UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

THE CHINA FUND, INC. |

(Name of Registrant as Specified in Its Charter) |

| |

CITY OF LONDON INVESTMENT GROUP PLC CITY OF LONDON INVESTMENT MANAGEMENT COMPANY LIMITED BARRY M. OLLIFF JULIAN REID RICHARD A. SILVER |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

City of London Investment Management Company Limited, together with the other participants named therein, has filed a definitive proxy statement and accompanyingBLUE proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of a slate of director nominees and certain business proposals at the upcoming 2018 annual meeting of stockholders of The China Fund, Inc., a Maryland corporation.

Please contact Saratoga Proxy Consulting LLC, which is assisting us, if you have any questions, require assistance in voting yourBLUE proxy card, or need additional copies of our proxy materials. Saratoga can be reached toll-free at (888) 368-0379.

Item 1: City of London released the following letter to its clients:

On Friday, March 23rd 2018, The China Fund, Inc. (NYSE Symbol: CHN), a US-listed Closed-End Fund (CEF) in which City of London Investment Management (CLIM) is invested on behalf of our clients, announced a 30-day postponement of its Annual Meeting of Stockholders, just four days before the meeting was scheduled to occur. The Board gave no reason for the postponement (they are not legally required to do so), but to us at CLIM, there was on obvious motive: with the results of the upcoming meeting clear to the Board, we believe the Board postponed the meeting to prevent its Chairman from losing his seat and the investment manager from being terminated by Shareholders.

CLIM is the beneficial owner of 27.6% of the outstanding shares of CHN. We have held shares of CHN every year since 2007. Over the years, we have had frequent communication with the Board on a variety of issues, guided by ourStatement on Corporate Governance and Voting Policy for Closed-End Funds (Statement). CLIM has a long history of engagement with the majority of the Boards of the CEFs in which we invest, viewing it as our responsibility as a shareholder to convey our concerns for the good of both our clients and the CEF sector as a whole. While we always endeavor to make these conversations cordial and constructive, our relationship with the Board of CHN, in particular, has deteriorated over the course of the last year.

Our current differences with the CHN Board spring from events that took place in 2009, when the Board had a different Chair, and CHN’s investment manager was Martin Currie Ltd. (“Martin Currie”). In April of that year, CHN made a purchase of convertible bonds in a transaction that, in part, benefited a private fund also managed by Martin Currie – a portion of the proceeds from the convertible bond issuance were to be used to redeem bonds held by the private fund, providing it with some much-needed liquidity during the Global Financial Crisis. While certain individuals at Martin Currie were aware of the conflict, it is our understanding that the Board was not informed of the full scope of the transaction when they granted a conflict waiver, enabling the purchase to go forward.

The transaction created multiple issues down the line for CHN when, less than two years later, the convertible bonds were written down to zero. When the bonds were finally sold it was for only 55% of their face value. While CHN was made whole due to an indemnity agreement with Martin Currie (prompted by and implemented subsequent to the convertible bond purchase), the entire transaction caught the attention of regulators (both the FSA and the SEC) and the fallout was significant. The Portfolio Manager of CHN was sanctioned and fined and Martin Currie was fined a total of £8.6 million by both the FSA and the SEC. The details of the SEC Administrative Proceeding can be found here: https://www.sec.gov/litigation/admin/2014/ic-31066.pdf.

In the aftermath of this, the Board opted to appoint a new manager, which we supported. We felt that the changes at Martin Currie warranted a Shareholder vote on the management of CHN. RCM Asia Pacific (later merged into Allianz Global Investors (“Allianz”)) was confirmed as the manager of CHN at the 2012 Annual Meeting of Stockholders.

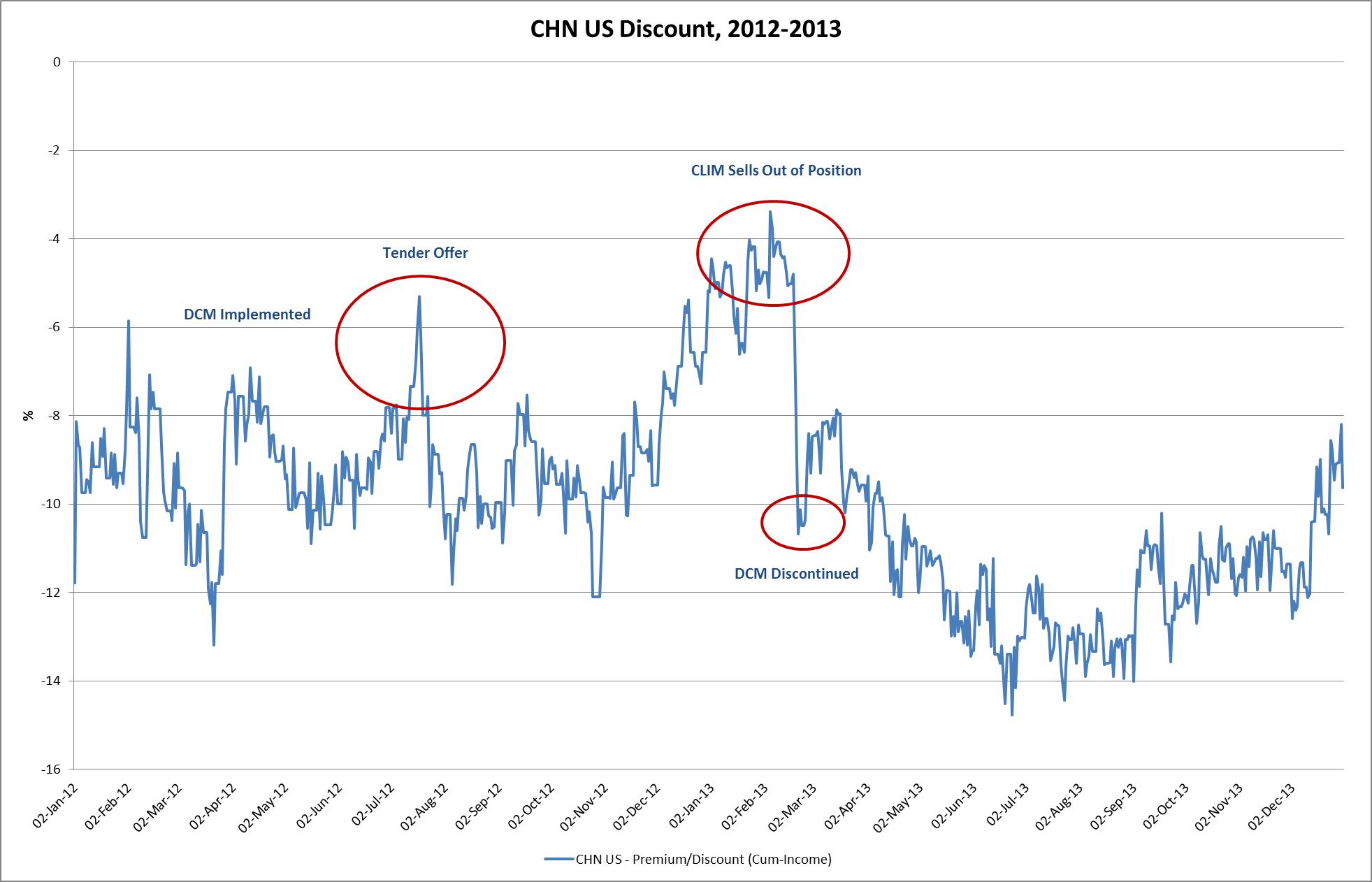

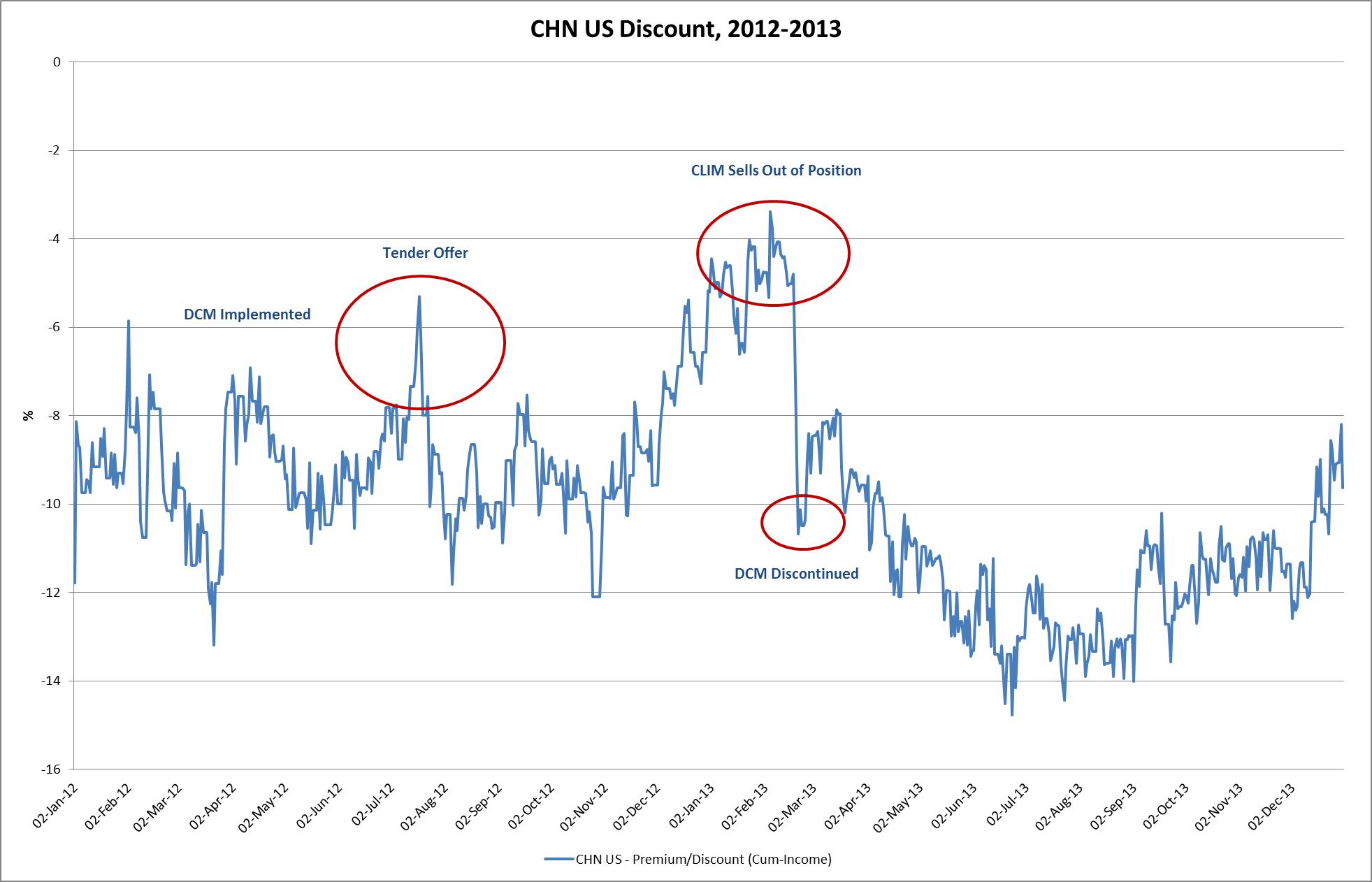

The identity of the investment manager was not the only area of concern for us, however. During the years leading up to the change from Martin Currie, CHN had regularly traded at a discount wider than 10% and we felt it unlikely that simply appointing a new manager would remedy this. To address the discount issue, following the start of Allianz’s tenure, the Board conducted a tender offer for 25% of shares at 99% of NAV and also implemented a Discount Management Program, committing to buy back shares in the market in the event CHN’s discount traded wider than 8%. While the buyback got off to what we considered a sluggish start, it was ultimately successful, with the result that CHN’s shares traded as narrow as 3.5% by early 2013, at which point we had sold entirely out of our position.

Shortly thereafter, in March of 2013, the Board announced that it would be ending its successful Discount Management Program. Although we were no longer shareholders of CHN, we took the time to address the Chairman, expressing our disappointment with the decision. We predicted in our letter to him that the discount would widen and, when we were quickly shown to be correct, we began to build a position in CHN once again.

Over the ensuing years, as we added to our position in CHN, we also continued to write to the Board. In 2013 and 2014, we wrote a total of four letters, highlighting our concerns about the widening discount, the large unrealized capital gains on CHN, the cash management policy and the plans that were in place to deal with some of the unlisted “legacy” positions that remained from the “Martin Currie days.”

During 2015 and 2016, our attention turned more specifically towards the composition of the Board itself, and we began to inform Directors when we would be choosing to withhold our votes from their upcoming elections, and the reason(s) for our decision. As outlined in our previously mentionedStatement, we may oppose Directors for various reasons, from excessive length of service (more than 9 years) to service on what we consider to be too many other Boards (5+) to lack of relevant experience, to failing in their fiduciary duty owed to Shareholders.

At that point, we also began to lobby all of the Boards of our US-listed CEF holdings to adopt a “majority” voting standard for Board elections, rather than the “plurality” standard that virtually all used, to improve corporate governance and help make Boards more responsive and accountable to Shareholders. The difference between these standards is a matter of a Director needing the lion’s share of the votes in order to be seated (“majority”) or simply needing one affirmative vote to be seated (“plurality”). Many of the Boards, including CHN, agreed to make this change and we were hopeful that the increased accountability to investors would help compel Directors to act in the best interest of Shareholders.

In April 2017, following five years of weak performance from CHN’s manager, Allianz, the Board of CHN proposed a change. While we had expressed concern about Allianz’s performance just a few months prior and felt we could have welcomed new management, the Board’s particular choice of replacement was shocking to us. The proposed manager was Open Door Investment Management (“Open Door”), a San Francisco-based Advisor co-founded by the former Portfolio Manager of CHN who had been sanctioned and fined for his actions at Martin Currie.

Nowhere in the press release announcing this proposal did the Board mention the former CHN Portfolio Manager’s relationship with Open Door and his history with CHN. In fact, his name was not disclosed in the announcement at all. Instead, the Board indicated CHN would be managed by his partner, similarly neglecting to mentionhis prior stint as manager of CHN (he had worked alongside the former Portfolio Manager and briefly taken over after his departure).

The inappropriateness of this proposal was clear to us, and we wrote to the Board immediately to express our disappointment and our intention to vote against Open Door. Despite CLIM being the largest shareholder in CHN, the Board pressed on with the proposal, even adjourning and reconvening the Special Meeting twice as they struggled unsuccessfully to garner the necessary votes. We continued to write to the Board following these adjournments, making our letters public so other Shareholders were aware of our position. Ultimately, after the Board realized that enough Shareholders would not support the proposal, they finally held the meeting and the proposal was defeated.

Looking back over our numerous years of interaction with the Board of CHN, culminating in their disturbing proposal to award a management contract to persons connected to a particularly unsavory part of CHN’s past, we determined that major change was needed. We had stated in recent letters to the Board that we would submit a proposal to terminate the manager and we moved forward with our plans to do that. But, for the first time in more than ten years, we felt it necessary to propose new Directors for the Board of a fund in which we invest. We did not believe that replacing the manager would fix everything that was wrong at CHN – we believe many of the problems stem from the Board and, particularly, with its Chairman who has been on the Board for 26 years. With CHN’s Chairman up for reelection at this year’s Annual Meeting of Stockholders, we came to view the meeting as a perfect opportunity to effect real change to the Board by replacing two incumbent directors, including the person we believe to be the main driver of the poor decision-making that had plagued CHN for years, with two experienced and fully independent Director nominees committed to acting in the best interests of all Shareholders.

During the next few months we engaged in proxy solicitation and outreach, offering Shareholders of CHN a new path forward. Our arguments were compelling enough that Institutional Shareholder Services, known as ISS, the industry-leading advisor offering recommendations to Shareholders, endorsed our termination proposal and our Director nominees over CHN’s nominees, including the Chairman.

We believe the writing was on the wall for the CHN Board. They had failed to control the discount, choosing to abandon their Discount Management Program. They had failed in their oversight of Allianz. They had failed to install their handpicked manager due to the objections of the majority of Shareholders. Finally, faced with the risk of losing their Chairman and another Director, they made a desperate move: They postponed the Annual Meeting of Stockholders – if they were winning they would not have delayed the meeting! Now it appears that the Board is taking whatever measures it can to avoid facing reality and to further entrench themselves. They filed suit against City of London in Federal Court in the United States District Court for the Southern District of New York in an attempt to halt our proxy solicitations, accusing us of making material misleading statements in our proxy materials. The Court denied in full CHN’s motion for a temporary restraining order, expedited discovery and preliminary injunction, finding that CHN did not establish a likelihood of success on the merits of its claims challenging our proxy materials. Despite the Court, in a detailed ruling, denying CHN’s motions, CHN has chosen to prolong the expense and delay of this claim, and has filed an appeal of the Court’s decision.

For our part, we filed a Verified Complaint in the Circuit Court of Baltimore County, Maryland, where CHN is incorporated, asking the Court to compel CHN to hold the Annual Meeting of Stockholders on the currently scheduled date of April 26th, among other things. Even before our case was heard by the Circuit Court, CHN postponed the meeting again, setting a new date of May 23rd, 2018. The Circuit Court has stated that it expects the meeting to be held on that date with no further delays, despite the uncertain timeline of the appeal of the Southern District of New York’s decision.

What is clear to us now is that the Board of CHN is deeply entrenched and committed to retaining their comfortable jobs at the expense of the very people they were originally elected to serve the Shareholders. All of the legal avenues they are pursuing to deny the will of Shareholders are being paid for BY THOSE SAME SHAREHOLDERS. The incumbent Directors, it should be noted, hold less than 0.01% of the outstanding shares of CHNcombined. They have, effectively, no skin in the game and appear willing to keep spending Shareholder resources indefinitely to try to save their seats. In our view, nothing else could explain the “scorched earth” strategy they are employing.

We are committed to acting in the interest of our Clients and will continue to represent their interests fully until we get the best outcome possible.

Watch this space…

Item 2: City of London included the following slides in a presentation to clients:

Update #2 - China Fund Inc. (CHN US) » City of London is looking to improve the governance of the Fund, using the options available to shareholders under the 1940 Act » We are a long - term shareholder » We have communicated our concerns, per the list below, with the Board on numerous occasions over the years, via telephone calls, 1:1 meetings, and formal letters: • The Chairman has been on the Board since inception (26 years) • The Board lost credibility when it tried to install an investment manager whose principal was previously sanctioned for wrongdoing in connection with his role as the Portfolio Manager of the Fund • The Fund trades at a persistently wide discount • The Fund’s costs are unconstrained • The Fund’s investment performance is poor 0

Update #2 - China Fund Inc. (CHN US) » In January 2018, we decided to file our own proxy to: • Terminate the investment management contract; and • Replace two existing Directors with our two nominees » The Annual Meeting was scheduled for March 27th » ISS recommended supporting our proxy, as stated in our Press Release on March 19th: • “Considering the fund's underperformance relative to its peer group over one - , three - ,and five year periods, and the board's failure to engage an investment advisor the requisite number of shareholders would feel compelled to support, the dissident has presented a convincing case that some board change is needed and additional shareholder perspective might be beneficial .” » ISS is widely recognized as the leading independent voting and corporate governance advisory firm, and their analysis and recommendations are relied on by major institutional investment firms, mutual funds, and fiduciaries throughout the world. 1

Update #2 - China Fund Inc. (CHN US) » CHN’s Board of Directors postponed their Annual Meeting from March 27 th to April 26 th. • We believe the results of the annual meeting were clear to the Board at the time it decided to postpone the meeting. • We believe that a quorum would have been present at the meeting. • The Board continues to focus on entrenchment. 2

Update #2 - China Fund Inc. (CHN US) » Proxy Contest Moves to the Courts: • We filed a Verified Complaint in the Circuit Court of Baltimore County, Maryland, bringing claims against China Fund and the members of the Board. - We are asking the Maryland Court to compel China Fund to hold the annual meeting on April 26, with no further delays, among other things . • The Fund (via the Board’s actions) sued CLIM (among others) in Federal Court in New York, alleging “material misstatements and omissions.” - The Court has denied in full China Fund’s motion for a temporary restraining order, expedited discovery and preliminary injunction. - The China Fund has filed a motion for an expedited appeal. 3

Update #2 - China Fund Inc. (CHN US) » The current status for CHN: • The Board has used shareholder assets to sue their largest shareholder, and accused CLIM of “material misstatements and omissions.” • This lawsuit was denied in full by the court, and CHN has filed a motion for an expedited appeal. • The Board repeatedly wasted stockholder resources on multiple adjournments and proxy solicitations in their failed attempts to install Open Door as an investment adviser last summer. • The Board continues to frustrate the wishes of its stockholders and further entrench themselves – if they were winning, they would have held the meeting when originally scheduled . • Maryland lawsuit is pending, and the postponed meeting is still scheduled for April 26 th . 4