CS FIRST BOSTON

CHEMICAL CONFERENCE

September 16, 2003

9:15 a.m. EDT

Robert E. Lee – President and Chief Executive Officer

Slide 1 – LOGO

Introduction – Good morning and it is a pleasure to speak you as the new CEO of Millennium Chemicals. Millennium has undergone several changes during the last few months and I believe we have in place a strategy that will yield success in the near term and position the company for growth in the future.

Our immediate priority will be focusing Millennium on getting back to the basic fundamentals of doing business. Quite simply focusing on our customers, our costs and being competitive in the marketplace.

Today, I will review for you our strategic priorities and the recent initiatives, a brief outlook of the third quarter as well as provide you with a more detailed picture of the key changes for Millennium. Then I will be glad to answer questions that you may have.

Slide 2 – DISCLAIMER

Before we start, our lawyers asked me to preface with our safe harbor legal statement: The statements made in this presentation, relating to matters that are not historical facts, are forward looking statements. Our forward-looking statements are present expectations and actual events and results may differ materially due to the impact of factors such as industry cyclicality, general economic conditions, production capacity, competitive products and prices and other risks and uncertainties detailed in the Company’s SEC filings. Please note we disclaim any obligation to update our forward-looking statements.

Slide 3 – SALES BREAKDOWN

I would like to give those who are not familiar with Millennium a brief overview of our company. Including Equistar, Millennium Chemicals’ proforma sales were $3.2 billion dollars last year. Wholly owned accounted for sales of $1.6 billion dollars with TiO2 representing 73 percent of that total. Approximately 50% of the sales from wholly-owned operations are outside the United States. We are strategically positioned to serve our global customer base with plants and sales offices in all major markets.

Slide 4 – LEADING MARKET POSITIONS

Millennium’s major businesses enjoy leading market position in all of its core businesses, specifically TiO2, VAM and Acetic Acid.

For the industry, Titanium dioxide, or “TiO2”, is a 3 ½ million ton-per-year global product manufactured by a relatively small number of specialist producers. It is the brightest white pigment with the highest opacity of any commercial product, and is used to impart whiteness and opacity to paints, plastics, paper and in many other smaller applications. Customers include AKZO, Sherwin Williams, and Valspar.

Acetic acid is one of the world’s most important intermediate chemicals, and is used in the manufacture of vinyl acetate monomer (VAM), purified terephthalic acid (PTA), acetic anhydride, monochloroacetic acid (MCA), and acetate esters. The largest end use for acetic acid is as a raw material for the production of vinyl acetate monomer (VAM). Customers for this product include Dupont, DAK America, Exxon and AKZO.

Vinyl acetate monomer is a key raw material for the production of polyvinyl acetate (PVAc) and polyvinyl alcohol (PVOH or PVA). Approximately 80 percent of all VAM produced in the world is used to make these two chemicals. Polyvinyl acetate (PVAc) and copolymers of VAM are used in the manufacture of paints, adhesives, paper coatings, textile treatments and plastics. Key customers here include National Starch, Rohm & Haas, Noltex and HB Fuller.

Slide 5 – STRATEGIC PRIORITIES

Now let me review what we plan to do with this business. Over the near term we are directing our full energies on three key areas. The first relates to achieving a cost leadership position in our core businesses. We need to make step changes in our manufacturing and business processes that reduce our total cost to allow us the ability to deliver profitable results in these ever changing competitive economic times. There are opportunities to grow these businesses and we plan to earn our right to grow using our improving cost position. The critical point here being we need to get our cost position correct first.

We also need to get refocused on our customers. We have improved the performance characteristics of our TiO2 products to bring them up to industry leading or matching positions. We will now work to maintain the performance competitiveness of our products. The entire organization understands that everything we do is about customers and our ability to profitably serve them. I personally will be spending much of my time with customers. We have existing capacity and a renewed competitive product mix that will allow differentiated growth over the near term without significant investment. We plan to put the new products and capacity to good use.

The third key priority is to improve our balance sheet to allow our management team to make good business decisions without challenging our financial stability. We will improve our cash flow performance as well as review the entire balance sheet for cash optimization.

We have aligned our new organization around these objectives.

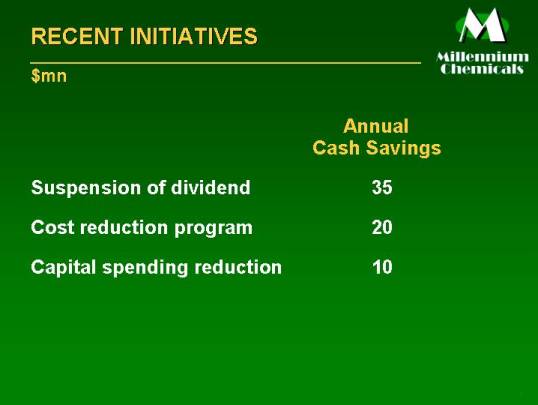

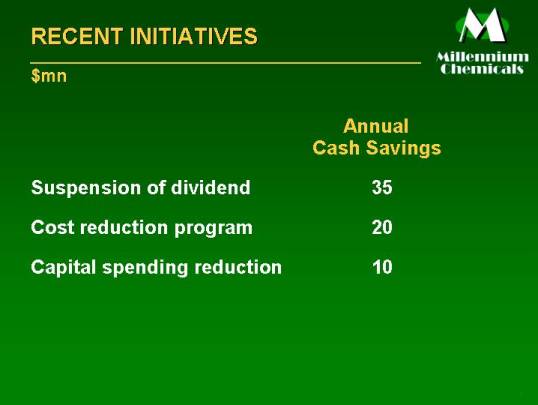

Slide 6 – RECENT INITIATIVES

The decisions that we have made over the last two months relate directly to these priorities. The suspension of the dividend was required as we were faced with a very leveraged balance sheet and tight cyclical cash flows. Continuing to pay the dividend would have exacerbated the problem.

Just as we could not currently afford the dividend, we could also not afford to work on all of the initiatives that we were previously pursuing. We needed to focus our activities around our core businesses and back to the basic fundamentals of cost reduction and providing competitive products to customers. Our recently announced worldwide cost reduction program eliminates 175 employee positions and saves $20 million annually.

We have also reduced capital investment projects to primarily the basics items of safety, environmental and very fast cost reduction opportunities. We will maintain this approach for the foreseeable future.

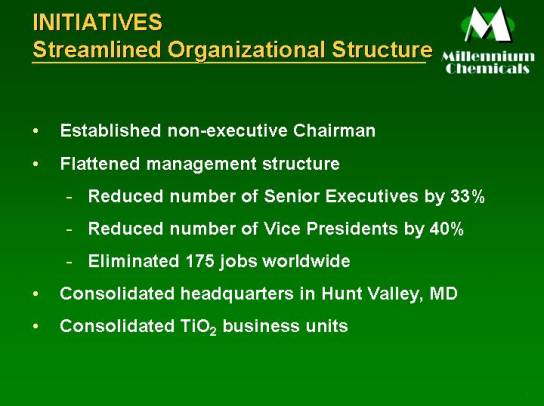

Slide 7- STREAMLINED ORGANIZATION STRUCTURE

Critical to the narrowed focus of our strategy was the decision to flatten the organization structure. At the top we made the Chairman’s role non-executive. We believe this improves corporate governance and allows the management of Millennium to focus on delivering results with oversight by the Board. We flattened the executive ranks to match the priorities and broaden spans of control. The result of these efforts reduced our executive headcount by 1/3. Other non-direct manufacturing headcount reductions exceeded 15%.

We have closed our New Jersey corporate office and consolidated with our corporate office in Hunt Valley, Maryland to reduce costs and better align corporate and operational decision-making.

We also have consolidated our business unit structures and are now functionally focused around the world to better, and more cost effectively, serve our customers. At the end of the day that is why we are in business...to sell competitive products and earn an acceptable profit.

Slide 8 –OUTLOOK

Before I provide you more details on the key changes at Millennium, I would like now to provide to you a brief outlook on our upcoming third quarter earnings results.

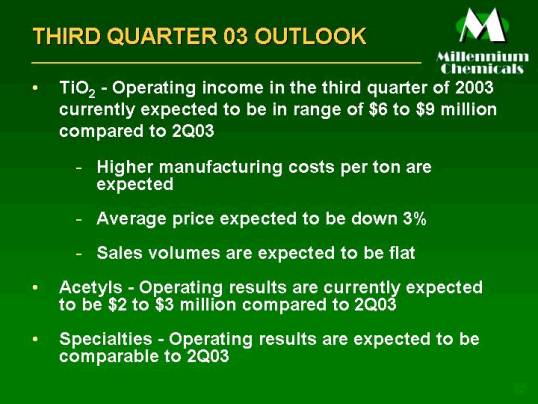

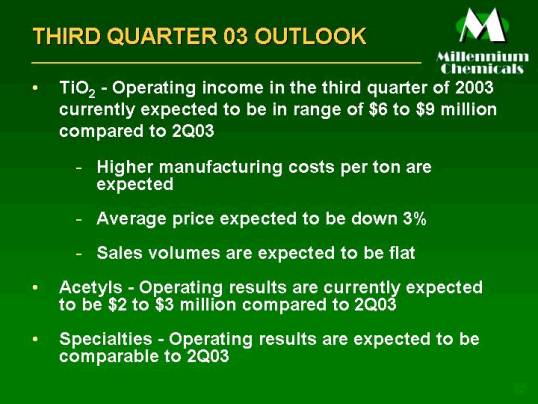

The operating income of the Titanium Dioxide (Ti02) business in the third

quarter of 2003 is currently expected to be in the range of $6 to $8 million compared to $23 million in the second quarter of 2003. This is a result in part due to expected higher manufacturing costs per metric ton due to lower operating rates. Also the average global selling price is expected to be down 3-4 percent in US dollars in the quarter. However, some good news is that sales volumes are expected to be flat.

In our Acetyls business, the operating results are currently expected to be $2 to $3 million in the third quarter of 2003 compared to $5 million in the second quarter of 2003. This decline is primarily due to the higher natural gas cost experienced in the second quarter of 2003 which flows through cost of goods sold in the third quarter of 2003. However, we expect operating results for the fourth quarter of 2003 to be substantially higher because of lower average natural gas cost and stable market conditions.

The operating results from our Specialties business are expected to be comparable to the second quarter.

That is a brief outlook of the third quarter, I would now like to turn your attention to the key changes we will be undergoing at Millennium.

Slide 9 - KEY CHANGES

Going forward, there will be several key changes to our approach. I would like to discuss each in some detail.

We will be obsessive about our cost. We will grow the top line with our customers. We will review our asset mix. We will actively manage Equistar. We will be cautious in our capital investment and finally we will instill greater performance accountability across the organization.

We will be a family on a very tight budget. We will be disciplined on costs in all areas of the business. We need to have a cost position that makes us profitable in any chemical cycle. That means we will look to reduce our total cost to serve and not just our manufacturing cost. Every cost item will be challenged as to whether it to matches our priorities and our current state of affordability. Millennium has been focused on cost in the past. This will be different, our cost reduction attitude will be ramped to obsessive.

Slide 11 – GROW THE TOP LINE

Our business depends on meeting and exceeding customer expectations. All departments regardless of their function will be customer conscious. We will grow our top line with our customers. We are intricately linked with our customers and only through their success will we achieve greater shareholder value. We will look to gain new customers to partner with in regions where opportunities exist and we will manage price consistent with profit optimization. As I said before, one of my personal focuses will be customer interaction and satisfaction. Customers will meet Bob Lee. We have the products. We have the capacity. And more importantly, we have a great customer base. We need to translate that into more business.

Slide 12 – REVIEW ASSET MIX

We are and will continue to review our assets for strategic fit around our priorities of costs, customers and financial flexibility. Our core businesses are sound and competitive. We are reviewing the strategy of our Fragrance and Flavors business to assure alignment around our priorities. We will also be much more active in the governance process relating to our single largest asset.... Our joint venture interest in Equistar.

Slide 13 – ACTIVELY MANAGE EQUISTAR

Equistar’s size in Millennium’s business portfolio make it an integral part of our success. We will work towards achieving a more consistent alignment of Equistar’s future and our goals. We will expect a heightened focus at Equistar on both cost and asset performance as it relates to optimizing cash flow. We cannot and will not sit back and wait for the chemical cycle to generate acceptable cash returns.

Slide 14 – CAUTIOUS CAPITAL INVESTMENT

We will remain cautious about our spending and investment decisions. We will invest capital prudently on projects that represent short-term strategic payback. We will also invest capital in our core business only as needed to meet market demand that exists today. As we reduce our cost position and fully implement our product line renewal efforts, we will earn the right to grow beyond our current capabilities. In the meantime, we have most of what we need to deliver improved results.

Slide 15 – PERFORMANCE ACCOUNTABILITY

We are also developing key performance metrics that will track our performance and establish accountability across the organization, including at the Board level. We will link our performance to shareholder value and we will be accountable for delivering improved results. We are eliminating EVA as an incentive tool and will use the concept only as a financial tool for business analysis.

I am excited about Millennium’s future and the tremendous people and businesses we have. It will be a challenging time ahead, but Millennium’s businesses are sound and we are focused on delivering improved results.

Slide 16 – LOGO

Thanks for your attention, and now I would be happy to take your questions.