UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under § 240.14a-12 |

SPRINT NEXTEL CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of filing fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials: |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

The following email was sent from Dan Hesse, Chief Executive Officer of Sprint Nextel Corporation (“Sprint”), to Sprint employees on June 11, 2013:

Subject line:Sprint and SoftBank pursuing amended merger agreement; discussions with DISH terminated

Dear Sprint Teammates,

Sprint’s Board of Directors has unanimously accepted an amended merger agreement with improved terms from SoftBank. The new agreement would increase upfront cash paid to Sprint shareholders by $1.48 per share or $4.5 billion. The total cash consideration available to Sprint stockholders would be $16.64 billion. Under this new agreement, SoftBank will own 78% of Sprint. For more details, see our company news release.

The Special Committee of the Sprint Board and its advisors conducted a lengthy due diligence process with Dish Corporation over many weeks. After numerous in-person meetings and conference calls across a wide variety of subjects, the Special Committee decided DISH’s unsolicited proposal to acquire Sprint was not reasonably likely to lead to an offer superior to the SoftBank agreement. The Special Committee has now terminated discussions with DISH, but has given a June 18th, 2013 deadline to provide a “best and final” offer.

Our shareholders need to vote on the amended SoftBank merger agreement. To allow ample time to evaluate the new agreement, we will move the special meeting of the shareholders from June 12th to June 25th. It is our expectation that the merger with SoftBank will be completed in July.

We believe the amended merger agreement with SoftBank is good for shareholders, customers and employees, and it can enhance Sprint’s long-term value by creating a company that’s stronger and more competitive.

We’ll update you as we can when more information is available. Thank you for all you do for Sprint.

Sincerely,

Dan

Cautionary Statement Regarding Forward Looking Statements

This document includes “forward-looking statements” within the meaning of the securities laws. The words “may,” “could,” “should,” “estimate,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “target,” “plan,” “providing guidance” and similar expressions are intended to identify information that is not historical in nature.

This document contains forward-looking statements relating to the proposed transactions between Sprint Nextel Corporation (“Sprint”) and SoftBank Corp. (“SoftBank”) and its group companies, including Starburst II, Inc. (“Starburst II”), and the proposed acquisition by Sprint of Clearwire Corporation (“Clearwire”). All statements, other than historical facts, including, but not limited to: statements regarding the expected timing of the closing of the transactions; the ability of the parties to complete the transactions considering the various closing conditions; the expected benefits of the transactions such as improved operations, enhanced revenues and cash flow, growth potential, market profile and financial strength; the competitive ability and position of SoftBank or Sprint; and any assumptions underlying any of the foregoing, are forward-looking statements. Such statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. You should not place undue reliance on such statements. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, that (1) one or more closing conditions to the transactions may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the transactions or that the required approval by Sprint’s stockholders for the SoftBank transaction or Clearwire’s stockholders for the Clearwire transaction may not be obtained; (2) there may be a material adverse change of Sprint or the business of Sprint may suffer as a result of uncertainty surrounding the transactions; (3) the transactions may involve unexpected costs, liabilities or delays; (4) the legal proceedings that may have been initiated, as well as any additional legal proceedings that may be initiated, related to the transactions; and (5) other risk factors as detailed from time to time in Sprint’s, Starburst II’s and Clearwire’s reports filed with the SEC, including Sprint’s and Clearwire’s Annual Reports on Form 10-K for the year ended December 31, 2012 and Quarterly Reports on

Form 10-Q for the quarter ended March 31, 2013, and other factors that are set forth in the proxy statement/prospectus contained in Starburst II’s Registration Statement on Form S-4, which was declared effective by the SEC on May 1, 2013, and in other materials that will be filed by Sprint, Starburst II and Clearwire in connection with the transactions. There can be no assurance that the transactions will be completed, or if completed, that such transactions will close within the anticipated time period or that the expected benefits of the transactions will be realized.

All forward-looking statements contained in this document and the documents referenced herein are made only as of the date of the document in which they are contained, and none of Sprint, SoftBank or Starburst II undertakes any obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements.

The following presentation was first used on June 11, 2013.

|

Amended SoftBank Agreement – Maximizing Value and Certainty June 10, 2013 |

|

Cautionary Statement 2 This document includes “forward-looking statements” within the meaning of the securities laws. The words “may,” “could,” “should,” “estimate,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “target,” “plan,” “providing guidance” and similar expressions are intended to identify information that is not historical in nature. This document contains forward-looking statements relating to the proposed transactions between Sprint Nextel Corporation (“Sprint”) and SoftBank Corp. (“SoftBank”) and its group companies, including Starburst II, Inc. (“Starburst II”), and the proposed acquisition by Sprint of Clearwire Corporation (“Clearwire”). All statements, other than historical facts, including, but not limited to: statements regarding the expected timing of the closing of the transactions; the ability of the parties to complete the transactions considering the various closing conditions; the expected benefits of the transactions such as improved operations, enhanced revenues and cash flow, growth potential, market profile and financial strength; the competitive ability and position of SoftBank or Sprint; and any assumptions underlying any of the foregoing, are forward-looking statements. Such statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. You should not place undue reliance on such statements. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, that (1) there may be a material adverse change of SoftBank; (2) the proposed financing may involve unexpected costs, liabilities or delays or may not be completed on terms acceptable to SoftBank, if at all; and (3) other factors as detailed from time to time in Sprint’s, Starburst II’s and Clearwire’s filings with the Securities and Exchange Commission (“SEC”), including Sprint’s and Clearwire’s Annual Reports on Form 10-K for the year ended December 31, 2012 and Quarterly Reports on Form 10-Q for the quarter ended March 31, 2013, and other factors that are set forth in the proxy statement/prospectus contained in Starburst II’s Registration Statement on Form S-4, which was declared effective by the SEC on May 1, 2013, and in other materials that will be filed by Sprint, Starburst II and Clearwire in connection with the transactions, which will be available on the SEC’s web site (www.sec.gov). There can be no assurance that the transactions will be completed, or if completed, that such transactions will close within the anticipated time period or that the expected benefits of such transactions will be realized. All forward-looking statements contained in this document and the documents referenced herein are made only as of the date of the document in which they are contained, and none of Sprint, SoftBank or Starburst II undertakes any obligation to update any forward- looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements. |

|

Amended Terms Maximize Value and Certainty Rigorous Special Committee process results in improved terms for Sprint shareholders Greater value $4.5 billion of additional cash to Sprint’s shareholders Maintains July closing June 25 th vote date High degree of certainty - CFIUS & DOJ approvals in-hand; FCC expected shortly Immediate participation in SoftBank upside (capital + synergies) Special Committee and Sprint Board unanimously recommend FOR improved SoftBank transaction DISH proposal not likely to lead to a superior offer 3 |

|

Significantly Improved Transaction Terms Cash consideration up from $4.02 per share to $5.50 per share Additional $4.5 billion of cash to Sprint Shareholders Additional cash contribution of $1.5 billion from SoftBank Reallocation of $3.0 billion of previously committed primary capital to Sprint Shareholders Cash purchase price paid to Sprint shareholders increased from $7.30 per share to $7.65 per share, subject to proration, a 52% premium to the unaffected trading price prior to the deal announcement. Cash portion of merger consideration increased from 55% to 72% Purchase price of SoftBank primary investment in Sprint increased from $5.25 to $6.25 per share Sprint shareholders will own 22% of better capitalized, more competitive company 4 |

|

Overview of Improved Terms Original Agreement Amended Agreement Price Paid to Sprint Shareholders $7.30 $7.65 Primary Price $5.25 $6.25 Primary Investment $4.9bn $1.9bn Cash per Share $4.02 $5.50 % Cash / % Stock Mix 55% / 45% 72% / 28% Weighted Average SoftBank Investment (1) $6.56 $7.48 Total SB Investment (2) $20.14bn $21.64bn Sprint Ownership 30% (FD) 22% (FD) SoftBank Ownership 70% (FD) 78% (FD) Source: Sprint Management and company filings. Note: Dollars in billions, except per share data. (1) (2) 14% Increase from Original Agreement 5 $1.48 Increase from Original Agreement On remaining investment. Includes $3.1 billion convertible investment. Does not include cost to exercise warrants. |

|

Transaction Overview Pre- Transaction ~3.0 billion Sprint shares outstanding SoftBank invested $3.1 billion in convertible debt @ $5.25 / share at signing † SoftBank invests $1.9 billion in newly issued shares @ $6.25/share † † Shares O/S* 3.1B 4.0B 3.6B 78% SoftBank (3.1B shares) 22% existing Sprint shareholders (0.9B shares) Step 2a Step 1 Post-close ownership $5B cash infusion into Sprint SoftBank 4.0B Step2b $16.6B cash to Sprint shareholders Sprint shareholders Shortly after signing At close 6 * Fully diluted pro forma shares outstanding † Converts into equity immediately prior to closing of Steps 2a and 2b †† In addition, SoftBank receives five-year warrant to purchase 54.6M shares in newly recapitalized Sprint at $5.25 per share for total additional consideration of $287M 0.0B 0.9B 0.6B 3.1B 0% 23% 16% 78% Total SB Shares Total SB Owner- ship |

|

Stronger, Better Capitalized Competitor SoftBank total primary investment of $5 billion Strengthens Sprint’s balance sheet and provides capital for continued network build-out Transaction allows Sprint to implement SoftBank's operational and technology expertise Synergies and performance improvements allow for reallocation of cash to stockholders: Eight months of cooperative efforts between Sprint and SoftBank management has resulted in high visibility to operating and capital expenditure reductions New Sprint will retain financial flexibility to compete with large, well capitalized competitors 7 |

|

SoftBank Subscriber Growth (millions) 2012 Wireless EBITDA Margins ’06 – ’13 CAGR: + 17% Source: Company filings, investor presentations Source: Company filings, investor presentations Note: Includes SoftBank Mobile (including communication modules), Willcom, and EMOBILE’s accumulated subscribers. SoftBank acquired Vodafone Japan in March 2006 SoftBank Has Extensive Wireless Experience Driving Growth and Margin 8 |

|

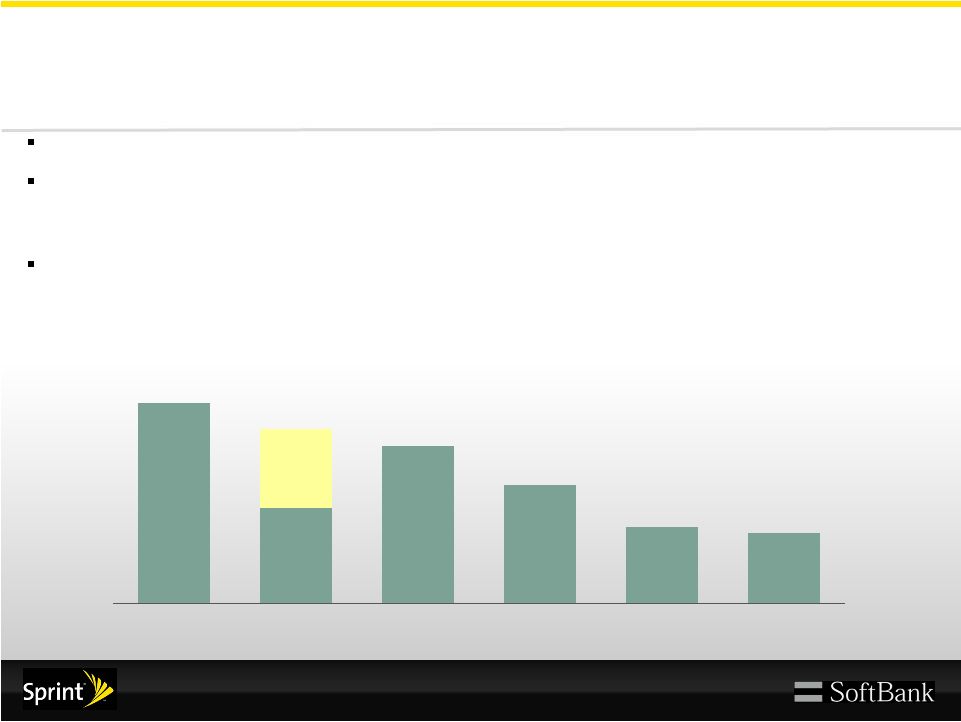

SoftBank Transaction Provides Global Scale Benefits Sprint + SoftBank will be the world’s third largest seller of smartphones (significant economies of scale) Sprint will leverage SoftBank’s experience in building out LTE on 2.5 GHz spectrum to improve the customer experience: (1) accelerated expansion of nationwide footprint (2) faster data speeds (3) increased capacity Given the complementary nature of Sprint and SoftBank’s businesses, including a shared history of technical and marketing innovations and the potential for purchasing power synergies, the transaction provides the opportunity to further enhance Sprint’s standalone record of consumer service and innovation in the telecommunications market 99mm 86mm 78mm 58mm 38mm 35mm Verizon Softbank + Sprint AT&T NTT Docomo KDDI T-mobile + Metro Softbank 39mm Sprint 47mm (1) Note: SoftBank subscribers as of 4/31/2013 and all others as of 3/31/2013. (1) Total wireless subscribers excluding communication modules. Softbank subscribers pro forma for Mobile, Willcom, and EMOBILE’s accumulated subscribers. (1) Retail Wireless Subscribers 9 |

|

Process Led by Experienced and Independent Special Committee 10 Larry Glasscock Chairman of Special Committee Former Chairman of WellPoint, Inc. James H. Hance Chairman of Sprint Nextel Board Senior Advisor to The Carlyle Group V. Janet Hill Director Principal of Hill Family Advisors William R. Nuti Director Chairman, CEO & President of NCR Corporation Rodney O’Neal Director President & CEO of Delphi Automotive Other Experience: •Director of Simon Property Group, Sysco Corporation and Zimmer Holdings •Sprint director since August 2007 Other Experience: •Previous Vice Chairman of BAML •Director of Duke Energy Corporation, Cousins Properties Incorporated, Ford Motor Company and The Carlyle Group •Sprint director since February 2005 Other Experience: •Prior VP Alexander & Associates, Inc. •Director of The Carlyle Group, The Wendy’s Company, Dean Foods, Inc. and Nextel Communications, Inc. •Sprint director since 2005 Other Experience: •Prior President, CEO and COO of Symbol Technologies, Inc •Prior dual Sr. VP of Worldwide Service Provider Operations and U.S. Theater Operations at Cisco Systems •Sprint director since June 2008 Other Experience: •Exec. VP of the former Delphi Safety, Thermal & Electrical Architecture Sector, President of Dynamics, Propulsion, and Thermal Sector of Delphi Automotive •Sprint director since August 2007 Financial Advisor: BofA Merrill Lynch; Legal Counsel: Shearman & Sterling LLP; Network & Spectrum Consultant: Spectrum Management Consulting; Regulatory Counsel: Bingham McCutchen LLP |

|

Key Special Committee Considerations in Evaluating DISH Preliminary Proposal Economic terms have not changed since April 15th Uncertainty surrounding the DISH proposal, including: DISH has not submitted an actionable offer despite Special Committee deadline of June 6th The increased time to close (1H14) DISH’s not providing a combined operational and financial plan The status of DISH’s funding commitments The interim funding needs of the company The risks inherent in the leverage of the pro forma combined DISH/Sprint 11 |

|

Transaction Process Highlights 12 Established objective process Special Committee promptly formed upon receiving April 15 DISH proposal Promptly retained independent advisors Ensured comprehensive & rigorous review by staying proactive & responsive Obtained waivers and non-disclosure agreements that allowed Sprint to furnish non-public information to, and to engage with, DISH Sprint has complied with nearly all of DISH’s voluminous diligence requests Sprint management and Special Committee advisors have had 9 face-to-face meetings and numerous conference calls with DISH to try to advance their offer Sprint completed due diligence on DISH Dedicated to thorough consideration of options to maximize shareholder value Special Committee met 15 times since inception Special Committee met with, and provided information to, DISH and listened to their explanation and plans Special Committee also engaged with Softbank to garner improved terms |

|

Frequently Asked Process Questions 13 Why did it take so long to engage DISH? Original DISH proposal (4/15/13) was a letter (no merger agreement or commitment letters) In order to engage in discussions, the board/special committee needed to establish that the proposal was reasonably likely to lead to a superior proposal To make this determination, any required financing must be found to be fully committed or reasonably determined to be available DISH provided a draft merger agreement on 5/2/13 DISH provided unsigned draft commitment letter on 5/13/13 Ultimately, Sprint was able to secure a waiver under the SoftBank merger agreement in order to have discussions with DISH on 5/20/13 Did DISH get access to the diligence information it needed? DISH had originally requested a two-week confirmatory diligence period 9 in-person and over 12 telephonic meetings with DISH Made available more than 2,000 documents |

|

Special Committee Ran a Robust Process That Delivered Additional Value For Stockholders 14 4/15 DISH proposal announced Did not include financing commitments or mark-up of merger agreement Special Committee is formed Retains independent financial and legal advisors 4/20 Special Committee request additional details about DISH proposal in order to be able to evaluate it 4/24 DISH provides limited response to Special Committee request. DISH sends letter to Special Committee, states confirmatory due diligence should be completed in two weeks from receiving access. 4/26 To facilitate DISH’s ability to provide information to it, Special Committee obtains waiver from Softbank to permit Special Committee to meet with DISH and obtain information. 4/27 Special Committee provides confidentiality agreement to DISH, but doesn’t receive any reaction until late the following day 4/30 DISH and Sprint execute confidentiality agreement |

|

Special Committee Ran a Robust Process That Delivered Additional Value For Stockholders 15 5/2 DISH provides draft merger agreement 5/3 Special Committee advisors and Sprint management meet with DISH • DISH presents financing plan and analysis of regulatory issues 5/9 DISH presents high level business plan and synergy estimates • DISH represents that financing commitments are prepared, but will only be delivered as “final item” 5/13 DISH provides “redacted” forms of financing commitments (unsigned) 5/16 DISH represents that executed financing commitments will be delivered 5/17; commitments not actually delivered until 5/23 5/20 Special Committee obtains waiver from Softbank to allow it to provide non-public information to, and to negotiate with, DISH • Special Committee provides draft confidentiality agreement to DISH • Special Committee requests definitive proposal by June 6 5/21 Confidentiality agreement signed; DISH initial diligence request not provided to Sprint until late the following day |

|

Special Committee Ran a Robust Process That Delivered Additional Value For Stockholders 16 5/22 Sprint begins to provide written information in an electronic data room 5/24 - 6/10 9 in person diligence meetings in New York, Kansas City, Denver and Washington D.C. • • • 5/28 Special Committee advisers have conference call with DISH advisors to raise issues with DISH draft merger agreement 5/29 Sprint makes management presentation to DISH regarding its network plans Later that day, DISH announces tender offer for Clearwire 5/31 DISH advises that it will not respond to merger agreement issues raised by Special Committee, but requests mark-up Numerous conference calls to provide information to DISH DISH has continued to make additional diligence requests to Sprint throughout this time period; Sprint has complied with substantially all of these requests Special Committee completes due diligence on DISH |

|

Special Committee Ran a Robust Process That Delivered Additional Value For Stockholders 17 6/1 DISH requests in-person meeting with Special Committee 6/3 Sprint provides mark up of merger agreement. Special Committee sends letter to DISH confirming request for definitive proposal by June 6 and agrees to meet with DISH on June 7 to discuss proposal. 6/6 DISH sends letter to Special Committee advising that it will not provide proposal that day 6/7 Special Committee meets with DISH DISH does not put forward firm proposal |

|

Revised offer maximizes value and certainty for Sprint shareholders, including: Increased pro-rata cash consideration from $4.02 to $5.50 / share On track to regulatory approval and closing in July Sprint + Softbank positions New Sprint better than ever before vis-à-vis key competitors in the market Significant capital to accelerate network build out Enhanced scale Expertise in deployment of 2.5GHz spectrum for LTE Sprint shareholders will own 22% of New Sprint, providing shareholders an opportunity to participate in the upside created by a better capitalized and more capable New Sprint Sprint board of directors unanimously recommends shareholders vote ‘FOR’ the merger 18 |

|

Share Calculation Today @ Closing 5-Year Warrant Sprint @ Common Step 2a (1) Purchase to Step 2b 55mm Step 2c (2) ($ in billions, shares in millions) Market issuance Sprint $12.14bn Secondar Sprint Warrant Sprint Existing common shares 3,023 -- 3,023 (2,175) 848 -- 848 Common shares issued to Softbank -- 304 304 -- 304 -- 304 Purchase outstanding Sprint shares -- -- -- 2,175 2,175 -- 2,175 Total common shares 3,023 304 3,327 -- 3,327 -- 3,327 Dilution (3) 34 -- 34 -- 35 -- 35 Conversion shares / Warrant 590 -- 590 -- 590 55 645 Fully-diluted shares 3,647 304 3,951 -- 3,952 55 4,007 Softbank beneficial shares 590 894 3,070 3,124 Softbank beneficial ownership % 16% 23% 78% 78% Cumulative investment $3.1 $5.0 $21.6 $21.9 Price $5.25 $6.25 $7.65 $5.25 Shares per Step 590 304 2,175 55 (1) Per share amount under Step 2a is implied based on contemplated amount of total equity contribution. (2) Per share amount under Step 2c is implied based on warrant exercisable for shares of Parent (Sprint post-merger). (3) Dilution based on treasury stock method. Sprint at market, Steps 1 and 2a assume $7.24 stock price (6/7/2013 close). Steps 2b and 2c assume $7.65 stock price. 20 |