UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under § 240.14a-12 |

SPRINT CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of filing fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0- 11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials: |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

| | |

| |

|

Notice of Annual Meeting of Stockholders and Proxy Statement |

To be held August 6, 2014 |

Notice of Annual Meeting and Proxy Statement

It is my pleasure to invite you to attend our 2014 Annual Meeting of Stockholders on Wednesday, August 6, 2014 at 1:00 p.m. Pacific. We are very pleased that this year’s annual meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the 2014 Annual Meeting online, vote your shares electronically and submit your questions during the meeting by visitingwww.virtualshareholdermeeting.com/SprintCorp14.

The purpose of the annual meeting is to consider and take action on the following:

| | 1. | Election of the nine directors named in the proxy statement; |

| | 2. | Ratification of the selection of the independent registered public accounting firm; |

| | 3. | Advisory approval of the Company’s named executive officer compensation; |

| | 4. | Vote on two stockholder proposals, if presented at the meeting; and |

| | 5. | Any other business that properly comes before the meeting as well as any adjournment or postponement of the meeting. |

We are taking advantage of Securities and Exchange Commission rules that allow us to furnish proxy materials to you via the Internet. Unless you have already requested to receive a printed set of proxy materials, you will receive a Notice Regarding the Availability of Proxy Material, or Notice. The Notice contains instructions on how to access proxy materials and vote your shares via the Internet or, if you prefer, to request a printed set of proxy materials at no additional cost to you. We believe that this approach provides a convenient way for you to access your proxy materials and vote your shares, while lowering our printing and delivery costs and reducing the environmental impact associated with our annual meeting.

Stockholders of record as of June 9, 2014 are eligible to vote at the annual meeting. On or about June 27, 2014, we mailed the Notice or, for stockholders who have already requested to receive a printed set of proxy materials, this proxy statement, the accompanying proxy card and the Transition Report on Form 10-K for the three month transition period ended March 31, 2014.

|

By order of the Board of Directors,

Charles R. Wunsch Senior Vice President, General Counsel and Corporate Secretary |

| | | | | | |

REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: |

| | VIA THE INTERNET Visit the website listed on your proxy card | |  | | BY MAIL Sign, date and return your proxy card in the enclosed envelope |

| | | |

| | BY TELEPHONE Call the telephone number on your proxy card | |  | | IN PERSON Attend our virtual stockholder meeting on August 6, 2014 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON AUGUST 6, 2014. The Notice of Annual Meeting, Proxy Statement and Transition Report on Form 10-K are available at

www.proxyvote.com.

| | | | |

| |

2 | Notice of Annual Meeting and Proxy Statement | | |  | |

Proposal 1 – Election of Directors

Proposal 1 - Election of Directors

Our bylaws currently fix the number of directors at ten. Our board is currently composed of nine directors. Each of our nine directors is standing for election to serve until the 2015 annual meeting and until a successor has been duly elected and qualified. Although we expect to fill the tenth seat on the board after the annual meeting, you may not vote for more than nine nominees, either in person or by proxy.

Unless you direct otherwise, the persons named in the accompanying proxy will vote your shares for the election of the nominees named below. Each nominee has consented to be named and to continue to serve if elected. If any of the nominees becomes unavailable for election for any reason, the proxies will be voted for the other nominees and for any substitutes.

All our directors bring to our board significant executive leadership experience derived from their service as executives and, in some cases, chief executive officers, of large corporations. They also bring extensive board experience and a diversity of views and perspectives derived from their individual experiences working globally in a broad range of industries and occupations. Certain individual experiences, qualifications and skills of our directors that contribute to our board’s effectiveness as a whole are described under “—Nominees for Director” below. No family relationships exist among any of our directors or executive officers.

Director Nomination Process

On July 10, 2013, SoftBank Corp. and certain of its wholly-owned subsidiaries (together, “SoftBank”) completed a merger (the “SoftBank Merger”) with Sprint Nextel Corporation, a Kansas corporation (“Sprint Nextel”) as contemplated by the Agreement and Plan of Merger, dated as of October 15, 2012, (as amended, the “Merger Agreement”). The SoftBank Merger consideration totaled approximately

$22.2 billion, consisting of cash and stock. As a result of the SoftBank Merger and subsequent open market securities purchases, SoftBank owns approximately 80% of Sprint Corporation (“Sprint” or the “Company”).

So long as SoftBank remains our controlling stockholder, our governing documents confer upon SoftBank certain rights. Our bylaws, as contemplated by the Merger Agreement, require our board until July 10, 2015 to be composed as follows:

| | • | | the Chief Executive Officer of Sprint; |

| | • | | three independent directors designated by SoftBank; |

| | • | | three continuity directors (independent directors who served on the Sprint Nextel board); and |

| | • | | three additional directors, who need not be independent, designated by SoftBank. |

We consider all directors nominated by SoftBank, except the continuity directors and our CEO, to be “SoftBank Designees.” SoftBank Designees who are not independent are known as “SoftBank Affiliate Directors.”

Upon the closing of the SoftBank Merger, our board consisted of seven members, including our CEO, Daniel R. Hesse, three continuity directors, Robert R. Bennett, Gordon M. Bethune, and Frank Ianna, one independent director designated by SoftBank, Adm. Michael G. Mullen, and two additional directors designated by SoftBank, Masayoshi Son and Ronald D. Fisher. Our board subsequently established a Vacancy Resolution Committee to fill the remaining three vacancies. The Vacancy Resolution Committee, upon nomination by SoftBank, appointed Sara Martinez Tucker to our board as an independent director (and SoftBank Designee) and Marcelo Claure to our board, as a SoftBank Affiliate Director. The remaining board seat will be filled by the Vacancy Resolution Committee.

| | | | |

| |

| | | Notice of Annual Meeting and Proxy Statement | 3 | |

Proposal 1 – Election of Directors

Beginning July 11, 2015 through July 10, 2016 there is no requirement to retain the continuity directors. SoftBank will, however, be required to nominate six independent directors, our Chief Executive Officer and three additional directors of its choosing who need not be independent to our board. These provisions remain in effect until the combined voting interest of SoftBank and its controlled affiliates in our Company falls below 50% and remains below 50% for 90 consecutive days.

Moving forward, the Nominating and Corporate Governance Committee, or Nominating Committee, will take an active role in evaluating prospective candidates or current board members for nomination, including those candidates nominated by SoftBank. The Nominating Committee considers all factors it deems relevant, including, but not limited to, the candidate’s:

| | • | | character, including reputation for personal integrity and adherence to high ethical standards; |

| | • | | knowledge and experience in leading a successful company, business unit or other institution; |

| | • | | independence from our company; |

| | • | | ability to contribute diverse views and perspectives; |

| | • | | ability and willingness to devote the time and attention necessary to be an effective director |

| | — | | all in the context of an assessment of the needs of our board at that point in time. |

Consistent with its charter and our Corporate Governance Guidelines, our Nominating Committee places a great deal of importance on identifying candidates having a variety of views and perspectives arising out of their individual experiences, professional expertise, educational background, and skills. In considering candidates for our board, the Nominating Committee considers the totality of each candidate’s credentials in the context of this standard.

The Nominating Committee considers candidates recommended by our stockholders, using the same key factors described above for purposes of its evaluation. A stockholder who wishes to recommend a prospective nominee for our board should notify the Corporate Secretary in writing with supporting material that the stockholder considers appropriate. The Nominating Committee considers whether to nominate any person nominated by a stockholder pursuant to the provisions of our bylaws relating to stockholder nominations for election at an annual stockholder meeting. To nominate a director, the stockholder must deliver the information as required by our bylaws.

| | | | |

| |

4 | Notice of Annual Meeting and Proxy Statement | | |  | |

Proposal 1 – Election of Directors

Nominees for Director

| | | | | | |

| | | | ROBERT R. BENNETT, 56, Sprint director since 2006; Managing Director of Hilltop Investments, LLC, a private investment company. |

| | | | |

| | | | Status: Independent, Continuity Director | | Committees: Audit (Chair) and Finance |

| | | | | | |

Public Company Board Directorships: Hewlett-Packard Company, Discovery Communications, Inc., and Liberty Media Corporation

Former Directorships Held During the Past Five Years: Liberty Interactive Corporation, Demand Media, Inc., and Discovery Holding Company

Biography: Mr. Bennett served as President of Discovery Holding Company from March 2005 until September 2008, when the company merged with Discovery Communications, Inc., creating a new public company. Mr. Bennett also served as President and CEO of Liberty Media Corporation (now Liberty Interactive Corporation) from April 1997 until August 2005 and continued as President until February 2006. He was with Liberty Media from its inception, serving as its principal financial officer and in various other capacities. Prior to his tenure at Liberty Media, Mr. Bennett worked with Tele-Communications, Inc. and the Bank of New York.

Qualifications: Mr. Bennett has extensive knowledge of the capital markets and other financial and operational issues from his experiences as a principal financial officer and president and chief executive officer of Liberty Media, which allows him to provide an invaluable perspective on financial and operational matters to our board.

| | | | | | |

| | | | GORDON M. BETHUNE, 72, Sprint director since 2004; retired Chairman and Chief Executive Officer of Continental Airlines, Inc., an international commercial airline company. |

| | | | | | |

| | | | Status: Independent, Continuity Director | | Committees: Compensation (Chair) and Nominating |

Public Company Board Directorships: Honeywell International, Inc. and Prudential Financial, Inc.

Former Directorships Held During the Past Five Years: Willis Group Holdings, Ltd.

Biography: Mr. Bethune served as Chief Executive Officer of Continental Airlines from 1994 and as Chairman and Chief Executive Officer from 1996 until December 30, 2004.

Qualifications: Mr. Bethune has extensive experience serving as a chief executive officer and director of large international corporations, providing our board with the perspective of someone familiar with all facets of an international enterprise. He has extensive experience with developing and implementing strategies and policies for the acquisition and development of employee talent.

| | | | |

| |

| | | Notice of Annual Meeting and Proxy Statement | 5 | |

Proposal 1 – Election of Directors

| | | | | | | | |

| | | | MARCELO CLAURE, 43, Sprint director since 2014; Chairman, CEO and President of Brightstar Corporation. |

| | | | | | | | |

| | | | Status: | | SoftBank Affiliate Director SoftBank Designee | | Committee: Finance |

| | | | | | | | |

Biography: Mr. Claure is the founder of Brightstar Corp. and has been its Chairman, Chief Executive Officer and President since October 1997. Brightstar provides value-added distribution, supply chain solutions, handset protection and insurance, buy-back and trade-in solutions, multi-channel retail solutions, and financial services to wireless manufacturers, retailers and operators. Mr. Claure has been an Executive Director of Brightstar Corp. since October 1997. He serves as a Director of Activate IT, Inc. He serves on the board of directors of the Bolivian-American Chamber of Commerce and serves on the Board of Trustees of Bentley College.

Qualifications: Mr. Claure was selected because of his experience making Brightstar one of the largest global distribution, services, and innovation companies in the telecommunications industry. His experience in the telecommunications industry provides a valuable perspective to our board.

| | | | | | | | |

| | | | RONALD D. FISHER, 66, Sprint director since 2013 and Vice Chairman of the Board; Director and President of SoftBank Holdings Inc. |

| | | | | | | | |

| | | | Status: | | SoftBank Affiliate Director SoftBank Designee | | Committees: Finance (Chair) Compensation |

| | | | | | | | |

Public Company Board Directorships: SoftBank Corp. (Tokyo Stock Exchange)

Biography: Mr. Fisher has over 30 years of experience of working with high growth and turnaround technology companies. Mr. Fisher joined SoftBank in 1995, overseeing its U.S. operations and other activities outside of Asia, and was the founder of SoftBank Capital. He is currently Director and President of SoftBank Holdings, Inc. Prior to joining SoftBank, Mr. Fisher was the CEO of Phoenix Technologies Ltd., the leading developer and marketer of system software products for personal computers, from 1990 to 1995. Mr. Fisher joined Phoenix from Interactive Systems Corporation, a UNIX software company that was purchased by the Eastman Kodak Company in 1988. At Interactive Systems he served for five years as President, initially as COO and then CEO. Mr. Fisher’s experience prior to Interactive Systems includes senior executive positions at Visicorp, TRW, and ICL (USA).

Qualifications: Mr. Fisher was selected because he possesses particular knowledge and experience in technology industries, and with strategic planning and leadership of complex organizations, including at other public corporations.

| | | | |

| |

6 | Notice of Annual Meeting and Proxy Statement | | |  | |

Proposal 1 – Election of Directors

| | | | |

| | | | DANIEL R. HESSE, 60, Sprint director since 2007, President and Chief Executive Officer of Sprint. |

| | | | |

| | | | Status: Executive Director |

| | | | |

| | | | Former Directorships Held During the Past Five Years: Clearwire Corporation |

Biography: Before becoming the President and Chief Executive Officer in December 2007, Mr. Hesse was Chairman, President, and Chief Executive Officer of Embarq Corporation. He served as Chief Executive Officer of Sprint’s Local Telecommunications Division from June 2005 until the Embarq spin-off in May 2006. Before that, Mr. Hesse served as Chairman, President and Chief Executive Officer of Terabeam Corp., a wireless telecommunications service provider and technology company, from 2000 until 2004. Prior to serving at Terabeam Corp., Mr. Hesse spent 23 years at AT&T holding various senior management positions, including President and Chief Executive Officer of AT&T Wireless Services. He serves on the board of directors of the National Board of Governors of the Boys and Girls Clubs of America and the University of Notre Dame’s Mendoza College of Business.

Qualifications: As our President and Chief Executive officer, Mr. Hesse provides our board with unparalleled insight into our company’s operations, and his 37 years of experience in the telecommunications industry provides substantial knowledge of the challenges and opportunities facing our company.

| | | | | | |

| | | | FRANK IANNA, 65, Sprint director since 2009; retired. |

| | | | | | |

| | | | Status: Independent, Continuity Director | | Committees: Audit and Nominating |

| | | | | | |

| | | | Public Company Board Directorships: Harbinger Group, Inc. |

| | | | | | |

Former Directorships Held During the Past Five Years: Clearwire Corporation and Tellabs, Inc.

Biography: Mr. Ianna retired from AT&T in 2003 after a 31-year career serving in various executive positions, most recently as President of Network Services. Following his retirement, Mr. Ianna served as a business consultant, executive and board member for several private and nonprofit enterprises. He has experience in telecom company operations as well as wireless technology.

Qualifications: Mr. Ianna’s technical background and expertise, as well as his vast experience in the telecommunications industry as an executive and director for a diverse array of enterprises, allows him to provide a unique perspective to our board on a wide variety of issues.

| | | | |

| |

| | | Notice of Annual Meeting and Proxy Statement | 7 | |

Proposal 1 – Election of Directors

| | | | | | |

| | | | ADM. MICHAEL G. MULLEN, 67, Sprint director since 2013; former 17th Chairman of the Joint Chiefs of Staff |

| | | | | | |

| | | | Status: Independent, SoftBank Designee | | Committee: Compensation |

| | | | | | |

| | | | Public Company Board Directorships: General Motors Company |

| | | | | | |

Biography: Adm. Mullen serves on the board of directors as the “Security Director” under the National Security Agreement between Sprint, SoftBank, the Department of Justice, the Department of Homeland Security, and the Department of Defense (the “NSA”). Admiral Mullen served as the 17th Chairman of the Joint Chiefs of Staff from October 2007 until his retirement in September 2011. Previously, Admiral Mullen served as the 28th Chief of Naval Operations (“CNO”) from July 2005 to 2007. CNO was one of four different four-star assignments Admiral Mullen held, including Commander, U.S. Naval Forces Europe and Commander, Allied Joint Force Command, and the 32nd Vice Chief of Naval Operations. Since 2012, he has served as President of MGM Consulting LLC and is the Charles and Marie Robertson Visiting Professor at the Woodrow Wilson School of Public and International Affairs at Princeton University.

Qualifications: Adm. Mullen brings to our board extensive senior leadership experience gained during his 43-year career in the U.S. military. As Chairman of the Joint Chiefs of Staff, the highest ranking officer in the U.S. military, Adm. Mullen led the armed forces during a critical period of transition, overseeing two active war zones. Adm. Mullen’s experience and relationships within the government allow him to lead our Government Security Committee and provide guidance on national security matters impacting the telecommunications industry. Adm. Mullen’s unique experience leading change in complex organizations, executive development and succession planning, diversity implementation, crisis management, strategic planning, budget policy, risk management, and technical innovation, are important to the oversight of Sprint’s business and allows him to make a significant and invaluable contribution to our board.

| | | | | | | | |

| | | | MASAYOSHI SON, 56, Chairman of the Board, Sprint director since 2013; Chief Executive Officer and Chairman of the Board of SoftBank Corp. |

| | | | | | | | |

| | | | Status: | | SoftBank Affiliate Director, SoftBank Designee | | Committee: Finance |

| | | | | | | | |

Public Company Board Directorships: SoftBank Corp. and Yahoo! Japan Corporation (each are listed on the Tokyo Stock Exchange)

Biography: Mr. Son founded SoftBank in September 1981, and has been its President and Chairman ever since and its Chief Executive Officer since February 1986. Mr. Son serves in various capacities with SoftBank’s portfolio of companies, including service with BB Technologies Corporation (currently SoftBank BB Corp.) as president since 2001 and as Chairman and CEO since 2004, service with Japan Telecom Co., Ltd. (currently SoftBank Telecom Corp.) as Chairman since 2004 and CEO since 2006, and with Vodafone K.K. (currently SoftBank Mobile Corp.) as CEO and Chairman since 2006. In addition, Mr. Son has served as Chairman of Yahoo! Japan Corporation since 1996, which was established as a joint venture between SoftBank and Yahoo! Inc. Mr. Son has also served as Chairman of the Broadband Association in Japan and of The Great East Japan Earthquake Recovery Initiative Foundation.

| | | | |

| |

8 | Notice of Annual Meeting and Proxy Statement | | |  | |

Proposal 1 – Election of Directors

Qualifications: Mr. Son’s vast experience in the telecommunications industry, including his successes in Japan disrupting telecom duopolies, is valuable to Sprint. As part of the SoftBank Merger, it was determined that Mr. Son, because of his interest as Chairman and Chief Executive Officer of SoftBank, our controlling stockholder, would be appointed to our board. Mr. Son provides expertise, leadership and strategic direction to the Sprint board.

| | | | | | |

| | | | SARA MARTINEZ TUCKER, 59, Sprint director since 2013; President and Chief Executive Officer of the National Math and Science Initiative |

| | | | | | |

| | | | Status: Independent, SoftBank Designee | | Committees: Nominating (Chair) and Audit |

| | | | | | |

Public Company Board Directorships: American Electric Power Co., Inc. and Xerox Corp.

Biography: Ms. Tucker has been Chief Executive Officer and President at National Math and Science Initiative, Inc. since March 2013. Ms. Tucker served as the Under Secretary of the U.S. Department of Education from 2006 to December 2008. Her responsibilities included overseeing policies, programs and activities related to postsecondary education, vocational and adult education, and federal student aid. Ms. Tucker served as the Chief Executive Officer and President of the Hispanic Scholarship Fund from 1997 to October 1, 2006. Previously, she worked for 16 years at AT&T and served as Regional Vice President of its Global Business Communications Systems. She serves as a Director of Teach For America, Inc. She has been a Trustee of University of Notre Dame since June 2009.

Qualifications: Ms. Tucker brings to our board expertise relevant to a large telecommunications company, including her business experience and executive leadership expertise. These skills and experience are the result of her education, experience in the telecommunications industry, service at the U.S. Department of Education, leadership positions at the Hispanic Scholarship Fund and her service on other public company boards and committees.

| | | | |

| |

| | | Notice of Annual Meeting and Proxy Statement | 9 | |

Proposal 1 – Election of Directors

Summary of Director Qualifications and Expertise

The table below summarizes the key qualifications, skills or attributes of each of our directors that were most relevant to the decision to nominate him or her to serve on our board. The lack of a mark does not mean the director does not possess that qualification or skill; rather a mark indicates a specific area of focus or expertise on which our board relies most heavily. These qualifications and relevant experience have been discussed in more detail above.

Our Board of Directors Recommends That You Vote “FOR” The Directors Nominated In Proposal 1.

| | | | |

| |

10 | Notice of Annual Meeting and Proxy Statement | | |  | |

Board Operations

As part of the SoftBank Merger, SoftBank was given certain governance rights, which are detailed in our Certificate of Incorporation, Bylaws and other corporate governance documents available atwww.sprint.com/governance.

In connection with the close of the SoftBank Merger, Sprint became the successor registrant to Sprint Nextel under Rule 12g-3 of the Securities Exchange Act of 1934 (the “Exchange Act”) and is the entity subject to the reporting requirements of the Exchange Act for filings with the Securities and Exchange Commission (the “SEC”) subsequent to the closing of the SoftBank Merger. From time to time, we will distinguish between the Sprint Nextel board (the board in place prior to the closing of the SoftBank Merger) and the Sprint

Corporation board. Any information provided regarding a Sprint Nextel director who did not become a Sprint director will not cover the portion of the period during which such director did not hold office (i.e., any time after July 10, 2013).

Corporate Governance Matters

We have elected to be treated as a “controlled company” under New York Stock Exchange, or NYSE, listing standards because more than 50% of our voting power is held by SoftBank. Accordingly, we are exempt from certain requirements of the NYSE corporate governance rules, including the requirement that we have a majority of independent directors on our board and the requirement that the compensation and nominating and corporate governance committees of the board have written charters addressing certain specified matters.

Governance Highlights

In keeping with good corporate governance practices, we maintain a comprehensive set of corporate governance initiatives that include the following:

| | ü | maintaining a majority of independent directors; |

| | ü | an Audit Committee comprised solely of independent directors; |

| | ü | a Nominating Committee currently comprised solely of independent directors; |

| | ü | a Compensation Committee chaired by an independent director; |

| | ü | Bylaws that provide, for so long as we are a controlled company, at least one member of our Compensation Committee and Nominating Committee will be independent; |

| | ü | maintaining written charters for each of our standing committees; |

| | ü | giving independent directors the ability to propose agenda items, including for executive sessions; |

| | ü | refining our policies and goals with respect to the determination of executive compensation programs, including increasing emphasis on performance-based equity compensation, as further described under “Executive Compensation — Compensation Discussion and Analysis”; |

| | ü | permitting our stockholders to take certain actions by written consent; |

| | ü | adopting stock ownership guidelines for any officer at the level of senior vice president or above and for outside directors; and |

| | ü | maintaining a declassified board. |

| | | | |

| |

| | | Notice of Annual Meeting and Proxy Statement | 11 | |

In addition, we have also adopted the following corporate governance initiatives:

| • | | requiring outside directors to hold executive sessions without management present no less than two times a year, which may be at or in conjunction with regularly-scheduled board meetings; |

| • | | publishing ourCorporate Governance Guidelines and charters for all standing committees of our board, which detail important aspects of our governance policies and practices on our website; |

| • | | maintaining limits on the number of other public company boards and audit committees on which our directors may serve; |

| • | | adopting a policy that prohibits our independent registered public accounting firm from providing professional services, including tax services, to any employee or board member or any of their immediate family members that would impair the independence of our independent registered public accounting firm; and |

| • | | conducting annual board and committee evaluations. |

In the event we cease to be a controlled company within the meaning of the NYSE’s rules, we would then be required to comply with certain governance requirements after the transition periods specified by the NYSE.

Contacting our Board

We value the views of our stakeholders. Consistent with this approach, our board has established a system to receive, track and respond to communications from stakeholders addressed to our board or to our outside directors. A statement regarding our board communications policy is available atwww.sprint.com/governance.

Any stakeholder who wishes to communicate with our board or any director may write to our General Counsel, Senior Vice President and Corporate Secretary, who is our Board Communications Designee, at the following address:

Sprint Corporation

6200 Sprint Parkway

Overland Park, KS 66251

KSOPHF0302-3B424

or email:boardinquiries@sprint.com.

Our board has instructed the Board Communications Designee to examine incoming communications and forward to our board, or individual directors as appropriate, communications deemed relevant to our board’s roles and responsibilities. Our board has requested that certain types of communications not be forwarded, and be redirected if appropriate, such as: spam, business solicitations or advertisements, resumes or employment inquiries, service complaints or inquiries, surveys, or any threatening or hostile materials. The Board Communications Designee will review all appropriate communications and report on the communications to the chair of the Nominating Committee or the full Nominating Committee, the full board, or the outside directors, as appropriate. The Board Communications Designee will take additional action or respond to letters in accordance with instructions from the relevant board source. Communications relating to accounting, internal accounting controls, or auditing matters will be referred promptly to members of the Audit Committee in accordance with our policy on communications with our board of directors.

Board Leadership Structure

Our board has determined that it is in the best interest of the Company to designate Mr. Son as the non-executive chairman and Mr. Fisher as the non-executive vice-chairman.

| | | | |

| |

12 | Notice of Annual Meeting and Proxy Statement | | |  | |

We believe our board leadership structure provides the appropriate balance of directors affiliated with our controlling stockholder, independent directors and CEO, working together to represent the interests of our entire stockholder base.

In part because of the unique qualifications and skills of our non-executive chairman and vice chairman, our board believes that this structure enhances our board’s oversight of, and independence from, management. Further, it fosters the ability of our board to carry out its roles and responsibilities on behalf of the stockholders and benefits the Company’s overall corporate governance.

Independence of Directors

Our board is currently comprised of nine members, five of whom are independent under rules of the NYSE. As a matter of practice, our board undertakes an annual review of director independence. During this review, our board considers all transactions and relationships between each director or any member of his immediate family and the companies by which they are employed as an executive officer (if applicable) to determine whether they have any relationships with our company and its affiliates. The purpose of this review is to determine whether any such relationships or transactions are considered “material relationships” that would be inconsistent with a determination that a director is independent. Our board has not adopted any “categorical standards” for assessing independence; preferring instead to consider and disclose existing relationships with the non-management directors and the Company. Our board observes all criteria for independence established by the NYSE.

Executive Sessions

Sprint’s non-management directors meet in executive sessions without any management participation by officers or employee directors. These executive

sessions are currently held either before, after or otherwise in conjunction with our board’s regularly scheduled meetings each year. Additional executive sessions can be scheduled at the request of the non-management directors.

The director who presides over the executive sessions of our board is our chairman, Mr. Son. The committee chairperson chairs the executive sessions of his or her committee. If that chairman or committee chairperson is not present, our vice chairman or another director will be chosen to preside. Our board does not have a lead independent director. Our board may select a presiding director for any independent director executive sessions, as needed.

Risk Management

Our board takes an active role in overseeing management of the Company’s risks, both through its own consideration of risks associated with our operations and strategic initiatives and through its committees’ consideration of various risks applicable to that committee’s areas of focus.

The Audit Committee reviews enterprise risks as part of its purpose to assist our board in fulfilling our board’s oversight responsibilities with respect to the Company’s enterprise risk management program. The Audit Committee receives regular reports regarding enterprise risk management matters from members of management who oversee the Company’s Corporate Audit Services, or internal audit, and Legal Department and informs our board of such matters through regular committee reports. In addition to receiving regular reports from the Audit Committee concerning our enterprise risk management program, our board also reviews information concerning other risks through regular reports of its other committees, including information regarding financial risk management from the Finance Committee,

| | | | |

| |

| | | Notice of Annual Meeting and Proxy Statement | 13 | |

compensation-related risk from the Compensation Committee and governance-related risk from the Nominating Committee.

Our management is responsible for our day-to-day risk management. Our management, internal audit, and internal control areas serve as the primary monitoring and testing functions for company-wide policies and procedures, and manage the day-to-day oversight of the risk management strategy for our ongoing business. This oversight includes identifying and evaluating potential risks that may exist at the enterprise, strategic, financial, operational, compliance, and reporting levels.

We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing the Company and that our board leadership structure supports this approach.

Code of Ethics

Our code of ethics, The Sprint Code of Conduct, is available atwww.sprint.com/governance or by email atshareholder.relations@sprint.com. It describes the ethical and legal responsibilities of directors and employees of our company and our subsidiaries, including senior financial officers and executive officers.

All of our directors and employees (including all senior financial officers and executive officers) are required to comply withThe Sprint Code of Conduct. In support of the ethics code, we have provided employees with a number of avenues for the reporting of potential ethics violations or similar concerns or to seek guidance on ethics matters, including a 24/7 telephone helpline. The Audit Committee has established procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters, including the confidential, anonymous submission by our employees of any concerns regarding questionable financial and non-financial matters to the Ethics Helpline at 1-800-788-7844, by mail to the Audit Committee, c/o Sprint Corporation, 6200 Sprint Parkway, Overland Park, KS 66251, KSOPHF0302-3B424, or by email toethicshelpline@sprint.com. Our Chief Ethics Officer reports regularly on our ethics and compliance program to the Audit Committee and annually to the entire board.

Compensation Committee Interlocks and Insider Participation

There were no compensation committee interlocks or insider participation during the transition period ended March 31, 2014.

| | | | |

| |

14 | Notice of Annual Meeting and Proxy Statement | | |  | |

Board Committees

Our board has four standing committees: Audit Committee, Finance Committee, Compensation Committee, and Nominating Committee. Each committee is described in the table below and each has a charter that describes such committee’s primary functions and principal responsibilities. A current copy of ourCorporate Governance Guidelines and the charter for each standing committee of our board is available atwww.sprint.com/governance or by email atshareholder.relations@sprint.com. Our charters andCorporate Governance Guidelines were adopted by our board and are annually reviewed and revised as necessary.

| | |

| Committee Name and Membership | | Primary Functions |

The Audit Committee Robert R. Bennett, Chair Frank Ianna Sara Martinez Tucker Ms. Tucker and Messrs. Bennett and Ianna are each an “audit committee financial expert” as defined in the SEC’s rules and each are financially literate and able to devote sufficient time to serving on the Audit Committee. | | Include assisting our board in fulfilling its oversight responsibilities with respect to: • the integrity of our financial statements and related disclosures, as well as related accounting and financial reporting processes; • our compliance with legal and regulatory requirements; • our independent registered public accounting firm’s qualifications, independence, audit and review scope, and performance; • the audit scope and performance of our internal audit function; • related party transactions policy and procedures; • our ethics and compliance program; • the audit committee report to be included in our annual proxy statement, and • our enterprise risk management program. The Audit Committee also has sole authority for the appointment, retention, termination, compensation, evaluation and oversight of our independent registered public accounting firm. The committee’s principal responsibilities in serving these functions are described in the Audit Committee Charter. |

The Finance Committee Ronald D. Fisher, Chair Robert R. Bennett Marcelo Claure Masayoshi Son | | Include: • reviewing and approving our financing activities consistent with the authorization levels set forth in our fiscal policy; • reviewing and making recommendations to our board on our capital structure, annual budgets, financial risk management, fiscal policy, investment policy and other significant financial initiatives; and • reviewing and approving proposed acquisitions, dispositions, mergers, joint ventures and similar transactions consistent with the authorization levels set forth in our fiscal policy. |

| | | | |

| |

| | | Notice of Annual Meeting and Proxy Statement | 15 | |

| | |

| Committee Name and Membership | | Primary Functions |

The Compensation Committee Gordon M. Bethune, Chair Ronald D. Fisher Adm. Michael G. Mullen | | Include: • discharging our board’s responsibilities relating to compensation of our executives in general and our principal senior officers in particular; • reporting on executive compensation in our annual proxy statement in accordance with applicable rules and regulations; and • reviewing with management plans for the development and orderly succession of senior officers. Additional information about these processes and procedures can be found below in “Executive Compensation — Compensation Discussion and Analysis.” Generally, the Compensation Committee’s primary processes for establishing and overseeing outside director compensation and the role of Company personnel and compensation consultants are similar to those regarding executive compensation. Any appropriate changes to outside director compensation are made following recommendation to our board by the Compensation Committee. In accordance with its charter, the Compensation Committee may delegate authority to subcommittees or any committee member when appropriate. |

The Nominating & Corporate Governance Committee Sara Martinez Tucker, Chair Gordon M. Bethune Frank Ianna | | Subject to our Certificate of Incorporation, Bylaws and Corporate Governance Guidelines, include: • ensuring that our company has effective corporate governance policies and procedures and an effective board and board review process; • assisting our board by identifying individuals qualified to become directors; • recommending to our board for approval the director nominees for the next annual meeting of the stockholders; • recommending to our board for approval the chairs and members of each board committee; and • developing, reviewing, and recommending to our board corporate governance policies and practices designed to benefit our stockholders. |

| | | | |

| |

16 | Notice of Annual Meeting and Proxy Statement | | |  | |

Meetings & Attendance

| | | | | | | | |

| | | Calendar year 2013 Board and

Committee Meetings | | Transition

Period |

| | | | | |

| | | Total | | Sprint

Corporation | | Sprint Nextel | | Sprint Corporation |

| | | | | |

Board Meetings | | 13 | | 4 | | 9 | | 4 |

| | | | | |

Audit Committee | | 11 | | 5 | | 6 | | 2 |

| | | | | |

Compensation Committee | | 6 | | 3 | | 3 | | 2 |

| | | | | |

Finance Committee | | 11 | | 4 | | 7 | | 2 |

| | | | | |

Nominating Committee | | 2 | | None | | 2 | | None |

Attendance at Annual Meetings

The Company does not have a policy requiring director attendance at its annual meeting. The Company did not have an annual meeting in 2013.

Board and Committee Meeting Attendance

During the three-month transition period ended March 31, 2014 and during the fiscal year ended December 31, 2013, all

directors attended at least 75% or more of the aggregate of the meetings of the board and of each of the board committees on which he or she served, except Sprint Nextel’s former director, William R. Nuti.

Board Meetings

Directors are expected to devote sufficient time to prepare properly for and attend meetings of our board, its committees, and executive sessions and to attend our annual meeting of stockholders.

| | | | |

| |

| | | Notice of Annual Meeting and Proxy Statement | 17 | |

Corporate Responsibility

At Sprint, our corporate social responsibility program is based on the belief that doing good creates good - both for our business and for our community. Our program gives us the opportunity to play a transformative role within the telecommunications industry, as well as within

our communities and for our environment. Our board supports these efforts. To that end, it has delegated the oversight of our corporate responsibility efforts to our Nominating Committee. Our Nominating Committee reviews and reports to our board on a periodic basis those matters relating to the Company’s corporate social responsibility and sustainability objectives.

| | | | |

| Focus Area | | 2013 Achievements |

| People: We believe we should operate in a socially responsible way. This commitment sets the course for new opportunities for our customers, employees and communities. | | - | | Provided charitable support for nearly 600 unique organizations, including more than $4 million in grants from the Sprint Foundation. |

| | - | | Contributed more than 196,000 employee volunteer hours to community organizations across the country, worth an estimated $4.4 million. |

| | - | | Launched a new Employee Resource Group, called REAL DEAL for employees with disabilities and the co-workers who support them. |

| Product: Sprint offers solutions that allow customers to minimize their environmental footprint, help drivers stay safe behind the wheel, and to empower seniors and people with disabilities through accessible technology. | | - | | Launched an Accessible Education ID Pack that makes it simple for students with print disabilities to access web-based educational content from their smartphone. |

| | - | | Worked with suppliers to launch two accessible mobile devices: Kyocera Kona, the first feature phone in the U.S. wireless industry to offer verbal translation enabling Internet browsing, and LG Optimus F3™, the first U.S. smartphone to come preloaded with TalkBack by Google. |

| | - | | Developed a new website focused on providing a variety of privacy, safety and security content and solutions for customers. |

| Planet: Sprint’s commitment to the planet means we strive to ensure responsible environmental stewardship in everything we do. | | - | | Published a new supplier guide which provides information to suppliers on how to meet Sprint’s materiality assessment and greenhouse gas measurement and reporting criteria. |

| | - | | Sponsored a report commissioned by the World Wildlife Fund and the Carbon Disclosure Project called “The 3% Solution,” which uses rigorous analysis from the world’s leading consulting firms to demonstrate how the U.S. corporate sector can drive millions of dollars in savings by investing in carbon reduction activities. |

Political Contributions

Our Nominating Committee has oversight of Sprint’s political contributions and expenses. Our Nominating Committee also reviews the Company’s annual report on political contributions and discusses this report with our board. The report is available on our website athttp://www.sprint.com/responsibility/gov-ethicspolicy/contributions.html. The report not only lists our contributions to political candidates during 2013, but it also describes the processes and oversight used in connection with such contributions.

| | | | |

| |

18 | Notice of Annual Meeting and Proxy Statement | | |  | |

Director Compensation

The compensation of our outside directors is partially equity-based and is designed to comply with our Corporate Governance Guidelines, which provide that the guiding principles behind our non-employee director compensation practices are: (1) alignment with stockholder interests; (2) preservation of independence; and (3) preservation of the fiduciary duties owed to all stockholders.

Components of Compensation

The following table summarizes director compensation for the members of Sprint Corporation’s board, with the exception of Messrs. Fisher, Hesse and Son. Our directors are also reimbursed for direct expenses relating to their activities as members of our board.

| | | | |

| Compensation Element | | Calendar Year

2013

Compensation | | Calendar Year

2014

Compensation |

| | | ($)(1) | | ($) |

Annual Retainer | | 80,000 | | 85,000 |

| | | |

Chairman Retainer | | N/A | | N/A |

| | | |

Audit Chair Retainer | | 20,000 | | 25,000 |

| | | |

Compensation Chair Retainer | | 15,000 | | 20,000 |

| | | |

Security Director Retainer(2) | | 155,000 | | 160,000 |

| | | |

Finance Chair Retainer | | N/A | | N/A |

| | | |

Nominating & Corporate Governance Chair Retainer | | N/A | | 15,000 |

| | | |

Special Chair Retainer(3) | | 10,000 | | 15,000 |

| | | |

Meeting Fees (per meeting): | | | | |

| | | |

In Person | | 2,000 | | 2,000 |

| | | |

Telephonic | | 1,000 | | 1,000 |

| | | |

Restricted Stock Units(4) | | Annual grant

value of 110,000 | | Annual grant

value of 150,000 |

| (1) | Reflects compensation program adopted upon closing of the SoftBank Merger. |

| (2) | Adm. Mullen does not receive an Annual Retainer. |

| (3) | Includes any non-standing committee of directors established from time to time, but excludes the Vacancy Resolution Committee. |

| (4) | Generally, restricted stock units or RSUs, underlying which are shares of our common stock, are granted each year on the date of the annual meeting of stockholders. Each grant vests in full upon the subsequent annual meeting. In addition, in connection with their appointments to the board. Mr. Claure, Adm. Mullen, and Ms. Tucker were granted sign-on RSU awards valued at $110,000. |

| | | | |

| |

| | | Notice of Annual Meeting and Proxy Statement | 19 | |

Mr. Son does not receive any fees for his service on our board. On August 6, 2013, our board determined Mr. Fisher’s compensation for serving as a member of our board. In recognition of his vice chairman activities, our board adopted a compensation program for Mr. Fisher, to provide as follows:

| | (1) | Annual cash retainer of $500,000; |

| | (2) | Annual grant of $500,000 in restricted stock units commencing on August 6, 2013 and each year thereafter at the annual stockholders’ meeting and vesting in full upon the earlier of the subsequent annual stockholders’ meeting or the first anniversary of the date of the grant; and |

| | (3) | Other benefits as described below. |

Other Benefits

We believe that it serves the interests of our company and our stockholders to enable our outside directors to utilize our communications services. Accordingly, each outside director, except Mr. Son, is entitled to receive wireless devices, including accessories and the related wireless service, wireline long distance services, and long distance calling cards with a maximum limit of $12,000 per year. Outside directors may also receive specialized equipment, on an as-needed basis, with equipment valued at greater than $1,000 requiring Compensation Committee approval. In addition to the value of the communications service, the value of any additional services and features and the value of the wireless devices, replacements and associated accessories are included in the value of the communications benefit. There may be other circumstances in which devices are provided to board members (such as demonstration, field testing, and training units, or devices for use while

traveling internationally); these devices must be returned or they will be converted to a consumer account and applied toward the wireless devices under this communications benefit.

Our outside directors, except Mr. Son, are eligible for our charitable matching gifts program. Under this program, the Sprint Foundation matches contributions made to qualifying organizations on a dollar-for-dollar basis, up to the annual donor maximum of $5,000. The annual maximum contribution per donor, per organization, is $2,500.

We do not offer retirement benefits to outside directors, except that our communications benefit as described above continues after retirement from board service provided members have served on our board for at least three years, and the benefit will continue for such members for the period of time our board member served on our board (including service on the Sprint Nextel board).

Deferred Compensation Plans

We maintain a Deferred Compensation Plan, a nonqualified and unfunded plan under which our outside directors can defer receipt of all or part of their annual and additional retainer fees and meeting fees into various investment funds and stock indices, including a fund that tracks our shares of common stock. During the transition period ended March 31, 2014, no directors participated in our Deferred Compensation Plan. Our directors may also participate in our Directors’ Shares Plan, under which they can elect to use all or part of their annual and additional retainer fees and meeting fees to purchase shares of our common stock in lieu of receiving cash payments. Our outside directors can also elect to defer receipt of these shares. During

| | | | |

| |

20 | Notice of Annual Meeting and Proxy Statement | | |  | |

the transition period, no directors participated in our Directors’ Shares Plan.

On an annual basis, our outside directors are given the opportunity to either enroll in or discontinue their participation in one or both of these plans. Our directors are also provided the opportunity to elect before the end of each calendar year to defer the receipt of shares underlying any portion of any RSU awarded in the following calendar year. Four of our Outside Directors elected to defer the receipt of shares underlying their 2014 RSU awards vesting in 2015.

Stock Ownership Guidelines

Our board believes directors should have a meaningful financial stake in the company, and therefore has established a desired ownership level for non-employee directors of equity or equity interests. To the extent any director has not met this minimum ownership level, each such director is expected to retain at least half of his or her shares or share equivalents (for example, options or restricted stock units)

awarded by Sprint, subject to our board’s consideration of individual circumstances.

Our director stock ownership guidelines currently require outside directors, other than SoftBank Affiliate Directors (Messrs. Son, Fisher and Claure), to hold equity or equity interests equal to at least five times the annual board retainer amount (in other words $425,000 while the current $85,000 retainer is in place). To the extent any outside director has not met this minimum ownership level, each such director is expected to retain at least half of his or her shares or share equivalents awarded by us. Our board retains flexibility to grant exceptions to the guidelines based on its consideration of individual circumstances. Our board increased required ownership effective January 1, 2014. For 2013, the minimum ownership level was three times the annual board retainer. As of March 31, 2014, each of our directors with the exception of Adm. Mullen, Mr. Ianna, and Ms. Tucker met the stock ownership requirements.

| | | | |

| |

| | | Notice of Annual Meeting and Proxy Statement | 21 | |

2014 Director Compensation Table

On February 20, 2014, our Board resolved to change our fiscal year end from December 31 to March 31, effective March 31, 2014 in order to align our fiscal year with SoftBank. The table below sets forth the compensation earned by our outside directors who served during the three month transition period ended March 31, 2014.

Compensation information for Mr. Hesse, our President and Chief Executive Officer, can be found in the “Executive Compensation” section of this proxy statement.

| | | | | | | | |

| Name | | Fiscal Year | | Fees Earned

or Paid in Cash ($)(1) | | Stock

Awards

($)(2) | | Total

($) |

| Robert R. Bennett | | 3 months ended

March 31, 2014 | | 39,500 | | — | | 39,500 |

| Gordon M. Bethune | | 3 months ended

March 31, 2014 | | 35,250 | | — | | 35,250 |

| Marcelo Claure | | 3 months ended

March 31, 2014 | | 30,250 | | 110,000 | | 140,250 |

| Ronald D. Fisher | | 3 months ended

March 31, 2014 | | 125,000 | | — | | 125,000 |

| Frank Ianna | | 3 months ended

March 31, 2014 | | 30,250 | | — | | 30,250 |

| Adm. Michael G. Mullen | | 3 months ended

March 31, 2014 | | 47,000 | | — | | 47,000 |

| Masayoshi Son | | 3 months ended

March 31, 2014 | | N/A | | — | | — |

| Sara Martinez Tucker | | 3 months ended

March 31, 2014 | | 28,125 | | — | | 28,125 |

| (1) | Consists of annual retainer fees, chairman and committee chair fees, and board and committee meeting fees. |

| (2) | Represents the grant date fair value of 13,480 RSUs granted to Mr. Claure on February 19, 2014 in connection with his appointment to the board in January 2014. The grant date fair value is calculated in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. For a discussion of the assumptions used in determining the compensation cost associated with stock awards, see note 2 of the Notes to the Consolidated Financial Statements in our transition report onForm 10-K for the three-month transition period ended March 31, 2014. As of March 31, 2014, our outside directors, except Mr. Son, held stock awards in the form of RSUs as follows: Mr. Bennett—16,750, Mr. Bethune—16,750, Mr. Claure—13,480, Mr. Fisher—71,736, Mr. Ianna—16,750, Adm. Mullen—15,782, and Ms. Tucker—17,214. Although we issued no cash dividends during the first quarter of 2014, it is our policy that any cash dividend equivalents on the RSUs granted to the outside directors are reinvested into RSUs, which vest when the underlying RSUs vest. |

| | | | |

| |

22 | Notice of Annual Meeting and Proxy Statement | | |  | |

Audit Committee Report

The Audit Committee has reviewed and discussed our audited consolidated financial statements with management. The Audit Committee has also discussed with the independent registered public accounting firm the matters required to be discussed by Auditing Standard No. 16, issued by the Public Company Accounting Oversight Board, or PCAOB, in Rule 3200T.

The Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm its independence.

The Audit Committee met with senior management periodically during 2014 to consider the adequacy of our internal controls and discussed these matters with our independent registered public accounting firm and with appropriate financial personnel. The Audit Committee also discussed with senior management our disclosure controls and procedures and the certifications by our CEO and our Chief Financial Officer, or CFO, which are required for certain of our filings with the SEC. The Audit Committee met privately with the independent registered public accounting firm, our internal auditors and other members of management, each of whom has unrestricted access to the Audit Committee.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the board that our audited consolidated financial statements be included in our transition report on Form 10-K for the transition period ended March 31, 2014 for filing with the SEC.

The Audit Committee

Robert R. Bennett, Chair

Frank Ianna

Sara Martinez Tucker

| | | | |

| |

| | | Notice of Annual Meeting and Proxy Statement | 23 | |

Compensation Discussion and Analysis

In connection with our change in fiscal year, this compensation discussion and analysis describes and analyzes our compensation program for our named executive officers for both the three-month transition period ended March 31, 2014 (Transition Period) as well as for the 12-month fiscal year ended December 31, 2013 (fiscal year 2013).

The named executive officers for the Transition Period were: Daniel R. Hesse, President and CEO; Joseph J. Euteneuer, CFO; Dow Draper, President, Prepaid; Steven L. Elfman, President, Products and Services; and Robert L. Johnson, President, Sprint Retail and Chief Service and Information Technology Officer.

Compensation Overview

Philosophy and Objectives of Our Executive Compensation Program

| | • | | Attract and retain qualified and experienced executives by providing base salaries, target incentives, and benefits that are market competitive and by requiring that a large portion of total compensation is earned over a multi-year period and subject to forfeiture to the extent that vesting requirements and performance objectives are not met; |

| | • | | Pay for performance by tying a substantial portion of our executives’ compensation opportunities directly to, and rewarding them for, our performance through short- and long-term incentive compensation plans that include performance objectives most critical to driving our continued financial and operational improvement and long-term stockholder value; and |

| | • | | Align compensation with stockholder interests by structuring our compensation programs to align executive interests with those of our stockholders, mitigate the possibility that our executives undertake excessively risky business strategies, and adhere to corporate governance best practices. |

Components of Our Executive Compensation Program

The major components of our executive compensation program are base salary, our short-term incentive compensation (STIC) plan, and our long-term incentive compensation (LTIC) plan. The base salaries as of March 31, 2014 and target opportunities under our fiscal year 2013 STIC and LTIC plans for our named executive officers are listed below.

| | | | | | | | | | | | |

| Named Executive Officer | | Base Salary ($) | | | 2013 STIC Plan ($)(1) | | | 2013 LTIC Plan ($)(2) | |

Hesse | | | 1,200,000 | | | | 2,400,000 | | | | 13,800,000 | |

Euteneuer | | | 775,000 | | | | 1,007,500 | | | | 4,025,000 | |

Draper(3) | | | 375,000 | | | | 147,303 | | | | — | |

Elfman | | | 650,000 | | | | 812,500 | | | | 3,737,500 | |

Johnson | | | 625,000 | | | | 625,000 | | | | 1,840,000 | |

| (1) | The amount for Mr. Draper reflects his target opportunity for the second half-year performance period from July 1, 2013 through December 31, 2013 under the 2013 STIC plan. See “—Performance and Key Compensation Decisions—STIC Plan.” Mr. Draper was not employed by Sprint before July 1, 2013 and therefore did not participate in Sprint’s 2013 STIC plan during the first half-year performance period. |

| | | | |

| |

24 | Notice of Annual Meeting and Proxy Statement | | |  | |

| (2) | As adjusted for the one-time overall 2013 LTIC plan target opportunity increase of 15% in connection with the SoftBank Merger, as discussed below. |

| (3) | Mr. Draper did not participate in Sprint’s 2013 LTIC plan but received a sign-on award on September 10, 2013 of 131,579 RSUs, which had a total market value on the grant date of $832,895. |

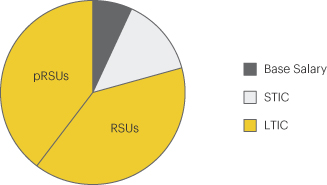

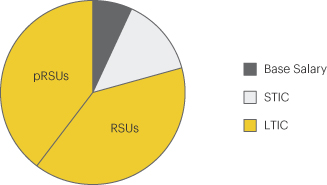

CEO Compensation Ratio

Our mix of fixed and performance-based compensation target opportunities under the 2013 STIC and LTIC plans for Mr. Hesse is illustrated by the following:

Performance and Key Compensation Decisions

Fiscal year 2013 marked one of the most eventful years in Sprint’s history. We successfully completed the SoftBank Merger, which strengthened Sprint’s balance sheet and provided capital for continued investment in the modernization of our network, allowing us to upgrade our technology, expand our service offerings and to improve the quality and reliability of our product offerings. The SoftBank Merger also has allowed Sprint to leverage SoftBank’s operational and technological expertise. We also completed the acquisition (Clearwire Acquisition) of the remaining equity interests in Clearwire Corporation and its consolidated subsidiary Clearwire Communications LLC that we did not previously own, from which we expect to fully utilize and integrate Clearwire’s complementary 2.5 gigahertz (GHz) spectrum and tower resources for use in conjunction with our network modernization plan. In addition, we shut down the iDEN network in 2013, and through our network modernization project, we are repurposing the 800 megahertz (MHz) iDEN spectrum and are continuing our buildout of fourth generation (4G) services using Long Term Evolution (LTE). We also unveiled Sprint SparkSM, a combination of advanced network and device technology capable of delivering up to 50-60 Mbps peak speeds today with increasing speed potential over time.

The Company also recognized the benefits of leadership continuity in light of the transformative SoftBank Merger and the ongoing execution of our network modernization plans. As a result, the Company entered into a new employment agreement in fiscal year 2013 with Mr. Hesse, which replaced his prior employment agreement. The agreement provides for a term through July 31, 2018, subject to earlier termination as provided in the agreement. The agreement provides for an annual base salary of $1,200,000 and participation in our STIC and LTIC plans. Also in fiscal year 2013, Mr. Hesse was granted a one-time award of 1,733,102 RSUs and 1,733,102 stock options. The RSUs and stock options vest on the fifth anniversary of their grant or, if earlier, upon an involuntary termination without cause or resignation with good

| | | | |

| |

| | | Notice of Annual Meeting and Proxy Statement | 25 | |

reason, or upon death or disability, and are subject to certain restrictions, including Mr. Hesse’s compliance with the restrictive covenants in his employment agreement and clawback at the discretion of the board of any value related to his knowing or intentional fraudulent or illegal conduct. These awards were intended to enhance our ability to retain Mr. Hesse’s leadership for a minimum period of at least five years during which the Company plans to undergo a transformative change.

We continued to build on the successes of fiscal year 2013 throughout the Transition Period, as we delivered operating income of $420 million, representing our best performance on this metric in over seven years. We also launched the revolutionary new FramilySM plan during the Transition Period, which quickly became the fastest growing Sprint rate plan on record.

STIC Plan

Our STIC plan is our annual cash incentive plan, which is intended to ensure that annual incentives are tied to the successful achievement of critical operating and financial objectives that are the leading drivers of sustainable increases in stockholder value. As required under the SoftBank Merger Agreement, the Compensation Committee used two six-month performance periods for determining amounts payable under the 2013 STIC plan. The two six-month performance periods for 2013 provided flexibility to revisit the performance criteria at mid-year due to the anticipated transformative SoftBank Merger in 2013. The first performance period was from January 1, 2013 through June 30, 2013, and the second period was from July 1, 2013 through December 31, 2013. The SoftBank Merger closed on July 10, 2013. Each performance period had discrete performance objectives, and participants generally had to be employed on December 31, 2013 in order to receive compensation for either period.

The table below summarizes our key priorities during fiscal year 2013 and throughout the Transition Period as well as the metrics selected in support of these priorities, and the rationale for why each was chosen by the Compensation Committee.

| | | | |

| Priority | | Objective | | Rationale |

Customer Experience | | Sprint platform postpaid subscriber churn, which is a measure of our ability to retain our subscribers who pay for their wireless service on a contract basis, typically for one- or two-year periods. | | Measures the degree to which we retain our most profitable subscribers. |

Strengthening our Brand | | Sprint platform net additions, which is a measure of the new wireless subscribers we gain, net of deactivations. | | Measures the degree to which we have attracted new subscribers to the Sprint brand. |

Generating Cash | | Adjusted EBITDA, which means Adjusted Operating Income Before Depreciation and Amortization less severance, exit costs and other special items. Includes certain impacts from the SoftBank Merger and Clearwire Acquisition that were not included in the standalone plan from which the 2013 STIC targets were established. | | Measures our ability to generate cash and profit, which are critical to our ability to invest in our business and service our debt. |

| | | | |

| |

26 | Notice of Annual Meeting and Proxy Statement | | |  | |

The Compensation Committee approved the effective aggregate payout percentage for the 2013 STIC plan at 118.96% of the target award opportunity for all eligible employees who participated in the 2013 STIC plan for the full fiscal year 2013, including our named executive officers, based on actual performance results. Our 2013 STIC plan objectives, targets, and actual results are summarized in the tables below.

| | | | | | | | |

| Fiscal Year 2013 First Half-Year Performance Period |

| Objective | | Weight | | Target | | Actual Results | | Percent Payout |

Sprint Platform Postpaid Subscriber Churn | | 30% | | 1.87% | | 1.83% | | 116.7% |

Sprint Platform Net Additions | | 20% | | 549,000 | | 989,000 | | 200.0% |

Adjusted EBITDA | | 50% | | $2,582 million | | $2,782 million | | 200.0% |

First Half-Year Payout | | 175.01% |

| | | | | | | | |

| Fiscal Year 2013 Second Half-Year Performance Period |

| Objective | | Weight | | Target | | Actual Results | | Percent Payout |

Sprint Platform Postpaid Subscriber Churn | | 30% | | 1.88% | | 2.03% | | 28.56% |

Sprint Platform Net Additions | | 20% | | 223,000 | | (212,000) | | 0% |

Adjusted EBITDA | | 50% | | $2,909 million | | $2,930 million | | 110.53% |

Second Half-Year Payout | | 63.83% |

Payouts under the 2013 STIC plan were capped at 200% of target opportunity. The payout for the second half-year performance period was computed by adding the first half-year performance achievements that were above the 200% payout level for Sprint platform net additions and adjusted EBITDA to the second half-year achievement. We outperformed our adjusted EBITDA target for each of the six-month periods during fiscal year 2013; however, we underperformed on our performance objectives set for Sprint platform postpaid subscriber churn and Sprint platform net additions in the second half of 2013, despite having highest-ever Sprint platform subscribers at December 31, 2013 of 53.9 million. This occurred at a time of continued modernization of our network, including our expansion of 4G LTE to more than 200 million people and launching Sprint SparkTM in 11 markets as of December 31, 2013.

Our Compensation Committee did not establish financial and operational objectives and respective weightings and targets for the Transition Period. As a result, no payouts under our STIC plan related to performance during the Transition Period were made.

LTIC Plan

Our LTIC plan is designed to encourage retention, link payment of performance-based awards to achievement of financial and operational objectives critical to our long-term success, and create commonality of interests between our executives and our stockholders. By dovetailing with the STIC plan, it is also intended to create balance between short-term, or annual, performance goals and longer-term objectives that are critical to growing and sustaining stockholder value. We granted two types of awards under our 2013 LTIC plan:

| | • | | Time-based restricted stock units (RSUs)—vest on February 27, 2016. |

| | • | | Performance-based RSUs—vest on February 27, 2016, with payout conditioned on achievement of a predetermined performance objective during a single two-year performance period of 2014-2015. |

| | | | |

| |

| | | Notice of Annual Meeting and Proxy Statement | 27 | |

The Compensation Committee selected the following primary objective to support our efforts with respect to the performance-based RSUs under the 2013 LTIC plan:

| | | | |

| Priority | | Objective | | Rationale |

Generating Cash | | Cumulative adjusted EBITDA | | Measures our ability to generate cash and profit, which are critical to our ability to invest in our business and service our debt. |

The Compensation Committee selected cumulative adjusted EBITDA as the primary objective in order to emphasize long-term focus on earnings and growing subscribers and revenues. Sprint offers wireless services on a postpaid and prepaid payment basis to retail subscribers and also on a wholesale and affiliate basis, which includes the sale of wireless services that utilize the Sprint network but are sold under a wholesaler’s brand. Payment on the adjusted EBITDA objective noted above in excess of 150% up to 200% of the targeted opportunity is contingent on achieving an additional objective of retail net subscriber additions, which includes both prepaid and postpaid additions but excludes wholesale and affiliate additions. The Compensation Committee believes use of retail net subscriber additions supports Sprint’s core focus of growing our subscriber base. Failure to attain the minimum threshold achievement level on the cumulative adjusted EBITDA performance objective results in forfeiture of the associated opportunity.

Pursuant to the terms of the SoftBank Merger Agreement, we delayed the grant of awards under the 2013 LTIC plan until after closing of the SoftBank Merger. As a result, awards under the 2013 LTIC plan were not granted on our typical schedule in February. Recognizing that participants would have received additional RSUs through the SoftBank Merger’s equity exchange process in the absence of this delay of the traditional February grant and that participants would have benefited from the value creation since February 2013 with respect to those awards, the Compensation Committee increased participants’ overall 2013 LTIC plan target opportunities by 15%. The Compensation Committee decided such increase also was appropriate in order to reward participants for their performance in the first half of 2013. The adjusted target opportunities under the 2013 LTIC plan for our executives are reflected in “—Compensation Overview—Components of Our Executive Compensation Program.” Mr. Draper did not participate in our 2013 LTIC plan, but he received a sign-on award of time-based RSUs on September 10, 2013, which is reflected in “—Compensation Overview—Components of Our Executive Compensation Program.”

Consistent with its decisions regarding the STIC plan for the Transition Period, our Compensation Committee did not establish financial and operational objectives and respective weightings and targets for the Transition Period. As a result, no grants under our LTIC plan related to performance were made during the Transition Period.

Corporate Governance Highlights

We endeavor to maintain good governance standards, including with respect to our executive compensation practices. Several highlights are listed below:

| | • | | Our named executive officers are subject to a clawback provision in our incentive compensation programs, under which we may recover payouts thereunder to the extent based on financial results or operating metrics impacted by the named executive officer’s knowing or intentional fraudulent or illegal conduct. |

| | | | |

| |

28 | Notice of Annual Meeting and Proxy Statement | | |  | |

| | • | | We have stock ownership guidelines. See “—Other Components of Executive Compensation—Stock Ownership Guidelines;” |

| | • | | Our named executive officers receive few perquisites, entitlements or elements of non-performance-based compensation, except for market-competitive salaries and modest benefits that are comparable to those provided to all employees; |

| | • | | Our severance benefits are positioned conservatively relative to market practices, with no benefit in excess of two times base salary plus annual incentive, change-in-control benefits payable only upon a “double-trigger” qualified termination, and no golden parachute excise tax gross-ups; and |

| | • | | The Compensation Committee retains Frederic W. Cook & Co., Inc. (Cook) as an independent advisor that performs no other work for the Company. |

Setting Executive Compensation

Role of Compensation Consultant and Executive Officers