SECOND QUARTER 2003 AND OUTLOOK

ANALYST CONFERENCE CALL

AUGUST 21, 2003 – 11:00 AM EDT

Mickey Foster – Vice President – Corporate and Investor Relations

Slide 1 - LOGO

Introduction – Good morning and thank you for participating in Millennium Chemicals’ analyst conference call and welcome to those participants on the Internet. Today we will cover results for the second quarter 2003 and our outlook. Speakers include Bob Lee, our President and Chief Executive Officer, Jack Lushefski, our EVP and Chief Financial Officer, and myself, Mickey Foster, VP of Corporate and Investor Relations.

As we announced in the invitation to this conference call, you can view the slides and listen to our presentation live by accessing our website (www.millenniumchem.com) and clicking on the Investor Relations icon.

The slides available to our Internet participants are meant as an enhancement tool and they contain information which is either in our press release or which we will discuss during this presentation.

Here are two instructions for our Internet participants:

First, in addition to asking questions on the conference call as you have traditionally done, you can ask questions by clicking on the “send question” button located on the left hand portion of your screen and we will respond to them live during the Q&A portion of this conference call.

Second, the slides will automatically move forward during the presentation on your screen.

Slide 2 - DISCLAIMER

Before we start, our lawyers asked me to preface with our safe harbor legal statement: The statements made on this conference call relating to matters that are not historical facts, are forward looking statements. Our forward-looking statements are present expectations and actual events and results may differ materially due to the impact of factors such as industry cyclicality, general economic conditions, production capacity, competitive products and prices and other risks and uncertainties detailed in the Company’s SEC filings. Please note we disclaim any obligation to update our forward-looking statements. In addition, any non-GAAP financial measure discussed in this presentation will be reconciled to the most directly comparable GAAP measure either in the presentation itself or in information to be posted with our presentation materials on our website.

Bob will begin. Jack then will cover the financials. Next, I will cover TiO2, Acetyls and Equistar. Finally, Bob will end with our key changes. Then we will be glad to answer questions. Bob...

Robert E. Lee – President and Chief Executive Officer

Thank you Mickey. Good morning. I’m very pleased to speak to you for the first time as the CEO of Millennium. The first few weeks on the job have been very challenging, as we have had to make some difficult decisions but I believe we are heading in the right direction with a focus on the important priorities that will drive our success.

Slide 3 - STRATEGIC PRIORITIES

Over the near term we are directing our full energies on three key areas. The first relates to a continuing focus on our costs. We need to not only continue to tweak our cost and improve our efficiency year-in and year-out, but we need to also make step changes in our manufacturing and business processes to reduce our total cost as well as the asset intensity of our business.

We also need to get refocused on our customers. We have spent several years improving the performance characteristics of our TiO2 products to bring them up to industry leading or matching positions. Now that we have caught up with the industry, we will maintain that position and improve our competitive positions at our customers. The entire organization understands that everything we do is about customers and our ability to profitably serve them. I personally will be spending much of my time with customers.

The third key priority is to maintain and improve our balance sheet to allow our management team the financial flexibility to make good business decisions without challenging our financial security.

We have aligned our new organization around these objectives.

Slide 4 - RECENT INITIATIVES

The decisions that we have made over the last few weeks relate directly to these priorities. The suspension of the dividend was required, as we were faced with a heavy debt burden and tight cash flows. Continuing to pay the dividend was not the right course of action. It is my belief that this half-step backwards will get us to a better value quicker than by continuing with these payments.

Just as we could not currently afford the dividend, we could also not afford to work on all of the initiatives that we were working to deliver. We needed to get our activities focused around our core businesses and eliminate the overhead associated with everything else. We cannot afford the luxury of saying “things will get better as the chemical cycle turns.” Getting back to the basic fundamentals of the business allows us to reduce our cost by $20 million.

We have reduced capital investment projects to primarily the basics items of safety, environmental and very fast cost-reduction opportunities. We will maintain this approach for the foreseeable future.

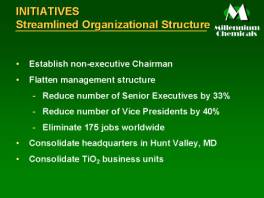

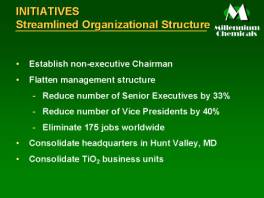

Slide 5 - STREAMLINED ORGANIZATION STRUCTURE

Critical to the narrowed focus of our strategy was the decision to flatten the organization structure. At the top we made the Chairman’s role non-executive as we believe it is better corporate governance but also allows the management of Millennium to focus on delivering results. We flattened the executive ranks to

match our priorities and broaden spans of control. This resulted in a 33% reduction in senior management and a 40% reduction in other executives in the business. In total we reduced our non-direct manufacturing employees by over 15%, eliminating 175 positions worldwide.

The decision to consolidate our corporate office in Hunt Valley, Maryland allows us not only to reduce costs, but better aligns corporate and operational decision-making. The same holds true for the elimination of separate business unit structures around the coatings, plastic and paper markets. We are now functionally focused around the world to better, and more cost-effectively, serve our customers. At the end of the day, that is why we are in business...to sell products at an acceptable profit. Now I will turn you over to Jack, who will discuss our financial results and restatement issues.

John E. Lushefski – Chief Financial Officer

Thanks Bob.

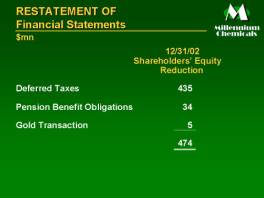

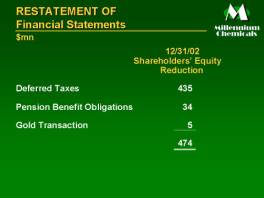

Slide 6 - RESTATEMENT OF FINANCIAL STATEMENTS

I would now like to review some details of Millennium’s reported results for the second quarter of 2003 and our financial position at the end of June 30, 2003. Before I begin that review, I will discuss the effects on December 31, 2002 Shareholders’ equity of the restatement items disclosed in our Form 10-Q which was filed two days ago.

As a result of errors discovered in the third quarter of 2003, the Company is restating its financial statements for the years 1998 through 2002 and for the first quarter of 2003, to correct its accounting for deferred taxes relating to its Equistar investment and French subsidiaries, the calculation of its pension benefit obligations and its accounting for a multi-year gold transaction.

As we have detailed on slide 6, the corrections of the errors relating to deferred taxes had the effect of reducing shareholders’ equity at December 31, 2002 by $435 million. The corrections relating to pension benefit obligations and the gold transaction reduced shareholders’ equity at December 31, 2002 by $34 million and $5 million, respectively. For a more detailed description of the aggregate effects of these restatements, see Note 2 to the Company’s Financial Statements included in Form 10-Q filed on August 19th.

Our entire senior leadership team at Millennium is focusing on the priority of correcting the Company’s financial statements. We are working with our independent auditors, PricewaterhouseCoopers LLP, who must audit the corrections. We are also evaluating ways to improve our processes and controls so that issues like these are less likely to surface in the future.

The Company intends to file an amendment to its Annual Report on Form 10-K for the year ended December 31, 2002 and an amendment to its Quarterly Report on Form 10-Q for the quarter ended March 31, 2003 to reflect the corrections. These amendments are being prepared and will be filed as soon as possible with, of course, the concurrence of Pricewaterhouse-Coopers.

These corrections do not affect the underlying fundamentals of our business operations nor do they affect cash flow of Millennium in 2003.

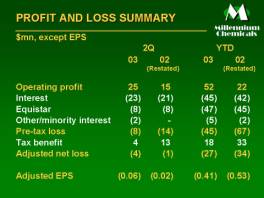

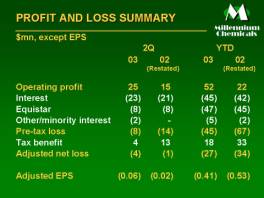

Slide 7 – PROFIT AND LOSS SUMMARY

Let’s now move on and discuss performance for the second quarter and year-to-date. Please note that these figures have all been adjusted for the accounting errors that I’ve discussed. Let’s start with Millennium’s Profit and Loss Summary slide which provides abbreviated Statements of Operations to arrive at adjusted earnings after exclusion of certain items. Table V in our press release provides a reconciliation from reported GAAP earnings to Adjusted GAAP for the same items on an after-tax basis.

Operating income for the second quarter of 2003 was $25 million, up $10 million from the second quarter of last year, but down $2 million from what was earned in the first quarter of 2003.

Second quarter net interest expense was $23 million, up $2 million from the expense level for the second quarter of last year and up $1 million from the first quarter of 2003. Average net debt levels during the second quarter of this year were about $60 million higher than average net debt levels during the second quarter of last year.

Our share of Equistar’s operations, on an after interest basis, generated a loss of $8 million in both the second quarter of 2003 and 2002.

Income tax benefits were recognized during the second quarter of 2003 and year-to-date 2003. This is different than Millennium’s original first quarter 2003 tax provision, included in our financial statements in Form 10Q for the quarter ended March 2003, when tax benefits were not recognized for tax jurisdictions that reported losses. This change relates to our deferred tax accounting error corrections for prior years that add deferred tax liabilities to our balance sheet and therefore allow the accrual of deferred tax assets to continue.

The adjusted net loss for the quarter was $4 million or 6 cents per share versus a net loss of $1 million or 2 cents per share for the second quarter last year.

Slide 8 – EARNINGS (LOSS) AND EPS

Moving to slide 8 ...this slide provides a reconciliation from our reported GAAP net loss to the adjusted GAAP loss I provided and discussed on slide 7. Reorganization expenses related to the cost reduction program outlined in our press release and our share of Equistar’s debt prepayment cost are highlighted as reconciling items for the second quarter of 2003.

Slide 9 – EARNINGS (LOSS) AND EPS

Slide 9 provides the same reconciliation from reported GAAP to adjusted GAAP for the first six months of 2003. The cumulative effect of accounting change for asset retirement obligations and our share of Equistar’s loss on sale of assets from the first quarter of 2003 are added as reconciling items.

Slide 10 – NET DEBT

Let’s move to a discussion of our balance sheet and cash flow. Net debt at the end of the quarter was $1.196 billion, a balance that is $51 million higher than our net debt balance at the beginning of the quarter and $79 million higher than our net debt balance at the beginning of the year.

Slide 11 – CHANGE IN NET DEBT

Slide 11 details our change in net debt for both the second quarter of 2003 and year-to-date June 30, 2003.

Our semi-annual interest payments on our Senior Notes and Senior Debentures were made in the second quarter and amounted to a $43 million use of cash.

Cash used for capital spending remained at a very low rate as we continue to conserve cash by limiting capital to important safety, environmental and short payback discretionary projects.

Trade working capital, defined as accounts receivable plus inventories less accounts payable, increased during the quarter and was a use of $37 million in cash. The primary reason for that increase related to increased TiO2 finished

goods inventory and to a lesser extent a reduced level of accounts payable at June when compared to March.

The source and use of cash for other assets and liabilities relates to the seasonal timing of payments of such items as insurance, property tax, payroll-related costs and long term liabilities.

Net debt increased during the quarter by $51 million. We did not receive a distribution from Equistar in the quarter and do not expect distributions for at least the next twelve months.

Slide 12 – DEBT STATISTICS

EBITDA to net interest coverage as defined in our credit agreement, for the trailing twelve months to June was about 2.38 times and our net debt to EBITDA leverage ratio was 5.64 times. Based on those debt statistics, Millennium is in compliance with the financial covenants in the credit agreement at June 30, 2003. We do not believe we will be in compliance at the end of the third quarter and will be seeking an amendment to the credit agreement before September 30, 2003. Please refer to our recently filed Form 10-Q for a more complete discussion of our credit agreement and liquidity, particularly Note 8 to our financial statements and the Liquidity and Capital Resource section of Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Now, I’ll turn it over to Mickey who will discuss some details about performance in some of our business segments and Equistar.

Mickey Foster – Vice President

Corporate and Investor Relations

Slide 13 – TiO2 OPERATING INCOME

Thanks Jack. The Titanium Dioxide (TiO2) segment reported second quarter operating income of $23 million, compared to $15 million in the second quarter of 2002 and $21 million in the first quarter of 2003.

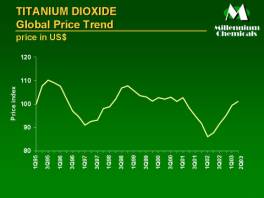

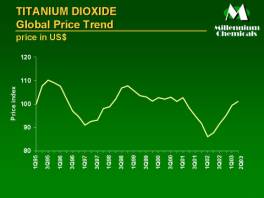

Slide 14 – GLOBAL TIO2 PRICE TREND

In local currencies, average second quarter prices increased 7 percent from the second quarter of 2002 and were comparable to the first quarter of 2003. In US dollar terms, the second quarter worldwide average selling prices increased 15 percent from the second quarter of 2002 and increased 2 percent from the first quarter of 2003.

Slide 15 – TIO2 GLOBAL SALES VOLUME

Second quarter 2003 TiO2 sales volume of 145,000 metric tons represented a decrease of 15 percent from the second quarter of 2002 and was equal to the first quarter of 2003. Sales volume trended down each month during the quarter and was lower than expected due to the weak global economy; adverse weather, primarily in North America; and competitive pressures.

Slide 16 – TIO2 OPERATING RATE

The second quarter 2003 TiO2 operating rate was 96 percent of annual nameplate capacity of 690,000 metric tons compared to 89 percent in the second quarter of 2002 and 88 percent in the first quarter of 2003. The Company’s TiO2 finished goods inventories increased during the second quarter.

Slide 17 – TIO2 OUTLOOK

Operating profit in the TiO2 business segment is expected to decline in the third quarter of 2003 compared to the second quarter of 2003 as production may slow to meet a softer demand outlook due to continuing weakness resulting from uncertain worldwide economic conditions and competitive pressures. Weakening foreign currencies against the US dollar and competitive pricing may result in downward pressure on average US dollars TiO2 selling prices in the third quarter of 2003.

Slide 18 – ACETYLS HIGHLIGHTS

The Acetyls segment reported second quarter operating income of $5 million compared to $3 million in the second quarter of 2002 and $7 million in the first quarter of 2003. The extended acetic acid plant shutdown impacted profits by about $3 million in the second quarter of 2003.

In the aggregate, the weighted-average US dollar price for VAM and acetic acid in the second quarter of 2003 increased 42 percent compared to the second quarter of 2002 and 8 percent from the first quarter of 2003. Margins for the same periods have not increased similarly due to rising natural gas feedstock prices. Aggregate volume for VAM and acetic acid in the second quarter of 2003 decreased 13 percent from the second quarter of 2002 and decreased 10 percent from the first quarter of 2003.

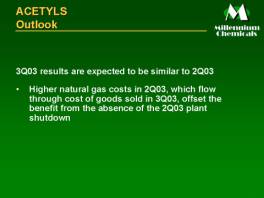

Slide 19 – ACETYLS OUTLOOK

Operating profit in the Acetyls business segment for the third quarter of 2003 is expected to be similar to the second quarter of 2003 reflecting stable market conditions in Europe and the Americas. Higher natural gas costs in the second quarter of 2003, which flow through cost of goods sold in the third quarter of 2003, offset the benefit from the absence of the plant shutdown which occurred in the second quarter.

Slide 20 – EQUISTAR HIGHLIGHTS

Millennium’s 29.5 percent stake in Equistar generated a post-interest loss on investment of $(14) million in the second quarter of 2003 compared to a loss of $(8) million in the second quarter of 2002 and a $(43) million loss in the first quarter of 2003. Equistar’s Gulf Coast olefin plants that can consume liquid raw materials demonstrated their differential cost advantage despite crude oil prices remaining high, averaging close to $30 per barrel for the second quarter. This advantage was partially offset by depressed volumes for Equistar and for the chemical industry, caused by post-Iraq war inventory reductions, the impact of SARS, and generally poor economic conditions.

Slide 21 – EQUISTAR OUTLOOK

During the second quarter of 2003, Equistar’s sales volume generally demonstrated a slow but steady improvement and this trend has continued into the third quarter of 2003. Equistar expects to continue to benefit from its liquid raw material advantage, although this advantage may not be as strong as the second quarter of 2003. The potential for continued raw material cost volatility represents an uncertainty, but Equistar believes that market fundaments will continue to favor its liquid-based olefins position. Performance in the third quarter of 2003 will be largely dependent upon the pace of global economic recovery. Assuming moderate economic recovery and improved global stability, Equistar would expect to benefit from strengthening sales volume and moderating raw material prices. However, given current depressed industry operating rates, it will be difficult to achieve and sustain product margin improvements in the near term.

Thanks, and now I’ll turn it over to Bob...

Robert E. Lee – President

And Chief Executive Officer

Slide 22 - KEY CHANGES

To wrap up our formal comments I would like to outline what the management team will be working on.

We will be obsessive about costs. An operational excellence model will drive all of our decision-making. We need to have a cost position that makes us profitable in any chemical cycle. That means we are looking at every item of cost with a different prospective than we have had in the past. Every cost item will be challenged as to whether it to matches our priorities and our current state of affordability.

We will grow our top line. We will make our decisions regarding our customers to align with their grow plans and we will be competitive.

We are and will continue to review our assets for strategic fit around our priorities of costs, customers and financial flexibility.

We will be much more active in the governance process relating to our single largest asset....Our joint venture interest in Equistar.

We will remain cautious about our spending and investment decisions and, most importantly, we will hold ourselves accountable for delivering acceptable results. Key performance metrics are being established, including at the Board level, to align our team around successful execution.

We still have much work to do and I look forward to giving you regular updates. Let’s now open the lines for questions.

Slide 23 – LOGO

Thanks for your attention, and now we’d be happy to take your questions.

AFTER QUESTIONS & ANSWERS

MICKEY FOSTER

If you were unable to hear the entire call, playback will be available until Thursday, August 28, by calling 973-341-3080; reservation #4126032 and you can access the speech and slides on the Internet at http://www.millenniumchem.com. Thanks for listening, and if you have further questions please call.