matters in accordance with their best judgment.

Any stockholder has the right to revoke his or her proxy at any time before it is voted by (i) delivering a written notice of revocation or duly executed proxy bearing a later date to the Company

at its principal executive office at One Coldwater Creek Drive, Sandpoint, Idaho 83864, Attention: Corporate Secretary, or (ii) attending the meeting and voting in person.

The election of the Class III directors shall be determined by a plurality of the votes cast.

The approval of Proposals 2 and 4 shall be determined by the affirmative vote of a majority of the votes cast by the stockholders who are present in person or represented by proxy who are entitled to vote at the Annual Meeting.

The approval of Proposal 3 shall be determined by the affirmative vote of a majority of the outstanding shares of Common Stock.

Abstentions are treated as shares present and entitled to vote for quorum purposes. Because abstentions represent shares entitled to vote, the effect of an abstention will be the same as a vote against a proposal. However, abstentions will have no effect on the election of directors.

If you hold shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respect to certain matters to be acted upon. Under the rules that govern brokers in such circumstances, brokers will have the discretion to vote such shares on routine matters, but not on non-routine matters. Broker non-votes are shares held by brokers or other nominees that do not have discretionary authority to vote on a matter and have not received specific voting instructions from their clients. Broker non-votes are not counted or deemed to be present or represented for the purpose of determining whether stockholders have approved a proposal. Thus, broker non-votes will not otherwise affect the outcome of a proposal. However, because the approval of Proposal 3 requires the affirmative vote of all outstanding shares of Common Stock, broker non-votes will have the same effect as a vote against the proposal. Shares represented by broker non-votes are treated as shares present and entitled to vote for quorum purposes.

All votes will be tabulated by the appointed Inspector of Election. The Inspector of Election will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

The entire cost of soliciting proxies will be borne by Coldwater Creek. Proxies will be solicited principally through the use of the mails, but, if deemed desirable, may be solicited personally or by telephone or special letter by officers and other employees of Coldwater Creek for no additional compensation. Arrangements may be made with brokerage houses and other custodians, nominees and fiduciaries to send proxies and proxy material to the beneficial owners of the Common Stock. Such persons may be reimbursed for their expenses. The Company has engaged Mellon Investor Services to assist in soliciting proxies, which it may solicit by telephone or in person. The Company anticipates paying Mellon Investor Services a fee of $6,500, plus expenses.

2

PROPOSAL 1

ELECTION OF DIRECTORS

Each member of the Board is assigned to one of three classes. One class is elected at each successive Annual Meeting to hold office for a three-year term and until successors of such class have been qualified and elected. Currently, the Board consists of seven directors, five of whom are independent as defined by the rules of the NASDAQ Stock Market (“NASDAQ”). The term of the Class III directors will expire at this Annual Meeting. The current Class III nominees to the Board, whose terms will expire at the 2009 Annual Stockholders Meeting, are set forth below.

The proxy holders intend to vote all proxies received by them in the accompanying form for the nominees for director listed below. Proxies may not be voted for a greater number of persons than the number of nominees named below. In the event that any other director is unable, or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present Board to fill the vacancy. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them for the nominees listed below. As of the date of this Proxy Statement, the Board is not aware that any nominee is unable to serve or intends to decline to serve as a director.

The Board recommends that stockholders vote FOR the nominees listed below:

Name | Principal Occupation | Director Since | Age | |||

Dennis C. Pence | Chairman of the Board of Directors, Chief Executive Officer and Secretary of Coldwater Creek Inc. | 1988 | 56 | |||

Robert H. McCall | President, McCall & Landwehr, P.A. | 1994 | 60 | |||

Dennis C. Penceco-founded Coldwater Creek in 1984, and has served as a Director since the Company’s incorporation in 1988, serving as the Board’s Chairman since July 1999 and as its Vice-Chairman prior to that. Since September 26, 2002, as well as from 1984 through December 2000, Mr. Pence has served as the Company’s Chief Executive Officer. From June 4, 2002, to September 25, 2002, he provided his executive management services to the Company. From January 5, 2002, to June 3, 2002, Mr. Pence served as the Company’s Interim Chief Financial Officer and Treasurer. From January 1, 2001 to January 4, 2002, Mr. Pence was semi-retired. Mr. Pence has also served as Chairman of the Board’s Executive Committee since its formation on May 2000, and, as Secretary since July 1998. From 1984 through 2000, Mr. Pence also served as the Company’s President. From April 1999 to December 2000, he was also the President of the Company’s Internet Commerce Division. Prior to co-founding Coldwater Creek, Mr. Pence was employed by Sony Corp. of America, a publicly held manufacturer of audio, video, communication, and information technology products, from 1975 to 1983, where his final position was National Marketing Manager-Consumer Video Products. Mr. Pence served as a Board member of Panhandle State Bank from March 2002 through December 2005.

Robert H. McCall, a Certified Public Accountant, has served as a Director since 1994, as Chairman of the Board’s Audit Committee since February 1995, as a member of the Board’s Nominating and Corporate Governance Committee since April 2004, and as a member of the Board’s Compensation Committee since June 2005. Mr. McCall has also served as a member of the Board’s Executive Committee since its formation in May 2000. From February 1995 to July 2000, Mr. McCall also served as a member of the Board’s Compensation Committee. Since 1981, Mr. McCall has been President of McCall & Landwehr, P.A., a certified public accounting firm.

3

Directors Not Standing for Election

Directors who are not standing for election at this year’s Annual Meeting are set forth below.

Name | Principal Occupation | Director Since | Class and Year in Which Term Will Expire | Age | ||||

James R. Alexander | President of Alexander & Co., LLC | 2000 (Previously 1994- 1998) | Class II 2007 | 63 | ||||

Jerry Gramaglia | Venture Partner for Arrowpath Venture Capital | 2004 | Class II 2007 | 50 | ||||

Kay Isaacson-Leibowitz | Former Executive Vice President of Beauty Niches for Victoria’s Secret Stores | 2005 | Class II 2007 | 59 | ||||

Curt Hecker | President and Chief Executive Officer, Intermountain Community Bancorp | 1995 | Class I 2008 | 45 | ||||

Georgia Shonk-Simmons | President and Chief Merchandising Officer of Coldwater Creek Inc. | 2001 | Class I 2008 | 54 | ||||

James R. Alexander has served as a Director since March 2000, as well as a member of the Board’s Audit Committee since July 2000, as a member of the Board’s Compensation Committee since November 2002, and as the Board’s Compensation Committee Chairman since June 2004. Mr. Alexander has also served as Chairman of the Board’s Nominating and Corporate Governance Committee from April 2004 to June 2004, and as a member of that Committee since April 2004. From July 2000 to July 2001, Mr. Alexander also served as a member of the Board’s Compensation Committee. Mr. Alexander had previously served as a Director, as well as Chairman of the Board’s Compensation Committee, from 1994 to 1998, before declining to stand for re-election due to other professional obligations. Mr. Alexander has been an independent catalog consultant for over 25 years, serving a variety of mail order retailers of apparel, gifts and home decor. Mr. Alexander is President of Alexander & Co., LLC, a direct marketing and retail consulting firm.

Jerry Gramaglia has served as a Director, as well as a member of both the Board’s Compensation Committee and Nominating and Corporate Governance Committee since June 2004. In May 2002, Mr. Gramaglia joined Arrowpath Venture Capital where he now serves as a Venture Partner. From June 1998 to May 2002, Mr. Gramaglia served as Chief Marketing Officer and subsequently as President and Chief Operations Officer for E*TRADE Group, Inc., a leading provider of electronic financial services. Mr. Gramaglia began his career at Procter & Gamble and subsequently held marketing and general management positions for Nestle, PepsiCo, Imasco and Sprint.

Kay Isaacson-Leibowitz has served as a Director since February 2005 and as a member of the Board’s Compensation Committee and the Nominating and Corporate Governance Committee since June 2005. Mrs. Isaacson-Leibowitz served as Executive Vice President of Beauty Niches for Victoria’s Secret Stores from July 2003 to February 2006. From 1995 to 2003, Mrs. Isaacson-Leibowitz served as Executive Vice President of Merchandising for Victoria’s Secret Stores. From 1994 to 1995, Mrs. Isaacson-Leibowitz served as acting President and Senior Vice President of Merchandising for Banana Republic. Mrs. Isaacson-Leibowitz also serves as Chairman of the Advisory Board for City University of New York Honors College and is a Board member for World of Children.

Curt Hecker has served as a Director, as well as a member of the Board’s Audit Committee, since August 1995, as a member of the Board’s Executive Committee since July 2001, as Chairman of the

4

Board’s Nominating and Corporate Governance Committee since June 2004 and as a member of that Committee since April 2004. Mr. Hecker also served as Chairman of the Board’s Compensation Committee from July 2001 to June 2004. Since October 1997, Mr. Hecker has served as President, Chief Executive Officer and a Board member of publicly held Intermountain Community Bancorp as well as Chief Executive Officer and a Board member of Panhandle State Bank, Intermountain Community Bancorp’s wholly-owned subsidiary. From August 1995 to October 2001, Mr. Hecker also served as President of Panhandle State Bank. Prior to joining Panhandle State Bank, Mr. Hecker held various management positions with West One Bank.

Georgia Shonk-Simmons has served as a Director, as well as the Company’s President, since January 1, 2001. Since September 26, 2002, Ms. Shonk-Simmons has served as the Company’s Chief Merchandising Officer. From January 1, 2001, to September 25, 2002, Ms. Shonk-Simmons served as the Company’s Chief Executive Officer. From April 1999 to December 2000, Ms. Shonk-Simmons served as President of the Company’s Catalog & Retail Sales Division. Ms. Shonk-Simmons joined the Company as Chief Merchant and Vice President of Merchandising in June 1998. From 1994 to 1998, Ms. Shonk-Simmons was Executive Vice President of the Newport News Catalog Division of Spiegel, Inc., a publicly held international retailer. Prior to that, from 1981 to 1994, Ms. Shonk-Simmons held a number of other positions of increasing responsibility with Spiegel, including Vice President of Merchandising for Spiegel Catalog beginning in 1991. Prior to joining Spiegel, Ms. Shonk-Simmons held various buyer positions with Lytton’s, Carson Pirie Scott and Hahne’s.

BOARD MEETINGS AND COMMITTEES

The Company’s Board held five meetings during fiscal 2005. Each incumbent director attended all of the Board meetings during fiscal 2005. Warren R. Hashagen, who was a director until June 11, 2005, did not attend one Board meeting during fiscal 2005. In addition, executive sessions of the independent directors without management present were held regularly throughout fiscal 2005 to discuss relevant subjects.

It is the Company’s policy that all directors attend the Company’s Annual Meeting of Stockholders, except directors whose terms are expiring at that Annual Meeting and who are not standing for re-election. All continuing directors attended the 2005 Annual Meeting of Stockholders, and it is anticipated that all directors will attend the 2006 Annual Meeting of Stockholders.

The Board has an Executive Committee, an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The Executive Committee held two meetings during fiscal 2005 and each member attended 100% of the meetings. The Audit Committee held ten meetings during fiscal 2005 for which there was 100% attendance by its members, with the exception of Warren R. Hashagen who attended all but one meeting. The Compensation Committee held eleven meetings during fiscal 2005 for which there was 100% attendance by its members. The Nominating and Corporate Governance Committee held six meetings during fiscal 2005 for which there was 100% attendance by its members, with the exception of James R. Alexander who was unable to attend one meeting and Kay Isaacson-Leibowitz who was unable to attend one meeting.

Executive Committee. The Executive Committee is empowered to act in general for the entire Board in intervals between meetings of the Board, with the exception of certain matters that by law may not be delegated. The Executive Committee meets as necessary and all actions by the Executive Committee are reported to the Board. The Executive Committee will also administer the 2006 Employee Stock Purchase Plan if approved by the Company’s stockholders (see Proposal 2). The actions taken by the Executive Committee are binding and do not require ratification by the Board to be legally effective. The Executive Committee currently consists of Curt Hecker, Robert H. McCall and Dennis C. Pence (Chairman).

5

Audit Committee. The Audit Committee’s primary responsibilities include the evaluation, appointment and oversight of the Company’s independent registered public accounting firm, the approval of all audit fees and all other compensation to be paid to the Company’s independent registered public accounting firm and of any non-audit services performed by the Company’s independent registered public accounting firm, the evaluation of the independence of the Company’s independent registered public accounting firm, the review and approval of the scope of audit activities performed by the Company’s independent registered public accounting firm, the review of accounting practices and internal controls and the review of audit results. The Audit Committee currently consists of James R. Alexander, Curt Hecker and Robert H. McCall (Chairman). Until June 11, 2005, the Committee also included Warren R. Hashagen. The Board has determined that all Committee members meet the independence requirements of the SEC and NASDAQ. The Board has also determined that Robert H. McCall qualifies as an “audit committee financial expert” within the meaning of the applicable rules of the SEC.

Compensation Committee. The Compensation Committee is responsible for evaluating the performance of the Chief Executive Officer and reviewing and establishing the compensation structure for the Company’s executive officers, including salary rates, participation in incentive compensation and benefit plans and other forms of compensation, and administering the Company’s Amended and Restated Stock Option/Stock Issuance Plan. The Compensation Committee currently consists of James R. Alexander (Chairman), Jerry Gramaglia, Kay Isaacson-Leibowitz and Robert H. McCall. Until June 11, 2005 the Committee also included Warren R. Hashagen. The Board has determined that all of the Compensation Committee members meet the independence requirements of NASDAQ.

Nominating and Corporate Governance Committee. The principal functions of the Nominating and Corporate Governance Committee are to identify and evaluate individuals qualified to become Board members, recommend to the Board candidates for election or re-election to, or removal from, the Board, consider and make recommendations to the Board concerning the size and composition of the Board, consider from time to time the Board committee structure and makeup, and recommend to the Board retirement policies and procedures affecting Board members. Additionally, this Committee assists the Board in its oversight responsibilities relating to the Company’s corporate governance matters. The Nominating and Corporate Governance Committee currently consists of James R. Alexander, Jerry Gramaglia, Curt Hecker (Chairman), Kay Isaacson-Leibowitz and Robert H. McCall. Until June 11, 2005 the Committee also included Warren R. Hashagen. The Board has determined that all of the Nominating and Corporate Governance Committee members meet the independence requirements of NASDAQ. The Nominating and Corporate Governance Committee considers Board candidates identified by its members, by other Board members or management, by stockholders and by other external sources, as described below.

STOCKHOLDER PROPOSALS FOR NEXT YEAR’S ANNUAL MEETING

Stockholder proposals intended to be considered for inclusion in next year’s Proxy Statement for the 2007 Annual Meeting of Stockholders must be received by Coldwater Creek no later than January 8, 2007. Such proposals may be included in next year’s Proxy Statement if they comply with certain rules and regulations promulgated by the SEC and the procedures set forth in the Company’s bylaws. For proposals not intended to be submitted for inclusion in next year’s Proxy Statement, but sought to be presented at the next Annual Meeting, the Company’s bylaws provide that stockholder proposals, including director nominations, must be received by the Company no later than the close of the 60th day nor earlier than the close of the 90th day prior to the first anniversary of the prior year’s Annual Meeting. The Company has additional requirements for stockholder nominations to the Board, as described below. In addition, proxies to be solicited by the Board for the 2007 Annual Meeting will confer discretionary authority to vote on any stockholder proposal presented at that meeting, unless

6

the Company receives notice of such proposal not later than March 24, 2007. All stockholder proposals must be in writing and mailed to the Company’s principal executive offices, One Coldwater Creek Drive, Sandpoint, Idaho 83864, Attention: Corporate Secretary.

Stockholder Nominations for Director. Stockholders may recommend candidates for nomination to the Board for consideration by the Nominating and Corporate Governance Committee by submitting in writing the names and required supporting information described below to the Company’s principal executive offices, One Coldwater Creek Drive, Sandpoint, Idaho 83864, Attention: Corporate Secretary.

Such recommendation must include the following information:

| • | information regarding the stockholder making the proposal, including name, address, and number of shares of Coldwater Creek stock beneficially owned by such person; |

| • | a representation that the stockholder or the stockholder’s nominee is entitled to vote at the meeting at which directors will be elected, and that the stockholder or the stockholder’s designee intends to cast its vote for the election of the director, if nominated; |

| • | the name and business address and residence of the person or persons being nominated and such other information regarding each nominated person that would be required in a proxy statement filed pursuant to the Security and Exchange Commission’s proxy rules, including, but not limited to: |

| • | a copy of the nominee’s resume; |

| • | biographical information for the last five years, including directorships and principal occupation or employment of such person; |

| • | date of birth; |

| • | a list of references; |

| • | a description of any relationship, arrangement or understanding between the stockholder and the nominee and any other person (including names) pursuant to which the nomination is being made; |

| • | a description of any direct or indirect relationship, arrangement or understanding between the stockholder or the nominee and the Company; and |

| • | the consent of each such nominee to be named in the Proxy Statement and to serve as a director if elected. |

Following verification of this information, the Nominating and Corporate Governance Committee will make an initial analysis of the qualifications of the candidate pursuant to the director qualification criteria for director nominations described below. The Nominating and Corporate Governance Committee screens and evaluates potential candidates in the same manner regardless of the source of the recommendation.

Qualification Criteria for Director Nominations. The Nominating and Corporate Governance Committee identifies, evaluates and recommends prospective directors to the Board with the goal of creating a balance of knowledge, experience and diversity. Potential candidates will be identified from a number of sources, including current Board members, employees, stockholders and other interested parties, as appropriate. The Nominating and Corporate Governance Committee is not required to nominate candidates who are recommended by stockholders, employees or other interested parties. Candidates nominated for election or re-election to the Board should possess the following qualifications:

| • | The highest professional and personal ethics and values, consistent with the image and reputation of the Company. |

7

| • | High-level leadership experience in business and administrative functions with an ability to understand business problems and evaluate and formulate solutions. |

| • | Industry-related and other special expertise and skills that are relevant to the Company and complementary to the background and experience of other Board members. |

| • | Ability to devote the time necessary to carrying out the duties and responsibilities of Board membership. |

| • | Willingness to be an active, objective and constructive participant at meetings of the Board and its Committees. |

| • | Commitment to serve on the Board over a period of several years to develop knowledge about the Company’s business. |

| • | Commitment to enhancing stockholder value and representing the best interests of all stockholders and to objectively evaluate management performance. |

| • | The majority of directors on the Board should be “independent,” not only as that term may be legally defined, but also without the appearance of any conflict in serving as a director. In addition, directors should be independent of any particular constituency and be able to represent all stockholders of the Company. |

DIRECTOR COMPENSATION

Cash compensation paid to the non-employee directors for their service on the Board and its committees is as follows:

| Annual Retainer | Meeting Fees (1) | ||||||

Board of Directors | $ | 55,000 | One hour or more: Under one hour: | $3,000 $1,000 | |||

Committees of the Board of Directors | $ | 5,000 | One hour or more: Under one hour: | $2,000 $ 500 | |||

Audit Committee Chair | $ | 30,000 | |||||

Compensation Committee Chair | $ | 15,000 | |||||

Nominating and Corporate Governance Committee Chair | $ | 15,000 | |||||

| (1) | These meeting fees became effective for meetings held after October 1, 2005. For meetings held on or prior to October 1, 2005 during fiscal 2005, the fee amounts were as follows: $2,000 for each Board meeting that exceeded one hour and $500 for each meeting that did not exceed one hour; and $2,000 for each meeting of a committee of the Board. |

During fiscal 2005, the Company also granted James R. Alexander, Jerry Gramaglia, Robert H. McCall, Curt Hecker and Kay Isaacson-Leibowitz restricted stock units (“RSUs”) having a value of $25,000. Each grant was for 1,487 shares of Common Stock, based on the $16.81 fair market value of the Common Stock on the October 1, 2005 grant date. The RSUs will vest on the date of this Annual Meeting.

During fiscal 2005, the Company also paid $8,114 on behalf of each James R. Alexander and Robert H. McCall for medical insurance premiums. Additionally, the Company paid $450 on behalf of each James R. Alexander, Jerry Gramaglia, Curt Hecker and Robert H. McCall for life insurance premiums.

8

Beginning in fiscal 2006, RSUs having a value of $25,000 will be automatically granted to each individual who continues to serve as a non-employee director on the date of the Company’s annual stockholders meeting, provided such individual has served as a non-employee director for at least 90 days. This automatic RSU grant will be based on the fair market value of the Common Stock on the date of grant. The RSUs will vest upon completion of one year of Board service measured from the grant date. These RSUs will be granted under the Company ‘s Amended and Restated Stock Option/Stock Issuance Plan and form of Stock Unit Agreement between the Company and the non-employee director. Each RSU will immediately vest in full upon certain corporate transactions or a change in control of the Company.

Additionally, new non-employee directors who join the Board will receive stock options to purchase 30,000 shares of Common Stock (the “New Director Options”). The New Director Options will have an exercise price equal to the fair market value of the Common Stock on the date of grant. These options will vest in one installment after the completion of three years of continuous Board service, as measured from the grant date. The New Director Options will be issued under the Company’s Amended and Restated Stock Option/Stock Issuance Plan and form of Non-Qualified Stock Option Agreement between the Company and the non-employee director. Each New Director Option will immediately vest in full upon certain corporate transactions or a change in control of the Company.

CORPORATE GOVERNANCE

Codes of Conduct

The Company has adopted a Code of Ethics for its Principal Executive Officer, its Principal Financial Officer and its Principal Accounting Officer. A copy of this Code of Ethics is available on the Investor Relations portion of the Company’s website at http://www.coldwatercreek.com. Any future amendments to this Code of Ethics, and any waiver of this Code of Ethics that applies to the Company’s Principal Executive Officer, Principal Financial Officer or Principal Accounting Officer, will also be posted on http://www.coldwatercreek.com.

The Company has adopted a Code of Business Conduct and Ethics for the members of its Board. A copy of this Code of Business Conduct and Ethics is available on the Investor Relations portion of the Company’s website at http://www.coldwatercreek.com. Any future amendments to or waivers of this Code of Business Conduct and Ethics will also be posted on http://www.coldwatercreek.com.

The Company’s Code of Business Conduct applicable to all its employees is also available on the Investor Relations portion of the Company’s website at http://www.coldwatercreek.com. Any future amendments to this Code of Business Conduct will also be posted on http://www.coldwatercreek.com.

Board Committee Charters

The Charters of the Audit Committee, the Executive Committee, the Compensation Committee and the Nominating and Corporate Governance Committee are available on the Investor Relations portion of the Company’s website at http://www.coldwatercreek.com. A copy of the Audit Committee Charter, which was amended in June 2005, is also attached as Appendix A to this Proxy Statement.

Board Independence

The Board has determined that five of the seven directors who currently serve on the Company’s Board of Directors are “independent” within the meaning of NASDAQ rules. In addition, the Board has determined that each member of the Board’s Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee is independent as required by the rules of the SEC and NASDAQ.

9

Stockholder Communications With the Board of Directors

Stockholders and other interested parties may contact the Board of Directors, or any member of the Board, at the following address:

Coldwater Creek Board of Directors

c/o Coldwater Creek Inc.

One Coldwater Creek Drive

Sandpoint, ID 83864

Or by e-mail at BoardofDirectors@thecreek.com

Information about the procedures for contacting the Board of Directors is available on the Investor Relations portion of the Company’s website at http://www.coldwatercreek.com.

Information on the Company’s website is not incorporated by reference into this Proxy Statement.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of Common Stock as of March 31, 2006, by:

| • | each person, or group of affiliated persons, known by the Company to beneficially own more than 5% of the outstanding shares of its Common Stock; |

| • | each director and nominee for director; |

| • | the Company’s Chief Executive Officer and each of its other four most highly compensated executive officers as of the end of its 2005 fiscal year; and |

| • | all of the Company’s current directors and executive officers as a group. |

All shares are subject to the named person’s sole voting and investment power except where otherwise indicated.

Name and Address of Beneficial Owner | Shares Beneficially Owned | Percentage of Shares Beneficially Owned (a) | |||

Dennis Pence (b)(c) | 32,506,666 | 35.21 | % | ||

Ann Pence (b)(d) | 32,506,666 | 35.21 | % | ||

FMR Corp (e) | 5,214,900 | 5.65 | % | ||

James R. Alexander (f) | 44,700 | * | |||

Jerry Gramaglia (g) | 75,216 | * | |||

Curt Hecker (h) | 202,494 | * | |||

Kay Isaacson-Leibowitz (i) | 50,144 | * | |||

Robert H. McCall (j) | 122,347 | * | |||

Georgia Shonk-Simmons (k) | 573,482 | * | |||

Melvin Dick (l) | 245,341 | * | |||

Dan Griesemer (m) | 300,365 | * | |||

Dan Moen (n) | 50,476 | * | |||

All Directors and Executive Officers as a group (11 persons) (o) | 34,257,792 | 36.46 | % | ||

| * | Less than one percent. |

| (a) | The information in this table is based upon information furnished to the Company by each director, executive officer and principal stockholder or contained in filings made by these persons with the |

10

SEC. The calculation of the percentage of shares beneficially owned is based on 92,318,349 shares of the Company’s Common Stock outstanding as of March 31, 2006. Shares of Common Stock subject to stock options which are currently exercisable or will become exercisable within 60 days after March 31, 2006, are deemed outstanding for computing the percentage of the person or group holding such options, but are not deemed outstanding for computing the percentage of any other person or group. |

| (b) | Dennis Pence and Ann Pence divorced in June 2003. They continue to share voting power over the shares each of them hold directly pursuant to an informal agreement. This arrangement may be terminated by either of them at any time. |

| (c) | Includes (a) 17,998,672 shares owned of record by Ann Pence; (b) 244,687 shares owned of record by the JCP Irrevocable Trust; (c) 135,000 shares owned of record by the Dancing River Foundation; and (d) 150,000 shares owned of record by the Wild Rose Foundation. Mr. Pence disclaims beneficial ownership over all such shares. Address: c/o Coldwater Creek Inc., One Coldwater Creek Drive, Sandpoint, Idaho 83864. |

| (d) | Includes (a) 13,978,307 shares owned of record by Dennis Pence; (b) 244,687 shares owned of record by the JCP Irrevocable Trust; (c) 135,000 shares owned of record by the Dancing River Foundation; and (d) 150,000 shares owned of record by the Wild Rose Foundation. Ms. Pence disclaims beneficial ownership over all such shares. Address: c/o Coldwater Creek Inc., One Coldwater Creek Drive, Sandpoint, Idaho 83864. |

| (e) | Consists of 5,214,900 shares beneficially owned by FMR Corp. as reported on Form 13G as of December 31, 2005. Address: 82 Devonshire Street, Boston, Massachusetts 02109. |

| (f) | Includes 41,513 shares issuable upon exercise of options that are currently exercisable or will become exercisable within 60 days after March 31, 2006. Address: c/o Coldwater Creek Inc., One Coldwater Creek Drive, Sandpoint, Idaho 83864. |

| (g) | Includes 67,716 shares issuable upon exercise of options that are currently exercisable or will become exercisable within 60 days after March 31, 2006. Address: c/o Coldwater Creek Inc., One Coldwater Creek Drive, Sandpoint, Idaho 83864. |

| (h) | Includes 165,929 shares issuable upon exercise of options that are currently exercisable or will become exercisable within 60 days after March 31, 2006. Address: c/o Coldwater Creek Inc., One Coldwater Creek Drive, Sandpoint, Idaho 83864. |

| (i) | Includes 45,144 shares issuable upon exercise of options that are currently exercisable or will become exercisable within 60 days after March 31, 2006. Address: c/o Coldwater Creek Inc., One Coldwater Creek Drive, Sandpoint, Idaho 83864. |

| (j) | Consists of 122,347 shares issuable upon exercise of options that are currently exercisable or will become exercisable within 60 days after March 31, 2006. Address: c/o Coldwater Creek Inc., One Coldwater Creek Drive, Sandpoint, Idaho 83864. |

| (k) | Includes 558,680 shares issuable upon exercise of options that are currently exercisable or will become exercisable within 60 days after March 31, 2006. Address: c/o Coldwater Creek Inc., One Coldwater Creek Drive, Sandpoint, Idaho 83864. |

| (l) | Includes 222,046 shares issuable upon exercise of options that are currently exercisable or will become exercisable within 60 days after March 31, 2006. Address: c/o Coldwater Creek Inc., One Coldwater Creek Drive, Sandpoint, Idaho 83864. |

| (m) | Consists of 300,365 shares issuable upon exercise of options that are currently exercisable or will become exercisable within 60 days after March 31, 2006. Address: c/o Coldwater Creek Inc., One Coldwater Creek Drive, Sandpoint, Idaho 83864. |

| (n) | Includes 28,201 shares issuable upon exercise of options that are currently exercisable or will become exercisable within 60 days after March 31, 2006. Address: c/o Coldwater Creek Inc., One Coldwater Creek Drive, Sandpoint, Idaho 83864. |

| (o) | Includes 1,634,305 shares issuable upon exercise of options that are currently exercisable or will become exercisable within 60 days after March 31, 2006. |

11

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth certain information concerning compensation earned by the Company’s Chief Executive Officer and each of the Company’s four other most highly compensated executive officers whose salary and bonus for the 2005 fiscal year was in excess of $100,000 for services rendered in all capacities to the Company and its subsidiaries. The persons named in the table are hereinafter referred to as the “Named Executive Officers.”

| Annual Compensation | Long Term Compensation | |||||||||||||||||

Name & Position | Fiscal Year | Salary | Bonus | Restricted Stock Units | Number of Securities Underlying Options | All other (7) | ||||||||||||

Dennis Pence Chairman of the Board, Secretary and Chief Executive Officer | 2005 2004 2003 | $ | 800,000 700,000 600,000 | $ | 1,037,066 1,315,177 220,500 | | — — — | | — — — | $ | 12,881 6,410 2,343 | (1) (1) (1) | ||||||

Georgia Shonk-Simmons President and Chief Merchandising Officer | 2005 2004 2003 | | 525,000 500,000 475,000 | | 1,776,455 438,392 115,500 | (2) (2) (2) | 26,400 — — | (6) | 47,700 — — | | 10,696 5,384 2,758 | (1) (1) (1) | ||||||

Dan Griesemer Executive Vice President, Sales & Marketing | 2005 2004 2003 | | 400,000 350,000 270,000 | | 637,096 420,011 105,000 | (3) (3) (3) | 30,750 — — | (6) | 55,650 84,375 177,188 | | 9,120 5,142 1,038 | (1) (1) (1) | ||||||

Melvin Dick Executive Vice President and Chief Financial Officer | 2005 2004 2003 | | 375,000 325,000 300,000 | | 274,997 355,752 96,250 | (4) (4) (4) | 19,800 — — | (6) | 35,850 50,625 126,563 | | 9,120 2,858 1,731 | (1) (1) (1) | ||||||

Dan Moen Senior Vice President and Chief Information Officer | 2005 2004 2003 | | 275,000 222,000 201,185 | | 215,111 154,105 27,895 | (5) (5) (5) | 13,200 — — | (6) | 23,850 25,313 50,625 | | 7,577 5,865 6,167 | (1) (1) (1) | ||||||

| (1) | Primarily represents matching contributions made by the Company to the Named Executive Officers’ accounts under the Company’s 401(k) Plan. |

| (2) | The amount reported for fiscal 2005 includes payment of the deferred compensation bonus amount of $1,425,000 on September 1, 2005. See “Deferred Compensation Program” for further details. The amounts reported for fiscal 2004 and 2003 exclude the Company’s accrual of $456,108 and $454,037, respectively, of Ms. Shonk-Simmons’ deferred compensation bonus under this program. |

| (3) | The amount reported for fiscal 2005 includes payment of the deferred compensation bonus amount of $300,000 on September 1, 2005. See “Deferred Compensation Program” for further details. The amounts reported for fiscal 2004 and 2003 exclude the Company’s accrual of $83,891 and $80,456, respectively, of Mr. Griesemer’s deferred compensation bonus under this program. |

| (4) | Excludes the Company’s accrual of $75,000, $75,000 and $62,019 for fiscal year 2005, 2004 and 2003, respectively, of a deferred compensation bonus payable to Mr. Dick under the program described below. See “Deferred Compensation Program” for further details. |

| (5) | Excludes the Company’s accrual of $75,000, $56,250 and $10,417 for fiscal year 2005, 2004 and 2003, respectively, of a deferred compensation bonus payable to Mr. Moen under the program as described below. See “Deferred Compensation Program” for further details. |

12

| (6) | Restricted Stock Units are granted pursuant to the Company’s Amended and Restated Stock Option/Stock Issuance Plan and will vest and be deliverable on May 8, 2008. |

| (7) | These amounts do not include imputed compensation related to the personal use of the Company’s business jet fractional share program by the Named Executive Officers. The imputed compensation was less than $50,000 for any Named Executive Officer. |

Deferred Compensation Program

The Compensation Committee authorized compensation bonus pools for officers subject to the reporting requirements of Section 16 of the Securities and Exchange Act of 1934 (“Section 16 officers”) that, in aggregate, totaled $600,000 at January 28, 2006. The Company’s Chief Executive Officer authorized compensation bonus pools for other employees that, in aggregate, totaled $4.7 million at January 28, 2006. These bonus pools serve as additional incentives to retain certain key employees. The Company is accruing the related compensation expense to each employee on a straight-line basis over the retention periods as it is currently anticipated that the performance criteria specified in the agreements will be met. On September 1, 2005, Ms. Shonk-Simmons and Mr. Griesemer were paid $1,425,000 and $300,000 respectively under the deferred compensation program, pursuant to awards made under the program in 2002.

The total compensation and dates to be paid are summarized as follows (in thousands):

Description | Amount | Dates to be paid (1) | |||

Named Executive Officers: | |||||

Melvin Dick | $ | 225 | April 2006 | ||

Dan Moen | 225 | May 2007 | |||

| $ | 450 | ||||

Other Executive Officer: | |||||

Gerard El Chaar | 150 | April 2006 | |||

Thirty-two non-executive employees | 4,675 | April 2006-April 2009 | |||

Total | $ | 5,125 | |||

| (1) | The amounts will be paid contingent upon (a) continued employment by the employee through the date of payment, (b) the Company’s achievement of earnings equal to at least two-thirds of its plan for the prior fiscal year and (c) satisfactory performance evaluations for the employee. |

13

Option Grants in Last Fiscal Year

The following table contains information concerning stock options granted to the Named Executive Officers during the fiscal year ended January 28, 2006. All grants were made under the Company’s Amended and Restated Stock Option/Stock Issuance Plan. No stock appreciation rights (“SAR”) were granted to the Named Executive Officers during the fiscal year ended January 28, 2006.

| Individual Grants | ||||||||||||||||||

Name | Number of granted (#) | % of total options/SAR granted to employees in fiscal year (%) | Exercise or ($/share) (1) | Market grant ($) | Expiration Date | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation For Option Term (2) | ||||||||||||

| 5% ($) | 10% ($) | |||||||||||||||||

Dennis C. Pence | — | — | — | — | — | — | — | |||||||||||

Georgia Shonk-Simmons | 47,700 (3)(4) | 9.2% | $ | 11.38 | $ | 11.38 | 5/8/2012 | $ | 220,985 | $ | 514,988 | |||||||

Dan Griesemer | 55,650 (3)(4) | 10.7% | 11.38 | 11.38 | 5/8/2012 | 257,815 | 600,820 | |||||||||||

Melvin Dick | 35,850 (3)(4) | 6.9% | 11.38 | 11.38 | 5/8/2012 | 166,086 | 387,051 | |||||||||||

Dan Moen | 23,850 (3)(4) | 4.6% | 11.38 | 11.38 | 5/8/2012 | 110,492 | 257,494 | |||||||||||

| (1) | The exercise price may be paid in cash or in shares of the Company’s Common Stock valued at fair market value on the exercise date. Alternatively, the option may be exercised through a cashless exercise procedure pursuant to which the optionee provides irrevocable instructions to a brokerage firm to sell the purchased shares and to remit to the Company, out of the sale proceeds, an amount equal to the exercise price. |

| (2) | Amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based upon assumed rates of share price appreciation set by the SEC of five percent and ten percent compounded annually from the date the respective options were granted to their expiration date. The gains shown are net of the option exercise price, but do not include deductions for taxes or other expenses associated with the exercise. Actual gains, if any, are dependent on the performance of the Common Stock and the date on which the option is exercised. There can be no assurance that the amounts reflected will be achieved. |

| (3) | These options vest in three equal annual installments measured from the grant date. |

| (4) | These options will become exercisable on an accelerated basis upon liquidation or dissolution of the Company or a merger or consolidation in which there is a change in ownership of securities possessing more than 50% of the total combined voting power of the Company’s outstanding securities, unless the option is assumed by the surviving entity or replaced with a comparable option relating to the shares of capital stock of the acquiring entity or replaced with a cash incentive program that preserves the spread at the time of such transaction and provides for payout over the vesting schedule of such option. |

14

Option Exercises and Holdings

The following table provides information with respect to the Named Executive Officers concerning exercises of options during fiscal 2005 and unexercised options held as of January 28, 2006. No SARs have been granted to any Named Executive Officer.

Aggregated Option/SAR Exercises in Last Fiscal Year and

Fiscal Year-End Option/SAR Values

Shares on | Value realized | Number of securities underlying unexercised options at fiscal year | Value of unexercised in-the-money options at fiscal year end ($)(2) | ||||||||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||

Dennis Pence | — | — | — | — | — | — | |||||||||

Georgia Shonk-Simmons | 209,940 | $ | 3,540,464 | 617,780 | 47,700 | $ | 11,409,962 | $ | 871,002 | ||||||

Dan Griesemer | — | — | 239,627 | 267,431 | 4,318,620 | 4,159,592 | |||||||||

Melvin Dick | — | — | 174,658 | 228,225 | 3,098,560 | 3,683,699 | |||||||||

Dan Moen | 22,275 | 342,306 | 5,063 | 86,625 | 73,110 | 1,311,037 | |||||||||

| (1) | Based upon the closing selling price of the Common Stock, as reported by NASDAQ on the exercise date, less the exercise price paid per share. |

| (2) | Based upon the closing selling price of $20.76 per share on January 28, 2006, as reported by NASDAQ on that date, less the option exercise price payable per share. |

Supplemental Employee Retirement Plan

On October 1, 2005, the Board approved a Supplemental Employee Retirement Plan (“SERP”) for certain executive officers and key employees of the Company effective as of October 30, 2005. The SERP is an unfunded, non-qualified benefit plan that will provide eligible participants with monthly benefits upon retirement, termination of employment, death or disability, subject to certain conditions. The initial participants in the SERP were Georgia Shonk-Simmons, Melvin Dick, and Dan Griesemer, and on November 1, 2005 the Compensation Committee approved Dennis C. Pence as an additional participant.

The following table sets forth the aggregate estimated annual retirement benefits as January 28, 2006 for the years of service and compensation levels specified below.

| Years of Service | |||||||||||||

| Remuneration | 5 | 10 | 15 | 20 | |||||||||

| $ | 300,000 | $ | 37,500 | $ | 75,000 | $ | 112,500 | $ | 150,000 | ||||

| 400,000 | 50,000 | 100,000 | 150,000 | 200,000 | |||||||||

| 500,000 | 62,500 | 125,000 | 187,500 | 250,000 | |||||||||

| 600,000 | 75,000 | 150,000 | 225,000 | 300,000 | |||||||||

| 700,000 | 87,500 | 175,000 | 262,500 | 350,000 | |||||||||

| 800,000 | 100,000 | 200,000 | 300,000 | 400,000 | |||||||||

| 900,000 | 112,500 | 225,000 | 337,500 | 450,000 | |||||||||

| 1,000,000 | 125,000 | 250,000 | 375,000 | 500,000 | |||||||||

Normal SERP retirement benefits are determined by multiplying a percentage equal to 2.5% of each eligible executive’s average monthly earnings by the number of years of a participant’s service with the Company, up to a maximum of 20 years. “Average monthly earnings” means the highest average of the participant’s monthly base salary during any consecutive 60-month period after October 30, 2005 in which the participant is an employee in the 120 months preceding his or her

15

employment termination. For purposes of this calculation in applicable circumstances, the 60- and 120-month periods shall refer to such fewer number of months as measured from October 30, 2005 to a participant’s employment termination date. As of the effective date of the SERP, Mr. Pence was credited with 22 years of service, Ms. Shonk-Simmons with 7.33 years of service, Mr. Dick with 3.33 years of service and Mr. Griesemer with 4.08 years of service.

No benefits will be payable under the SERP upon retirement unless a participant has become fully vested. SERP benefits vest as to each participant after he or she (a) provides continuous services to the Company for at least (i) five years after adoption of the SERP or (ii) a total of 15 years and (b) reaches the age of 55. If a participant engages in certain competitive activities or in fraudulent or dishonest conduct or otherwise fails to comply with the Company’s professional or ethical standards, all SERP benefits of such participant will immediately cease and be forfeited. Further, in the event of a change in control of the Company, the Board has the discretion to accelerate the vesting of all accrued benefits under the SERP and provide for a lump-sum payment to each participant equal to the actuarial equivalent of each participant’s accrued benefits.

Benefits are generally payable to vested participants over their lifetime after separation from service on or after age 62, subject to the advance election by a participant for his or her spouse to receive a survivor annuity equal to 50% or 100% of the participant’s benefit. If a participant continues providing services after age 62, the benefit will continue to accrue (subject to the 20-year maximum) and vested benefits will be payable upon retirement. If a vested participant retires before reaching the age of 62, his or her SERP benefit will stop accruing and the amount of the SERP benefit will be reduced by multiplying his or her normal retirement benefit by 4% for each year that his or her age is under 62 as of the date of retirement.

Upon termination due to a participant’s disability, if the participant is not vested, the participant will continue to accrue years of benefit service and years of vested service during the period of disability until he or she is fully vested, and benefit payments would commence at the earliest of early retirement age (age 55) or when vested. Benefits payable upon disability are offset by amounts received under the Company’s long term disability plan, but are not offset by social security or other offset amounts. If a participant dies before becoming vested in the SERP or dies without a surviving spouse, no benefits are payable. If a vested participant dies prior to retirement and has a surviving spouse, the spouse will receive during his or her lifetime monthly payments in the amount that would have been payable if the participant had survived and had elected the 50% joint and survivor annuity. If a participant dies after retirement, survivor benefits are payable only if the participant had elected payment of a joint and survivor annuity.

Compensation Committee Report on Executive Compensation

The Board’s Compensation Committee is comprised solely of non-employee, independent directors. Since June 11, 2005, the Compensation Committee has consisted of James R. Alexander (Chairman), Jerry Gramaglia, Kay Isaacson-Leibowitz and Robert H. McCall. From June 12, 2004 to June 11, 2005, the Compensation Committee consisted of James R. Alexander (Chairman), Jerry Gramaglia and Warren R. Hashagen. The Compensation Committee met eleven times during the fiscal year ended January 28, 2006.

The Compensation Committee is responsible for evaluating the performance of the Chief Executive Officer (“CEO”) and determining the salaries, bonuses, deferred and other compensation of the CEO and the Company’s other executive officers. The Compensation Committee also has the sole and exclusive authority to grant stock options and RSUs to the Company’s executive officers under the Company’s Amended and Restated Stock Option/Stock Issuance Plan (the “Plan”).

16

The policies of the Compensation Committee with respect to executive officers, including the CEO, are to provide compensation sufficient to attract, motivate and retain executives of outstanding ability and potential and to establish an appropriate relationship between executive compensation and the creation of shareholder value. The Compensation Committee seeks to balance the desire for immediate earnings and the longer term goal of enhancing shareholder value. To meet these goals, the Compensation Committee has adopted a mix among the compensation elements of salary, bonus, deferred compensation, stock options and restricted stock units.

The Compensation Committee determines the base salaries for executive officers based upon a review of salary surveys for comparable positions in similar companies. The Compensation Committee may further adjust the salary of an executive officer based upon the Company’s overall financial or other performance during the previous year, the executive officer’s responsibilities and relative position within the Company during the previous year, including any changes therein, and the executive officer’s performance against the objectives established for his or her area of responsibility during the previous year.

Under the Company’s executive incentive program, executive officers may receive a component of their compensation in bonus payments, based on the Compensation Committee’s evaluation of the individual’s performance and overall corporate performance against financial and other goals. As in prior years, in fiscal 2005 the portion attributable to the Company’s performance was determined for each participant based on target levels of revenue growth and EBIT (earnings before interest and taxes) performance. The targets for revenue growth and EBIT are set at the beginning of the fiscal year and are the same for all participants, although award amounts differ by level. If either revenue growth or EBIT does not exceed a minimum level, no bonus will be awarded under the program.

In awarding stock options and RSUs, the Compensation Committee considers a number of factors, including an executive officer’s responsibilities and relative position within the Company, including any changes therein, the individual performance of the executive officer, the executive officer’s existing equity interest in the Company, including stock options and/or RSUs held, the extent to which any stock options and/or RSUs held remain unvested, and the total number of stock options and/or RSUs to be awarded.

The Company has also entered into deferred compensation agreements with certain of its current executive officers, other than Mr. Pence. These agreements are designed to encourage retention. The agreements generally provide for a lump-sum cash payment at the end of a three-year performance period, assuming certain performance standards are met. These standards include the individual’s continued employment and performance at a “meets expectations” level, and the Company’s achievement of a minimum net income target based on its internal business plan.

Following an analysis of the total compensation payable to the Company’s executive officers, the cost of various compensation alternatives, peer company comparator data, the desire to balance short- and long-term compensation for the Company’s executive officers and other factors, and after consultation with outside compensation consultants, the Committee adopted a Supplemental Employee Retirement Plan (“SERP”) in October 2005 for certain executive officers and key employees of the Company. The SERP is designed to encourage retention and provides eligible participants with monthly retirement benefits after a participant becomes fully vested in the SERP. SERP benefits vest after a participant (a) provides continuous service to the Company for at least five years after adoption of the SERP or a total of 15 years and (b) reaches the age of 55. Benefits are generally determined by multiplying a percentage equal to 2.5% of each participant’s average monthly earnings by the number of years of a participant’s service with the Company, up to 20 years. Currently, Mr. Pence, Ms. Shonk-Simmons, Mr. Dick and Mr. Griesemer participate in the SERP.

17

Compensation of CEO

The Compensation Committee uses the same procedures described above for other executive officers in setting the annual salary and bonus for the Company’s CEO. In light of Mr. Pence’s equity holdings, the Committee has not in the past awarded stock options or other equity-based compensation to Mr. Pence. Additionally, Mr. Pence has never been awarded a retention compensation agreement. The Compensation Committee determines the CEO’s salary based on factors such as the Company’s achievement of operational and financial goals and on comparisons of CEO compensation in similar companies. During fiscal 2005, considering these factors and recognizing Mr. Pence’s continued strong leadership and his lack of participation in the Company’s equity-based incentive programs, the Committee approved an increase in Mr. Pence’s base compensation from $800,000 to $825,000. In addition, based on an analysis of Mr. Pence’s total compensation package, and its relation to the level of compensation paid to other executive officers of the Company and of peer companies, and in light of his substantial contribution to the Company, the Committee approved Mr. Pence’s inclusion in the SERP described above. Mr. Pence is fully vested in the retirement benefits payable to him under the SERP. In fiscal 2005, as in prior years, Mr. Pence also participated in the Company’s executive incentive program as described above, pursuant to which his incentive pay was determined based on the Company achieving its corporate goals for revenue growth and EBIT and the Compensation Committee’s evaluation of his individual performance.

Compliance with Internal Revenue Code Section 162(m).

Section 162(m) of the Internal Revenue Code disallows a tax deduction to publicly held companies for compensation paid to certain of their executive officers, to the extent that compensation exceeds $1 million per covered officer in any fiscal year. The limitation applies only to compensation that is not considered to be performance-based and does not apply to options granted by the Compensation Committee under the Plan at fair market value on the grant date. A portion of the compensation paid to the Company’s CEO and its President and Chief Merchandising Officer during the fiscal year ended January 28, 2006 exceeded the $1 million limit. Compensation paid to the Company’s other executive officers during the fiscal year ended January 28, 2006 did not exceed the $1 million limit. The Compensation Committee anticipates that non-performance based compensation to be paid to the Company’s CEO, President and Chief Merchandising Officer and other executives during the fiscal year ending February 3, 2007 will not exceed the $1 million limit. The Committee may continue to authorize compensation payments that are not deductible if, in its judgment, such payments are necessary to achieve the Company’s compensation objectives.

It is the opinion of the Compensation Committee that the executive compensation policies and plans provide the necessary total remuneration program to properly align the Company’s performance and the interests of the Company’s stockholders through the use of competitive and equitable executive compensation in a balanced and reasonable manner, for both the short- and long-term.

FROM THE MEMBERS OF THE COMPENSATION COMMITTEE

James R. Alexander

Jerry Gramaglia

Kay Isaacson-Leibowitz

Robert H. McCall

18

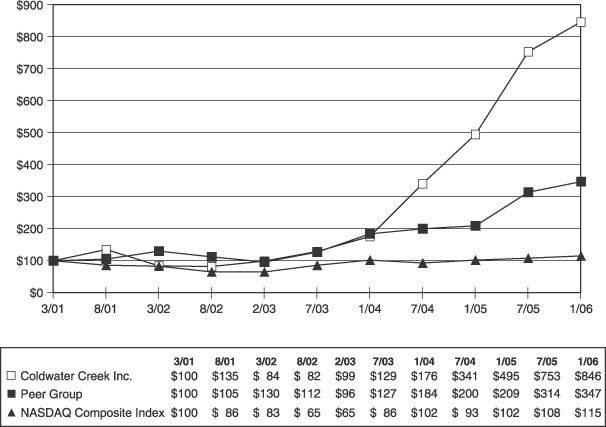

PERFORMANCE GRAPH

The following performance graph shows the percentage change in cumulative total return to a holder of the Company’s Common Stock (NASDAQ:CWTR) compared with the cumulative total return, assuming dividend reinvestment, of the NASDAQ Composite Index and the industry peer group indicated below, during the period from March 2, 2001 through January 28, 2006. The Company paid no cash dividends during the periods presented.

Comparison of Five Year Cumulative Total Return*

* $100 invested on March 2, 2001 in stock or index including reinvestment of dividends.

Peer Group: | Chico’s FAS, Inc. (NASDAQ:CHS) Nordstrom, Inc. (NASDAQ:JWN) The J. Jill Group, Inc. (NASDAQ: JILL) Ann Taylor Stores Corp. (NASDAQ:ANN) Talbots, Inc. (NASDAQ:TLB) |

Notwithstanding anything to the contrary set forth in any of the Company’s previous filings made under the Securities Act of 1933, as amended, or the Exchange Act of 1934, as amended, that might incorporate future filings made by the Company under those statutes, neither the preceding Performance Graph nor the Compensation Committee Report is to be incorporated by reference into any such prior filings, nor shall such graph or report be incorporated by reference into any future filings made by the Company under those statutes.

19

Audit Committee Report on the Fiscal Year Ended January 28, 2006

The information contained in this report shall not be deemed to be soliciting material or filed with the SEC, or subject to Regulation 14A or 14C or to the liabilities of Section 18 of the Exchange Act, except to the extent that the Company specifically request that the information be treated as soliciting material or specifically incorporate it by reference into a document filed under the Securities Act of 1933, as amended, or the Exchange Act.

The Board’s Audit Committee (the “Committee”) is comprised solely of independent directors, as defined by the rules of NASDAQ and the SEC. The members of the Committee are James R. Alexander, Curt Hecker and Robert H. McCall (Chairman). Warren Hashagen joined the Committee on March 27, 2004 and left the Committee on June 11, 2005. The Committee met ten times during the fiscal year ended January 28, 2006.

The Committee is governed by a written charter adopted and approved by the Board. The Committee reviews the charter and assesses its adequacy annually. The Committee oversees the Company’s financial reporting process on behalf of the Board. Management is responsible for the Company’s internal controls and the financial reporting process. The Company’s independent registered public accounting firm for the fiscal year ended January 28, 2006, KPMG LLP, were responsible for performing an independent audit of the Company’s consolidated financial statements for the fiscal year ended January 28, 2006 in accordance with auditing standards generally accepted in the United States of America and to issue a report thereon. The Company’s independent registered public accounting firm, as well as the Company’s internal auditor, have full access to the Committee and regularly meet with the Committee without management being present to discuss appropriate matters.

Based on the Committee’s review of the audited consolidated financial statements, its discussion with management regarding the audited consolidated financial statements, its receipt from KPMG LLP of written disclosures and the letter required by Independence Standards Board Standard No. 1, its discussions with KPMG LLP regarding its independence, the audited financial statements, the matters required to be discussed by the Statement on Auditing Standards 61, as amended, and other matters, the Committee recommended to the Board that the audited consolidated financial statements for the fiscal year ended January 28, 2006 be included in the Company’s Annual Report on Form 10-K for such fiscal year.

FROM THE MEMBERS OF THE AUDIT COMMITTEE

James R. Alexander

Curt Hecker

Robert H. McCall

20

BOARD AND COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Other than that disclosed immediately hereafter, no current executive officer of the Company has ever served as a member of the Board of Directors, or any committee thereof, of any other entity that has or has had one or more executive officers serving as a member of the Company’s Board, or any committee thereof. From March 2002 to December 2005, Mr. Pence served on the Board of Directors of publicly-held Intermountain Community Bancorp, and its wholly-owned subsidiary, Panhandle State Bank. Mr. Hecker, a member of the Company’s Board and a member of its Executive Committee, Audit Committee and Nominating and Corporate Governance Committee, serves as President, Chief Executive Officer and a Board member of Intermountain Community Bancorp and as Chief Executive Officer and a Board member of Panhandle State Bank. Mr. Hecker served on the Compensation Committee from November 9, 2002 to June 12, 2004.

Since June 12, 2005, the Compensation Committee consisted of James R. Alexander (Chairman), Jerry Gramaglia, Kay Isaacson-Leibowitz and Robert H. McCall and until June 11, 2005 included Warren R. Hashagen. None of the individuals serving on the Compensation Committee during fiscal year 2005 was an officer or employee of the Company during the fiscal year 2005, was an officer of the Company prior to fiscal year 2005 or had any relationship required to be disclosed by the rules of the SEC under the “Certain Relationships and Related Transactions” heading below with the exception of Warren R. Hashagen, who entered into a consulting agreement with the Company upon his departure from the Board.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Dennis Pence and Ann Pence personally participate in a business jet fractional share program through two entities they own. Ann Pence, who was the Vice Chairman of the Company’s Board of Directors until August 2004, is a holder of more than five percent of the Company’s common stock and holds the title of Chairman Emeritus. The Company maintains an arrangement with Dennis Pence and Ann Pence pursuant to which, on occasion, it reimburses them for the usage of their fractional share interests to fulfill a portion of its business travel needs. For flights by Mr. Pence and other corporate executives made exclusively for official corporate purposes, the Company reimburses these entities for:

| • | a usage based pro rata portion of the actual financing costs of the jet fractional share rights; |

| • | a usage based pro rata portion of the actual monthly maintenance fees; and |

| • | actual hourly usage fees. |

Aggregate expense reimbursements totaled approximately $550,000 during the fiscal year ended January 28, 2006. In addition to providing for a more efficient utilization of executive time, the Company believes that these reimbursements constituted a savings as compared to the costs which would have been incurred had the Company chartered comparable aircraft. In October 2005, the Company obtained interests in a business jet fractional share program sufficient to satisfy its executive travel requirements.

On June 14, 2003, the Company’s Board of Directors approved a charitable contribution of $100,000 to the Morning Light Foundation, Inc., a not-for-profit organization. Dennis Pence, the Company’s Chairman and Chief Executive Officer, is the founder and a board member of the Morning Light Foundation, Inc.

Ann Pence retired from her position as a Director of the Company effective August 23, 2004. In connection with her retirement, and in recognition of her contributions as co-founder of the Company,

21

she was given the honorary title of Chairman Emeritus and was extended certain post-retirement benefits. During the fiscal 2004 third quarter, the Company accrued the net present value of the expected future benefit costs in the amount of $200,000.

Effective June 11, 2005, in connection with his resignation from the Company’s Board of Directors, Warren R. Hashagen entered into an agreement to provide strategic and operational consulting services. The agreement, which expires on June 10, 2006, unless earlier terminated by either party, provides for cash compensation of $20,000 per month, plus reimbursement of expenses. The agreement also includes customary confidentiality provisions and requires Mr. Hashagen to notify the Company prior to engaging in business activities that are competitive with the Company’s business.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and executive officers, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Officers, directors and greater than ten-percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) reports they file.

Based solely upon review of the copies of such reports furnished to the Company and written representations that no other reports were required, the Company believes that there was compliance for fiscal year 2005 with all Section 16(a) filing requirements applicable to the Company’s officers, directors and greater than ten-percent beneficial owners except for one non-timely filed Form 4 for Dennis Pence.

ANNUAL REPORT

The Annual Report of the Company for the fiscal year ended January 28, 2006 has been mailed concurrently with the mailing of the Notice of Annual Meeting and Proxy Statement to all stockholders entitled to notice of and to vote at the Annual Meeting. The Annual Report is not incorporated into this Proxy Statement and is not considered proxy soliciting material. In compliance with Rule 14a-3 promulgated under the Securities Exchange Act of 1934, the Company hereby undertakes to provide without charge to each person upon written request, a copy of the Company’s Annual Report on Form 10-K, including the financial statements thereto. Requests for such copies should be directed to Coldwater Creek Inc., One Coldwater Creek Drive, Sandpoint, Idaho 83864, Attention: Investor Relations. Copies of the Company’s various SEC reports, including its Annual Report on Form 10-K, are available for immediate retrieval from the SEC’s web site (www.sec.gov) and are available on the Investor Relations portion of the Company’s website at www.coldwatercreek.com.

22

PROPOSAL 2:

APPROVAL OF THE COMPANY’S

2006 EMPLOYEE STOCK PURCHASE PLAN

This section provides a summary of the terms of the 2006 Employee Stock Purchase Plan and the proposal to approve the plan.

The Board of Directors approved the Company’s 2006 Employee Stock Purchase Plan on March 24, 2006, subject to stockholder approval at this meeting. The Company is asking the stockholders to approve the 2006 Employee Stock Purchase Plan as the Company believes the plan will be a valuable tool in motivating its employees. The purpose of the 2006 Employee Stock Purchase Plan is to enable eligible employees of the Company or any of its participating affiliates, through payroll deductions, to purchase shares of Common Stock, to increase the employees’ interest in its growth and success and encourage employees to remain in the employ of the Company or its participating affiliates. There are currently no participants in the 2006 Employee Stock Purchase Plan. Because participation in the 2006 Employee Stock Purchase Plan is subject to the discretion of each eligible employee and the amounts received by participants under the plan are subject to the fair market value of the Common Stock on future dates, the benefits or amounts that will be received by any participant or groups of participants if the 2006 Employee Stock Purchase Plan is approved are not currently determinable. On the Record Date, there were approximately six executive officers and 7,700 employees of the Company and its subsidiaries who were eligible to participate in the 2006 Employee Stock Purchase Plan.

Description of the Plan