ATI’S 2021 EXECUTIVE COMPENSATION—PAY FOR PERFORMANCE

Why We Are Providing Supplemental Disclosure

In response to the unprecedented disruption created by the COVID-19 pandemic and other recent challenges facing our business, and to ensure that our executive compensation programs continue to both incent performance and support retention of key talent, we made important changes to our 2021 compensation programs compared to our prior-year programs.

The purpose of this supplemental disclosure is to provide our investors with additional insights into the specific components and features of our 2021 short-term and long-term incentive compensation programs, our rigorous goal-setting processes, and the direct link between our 2021 realized compensation outcomes and ATI’s financial and stock price performance.

Specifically, this supplement provides additional disclosure regarding:

| | • | | our Personnel and Compensation Committee’s rationale for adopting 2021 annual cash incentive (“2021 APP”) performance metrics that were lower than the metrics established prior to the onset of the pandemic for our 2020 annual cash incentive program (the “2020 APP”); |

| | • | | the performance share units that we granted in 2021 (“2021-2023 PSUs”), which vest over a three-year period based on ATI’s relative total shareholder return (“TSR”), including the composition of our TSR peer group, the performance targets applicable to the 2021-2023 PSUs, and the negative TSR cap that limits the number of shares payable upon settlement of the 2021-2023 PSUs if absolute returns are negative for the three-year performance period; and |

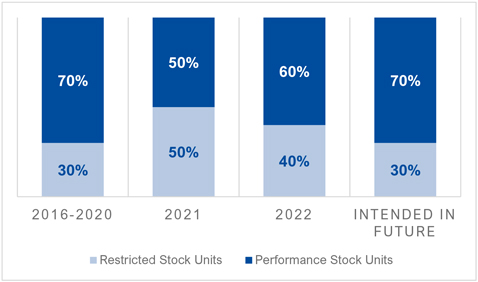

| | • | | the Committee’s reasons for reducing to 50% the relative proportion of PSUs compared to the time-vested equity component of awards under our 2021 long-term incentive program and plans to restore our historical target 70/30 mix. |

Additionally, this supplement reiterates: (a) the disclosure included on page 51 of the Proxy Statement for our 2022 Annual Meeting, which disclosed the performance metrics for the PSUs that were granted in 2019 and vested in 2021 (our “2019-2021 PSUs”), ATI’s actual performance relative to those metrics, and resulting below-target settlement of those awards, and (b) the previously-disclosed results of our 2020 APP.

Say on Pay and Our Commitment to Pay for Performance

Each year we ask our stockholders to approve the compensation of ATI’s named executive officers. This proposal, commonly known as a “Say On Pay” proposal, gives our stockholders the opportunity to express their views on our NEOs’ compensation. While this vote is advisory, and not binding on our Company, it provides valuable information to our Personnel and Compensation Committee regarding investor sentiment about our executive compensation philosophy, policies and practices. The Committee will consider the outcome of this vote when determining executive compensation for the remainder of 2022 and in future years.

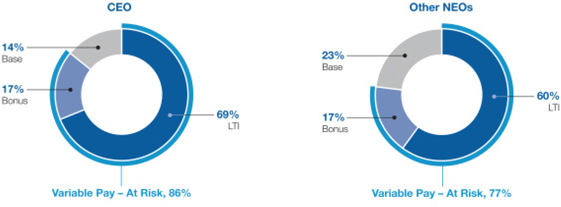

In recent years, ATI has consistently demonstrated its firm commitment to pay for performance. Fundamentally, our executive compensation program links compensation to the achievement of specific, predetermined financial and performance goals that further our most impactful business strategies. Our shareholders clearly recognize this commitment and the strong link between overall NEO compensation and our performance. In fact, in 2021, our Say On Pay proposal received the support of more than 98% of the shares voted at our Annual Meeting, and since 2018, our Say On Pay proposals have received, on average, the support of 95% of the shares voted.

When casting your Say On Pay vote, we urge you to consider:

Our business and stock price performance were heavily impacted in 2020 and 2021 by the COVID-19 pandemic and other challenges facing our business. The sudden and widespread impact of the COVID-19 pandemic severely affected each of our primary end-markets, and in particular commercial aerospace, our largest end-market. These impacts were exacerbated by ongoing issues associated with Boeing’s 737 Max and other programs, as well as a prolonged labor strike at our Specialty Rolled Products business in 2021.

We urgently took bold, decisive actions in response to these challenges and transformed ATI over the course of 2020 and 2021 to create meaningful shareholder value. We viewed the 2020-2021 time frame as an opportunity to structurally transform our business, sharpening our focus on the products and markets where our unique capabilities set us apart. We announced that we would exit production of low-margin standard stainless products, streamline the operations of our SRP business and redirect resources to more profitable products and markets. We succeeded, exiting production of standard stainless products in 2021 as promised.

Our recent stock price reflects the early successes of these critical efforts. While our relative TSR for the period ending December 31, 2021 generally lagged those of our peers, our stock price increased markedly since the beginning of 2022 following the announcements of our full year 2021 results and expectations for 2022, as well as our long-term objectives. We believe this dramatic improvement clearly reflects our success in executing our multi-year strategies, as well as market expectations for our ability to deliver stockholder value. Moreover, in 2022 we began to return capital to stockholders, announcing a $150 million stock repurchase program earlier this year. As a point of reference, on April 22, 2022, our closing