Defined Financial Terms

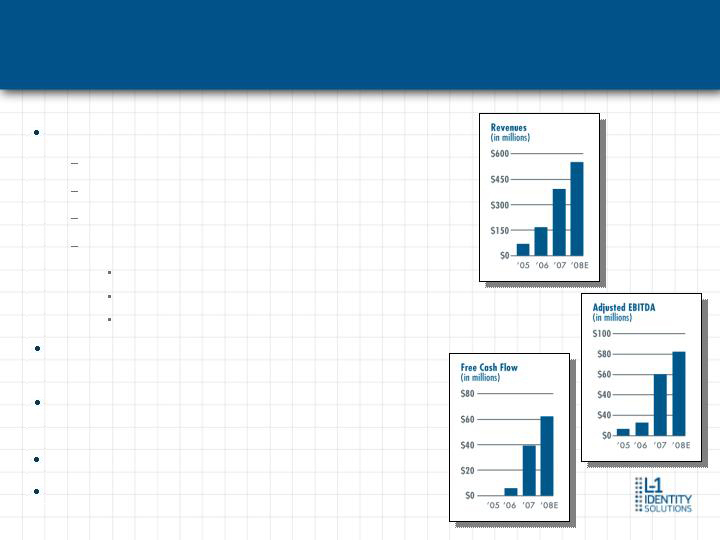

Adjusted EBITDA

L-1 Identity Solutions uses Adjusted EBITDA as a non-GAAP financial performance measurement. Adjusted EBITDA is calculated by adding

back to net income (loss) interest, income taxes, depreciation, amortization, and stock-based compensation expense. Adjusted EBITDA is

provided to investors to supplement the results of operations reported in accordance with GAAP. Management believes Adjusted EBITDA is

useful to help investors analyze the operating trends of the business before and after the adoption of SFAS 123(R) and to assess the

relative underlying performance of businesses with different capital and tax structures. Management believes that Adjusted EBITDA

provides an additional tool for investors to use in comparing L-1 Identity Solutions financial results with other companies in the industry,

many of which also use Adjusted EBITDA in their communications to investors. By excluding non-cash charges such as amortization,

depreciation and stock-based compensation, as well as non-operating charges for interest and income taxes, L-1 Identity Solutions can

evaluate its operations and can compare its results on a more consistent basis to the results of other companies in the industry.

Management also uses Adjusted EBITDA to evaluate potential acquisitions, establish internal budgets and goals, and evaluate

performance.

L-1 Identity Solutions considers Adjusted EBITDA to be an important indicator of the Company's operational strength and performance of

its business and a useful measure of the Company's historical operating trends. However, there are significant limitations to the use of

Adjusted EBITDA since it excludes interest income and expense and income taxes, all of which impact the Company's profitability, as well

as depreciation and amortization related to the use of long term assets which benefit multiple periods. L-1 Identity Solutions believes that

these limitations are compensated by providing Adjusted EBITDA only with GAAP net income (loss) and clearly identifying the difference

between the two measures. Consequently, Adjusted EBITDA should not be considered in isolation or as a substitute for net income (loss)

presented in accordance with GAAP. Adjusted EBITDA as defined by the Company may not be comparable with similarly named measures

provided by other entities. A reconciliation of GAAP net income (loss) to Adjusted EBITDA is included in the press release for first Quarter

2008 Financial results.

28

Defined Financial Terms

Unlevered Free Cash Flow

Unlevered Free Cash Flow represents cash flow from operating activities, plus interest expense less capital expenditures L-1 believes

unlevered free cash flow is a useful measure for assessing the company's liquidity, meeting its debt service requirements and making

acquisitions. Unlevered free cash flow is not necessarily comparable to similar measures used by other entities and is not a substitute for

GAAP measures of liquidity such as cash flows from operating activities

Backlog

Backlog represents sales value of firm orders for products and services not yet delivered and, for long term executed contractual

arrangements (contracts, subcontracts, and customer commitments), the estimated future sales value of estimated product shipments,

transactions processed and services to be provided over the term of the contractual arrangements, including renewal options expected to

be exercised. For contracts with indefinite quantities backlog reflects estimated quantities based on current activity levels. Backlog will not

necessarily result in future revenue because firm orders may be cancelled, firm orders from governmental agencies may remain subject to

funding options, renewals may not be exercised by the customers, and the quantities ordered, the volume of transaction processed or

services to be provided may be less than estimated. Backlog includes deferred revenues. Contractual arrangements could be cancelled by

our customers without penalty for lack of performance. Contracts terminated by our customers for convenience generally would result in

recovery of actual costs incurred and profit, if any, on work performed through the date of cancellation

29