Exhibit 99.2

Investor Update Regarding Sprint PCS Affiliates and Nextel Partners

August 17, 2005

Cautionary Note

Certain of the statements in this document are forward-looking information within the meaning of the federal securities laws. These statements are based on various assumptions as to future events as to which there necessarily can be no assurance, including the future results of operations of the companies mentioned. There could be differences between these assumptions and actual future circumstances or events, including in the case of Nextel Partners, Inc. (“Partners”) as a result of the put process or in the event that Sprint Nextel and Partners enter into a negotiated settlement, and those differences could be material.

In addition, this presentation includes various statements of our opinions, indicated by phrases such as “we believe,” “in our opinion”, “our view” and the like, including with regards to:

The existing business and future results of operations of the companies mentioned;

The Partners put process, including our interpretation of various terms in Partners’ certificate of incorporation and other documents governing it; and Valuation methodologies.

While we base these statements of opinion on facts or assumptions we believe to be reliable, statements of opinion are only that and readers must recognize that others, including Partners, have opposing opinions. In addition, all statements of opinion are made as of the date of this presentation and could change based on future developments or the discovery of or reassessment of existing facts, presently known or unknown to us. Valuations are inherently complex and subject to varying opinions and there can be no assurance as the outcome of negotiations or any arbitration concerning value or other matters. This document speaks only as of its date, and we disclaim any duty to update the information herein.

1

Additional Information and Where to Find It

We may file a registration statement with the SEC in order to issue shares as consideration for the exercise of the Partners’ put right. SHAREHOLDERS ARE ENCOURAGED TO READ THAT REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, INLUDING THE PROSPECTUS THAT WOULD BE A PART OF THE REGISTRATION STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PURCHASE OF PARTNERS’ CLASS A COMMON STOCK PURSUANT TO PARTNERS’ PUT RIGHT. When such documents are filed with the SEC, investors and security holders will be able to obtain them when they become available free of charge at the SEC’s web site, www.sec.gov, or from Sprint Nextel Investor Relations at Sprint Nextel Corporation, 2001 Edmund Halley Drive, Reston, Virginia 20191, 703.433.4300.

Participants in Solicitation

We and our directors and executive officers and other members of our management and employees may be deemed to be participants in the solicitation of proxies from Partners’ shareholders. Information concerning our directors and executive officers is included in the definitive joint proxy statement/prospectus contained in Sprint’s Registration Statement on Form S-4 (Reg. No. 333-123333) filed with the SEC on June 10, 2005. Additional information regarding the interests of our participants in the solicitation of proxies in respect of the put right, if any, will be included in the registration statement to be filed with the SEC.

2

General Update

Acquisition of US Unwired completed August 12

Ongoing discussions with other PCS Affiliates regarding new commercial arrangements or other possible resolution of existing disputes

Litigation initiated by Alamosa, Gulf Coast, iPCS, Enterprise and UbiquiTel

Forbearance agreements through 1/1/06 with four PCS Affiliates (including UbiquiTel and iPCS)

No ongoing discussions with Nextel Partners regarding a potential acquisition.

3

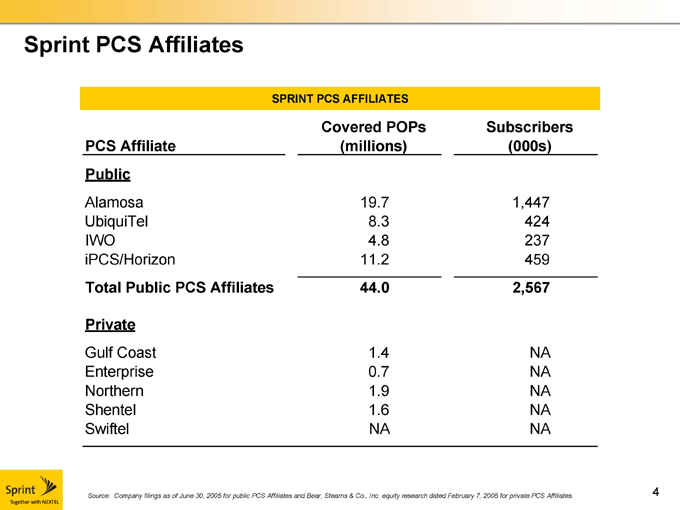

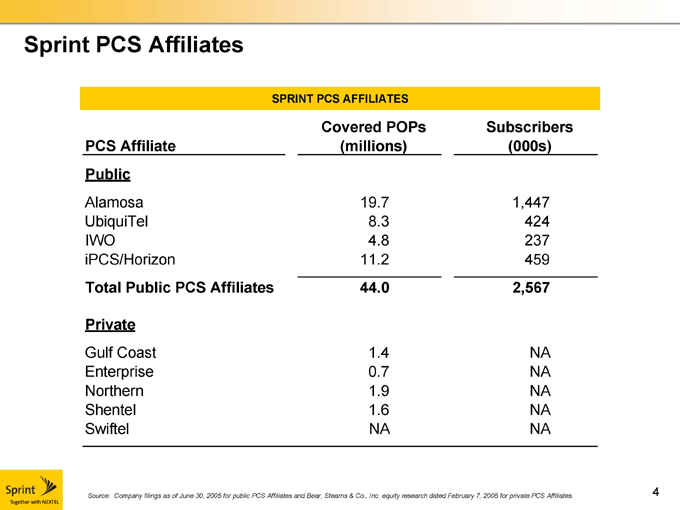

Sprint PCS Affiliates

SPRINT PCS AFFILIATES

Covered POPs Subscribers

PCS Affiliate (millions) (000s)

Public

Alamosa 19.7 1,447

UbiquiTel 8.3 424

IWO 4.8 237

iPCS/Horizon 11.2 459

Total Public PCS Affiliates 44.0 2,567

Private

Gulf Coast 1.4 NA

Enterprise 0.7 NA

Northern 1.9 NA

Shentel 1.6 NA

Swiftel NA NA

Source: Company filings as of June 30, 2005 for public PCS Affiliates and Bear, Stearns & Co., Inc. equity research dated February 7, 2005 for private PCS Affiliates.

4

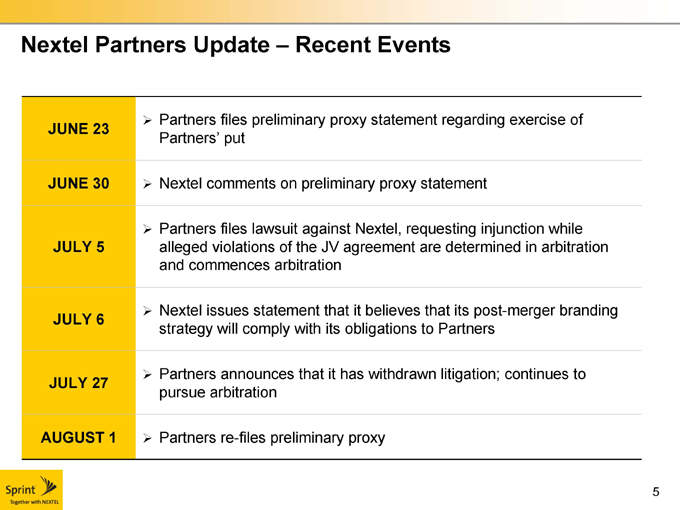

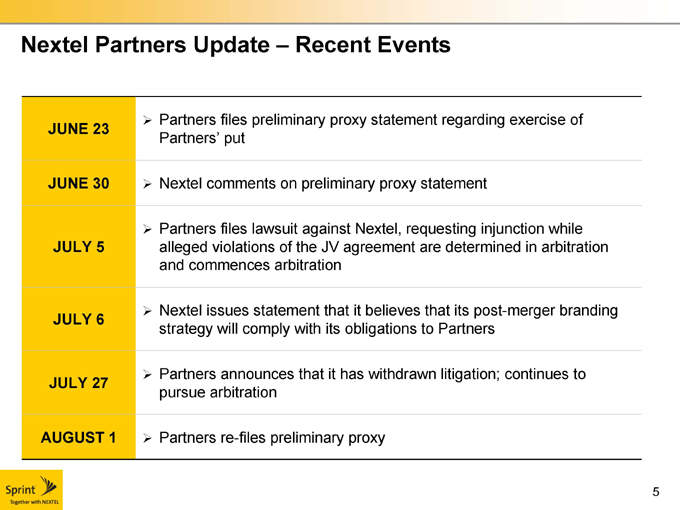

Nextel Partners Update – Recent Events

JUNE 23

Partners files preliminary proxy statement regarding exercise of Partners’ put

JUNE 30

Nextel comments on preliminary proxy statement

JULY 5

Partners files lawsuit against Nextel, requesting injunction while alleged violations of the JV agreement are determined in arbitration and commences arbitration

JULY 6

Nextel issues statement that it believes that its post-merger branding strategy will comply with its obligations to Partners

JULY 27

Partners announces that it has withdrawn litigation; continues to pursue arbitration

AUGUST 1

Partners re-files preliminary proxy

5

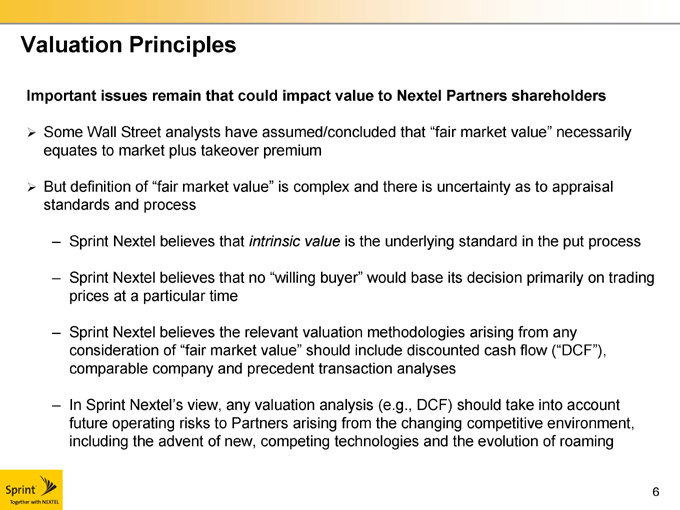

Valuation Principles

Important issues remain that could impact value to Nextel Partners shareholders

Some Wall Street analysts have assumed/concluded that “fair market value” necessarily equates to market plus takeover premium

But definition of “fair market value” is complex and there is uncertainty as to appraisal standards and process

Sprint Nextel believes that intrinsic value is the underlying standard in the put process

Sprint Nextel believes that no “willing buyer” would base its decision primarily on trading prices at a particular time

Sprint Nextel believes the relevant valuation methodologies arising from any consideration of “fair market value” should include discounted cash flow (“DCF”), comparable company and precedent transaction analyses

In Sprint Nextel’s view, any valuation analysis (e.g., DCF) should take into account future operating risks to Partners arising from the changing competitive environment, including the advent of new, competing technologies and the evolution of roaming

6

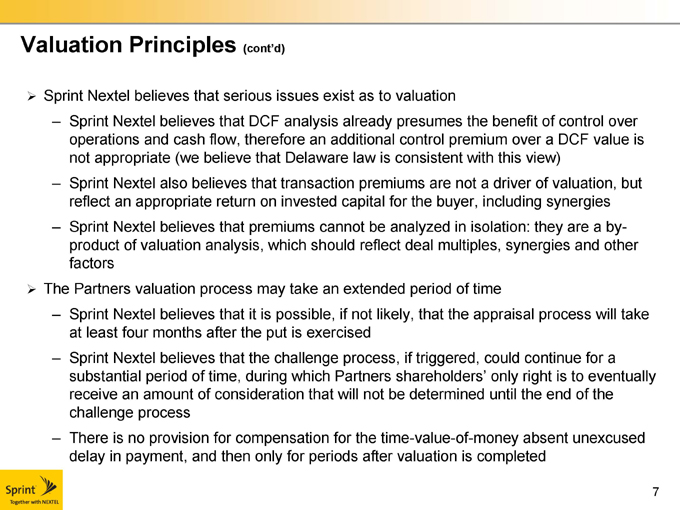

Valuation Principles (cont’d)

Sprint Nextel believes that serious issues exist as to valuation

Sprint Nextel believes that DCF analysis already presumes the benefit of control over operations and cash flow, therefore an additional control premium over a DCF value is not appropriate (we believe that Delaware law is consistent with this view) Sprint Nextel also believes that transaction premiums are not a driver of valuation, but reflect an appropriate return on invested capital for the buyer, including synergies Sprint Nextel believes that premiums cannot be analyzed in isolation: they are a by-product of valuation analysis, which should reflect deal multiples, synergies and other factors

The Partners valuation process may take an extended period of time

Sprint Nextel believes that it is possible, if not likely, that the appraisal process will take at least four months after the put is exercised Sprint Nextel believes that the challenge process, if triggered, could continue for a substantial period of time, during which Partners shareholders’ only right is to eventually receive an amount of consideration that will not be determined until the end of the challenge process There is no provision for compensation for the time-value-of-money absent unexcused delay in payment, and then only for periods after valuation is completed

7

Valuation Principles (cont’d)

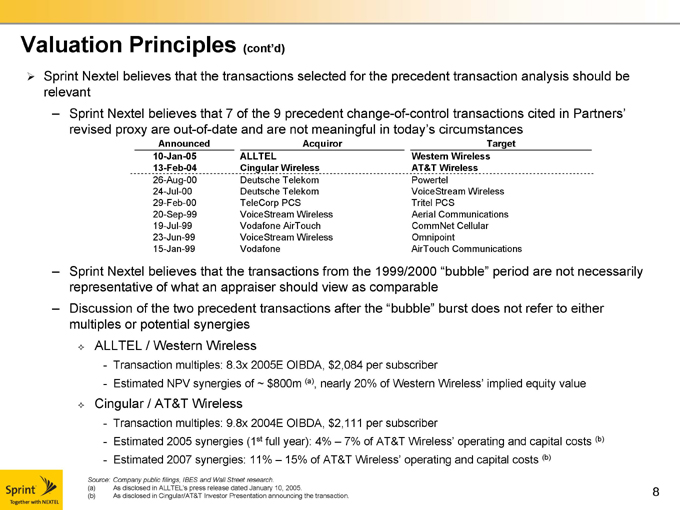

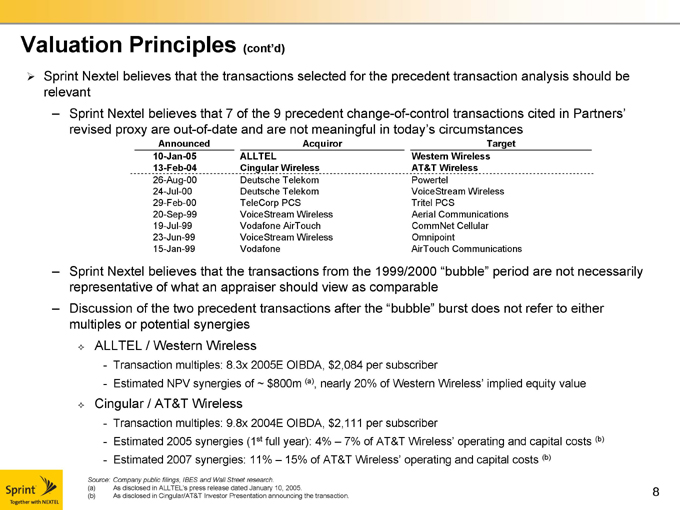

Sprint Nextel believes that the transactions selected for the precedent transaction analysis should be relevant

Sprint Nextel believes that 7 of the 9 precedent change-of-control transactions cited in Partners’ revised proxy are out-of-date and are not meaningful in today’s circumstances

Announced Acquiror Target

10-Jan-05 ALLTEL Western Wireless

13-Feb-04 Cingular Wireless AT&T Wireless

26-Aug-00 Deutsche Telekom Powertel

24-Jul-00 Deutsche Telekom VoiceStream Wireless

29-Feb-00 TeleCorp PCS Tritel PCS

20-Sep-99 VoiceStream Wireless Aerial Communications

19-Jul-99 Vodafone AirTouch CommNet Cellular

23-Jun-99 VoiceStream Wireless Omnipoint

15-Jan-99 Vodafone AirTouch Communications

Sprint Nextel believes that the transactions from the 1999/2000 “bubble” period are not necessarily representative of what an appraiser should view as comparable Discussion of the two precedent transactions after the “bubble” burst does not refer to either multiples or potential synergies

ALLTEL / Western Wireless

Transaction multiples: 8.3x 2005E OIBDA, $2,084 per subscriber

Estimated NPV synergies of ~ $800m (a), nearly 20% of Western Wireless’ implied equity value

Cingular / AT&T Wireless

Transaction multiples: 9.8x 2004E OIBDA, $2,111 per subscriber

Estimated 2005 synergies (1st full year): 4% – 7% of AT&T Wireless’ operating and capital costs (b) Estimated 2007 synergies: 11% – 15% of AT&T Wireless’ operating and capital costs (b)

Source: Company public filings, IBES and Wall Street research.

(a) As disclosed in ALLTEL’s press release dated January 10, 2005.

(b) As disclosed in Cingular/AT&T Investor Presentation announcing the transaction.

8

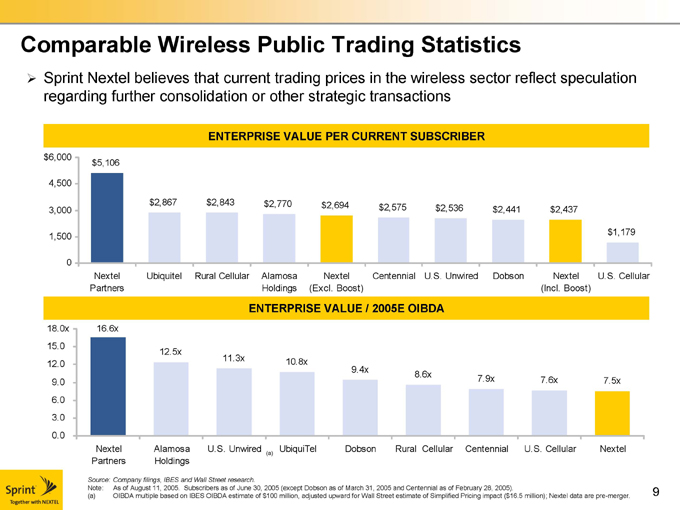

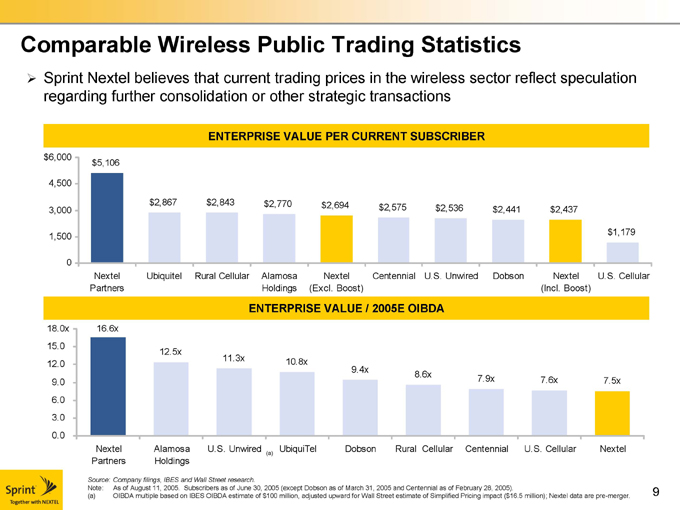

Comparable Wireless Public Trading Statistics

Sprint Nextel believes that current trading prices in the wireless sector reflect speculation regarding further consolidation or other strategic transactions

ENTERPRISE VALUE PER CURRENT SUBSCRIBER

$6,000 4,500 3,000 1,500 0 $5,106 $2,867 $2,843 $2,770 $2,694 $2,575 $2,536 $2,441 $2,437 $1,179

Nextel Partners

Ubiquitel

Rural Cellular

Alamosa Holdings

Nextel (Excl. Boost)

Centennial

U.S. Unwired

Dobson

Nextel (Incl. Boost)

U.S. Cellular

ENTERPRISE VALUE / 2005E OIBDA

18.0x 15.0 12.0 9.0 6.0 3.0 0.0

16.6x

12.5x

11.3x

10.8x

9.4x

8.6x

7.9x

7.6x

7.5x

Nextel Partners

Alamosa Holdings

U.S. Unwired (a)

UbiquiTel

Dobson

Rural Cellular

Centennial

U.S. Cellular

Nextel

Source: Company filings, IBES and Wall Street research.

Note: As of August 11, 2005. Subscribers as of June 30, 2005 (except Dobson as of March 31, 2005 and Centennial as of February 28, 2005).

(a) OIBDA multiple based on IBES OIBDA estimate of $100 million, adjusted upward for Wall Street estimate of Simplified Pricing impact ($16.5 million); Nextel data are pre-merger.

9

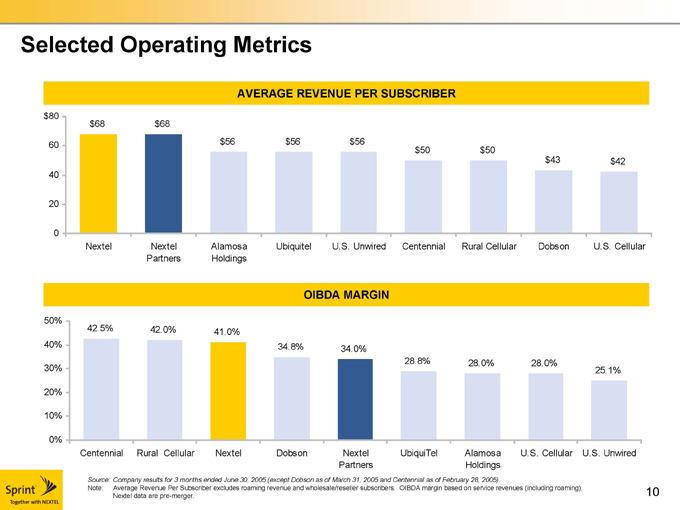

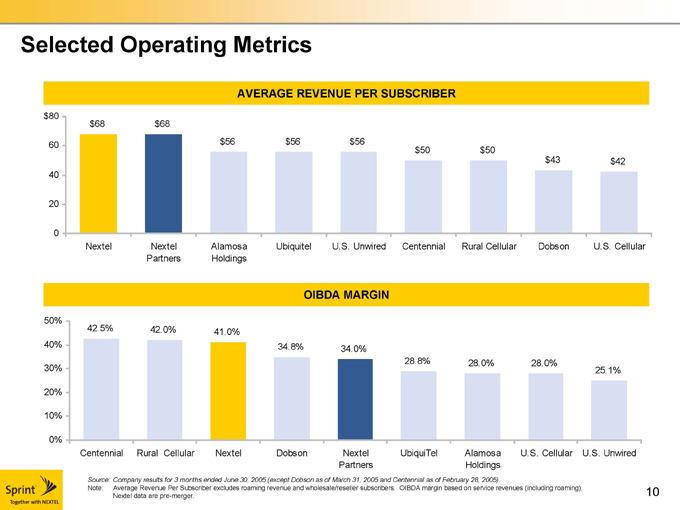

Selected Operating Metrics

AVERAGE REVENUE PER SUBSCRIBER

$80 60 40 20 0 $68

Nextel $68

Nextel Partners $56

Alamosa Holdings $56

Ubiquitel $56

U.S. Unwired $50

Centennial $50

Rural Cellular $43

Dobson $42

U.S. Cellular

OIBDA MARGIN

50% 40% 30% 20% 10% 0%

42.5%

Centennial

42.0%

Rural Cellular

41.0%

Nextel

34.8%

Dobson

34.0%

Nextel Partners

28.8%

UbiquiTel

28.0%

Alamosa Holdings

28.0%

U.S. Cellular

25.1%

U.S. Unwired

Source: Company results for 3 months ended June 30, 2005 (except Dobson as of March 31, 2005 and Centennial as of February 28, 2005).

Note: Average Revenue Per Subscriber excludes roaming revenue and wholesale/reseller subscribers. OIBDA margin based on service revenues (including roaming);

Nextel data are pre-merger.

10

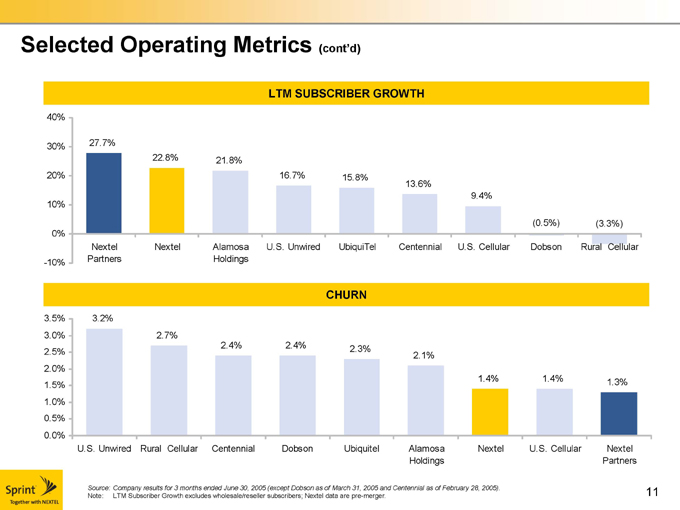

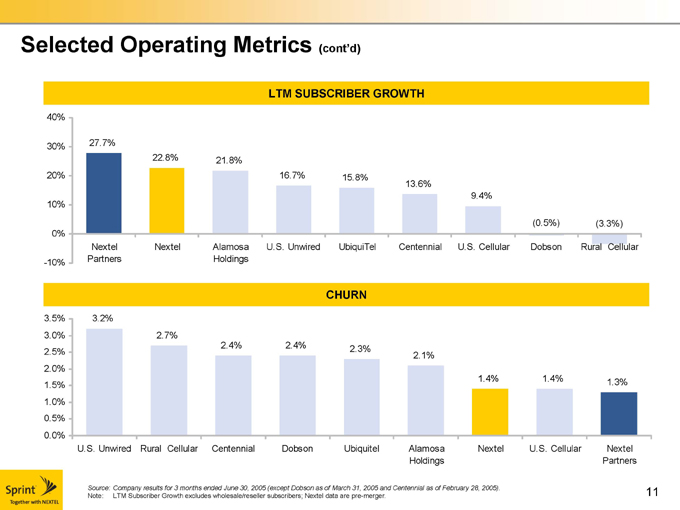

Selected Operating Metrics (cont’d)

LTM SUBSCRIBER GROWTH

40% 30% 20% 10% 0% -10%

27.7%

Nextel Partners

22.8%

Nextel

21.8%

Alamosa Holdings

16.7%

U.S. Unwired

15.8%

UbiquiTel

13.6%

Centennial

9.4%

U.S. Cellular

(0.5%)

Dobson

(3.3%)

Rural Cellular

CHURN

3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0%

3.2%

U.S. Unwired

2.7%

Rural Cellular

2.4%

Centennial

2.4%

Dobson

2.3%

Ubiquitel

2.1%

Alamosa Holdings

1.4%

Nextel

1.4%

U.S. Cellular

1.3%

Nextel Partners

Source: Company results for 3 months ended June 30, 2005 (except Dobson as of March 31, 2005 and Centennial as of February 28, 2005).

Note: LTM Subscriber Growth excludes wholesale/reseller subscribers; Nextel data are pre-merger.

11

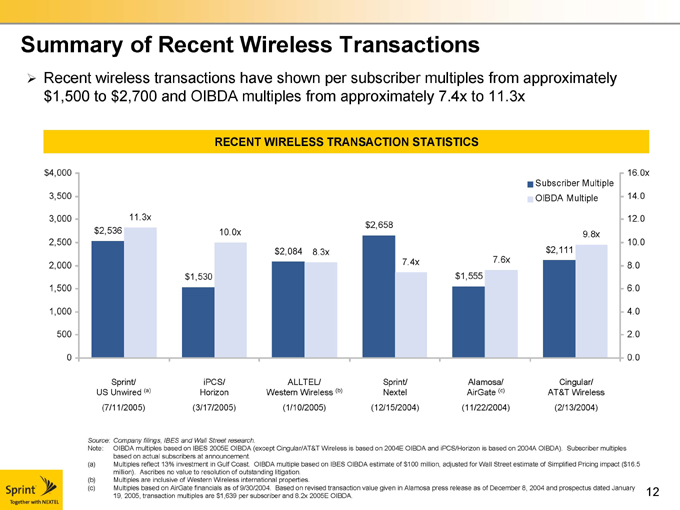

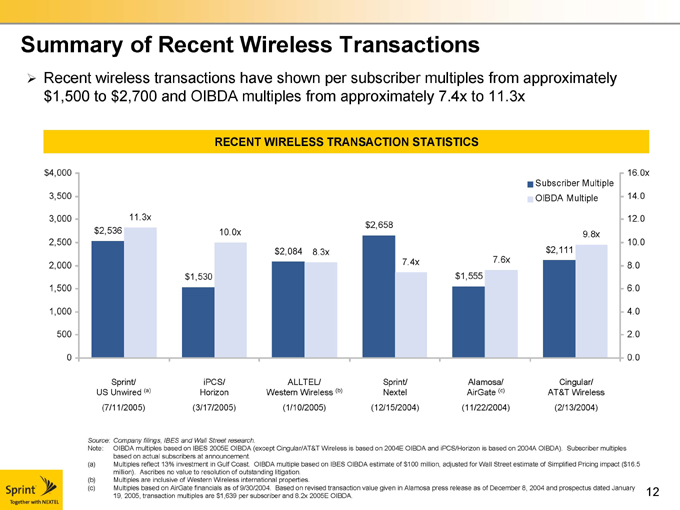

Summary of Recent Wireless Transactions

Recent wireless transactions have shown per subscriber multiples from approximately $1,500 to $2,700 and OIBDA multiples from approximately 7.4x to 11.3x

RECENT WIRELESS TRANSACTION STATISTICS

$4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0 $2,536

11.3x $1,530

10.0x $2,084

8.3x $2,658

7.4x $1,555

7.6x $2,111

9.8x

Subscriber Multiple OIBDA Multiple

16.0x 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0

Sprint/ US Unwired (a) (7/11/2005) iPCS/ Horizon (3/17/2005)

ALLTEL/ Western Wireless (b) (1/10/2005)

Sprint/ Nextel (12/15/2004)

Alamosa/ AirGate (c) (11/22/2004)

Cingular/ AT&T Wireless (2/13/2004)

Source: Company filings, IBES and Wall Street research.

Note: OIBDA multiples based on IBES 2005E OIBDA (except Cingular/AT&T Wireless is based on 2004E OIBDA and iPCS/Horizon is based on 2004A OIBDA). Subscriber multiples based on actual subscribers at announcement.

(a) Multiples reflect 13% investment in Gulf Coast. OIBDA multiple based on IBES OIBDA estimate of $100 million, adjusted for Wall Street estimate of Simplified Pricing impact ($16.5 million). Ascribes no value to resolution of outstanding litigation.

(b) Multiples are inclusive of Western Wireless international properties.

(c) Multiples based on AirGate financials as of 9/30/2004. Based on revised transaction value given in Alamosa press release as of December 8, 2004 and prospectus dated January 19, 2005, transaction multiples are $1,639 per subscriber and 8.2x 2005E OIBDA.

12

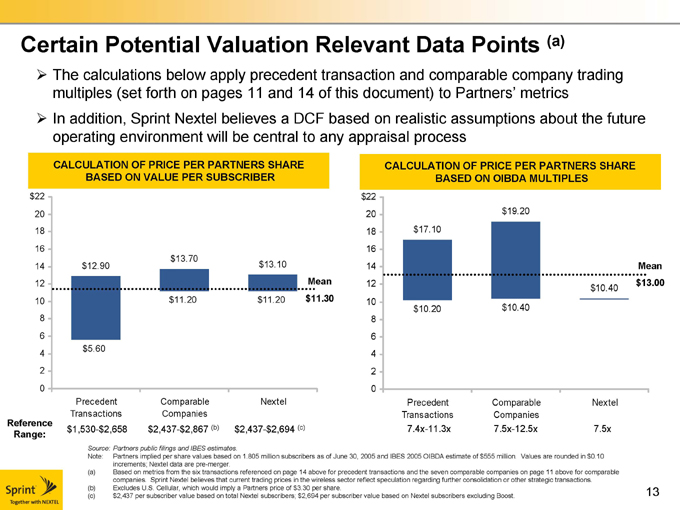

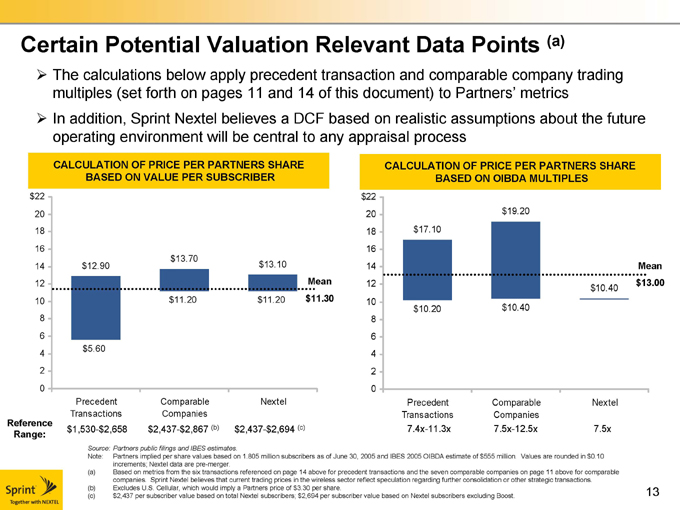

Certain Potential Valuation Relevant Data Points (a)

The calculations below apply precedent transaction and comparable company trading multiples (set forth on pages 11 and 14 of this document) to Partners’ metrics In addition, Sprint Nextel believes a DCF based on realistic assumptions about the future operating environment will be central to any appraisal process

CALCULATION OF PRICE PER PARTNERS SHARE

BASED ON VALUE PER SUBSCRIBER

$22 20 18 16 14 12 10 8 6 4 2 0 $12.90 $5.60 $13.70 $11.20 $13.10 $11.20

Mean $11.30

Precedent Transactions

Comparable Companies

Nextel

CALCULATION OF PRICE PER PARTNERS SHARE

BASED ON OIBDA MULTIPLES

$22 20 18 16 14 12 10 8 6 4 2 0 $17.10 $10.20 $19.20 $10.40 $10.40

Mean $13.00

Precedent Transactions 7.4x-11.3x

Comparable Companies 7.5x-12.5x

Nextel

7.5x

Source: Partners public filings and IBES estimates.

Note: Partners implied per share values based on 1.805 million subscribers as of June 30, 2005 and IBES 2005 OIBDA estimate of $555 million. Values are rounded in $0.10 increments; Nextel data are pre-merger.

(a) Based on metrics from the six transactions referenced on page 14 above for precedent transactions and the seven comparable companies on page 11 above for comparable companies. Sprint Nextel believes that current trading prices in the wireless sector reflect speculation regarding further consolidation or other strategic transactions.

(b) Excludes U.S. Cellular, which would imply a Partners price of $3.30 per share.

(c) $2,437 per subscriber value based on total Nextel subscribers; $2,694 per subscriber value based on Nextel subscribers excluding Boost.

13

Reference Range: $1,530- $2,658 $2,437- $2,867 (b) $2,437- $2,694 (c)

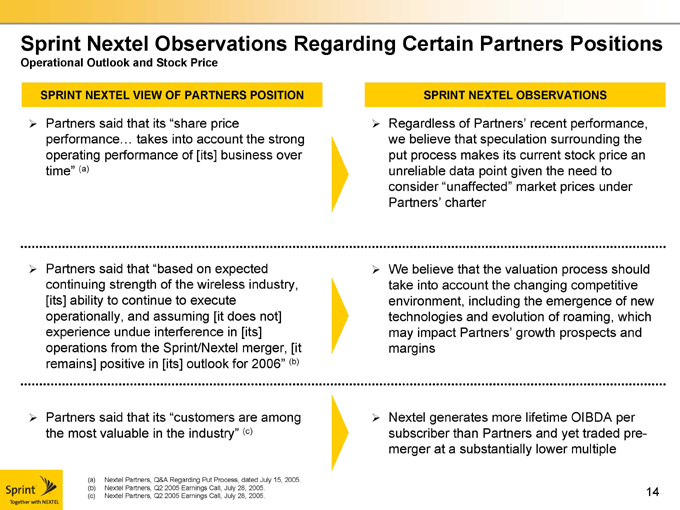

Sprint Nextel Observations Regarding Certain Partners Positions

Operational Outlook and Stock Price

SPRINT NEXTEL VIEW OF PARTNERS POSITION

Partners said that its “share price performance… takes into account the strong operating performance of [its] business over time” (a)

SPRINT NEXTEL OBSERVATIONS

Regardless of Partners’ recent performance, we believe that speculation surrounding the put process makes its current stock price an unreliable data point given the need to consider “unaffected” market prices under Partners’ charter

Partners said that “based on expected continuing strength of the wireless industry, [its] ability to continue to execute operationally, and assuming [it does not] experience undue interference in [its] operations from the Sprint/Nextel merger, [it remains] positive in [its] outlook for 2006” (b)

We believe that the valuation process should take into account the changing competitive environment, including the emergence of new technologies and evolution of roaming, which may impact Partners’ growth prospects and margins

Partners said that its “customers are among the most valuable in the industry” (c)

Nextel generates more lifetime OIBDA per subscriber than Partners and yet traded pre-merger at a substantially lower multiple

(a) Nextel Partners, Q&A Regarding Put Process, dated July 15, 2005. (b) Nextel Partners, Q2 2005 Earnings Call, July 28, 2005.

(c) Nextel Partners, Q2 2005 Earnings Call, July 28, 2005.

14

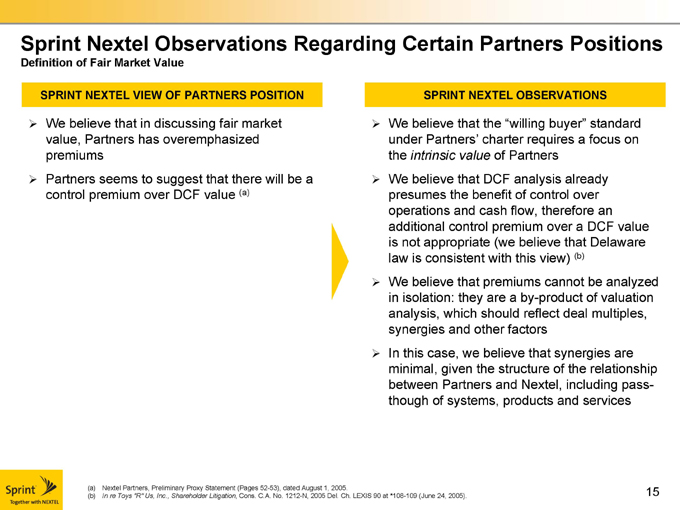

Sprint Nextel Observations Regarding Certain Partners Positions

Definition of Fair Market Value

SPRINT NEXTEL VIEW OF PARTNERS POSITION

We believe that in discussing fair market value, Partners has overemphasized premiums Partners seems to suggest that there will be a control premium over DCF value (a)

SPRINT NEXTEL OBSERVATIONS

We believe that the “willing buyer” standard under Partners’ charter requires a focus on the intrinsic value of Partners We believe that DCF analysis already presumes the benefit of control over operations and cash flow, therefore an additional control premium over a DCF value is not appropriate (we believe that Delaware law is consistent with this view) (b) We believe that premiums cannot be analyzed in isolation: they are a by-product of valuation analysis, which should reflect deal multiples, synergies and other factors In this case, we believe that synergies are minimal, given the structure of the relationship between Partners and Nextel, including pass-though of systems, products and services

(a) Nextel Partners, Preliminary Proxy Statement (Pages 52-53), dated August 1, 2005.

(b) In re Toys “R” Us, Inc., Shareholder Litigation, Cons. C.A. No. 1212-N, 2005 Del. Ch. LEXIS 90 at *108-109 (June 24, 2005).

15

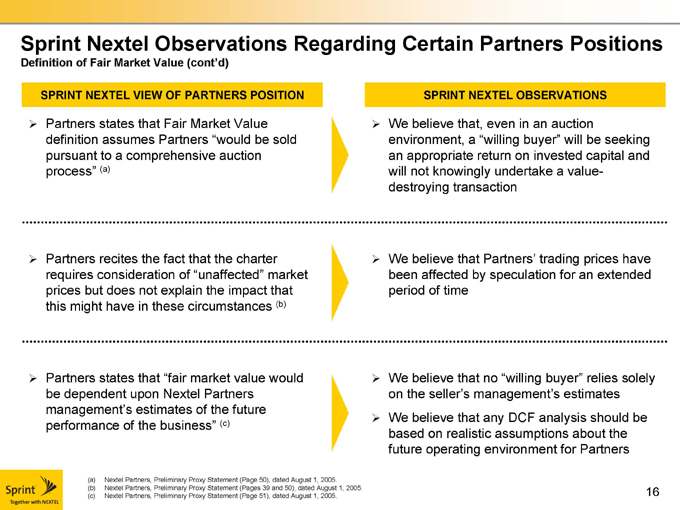

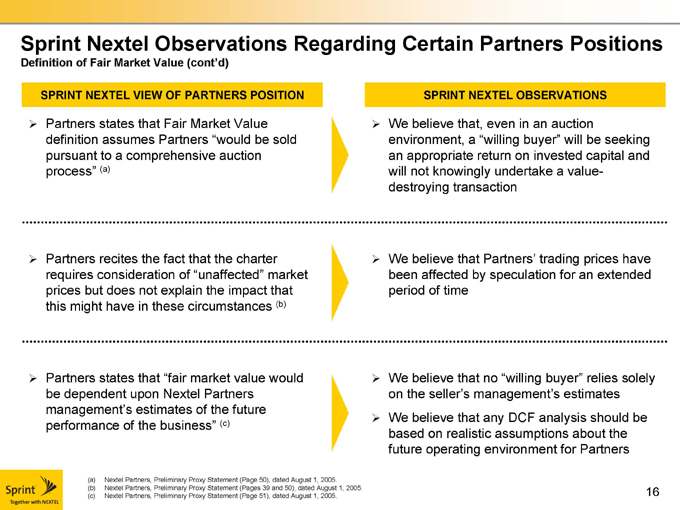

Sprint Nextel Observations Regarding Certain Partners Positions

Definition of Fair Market Value (cont’d)

SPRINT NEXTEL VIEW OF PARTNERS POSITION

Partners states that Fair Market Value definition assumes Partners “would be sold pursuant to a comprehensive auction process” (a)

SPRINT NEXTEL OBSERVATIONS

We believe that, even in an auction environment, a “willing buyer” will be seeking an appropriate return on invested capital and will not knowingly undertake a value-destroying transaction

Partners recites the fact that the charter requires consideration of “unaffected” market prices but does not explain the impact that this might have in these circumstances (b)

We believe that Partners’ trading prices have been affected by speculation for an extended period of time

Partners states that “fair market value would be dependent upon Nextel Partners management’s estimates of the future performance of the business” (c)

We believe that no “willing buyer” relies solely on the seller’s management’s estimates We believe that any DCF analysis should be based on realistic assumptions about the future operating environment for Partners

(a) Nextel Partners, Preliminary Proxy Statement (Page 50), dated August 1, 2005.

(b) Nextel Partners, Preliminary Proxy Statement (Pages 39 and 50), dated August 1, 2005. (c) Nextel Partners, Preliminary Proxy Statement (Page 51), dated August 1, 2005.

16