UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07751

Nuveen Multistate Trust IV

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Christopher M. Rohrbachar

Vice President and Secretary

333 West Wacker Drive,

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: May 31

Date of reporting period: May 31, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Bond Funds

| Fund Name | Class A | Class C | Class C2 | Class I | |

| Nuveen Kansas Municipal Bond Fund | FKSTX | FAFOX | FCKSX | FRKSX | |

| Nuveen Kentucky Municipal Bond Fund | FKYTX | FKCCX | FKYCX | FKYRX | |

| Nuveen Michigan Municipal Bond Fund | FMITX | FAFNX | FLMCX | NMMIX | |

| Nuveen Missouri Municipal Bond Fund | FMOTX | FAFPX | FMOCX | FMMRX | |

| Nuveen Ohio Municipal Bond Fund | FOHTX | FAFMX | FOHCX | NXOHX | |

| Nuveen Wisconsin Municipal Bond Fund | FWIAX | FWCCX | FWICX | FWIRX |

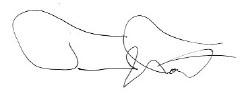

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | 1.66% | 2.70% | 4.30% |

| Class A Shares at maximum Offering Price | (2.60)% | 1.82% | 3.85% |

| S&P Municipal Bond Index | 1.26% | 2.94% | 4.32% |

| Lipper Other States Municipal Debt Funds Classification Average | 0.57% | 2.09% | 3.46% |

| Class C2 Shares | 1.09% | 2.15% | 3.73% |

| Class I Shares | 1.89% | 2.90% | 4.51% |

| Average Annual | ||

| 1-Year | Since Inception | |

| Class C Shares | 0.87% | 2.99% |

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | 2.32% | 3.51% | 4.44% |

| Class A Shares at maximum Offering Price | (1.99)% | 2.62% | 4.00% |

| Class C2 Shares | 1.74% | 2.94% | 3.87% |

| Class I Shares | 2.44% | 3.71% | 4.65% |

| Average Annual | ||

| 1-Year | Since Inception | |

| Class C Shares | 1.51% | 3.03% |

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Expense Ratios | 0.86% | 1.66% | 1.41% | 0.66% |

| Effective Leverage Ratio | 5.13% |

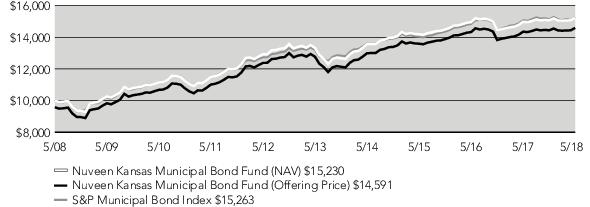

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | 0.57% | 2.42% | 3.84% |

| Class A Shares at maximum Offering Price | (3.65)% | 1.56% | 3.39% |

| S&P Municipal Bond Index | 1.26% | 2.94% | 4.32% |

| Lipper Other States Municipal Debt Funds Classification Average | 0.57% | 2.09% | 3.46% |

| Class C2 Shares | 0.02% | 1.88% | 3.26% |

| Class I Shares | 0.80% | 2.65% | 4.04% |

| Average Annual | ||

| 1-Year | Since Inception | |

| Class C Shares | (0.21)% | 2.38% |

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | 0.98% | 3.09% | 3.94% |

| Class A Shares at maximum Offering Price | (3.29)% | 2.21% | 3.49% |

| Class C2 Shares | 0.42% | 2.53% | 3.38% |

| Class I Shares | 1.12% | 3.30% | 4.15% |

| Average Annual | ||

| 1-Year | Since Inception | |

| Class C Shares | 0.11% | 2.31% |

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Expense Ratios | 0.80% | 1.60% | 1.35% | 0.60% |

| Effective Leverage Ratio | 12.77% |

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | 0.94% | 3.00% | 4.15% |

| Class A Shares at maximum Offering Price | (3.33)% | 2.11% | 3.70% |

| S&P Municipal Bond Index | 1.26% | 2.94% | 4.32% |

| Lipper Other States Municipal Debt Funds Classification Average | 0.57% | 2.09% | 3.46% |

| Class C2 Shares | 0.27% | 2.41% | 3.57% |

| Class I Shares | 1.06% | 3.18% | 4.35% |

| Average Annual | ||

| 1-Year | Since Inception | |

| Class C Shares | 0.06% | 3.03% |

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | 1.08% | 3.66% | 4.27% |

| Class A Shares at maximum Offering Price | (3.13)% | 2.77% | 3.82% |

| Class C2 Shares | 0.59% | 3.10% | 3.70% |

| Class I Shares | 1.39% | 3.88% | 4.48% |

| Average Annual | ||

| 1-Year | Since Inception | |

| Class C Shares | 0.38% | 2.97% |

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Expense Ratios | 0.86% | 1.66% | 1.41% | 0.66% |

| Effective Leverage Ratio | 3.30% |

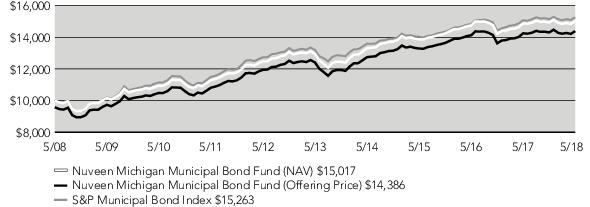

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | 1.64% | 3.09% | 4.51% |

| Class A Shares at maximum Offering Price | (2.64)% | 2.22% | 4.07% |

| S&P Municipal Bond Index | 1.26% | 2.94% | 4.32% |

| Lipper Other States Municipal Debt Funds Classification Average | 0.57% | 2.09% | 3.46% |

| Class C2 Shares | 1.10% | 2.53% | 3.94% |

| Class I Shares | 1.86% | 3.31% | 4.73% |

| Average Annual | ||

| 1-Year | Since Inception | |

| Class C Shares | 0.83% | 3.15% |

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | 2.00% | 3.83% | 4.65% |

| Class A Shares at maximum Offering Price | (2.32)% | 2.94% | 4.20% |

| Class C2 Shares | 1.37% | 3.25% | 4.07% |

| Class I Shares | 2.22% | 4.04% | 4.85% |

| Average Annual | ||

| 1-Year | Since Inception | |

| Class C Shares | 1.10% | 3.09% |

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Expense Ratios | 0.78% | 1.58% | 1.33% | 0.58% |

| Effective Leverage Ratio | 0.00% |

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | 0.92% | 2.81% | 4.23% |

| Class A Shares at maximum Offering Price | (3.35)% | 1.94% | 3.79% |

| S&P Municipal Bond Index | 1.26% | 2.94% | 4.32% |

| Lipper Ohio Municipal Debt Funds Classification Average | 0.51% | 2.18% | 3.39% |

| Class C2 Shares | 0.34% | 2.25% | 3.66% |

| Class I Shares | 1.04% | 3.01% | 4.43% |

| Average Annual | ||

| 1-Year | Since Inception | |

| Class C Shares | 0.13% | 2.84% |

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | 1.15% | 3.56% | 4.33% |

| Class A Shares at maximum Offering Price | (3.06)% | 2.68% | 3.88% |

| Class C2 Shares | 0.66% | 3.02% | 3.76% |

| Class I Shares | 1.36% | 3.78% | 4.54% |

| Average Annual | ||

| 1-Year | Since Inception | |

| Class C Shares | 0.36% | 2.78% |

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Expense Ratios | 0.78% | 1.58% | 1.33% | 0.58% |

| Effective Leverage Ratio | 4.79% |

| Average Annual | |||

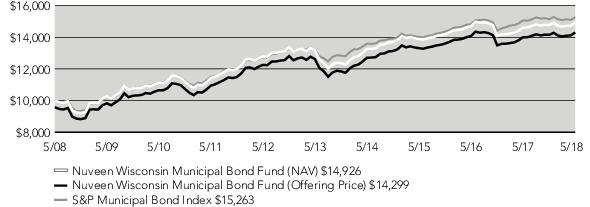

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | 2.08% | 2.54% | 4.09% |

| Class A Shares at maximum Offering Price | (2.17)% | 1.67% | 3.64% |

| S&P Municipal Bond Index | 1.26% | 2.94% | 4.32% |

| Lipper Other States Municipal Debt Funds Classification Average | 0.57% | 2.09% | 3.46% |

| Class C2 Shares | 1.50% | 1.98% | 3.51% |

| Class I Shares | 2.21% | 2.74% | 4.29% |

| Average Annual | ||

| 1-Year | Since Inception | |

| Class C Shares | 1.27% | 3.19% |

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | 2.37% | 3.51% | 4.23% |

| Class A Shares at maximum Offering Price | (1.90)% | 2.62% | 3.78% |

| Class C2 Shares | 1.79% | 2.94% | 3.65% |

| Class I Shares | 2.60% | 3.73% | 4.44% |

| Average Annual | ||

| 1-Year | Since Inception | |

| Class C Shares | 1.56% | 3.17% |

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Expense Ratios | 0.86% | 1.66% | 1.41% | 0.67% |

| Effective Leverage Ratio | 3.01% |

| Share Class | ||||

| Class A1 | Class C | Class C2 | Class I | |

| Dividend Yield | 3.16% | 2.50% | 2.73% | 3.51% |

| SEC 30-Day Yield | 2.25% | 1.56% | 1.80% | 2.55% |

| Taxable-Equivalent Yield (29.7%)2 | 3.20% | 2.22% | 2.56% | 3.63% |

| Share Class | ||||

| Class A1 | Class C | Class C2 | Class I | |

| Dividend Yield | 2.86% | 2.20% | 2.42% | 3.21% |

| SEC 30-Day Yield | 2.20% | 1.50% | 1.75% | 2.49% |

| Taxable-Equivalent Yield (30.0%)2 | 3.14% | 2.14% | 2.50% | 3.56% |

| Share Class | ||||

| Class A1 | Class C | Class C2 | Class I | |

| Dividend Yield | 2.58% | 1.91% | 2.12% | 2.91% |

| SEC 30-Day Yield | 1.91% | 1.21% | 1.45% | 2.20% |

| Taxable-Equivalent Yield (28.3%)2 | 2.66% | 1.69% | 2.02% | 3.07% |

| Share Class | ||||

| Class A1 | Class C | Class C2 | Class I | |

| Dividend Yield | 3.18% | 2.53% | 2.80% | 3.54% |

| SEC 30-Day Yield | 2.38% | 1.69% | 1.94% | 2.68% |

| Taxable-Equivalent Yield (29.9%)2 | 3.40% | 2.41% | 2.77% | 3.82% |

| Share Class | ||||

| Class A1 | Class C | Class C2 | Class I | |

| Dividend Yield | 2.70% | 2.03% | 2.24% | 2.99% |

| SEC 30-Day Yield - Subsidized | 2.05% | 1.34% | 1.59% | 2.34% |

| SEC 30-Day Yield - Unsubsidized | 2.05% | 1.34% | 1.59% | 2.34% |

| Taxable-Equivalent Yield - Subsidized (29.0%)2 | 2.89% | 1.89% | 2.24% | 3.30% |

| Taxable-Equivalent Yield - Unsubsidized (29.0%)2 | 2.89% | 1.89% | 2.24% | 3.30% |

| Share Class | ||||

| Class A1 | Class C | Class C2 | Class I | |

| Dividend Yield | 3.07% | 2.40% | 2.63% | 3.43% |

| SEC 30-Day Yield | 2.49% | 1.81% | 2.05% | 2.80% |

| Taxable-Equivalent Yield (30.3%)2 | 3.57% | 2.60% | 2.94% | 4.02% |

| Fund Allocation (% of net assets) | |

| Long-Term Municipal Bonds | 103.4% |

| Other Assets Less Liabilities | (0.2)% |

| Net Assets Plus Floating Rate Obligations | 103.2% |

| Floating Rate Obligations | (3.2)% |

| Net Assets | 100% |

| Portfolio Composition (% of total investments) | |

| U.S. Guaranteed | 23.6% |

| Tax Obligation/Limited | 22.5% |

| Utilities | 9.5% |

| Health Care | 8.8% |

| Tax Obligation/General | 7.8% |

| Transportation | 7.5% |

| Water and Sewer | 6.1% |

| Consumer Staples | 5.3% |

| Other | 8.9% |

| Total | 100% |

| Bond Credit Quality (% of total investment exposure) | |

| U.S. Guaranteed | 25.1% |

| AAA | 3.3% |

| AA | 20.8% |

| A | 23.7% |

| BBB | 11.6% |

| BB or Lower | 9.3% |

| N/R (not rated) | 6.2% |

| Total | 100% |

| Fund Allocation (% of net assets) | |

| Long-Term Municipal Bonds | 104.4% |

| Other Assets Less Liabilities | 4.0% |

| Net Assets Plus Floating Rate Obligations | 108.4% |

| Floating Rate Obligations | (8.4)% |

| Net Assets | 100% |

| Portfolio Composition (% of total investments) | |

| Tax Obligation/Limited | 20.1% |

| Health Care | 18.9% |

| U.S. Guaranteed | 16.0% |

| Education and Civic Organizations | 14.1% |

| Water and Sewer | 11.9% |

| Transportation | 10.2% |

| Utilities | 7.5% |

| Other | 1.3% |

| Total | 100% |

| Bond Credit Quality (% of total investment exposure) | |

| U.S. Guaranteed | 18.9% |

| AAA | 7.4% |

| AA | 27.1% |

| A | 31.6% |

| BBB | 14.1% |

| BB or Lower | 0.1% |

| N/R (not rated) | 0.8% |

| Total | 100% |

| Fund Allocation (% of net assets) | |

| Long-Term Municipal Bonds | 100.6% |

| Other Assets Less Liabilities | 1.4% |

| Net Assets Plus Floating Rate Obligations | 102.0% |

| Floating Rate Obligations | (2.0)% |

| Net Assets | 100% |

| Portfolio Composition (% of total investments) | |

| Education and Civic Organizations | 26.8% |

| Tax Obligation/General | 21.1% |

| Health Care | 11.6% |

| Tax Obligation/Limited | 10.1% |

| Water and Sewer | 9.3% |

| U.S. Guaranteed | 9.1% |

| Utilities | 7.2% |

| Other | 4.8% |

| Total | 100% |

| Bond Credit Quality (% of total investment exposure) | |

| U.S. Guaranteed | 9.0% |

| AAA | 16.8% |

| AA | 53.6% |

| A | 15.5% |

| BBB | 1.6% |

| BB or Lower | 3.0% |

| N/R (not rated) | 0.5% |

| Total | 100% |

| Fund Allocation (% of net assets) | |

| Long-Term Municipal Bonds | 100.0% |

| Short-Term Municipal Bonds | 0.5% |

| Other Assets Less Liabilities | (0.5)% |

| Net Assets | 100% |

| Portfolio Composition (% of total investments) | |

| Health Care | 23.3% |

| Tax Obligation/Limited | 18.0% |

| Education and Civic Organizations | 11.9% |

| U.S. Guaranteed | 11.5% |

| Tax Obligation/General | 11.0% |

| Water and Sewer | 8.3% |

| Long-Term Care | 5.7% |

| Other | 10.3% |

| Total | 100% |

| Bond Credit Quality (% of total investment exposure) | |

| U.S. Guaranteed | 11.5% |

| AAA | 2.2% |

| AA | 37.4% |

| A | 27.4% |

| BBB | 10.2% |

| BB or Lower | 1.9% |

| N/R (not rated) | 9.4% |

| Total | 100% |

| Fund Allocation (% of net assets) | |

| Long-Term Municipal Bonds | 99.1% |

| Other Assets Less Liabilities | 0.9% |

| Net Assets | 100% |

| Portfolio Composition (% of total investments) | |

| U.S. Guaranteed | 19.5% |

| Tax Obligation/General | 18.0% |

| Tax Obligation/Limited | 14.4% |

| Water and Sewer | 11.4% |

| Health Care | 10.0% |

| Education and Civic Organizations | 8.8% |

| Transportation | 7.6% |

| Other | 10.3% |

| Total | 100% |

| Bond Credit Quality (% of total investment exposure) | |

| U.S. Guaranteed | 22.8% |

| AAA | 15.9% |

| AA | 39.4% |

| A | 12.9% |

| BBB | 2.0% |

| BB or Lower | 4.8% |

| N/R (not rated) | 2.2% |

| Total | 100% |

| Fund Allocation (% of net assets) | |

| Long-Term Municipal Bonds | 99.6% |

| Other Assets Less Liabilities | 0.4% |

| Net Assets | 100% |

| Portfolio Composition (% of total investments) | |

| Tax Obligation/Limited | 33.8% |

| Housing/Multifamily | 12.2% |

| Health Care | 11.0% |

| U.S. Guaranteed | 10.9% |

| Long-Term Care | 8.0% |

| Water and Sewer | 4.9% |

| Other | 19.2% |

| Total | 100% |

| Bond Credit Quality (% of total investment exposure) | |

| U.S. Guaranteed | 13.0% |

| AAA | 1.1% |

| AA | 23.5% |

| A | 31.3% |

| BBB | 15.5% |

| BB or Lower | 3.3% |

| N/R (not rated) | 12.3% |

| Total | 100% |

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Actual Performance | ||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,010.40 | $1,007.40 | $1,008.50 | $1,011.50 |

| Expenses Incurred During the Period | $ 4.06 | $ 8.06 | $ 6.81 | $ 3.06 |

| Hypothetical Performance (5% annualized return before expenses) | ||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,020.89 | $1,016.90 | $1,018.15 | $1,021.89 |

| Expenses Incurred During the Period | $ 4.08 | $ 8.10 | $ 6.84 | $ 3.07 |

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Actual Performance | ||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,005.40 | $1,002.40 | $1,003.50 | $1,007.50 |

| Expenses Incurred During the Period | $ 3.95 | $ 7.94 | $ 6.69 | $ 2.95 |

| Hypothetical Performance (5% annualized return before expenses) | ||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,020.99 | $1,017.00 | $1,018.25 | $1,021.99 |

| Expenses Incurred During the Period | $ 3.98 | $ 8.00 | $ 6.74 | $ 2.97 |

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Actual Performance | ||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,005.60 | $1,000.70 | $1,001.80 | $1,005.80 |

| Expenses Incurred During the Period | $ 4.10 | $ 8.08 | $ 6.84 | $ 3.10 |

| Hypothetical Performance (5% annualized return before expenses) | ||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,020.84 | $1,016.85 | $1,018.10 | $1,021.84 |

| Expenses Incurred During the Period | $ 4.13 | $ 8.15 | $ 6.89 | $ 3.13 |

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Actual Performance | ||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,009.60 | $1,005.60 | $1,006.90 | $1,010.70 |

| Expenses Incurred During the Period | $ 3.91 | $ 7.90 | $ 6.65 | $ 2.91 |

| Hypothetical Performance (5% annualized return before expenses) | ||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,021.04 | $1,017.05 | $1,018.30 | $1,022.04 |

| Expenses Incurred During the Period | $ 3.93 | $ 7.95 | $ 6.69 | $ 2.92 |

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Actual Performance | ||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,004.20 | $1,000.20 | $1,001.30 | $1,004.40 |

| Expenses Incurred During the Period | $ 3.90 | $ 7.88 | $ 6.64 | $ 2.90 |

| Hypothetical Performance (5% annualized return before expenses) | ||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,021.04 | $1,017.05 | $1,018.30 | $1,022.04 |

| Expenses Incurred During the Period | $ 3.93 | $ 7.95 | $ 6.69 | $ 2.92 |

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Actual Performance | ||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,010.50 | $1,006.40 | $1,007.60 | $1,011.60 |

| Expenses Incurred During the Period | $ 4.41 | $ 8.40 | $ 7.16 | $ 3.41 |

| Hypothetical Performance (5% annualized return before expenses) | ||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,020.54 | $1,016.55 | $1,017.80 | $1,021.54 |

| Expenses Incurred During the Period | $ 4.43 | $ 8.45 | $ 7.19 | $ 3.43 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| LONG-TERM INVESTMENTS – 103.4% | ||||||

| MUNICIPAL BONDS – 103.4% | ||||||

| Consumer Staples – 5.5% | ||||||

| $ 1,000 | Buckeye Tobacco Settlement Financing Authority, Ohio, Tobacco Settlement Asset-Backed Revenue Bonds, Senior Lien, Series 2007A-2, 5.750%, 6/01/34 | 7/18 at 100.00 | B- | $994,780 | ||

| 1,000 | California County Tobacco Securitization Agency, Tobacco Settlement Asset-Backed Bonds, Los Angeles County Securitization Corporation, Series 2006A, 5.450%, 6/01/28 | 12/18 at 100.00 | B2 | 1,013,530 | ||

| 190 | Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Bonds, Series 2007A-1, 5.000%, 6/01/33 | 7/18 at 100.00 | B+ | 190,950 | ||

| 500 | Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Bonds, Series 2017A-1, 5.000%, 6/01/29 | 6/27 at 100.00 | BBB | 572,360 | ||

| 1,035 | Guam Economic Development & Commerce Authority, Tobacco Settlement Asset-Backed Bonds, Series 2007A, 5.250%, 6/01/32 | 6/18 at 100.00 | N/R | 1,035,041 | ||

| 775 | Inland Empire Tobacco Securitization Authority, California, Tobacco Settlement Asset-Backed Bonds, Series 2007, 4.625%, 6/01/21 | 7/18 at 100.00 | N/R | 775,217 | ||

| 1,500 | Iowa Tobacco Settlement Authority, Asset Backed Settlement Revenue Bonds, Series 2005C, 5.500%, 6/01/42 | 6/18 at 100.00 | B+ | 1,505,685 | ||

| 750 | Iowa Tobacco Settlement Authority, Tobacco Asset-Backed Revenue Bonds, Series 2005B, 5.600%, 6/01/34 | 6/18 at 100.00 | BB- | 757,290 | ||

| 950 | New York Counties Tobacco Trust VI, New York, Tobacco Settlement Pass-Through Bonds, Series 2016A-1, 5.625%, 6/01/35 | No Opt. Call | BBB | 1,052,011 | ||

| 625 | New York Counties Tobacco Trust VI, New York, Tobacco Settlement Pass-Through Bonds, Turbo Term Series 2016A. Including 2016A-1, 2016A-2A and 2016A-2B, 5.000%, 6/01/51 | 6/26 at 100.00 | N/R | 656,050 | ||

| 1,535 | Puerto Rico, The Children's Trust Fund, Tobacco Settlement Asset-Backed Refunding Bonds, Series 2002, 5.500%, 5/15/39 | 8/18 at 100.00 | Ba1 | 1,531,163 | ||

| 320 | Tobacco Settlement Financing Corporation, New Jersey, Tobacco Settlement Asset-Backed Bonds, Series 2018B, 5.000%, 6/01/46 | 6/28 at 100.00 | BBB | 344,230 | ||

| 2,510 | TSASC Inc., New York, Tobacco Asset-Backed Bonds, Series 2006, 5.000%, 6/01/48 | 6/27 at 100.00 | N/R | 2,583,242 | ||

| 12,690 | Total Consumer Staples | 13,011,549 | ||||

| Education and Civic Organizations – 4.4% | ||||||

| 675 | Kansas Development Finance Authority, Revenue Bonds, Kansas Board of Regents University of Kansas Medical Center Research Institute, Series 2010N, 5.000%, 4/01/29 | 4/20 at 100.00 | Aa2 | 712,591 | ||

| 250 | Kansas Development Finance Authority, Revenue Bonds, Kansas State University Projects, Refunding Series 2016A, 4.000%, 3/01/27 | 3/24 at 100.00 | Aa3 | 268,410 | ||

| Kansas Development Finance Authority, Revenue Bonds, Wichita State University Union Corporation Student Housing Project, Series 2013F-1: | ||||||

| 1,690 | 5.250%, 6/01/38 | 6/21 at 100.00 | Aa3 | 1,838,956 | ||

| 2,000 | 5.250%, 6/01/42 | 6/21 at 100.00 | Aa3 | 2,171,440 | ||

| 1,000 | New York City Industrial Development Agency, New York, PILOT Revenue Bonds, Queens Baseball Stadium Project, Series 2006, 5.000%, 1/01/46 – AMBAC Insured | 7/18 at 100.00 | BBB | 1,013,540 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Education and Civic Organizations (continued) | ||||||

| $ 1,000 | Topeka, Kansas, Economic Development Revenue Bonds, YMCA Project, Refunding Series 2011A, 6.500%, 9/01/32 | 9/21 at 100.00 | N/R | $1,046,410 | ||

| 3,135 | Washburn University of Topeka, Kansas, Revenue Bonds, Series 2015A, 5.000%, 7/01/35 | 7/25 at 100.00 | A1 | 3,538,349 | ||

| 9,750 | Total Education and Civic Organizations | 10,589,696 | ||||

| Financials – 0.5% | ||||||

| 1,020 | New York Liberty Development Corporation, Revenue Bonds, Goldman Sachs Headquarters Issue, Series 2005, 5.250%, 10/01/35 | No Opt. Call | A | 1,282,364 | ||

| Health Care – 9.1% | ||||||

| 400 | Hutchinson, Kansas, Hospital Facilities Revenue Bonds, Hutchinson Regional Medical Center, Inc., Series 2016, 5.000%, 12/01/41 | 12/26 at 100.00 | Baa2 | 427,072 | ||

| 875 | Illinois Finance Authority, Revenue Bonds, Presence Health Network, Series 2016C, 5.000%, 2/15/36 | 2/27 at 100.00 | AA+ | 995,129 | ||

| 5,000 | Kansas Development Finance Authority, Health Facilities Revenue Bonds, KU Health System, Series 2011H, 5.125%, 3/01/39 | 3/20 at 100.00 | AA- | 5,260,700 | ||

| 3,715 | Kansas Development Finance Authority, Health Facilities Revenue Bonds, Stormont-Vail Health Care Inc., Series 2011F, 5.250%, 11/15/29 | 11/19 at 100.00 | A2 | 3,889,605 | ||

| 2,000 | Kansas Development Finance Authority, Health Facilities Revenue Bonds, Stormont-Vail Health Care Inc., Series 2013J, 5.000%, 11/15/38 | 11/22 at 100.00 | A2 | 2,154,120 | ||

| Kansas Development Finance Authority, Revenue Bonds, Sisters of Charity of Leavenworth Health Services Corporation, Series 2010A: | ||||||

| 135 | 5.000%, 1/01/23 | 1/20 at 100.00 | AA- | 141,483 | ||

| 197 | 5.000%, 1/01/40 (UB) | 1/20 at 100.00 | AA- | 205,014 | ||

| 230 | Kansas Development Finance Authority, Revenue Bonds, Sisters of Charity of Leavenworth Health Services Corporation, Tender Option Bond Trust 2015-XF0063, 14.509%, 1/01/40, 144A (IF) | 1/20 at 100.00 | AA- | 273,772 | ||

| 2,500 | Lawrence, Kansas, Hospital Revenue Bonds, Lawrence Memorial Hospital, Series 2018A, 5.000%, 7/01/48 | 7/28 at 100.00 | A | 2,825,075 | ||

| 3,000 | Manhattan, Kansas, Hospital Revenue Bonds, Mercy Regional Health Center, Inc., Refunding Series 2013, 5.000%, 11/15/29 | 11/22 at 100.00 | A+ | 3,279,390 | ||

| 2,000 | University of Kansas Hospital Authority, Health Facilities Revenue Bonds, KU Health System, Refunding & Improvement Series 2015, 5.000%, 9/01/45 | 9/25 at 100.00 | AA- | 2,230,960 | ||

| 20,052 | Total Health Care | 21,682,320 | ||||

| Housing/Single Family – 0.0% | ||||||

| 5 | Sedgwick and Shawnee Counties, Kansas, GNMA Mortgage-Backed Securities Program Single Family Revenue Bonds, Series 1997A-1, 6.950%, 6/01/29 (Alternative Minimum Tax) | No Opt. Call | N/R | 5,034 | ||

| Industrials – 1.3% | ||||||

| 425 | Indiana Finance Authority, Environmental Improvement Revenue Bonds, United States Steel Corporation Project, Refunding Series 2010, 6.000%, 12/01/26 | 6/20 at 100.00 | BB- | 437,015 | ||

| 360 | Indiana Finance Authority, Environmental Improvement Revenue Bonds, United States Steel Corporation Project, Refunding Series 2011, 6.000%, 12/01/19 | No Opt. Call | BB- | 372,438 | ||

| 1,000 | Iowa Finance Authority, Iowa, Midwestern Disaster Area Revenue Bonds, Iowa Fertilizer Company Project, Series 2013, 5.250%, 12/01/25 | 12/23 at 100.00 | B | 1,071,260 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Industrials (continued) | ||||||

| $ 530 | Iowa Finance Authority, Iowa, Midwestern Disaster Area Revenue Bonds, Iowa Fertilizer Company Project, Series 2016, 5.875%, 12/01/26, 144A | 6/18 at 105.00 | B | $556,945 | ||

| 205 | Iowa Finance Authority, Iowa, Midwestern Disaster Area Revenue Bonds, Iowa Fertilizer Company Project, Series 2018A, 5.250%, 12/01/50 (Mandatory Put 12/01/22) | 12/22 at 103.00 | B | 217,714 | ||

| 435 | New York Liberty Development Corporation, New York, Liberty Revenue Bonds, 3 World Trade Center Project, Class 1 Series 2014, 5.000%, 11/15/44, 144A | 11/24 at 100.00 | N/R | 462,544 | ||

| 2,955 | Total Industrials | 3,117,916 | ||||

| Long-Term Care – 2.8% | ||||||

| 3,125 | Kansas Development Finance Authority, Revenue Bonds, Lifespace Communities, Inc., Refunding Series 2010S, 5.000%, 5/15/30 | 5/20 at 100.00 | A | 3,253,750 | ||

| 2,715 | Wichita, Kansas, Health Care Facilities Revenue Bonds, Presbyterian Manors, Series 2013IV-A, 6.375%, 5/15/43 | 5/23 at 100.00 | N/R | 2,854,904 | ||

| 665 | Wichita, Kansas, Health Care Facilities Revenue Bonds, Presbyterian Manors, Series 2014IV-A, 5.625%, 5/15/44 | 5/24 at 100.00 | N/R | 679,617 | ||

| 6,505 | Total Long-Term Care | 6,788,271 | ||||

| Tax Obligation/General – 8.1% | ||||||

| 565 | Anderson County, Kansas, General Obligation Bonds, Refunding and Improvement Series 2013A, 5.000%, 8/01/33 – AGM Insured | 8/23 at 100.00 | AA | 634,687 | ||

| 2,250 | Johnson County Unified School District 229, Blue Valley, Kansas, General Obligation Bonds, Series 2012A, 5.000%, 10/01/23 – NPFG Insured | 10/22 at 100.00 | Aaa | 2,525,288 | ||

| 2,000 | Johnson County Unified School District 231 Gardner Edgerton, Kansas, General Obligation Bonds, Refunding & Improvement Series 2012A, 5.000%, 10/01/23 | 10/22 at 100.00 | AA- | 2,239,420 | ||

| 2,200 | Johnson County Unified School District 231 Gardner Edgerton, Kansas, General Obligation Bonds, Refunding & Improvement Series 2013A, 5.000%, 10/01/28 | 10/23 at 100.00 | AA- | 2,474,890 | ||

| 1,490 | Johnson County Unified School District 231 Gardner Edgerton, Kansas, General Obligation Bonds, Refunding & Improvement Series 2016A, 5.000%, 10/01/33 | 10/25 at 100.00 | AA- | 1,696,156 | ||

| 1,250 | Johnson County Unified School District 512, Shawnee Mission, Kansas, General Obligation Bonds, Refunding & Improvement Series 2015, 5.000%, 10/01/34 | 10/25 at 100.00 | Aaa | 1,452,500 | ||

| 2,000 | Sedgwick County Unified School District 260, Kansas, General Obligation Bonds, Refunding & School Building Series 2018B, 5.000%, 10/01/40 | 10/26 at 100.00 | Aa3 | 2,294,240 | ||

| 45 | Sedgwick County Unified School District 262, Kansas, General Obligation Bonds, Refunding & Improvement Series 2008, 5.000%, 9/01/23 – AGC Insured | 9/18 at 100.00 | AA | 45,367 | ||

| 2,000 | Wichita, Kansas, General Obligation Bonds, Airport Series 2015C, 5.000%, 12/01/39 (Alternative Minimum Tax) | 12/25 at 100.00 | AA+ | 2,242,360 | ||

| Wyandotte County Unified School District 203, Piper, Kansas, General Obligation Bonds, Improvement Series 2018A: | ||||||

| 1,240 | 5.000%, 9/01/39 | 9/28 at 100.00 | AA- | 1,442,963 | ||

| 1,000 | 5.000%, 9/01/40 | 9/28 at 100.00 | AA- | 1,163,680 | ||

| 1,000 | 4.000%, 9/01/48 | 9/28 at 100.00 | AA- | 1,029,640 | ||

| 17,040 | Total Tax Obligation/General | 19,241,191 | ||||

| Tax Obligation/Limited – 23.3% | ||||||

| Dodge City, Kansas, Sales Tax Revenue Bonds, Refunding Series 2016: | ||||||

| 2,295 | 5.000%, 6/01/30 – AGM Insured | 6/27 at 100.00 | AA | 2,662,223 | ||

| 1,320 | 5.000%, 6/01/31 – AGM Insured | 6/27 at 100.00 | AA | 1,526,712 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Tax Obligation/Limited (continued) | ||||||

| $ 1,860 | Government of Guam, Business Privilege Tax Bonds, Refunding Series 2015D, 5.000%, 11/15/24 | No Opt. Call | A | $2,051,003 | ||

| Government of Guam, Business Privilege Tax Bonds, Series 2011A: | ||||||

| 1,000 | 5.000%, 1/01/23 | 1/22 at 100.00 | A | 1,067,610 | ||

| 500 | 5.000%, 1/01/31 | 1/22 at 100.00 | A | 521,905 | ||

| 650 | 5.250%, 1/01/36 | 1/22 at 100.00 | A | 682,539 | ||

| 875 | 5.125%, 1/01/42 | 1/22 at 100.00 | A | 908,346 | ||

| 1,910 | Government of Guam, Business Privilege Tax Bonds, Series 2012B-1, 5.000%, 1/01/42 | 1/22 at 100.00 | A | 1,968,484 | ||

| Government of Guam, Hotel Occupancy Tax Revenue Bonds, Series 2011A: | ||||||

| 3,300 | 6.000%, 11/01/26 | 5/21 at 100.00 | A- | 3,572,316 | ||

| 990 | 6.500%, 11/01/40 | 5/21 at 100.00 | A- | 1,098,128 | ||

| Guam Government, Limited Obligation Section 30 Revenue Bonds, Series 2016A: | ||||||

| 3,000 | 5.000%, 12/01/24 | No Opt. Call | BBB+ | 3,308,160 | ||

| 1,000 | 5.000%, 12/01/30 | 12/26 at 100.00 | BBB+ | 1,087,910 | ||

| 3,290 | 5.000%, 12/01/33 | 12/26 at 100.00 | BBB+ | 3,534,710 | ||

| 4,250 | 5.000%, 12/01/46 | 12/26 at 100.00 | BBB+ | 4,509,420 | ||

| 1,000 | Illinois Sports Facility Authority, State Tax Supported Bonds, Series 2001, 0.000%, 6/15/23 – AMBAC Insured | No Opt. Call | BBB- | 822,600 | ||

| 2,630 | Johnson County Community College, Kansas, Certificates of Participation, Series 2017, 4.000%, 10/01/28 | 10/26 at 100.00 | Aa1 | 2,895,683 | ||

| 1,500 | Kansas Department of Transportation, Highway Revenue Bonds, Series 2015B, 5.000%, 9/01/35 | 9/25 at 100.00 | AAA | 1,718,055 | ||

| 2,000 | Kansas Department of Transportation, Highway Revenue Bonds, Series 2017A, 5.000%, 9/01/33 | 9/27 at 100.00 | AAA | 2,370,340 | ||

| 1,670 | Kansas Development Finance Authority, K-State Olathe Innovation Campus Inc., Johnson County Sales Tax Revenue Bonds, Series 2009L, 5.000%, 9/01/39 | 9/19 at 100.00 | AA | 1,731,306 | ||

| 360 | Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion Project, Refunding Series 2010B-2, 5.250%, 6/15/50 | 6/20 at 100.00 | BBB- | 368,474 | ||

| 5,000 | Overland Park Development Corporation, Kansas, First Tier Revenue Bonds, Overland Park Convention Center, Series 2007A, 5.250%, 1/01/32 – AMBAC Insured | 7/18 at 100.00 | BB+ | 5,007,650 | ||

| 1,810 | Overland Park Transportation Development District, Kansas, Sales Tax Revenue Bonds, Oak Park Mall Project, Series 2010, 5.900%, 4/01/32 | 4/20 at 100.00 | BBB | 1,876,300 | ||

| Overland Park, Kansas, Sales Tax Revenue Bonds, Prairiefire Community Improvement District No. 1 Project, Series 2012B: | ||||||

| 200 | 5.250%, 12/15/29 | 12/22 at 100.00 | N/R | 176,586 | ||

| 200 | 6.100%, 12/15/34 | 12/22 at 100.00 | N/R | 176,234 | ||

| 2,775 | Overland Park, Kansas, Sales Tax Special Obligation Revenue Bonds, Prairiefire at Lionsgate Project, Series 2012, 6.000%, 12/15/32 | 12/22 at 100.00 | N/R | 2,399,293 | ||

| 1,500 | Puerto Rico Infrastructure Financing Authority, Special Tax Revenue Bonds, Refunding Series 2005C, 5.500%, 7/01/27 – AMBAC Insured | No Opt. Call | C | 1,599,570 | ||

| 2,000 | Virgin Islands Public Finance Authority, Gross Receipts Taxes Loan Note, Refunding Series 2012A, 5.000%, 10/01/32 – AGM Insured | 10/22 at 100.00 | AA | 2,163,520 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Tax Obligation/Limited (continued) | ||||||

| Wyandotte County-Kansas City Unified Government, Kansas, Sales Tax Special Obligation Bonds, Kansas International Speedway Corporation Project, Refunding Series 2014: | ||||||

| $ 1,370 | 5.000%, 12/01/25 | 12/24 at 100.00 | A+ | $1,573,171 | ||

| 1,260 | 5.000%, 12/01/26 | 12/24 at 100.00 | A+ | 1,446,052 | ||

| 305 | Wyandotte County-Kansas City Unified Government, Kansas, Sales Tax Special Obligation Bonds, Vacation Village Project Area 1 and 2A, Series 2015, 5.750%, 9/01/32 | 9/25 at 100.00 | N/R | 324,441 | ||

| 495 | Wyandotte County-Kansas City Unified Government, Kansas, Sales Tax Special Obligation Revenue Bonds, Kansas International Speedway Corporation, Series 1999, 0.000%, 12/01/27 – NPFG Insured | No Opt. Call | Aaa | 330,581 | ||

| 52,315 | Total Tax Obligation/Limited | 55,479,322 | ||||

| Transportation – 7.8% | ||||||

| 1,155 | Colorado High Performance Transportation Enterprise, C-470 Express Lanes Revenue Bonds, Senior Lien Series 2017, 5.000%, 12/31/56 | 12/24 at 100.00 | BBB | 1,251,004 | ||

| 1,950 | Guam International Airport Authority, Revenue Bonds, Series 2013C, 6.250%, 10/01/34 (Alternative Minimum Tax) | 10/23 at 100.00 | BBB | 2,204,299 | ||

| 2,000 | Houston, Texas, Airport System Special Facilities Revenue Bonds, United Airlines, Inc. Airport Improvement Projects, Series 2018C, 5.000%, 7/15/28 (Alternative Minimum Tax) | No Opt. Call | BB | 2,251,800 | ||

| 505 | Houston, Texas, Airport System Special Facilities Revenue Bonds, United Airlines, Inc. Terminal E Project, Refunding Series 2014, 4.750%, 7/01/24 (Alternative Minimum Tax) | No Opt. Call | BB | 546,703 | ||

| 1,930 | Illinois Toll Highway Authority, Toll Highway Revenue Bonds, Senior Lien Series 2016B, 5.000%, 1/01/41 | 7/26 at 100.00 | AA- | 2,182,772 | ||

| 100 | Maryland Economic Development Corporation, Private Activity Revenue Bonds AP, Purple Line Light Rail Project, Green Bonds, Series 2016D, 5.000%, 3/31/46 (Alternative Minimum Tax) | 9/26 at 100.00 | BBB+ | 109,684 | ||

| 1,000 | Massachusetts Port Authority, Special Facilities Revenue Bonds, Delta Air Lines Inc., Series 2001A, 5.500%, 1/01/19 – AMBAC Insured (Alternative Minimum Tax) | 7/18 at 100.00 | N/R | 1,002,200 | ||

| New York Transportation Development Corporation, New York, Special Facility Revenue Bonds, American Airlines, Inc. John F Kennedy International Airport Project, Refunding Series 2016: | ||||||

| 1,705 | 5.000%, 8/01/26 (Alternative Minimum Tax) | 8/21 at 100.00 | BB | 1,804,316 | ||

| 2,155 | 5.000%, 8/01/31 (Alternative Minimum Tax) | 8/21 at 100.00 | BB | 2,274,538 | ||

| 1,515 | New York Transportation Development Corporation, Special Facilities Bonds, LaGuardia Airport Terminal B Redevelopment Project, Series 2016A, 5.000%, 7/01/46 (Alternative Minimum Tax) | 7/24 at 100.00 | BBB | 1,644,396 | ||

| 2,000 | Virginia Small Business Financing Authority, Private Activity Revenue Bonds, Transform 66 P3 Project, Senior Lien Series 2017, 5.000%, 12/31/56 (Alternative Minimum Tax) | 6/27 at 100.00 | BBB | 2,192,300 | ||

| 945 | Virginia Small Business Financing Authority, Senior Lien Revenue Bonds, Elizabeth River Crossing, Opco LLC Project, Series 2012, 5.250%, 1/01/32 (Alternative Minimum Tax) | 7/22 at 100.00 | BBB | 1,029,757 | ||

| 16,960 | Total Transportation | 18,493,769 | ||||

| U.S. Guaranteed – 24.5% (4) | ||||||

| 2,000 | Allen County, Kansas Public Building Commission Revenue Bonds, Allen County Hospital Project, Series 2012, 5.150%, 12/01/36 (Pre-refunded 12/01/22) | 12/22 at 100.00 | A | 2,265,660 | ||

| 935 | Anderson County, Kansas, General Obligation Bonds, Refunding and Improvement Series 2013A, 5.000%, 8/01/33 (Pre-refunded 8/01/23) – AGM Insured | 8/23 at 100.00 | AA | 1,067,863 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| U.S. Guaranteed (4) (continued) | ||||||

| $ 2,000 | Butler County Unified School District 402, Kansas, General Obligation Bonds, Series 2008A, 5.125%, 9/01/32 (Pre-refunded 9/01/18) – AGC Insured | 9/18 at 100.00 | A1 | $2,015,600 | ||

| 1,000 | Dodge City, Kansas, Sales Tax Revenue Bonds, Series 2009, 5.000%, 6/01/34 (Pre-refunded 6/01/19) – AGC Insured | 6/19 at 100.00 | AA | 1,032,210 | ||

| 1,115 | Guam Government, Limited Obligation Section 30 Revenue Bonds, Series 2009A, 5.750%, 12/01/34 (Pre-refunded 12/01/19) | 12/19 at 100.00 | BBB+ | 1,179,191 | ||

| 3,000 | Johnson and Miami Counties Unified School District 230, Kansas, General Obligation Bonds, Series 2011A, 5.250%, 9/01/28 (Pre-refunded 9/01/21) | 9/21 at 100.00 | Aa3 | 3,282,690 | ||

| Johnson County Public Building Commission, Kansas, Lease Purchase Revenue Bonds, Series 2011A: | ||||||

| 1,320 | 4.000%, 9/01/25 (Pre-refunded 9/01/20) | 9/20 at 100.00 | AAA | 1,382,594 | ||

| 1,020 | 4.000%, 9/01/26 (Pre-refunded 9/01/20) | 9/20 at 100.00 | AAA | 1,068,368 | ||

| 1,000 | 4.000%, 9/01/27 (Pre-refunded 9/01/20) | 9/20 at 100.00 | AAA | 1,047,420 | ||

| 1,220 | 4.125%, 9/01/28 (Pre-refunded 9/01/20) | 9/20 at 100.00 | AAA | 1,281,195 | ||

| 1,270 | 4.250%, 9/01/29 (Pre-refunded 9/01/20) | 9/20 at 100.00 | AAA | 1,337,170 | ||

| 3,950 | Kansas Development Finance Authority, Health Facilities Revenue Bonds, Hays Medical Center Inc., Series 2010Q, 5.000%, 5/15/35 (Pre-refunded 5/15/19) | 5/19 at 100.00 | N/R | 4,070,041 | ||

| Kansas Development Finance Authority, Hospital Revenue Bonds, Adventist Health System/Sunbelt Obligated Group, Series 2009C: | ||||||

| 8,460 | 5.750%, 11/15/38 (Pre-refunded 11/15/19) (UB) (5) | 11/19 at 100.00 | AA | 8,930,207 | ||

| 190 | 5.750%, 11/15/38 (Pre-refunded 11/15/19) (UB) (5) | 11/19 at 100.00 | N/R | 200,167 | ||

| Kansas Development Finance Authority, Revenue Bonds, Sisters of Charity of Leavenworth Health Services Corporation, Series 2010A: | ||||||

| 865 | 5.000%, 1/01/23 (Pre-refunded 1/01/20) | 1/20 at 100.00 | N/R | 906,814 | ||

| 1,318 | 5.000%, 1/01/40 (Pre-refunded 1/01/20) (UB) | 1/20 at 100.00 | N/R | 1,382,128 | ||

| 1,520 | Kansas Development Finance Authority, Revenue Bonds, Sisters of Charity of Leavenworth Health Services Corporation, Tender Option Bond Trust 2015-XF0063, 14.509%, 1/01/40 (Pre-refunded 1/01/20), 144A (IF) | 1/20 at 100.00 | N/R | 1,809,271 | ||

| 3,100 | Kansas Independent College Finance Authority, Educational Facilities Revenue Bonds, Tabor College Project, Series 2013, 5.800%, 3/01/37 (Pre-refunded 3/01/20) | 3/20 at 100.00 | N/R | 3,295,765 | ||

| 2,575 | Kansas State Power Pool, Electric Utility Revenue Bonds, Dogwood Energy Facility, Series 2012A, 5.000%, 12/01/31 (Pre-refunded 12/01/20) | 12/20 at 100.00 | A3 | 2,764,443 | ||

| 1,000 | Olathe, Kansas, Health Facilities Revenue Bonds, Olathe Medical Center, Series 2010A, 5.000%, 9/01/30 (Pre-refunded 9/01/19) | 9/19 at 100.00 | A+ | 1,038,340 | ||

| 1,000 | Sedgwick County Unified School District 260, Kansas, General Obligation Bonds, Refunding & School Improvement Series 2012, 5.000%, 10/01/30 (Pre-refunded 10/01/22) | 10/22 at 100.00 | AA- | 1,124,120 | ||

| 1,955 | Sedgwick County Unified School District 262, Kansas, General Obligation Bonds, Refunding & Improvement Series 2008, 5.000%, 9/01/23 (Pre-refunded 9/01/18) – AGC Insured | 9/18 at 100.00 | AA | 1,969,897 | ||

| 500 | Unified School District 470, Cowley County, Kansas, General Obligation Bonds, Series 2008A, 5.500%, 9/01/21 (Pre-refunded 9/01/18) – AGM Insured | 9/18 at 100.00 | AA | 504,320 | ||

| 4,000 | Wichita, Kansas, Hospital Facilities Revenue Refunding and Improvement Bonds, Via Christi Health System Inc., Series 2011A-IV, 5.000%, 11/15/29 (Pre-refunded 11/15/21) | 11/21 at 100.00 | N/R | 4,394,960 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| U.S. Guaranteed (4) (continued) | ||||||

| $ 2,500 | Wichita, Kansas, Water and Sewer Utility Revenue Bonds, Series 2009A, 5.000%, 10/01/39 (Pre-refunded 10/01/19) | 10/19 at 100.00 | AA- | $2,605,225 | ||

| Wyandotte County Unified School District 203, Piper, Kansas, General Obligation Bonds, Series 2008B: | ||||||

| 1,695 | 5.500%, 9/01/28 (Pre-refunded 9/01/18) | 9/18 at 100.00 | N/R | 1,711,289 | ||

| 390 | 5.500%, 9/01/28 (Pre-refunded 9/01/18) | 9/18 at 100.00 | AA- | 393,697 | ||

| Wyandotte County-Kansas City Unified Government, Kansas, Utility System Revenue Bonds, Series 2009A: | ||||||

| 1,075 | 5.000%, 9/01/29 (Pre-refunded 3/01/19) – BHAC Insured | 3/19 at 100.00 | AA+ | 1,101,811 | ||

| 3,000 | 5.250%, 9/01/34 (Pre-refunded 3/01/19) – BHAC Insured | 3/19 at 100.00 | AA+ | 3,080,340 | ||

| 54,973 | Total U.S. Guaranteed | 58,242,796 | ||||

| Utilities – 9.8% | ||||||

| 1,255 | Beaver County Industrial Development Authority, Pennsylvania, Pollution Control Revenue Refunding Bonds, FirstEnergy Nuclear Generation Project, Series 2006A, 3.500%, 4/01/41 (Mandatory Put 6/01/20) (6) | No Opt. Call | N/R | 633,775 | ||

| 1,500 | Coffeyville, Kansas, Electric Utility System Revenue Bonds, Series 2015B, 5.000%, 6/01/42 – NPFG Insured, 144A | 6/25 at 100.00 | BBB+ | 1,623,000 | ||

| 305 | Guam Power Authority, Revenue Bonds, Refunding Series 2017A, 5.000%, 10/01/40 | 10/27 at 100.00 | BBB- | 329,589 | ||

| 1,375 | Guam Power Authority, Revenue Bonds, Series 2012A, 5.000%, 10/01/30 – AGM Insured | 10/22 at 100.00 | AA | 1,501,459 | ||

| Guam Power Authority, Revenue Bonds, Series 2014A: | ||||||

| 1,000 | 5.000%, 10/01/32 | 10/24 at 100.00 | AA | 1,102,710 | ||

| 1,000 | 5.000%, 10/01/33 | 10/24 at 100.00 | AA | 1,100,900 | ||

| Kansas Municipal Energy Agency, Power Project Revenue Bonds, Dogwood Project, Series 2018A: | ||||||

| 1,000 | 5.000%, 4/01/33 – BAM Insured | 4/26 at 100.00 | AA | 1,119,280 | ||

| 1,000 | 5.000%, 4/01/34 – BAM Insured | 4/26 at 100.00 | AA | 1,115,620 | ||

| 1,000 | 5.000%, 4/01/35 – BAM Insured | 4/26 at 100.00 | AA | 1,112,710 | ||

| 1,500 | Kansas Municipal Energy Agency, Power Project Revenue Bonds, Jameson Energy Center Project, Series 2013, 5.750%, 7/01/38 | 7/23 at 100.00 | A- | 1,713,285 | ||

| Kansas State Power Pool, Electric Utility Revenue Bonds, Dogwood Energy Facility, Series 2012A: | ||||||

| 1,395 | 5.000%, 12/01/22 | No Opt. Call | A3 | 1,550,445 | ||

| 1,265 | 5.000%, 12/01/23 | 12/22 at 100.00 | A3 | 1,396,876 | ||

| 1,000 | Ohio Air Quality Development Authority, Ohio, Pollution Control Revenue Bonds, FirstEnergy Generation Project, Refunding Series 2006A, 3.750%, 12/01/23 (Mandatory Put 12/03/18) (6) | No Opt. Call | N/R | 505,000 | ||

| 515 | Pennsylvania Economic Development Financing Authority, Exempt Facilities Revenue Bonds, Shippingport Project, First Energy Guarantor., Series 2005A, 3.750%, 12/01/40 (Mandatory Put 7/01/20) (6) | No Opt. Call | N/R | 260,075 | ||

| 1,595 | Virgin Islands Water and Power Authority, Electric System Revenue Bonds, Series 2007B, 5.000%, 7/01/31 | 8/18 at 100.00 | CCC | 1,311,888 | ||

| 2,250 | Wyandotte County-Kansas City Unified Government, Kansas, Utility System Revenue Bonds, Improvement Series 2016A, 5.000%, 9/01/40 | 9/25 at 100.00 | A+ | 2,517,547 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Utilities (continued) | ||||||

| $ 1,535 | Wyandotte County-Kansas City Unified Government, Kansas, Utility System Revenue Bonds, Refunding & Improvement Series 2011A, 5.000%, 9/01/28 | 9/21 at 100.00 | A+ | $1,664,201 | ||

| 2,500 | Wyandotte County-Kansas City Unified Government, Kansas, Utility System Revenue Bonds, Refunding Series 2012A, 5.000%, 9/01/32 | 9/22 at 100.00 | A+ | 2,748,900 | ||

| 22,990 | Total Utilities | 23,307,260 | ||||

| Water and Sewer – 6.3% | ||||||

| 100 | Guam Government Waterworks Authority, Water and Wastewater System Revenue Bonds, Refunding Series 2014A, 5.000%, 7/01/35 | 7/24 at 100.00 | A- | 105,509 | ||

| 1,225 | Guam Government Waterworks Authority, Water and Wastewater System Revenue Bonds, Refunding Series 2017, 5.000%, 7/01/40 | 7/27 at 100.00 | A- | 1,312,600 | ||

| Guam Government Waterworks Authority, Water and Wastewater System Revenue Bonds, Series 2013: | ||||||

| 1,750 | 5.000%, 7/01/28 | 7/23 at 100.00 | A- | 1,880,305 | ||

| 500 | 5.250%, 7/01/33 | 7/23 at 100.00 | A- | 538,660 | ||

| 2,000 | 5.500%, 7/01/43 | 7/23 at 100.00 | A- | 2,176,700 | ||

| 6,440 | Guam Government Waterworks Authority, Water and Wastewater System Revenue Bonds, Series 2016, 5.000%, 1/01/46 | 7/26 at 100.00 | A- | 6,830,264 | ||

| 2,000 | Wichita, Kansas, Water and Sewer Utility Revenue Bonds, Refunding Series 2011A, 5.000%, 10/01/28 | 10/21 at 100.00 | AA- | 2,181,240 | ||

| 14,015 | Total Water and Sewer | 15,025,278 | ||||

| $ 231,270 | Total Long-Term Investments (cost $241,762,152) | 246,266,766 | ||||

| Floating Rate Obligations – (3.2)% | (7,620,000) | |||||

| Other Assets Less Liabilities – (0.2)% | (448,235) | |||||

| Net Assets – 100% | $ 238,198,531 | |||||

| (1) | All percentages shown in the Portfolio of Investments are based on net assets. | |

| (2) | Optional Call Provisions: Dates (month and year) and prices of the earliest optional call or redemption. There may be other call provisions at varying prices at later dates. Certain mortgage-backed securities may be subject to periodic principal paydowns. Optional Call Provisions are not covered by the report of independent registered public accounting firm. | |

| (3) | For financial reporting purposes, the ratings disclosed are the highest of Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) or Fitch, Inc. (“Fitch”) rating. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Ratings below BBB by Standard & Poor’s, Baa by Moody’s or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not rated by any of these national rating agencies. Ratings are not covered by the report of independent registered public accounting firm. | |

| (4) | Backed by an escrow or trust containing sufficient U.S. Government or U.S. Government agency securities, which ensure the timely payment of principal and interest. | |

| (5) | Investment, or portion of investment, has been pledged to collateralize the net payment obligations for investments in inverse floating rate transactions. | |

| (6) | As of, or subsequent to, the end of the reporting period, this security is non-income producing. Non-income producing, in the case of a fixed-income security, generally denotes that the issuer has (1) defaulted on the payment of principal or interest, (2) is under the protection of the Federal Bankruptcy Court or (3) the Fund’s Adviser has concluded that the issue is not likely to meet its future interest payment obligations and has ceased accruing additional income on the Fund’s records. | |

| 144A | Investment is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These investments may only be resold in transactions exempt from registration, which are normally those transactions with qualified institutional buyers. | |

| IF | Inverse floating rate security issued by a tender option bond (“TOB”) trust, the interest rate on which varies inversely with the Securities Industry Financial Markets Association (SIFMA) short-term rate, which resets weekly, or a similar short-term rate, and is reduced by the expenses related to the TOB trust. | |

| UB | Underlying bond of an inverse floating rate trust reflected as a financing transaction. See Notes to Financial Statements, Note 3 – Portfolio Securities and Investments in Derivatives, Inverse Floating Rate Securities for more information. |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| LONG-TERM INVESTMENTS – 104.4% | ||||||

| MUNICIPAL BONDS – 104.4% | ||||||

| Education and Civic Organizations – 14.7% | ||||||

| $ 155 | Campbellsville, Kentucky, Industrial Building Revenue Bonds, Campbellsville University Project, Series 2017, 5.000%, 3/01/39 | 3/27 at 100.00 | N/R | $160,881 | ||

| 880 | Eastern Kentucky University, General Receipts Bonds, Refunding Series 2012A, 5.000%, 4/01/20 | No Opt. Call | A1 | 925,593 | ||

| Kentucky Economic Development Finance Authority, Revenue Bonds, Next Generation Kentucky Information Highway Project, Senior Series 2015A: | ||||||

| 2,500 | 5.000%, 7/01/40 | 7/25 at 100.00 | BBB+ | 2,678,900 | ||

| 2,500 | 5.000%, 1/01/45 | 7/25 at 100.00 | BBB+ | 2,672,475 | ||

| Kentucky Higher Education Student Loan Corporation, Student Loan Revenue Bonds, Senior Series 2014A: | ||||||

| 900 | 5.000%, 6/01/22 (Alternative Minimum Tax) | No Opt. Call | A | 970,758 | ||

| 700 | 5.000%, 6/01/23 (Alternative Minimum Tax) | No Opt. Call | A | 764,456 | ||

| 400 | 5.000%, 6/01/24 (Alternative Minimum Tax) | No Opt. Call | A | 439,888 | ||

| Louisville-Jefferson County Metro Government, Kentucky, Revenue Bonds, Bellarmine University Inc. Project, Refunding & Improvement Series 2015: | ||||||

| 1,790 | 5.000%, 5/01/31 | 5/25 at 100.00 | Baa3 | 1,976,679 | ||

| 1,210 | 5.000%, 5/01/40 | 5/25 at 100.00 | Baa3 | 1,296,696 | ||

| Murray State University, Kentucky, General Receipts Bonds, Series 2015A: | ||||||

| 1,125 | 5.000%, 3/01/26 | 3/25 at 100.00 | A1 | 1,290,938 | ||

| 1,075 | 5.000%, 3/01/27 | 3/25 at 100.00 | A1 | 1,232,133 | ||

| 2,290 | Northern Kentucky University, General Receipts Bonds, Refunding Series 2016A, 5.000%, 9/01/23 | No Opt. Call | A1 | 2,597,226 | ||

| 4,000 | University of Kentucky, General Receipts Bonds, Refunding Series 2015B, 5.000%, 10/01/27 | 4/25 at 100.00 | AA | 4,642,800 | ||

| 8,500 | University of Kentucky, General Receipts Bonds, Refunding Series 2018A, 4.000%, 10/01/30 | 4/26 at 100.00 | AA | 9,156,285 | ||

| 2,000 | University of Kentucky, General Receipts Bonds, Series 2015A, 5.000%, 4/01/29 | 4/25 at 100.00 | AA | 2,310,520 | ||

| 250 | University of Kentucky, General Receipts Bonds, Series 2016A, 5.000%, 4/01/32 | 4/25 at 100.00 | AA | 286,450 | ||

| University of Louisville, Kentucky, Revenue Bonds, General Receipts Series 2011A: | ||||||

| 150 | 5.000%, 9/01/20 | No Opt. Call | A+ | 160,052 | ||

| 2,005 | 5.000%, 9/01/26 | 9/21 at 100.00 | A+ | 2,179,656 | ||

| 1,910 | University of Louisville, Kentucky, Revenue Bonds, General Receipts Series 2012A, 5.000%, 9/01/25 | 9/21 at 100.00 | A+ | 2,078,252 | ||

| 2,500 | University of Louisville, Kentucky, Revenue Bonds, General Receipts Series 2016C, 4.000%, 9/01/28 | 3/26 at 100.00 | A+ | 2,680,400 | ||

| 4,605 | University of Louisville, Kentucky, Revenue Bonds, General Receipts Series 2016D, 5.000%, 3/01/31 | 9/26 at 100.00 | A+ | 5,269,271 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Education and Civic Organizations (continued) | ||||||

| Western Kentucky University, General Receipts Revenue Bonds, Series 2016A: | ||||||

| $ 2,690 | 5.000%, 9/01/25 | No Opt. Call | A1 | $3,113,540 | ||

| 2,820 | 5.000%, 9/01/26 | 9/25 at 100.00 | A1 | 3,259,976 | ||

| 46,955 | Total Education and Civic Organizations | 52,143,825 | ||||

| Health Care – 19.7% | ||||||

| Glasgow, Kentucky, Healthcare Revenue Bonds, T.J. Samson Community Hospital Project, Series 2011: | ||||||

| 100 | 5.350%, 2/01/24 | 8/21 at 100.00 | BBB- | 105,389 | ||

| 2,000 | 6.375%, 2/01/35 | 8/21 at 100.00 | BBB- | 2,148,700 | ||

| 3,310 | 6.450%, 2/01/41 | 8/21 at 100.00 | BBB- | 3,550,174 | ||

| 8,000 | Kentucky Bond Development Corporation, Hospital Revenue Bonds, Saint Elizabeth Medical Center, Inc., Refunding Series 2016, 5.000%, 5/01/39 | 5/26 at 100.00 | AA | 9,028,720 | ||

| Kentucky Economic Development Finance Authority, Hospital Revenue Bonds, Baptist Healthcare System Obligated Group, Series 2009A: | ||||||

| 550 | 5.375%, 8/15/24 | 8/18 at 100.00 | A | 553,492 | ||

| 3,545 | 5.625%, 8/15/27 | 8/18 at 100.00 | A | 3,570,205 | ||

| Kentucky Economic Development Finance Authority, Hospital Revenue Bonds, Baptist Healthcare System Obligated Group, Series 2011: | ||||||

| 1,500 | 5.000%, 8/15/42 | 8/21 at 100.00 | A | 1,582,770 | ||

| 3,000 | 5.250%, 8/15/46 | 8/21 at 100.00 | A | 3,192,870 | ||

| 3,000 | Kentucky Economic Development Finance Authority, Hospital Revenue Bonds, Baptist Healthcare System Obligated Group, Series 2017B, 5.000%, 8/15/46 | 8/27 at 100.00 | A | 3,289,260 | ||

| 500 | Kentucky Economic Development Finance Authority, Hospital Revenue Bonds, Owensboro Health, Refunding Series 2017A, 5.250%, 6/01/41 | 6/27 at 100.00 | Baa3 | 551,580 | ||

| 1,295 | Kentucky Economic Development Finance Authority, Revenue Bonds, Catholic Health Initiatives, Refunding Series 2009A, 5.000%, 5/01/24 | 5/19 at 100.00 | BBB+ | 1,323,982 | ||

| 10,000 | Kentucky Economic Development Finance Authority, Revenue Bonds, Catholic Health Initiatives, Series 2013A, 5.250%, 1/01/45 | 1/23 at 100.00 | BBB+ | 10,720,500 | ||

| 3,320 | Louisville/Jefferson County Metro Government, Kentucky, Revenue Bonds, Catholic Health Initiatives, Series 2012A, 5.000%, 12/01/26 | 6/22 at 100.00 | BBB+ | 3,571,922 | ||

| 2,000 | Murray, Kentucky, Hospital Facilities Revenue Bonds, Murray-Calloway County Public Hospital Corporation Project, Refunding Series 2016, 5.000%, 8/01/37 | 8/26 at 100.00 | Baa3 | 2,142,260 | ||

| 7,500 | Pikeville, Kentucky, Hospital Revenue Bonds, Pikeville Medical Center, Inc. Project, Improvement and Refunding Series 2011, 6.500%, 3/01/41 | 3/21 at 100.00 | Baa2 | 8,148,375 | ||

| 8,000 | Russell, Kentucky, Revenue Bonds, Bon Secours Health System, Series 2013, 5.000%, 11/01/26 | 11/22 at 100.00 | A | 8,861,440 | ||

| 3,250 | Warren County, Kentucky, Hospital Refunding Revenue Bonds, Bowling Green-Warren County Community Hospital Corporation, Series 2013, 5.000%, 4/01/35 | 4/23 at 100.00 | A+ | 3,536,780 | ||

| Warren County, Kentucky, Hospital Revenue Bonds, Bowling Green-Warren County Community Hospital Corporation, Series 2012A: | ||||||

| 1,980 | 5.000%, 10/01/33 | 10/22 at 100.00 | A+ | 2,162,952 | ||

| 2,000 | 5.000%, 10/01/37 | 10/22 at 100.00 | A+ | 2,167,800 | ||

| 64,850 | Total Health Care | 70,209,171 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Housing/Multifamily – 0.3% | ||||||

| $ 1,105 | Kentucky Housing Corporation, Conduit Multifamily Mortgage Revenue Bonds, Florence Homes III Apartments Project, Series 2005B, 5.000%, 6/01/35 (Alternative Minimum Tax) (Mandatory Put 6/01/23) | 8/18 at 100.00 | N/R | $ 1,108,613 | ||

| Housing/Single Family – 0.4% | ||||||

| Kentucky Housing Corporation, Housing Revenue Bonds, Series 2011B: | ||||||

| 150 | 3.000%, 1/01/21 | No Opt. Call | AAA | 154,394 | ||

| 485 | 3.000%, 7/01/21 | No Opt. Call | AAA | 500,859 | ||

| 670 | 3.100%, 7/01/22 | 7/21 at 100.00 | AAA | 692,679 | ||

| 1,305 | Total Housing/Single Family | 1,347,932 | ||||

| Tax Obligation/General – 0.7% | ||||||

| 2,205 | Louisville and Jefferson County Metropolitan Government, Kentucky, General Obligation Bonds, Center City Project Series 2016, 4.000%, 12/01/30 | 12/25 at 100.00 | AAA | 2,376,505 | ||

| Tax Obligation/Limited – 21.0% | ||||||

| Barren County School District Finance Corporation, Kentucky, School Building Revenue Bonds, Series 2015: | ||||||

| 1,250 | 5.000%, 8/01/24 | No Opt. Call | A1 | 1,441,950 | ||

| 1,760 | 5.000%, 8/01/25 | 2/25 at 100.00 | A1 | 2,025,954 | ||

| 1,000 | Kentucky Asset/Liability Commission, General Fund Revenue Project Notes, Federal Highway Trust Fund First Series 2010A, 5.000%, 9/01/21 | 9/20 at 100.00 | AA | 1,063,370 | ||

| 2,000 | Kentucky Bond Development Corporation, Tax Increment Revenue Bonds, Summit Lexington Project, Series 2016A, 4.400%, 10/01/24 | No Opt. Call | N/R | 1,930,860 | ||

| Kentucky Economic Development Finance Authority, Louisville Arena Project Revenue Bonds, Louisville Arena Authority, Inc., Series 2017A: | ||||||

| 13,650 | 4.000%, 12/01/41 – AGM Insured (UB) (4) | 12/27 at 100.00 | AA | 14,052,402 | ||

| 3,100 | 5.000%, 12/01/45 – AGM Insured | 12/27 at 100.00 | AA | 3,420,075 | ||

| 7,985 | Kentucky State Property and Buildings Commission, Revenue Bonds, Project 112, Refunding Series 2016B, 5.000%, 11/01/24 | No Opt. Call | A1 | 9,073,994 | ||

| Kentucky State Property and Buildings Commission, Revenue Bonds, Project 115, Series 2017: | ||||||

| 7,000 | 5.000%, 4/01/32 (UB) (4) | 4/27 at 100.00 | A1 | 7,933,030 | ||

| 6,000 | 5.000%, 4/01/38 | 4/27 at 100.00 | A1 | 6,731,220 | ||

| 125 | Kentucky State Property and Buildings Commission, Revenue Bonds, Project 84, Series 2005, 5.000%, 8/01/19 – NPFG Insured | No Opt. Call | A1 | 129,358 | ||

| Kentucky State Property and Buildings Commission, Revenue Bonds, Project 93, Refunding Series 2009: | ||||||

| 285 | 5.250%, 2/01/28 – AGC Insured | 2/19 at 100.00 | AA | 291,512 | ||

| 285 | 5.250%, 2/01/29 – AGC Insured | 2/19 at 100.00 | AA | 291,512 | ||

| Kentucky Turnpike Authority, Economic Development Road Revenue Bonds, Revitalization Project, Refunding Series 2012A: | ||||||

| 1,250 | 5.000%, 7/01/30 | 7/22 at 100.00 | AA- | 1,375,938 | ||

| 6,740 | 5.000%, 7/01/31 | 7/22 at 100.00 | AA- | 7,410,832 | ||

| 5,000 | Kentucky Turnpike Authority, Economic Development Road Revenue Bonds, Revitalization Project, Refunding Series 2017B, 5.000%, 7/01/28 (UB) (4) | 7/27 at 100.00 | AA- | 5,942,150 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Tax Obligation/Limited (continued) | ||||||

| Kentucky Turnpike Authority, Economic Development Road Revenue Bonds, Revitalization Project, Series 2017A: | ||||||

| $ 1,930 | 5.000%, 7/01/33 (UB) (4) | 7/27 at 100.00 | AA- | $2,236,291 | ||

| 550 | 5.000%, 7/01/36 (UB) (4) | 7/27 at 100.00 | AA- | 630,223 | ||

| 500 | 5.000%, 7/01/37 (UB) (4) | 7/27 at 100.00 | AA- | 572,505 | ||

| Lexington-Fayette Urban County Government Public Facilities Corporation, Kentucky State Lease Revenue Bonds, Eastern State Hospital Project, Series 2011A: | ||||||

| 2,990 | 5.000%, 6/01/20 | No Opt. Call | A1 | 3,166,679 | ||

| 1,000 | 5.000%, 6/01/21 | No Opt. Call | A1 | 1,083,970 | ||

| 3,000 | 5.250%, 6/01/29 | 6/21 at 100.00 | A1 | 3,248,100 | ||

| 500 | Pendleton County, Kentucky, Leasing Trust Revenue Bonds, Kentucky Association of Counties, Series 1993A, 6.400%, 3/01/19 | No Opt. Call | B | 505,530 | ||

| 67,900 | Total Tax Obligation/Limited | 74,557,455 | ||||

| Transportation – 10.6% | ||||||

| Kenton County Airport Board, Kentucky, Airport Revenue Bonds, Cincinnati/Northern Kentucky International Airport, Series 2016: | ||||||

| 1,635 | 5.000%, 1/01/25 | No Opt. Call | A+ | 1,851,703 | ||

| 1,855 | 5.000%, 1/01/30 | 1/26 at 100.00 | A+ | 2,083,295 | ||

| 1,750 | 5.000%, 1/01/31 | 1/26 at 100.00 | A+ | 1,965,372 | ||

| 1,620 | 5.000%, 1/01/32 | 1/26 at 100.00 | A+ | 1,812,424 | ||

| 1,520 | 5.000%, 1/01/33 | 1/26 at 100.00 | A+ | 1,716,901 | ||

| 2,000 | Kentucky Public Transportation Infrastructure Authority, First Tier Toll Revenue Bonds, Downtown Crossing Project, Capital Appreciation Series 2013B, 0.000%, 7/01/23 | No Opt. Call | Baa3 | 1,711,780 | ||

| Kentucky Public Transportation Infrastructure Authority, First Tier Toll Revenue Bonds, Downtown Crossing Project, Series 2013A: | ||||||

| 250 | 5.750%, 7/01/49 | 7/23 at 100.00 | Baa3 | 274,600 | ||

| 11,500 | 6.000%, 7/01/53 | 7/23 at 100.00 | Baa3 | 12,777,880 | ||

| Lexington-Fayette Urban County Government, Kentucky, General Airport Revenue Refunding Bonds, Series 2012B: | ||||||

| 1,215 | 5.000%, 7/01/29 (Alternative Minimum Tax) | 7/22 at 100.00 | AA | 1,330,972 | ||

| 1,100 | 5.000%, 7/01/31 (Alternative Minimum Tax) | 7/22 at 100.00 | AA | 1,204,104 | ||

| 1,000 | 5.000%, 7/01/38 | 7/22 at 100.00 | AA | 1,100,750 | ||

| Louisville Regional Airport Authority, Kentucky, Airport System Revenue Bonds, Refunding Series 2014A: | ||||||

| 1,250 | 5.000%, 7/01/21 (Alternative Minimum Tax) | No Opt. Call | A+ | 1,350,400 | ||

| 1,625 | 5.000%, 7/01/22 (Alternative Minimum Tax) | No Opt. Call | A+ | 1,788,719 | ||

| 1,555 | 5.000%, 7/01/31 (Alternative Minimum Tax) | 7/24 at 100.00 | A+ | 1,705,680 | ||

| 1,500 | 5.000%, 7/01/32 (Alternative Minimum Tax) | 7/24 at 100.00 | A+ | 1,641,885 | ||

| River City Inc. Parking Authority, Kentucky, First Mortgage Bonds, Refunding Series 2016B: | ||||||

| 1,495 | 5.000%, 12/01/26 | 6/26 at 100.00 | AA | 1,741,854 | ||

| 1,575 | 5.000%, 12/01/27 | 6/26 at 100.00 | AA | 1,826,464 | ||

| 34,445 | Total Transportation | 37,884,783 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| U.S. Guaranteed – 16.7% (5) | ||||||

| Kentucky Economic Development Finance Authority, Hospital Revenue Bonds, Baptist Healthcare System Obligated Group, Series 2009A: | ||||||

| $ 550 | 5.375%, 8/15/24 (Pre-refunded 8/15/18) | 8/18 at 100.00 | N/R | $554,219 | ||

| 3,545 | 5.625%, 8/15/27 (Pre-refunded 8/15/18) | 8/18 at 100.00 | N/R | 3,573,927 | ||

| Kentucky Economic Development Finance Authority, Hospital Revenue Bonds, Owensboro Medical Health System, Series 2010A: | ||||||

| 3,925 | 5.500%, 6/01/21 (Pre-refunded 6/01/20) | 6/20 at 100.00 | Baa3 | 4,196,689 | ||

| 165 | 6.375%, 6/01/40 (Pre-refunded 6/01/20) | 6/20 at 100.00 | Baa3 | 179,228 | ||

| 5,150 | 6.500%, 3/01/45 (Pre-refunded 6/01/20) | 6/20 at 100.00 | Baa3 | 5,601,346 | ||

| Kentucky Economic Development Finance Authority, Hospital Revenue Bonds, Saint Elizabeth Medical Center, Refunding & Improvement Series 2009A: | ||||||

| 210 | 5.375%, 5/01/34 (Pre-refunded 5/01/19) | 5/19 at 100.00 | N/R | 216,827 | ||

| 5,010 | 5.500%, 5/01/39 (Pre-refunded 5/01/19) | 5/19 at 100.00 | N/R | 5,178,486 | ||

| Kentucky Economic Development Finance Authority, Louisville Arena Project Revenue Bonds, Louisville Arena Authority, Inc., Series 2008-A2: | ||||||

| 3,505 | 0.000%, 12/01/22 – AGC Insured (ETM) | No Opt. Call | AA | 3,178,334 | ||

| 3,750 | 0.000%, 12/01/23 – AGC Insured (ETM) | No Opt. Call | AA | 3,303,825 | ||

| 5,000 | Kentucky Economic Development Finance Authority, Louisville Arena Project Revenue Bonds, Louisville Arena Authority, Inc., Tender Option Bonds Trust 2016-XG0027, 17.483%, 12/01/28 (Pre-refunded 6/01/18) – AGC Insured, 144A (IF) | 6/18 at 100.00 | AA | 5,000,000 | ||

| 2,750 | Kentucky Infrastructure Authority, Wastewater and Drinking Water Revolving Fund Program Revenue Bonds, Series 2012A, 5.000%, 2/01/30 (Pre-refunded 2/01/22) | 2/22 at 100.00 | AAA | 3,046,753 | ||

| Kentucky State Property and Buildings Commission, Revenue Bonds, Project 93, Refunding Series 2009: | ||||||

| 2,215 | 5.250%, 2/01/28 (Pre-refunded 2/01/19) – AGC Insured | 2/19 at 100.00 | AA | 2,267,097 | ||

| 2,215 | 5.250%, 2/01/29 (Pre-refunded 2/01/19) – AGC Insured | 2/19 at 100.00 | AA | 2,267,097 | ||

| 1,800 | Kentucky Turnpike Authority, Economic Development Road Revenue Bonds, Revitalization Project, Refunding Series 2011A, 5.000%, 7/01/24 (Pre-refunded 7/01/21) | 7/21 at 100.00 | AA- | 1,963,062 | ||

| 500 | Kentucky Turnpike Authority, Economic Development Road Revenue Bonds, Revitalization Project, Refunding Series 2012A, 5.000%, 7/01/24 (Pre-refunded 7/01/22) | 7/22 at 100.00 | AA- | 558,205 | ||

| 25 | Kentucky Turnpike Authority, Economic Development Road Revenue Bonds, Revitalization Project, Series 2008A, 5.000%, 7/01/28 (Pre-refunded 7/01/18) | 7/18 at 100.00 | AA- | 25,066 | ||

| 2,820 | Kentucky Turnpike Authority, Economic Development Road Revenue Bonds, Revitalization Project, Series 2009A, 5.000%, 7/01/29 (Pre-refunded 7/01/19) | 7/19 at 100.00 | AA- | 2,917,769 | ||

| 2,000 | Northern Kentucky Water District, Revenue Bonds, Series 2009, 6.500%, 2/01/33 (Pre-refunded 8/01/18) – AGM Insured | 8/18 at 100.00 | Aa3 | 2,015,520 | ||

| 65 | Owensboro, Kentucky, Water Revenue Bonds, Refunding & Improvement Series 2009, 5.000%, 9/15/29 (Pre-refunded 9/15/18) – AGC Insured | 9/18 at 100.00 | AA | 65,625 | ||

| Paducah, Kentucky, Electric Plant Board Revenue Bonds, Series 2009A: | ||||||

| 3,995 | 5.000%, 10/01/25 (Pre-refunded 4/01/19) | 4/19 at 100.00 | A- | 4,101,786 | ||

| 95 | 5.000%, 10/01/28 (Pre-refunded 4/01/19) – AGC Insured | 4/19 at 100.00 | A- | 97,539 | ||

| 8,880 | 5.250%, 10/01/35 (Pre-refunded 4/01/19) – AGC Insured | 4/19 at 100.00 | AA | 9,139,207 | ||

| 58,170 | Total U.S. Guaranteed | 59,447,607 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Utilities – 7.8% | ||||||

| $ 40 | Frankfort Electric & Water Plant Board, Kentucky, Electric and Water Revenue Bonds, Series 2015A, 4.000%, 12/01/18 – AGM Insured | No Opt. Call | AA | $40,468 | ||

| 4,740 | Owen County, Kentucky, Waterworks System Revenue Bonds, Kentucky-American Water Company Project, Series 2009A, 6.250%, 6/01/39 | 6/19 at 100.00 | A | 4,939,222 | ||

| 5,315 | Owen County, Kentucky, Waterworks System Revenue Bonds, Kentucky-American Water Company Project, Series 2009B, 5.625%, 9/01/39 | 9/19 at 100.00 | A | 5,546,575 | ||

| 2,000 | Owensboro, Kentucky, Electric Light and Power System Revenue Bonds, Series 2017, 4.000%, 1/01/26 | No Opt. Call | A | 2,167,020 | ||

| 2,000 | Paducah, Kentucky, Electric Plant Board Revenue Bonds, Refunding Series 2016A, 5.000%, 10/01/33 – AGM Insured | 10/26 at 100.00 | AA | 2,236,380 | ||

| Paducah, Kentucky, Electric Plant Board Revenue Bonds, Series 2009A: | ||||||

| 2,945 | 5.000%, 10/01/20 – AGC Insured | 4/19 at 100.00 | AA | 3,016,357 | ||

| 5 | 5.250%, 10/01/35 – AGC Insured | 4/19 at 100.00 | AA | 5,128 | ||

| Princeton Electric Plant Board, Kentucky, Revenue Bonds, Refunding Series 2015: | ||||||

| 225 | 5.000%, 11/01/21 – AGM Insured | No Opt. Call | AA | 244,492 | ||

| 1,000 | 5.000%, 11/01/25 – AGM Insured | 5/25 at 100.00 | AA | 1,139,750 | ||

| 1,100 | 5.000%, 11/01/34 – AGM Insured | 5/25 at 100.00 | AA | 1,228,315 | ||

| 1,635 | 5.000%, 11/01/37 – AGM Insured | 5/25 at 100.00 | AA | 1,814,997 | ||

| 4,250 | Public Energy Authority of Kentucky, Gas Supply Revenue Bonds, Series 2018A, 4.000%, 4/01/48 (Mandatory Put 4/01/24) | 1/24 at 100.37 | A3 | 4,550,560 | ||

| Russellville, Kentucky, Electric Plant Board Electric Revenue Bonds, Refunding Series 2015A: | ||||||

| 380 | 5.000%, 8/01/22 – BAM Insured | No Opt. Call | AA | 419,501 | ||

| 405 | 5.000%, 8/01/24 – BAM Insured | No Opt. Call | AA | 456,775 | ||

| 26,040 | Total Utilities | 27,805,540 | ||||

| Water and Sewer – 12.5% | ||||||

| 2,525 | Kentucky Infrastructure Authority, Wastewater and Drinking Water Revolving Fund Program Revenue Bonds, Refunding Series 2016A, 5.000%, 2/01/28 | 2/26 at 100.00 | AAA | 2,973,970 | ||

| Kentucky Infrastructure Authority, Wastewater and Drinking Water Revolving Fund Program Revenue Bonds, Tender Option Bond Trust 2015-XF2109: | ||||||

| 1,330 | 14.586%, 2/01/25, 144A (IF) (4) | No Opt. Call | AAA | 2,231,700 | ||

| 1,070 | 14.610%, 2/01/26, 144A (IF) (4) | 2/25 at 100.00 | AAA | 1,796,797 | ||

| Kentucky Infrastructure Authority, Wastewater and Drinking Water Revolving Fund Revenue Bonds, Series 2018A: | ||||||

| 4,265 | 5.000%, 2/01/30 (UB) (4) | 2/28 at 100.00 | AAA | 5,138,216 | ||

| 5,000 | 5.000%, 2/01/31 (UB) (4) | 2/28 at 100.00 | AAA | 6,000,050 | ||

| 115 | Kentucky Rural Water Finance Corporation, Multimodal Public Projects Revenue Bonds, Flexible Term Program, Series 2001A, 5.375%, 2/01/20 | 8/18 at 100.00 | A+ | 115,343 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Water and Sewer (continued) | ||||||

| Logan/Todd Regional Water Commission, Kentucky, Revenue Bonds, Refunding Series 2016A: | ||||||

| $ 1,005 | 5.000%, 7/01/25 – AGM Insured | No Opt. Call | AA | $1,162,041 | ||

| 1,060 | 5.000%, 7/01/26 – AGM Insured | No Opt. Call | AA | 1,237,476 | ||

| 1,115 | 5.000%, 7/01/27 – AGM Insured | 7/26 at 100.00 | AA | 1,294,660 | ||

| 1,175 | 5.000%, 7/01/28 – AGM Insured | 7/26 at 100.00 | AA | 1,361,566 | ||

| 1,240 | 5.000%, 7/01/29 – AGM Insured | 7/26 at 100.00 | AA | 1,429,137 | ||

| 7,500 | Louisville and Jefferson County Metropolitan Sewer District, Kentucky, Sewer and Drainage System Revenue Bonds, Refunding Series 2011A, 5.000%, 5/15/28 | 11/21 at 100.00 | AA | 8,190,750 | ||

| 795 | Louisville and Jefferson County Metropolitan Sewer District, Kentucky, Sewer and Drainage System Revenue Bonds, Series 2014A, 5.000%, 5/15/27 | 11/24 at 100.00 | AA | 917,772 | ||

| 2,990 | Louisville and Jefferson County Metropolitan Sewer District, Kentucky, Sewer and Drainage System Revenue Bonds, Series 2017A, 5.000%, 5/15/29 | 11/26 at 100.00 | AA | 3,518,632 | ||

| Northern Kentucky Water District, Revenue Bonds, Series 2012: | ||||||

| 2,690 | 5.000%, 2/01/22 | No Opt. Call | Aa3 | 2,969,249 | ||

| 3,495 | 5.000%, 2/01/26 | 2/22 at 100.00 | Aa3 | 3,821,608 | ||

| 130 | Owensboro, Kentucky, Water Revenue Bonds, Refunding & Improvement Series 2009, 5.000%, 9/15/29 – AGC Insured | 9/18 at 100.00 | AA | 131,177 | ||

| 37,500 | Total Water and Sewer | 44,290,144 | ||||

| $ 340,475 | Total Long-Term Investments (cost $363,015,655) | 371,171,575 | ||||

| Floating Rate Obligations – (8.4)% | (29,845,000) | |||||

| Other Assets Less Liabilities – 4.0% | 14,191,629 | |||||

| Net Assets – 100% | $ 355,518,204 | |||||

| (1) | All percentages shown in the Portfolio of Investments are based on net assets. | |

| (2) | Optional Call Provisions: Dates (month and year) and prices of the earliest optional call or redemption. There may be other call provisions at varying prices at later dates. Certain mortgage-backed securities may be subject to periodic principal paydowns. Optional Call Provisions are not covered by the report of independent registered public accounting firm. | |

| (3) | For financial reporting purposes, the ratings disclosed are the highest of Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) or Fitch, Inc. (“Fitch”) rating. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Ratings below BBB by Standard & Poor’s, Baa by Moody’s or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not rated by any of these national rating agencies. Ratings are not covered by the report of independent registered public accounting firm. | |

| (4) | Investment, or portion of investment, has been pledged to collateralize the net payment obligations for investments in inverse floating rate transactions. | |

| (5) | Backed by an escrow or trust containing sufficient U.S. Government or U.S. Government agency securities, which ensure the timely payment of principal and interest. | |

| 144A | Investment is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These investments may only be resold in transactions exempt from registration, which are normally those transactions with qualified institutional buyers. | |

| ETM | Escrowed to maturity. | |

| IF | Inverse floating rate security issued by a tender option bond (“TOB”) trust, the interest rate on which varies inversely with the Securities Industry Financial Markets Association (SIFMA) short-term rate, which resets weekly, or a similar short-term rate, and is reduced by the expenses related to the TOB trust. | |

| UB | Underlying bond of an inverse floating rate trust reflected as a financing transaction. See Notes to Financial Statements, Note 3 – Portfolio Securities and Investments in Derivatives, Inverse Floating Rate Securities for more information. |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| LONG-TERM INVESTMENTS – 100.6% | ||||||

| MUNICIPAL BONDS – 100.6% | ||||||

| Consumer Staples – 2.3% | ||||||

| $ 3,030 | Michigan Tobacco Settlement Finance Authority, Tobacco Settlement Asset-Backed Revenue Bonds, Senior Lien Series 2007A, 6.000%, 6/01/34 | 7/18 at 100.00 | B- | $3,045,635 | ||

| 2,215 | Michigan Tobacco Settlement Finance Authority, Tobacco Settlement Asset-Backed Revenue Bonds, Series 2008A, 6.875%, 6/01/42 | 6/18 at 100.00 | B2 | 2,219,385 | ||

| 5,245 | Total Consumer Staples | 5,265,020 | ||||

| Education and Civic Organizations – 27.0% | ||||||

| 1,480 | Central Michigan University Board of Trustees, General Revenue Bonds, Refunding Series 2014, 5.000%, 10/01/39 | 10/24 at 100.00 | Aa3 | 1,677,565 | ||

| 3,835 | Eastern Michigan University, General Revenue Bonds, Series 2018A, 4.000%, 3/01/44 – AGM Insured | 3/28 at 100.00 | AA | 3,950,395 | ||

| Ferris State University, Michigan, General Revenue Bonds, Refunding Series 2016: | ||||||

| 2,575 | 5.000%, 10/01/33 | 10/26 at 100.00 | A+ | 2,945,671 | ||

| 2,695 | 5.000%, 10/01/34 | 10/26 at 100.00 | A+ | 3,072,327 | ||

| 350 | Grand Valley State University, Michigan, General Revenue Bonds, Refunding Series 2014B, 5.000%, 12/01/28 | 12/24 at 100.00 | A+ | 398,759 | ||

| Grand Valley State University, Michigan, General Revenue Bonds, Series 2017: | ||||||

| 250 | 5.000%, 12/01/30 | 12/24 at 100.00 | A+ | 283,075 | ||

| 250 | 5.000%, 12/01/32 | 12/24 at 100.00 | A+ | 281,178 | ||

| 1,000 | Michigan Finance Authority, Public School Academy Limited Obligation Revenue Bonds, Hanley International Academy, Inc. Project, Series 2010A, 6.125%, 9/01/40 | 9/20 at 100.00 | BB+ | 1,010,180 | ||

| 500 | Michigan Finance Authority, Public School Academy Limited Obligation Revenue Bonds, Holly Academy Project, Refunding Series 2011, 7.750%, 10/01/30 | 10/21 at 100.00 | BBB- | 545,600 | ||

| 830 | Michigan Finance Authority, Public School Academy Revenue Bonds, Detroit Service Learning Academy Project, Refunding Series 2011, 7.000%, 10/01/31 | 10/21 at 100.00 | B | 801,373 | ||

| 1,000 | Michigan State University, General Revenue Bonds, Refunding Series 2010C, 5.000%, 2/15/40 | 2/20 at 100.00 | AA+ | 1,044,320 | ||

| 4,370 | Michigan State University, General Revenue Bonds, Series 2015A, 5.000%, 8/15/40 | 8/25 at 100.00 | AA+ | 4,940,853 | ||

| 1,800 | Michigan Technological University, General Revenue Bonds, Refunding Series 2015A, 5.000%, 10/01/45 | 10/25 at 100.00 | A1 | 2,016,234 | ||

| Northern Michigan University, General Revenue Bonds, Series 2018A: | ||||||

| 500 | 5.000%, 12/01/32 (WI/DD, Settling 6/06/18) | 6/28 at 100.00 | A1 | 584,330 | ||

| 400 | 5.000%, 12/01/34 (WI/DD, Settling 6/06/18) | 6/28 at 100.00 | A1 | 463,724 | ||

| Oakland University, Michigan, General Revenue Bonds, Series 2016: | ||||||

| 2,600 | 5.000%, 3/01/41 | 3/26 at 100.00 | A1 | 2,922,348 | ||