Corporate Overview

September 2008

Safe Harbor Statement

This presentation contains forward-looking statements that involve risks and uncertainties. Forward-looking

statements in this document and those made from time to time by L-1 Identity Solutions, Inc. through its senior

management are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of

1995. These forward-looking statements reflect the Company's current views based on management's beliefs and

assumptions and information currently available. Forward-looking statements concerning future plans or results

are necessarily only estimates, and actual results could differ materially from expectations. Certain factors that

could cause or contribute to such differences include, among other things, the availability of government funding

for L-1's products and solutions, the size and timing of federal contract awards, performance on existing and

future contracts, general economic and political conditions and other factors affecting spending by customers,

and the unpredictable nature of working with government agencies. Additional risks and uncertainties are

described in the Securities and Exchange Commission filings of the Company, including the Company's Form

10-K for year ended December 31, 2007 and Form 10-Q for the quarter ended June 30, 2008. The Company

expressly disclaims any intention or obligation to update any forward-looking statements.

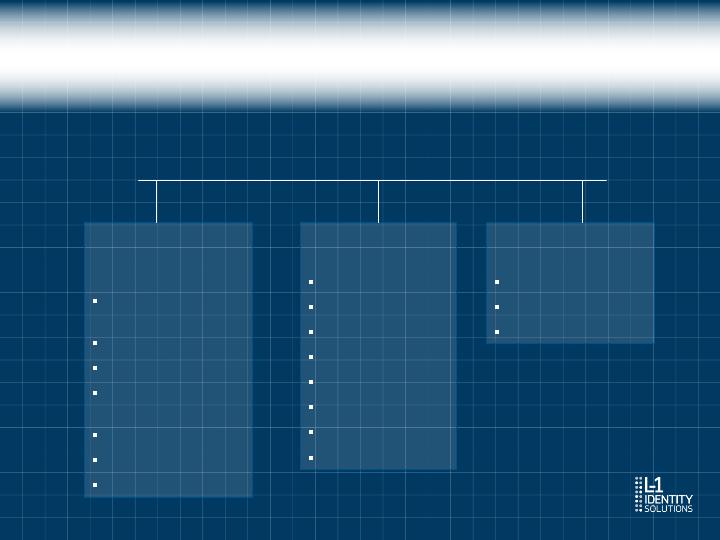

Evolution of Identity Management

Security, Defense and

Intelligence Issues

Industry Players

ID Management

Industry

L-1 Drives the Development of a

New Industry to Better Focus on

Identity Issues

Secure Credentialing

Biometrics

Access Control

Enrollment Services

Government Security

Consulting

L-1 Strategic Vision

Be the premier identity solutions company with customized and

interoperable solutions and services that meet any ID program

requirements, on time and in budget

Remain at the forefront of the latest advances in multi-modal biometric

recognition capabilities as a means to uniquely identify individuals

Use advanced technologies to produce the most secure identification

documents possible that serve as proof of identity

Offer government consulting services that address the most important

areas of security and intelligence in the U.S. today

Our commitment to shareholders is a disciplined fiscal

operating model that delivers strong and predictable results

Achieve organic growth in excess of 20% annually complemented by a

focused acquisition strategy

Profitable, with solid margins and strong cash flow

Deliver exceptional shareholder value

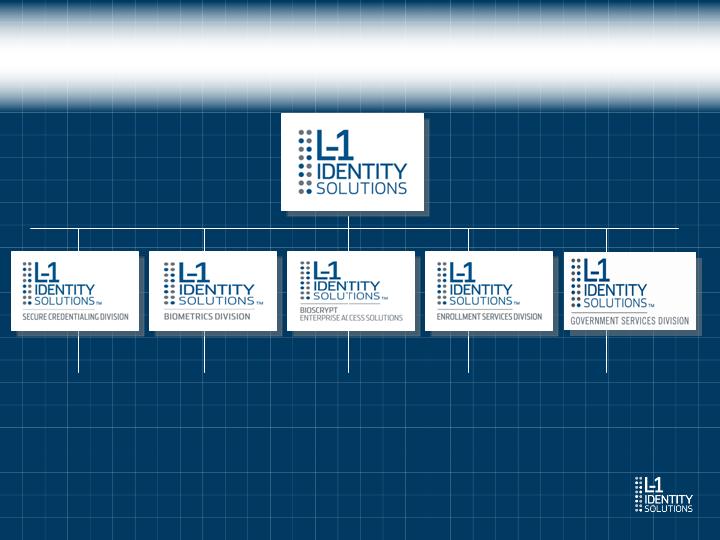

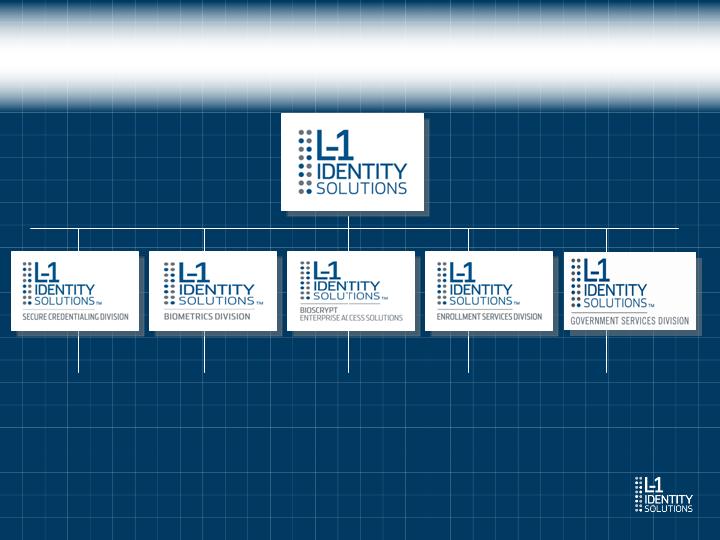

L-1 Identity Solutions

L-1 Identity Solutions Company

Secure Credentialing

Biometrics

Enrollment Services

Government Security Consulting

Human Intelligence

Engineering and Analytical Solutions

Information Technology

Enterprise Access Control

Proven management team and 2,200+ employees globally

Headquartered in Stamford, CT with offices

located throughout the U.S. and Europe

U.S. based technology development

NYSE: ID

Building a Leader in Identity Management

Identix

Iridian

SecuriMetrics

Viisage

Digimarc

Comnetix

IBT

Bioscrypt

McClendon

Advanced Concepts

Spectal

Customer-Driven Divisions

Biometrics

Division

Live scan

ABIS

Iris

Facial Recognition

Fingerprint

Mobile ID

Jail Management

Criminal

Secure

Credentialing

Division

Passports, Visas,

Passport Card, BCC

CAC

Driver’s License

Automated skills

testing

National ID

Voter Registration

Authentication

Access Control

Division

Fingerprint

Facial – 3D

Logical

ID Solutions

Government

Security Consulting

Services

Intelligence Services

Engineering &

Analytical Solutions

Information

Technology Services

Enrollment Services

Division

HAZPRINT

TWIC

Civil

- Day worker

- Healthcare

- Financial

- Insurance

- School employees

- Government employees

Criminal / law

enforcement

ID Services

Customer-Driven Divisions

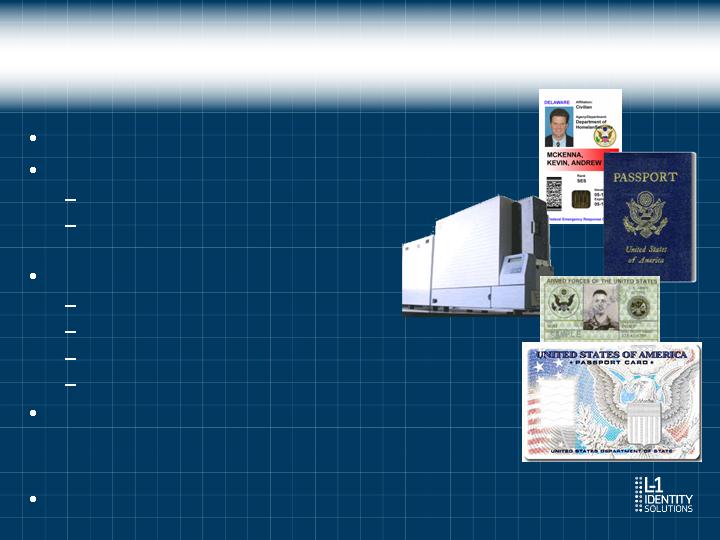

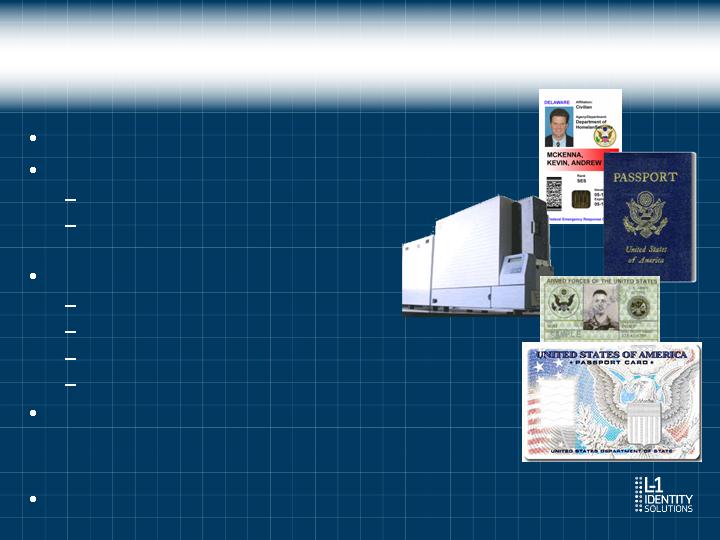

Secure Credentialing Division

Produced more than 500M secure

credentials to date

High resolution, non-fading image printing

Central issuance, over-the-counter,

hybrid DMV solutions

Key contracts

State driver’s licenses

Passport Card

Border Crossing Card

U.S. Passport

Combined with Digimarc ID Systems,

L-1 supports driver’s licenses

and ID cards in 41 states

International ID cards for 29 countries globally

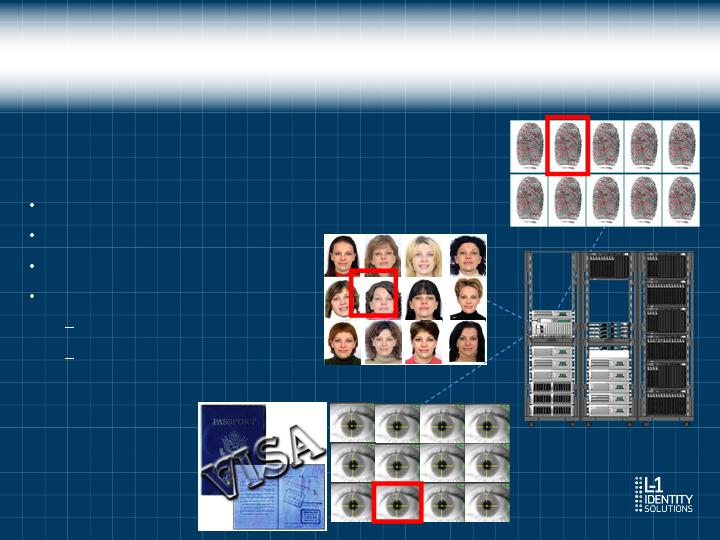

Biometrics Division

Pier-T

TouchPrint™

Booking Stations

DFR®

Readers

FaceIt®Quality

Assessment

and Capture

Software

TP-4800 Palm,

Slap & Roll

TP-4100

Photo Image

Capture and

Matching

System

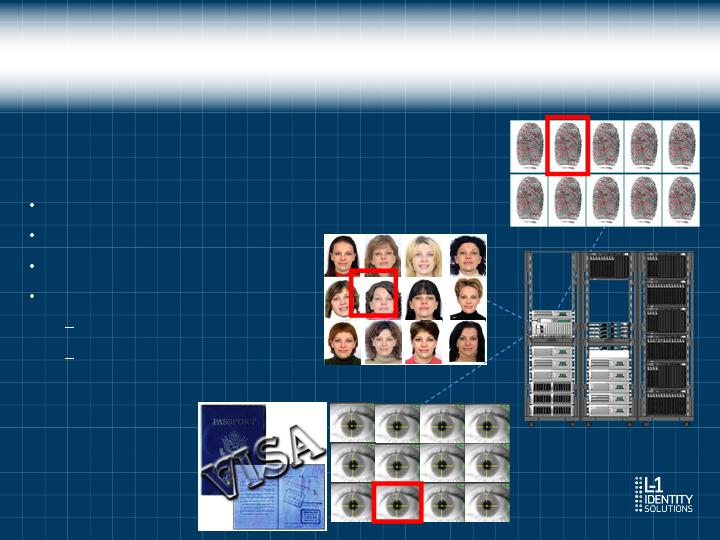

Large Scale Multi-Biometric Search Engines

ABIS®with Finger Face and/or Iris Matching

DoD ABIS (finger, face and iris)

State Driver’s Licenses

National ID & Voter Registration

State Department

Visa applications

70 million+ record database,

largest in the world!

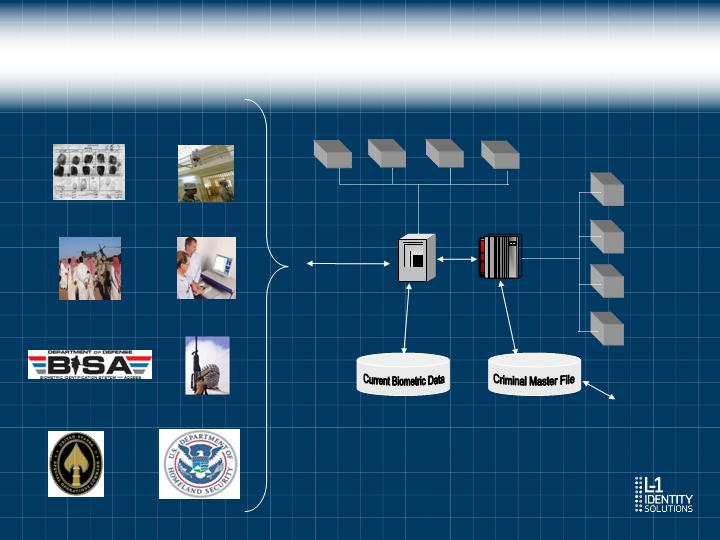

Biometrics Division

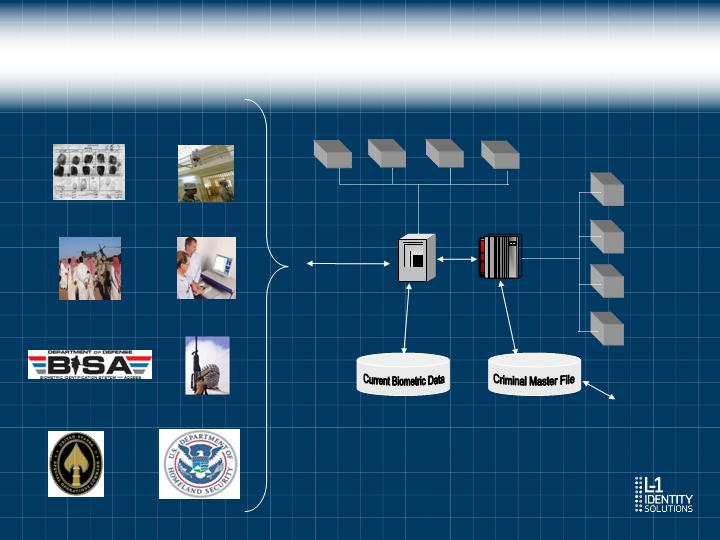

DoD Biometric

Fusion Center

FBI

CJIS

Other

Governmental

Organizations

DoD

Organizations

Arrestees

Biometrics Division

Detainees, Locally

Employed Personnel, etc.

Force Protection

Initiatives (FPI, MNFI)

Criminal Master Files

Enemy Prisoner of

War Records

Submission Sources

Terrorist/Crime

Scenes (Latent Prints)

Biometric Identification

System for Access

U.S. Government Agencies

Ingests Information from Any

Source and Searches Against Any

Biometric or Multiple Biometric

ABIS®

Biometrics Division

HIIDE™ - Finger Face and Iris

Integrated Biometric

Identity System

(IBIS) – Credential

and Fingerprint

Matching System

Identity Verification: Mobile ID

HIIDE™ Expansion Module

(EM) Jumpkits

HIIDE device

HIIDE Expansion Module

L-1 TouchPrint ™ 4100 Live Scan device for

slap and roll fingerprint capture

Battery

All in a highly compact and ruggedized case

NO LAPTOP REQUIRED

Access Control Solutions Division

Biometric physical and logical access control

Finger, face and/or iris physical access control linked to

logical access control security

ID enrollment software and mobile solutions

Strong presence in the commercial enterprise market with

over 400 global customers and an install base of over

260,000 access control units

Significant partners including Kronos, Honeywell, ADI,

Lenel and HP, among others

HSPD-12 PIV

Access System

Walkthrough

Facial Access

System

Wall Mounted Iris Access

Logical Access Credential

Manager

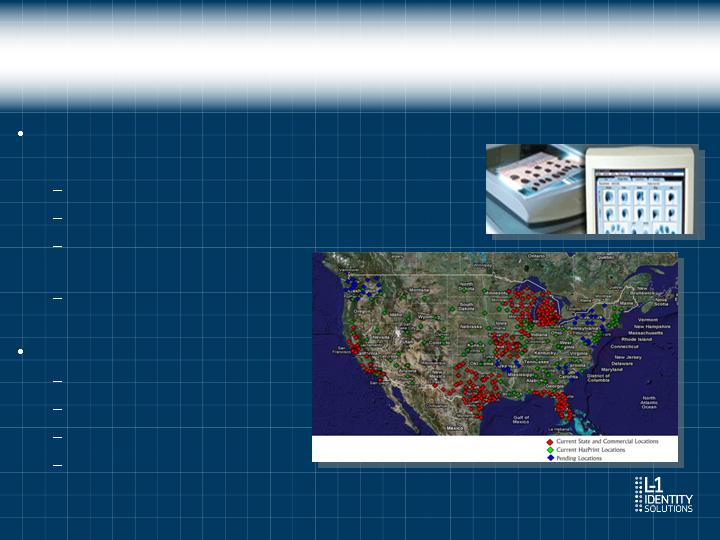

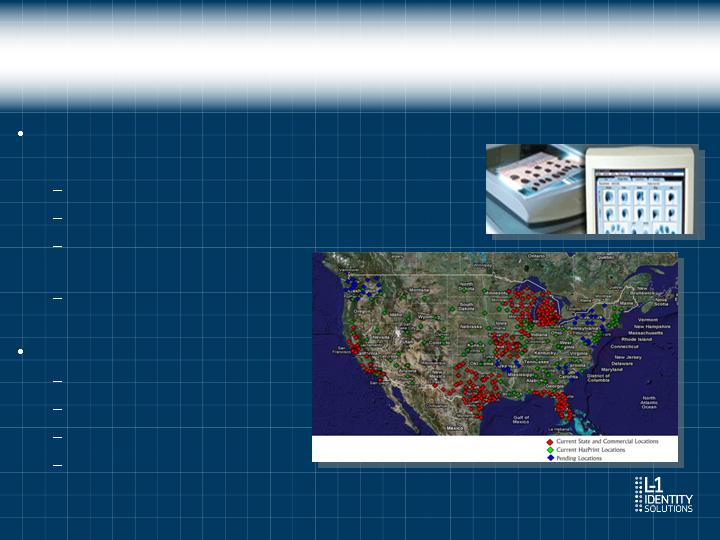

Enrollment Services Division

Total business & technology infrastructure for

outsourcing biometric capture

500+ locations across the USA and Canada

Presence in 46 states

4M people printed

to date

Service >1.2M

customers annually

Key contracts

HAZPRINT

HSPD-12

TWIC

State pre-employment

programs

Gov’t Security Consulting Services Divisions

Counterterrorism

Information sharing and analysis

Counterintelligence

Behavioral science

Vulnerability assessments

Surveillance and surveillance

detection

Computer forensics

Operational support

Training

Intelligence Services

formerly SpecTal

Imagery analysis

Spectral science, hyperspectral / multi-

spectral systems

Geospatial systems

Model making and prototype fabrication

Engineering & Analytical Solutions

formerly McClendon

Information assurance

Systems engineering

Telecommunications R&D

Public safety consulting

Information Technology Solutions

formerly Advanced Concepts

2008 Highlights

CONTRACT WINS

U.S. Passport Card ($215M,

5 years)

U.S. Border Crossing Card

($24.8M, 5 years)

HIIDEs, PIERs, HIIDE EMs,

Jumpkits (approx. $16.4M)

Driver’s license extensions

(>$16M)

Project Management Office

Defense Travel System (PMO-

DTS) ($50M, 5 year BPA)

RT program expanded at new

airports and terminals

Support kiosks in 17 U.S. airports

MILESTONES

Digimarc ID Systems and

Bioscrypt acquisitions

completed

Released latest iris

algorithm, Daugman '08

Enrollment services

processing increased 36%

Introduced 3D face reader

for physical access control

Launched next generation

TenPrint and palm reader

International voter and

national ID systems

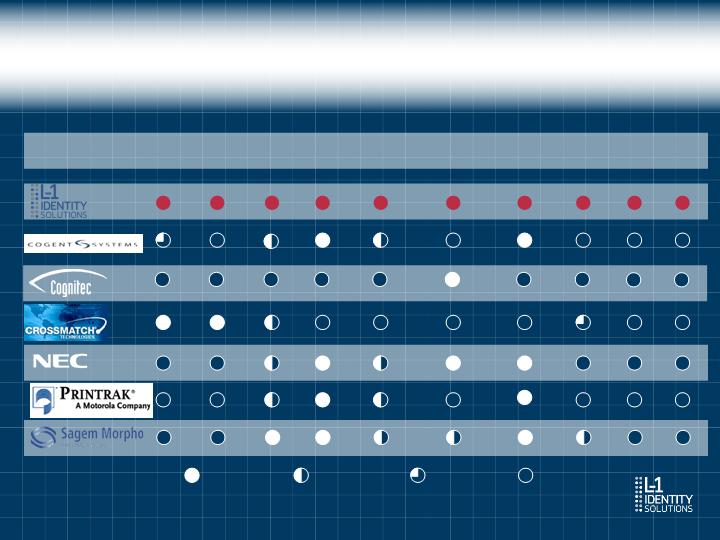

Partners

Robust open architecture technologies encourage

many prime contractors look to partner on large

contracts:

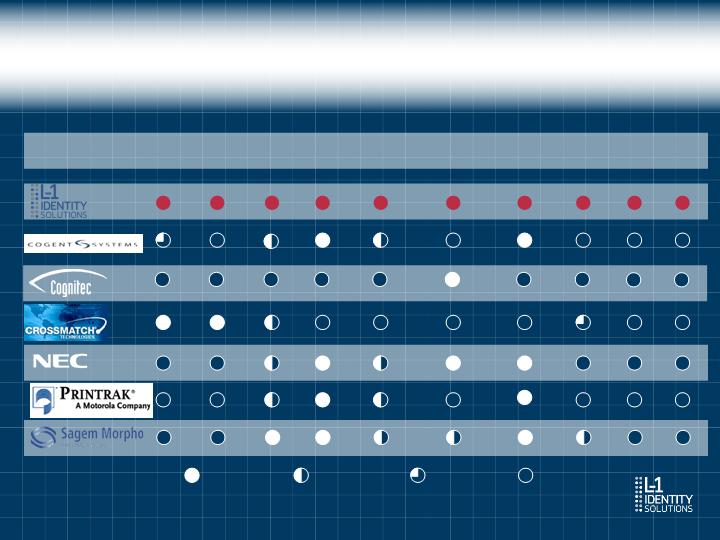

Competitive Landscape

Strong Presence

Limited Presence

No Presence

Minimal Presence

Mobile

ID

Full

Hand

Biometric

Data-Mining

AFIS

Facial

Recognition

Intel

Svcs

Live

Scan

Iris

Credentialing

(Pay-by-Click)

ABIS

Quarterly Financial Review

$0.04

$0.03 – $0.05

($0.02)

($0.06)

EPS

$22.5m

$20m - $22m

$14.1m

$3.8m

Adj. EBITDA

$145m

$135m - $145m

$90.1m

$24.9m

Revenues

Q2’08(A)

Q2’08(E)

Q2’07(A)

Q2’06(A)

Q3’08 Forecast

$0.04 – $0.06

$0.02

($0.66)

EPS

$20m - $23m

$19.1m

($1.0)m

Adj. EBITDA

$140m - $150m

$115.5m

$39.8m

Revenues

Q3’08(E)*

Q3’07(A)

Q3’06(A)

*Excludes Digimarc ID Systems business

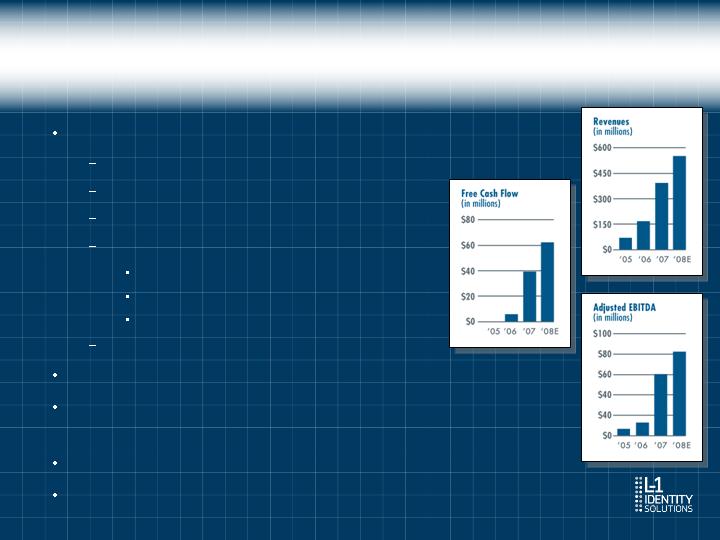

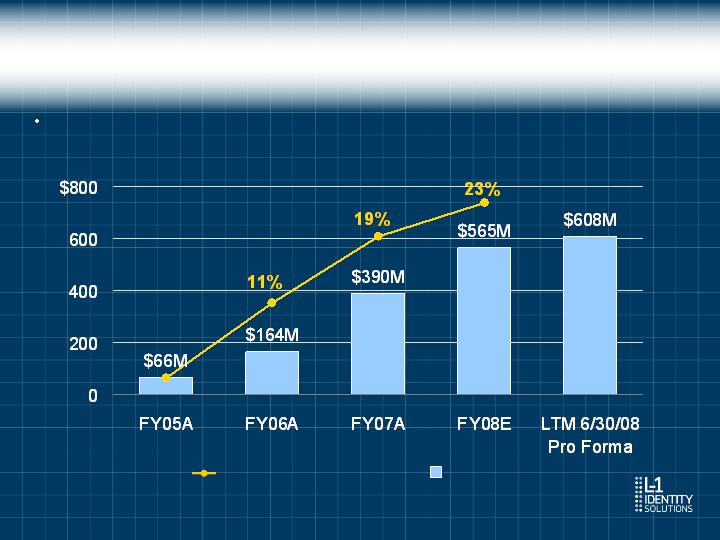

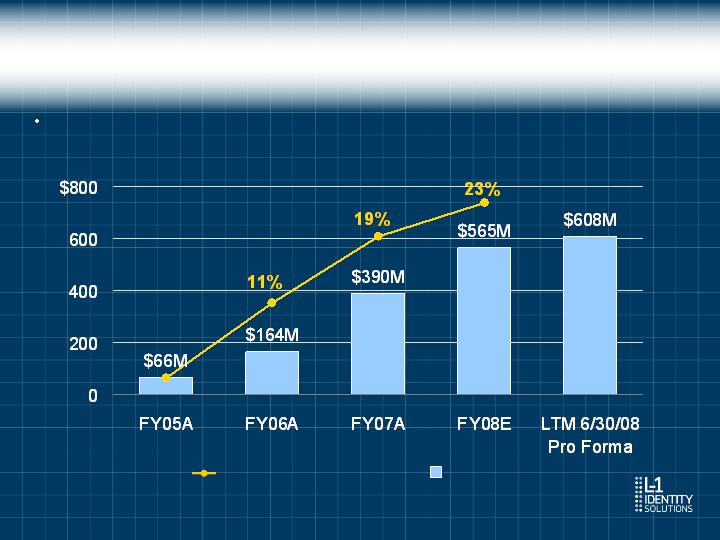

FY’05/’06/’07 Review and FY’08 Expectations

Free Cash Flow

EPS

Adj. EBITDA

Revenue

($0.2)

($0.37)

$6.6m

$66.2m

FY’05 (A)

$9.0m

($0.71)

$23.6m

$164.4m

FY’06 (A)

$39.7m

$0.24

$60.1m

$389.5

FY’07 (A)

$63m

$0.12

$83m

$565m

FY’08 (E)

$70m

N/A

$101m

$608m

Pro Forma

LTM 6/30/08

(a) After adding back non-recurring charges of $3.3 million

(b) Using mid-point of expected range

(c) Includes ID Systems business of Digimarc, Bioscrypt, ACI & McClendon as if they had been acquired on

7/1/07 and excludes the impact of non-recurring items

(a)

(a)

(c)

(b)

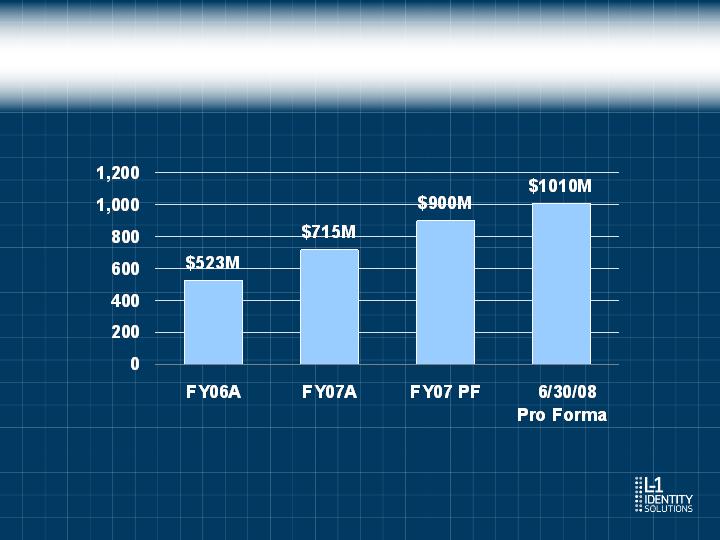

Total Revenues

(**)

Organic Growth

($ in millions)

(*) Only includes nine months of Bioscrypt.

(**) Includes ID Systems business of Digimarc, Bioscrypt, ACI & McClendon as if they had been

acquired on 7/1/07 and excludes the impact of non-recurring items

Strong total and organic revenue growth

Proven Revenue Growth Track

Revenue CAGR 105%

(*)

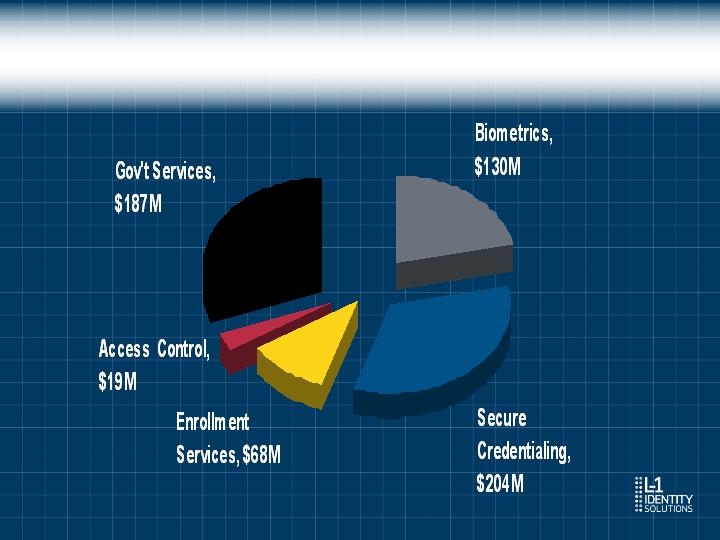

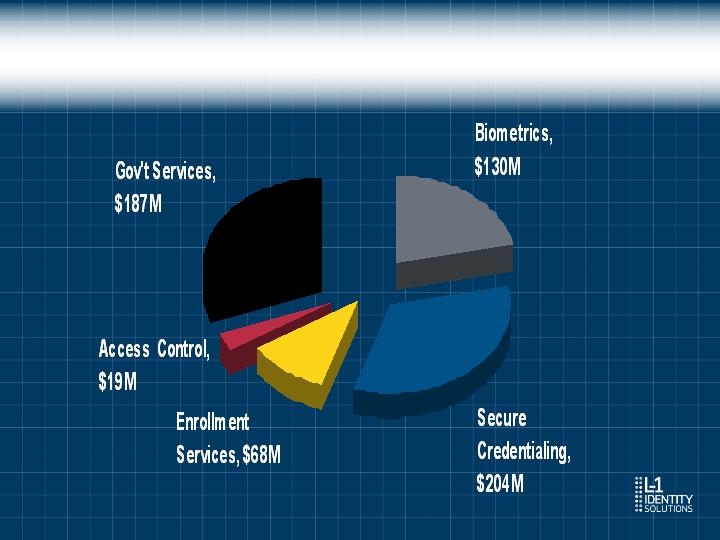

Revenue Mix by Division

LTM 6/30/08 Pro-Forma Includes ID Systems business of Digimarc, Bioscrypt, ACI & McClendon as if they had been

acquired on 7/1/07 and excludes the impact of non-recurring items

($ in millions)

Solid Adjusted EBITDA

EBITDA CAGR 132%

EBITDA 10% 15% 15% 15% 17%

Margins

(a)

(a) Includes ID Systems business of Digimarc, Bioscrypt, ACI & McClendon as if they had been acquired

on 7/1/07 and excludes the impact of non-recurring items

Management’s focus on high value solution offerings, working capital and the

growing backlog has led to significant increases in Cash Flow

($ in millions)

(a) Includes ID Systems business of Digimarc, Bioscrypt, ACI & McClendon as if they had been acquired

on 7/1/07 and excludes the impact of non-recurring items

Strong Cash Generation

EBITDA

Unlevered Free Cash Flow

(a)

($ in millions)

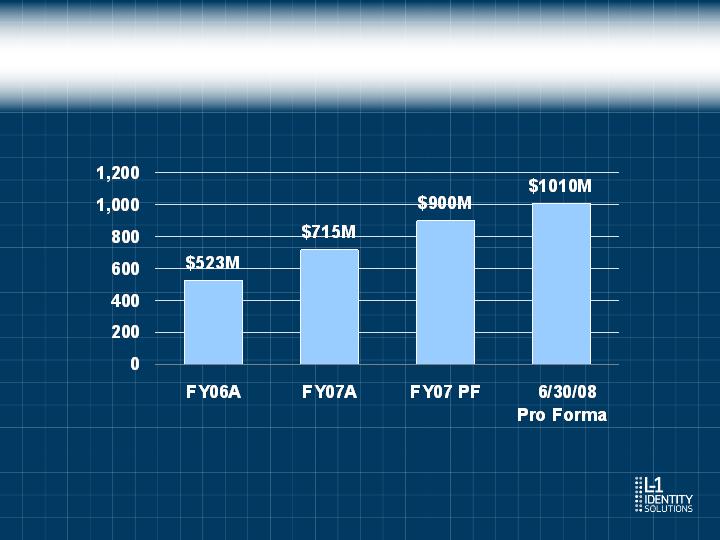

Growing Backlog Provides Significant

Visibility and Stability

Ending Backlog

Pro Forma 12/31/07 backlog of $900M represents approximately 90% of

Pro Forma 2008 sales including growth on existing contracts

Backlog is Diversified and Growing

Summary

Multi-modal strategy validated by strong

customer momentum

Continue to build expertise with talented,

experienced professionals

Capabilities to address most viable potential

biometric markets

Address ID management challenges with

customized solutions

Strong organic revenue, significant decrease of

operating expenses and profit growth of 20%

Increase growth margin with emphasis on

software and Intellectual Property

Defined Financial Terms

Adjusted EBITDA

L-1 Identity Solutions uses Adjusted EBITDA as a non-GAAP financial performance measurement. Adjusted EBITDA is calculated by adding

back to net income (loss) interest, income taxes, depreciation, amortization, and stock-based compensation expense. Adjusted EBITDA is

provided to investors to supplement the results of operations reported in accordance with GAAP. Management believes Adjusted EBITDA is

useful to help investors analyze the operating trends of the business before and after the adoption of SFAS 123(R) and to assess the

relative underlying performance of businesses with different capital and tax structures. Management believes that Adjusted EBITDA

provides an additional tool for investors to use in comparing L-1 Identity Solutions financial results with other companies in the industry,

many of which also use Adjusted EBITDA in their communications to investors. By excluding non-cash charges such as amortization,

depreciation and stock-based compensation, as well as non-operating charges for interest and income taxes, L-1 Identity Solutions can

evaluate its operations and can compare its results on a more consistent basis to the results of other companies in the industry.

Management also uses Adjusted EBITDA to evaluate potential acquisitions, establish internal budgets and goals, and evaluate

performance.

L-1 Identity Solutions considers Adjusted EBITDA to be an important indicator of the Company's operational strength and performance of

its business and a useful measure of the Company's historical operating trends. However, there are significant limitations to the use of

Adjusted EBITDA since it excludes interest income and expense and income taxes, all of which impact the Company's profitability, as well

as depreciation and amortization related to the use of long term assets which benefit multiple periods. L-1 Identity Solutions believes that

these limitations are compensated by providing Adjusted EBITDA only with GAAP net income (loss) and clearly identifying the difference

between the two measures. Consequently, Adjusted EBITDA should not be considered in isolation or as a substitute for net income (loss)

presented in accordance with GAAP. Adjusted EBITDA as defined by the Company may not be comparable with similarly named measures

provided by other entities. A reconciliation of GAAP net income (loss) to Adjusted EBITDA is included in the press release for first Quarter

2008 Financial results. A reconciliation of Adjusted EBITDA to net income for the historical periods has been included in the press

releases for the respective periods. No reconciliation has been presented for Pro Forma LTM 6/30/08 since the net income for such period

is not available.

Defined Financial Terms

Unlevered Free Cash Flow

Unlevered Free Cash Flow represents cash flow from operating activities, plus interest expense less capital expenditures L-1 believes

unlevered free cash flow is a useful measure for assessing the company's liquidity, meeting its debt service requirements and making

acquisitions. Unlevered free cash flow is not necessarily comparable to similar measures used by other entities and is not a substitute for

GAAP measures of liquidity such as cash flows from operating activities

Backlog

Backlog represents sales value of rm orders for products and services not yet delivered and, for long term executed contractual

arrangements (contracts, subcontracts, and customer commitments), the estimated future sales value of estimated product shipments,

transactions processed and services to be provided over the term of the contractual arrangements, including renewal options expected to

be exercised. For contracts with indenite quantities backlog reects estimated quantities based on current activity levels. Backlog will not

necessarily result in future revenue because rm orders may be cancelled, rm orders from governmental agencies may remain subject to

funding options, renewals may not be exercised by the customers, and the quantities ordered, the volume of transaction processed or

services to be provided may be less than estimated. Backlog includes deferred revenues. Contractual arrangements could be cancelled by

our customers without penalty for lack of performance. Contracts terminated by our customers for convenience generally would result in

recovery of actual costs incurred and prot, if any, on work performed through the date of cancellation