As filed with the Securities and Exchange Commission on August 25, 2011

File No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

¨ Pre-Effective Amendment No.

¨ Post-Effective Amendment No.

NUVEEN MULTISTATE TRUST II

(Exact Name of Registrant as Specified in Charter)

333 West Wacker Drive

Chicago, Illinois 60606

(Address of Principal Executive Offices, Zip Code)

Registrant’s Telephone Number, including Area Code (312) 917-7700

Kevin J. McCarthy

Vice President and Secretary

333 West Wacker Drive

Chicago, Illinois 60606

(Name and Address of Agent for Service)

Copy to:

Deborah Bielicke Eades Vedder Price P.C. 222 North LaSalle Street Chicago, Illinois 60601 | Eric F. Fess Chapman and Cutler LLP 111 West Monroe Street Chicago, Illinois 60603 |

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

TITLE OF SECURITIES BEING REGISTERED: Shares of Beneficial Interest (par value $0.01 per share) of the Registrant.

No filing fee is required because of reliance on Section 24(f) and an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

It is proposed that this filing will become effective on September 23, 2011 pursuant to Rule 488 under the Securities Act of 1933.

Important Information for Nuveen Massachusetts Municipal Bond Fund 2 Shareholders

At a Special Meeting of shareholders of Nuveen Massachusetts Municipal Bond Fund 2 (the “Acquired Fund”), a series of Nuveen Multistate Trust II (the “Trust”), you will be asked to vote upon an important change affecting your fund. The purpose of the Special Meeting is to allow you to vote on a reorganization of your fund into Nuveen Massachusetts Municipal Bond Fund (the “Acquiring Fund”). If the reorganization is approved and completed, you will become a shareholder of the Acquiring Fund. The Acquired Fund and the Acquiring Fund are collectively referred to herein as the “Funds.”

Although we recommend that you read the complete Proxy Statement/Prospectus, for your convenience, we have provided the following brief overview of the issue to be voted on.

| Q. | Why am I receiving this Proxy Statement/Prospectus? |

| A. | Nuveen Fund Advisors, Inc. (“Nuveen Fund Advisors”), each Fund’s investment adviser, has proposed the reorganization of the Acquired Fund into the Acquiring Fund, as well as a number of other fund reorganizations between funds with similar investment objectives and policies, as part of an initiative to eliminate certain redundancies among the products it offers and in an effort to achieve certain operating efficiencies. |

| Q. | What advantages will the reorganization produce for Acquired Fund shareholders? |

| A. | Nuveen Fund Advisors and the Board of Trustees of the Trust (the “Board”) believe that shareholders of the Acquired Fund will benefit from operational efficiencies and economies of scale that are expected to arise as a result of the larger net asset size, and expected continued growth in net assets, of the Acquiring Fund following the reorganization. These operational efficiencies and economies of scale are expected to result in lower net expenses for all shareholders. |

| Q. | What are the similarities between the investment policies of the Funds? |

| A. | The investment objective of the Funds is identical—to provide as high a level of current interest income exempt from regular federal, state and, in some cases, local income taxes as is consistent with preservation of capital. Except as described below, the Funds also have substantially similar current principal investment strategies and risks, and are managed by the same portfolio manager. However, the Acquiring Fund may invest up to 20% of its net assets in high yield bonds whereas the Acquired Fund may not invest in such bonds. High yield bonds involve greater risks, including the possibility of default or bankruptcy, and are regarded as predominantly speculative with respect to the issuer’s capacity to pay interest and repay capital. Additionally, the Acquiring Fund is a diversified fund while the Acquired Fund is a non-diversified fund. As a non-diversified fund, the Acquired Fund may invest a larger portion of its assets in a fewer number of issuers than the Acquiring Fund, and therefore may be more susceptible to changes in the financial condition of individual municipal bond issuers in which it invests as well as any single political, regulatory or economic occurrence affecting such issuers. A more detailed comparison of the investment objectives, policies and risks of the Funds is contained in the Proxy Statement/Prospectus. |

| Q. | What will happen if shareholders do not approve the reorganization? |

| A. | If the reorganization is not approved by shareholders, the Board will take such actions as it deems to be in the best interests of the Acquired Fund, which may include additional solicitation or continuing to operate the Fund as a stand-alone fund. |

| Q. | Will Acquired Fund shareholders receive new shares in exchange for their current shares? |

| A. | Yes. If shareholders approve the reorganization and it is completed, each Acquired Fund shareholder will receive shares of the Acquiring Fund in an amount equal in total value to the total value of the Acquired Fund shares surrendered by such shareholder. |

| Q. | Will this reorganization create a taxable event for me? |

| A. | No. The reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes. It is expected that you will recognize no gain or loss for federal income tax purposes as a result of the reorganization. |

| Q. | How do total operating expenses compare between the two Funds? |

| A. | If the reorganization is completed, the net expenses of the Acquiring Fund are expected to be lower than the net expenses of the Acquired Fund for all share classes. |

| Q. | Who will bear the costs of the reorganization? |

| A. | The reorganization is expected to result in cost savings for each Fund. In light of these anticipated cost savings, the costs of the reorganization will be allocated between the Funds ratably up to each Fund’s projected cost savings during the first year following the reorganization. Nuveen Fund Advisors estimates that reorganization costs will be approximately $121,000 and that the benefit during the first year following the reorganization will be approximately $21,000 to the Acquired Fund and approximately $21,000 to the Acquiring Fund. Nuveen Investments, Inc. (“Nuveen”), the parent company of Nuveen Fund Advisors, will absorb the remaining reorganization cost of approximately $79,000. If the reorganization is not approved or completed, Nuveen will pay all such reorganization expenses. |

| Q. | What is the timetable for the reorganization? |

| A. | If approved by shareholders on November 7, 2011, the reorganization is expected to occur at the close of business on November 18, 2011. |

| Q. | Whom do I call if I have questions? |

| A. | If you need any assistance, or have any questions regarding the proposal or how to vote your shares, please call Computershare Fund Services, your proxy solicitor, at (866) 963-6130. Please have your proxy material available when you call. |

| Q. | How do I vote my shares? |

| A. | You may vote by mail, telephone or over the Internet: |

| • | To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. |

| • | To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. |

| • | To vote over the Internet, go to the Internet address provided on your proxy card and follow the instructions, using your proxy card as a guide. |

| Q. | Will Nuveen contact me? |

| A. | You may receive a call from representatives of Computershare Fund Services, the proxy solicitation firm retained by Nuveen, to verify that you received your proxy materials and to answer any questions you may have about the reorganization. |

| Q. | How does the Board suggest that I vote? |

| A. | After careful consideration, the Board has agreed unanimously that the reorganization is in the best interests of your Fund and recommends that you vote “FOR” the reorganization. |

, 2011

Dear Shareholders:

We are pleased to invite you to the special meeting of shareholders of Nuveen Massachusetts Municipal Bond Fund 2 (the “Special Meeting”). The Special Meeting is scheduled for November 7, 2011, at 2:00 p.m., Central time, in the 31st floor conference room of Nuveen Investments, Inc., 333 West Wacker Drive, Chicago, Illinois 60606.

At the Special Meeting, you will be asked to consider and approve a very important proposal. Subject to shareholder approval, Nuveen Massachusetts Municipal Bond Fund (the “Acquiring Fund”), a series of Nuveen Multistate Trust II (the “Trust”), will acquire all the assets and liabilities of Nuveen Massachusetts Municipal Bond Fund 2 (the “Acquired Fund”), another series of the Trust, in exchange solely for shares of the Acquiring Fund, which will be distributed in complete liquidation of the Acquired Fund to the shareholders of the Acquired Fund (the “Reorganization”).

Nuveen Fund Advisors, Inc. (“Nuveen Fund Advisors”), each Fund’s investment adviser, has proposed the Reorganization involving the Acquired Fund, as well as a number of other reorganizations involving other funds advised by Nuveen Fund Advisors, to eliminate certain redundancies among the products it offers and in an effort to achieve certain operating efficiencies.

The Reorganization is being proposed because Nuveen Fund Advisors and the Board of Trustees of the Trust (the “Board”) believe that the shareholders of the Acquired Fund will benefit from potential operating efficiencies and economies of scale that may be achieved by combining the Funds pursuant to the Reorganization. Following the Reorganization, the Acquiring Fund is expected to have lower net expenses than the Acquired Fund had prior to the Reorganization. The Board believes the Reorganization is in the best interests of the Acquired Fund, and recommends that you vote “For” the proposed Reorganization.

The attached Proxy Statement/Prospectus has been prepared to give you information about this proposal.

All shareholders are cordially invited to attend the Special Meeting. In order to avoid delay and additional expense for the Acquired Fund, and to assure that your shares are represented, please vote as promptly as possible, whether or not you plan to attend the Special Meeting. You may vote by mail, telephone or over the Internet.

| • | To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. |

| • | To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. |

| • | To vote over the Internet, go to the Internet address provided on your proxy card and follow the instructions, using your proxy card as a guide. |

We appreciate your continued support and confidence in Nuveen and our family of funds.

| Very truly yours, |

| Kevin J. McCarthy |

| Vice President and Secretary |

, 2011

NUVEEN MASSACHUSETTS MUNICIPAL BOND FUND 2

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 7, 2011

To the Shareholders:

Notice is hereby given that a special meeting of shareholders of Nuveen Massachusetts Municipal Bond Fund 2 (the “Acquired Fund”), a series of the Nuveen Multistate Trust II (the “Trust”), a Massachusetts business trust, will be held in the 31st floor conference room of Nuveen Investments, Inc., 333 West Wacker Drive, Chicago, Illinois 60606, on November 7, 2011 at 2:00 p.m., Central time (the “Special Meeting”), for the following purposes:

1. To approve an Agreement and Plan of Reorganization (and the related transactions) which provides for (i) the transfer of all the assets of the Acquired Fund to Nuveen Massachusetts Municipal Bond Fund (the “Acquiring Fund”) in exchange solely for voting shares of beneficial interest of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Acquired Fund; and (ii) the distribution by the Acquired Fund of all the shares of each class of the Acquiring Fund to the holders of shares of the corresponding class of the Acquired Fund in complete liquidation and termination of the Acquired Fund.

2. To transact such other business as may properly come before the Special Meeting.

Only shareholders of record as of the close of business on September 9, 2011 are entitled to vote at the Special Meeting or any adjournment thereof.

All shareholders are cordially invited to attend the Special Meeting. In order to avoid delay and additional expense for the Acquired Fund, and to assure that your shares are represented, please vote as promptly as possible, whether or not you plan to attend the Special Meeting. You may vote by mail, telephone or over the Internet.

| • | To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. |

| • | To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. |

| • | To vote over the Internet, go the Internet address provided on your proxy card and follow the instructions, using your proxy card as a guide. |

| Kevin J. McCarthy |

| Vice President and Secretary |

Proxy Statement/Prospectus

Dated , 2011

Relating to the Acquisition of the Assets and Liabilities of

NUVEEN MASSACHUSETTS MUNICIPAL BOND FUND 2

by NUVEEN MASSACHUSETTS MUNICIPAL BOND FUND

This Proxy Statement/Prospectus is being furnished to shareholders of Nuveen Massachusetts Municipal Bond Fund 2 (the “Acquired Fund”), a series of the Nuveen Multistate Trust II (the “Trust”), a Massachusetts business trust and an open-end investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and relates to the special meeting of shareholders of the Acquired Fund to be held in the 31st floor conference room of Nuveen Investments, Inc., 333 West Wacker Drive, Chicago, Illinois 60606, on November 7, 2011 at 2:00 p.m., Central time and at any and all adjournments thereof (the “Special Meeting”). This Proxy Statement/Prospectus is provided in connection with the solicitation by the Board of Trustees of the Trust (the “Board”) of proxies to be voted at the Special Meeting, and any and all adjournments thereof. The purpose of the Special Meeting is to consider the proposed reorganization (the “Reorganization”) of the Acquired Fund into Nuveen Massachusetts Municipal Bond Fund (the “Acquiring Fund”), another series of the Trust. The Acquired Fund and the Acquiring Fund are referred to herein collectively as the “Funds” and individually as a “Fund.” If shareholders approve the Reorganization and it is completed, shareholders of the Acquired Fund will receive shares of the corresponding class of the Acquiring Fund with the same total value as the total value of the Acquired Fund shares surrendered by such shareholders. The Board has determined that the Reorganization is in the best interest of the Acquired Fund. The address, principal executive office and telephone number of the Funds and the Trust is 333 West Wacker Drive, Chicago, Illinois 60606, (800) 257-8787.

The enclosed proxy and this Proxy Statement/Prospectus are first being sent to shareholders of the Acquired Fund on or about , 2011. Shareholders of record as of the close of business on September 9, 2011 are entitled to vote at the Special Meeting and any adjournment thereof.

The Securities and Exchange Commission has not approved or disapproved these securities or determined whether the information in this Proxy Statement/Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This Proxy Statement/Prospectus concisely sets forth the information shareholders of the Acquired Fund should know before voting on the Reorganization (in effect, investing in Class A, Class B, Class C and Class I shares of the Acquiring Fund) and constitutes an offering of Class A, Class B, Class C and Class I shares of beneficial interest, par value $0.01 per share, of the Acquiring Fund. Please read it carefully and retain it for future reference.

The following documents have been filed with the Securities and Exchange Commission (“SEC”) and are incorporated into this Proxy Statement/Prospectus by reference and also accompany this Proxy Statement/Prospectus:

| (i) | the Trust’s prospectus dated June 30, 2011, as supplemented through the date of this Proxy Statement/Prospectus, relating to the Funds; and |

| (ii) | the audited financial statements contained in the Acquiring Fund’s Annual Report for the fiscal year ended February 28, 2011; and |

| (iii) | the audited financial statements contained in the Acquired Fund’s Annual Report for the fiscal year ended February 28, 2011. |

The following documents contain additional information about the Acquired Fund and Acquiring Fund, have been filed with the SEC and are incorporated into this Proxy Statement/Prospectus by reference:

| (i) | the Statement of Additional Information relating to the proposed Reorganization, dated , 2011 (the “Reorganization SAI”); and |

| (ii) | the Trust’s statement of additional information dated June 30, 2011, as supplemented through the date of this Proxy Statement/Prospectus, relating to the Funds. |

No other parts of the documents referenced above are incorporated by reference herein.

Copies of the foregoing may be obtained without charge by calling or writing the Funds at the telephone number or address shown above. If you wish to request the Reorganization SAI, please ask for the “Reorganization SAI.” In addition, the Acquiring Fund will furnish, without charge, a copy of its most recent annual report and subsequent semi-annual report to a shareholder upon request. Any such request should be directed to the Acquiring Fund by calling (800) 257-8787 or by writing the Acquiring Fund at 333 West Wacker Drive, Chicago, Illinois 60606.

The Trust is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the 1940 Act, and in accordance therewith files reports and other information with the SEC. Reports, proxy statements, registration statements and other information filed by the Trust (including the Registration Statement relating to the Acquiring Fund on Form N-14 of which this Proxy Statement/Prospectus is a part) may be inspected without charge and copied (for a duplication fee at prescribed rates) at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 or at the SEC’s Northeast Regional Office (3 World Financial Center, New York, New York 10281) or Midwest Regional Office (175 W. Jackson Boulevard, Suite 900, Chicago, Illinois 60604). You may call the SEC at (202) 551-8090 for information about the operation of the Public Reference Room. You may obtain copies of this information, with payment of a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549. You may also access reports and other information about the Funds on the EDGAR database on the SEC’s Internet site at http://www.sec.gov.

TABLE OF CONTENTS

| Page | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

Distribution, Purchase, Redemption, Exchange of Shares and Dividends | 3 | |||

Certain Federal Income Tax Consequences of the Reorganization | 3 | |||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 7 | ||||

| 7 | ||||

| 9 | ||||

| 9 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

Distribution, Purchase, Redemption, Exchange of Shares and Dividends | 13 | |||

| 14 | ||||

Payments to Broker-Dealers and Other Financial Intermediaries | 14 | |||

| 14 | ||||

| 14 | ||||

| 16 | ||||

Continuation of Shareholder Accounts and Plans; Share Certificates | 16 | |||

| 16 | ||||

| 16 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

Information Filed with the Securities and Exchange Commission | 20 | |||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

i

TABLE OF CONTENTS

(continued)

| Page | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| I-1 | ||||

ii

The following is a summary of, and is qualified by reference to, the more complete information contained in this Proxy Statement/Prospectus and the information attached hereto or incorporated herein by reference, including the Agreement and Plan of Reorganization. As discussed more fully below and elsewhere in this Proxy Statement/Prospectus, the Board believes the proposed Reorganization is in the best interests of each Fund and that the interests of each Fund’s existing shareholders would not be diluted as a result of the Reorganization. If the Reorganization is approved and completed, shareholders of the Acquired Fund will become shareholders of the Acquiring Fund and will cease to be shareholders of the Acquired Fund.

Shareholders should read the entire Proxy Statement/Prospectus carefully together with the Acquiring Fund’s Prospectus that accompanies this Proxy Statement/Prospectus and is incorporated herein by reference. This Proxy Statement/Prospectus constitutes an offering of Class A, Class B, Class C and Class I shares of the Acquiring Fund only.

Nuveen Fund Advisors, Inc. (“Nuveen Fund Advisors” or the “Adviser”), each Fund’s investment adviser, has proposed the reorganization of the Acquired Fund into the Acquiring Fund, as well as a number of other fund reorganizations between funds with similar investment objectives and policies, as part of an initiative to eliminate certain redundancies among the products it offers and in an effort to achieve certain operating efficiencies.

This Proxy Statement/Prospectus is being furnished to shareholders of the Acquired Fund in connection with the proposed combination of the Acquired Fund with and into the Acquiring Fund pursuant to the terms and conditions of the Agreement and Plan of Reorganization dated , 2011 by the Trust, on behalf of and between the Acquired Fund and the Acquiring Fund, and Nuveen Fund Advisors (the “Agreement”). The Agreement provides for (i) the transfer of all the assets of the Acquired Fund to the Acquiring Fund in exchange solely for Class A, Class B, Class C and Class I voting shares of beneficial interest, par value $0.01 per share, of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Acquired Fund; and (ii) the distribution by the Acquired Fund of all the shares of each class of the Acquiring Fund to the shareholders of the corresponding class of the Acquired Fund in complete liquidation and termination of the Acquired Fund as soon as practicable following the Closing Date (as defined herein).

If shareholders approve the Reorganization and it is completed, Acquired Fund shareholders will become shareholders of the Acquiring Fund. The Board has determined that the Reorganization is in the best interests of the Acquired Fund and that the interests of existing shareholders will not be diluted as a result of the Reorganization. The Board unanimously approved the Reorganization and the Agreement on July 25, 2011. The Board recommends a vote “FOR” the Reorganization.

The Reorganization is expected to result in cost savings for each Fund. In light of these anticipated cost savings, the costs of the Reorganization will be allocated between the Funds ratably up to each Fund’s projected cost savings during the first year following the Reorganization. Nuveen Fund Advisors estimates that Reorganization costs will be approximately $121,000 and that the benefit of the Reorganization during the first year following the Reorganization will be approximately $21,000 to the Acquired Fund and approximately $21,000 to the Acquiring Fund. Nuveen Investments, Inc.

(“Nuveen”), the parent company of Nuveen Fund Advisors, will absorb the remaining Reorganization costs of approximately $79,000. If the Reorganization is not approved or completed, Nuveen will pay all such Reorganization expenses.

The Board is asking shareholders of the Acquired Fund to approve the Reorganization at the Special Meeting to be held on November 7, 2011. Approval of the Reorganization requires the favorable vote of the holders of a majority of the outstanding voting securities entitled to vote, as defined by the 1940 Act. See “Voting Information and Requirements” below.

If shareholders of the Acquired Fund approve the Reorganization, it is expected that the Reorganization will occur at the close of business on November 18, 2011 (the “Closing Date”), but it may be at a different time as described herein. If the Reorganization is not approved, the Board will take such action as it deems to be in the best interests of the Acquired Fund. The Closing Date may be delayed and the Reorganization may be abandoned at any time by the mutual agreement of the parties. In addition, either Fund may at its option terminate the Agreement at or before the Closing Date due to (i) a breach by any other party of any representation, warranty, or agreement contained in the Agreement to be performed at or before the Closing Date, if not cured within 30 days, (ii) a condition precedent to the obligations of the terminating party that has not been met and reasonably appears will not or cannot be met, or (iii) a determination by the Board that the consummation of the transactions contemplated by the Agreement is not in the best interests of a Fund.

Reasons for the Proposed Reorganization

The Board believes that the proposed Reorganization would be in the best interests of each Fund. In approving the Reorganization, the Board considered a number of principal factors in reaching its determination, including the following:

| • | the similarities and differences in the Funds’ investment objectives and principal investment strategies; |

| • | the Funds’ relative risks; |

| • | the Funds’ relative sizes; |

| • | the relative investment performance of the Funds and portfolio manager; |

| • | the relative fees and expense ratios of the Funds, including the permanent expense caps in place for each Fund; |

| • | the anticipated tax-free nature of the Reorganization; |

| • | the expected costs of the Reorganization and the extent to which the Funds would bear any such costs; |

| • | the terms of the Reorganization and whether the Reorganization would dilute the interests of shareholders of the Funds; |

| • | the effect of the Reorganization on shareholder services and shareholder rights; |

2

| • | alternatives to the Reorganization; and |

| • | any potential benefits of the Reorganization to Nuveen Fund Advisors and its affiliates as a result of the Reorganization. |

For a more detailed discussion of the Board’s considerations regarding the approval of the Reorganization, see “The Board’s Approval of the Reorganization.”

Distribution, Purchase, Redemption, Exchange of Shares and Dividends

The Funds have identical procedures for purchasing, exchanging and redeeming shares, and for making distributions. Both Funds offer four classes of shares: Class A, Class B, Class C and Class I shares. The classes of each Fund have the same investment eligibility criteria. See “Comparison of the Funds—Distribution, Purchase, Redemption, Exchange of Shares and Dividends” below for a more detailed discussion.

Certain Federal Income Tax Consequences of the Reorganization

The Reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes. If the Reorganization so qualifies, neither the Acquired Fund nor its shareholders will recognize any gain or loss as a direct result of the transfers contemplated by the Reorganization. In connection with the Reorganization, a portion of the Acquired Fund’s portfolio assets may be sold prior to the Reorganization, which could result in the Acquired Fund declaring taxable distributions to its shareholders on or prior to the Closing Date. However, it is not expected that any significant portfolio sales will occur in connection with the Reorganization. For a more detailed discussion of the federal income tax consequences of the Reorganization, please see “The Proposed Reorganization—Certain Federal Income Tax Consequences” below.

The investment objective of the Funds is identical—to provide as high a level of current interest income exempt from regular federal, state and, in some cases, local income taxes as is consistent with preservation of capital. The investment objective of the Funds may not be changed without shareholder approval.

The Acquired Fund and the Acquiring Fund have substantially similar current principal investment strategies and risks. The similarities and differences of the principal investment strategies of the Funds are:

Acquired Fund | Acquiring Fund | |

• Under normal market conditions, the Fund invests at least 80% of its net assets in municipal bonds that pay interest that is exempt from regular federal and Massachusetts personal income tax. | • Under normal market conditions, the Fund invests at least 80% of its net assets in municipal bonds that pay interest that is exempt from regular federal and Massachusetts personal income tax. | |

3

Acquired Fund | Acquiring Fund | |

• The municipal securities in which the Fund invests are, at the time of purchase (i) rated BBB/Baa or higher; (ii) unrated, but judged to be of comparable quality by the Fund’s sub-adviser; or (iii) backed by an escrow or trust account containing sufficient U.S. Government or U.S. government agency securities to ensure timely payment of principal and interest. | • The Fund invests at least 80% of its net assets in investment grade municipal bonds rated BBB/Baa or higher at the time of purchase by at least one independent rating agency, or, if unrated, judged by the Fund’s sub-adviser to be of comparable quality. | |

• The Fund may invest up to 20% of its net assets in below investment grade municipal bonds, commonly referred to as “high yield” or “junk” bonds. | ||

• The Fund may invest up to 15% of its net assets in municipal securities whose interest payments vary inversely with changes in short-term tax-exempt interest rates (i.e., inverse floating rate securities). | • The Fund may invest up to 15% of its net assets in municipal securities whose interest payments vary inversely with changes in short-term tax-exempt interest rates (i.e., inverse floating rate securities). | |

The Acquired Fund and the Acquiring Fund have substantially similar current principal investment strategies and risks, and have been managed by the same portfolio manager since January 2011. However, the Acquiring Fund may invest up to 20% of its net assets in high yield bonds whereas the Acquired Fund may not invest in municipal bonds rated below BBB/Baa by Moody’s, S&P or Fitch. Additionally, the Acquiring Fund is a diversified fund while the Acquired Fund is a non-diversified fund. Prior to May 31, 2011, the Acquired Fund was also required to invest at least 80% of its net assets in insured municipal securities. In March 2011, the Board approved the elimination of the insurance mandate and the elimination of “Insured” from the Acquired Fund’s name.

In evaluating the Reorganization, each Acquired Fund shareholder should consider the risks of investing in the Acquiring Fund, which are described in the section below entitled “Risk Factors.”

The Reorganization may result in one-time brokerage costs for the Acquired Fund to the extent it is necessary for the Acquired Fund to sell securities prior to the Reorganization so that the Acquiring Fund’s portfolio immediately following the Reorganization remains in compliance with its investment policies and restrictions. If the Reorganization had occurred as of , 2011, the Acquiring Fund would not have been required to dispose of securities of the Acquiring Fund in order to comply with its investment policies and restrictions, and would not have sold any material portion of the securities in the Acquired Fund’s portfolio solely as a result of the Reorganization. Any portfolio sales that occur prior to the Reorganization may result in taxable distributions to Acquired Fund shareholders. See “The Proposed Reorganization—Certain Federal Income Tax Consequences” below.

The tables below provide information about the fees and expenses attributable to each class of shares of the Funds, and the pro forma fees and expenses of the combined fund. Shareholder fees reflect the fees currently in effect for each Fund. Annual Fund Operating Expenses reflect the fees and expenses for the Funds as of their fiscal year ended February 28, 2011. The pro forma fees and expenses are based on the amounts shown in the table for each Fund, assuming the Reorganization occurred as of February 28, 2011.

4

Shareholder Fees

(paid directly from your investment)

| Acquired Fund | Acquiring Fund | Combined Fund Pro Forma | ||||

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | ||||||

Class A | 4.20% | 4.20% | 4.20% | |||

Class B | None | None | None | |||

Class C | None | None | None | |||

Class I | None | None | None | |||

Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of purchase price or redemption proceeds) | ||||||

Class A | None | None | None | |||

Class B | 5.00% | 5.00% | 5.00% | |||

Class C | 1.00% | 1.00% | 1.00% | |||

Class I | None | None | None | |||

Maximum Sales Charge (Load) Imposed on Reinvested Dividends | ||||||

Class A | None | None | None | |||

Class B | None | None | None | |||

Class C | None | None | None | |||

Class I | None | None | None | |||

Exchange Fee | ||||||

Class A | None | None | None | |||

Class B | None | None | None | |||

Class C | None | None | None | |||

Class I | None | None | None | |||

Annual Low Balance Account Fee (for accounts under $1,000)1 | ||||||

Class A | $15 | $15 | $15 | |||

Class B | $15 | $15 | $15 | |||

Class C | $15 | $15 | $15 | |||

Class I | $15 | $15 | $15 |

| 1 | Fee applies to the following types of accounts held directly with the Fund: accounts established pursuant to the Uniform Transfers to Minors Act (UTMA) or Uniform Gifts to Minors Act (UGMA). |

5

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Acquired Fund | Acquiring Fund | Combined Fund Pro Forma1 | ||||||||||

Management Fees | ||||||||||||

Class A | 0.53 | % | 0.53 | % | 0.53 | % | ||||||

Class B | 0.53 | % | 0.53 | % | 0.53 | % | ||||||

Class C | 0.53 | % | 0.53 | % | 0.53 | % | ||||||

Class I | 0.53 | % | 0.53 | % | 0.53 | % | ||||||

Distribution and Service (12b-1 ) Fees | ||||||||||||

Class A | 0.20 | % | 0.20 | % | 0.20 | % | ||||||

Class B | 0.95 | % | 0.95 | % | 0.95 | % | ||||||

Class C | 0.75 | % | 0.75 | % | 0.75 | % | ||||||

Class I | 0.00 | % | 0.00 | % | 0.00 | % | ||||||

Other Expenses | ||||||||||||

Class A | 0.13 | % | 0.12 | % | 0.11 | % | ||||||

Class B | 0.13 | % | 0.12 | % | 0.11 | % | ||||||

Class C | 0.13 | % | 0.12 | % | 0.11 | % | ||||||

Class I | 0.13 | % | 0.12 | % | 0.11 | % | ||||||

Total Annual Fund Operating Expenses | ||||||||||||

Class A | 0.86 | % | 0.85 | % | 0.84 | % | ||||||

Class B | 1.61 | % | 1.60 | % | 1.59 | % | ||||||

Class C | 1.41 | % | 1.40 | % | 1.39 | % | ||||||

Class I | 0.66 | % | 0.65 | % | 0.64 | % | ||||||

| 1 | Pro forma expenses do not include the expenses to be charged to the Funds in connection with the Reorganization. See “The Proposed Reorganization—Reorganization Expenses” for additional information about these expenses. |

Example

The example below is intended to help you compare the cost of investing in each Fund and the pro forma cost of investing in the combined fund. The example assumes you invest $10,000 in a Fund for the time periods indicated (based on information in the tables above) and then either redeem or do not redeem your shares at the end of a period. The example assumes that your investment has a 5% return each year and that a Fund’s expenses remain at the level shown in the table above. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Acquired Fund | Acquiring Fund | Combined Fund Pro Forma | ||||||||||

1 Year | ||||||||||||

Assuming you sold your shares at the end of each period | ||||||||||||

Class A | $ | 504 | $ | 503 | $ | 502 | ||||||

Class B | $ | 564 | $ | 563 | $ | 562 | ||||||

Class C | $ | 144 | $ | 143 | $ | 142 | ||||||

Class I | $ | 67 | $ | 66 | $ | 65 | ||||||

Assuming you kept your shares | ||||||||||||

Class A | $ | 504 | $ | 503 | $ | 502 | ||||||

Class B | $ | 164 | $ | 163 | $ | 162 | ||||||

Class C | $ | 144 | $ | 143 | $ | 142 | ||||||

Class I | $ | 67 | $ | 66 | $ | 65 | ||||||

6

| Acquired Fund | Acquiring Fund | Combined Fund Pro Forma | ||||||||||

3 Years | ||||||||||||

Assuming you sold your shares at the end of each period | ||||||||||||

Class A | $ | 683 | $ | 680 | $ | 677 | ||||||

Class B | $ | 808 | $ | 805 | $ | 802 | ||||||

Class C | $ | 446 | $ | 443 | $ | 440 | ||||||

Class I | $ | 211 | $ | 208 | $ | 205 | ||||||

Assuming you kept your shares | ||||||||||||

Class A | $ | 683 | $ | 680 | $ | 677 | ||||||

Class B | $ | 508 | $ | 505 | $ | 502 | ||||||

Class C | $ | 446 | $ | 443 | $ | 440 | ||||||

Class I | $ | 211 | $ | 208 | $ | 205 | ||||||

5 Years | ||||||||||||

Assuming you sold your shares at the end of each period | ||||||||||||

Class A | $ | 877 | $ | 872 | $ | 866 | ||||||

Class B | $ | 976 | $ | 971 | $ | 966 | ||||||

Class C | $ | 771 | $ | 766 | $ | 761 | ||||||

Class I | $ | 368 | $ | 362 | $ | 357 | ||||||

Assuming you kept your shares | ||||||||||||

Class A | $ | 877 | $ | 872 | $ | 866 | ||||||

Class B | $ | 876 | $ | 871 | $ | 866 | ||||||

Class C | $ | 771 | $ | 766 | $ | 761 | ||||||

Class I | $ | 368 | $ | 362 | $ | 357 | ||||||

10 Years | ||||||||||||

Assuming you sold your shares at the end of each period | ||||||||||||

Class A | $ | 1,436 | $ | 1,425 | $ | 1,414 | ||||||

Class B | $ | 1,710 | $ | 1,699 | $ | 1,688 | ||||||

Class C | $ | 1,691 | $ | 1,680 | $ | 1,669 | ||||||

Class I | $ | 822 | $ | 810 | $ | 798 | ||||||

Assuming you kept your shares | ||||||||||||

Class A | $ | 1,436 | $ | 1,425 | $ | 1,414 | ||||||

Class B | $ | 1,710 | $ | 1,699 | $ | 1,688 | ||||||

Class C | $ | 1,691 | $ | 1,680 | $ | 1,669 | ||||||

Class I | $ | 822 | $ | 810 | $ | 798 | ||||||

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect a Fund’s performance. During the most recent fiscal year for which audited financial statements are available, the Funds had the following portfolio turnover rates:

Fund | Fiscal Year End | Rate | ||||||

Acquired Fund | 2/28/11 | 5 | % | |||||

Acquiring Fund | 2/28/11 | 7 | % | |||||

7

After the Reorganization is completed, the portfolio manager of the Acquiring Fund may, in his discretion, sell securities acquired from the Acquired Fund. To the extent that the portfolio manager chooses to sell a significant percentage of such securities, the Acquiring Fund’s portfolio turnover rate and brokerage costs may be higher than they otherwise would have been.

In evaluating the Reorganization, you should consider carefully the risks of the Acquiring Fund to which you will be subject if the Reorganization is approved and completed. Investing in a mutual fund involves risk, including the risk that you may receive little or no return on your investment or even that you may lose part or all of your investment. Because of these and other risks, you should consider an investment in the Acquiring Fund to be a long-term investment. An investment in the Acquiring Fund may not be appropriate for all shareholders. For a complete description of the risks of an investment in the Acquiring Fund, see the section in the Acquiring Fund’s Prospectus entitled “Principal Risks.”

Because the Funds have substantially similar current investment strategies, the principal risks of each Fund are substantially similar. The principal risks of investing in the Acquiring Fund are described below. An investment in the Acquired Fund is also subject to each of these principal risks other than the additional credit risk associated with high yield bonds. In addition, the Acquired Fund is subject to the risks associated with being a non-diversified fund. As a non-diversified fund, the Acquired Fund may invest a larger portion of its assets in a fewer number of issuers than a diversified fund, and therefore may be more susceptible to changes in the financial condition of individual municipal bond issuers in which it invests, as well as any single political, regulatory or economic occurrence affecting such issuers.

Market Risk. The market values of municipal bonds owned by the Fund may decline, at times sharply and unpredictably.

Credit Risk. Credit risk is the risk that an issuer of a municipal bond may be unable or unwilling to make interest and principal payments when due and the related risk that the value of a bond may decline because of concerns about the issuer’s ability or willingness to make such payments. Credit risk is heightened for the Fund because it may invest up to 20% of its net assets in below investment grade (“high yield” or “junk”) municipal bonds. High yield bonds, while generally offering higher yields than investment grade bonds with similar maturities, involve greater risks, including the possibility of default or bankruptcy, and are regarded as predominantly speculative with respect to the issuer’s capacity to pay interest and repay principal.

Interest Rate Risk. Interest rate risk is the risk that the value of the Fund’s portfolio will decline because of rising interest rates. Interest rate risk may be increased by the Fund’s investment in inverse floating rate securities because of the leveraged nature of these investments.

State Concentration Risk. Because the Fund primarily purchases municipal bonds from Massachusetts, the Fund is more susceptible to adverse economic, political or regulatory changes affecting municipal bond issuers in that state.

Income Risk. The income from the Fund’s portfolio may decline because of falling market interest rates. This can result when the Fund invests the proceeds from new share sales, or from matured or called bonds, at market interest rates that are below the portfolio’s current earnings rate. Also, if the Fund invests in inverse floating rate securities, the Fund’s income may decrease if short-term interest rates rise.

8

Leveraged Securities Risk. The Fund may invest in inverse floating rate securities which create effective leverage. Because these securities create leveraged exposure to underlying municipal bonds, the amount the Fund invests in such securities exposes it to risks and potential returns to a greater extent than the amount actually invested. The interest payments the Fund receives on such securities vary inversely with the short-term financing rates paid by the securities’ issuers, and those interest payments will decrease if short-term interest rates increase. In addition, the value of these securities will vary by more than the value of the underlying bonds due to the leveraged nature of the investments. Also, the holder of the floating rate securities that has provided the leverage associated with a Fund’s inverse floating rate securities may cause the Fund to purchase or otherwise retire those floating rate securities (i.e., to effectively cause the Fund to repay the leverage provided by such holder), which may require the Fund to raise cash through the sale of portfolio securities at times and at prices that are not desirable for the Fund.

Tax Risk. Income from municipal bonds held by the Fund could be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the Internal Revenue Service or state tax authorities, or noncompliant conduct of a bond issuer. In addition, a portion of the Fund’s otherwise exempt-interest dividends may be taxable to those shareholders subject to the federal alternative minimum tax.

Fundamental Investment Restrictions

The Funds have substantially similar fundamental investment restrictions that cannot be changed without shareholder approval. However, the Acquiring Fund is diversified and the Acquired Fund is non-diversified. As a diversified fund, the Acquiring Fund, with respect to 75% of its assets, may not invest more than 5% of its total assets in the securities of any one issuer (other than securities of the U.S. government). The Acquired Fund is not subject to this restriction.

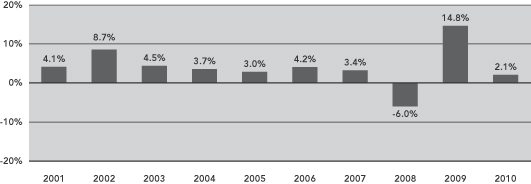

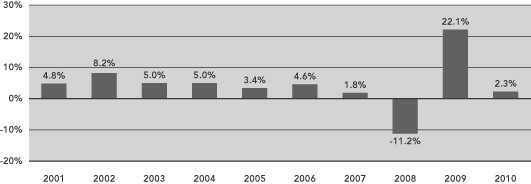

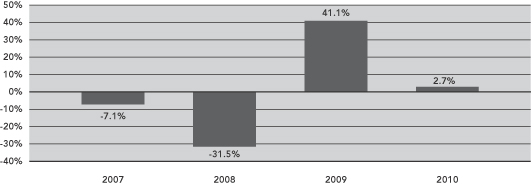

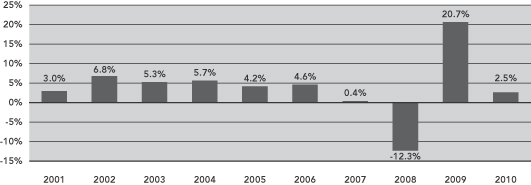

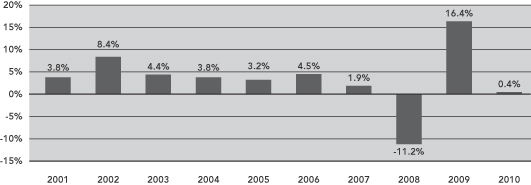

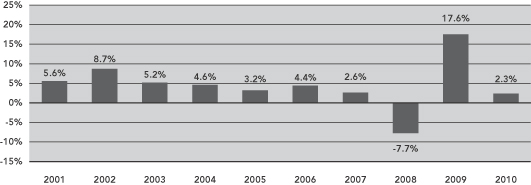

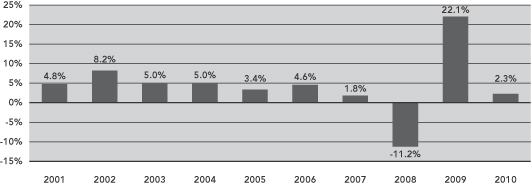

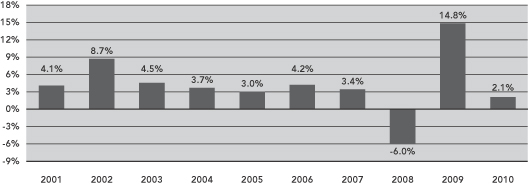

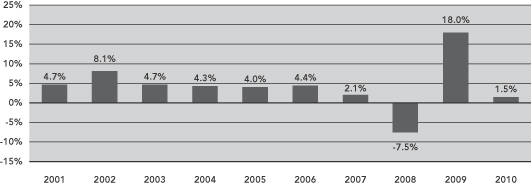

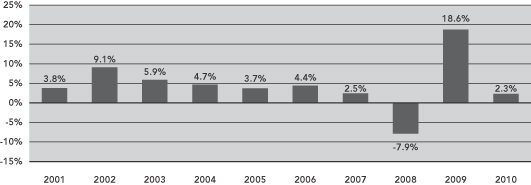

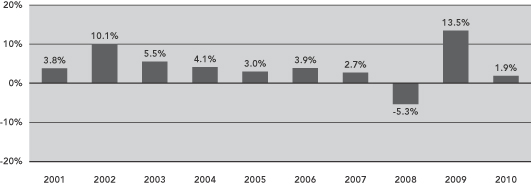

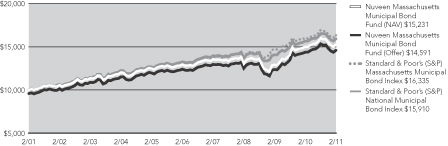

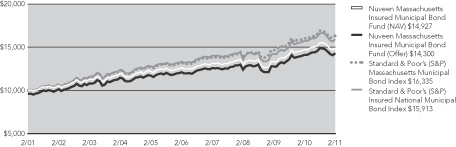

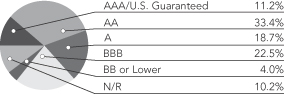

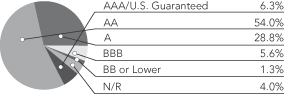

A comparison of the total returns of the Funds for the periods ended December 31, 2010, based on historical fees and expenses for each period, is set forth in the chart and tables below.

The bar chart below illustrates annual calendar year returns for each Fund’s Class A shares. The bar chart does not reflect sales charges, and if these charges were reflected, the returns would be less than those shown. The tables below illustrate average annual returns for the one-year, five-year and ten-year periods ended December 31, 2010 for each Fund. The tables also show how each Fund’s performance compares with the returns of broad measures of market performance and a peer group of funds with similar investment objectives. This information is intended to help you assess the variability of Fund returns (and consequently, the potential rewards and risks of a Fund investment).

Returns before taxes do not reflect the effects of any income or capital gains taxes. All after-tax returns are calculated using the highest historical marginal individual federal income tax rates and do not reflect the impact of any state or local tax. After-tax returns are shown for Class A shares only; after-tax returns for Class B, Class C and Class I shares will vary. Returns after taxes on distributions reflect the taxed return on the payment of dividends and capital gains. Returns after taxes on distributions and sale of shares assume you sold your shares at period end, and, therefore, are also adjusted for any capital gains or losses incurred on the sale of Fund shares. Returns for market indices do not include expenses, which are deducted from Fund returns, or taxes.

9

Your own actual after-tax returns will depend on your specific tax situation and may differ from what is shown here. After-tax returns are not relevant to investors who hold Fund shares in tax-deferred accounts such as individual retirement accounts (IRAs) or employer-sponsored retirement plans.

Past performance does not necessarily indicate future performance. Updated performance information is available at www.nuveen.com or by calling (800) 257-8787.

Total Returns

Acquired Fund Class A Annual Total Return

During the periods shown in the bar chart, the Acquired Fund’s highest and lowest calendar quarter returns were 6.86% and -4.26%, respectively, for the quarters ended September 30, 2009 and December 31, 2010. The Acquired Fund’s Class A year-to-date return through June 30, 2011 was 4.21%.

Acquiring Fund Class A Annual Total Return

During the periods shown in the bar chart, the Acquiring Fund’s highest and lowest calendar quarter returns were 10.56% and -6.24%, respectively, for the quarters ended September 30, 2009 and December 31, 2008. The Acquiring Fund’s Class A year-to-date return through June 30, 2011 was 3.78%.

10

| Average Annual Total Returns for the Periods Ended December 31, 2010 | ||||||||||||

Acquired Fund | 1 Year | 5 Years | 10 Years | |||||||||

Class A (return before taxes) | -2.13 | % | 2.62 | % | 3.70 | % | ||||||

Class A (return after taxes on distributions) | -2.23 | % | 2.50 | % | 3.62 | % | ||||||

Class A (return after taxes on distributions and sale of fund shares) | 0.05 | % | 2.76 | % | 3.73 | % | ||||||

Class B (return before taxes) | -2.64 | % | 2.54 | % | 3.52 | % | ||||||

Class C (return before taxes) | 1.48 | % | 2.93 | % | 3.56 | % | ||||||

Class I (return before taxes) | 2.31 | % | 3.71 | % | 4.35 | % | ||||||

Standard & Poor’s National Municipal Bond Index (reflects no deduction for fees, expenses or taxes) | 2.45 | % | 3.83 | % | 4.82 | % | ||||||

Standard & Poor’s Massachusetts Municipal Bond Index (reflects no deduction for fees, expenses or taxes) | 1.92 | % | 4.32 | % | 5.04 | % | ||||||

Lipper Massachusetts Municipal Debt Funds Average (reflects no deduction for taxes or certain expenses) | 0.82 | % | 2.94 | % | 3.93 | % | ||||||

| Average Annual Total Returns for the Periods Ended December 31, 2010 | ||||||||||||

Acquiring Fund | 1 Year | 5 Years | 10 Years | |||||||||

Class A (return before taxes) | -2.05 | % | 2.50 | % | 3.88 | % | ||||||

Class A (return after taxes on distributions) | -2.05 | % | 2.47 | % | 3.87 | % | ||||||

Class A (return after taxes on distributions and sale of fund shares) | 0.26 | % | 2.74 | % | 3.95 | % | ||||||

Class B (return before taxes) | -2.36 | % | 2.46 | % | 3.70 | % | ||||||

Class C (return before taxes) | 1.75 | % | 2.81 | % | 3.76 | % | ||||||

Class I (return before taxes) | 2.62 | % | 3.59 | % | 4.54 | % | ||||||

Standard & Poor’s National Municipal Bond Index (reflects no deduction for fees, expenses or taxes) | 2.45 | % | 3.83 | % | 4.82 | % | ||||||

Standard & Poor’s Massachusetts Municipal Bond Index (reflects no deduction for fees, expenses or taxes) | 1.92 | % | 4.32 | % | 5.04 | % | ||||||

Lipper Massachusetts Municipal Debt Funds Average (reflects no deduction for taxes or certain expenses) | 0.82 | % | 2.94 | % | 3.93 | % | ||||||

Investment Adviser and Sub-Adviser

Both Funds are managed by Nuveen Fund Advisors, which offers advisory and investment management services to a broad range of mutual fund clients. Nuveen Fund Advisors has overall responsibility for management of the Funds, oversees the management of the Funds’ portfolios, manages the Funds’ business affairs and provides certain clerical, bookkeeping and other administrative services. Nuveen Fund Advisors is located at 333 West Wacker Drive, Chicago, IL 60606. Nuveen Fund Advisors is a subsidiary of Nuveen. On November 13, 2007, Nuveen was acquired by investors led by Madison Dearborn Partners, LLC, which is a private equity investment firm based in Chicago, Illinois. The Nuveen family of advisers has been providing advice to investment companies since 1976.

Nuveen Fund Advisors has selected its affiliate, Nuveen Asset Management, LLC, located at 333 West Wacker Drive, Chicago, IL 60606, to serve as a sub-adviser to each of the Funds. Nuveen Asset Management, LLC manages the investment of the Funds’ assets on a discretionary basis, subject to the supervision of Nuveen Fund Advisors.

11

Michael S. Hamilton, Senior Vice President of Nuveen Asset Management, is the portfolio manager of the Funds. Mr. Hamilton has been a portfolio manager of the Funds since January 2011. He entered the financial services industry with FAF Advisors, Inc. (“FAF”) in 1989, and joined Nuveen Asset Management on January 1, 2011 in connection with Nuveen’s acquisition of a portion of FAF’s asset management business. He manages 17 Nuveen-sponsored investment companies, with a total of approximately $1.6 billion under management.

For a complete description of the advisory services provided to the Acquiring Fund, see the section of the Funds’ Prospectus entitled “Who Manages the Funds” and the section of the Funds’ Statement of Additional Information entitled “Investment Adviser and Sub-Adviser.”

Pursuant to an investment management agreement between Nuveen Fund Advisors and the Trust, on behalf of the Acquired Fund and the Acquiring Fund, each Fund pays Nuveen Fund Advisors fund-level fees, payable monthly, at the same annual rates, as set forth below:

| Management Fee | ||||

Average Daily Net Assets | ||||

For the first $125 million | 0.3500 | % | ||

For the next $125 million | 0.3375 | % | ||

For the next $250 million | 0.3250 | % | ||

For the next $500 million | 0.3125 | % | ||

For the next $1 billion | 0.3000 | % | ||

For the next $3 billion | 0.2750 | % | ||

For net assets over $5 billion | 0.2500 | % | ||

In addition to the fund-level fee, each Fund pays a complex-level fee, which is the same for each Fund. The maximum complex-level fee is 0.20% of the Fund’s net assets, based upon complex-level “eligible assets” of $55 billion. Therefore, the maximum management fee rate for each Fund is the fund-level fee rate plus 0.20%. As complex-level eligible assets increase, the complex-level fee rate decreases pursuant to a breakpoint schedule.

For the fiscal year ended February 28, 2011, each Fund paid Nuveen Fund Advisors a management fee at a rate of 0.53% of average net assets.

Pursuant to the investment management agreement, Nuveen Fund Advisors has agreed to waive fees and/or reimburse expenses so that total annual Fund operating expenses (excluding Rule 12b-1 distribution and service fees, interest, taxes, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 0.750% of the average daily net assets of any class of Acquiring Fund shares and 0.975% of the average daily net assets of any class of Acquired Fund shares. These expense limitations may be terminated or modified only with the approval of shareholders of the respective Fund. Thus, the Acquiring Fund expense limitation will remain in place following the Reorganization.

Each Fund has adopted a distribution and service plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act. The Plan provides that Class B shares and Class C shares are subject to a distribution fee, and that Class A shares, Class B shares and Class C shares are each subject to a service fee. Class I shares are not subject to either distribution or service fees.

12

Under the Plan, each Fund is authorized to pay an annual rate not to exceed (a) 0.20% of the average daily net assets of the Class A shares as a service fee, (b) 0.75% of the average daily net assets of the Class B shares as a distribution fee and 0.20% of the average daily net assets of the Class B shares as a service fee, and (c) 0.55% of the average daily net assets of the Class C shares as a distribution fee and 0.20% of the average daily net assets of the Class C shares as a service fee. For a complete description of these arrangements for the Acquiring Fund, see the section of the Fund’s Prospectus entitled “What Share Classes We Offer” and the section of the Fund’s Statement of Additional Information entitled “Distribution and Service Plans.”

Both Funds are series of the Trust and, as a result, have the same Board and the same officers. The management of each Fund, including general oversight of the duties performed by Nuveen Fund Advisors under the Investment Management Agreement for each Fund, is the responsibility of the Board. There are currently ten members of the Board, one of whom is an “interested person” (as defined in the 1940 Act) and nine of whom are not interested persons (the “independent board members”). The names and business addresses of the board members and officers of the Funds and their principal occupations and other affiliations during the past five years are set forth under “Management” in the Statement of Additional Information for the Funds incorporated herein by reference.

Distribution, Purchase, Redemption, Exchange of Shares and Dividends

Each Fund offers four classes of shares: Class A, Class B, Class C and Class I shares. You may purchase, redeem or exchange shares of the Funds on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange shares of each Fund through a financial advisor or other financial intermediary or directly from such Fund. Class B shares are available only through exchanges and dividend reinvestments by current Class B shareholders. Each Fund’s initial and subsequent investment minimums generally are as follows, although each Fund may reduce or waive the minimums in some cases:

Class A and Class C | Class I | |||

| Eligibility and Minimum Initial Investment | $3,000 for all accounts | Available only through fee-based programs and to other limited categories of investors as described in the prospectus.

$100,000 for all accounts except:

• $250 for clients of financial intermediaries and family offices that have accounts holding Class I shares with an aggregate value of at least $100,000 (or that are expected to reach this level).

• No minimum for certain other categories of eligible investors as described in the prospectus. | ||

| Minimum Additional Investment | $100 | No minimum. |

For a complete description of purchase, redemption and exchange options, see the section of the Funds’ Prospectus entitled “How You Can Buy and Sell Shares,” “General Information” and “How to Sell Shares,” and the section of the Funds’ Statement of Additional Information entitled “Purchase and Redemption of Fund Shares.”

13

No initial sales charge or contingent deferred sales charges will be imposed on shares of the Acquiring Fund received or shares of the Acquired Fund exchanged in connection with the Reorganization. The holding period for Class B shares and Class C shares and the conversion period for Class B shares of the Acquiring Fund received in connection with the Reorganization will include the period during which the Acquired Fund shares exchanged were held by such shareholder.

The Funds intend to pay income dividends on a monthly basis. The Funds declare and pay any taxable capital gains or other taxable distributions once a year at year end. If the Reorganization is approved by the shareholders of the Acquired Fund, the Acquired Fund intends to distribute to its shareholders, prior to the closing of the Reorganization, all its net investment income and net capital gains, if any, for the period ending on the Closing Date.

Distributions paid by the Funds that are properly designated as exempt-interest dividends will generally be exempt from regular federal and Massachusetts state income tax. Each Fund intends to invest its assets in a manner such that a significant portion of its distributions to shareholders will generally be exempt-interest dividends. All or a portion of these distributions, however, may be subject to the federal alternative minimum tax. The Funds’ distributions that are not designated as exempt-interest dividends are generally taxed as ordinary income or capital gains for regular federal income tax purposes.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of a Fund through a broker-dealer or other financial intermediary (such as a bank or financial advisor), the Fund, its distributor or its investment adviser may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your financial advisor or visit your financial intermediary’s website for more information.

Additional information concerning the Acquiring Fund and Acquired Fund is contained in this Proxy Statement/Prospectus and additional information regarding the Acquiring Fund is contained in the accompanying Fund’s Prospectus. The cover page of this Proxy Statement/Prospectus describes how you may obtain further information.

The proposed Reorganization will be governed by the Agreement, which is attached as Appendix I. The Agreement provides that the Acquired Fund will transfer all its assets to the Acquiring Fund solely in exchange for the issuance of full and fractional voting shares of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Acquired Fund. The closing of the Reorganization will take place at the close of business on the Closing Date. The following discussion of the Agreement is qualified in its entirety by the full text of the Agreement.

The Acquired Fund will transfer all its assets to the Acquiring Fund, and in exchange, the Acquiring Fund will assume all the liabilities of the Acquired Fund and deliver to the Acquired Fund a number of full and fractional shares of the Acquiring Fund having a net asset value equal to the value of the assets of the Acquired Fund less the liabilities of the Acquired Fund assumed by the Acquiring

14

Fund. On or as soon after the Closing Date as is practicable, but in no event later than 12 months after the Closing Date, the Acquired Fund will distribute in complete liquidation of the Acquired Fund, pro rata to its shareholders of record, all Acquiring Fund shares received by the Acquired Fund. This distribution will be accomplished by the transfer of the Acquiring Fund shares credited to the account of the Acquired Fund on the books of the Acquiring Fund to open accounts on the share records of the Acquiring Fund in the name of the Acquired Fund shareholders, and representing the respective pro rata number of Acquiring Fund shares due such shareholders. All issued and outstanding shares of the Acquired Fund will simultaneously be canceled on the books of the Acquired Fund. As a result of the proposed Reorganization, each Acquired Fund shareholder will receive a number of Acquiring Fund shares of the same class and equal in value, as of the close of regular trading on the New York Stock Exchange on the Closing Date, to the value of the Acquired Fund shares of the corresponding class surrendered by such shareholder.

The Board has determined that the proposed Reorganization is in the best interests of each Fund and that the interests of shareholders will not be diluted as a result of the transactions contemplated by the Agreement.

The consummation of the Reorganization is subject to the terms and conditions of, and the representations and warranties being true as set forth in, the Agreement. The Agreement may be terminated by mutual agreement of the Funds. In addition, either Fund may at its option terminate the Agreement at or before the Closing Date due to (i) a breach by any other party of any representation, warranty, or agreement to be performed at or before the Closing Date, if not cured within 30 days, (ii) a condition precedent to the obligations of the terminating party that has not been met and it reasonably appears that it will not or cannot be met, or (iii) a determination by the Board that the consummation of the transactions contemplated by the Agreement is not in the best interests of a Fund.

The Acquired Fund will, within a reasonable period of time before the Closing Date, furnish the Acquiring Fund with a list of the Acquired Fund’s portfolio securities and other investments. The Acquiring Fund will, within a reasonable period of time before the Closing Date, furnish the Acquired Fund with a list of the securities, if any, on the Acquired Fund’s list referred to above that do not conform to the Acquiring Fund’s investment objective, policies, and restrictions. The Acquired Fund, if requested by the Acquiring Fund, will dispose of securities on the Acquiring Fund’s list before the Closing Date. In addition, if it is determined that the portfolios of the Funds, when aggregated, would contain investments exceeding certain percentage limitations imposed upon the Acquiring Fund with respect to such investments, the Acquired Fund, if requested by the Acquiring Fund, will dispose of a sufficient amount of such investments as may be necessary to avoid violating such limitations as of the Closing Date. The sale of such investments could result in taxable distributions to shareholders of the Acquired Fund prior to the Reorganization. Notwithstanding the foregoing, nothing in the Agreement will require the Acquired Fund to dispose of any investments or securities if, in the reasonable judgment of the Board or the Adviser, such disposition would adversely affect the tax-free nature of the Reorganization for federal income tax purposes or would otherwise not be in the best interests of the Acquired Fund. See “Certain Federal Income Tax Consequences” below. However, it is not expected that any significant portfolio sales will occur in connection with the Reorganization.

If the Reorganization is approved, each of the Acquired Fund and Acquiring Fund will be charged expenses incurred in connection with the Reorganization ratably up to each Fund’s projected cost savings during the first year following the Reorganization. See “Reorganization Expenses” below. In addition, the Reorganization may result in one-time brokerage costs for the Acquired Fund to the extent it is necessary for the Acquired Fund to sell securities prior to the Reorganization so that the

15

Acquiring Fund’s portfolio immediately following the Reorganization remains in compliance with its investment policies and restrictions. However, if the Reorganization had occurred as of , 2011, the Acquiring Fund would not have been required to dispose of securities of the Acquiring Fund in order to comply with its investment policies and restrictions, and would not have sold any material portion of the securities in the Acquired Fund’s portfolio solely as a result of the Reorganization.

After the Reorganization is completed, the portfolio manager of the Acquiring Fund may, in his discretion, sell securities acquired from the Acquired Fund. To the extent that the portfolio manager chooses to sell a significant percentage of such securities, the Acquiring Fund’s portfolio turnover rate and brokerage costs may be higher than they otherwise would have been.

Description of Securities to be Issued

Shares of Beneficial Interest. The Acquiring Fund has established and designated Class A, Class B, Class C and Class I shares, par value $0.01 per share. The Trust’s Declaration of Trust permits the Board, in its sole discretion, and subject to compliance with the 1940 Act, to further subdivide the shares of the Acquiring Fund into one or more other classes of shares.

Voting Rights of Shareholders. Holders of shares of the Acquiring Fund are entitled to one vote per share on matters as to which they are entitled to vote, with fractional shares voting proportionally. The Acquiring Fund operates as a series of the Trust, an open-end management investment company registered with the SEC under the 1940 Act. The Trust currently has ten series, including the Acquiring Fund, and the Board may, in its sole discretion, create additional series from time to time. Separate votes generally are taken by each series on matters affecting an individual series. In addition to the specific voting rights described above, shareholders of the Acquiring Fund are entitled, under current law, to vote with respect to certain other matters, including changes in fundamental investment policies and restrictions. Moreover, under the 1940 Act, shareholders owning not less than 10% of the outstanding shares of the Trust may request that the Board call a shareholders’ meeting for the purpose of voting upon the removal of one or more board members.

Continuation of Shareholder Accounts and Plans; Share Certificates

If the Reorganization is approved, the Acquiring Fund will establish an account for each Acquired Fund shareholder containing the appropriate number of shares of the appropriate class of the Acquiring Fund. The shareholder services and shareholder programs of the Funds are identical. Shareholders of the Acquired Fund who are accumulating shares through systematic investing, or who are receiving payments under the systematic withdrawal plan, will retain the same rights and privileges after the Reorganization through plans maintained by the Acquiring Fund. No certificates for Acquiring Fund shares will be issued as part of the Reorganization.

State Street Bank & Trust Company serves as the custodian for the Funds and Boston Financial Data Services serves as transfer agent for the Funds. PricewaterhouseCoopers LLP serves as the independent auditors for the Funds.

Certain Federal Income Tax Consequences

As a condition to each Fund’s obligation to consummate the Reorganization, each Fund will receive a tax opinion from Vedder Price P.C. (which opinion will be based on certain factual

16

representations and certain customary assumptions and exclusions) substantially to the effect that, on the basis of the existing provisions of the Internal Revenue Code of 1986, as amended (the “Code”), current administrative rules and court decisions, for federal income tax purposes:

| 1. | The transfer of all the assets of the Acquired Fund to the Acquiring Fund in exchange solely for Acquiring Fund shares and the assumption by the Acquiring Fund of all the liabilities of the Acquired Fund, followed by the pro rata distribution to the Acquired Fund shareholders of all the Acquiring Fund shares received by the Acquired Fund in complete liquidation of the Acquired Fund, will constitute a “reorganization” within the meaning of Section 368(a) of the Code, and the Acquiring Fund and the Acquired Fund will each be a “party to a reorganization” within the meaning of Section 368(b) of the Code with respect to the Reorganization. |

| 2. | No gain or loss will be recognized by the Acquiring Fund upon the receipt of all the assets of the Acquired Fund solely in exchange for Acquiring Fund shares and the assumption by the Acquiring Fund of all the liabilities of the Acquired Fund. |

| 3. | No gain or loss will be recognized by the Acquired Fund upon the transfer of all the Acquired Fund’s assets to the Acquiring Fund solely in exchange for Acquiring Fund shares and the assumption by the Acquiring Fund of all the liabilities of the Acquired Fund or upon the distribution (whether actual or constructive) of all such Acquiring Fund shares to the Acquired Fund shareholders solely in exchange for such shareholders’ shares of the Acquired Fund in complete liquidation of the Acquired Fund. |

| 4. | No gain or loss will be recognized by Acquired Fund shareholders upon the exchange of their Acquired Fund shares solely for Acquiring Fund shares pursuant to the Reorganization. |

| 5. | The aggregate basis of the Acquiring Fund shares received by each Acquired Fund shareholder pursuant to the Reorganization will be the same as the aggregate basis of the Acquired Fund shares exchanged therefor by such shareholder. The holding period of the Acquiring Fund shares received by each Acquired Fund shareholder will include the period during which the Acquired Fund shares exchanged therefor were held by such shareholder, provided such Acquired Fund shares are held as capital assets at the effective time of the Reorganization. |

| 6. | The basis of the Acquired Fund’s assets acquired by the Acquiring Fund will be the same as the basis of such assets to the Acquired Fund immediately before the Reorganization. The holding period of the assets of the Acquired Fund in the hands of the Acquiring Fund will include the period during which those assets were held by the Acquired Fund. |

Prior to the closing of the Reorganization, the Acquired Fund will declare a distribution to its shareholders, which together with all previous distributions, will have the effect of distributing to shareholders all its net investment income and realized net capital gains (after reduction by any available capital loss carryforwards), if any, through the closing of the Reorganization. Except to the extent this distribution is designated as an exempt-interest dividend, it will be taxable to shareholders

17

for regular federal income tax purposes and may include net capital gains resulting from the sale of portfolio assets discussed below. All or a portion of this distribution may be subject to the federal alternative minimum tax. Additional distributions may be made if necessary. All dividends and distributions will be reinvested in additional shares of the Acquired Fund unless a shareholder has made an election to receive dividends and distributions in cash. Dividends and distributions are treated the same for federal income tax purposes whether received in cash or additional shares.

To the extent that a portion of the Acquired Fund’s portfolio assets are sold prior to the Reorganization, the federal income tax effect of such sales would depend on the holding periods of such assets and the difference between the price at which such portfolio assets were sold and the Fund’s basis in such assets. Any net capital gains (net long-term capital gain in excess of any net short-term capital loss) recognized in these sales, after the application of any available capital loss carryforwards (capital losses from prior taxable years that may be used to offset future capital gains), would be distributed to the Acquired Fund’s shareholders as capital gain dividends. Any net short-term capital gains (in excess of any net long-term capital loss and after application of any available capital loss carryforwards) would be distributed as ordinary dividends. All such distributions would be made during or with respect to the Acquired Fund’s taxable year in which the sale occurs and would be taxable to shareholders for federal income tax purposes.

After the Reorganization, the Acquiring Fund’s ability to use the Acquired Fund’s and Acquiring Fund’s pre-Reorganization capital losses, if any, may be limited under certain federal income tax rules applicable to reorganizations of this type. Therefore, in certain circumstances, former shareholders of the Acquired Fund may pay federal income tax sooner, or may pay more federal income taxes, than they would have had the Reorganization not occurred. The effect of these potential limitations, however, will depend on a number of factors, including the amount of the losses, the amount of gains to be offset, the exact timing of the Reorganization and the amount of unrealized capital gains in the Funds at the time of the Reorganization.

In addition, shareholders of the Acquired Fund will receive a proportionate share of any taxable income and gains realized by the Acquiring Fund and not distributed to its shareholders prior to the Reorganization when such income and gains are eventually distributed by the Acquiring Fund. As a result, shareholders of the Acquired Fund may receive a greater amount of taxable distributions than they would have had the Reorganization not occurred.

This description of the federal income tax consequences of the Reorganization is made without regard to the particular facts and circumstances of any shareholder. Shareholders are urged to consult their own tax advisors as to the specific consequences to them of the Reorganization, including the applicability and effect of state, local, non-U.S. and other tax laws.

The Acquired Fund, Acquiring Fund and Nuveen will be responsible for a portion of the expenses associated with the Reorganization, including, but not limited to, legal and auditing fees, the costs of printing and distributing this Proxy Statement/Prospectus, and the solicitation expenses discussed below, if the Reorganization is approved. Nuveen Fund Advisors estimates that expenses for the Reorganization will be approximately $121,000. It is anticipated that these expenses will be offset over time by the lower operating expenses of the Acquiring Fund that are expected to result after the Reorganization. Each of the Acquired Fund and Acquiring Fund will be responsible for expenses

18

incurred in connection with the Reorganization ratably up to each Fund’s projected cost savings during the first year following the Reorganization. If the Reorganization were completed on February 28, 2011, Nuveen Fund Advisors estimates that Acquired Fund shareholders, as shareholders of the Acquiring Fund, would save approximately $21,000 in the first year after the Reorganization and that Acquiring Fund shareholders would save approximately $21,000 in the first year after the Reorganization. Accordingly, if the Reorganization is approved or completed, the Acquired Fund will pay approximately $21,000 of the Reorganization costs and the Acquiring Fund will pay approximately $21,000 of the Reorganization costs. Nuveen will absorb the remaining Reorganization costs of approximately $79,000. If the Reorganization is not approved or completed, Nuveen will pay all costs associated with the Reorganization.