The Impac Companies

Corporate & Capital Markets Overview

March, 2007

Disclaimer

This presentation contains or may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934. Forward-looking statements, some of which are based on various assumptions and events that are beyond our control, may be

identified by reference to a future period or periods or by the use of forward-looking terminology, such as “may,” “will,” “should”, “believe,” “expect,” “likely,”

“should,” “anticipate,” or similar terms or variations on those terms or the negative of those terms, and includes statements regarding our mortgage loan margins.

The forward-looking statements are based on current management expectations. Actual results may differ materially as a result of several factors, including, but not

limited to, failure to achieve projected earnings levels; unexpected or greater than anticipated increases in credit and bond spreads; the ability to generate sufficient

liquidity; the ability to access the equity markets; continued increase in price competition; inability to sell Option ARM product based on pricing or other factors;

risks related to the Company's restatements; risk related to the inability to maintain effective disclosure and internal controls; risks of delays in raising, or the

inability to raise on acceptable terms, additional capital, either through equity offerings, lines of credit or otherwise; the ability to generate taxable income and to

pay dividends; interest rate fluctuations on our assets that unexpectedly differ from those on our liabilities; unanticipated interest rate fluctuations; changes in

expectations of future interest rates; unexpected increase in our loan repurchase obligations; inability to originate an increased amount of commercial loans due to

lack of interest in our product; unexpected increase in prepayment rates on our mortgages; changes in assumptions regarding estimated loan losses or an increase in

loan losses; continued ability to access the securitization markets or other funding sources, the availability of financing and, if available, the terms of any financing;

changes in markets which the Company serves, such as mortgage refinancing activity and housing price appreciation; the inability to expand our Alt-A wholesale

and commercial platforms due to market conditions; the adoption of new laws that affect our business or the business of people with whom we do business; changes

in laws that affect our products and our business; volatility in the mortgage industry that effects the Company although the changes in the industry are not directly

applicable to the Company; and other general market and economic conditions that may effect the mortgage industry.

For a discussion of these and other risks and uncertainties that could cause actual results to differ from those contained in the forward-looking statements, see “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q. This presentation contains or may contain non-GAAP measures describing the company’s performance. You can find the

reconciliation of those measures to GAAP measures in our press releases on our website at www.impaccompanies.com under stockholder relations. This

presentation speaks only as of its date and we do not undertake, and specifically disclaim any obligation, to publicly release the results of any revisions that may be

made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements.

No opinion, advice, statement or other information (“Information”) contained or provided herein or hereby is intended or shall be construed as a prediction of the

performance of any security, fund, or obligation. Reliance upon any Information shall be at the sole risk of the reader. Prior to the execution of a purchase or sale or

any security or investment, you are advised to review carefully the corresponding offering document, and to consult with your broker or other financial advisor or

other professionals as appropriate. Neither Impac Mortgage Holdings, Inc. (the “Company” or “Impac”), nor its affiliates, information providers or content

providers shall have any liability for investment decisions based upon, or the results obtained from the Information. Financial information contained in the

information is not audited, and neither Impac, nor its affiliates, information providers or content providers guarantee or warrant the timeliness, sequence, accuracy,

or completeness of the Information. Nothing contained in this presentation is intended to be, nor shall be construed as, investment advice. You acknowledge that the

Information is provided for informational purposes only and is not intended as investment advice or for trading purposes.

1

Free Writing Prospectus

This document constitutes a free writing prospectus.

Impac Secured Assets Corporation (the “Depositor”) has filed a registration statement (including a prospectus) with

the SEC for the offering to which this free writing prospectus relates. Before you invest, you are encouraged to read

the base prospectus in that registration statement and other documents the issuing entity has filed with the SEC for

more complete information about the issuing entity and this offering. You may get these documents for free by

visiting EDGAR on the SEC Website at www.sec.gov. Alternatively, the Depositor will arrange to send you the base

prospectus if you request it by calling (949) 475-3600.

This free writing prospectus is not required to contain all information that is required to be included in the base

prospectus.

The information in this free writing prospectus is preliminary and is subject to completion or change.

The information in this free writing prospectus, if conveyed prior to the time of your commitment to purchase,

supersedes information contained in any prior similar free writing prospectus relating to these securities.

This free writing prospectus is not an offer to sell or a solicitation of an offer to buy these securities in any state

where such offer, solicitation or sale is not permitted.

2

Contents

1)

Executive Summary

2)

Overview

3)

Our Portfolio

4)

Credit & Collateral

5)

Loan Analytics

6)

Impac Commercial Capital Corp.

3

Executive Summary

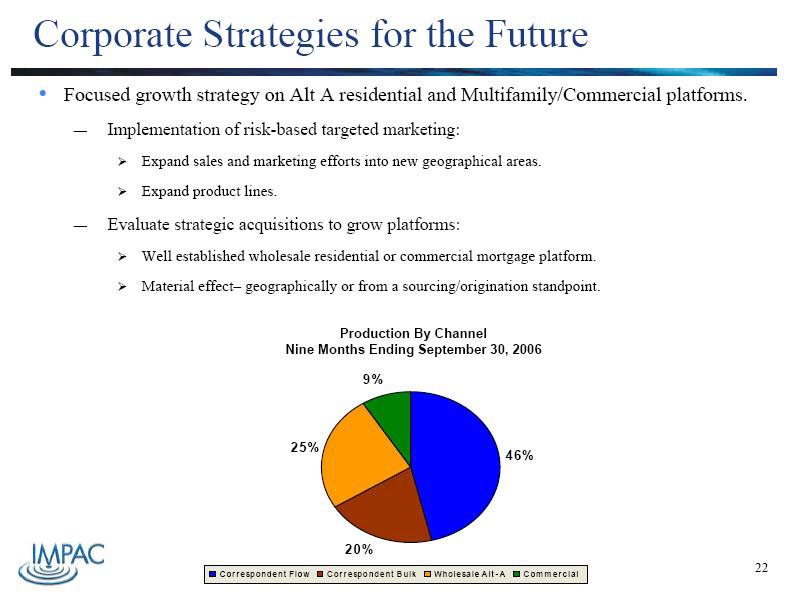

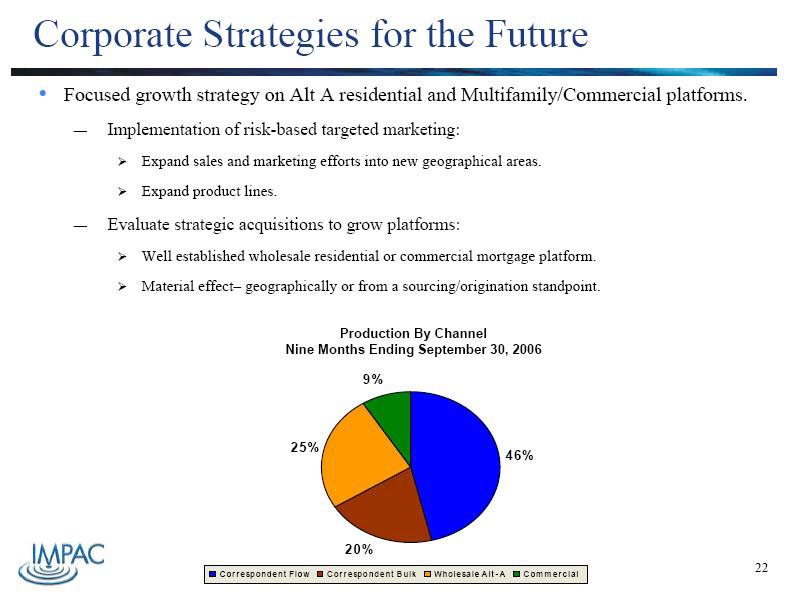

Impac is an Alt-A originator& has been at the forefront of the Alt-A market for over 15 years.

Our main focus is to originate & invest for long-term; we sell whole loans opportunistically.

As a mortgage REIT, we own our residuals, in both CMO & REMIC form.

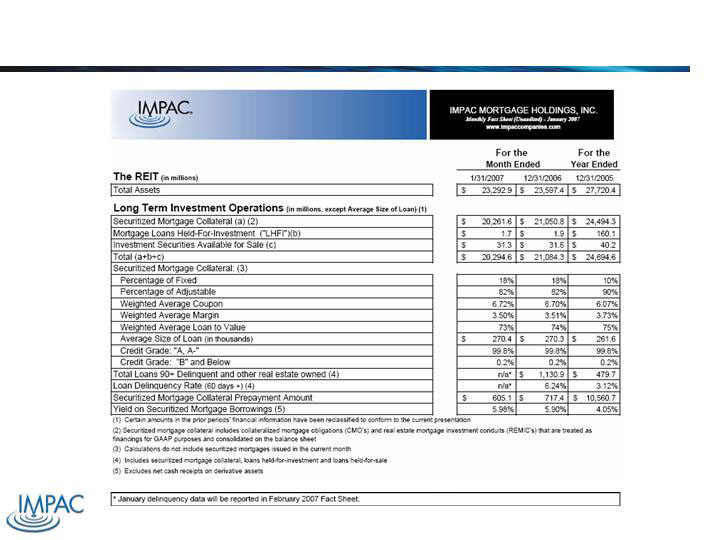

At 1/31/07, securitized collateral was approx. $20.3B.

We also own portions of the capital structure of our securitizations, both public & private.

Through both residual & bond ownership, we are in alignment with our long-term bondholders.

The current turbulent market is an opportunity to differentiate ourselves from the rest of the

playing field.

We are an Alt-A originator, not a subprime shop.

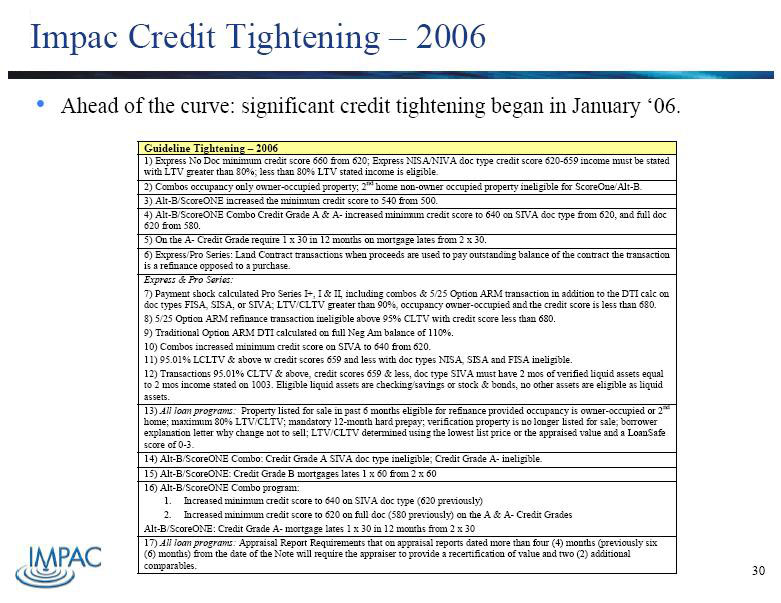

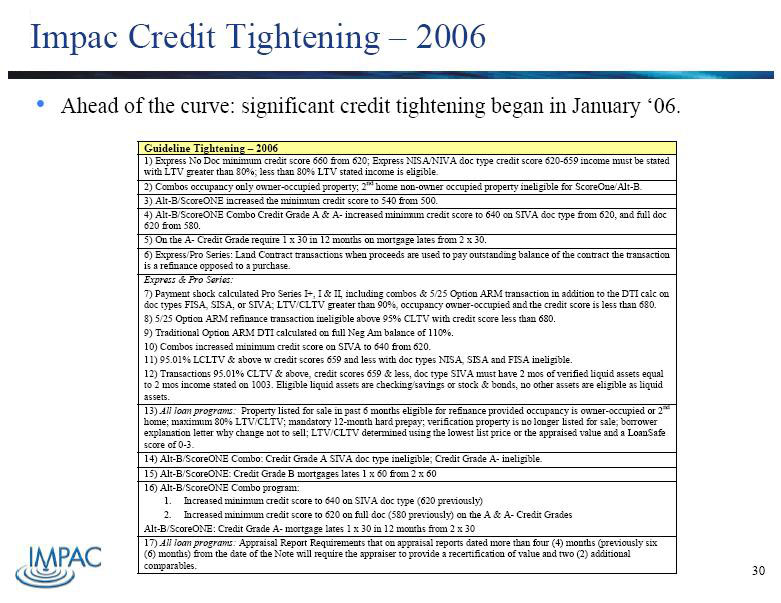

Starting in Jan ’06 & throughout the year, we proceeded to make approx. 20 major credit

tightening changes to our underwriting guidelines.

That trend continues today, with numerous credit tightening events year-to-date.

5

Executive Summary (cont’d)

Our primary origination / securitization focus is long duration, high credit quality assets.

We have implemented extensive 3rd party & proprietary analytics to create detailed risk assessment at

origination.

Core Logic, Loan Performance, & internally-developed risk & pricing models.

Exhaustive analysis of credit-driven parameters: property, borrower, FICO, LTV/CLTV, broker/correspondent scoring &

risk, among others.

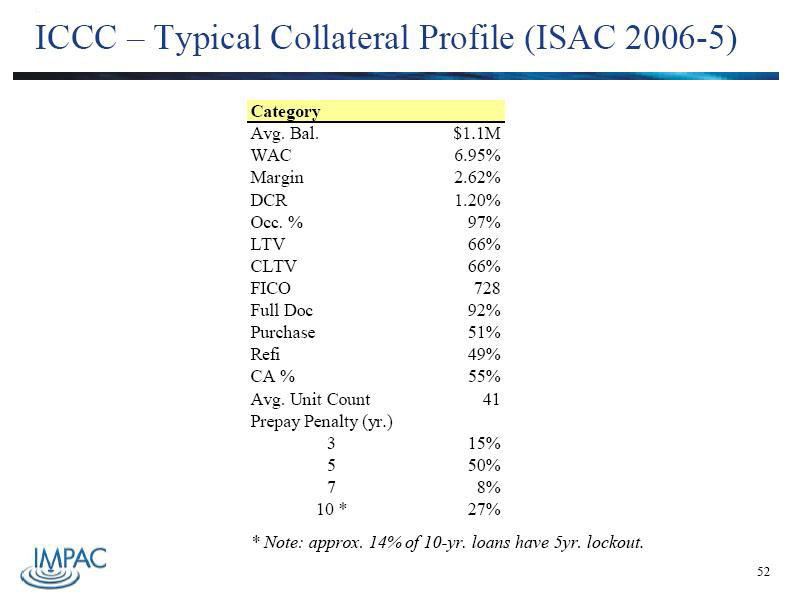

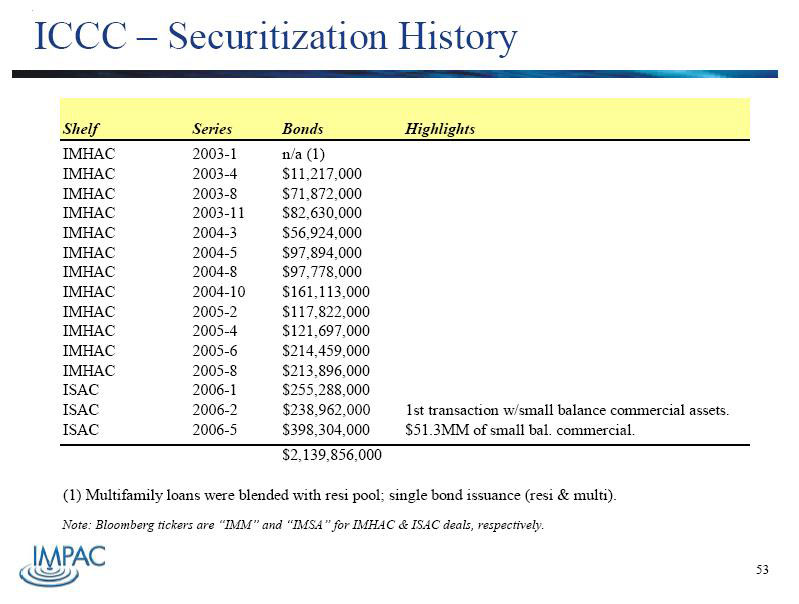

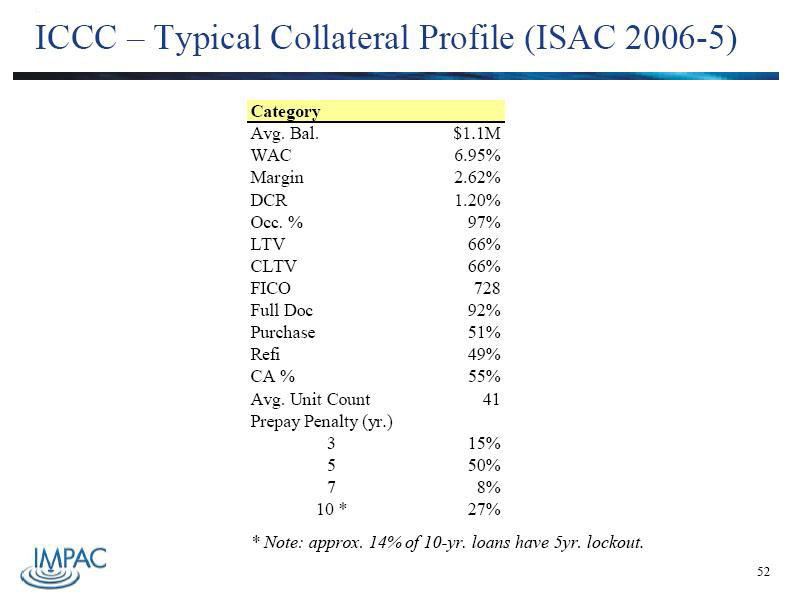

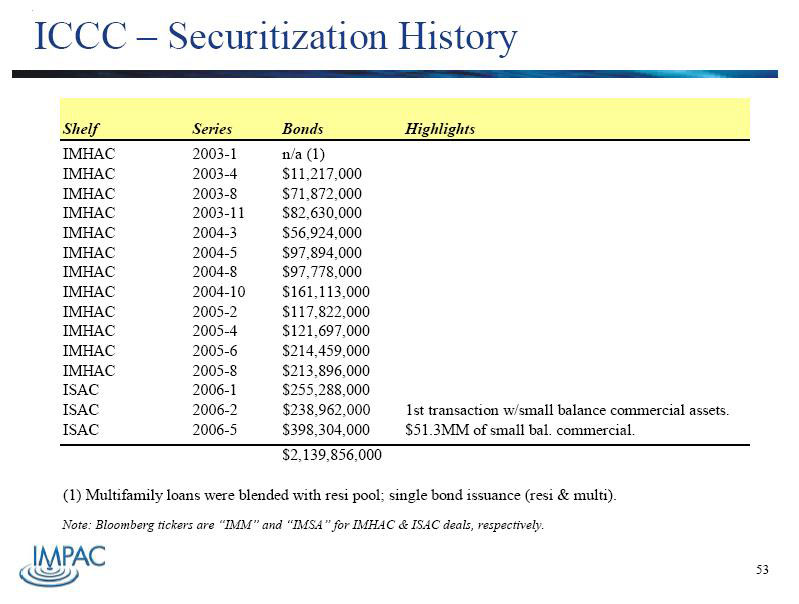

Our commercial platform, ICCC, is at the forefront of small balance multifamily & commercial origination &

securitization in pro rata & sequential non-CMBS structures.

Since 2003, 14 deals, approx. $2.2B in securitized collateral, Impac retains all residuals.

Highlight: December ’06, ISAC 06-5, AAA/Aaa Ambac-wrapped, $398MM, 4.5yr, priced at L+20bps.

First ever wrapped small balance multifamily-commercial transaction in the industry.

Bonds Sold to Bank, Money Manager & Insurance Co.’s (ABS, CMBS & CDO investors) in U.S. & Europe.

ICCC product is a natural fit for our REIT balance sheet: long duration, high credit quality (720+ FICO, mid 60’s

LTV, $1.1MM avg. bal.), slow prepay.

6

Who is Impac?

We are

An Alt-A originator, among the first in the industry.

An independent, publicly traded (since 1995) mortgage REIT (NYSE: “IMH”).

A major investor in our own securitizations.

Retention of CMO & REMIC residuals (the 1st loss piece) for balance sheet growth.

Retention of selected tranches, both public & private, within the capital structure.

An innovator in Alt-A products & capital markets execution.

On the web at: www.impaccompanies.com.

We aren’t

A subprime shop.

8

Core Takeout Strategy

We securitize via our “IMSA” or “IMM” (Bloomberg ticker) shelves:

Alt-A hybrid ARMs.

Alt-A fixed 1st TDs.

Small groups (typically 2-4% of deal UPB) of Alt-A 2nd TDs.

Our small balance multifamily-commercial origination (ICCC).

We opportunistically sell via whole loan:

Alt-A hybrid ARMs.

Alt-A fixed 1st TDs.

Alt-A 2nd TDs.

Alt-A Option ARM product.

9

Recent Press Release / 3-5-07

Impac Mortgage Holdings, Inc. Clarifies Position as an Alt-A Lender and Misconceptions in the Market Place

IRVINE, Calif., March 5 /PRNewswire-FirstCall/ --

The following is in response to recent media reports that have had an adverse impact upon our common stock price, Impac

Mortgage Holdings, Inc. (NYSE: IMH), or the "Company", a Maryland corporation being taxed as a real estate investment

trust ("REIT"):

1) Impac is an Alt-A Lender. Substantially all of the mortgages we originate or acquire are Alt-A loans. We define Alt-

A loans as mortgages made to borrowers whose credit is generally within Fannie Mae and Freddie Mac guidelines, but have

loan characteristics that make them non-conforming under those guidelines. As of the fourth quarter 2006, 99.8% of the loans

held in our portfolio had a credit grade of A or A-, which means that the credit rating exceeded 620, with a weighted average

loan-to-value ratio of 74%. As of December 31, 2006, the weighted average credit score of the Alt-A loans in our portfolio

(i.e. the long-term investment operations) was 697. During 2006, subprime mortgages represented 0.4% of acquisitions and

0.2% of the ending securitized mortgage collateral. We define subprime mortgages made to borrowers with credit ratings less

than 620, or other characteristics, that increase the credit risk. In addition, the major credit rating agencies, mortgage bond

investors and our industry identify the Company as an Alt-A lender.

2) The Company's liquidity position is strong. At December 31, 2006, the Company reported approximately $180.0 million

in cash and cash equivalents. Further, the Company has additional liquidity of approximately $75.0 million in equity invested

in mortgage loans held-for-sale and other liquidity sources at the Company's disposal.

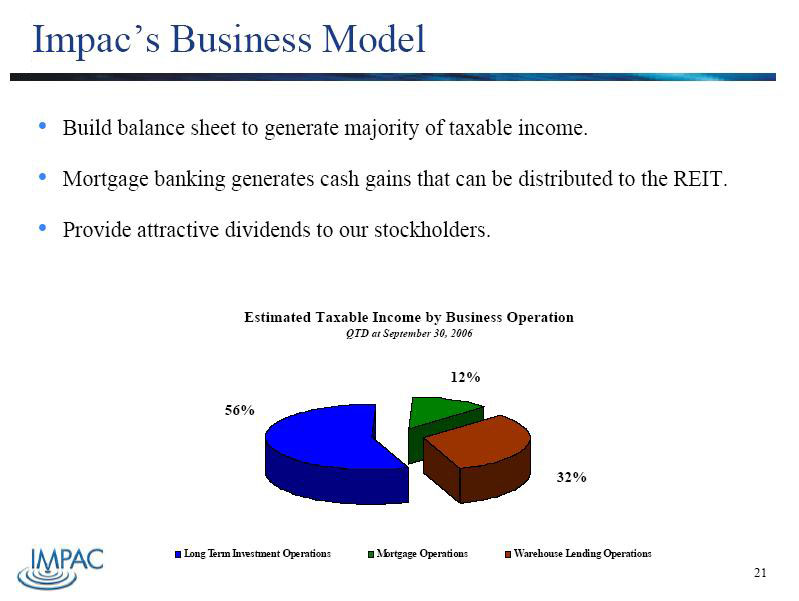

3) Estimated taxable income is the primary indicator for common stock dividends. During 2006, the Company had estimated

taxable income of $79.5 million, or $1.05 per diluted common share. During 2006, we paid common stock dividends of

$72.3 million, or $0.95 per diluted common share.

10

4) Estimated taxable income during the fourth quarter 2006 was generated entirely from the balance sheet at the REIT and

did not include a dividend from our taxable REIT subsidiary.

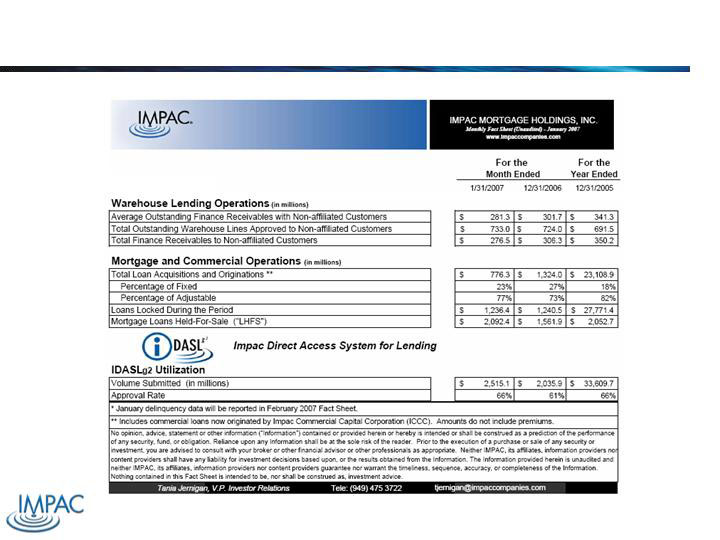

5) The Company believes it has sufficient financing under its reverse repurchase agreements to meet its ongoing origination

and funding needs.

6) The Company continues to meet all of its loan repurchase obligations. In the future we expect loan repurchase obligations

to decline based on a reduction in whole loan sales and improved credit and duration characteristics. Since January 2006, we

have tightened our underwriting guidelines 20 times, which resulted in a 40% decline in total production primarily related to

bulk acquisitions. Although total acquisitions and originations declined, we believe we have benefited from an improved

credit risk and duration profile. We believe this was validated by the securitization market where despite one of the more

turbulent credit spread environments in recent history, Impac executed its most recent securitization with the tightest bond

spreads it has experienced in over a year.

7) The restatements for 2004 - 2005, as previously described in our Form 8-K filed on February 23, 2007 has no effect on

the Company's net earnings, cash position, stockholders' equity or taxable income.

In summary:

Mr. Tomkinson commented, "It is unfortunate for our stockholders that the Company continues to be put in the same

category as subprime lenders, when essentially we have no exposure to subprime loans. In anticipation of a downturn in the

industry, Impac, since January 2006, began increasing its loan loss reserves, preserving capital, increasing its pricing and

tightening its underwriting guidelines with the intent to further improve the performance of our Alt-A mortgage portfolio."

Mr. Tomkinson concluded, "We believe that the Company has adequately prepared for this challenging market. We believe

that the Company is well capitalized, diversified in its business segments and has the expertise to manage through this

lending cycle."

Recent Press Release / 3-5-07 (cont’d)

11

Recent Press Release / 3-5-07 (cont’d)

Safe Harbor

This release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements, some of which are based on various assumptions and events that are beyond our control may be identified by reference to a future period or periods or by

the use of forward-looking terminology, such as "may," "will," "believe," "expect," "likely," "should," "could," "anticipate," or similar terms or variations on those terms or the

negative of those terms. The forward-looking statements are based on management expectations. Actual results may differ materially as a result of several factors, including, but not

limited to, failure to achieve projected earnings levels; unexpected or greater than anticipated increases in credit and bond spreads; the ability to generate sufficient liquidity; the

ability to access the equity markets; continued increase in price competition; inability to sell Option ARM product based on pricing or other factors; risks related to the Company's

restatements; risk related to the inability to maintain effective disclosure and internal controls; risks of delays in raising, or the inability to raise on acceptable terms, additional capital,

either through equity offerings, lines of credit or otherwise; the ability to generate taxable income and to pay dividends; interest rate fluctuations on our assets that unexpectedly differ

from those on our liabilities; unanticipated interest rate fluctuations; changes in expectations of future interest rates; unexpected increase in our loan repurchase obligations; inability

to originate an increased amount of commercial loans due to lack of interest in our product; unexpected increase in prepayment rates on our mortgages; changes in assumptions

regarding estimated loan losses or an increase in loan losses; continued ability to access the securitization markets or other funding sources, the availability of financing and, if

available, the terms of any financing; changes in markets which the Company serves, such as mortgage refinancing activity and housing price appreciation; the inability to expand our

Alt-A wholesale and commercial platforms due to market conditions; the adoption of new laws that affect our business or the business of people with whom we do business; changes

in laws that affect our products and our business; volatility in the mortgage industry that effects the Company although the changes in the industry are not directly applicable to the

Company; and other general market and economic conditions that may effect the mortgage industry.

For a discussion of these and other risks and uncertainties that could cause actual results to differ from those contained in the forward-looking statements, see Item 1A "Risk Factors"

and Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our annual report on Form 10-K for the year ended December 31, 2005 and

our subsequent Form 10-Q filings during 2006. This document speaks only as of its date and we do not undertake, and specifically disclaim any obligation, to publicly release the

results of any revisions that may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements.

About the Company

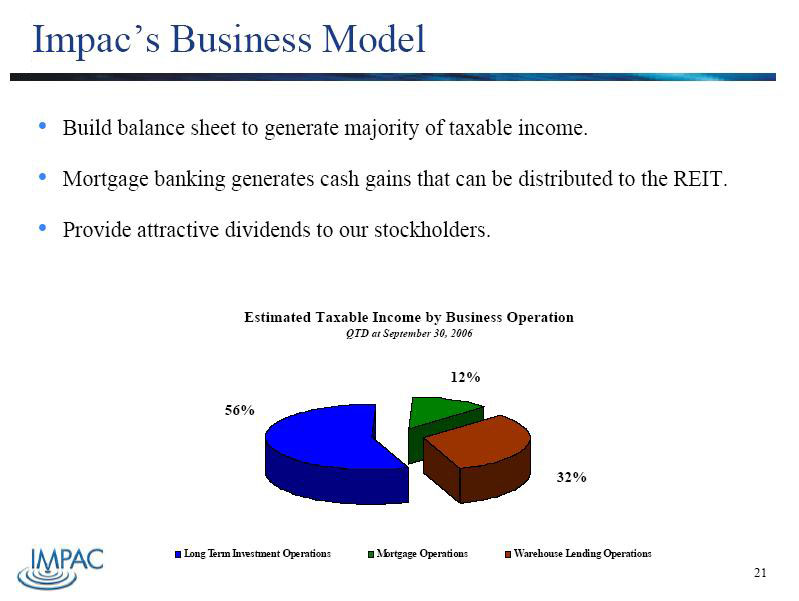

Impac Mortgage Holdings, Inc. is a mortgage REIT, which operates four core businesses: (1) the Long-Term Investment Operations, (2) the Mortgage Operations, (3) the Warehouse

Lending Operations and (4) the Commercial Operations. The Long-Term Investment Operations invests primarily in non-conforming Alt-A ("Alt-A") mortgage loans and to a lesser

extent small-balance commercial loans originated by the Commercial Operations. The Mortgage Operations acquires, originates, sells and securitizes primarily Alt-A residential

mortgage loans, the Warehouse Lending Operations provides short-term financing to mortgage loan originators and the Commercial Operations originates small-balance commercial

loans for sale to the Long-Term Investment Operations or to third parties. The Company is organized as a REIT for tax purposes, which generally allows it to pass through earnings to

stockholders without federal income tax at the corporate level.

For additional information, questions or comments, please call Tania Jernigan, VP of Investor Relations at (949) 475-3722 or email tjernigan@impaccompanies.com. Web site:

www.impaccompanies.com

SOURCE Impac Mortgage Holdings, Inc.

CONTACT: Investors, Tania Jernigan, VP of Investor Relations of Impac

Mortgage Holdings, Inc., +1-949-475-3722, tjernigan@impaccompanies.com; or

Media, Saskia Sidenfaden, Senior Media Executive of CCG Investor Relations,

+1-310-477-9800, ext. 120, Saskia.Sidenfaden@ccgir.com, for Impac Mortgage

Holdings, Inc.

12

Impac Executive Team

Joseph R. Tomkinson

Chairman/Chief Executive Officer

Impac Mortgage Holdings, Inc.

William S. Ashmore

President/Director

Impac Mortgage Holdings, Inc.

Richard J. Johnson

Executive Vice President/Chief Operating Officer

Impac Mortgage Holdings, Inc.

Gretchen D. Verdugo

Executive Vice President/Chief Financial Officer

Impac Mortgage Holdings, Inc.

Ronald M. Morrison

Executive Vice President/General Counsel

Impac Mortgage Holdings, Inc.

From left to right:

Back Row: Richard Johnson, Gretchen Verdugo, Ron Morrison

Front Row: Joe Tomkinson, Bill Ashmore

13

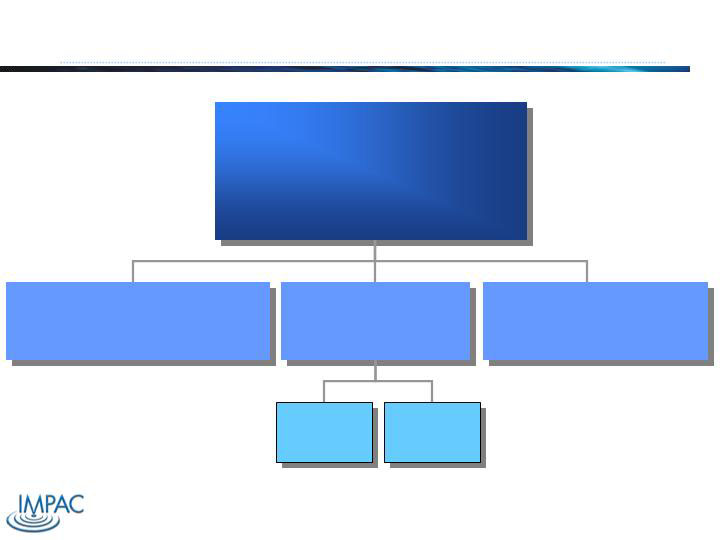

Corporate Structure

Impac Mortgage Holdings, Inc.

(NYSE: IMH)

Long-Term Investment Operations

(The REIT)

Impac Warehouse Lending Group, Inc.

Warehouse Lending Operations

(Qualified Subsidiary)

Impac Funding Corporation

Mortgage Operations

(Taxable Subsidiary)

ILG

Wholesale

Origination

Platform

IFC

Correspondent

Origination

Platform

Impac Commercial Capital Corp.

Small Balance Commercial and

Multifamily Operations

(Taxable Subsidiary)

14

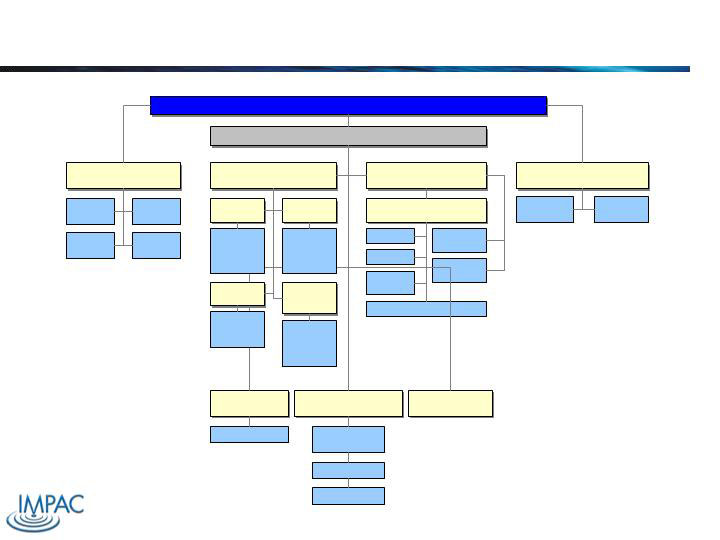

Organizational Structure

Joe Tomkinson, Chairman & CEO

William Ashmore, President

Gretchen Verdugo,

EVP, Chief Financial Officer

Ron Morrison

EVP, General Counsel

Finance /

Accounting

Internal

Audit

Default

Mgmt.

Master

Servicing

Client

Administration

Human

Resources

Greg Davis

SVP, Nat’l Sales

IFC / ILG Sales

Andrew McCormick

EVP, Chief Investment Officer

Nancy Pollard

EVP, Secondary Marketing

Trading

Structured

Finance

Andy Chawla

SVP, Enterprise Risk Mgmt

IFC/ILG

Underwriting

Quality Control

ERM / Analytics

Asset Liability

Mgmt.

Richard Johnson

EVP, Chief Operating Officer

Analytics

Transaction

Mgmt.

Bill Endresen

President, ICCC

Kathy Murray

SVP, Operations

Elaine Batlis

President,

IWLG

Secondary Mktg. Operations

Tania Jernigan

VP, Investor Relations

Jeff Ratter

SVP, I.T.

Small Bal.

Commercial

& Multifamily

Platform

Impac

Origination

Platform &

Facilities

Impac and 3rd

Party Affiliate

Warehousing

Platform

Impac

Technology

Platform

15

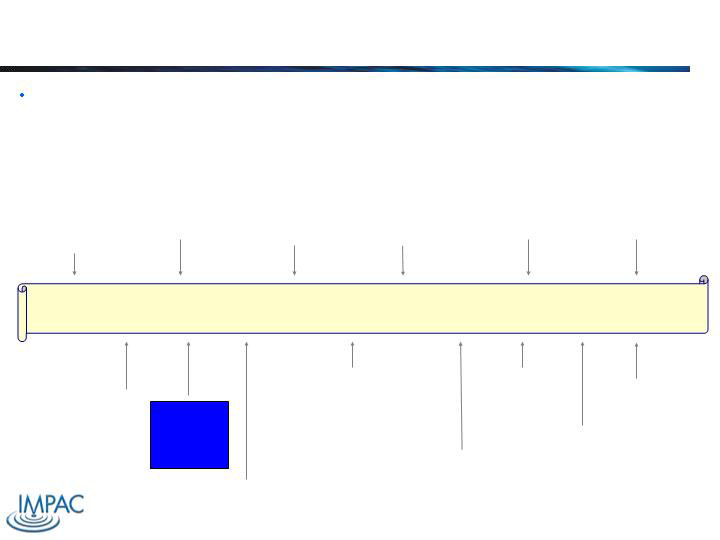

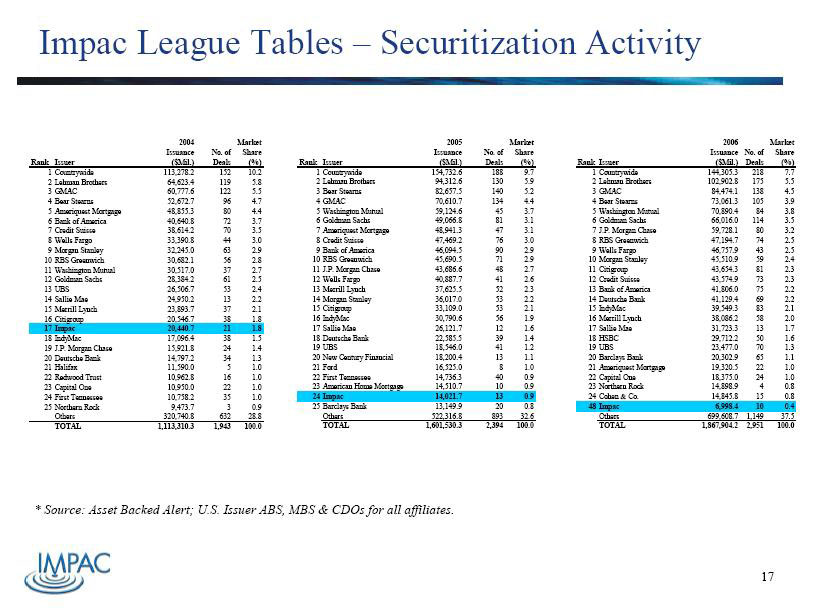

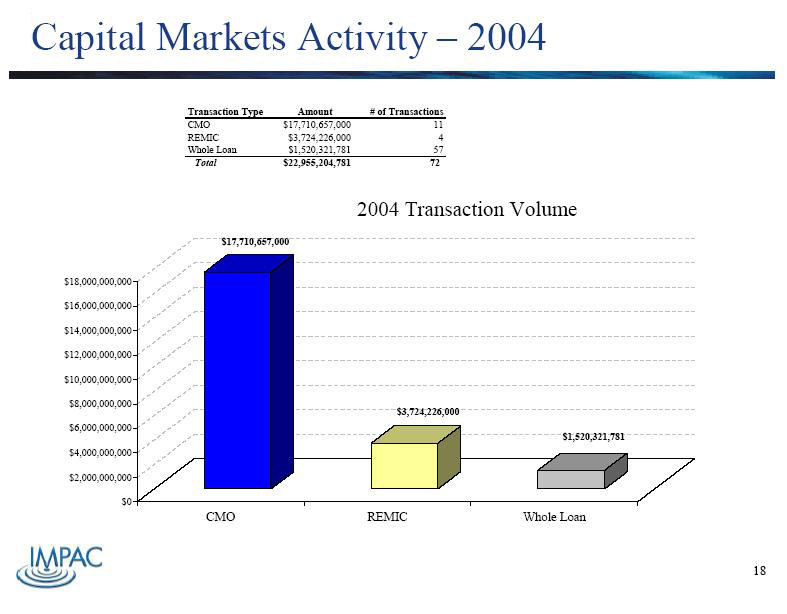

Key Events in Impac History

1981 1986 1991 1994 1995 2000 2002 2003 2004 2005 2006

Joe Tomkinson,

Impac’s

Chairman &

CEO, founded a

small mortgage

brokerage firm.

Joe sells his ownership to

Imperial Bank, creating

Imperial Bank Mortgage.

Imperial Bank Mortgage

launches to public as

Imperial Credit

Industries, Inc.

Imperial Credit

creates the

“Smart” loan,

the first Alt-A

product.

Imperial Credit creates the

“Express” loan product.

The residential mortgage

division of Imperial Credit

launches to the public as

Impac Mortgage Holdings

(“IMH”), a mortgage REIT

which primarily invests in

Alt-A loan products

From our predecessor firm’s “Smart Loan” (the industry’s first Alt-A product), to our current small balance

multifamily/commercial products, Impac spans 25 years of innovative history.

Impac creates Impac

Direct Access for

Lending, a web-based

lending tool.

Impac opens Impac

Commercial Capital Corp

to originate small balance

multifamily loans for

diversification of the

REIT’s balance sheet.

1) Impac issues its first $1B

Alt-A resi securitization.

2) Impac’s small balance

multifamily securitization

begins.

Impac issues its

first $2B Alt-A

securitization.

Impac opens

Wholesale

operations in

Chicago.

Impac achieves

record

origination of

$22B.

Impac issues

innovative wrapped,

single tranche, small

balance multifamily /

commercial

securitization structure,

an industry first.

Impac implements

over 17 credit

tightening events,

beginning in January,

shifting portfolio

origination to long

duration, high credit

quality loans.

16

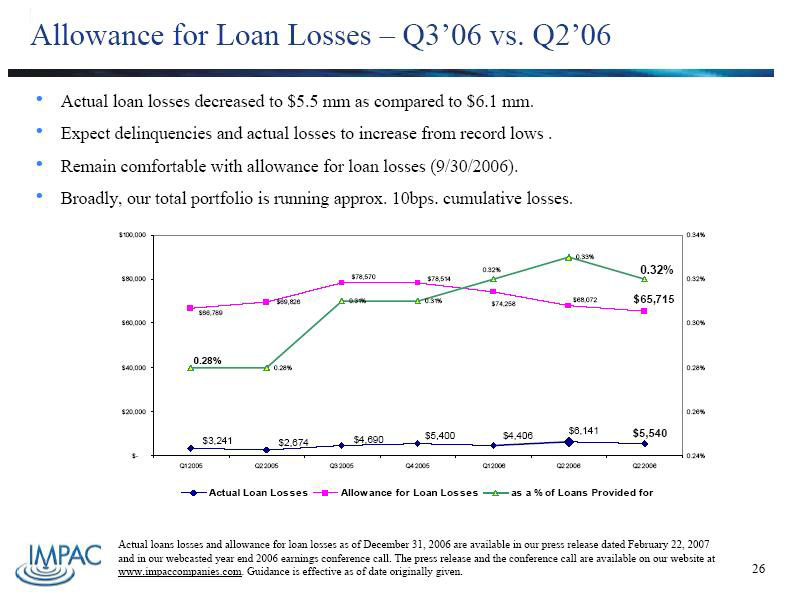

REIT Portfolio Snapshot – Jan ‘07

24

REIT Portfolio Snapshot – Jan ‘07

25

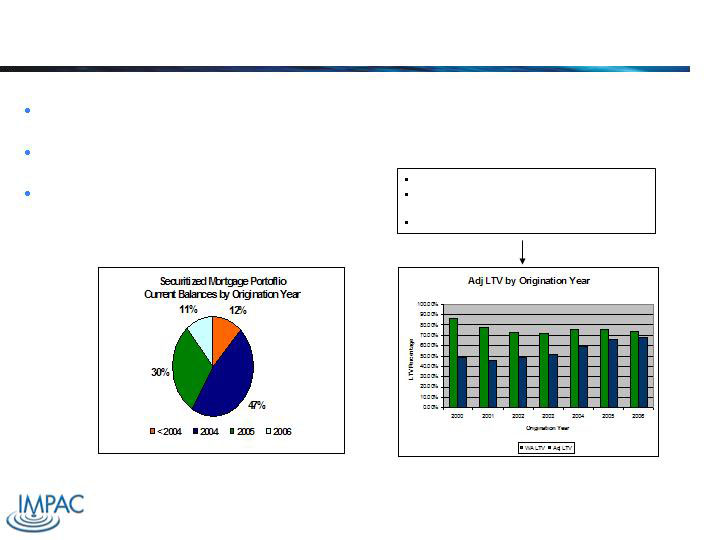

Concentrated in geographical areas with favorable HPA & employment characteristics.

89% of loans acquired prior to 2006.

47% of current balances originated in 2004.

Portfolio Credit Characteristics

Utilizes WA National HPA Rates.

Doesn’t Include Favorable Geographical

Weighting.

75% of Portfolio in much Higher HPA rate

All data as of 6/30/06.

The information contained herein regarding estimated WA LTV is provided for informational purposes only to assist in the understanding of certain characteristics of our

loan portfolio and are not a projection of future performance, financial position or cash flows. The information is based upon (i) assumptions that, while presented with

numerical specificity, are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control, and

(ii) assumptions that were made for the purpose of simplifying the information. No representation is being made that the results of the information will be achieved.

28

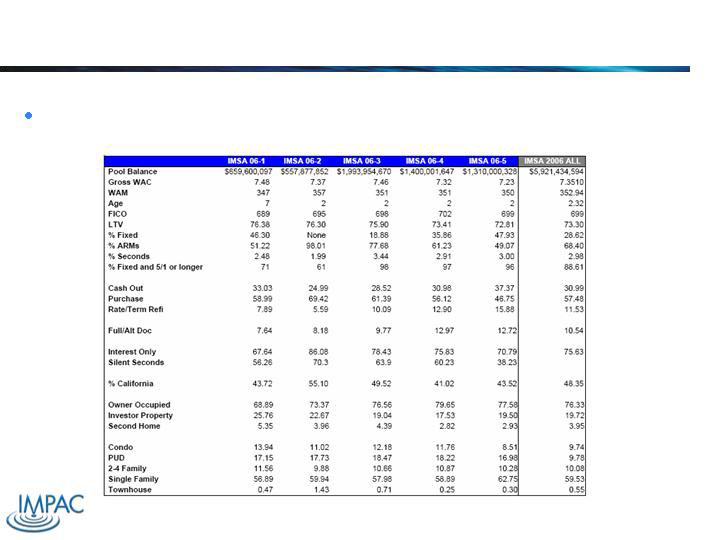

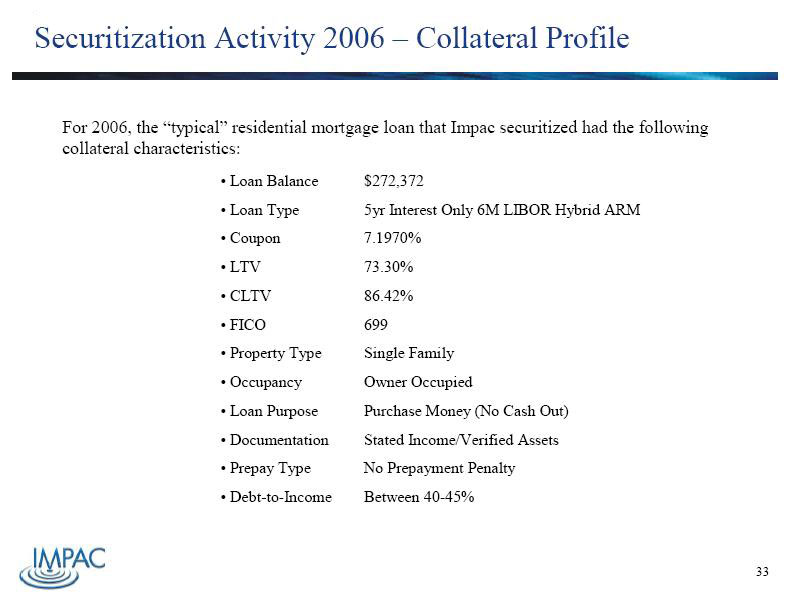

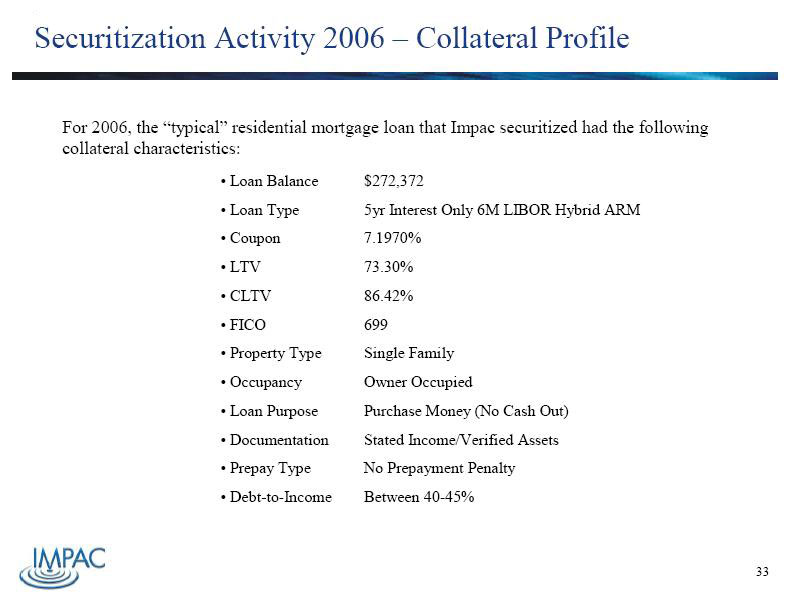

Securitization Activity 2006 – Collateral Profile

Summary Residential Loan Characteristics

32

Alt-A vs. Subprime Credit Comparison

ALT – A

Tradelines – Minimum of 5 trades required

Depth – Minimum 24 months with one of the 5 trades having a

$5,000 high balance

Mortgage lates – No rolling lates allowed

BK/Foreclosure – None allowed in the past 24 months for BK

and none in 36 months for foreclosure

Chargeoff’s/Collections – None allowed in the past 24 months

Judgments/Tax Liens – None allowed in the past 24 months

Consumer Credit Counseling (CCC) – Must be released at least

12 months prior to close

Forbearance – Not allowed

Grade level based on mortgage rating only – Not allowed

Minimum credit score - 620

SUBPRIME

Tradelines – None required at 90% LTV or less. Over 90% 3

trades required

Depth – minimum 6 months with no high balance required

Mortgage lates – Lates allowed within the last 12 months – up to

90 days late

BK/Foreclosure – No minimum time from BK discharge. No

Foreclosure within past 12 months

Chargeoff’s/Collections – If greater than 12 months, disregard

Judgments/Tax liens – No minimum time limits.

Consumer Credit Counseling (CCC) – No minimum time period

since release

Forbearance – Allowed

Grade level based on mortgage rating only – Allowed

Minimum credit score 500

34

Alt-A vs. Subprime Income/Assets Comparison

ALT – A

Bank Statement only program to verify income –

Not allowed

Minimum income verification time period – 2 years

Residual income calculation – Not required

Gift of equity – Not allowed

Source and seasoning of assets - Required

SUBPRIME

Bank Statement only program to verify income –

Allowed on 6 months or 12 months bank statements

Minimum income verification time period – 12

months

Residual income calculation – Required

Gift of equity – Allowed

Seasoning of assets – Not Required

35

Current Strategy / Future Benefits

Acquiring/originating higher credit, longer duration loans by utilizing risk-

based target marketing:

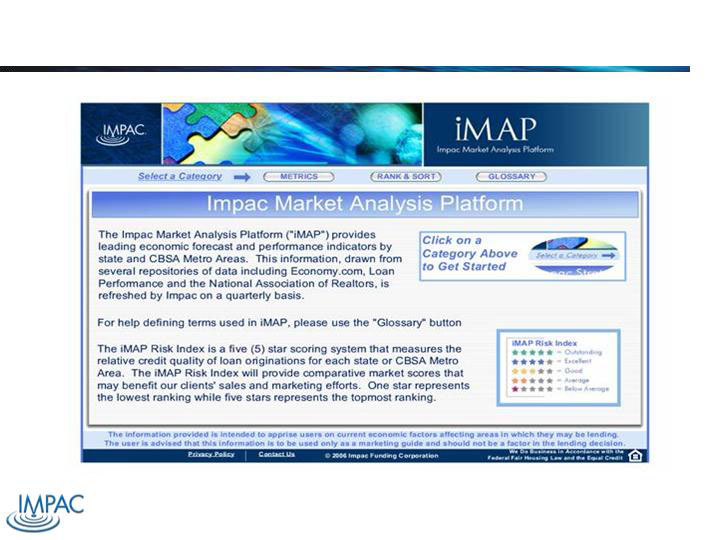

“iMAP” (external proprietary analytical/marketing tool).

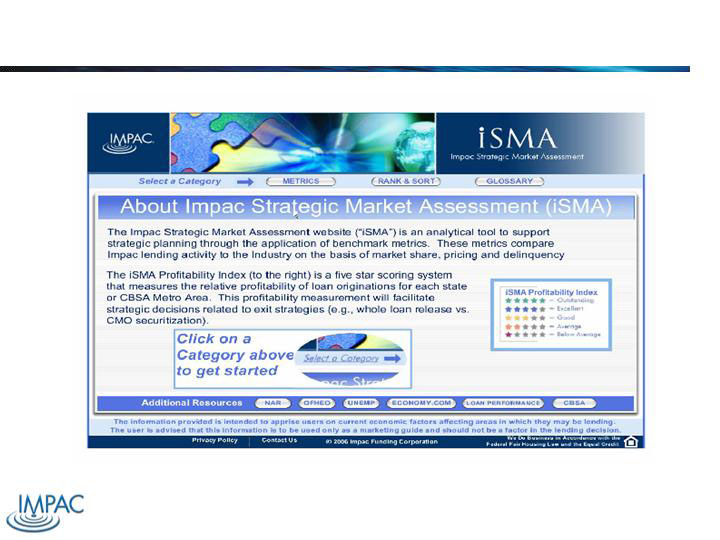

“iSMA” (internal profitability ranking).

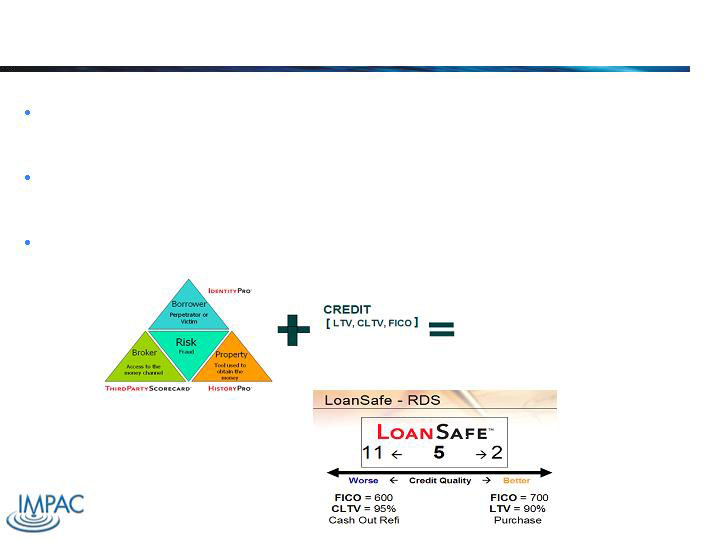

Leveraging third-party products to pre-screen potential fraudulent loans:

LoanSafe (tool for identifying high risk components of loan transactions).

HistoryPro (property-based risk score measuring home prices, foreclosure rates

and flip activity).

Integrate cutting-edge technologies to optimize pricing and selectively invest in

loans.

37

Macro-Economic Approach

Macro-Economic Strategy Management Using Proprietary Tools

CBSA 1 to 5 star ranking system – Quarterly Update.

1 Year Forward Projected Unemployment.

1 Year Forward Projected House Price Appreciation.

Alt-A and Sub-Prime Industry Delinquency.

Industry Product Level Performance.

Projected Purchase and Refinance Mortgage Originations.

% of 2nd Homes and Investor Homes in each CBSA.

Display of Household Income.

Ability to sort data to extract most current performance.

Understand the macro-economic environment for credit decisions, sales expansion

and investment decisions.

38

Proprietary Tools: Market Analysis

39

Proprietary Tools: Profitability Analysis

40

Impac’s Use of LoanSafe Analytics

LoanSafe score assesses individual, loan-level risk by reviewing:

Property

Borrower

Third Party Broker/Correspondent Risk

LoanSafe is predominantly a collateral risk assessment tool.

“Adjusted LoanSafe” is a more robust LoanSafe scoring process

with FICO, LTV, & CLTV added.

This results in a comprehensive loan level risk profile / assessment.

41

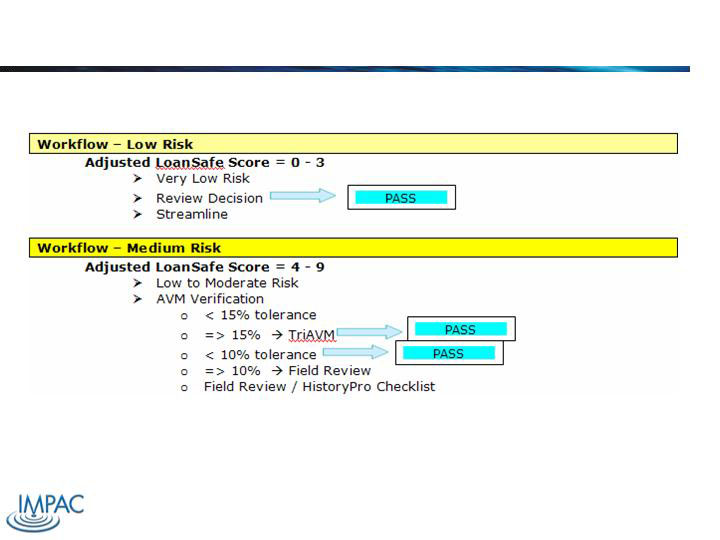

Adjusted LoanSafe Score

Adjusted

Loan Safe

Score

“Adjusted LoanSafe Score” is the most robust scoring mechanism in use by Impac to

analyze loans.

As it has been continually refined, it has been systematically layered into our pricing

engines and used to evaluate Impac’s existing REIT portfolio.

In simple terms, the lower the score, the better the overall credit.

42

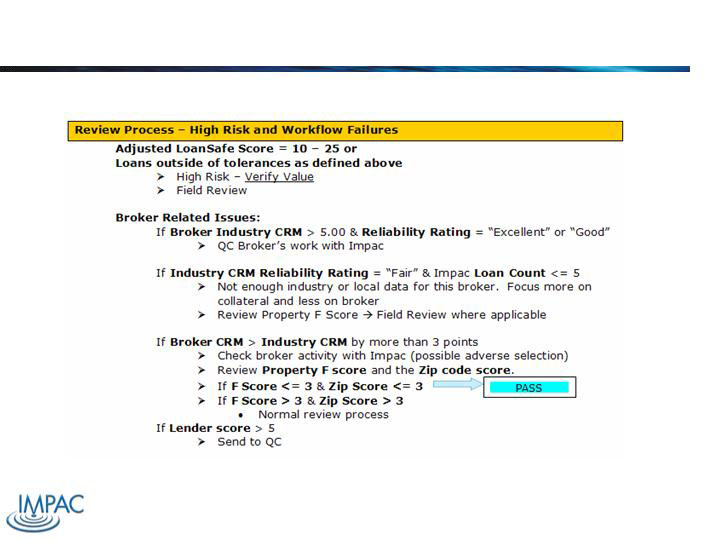

LoanSafe Process – Low & Medium Risk

43

LoanSafe Process – High Risk

44

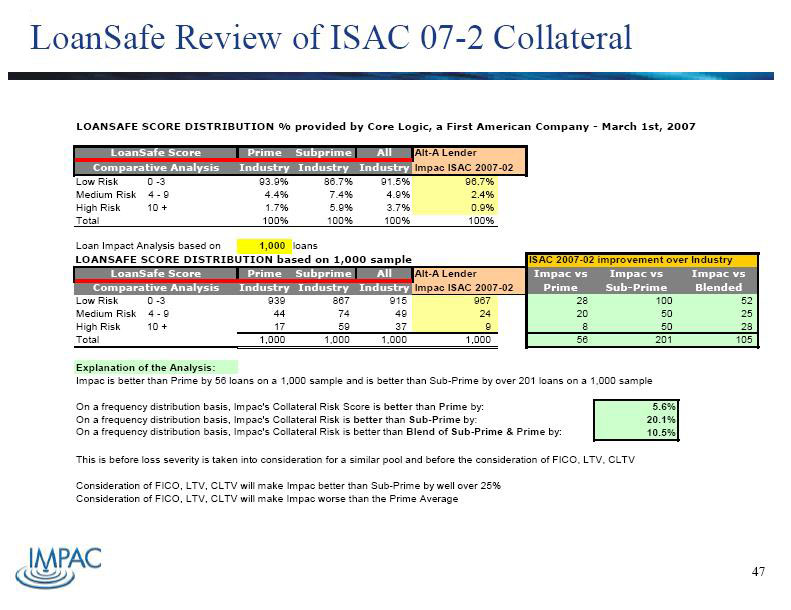

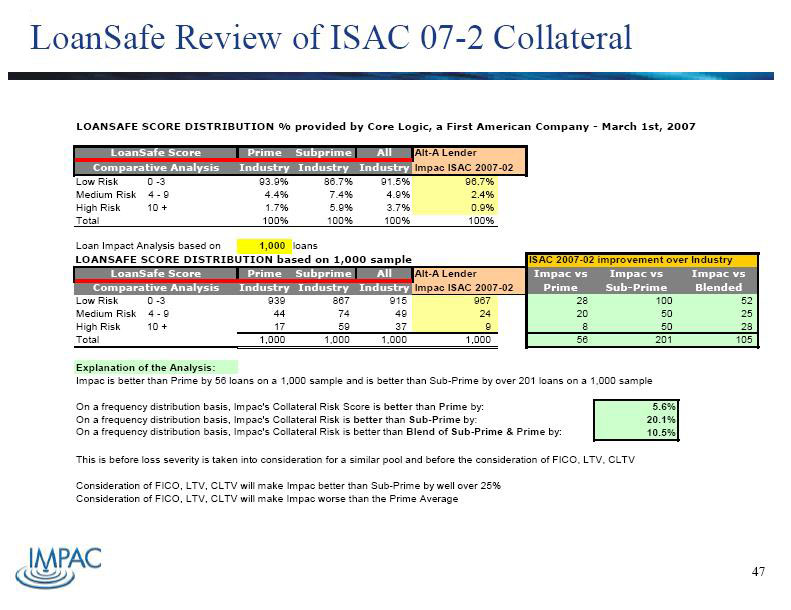

LoanSafe Review of ISAC 07-2 Collateral

Key Summary – LoanSafe Scoring

LoanSafe review of 3,369 Resi hybrid ARM and Fixed 1st loans allocated to the transaction*.

98.7% (3,326 loans) resulted in comprehensive LoanSafe scoring.

96.7% (3,216 loans) had a LoanSafe score of 0 – 3 (low risk).

2.4% (80 loans) had a LoanSafe score of 4 – 9 (medium risk).

0.9% (30 loans) had a LoanSafe score of 10+ (higher risk).

Additional Detail

76.8% (2,553 loans) of loans where LoanSafe scoring available came from top 5 states: CA, FL, AZ, IL,

& NY.

97.6% of these loans have LoanSafe score of 0 – 3 (low risk).

2.0% of these loans have LoanSafe score of 4 - 9 (medium risk).

0.4% of these loans have LoanSafe score of 10+ (medium risk).

* Note: resi ARM & Fixed 1sts analyzed by LoanSafe; 2nd TD scoring is TBD, as 2nd TD loan population currently being determined.

45

LoanSafe Review of ISAC 07-2 Collateral

Origination Channel Analysis:

97.9% of wholesale channel origination had LoanSafe scores.

Over 96% of wholesale channel loans were 0 – 3 (low risk category).

100% of loans from the correspondent bulk channel had LoanSafe scores.

99.6% of loans from the correspondent flow channel had LoanSafe scores.

Over 97% of correspondent channel (bulk +flow) loans were 0 – 3 (low risk category).

Perspective:

In a 3 year ILG (Impac’s wholesale channel) origination test conducted in late

2005, LoanSafe scores of “0” for the back-tested loans had a loss severity of less

than $ 1,000 per loan, when compared to loss severity of over $ 30,000 on loans

with LoanSafe scores of 25.

46

6. Impac Commercial Capital Corp. (“ICCC”)

48

ICCC – Impac Commercial Capital Corporation

49

Organizational Structure

William Endresen, President

Ron Stoffers

EVP, Chief Credit Officer

Underwriting

Bob Zietlow,

VP, Chief Appraiser

Paul Cleary

SVP, Operations

Origination Platform

Appraisal

Keith Nisenson

SVP, Eastern Sales

Fred Barrow

SVP, Western Sales

CA

TX

CO

OR

IL

MO

Production

Compliance

Loan Administration

ICCC comprised of approximately 80 personnel, staffed principally at the Company’s Irvine corporate office.

Regional markets served by satellite sales offices and applicable support staff.

50

Impac Commercial Capital Corp.

Impac’s small balance multifamily-commercial origination platform (“ICCC”).

Securitization in discreet pools within Impac trusts (CMO & REMIC).

Leading innovator in small balance multifamily-commercial securitization

within senior/sub/oc (both pro-rata pay & sequential pay) structures since

2003:

14 Deals, $2.14B in bond issuance, $2.2B in collateral securitized.

100% residual retention: Impac retains first loss.

Recent market innovation: ISAC 06-5 (Dec. ’06):

Ambac-wrapped AAA senior/sub/oc, 96.7% bond size (3.30% initial oc).

51

Case Study: ISAC 2006-5 / Class 2A

First wrapped small balance multifamily-commercial securitization in the industry.

$398.3MM bond, 96.70% of capital structure (@ BBB attachment).

Aaa / AAA rating via Ambac wrap.

Priced at L + 20bps.

4.5 yr. WAL.

Impac retains 100% of residual.

Structure: senior/sub/OC.

Initial OC @ 3.30%, growing to 5.65%.

$411.9MM collateral deposited.

Wide distribution:

Sold to Bank, Money Manager & Insurance Co.’s (ABS, CMBS & CDO investors) in U.S. & Europe.

54

Impac Commercial Capital Corp.

55

Impac Commercial Capital Corp.

56

Impac Commercial Capital Corp.

57

ICCC – Recent Funding Sample

58

ICCC – Recent Funding Sample

59

Contact Info

Impac – Corporate Office

Andrew McCormick

EVP, Chief Investment Officer

The Impac Companies

19500 Jamboree Road

Irvine, CA 92612

Office: 949-475-4999

Cell: 917-539-1241

andrew.mccormick@impaccompanies.com

www.impaccompanies.com

Impac – NYC Office

Jim Malloy

SVP, Secondary Marketing

The Impac Companies

787 Seventh Ave, Suite 938

New York, NY 10019

Office: 212-786-6133

Cell: 949-648-0417

jim.malloy@impaccompanies.com

www.impaccompanies.com

60

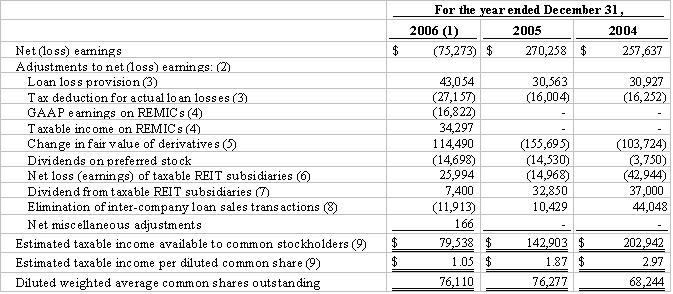

Year-ended 2006 vs. Year-ended 2005

Estimated Taxable Income available to IMH Common Stockholders

Estimated taxable income available to IMH common stockholders excludes net earnings from IFC and its subsidiaries and the elimination of intercompany loan sale transactions. The following schedule reconciles net earnings to estimated taxable income available to common stockholders of the REIT.

| (1) | Estimated taxable income includes estimates of book to tax adjustments which can differ from actual taxable income as calculated when we file our annual corporate tax return. Since estimated taxable income is a non-GAAP financial measurement, the reconciliation of estimated taxable income available to common stockholders to net (loss) earnings is intended to meet the requirements of Regulation G as promulgated by the SEC for the presentation of non-GAAP financial measurements. To maintain our REIT status, we are required to distribute a minimum of 90 percent of our annual taxable income to our stockholders. |

| (2) | Certain adjustments are made to net (loss) earnings in order to calculate taxable income due to differences in the way revenues and expenses are recognized under the two methods. |

| (3) | To calculate estimated taxable income, actual loan losses are deducted. For the calculation of net earnings, GAAP requires a deduction for estimated losses inherent in our mortgage portfolios in the form of a provision for loan losses, which are not deductible for tax purposes. Therefore, as the estimated losses provided for under GAAP are actually realized, the losses will negatively and may materially effect future taxable income. |

| (4) | Includes GAAP to tax differences related to the ISAC REMIC 2005-2, ISAC REMIC 2006-1, ISAC REMIC 2006-3, ISAC REMIC 2006-4, and ISAC REMIC 2006-5 securitizations, which were treated as secured borrowings for GAAP purposes and sales for tax purposes. The REMIC GAAP income excludes the provision for loan losses recorded that may relate to the REMIC collateral included in securitized mortgage collateral. The Company does not have any specific valuation allowances recorded as an offset to the REMIC collateral. |

| (5) | The mark-to-market change for the valuation of derivatives at IMH is income or expense for GAAP financial reporting purposes but is not included as an addition or deduction for taxable income calculations until realized. |

| (6) | Represents net (loss) earnings of IFC and ICCC, our taxable REIT subsidiaries (TRS), which may not necessarily equal taxable income. Starting January 1, 2006, the Company elected to convert ICCC from a qualified REIT subsidiary to a TRS. |

| (7) | Any dividends paid to IMH by the TRS in excess of their cumulative undistributed earnings and profits taxable income minus taxes paid would be recognized as a return of capital by IMH to the extent of IMH’s capital investment in the TRS. Distributions from the TRS to IMH may not equal the TRS net earnings, however, IMH can only recognize dividend distributions received from the TRS as taxable income to the extent that the TRS distributions are from current or prior period undistributed earnings and profits taxable income minus taxes paid. Any distributions by the TRS in excess of IMH’s capital investment in the TRS would be taxed as capital gains. |

| (8) | Includes the effects to taxable income associated with the elimination of gains from inter-company loan sales and other inter-company transactions between IFC, ICCC, and IMH, net of tax and the related amortization of the deferred charge. |

| (9) | Excludes the deduction for common stock cash dividends paid and the availability of a deduction attributable to net operating loss carry-forwards. As of December 31, 2006, the Company has estimated federal net operating loss carry-forwards of $8.2 million that are expected to be utilized prior to their expiration in the year 2020. |