UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-09156

Illington Funds

(Exact name of registrant as specified in charter)

427 Bedford Road, Suite 230

Pleasantville, New York 10570

(Address of principal executive offices)(Zip code)

Jeffrey J. Unterreiner, Vice-President and Chief Compliance Officer

3401 Technology Dr., Suite 200

Lake Saint Louis, MO 63367

(Name and address of agent for service)

Registrant's telephone number, including area code: 914-773-7888

Date of fiscal year end: December 31

Date of reporting period: June 30, 2006

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSRS in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

ILLINGTON FUNDS

SEMI-ANNUAL REPORT

Illington OPTI-flex® Fund

Johnson Illington Tactical Equities Strategy Fund

June 30, 2006

The Illington Funds consists of two mutual funds, the

Illington OPTI-flex® Fund

and the

Johnson Illington Tactical Equities Strategy Fund

This report has been prepared for shareholders

and may be distributed to others only if preceded

or accompanied by a current prospectus.

Illington Funds

427 Bedford Road

Pleasantville, NY 10570

1-888-337-5132

www.illingtonfunds.com

Letter from the President

Dear Valued Shareholder,

We are pleased to provide you with this Semi-Annual Report for the Illington OPTI-flex® Fund and the Johnson Illington Tactical Equities Strategy Fund for the period January 1, 2006 to June 30, 2006.

In this report, you will find a letter from Jeff Unterreiner, portfolio manager of the Illington OPTI-flex® Fund and Hugh Johnson, portfolio manager of the Johnson Illington Tactical Equities Strategy Fund.

In their respective letters, Mr. Unterreiner and Mr. Johnson provide information on how their funds performed, as well as their market perspectives for the rest of the year.

In addition, this report provides financial information for the first half of the year 2006 about the Illington Funds.

Should you have any questions concerning this annual report, please contact your financial advisor, or feel free to contact us at 1 (888) 337 – 5132, e-mail us at info@illington.com, or visit us at www.illingtonfunds.com.

We thank you for making our funds a part of your investment strategy. We hope to continue to have the opportunity to earn your trust, respect and confidence.

Sincerely,

/s/

Salvatore M. Capizzi

President

Illington Funds

NOT PART OF THE ANNUAL REPORT

July 6, 2006

Dear fellow shareholder:

As you may know, I became primary portfolio manager of our Illington OPTI-flex® Fund at the end of July 2002. Overall, the market has been quite good since then, and while our strategy of risk reduction often leads to underperformance in advancing markets, I am quite pleased that we have beat most indexes throughout the advance as shown in the chart below.

distributed by Illington Capital Inc., member NASD and SIPC.

2nd Quarter

Year-To-Date

Past 12 months

Since July 31, 2002

(3-31-06 to 6-30-06)

(12-31-05 to 6-30-06)

(6-30-05 to 6-30-06)

(7-31-02 to 6-30-06)

(total return)

(annualized)

Illington OPTI-flex® Fund – Class C

-3.02%

6.37%

14.90%

74.36%

15.25%

Benchmark Return*(see description below)

0.27

4.43

11.24

52.58

11.39

Dow Jones World Stock Index

-1.49

5.11

16.48

67.41

14.06

Wilshire 5000 “Total Market” Index

-2.33

2.65

8.19

49.12

10.74

Illington OPTI-flex® Fund – Class C

annualized returns ending 6/30/2006

One year

+14.90%

Three year

+17.14%

Five year

+ 5.14%

Since Inception

+ 3.37%

(9/30/1996)

The performance data quoted represents past performance. The above performance information for the Fund does not reflect the imposition of a 1% Contingent Deferred Sales Charge on shares held less than 1 year. If reflected, the fee would reduce the quoted performance. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investors shares, when redeemed, may be worth more or less than original cost. Current performance may be lower or higher than the performance data quoted. Updated performance data to the most recent month end can be found on our website at www.illingtonfunds.com. The Dow Jones World Stock Index measures the performance of more than 2000 companies world-wide representing more than 80% of the world’s equity capital. The Wilshire 5000 Index measures the pe rformance of all U.S. equity securities with readily available price data. Both are unmanaged indices. Investors cannot invest directly in an index. The Illington OPTI-flex® Fund may or may not purchase the types of securities represented by the indices. The data presented above represents returns of Class C shares of the Illington OPTI-flex® Fund, which have higher distribution and service fees than Class A shares, and therefore may have lower returns than Class A shares

While our macro stock vs. bond allocation has favored stocks since March of 2003 we certainly do get moves against the larger long-term trend, as was obviously the case from early May to mid June. We underperformed our benchmark for the quarter primarily because many of the things that have worked well for us over the past year were harder hit in the recent decline. For example, our 3 emerging markets equity funds were all down over 20% high to low in the quarter, but remain up over 25% in the past 12 months. Likewise, the Russell 2000 (small-cap) Index declined by 14.62% high to low, but remains up 14.25% over the past 12 months while the S&P 500 only fell by 8.10% high to low, but has only gained 8.63% for the past 12 month period. I think we are on the right side of longer-term moves in these asset classes, but we may need to acce pt some greater short-term volatility. For the quarter, value stocks tended to outperform growth as has been a trend for most of the past 3 years. And our financial and energy positions did well for the quarter limiting the losses on the overall portfolio.

Market Outlook: I thought stocks were attractively priced before the declines of the 2nd quarter, so I think they are even more attractively priced now. And despite a 64% run in the S&P 500 since the October 9, 2002 low (75% including dividends), stocks are actually 35% cheaper relative to the level of earnings (source: Standard & Poor’s, First Call, FactSet, JPMorgan). Having said this, the summer can be a slow period for stocks so we may not realize the value immediately. While we may pull back some of our small-cap money if we get a short-term advance, I’m expecting to remain overweight to stocks for most of the rest of the year.

Sincerely,

/s/

Jeffrey J. Unterreiner, Portfolio Manager

Illington OPTI-flex® Fund

* Our benchmark for investment performance is an average of “the market return” and a 10% fixed annual return. For the purpose of this model, “the market return” is considered to be an average of the Wilshire 5000 Stock Index and the Dow Jones World Stock Index. There can be no guarantee that the benchmark will be met through the use of our investment strategy, and we would NOT expect to meet the benchmark over every period of evaluation. However, the benchmark can be used as a good starting point in evaluating the effectiveness of the manager over periods of 12 months or longer.

August 7, 2006

Dear shareholder:

It is with pleasure that I send along your portfolio report for the semi-annual period ending on June 30th. As always, we appreciate the confidence you place in us through your investment in the Johnson Illington Tactical Equities Strategy Fund.

First, of course, we need to bring you up-to-date on developments in the financial markets and the economy after a quarter that has been somewhat more volatile, if not turbulent, than expected.

At the end of the first quarter we (a) remained optimistic about the direction of the economy, profits, and stock prices, (b) were very cognizant that, this being the fourth year of the current cycle, the risks had increased, and (c) identified the risks as being higher interest rates, higher oil prices, and a decline in U.S. housing activity. That’s the way it looked to us then and essentially that’s the way it looks to us now. But, candidly, it has become somewhat more difficult to hang onto that optimism.

There are two important changes. First, the financial markets have not performed well since early May. The stock market has declined and investors have chosen to take less risk. They have migrated to the safer sectors of the stock market (utilities and consumer staples companies have been the best performers); they have sold more volatile, small capitalization stocks and bought larger capitalization stocks; and they have begun to avoid lower rated bonds in favor of higher quality U.S. Treasuries. This to us is important. We have continuously expressed our belief that investors collectively often have a very good sense of what lies ahead. Investors may be more prescient than investment strategists and economists and even policy-makers. It is for that reason that the performance of the stock market is an important component of the Conference Board’s Index of Leading Economic Indicators.

The second significant change has been the performance of some important economic variables. Not only has the Federal Reserve raised short-term interest rates, but the growth rate of the money supply has slowed. This is quite important since, as you know instinctively, it’s still money that drives both the economy and the financial markets. Perhaps as a result of a slowdown in the growth of money, the Conference Board’s Index of Leading Economic Indicators may have reached its high last January.

So, although change is a constant in our ever-evolving world, these changes are not particularly welcome changes. We have learned, however, that we need to accept the financial markets and economy for what they are. As a result, we have recently taken some initial steps to shore up the defenses of portfolios. We have, for example, reduced our exposure to stocks; have made sure we have over-weighted the sectors of the stock market that tend to perform well in tougher times, and have reduced our exposure to smaller riskier, more volatile companies. We learned in the 2000-2003 period that preservation of capital is the key to providing clients with above-market portfolio performance.

Now, having offered panoply of gloomy news, we need to offer the more upbeat side of things. First, we still believe that the outcome will be positive for the economy and the financial markets. We believe the economy will only slow and will not have a hard landing or recession. If we’re right on the economy, then the current decline in the stock market will turn out to be a mid-cycle correction and not the beginning of an extended decline. Secondly, bear market declines and recessions do not historically last a long time. We have every reason to believe that, if we are seeing a cyclical peak, it is likely to be behind us in months, not years. Although the risks of interest rates, oil prices, and housing remain, each appears manageable. We are particularly gratified that, in as clear a statement on monetary policy as we have heard in years, Ben Bernanke, the new Chairman of the Federal Reserve, has stated t hat Federal Reserve policy will be balanced (i.e. The Federal Reserve will consider both the state of the economy and inflation) and forward-looking (i.e. the Federal Reserve will base its decisions on interest rates on the outlook for the economy and inflation). This is, we believe, extraordinarily enlightened and certainly reduces (although does not eliminate) the chance that the Federal Reserve will make an interest-rate mistake.

It is for these reasons that we have only taken modest steps to shore our defenses. Naturally, if the financial markets tell us that we need to take further steps we will. We are, however, very hopeful, maybe even confident, that this will not be necessary and the markets and economic variables will require us to shift portfolios back to a more bullish structure.

On behalf of all of us at Johnson Illington Advisors, I want to thank you for your continued confidence.

Very Truly Yours,

/s/

Hugh A. Johnson, Portfolio Manager

Johnson Illington Tactical Equities Strategy Fund

2nd Quarter

Year-To-Date

(3-31-06 to 6-30-06)

(12-31-05 to 6-30-06)

Johnson Illington Tactical Equities Strategy Fund – Class C

-3.24%

-1.30% (inception)

Standard & Poor’s 500 Stock Index

-1.44

2.71

Wilshire 5000 “Total Market” Index

-2.38

2.49

The performance data quoted represents past performance. The above performance information for the Fund does not reflect the imposition of a 1% Contingent Deferred Sales Charge on shares held less than 1 year. If reflected, the fee would reduce the quoted performance. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investors shares, when redeemed, may be worth more or less than original cost. Current performance may be lower or higher than the performance data quoted. Updated performance data to the most recent month end can be found on our website at www.illingtonfunds.com. The Standard & Poor’s 500 Stock Index measures the performance of 500 large U. S. companies. The Wilshire 5000 Index measures the performance of all U.S. equity securities with readily avai lable price data. Both are unmanaged indices. Investors cannot invest directly in an index. The Johnson Illington Tactical Equities Strategy Fund may or may not purchase the types of securities represented by the indices. The data presented above represents returns of Class C shares of the Johnson Illington Tactical Equities Strategy Fund, which have higher distribution and service fees than Class A shares, and therefore may have lower returns than Class A shares.

ILLINGTON OPTI-flex® Fund |

Schedule of Investments |

June 30, 2006(Unaudited) |

| |

Shares/Principal Amount | | Market Value | % of Assets |

| | | | | |

REGISTERED INVESTMENT COMPANIES - 99.43% | | | |

5,875 | Burnham Financial Services Class A | | $ 131,666 | |

13,409 | CGM Focus Fund * | | 516,634 | |

13,073 | Dreyfus Premier Emerging Markets Class A | | 298,577 | |

5,394 | FBR Small Cap Financial Class A | | 172,879 | |

7,257 | FBR Small Cap Value Class A | | 339,614 | |

1,489 | Franklin Balance Sheet Investment | | 99,957 | |

4,045 | Franklin Micro-Cap Fund | | 163,700 | |

19,668 | Franklin Mutual Recovery | | 259,027 | |

15,181 | Hodges Fund | | 377,411 | |

4,615 | Hotchkis & Wiley Large Cap Value Class A | | 107,616 | |

3,648 | Hotchkis & Wiley Small Cap Value Class A | | 176,213 | |

21,393 | Matthews Asian Growth Income | | 387,859 | |

7,669 | N/I Numeric Investors Small Cap Value | | 142,331 | |

7,717 | Oppenheimer Developing Markets Class A | | 280,903 | |

23,256 | Pioneer Cullen Value Fund | | 425,111 | |

6,530 | Pioneer High Yield Class A | | 70,065 | |

24,390 | Pioneer Global High Yield | | 292,198 | |

14,951 | Rydex Russell 2000 Advantage H | | 509,665 | |

4,346 | Scudder Dreman High Return Equity Fund | | 203,443 | |

4,149 | Scudder Dreman Small Cap Value | | 151,258 | |

14,514 | Templeton Developing Markets Fund | | 358,645 | |

28,136 | Templeton Global Long-Short Class A * | | 351,414 | |

| | | | | |

Total Registered Investment Companies (Cost $4,818,418) | | $ 5,816,182 | 99.43% |

| | | | | |

Short-Term Investments | | | |

24,782 | Flex Funds Money Market Fund - Rate 5.04% ** | | 24,782 | 0.42% |

| | (Cost $24,782) | | | |

| | | | | |

| | Total Investments | | 5,840,964 | 99.86% |

| | ( Cost $4,843,200) | | | |

| | | | | |

| Other Assets less Liabilities | | 8,271 | 0.14% |

| | | | | |

| | Net Assets | | $ 5,849,235 | 100.00% |

| | | | | |

| | | | | |

| | | | | |

*Represents Non-Income Producing Security | | | |

**Variable Rate Security; The coupon rate shown represents the rate at June 30, 2005. | |

| | | | | |

The accompanying notes are an integral part of these financial statements.

Johnson Illington Tactical Equity Strategy Fund |

Schedule of Investments |

June 30, 2006 (Unaudited) |

| |

Shares/Principal Amount | | Market Value | % of Assets |

COMMON STOCK | | | | |

INDUSTRIALS - 13.89% | | | |

75 | General Dynamics | | 4,910 | |

110 | General Electric Co. | | 3,626 | |

60 | Pitney Bowes, Inc. | | 2,478 | |

95 | United Technicians Corp. | | 6,025 | |

| | | | 17,039 | 13.89% |

CONSUMER CYCLICALS - 5.93% | | | |

55 | Mcgraw-Hill Cos Inc. | | 2,763 | |

95 | Staples, Inc. | | 2,313 | |

45 | Target Corp. | | 2,199 | |

| | | | 7,275 | 5.93% |

CONSUMER NON CYCLICALS - 9.32% | | | |

40 | Clorox Co. | | 2,439 | |

65 | Colgate-Palmolive Co. | | 3,894 | |

85 | Pepsico, Inc. | | 5,103 | |

| | | | 11,436 | 9.32% |

ENERGY - 10.75% | | | | |

60 | Conocophilips | | 3,932 | |

40 | Exxon Mobil Corp. | | 2,454 | |

55 | Sunoco, Inc. | | 3,811 | |

50 | Western Gas Resources | | 2,993 | |

| | | | 13,190 | 10.75% |

FINANCE - 17.07% | | | | |

60 | American Express Co. | | 3,193 | |

45 | American International Group, Inc. | | 2,657 | |

65 | Bank of America Corp. | | 3,127 | |

40 | Capital One Financial Corp. | | 3,418 | |

105 | Citigroup, Inc. | | 5,065 | |

40 | Franklin Resources | | 3,472 | |

| | | | 20,932 | 17.07% |

SCIENCE/TECHNOLOGY - 8.95% | | | |

115 | Cisco Systems, Inc. | | 2,246 | |

80 | Dell, Inc. | | 1,957 | |

125 | Intel Corp. | | 2,375 | |

30 | International Business Machines | | 2,305 | |

90 | Microsoft Corp. | | 2,097 | |

| | | | 10,980 | 8.95% |

UTILITIES - 2.99% | | | | |

125 | Duke Energy Holdings Corp. | | 3,671 | |

| | | | 3,671 | 2.99% |

OTHER - 9.12% | | | | |

55 | I-shares Russell 2000 Index | | 3,939 | |

52 | S&P Midcap SPDR | | 7,250 | |

| | | | 11,189 | 9.12% |

TELECOMMUNICATIONS - 2.08% | | | |

40 | Alltel Corp. | | 2,553 | |

| | | | 2,553 | 2.08% |

HEALTHCARE - 10.24% | | | | |

75 | Aetna, Inc. | | 2,995 | |

65 | Bard C. R. Inc. | | 4,762 | |

65 | Lincare Holdings, Inc. | | 2,460 | |

50 | Medtronic, Inc. | | 2,346 | |

| | | | 12,563 | 10.24% |

| | | | | |

TOTAL FOR COMMON STOCK (Cost $113,471 ) - 90.37% | | 110,828 | 90.37% |

| | | | | |

OTHER ASSETS LESS LIABILITIES, NET - 9.63% | | 11,814 | 9.63% |

| | | | | |

NET ASSETS - 100.00% | | | $ 122,642 | 100.00% |

The accompanying notes are an integral part of these financial statements.

ILLINGTON Funds |

Statements of Assets and Liabilities |

June 30, 2006 (Unaudited) |

| | |

| | | Illington | | Johnson Illington |

| | | OPTI-flex® | | Tactical Equities Strategy |

| | | Fund | | Fund |

Assets | | | | |

Investments in securities: | | | | |

At Cost | | $ 4,843,200 | | $ 113,471 |

At Fair Value | | $ 5,840,964 | | $ 110,828 |

| | | | | |

Cash | | 19,031 | | 5,237 |

Interest receivable | | 17 | | - |

Dividends receivable | | - | | 71 |

Receivable for investments sold | | - | | 7,905 |

Total assets | | 5,860,012 | | 124,041 |

| | | | | |

Liabilities | | | | |

Payable to advisor | | 3,503 | | 685 |

12b-1 fees payable | | 3,218 | | 236 |

Administration fees payable | | 1,025 | | 33 |

Universal Service fees | | 3,032 | | 445 |

Total liabilities | | 10,778 | | 1,399 |

| | | | | |

| | | | | |

Net Assets: | | $ 5,849,234 | | $ 122,642 |

(unlimited number of shares authorized) | | | |

| | | | | |

Net Assets consist of: | | | | |

Paid in capital | | 4,744,535 | | 125,215 |

Accumulated undistributed net investment loss | (48,868) | | (521) |

Accumulated net realized gain (loss) on: | | | | |

Investment securities | | 180,584 | | 593 |

Net unrealized appreciation (depreciation) on: | | |

Investment securities | | 972,983 | | (2,645) |

| | | | | |

Net Assets | | $ 5,849,234 | | $ 122,642 |

| | | | | |

| | | | | |

Shares Outstanding | | 92,930 | | 12,326 |

| | | | | |

Class A: | | | | |

Net assets applicable to Class A shares | | $ 748,316 | | $ 120,668 |

| | | | | |

Shares outstanding (unlimited numbers of shares authorized) | 92,930 | | 12,326 |

| | | | | |

Net asset value and redemption price per share | $ 8.05 | | $ 9.79 |

| | | | | |

| | | | | |

Offering price (Net asset value/94.25%) | $ 8.54 | | $ 10.39 |

| | | | | |

Class C: | | | | |

Net assets applicable to Class C shares | | $ 5,100,919 | | $ 1,974 |

| | | | | |

Shares outstanding (unlimited numbers of shares authorized) | 635,644 | | 200 |

| | | | | |

Net asset value and offering price per share | $ 8.02 | | $ 9.87 |

| | | | | |

Redemption Price ($8.02 x 99%),($9.37 x 99%)** | $ 7.94 | | $ 9.77 |

| | | | | |

* A deferred sales charge applies only if redemption occurs less than one year from date of purchase. |

** A 1% deferred sales charge applies only if redemption occurs less than one year from date of purchase. |

The accompanying notes are an integral part of these financial statements.

ILLINGTON Funds |

Statements of Operations |

June 30, 2006 (Unaudited) |

| | |

| | | | | | | Illington | | Johnson Illington |

| | | | | | | OPTI-flex® | | Tactical Equities Strategy |

| | | | | | | Fund | | Fund |

Investment Income | | | | | | | |

Dividend income | | | | | $ 17,597 | | $ 877 |

Interest income | | | | | 348 | | - |

Total Income | | | | | 17,945 | | 877 |

| | | | | | | | | |

Expenses | | | | | | | | |

Investment advisor fee | | | | 21,300 | | 684 |

12b-1 fees | | | | | | | | |

Class A | | | | | | 450 | | 138 |

Class C | | | | | | 19,952 | | 98 |

Administration expenses | | | | 6,651 | | 32 |

Universal Service expenses | | | | 18,461 | | 445 |

Total Expenses | | | | | 66,814 | | 1,397 |

| | | | | | | | | |

Net Investment Income (Loss) | | | | (48,869) | | (520) |

| | | | | | | | | |

| | | | | | | | | |

Realized & Unrealized Gain (Loss) | | | | | |

Net realized gain (loss) on investment securities | | 180,584 | | 593 |

Capital gain income from investment companies | | - | | - |

Change in unrealized appreciation (depreciation) | | | | |

on investment securities | | | | 162,190 | | (2,645) |

Net realized and unrealized gain (loss) on investment securities |

342,774 | |

(2,052) |

Net increase (decrease) in net assets resulting from operations | $ 293,905 | | $ (2,572) |

| | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

ILLINGTON Funds |

Statements of Changes in Net Assets |

| | | | | | | Illington | | Johnson Illington |

| | | | | | | OPTI-flex® Fund | | Tactical Equities Strategy Fund |

| | | | | | | | | | | | |

| | | | | | | (Unaudited) | | | | (Unaudited) | |

| | | | | | | Period Ended | | Period Ended | | Year Ended | |

| | | | | | | June 30, 2006 | | Dec. 31, 2005 | | June 30, 2006 | |

Increase (Decrease) in Net Assets | | | | | | | | | |

Operations | | | | | | | | | | |

Net investment income (loss) | | | $ (48,869) | | $ (7,037) | | $ (520) | |

Net realized gain (loss) on investment securities | 180,584 | | 685,184 | | 593 | |

Capital gain income from investment companies | - | | - | | - | |

Change in net unrealized appreciation (depreciation) | 162,190 | | (219,297) | | (2,645) | |

Net increase (decrease) in net assets resulting from operations |

293,905 | |

458,850 | |

(2,572) | |

| | | | | | | | | | | | |

Distributions | | | | | | | | | | |

From net investment income, Class A | | - | | - | | - | |

From net investment income, Class C | | - | | - | | - | |

From short-term capital gains, Class A | | - | | - | | - | |

From short-term capital gains, Class C | | - | | - | | - | |

From long-term capital gains, Class A | | - | | - | | - | |

From long-term capital gains, Class C | | - | | - | | - | |

From return of capital, Class A | | | - | | - | | - | |

From return of capital, Class C | | | - | | - | | - | |

Total distributions | | | | - | | - | | - | |

| | | | | | | | | | | | |

Capital Share Transactions - Class A | | | | | | | |

Proceeds from sale of shares | | | 850,765 | | - | | 124,200 | |

Shares issued in reinvestment of dividends | - | | - | | - | |

Shares redeemed | | | | (91,855) | | - | | (985) | |

| | | | | | | 758,910 | | 0 | | 123,215 | |

Capital Share Transactions - Class C | | | | | | | |

Proceeds from sale of shares | | | 1,368,615 | | 1,834,255 | | 2,000 | |

Shares issued in reinvestment of dividends | - | | - | | - | |

Shares redeemed | | | | (1,405,001) | | (1,922,327) | | - | |

| | | | | | | (36,387) | | (88,072) | | 2,000 | |

Net increase in net assets resulting | | | | | | | |

from capital share transactions | | | 722,523 | | (88,072) | | 125,214 | |

| | | | | | | | | | | | |

Total increase in net assets | | | 1,016,428 | | 370,778 | | 122,642 | |

| | | | | | | | | | | | |

Net Assets | | | | | | | | | | |

Beginning of period | | | | $ 4,832,807 | | $ 4,462,029 | | $ - | |

| | | | | | | | | | | | |

End of period | | | | | $ 5,849,235 | | $ 4,832,807 | | $ 122,642 | |

| | | | | | | | | | | | |

Accumulated undistributed net investment income | $ - | | $ - | | $ - | |

| | | | | | | | | | | | |

Capital Share Transactions - A Shares | | | | | | | |

Shares sold | | | | | 104,288 | | - | | 12,426 | |

Shares issued in reinvestment of distributions | - | | - | | - | |

Shares repurchased | | | | (11,358) | | - | | (100) | |

| | | | | | | | | | | | |

Net increase from capital share transactions | 92,930 | | - | | 12,326 | |

| | | | | | | | | | | | |

Capital Share Transactions - C Shares | | | | | | | |

Shares sold | | | | | 169,299 | | 263,284 | | 200 | |

Shares issued in reinvestment of distributions | - | | - | | - | |

Shares repurchased | | | | (172,939) | | (274,395) | | - | |

| | | | | | | | | | | | |

Net increase from capital share transactions | (3,640) | | (11,111) | | 200 | |

The accompanying notes are an integral part of these financial statements.

ILLINGTON Funds |

Illington OPTI-flex® Fund – Class C | | | | | | | | | |

Financial Highlights | (Unaudited) | | | | | | | | | | |

Selected data for a share outstanding throughout the period: | 1/1/2006 | | 1/1/2005 | | 1/1/2004 | | 1/1/2003 | | 1/1/2002 | | 1/1/2001 |

| | to | | to | | to | | to | | to | | to |

| | 6/30/2006 | | 12/31/2005 | | 12/31/2004 | | 12/31/2003 | | 12/31/2002 | | 12/31/2001 |

Selected Per Share Date | | | | | | | | | | | |

Net Asset Value - Beginning of Period | $ 7.54 | | $ 6.85 | | $ 5.88 | | $ 4.56 | | $ �� 6.19 | | $ 8.95 |

| | | | | | | | | | | | |

Income from Investment Operations | | | | | | | | | | | |

Net Investment Income (Loss) (1) | (0.01) | * | (0.01) | * | (0.06) | * | (0.04) | * | 0.49 | | 0.07 |

Net Realized and Unrealized Gain (Loss) | 0.49 | | 0.70 | | 1.03 | | 1.36 | | (1.21) | | (2.61) |

Total from Investment Operations | 0.48 | | 0.69 | | 0.97 | | 1.32 | | (0.72) | | (2.54) |

| | | | | | | | | | | | |

Less Distributions to Shareholders: | | | | | | | | | | | |

From Net Investment Income | 0.00 | | 0.00 | | 0.00 | | 0.00 | | (0.91) | | 0.00 |

From Net Realized Gain | 0.00 | | 0.00 | | 0.00 | | 0.00 | | 0.00 | | (0.22) |

Total Distributions | 0.00 | | 0.00 | | 0.00 | | 0.00 | | (0.91) | | (0.22) |

| | | | | | | | | | | | |

Net Asset Value - End of Period | $ 8.02 | | $ 7.54 | | $ 6.85 | | $ 5.88 | | $ 4.56 | | $ 6.19 |

| | | | | | | | | | | | |

Total Return(2) | 6.37% | | 10.07% | | 16.50% | | 28.95% | | -11.59% | | -28.36% |

| | | | | | | | | | | | |

Ratios and Supplemental Data | | | | | | | | | | | |

Net Assets - End of Period (Thousands) | $ 5,101 | | $ 4 ,833 | | $ 4,462 | | $ 3,363 | | $ 2,018 | | $ 8,961 |

Ratio of Expenses to Average Net Assets (3) | 2.40% | ** | 2.38% | | 2.27% | | 2.29% | | 2.19% | | 1.23% |

Ratio of Net Investment Income (Loss) to Average Net Assets(1) | -1.76% | ** | -0.15% | | -1.03% | | -0.81% | | -1.31% | | 0.97% |

Ratio of expenses to Average Net Assets, before | | | | | | | | | | | |

reimbursement and voluntary fee reductions (3) | 2.32% | ** | 2.38% | | 2.40% | | 2.40% | | 4.09% | | 3.06% |

Portfolio Turnover Rate | 29.26% | ** | 45.75% | | 33.46% | | 146.05% | | 2077.74% | | 957.96% |

Johnson Illington Tactical Equities Strategy Fund – Class C | | | | | | | | | |

Financial Highlights | (Unaudited) | | | | | | | | | | |

Selected data for a share outstanding throughout the period: | 1/1/2006 | | | | | | | | | | |

| | to | | | | | | | | | | |

| | 6/30/2006 | | | | | | | | | | |

Selected Per Share Data | | | | | | | | | | | |

Net Asset Value - Beginning of Period | $ 10.00 | | | | | | | | | | |

| | | | | | | | | | | | |

Income from Investment Operations | | | | | | | | | | | |

Net Investment Income (Loss) (1) | 0.00 | | | | | | | | | | |

Net Realized and unrealized Gain (Loss) | (0.13) | | | | | | | | | | |

Total from Investment Operations | (0.13) | | | | | | | | | | |

| | | | | | | | | | | | |

Less Distributions to Shareholders | | | | | | | | | | | |

From Net Investment Income | 0.00 | | | | | | | | | | |

From Net Realized Gain | 0.00 | | | | | | | | | | |

Total Distributions | 0.00 | | | | | | | | | | |

| | | | | | | | | | | | |

Net Asset Value - End of Period | $ 9.87 | | | | | | | | | | |

| | | | | | | | | | | | |

Total Return(2) | -1.30% | | | | | | | | | | |

| | | | | | | | | | | | |

Ratios and Supplemental Data | | | | | | | | | | | |

Net Assets - End of Period (Thousands) | $ 2 | | | | | | | | | | |

Ratio of Expenses to Average Net Assets (3) | 2.65% | ** | | | | | | | | | |

Ratio of Net Investment Income (Loss) to Average Net Assets(1) | -0.53% | ** | | | | | | | | | |

Portfolio Turnover Rate

| 224.92% | ** | | | (Please see footnotes on page 12) | | | | | | |

ILLINGTON Funds |

Illington Funds - Class A | | | | |

Financial Highlights | | | | |

(For a Fund share outstanding throughout each period) | | | |

| | | | | |

| | Illington OPTI-flex® | | | Johnson Illington Tactical |

| | Fund | | | Equities Strategy Fund |

| | | | | |

| | (Unaudited) | | | (Unaudited) |

| | Six Months Ended | | | Six Months Ended |

| | June 30, 2006 | | | June 30, 2006 |

Selected Per Share Data | | | | |

Net asset value, beginning of period | $ 7.54 | | | $ 10.00 |

| | | | | |

Income from investment operations | | | | |

Net investment income (loss) | (0.01) | * | | 0.00 |

Net realized and unrealized gain (loss) | 0.52 | | | (0.21) |

Total from investment operations | 0.51 | | | (0.21) |

| | | | | |

Less Distributions to shareholders: | | | | |

From net investment income | - | | | - |

From net realized gain | - | | | - |

Total distributions | - | | | - |

| | | | | |

Net asset value, end of period | $ 8.05 | | | $ 9.79 |

| | | | | |

Total Return | 6.76% | | | -2.10% |

| | | | | |

Ratios and Supplemental Data | | | | |

Net assets, end of period (000) | $ 11,396 | | | $ 121 |

Ratio of expenses to average net assets | 1.65% | | | 1.90% |

Ratio of net investment income (loss) to | | | | |

average net assets | (1.03)% | | | (0.34)% |

Ratio of expenses to Average Net Assets, before | | | | |

reimbursement and voluntary fee reductions (3) | 1.58% | | | - |

Portfolio turnover rate | 29.26% | | | 224.92% |

FOOTNOTES | | | | |

1) Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

2) Total return in the above table represents the rate that the investor would have earned or lost on an investment in the fund assuming reinvestment of dividends. |

3) These ratios exclude the expenses of the registered investment companies in which the Fund invests. |

* Per share amounts were calculated using the average share method. | | | |

** Annualized | | | |

The accompanying notes are an integral part of these financial statements.

NOTES TO FINANCIAL STATEMENTS

June 30, 2006 (Unaudited)

1. ORGANIZATION and SIGNIFICANT ACCOUNTING POLICIES

The Illington Funds (the “Trust”) was organized as a Massachusetts business trust on May 3, 1996, and is registered as a diversified, open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The business and affairs of the Trust are managed under the direction of its Board of Trustees.

The Trust has retained the services of Illington Fund Management LLC (the “Adviser”) as investment adviser for each series of the Trust. PROACTIVE Money Management, Inc. (a “Sub-adviser”) acts as investment sub-adviser to the Illington OPTI-flex® Fund (the “OPTI Fund”). Johnson Illington Advisors, LLC (a “Sub-adviser”), a majority-owned subsidiary of the Adviser, acts as investment sub-adviser to the Johnson Illington Tactical Equities Strategy Fund (the “JI TES Fund,” together with the OPTI Fund, the “Funds” and each individually a “Fund”). The Trust's Declaration of Trust permits the Trust to offer and sell an unlimited number of full and fractional shares of beneficial interest in the Trust's existing funds and to create additional funds. All shares have a par value of $.10 per share, are fully paid, non-assessable and fully transferable when issued. All shares are issued as full or fractional shares. All shares have certain voting and dividend rights, but do not have preemptive or conversion rights.

Use of estimates. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America ("GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Valuation of investments. Securities owned by the Funds and listed or traded on any national securities exchange are valued at each closing of the New York Stock Exchange on the basis of the last sale on such exchange each day that the exchange is open for business. If there is no sale on that day, or if the security is not listed, it is valued at its last bid quotation on the exchange or, in the case of unlisted securities, as obtained from an established market maker. The assets of the OPTI Fund consist primarily of other mutual funds, which are valued at their respective published net asset values at the end of each day. Futures contracts are valued on the basis of the cost of closing out the liability; i.e., at the settlement price of a closing contract or at the asked quotation for such a contract if there is no sale. Money market instruments (certificates of deposit, commercial paper , etc.) in the Funds are valued either at amortized cost or at original cost plus accrued interest, both of which approximate current value. Fixed income securities are priced at the current quoted bid price. However, U.S. Government Securities and other fixed income securities may be valued on the basis of prices provided by an independent pricing service when such prices are believed to reflect the fair market value of such securities. The prices provided by a pricing service are determined without regard to bid or last sale prices but take into account securities prices, yields, maturities, call features, ratings, institutional size trading in similar groups of securities and developments related to specific securities. Portfolio securities for which market quotations are not readily available are to be valued by the Adviser in good faith at its own expense under the direction of the Trustees.

Repurchase agreements. The Funds may engage in repurchase agreement transactions whereby a Fund takes possession of an underlying debt instrument subject to an obligation of the seller to repurchase the instrument from the Fund and an obligation of the Fund to resell the instrument at an agreed upon price and term. At all times, the Fund maintains the value of collateral, including accrued interest, at least 100% of the amount of the repurchase agreement, plus accrued interest. If the seller defaults or the fair value of the collateral declines, realization of the collateral by the Fund may be delayed or limited. As of June 30, 2006, neither Fund was invested in any repurchase agreements.

Federal income taxes. It is each Fund's policy to continue to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income and net capital gains to its shareholders. Therefore, no federal income tax provision is required.

Distributions to shareholders. Dividends to shareholders are recorded on the ex-dividend date. Each Fund declares and pays dividends from net investment income annually. Each Fund distributes net capital gains, if any, on an annual basis. The amounts of dividends from net investment income and of distributions from net realized gains are determined in accordance with federal income tax regulations which may differ from GAAP. These differences are primarily due to deferrals of certain losses and expiring capital loss carryforwards. These "book/tax" differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification.

Dividend and distributions to shareholders which exceed net investment income and net realized capital gains for financial reporting purposes but not for tax purposes are reported as dividends in excess of net investment income or distributions in excess of net realized gains.

Other. The Fund records purchases and sales of investments on the trade date. The Fund calculates realized gains and losses from sales of investments on the specific identification basis. Dividend income is recognized on the ex-dividend date and interest income is recognized as earned.

2. INVESTMENT TRANSACTIONS

For the six months ended June 30, 2006, the cost of purchases and proceeds from sales, excluding short-term investments were $5,473,819 and $3,551,867 for the Illington OPTI-flex® Fund and $238,441 and $124,970 for the Johnson Illington Tactical Equity Strategies Fund, respectively. There were no purchases or sales of U.S. Government and agency obligations.

The U.S. Federal income tax basis of the Funds’ investments at June 30, 2006, was $4,818,418 for the Illington OPTI-flex® Fund and $113,471 for the Johnson Illington Tactical Equity Strategies Fund and net unrealized appreciation for U.S. Federal income tax purposes was $972,983 (gross unrealized appreciation $980,834; gross unrealized depreciation $7,851) for the Illington OPTI-flex® Fund and net unrealized depreciation for U.S. Federal income tax purposes was $2,645 (gross unrealized appreciation $2,284; gross unrealized depreciation $4,929) for the Johnson Illington Tactical Equity Strategies Fund.

3. AGREEMENTS and OTHER TRANSACTIONS WITH AFFILIATES

Pursuant to the Investment Advisory Agreements with the Trust, the Adviser, subject to the supervision of the Trust’s Board of Trustees and in conformity with the stated objective and policies of each Fund, manages both the investment operations of the Funds and the composition of each Fund's portfolio, including the purchase, retention, and disposition of securities. In connection therewith, the Adviser is obligated to keep certain books

and records of the Funds. The Adviser also administers the Funds’ corporate affairs, and in connection therewith, furnishes the Funds with office facilities, together with those ordinary clerical and bookkeeping services which are not being furnished by U. S. Bank, N.A., the Funds’ custodian, and Mutual Shareholder Services, the Funds’ transfer and disbursing agent. The management services of the Adviser are not exclusive under the terms of the Investment Advisory Agreements and the Adviser is free to render management services to others.

From February 1, 2003 until October 24, 2005, PROACTIVE Financial Services, Inc. was investment adviser to the OPTI Fund. Prior to February 1, 2003, the Investment Adviser to the OPTI Fund was PROACTIVE Money Management, Inc. (the “Prior Manager” and together with PROACTIVE Financial Services, Inc., the “Prior Managers”). The Prior Manager was Adviser to the Fund since its inception on September 30, 1996.

The Adviser earns an annual fee, payable in monthly installments from each Fund for its services (the “Management Fees”). For the OPTI Fund, the Adviser receives a fee at the rate of 0.75% of the Fund's first $500 million of average net assets and 0.65% of the Fund's average net assets in excess of $500 million. For the period ended December 31, 2005, the manager earned a management fee of $6,775. For the periods ending October 24, 2005, December 31, 2004, and December 31, 2003, the Prior Managers earned management fees of $28,753, $28,007, and $19,897 respectively. For the JI TES Fund, the Adviser receives a fee at the rate of 1.00% of the Fund’s average net assets.

Both Funds have agreements (“USF Agreements”) with the Adviser under which they pay the Adviser a “Universal Services Fee” in return for payment of all administrative bills. Administrative bills include, but are not limited to: audit, transfer agency, legal, printing, postage, custody, insurance, and registration bills and fees. Under each USF Agreement, the only bills that will remain the responsibility of the Funds will be the Management Fee (currently 0.75% for the OPTI Fund and 1.00% for the JI TES Fund), and distribution fees (currently 0.75% 12b-1 fee and 0.25% shareholder service fee for Class C share and 0.25% shareholder service fee for Class A share). Each USF Agreement will remain in place for a period of one year, and thereafter shall continue from year to year subject to approval at least annually by a majority of the Trustees of the Trust who are not parties to the agreement or interested persons of any such party. The "Universal Services Fee" is equal to 0.65% of the Funds’ first $20 million in average net assets, 0.50% of average net assets between $20 million and $100 million, and 0.25% of average net assets over $100 million. For the periods ended December 31, 2005 and December 31, 2004, the "Universal Services Fee" for the OPTI Fund totaled $30,791 and $24,345 respectively.

Rule 12b-1 of the Investment Company Act permits mutual funds that adopt a written plan to pay out of fund assets certain expenses relating to the sale and distribution of their shares. Each Fund has adopted distribution and service plans (each a “Plan” and together, the “Plans”). Under each Fund’s Plan related to the Class A Shares, the Fund will pay Illington Capital, Inc. (the “Distributor”) an annual fee of up to 0.25%, of the average daily net assets of the respective Fund’s Class A Shares. Under each Fund’s Plan related to the Class C Shares, the Fund will pay the Distributor an annual distribution fee of 0.75% of Fund assets and an annual service fee of 0.25% of Fund assets of the respective Fund’s Class C Shares. Because these fees are paid out of the Fund’s assets on an on-going basis, over time these fees will increase the cost of your investment and may cost you more than paying other types of sales charges.

Distribution fees are used primarily to offset initial and ongoing commissions paid to brokerage firms for selling shares of a Fund. The Distributor may use distribution fees that are not allocated to brokerage firms to reduce its own sales and marketing expenses. Service fees are used primarily to reimburse brokerage firms for providing personal services to Fund shareholders and maintaining shareholder accounts. The Distributor may use service fees that are not allocated to brokerage firms to reduce its own expenses for providing personal services and maintaining shareholder accounts.

In addition, the Adviser, the Sub-Advisers, the Distributor and their affiliates may make substantial payments to dealers or other financial intermediaries related to distribution and sales support activities out of their own resources including the profits from advisory fees received from the Fund. Some of these distribution related payments may be made to dealers or financial intermediaries for marketing promotional related expenses. These payments are often referred to as “revenue sharing” payments. In some circumstances, these revenue sharing payments may create an incentive for a financial adviser, its employees or associated persons to recommend or sell shares of a Fund to you.

4. DISTRIBUTIONS TO SHAREHOLDERS

As of June 30, 2006, the components of accumulated earnings (deficit) on a tax basis for the Fund were as follows:

Illington OPTI-flex® Fund

Undistributed Ordinary Income | Accumulated Capital and Other Gains and (Losses) | Unrealized Appreciation/(Depreciation) | Total Accumulated Earnings/(Deficit) |

$(48,868) | $180,584 | $972,983 | $1,104,699 |

Johnson Illington Tactical Equity Strategies Fund

Undistributed Ordinary Income | Accumulated Capital and Other Gains and (Losses) | Unrealized Appreciation/(Depreciation) | Total Accumulated Earnings/(Deficit) |

$(521) | $593 | $(2,645) | $(2,573) |

The difference between book basis and tax-basis unrealized appreciation is attributable primarily to the deferral of losses on wash sales.

5. FEDERAL TAX INFORMATION

For federal income tax purposes, the Illington OPTI-flex® Fund had a capital loss carryforward of $7,488,647 as of June 30, 2006, which is available to offset future capital gains, if any. [Of this $7,488,647, $4,150,554 and $3,338,093 are due to expire in 2009 and 2010, respectively]. To the extent that these carryforwards are used to offset future capital gains, it is probable that the gains that are offset will not be distributed to shareholders. As of June 30, 2006 the Johnson Illington Tactical Equity Strategies Fund has no capital loss carryforwards.

END OF NOTES TO FINANCIAL STATEMENTS

Expense Example

As a shareholder of either of the Illington Funds, you incur three types of cost: management fees, distribution and service fees, and the Universal Services Fees. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 made at the beginning of the period and held for the entire period, January 1, 2006 through June 30, 2006.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in these Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Illington Illington OPTI-flex® Fund - Class A | | |

| | Beginning Account Value | Ending Account Value | Expenses Paid During the Period* |

| | January 1, 2006 | June 30, 2006 | January 1, 2006 to June 30, 2006 |

Actual | $1,000.00 | $1,067.64 | $8.46 |

Hypothetical | | | |

(5% Annual Return before expenses) | $1,000.00 | $1,016.61 | $8.25 |

| | | | |

* Expenses are equal to the Fund's annualized expense ratio of 1.65%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

Illington Illington OPTI-flex® Fund - Class C | | |

| | Beginning Account Value | Ending Account Value | Expenses Paid During the Period* |

| | January 1, 2006 | June 30, 2006 | January 1, 2006 to June 30, 2006 |

Actual | $1,000.00 | $1,063.66 | $12.28 |

Hypothetical | | | |

(5% Annual Return before expenses) | $1,000.00 | $1,012.89 | $11.98 |

| | | | |

* Expenses are equal to the Fund's annualized expense ratio of 2.40%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

Johnson Illington Tactical Equities Fund - Class A | | |

| | Beginning Account Value | Ending Account Value | Expenses Paid During the Period* |

| | January 1, 2006 | June 30, 2006 | January 1, 2006 to June 30, 2006 |

Actual | $1,000.00 | $979.00 | $9.32 |

Hypothetical | | | |

(5% Annual Return before expenses) | $1,000.00 | $1,015.37 | $9.49 |

| | | | |

* Expenses are equal to the Fund's annualized expense ratio of 1.90%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

Johnson Illington Tactical Equities Fund - Class C | | |

| | Beginning Account Value | Ending Account Value | Expenses Paid During the Period* |

| | January 1, 2006 | June 30, 2006 | January 1, 2006 to June 30, 2006 |

Actual | $1,000.00 | $989.00 | $13.07 |

Hypothetical | | | |

(5% Annual Return before expenses) | $1,000.00 | $1,011.65 | $13.22 |

| | | | |

* Expenses are equal to the Fund's annualized expense ratio of 2.65%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

OTHER INFORMATION REGARDING TRUSTEES (unaudited)

Illington Funds (the “Trust”) is supervised by its Board of Trustees, an independent body that has ultimate responsibility for each Fund’s activities. The Trustees of the Trust are listed below. Unless otherwise noted, the business address of each Trustee is 427 Bedford Road, Suite 230, Pleasantville, NY 10570.

The Trust is managed by its Trustees. Their names, positions and principal occupations during the past five years are listed below:

"Non-Interested" Trustees

Name and Year of Birth | Position and Length of Service1 | Principal Occupation(s) During Past Five Years |

Joseph J. DioGuardi Year of Birth: 1941 | Trustee since 2005 | Since 1989, founder and principal of Truth in Government, a nonpartisan organization seeking federal fiscal and accounting reforms. Professional Certified Public Accountant since 1965. Member of the United States House of Representatives, 1985-1989. |

Peter T. Endler Year of Birth: 1958 | Trustee since 2005 | Consultant and professional investor. President and Chief Operating Officer, Media Vault, Inc., a technology company developing and commercializing new media marketing products and web sites, 1999-2001. |

"Interested" Trustee

Name and Year of Birth | Position and Length of Service1 | Principal Occupation(s) During Past Five Years |

Charles M. White Year of Birth: 1958 | Trustee and Chairman of the Board of Trustees since 2005 | Executive Vice President and Director of Investments, Illington Fund Management LLC, the investment adviser to the Trust, since 2005. Formerly Chief Investment Strategist for Merriman, Curhan, Ford & Company, an investment banking and investment advisory firm, 2003-2004. Vice Chairman and head of portfolio management and both stock and bond selection committees, Avatar Associates, a registered investment adviser, 1988-2003. |

1 Trustees and officers of the Trust serve until their resignation, removal or retirement

The Trust pays each Trustee who is not an "interested person" an annual fee of $2,000, plus $500 for each meeting of the Board of Trustees attended. Messrs. DioGuardi and Endler comprise the Audit Committee for the Trust. Each member of the Audit Committee is paid $250 for each meeting of the Audit Committee attended. Trustee fees (including Audit Committee meeting fees) for the OPTI Fund totaled $8,000 for the year ended December 31, 2005 ($8,000 in 2004; $8,000 in 2003). Audit Committee meeting fees totaled $2,800 for the year ended December 31, 2005 ($2,800 in 2004; $2,800 in 2003). No fees were paid to trustees during the six months ending June 30, 2006. Mr. White and all the other officers serve without compensation from the Trust.

ADDITIONAL INFORMATION (unaudited)

Proxy Voting - A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted proxies during the most recent 12 month period, are available without charge upon request by (1) calling the Fund at (888) 587-3539 and (2) from Fund documents filed with the Securities and Exchange Commission ("SEC") on the SEC's website at www.sec.gov.

Portfolio Holdings - The Trust files a complete schedule of investments with the SEC for the first and third quarter of each fiscal year on Form N-Q. The Trust’s first and third fiscal quarters end on March 31 and September 30, respectively. The Form N-Q filing must be made within 60 days of the end of the quarter, and the Trust’s first Form N-Q was filed with the SEC on November 24, 2004. The Trust’s Forms N-Q are available on the SEC’s website at http://sec.gov, or they may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC (call 1-800-732-0330 for information on the operation of the Public Reference Room). You may also obtain copies by calling the Fund at 1-888-587-3539.

Approval of Investment Advisory Contracts – A special meeting of the Board of Trustees (the “Board”) of the Trust was held on June 27, 2006. That meeting was called for the purpose of discussing a potential “change in control” (as defined under the Act) of the Adviser, resulting from the possible purchase of a majority of equity ownership of the Adviser by an existing minority investor of the Adviser. The Board reviewed the potential impact of such a “change in control” on the Trust, including the termination of the investment advisory agreements in place for the OPTI Fund and the JI TES Fund at the time with the Adviser. The Board also reviewed the impact of the potential “change in control” of the Sub-adviser to the JI TES Fund, due to the Adviser’s voting interest in the Sub-adviser, and the termination of the investment subadviso ry agreement with the Sub-adviser to that Fund that would result from such a “change in control.”

The Board noted that, in the event those three agreements (the “Original Agreements”) were terminated, the Board would need to approve interim investment advisory agreements for each of the OPTI Fund and the JI TES Fund and an interim subadvisory agreement for the JI TES Fund (the “Interim Agreements”), while at the same time seeking shareholder approval of “final” agreements for each of the Funds (the “Final Agreements”). The Adviser presented the Board with draft forms of each of the Interim Agreements and the Final Agreements, which did not differ significantly from the investment advisory and subadvisory agreements previously approved by the Board in 2005 and approved by the shareholders of the Funds at a meeting held on September 30, 2005. This process was discussed in greater detail in the Annual Report for the period ended 12/31/2005.

With respect to each of the Interim and Final Agreements as they applied to each of the Funds, the Board considered factors such as (i) the nature, extent and quality of services to be provided under the Interim Agreements and Final Agreements; (ii) the performance of each Fund under the current advisory agreements and subadvisory agreement; (iii) the cost of the services to be provided and profits to be realized by the Adviser and the Sub-adviser and their affiliates under the Interim Agreements and Final Agreements; (iv) the extent to which economies of scale will be realized as the series of the Trust grow; and (v) whether the fee schedules under the Interim Agreements and Final Agreements reflect those economies of scale.

The Board examined performance information of the OPTI Fund and data comparing that Fund to its benchmark. The Board also reviewed the fee schedules for each of the Funds, which did not change from the existing agreements, and also reviewed the profitability of both the Adviser and the Sub-adviser. The Board also discussed the Adviser’s subsidization of the Funds, and the benefits the Funds received from that subsidization. The Board also noted that, despite the potential “change in control” of the Adviser and the Sub-adviser, there were no changes in the compensation to be paid to the Adviser or the Sub-adviser under the Interim Agreements or Final Agreements from the Original Agreements; there would be no changes in the duties to be performed under the Interim Agreements or Final Agreements by the Adviser or by the Sub-adviser; and no change in officers or employees of the Adviser was expected as a result of the potential “change in control.” Resources of the Adviser were also expected to be greater as a result of the “change in control.”

The Board concluded that if a “change in control” of the Adviser and the Sub-adviser were to occur, and the agreements in effect at the time of the meeting were to terminate, the Trust should enter into the Interim Agreements with the Adviser with respect to each of the OPTI Fund and the JI TES Fund, and with the Sub-adviser with respect to the JI TES Fund. The Board resolved that those Interim Agreements should commence as of the same date as the “change of control,” and terminate upon the earlier of the 150th day following the date of the “change in control,” or upon the ratification of the Final Agreements by the shareholders of each of the respective Funds. The Board also approved the form of the Final Agreements, and instructed the officers of the Trust and the Adviser to seek shareholder ratification of the Final Agreements in the event that a “ ;change in control” of the Adviser and the Sub-adviser were to take place.

ADDITIONAL INFORMATION (unaudited)

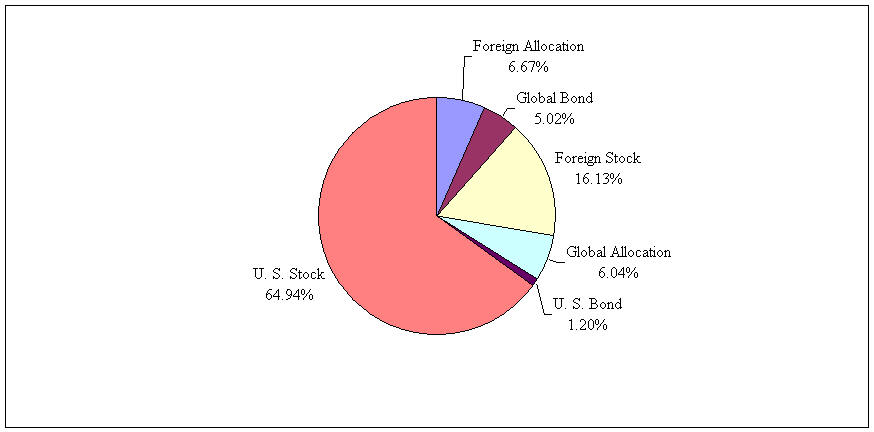

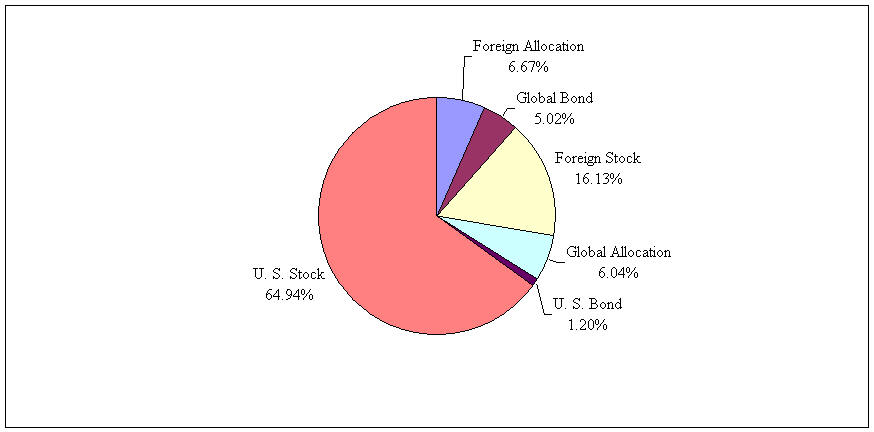

The following chart gives a visual breakdown of the Fund by the asset allocation of the underlying mutual funds represented as a percentage of the portfolio of investments.

Illington OPTI-flex® Fund

by Asset Allocation

as of June 30, 2006

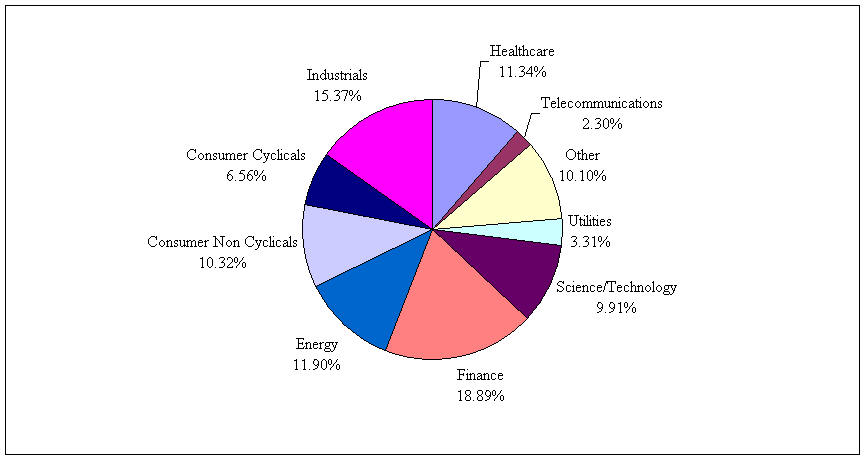

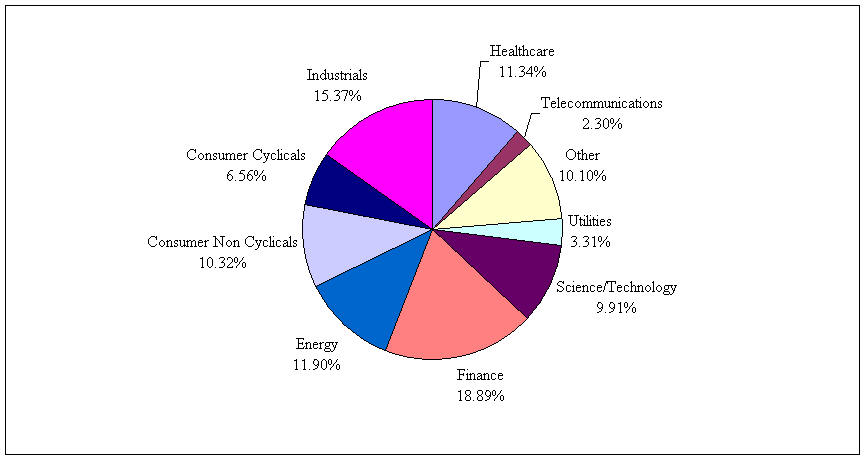

Johnson Illington Tactical Equities Strategy Fund

by Asset Allocation

as of June 30, 2006

ILLINGTON Funds

INVESTMENT ADVISER

Illington Fund Management LLC

427 Bedford Road, Suite 230

Pleasantville, NY 10570

914-773-7888

INVESTMENT SUB-ADVISERS

Illington OPTI-flex® Fund

PROACTIVE Money Management, Inc.

3401 Technology Dr., Suite 200

Lake Saint Louis, MO 63367-2599

1-1-1

636-561-0100

Johnson Illington Tactical Equities Strategy Fund

Johnson Illington Advisors, LLC

677 Broadway

Albany, NY 12207

518-641-6860

DISTRIBUTOR

Illington Capital, Inc.

3401 Technology Dr., Suite 200

Lake Saint Louis, MO 63367-2599

888-337-5132

CUSTODIAN

U. S. Bank, N.A.

425 Walnut Street

Cincinnati, OH 43017

TRANSFER AGENT AND DIVIDEND

DISBURSING AGENT

Mutual Shareholder Services, Inc.

8869 Brecksville Road, Suite C.

Brecksville, OH 44141

LEGAL COUNSEL

Seyfarth Shaw LLP

55 East Monroe St., Suite 4200

Chicago, IL 60603

AUDITORS

Cohen McCurdy, Ltd.

800 Westpoint Parkway, Suite 1100

Westlake, OH 44145-1139

Item 2. Code of Ethics. Not applicable.

Item 3. Audit Committee Financial Expert. Not applicable.

Item 4. Principal Accountant Fees and Services. Not applicable.

Item 5. Audit Committee of Listed Companies. Not applicable.

Item 6. Schedule of Investments.

Not applicable – schedule filed with Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Funds. Not applicable.

Item 8. Portfolio Managers of Closed-End Funds. Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Funds. Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant has not adopted procedures by which shareholders may recommend nominees to the registrant's board of directors.

Item 11. Controls and Procedures.

(a)

Based on an evaluation of the registrant’s disclosure controls and procedures as of August 8, 2005, the disclosure controls and procedures are reasonably designed to ensure that the information required in filings on Forms N-CSR is recorded, processed, summarized, and reported on a timely basis.

(b)

There were no significant changes in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal half-year that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1)

EX-99.CODE ETH. Not applicable.

(a)(2)

EX-99.CERT. Filed herewith.

(a)(3)

Any written solicitation to purchase securities under Rule 23c-1 under the Act (17 CFR 270.23c-1) sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable.

(b)

EX-99.906CERT. Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Illington Funds

By /s/Salvatore M. Capizzi

Salvatore M. Capizzi

President

Date September 6, 2006

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By /s/Salvatore M. Capizzi

Salvatore M. Capizzi

President

Date September 6, 2006

By /s/Jeffrey J Unterreiner

Jeffrey J Unterreiner

Treasurer

Date September 6, 2006