2005 Plan does not purport to be complete and is qualified in its entirety by reference to the full text of the 2005 Plan, which was included as Appendix B to our Definitive Proxy Statement on Form 14A, filed with the SEC on September 7, 2005.

The purposes of the 2005 Plan are to attract and retain the best available personnel for positions of substantial responsibility, to provide additional incentive to employees and directors, and to promote the success of our business. Options, stock purchase rights and other stock-based awards may be granted under the 2005 Plan. This will give the Company greater flexibility in providing stock-based incentive compensation to our employees and directors than is currently available under the Company’s existing stock option plans.

The 2005 Plan is administered by the Board of Directors, which may delegate its powers under the 2005 Plan to one or more committees or sub-committees of the Board of Directors. Subject to the provisions of the 2005 Plan, the administrator of the 2005 Plan has authority in its discretion to: (1) determine fair market value of our common stock; (2) select employees and directors to whom awards may be granted; (3) determine the number of shares covered by awards; (4) approve forms of agreement for use under the 2005 Plan; (5) determine the terms and conditions of awards; (6) determine whether and under what circumstances an option may be settled in cash instead of common stock; (7) prescribe, amend or rescind rules and regulations relating to the 2005 Plan; and (8) construe and interpret the terms of the 2005 Plan and awards granted pursuant to the 2005 Plan. While we expect that the plan administrator will make awards from time to time under the 2005 Plan, it has no current plans, proposals or arrangements to make any specific grants under the 2005 Plan.

The stock subject to options and awards under the 2005 Plan is authorized but unissued shares of our common stock or shares of treasury common stock. Any shares subject to an option that for any reason expires or is terminated unexercised as to such shares and any restricted stock that is forfeited and repurchased by us at not more than its exercise price as a result of the exercise of a repurchase option may again be the subject of an option or award under the 2005 Plan. The number of shares of common stock that may be issued under the 2005 Plan as proposed to be amended may not exceed 4,000,000 shares, subject to adjustment, as described below.

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to public companies for compensation in excess of $1 million paid to the chief executive officer or any of the four other most highly compensated officers. Certain performance-based compensation is specifically exempt from the deduction limit if it otherwise meets the requirements of Section 162(m). One of the requirements for equity compensation plans is that there must be a limit to the number of shares granted to any one individual under the plan. Accordingly, the 2005 Plan provides that no participant may receive, over the term of the 2005 Plan, awards for more than an aggregate of 1,000,000 shares of common stock with respect to which awards may be granted under the 2005 Plan. Stockholder approval of this proposal will constitute stockholder approval of this limitation for Section 162(m) purposes.

Nonstatutory stock options, or NSOs, stock purchase rights and other stock-based awards (other than incentive stock options) may be granted to employees and directors. Incentive stock options, ISOs, may be granted only to employees. Each option will be designated in the stock option agreement as either an ISO or an NSO. As of December 31, 2006, we estimate that approximately

1,047 employees, as well as our twelve non-employee directors, were eligible to participate in the 2005 Plan. Notwithstanding the terms of any award under the 2005 Plan, in the event of certain misconduct by a participant, all awards to that participant will be terminated and all shares acquired by the participant under the 2005 Plan will be subject to repurchase by us at any time within 180 days after we have knowledge of such misconduct.

Terms and Conditions of Options

Exercise Price. The exercise price for shares issued upon exercise of options will be determined by the 2005 Plan administrator. The exercise price of ISOs may not be less than 100% of the fair market value on the date the option is granted. The exercise price of ISOs granted to a 10% or greater stockholder may not be less than 110% of the fair market value on the date of grant.

Form of Consideration. The means of payment for shares issued upon exercise of an option will be specified in each option agreement. The 2005 Plan permits payment to be made by cash, check, promissory note of the participant, wire transfer, other shares of our common stock (with some restrictions), consideration received by us under a cashless exercise program implemented by us in connection with the 2005 Plan, or any combination of the foregoing.

Term of Options. The term of an option may be no more than ten years from the date of grant, except that the term of an option granted to a 10% or greater stockholder may not exceed five years from the date of grant.

Termination of Employment. No option may be exercised more than three months following termination other than by reason of the participant’s death or disability, or such other period as set forth in the option agreement. If, on the date of termination, a participant is not fully vested, the shares covered by the unvested portion will revert to the 2005 Plan.

Death or Disability. An option is exercisable for 12 months following death of the participant or termination for a disability or such other period as set forth in the option agreement. If, on the date of death or termination, a participant is not fully vested, the shares covered by the unvested portion will revert to the 2005 Plan.

Other Provisions. The stock option agreement for each option grant may contain other terms, provisions and conditions not inconsistent with the 2005 Plan, as may be determined by the 2005 Plan administrator.

Terms and Conditions of Stock Purchase Rights

Rights to Purchase. Stock purchase rights may be issued either alone, in addition to, or in tandem with, other awards granted under the 2005 Plan and/or cash awards made outside of the 2005 Plan. The offer to purchase stock under the 2005 Plan will be accepted by execution by the participant of a stock purchase agreement.

Right of Repurchase. Unless the 2005 Plan administrator determines otherwise, the stock purchase agreement will give the Company the right to repurchase the stock sold upon the termination of the participant’s service to the Company or upon the failure to satisfy any performance objectives or other conditions specified in the stock purchase agreement. The repurchase price will be the purchase price paid by the participant or such other price as set forth in the stock purchase agreement. The repurchase right will lapse upon such conditions or at such rate as the 2005 Plan administrator may determine and set forth in the stock purchase agreement.

Other Stock-Based Awards

The 2005 Plan administrator will have the right to grant other awards based upon the Company’s common stock, having such terms and conditions as the 2005 Plan administrator may determine, including the grant of shares based upon certain conditions, the grant of securities convertible into common stock, the grant of stock appreciation rights and the grant of dividend equivalent rights.

Adjustments

Changes in Capitalization. In the event of a stock split, reverse stock split, stock dividend, recapitalization, combination of shares, reclassification of shares, spin-off or other similar change in

57

capitalization or event, or any distribution to holders of common stock other than a normal cash dividend, (1) the number and class of securities available under the 2005 Plan, (2) the per-participant limit, (3) the number and class of securities and exercise price per share subject to each outstanding award, (4) the price per share at which outstanding restricted shares may be repurchased, and (5) the terms of each other outstanding award will be appropriately adjusted (or substituted awards may be made, if applicable) to the extent that the administrator of the 2005 Plan determines, in good faith, necessary and appropriate.

Dissolution or Liquidation. The 2005 Plan administrator in its discretion may provide for a participant to have the right to exercise his or her award until 15 days prior to any dissolution or liquidation of the Company. To the extent not previously exercised, an award will terminate immediately prior to the consummation of any proposed dissolution or liquidation.

Sale of the Company. Except as otherwise provided in any stock option agreement or stock purchase agreement or other document evidencing such rights, in the event a third party acquires a majority of the voting power of the Company, whether through the sale of substantially all of its assets, the sale of its voting securities or a merger or consolidation, the 2005 Plan administrator, in its discretion, may provide for the assumption, substitution or adjustment of each outstanding award, accelerate the vesting of options and terminate any restrictions on stock awards, or cancel awards for a cash payment to the participant.

Limits on Transferability

An incentive stock option granted under the 2005 Plan may not be transferred during a participant’s lifetime and will not be transferable other than by will or by the laws of descent and distribution following the participant’s death. Nonstatutory stock options, stock purchase rights or shares granted under the 2005 Plan may be assigned during a participant’s lifetime to members of the participant’s family or to a trust established for such family members or the participant’s former spouse pursuant to the participant’s estate plan or pursuant to a domestic relations order.

Amendment and Termination

The Board of Directors of the Company may at any time amend, alter, suspend or terminate the 2005 Plan. The Board will obtain stockholder approval of any 2005 Plan amendment to the extent necessary and desirable to comply with applicable laws. No amendment, alteration, suspension or termination of the 2005 Plan will impair the rights of any participant, unless mutually agreed in writing.

Federal Income Tax Consequences

Incentive Stock Options — A participant who receives an ISO will recognize no taxable income for regular federal income tax purposes upon either the grant or the exercise of such ISO. However, when a participant exercises an ISO, the difference between the fair market value of the shares purchased and the option price of those shares will be includable in determining the participant’s alternative minimum taxable income.

If the shares are retained by the participant for at least one year from the date of exercise and two years from the date of grant of the options, gain will be taxable to the participant upon sale of the shares acquired upon exercise of the ISO, as a long-term capital gain. In general, the adjusted basis for the shares acquired upon exercise will be the option price paid with respect to such exercise. The Company will not be entitled to a tax deduction arising from the exercise of an ISO if the employee qualifies for such long-term capital gain treatment.

Nonstatutory Stock Options (NSOs ) — A participant will not recognize taxable income for federal income tax purposes at the time an NSO is granted. However, the participant will recognize compensation taxable as ordinary income at the time of exercise for all shares that are not subject to a substantial risk of forfeiture. The amount of such compensation will be the difference between the option price and the fair market value of the shares on the date of exercise of the option. The

58

Company will be entitled to a deduction for federal income tax purposes at the same time and in the same amount as the participant is deemed to have recognized compensation income with respect to shares received upon exercise of the NSO. The participant’s basis in the shares will be adjusted by adding the amount so recognized as compensation to the purchase price paid by the participant for the shares.

The participant will recognize gain or loss when he or she disposes of shares obtained upon exercise of an NSO in an amount equal to the difference between the selling price and the participant’s tax basis in such shares. Such gain or loss will be treated as long-term or short-term capital gain or loss, depending upon the holding period.

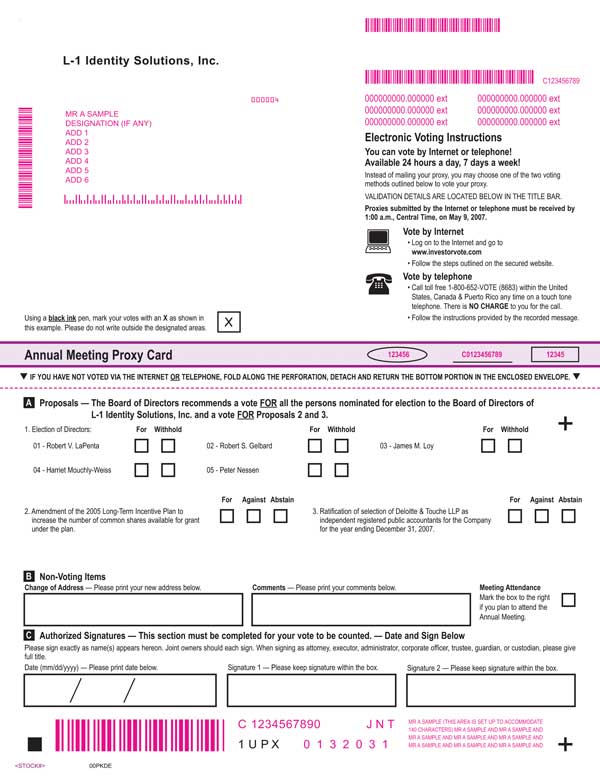

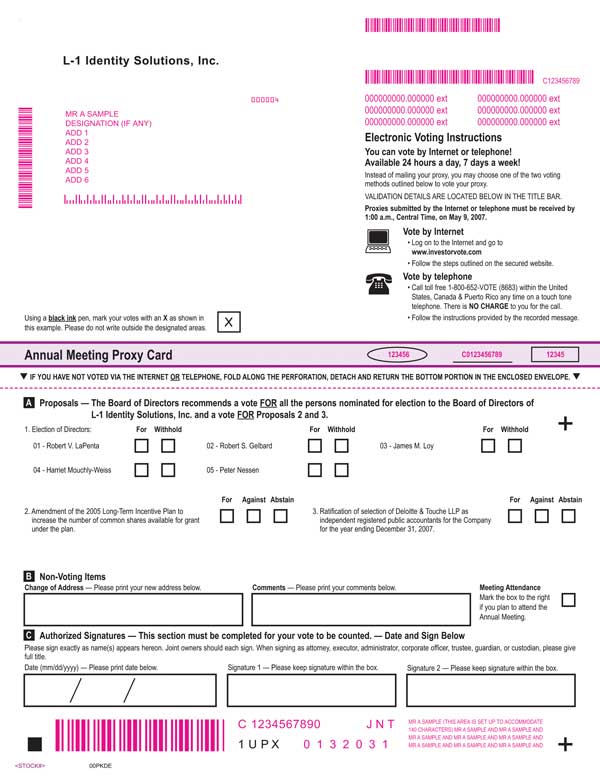

The Board of Directors recommends that the Amended Plan be approved by the stockholders.

See ‘‘EXECUTIVE COMPENSATION — REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS’’ included in this Proxy Statement for additional information concerning the Long-Term Incentive Plan.

The Board of Directors recommends a vote FOR this proposal.

59

PROPOSAL NO. 3

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Board of Directors recommends that the stockholders ratify the selection of Deloitte & Touche LLP, as our independent registered public accounting firm to audit our consolidated financial statements including those of our subsidiaries for the year ended December 31, 2007. The Audit Committee approved the selection of Deloitte &Touche LLP as our independent registered public accounting firm for 2007. Deloitte & Touche LLP is currently our independent registered public accounting firm.

The Board of Directors recommends a vote FOR this proposal.

Change of Independent Registered Public Accounting Firm

By letter dated March 21, 2006, BDO Seidman, LLP (‘‘BDO’’) notified the Company that BDO had resigned as the Company’s independent registered public accounting firm. BDO served as the Company’s independent registered public accounting firm since November 3, 1999.

During the two most recent fiscal years and through March 21, 2006, there have been no disagreements with BDO on any matter of accounting principles or practices, financial statement disclosures, or auditing scope or procedures, which disagreements, if not resolved to the satisfaction of BDO, would have caused BDO to make reference to the subject matter of the disagreement in connection with its reports on the financial statements for such periods.

During the two most recent fiscal years and through March 21, 2006, there have been no reportable events as described in Item 304(a)(1)(v) of Regulation S-K, other than the material weaknesses noted below.

BDO’s reports on the Company’s financial statements for the fiscal years ended December 31, 2005 and December 31, 2004 did not contain any adverse opinion or disclaimer of opinion, and were not qualified or modified as to audit scope or accounting principles, although the reports contained an explanatory paragraph in each year concerning a material uncertainty relative to a class action suit brought against the Company and its officers and board members. As described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005, BDO’s report on management’s assessment of the effectiveness of internal control over financial reporting and the effectiveness of internal control ov er financial reporting as of December 31, 2005 expressed the opinion that the Company did not maintain effective internal control over financial reporting due to the following material weakness: the ineffectiveness of the Company’s financial statement close process due to insufficient personnel within the accounting function to effect a timely and accurate financial statement close process with the necessary level of review and supervision. As described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004, BDO’s report on management’s assessment of the effectiveness of internal control over financial reporting and the effectiveness of internal control over financial reporting as of December 31, 2004, expressed the opinion that the Company did not maintain effective internal control over financial reporting due to the following material weaknesses: the lack of sufficient personnel resources and technical accounting expertise within the accounting funct ion to effect a timely financial close process and effectively evaluate and resolve non-routine and/or complex accounting transactions and the lack of control processes around information technology systems.

The Company provided BDO with a copy of the Current Report on Form 8-K filed on March 24, 2006 and Form 8-K/A filed April 3, 2006 related to this matter and requested that BDO furnish it with a letter addressed to the Securities and Exchange Commission, stating whether it agreed with the statements made by the Company, and if not, stating the respects in which it did not agree. By letter dated April 3, 2006, BDO stated that it agreed with the statements contained in the foregoing disclosure.

On May 1, 2006, the Audit Committee of the Company decided to engage Deloitte & Touche LLP as the Company’s independent registered public accounting firm commencing with the audit for the fiscal year ending December 31, 2006.

60

During the Company’s fiscal years ended December 31, 2005 and December 31, 2004 and the period from December 31, 2005 through May 1, 2006, neither the Company, nor anyone on its behalf, consulted with Deloitte & Touche LLP with respect to either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and no written report or oral advice was provided by Deloitte & Touche LLP that Deloitte & Touche LLP concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing, or financial reporting issue or (ii) a ny matter that was the subject of either a disagreement as defined in Item 304(a)(1)(iv) of Regulation S-K or a reportable event as described in Item 304(a)(1)(v) of Regulation S-K.

61

ANNUAL REPORT AND COMPANY INFORMATION

A copy of our 2006 Annual Report to stockholders on Form 10-K is being furnished to stockholders concurrently herewith. Exhibits to the Annual Report will be furnished to stockholders upon payment of photocopying charges.

PROPOSALS BY STOCKHOLDERS

Proposals that stockholders wish to include in our 2008 Proxy Statement and related form of proxy for presentation at our 2008 annual meeting of stockholders must be received by us at 177 Broad Street, Stamford, CT 06901, Attention of Mark S. Molina, Secretary, no later than February 25, 2008.

Any stockholder proposal must be in accordance with the rules and regulations promulgated by the SEC. With respect to proposals submitted by a stockholder other than for inclusion in our 2007 Proxy Statement and related form of proxy, timely notice of any stockholder proposal must be received by us in accordance with our By-Laws and our rules and regulations no later than February 25, 2008. Any proxies solicited by the Board of Directors for the 2008 annual meeting may confer discretionary authority to vote on any proposals notice of which is not timely received.

The notice shall set forth as to each matter the stockholder proposes to bring before the annual meeting: (i) a brief description of the proposal desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting, (ii) the name and address, as they appear on the Company’s books, of the stockholder proposing such business and of the beneficial owners (if any) of the stock registered in such stockholder’s name and the name and address of other stockholders known by such stockholder to be supporting such proposal on the date of the stockholder notice, (iii) the class and number of shares of the Company which are held of record, beneficially owned or represented by proxy by the stockholders and by any other stockholders known by such stockholder to be supporting such proposal on the record date for the annual meeting in question (if such date shall then have been made publicly available) and on the date of such stockholder’s notice, (iv) any material interest of the stockholder in such proposal and (v) any other information that is required to be provided by the stockholder pursuant to Regulation 14A under the Securities Exchange Act of 1934, in his or her capacity as a proponent to a stockholder proposal.

In order to include information with respect to a stockholder proposal in the Company’s Proxy Statement and related form of proxy for a stockholder’s meeting, stockholders must provide notice as required by the regulations promulgated under the Securities Exchange Act of 1934.

It is important that your proxy be returned promptly, whether by mail, by the Internet or by telephone. The proxy may be revoked at any time by you before it is exercised. If you attend the meeting in person, you may withdraw any proxy (including an Internet or telephonic proxy) and vote your own shares.

| By Order of the Board of Directors. |

| ROBERT V. LAPENTA

Chairman of the Board,

President and Chief Executive Officer |

62

Table of ContentsAnnex A

AMENDMENT TO THE

VIISAGE TECHNOLOGY, INC.

2005 LONG-TERM INCENTIVE PLAN

WHEREAS, L-1 Identity Solutions, Inc. (the ‘‘Company’’) maintains the Viisage Technology, Inc. 2005 Long-Term Incentive Plan (the ‘‘Plan’’) for the benefit of eligible employees and non-employee directors of the Company and its affiliates.

WHEREAS, the Board of Directors of the Company (the ‘‘Board’’) desires to amend the Plan to: (i) change the name of the Plan to reflect the change in the name of the Company and (ii) to increase the maximum aggregate number of Shares which may be subject to Awards and issued under the Plan; and

WHEREAS, Section 15 of the Plan provides that, subject to any legally necessary or desirable stockholder approval, the Board may amend the Plan at any time.

NOW, THEREFORE, in accordance with the foregoing, the Plan shall be amended as follows:

|  |  |

| 1. | Effective as of April 3, 2007, the name of the Plan shall be changed to the ‘‘L-1 Identity Solutions, Inc. 2005 Long-Term Incentive Plan’’ and ‘‘L-1 Identity Solutions, Inc.’’ shall be substituted for each reference in the Plan to ‘‘Viisage Technology, Inc.’’ |

|  |  |

| 2. | Effective as of the date that stockholder approval is obtained, the first section of Section 4(a) of the Plan shall be amended in its entirety as follows: |

‘‘Number of Shares. Subject to the provisions of Section 13 of the Plan, the maximum aggregate number of Shares which may be subject to Awards and issued under the Plan is 4,000,000 Shares.’’

IN WITNESS WHEREOF, and as evidence of the adoption of the Amendment set forth herein, the Board has caused this Amendment to be executed this 3rd day of April, 2007.

| L-1 IDENTITY SOLUTIONS, INC. |

| BY: /s/ Robert V. LaPenta

TITLE: Chairman of the Board, President and Chief Executive Officer |