UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-7739 |

|

Harding, Loevner Funds, Inc. |

(Exact name of registrant as specified in charter) |

|

50 Division Street, Somerville, NJ | | 08876 |

(Address of principal executive offices) | | (Zip code) |

|

David R. Loevner, President 50 Division Street, Somerville, NJ 08876 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (877) 435-8105 | |

|

Date of fiscal year end: | 10/31 | |

|

Date of reporting period: | 10/31/2005 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

Annual Report | | October 31, 2005 |

HARDING • LOEVNER®

Family of Mutual Funds

• International Equity Portfolio Investor Class

• Emerging Markets Portfolio

Harding Loevner Funds, Inc. |

P.O. Box 642, OPS 22 |

Boston, MA 02117-0642 |

Fax: 617-927-8400 |

1.877.435.8105 • www.hardingloevner.com

Harding, Loevner Funds, Inc.

Table of Contents

For use only when preceded or accompanied by a prospectus. Read the prospectus carefully before you invest or send money.

Harding, Loevner Funds, Inc.

Hypothetical Expense Example

October 31, 2005 (unaudited)

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of fund shares; and (2) ongoing costs, including management fees and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2005 to October 31, 2005 for the Institutional Class of International Equity Portfolio and Emerging Markets Portfolio and from September 30, 2005 (commencement of operations) to October 31, 2005 for the Investor Class of International Equity Portfolio.

Actual Expenses

The first line under each Porfolio in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Portfolio under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line under each Portfolio in the table below provides information about hypothetical account values and hypothetical expenses based on each Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of fund shares. Therefore, the second line under each Portfolio in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | |

| | | Beginning

Account Value | | Ending Account

Value | | Annualized | | Expenses Paid

During Period*

(May 1, 2005 to | |

| | | May 1, 2005 | | October 31, 2005 | | Expense Ratio | | October 31, 2005) | |

| International Equity Portfolio, Institutional Class | | | | | | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | | | $ | 1,098.00 | | | | 1.00 | % | | | $ | 5.29 | | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,020.16 | | | | 1.00 | % | | | 5.09 | | |

| Emerging Markets Portfolio | | | | | | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | | | $ | 1,223.30 | | | | 1.68 | % | | | $ | 9.42 | | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,016.73 | | | | 1.68 | % | | | 8.55 | | |

| | | | | | | | | | | | | | | | | | |

* Expenses are calculated using each Portfolio’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by number of days in the period (184 days), and divided by the number of days in the year (365 days).

Harding, Loevner Funds, Inc.

Hypothetical Expense Example (continued)

October 31, 2005 (unaudited)

| | | | | | | | | | |

| | | Beginning

Account Value | | Ending Account

Value | | Annualized

Expense | | Expenses Paid

During Period*

(September 30,

2005 to | |

| | | September 30, 2005 | | October 31, 2005 | | Ratio | | October 31, 2005) | |

| International Equity Portfolio, Investor Class | | | | | | | | | | | | | | | | | |

| Actual | | | $ | 1,000.00 | | | | $ | 953.90 | | | | 1.25 | % | | | $ | 1.07 | | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,003.29 | | | | 1.25 | % | | | 1.10 | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

* Expenses are calculated using each Portfolio’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by number of days in the period (32 days), and divided by the number of days in the year (365 days).

Harding, Loevner Funds, Inc.

International Equity Portfolio — Overview

(unaudited)

| | | | |

| | | Returns for the Period Ended October 31, 2005 | |

| | | Cumulative Total Returns | | Average Annualized

Total Return | |

| FUND NAME | | Last 12 Months | | 5 YR | | 10 YR | | 5 YR | | 10 YR | |

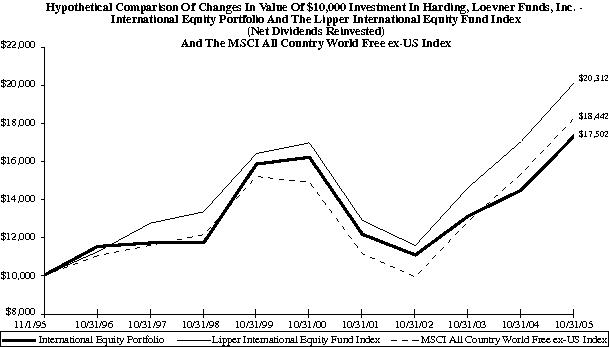

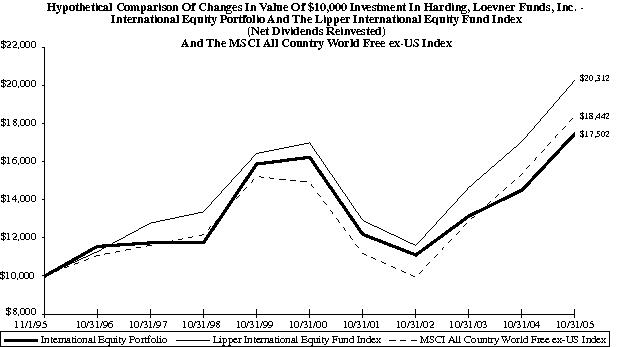

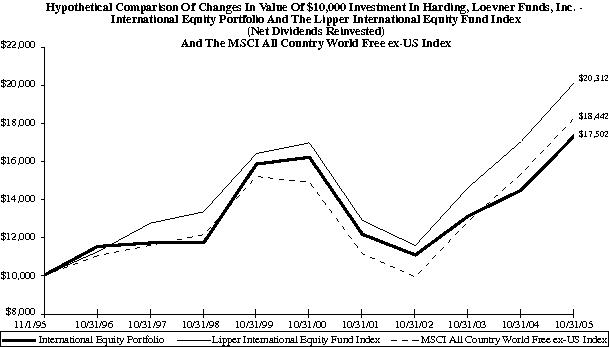

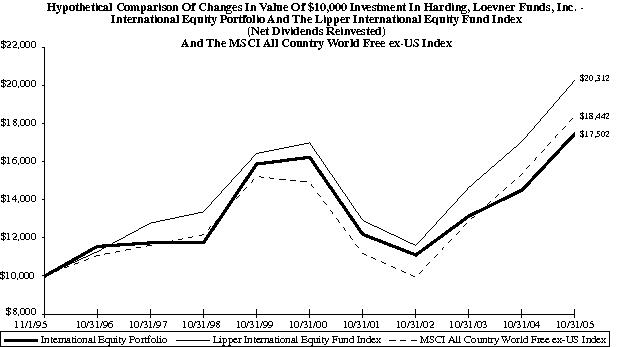

| International Equity Portfolio (11/1/94) | | | 20.58% | | | 7.83% | | 75.02% | | 1.52% | | 5.76% | |

| MSCI All Country World ex USA Free

(Net dividend) | | | 20.06% | | | 23.62% | | 84.42% | | 4.33% | | 6.31% | |

| Lipper International Fund Index | | | 18.90% | | | 19.43% | | 103.12% | | 3.62% | | 7.34% | |

| | | | | | | | | | | | | | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by visiting the website at www.hardingloevner.com

Investment return reflects voluntary fee waivers in effect. Absence such waivers, total return would be reduced. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions.

1

Harding, Loevner Funds, Inc.

International Equity Portfolio — Overview (continued)

(unaudited)

The Institutional share class of the Portfolio rose in value by 20.58% net of fees in the financial year ending October 31, 2005. In comparison, the benchmark MSCI All Country World ex-US Index rose by 20.06%—its value component by 20.38%, and its growth component by 19.75%. Please refer to the preceding page of the report for complete performance information.

Relative performance during the year was positive, though modest. Our quality-and-growth-oriented investment style, which was out of favor in the two preceding years, ceased to be a drag in the year just ended. Stocks of high quality companies, those with strong finances, good management, and the ability both to defend margins and generate growth over long periods of time, held their own against stocks of riskier companies, with more cyclical or less durable businesses. In an environment in which nominal yields remain low, investors hungry for high returns are prepared to seek them in risky assets. Rising interest rates bring reminders of the dangers, and increasing caution. We feel that the extreme relative under pricing of high quality companies (noted emphatically in these pages last year) is at last unwinding, and that our tenacity in adhering to our long-held investment philosophy, which focuses exclusively on such companies, is again being rewarded.

Amidst a benign business environment, corporate earnings growth has been surprisingly strong. We think growth will become increasingly hard to achieve, and thus increasingly valued by investors. US interest rates are rising steadily, gasoline and other energy bills are taking an increasing share of consumers’ wallet, while their confidence is being sapped by evidence that house prices are beginning to wobble. It could be that the much-predicted weakening of US consumer demand is now very close.

Good managements continue to focus on costs, and to seek growth in faster-growing economies in Asia, and Latin America as well as in Central and Eastern Europe. Opportunities to grow in the larger, but far more mature markets in Western Europe are few. We worry that this is a longer term, not just a cyclical phenomenon. Populations are not growing, and immigration is modest, exacerbating the weakness of demand that would in any case be expected when unemployment is high and job security is low.

Japan faces a similar long-term demographic drag, but a brighter near-term cyclical outlook. We have long observed the self-improvement that Japanese companies have undertaken in recent years, but now we observe that the operating environment has also changed for the better. The causes of long-lasting changes in direction of consumer confidence are mysterious (not just to us, but to most forecasters), but it does now appear that there has been a change in the national psyche towards optimism. We believe this change may lead to a long-lasting upturn in consumer spending as well as in corporate investment.

The pace of corporate investment in developing economies has not been an issue. Multi-nationals are seeking sources of growth, governments are flush with cash, especially in emerging Asia, and consumers are increasingly turning from being consistent savers to being consistent spenders. The result has changed the outlook for several global industries, most notably for those in the Materials sector, as well for the capital goods industry as manufacturing capacity is expanded and pent-up demand for better public infrastructure is met.

Our view that companies face difficulty in growing in mature economies and that developing economies will thus be an important source of growth for all companies is not new. Indeed, our world view, formed from the many meetings and contacts we have with companies in all sectors and geographies, has undergone little change in this regard. As a result, the Portfolio is little changed in terms of either geographical or industrial exposure. The companies we bought are from a wide range of industries and geographies, but are, we believe, going to grow fast, and for a long time. In Energy we continued our policy of avoiding the oil majors, with diversified, but lower revenue growth opportunities, in favor of companies with well-defined opportunities: in the case of BG Group from the growth in demand of natural gas, and in the case of Gazprom from increased investment in production and distribution capacity to enable it to monetize its vast quantities of Russian energy reserves. In Financials, too, we sought geographies and segments that can grow fast while the industry as a whole does not. We bought a holding in an Austrian bank, Erste, which is becoming a market leader in Central Europe, as well as a Polish bank, Pekao, where we are directly benefiting from large, and, we think, sustainable growth in consumer demand in that country. Elsewhere in the sector, we bought a new holding in an Indian bank, ICICI, but financed it with a partial sale of its competitor, HDFC Bank. In China, we bought a new holding in port operator, China Merchants. These new emerging market holdings were offset by sales of two Thai companies, cellular operator Advanced Info Services, and Bangkok Bank, so that overall exposure to emerging markets was roughly unchanged. There were a number of other transactions during the year, all driven by company specific or price issues.

It has been a good year for our shareholders. Markets returns have been strong, and Portfolio returns stronger still. Our focus on high quality growth companies is, of course, unchanged. Our conviction that they offer the prospect of returns above those of the market as a whole is also unchanged.

2

Harding, Loevner Funds, Inc.

International Equity Portfolio — Overview (continued)

(unaudited)

Past performance does not guarantee future results.

The Portfolio invests in foreign securities, which will involve greater volatility and political, economic and currency risks and differences in accounting methods. It also invests in emerging markets, which involve unique risks, such as exposure to economies less diverse and mature than the US or other more established foreign markets. Economic and political instability may cause larger price changes in emerging markets securities than other foreign securities.

Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

MSCI All Country World Free ex-US Index includes all developed and emerging markets in the MSCI universe of 48 countries, excluding the US, with Free versions of countries where they exist. Net dividends reinvested.

Lipper International Fund Index, an unmanaged index published by Lipper Analytical Services, Inc., includes 30 funds that are generally similar to the Fund, although some funds in the index may have somewhat different investment policies or objectives.

You cannot invest directly in an Index.

3

Harding, Loevner Funds, Inc.

International Equity Portfolio

Statement of Net Assets

| | Percentage of | |

Industry | | Net Assets | |

Advertising Agencies | | | 2.6 | % | |

Automobiles | | | 1.3 | | |

Automotive | | | 1.7 | | |

Banks | | | 17.2 | | |

Beverages, Food & Tobacco | | | 4.9 | | |

Commercial Banks | | | 2.4 | | |

Construction Materials | | | 1.6 | | |

Cosmetics & Personal Care | | | 1.6 | | |

Discount Stores | | | 1.7 | | |

Diversified Electronics | | | 2.1 | | |

Diversified Food | | | 4.0 | | |

Electric Utilities | | | 1.2 | | |

Electronic Equipment & Instruments | | | 6.3 | | |

Food & Drug Retailing | | | 2.3 | | |

General Diversified | | | 5.8 | | |

Health Care Equipment & Supplies | | | 1.3 | | |

Heavy Machinery | | | 6.2 | | |

Industrial Chemicals & Gases Manufacturers | | | 2.9 | | |

Insurance | | | 1.8 | | |

Integrated International Oil Producers | | | 2.3 | | |

Media | | | 1.8 | | |

Medical Supplies | | | 1.9 | | |

Miscellaneous Retailers | | | 1.0 | | |

Oil & Gas | | | 9.7 | | |

Other Financial Services | | | 1.8 | | |

Parts & Components | | | 1.8 | | |

Pharmaceuticals | | | 6.6 | | |

Real Estate | | | 2.4 | | |

Software | | | 2.0 | | |

Textiles & Apparel | | | 1.0 | | |

Transportation | | | 1.0 | | |

Wholesalers | | | 1.2 | | |

Total Investments | | | 103.4 | | |

Other Assets Less Liabilities | | | (3.4 | ) | |

Net Assets | | | 100.0 | % | |

4

Harding, Loevner Funds, Inc.

International Equity Portfolio

Statement of Net Assets

October 31, 2005 (continued)

| | Shares | | Value (1) | |

Long Term Investments - 97.9% | | | | | |

Common Stocks - 97.9% | | | | | |

Austria - 3.2% | | | | | |

Erste Bank der Oesterreichischen Sparkassen AG (Banks) | | 112,500 | | $ | 5,849,279 | |

Oest Elektrizitatswirts, Class A (Electric Utilities) | | 11,600 | | 3,698,181 | |

| | | | 9,547,460 | |

Bermuda - 1.8% | | | | | |

Bunge Ltd. (Beverages, Food & Tobacco) | | 101,800 | | 5,287,492 | |

Canada - 4.9% | | | | | |

EnCana Corp. (Oil & Gas) | | 169,732 | | 7,783,910 | |

Imperial Oil Ltd. (Integrated International Oil Producers) | | 80,080 | | 7,033,426 | |

| | | | 14,817,336 | |

France - 11.8% | | | | | |

Air Liquide (Industrial Chemicals & Gases Manufacturers) | | 47,075 | | 8,560,629 | |

Carrefour SA (Miscellaneous Retailers) | | 67,560 | | 3,002,721 | |

Dassault Systemes SA (Software) | | 117,800 | | 6,074,996 | |

LVMH Moet Hennessy Louis Vuitton SA (Beverages, Food & Tobacco) | | 75,400 | | 6,105,012 | |

Sanofi-Aventis (Pharmaceuticals) | | 68,000 | | 5,444,716 | |

Schneider Electric SA (Heavy Machinery) | | 76,910 | | 6,315,115 | |

| | | | 35,503,189 | |

Germany - 2.3% | | | | | |

Metro AG (Food & Drug Retailing) | | 151,470 | | 6,888,954 | |

Hong Kong - 6.4% | | | | | |

China Merchants Holdings International Co., Ltd. (Transportation) | | 1,594,000 | | 3,101,576 | |

Denway Motors Ltd. (Automobiles) | | 12,540,000 | | 3,772,783 | |

Hutchison Whampoa Ltd. (General Diversified) | | 609,000 | | 5,780,280 | |

Li & Fung Ltd. (Wholesalers) | | 1,700,000 | | 3,638,616 | |

Yue Yuen Industrial Holdings Ltd. (Textiles & Apparel) | | 1,204,500 | | 3,041,234 | |

| | | | 19,334,489 | |

India - 2.2% | | | | | |

HDFC Bank Ltd. (Banks) | | 235,300 | | 3,172,881 | |

ICICI Bank Ltd. (Banks) | | 300,000 | | 3,319,512 | |

| | | | 6,492,393 | |

Ireland - 1.6% | | | | | |

CRH plc (Construction Materials) | | 188,452 | | 4,709,501 | |

Japan - 18.1% | | | | | |

Daikin Industries Ltd. (Heavy Machinery) | | 256,600 | | 6,679,546 | |

Hirose Electronics Co., Ltd. (Electronic Equipment & Instruments) | | 42,200 | | 4,836,812 | |

JSR Corp. (Automotive) | | 217,700 | | 5,126,393 | |

Kao Corp. (Cosmetics & Personal Care) | | 195,900 | | 4,678,376 | |

Keyence Corp. (Electronic Equipment & Instruments) | | 34,650 | | 8,013,610 | |

Mitsubishi Corp. (General Diversified) | | 600,600 | | 11,761,087 | |

| | | | | | |

See Notes to Financial Statements

5

Harding, Loevner Funds, Inc.

International Equity Portfolio

Statement of Net Assets

October 31, 2005 (continued)

Sumitomo Realty & Development Co., Ltd. (Real Estate) | | 451,000 | | $ | 7,244,824 | |

Yokogawa Electric Corp. (Electronic Equipment & Instruments)† | | 416,000 | | 6,125,727 | |

| | | | 54,466,375 | |

Mexico - 1.7% | | | | | |

Wal-Mart de Mexico SA de CV - ADR (Discount Stores) | | 107,490 | | 5,227,626 | |

Netherlands - 4.2% | | | | | |

Heineken NV (Beverages, Food & Tobacco) | | 105,337 | | 3,336,089 | |

Qiagen NV (Health Care Equipment & Supplies)*† | | 314,400 | | 3,742,210 | |

VNU NV (Media) | | 171,200 | | 5,442,450 | |

| | | | 12,520,749 | |

Poland - 1.0% | | | | | |

Bank Pekao SA - GDR (Banks) | | 62,800 | | 3,021,728 | |

Russia - 2.3% | | | | | |

OAO Gazprom - Sponsored ADR Reg S (Oil & Gas)† | | 115,100 | | 6,803,927 | |

Singapore - 1.1% | | | | | |

DBS Group Holdings Ltd. (Commercial Banks) | | 353,083 | | 3,195,064 | |

South Africa - 2.5% | | | | | |

Sasol Ltd. (Oil & Gas) | | 238,600 | | 7,615,439 | |

South Korea - 2.1% | | | | | |

Samsung Electronics Co., Ltd. - GDR (Diversified Electronics) | | 23,800 | | 6,356,049 | |

Spain - 3.9% | | | | | |

Banco Santander Central Hispano SA (Banks) | | 608,400 | | 7,758,980 | |

Bankinter SA (Commercial Banks) | | 70,000 | | 4,017,757 | |

| | | | 11,776,737 | |

Sweden - 3.6% | | | | | |

Atlas Copco AB, Class A (Heavy Machinery) | | 307,800 | | 5,621,144 | |

Skandinaviska Enskilda Banken AB, Class A (Banks) | | 277,400 | | 5,173,754 | |

| | | | 10,794,898 | |

Switzerland - 11.3% | | | | | |

Actelion Ltd. (Pharmaceuticals)* | | 41,000 | | 4,607,734 | |

Nestle SA - ADR (Diversified Food) | | 99,420 | | 7,392,394 | |

Roche Holding AG - Genusschein (Pharmaceuticals) | | 66,430 | | 9,924,513 | |

Swiss Re - Registered (Insurance) | | 77,800 | | 5,253,206 | |

UBS AG - Registered (Banks) | | 80,210 | | 6,808,679 | |

| | | | 33,986,526 | |

Taiwan - 1.8% | | | | | |

Taiwan Semiconductor Manufacturing Co. (Parts & Components) | | 3,514,794 | | 5,497,465 | |

United Kingdom - 10.1% | | | | | |

BG Group plc (Oil & Gas) | | 791,500 | | 6,945,346 | |

Smith & Nephew plc (Medical Supplies) | | 685,500 | | 5,800,362 | |

Standard Chartered plc (Other Financial Services) | | 252,540 | | 5,302,160 | |

See Notes to Financial Statements

6

Harding, Loevner Funds, Inc.

International Equity Portfolio

Statement of Net Assets

October 31, 2005 (continued)

Unilever plc (Diversified Food) | | 449,400 | | $ | 4,556,237 | |

WPP Group plc (Advertising Agencies) | | 804,730 | | 7,905,265 | |

| | | | 30,509,370 | |

Total Common Stocks (Cost $212,526,933) | | | | 294,352,767 | |

Total Long Term Investments (Cost $212,526,933) | | | | 294,352,767 | |

Short Term Investments - 3.6% | | Face

Amount | | | |

Federal Home Loan Bank, 3.693%, due 11/04/05†† | | 4,908,578 | | 4,908,578 | |

Federal Home Loan Mortgage Corporation, 3.686%, due 11/02/05†† | | 5,839,310 | | 5,839,310 | |

Total Short Term Investments (Cost $10,747,888) | | | | 10,747,888 | |

Repurchase Agreement - 1.9% | | | | | |

Investors Bank & Trust Repurchase Agreement, 2.75%, due 11/01/05 in the

amount of $5,890,577; issued 10/31/05 (collateralized by $5,889,597 par of

FNMA #704534, 3.756%, due 06/31/33, SBA #506124, 7.375%, due 12/25/14

and SBA #506413, 7.325% due 09/25/15 with an aggregate market

value of $6,184,634) (Cost $5,890,127) | | $ | 5,890,127 | | 5,890,127 | |

Total Investments - 103.4% (Cost $229,164,948) | | | | $ | 310,990,782 | |

| | | | | | | |

See Notes to Financial Statements

7

Harding, Loevner Funds, Inc.

International Equity Portfolio

Statement of Net Assets

October 31, 2005 (continued)

| | Value (1) | |

Liabilities, Net of Other Assets - (3.4)% | | | |

Foreign currency (cost $194,055) | | $ 186,756 | |

Dividends receivable | | 356,486 | |

Receivable for fund shares sold | | 5,488 | |

Tax reclaim receivable | | 288,658 | |

Prepaid expenses | | 2,530 | |

Other assets | | 1,571 | |

Collateral for securities loaned ($10,174,788) | | (10,747,888 | ) |

Payable for distribution fees | | (27 | ) |

Payable for fund shares redeemed | | (1,650 | ) |

Payable to investment advisor | | (195,462 | ) |

Other liabilities | | (149,760 | ) |

| | $ (10,253,298 | ) |

Net Assets - 100% | | | |

Institutional Class | | | |

Applicable to 20,144,865 outstanding $.001 par value shares (authorized 250,000,000 shares) | | $ 300,227,412 | |

Net Asset Value, Offering Price and Redemption Price Per Share | | $ 14.90 | |

Investor Class | | | |

Applicable to 34,210 outstanding $.001 par value shares (authorized 250,000,000 shares) | | $ 510,072 | |

Net Asset Value, Offering Price and Redemption Price Per Share | | $ 14.91 | |

Components of Net Assets as of October 31, 2005 were as follows: | | | |

Paid-in capital | | $ 217,624,438 | |

Accumulated undistributed net investment income | | 1,524,829 | |

Accumulated distributions in excess of net realized gain on investments and foreign currency-related transactions | | (212,286 | ) |

Net unrealized appreciation on investments and on assets and liabilities denominated in foreign currencies (Note 4) | | 81,800,503 | |

| | $ 300,737,484 | |

Summary of Abbreviations

ADR | - | American Depository Receipt |

FNMA | - | Federal National Mortgage Association |

GDR | - | Global Depositary Receipt |

SBA | - | Small Business Administration |

(1) | | See Note 2 to Financial Statements |

* | | Non-income producing security |

† | | All or a portion of this security was out on loan at October 31, 2005; the value of the securities loaned amounted to $10,174,788. The value of collateral amounted to $10,747,888 which consisted of cash equivalents. |

†† | | Represents investments of security lending collateral. |

See Notes to Financial Statements

8

Harding, Loevner Funds, Inc.

Emerging Markets Portfolio—Overview

(unaudited)

| | | | |

| | | Returns for the Period Ended October 31, 2005 | |

| | | Cumulative Total Returns | | Average Annualized

Total Return | |

| FUND NAME | | Last 12 Months | | 5 YR | | Inception | | 5 YR | | Inception | |

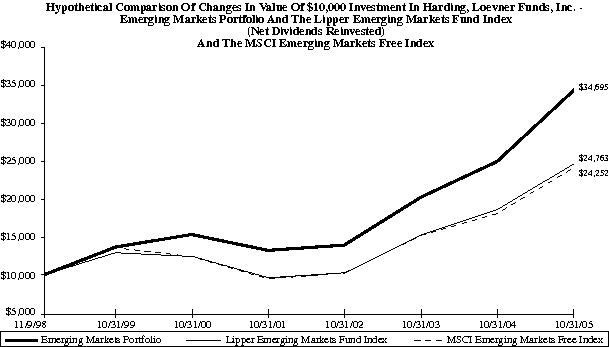

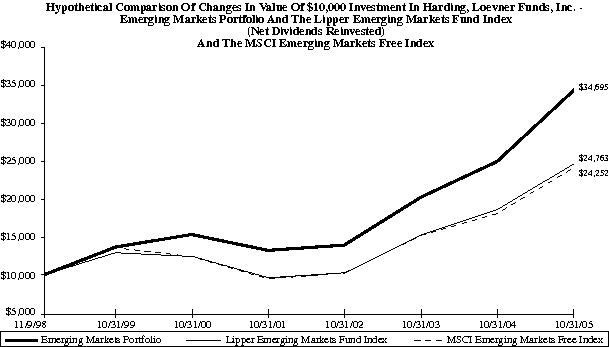

| Emerging Markets Portfolio (11/9/98) | | | 38.76% | | | 126.08% | | 246.95% | | 17.72% | | 19.52% | |

| MSCI Emerging Markets Free (Net dividend) | | | 33.80% | | | 95.19% | | 142.52% | | 14.31% | | 13.54% | |

| Lipper Emerging Markets Funds Index | | | 32.96% | | | 99.90% | | 147.63% | | 14.86% | | 13.88% | |

| | | | | | | | | | | | | | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by visiting the website at www.hardingloevner.com.

Investment return reflects voluntary fee waivers in effect. Absence such waivers, total return would be reduced. The performance provided does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions.

9

Harding, Loevner Funds, Inc.

Emerging Markets Portfolio — Overview (continued)

(unaudited)

The Portfolio rose in value by 38.76% net of fees in the financial year ending October 31, 2005. In comparison, the benchmark MSCI Emerging Markets Index rose by 33.80%. Please refer to the preceding page of the report for complete performance information.

We feel the basic trends favoring the continued progress of the developing markets are powerful. The confluence of growing workforces, improving economic management by governments, and globalization of trade in services as well as goods has led to strong economic performance. Emerging markets economies are growing at around twice the pace of the developed world. Increased foreign exchange reserves have facilitated stable currencies and falling domestic interest rates, which in turn have fuelled the empowerment of emerging markets consumers.

Emerging markets companies (EM) are growing their revenues at approximately three times the rate of their developed markets counterparts. Less well known is the fact that the stocks of these companies are of significantly higher quality than developed markets stocks. While the emerging markets have appreciated significantly over the past three years, the combination of earnings growth and the reducing risk of the EM economies provide the basis for our view of long-term favorable performance.

Over half of the Portfolio is invested in the stocks of companies focused on the “emerging” consumer in their domestic and regional markets. These include our overweights in Consumer Discretionary and Consumer Staples, along with the exposure to retail banks and cellular telephone operators. The dynamics of the development of the EM consumer wallet are specific in each country. For example, the development of mortgage financing in Mexico has fuelled demand for affordable homes, built by Portfolio holdings Concorcio Ara and Urbi Desarrollos Urbanos. In India, Bharti Tele-Ventures continues to roll out its GSM cellular platform, in a country where cellular penetration is currently around 10% and expected to triple. JD Group operates a range of retail formats positioned to benefit from strong household formation in South Africa.

The Emerging Markets are also home to an increasing number of companies that participate in global industries and compete for customers in the developed economies as well as at home. Traditionally, the Emerging Markets have been associated with exporters of natural resources, agricultural products and low-cost manufactured goods. During the year, we cut back our exposure to extractive industries to a significantly underweight position, corresponding to our view that most commodity prices have passed their cyclical peak. Our sales included long-term holding CVRD, the Brazilian iron ore miner, and Yangzhou Coal and the Aluminum Company of China. We continue to be highly selective in our stocks of low-cost manufacturers. For example, we sold Yue Yuen, the manufacturer of athletic footwear, because we anticipated the company’s difficultly in passing through labor and petrochemical feedstock cost increases to customers such as Nike and Adidas. We bought Johnson Electric, the producer of micro-motors, in order to benefit from scale economies and the decreasing costs of steel, a key raw material.

We are underweight in Information Technology overall because, we believe, relatively few businesses are positioned to win over successive technology product cycles. We continue to hold global technology leaders such as Samsung and Taiwan Semiconductor, and added Hon Hai, a Taiwanese electronics contract manufacturer.

Our Energy exposure is focused on companies that, we believe, are positioned to benefit from an environment of generally high energy prices, but we are underweight in stocks directly dependent on the oil price. A notable theme within Energy is the strategic role of Russian producers; holdings include Gazprom, the owner of the world’s largest gas reserves. Other holdings include Sasol, the South African integrated producer, now commercializing its gas-to-liquids petrochemical technology, and sour crude refiners such as Reliance of India.

Our investment process is designed to identify high quality growth companies from which to build a diversified portfolio of 70 or 80 stocks, reflecting our analytic insights. Reassuringly, we observe that the outperformance of the Portfolio this year is attributable primarily to the stock selection arising from our analytic insights, rather than to the results of any geographic ‘bets’.

10

Harding, Loevner Funds, Inc.

Emerging Markets Portfolio — Overview (continued)

(unaudited)

Past performance does not guarantee future results.

The Portfolio invests in foreign securities, which will involve greater volatility and political, economic and currency risks and differences in accounting methods. It also invests in emerging markets, which involve unique risks, such as exposure to economies less diverse and mature than the US or other more established foreign markets. Economic and political instability may cause larger price changes in emerging markets securities than other foreign securities.

Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

MSCI Emerging Markets Free Index includes all emerging markets in the MSCI universe of 26 countries, with Free versions of countries where they exist. Net dividends reinvested.

Lipper Emerging Market Fund Index, an unmanaged index published by Lipper Analytical Services, Inc., includes 30 funds that are generally similar to the Fund, although some funds in the index may have somewhat different investment policies or objectives. You cannot invest directly in this Index.

You cannot invest directly in an Index.

11

Harding, Loevner Funds, Inc.

Emerging Markets Portfolio

Statement of Net Assets

Industry | | Percentage of

Net Assets | |

Aerospace & Defense | | | 1.3 | % | |

Automotive | | | 5.5 | | |

Banks | | | 17.5 | | |

Beverages, Food & Tobacco | | | 2.2 | | |

Brewers | | | 1.7 | | |

Building Materials | | | 2.7 | | |

Commercial Banks | | | 1.6 | | |

Commercial Services & Supplies | | | 1.0 | | |

Computer Software & Processing | | | 1.5 | | |

Computers & Information | | | 0.7 | | |

Discount Stores | | | 1.6 | | |

Diversified Electronics | | | 4.6 | | |

Electrical Equipment | | | 5.1 | | |

Entertainment & Leisure | | | 1.2 | | |

Financial Services | | | 1.2 | | |

Heavy Machinery | | | 1.2 | | |

Home Construction, Furnishings & Appliances | | | 4.2 | | |

Industrial Conglomerates | | | 1.3 | | |

Insurance | | | 1.8 | | |

Metals & Mining | | | 3.6 | | |

National & Regional Food Chains | | | 1.3 | | |

Oil & Gas | | | 11.9 | | |

Parts & Components | | | 3.1 | | |

Pharmaceuticals | | | 1.3 | | |

Real Estate | | | 1.2 | | |

Retailers | | | 2.2 | | |

Securities Brokerage | | | 1.2 | | |

Systems & Subsystems | | | 1.0 | | |

Telephone Systems | | | 11.3 | | |

Transportation | | | 5.5 | | |

Total Investments | | | 101.5 | | |

Other Assets Less Liabilities | | | (1.5 | ) | |

Net Assets | | | 100.0 | % | |

12

Harding, Loevner Funds, Inc.

Emerging Markets Portfolio

Statement of Net Assets

October 31, 2005 (continued)

| | Shares | | Value (1) | |

Long Term Investments - 96.0% | | | | | |

Common Stocks - 89.0% | | | | | |

Brazil - 3.7% | | | | | |

Companhia Brasileira de Distribuicao Grupo Pao de Acucar (National & Regional Food Chains)† | | 315,000 | | $ | 8,681,400 | |

Embraer Aircraft Corp. - ADR (Aerospace & Defense) | | 235,360 | | 9,129,614 | |

Petroleo Brasileiro SA - ADR (Oil & Gas) | | 122,000 | | 7,795,800 | |

| | | | 25,606,814 | |

Cayman Islands - 1.2% | | | | | |

ASM Pacific Technology Ltd. (Heavy Machinery) | | 1,787,000 | | 8,293,373 | |

Chile - 1.2% | | | | | |

Banco Santander - ADR (Banks) | | 208,000 | | 8,122,400 | |

Egypt - 3.1% | | | | | |

Egyptian Mobile Phone Network (Telephone Systems) | | 263,000 | | 8,684,224 | |

Orascom Telecom Holding SAE - GDR (Telephone Systems) | | 260,700 | | 12,792,591 | |

| | | | 21,476,815 | |

Hong Kong - 5.5% | | | | | |

China Merchants Holdings International Co., Ltd. (Transportation) | | 4,856,000 | | 9,448,715 | |

China Mobile HK Ltd. - ADR (Telephone Systems) | | 418,000 | | 9,384,100 | |

Johnson Electric Holdings Ltd. (Electrical Equipment) | | 10,500,000 | | 9,497,524 | |

Techtronic Industries Co. (Electrical Equipment) | | 3,805,000 | | 9,388,084 | |

| | | | 37,718,423 | |

Hungary - 1.6% | | | | | |

Gedeon Richter Rt. (Pharmaceuticals) | | 53,900 | | 8,857,386 | |

MOL Magyar Olaj-es Gazipari Rt. (Oil & Gas) | | 23,075 | | 2,152,106 | |

| | | | 11,009,492 | |

India - 11.5% | | | | | |

Bajaj Auto Ltd. (Automotive) | | 237,000 | | 8,965,875 | |

Bharat Heavy Electricals (Electrical Equipment) | | 383,000 | | 9,788,119 | |

Bharti Tele-Ventures Ltd. (Telephone Systems)* | | 1,938,208 | | 13,889,617 | |

Gujarat Ambuja Cements Ltd. (Building Materials) | | 6,300,000 | | 9,732,965 | |

HDFC Bank Ltd. - ADR (Banks) | | 167,000 | | 7,379,730 | |

ICICI Bank Ltd. (Banks) | | 371,000 | | 4,105,130 | |

ICICI Bank Ltd. - Sponsored ADR (Banks) | | 225,000 | | 5,321,250 | |

Reliance Industries Ltd. - Sponsored GDR (Oil & Gas) | | 300,000 | | 10,069,096 | |

Satyam Computer Services Ltd. (Computer Software & Processing) | | 775,000 | | 10,455,317 | |

| | | | 79,707,099 | |

| | | | | | |

13

Harding, Loevner Funds, Inc.

Emerging Markets Portfolio

Statement of Net Assets

October 31, 2005 (continued)

Indonesia - 0.7% | | | | | |

PT International Nickel Indonesia Tbk (Metals & Mining) | | 3,349,500 | | $ | 4,785,777 | |

Luxembourg - 1.3% | | | | | |

Tenaris SA - ADR (Metals & Mining) | | 84,000 | | 9,227,400 | |

Malaysia - 4.4% | | | | | |

Malaysia International Shipping Corp. Berhad (Transportation) | | 4,106,000 | | 10,327,659 | |

Maxis Communications Berhad (Telephone Systems) | | 2,762,000 | | 6,588,450 | |

Public Bank Berhad (Banks) | | 3,087,200 | | 5,355,876 | |

Resorts World Berhad (Entertainment & Leisure) | | 2,950,000 | | 8,203,911 | |

| | | | 30,475,896 | |

Mexico - 8.7% | | | | | |

America Movil SA de CV, Series L - ADR (Telephone Systems) | | 408,000 | | 10,710,000 | |

Consorcio ARA SA de CV Series (Real Estate) | | 2,323,300 | | 8,575,455 | |

Controladora Comercial Mexicana SA de CV (Retailers) | | 5,145,000 | | 7,723,105 | |

Grupo Aeroportuario del Sureste SA de CV - ADR (Commercial Services & Supplies) | | 223,000 | | 7,247,500 | |

Grupo Financiero Banorte SA de CV, Class O (Financial Services) | | 945,000 | | 8,056,442 | |

Urbi Desarrollos Urbanos SA de CV (Home Construction, Furnishings & Appliances)* | | 1,018,000 | | 6,423,910 | |

Wal-Mart de Mexico SA de CV - ADR (Discount Stores) | | 230,800 | | 11,224,635 | |

| | | | 59,961,047 | |

Philippines - 1.2% | | | | | |

Philippine Long Distance Telephone Co. - Sponsored ADR (Telephone Systems)† | | 271,000 | | 8,170,650 | |

Poland - 2.1% | | | | | |

Bank Pekao SA (Banks) | | 155,400 | | 7,366,712 | |

Polski Koncern Naftowy Orlen SA (Oil & Gas) | | 391,700 | | 6,930,056 | |

| | | | 14,296,768 | |

Russia - 6.3% | | | | | |

Lukoil -Sponsored ADR (Oil & Gas) | | 244,000 | | 13,456,600 | |

OAO Gazprom - Sponsored ADR Reg S (Oil & Gas)† | | 161,500 | | 9,546,778 | |

OAO Gazprom - Sponsored GDR Reg S (Oil & Gas)† | | 142,000 | | 8,392,200 | |

Sberbank of Russia (Banks) | | 13,600 | | 12,104,000 | |

| | | | 43,499,578 | |

South Africa - 12.3% | | | | | |

Bidvest Group Ltd. (Industrial Conglomerates) | | 670,589 | | 8,989,103 | |

Impala Platinum Holdings Ltd. (Metals & Mining) | | 102,400 | | 11,177,529 | |

JD Group Ltd. (Home Construction, Furnishings & Appliances) | | 514,000 | | 5,495,680 | |

MTN Group Ltd. (Telephone Systems) | | 1,012,000 | | 7,537,450 | |

Pretoria Portland Cement Co., Ltd. (Building Materials) | | 200,000 | | 8,943,502 | |

SABMiller plc (Brewers) | | 630,000 | | 11,835,021 | |

Sasol Ltd. (Oil & Gas) | | 391,000 | | 12,479,617 | |

| | | | | | |

14

Harding, Loevner Funds, Inc.

Emerging Markets Portfolio

Statement of Net Assets

October 31, 2005 (continued)

South Africa (continued) | | | | | |

Standard Bank Group Ltd. (Banks) | | 800,769 | | $ | 8,254,855 | |

Steinhoff International Holdings Ltd. (Home Construction, Furnishings & Appliances)* | | 3,940,000 | | 10,317,318 | |

| | | | 85,030,075 | |

South Korea - 14.4% | | | | | |

Daewoo Shipbuilding & Marine Engineering Co., Ltd. (Transportation) | | 500,000 | | 10,020,589 | |

Hankook Tire Co., Ltd. (Automotive) | | 576,000 | | 6,919,727 | |

Hyundai Mobis (Automotive) | | 129,000 | | 10,298,309 | |

Hyundai Motor Co., Ltd. (Automotive) | | 156,800 | | 11,566,512 | |

Kookmin Bank - ADR (Banks) | | 176,500 | | 10,311,130 | |

S1 Corp. (Securities Brokerage) | | 193,000 | | 8,381,946 | |

Samsung Electronics Co., Ltd. - GDR (Diversified Electronics) | | 3,400 | | 902,134 | |

Samsung Electronics Co., Ltd. - GDR (Diversified Electronics) | | 80,750 | | 21,565,166 | |

Samsung Fire & Marine Insurance Co., Ltd. (Insurance) | | 131,500 | | 12,538,337 | |

Shinsegae Co., Ltd. (Retailers) | | 20,150 | | 7,236,547 | |

| | | | 99,740,397 | |

Taiwan - 5.8% | | | | | |

Advantech Co., Ltd. (Computers & Information) | | 2,105,585 | | 4,645,805 | |

Delta Electronics (Electrical Equipment) | | 3,980,168 | | 6,723,402 | |

Hon Hai Precision Industry Co., Ltd. (Parts & Components) | | 2,583,000 | | 11,162,988 | |

Synnex Technology International Corp. (Systems & Subsystems) | | 5,767,890 | | 6,983,350 | |

Taiwan Semiconductor Manufacturing Co. (Parts & Components) | | 6,790,844 | | 10,621,513 | |

| | | | 40,137,058 | |

Thailand - 0.8% | | | | | |

Siam Commercial Bank-Alien (Banks) | | 4,957,000 | | 5,743,459 | |

Turkey - 3.2% | | | | | |

Anadolu Efes Biracilik Ve Malt Sanayii AS (Beverages, Food & Tobacco) | | 273,722 | | 6,686,604 | |

Arcelik AS (Home Construction, Furnishings & Appliances) | | 1,090,000 | | 6,497,525 | |

Turkiye Is Bankasi (Banks) | | 1,300,000 | | 9,012,085 | |

| | | | 22,196,214 | |

Total Common Stocks (Cost $537,357,383) | | | | 615,198,735 | |

Preferred Stock - 7.0% | | | | | |

Brazil - 4.0% | | | | | |

All America Latina Logistica SA (Transportation) | | 204,800 | | 7,911,694 | |

Banco Itau Holding Financeria SA - ADR (Commercial Banks) | | 469,480 | | 11,248,741 | |

Sadia SA (Beverages, Food & Tobacco) | | 3,405,000 | | 8,407,407 | |

| | | | 27,567,842 | |

Russia - 1.7% | | | | | |

Transneft (Oil & Gas)* | | 7,200 | | 11,592,000 | |

| | | | | | |

15

Harding, Loevner Funds, Inc.

Emerging Markets Portfolio

Statement of Net Assets

October 31, 2005 (continued)

South Korea - 1.3% | | | | | |

Samsung Electronics Co., Ltd. - GDR (Diversified Electronics)† | | 45,000 | | $ | 9,192,942 | |

Total Preferred Stock (Cost $35,637,421) | | | | 48,352,784 | |

Total Long Term Investments (Cost $572,994,804) | | | | 663,551,519 | |

Short Term Investments - 2.8% | | Face

Amount | | | |

Federal Home Loan Bank, 3.693%, due 11/04/05†† | | 8,966,996 | | 8,966,996 | |

Federal Home Loan Mortgage Corporation, 3.686%, due 11/02/05†† | | 10,667,258 | | 10,667,258 | |

Total Short Term Investments (Cost $19,634,254) | | | | 19,634,254 | |

Repurchase Agreement - 2.7% | | | | | |

Investors Bank & Trust Repurchase Agreement, 2.75% due 11/01/05 in the

amount of $18,287,083; issued 10/31/05 (collateralized by $17,730,791 par of

SBA #’s 506241, 506323, 506333, and 506707, with rates ranging from 6.625%

to 7.125%, with maturity dates ranging from 09/25/16 to 11/25/28 and an

aggregate market value of $19,199,970). (Cost $18,285,686) | | $ | 18,285,686 | | 18,285,686 | |

Total Investments - 101.5% (Cost $610,914,744) | | | | $ | 701,471,459 | |

| | | | | | | |

16

Harding, Loevner Funds, Inc.

Emerging Markets Portfolio

Statement of Net Assets

October 31, 2005 (continued)

| | Value (1) | |

Liabilities, Net of Other Assets - (1.5)% | | | |

Cash | | $ | 804 | |

Foreign currency (cost $1,348,423) | | 1,345,086 | |

Dividends receivable | | 254,120 | |

Receivable for fund shares sold | | 5,133,636 | |

Receivable for open forward foreign currency contracts | | 3,886,133 | |

Receivable for securities sold | | 3,863,474 | |

Tax reclaim receivable | | 75,752 | |

Prepaid expenses | | 1,284 | |

Other assets | | 3,543 | |

Collateral for securities loaned ($18,780,638) | | (19,634,254 | ) |

Payable for fund shares redeemed | | (189,018 | ) |

Payable to investment advisor | | (627,158 | ) |

Payable for open forward currency exchange contracts | | (3,874,692 | ) |

Payable for securities purchased | | (321,187 | ) |

Other liabilities | | (421,406 | ) |

| | $ | (10,503,883 | ) |

Net Assets - 100% | | | |

Applicable to 22,723,891 outstanding $.001 par value shares (authorized 500,000,000 shares) | | $ | 690,967,576 | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 30.41 | |

Components of Net Assets as of October 31, 2005 were as follows: | | | |

Paid-in capital | | $ | 597,884,022 | |

Accumulated undistributed net investment income | | 1,217,858 | |

Accumulated undistributed net realized gain on investments and

foreign currency-related transactions | | 1,334,245 | |

Net unrealized appreciation on investments and on assets and liabilities

denominated in foreign currencies (Note 4) | | 90,531,451 | |

| | $ | 690,967,576 | |

Summary of Abbreviations

ADR | - | American Depository Receipt |

FNMA | - | Federal National Mortgage Association |

GDR | - | Global Depositary Receipt |

SBA | - | Small Business Administration |

(1) | | See Note 2 to Financial Statements |

* | | Non-income producing security |

† | | All or a portion of this security was out on loan at October 31, 2005; the value of the securities loaned amounted to $18,780,638. The value of collateral amounted to $19,634,254 which consisted of cash equivalents. |

†† | | Represents investments of security lending collateral. |

See Notes to Financial Statements

17

Harding, Loevner Funds, Inc.

Statements of Operations

Year Ended October 31, 2005

| | International | | Emerging | |

| | Equity | | Markets | |

| | Portfolio | | Portfolio | |

Investment Income | | | | | | | |

Interest | | | $ | 129,384 | | | $ | 195,594 | |

Dividends (net of foreign withholding taxes of $481,788 and $453,524, respectively) | | | 5,482,771 | | | 8,064,111 | |

Security lending income | | | 88,970 | | | 63,028 | |

Total investment income | | | 5,701,125 | | | 8,322,733 | |

Expenses | | | | | | | |

Investment advisory fees (Note 3) | | | 2,418,834 | | | 4,070,400 | |

Administration fees (Note 3) | | | 275,729 | | | 263,349 | |

Distribution fees, Investor Class | | | 27 | | | — | |

Custodian and accounting fees | | | 311,857 | | | 494,617 | |

Directors’ fees and expenses (Note 3) | | | 41,401 | | | 33,516 | |

Shareholder record keeping fees | | | 48,988 | | | 42,715 | |

Printing and postage fees | | | 12,781 | | | 9,006 | |

State registration filing fees | | | 22,798 | | | 27,453 | |

Professional fees | | | 111,611 | | | 95,618 | |

Other fees and expenses | | | 132,504 | | | 442,890 | |

Total expenses | | | 3,376,530 | | | 5,479,564 | |

Waiver of investment advisory fee (Note 3) | | | (151,391 | ) | | — | |

Net expenses | | | 3,225,139 | | | 5,479,564 | |

Net investment income | | | 2,475,986 | | | 2,843,169 | |

Realized and Unrealized Gain (Loss) (Note 4) | | | | | | | |

Net realized gain (loss) — | | | | | | | |

Investment transactions (net of foreign tax expense $281,308 and $66,342, respectively) | | | 41,100,021 | | | 1,316,038 | |

Foreign currency transactions | | | (647,163 | ) | | (1,557,866 | ) |

Net realized gain (loss) | | | 40,452,858 | | | (241,828 | ) |

Change in unrealized appreciation (depreciation) — | | | | | | | |

Investments | | | 18,760,691 | | | 78,617,619 | |

Translation of assets and liabilities denominated in foreign currency | | | (60,534 | ) | | (27,120 | ) |

Net change in unrealized appreciation | | | 18,700,157 | | | 78,590,499 | |

Net realized and unrealized gain | | | 59,153,015 | | | 78,348,671 | |

Net Increase in Net Assets Resulting from Operations | | | $ | 61,629,001 | | | $ | 81,191,840 | |

See Notes to Financial Statements

18

Harding, Loevner Funds, Inc.

Statements of Changes in Net Assets

| | International Equity Portfolio | |

| | Year Ended | | Year Ended | |

| | October 31, | | October 31, | |

| | 2005 | | 2004 | |

Increase in Net Assets from Operations | | | | | |

Net investment income | | $ | 2,475,986 | | $ | 2,907,009 | |

Net realized gain on investments and foreign currency transactions | | 40,452,858 | | 27,521,983 | |

Net change in unrealized appreciation on investments and translation of assets and liabilities denominated in foreign currency | | 18,700,157 | | 4,847,378 | |

Net increase in net assets resulting from operations | | 61,629,001 | | 35,276,370 | |

Distributions to Shareholders from: | | | | | |

Net investment income | | | | | |

Institutional Class | | (1,432,687 | ) | (2,167,605 | ) |

Total distributions to shareholders | | (1,432,687 | ) | (2,167,605 | ) |

Transactions in Shares of Common Stock | | | | | |

Proceeds from sale of shares | | | | | |

Investor Class | | 521,999 | | — | |

Institutional Class | | 11,311,197 | | 49,810,442 | |

Net Asset Value of shares issued to shareholders upon reinvestment of dividends | | | | | |

Institutional Class | | 1,313,542 | | 1,833,540 | |

Cost of shares redeemed | | | | | |

Investor Class | | (14,714 | ) | — | |

Institutional Class | | (88,011,589 | ) | (119,352,363 | ) |

Redemption fees | | | | | |

Institutional Class | | 400 | | — | |

Net Decrease in Net Assets from Fund Share Transactions | | (74,879,165 | ) | (67,708,381 | ) |

Net Decrease in Net Assets | | (14,682,851 | ) | (34,599,616 | ) |

Net Assets | | | | | |

At beginning of year | | 315,420,335 | | 350,019,951 | |

At end of year | | $ | 300,737,484 | | $ | 315,420,335 | |

Accumulated Undistributed Net Investment Income Included in Net Assets | | $ | 1,524,829 | | $ | 1,431,240 | |

See Notes to Financial Statements

19

Harding, Loevner Funds, Inc.

Statements of Changes in Net Assets (continued)

| | Emerging Markets Portfolio | |

| | Year Ended | | Year Ended | |

| | October 31, | | October 31, | |

| | 2005 | | 2004 | |

Increase (Decrease) in Net Assets from Operations | | | | | |

Net investment income | | $ | 2,843,169 | | $ | 219,128 | |

Net realized gain (loss) on investments and foreign currency transactions | | (241,828 | ) | 3,034,920 | |

Net change in unrealized appreciation on investments and translation of assets and liabilities denominated in foreign currency | | 78,590,499 | | 5,541,093 | |

Net increase in net assets resulting from operations | | 81,191,840 | | 8,795,141 | |

Distributions to Shareholders from: | | | | | |

Net investment income | | (120,585 | ) | (62,351 | ) |

Net realized gain from investments and foreign currency-related transactions | | (2,143,956 | ) | — | |

Total distributions to shareholders | | (2,264,541 | ) | (62,351 | ) |

Transactions in Shares of Common Stock | | | | | |

Proceeds from sale of shares | | 601,485,970 | | 30,147,050 | |

Net Asset Value of shares issued to shareholders upon reinvestment of dividends | | 2,223,089 | | 58,908 | |

Cost of shares redeemed | | (58,688,332 | ) | (1,798,399 | ) |

Redemption fees | | 214,731 | | 7,670 | |

Net Increase in Net Assets from Fund Share Transactions | | 545,235,458 | | 28,415,229 | |

Net Increase in Net Assets | | 624,162,757 | | 37,148,019 | |

Net Assets | | | | | |

At beginning of year | | 66,804,819 | | 29,656,800 | |

At end of year | | $ | 690,967,576 | | $ | 66,804,819 | |

Accumulated Undistributed Net Investment Income Included in Net Assets | | $ | 1,217,858 | | $ | 119,482 | |

See Notes to Financial Statements

20

Harding, Loevner Funds, Inc.

Financial Highlights

| | International Equity

Portfolio—

Investor Class | |

| | For the Period

Ended

Oct. 31, 2005(1) | |

Per Share Data | | | | | |

Net Asset Value, Beginning of Period | | | $ | 15.63 | | |

Decrease in Net Assets from Operations | | | | | |

Net investment loss | | | (0.00 | )* | |

Net realized and unrealized loss on investments and foreign currency-related transactions | | | (0.72 | ) | |

Net decrease from investment operations | | | (0.72 | ) | |

Net Asset Value, End of Period | | | $ | 14.91 | | |

Total Return | | | (4.61 | )% | |

Ratios/Supplemental Data: | | | | | |

Net assets, end of period (000’s) | | | $ | 510 | | |

Ratio of net operating expenses to average net assets | | | 1.25 | % | |

Ratio of net investment income (loss), to average net assets | | | (1.25 | )% | |

Decrease reflected in above expense ratios due to waiver of investment advisory and administration fees, and reimbursement of other expenses | | | 0.08 | % | |

Portfolio turnover rate | | | 38 | % | |

(1) | For the period September 30, 2005 (commencement of operations) through October 31, 2005. |

* | Rounds to less than $(0.01). |

See Notes to Financial Statements

21

Harding, Loevner Funds, Inc.

Financial Highlights (continued)

| | Emerging Markets Portfolio | |

| | For the Year | | For the Year | | For the Year | | For the Year | | For the Year | |

| | Ended | | Ended | | Ended | | Ended | | Ended | |

| | Oct. 31, 2005 | | Oct. 31, 2004 | | Oct. 31, 2003 | | Oct. 31, 2002 | | Oct. 31, 2001 | |

Per Share Data | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Year | | | $ | 22.31 | | | | $ | 18.16 | | | | $ | 12.49 | | | | $ | 11.88 | | | | $ | 14.89 | | |

Increase (Decrease) in Net Assets from Operations | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.11 | | | | 0.07 | | | | 0.07 | | | | 0.04 | | | | 0.01 | | |

Net realized and unrealized gain (loss) on investments and foreign currency-related transactions | | | 8.43 | | | | 4.12 | | | | 5.60 | | | | 0.58 | | | | (1.89 | ) | |

Net increase (decrease) from investment operations | | | 8.54 | | | | 4.19 | | | | 5.67 | | | | 0.62 | | | | (1.88 | ) | |

Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.02 | ) | | | (0.04 | ) | | | — | | | | (0.01 | ) | | | — | | |

Net realized gain from investments and foreign currency-related transactions | | | (0.42 | ) | | | — | | | | — | | | | — | | | | (1.13 | ) | |

Total distributions | | | (0.44 | ) | | | (0.04 | ) | | | — | | | | (0.01 | ) | | | (1.13 | ) | |

Net Asset Value, End of Year | | | $ | 30.41 | | | | $ | 22.31 | | | | $ | 18.16 | | | | $ | 12.49 | | | | $ | 11.88 | | |

Total Return | | | 38.76 | % | | | 23.09 | % | | | 45.40 | % | | | 5.22 | % | | | (13.48 | )% | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s) | | | $ | 690,968 | | | | $ | 66,805 | | | | $ | 29,657 | | | | $ | 10,116 | | | | $ | 2,731 | | |

Ratio of net operating expenses to average net assets | | | 1.68 | % | | | 1.75 | % | | | 1.75 | % | | | 1.75 | % | | | 1.75 | % | |

Ratio of net investment income, to average net assets | | | 0.87 | % | | | 0.51 | % | | | 0.76 | % | | | 0.19 | % | | | 0.08 | % | |

Decrease reflected in above expense ratios due to waiver of investment advisory and administration fees, and reimbursement of other expenses | | | — | | | | 0.02 | % | | | 0.08 | % | | | 0.39 | % | | | 1.15 | % | |

Portfolio turnover rate | | | 36 | % | | | 40 | % | | | 58 | % | | | 43 | % | | | 38 | % | |

22

Harding, Loevner Funds, Inc.

Notes to Financial Statements

1. Organization

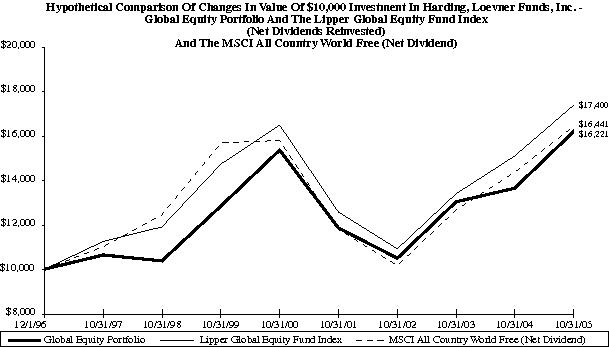

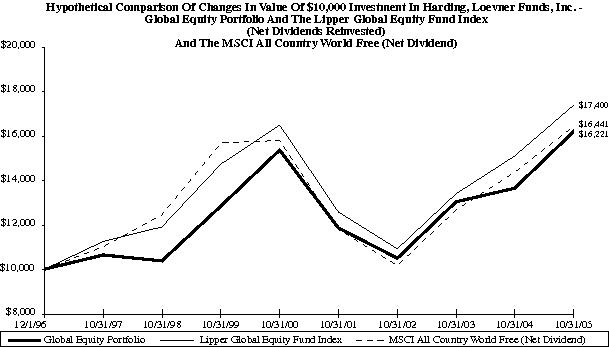

Harding, Loevner Funds, Inc. (the “Fund”) was organized as a Maryland corporation on July 31, 1996 and is registered under the Investment Company Act of 1940, as amended, as an open-end diversified management investment company. The Fund currently has four Portfolios (individually, “Portfolio”), all of which were active as of October 31, 2005: International Equity Portfolio (“International Equity”); Global Equity Portfolio; Institutional Emerging Markets Portfolio (“Institutional Emerging Markets”); and Emerging Markets Portfolio (“Emerging Markets”). International Equity and Emerging Markets are presented hereinafter. The investment objective of each portfolio is as follows: International Equity—to seek long-term capital appreciation through investments in equity securities of companies based outside the United States; Emerging Markets—to seek long-term capital appreciation through investments in equity securities of companies based in emerging markets.

International Equity commenced operations on October 31, 1996 after acquiring the net assets of Harding, Loevner Management, L.P.’s AMT Capital Fund, Inc. Emerging Markets commenced operations on November 9, 1998. Effective August 5, 2005, International Equity launched the Investor Class Shares and converted existing shareholders to the Institutional Class. Investor Class of International Equity commenced operations on September 30, 2005. The Fund is managed by Harding, Loevner Management, L.P. (the “Investment Adviser”).

2. Summary of Significant Accounting Policies

The accounting policies of the Fund are in conformity with accounting principles generally accepted in the United States (“GAAP”) for investment companies. The following is a summary of the Fund’s significant accounting policies:

Indemnifications

In the normal course of business, the Fund may enter into contracts that contain a variety of representations or that provide indemnification for certain liabilities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

Estimates

The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Valuation

The Board of Directors (the “Board”) of the Fund has adopted procedures (“Procedures”) to govern the valuation of the portfolio securities held by each series of the Fund in accordance with the Investment Company Act of 1940, as amended (“1940 Act”). The Procedures incorporate principles set forth in relevant pronouncements of the Securities and Exchange Commission (“SEC”) and its staff, including guidance on the obligations of funds and their Directors to determine, in good faith, the fair value of the fund’s portfolio securities when market quotations are not readily available.

All investments in the Portfolios are valued daily at their market prices, which results in unrealized gains or losses. Securities traded on an exchange are valued at their last sales price on that exchange. Securities for which no sales are reported are valued at the latest bid price obtained from a quotation reporting system or from established market makers. Repurchase agreements are valued at their amortized cost plus accrued interest. Securities for which market quotations are not readily available are fair valued by the Board or its delegate in accordance with the Procedures, although the actual calculations may be done by others. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, or the appropriate stock exchange (for exchange-traded securities), analysis of the issuer’s financial statements or other available documents and, if necessary, available information concerning other securities in similar circumstances. The Fund has implemented fair value pricing on a daily basis for all foreign equity securities held by the Portfolios. The fair value pricing utilizes quantitative models developed by an independent pricing service unless the Fund determines that use of another fair valuation methodology is appropriate. If a significant event occurs after the close of trading in a security but before the calculation of the Fund’s net asset value and such significant event has a material impact on the Fund’s net asset value per share (i.e. , more than $0.01 per share), then the security may be fair valued in accordance with the Procedures. As of October 31, 2005, there were no securities in the Fund which required valuation by the Board or its delegate.

23

Harding, Loevner Funds, Inc.

Notes to Financial Statements (continued)

2. Summary of Significant Accounting Policies (continued)

Securities

All securities transactions are recorded on a trade date basis. Interest income and expenses are recorded on an accrual basis. Dividend income is recorded on the ex-dividend date (except for certain foreign dividends that may be recorded as soon as the fund is informed of such dividends). The Fund accretes discount or amortizes premium on a daily basis as adjustments to interest income and the cost of investments. The Fund uses the specific identification method for determining realized gains or losses from sales of securities.

Income Tax

It is the policy of each Portfolio of the Fund to qualify as a regulated investment company, if such qualification is in the best interest of its shareholders, by complying with the applicable provisions of the Internal Revenue Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

Expenses

Expenses directly attributed to a specific Portfolio of the Fund are charged to that Portfolio’s operations; expenses not directly attributable to a specific Portfolio are allocated among the Portfolios either equitably or based on their average daily net assets.

Distribution Plan

Quasar Distributors, LLC serves as the non-exclusive distributor of each class of the Company’s shares. The Company has a distribution plan pursuant to Rule 12b-1 under the 1940 Act with respect to the Investor Class shares of International Equity and Global Equity. Under the terms of the plan, each Portfolio compensates the Distributor at a rate equal to 0.25% of the average daily net assets of the Portfolio attributable to its Investor Class shares for distribution and related services.

Dividends to Shareholders

It is the policy of the Fund to declare dividends from net investment income annually. Net short-term and long-term capital gains distributions for the Portfolios, if any, normally are distributed on an annual basis.

Dividends from net investment income and distributions from net realized gains from investment transactions have been determined in accordance with income tax regulations and may differ from net investment income and realized gains recorded by the Portfolios for financial reporting purposes. Differences result primarily from foreign currency transactions and timing differences related to recognition of income, and gains and losses from investment transactions. To the extent that any differences which are permanent in nature result in overdistributions to shareholders, the amount of the overdistribution is reclassified within the capital accounts based on its federal tax basis treatment. Temporary differences do not require reclassification. To the extent that they exceed net investment income and net realized gains for tax purposes, they are reported as returns of capital.

Currency Translation

Assets and liabilities denominated in foreign currencies and commitments under forward exchange currency contracts are translated into U.S. dollars at the mean of the quoted bid and asked prices of such currencies against the U.S. dollar. Purchases and sales of portfolio securities are translated at the rates of exchange prevailing when such securities were acquired or sold. Income and expenses are translated at exchange rates prevailing when accrued. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Net realized gains and losses from foreign currency-related transactions arise from sales of foreign currency, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Portfolios books, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized appreciation or depreciation on translation of assets and liabilities

24

Harding, Loevner Funds, Inc.

Notes to Financial Statements (continued)

2. Summary of Significant Accounting Policies (continued)

denominated in foreign currencies arise from changes in the value of assets and liabilities other than investments in securities at the period end, resulting from changes in the exchange rate.

Security Lending

Each Portfolio is authorized to lend securities from its investment portfolios to banks, brokers and other financial institutions if it receives collateral in cash, U.S. Government Securities or other liquid investments which will be maintained at all times in an amount equal to at least 102% of the current market value of the loaned securities. The loans will be terminable at any time by the Fund and the Portfolio will then receive the loaned securities within five days. During the period of such a loan, the Portfolio receives the income on the loaned securities and a loan fee and may thereby increase its total return. A Portfolio continues to receive interest or dividends on the securities loaned and simultaneously earns either interest on the investment of the cash collateral or fee income if the loan is otherwise collateralized. However, the Portfolio normally pays lending fees and related expenses from the interest or dividends earned on invested collateral. Should the borrower of the securities fail financially, there is a risk of delay in recovery of the securities or loss of rights in the collateral. However, loans are made only to borrowers which are approved by the Board of Directors and are deemed by Harding Loevner to be of good financial standing. The Portfolio may invest cash collateral it receives in connection with a loan of securities in securities of the U.S. Government and its agencies and other high quality short-term debt instruments. For purposes of complying with the Portfolio’s investment policies and restrictions, collateral received in connection with securities loans will not be deemed an asset of the Portfolio unless otherwise required by law.

For the period ended October 31, 2005, the market value of the securities on loan and the value of the related collateral were as follows:

| | | | | |

Portfolio | | Market Value of

Loaned Securities | | Collateral Value | |

International Equity | | | $ 10,174,788 | | | | $ 10,747,888 | | |

Emerging Markets | | | 18,780,638 | | | | 19,634,254 | | |

3. Significant Agreements and Transactions with Affiliates

The Fund’s Board of Directors has approved investment advisory agreements (the “Agreements”) with the Investment Adviser. The advisory fees are computed daily at an annual rate of 0.75% and 1.25% of the average daily net assets of International Equity and Emerging Markets, respectively.

In addition, the Fund has an administration agreement with Investors Bank & Trust Company, which provides certain accounting, clerical and bookkeeping services, corporate secretarial services and assistance in the preparation and filing of tax returns and reports to shareholders and the Securities and Exchange Commission. Under this agreement, International Equity and Emerging Markets incurred $275,729 and $263,349, respectively, in administration fees and $311,857 and $494,617, respectively, in custodian and accounting fees for the year ended October 31, 2005.

The Investment Adviser has voluntarily agreed to reduce its fee to the extent that aggregate expenses (exclusive of brokerage commissions, other investment expenses, interest on borrowings, taxes and extraordinary expenses) exceed an annual rate of 1.25% and 1.75%, respectively, of the average daily net assets of International Equity and Emerging Markets. For the year ended October 31, 2005, the Investment Adviser voluntarily waived $151,391 in investment advisory fees only from International Equity (Investors class $9).

Directors’ fees and related expenses for International Equity and Emerging Markets amounted to $41,101 and $33,516, respectively, for the year ended October 31, 2005.

The Fund has agreements with various financial intermediaries and “mutual fund supermarkets”, under which customers of these intermediaries may purchase and hold Fund shares. These intermediaries assess fees in consideration for providing certain distribution, account maintenance, record keeping and transactional services. In recognition of the savings of expenses to the Fund arising from the economies of scale associated with these intermediaries’ holding their customers’ shares in a

25

Harding, Loevner Funds, Inc.

Notes to Financial Statements (continued)

3. Significant Agreements and Transactions with Affiliates (continued)

single account with the Fund’s transfer agent, the Portfolio is authorized to pay to each intermediary up to 0.15% of its average daily net assets attributable to that intermediary for providing sub-accounting and related shareholder services (subject to the voluntary expense cap); the balance of the intermediaries’ fees are paid by the Fund. Because of the Fund’s voluntary cap on the Portfolios fees and expenses, the Fund paid a portion or all of each Portfolio’s share of these fees during the year ended October 31, 2005. The Fund may enter into similar arrangements with other intermediaries in the future.

4. Investment Transactions

Cost of purchases and proceeds from sales of investment securities, other than short-term investments, for the year ended October 31, 2005, were as follows for each Portfolio:

| | | | | |

Portfolio | | Purchase Cost of

Investment Securities | | Proceeds from Sales of

Investment Securities | |

International Equity | | | $ 118,695,682 | | | | $ 192,697,474 | | |

Emerging Markets | | | 636,245,353 | | | | 116,952,331 | | |

The cost of investments for federal income tax purposes and the components of net unrealized appreciation on investments at October 31, 2005, for each of the Portfolios were as follows:

| | | | | | | | | |

Portfolio | | Unrealized

Appreciation | | Unrealized

Depreciation | | Net | | Cost | |

International Equity | | | $ 85,204,626 | | | | $ 3,845,005 | | | $ 81,359,621 | | $ 229,631,161 | |

Emerging Markets | | | 94,861,455 | | | | 4,497,337 | | | 90,364,118 | | 611,107,341 | |

The unrealized depreciation on foreign currency for International Equity and Emerging Markets was $(25,331) and $(35,381), respectively, for the year ended October 31, 2005.

During the year ended October 31, 2004, the tax character of distributions paid from ordinary income was $2,167,605 and $62,351, respectively for International Equity and Emerging Markets.

During the year ended October 31, 2005, the tax character of distributions paid from ordinary income was $1,432,687 and $120,585, respectively for International Equity and Emerging Markets. The tax character of distributions paid from long-term capital gains was $2,143,956 for Emerging Markets.

As of October 31, 2005, the components of accumulated earnings/(deficit) on a tax basis were as follows:

Portfolio | | Undistributed

Ordinary

Income | | Undistributed

Long-Term

Capital Gains | | Accumulated

Capital and

Other Losses | | Unrealized

Appreciation/

(Depreciation)* | | Total

Accumulated

Earnings/(Deficit) | |

International Equity | | | $ 1,524,829 | | | | $ 253,927 | | | | $ — | | | | $ 81,334,290 | | | | $ 83,113,046 | | |

Emerging Markets | | | 1,227,975 | | | | 1,526,842 | | | | — | | | | 90,328,737 | | | | 93,083,554 | | |

* The difference between book basis and tax basis unrealized appreciation (depreciation) is attributable to the deferral of losses on wash sales and realization of unrealized appreciation of currency contracts.

At October 31, 2005, International Equity and Emerging Markets had no capital loss carryovers.

The International Equity utilized $40,745,543 of capital loss carryforwards in the current period to offset net realized capital gain for federal tax purposes.

26

Harding, Loevner Funds, Inc.

Notes to Financial Statements (continued)

4. Investment Transactions (continued)

Primarily as a result of differing book/tax treatment of foreign currency transactions and foreign capital gain tax expenses, the Fund made reclassifications among certain capital accounts. The reclassifications have no impact on the net assets of the Fund. As of October 31, 2005, the following reclassifications were made to the Statements of Net Assets.

| | | | | | | |

| | | | Accumulated Undistributed | | | |

| | | | Net Realized Gain/Loss on | | Accumulated | |

| | | | Investments & Foreign | | Undistributed | |

| | | | Currency Related | | Net Investment | |

Portfolio | | Paid-in Capital | | Transactions | | Income | |

International Equity | | | $ 1 | | | | $ 949,709 | | | | $ (949,710 | ) | |

Emerging Markets | | | 2,629 | | | | 1,621,579 | | | | (1,624,208 | ) | |

5. Foreign Exchange Contracts

The Portfolios, on occasion, enter into forward foreign exchange contracts in order to hedge their exposure to changes in foreign currency exchange rates on their foreign portfolio holdings. A forward foreign exchange contract is a commitment to purchase or sell a foreign currency at a future date at a negotiated forward rate. The gain or loss arising from the difference between the cost of the original contracts and the closing of such contracts is included in net realized gains or losses on foreign currency-related transactions. Fluctuations in the value of forward foreign exchange contracts are recorded for book purposes as unrealized appreciation or depreciation on assets and liabilities denominated in foreign currencies by the Portfolios. The Portfolios are also exposed to credit risk associated with counter party nonperformance on these forward foreign exchange contracts which is typically limited to the unrealized gain on each open contract.

The Portfolios enter into foreign currency transactions on the spot markets in order to pay for foreign investment purchases or to convert to dollars the proceeds from foreign investment sales or coupon interest receipts. As of October 31, 2005, the Portfolios had the following open foreign currency transactions to buy or sell currency on the spot markets:

Emerging Markets

| | | | | | | |

Settlement | | | | In Exchange For | | Net Unrealized | |

Date | | Sale | | (in U.S. dollars) | | Appreciation | |

11/4/2005 | | 806,563,668 HUF | | | $ 3,863,251 | | | | $ 11,441 | | |

| | | | | | | | | | | |

HUF Hungarian Forint

6. Capital Share Transactions

Transactions in capital stock for International Equity—Institutional Class were as follows for the years indicated:

| | | | | |

| | Year Ended | | Year Ended | |

| | October 31, 2005 | | October 31, 2004 | |

| | Shares | | Amount | | Shares | | Amount | |

Shares sold | | 803,180 | | $ 11,311,197 | | 4,113,187 | | $ 49,810,442 | |

Shares issued upon reinvestment of dividends | | 98,172 | | 1,313,542 | | 153,692 | | 1,833,540 | |

| | 901,352 | | 12,624,739 | | 4,266,879 | | 51,643,982 | |

Shares redeemed | | (6,174,345 | ) | (88,011,589 | ) | (9,832,119 | ) | (119,352,363 | ) |

Net decrease | | (5,272,993 | ) | $ (75,386,850 | ) | (5,565,240 | ) | $ (67,708,381 | ) |

27

Harding, Loevner Funds, Inc.

Notes to Financial Statements (continued)

6. Capital Share Transactions (continued)

Transactions in capital stock for International Equity—Investor Class were as follows for the period indicated:

| | | |

| | Period From | |

| | September 30, 2005 | |

| | to October 31, 2005 | |

| | Shares | | Amount | |

Shares sold | | 35,213 | | $ 521,999 | |

Shares issued upon reinvestment of dividends | | — | | — | |

| | 35,213 | | 521,999 | |

Shares redeemed | | (1,003 | ) | (14,714 | ) |

Net increase | | 34,210 | | $ 507,285 | |

Transactions in capital stock for Emerging Markets were as follows for the years indicated:

| | | | | |

| | Year Ended | | Year Ended | |

| | October 31, 2005 | | October 31, 2004 | |

| | Shares | | Amount | | Shares | | Amount | |

Shares sold | | 21,717,131 | | $ 601,485,970 | | 1,446,775 | | $ 30,147,050 | |

Shares issued upon reinvestment of dividends | | 90,369 | | 2,223,089 | | 3,013 | | 58,908 | |

| | 21,807,500 | | 603,709,059 | | 1,449,788 | | 30,205,958 | |

Shares redeemed | | (2,078,552 | ) | (58,688,332 | ) | (87,648 | ) | (1,798,399 | ) |

Net increase | | 19,728,948 | | $ 545,020,727 | | 1,362,140 | | $ 28,407,559 | |

Redemptions made within 90 days of purchase are subject to a redemption fee equal to 2% of the amount redeemed. For the year ended October 31, 2004, the Emerging Markets Portfolio received $7,670 in redemption fees, and for the year ended October 31, 2005, Emerging Markets and International Equity - Institutional Class received $214,731 and $400 in redemption fees, respectively, related to transactions in shares of common stock on the Statements of Changes in Net Assets.

7. Repurchase Agreements