As filed with the Securities and Exchange Commission on March 8, 2021

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07717

TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS

(Exact Name of Registrant as Specified in Charter)

1801 California St., Suite 5200, Denver, Colorado 80202

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: 1-888-233-4339

Erin D. Nelson, Esq., 1801 California St., Suite 5200, Denver, Colorado 80202

(Name and Address of Agent for Service)

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

| Item 1: | Report(s) to Shareholders. |

| | (a) | The Annual Report is attached. |

TRANSAMERICA VARIABLE FUNDS

TRANSAMERICA ASSET

ALLOCATION VARIABLE FUNDS

Annual Report

December 31, 2020

Table of Contents

Authorized for distribution only when accompanied or preceded by a prospectus. Investors should carefully consider a fund’s investment goals, risks, charges and expenses before investing. A prospectus contains this and other information; please read it carefully before investing.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

This report is not to be construed as an offering for sale of any contracts participating in the Subaccounts (Series) of the Transamerica Variable Funds or the Transamerica Asset Allocation Variable Funds, or as a solicitation of an offer to buy contracts unless preceded by or accompanied by a current prospectus which contains complete information about charges and expenses.

This report consists of the annual report of the Transamerica Asset Allocation Variable Funds and the annual report of the Calvert VP SRI Balanced Portfolio.

Proxy Voting Policies and Procedures

A description of the proxy voting policies and procedures of the Transamerica Asset Allocation Variable Funds is included in the applicable Statements of Additional Information which are available without charge, upon request: (i) by calling 1-800-755-5801; or (ii) on the SEC’s website at www.sec.gov. In addition, the Transamerica Asset Allocation Variable Funds are required to file Form N-PX, with the complete proxy voting record for the most recent twelve months ended June 30, no later than August 31 of each year. Form N-PX for the twelve months ended June 30, 2020, is available without charge, upon request by calling 1-800-851-9777 and on the SEC’s website at http://www.sec.gov.

Quarterly Portfolio Holdings

Each fiscal quarter, Transamerica Asset Allocation Variable Funds will file with the SEC a complete schedule of their monthly portfolio holdings on Form N-PORT. The Subaccounts’ holdings as of the end of the third month of every fiscal quarter, as reported on Form N-PORT, will be publicly available on the SEC’s website at http://www.sec.gov within 60 days of the end of the fiscal quarter.

TRANSAMERICA FINANCIAL LIFE INSURANCE COMPANY

440 Mamaroneck Avenue

Harrison, New York 10528

To Contract Holders with Interests in the

Transamerica Variable Funds:

We are pleased to present the most recent annual report for the Calvert VP SRI Balanced Portfolio. As required under applicable law, we are sending this annual report to contract holders of Group Variable Annuity Contracts issued by Transamerica Financial Life Insurance Company with unit interests in the Calvert Series Subaccount of the Transamerica Variable Funds, which invests its assets in the Calvert VP SRI Balanced Portfolio, a series of Calvert Variable Series, Inc.

Please call your retirement plan administrator, Transamerica Retirement Solutions, LLC, at (800) 755-5801 if you have any questions regarding these reports.

Dear Contract Holder,

On behalf of Transamerica Asset Allocation Variable Funds, we would like to thank you for your continued support and confidence in our products as we look forward to continuing to serve you and your financial professional in the future. We value the trust you have placed in us.

This annual report is provided to you with information about the investments of your Subaccount(s) during the fiscal year. The Securities and Exchange Commission currently requires that annual and semi-annual reports be provided to all contract holders invested in the Subaccounts, and we believe it to be an important part of the investment process. This report provides detailed information about your Subaccount(s) for the 12-month period ended December 31, 2020.

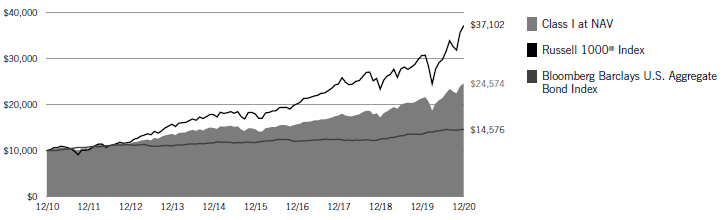

We believe it is important to understand the market conditions over the last fiscal year of the Subaccounts to provide context for reading this report. The period began with U.S. equity markets having recently reached all-time highs, as U.S./China trade relations improved and expectations for stable economic growth, benign inflation and low interest rates helped to foster optimism for 2020. Throughout January, sentiment remained strong, as equity markets traded higher.

By early February, headlines about a rapidly spreading respiratory virus in China (“COVID-19”) appeared, and fears of its global transmission began to rattle markets. Even though the S&P 500® Index reached a new record high on February 19, investors became quickly immersed in angst regarding COVID-19, and as cases exploded throughout Asia and Europe, its arrival to the U.S. sparked a historic selloff across almost all asset classes. A nationwide lockdown in the U.S. quickly went into effect in mid-March, and while the U.S. Federal Reserve (“Fed”) slashed short-term rates to zero, it could not prevent widespread selling across equity and credit markets. The S&P 500® Index experienced its fastest 35% decline in its history by the final week of March, while international markets saw similar declines with the MSCI EAFE Index losing approximately one-third of its value from peak to trough. Credit spreads more than tripled, and long-term Treasury yields collapsed as the 10-year Treasury yield dropped to an all-time low of 0.54%.

Throughout the spring, the U.S. economy experienced its worst economic contraction since the Great Depression as more than twenty million jobs were lost in the month of April and second quarter gross domestic product (“GDP”) plummeted by an annualized rate of -31%. However, as the Fed quickly implemented unprecedented amounts of large-scale asset purchases and credit support, and Congress passed the Coronavirus, Aid, Relief and Stimulus Act (“CARES”) providing more than $2 trillion to businesses and families, the markets began to see a recovery on the horizon.

By June, with virus case growth having declined, most states had loosened business shutdowns and social distancing requirements, and with pent-up demand from the earlier months now being combined with lower interest rates and market liquidity, GDP came roaring back in the third quarter to reach its highest rate of growth ever. Markets reacted accordingly as the S&P 500® Index regained its pre-pandemic high by the end of August, however, volatility returned in September and October as daily COVID-19 case levels increased exponentially to numbers well above those seen earlier in the year. A contentious presidential election and the inability of Congress to pass another round of economic relief also added to investor angst, however, markets resumed their advance in November after the election of Joe Biden as America’s 46th President inferred a potentially easier path for future economic stimulus. Shortly after the election, several pharmaceutical companies released clinical trial data on their COVID-19 vaccine candidates that displayed statistically high levels of efficacy, and this further encouraged higher stock prices.

By the end of the fiscal year, stocks were again pushing toward new all-time highs, as COVID-19 vaccines were approved and began to be distributed. In addition, another round of economic stimulus was approved, and investors began to focus on the prospects of economic and corporate recoveries in 2021. International equity markets, which lagged the U.S. during the 2020 recovery and throughout most of the last decade, approached all-time highs as the year ended.

For the one-year period ended December 31, 2020, the S&P 500® Index returned 18.40% while the MSCI EAFE Index, representing international developed market equities, returned 8.28%. During the same period, the Bloomberg Barclays US Aggregate Bond Index returned 7.51%. Please keep in mind that it is important to maintain a diversified portfolio as investment returns have historically been difficult to predict.

In addition to your active involvement in the investment process, we firmly believe that a financial professional is a key resource to help you build a complete picture of your current and future financial needs. Financial professionals are familiar with the market’s history, including long-term returns and volatility of various asset classes. With your financial professional, you can develop an investment program that incorporates factors such as your goals, your investment timeline and your risk tolerance.

Please contact your financial professional if you have any questions about the contents of this report, and thanks again for the confidence you have placed in us.

Sincerely,

Marijn Smit

President & Chief Executive Officer

Transamerica Asset Allocation Variable Funds

Tom Wald, CFA

Chief Investment Officer

Transamerica Asset Allocation Variable Funds

Bloomberg Barclays US Aggregate Bond Index: Measures investment grade, U.S. dollar denominated, fixed-rate taxable bonds, including Treasuries, government-related and corporate securities, as well as both mortgage- and asset-backed securities.

MSCI EAFE Index: A free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada.

S&P 500® Index: A market-capitalization weighted index of 500 large U.S. companies with common stock listed on the New York Stock Exchange or NASDAQ Stock Market.

The COVID-19 pandemic has caused substantial market disruption and dislocation around the world including the U.S. During periods of market disruption, which may trigger trading halts, the Subaccount’s exposure to the risks described elsewhere in the Prospectus will likely increase. As a result, whether or not the Subaccount invests in securities of issuers located in or with significant exposure to the countries directly affected, the value and liquidity of the Subaccount’s investments may be negatively affected.

The views expressed in this report reflect those of Transamerica Asset Management only and may not necessarily represent the views of Transamerica Asset Allocation Variable Funds. These views are as of the date of this report and subject to change based upon market conditions. These views should not be relied upon as investment advice and are not indicative of trading intent on behalf of Transamerica Asset Allocation Variable Funds. Investing involves risk, including potential loss of principal. The performance data presented represents past performance and does not guarantee future results. Indexes are unmanaged and it is not possible to invest directly in an index.

Disclosure of Expenses

(unaudited)

UNIT HOLDER EXPENSES

Transamerica Asset Allocation Variable Funds (each individually, a “Subaccount” and collectively, the “Subaccounts”) is a separate investment account established by Transamerica Financial Life Insurance Company, Inc. (“TFLIC”), and is used as an investment vehicle under certain tax-deferred annuity contracts issued by TFLIC. Each Subaccount invests in underlying subaccounts of Transamerica Variable Funds (“TVF”), a unit investment trust. Subaccount contract holders bear the costs of operating the Subaccount (such as the advisory fee).

The following examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in the Subaccounts and to compare these costs with the ongoing costs of investing in other funds.

The examples are based on an investment of $1,000 invested at July 1, 2020, and held for the entire six-month period until December 31, 2020.

ACTUAL EXPENSES

The information in the table below provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the appropriate column for your share class titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The information in the table below provides information about hypothetical account values and hypothetical expenses based on the Subaccounts’ actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Subaccounts’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Subaccount versus other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Actual Expenses | | | Hypothetical Expenses (A) | | | | |

| Subaccount | | Beginning

Account Value

July 1, 2020 | | | Ending

Account Value

December 31, 2020 | | | Expenses Paid

During Period (B) | | | Ending

Account Value

December 31, 2020 | | | Expenses Paid

During Period (B) | | | Net Annualized

Expense Ratio (C) (D) | |

Transamerica Asset Allocation – Short Horizon Subaccount | | $ | 1,000.00 | | | $ | 1,052.90 | | | $ | 1.03 | | | $ | 1,024.10 | | | $ | 1.02 | | | | 0.20 | % |

Transamerica Asset Allocation – Intermediate Horizon Subaccount | | | 1,000.00 | | | | 1,147.70 | | | | 1.08 | | | | 1,024.10 | | | | 1.02 | | | | 0.20 | |

Transamerica Asset Allocation – Intermediate/Long Horizon Subaccount | | | 1,000.00 | | | | 1,191.40 | | | | 1.10 | | | | 1,024.10 | | | | 1.02 | | | | 0.20 | |

| | |

| (A) | | 5% return per year before expenses. |

| |

| (B) | | Expenses are calculated using each Subaccount’s net annualized expense ratios, as disclosed in the table, multiplied by the average account value for the period, multiplied by the number of days in the period (184 days), and divided by the number of days in the year (366 days). |

| |

| (C) | | Net annualized expense ratios, as disclosed in the table, do not include the expenses of the underlying investments in which the Subaccounts invest. The total annual expenses, as stated in the fee table of the Subaccounts’ Prospectus, may differ from the expense ratios disclosed in this report. |

| |

| (D) | | Net annualized expense ratios are reflective of applicable fee waivers and/or reimbursements and recapture, if any, and based on the most recent six-months which may differ from the net expense ratio displayed in the Financial Highlights that covers a twelve-month period. |

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 4

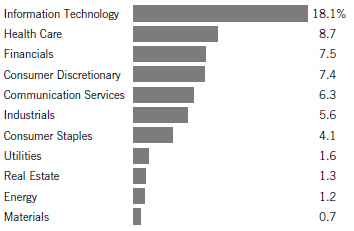

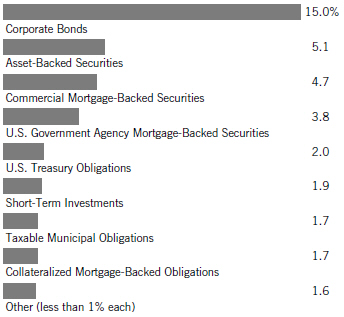

Schedules of Investments Composition

At December 31, 2020

(unaudited)

| | | | |

| Transamerica Asset Allocation – Short Horizon Subaccount | |

| |

| Asset Allocation | | Percentage of Net

Assets | |

U.S. Fixed Income Funds | | | 88.9 | % |

U.S. Equity Funds | | | 8.7 | |

International Equity Fund | | | 2.2 | |

Money Market Fund | | | 0.2 | |

Net Other Assets (Liabilities) | | | (0.0 | )* |

Total | | | 100.0 | % |

| | | | |

|

| Transamerica Asset Allocation – Intermediate Horizon Subaccount | |

| |

| Asset Allocation | | Percentage of Net

Assets | |

U.S. Fixed Income Funds | | | 46.0 | % |

U.S. Equity Funds | | | 40.1 | |

International Equity Fund | | | 13.7 | |

Money Market Fund | | | 0.2 | |

Net Other Assets (Liabilities) | | | (0.0 | )* |

Total | | | 100.0 | % |

| | | | |

|

| Transamerica Asset Allocation – Intermediate/Long Horizon Subaccount | |

| |

| Asset Allocation | | Percentage of Net

Assets | |

U.S. Equity Funds | | | 54.2 | % |

U.S. Fixed Income Funds | | | 27.2 | |

International Equity Fund | | | 18.5 | |

Money Market Fund | | | 0.1 | |

Net Other Assets (Liabilities) | | | (0.0 | )* |

Total | | | 100.0 | % |

| | | | |

| * | Percentage rounds to less than 0.1% or (0.1)%. |

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 5

Transamerica Asset Allocation – Short Horizon Subaccount

SCHEDULE OF INVESTMENTS

At December 31, 2020

| | | | | | | | |

| | | Shares | | | Value | |

| INVESTMENT COMPANIES - 100.0% | | | | | | |

| International Equity Fund - 2.2% | | | | | | |

Transamerica Variable International Equity (A) (B) | | | 5,481 | | | | $ 145,171 | |

| | | | | | | | |

| Money Market Fund - 0.2% | | | | | | |

Transamerica Variable Government Money Market (A) (B) | | | 707 | | | | 15,117 | |

| | | | | | | | |

| U.S. Equity Funds - 8.7% | | | | | | |

Transamerica Variable Large Growth (A) (B) | | | 757 | | | | 203,559 | |

Transamerica Variable Large Value Opportunities (A) (B) | | | 2,048 | | | | 214,342 | |

Transamerica Variable Small Cap Growth (A) (B) | | | 5,966 | | | | 73,323 | |

Transamerica Variable Small Cap Value (A) (B) | | | 5,557 | | | | 74,414 | |

| | | | | | | | |

| | | | | | | 565,638 | |

| | | | | | | | |

| U.S. Fixed Income Funds - 88.9% | | | | | | |

Transamerica Variable High Quality Bond (A) (B) | | | 54,394 | | | | 1,023,659 | |

| | | | | | | | |

| | | Shares | | | Value | |

| INVESTMENT COMPANIES (continued) | | | | | | |

| U.S. Fixed Income Funds (continued) | | | | | | |

Transamerica Variable High Yield Bond (A) (B) | | | 17,789 | | | | $ 697,577 | |

Transamerica Variable Inflation-Protected Securities (A) (B) | | | 33,421 | | | | 1,035,956 | |

Transamerica Variable Intermediate Bond (A) (B) | | | 57,626 | | | | 3,067,628 | |

| | | | | | | | |

| | | | | | | 5,824,820 | |

| | | | | | | | |

Total Investment Companies

(Cost $5,687,785) | | | | | | | 6,550,746 | |

| | | | | | | | |

Total Investments

(Cost $5,687,785) | | | | | | | 6,550,746 | |

Net Other Assets (Liabilities) - (0.0)% (C) | | | | | | | (1,032 | ) |

| | | | | | | | |

| | |

Net Assets - 100.0% | | | | | | | $ 6,549,714 | |

| | | | | | | | |

INVESTMENT VALUATION:

Valuation Inputs (D)

| | | | | | | | | | | | | | | | |

| | | Level 1 -

Unadjusted

Quoted Prices | | | Level 2 -

Other Significant

Observable Inputs | | | Level 3 -

Significant

Unobservable Inputs | | | Value | |

ASSETS Investments | | | | | | | | | | | | | | | | |

Investment Companies | | $ | 6,550,746 | | | $ | — | | | $ | — | | | $ | 6,550,746 | |

| | | | | | | | | | | | | | | | |

Total Investments | | $ | 6,550,746 | | | $ | — | | | $ | — | | | $ | 6,550,746 | |

| | | | | | | | | | | | | | | | |

FOOTNOTES TO SCHEDULE OF INVESTMENTS:

| | |

| (A) | | Affiliated investment of Transamerica Variable Funds. Affiliated interest income, dividend income, realized and unrealized gains (losses), if any, are broken out within the Statements of Operations. |

| (B) | | Non-income producing securities. |

| (C) | | Percentage rounds to less than 0.1% or (0.1)%. |

| (D) | | There were no transfers in or out of Level 3 during the year ended December 31, 2020. Please reference the Investment Valuation section of the Notes to Financial Statements for more information regarding investment valuation and pricing inputs. |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 6

Transamerica Asset Allocation – Intermediate Horizon Subaccount

SCHEDULE OF INVESTMENTS

At December 31, 2020

| | | | | | | | |

| | | Shares | | | Value | |

| INVESTMENT COMPANIES - 100.0% | | | | | | |

| International Equity Fund - 13.7% | | | | | | |

Transamerica Variable International Equity (A) (B) | | | 89,521 | | | | $ 2,370,927 | |

| | | | | | | | |

| Money Market Fund - 0.2% | | | | | | |

Transamerica Variable Government Money Market (A) (B) | | | 1,617 | | | | 34,585 | |

| | | | | | | | |

| U.S. Equity Funds - 40.1% | | | | | | |

Transamerica Variable Large Growth (A) (B) | | | 9,566 | | | | 2,573,235 | |

Transamerica Variable Large Value Opportunities (A) (B) | | | 24,212 | | | | 2,534,138 | |

Transamerica Variable Small Cap Growth (A) (B) | | | 74,203 | | | | 911,996 | |

Transamerica Variable Small Cap Value (A) (B) | | | 68,142 | | | | 912,531 | |

| | | | | | | | |

| | | | | | | 6,931,900 | |

| | | | | | | | |

| U.S. Fixed Income Funds - 46.0% | | | | | | |

Transamerica Variable High Quality Bond (A) (B) | | | 67,434 | | | | 1,269,047 | |

| | | | | | | | |

| | | Shares | | | Value | |

| INVESTMENT COMPANIES (continued) | | | | | | |

| U.S. Fixed Income Funds (continued) | | | | | | |

Transamerica Variable High Yield Bond (A) (B) | | | 25,253 | | | | $ 990,314 | |

Transamerica Variable Inflation-Protected Securities (A) (B) | | | 61,045 | | | | 1,892,237 | |

Transamerica Variable Intermediate Bond (A) (B) | | | 71,427 | | | | 3,802,283 | |

| | | | | | | | |

| | | | | | | 7,953,881 | |

| | | | | | | | |

Total Investment Companies

(Cost $13,268,699) | | | | | | | 17,291,293 | |

| | | | | | | | |

Total Investments

(Cost $13,268,699) | | | | | | | 17,291,293 | |

Net Other Assets (Liabilities) - (0.0)% (C) | | | | | | | (2,672 | ) |

| | | | | | | | |

| | |

Net Assets - 100.0% | | | | | | | $ 17,288,621 | |

| | | | | | | | |

INVESTMENT VALUATION:

Valuation Inputs (D)

| | | | | | | | | | | | | | | | |

| | | Level 1 -

Unadjusted

Quoted Prices | | | Level 2 -

Other Significant

Observable Inputs | | | Level 3 -

Significant

Unobservable Inputs | | | Value | |

ASSETS | | | | | | | | | | | | | | | | |

Investments | | | | | | | | | | | | | | | | |

Investment Companies | | $ | 17,291,293 | | | $ | — | | | $ | — | | | $ | 17,291,293 | |

| | | | | | | | | | | | | | | | |

Total Investments | | $ | 17,291,293 | | | $ | — | | | $ | — | | | $ | 17,291,293 | |

| | | | | | | | | | | | | | | | |

FOOTNOTES TO SCHEDULE OF INVESTMENTS:

| | |

| (A) | | Affiliated investment of Transamerica Variable Funds. Affiliated interest income, dividend income, realized and unrealized gains (losses), if any, are broken out within the Statements of Operations. |

| (B) | | Non-income producing securities. |

| (C) | | Percentage rounds to less than 0.1% or (0.1)%. |

| (D) | | There were no transfers in or out of Level 3 during the year ended December 31, 2020. Please reference the Investment Valuation section of the Notes to Financial Statements for more information regarding investment valuation and pricing inputs. |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 7

Transamerica Asset Allocation – Intermediate/Long Horizon Subaccount

SCHEDULE OF INVESTMENTS

At December 31, 2020

| | | | | | | | |

| | | Shares | | | Value | |

| INVESTMENT COMPANIES - 100.0% | |

| International Equity Fund - 18.5% | |

Transamerica Variable International Equity (A) (B) | | | 237,360 | | | | $ 6,286,364 | |

| | | | | | | | |

| Money Market Fund - 0.1% | |

Transamerica Variable Government Money Market (A) (B) | | | 2,275 | | | | 48,666 | |

| | | | | | | | |

| U.S. Equity Funds - 54.2% | |

Transamerica Variable Large Growth (A) (B) | | | 26,209 | | | | 7,050,339 | |

Transamerica Variable Large Value Opportunities (A) (B) | | | 62,767 | | | | 6,569,654 | |

Transamerica Variable Small Cap Growth (A) (B) | | | 191,241 | | | | 2,350,461 | |

Transamerica Variable Small Cap Value (A) (B) | | | 178,223 | | | | 2,386,715 | |

| | | | | | | | |

| | | | | | | 18,357,169 | |

| | | | | | | | |

| U.S. Fixed Income Funds - 27.2% | |

Transamerica Variable High Quality Bond (A) (B) | | | 34,210 | | | | 643,800 | |

| | | | | | | | |

| | | Shares | | | Value | |

| INVESTMENT COMPANIES (continued) | |

| U.S. Fixed Income Funds (continued) | |

Transamerica Variable High Yield Bond (A) (B) | | | 31,907 | | | | $ 1,251,216 | |

Transamerica Variable Inflation-Protected Securities (A) (B) | | | 87,187 | | | | 2,702,563 | |

Transamerica Variable Intermediate Bond (A) (B) | | | 86,607 | | | | 4,610,339 | |

| | | | | | | | |

| | | | | | | 9,207,918 | |

| | | | | | | | |

Total Investment Companies

(Cost $22,995,846) | | | | 33,900,117 | |

| | | | | | | | |

Total Investments

(Cost $22,995,846) | | | | 33,900,117 | |

Net Other Assets (Liabilities) - (0.0)% (C) | | | | | | | (5,560 | ) |

| | | | | | | | |

| | |

Net Assets - 100.0% | | | | | | | $ 33,894,557 | |

| | | | | | | | |

INVESTMENT VALUATION:

Valuation Inputs (D)

| | | | | | | | | | | | | | | | |

| | | Level 1 -

Unadjusted

Quoted Prices | | | Level 2 -

Other Significant

Observable Inputs | | | Level 3 -

Significant

Unobservable Inputs | | | Value | |

ASSETS | | | | | | | | | | | | | | | | |

Investments | | | | | | | | | | | | | | | | |

Investment Companies | | $ | 33,900,117 | | | $ | — | | | $ | — | | | $ | 33,900,117 | |

| | | | | | | | | | | | | | | | |

Total Investments | | $ | 33,900,117 | | | $ | — | | | $ | — | | | $ | 33,900,117 | |

| | | | | | | | | | | | | | | | |

FOOTNOTES TO SCHEDULE OF INVESTMENTS:

| | |

| (A) | | Affiliated investment of Transamerica Variable Funds. Affiliated interest income, dividend income, realized and unrealized gains (losses), if any, are broken out within the Statements of Operations. |

| (B) | | Non-income producing securities. |

| (C) | | Percentage rounds to less than 0.1% or (0.1)%. |

| (D) | | There were no transfers in or out of Level 3 during the year ended December 31, 2020. Please reference the Investment Valuation section of the Notes to Financial Statements for more information regarding investment valuation and pricing inputs. |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 8

STATEMENTS OF ASSETS AND LIABILITIES

At December 31, 2020

| | | | | | | | | | | | |

| | | Short Horizon | | | Intermediate

Horizon | | | Intermediate/Long

Horizon | |

Assets: | | | | | | | | | | | | |

Affiliated investments, at value (A) | | $ | 6,550,746 | | | $ | 17,291,293 | | | $ | 33,900,117 | |

Cash | | | 75 | | | | 266 | | | | 146 | |

Receivables and other assets: | | | | | | | | | | | | |

Affiliated investments sold | | | 3,085 | | | | 371,271 | | | | 98,794 | |

Units sold | | | 1,512 | | | | 11,976 | | | | 51,365 | |

Total assets | | | 6,555,418 | | | | 17,674,806 | | | | 34,050,422 | |

| | | | |

Liabilities: | | | | | | | | | | | | |

Payables and other liabilities: | | | | | | | | | | | | |

Affiliated investments purchased | | | 1,512 | | | | 186,775 | | | | 51,365 | |

Units redeemed | | | 3,085 | | | | 196,473 | | | | 98,794 | |

Investment advisory fees | | | 1,107 | | | | 2,937 | | | | 5,706 | |

Total liabilities | | | 5,704 | | | | 386,185 | | | | 155,865 | |

Net assets | | $ | 6,549,714 | | | $ | 17,288,621 | | | $ | 33,894,557 | |

| | | | |

Net assets consist of: | | | | | | | | | | | | |

Costs of accumulation units | | $ | 371,437 | | | $ | (2,142,780 | ) | | $ | 4,831,008 | |

Total distributable earnings (accumulated losses) | | | 6,178,277 | | | | 19,431,401 | | | | 29,063,549 | |

Net assets | | $ | 6,549,714 | | | $ | 17,288,621 | | | $ | 33,894,557 | |

Accumulation units | | | 256,379 | | | | 519,819 | | | | 916,146 | |

Unit value | | $ | 25.55 | | | $ | 33.26 | | | $ | 37.00 | |

| | | | | | | | | | | | | |

(A) Affiliated investments, at cost | | $ | 5,687,785 | | | $ | 13,268,699 | | | $ | 22,995,846 | |

STATEMENTS OF OPERATIONS

For the year ended December 31, 2020

| | | | | | | | | | | | |

| | | Short Horizon | | | Intermediate

Horizon | | | Intermediate/Long

Horizon | |

Investment Income: | | | | | | | | | | | | |

Interest income from affiliated investments | | $ | 6 | | | $ | 23 | | | $ | 12 | |

| | | | |

Expenses: | | | | | | | | | | | | |

Investment advisory fees | | | 12,414 | | | | 32,403 | | | | 61,312 | |

| | | | |

Net investment income (loss) | | | (12,408 | ) | | | (32,380 | ) | | | (61,300 | ) |

| | | | |

Net realized gain (loss) on: | | | | | | | | | | | | |

Affiliated investments | | | 216,336 | | | | 2,030,025 | | | | 5,623,095 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | |

Affiliated investments | | | 246,983 | | | | 157,767 | | | | (712,091 | ) |

Net realized and change in unrealized gain (loss) | | | 463,319 | | | | 2,187,792 | | | | 4,911,004 | |

Net increase (decrease) in net assets resulting from operations | | $ | 450,911 | | | $ | 2,155,412 | | | $ | 4,849,704 | |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 9

STATEMENTS OF CHANGES IN NET ASSETS

For the years ended:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Short Horizon | | | Intermediate Horizon | | | Intermediate/Long Horizon | |

| | | December 31,

2020 | | | December 31,

2019 | | | December 31,

2020 | | | December 31,

2019 | | | December 31,

2020 | | | December 31,

2019 | |

| From operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | (12,408 | ) | | $ | (11,760 | ) | | $ | (32,380 | ) | | $ | (32,179 | ) | | $ | (61,300 | ) | | $ | (59,467 | ) |

Net realized gain (loss) | | | 216,336 | | | | 111,653 | | | | 2,030,025 | | | | 556,513 | | | | 5,623,095 | | | | 995,234 | |

Net change in unrealized appreciation (depreciation) | | | 246,983 | | | | 387,804 | | | | 157,767 | | | | 1,703,768 | | | | (712,091 | ) | | | 4,012,901 | |

Net increase (decrease) in net assets resulting from operations | | | 450,911 | | | | 487,697 | | | | 2,155,412 | | | | 2,228,102 | | | | 4,849,704 | | | | 4,948,668 | |

| | | | | | | |

Unit transactions: | | | | | | | | | | | | | | | | | | | | | | | | |

Units sold | | | 1,292,008 | | | | 838,696 | | | | 1,528,988 | | | | 1,516,406 | | | | 2,466,468 | | | | 2,930,883 | |

Units redeemed | | | (1,169,591 | ) | | | (964,324 | ) | | | (3,083,063 | ) | | | (2,095,053 | ) | | | (5,397,715 | ) | | | (2,918,410 | ) |

Net increase (decrease) in net assets resulting from unit transactions | | | 122,417 | | | | (125,628 | ) | | | (1,554,075 | ) | | | (578,647 | ) | | | (2,931,247 | ) | | | 12,473 | |

Net increase (decrease) in net assets | | | 573,328 | | | | 362,069 | | | | 601,337 | | | | 1,649,455 | | | | 1,918,457 | | | | 4,961,141 | |

| | | | | | | |

Net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning of year | | | 5,976,386 | | | | 5,614,317 | | | | 16,687,284 | | | | 15,037,829 | | | | 31,976,100 | | | | 27,014,959 | |

End of year | | $ | 6,549,714 | | | $ | 5,976,386 | | | $ | 17,288,621 | | | $ | 16,687,284 | | | $ | 33,894,557 | | | $ | 31,976,100 | |

| | | | | | | |

Unit transactions - shares: | | | | | | | | | | | | | | | | | | | | | | | | |

Units sold | | | 53,149 | | | | 36,241 | | | | 52,842 | | | | 55,097 | | | | 80,960 | | | | 98,802 | |

Units redeemed | | | (47,897 | ) | | | (41,797 | ) | | | (105,974 | ) | | | (76,117 | ) | | | (171,707 | ) | | | (99,115 | ) |

Net increase (decrease) | | | 5,252 | | | | (5,556 | ) | | | (53,132 | ) | | | (21,020 | ) | | | (90,747 | ) | | | (313 | ) |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 10

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| For a unit outstanding during the years indicated: | | Short Horizon | |

| | | December 31,

2020 | | | December 31,

2019 | | | December 31,

2018 | | | December 31,

2017 | | | December 31,

2016 | |

Unit value, beginning of year | | $ | 23.80 | | | $ | 21.87 | | | $ | 22.46 | | | $ | 21.56 | | | $ | 20.81 | |

| | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (A) | | | (0.05 | ) | | | (0.05 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.04 | ) |

Net realized and unrealized gain (loss) | | | 1.80 | | | | 1.98 | | | | (0.55 | ) | | | 0.94 | | | | 0.79 | |

Total investment operations | | | 1.75 | | | | 1.93 | | | | (0.59 | ) | | | 0.90 | | | | 0.75 | |

| | | | | | |

Unit value, end of year | | $ | 25.55 | | | $ | 23.80 | | | $ | 21.87 | | | $ | 22.46 | | | $ | 21.56 | |

Total return | | | 7.35 | % | | | 8.80 | % | | | (2.62 | )% | | | 4.19 | % | | | 3.58 | % |

| | | | | | |

Ratio and supplemental data: | | | | | | | | | | | | | | | | | | | | |

Net assets end of year (000’s) | | $ | 6,550 | | | $ | 5,976 | | | $ | 5,614 | | | $ | 5,817 | | | $ | 5,754 | |

Expenses to average net assets (B) | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % |

Net investment income (loss) to average net assets | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% |

Portfolio turnover rate | | | 58 | % | | | 36 | % | | | 44 | % | | | 34 | % | | | 33 | % |

| | |

| (A) | | Calculated based on average number of units outstanding. |

| (B) | | Does not include expenses of the underlying investments in which the Subaccount invests. |

| | | | | | | | | | | | | | | | | | | | |

| For a unit outstanding during the years indicated: | | Intermediate Horizon | |

| | | December 31,

2020 | | | December 31,

2019 | | | December 31,

2018 | | | December 31,

2017 | | | December 31,

2016 | |

Unit value, beginning of year | | $ | 29.13 | | | $ | 25.32 | | | $ | 26.91 | | | $ | 24.28 | | | $ | 23.12 | |

| | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (A) | | | (0.06 | ) | | | (0.06 | ) | | | (0.05 | ) | | | (0.05 | ) | | | (0.05 | ) |

Net realized and unrealized gain (loss) | | | 4.19 | | | | 3.87 | | | | (1.54 | ) | | | 2.68 | | | | 1.21 | |

Total investment operations | | | 4.13 | | | | 3.81 | | | | (1.59 | ) | | | 2.63 | | | | 1.16 | |

| | | | | | |

Unit value, end of year | | $ | 33.26 | | | $ | 29.13 | | | $ | 25.32 | | | $ | 26.91 | | | $ | 24.28 | |

Total return | | | 14.19 | % | | | 15.04 | % | | | (5.92 | )% | | | 10.84 | % | | | 5.01 | % |

| | | | | | |

Ratio and supplemental data: | | | | | | | | | | | | | | | | | | | | |

Net assets end of year (000’s) | | $ | 17,289 | | | $ | 16,687 | | | $ | 15,038 | | | $ | 17,618 | | | $ | 17,250 | |

Expenses to average net assets (B) | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % |

Net investment income (loss) to average net assets | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% |

Portfolio turnover rate | | | 73 | % | | | 23 | % | | | 37 | % | | | 40 | % | | | 26 | % |

| | |

| (A) | | Calculated based on average number of units outstanding. |

| (B) | | Does not include expenses of the underlying investments in which the Subaccount invests. |

| | | | | | | | | | | | | | | | | | | | |

| For a unit outstanding during the years indicated: | | Intermediate/Long Horizon | |

| | | December 31,

2020 | | | December 31,

2019 | | | December 31,

2018 | | | December 31,

2017 | | | December 31,

2016 | |

Unit value, beginning of year | | $ | 31.76 | | | $ | 26.82 | | | $ | 29.04 | | | $ | 25.48 | | | $ | 24.13 | |

| | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (A) | | | (0.06 | ) | | | (0.06 | ) | | | (0.06 | ) | | | (0.05 | ) | | | (0.05 | ) |

Net realized and unrealized gain (loss) | | | 5.30 | | | | 5.00 | | | | (2.16 | ) | | | 3.61 | | | | 1.40 | |

Total investment operations | | | 5.24 | | | | 4.94 | | | | (2.22 | ) | | | 3.56 | | | | 1.35 | |

| | | | | | |

Unit value, end of year | | $ | 37.00 | | | $ | 31.76 | | | $ | 26.82 | | | $ | 29.04 | | | $ | 25.48 | |

Total return | | | 16.50 | % | | | 18.40 | % | | | (7.65 | )% | | | 13.97 | % | | | 5.60 | % |

| | | | | | |

Ratio and supplemental data: | | | | | | | | | | | | | | | | | | | | |

Net assets end of year (000’s) | | $ | 33,895 | | | $ | 31,976 | | | $ | 27,015 | | | $ | 31,431 | | | $ | 28,225 | |

Expenses to average net assets (B) | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % |

Net investment income (loss) to average net assets | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% |

Portfolio turnover rate | | | 71 | % | | | 25 | % | | | 30 | % | | | 25 | % | | | 21 | % |

| | |

| (A) | | Calculated based on average number of units outstanding. |

| (B) | | Does not include expenses of the underlying investments in which the Subaccount invests. |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 11

NOTES TO FINANCIAL STATEMENTS

At December 31, 2020

1. ORGANIZATION

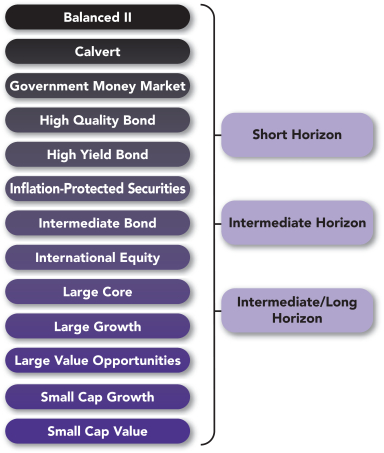

Transamerica Asset Allocation Variable Funds (the “Separate Account”), is a non-diversified separate account of Transamerica Financial Life Insurance Company (“TFLIC”), and is registered as a management investment company under the Investment Company Act of 1940, as amended. The Separate Account applies investment company accounting and reporting guidance. The Separate Account is composed of three different subaccounts (each, a “Subaccount” and collectively, the “Subaccounts”) that are separate investment funds and are as follows. Each Subaccount invests substantially all of its investable assets among certain Transamerica Variable Funds (“TVF”). Certain TVF subaccounts invest substantially all of their investable assets in underlying series of Transamerica Funds (each a “Fund” and collectively, the “Funds”).

|

| Subaccount |

Transamerica Asset Allocation – Short Horizon Subaccount (“Short Horizon”) |

Transamerica Asset Allocation – Intermediate Horizon Subaccount (“Intermediate Horizon”) |

Transamerica Asset Allocation – Intermediate/Long Horizon Subaccount (“Intermediate/Long Horizon”) |

The only shareholders of the Separate Account are contract holders of the affiliated insurance company variable life and annuity contracts.

Transamerica Asset Management, Inc. (“TAM”) serves as investment manager for the Subaccounts pursuant to an investment management agreement. TAM provides continuous and regular investment management services to the Subaccounts. TAM supervises each Subaccount’s investments, conducts its investment program and provides supervisory and management services to the Subaccounts.

TAM is responsible for all aspects of the day-to-day management of the Subaccounts.

TAM’s investment management services also include the provision of supervisory and administrative services to the Subaccounts. These services include performing certain administrative services for the Subaccounts and supervising and overseeing the administrative, clerical, recordkeeping and bookkeeping services provided to the Subaccounts by State Street Bank and Trust Company (“State Street”), to whom TAM has outsourced the provision of certain services as described below: to the extent agreed upon by TAM and the Subaccounts from time to time, monitoring and verifying the custodian’s daily calculation of the Net Asset Values (“NAV”); shareholder relations functions; compliance services; valuation services; assisting in due diligence and in the oversight and monitoring of certain activities of sub-advisers and certain aspects of Subaccount investments; assisting with Subaccount combinations and liquidations: oversight of the preparation and filing, and review, of all returns and reports, in connection with federal, state and local taxes; oversight and review of regulatory reporting; supervising and coordinating the Subaccounts’ custodian and dividend disbursing agent and monitoring their services to the Subaccounts; assisting the Subaccounts in preparing reports to shareholders; acting as liaison with the Subaccounts’ independent public accountants and providing, upon request, analyses, fiscal year summaries and other audit related services; assisting in the preparation of agendas and supporting documents for and minutes of meetings of trustees and committees of trustees; assisting in the preparation of regular communications with the trustees; and providing personnel and office space, telephones and other office equipment as necessary in order for TAM to perform supervisory and administrative services to the Subaccounts.

For each of the Funds, TAM currently acts as a “manager of managers” and hires sub-advisers to furnish day-to-day investment advice and recommendations to the Funds.

2. SIGNIFICANT ACCOUNTING POLICIES

In preparing the Subaccounts’ financial statements in accordance with Generally Accepted Accounting Principles in the United States of America (“GAAP”), estimates or assumptions (which could differ from actual results) may be used that affect reported amounts and disclosures. The following is a summary of significant accounting policies followed by the Subaccounts.

Security transactions: Security transactions are accounted for on the trade date. Security gains and losses are calculated on the specific identification basis. Net realized gain (loss) is from investments in units of investment companies.

Operating expenses: The Separate Account accounts separately for the assets, liabilities, and operations of each Subaccount. Each Subaccount will indirectly bear the fees and expenses reflected in the corresponding TVF unit value. These expenses are not reflected in the expenses within the Statements of Operations of the Subaccount and are not included in the Expenses to average net assets, and Net investment income (loss) to average net assets within the Financial Highlights.

Indemnification: In the normal course of business, the Subaccounts enter into contracts that contain a variety of representations that provide general indemnifications. The Subaccounts’ maximum exposure under these arrangements is unknown, as this would involve

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 12

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2020

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

future claims that may be made against the Subaccounts and/or their affiliates that have not yet occurred. However, based on experience, the Subaccounts expect the risk of loss to be remote.

3. INVESTMENT VALUATION

All investments in securities are recorded at their estimated fair value. The value of each Subaccount’s investment in a corresponding TVF subaccount is valued at the TVF unit value per share at the official close of the New York Stock Exchange (“NYSE”) each day the NYSE is open for business.

The Subaccounts utilize various methods to measure the fair value of their investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The three levels (“Levels”) of inputs of the fair value hierarchy are defined as follows:

Level 1—Unadjusted quoted prices in active markets for identical securities.

Level 2—Inputs, other than quoted prices included in Level 1, which are observable, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data.

Level 3—Unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available, which may include the Subaccounts’ own assumptions used in determining the fair value of investments.

The inputs used to measure fair value may fall into different Levels of the fair value hierarchy. In such cases, for disclosure purposes, the Level in the fair value hierarchy that is assigned to the fair value measurement of a security is determined based on the lowest Level input that is significant to the fair value measurement in its entirety. Certain investments that are measured at fair value using NAV per share, or its equivalent, using the “practical expedient” have not been classified in the fair value Levels. The hierarchy classification of inputs used to value the Subaccounts’ investments at December 31, 2020, is disclosed within the Investment Valuation section of each Subaccount’s Schedule of Investments.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, but not limited to, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is generally greatest for instruments categorized in Level 3. Due to the inherent uncertainty of valuation, the determination of values may differ significantly from values that would have been realized had a ready market for investments existed, and the differences could be material.

Fair value measurements: Each Subaccount invests substantially all of its investable assets among certain TVF subaccounts and the TVF subaccounts invest all of their investable assets in the Funds. The summary of the inputs used for valuing each Fund’s assets carried at fair value is discussed in the Investment Valuation section of the Funds’ Notes to Financial Statements. Descriptions of the valuation techniques applied to the Subaccounts’ significant categories of assets and liabilities measured at fair value on a recurring basis are as follows:

Investment companies: Certain investment companies are valued at the NAV as the practical expedient. These investment companies are not included within the fair value hierarchy. Certain other investment companies are valued at the actively traded NAV and no valuation adjustments are applied. These investment companies are categorized in Level 1 of the fair value hierarchy.

4. RISK FACTOR

Investing in the Subaccounts involves certain key risks related to the Subaccounts’ trading activity. Please reference the Subaccounts’ prospectus for a more complete discussion of the following risk(s), as well as other risks of investing in the Subaccounts.

Market risk: The market values of a Subaccount’s securities and other assets will fluctuate, sometimes sharply and unpredictably, due to changes in general market conditions, overall economic trends or events, governmental actions or interventions, actions taken by the U.S. Federal Reserve or foreign central banks, political developments, investor sentiment, public health emergencies such as a pandemic, and other factors that may or may not be related to the issuer of the security or other asset. The market prices of securities and other assets also may go down due to events or conditions that affect particular sectors, industries or issuers. Adverse market conditions may be prolonged and may not have the same impact on all types of securities or other assets.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 13

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2020

4. RISK FACTOR (continued)

Economies and financial markets throughout the world are increasingly interconnected. Economic, financial or political events, trading and tariff arrangements, public health events, terrorism, technology and data interruptions, natural disasters, and other circumstances in one or more countries or regions could be highly disruptive to, and have profound impacts on, global economies or markets. As a result, whether or not a Subaccount invests in securities of issuers located in or with significant exposure to the countries directly affected, the value and liquidity of a Subaccount’s investments may go down.

The COVID-19 pandemic has caused substantial market disruption around the world, including the U.S. There have been periods of extreme volatility, and periods where there have been no buyers for certain securities, including U.S. Treasury securities. Some sectors of the economy and individual issuers have experienced particularly large losses. The pandemic has reduced liquidity of particular investments and asset classes; resulted in significant disruptions to business operations, including business closures; strained healthcare systems; disrupted supply chains, consumer demand and employee availability; and restricted travel. These conditions may continue for an extended period of time, or worsen. The pandemic may result in a sustained domestic or global economic downturn or recession. Developing or emerging market countries may be more adversely impacted. The ultimate economic fallout from the pandemic, and the long-term impact on economies, markets, industries and individual issuers, are not known.

The U.S. government and the Federal Reserve, as well as certain foreign governments and central banks, have taken extraordinary actions to support local and global economies and the financial markets in response to the COVID-19 pandemic. These actions have resulted in significant expansion of public debt, including in the U.S. The long-term consequences of this level of public debt are not known. In addition, certain interest rates have been reduced to very low levels. This and other government intervention into the economy and financial markets to address the pandemic may not work as intended, particularly if the efforts are perceived by investors as being unlikely to achieve the desired results.

The COVID-19 pandemic could continue to adversely affect the value and liquidity of a Subaccount’s investments, impair a Subaccount’s ability to satisfy redemption requests, and negatively impact a Subaccount’s performance.

5. FEES AND OTHER AFFILIATED TRANSACTIONS

TAM, the Subaccounts’ investment manager, is directly owned by Transamerica Life Insurance Company (“TLIC”) and AUSA Holding, LLC (“AUSA”), both of which are indirect, wholly owned subsidiaries of Aegon NV. TLIC is owned by Commonwealth General Corporation (“Commonwealth”). Commonwealth and AUSA are wholly owned by Transamerica Corporation (DE). Transamerica Corporation (DE) is wholly owned by Aegon International B.V., which is wholly owned by Aegon NV, a Netherlands corporation, and a publicly traded international insurance group.

The Subaccounts purchase interests in the TVF, which in turn, purchase interests in the Funds. The net assets of the Subaccounts will reflect the investment management fee and other expenses incurred by the Funds. TAM serves as the investment manager to each Fund.

All Subaccount holdings in investment companies are considered affiliated. Realized and unrealized gains (losses) are broken out within the Statements of Operations.

Investment advisory fees: TAM provides general investment advice to each Subaccount pursuant to the investment advisory agreement. For its services, each Subaccount pays management fees accrued daily and payable monthly, at an annual rate equal to 0.20% of each Subaccount’s daily ANA.

TFLIC is the legal holder of the assets in the Subaccounts and will at all times maintain assets in the Subaccounts with a total market value of at least equal to the contract liabilities for the Subaccounts.

Certain managing board members and officers of TFLIC are also trustees, officers, or employees of TAM or its affiliates. No interested managing board member, who is deemed an interested person due to current or former service with TAM or an affiliate of TAM receives compensation from the Separate Account. Similarly, none of the Separate Account’s officers or interested trustees receive compensation from the Subaccounts. The independent board members of TFLIC are also trustees of the Funds, for which they receive fees.

Deferred compensation plan: Under a non-qualified deferred compensation plan effective January 1, 2008, (as amended and restated January 1, 2010), available to the trustees, compensation may be deferred that would otherwise be payable by the Separate Account to an independent trustee on a current basis for services rendered as trustee. Deferred compensation amounts will accumulate based on the value of the investment option, as elected by the trustee.

Brokerage commissions: The Subaccounts incurred no brokerage commissions on security transactions placed with affiliates of the investment manager or sub-adviser(s) for the year ended December 31, 2020.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 14

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2020

6. PURCHASES AND SALES OF SECURITIES

For the year ended December 31, 2020, the cost of securities purchased and proceeds from securities sold (excluding short-term securities) are as follows:

| | | | | | | | |

Subaccount

| | Purchases of

Securities | | | Sales of

Securities | |

Short Horizon | | $ | 3,742,251 | | | $ | 3,632,211 | |

Intermediate Horizon | | | 11,754,239 | | | | 13,340,682 | |

Intermediate/Long Horizon | | | 21,933,570 | | | | 24,925,961 | |

7. FEDERAL INCOME TAXES

The operations of the Separate Account form a part of, and are taxed with, the operations of TFLIC, a wholly-owned subsidiary of Aegon USA. TFLIC does not expect, based upon current tax law, to incur any income tax upon the earnings or realized capital gains attributable to the Separate Account. Based upon this expectation, no charges are currently being deducted from the Separate Account for federal income tax purposes. The Subaccounts recognize the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. The Subaccounts’ tax returns remain subject to examination by the Internal Revenue Service and state tax authorities three years from the date of filing for federal purposes and four years from the date of filing for state purposes. Management has evaluated the Subaccounts’ tax provisions taken for all open tax years, and has concluded that no provision for income tax is required in the Subaccounts’ financial statements. If applicable, the Subaccounts recognize interest accrued related to unrecognized tax benefits in relation to interest and penalties expense in Other within the Statements of Operations. The Subaccounts identify their major tax jurisdictions as U.S. Federal, the state of Colorado, and foreign jurisdictions where the Subaccounts make significant investments; however, the Subaccounts are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

8. LEGAL PROCEEDINGS

On September 30, 2020, Transamerica Asset Management, Inc. (“TAM”), the investment manager of the funds, entered into a settlement with the Securities and Exchange Commission (the “SEC”) relating to expense recaptures. The recaptures at issue, which TAM self-reported to the SEC, involved amounts previously voluntarily waived and/or reimbursed to four money market funds to prevent the funds from experiencing a negative yield. In some cases recaptures under the voluntary yield waiver arrangements exceeded contractual expense limits. The recaptured amounts were not reflected in the funds’ prospectus fee tables. The funds involved were Transamerica Government Money Market, Transamerica BlackRock Government Money Market VP, Transamerica Partners Government Money Market and Transamerica Partners Institutional Government Money Market. The two Transamerica Partners Government Money Market funds reorganized into Transamerica Government Money Market in October of 2017.

Under the settlement order, TAM agreed to pay affected fund investors approximately $5.3 million in disgorgement and approximately $690,000 in prejudgment interest. These amounts represent expenses incurred above the applicable expense limit (plus interest). TAM was also censured and ordered to cease and desist from committing or causing any violations of certain statutory provisions and SEC rules. The settlement order imposes no civil penalty on TAM based upon TAM having self-reported the matter, the prompt remedial steps taken by TAM, and TAM’s cooperation in the SEC staff’s investigation. The settlement order does not affect TAM’s ability to manage the funds.

The foregoing is only a brief summary of the settlement order. A copy of the settlement order is available on the SEC’s website at https://www.sec.gov.

The settlement had no impact on the Subaccounts’ financial statements.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 15

Report of Independent Registered Public Accounting Firm

To the Board of Directors of Transamerica Financial Life Insurance Company and the Contract holders of Transamerica Asset Allocation Variable Funds

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of Transamerica Asset Allocation Variable Funds (the “Separate Account”) (comprising Transamerica Asset Allocation – Short Horizon Subaccount, Transamerica Asset Allocation – Intermediate Horizon Subaccount and Transamerica Asset Allocation – Intermediate/Long Horizon Subaccount) (collectively referred to as the “Subaccounts”), including the schedule of investments, as of December 31, 2020, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Subaccounts comprising Transamerica Asset Allocation Variable Funds at December 31, 2020, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended and their financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Separate Account’s management. Our responsibility is to express an opinion on the Subaccounts’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Separate Account in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Separate Account is not required to have, nor were we engaged to perform, an audit of the Separate Account’s internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Separate Account’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2020, by correspondence with the custodian and others, or by other appropriate auditing procedures where replies from others were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Transamerica investment companies since 1995.

Boston, Massachusetts

February 26, 2021

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 16

Management of the Trust

Board Members and Officers

The members of the Board (“Board Members”) and executive officers of the Trust are listed below.

“Interested Board Member” means a board member who may be deemed an “interested person” (as that term is defined in the 1940 Act) of the Trust because of his current or former service with TAM or an affiliate of TAM. Interested Board Members may also be referred to herein as “Interested Trustees.” “Independent Board Member” means a Board Member who is not an “interested person” (as defined under the 1940 Act) of the Trust and may also be referred to herein as an “Independent Trustee.”

The Board governs each fund and is responsible for protecting the interests of the shareholders. The Board Members are experienced executives who meet periodically throughout the year to oversee the business affairs of each fund and the operation of each fund by its officers. The Board also reviews the management of each fund’s assets by the investment manager and its respective sub-adviser.

The funds are among the funds managed and sponsored by TAM (collectively, “Transamerica Fund Family”). The Transamerica Fund Family consists of (i) Transamerica Funds (“TF”); (ii) Transamerica Series Trust (“TST”); (iii) Transamerica ETF Trust (“TET”); and (iv) Transamerica Asset Allocation Variable Funds (“TAAVF”). As of the date of this Annual Report, Transamerica Fund Family consists of 121 funds. With the exception of Mr. Smit, none of the Board Members serve on the board of trustees of TET. TET is overseen by a separate board of trustees.

The mailing address of each Board Member is c/o Secretary, 1801 California Street, Suite 5200, Denver, Colorado 80202.

Further information about the Fund’s Board Members and Officers is available in the Fund’s Statement of Additional Information, which can be obtained without charge by calling 1-888-233-4339 or visiting the Fund’s website at www.transamerica.com.

The Board Members, their age, their positions with the Trust, and their principal occupations for at least the past five years (their titles may have varied during that period), the number of funds in the Transamerica Fund Family the Board oversees, and other board memberships they hold are set forth in the table below. The length of time served is provided from the date a Board Member became a member of the Board.

| | | | | | | | | | |

| Name and Age | | Position(s)

Held with

Trust | | Term of

Office and

Length

of Time

Served* | | Principal Occupation(s)

During Past Five Years | | Number of

Funds in

Complex

Overseen

by Board

Member | | Other

Directorships

Held By Board

Member

|

INTERESTED BOARD MEMBERS |

Marijn P. Smit (47) | | Chairman of the Board, President and Chief Executive Officer | | Since 2014 | | Chairman of the Board, President and Chief Executive Officer, TF, TST and TAAVF (2014 – present); Chairman of the Board, President and Chief Executive Officer, TET (2017 – present); Director, Chairman of the Board, President and Chief Executive Officer, Transamerica Asset Management, Inc. (“TAM”) and Transamerica Fund Services, Inc. (“TFS”) (2014 – present); Senior Vice President, Transamerica Retirement Solutions LLC (2012 – present); Trust Officer, Massachusetts Fidelity Trust Company

(2014 – present); Vice President, Transamerica Life Insurance Company

(2010 – 2016); | | 121 | | Director,

Massachusetts

Fidelity Trust

Company

(2014 – 2021);

Director,

Aegon Global

Funds (2016 –

present) |

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 17

| | | | | | | | | | |

| Name and Age | | Position(s)

Held with

Trust | | Term of

Office and

Length

of Time

Served* | | Principal Occupation(s)

During Past Five Years | | Number of

Funds in

Complex

Overseen

by Board

Member | | Other

Directorships

Held By Board

Member

|

INTERESTED BOARD MEMBERS — continued |

| Marijn P. Smit (continued) | | | | | | Senior Vice President, Transamerica Financial Life Insurance Company

(2013 – 2016); Senior Vice President, Transamerica Retirement Advisors, Inc. (2013 – 2016) and President and Director, Transamerica Stable Value Solutions, Inc. (2010 – 2016). | | | | |

Alan F. Warrick (72) | | Board Member | | Since 2012 | | Board Member, TF, TST and TAAVF (2012 – present); Board Member, TPP, TPFG and TPFG II (2012 – 2018); Senior Advisor, Lovell Minnick Equity Partners (2010 – present); and Retired (2010). | | 116 | | N/A |

INDEPENDENT BOARD MEMBERS |

Sandra N. Bane (68) | | Board Member | | Since 2008 | | Retired (1999 – present); Board Member, TF, TST and TAAVF (2008 – present); Board Member, TPP, TPFG and TPFG II (2008 – 2018); and Partner, KPMG (1975 – 1999). | | 116 | | Big 5 Sporting

Goods

(2002 – present);

Southern

Company Gas

(energy services

holding

company)(2008 – present) |

Leo J. Hill (64) | | Lead Independent Board Member | | Since 2002 | | Principal, Advisor Network Solutions, LLC (business consulting) (2006 – present); Board Member, TST

(2001 – present); Board Member, TF

(2002 – present); Board Member, TAAVF

(2007 – present); Board Member, TPP, TPFG and TPFG II (2007 – 2018); Market President, Nations Bank of Sun Coast Florida

(1998 – 1999); Chairman, President and Chief Executive Officer, Barnett Banks of Treasure Coast Florida

(1994 – 1998); Executive Vice President and Senior Credit Officer, Barnett Banks of Jacksonville, Florida (1991 – 1994); and Senior Vice President and Senior Loan Administration Officer, Wachovia Bank of Georgia

(1976 – 1991). | | 116 | | Ameris Bancorp

(2013 – present);

Ameris Bank

(2013 – present) |

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 18

| | | | | | | | | | |

| Name and Age | | Position(s)

Held with

Trust | | Term of

Office and

Length

of Time

Served* | | Principal Occupation(s)

During Past Five Years | | Number of

Funds in

Complex

Overseen

by Board

Member | | Other

Directorships

Held By Board

Member

|

INDEPENDENT BOARD MEMBERS — continued |

David W. Jennings (74) | | Board Member | | Since 2009 | | Board Member, TF, TST and TAAVF (2009 – present); Board Member, TPP, TPFG and TPFG II (2009 – 2018); Managing Director, Hilton Capital Management, LLC

(2010 – present). | | 116 | | N/A |

Fredric A. Nelson III (64) | | Board Member | | Since 2017 | | Board Member, TF, TST and TAAVF (2017 – present); Board Member, TPP, TPFG and TPFG II (2017 – 2018); Chief Investment Officer (“CIO”), Commonfund (2011 – 2015); Vice Chairman, CIO, ING Investment Management Americas (2003 – 2009); Managing Director, Head of U.S. Equity, JP Morgan Investment Management (1994 – 2003); and Managing Director, Head of Global Quantitative Investments Group, Bankers Trust Global Investment Management

(1981 – 1994). | | 116 | | N/A |

John E. Pelletier (56) | | Board Member | | Since 2017 | | Board Member, TF, TST and TAAVF (2017 – present); Board Member, TPP, TPFG and TPFG II (2017 – 2018); Director, Center for Financial Literacy, Champlain College (2010 – present); Co-Chair, Vermont Financial Literacy Commission with Vermont State Treasurer

(2015 – 2018); Chairman, Vermont Universal Children’s Higher Education Savings Account Program Advisory Committee

(2015 – present); Founder and Principal, Sterling Valley Consulting LLC (a financial services consulting firm)

(2009 – 2017); Independent Director, The Sentinel Funds and Sentinel Variable Products Trust

(2013 – 2017); Chief Legal Officer, Eaton Vance Corp. (2007 – 2008); and Executive Vice President and Chief Operating Officer

(2004 – 2007), General Counsel (1997 – 2004), Natixis Global Associates. | | 116 | | N/A |

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 19

| | | | | | | | | | |

| Name and Age | | Position(s)

Held with

Trust | | Term of

Office and

Length

of Time

Served* | | Principal Occupation(s)

During Past Five Years | | Number of

Funds in

Complex

Overseen

by Board

Member | | Other

Directorships

Held By Board

Member

|

INDEPENDENT BOARD MEMBERS — continued |

Patricia L. Sawyer (70) | | Board Member | | Since 2007 | | Retired (2007 – present); President/Founder, Smith & Sawyer LLC (management consulting) (1989 – 2007); Board Member, TF and TST (2007 – present); Board Member, TAAVF

(1993 – present); Board Member, TPP, TPFG and TPFG II (1993 – 2018); and Trustee, Chair of Finance Committee and Chair of Nominating Committee

(1987 – 1996), Bryant University. | | 116 | | Honorary

Trustee,Bryant University

(1996 – present) |

John W. Waechter (69) | | Board Member | | Since 2005 | | Partner, Englander Fischer

(2016 – present); Attorney, Englander Fischer (2008 – 2015); Retired (2004 – 2008); Board Member, TST

(2004 – present); Board Member, TF

(2005 – present); Board Member, TAAVF

(2007 – present); Board Member, TPP, TPFG and TPFG II (2007 – 2018); Employee, RBC Dain Rauscher (securities dealer) (2004); Executive Vice President, Chief Financial Officer and Chief Compliance Officer, William R. Hough & Co. (securities dealer) (1979 – 2004); and Treasurer, The Hough Group of Funds (1993 – 2004). | | 116 | | Board Member,

Operation PAR,

Inc. (non-profit

organization)

(2008 – present);Board Member,

Remember Honor

Support, Inc.

(non-profit

organization)

(2013 – 2020); Board Member,

WRH Income

Properties, Inc.

(real estate)

(2014 – present); Board Member,

Boley PAR, Inc.

(non-profit

organization)

(2016 – present) |

| * | Each Board Member shall hold office until: 1) his or her successor is elected and qualified or 2) he or she resigns, retires or his or her term as a Board Member is terminated in accordance with the Trust’s Declaration of Trust. |

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 20

OFFICERS

The mailing address of each officer is c/o Secretary, 1801 California Street, Suite 5200, Denver, CO 80202. The following table shows information about the officers, including their year of birth, their positions held with the Trust and their principal occupations during the past five years (their titles may have varied during that period). Each officer will hold office until his or her successor has been duly elected or appointed or until his or her earlier death, resignation or removal.

| | | | | | |

| Name and Age | | Position | | Term of Office

and Length of

Time Served* | | Principal Occupation(s) or Employment

During Past Five Years |

Marijn P. Smit (47) | | Chairman of the Board, President and Chief Executive Officer | | Since 2014 | | See Interested Board Members Table Above. |

Christopher A. Staples, CFA (50) | | Vice President and Chief Investment Officer, Advisory Services | | Since 2005 | | Vice President and Chief Investment Officer, Advisory Services, TF and TST (2007 – present); Vice President and Chief Investment Officer, TET (2017 – present); Vice President and Chief Investment Officer, Advisory Services, TAAVF (2007 – present); Vice President and Chief Investment Officer, Advisory Services, TPP, TPFG and TPFG II (2007 – 2018); Director (2005 – 2019), Senior Vice President

(2006 – present), Senior Director, Investments

(2016 – present), Chief Investment Officer, Advisory Services (2012 – 2016) and Lead Portfolio Manager (2007 – present), TAM; Director, TFS (2005 – 2019); Trust Officer, Massachusetts Fidelity Trust Company (2010 – present); Registered Representative (2007 – 2016), Transamerica Capital, Inc. (“TCI”); and Registered Representative, TFA

(2005 – present). |

Thomas R. Wald, CFA (60) | | Vice President and Chief Investment Officer | | Since 2014 | | Chief Investment Officer, TF, TST and TAAVF (2014 – present); TET (2017 – present); Chief Investment Officer, TPP, TPFG and TPFG II (2014 – 2018); Director (2017 – 2020), Akaan Transamerica, S.A. de C.V., Sociedad Operadora de Fondos de Inversión; Chief Investment Officer, Transamerica Investments & Retirement (2014 – 2020); Director, Transamerica Funds Services, Inc. (2019 – present); Director (2019 – present); Senior Vice President and Chief Investment Officer, TAM (2014 – present); Director, TFS (2019 – present); and Trust Officer, Massachusetts Fidelity Trust Company (2015 – present). |

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2020 |

Page 21

| | | | | | |

| Name and Age | | Position | | Term of Office

and Length of

Time Served* | | Principal Occupation(s) or Employment

During Past Five Years |

Vincent J. Toner (50) | | Vice President and Treasurer | | Since 2014 | | Vice President and Treasurer, TF, TST and TAAVF (2014 – present), Vice President and Treasurer (2017 – present), Vice President, Principal Financial Officer and Treasurer (2020 – present), TET; Vice President and Treasurer, TPP, TPFG and TPFG II (2014 – 2018); Vice President (2016 – present), Treasurer

(2016 – 2019), Vice President, Administration and Treasurer (2014 – 2016), TAM; Vice President, Administration and Treasurer

(2014 – 2019), Senior Vice President

(2019 – present), TFS; Vice President (2016 – present), TCI; and Trust Officer (2015 – present), Massachusetts Fidelity Trust Company. |

Francine J. Rosenberger (53) | | Chief Compliance Officer | | Since 2019 | | Chief Compliance Officer, TF, TST, TET and TAAVF (2019 – present); Chief Compliance Officer (2019 – present), TAM; and General Counsel, Corporate Secretary and Fund Chief Compliance Officer, Steben & Company, Inc. (2013 – 2019). |

Molly Possehl (42) | | Anti-Money Laundering Officer | | Since 2019 | | Anti-Money Laundering Officer, TF, TST, TET and TAAVF (2019 – present); Assistant General Counsel, Transamerica Life Insurance Company/Aegon USA

(2013 – present); and Anti-Money Laundering Compliance Officer and Fraud Officer, Transamerica Life Insurance Company/Aegon USA (2015 – present). |

Erin D. Nelson (43) | | Chief Legal Officer and Secretary | | Since 2019 | | Chief Legal Officer and Secretary, TF, TST, TET and TAAVF (2019 – present); Assistant General Counsel II and Assistant Secretary, TAM (2019 – present); Assistant Secretary (2019 – present), TFS; and Senior Vice President and Chief Compliance Officer, ALPS Advisors, Inc. (2015 – 2019). |

Peter Sattelmair (43) | | Assistant Treasurer | | Since 2018 | | Assistant Treasurer, TF, TST and TAAVF

(2018 – present); and Director, Fund Administration, TAM

(2014 – present). |

Timothy Bresnahan (52) | | Assistant Secretary | | Since 2020 | | Assistant Secretary, TF, TST and TAAVF