Investor Presentation Jack Clancy, Chief Executive Officer Joe Lussier, Chief Financial Officer December 5, 2022

Disclaimer 2 This investor presentation has been prepared by Enterprise Bancorp, Inc., (the “Company” or “EBTC”) solely for informational purposes based on its own information, as well as information from public sources. Certain of the information contained herein may be derived from information provided by industry sources. The Company believes such information is accurate and that the sources from which it has been obtained are reliable. However, the Company has not independently verified such information and cannot guarantee the accuracy of such information. This investor presentation has been prepared to assist interested parties in making their own evaluation of the Company and does not purport to contain all of the information that may be relevant. In all cases, interested parties should conduct their own investigation and analysis of the Company and the data set forth in the investor presentation and other information provided by or on behalf of the Company. Cautionary Statement Regarding Forward-Looking Information This investor presentation contains statements about future events that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by references to a future period or periods or by the use of the words "believe," "expect," "anticipate," "intend," "estimate," "assume," "will," "should," "plan," and other similar terms or expressions. Forward-looking statements should not be relied on because they involve known and unknown risks, uncertainties and other factors, some of which are beyond the control of the Company. These risks, uncertainties, and other factors may cause the actual results, performance, and achievements of the Company to be materially different from the anticipated future results, performance or achievements expressed in, or implied by, the forward-looking statements. Factors that could cause such differences include, but are not limited to, general economic conditions, the impact of the ongoing COVID-19 pandemic and any current or future variants thereof, changes in market interest rates, the persistence of the current inflationary environment in the Company’s market areas and the United States, the uncertain impacts of quantitative tightening and current and future monetary policies of the Federal Reserve, regulatory considerations, competition and market expansion opportunities, changes in non-interest expenditures or in the anticipated benefits of such expenditures, the receipt of required regulatory approvals, changes in tax laws, and current or future litigation, regulatory examinations or other legal and/or regulatory actions, including as a result of the Company’s participation in and execution of government programs related to the COVID-19 pandemic and any current or future variants thereof. Therefore, the Company can give no assurance that the results contemplated in the forward-looking statements will be realized and readers are cautioned not to place undue reliance on the forward-looking statements contained in this press release. For more information about these factors, please see the Company’s reports filed with or furnished to the U.S. Securities and Exchange Commission (the "SEC"), including the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q on file with the SEC, including the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations." Any forward-looking statements contained in this investor presentation are made as of the date hereof, and the Company undertakes no duty, and specifically disclaims any duty, to update or revise any such statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

Disclaimer 3 Non-U.S. GAAP Financial Measures This presentation contains non-U.S. GAAP financial measures. For purposes of Regulation G promulgated by the SEC, a non-U.S. GAAP financial measure is a numerical measure of the registrant’s historical or future financial performance, financial position or cash flows that excludes amounts or is subject to adjustments that have the effect of excluding amounts that are included in the most directly comparable measure calculated and presented in accordance with U.S. GAAP in the statement of income, statement of financial condition or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented in this regard. U.S.GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, EBTC has provided reconciliations within this presentation, as necessary, of the non-U.S. GAAP financial measures to the most directly comparable U.S. GAAP financial measures. For more details on EBTC’s non-U.S. GAAP measures, refer to the Appendix in this presentation.

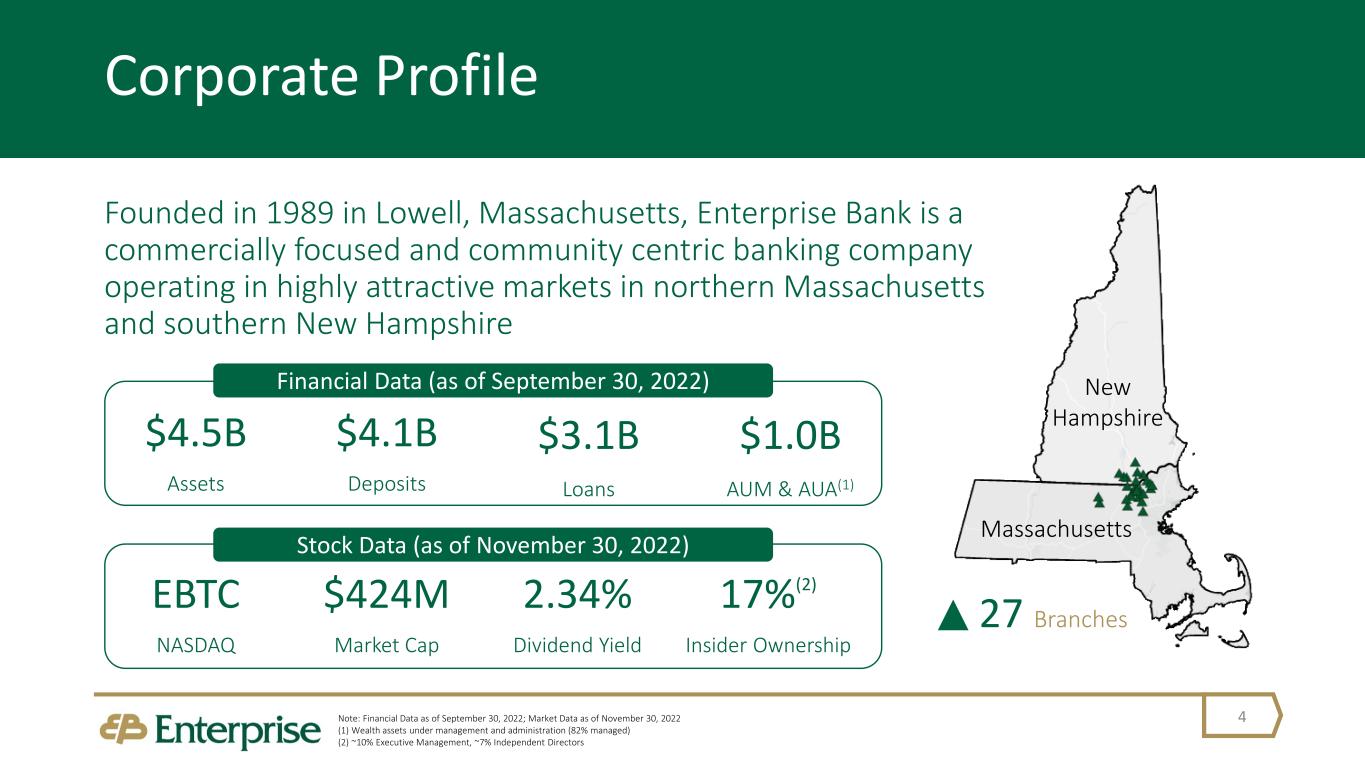

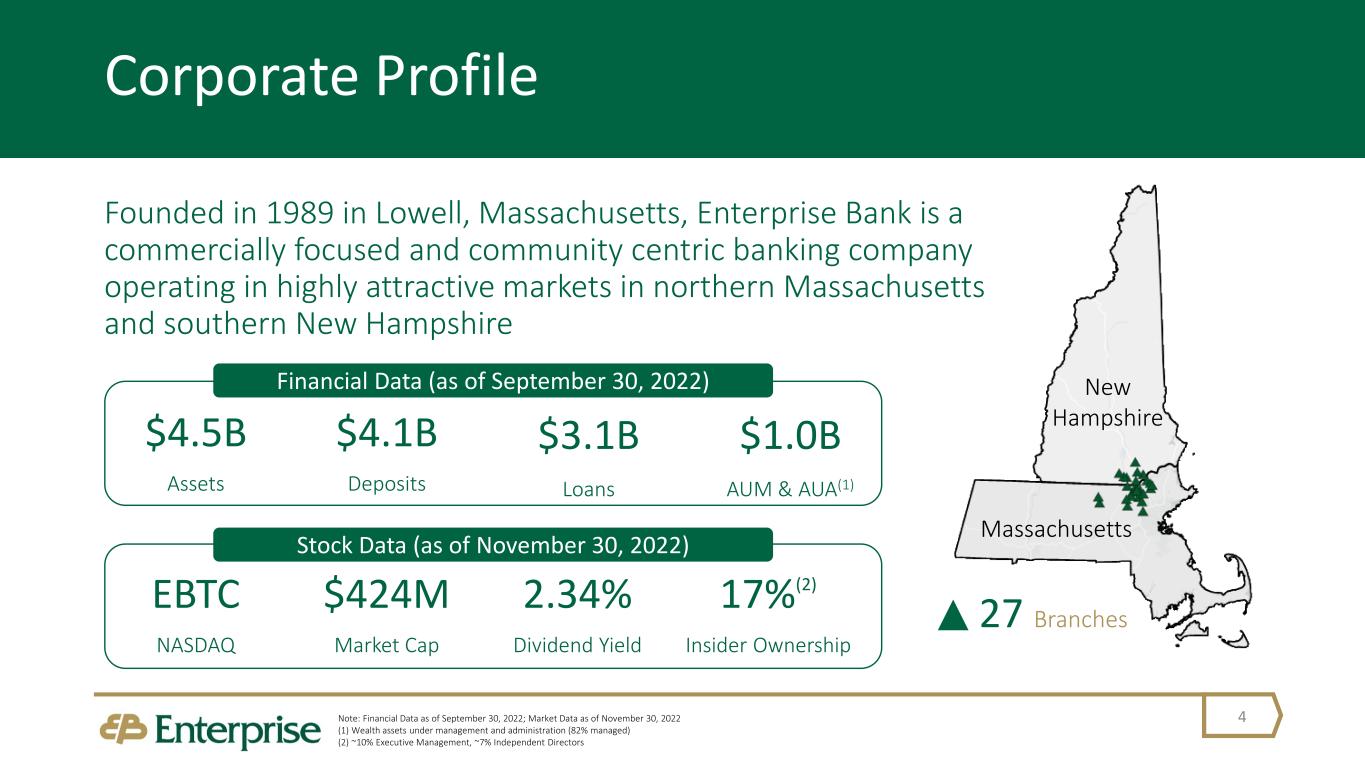

Corporate Profile Founded in 1989 in Lowell, Massachusetts, Enterprise Bank is a commercially focused and community centric banking company operating in highly attractive markets in northern Massachusetts and southern New Hampshire 4Note: Financial Data as of September 30, 2022; Market Data as of November 30, 2022 (1) Wealth assets under management and administration (82% managed) (2) ~10% Executive Management, ~7% Independent Directors Massachusetts New Hampshire$3.1B Loans $4.5B Assets $4.1B Deposits $1.0B AUM & AUA(1) 2.34% Dividend Yield EBTC NASDAQ $424M Market Cap 27 Branches 17%(2) Insider Ownership Financial Data (as of September 30, 2022) Stock Data (as of November 30, 2022)

Branch Footprint 5 27 branch locations serving 22 communities in carefully chosen, generally contiguous markets: 19 locations in Massachusetts Acton, Andover, Billerica (2), Chelmsford (2), Dracut, Fitchburg, Lawrence, Leominster, Lexington, Lowell (2), Methuen, North Andover, Tewksbury (2), Tyngsboro, Westford 8 locations in New Hampshire Derry, Hudson, Londonderry, Nashua (2), Pelham, Salem, Windham MA Branches NH Branches

Enterprise operates in vibrant economic markets with attractive demographics Highly regarded and recognized culture Experienced management team and Board of Directors that has an aligned interest through both meaningful insider and customer base ownership Dominant community bank in our footprint Operating philosophy that emphasizes low-cost, core funded deposits that will exhibit value in the high-interest rate environment Consistent history of strong growth and profitability Strong level of liquidity High quality commercial loan portfolio built on relationship banking Disciplined approach to credit and an above peer loan loss allowance level Investment Merits 6 Enterprise is a High-Quality, Relationship Driven, Community Bank Focused on Providing Long-Term Returns for Its Shareholders, Customers and Communities

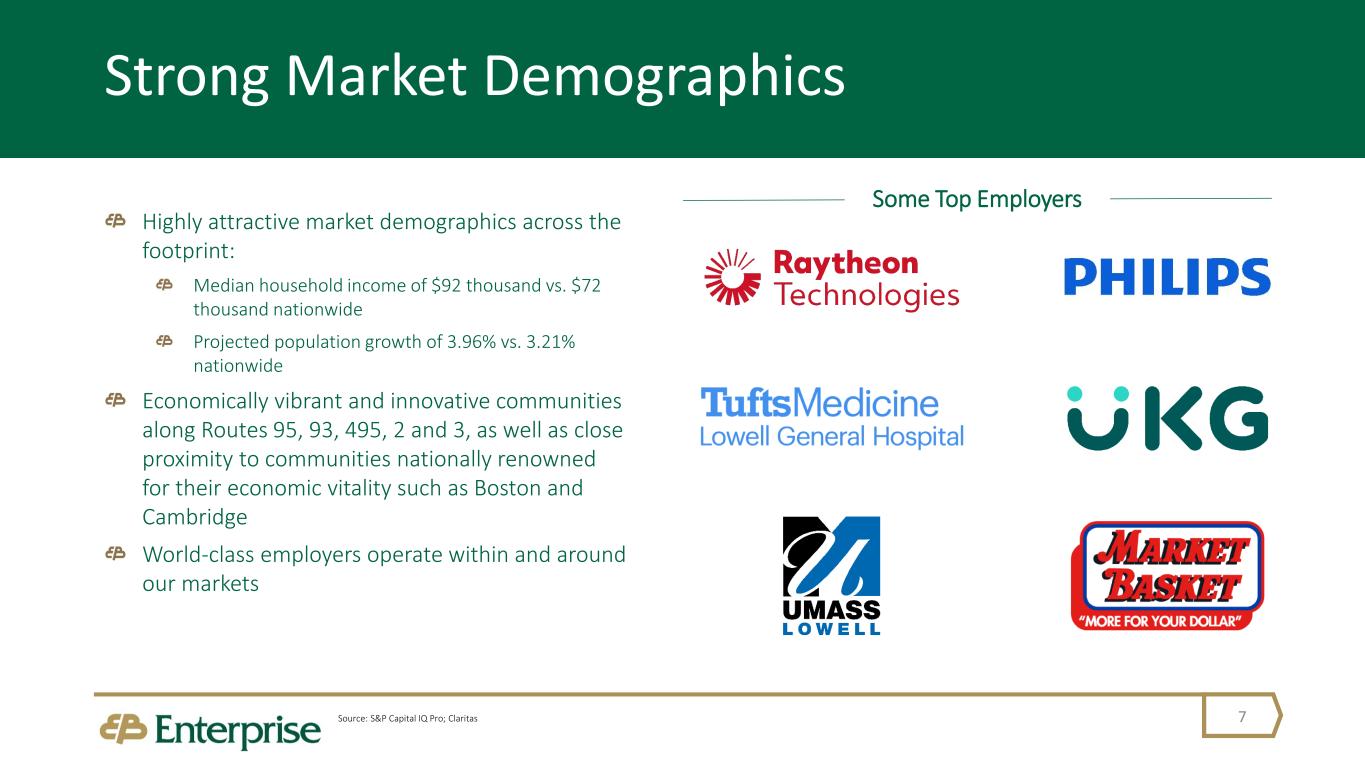

Strong Market Demographics 7Source: S&P Capital IQ Pro; Claritas Highly attractive market demographics across the footprint: Median household income of $92 thousand vs. $72 thousand nationwide Projected population growth of 3.96% vs. 3.21% nationwide Economically vibrant and innovative communities along Routes 95, 93, 495, 2 and 3, as well as close proximity to communities nationally renowned for their economic vitality such as Boston and Cambridge World-class employers operate within and around our markets Some Top Employers

A Highly Regarded Culture 8 Founded with a purpose to strengthen the economic fabric in our communities through our commitment to our customers’ success Recognized as a top place to work for eleven straight years by the Boston Globe Focused on the long-term with consistent investment in our team members, technology, and facilities Staffed with talented team members dedicated to exceptional service and a strong sales ethic Our Culture Our Non-Profit Collaborative, now in its 12th year, provides education seminars to our non-profit organizations and communities annually We supported over 400 organizations, both financially and through 24,000 volunteer hours, in 2021 Environmental, Social, & Governance Diversity, Equity, & Inclusion We celebrate and promote awareness of personal identity in the workplace to strengthen everyone’s sense of belonging within our Enterprise Bank family We promote a culture of team member engagement and invest in our people through numerous internal development and advancement programs Our team is comprised of 69% Women, 21% BIPOC/POC, 62% Women in Management, 12% BIPOC/POC in Management, 30% Women on our Board, 5% BIPOC/POC on our Board(1) (1) As of 6/30/2022

Experienced Leadership Team 9 Deep and highly experienced leadership team Average years with Enterprise – 24 years Average years in current roles – 14 years Strong and deep ties to the markets we serve Our leadership team has a high level of ownership Jack Clancy Chief Executive Officer Today’s Presenters Joe Lussier Chief Financial Officer Additional Participants Brian Bullock Chief Commercial Lending Officer Steve Larochelle Chief Banking Officer Mike Gallagher Chief Risk Officer

The Communities We Serve 10 Deposit Market Share in our Branch Footprint(1) (1) Based on FDIC branch data as of June 30, 2022 Note: Branch footprint based on communities listed on Slide 4 Deposits Deposit Rank Bank Branches ($MM) Market Share 1 Bank of America 15 5,826.6 20.0% 2 TD Bank 26 4,903.1 16.9% 3 27 4,018.4 13.8% 4 Citizens Financial 18 3,020.9 10.4% 5 Santander 26 2,905.1 10.0% 6 Lowell Five 12 1,245.3 4.3% 7 Bank of New England 5 893.9 3.1% 8 Middlesex Bancorp 2 631.9 2.2% 9 Eastern Bankshares 9 614.9 2.1% 10 Rollstone Bancorp 5 499.8 1.7% All Other Institutions 59 4,554.8 15.6% Total 204 28,114.7 100.0% Dominant market share within our primary markets Exceptional low-cost core deposit base Strong average branch size of ~$149 million with an average branch age of only 16 years Greater than 10% market share in 16 of the 22 communities we serve Enterprise Bank

The Communities We Serve 11 Deposit Market Share in our Branch Footprint for Massachusetts and New Hampshire(1) (1) Based on FDIC branch data as of June 30, 2022 Note: Branch footprint based on communities listed on Slide 4 Deposits Deposit Rank Bank Branches ($MM) Market Share 1 Bank of America 10 4,287 20.9% 2 TD Bank 19 3,489 17.0% 3 19 3,110 15.1% 4 Santander 19 1,961 9.5% 5 Citizens Financial 7 1,181 5.8% 6 Lowell Five 11 1,179 5.7% 7 Middlesex Bancorp 2 632 3.1% 8 Eastern Bankshares 7 588 2.9% 9 Rollstone Bancorp 5 481 2.3% 10 Fidelity Co-Op 4 459 2.2% Massachusetts Deposits Deposit Rank Bank Branches ($MM) Market Share 1 Citizens Financial 11 1,840 21.5% 2 Bank of America 5 1,539 18.0% 3 TD Bank 7 1,414 16.5% 4 Santander 7 944 11.0% 5 8 908 10.6% 6 Bank of New England 4 762 8.9% 7 Salem Co-Op 1 298 3.5% 8 JP Morgan Chase 3 152 1.8% 9 Millyard Bank 1 141 1.6% 10 Pentucket Bank 1 120 1.4% New Hampshire Average branch size of $163.7 million Average branch age of 19 years Average branch size of $113.5 million Average branch age of 9 years Enterprise Bank Enterprise Bank

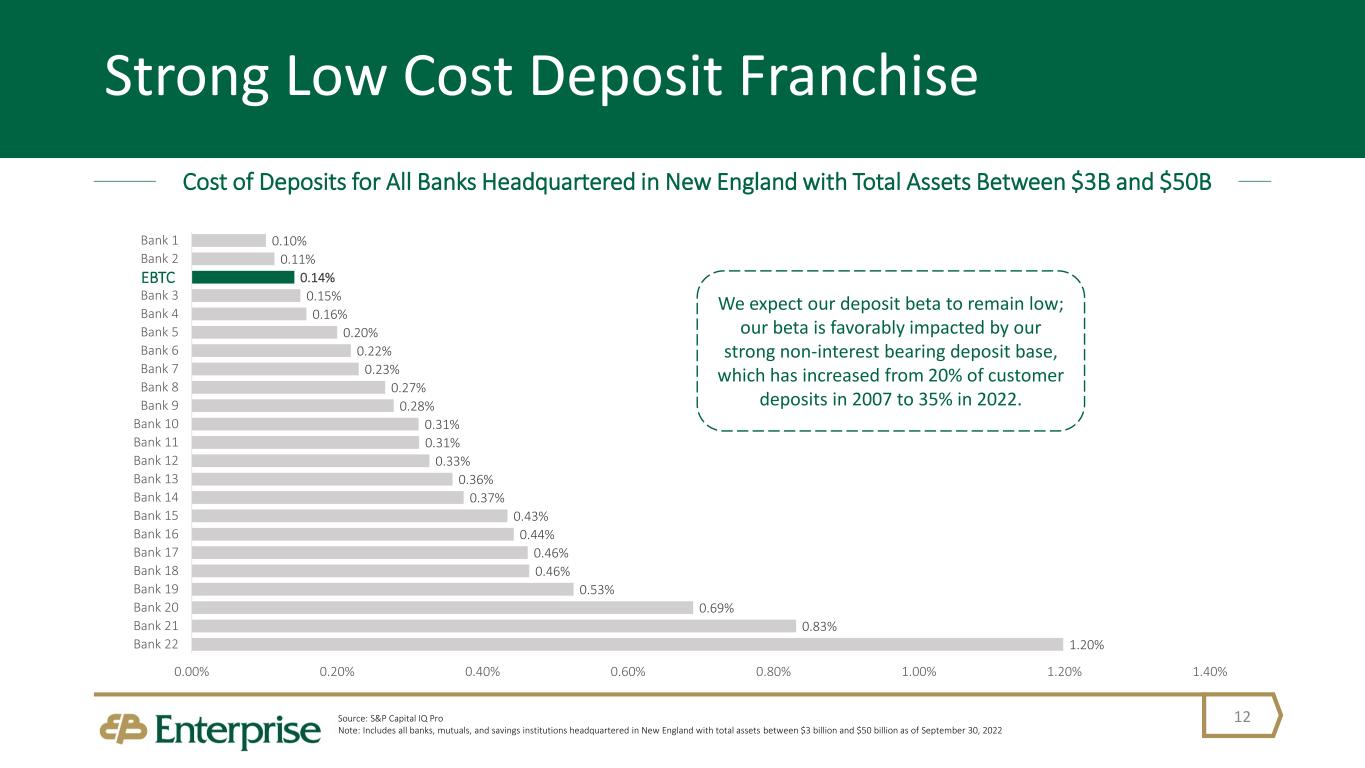

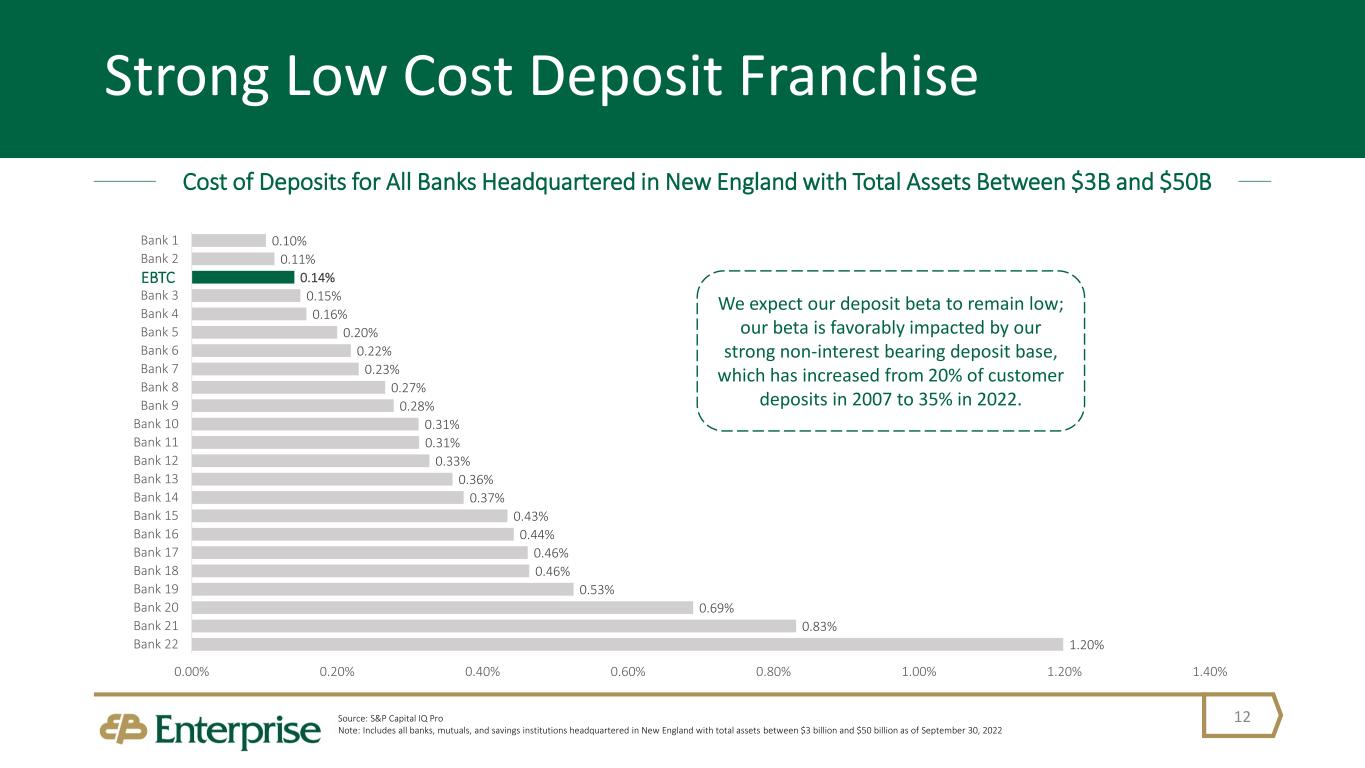

0.10% 0.11% 0.14% 0.15% 0.16% 0.20% 0.22% 0.23% 0.27% 0.28% 0.31% 0.31% 0.33% 0.36% 0.37% 0.43% 0.44% 0.46% 0.46% 0.53% 0.69% 0.83% 1.20% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% Bank 1 Bank 2 EBTC Bank 3 Bank 4 Bank 5 Bank 6 Bank 7 Bank 8 Bank 9 Bank 10 Bank 11 Bank 12 Bank 13 Bank 14 Bank 15 Bank 16 Bank 17 Bank 18 Bank 19 Bank 20 Bank 21 Bank 22 Strong Low Cost Deposit Franchise 12 Cost of Deposits for All Banks Headquartered in New England with Total Assets Between $3B and $50B Source: S&P Capital IQ Pro Note: Includes all banks, mutuals, and savings institutions headquartered in New England with total assets between $3 billion and $50 billion as of September 30, 2022 EBTC We expect our deposit beta to remain low; our beta is favorably impacted by our strong non-interest bearing deposit base, which has increased from 20% of customer deposits in 2007 to 35% in 2022.

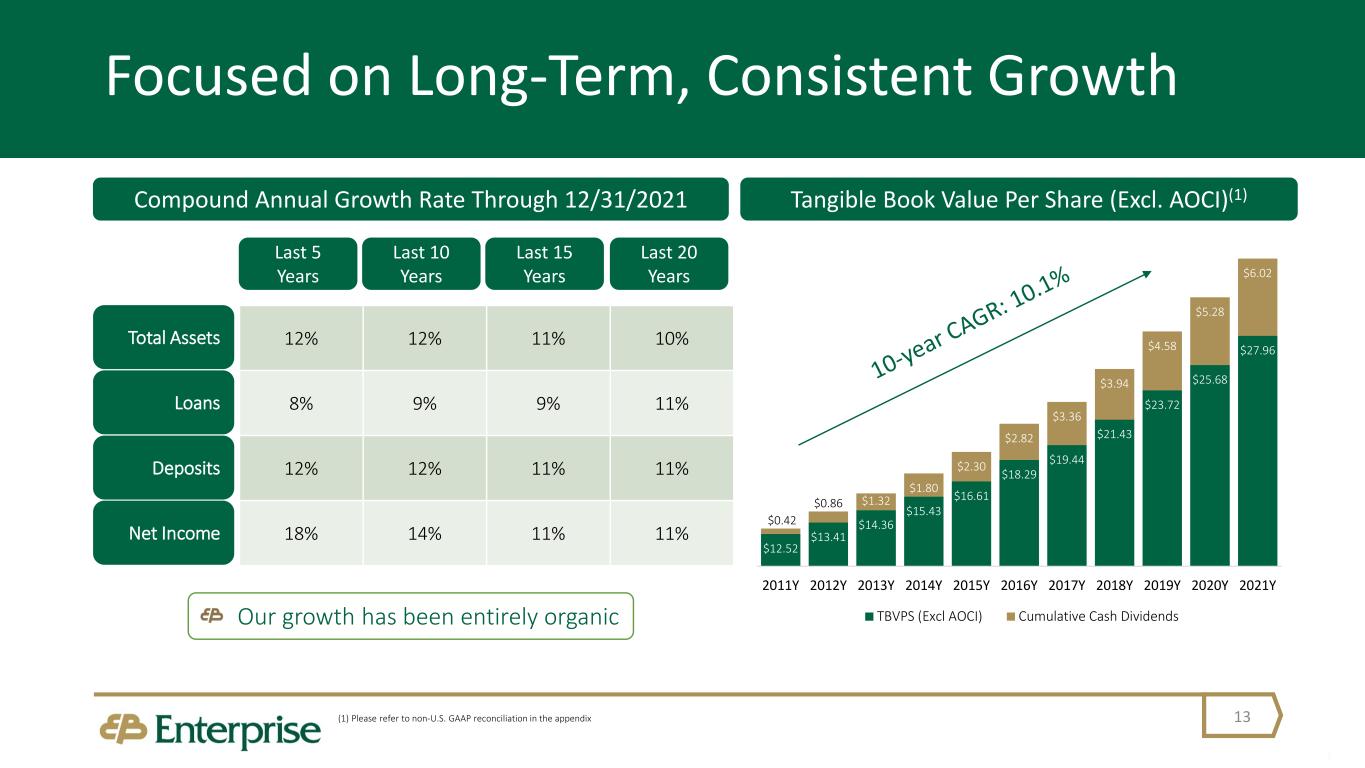

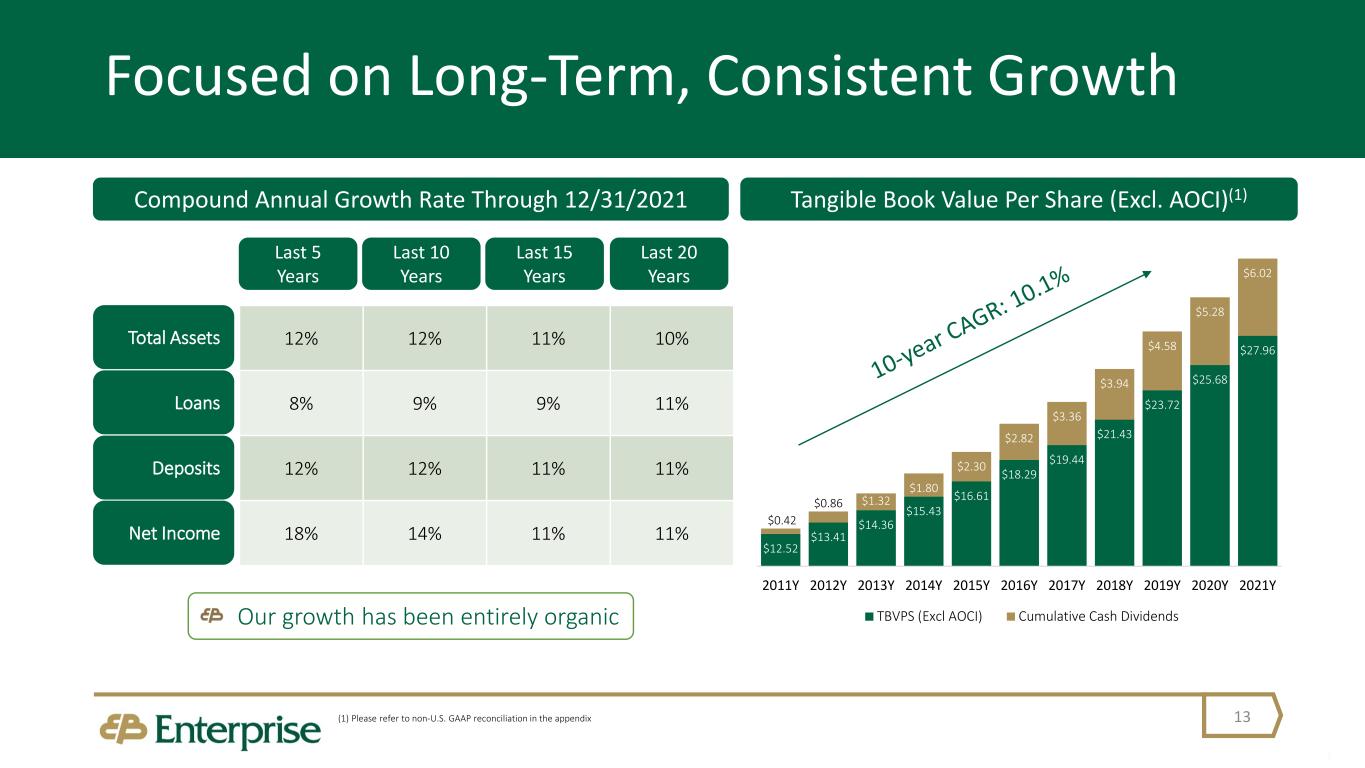

12% 12% 11% 10% 8% 9% 9% 11% 12% 12% 11% 11% 18% 14% 11% 11% Focused on Long-Term, Consistent Growth 13 Last 20 Years Net Income Total Assets Loans Deposits Compound Annual Growth Rate Through 12/31/2021 Last 5 Years Last 10 Years Last 15 Years Our growth has been entirely organic $12.52 $13.41 $14.36 $15.43 $16.61 $18.29 $19.44 $21.43 $23.72 $25.68 $27.96 $0.42 $0.86 $1.32 $1.80 $2.30 $2.82 $3.36 $3.94 $4.58 $5.28 $6.02 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 2021Y TBVPS (Excl AOCI) Cumulative Cash Dividends Tangible Book Value Per Share (Excl. AOCI)(1) (1) Please refer to non-U.S. GAAP reconciliation in the appendix

Highly Effective and Scalable Model 14 Wealth Management Personal Banking Residential Lending Commercial and Construction Lending We have the capabilities and service delivery to “punch above” our asset size in servicing our customers We are staffed with talented and relationship-centric team members who have strong ties to the communities they operate in, exhibit exceptional service and have a strong sale ethic Progressive cash management capabilities Our model is highly scalable for expanding to new markets Our brand resonates as “community”, “commercial”, and “relationship-driven” A leader in PPP Lending Our Core Business Lines Cash Management

2022 Q3 Highlights 15 Capital Paid a quarterly dividend of $0.205 per share Total capital to risk weighted assets ratio of 13.5% Tangible common equity to tangible assets ratio of 5.89% Liquidity $414 million in cash and equivalents at quarter end Over $1.1 billion in available borrowing capacity at the FHLB/FRB Loans Loans of $3.1 billion, an increase of 9% versus 2021 year end (excl. PPP loans) Loan to deposit ratio of 75% Loan to asset ratio of 69% Asset Quality Nonperforming loans to total loans of 0.18% Net charge-offs of $52k ACL of $51.2 million or 1.65% of total loans Operating Results Net income of $12.0 million, or $0.98 per diluted share ROAA of 1.05% and ROATCE of 16.80% PTPP Net Revenue(1) of $17.3 million Net interest margin of 3.61% Deposits Deposits of $4.1 billion, an increase of 4% versus 2021 year end 35% noninterest bearing deposits 0.14% cost of deposits (1) Please refer to non-U.S. GAAP reconciliation in the appendix

Financial Highlights 16

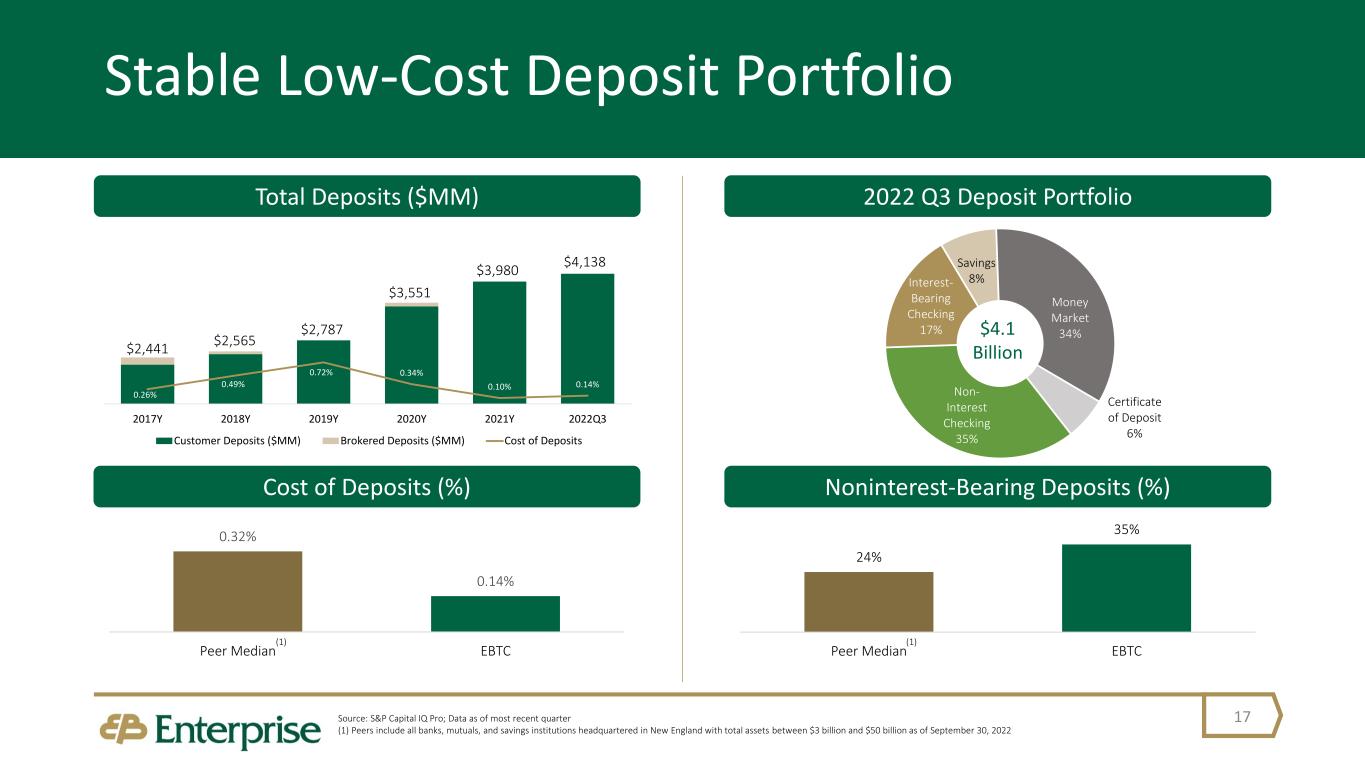

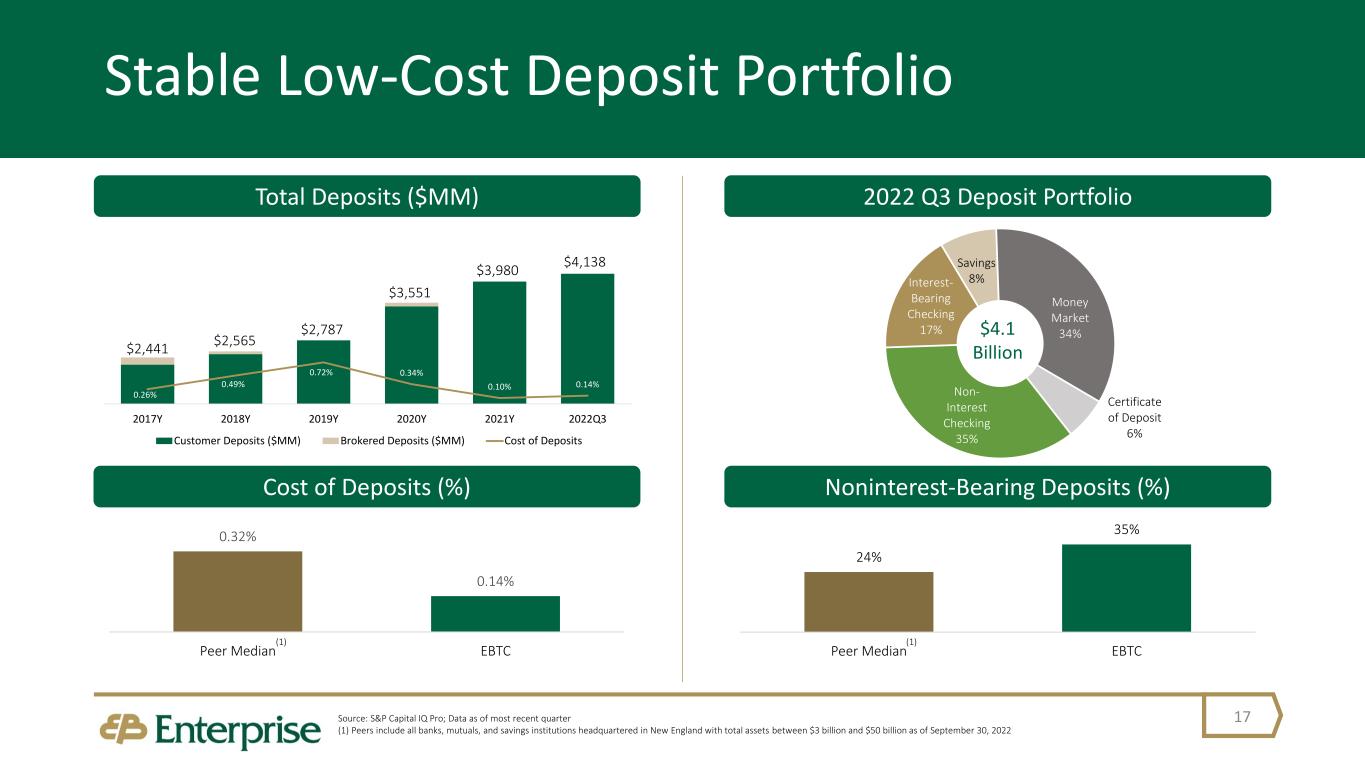

0.26% 0.49% 0.72% 0.34% 0.10% 0.14% 2017Y 2018Y 2019Y 2020Y 2021Y 2022Q3 Customer Deposits ($MM) Brokered Deposits ($MM) Cost of Deposits 0.32% 0.14% Peer Median EBTC Stable Low-Cost Deposit Portfolio 17Source: S&P Capital IQ Pro; Data as of most recent quarter (1) Peers include all banks, mutuals, and savings institutions headquartered in New England with total assets between $3 billion and $50 billion as of September 30, 2022 Non- Interest Checking 35% Interest- Bearing Checking 17% Savings 8% Money Market 34% Certificate of Deposit 6% 2022 Q3 Deposit PortfolioTotal Deposits ($MM) Noninterest-Bearing Deposits (%)Cost of Deposits (%) 24% 35% Peer Median EBTC $4.1 Billion (1) (1) $2,441 $2,565 $2,787 $3,551 $3,980 $4,138

Commercial Real Estate 61% Commercial & Industrial 13% Construction & Development 13% Residential 10% Home Equity Loans & Lines 3% $2,270 $2,388 $2,566 $2,631 $2,849 $3,107 2017Y 2018Y 2019Y 2020Y 2021Y 2022Q3 Loans (Excl. PPP) ($MM) PPP Loans ($MM) Total Loans ($MM) Diverse and Attractive Loan Portfolio 18 2022 Q3 Loan Portfolio $3.1 Billion$2,270 $2,388 $2,566 $3,074 $2,921 $3,109 Consistent growth driven by long-term relationships Commercially focused, relationship-based lender

Multi-Family 30% 1-4 Family 14% Retail 12% Industrial/Warehouse Building 11% Office 9% Non Real Estate 5% Other Categories < 5% 19% CRE Portfolio 19 Owner Occupied CRE Detail ($MM) Non-Owner Occupied CRE Detail ($MM) Real Estate / Rental 22% Health Care and Social Assistance 13% Other Services 10% Construction 10% Retail Trade 10% Manufacturing 8% Accommodation and Food 7% Other Categories < 5% 20% Total Balance: $684.1M Total Balance: $1,202.2M Source: Company documents Note: Data as of 9/30/2022

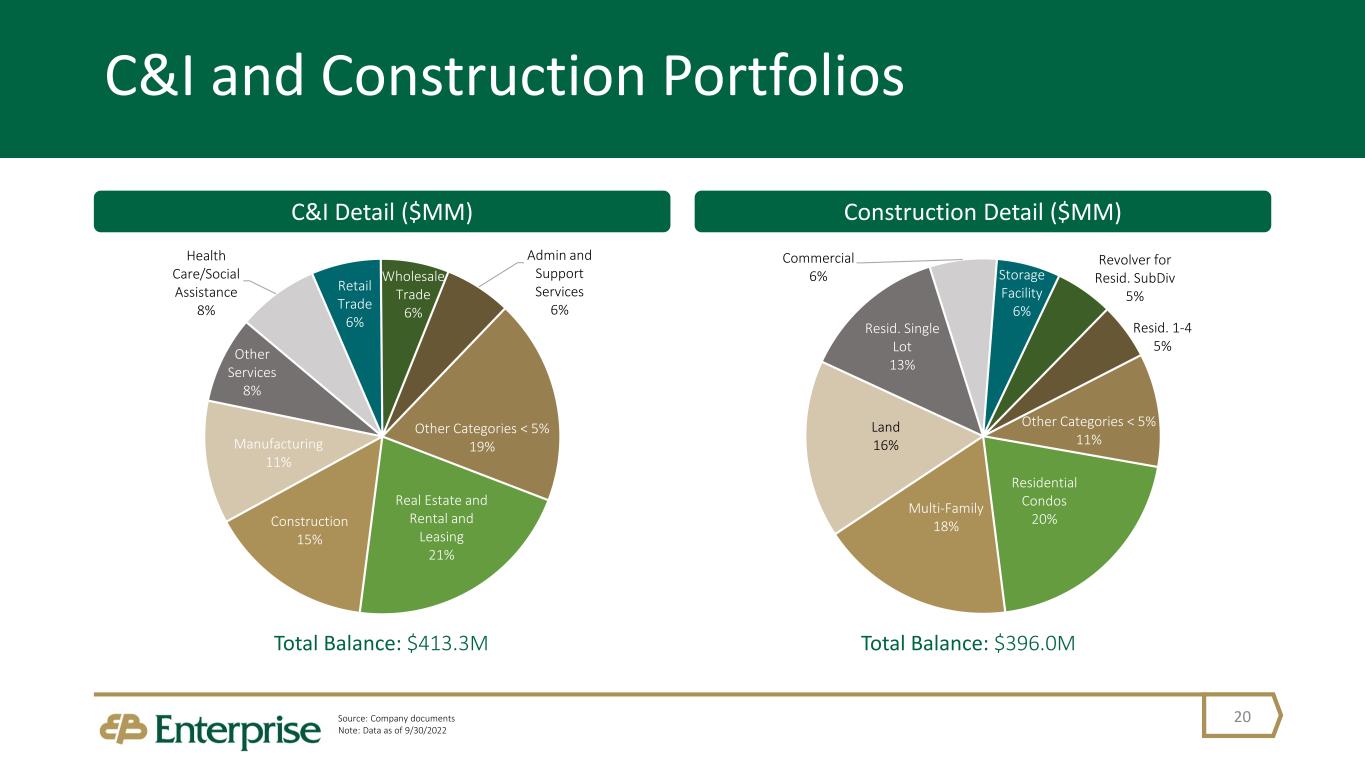

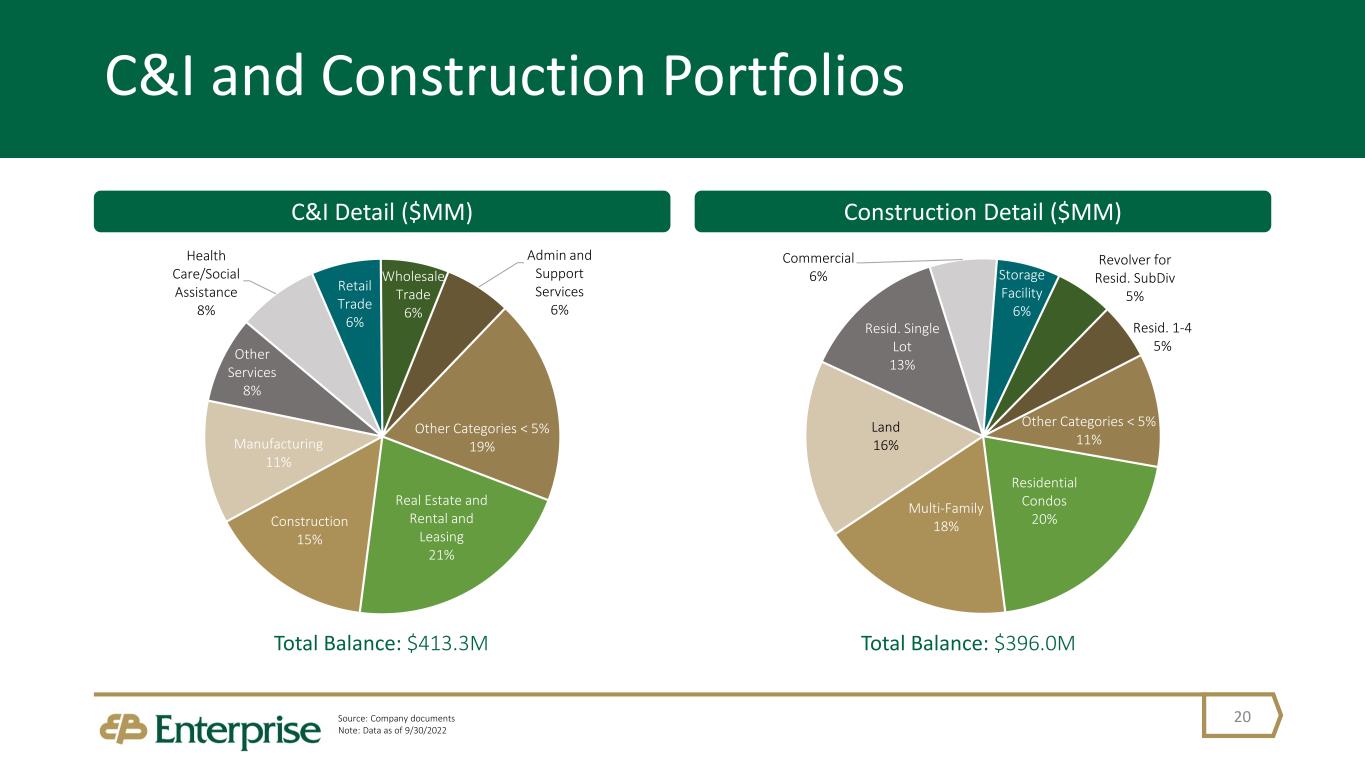

Residential Condos 20% Multi-Family 18% Land 16% Resid. Single Lot 13% Commercial 6% Storage Facility 6% Revolver for Resid. SubDiv 5% Resid. 1-4 5% Other Categories < 5% 11% C&I and Construction Portfolios 20 C&I Detail ($MM) Construction Detail ($MM) Real Estate and Rental and Leasing 21% Construction 15% Manufacturing 11% Other Services 8% Health Care/Social Assistance 8% Retail Trade 6% Wholesale Trade 6% Admin and Support Services 6% Other Categories < 5% 19% Total Balance: $413.3M Total Balance: $396.0M Source: Company documents Note: Data as of 9/30/2022

$32,915 $33,849 $33,614 $44,565 $51,125 $47,704 $51,211 1.45% 1.42% 1.31% 1.69% 1.94% 1.67% 1.65% 2017Y 2018Y 2019Y 2020Y 1/1/2021 2021Y 2022Q3 ACL Total ($000s) ACL/Loans 0.40% 0.49% 0.58% 1.24% 0.91% 0.18% -0.01% 0.06% 0.06% 0.05% 0.10% 0.00% 2017Y 2018Y 2019Y 2020Y 2021Y YTD'22 NPLs Excl Restructured/Loans NCOs/Avg Loans $1,430 $2,250 $1,180 $12,499 $1,770 $747 $3,939 2017Y 2018Y 2019Y 2020Y 2021Y YTD'21 YTD'22 Disciplined Credit Culture 21 Allowance for Credit Losses ($000s)(1) Nonperforming Loans and Charge Offs Provision Expense ($000s) Favorable long-term credit metrics highlighted by relatively low levels of nonperforming loans Conservatively positioned with strong level of allowance for credit losses 2020 provision expense related to increased risks from the pandemic 2022 YTD provision expense driven by strong loan portfolio growth (1) ACL/Loans ratios exclude PPP loans in calculation (2) Charge-off is net of $1.1 million gain on OREO sales (3) Year to date through September 30, 2021 (4) Year to date through September 30, 2022 (3) (4) (2) CECL Adoption (4)

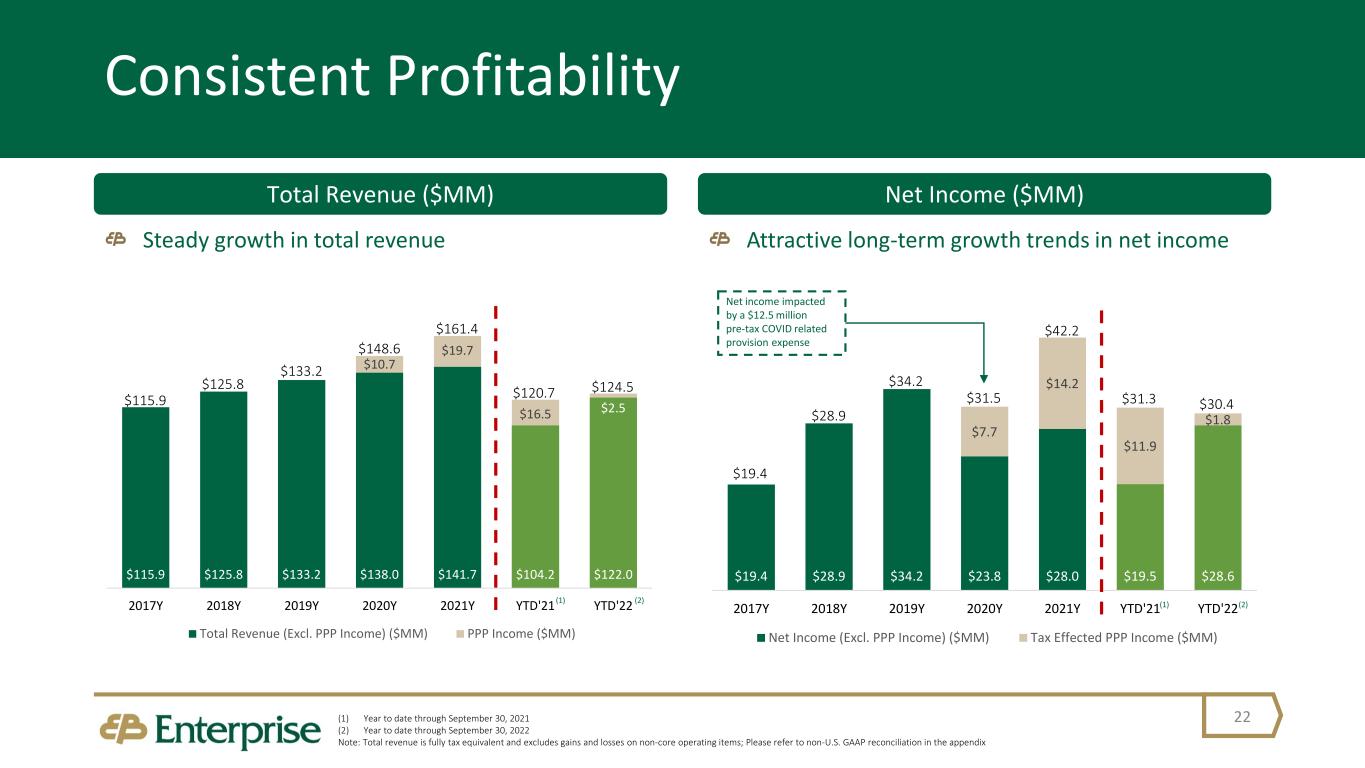

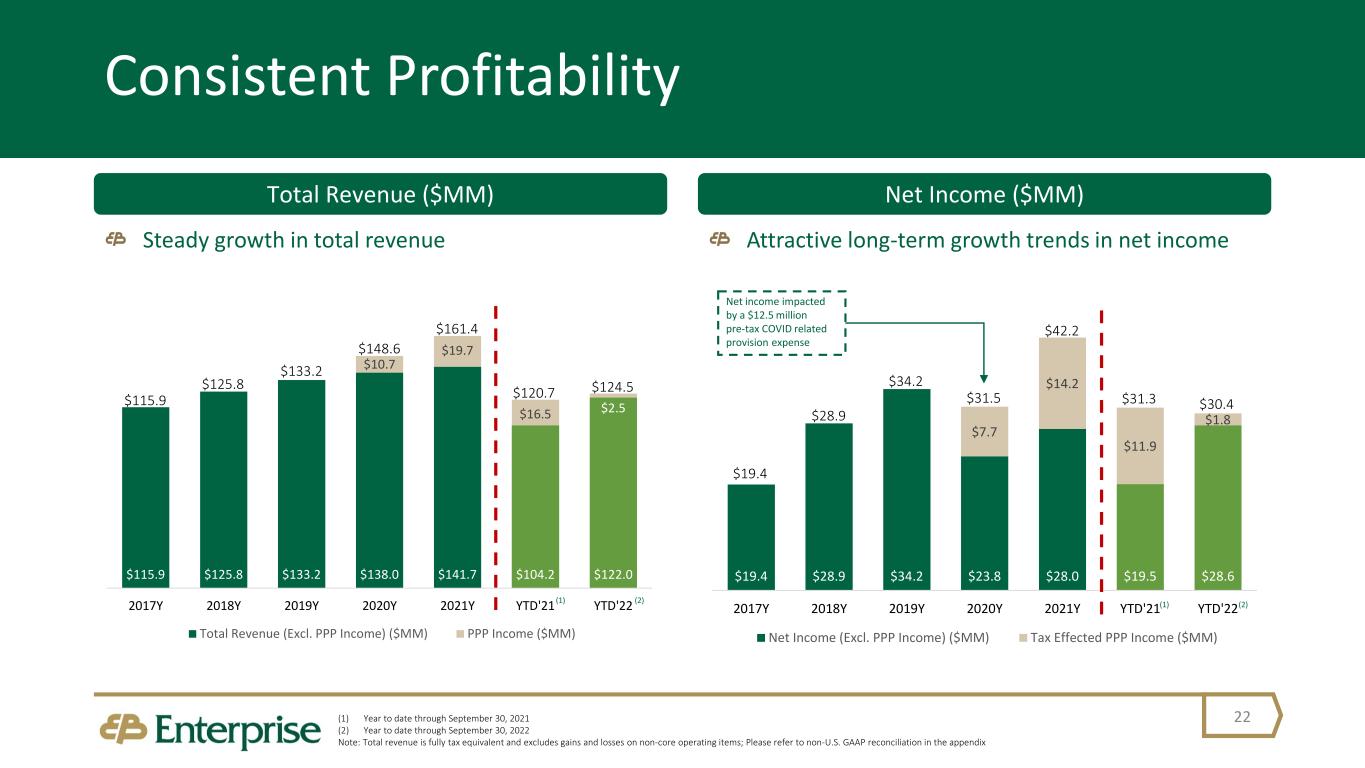

$115.9 $125.8 $133.2 $138.0 $141.7 $104.2 $122.0 $10.7 $19.7 $16.5 $2.5 2017Y 2018Y 2019Y 2020Y 2021Y YTD'21 YTD'22 Total Revenue (Excl. PPP Income) ($MM) PPP Income ($MM) Consistent Profitability 22 Net Income ($MM)Total Revenue ($MM) Steady growth in total revenue Attractive long-term growth trends in net income $115.9 $125.8 $133.2 $148.6 $161.4 $120.7 $124.5 (1) Year to date through September 30, 2021 (2) Year to date through September 30, 2022 Note: Total revenue is fully tax equivalent and excludes gains and losses on non-core operating items; Please refer to non-U.S. GAAP reconciliation in the appendix (1) (2) $19.4 $28.9 $34.2 $23.8 $28.0 $19.5 $28.6 $7.7 $14.2 $11.9 $1.8 2017Y 2018Y 2019Y 2020Y 2021Y YTD'21 YTD'22 Net Income (Excl. PPP Income) ($MM) Tax Effected PPP Income ($MM) $19.4 $28.9 $34.2 $31.5 $42.2 $31.3 $30.4 (1) (2) Net income impacted by a $12.5 million pre-tax COVID related provision expense

Quarterly Net Interest Margin Trends 23 Net Interest Income ($MM) As Reported Interest Spread $29.8 $29.1 $30.1 $31.3 $32.8 $32.9 $35.5 $39.7 $4.7 $6.0 $5.6 $4.9 $3.2 $1.5 $0.6 $0.4 3.76% 3.68% 3.71% 3.68% 3.56% 3.47% 3.55% 3.71% 2020Q4 2021Q1 2021Q2 2021Q3 2021Q4 2022Q1 2022Q2 2022Q3 PPP Contribution Net Interest Income (Excluding PPP) Adjusted NIM $34.5 $35.1 $35.6 $36.2 $36.0 $34.4 $36.2 $40.1 (1) Adjusted NIM reflect FTE NIM without the effects of PPP and interest earning deposits with banks Note: Net Interest Income is on a tax-equivalent basis 3.77% 3.86% 3.63% 3.54% 3.48% 3.41% 3.59% 3.82% 0.30% 0.26% 0.20% 0.17% 0.14% 0.14% 0.15% 0.22% 3.32% 3.48% 3.33% 3.28% 3.26% 3.19% 3.35% 3.48% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 2020Q4 2021Q1 2021Q2 2021Q3 2021Q4 2022Q1 2022Q2 2022Q3 Yield on Interest Earning Assets Cost of Funds Interest Spread (1)

Non-Interest Components 24 $15.0 $15.1 $15.8 $17.1 $18.5 $13.7 $13.9 12.9% 12.0% 11.8% 11.5% 11.4% 11.3% 11.1% 2017Y 2018Y 2019Y 2020Y 2021Y YTD'21 YTD'22 Noninterest Income NII/FTE Revenue $76.1 $80.9 $86.4 $93.3 $101.4 $74.9 $80.1 66% 64% 65% 63% 63% 62% 64% 2017Y 2018Y 2019Y 2020Y 2021Y YTD'21 YTD'22 Noninterest Expense Efficiency Ratio Noninterest Income ($MM) Noninterest Expense ($MM) Consistent wealth management fees supported by $1.0B in assets under management and administration Investment in our people, branches and technology provide runway for future growth Wealth Management 35% Deposit Fees 41% BOLI 6% Other 18% Salaries & Benefits 67% Occupancy & Equipment 9% Technology 10% Other 14% (1) Year to date through September 30, 2021 (2) Year to date through September 30, 2022 Note: Noninterest income and expense are adjusted for non-core operating items; Please refer to non-U.S. GAAP reconciliation in the appendix (1) (2) (1) (2)

$5,149 $5,624 $5,494 $5,815 $6,787 $4,965 2017Y 2018Y 2019Y 2020Y 2021Y YTD'22 $842 $798 $914 $977 $1,041 $836 2017Y 2018Y 2019Y 2020Y 2021Y 2022Q3 Wealth Management 25 Investment Assets Under Management ($MM) Customized investment management and trust services provided to individuals, family groups, commercial businesses, trusts, foundations, non-profit organizations, and endowments Brokerage and management services through a third-party arrangement with a licensed securities brokerage firm, with products designed primarily for the individual investor Retirement plan services are offered through third-party arrangements with leading 401(k) plan providers Wealth Management Revenue ($000) Investment Products & Services (1) Year to date through September 30, 2022 (1)

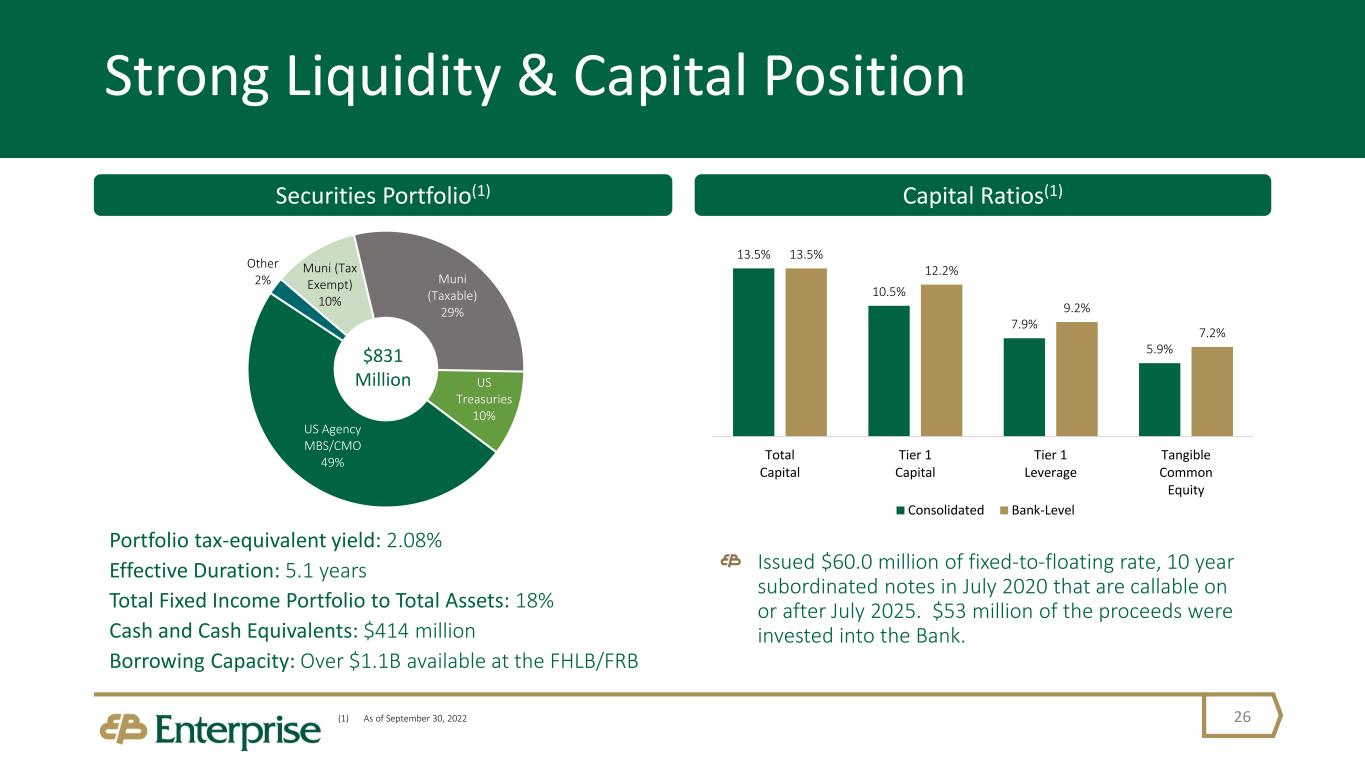

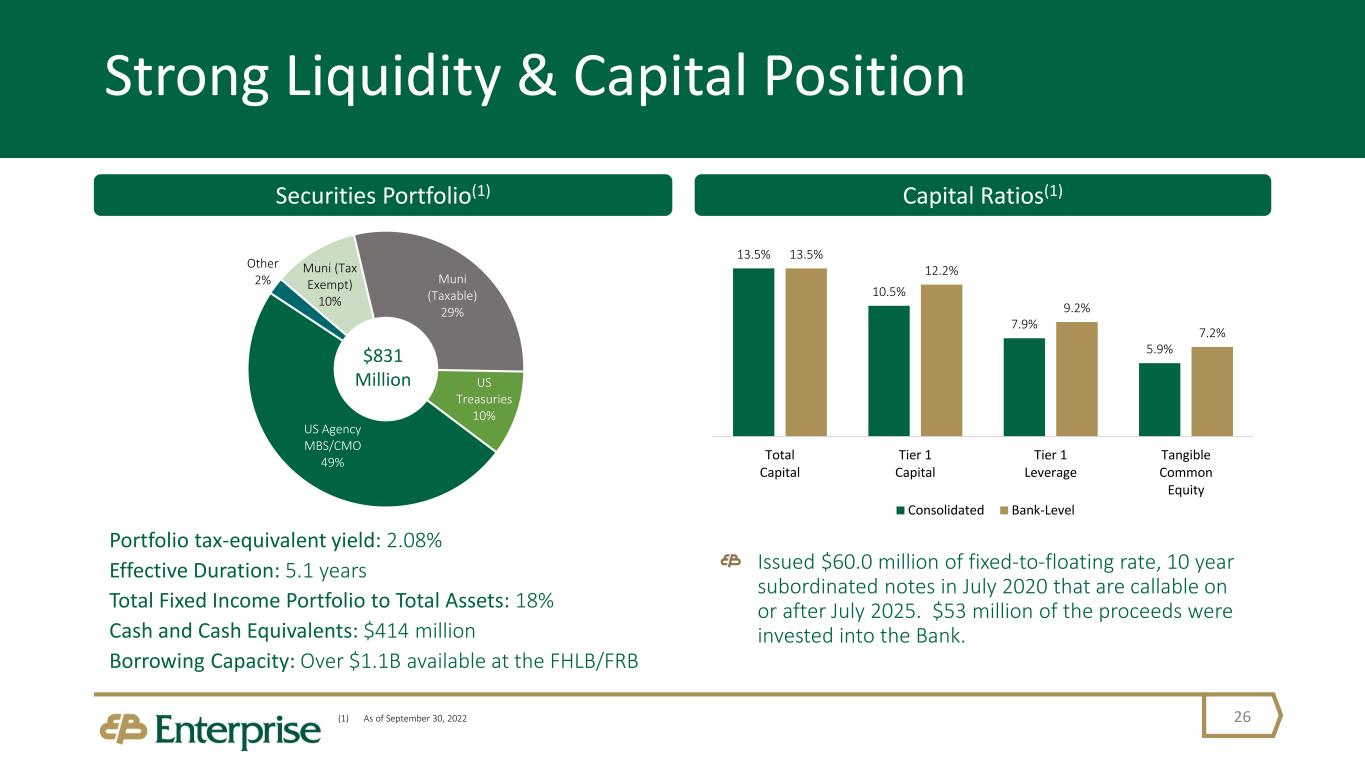

13.5% 10.5% 7.9% 5.9% 13.5% 12.2% 9.2% 7.2% Total Capital Tier 1 Capital Tier 1 Leverage Tangible Common Equity Consolidated Bank-Level Capital Ratios(1) Strong Liquidity & Capital Position 26 US Treasuries 10% US Agency MBS/CMO 49% Other 2% Muni (Tax Exempt) 10% Muni (Taxable) 29% $831 Million Securities Portfolio(1) Portfolio tax-equivalent yield: 2.08% Effective Duration: 5.1 years Total Fixed Income Portfolio to Total Assets: 18% Cash and Cash Equivalents: $414 million Borrowing Capacity: Over $1.1B available at the FHLB/FRB (1) As of September 30, 2022 Issued $60.0 million of fixed-to-floating rate, 10 year subordinated notes in July 2020 that are callable on or after July 2025. $53 million of the proceeds were invested into the Bank.

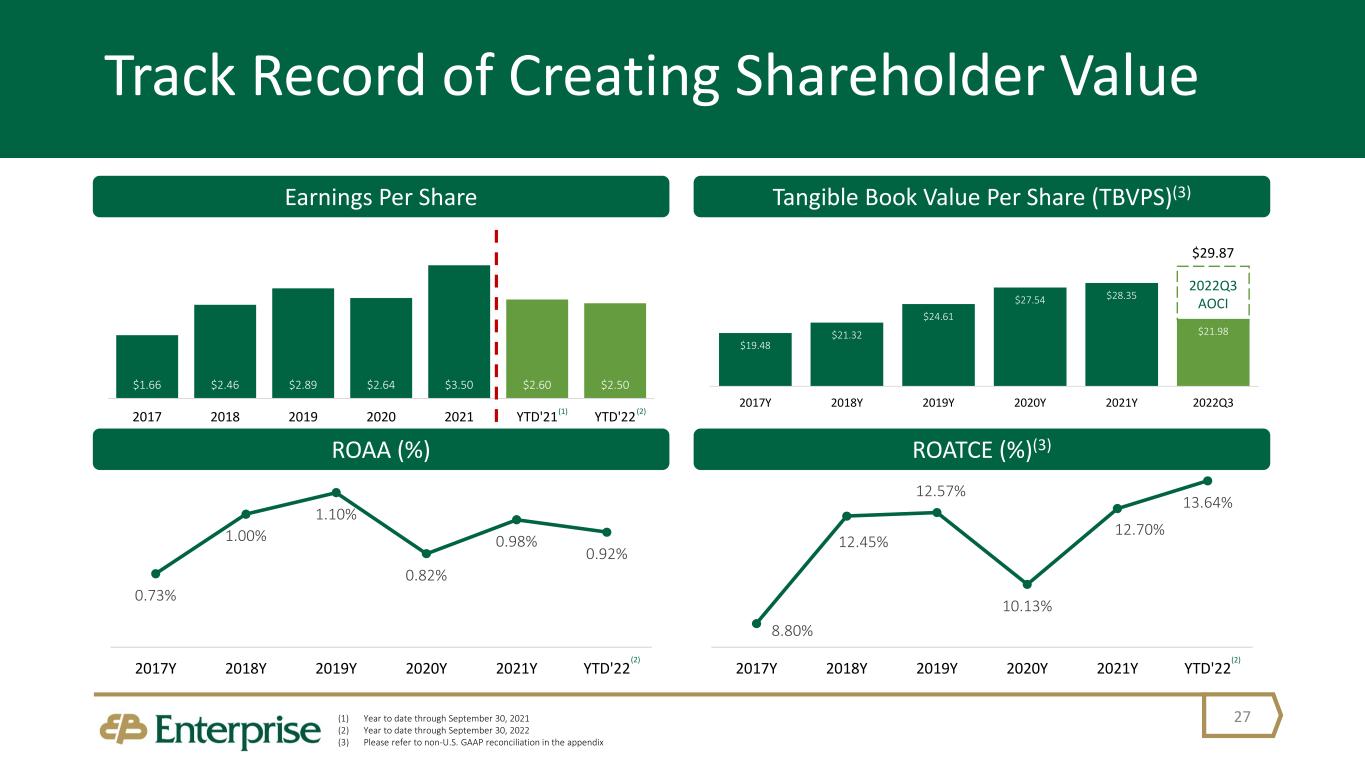

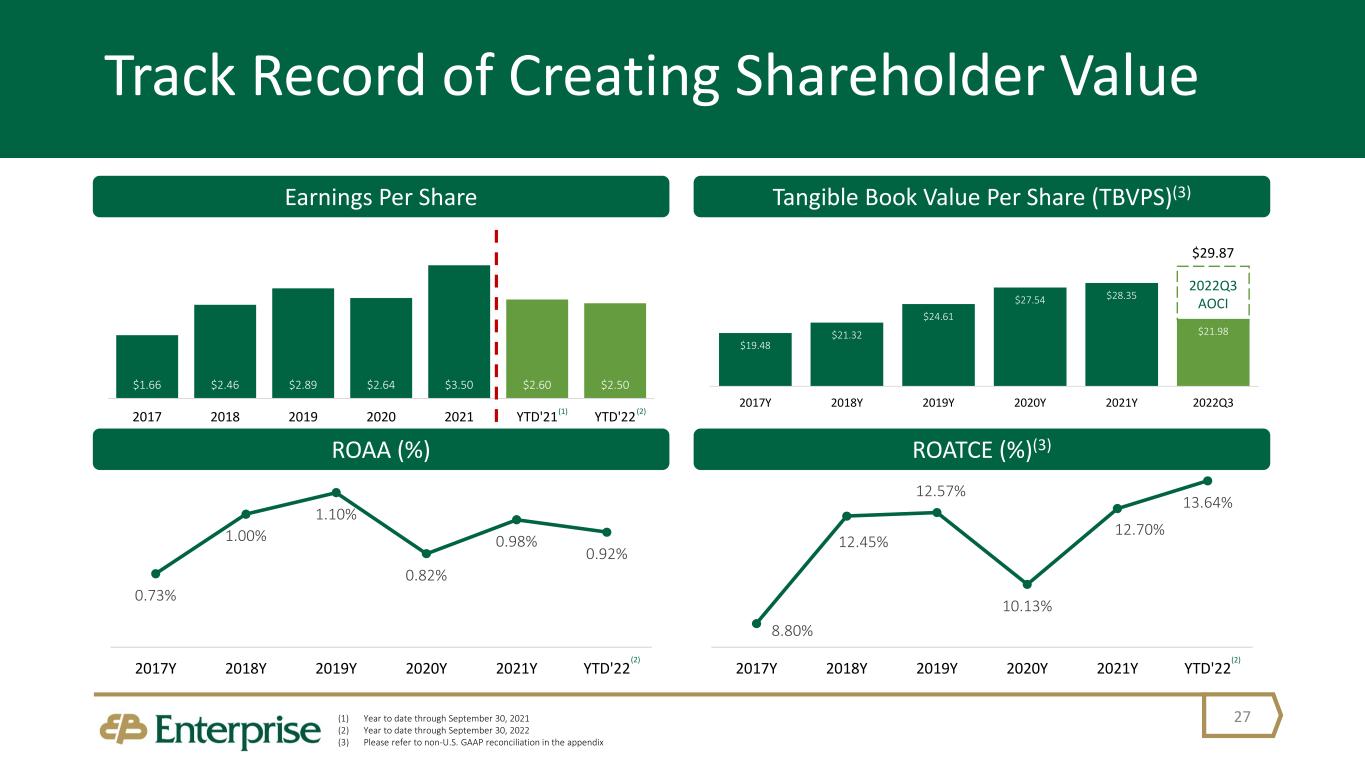

$1.66 $2.46 $2.89 $2.64 $3.50 $2.60 $2.50 2017 2018 2019 2020 2021 YTD'21 YTD'22 8.80% 12.45% 12.57% 10.13% 12.70% 13.64% 2017Y 2018Y 2019Y 2020Y 2021Y YTD'22 0.73% 1.00% 1.10% 0.82% 0.98% 0.92% 2017Y 2018Y 2019Y 2020Y 2021Y YTD'22 Track Record of Creating Shareholder Value 27 Earnings Per Share Tangible Book Value Per Share (TBVPS)(3) ROAA (%) ROATCE (%)(3) $19.48 $21.32 $24.61 $27.54 $28.35 $21.98 2017Y 2018Y 2019Y 2020Y 2021Y 2022Q3 2022Q3 AOCI $29.87 (1) Year to date through September 30, 2021 (2) Year to date through September 30, 2022 (3) Please refer to non-U.S. GAAP reconciliation in the appendix (2) (2) (1) (2)

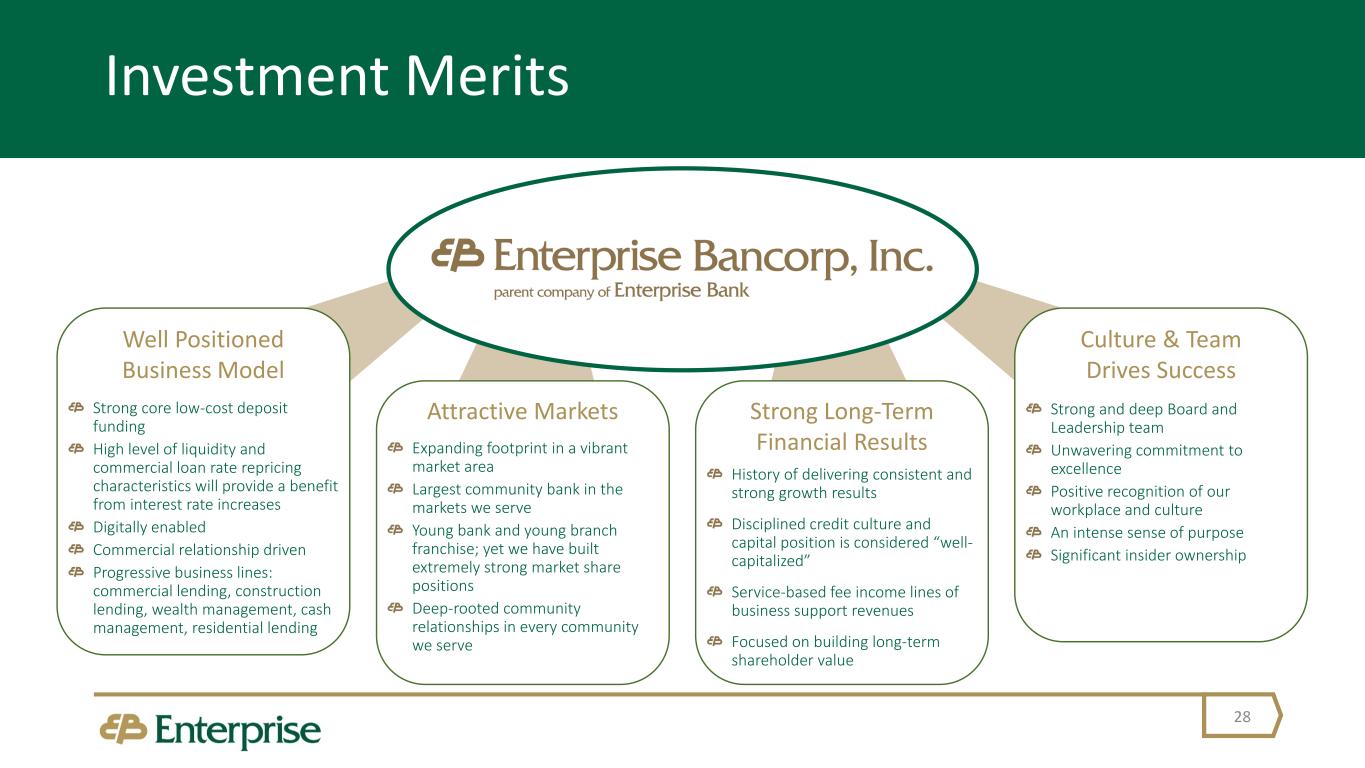

Investment Merits 28 Attractive Markets Expanding footprint in a vibrant market area Largest community bank in the markets we serve Young bank and young branch franchise; yet we have built extremely strong market share positions Deep-rooted community relationships in every community we serve Strong Long-Term Financial Results History of delivering consistent and strong growth results Disciplined credit culture and capital position is considered “well- capitalized” Service-based fee income lines of business support revenues Focused on building long-term shareholder value Culture & Team Drives Success Strong and deep Board and Leadership team Unwavering commitment to excellence Positive recognition of our workplace and culture An intense sense of purpose Significant insider ownership Well Positioned Business Model Strong core low-cost deposit funding High level of liquidity and commercial loan rate repricing characteristics will provide a benefit from interest rate increases Digitally enabled Commercial relationship driven Progressive business lines: commercial lending, construction lending, wealth management, cash management, residential lending

Appendix 29

Non-GAAP Reconciliation 30 Tangible common equity to tangible assets (the "tangible common equity ratio") and tangible book value per share are non-U.S. GAAP financial measures derived from U.S. GAAP-based amounts. We calculate the tangible common equity ratio by excluding the balance of intangible assets from common stockholders' equity and dividing by tangible assets. We calculate tangible book value per share by dividing tangible common equity by common shares outstanding, as compared to book value per common share, which we calculate by dividing common stockholders’ equity by common shares outstanding. We believe that this information is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of risk-based capital ratios. Accordingly, we believe that these non-U.S. GAAP financial measures provide information that is important to investors and that is useful in understanding our capital position and ratios. However, these non-U.S. GAAP financial measures are supplemental and are not a substitute for an analysis based on U.S. GAAP measures. As other companies may use different calculations for these measures, this presentation may not be comparable to other similarly titled measures reported by other companies. A reconciliation of the non-U.S. GAAP measure of tangible common equity ratio to the U.S. GAAP measure of common equity ratio and tangible book value per share to the U.S. GAAP measure of book value per share are set forth below. All dollars in thousands, except per share data Twelve Mos. Ended As of 2017 2018 2019 2020 2021 9/30/2022 Total Stockholders' Equity $231,810 $255,297 $296,641 $334,426 $346,895 $272,193 Less: Intangible Assets 5,656 5,656 5,656 5,656 5,656 5,656 Tangible Common Equity $226,154 $249,641 $290,985 $328,770 $341,239 $266,537 Total Assets $2,817,564 $2,964,358 $3,235,049 $4,014,324 $4,447,819 $4,529,820 Less: Intangible Assets 5,656 5,656 5,656 5,656 5,656 5,656 Tangible Assets $2,811,908 $2,958,702 $3,229,393 $4,008,668 $4,442,163 $4,524,164 Tangible Common Equity Ratio 8.0% 8.4% 9.0% 8.2% 7.7% 5.9% Basic Shares Outstanding 11,609,853 11,708,218 11,825,331 11,937,795 12,038,382 12,127,453 Book Value per Share $19.97 $21.80 $25.09 $28.01 $28.82 $22.44 Less: Intangible Book Value per Share 0.49 0.48 0.48 0.47 0.47 0.47 Tangible Book Value per Share $19.48 $21.32 $24.61 $27.54 $28.35 $21.98 Average Tangible Common Equity $220,289 $232,027 $272,177 $310,490 $331,907 $297,989 Net Income 19,393 28,881 34,200 31,456 42,171 30,410 ROATCE 8.80% 12.45% 12.57% 10.13% 12.70% 13.64%

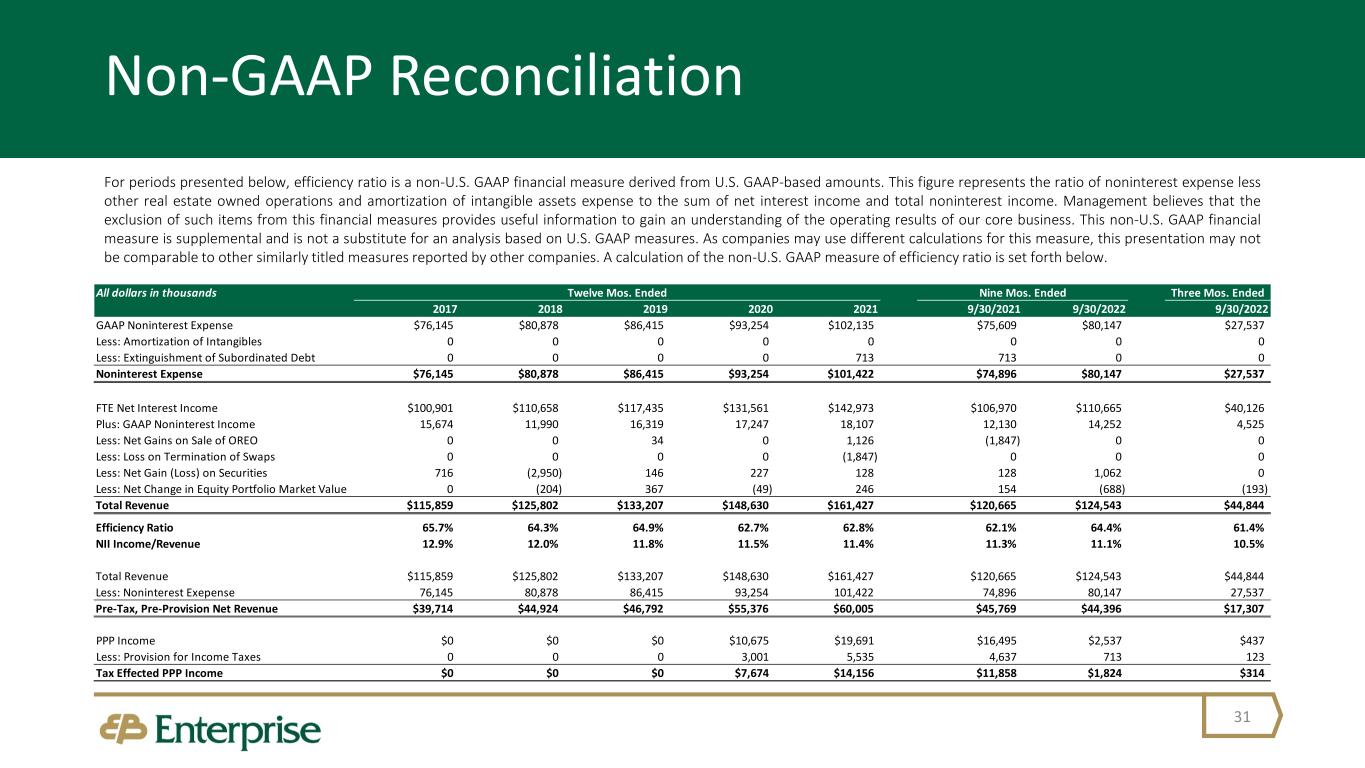

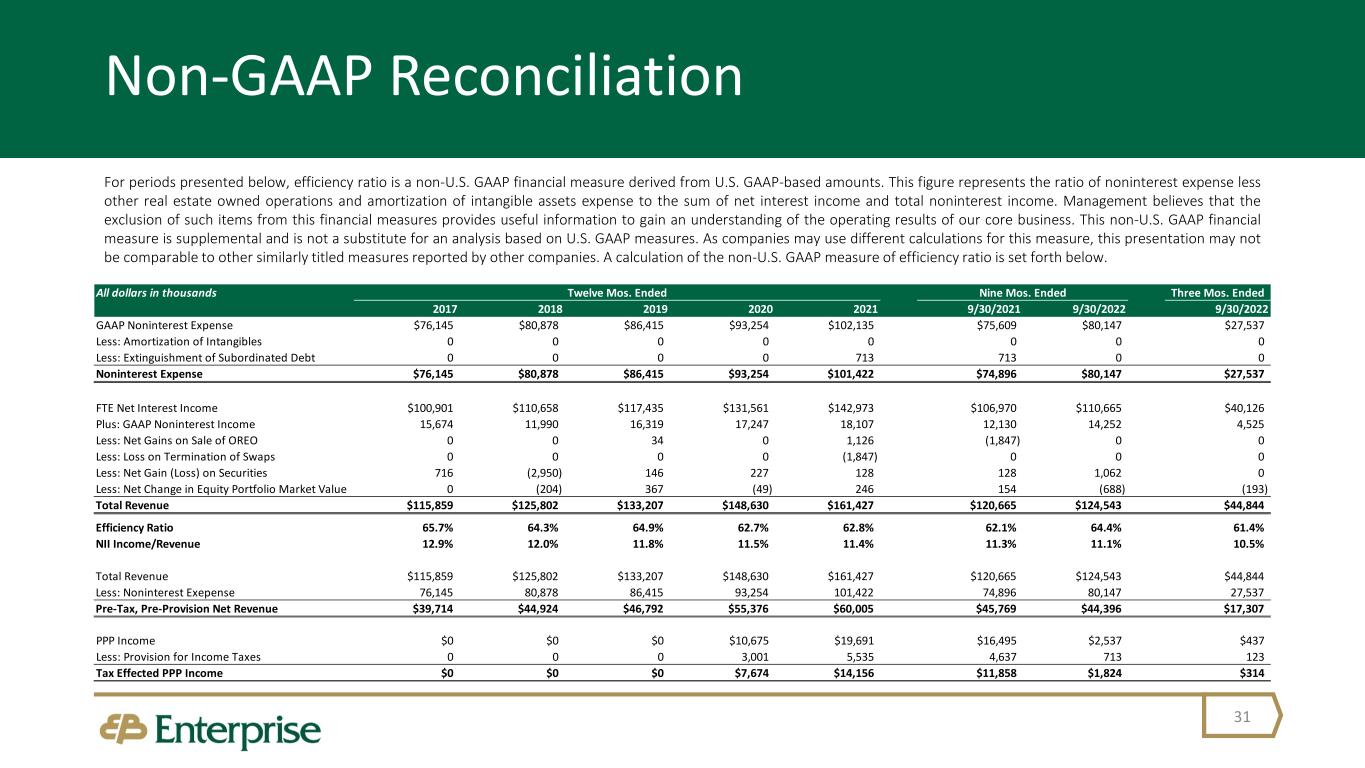

Non-GAAP Reconciliation 31 For periods presented below, efficiency ratio is a non-U.S. GAAP financial measure derived from U.S. GAAP-based amounts. This figure represents the ratio of noninterest expense less other real estate owned operations and amortization of intangible assets expense to the sum of net interest income and total noninterest income. Management believes that the exclusion of such items from this financial measures provides useful information to gain an understanding of the operating results of our core business. This non-U.S. GAAP financial measure is supplemental and is not a substitute for an analysis based on U.S. GAAP measures. As companies may use different calculations for this measure, this presentation may not be comparable to other similarly titled measures reported by other companies. A calculation of the non-U.S. GAAP measure of efficiency ratio is set forth below. PPP Income $0 $0 $0 $10,675 $19,691 $16,495 $2,537 $437 Less: Provision for Income Taxes 0 0 0 3,001 5,535 4,637 713 123 Tax Effected PPP Income $0 $0 $0 $7,674 $14,156 $11,858 $1,824 $314 All dollars in thousands Twelve Mos. Ended Nine Mos. Ended Three Mos. Ended 2017 2018 2019 2020 2021 9/30/2021 9/30/2022 9/30/2022 GAAP Noninterest Expense $76,145 $80,878 $86,415 $93,254 $102,135 $75,609 $80,147 $27,537 Less: Amortization of Intangibles 0 0 0 0 0 0 0 0 Less: Extinguishment of Subordinated Debt 0 0 0 0 713 713 0 0 Noninterest Expense $76,145 $80,878 $86,415 $93,254 $101,422 $74,896 $80,147 $27,537 FTE Net Interest Income $100,901 $110,658 $117,435 $131,561 $142,973 $106,970 $110,665 $40,126 Plus: GAAP Noninterest Income 15,674 11,990 16,319 17,247 18,107 12,130 14,252 4,525 Less: Net Gains on Sale of OREO 0 0 34 0 1,126 (1,847) 0 0 Less: Loss on Termination of Swaps 0 0 0 0 (1,847) 0 0 0 Less: Net Gain (Loss) on Securities 716 (2,950) 146 227 128 128 1,062 0 Less: Net Change in Equity Portfolio Market Value 0 (204) 367 (49) 246 154 (688) (193) Total Revenue $115,859 $125,802 $133,207 $148,630 $161,427 $120,665 $124,543 $44,844 Efficiency Ratio 65.7% 64.3% 64.9% 62.7% 62.8% 62.1% 64.4% 61.4% NII Income/Revenue 12.9% 12.0% 11.8% 11.5% 11.4% 11.3% 11.1% 10.5% Total Revenue $115,859 $125,802 $133,207 $148,630 $161,427 $120,665 $124,543 $44,844 Less: Noninterest Exepense 76,145 80,878 86,415 93,254 101,422 74,896 80,147 27,537 Pre-Tax, Pre-Provision Net Revenue $39,714 $44,924 $46,792 $55,376 $60,005 $45,769 $44,396 $17,307

All dollars in thousands 12/31/2020 3/31/2021 6/30/2021 9/30/2021 12/31/2021 3/31/2022 6/30/2022 9/30/2022 Net interest margin (tax-equivalent) 3.49% 3.62% 3.45% 3.39% 3.34% 3.28% 3.45% 3.61% Adjustment: PPP effect (0.05%) (0.23%) (0.22%) (0.30%) (0.22%) (0.11%) (0.04%) (0.03%) Adjustment: Interest-earning bank deposits effect 0.32% 0.29% 0.48% 0.59% 0.44% 0.30% 0.14% 0.13% Adjusted Net Interest Margin 3.76% 3.68% 3.71% 3.68% 3.56% 3.47% 3.55% 3.71% Three Mos. Ended Non-GAAP Reconciliation 32 Net interest margin adjusted for PPP effect and interest-earning bank deposits effect is a non-U.S. GAAP financial measure derived from U.S. GAAP-based amounts. We calculate this by excluding income related to the “Paycheck Protection Program” instituted by the US Federal Government during the onset of the COVID-19 pandemic, as well as income from deposits held at other financial institutions. Management believes that the exclusion of such items from this financial measures provides useful information to gain an understanding of the operating results of our core business. This non-U.S. GAAP financial measure is supplemental and is not a substitute for an analysis based on U.S. GAAP measures. As companies may use different calculations for this measure, this presentation may not be comparable to other similarly titled measures reported by other companies. A calculation of the non-U.S. GAAP measure of adjusted net interest margin is set forth below, as well as in our press releases.. All dollars in thousands, except per share data As of 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 9/30/2022 Tangible Book Value per Share $12.86 $13.84 $14.58 $15.80 $16.83 $18.22 $19.48 $21.32 $24.61 $27.54 $28.35 $21.98 Less: Acc. Other Comprehensive Income per Share $0.34 $0.42 $0.21 $0.37 $0.22 ($0.07) $0.04 ($0.11) $0.89 $1.86 $0.39 ($7.89) Tangible Book Value per Share, Excluding AOCI $12.52 $13.41 $14.36 $15.43 $16.61 $18.29 $19.44 $21.43 $23.72 $25.68 $27.96 $29.87 Annual Dividends Paid 0.42 0.44 0.46 0.48 0.50 0.52 0.54 0.58 0.64 0.70 0.74 Cumulative Dividends (2011-2021) 0.42 0.86 1.32 1.80 2.30 2.82 3.36 3.94 4.58 5.28 6.02 Twelve Mos. Ended