UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07755

Nuveen Multistate Trust II

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kathleen L. Prudhomme

Vice President and Secretary

901 Marquette Avenue

Minneapolis, Minnesota 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: February 28

Date of reporting period: February 28, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| Class / Ticker Symbol | |||||||

| Fund Name | Class A | Class C | Class C2 | Class I | |||

| Nuveen California High Yield Municipal Bond Fund | NCHAX | NAWSX | NCHCX | NCHRX | |||

| Nuveen California Municipal Bond Fund | NCAAX | NAKFX | NCACX | NCSPX | |||

| Nuveen California Intermediate Municipal Bond Fund | NUCAX | NUCCX | — | NUCIX | |||

NO BANK GUARANTEE

to Shareholders

Comments

and Dividend Information

and Effective Leverage Ratios

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | 0.25% | 6.73% | 4.31% |

| Class A Shares at maximum Offering Price | (4.00)% | 5.83% | 3.87% |

| S&P Municipal Yield Index | 4.42% | 5.80% | 4.61% |

| Lipper California Municipal Debt Fund Classification Average | 0.03% | 3.70% | 3.89% |

| Class C2 Shares | (0.30)% | 6.14% | 3.75% |

| Class I Shares | 0.44% | 6.95% | 4.52% |

| Average Annual | ||

| 1-Year | Since Inception | |

| Class C Shares | (0.44)% | 6.46% |

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

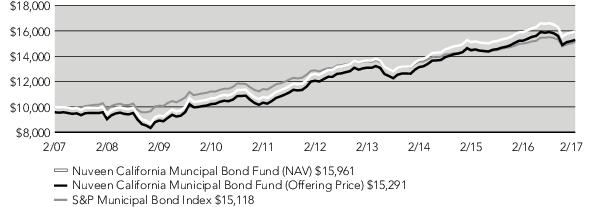

| Class A Shares at NAV | (0.36)% | 6.68% | 4.48% |

| Class A Shares at maximum Offering Price | (4.55)% | 5.76% | 4.03% |

| Class C2 Shares | (0.92)% | 6.10% | 3.89% |

| Class I Shares | (0.08)% | 6.90% | 4.67% |

| Average Annual | ||

| 1-Year | Since Inception | |

| Class C Shares | (1.16)% | 6.47% |

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Expense Ratios | 0.85% | 1.65% | 1.41% | 0.65% |

| Effective Leverage Ratio | 19.11% |

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | 0.36% | 4.84% | 4.78% |

| Class A Shares at maximum Offering Price | (3.88)% | 3.95% | 4.33% |

| S&P Municipal Bond Index | 0.76% | 3.25% | 4.22% |

| S&P Municipal Bond California Index | 0.35% | 3.90% | 4.53% |

| Lipper California Municipal Debt Funds Classification Average | 0.03% | 3.70% | 3.89% |

| Class C2 Shares | (0.22)% | 4.28% | 4.21% |

| Class I Shares | 0.61% | 5.07% | 4.99% |

| Average Annual | ||

| 1-Year | Since Inception | |

| Class C Shares | (0.38)% | 4.66% |

| Average Annual | |||

| 1-Year | 5-Year | 10-Year | |

| Class A Shares at NAV | (0.20)% | 5.02% | 4.85% |

| Class A Shares at maximum Offering Price | (4.39)% | 4.12% | 4.40% |

| Class C2 Shares | (0.78)% | 4.43% | 4.28% |

| Class I Shares | (0.04)% | 5.21% | 5.05% |

| Average Annual | ||

| 1-Year | Since Inception | |

| Class C Shares | (1.12)% | 4.60% |

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Expense Ratios | 0.76% | 1.56% | 1.31% | 0.56% |

| Effective Leverage Ratio | 0.00% |

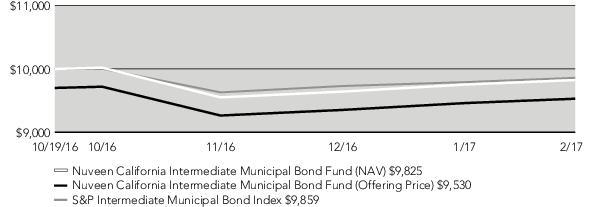

| Cumulative | ||

| Since Inception | ||

| Class A Shares at NAV | (1.75)% | |

| Class A Shares at maximum Offering Price | (4.70)% | |

| S&P Municipal Bond Intermediate Index | (1.41)% | |

| S&P Municipal Bond California Index | (1.53)% | |

| Lipper California Intermediate Municipal Debt Classification Average | (1.70)% | |

| Class C Shares | (2.42)% | |

| Class I Shares | (1.69)% |

| Cumulative | ||

| Since Inception | ||

| Class A Shares at NAV | (1.34)% | |

| Class A Shares at maximum Offering Price | (4.30)% | |

| Class C Shares | (2.17)% | |

| Class I Shares | (1.27)% |

| Share Class | |||

| Class A | Class C | Class I | |

| Gross Expense Ratios | 1.07% | 1.87% | 0.87% |

| Net Expense Ratios | 0.80% | 1.60% | 0.60% |

| Effective Leverage Ratio | 0.00% |

| Share Class | ||||

| Class A1 | Class C | Class C2 | Class I | |

| Dividend Yield | 3.75% | 3.08% | 3.34% | 4.11% |

| SEC 30-Day Yield - Subsidized | 3.65% | 3.01% | 3.26% | 4.01% |

| SEC 30-Day Yield - Unsubsidized | 3.65% | 3.01% | 3.26% | 4.01% |

| Taxable-Equivalent Yield - Subsidized (34.7)%2 | 5.59% | 4.61% | 4.99% | 6.14% |

| Taxable-Equivalent Yield - Unsubsidized (34.7)%2 | 5.59% | 4.61% | 4.99% | 6.14% |

| Share Class | ||||

| Class A1 | Class C | Class C2 | Class I | |

| Dividend Yield | 3.03% | 2.35% | 2.57% | 3.32% |

| SEC 30-Day Yield - Subsidized | 2.22% | 1.53% | 1.78% | 2.52% |

| SEC 30-Day Yield - Unsubsidized | 2.22% | 1.53% | 1.78% | 2.52% |

| Taxable-Equivalent Yield - Subsidized (34.7)%2 | 3.40% | 2.34% | 2.73% | 3.86% |

| Taxable-Equivalent Yield - Unsubsidized (34.7)%2 | 3.40% | 2.34% | 2.73% | 3.86% |

| Share Class | |||

| Class A1 | Class C | Class I | |

| Dividend Yield | 1.31% | 0.55% | 1.53% |

| SEC 30-Day Yield - Subsidized | 1.80% | 0.08% | 2.05% |

| SEC 30-Day Yield - Unsubsidized | (0.13)% | (1.90)% | 0.06% |

| Taxable-Equivalent Yield - Subsidized (34.7)%2 | 2.76% | 0.12% | 3.14% |

| Taxable-Equivalent Yield - Unsubsidized (34.7)%2 | (0.20)% | (2.91)% | 0.09% |

| Fund Allocation (% of net assets) | |

| Long-Term Municipal Bonds | 106.3% |

| Common Stocks | 0.5% |

| Other Assets Less Liabilities | 4.1% |

| Net Assets Plus Floating Rate Obligations | 110.9% |

| Floating Rate Obligations | (10.9)% |

| Net Assets | 100% |

| Portfolio Composition (% of total investments) | |

| Tax Obligation/Limited | 36.8% |

| Health Care | 13.9% |

| Education and Civic Organizations | 10.1% |

| Consumer Staples | 9.4% |

| Transportation | 8.4% |

| Tax Obligation/General | 6.6% |

| Other | 14.8% |

| Total | 100% |

| Bond Credit Quality (% of total investment exposure) | |

| AAA/U.S. Guaranteed | 4.2% |

| AA | 32.4% |

| A | 9.6% |

| BBB | 9.0% |

| BB or Lower | 16.8% |

| N/R (not rated) | 27.6% |

| N/A (not applicable) | 0.4% |

| Total | 100% |

| Fund Allocation (% of net assets) | |

| Long-Term Municipal Bonds | 99.0% |

| Other Assets Less Liabilities | 1.4% |

| Net Assets Plus Borrowings | 100.4% |

| Borrowings | (0.4)% |

| Net Assets | 100% |

| Portfolio Composition (% of total investments) | |

| Tax Obligation/General | 23.8% |

| Tax Obligation/Limited | 23.3% |

| Health Care | 12.2% |

| U.S. Guaranteed | 11.5% |

| Water and Sewer | 9.3% |

| Consumer Staples | 6.5% |

| Transportation | 5.1% |

| Other | 8.3% |

| Total | 100% |

| Bond Credit Quality (% of total investment exposure) | |

| AAA/U.S. Guaranteed | 16.0% |

| AA | 46.5% |

| A | 13.2% |

| BBB | 9.7% |

| BB or Lower | 10.2% |

| N/R (not rated) | 4.4% |

| Total | 100% |

| Fund Allocation (% of net assets) | |

| Long-Term Municipal Bonds | 102.5% |

| Other Assets Less Liabilities | (2.5)% |

| Net Assets | 100% |

| Portfolio Composition (% of total investments) | |

| Tax Obligation/Limited | 35.7% |

| U.S. Guaranteed | 20.5% |

| Health Care | 16.8% |

| Water and Sewer | 11.2% |

| Education and Civic Organizations | 6.2% |

| Consumer Staples | 5.9% |

| Other | 3.7% |

| Total | 100% |

| Bond Credit Quality (% of total investment exposure) | |

| AAA/U.S. Guaranteed | 20.5% |

| AA | 27.4% |

| A | 22.6% |

| BBB | 16.3% |

| BB or Lower | 8.0% |

| N/R (not rated) | 5.2% |

| Total | 100% |

Examples

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Actual Performance | ||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $ 943.30 | $ 940.40 | $ 941.50 | $ 944.20 |

| Expenses Incurred During the Period | $ 4.19 | $ 8.03 | $ 6.84 | $ 3.18 |

| Hypothetical Performance (5% annualized return before expenses) | ||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,020.48 | $1,016.51 | $1,017.75 | $1,021.52 |

| Expenses Incurred During the Period | $ 4.36 | $ 8.35 | $ 7.10 | $ 3.31 |

| Share Class | ||||

| Class A | Class C | Class C2 | Class I | |

| Actual Performance | ||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $ 960.90 | $ 957.40 | $ 957.90 | $ 962.50 |

| Expenses Incurred During the Period | $ 3.65 | $ 7.52 | $ 6.31 | $ 2.68 |

| Hypothetical Performance (5% annualized return before expenses) | ||||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,021.08 | $1,017.11 | $1,018.35 | $1,022.07 |

| Expenses Incurred During the Period | $ 3.76 | $ 7.75 | $ 6.51 | $ 2.76 |

| Share Class | |||

| Class A | Class C | Class I | |

| Actual Performance | |||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $ 982.50 | $ 975.80 | $ 983.10 |

| Expenses Incurred During the Period | $ 3.74 | $ 7.64 | $ 2.75 |

| Hypothetical Performance (5% annualized return before expenses) | |||

| Beginning Account Value | $1,000.00 | $1,000.00 | $1,000.00 |

| Ending Account Value | $1,021.03 | $1,017.06 | $1,022.02 |

| Expenses Incurred During the Period | $ 2.80 | $ 5.73 | $ 2.06 |

Independent Registered Public Accounting Firm

| Portfolio of Investments | February 28, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| LONG-TERM INVESTMENTS–106.8% | ||||||

| MUNICIPAL BONDS–106.3% | ||||||

| Consumer Discretionary–0.2% | ||||||

| Louisiana Local Government Environmental Facilities and Community Development Authority, Revenue Bonds, Southgate Suites Retail Project, Series 2007A: | ||||||

| $ 1,000 | 6.750%, 12/15/37 (4) | 12/17 at 100.00 | N/R | $649,900 | ||

| 160 | 6.000%, 12/15/37 (4) | 5/17 at 100.00 | N/R | 79,984 | ||

| 15 | Louisiana Local Government Environmental Facilities and Community Development Authority, Revenue Bonds, Southgate Suites Retail Project, Series 2007B, 9.000%, 12/15/14 (4) | No Opt. Call | N/R | 7,499 | ||

| 500 | Morongo Band of Mission Indians, California, Enterprise Revenue Bonds, Series 2008B, 6.500%, 3/01/28 | 3/18 at 100.00 | N/R | 520,270 | ||

| 1,675 | Total Consumer Discretionary | 1,257,653 | ||||

| Consumer Staples–10.1% | ||||||

| 27,000 | California County Tobacco Securitization Agency, Tobacco Settlement Asset-Backed Bonds, Alameda County Tobacco Asset Securitization Corporation, Subordinate Series 2006A, 0.000%, 6/01/50 | 5/17 at 13.28 | N/R | 2,381,940 | ||

| 1,155 | California County Tobacco Securitization Agency, Tobacco Settlement Asset-Backed Bonds, Golden Gate Tobacco Funding Corporation, Turbo, Series 2007A, 5.000%, 6/01/47 | 6/17 at 100.00 | N/R | 1,092,156 | ||

| California County Tobacco Securitization Agency, Tobacco Settlement Asset-Backed Bonds, Los Angeles County Securitization Corporation, Series 2006A: | ||||||

| 25 | 5.600%, 6/01/36 | 12/18 at 100.00 | B3 | 25,460 | ||

| 1,000 | 5.650%, 6/01/41 | 12/18 at 100.00 | B2 | 1,018,390 | ||

| 1,205 | 5.700%, 6/01/46 | 12/18 at 100.00 | B2 | 1,206,097 | ||

| 1,860 | California County Tobacco Securitization Agency, Tobacco Settlement Asset-Backed Bonds, Merced County Tobacco Funding Corporation, Series 2005A, 5.125%, 6/01/38 | 5/17 at 100.00 | B1 | 1,810,543 | ||

| 50 | California County Tobacco Securitization Agency, Tobacco Settlement Asset-Backed Bonds, Sonoma County Tobacco Securitization Corporation, Series 2005, 5.250%, 6/01/45 | 5/17 at 100.00 | B- | 48,527 | ||

| 20,000 | California County Tobacco Securitization Agency, Tobacco Settlement Asset-Backed Bonds, Stanislaus County Tobacco Funding Corporation, Series 2006A, 0.000%, 6/01/46 | 5/17 at 100.00 | N/R | 2,690,600 | ||

| Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Bonds, Series 2007A-1: | ||||||

| 10,250 | 5.000%, 6/01/33 | 6/17 at 100.00 | B- | 10,250,205 | ||

| 7,890 | 5.750%, 6/01/47 | 6/17 at 100.00 | B- | 7,930,239 | ||

| 15,250 | 5.125%, 6/01/47 | 6/17 at 100.00 | B- | 15,249,085 | ||

| 14,400 | Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Bonds, Series 2007A-2, 5.300%, 6/01/37 | 6/22 at 100.00 | B- | 14,448,528 | ||

| 19,050 | Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Revenue Bonds, First Subordinate Series 2007B-1, 0.000%, 6/01/47 | 6/17 at 17.48 | CCC+ | 2,589,657 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Consumer Staples (continued) | ||||||

| $ 2,000 | Guam Economic Development & Commerce Authority, Tobacco Settlement Asset-Backed Bonds, Series 2007A, 5.625%, 6/01/47 | 6/17 at 100.00 | N/R | $1,899,960 | ||

| 22,000 | Inland Empire Tobacco Securitization Authority, California, Tobacco Settlement Asset-Backed Bonds, Series 2007C-2, 0.000%, 6/01/47 | 6/17 at 13.65 | N/R | 2,691,700 | ||

| Silicon Valley Tobacco Securitization Authority, California, Tobacco Settlement Asset-Backed Bonds, Santa Clara County Tobacco Securitization Corporation, Series 2007A: | ||||||

| 1,000 | 0.000%, 6/01/36 | 6/17 at 34.85 | N/R | 341,660 | ||

| 7,500 | 0.000%, 6/01/47 | 6/17 at 18.52 | N/R | 953,475 | ||

| Tobacco Securitization Authority of Northern California, Tobacco Settlement Asset-Backed Bonds, Series 2005A-1: | ||||||

| 1,800 | 5.375%, 6/01/38 | 5/17 at 100.00 | B- | 1,768,734 | ||

| 460 | 5.500%, 6/01/45 | 5/17 at 100.00 | B- | 444,047 | ||

| Tobacco Securitization Authority of Southern California, Tobacco Settlement Asset-Backed Bonds, San Diego County Tobacco Asset Securitization Corporation, Senior Series 2006A: | ||||||

| 3,295 | 5.000%, 6/01/37 | 5/17 at 100.00 | BB+ | 3,294,835 | ||

| 10,330 | 5.125%, 6/01/46 | 5/17 at 100.00 | B+ | 10,290,333 | ||

| 167,520 | Total Consumer Staples | 82,426,171 | ||||

| Education and Civic Organizations–10.7% | ||||||

| 1,065 | California Educational Facilities Authority, Revenue Bonds, Dominican University, Series 2006, 5.000%, 12/01/36 | 5/17 at 100.00 | Ba1 | 1,068,280 | ||

| 2,000 | California Infrastructure and Economic Development Bank, Revenue Bonds, Academy of Motion Picture Arts and Sciences Obligated Group, Series 2015A, 5.000%, 11/01/41 | 11/23 at 100.00 | Aa2 | 2,271,340 | ||

| California Municipal Finance Authority Charter School Revenue Bonds, John Adams Academies, Inc. Project, Series 2015A: | ||||||

| 900 | 5.000%, 10/01/35 | 10/22 at 102.00 | BBB- | 927,468 | ||

| 1,335 | 5.250%, 10/01/45 | 10/22 at 102.00 | BBB- | 1,383,087 | ||

| 500 | 5.250%, 10/01/45 | 10/22 at 102.00 | BBB- | 518,010 | ||

| 1,000 | California Municipal Finance Authority, Charter School Lease Revenue Bonds, Nova Academy Project, Series 2016A, 5.000%, 6/15/46 | 6/26 at 100.00 | BB+ | 957,300 | ||

| 1,000 | California Municipal Finance Authority, Charter School Lease Revenue Bonds, Rocketship 7-Alma Academy Elementary School, Series 2012A, 6.250%, 6/01/43 | 12/21 at 101.00 | N/R | 1,069,460 | ||

| California Municipal Finance Authority, Charter School Lease Revenue Bonds, Santa Rosa Academy Project, Series 2015: | ||||||

| 400 | 5.125%, 7/01/35 | 7/25 at 100.00 | BB+ | 411,176 | ||

| 425 | 5.375%, 7/01/45 | 7/25 at 100.00 | BB+ | 437,924 | ||

| California Municipal Finance Authority, Charter School Revenue Bonds, John Adams Academies, Inc. Project, Series 2014A: | ||||||

| 1,400 | 5.000%, 10/01/34 | 10/22 at 102.00 | BBB- | 1,442,728 | ||

| 465 | 5.000%, 10/01/44 | 10/22 at 102.00 | BBB- | 474,398 | ||

| 1,145 | California Municipal Finance Authority, Charter School Revenue Bonds, Palmdale Aerospace Academy Project, Series 2016A, 5.000%, 7/01/46 | 7/26 at 100.00 | BB | 1,150,233 |

| Portfolio of Investments | February 28, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Education and Civic Organizations (continued) | ||||||

| California Municipal Finance Authority, Charter School Revenue Bonds, Partnerships to Uplift Communities Project, Series 2012A: | ||||||

| $ 1,330 | 5.000%, 8/01/32 | No Opt. Call | BB | $1,357,398 | ||

| 4,580 | 5.250%, 8/01/42 | No Opt. Call | BB | 4,673,661 | ||

| 1,795 | 5.300%, 8/01/47 | 8/22 at 100.00 | BB | 1,831,654 | ||

| 2,245 | California Municipal Finance Authority, Charter School Revenue Bonds, Rocketship Education, Multiple Projects, Series 2014A, 7.000%, 6/01/34 | 6/22 at 102.00 | N/R | 2,515,814 | ||

| California Municipal Finance Authority, Charter School Revenue Bonds, Urban Discovery Academy Project, Series 2014A: | ||||||

| 875 | 5.500%, 8/01/34 | 8/24 at 100.00 | BB- | 878,010 | ||

| 1,650 | 6.000%, 8/01/44 | 8/24 at 100.00 | BB- | 1,680,310 | ||

| California Municipal Finance Authority, Education Revenue Bonds, American Heritage Foundation Project, Series 2016A: | ||||||

| 840 | 5.000%, 6/01/36 | 6/26 at 100.00 | BBB- | 895,188 | ||

| 1,415 | 5.000%, 6/01/46 | 6/26 at 100.00 | BBB- | 1,492,358 | ||

| 1,335 | California Municipal Finance Authority, Educational Facilities Revenue Bonds, OCEAA Project, Series 2008A, 7.000%, 10/01/39 | 10/18 at 100.00 | N/R | 1,370,551 | ||

| California Municipal Finance Authority, Revenue Bonds, Azusa Pacific University Project, Refunding Series 2015B: | ||||||

| 1,435 | 5.000%, 4/01/35 | 4/25 at 100.00 | Baa3 | 1,516,723 | ||

| 770 | 5.000%, 4/01/41 | 4/25 at 100.00 | Baa3 | 806,783 | ||

| 1,500 | California Municipal Finance Authority, Revenue Bonds, Biola University, Refunding Series 2008A, 5.875%, 10/01/34 | 4/18 at 100.00 | Baa1 | 1,565,835 | ||

| 1,880 | California Municipal Finance Authority, Revenue Bonds, California Baptist University, Series 2016A, 5.000%, 11/01/46 | 11/26 at 100.00 | N/R | 1,869,547 | ||

| California Municipal Finance Authority, Revenue Bonds, Creative Center of Los Altos Project, Pinewood & Oakwood Schools, Series 2016B: | ||||||

| 500 | 4.000%, 11/01/36 | 11/26 at 100.00 | N/R | 457,770 | ||

| 600 | 4.500%, 11/01/46 | 11/26 at 100.00 | N/R | 549,492 | ||

| 1,290 | California Municipal Finance Authority, Revenue Bonds, Emerson College, Series 2011, 5.000%, 1/01/28 | No Opt. Call | BBB+ | 1,417,000 | ||

| 300 | California Municipal Finance Authority, Revenue Bonds, Goodwill Industries of Sacramento Valley & Northern Nevada Project, Series 2012A, 6.625%, 1/01/32 | 1/22 at 100.00 | N/R | 321,828 | ||

| 3,700 | California Municipal Finance Authority, Revenue Bonds, Goodwill Industries of Sacramento Valley & Northern Nevada Project, Series 2014A, 5.250%, 1/01/45 | 1/25 at 100.00 | N/R | 3,498,239 | ||

| California Municipal Finance Authority, Revenue Bonds, Touro College and University System, Series 2014A: | ||||||

| 1,245 | 5.250%, 1/01/34 | 7/24 at 100.00 | BBB- | 1,321,779 | ||

| 250 | 5.250%, 1/01/40 | 7/24 at 100.00 | BBB- | 262,523 | ||

| 1,075 | California School Finance Authority Charter School Facility Revenue Bonds, Grimmway Schools-Obligated Group, Series 2016A, 5.000%, 7/01/46 | 7/26 at 100.00 | BB+ | 1,036,870 | ||

| 1,020 | California School Finance Authority Charter School Revenue Bonds, California, ACE Charter Schools, Obligated Group, Series 2016A, 5.000%, 6/01/52 | 6/26 at 100.00 | N/R | 919,020 | ||

| 1,100 | California School Finance Authority, California, Charter School Revenue Bonds, Aspire Public Schools, Refunding Series 2015A, 5.000%, 8/01/45 | 8/25 at 100.00 | BBB | 1,143,241 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Education and Civic Organizations (continued) | ||||||

| $ 1,100 | California School Finance Authority, California, Charter School Revenue Bonds, Encore Education Obligated Group, Series 2016A, 5.000%, 6/01/52 | 6/26 at 100.00 | N/R | $998,866 | ||

| 1,300 | California School Finance Authority, California, Charter School Revenue Bonds, TEACH Public Schools Obligated Group, Series 2016A, 5.875%, 6/01/52 | No Opt. Call | N/R | 1,179,685 | ||

| California School Finance Authority, Charter School Revenue Bonds, CIty Charter School Obligated Group, Series 2016A: | ||||||

| 2,520 | 5.000%, 6/01/42 | 6/26 at 100.00 | N/R | 2,463,250 | ||

| 2,930 | 5.000%, 6/01/52 | 6/26 at 100.00 | N/R | 2,794,634 | ||

| 600 | California School Finance Authority, Charter School Revenue Bonds, Coastal Academy Project, Series 2013A, 5.000%, 10/01/42 | 10/22 at 100.00 | BBB- | 624,078 | ||

| California School Finance Authority, Charter School Revenue Bonds, Downtown College Prep - Obligated Group, Series 2016: | ||||||

| 1,500 | 4.750%, 6/01/36 | 6/26 at 100.00 | N/R | 1,452,060 | ||

| 1,180 | 5.000%, 6/01/46 | 6/26 at 100.00 | N/R | 1,155,409 | ||

| 2,500 | California School Finance Authority, Charter School Revenue Bonds, Rocketship Education - Obligated Group, Series 2016A, 5.000%, 6/01/46 | 6/25 at 100.00 | N/R | 2,443,425 | ||

| California School Finance Authority, Charter School Revenue Bonds, Rocketship Education Obligated Group, Series 2017A: | ||||||

| 275 | 5.125%, 6/01/47 | 6/26 at 100.00 | N/R | 274,015 | ||

| 1,300 | 5.250%, 6/01/52 | 6/26 at 100.00 | N/R | 1,293,682 | ||

| 1,220 | California School Finance Authority, Educational Facilities Revenue Bonds, Tri-Valley Learning Corporation, Series 2012A, 7.000%, 6/01/47 (4) | 6/20 at 102.00 | N/R | 610,073 | ||

| California School Finance Authority, Educational Facility Revenue Bonds, New Designs Charter School Project, Series 2014A: | ||||||

| 1,000 | 5.750%, 6/01/34 | 6/24 at 100.00 | BB+ | 1,073,390 | ||

| 1,500 | 6.000%, 6/01/44 | 6/24 at 100.00 | BB+ | 1,618,620 | ||

| California School Finance Authority, Educational Facility Revenue Bonds, Partnerships to Uplift Communities Valley Project, Series 2014: | ||||||

| 1,605 | 6.400%, 8/01/34 | 2/24 at 100.00 | BB- | 1,757,202 | ||

| 2,040 | 6.750%, 8/01/44 | 2/24 at 100.00 | BB- | 2,267,399 | ||

| California School finance Authority, School Facility Revenue Bonds, ICEF - View Park Elementary and Middle Schools, Series 2014A: | ||||||

| 575 | 5.625%, 10/01/34 | 10/24 at 100.00 | BB | 602,991 | ||

| 1,000 | 5.875%, 10/01/44 | 10/24 at 100.00 | BB | 1,057,570 | ||

| 520 | 6.000%, 10/01/49 | 10/24 at 100.00 | BB | 552,297 | ||

| 1,000 | California School Finance Authority, School Facility Revenue Bonds, Alliance for College-Ready Public Schools Project, Series 2015A, 4.125%, 7/01/35 | 7/25 at 100.00 | BBB | 899,020 | ||

| 1,015 | California School Finance Authority, School Facility Revenue Bonds, Alta Public Schools Project, Series 2014A, 6.500%, 11/01/34 | 11/24 at 100.00 | N/R | 1,088,253 | ||

| 600 | California School Finance Authority, School Facility Revenue Bonds, KIPP LA Projects, Series 2014A, 5.000%, 7/01/34 | 7/24 at 100.00 | BBB- | 626,094 | ||

| 1,250 | California School Finance Authority, School Facility Revenue Bonds, Value Schools, Series 2013, 6.650%, 7/01/33 | 7/23 at 100.00 | BB+ | 1,393,325 | ||

| 355 | California School Finance Authority, School Facility Revenue Bonds, Value Schools, Series 2016A, 6.000%, 7/01/51 | 7/26 at 100.00 | BB+ | 360,673 |

| Portfolio of Investments | February 28, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Education and Civic Organizations (continued) | ||||||

| $ 1,000 | California Statewide Communities Development Authority, Charter School Revenue Bonds - Albert Einstein Academy for Letters, Arts, & Sciences Charter School Series 2012, 6.000%, 11/01/32 | No Opt. Call | N/R | $1,023,510 | ||

| 1,000 | California Statewide Communities Development Authority, Revenue Bonds, Buck Institute for Research on Aging, Tender Option Bond Trust 2015-XF1035, 19.103%, 11/15/49 – AGM Insured (IF) (5) | 11/24 at 100.00 | AA | 1,585,700 | ||

| 850 | California Statewide Communities Development Authority, Revenue Bonds, The Culinary Institute of America, Series 2016B, 5.000%, 7/01/46 | 7/26 at 100.00 | Baa2 | 914,294 | ||

| 1,040 | California Statewide Communities Development Authority, School Facility Revenue Bonds, Alliance College-Ready Public Schools, Series 2011A, 7.000%, 7/01/46 | 7/21 at 100.00 | BBB- | 1,172,590 | ||

| 1,000 | California Statewide Communitities Development Authority, Charter School Revenue Bonds, Rocketship 4 - Mosaic Elementary Charter School, Series 2011A, 8.500%, 12/01/41 | 12/21 at 100.00 | N/R | 1,161,610 | ||

| 815 | California Statewide Community Development Authority, Charter School Revenue Bonds, Rocklin Academy Charter, Series 2011A, 8.250%, 6/01/41 | 6/21 at 100.00 | BB+ | 939,100 | ||

| 2,745 | California Statewide Community Development Authority, Revenue Bonds, Bentley School, Series 2010A, 7.000%, 7/01/40 | 7/20 at 101.00 | N/R | 3,116,563 | ||

| 1,000 | California Statewide Community Development Authority, Revenue Bonds, California Baptist University, Series 2007A, 5.500%, 11/01/38 | 11/17 at 102.00 | N/R | 1,016,050 | ||

| 350 | California Statewide Community Development Authority, Revenue Bonds, Montessori in Redlands School, Series 2007A, 5.125%, 12/01/36 | 4/17 at 100.00 | N/R | 350,231 | ||

| 200 | Hawaii Department of Budget and Finance, Private School Revenue Bonds, Montessori of Maui, Series 2007, 5.500%, 1/01/37 | 8/17 at 100.00 | N/R | 200,610 | ||

| 345 | Pingree Grove Village, Illinois, Charter School Revenue Bonds, Cambridge Lakes Learning Center, Series 2007, 6.000%, 6/01/36 | 6/18 at 100.00 | N/R | 343,403 | ||

| 1,250 | University of California, General Revenue Bonds, Tender Option Bond Trust 2016-XL0001, 16.320%, 5/15/39 (IF) (5) | 5/23 at 100.00 | AA | 1,925,050 | ||

| 84,845 | Total Education and Civic Organizations | 87,827,720 | ||||

| Health Care–14.8% | ||||||

| Antelope Valley Healthcare District, California, Revenue Bonds, Series 2016A: | ||||||

| 815 | 5.000%, 3/01/31 | 3/26 at 100.00 | Ba3 | 824,185 | ||

| 1,250 | 5.250%, 3/01/36 | 3/26 at 100.00 | Ba3 | 1,263,938 | ||

| 3,280 | 5.000%, 3/01/41 | 3/26 at 100.00 | Ba3 | 3,127,939 | ||

| 4,600 | 5.000%, 3/01/46 | 3/26 at 100.00 | Ba3 | 4,367,332 | ||

| 2,000 | California Health Facilities Financing Authority, California, Revenue Bonds, Sutter Health, Refunding Series 2016B, 4.000%, 11/15/41 (UB) (5) | 11/26 at 100.00 | AA- | 2,019,180 | ||

| 8,750 | California Health Facilities Financing Authority, California, Revenue Bonds, Sutter Health, Series 2016A, 5.000%, 11/15/46 (UB) (5) | 11/25 at 100.00 | AA- | 9,665,687 | ||

| 625 | California Health Facilities Financing Authority, Revenue Bonds, Kaiser Permanante System, Tender Option Bond Trust 2015-XF1002, 15.418%, 4/01/42 (IF) (5) | 4/22 at 100.00 | AA- | 849,525 | ||

| 1,220 | California Health Facilities Financing Authority, Revenue Bonds, Lucile Salter Packard Children's Hospital, Series 2012A, 5.000%, 8/15/51 (UB) (5) | 8/22 at 100.00 | AA | 1,344,684 | ||

| 7,800 | California Health Facilities Financing Authority, Revenue Bonds, Lucile Salter Packard Children's Hospital, Series 2016B, 5.000%, 8/15/55 (UB) (5) | 8/26 at 100.00 | AA | 8,622,354 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Health Care (continued) | ||||||

| California Health Facilities Financing Authority, Revenue Bonds, Lucile Salter Packard Children's Hospital, Tender Option Bond Trust 2015-XF0152: | ||||||

| $ 260 | 16.128%, 8/15/43 (IF) (5) | 8/24 at 100.00 | AA | $364,387 | ||

| 695 | 16.151%, 8/15/51 (IF) (5) | 8/22 at 100.00 | AA- | 979,116 | ||

| 80 | California Health Facilities Financing Authority, Revenue Bonds, Providence Health & Services, Tender Option Bond Trust 2015-XF0120, 19.800%, 10/01/38 (IF) (5) | 10/24 at 100.00 | AA- | 129,036 | ||

| California Health Facilities Financing Authority, Revenue Bonds, Providence Health & Services, Tender Option Bond Trust 2015-XF1034: | ||||||

| 3,600 | 19.818%, 10/01/44 (IF) (5) | 10/24 at 100.00 | AA- | 5,360,760 | ||

| 795 | 19.748%, 10/01/44 (IF) (5) | 10/24 at 100.00 | AA- | 1,182,364 | ||

| California Health Facilities Financing Authority, Revenue Bonds, Stanford Hospitals and Clinics, Tender Option Bond Trust 2015-XF0131: | ||||||

| 200 | 19.925%, 8/15/51 (IF) (5) | 8/22 at 100.00 | AA- | 293,750 | ||

| 200 | 19.914%, 8/15/51 (IF) (5) | 8/22 at 100.00 | AA- | 293,698 | ||

| California Health Facilities Financing Authority, Revenue Bonds, Stanford Hospitals and Clinics, Tender Option Bond Trust 2016-XG0049: | ||||||

| 1,000 | 16.088%, 8/15/51 (IF) (5) | 8/22 at 100.00 | AA | 1,374,890 | ||

| 250 | 16.092%, 8/15/51 (IF) (5) | 8/22 at 100.00 | AA | 343,750 | ||

| 750 | California Municipal Finance Authority, Revenue Bonds, Eisenhower Medical Center, Series 2010A, 5.750%, 7/01/40 | 7/20 at 100.00 | Baa2 | 815,085 | ||

| California Municipal Finance Authority, Revenue Bonds, NorthBay Healthcare Group, Series 2015: | ||||||

| 200 | 5.000%, 11/01/35 | 11/24 at 100.00 | BBB- | 212,686 | ||

| 750 | 5.000%, 11/01/40 | 11/24 at 100.00 | BBB- | 792,000 | ||

| 1,250 | 5.000%, 11/01/44 | 11/24 at 100.00 | BBB- | 1,319,150 | ||

| 1,000 | California Municipal Finance Authority, Revenue Bonds, NorthBay Healthcare Group, Series 2017A, 5.250%, 11/01/47 | 11/26 at 100.00 | BBB- | 1,075,300 | ||

| 1,000 | California Municipal Finance Authority, Reveue Bonds, Community Medical Centers, Series 2015A, 5.000%, 2/01/46 | 2/25 at 100.00 | A- | 1,075,750 | ||

| 1,230 | California Municipal Finance Authority, Reveue Bonds, Community Medical Centers, Series 2017A, 5.000%, 2/01/47 | 2/27 at 100.00 | A- | 1,344,636 | ||

| 1,780 | California Public Finance Authority, Revenue Bonds, Henry Mayo Newhall Hospital, Series 2017, 5.000%, 10/15/47 | 10/26 at 100.00 | BBB- | 1,891,748 | ||

| 1,000 | California Statewide Communities Development Authority, California, Redlands Community Hospital, Revenue Bonds, Series 2016, 4.000%, 10/01/41 | 10/26 at 100.00 | A- | 996,860 | ||

| California Statewide Communities Development Authority, California, Revenue Bonds, Loma Linda University Medical Center, Series 2014A: | ||||||

| 3,800 | 5.250%, 12/01/44 | 12/24 at 100.00 | BB+ | 4,015,194 | ||

| 9,600 | 5.500%, 12/01/54 | 12/24 at 100.00 | BB+ | 10,248,000 | ||

| California Statewide Communities Development Authority, California, Revenue Bonds, Loma Linda University Medical Center, Series 2016A: | ||||||

| 415 | 5.000%, 12/01/46 | 6/26 at 100.00 | BB+ | 431,500 | ||

| 2,795 | 5.250%, 12/01/56 | 6/26 at 100.00 | BB+ | 2,947,775 |

| Portfolio of Investments | February 28, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Health Care (continued) | ||||||

| California Statewide Communities Development Authority, Revenue Bonds, Cottage Health System Obligated Group, Refunding Series 2015: | ||||||

| $ 200 | 5.000%, 11/01/32 | 11/24 at 100.00 | A+ | $225,916 | ||

| 200 | 5.000%, 11/01/33 | 11/24 at 100.00 | A+ | 225,042 | ||

| California Statewide Communities Development Authority, Revenue Bonds, Henry Mayo Newhall Memorial Hospital, Series 2014: | ||||||

| 2,540 | 5.000%, 10/01/34 – AGM Insured | 10/24 at 100.00 | AA | 2,802,687 | ||

| 1,625 | 5.250%, 10/01/43 – AGM Insured | 10/24 at 100.00 | AA | 1,799,395 | ||

| 9,000 | California Statewide Communities Development Authority, Revenue Bonds, John Muir Health, Series 2016A, 5.000%, 8/15/51 (UB) (5) | 8/26 at 100.00 | A+ | 9,767,340 | ||

| California Statewide Community Development Authority, Revenue Bonds, Childrens Hospital of Los Angeles, Series 2007: | ||||||

| 250 | 5.000%, 8/15/39 – NPFG Insured | 8/17 at 100.00 | AA- | 252,803 | ||

| 5,750 | 5.000%, 8/15/47 | 8/17 at 100.00 | BBB+ | 5,799,795 | ||

| California Statewide Community Development Authority, Revenue Bonds, Daughters of Charity Health System, Series 2005A: | ||||||

| 3,115 | 5.750%, 7/01/24 (6) | 5/17 at 100.00 | CCC | 3,067,216 | ||

| 2,055 | 5.750%, 7/01/30 (6) | 5/17 at 100.00 | CCC | 1,977,095 | ||

| 2,045 | 5.500%, 7/01/35 (6) | 5/17 at 100.00 | CCC | 1,921,380 | ||

| 9,280 | 5.500%, 7/01/39 (6) | 5/17 at 100.00 | CCC | 8,283,421 | ||

| 230 | California Statewide Community Development Authority, Revenue Bonds, Daughters of Charity Health System, Series 2005H, 5.250%, 7/01/25 (6) | 5/17 at 100.00 | CCC | 225,363 | ||

| 715 | California Statewide Community Development Authority, Revenue Bonds, Sutter Health, Tender Option Bond Trust 2015-XF2186, 17.235%, 11/15/48 (IF) (5) | 5/18 at 100.00 | AA- | 828,485 | ||

| 1,285 | California Statewide Community Development Authority, Revenue Bonds, Sutter Health, Tender Option Bond Trust 2016-XF2351, 17.522%, 11/15/48 (IF) (5) | 5/18 at 100.00 | AA- | 1,488,955 | ||

| Marysville, California, Revenue Bonds, Fremont-Rideout Health Group, Series 2011: | ||||||

| 500 | 5.125%, 1/01/33 | 1/21 at 100.00 | BBB- | 497,285 | ||

| 650 | 5.250%, 1/01/42 | 1/21 at 100.00 | BBB- | 645,489 | ||

| 1,060 | Oak Valley Hospital District, Stanislaus County, California, Revenue Bonds, Series 2010A, 7.000%, 11/01/35 | 11/20 at 100.00 | BB | 1,096,665 | ||

| 500 | Palomar Pomerado Health Care District, California, Certificates of Participation, Series 2010, 6.000%, 11/01/41 | 11/20 at 100.00 | BBB- | 544,400 | ||

| 5,500 | Rancho Mirage Joint Powers Financing Authority, California, Revenue Bonds, Eisenhower Medical Center, Refunding Series 2007A, 5.000%, 7/01/38 | 7/17 at 100.00 | Baa2 | 5,539,765 | ||

| San Buenaventura, California, Revenue Bonds, Community Memorial Health System, Series 2011: | ||||||

| 1,000 | 8.000%, 12/01/26 | 12/21 at 100.00 | BB+ | 1,241,000 | ||

| 600 | 7.500%, 12/01/41 | 12/21 at 100.00 | BB+ | 700,020 | ||

| 2,500 | Tulare Local Health Care District, California, Revenue Bonds, Series 2007, 5.200%, 11/01/32 | 11/17 at 100.00 | BB- | 2,378,325 | ||

| 150 | Washington Township Health Care District, California, Revenue Bonds, Refunding Series 2007A, 5.000%, 7/01/32 | 7/17 at 100.00 | Baa1 | 151,034 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Health Care (continued) | ||||||

| $ 60 | Weatherford Hospital Authority, Oklahoma, Sales Tax Revenue Bonds, Series 2006, 6.000%, 5/01/31 | 5/19 at 100.00 | N/R | $ 61,834 | ||

| 113,800 | Total Health Care | 121,092,969 | ||||

| Housing/Multifamily–3.1% | ||||||

| 2,000 | California Housing Finance Agency, Multifamily Housing Revenue Bonds, Series 2014A-III, 4.600%, 8/01/39 | 2/24 at 100.00 | AA+ | 2,106,520 | ||

| 1,270 | California Municipal Finance Authority, Mobile Home Park Revenue Bonds, Caritas Affordable Housing Inc Projects, Series 2014B, 5.875%, 8/15/49 | 8/24 at 100.00 | N/R | 1,385,671 | ||

| 85 | California Municipal Finance Authority, Mobile Home Park Revenue Bonds, Caritas Projects Series 2010A, 6.400%, 8/15/45 | 8/20 at 100.00 | BBB | 92,576 | ||

| 1,385 | California Municipal Finance Authority, Mobile Home Park Revenue Bonds, Caritas Projects Series 2010B, 7.250%, 8/15/45 | 8/20 at 100.00 | N/R | 1,520,301 | ||

| 480 | California Municipal Finance Authority, Mobile Home Park Revenue Bonds, Caritas Projects Series 2012B, 7.250%, 8/15/47 | 8/22 at 100.00 | A1 | 545,635 | ||

| 2,000 | California Municipal Finance Authority, Mobile Home Park Revenue Bonds, Windsor Mobile Country Club, Subordinate Series 2013B, 7.000%, 11/01/48 | 11/23 at 100.00 | N/R | 2,284,260 | ||

| California Municipal Finance Authority, Mobile Home Park Senior Revenue Bonds, Caritas Affordable Housing, Inc. Projects, Series 2014A: | ||||||

| 1,515 | 5.250%, 8/15/39 | 8/24 at 100.00 | BBB | 1,666,667 | ||

| 575 | 5.250%, 8/15/49 | 8/24 at 100.00 | BBB | 629,033 | ||

| 350 | California Municipal Finance Authority, Student Housing Revenue Bonds, Bowles Hall Foundation, Series 2015A, 5.000%, 6/01/35 | 6/25 at 100.00 | Baa3 | 372,494 | ||

| 2,090 | California Statewide Communities Development Authority, Revenue Bonds, Lancer Educational Student Housing Project, Refunding Series 2016A, 5.000%, 6/01/46 | 6/26 at 100.00 | N/R | 2,046,444 | ||

| 330 | California Statewide Community Development Authority, Multifamily Housing Revenue Bonds, Magnolia City Lights, Series 1999X, 6.650%, 7/01/39 (Alternative Minimum Tax) | 5/17 at 100.00 | N/R | 330,304 | ||

| Independent Cities Finance Authority, California, Mobile Home Park Revenue Bonds, Augusta Communities Mobile Home Park, Series 2012A: | ||||||

| 1,000 | 5.000%, 8/15/36 | 8/26 at 100.00 | A | 1,115,680 | ||

| 740 | 5.000%, 5/15/39 | 5/22 at 100.00 | A+ | 782,121 | ||

| 1,010 | 5.000%, 5/15/47 | 5/22 at 100.00 | A+ | 1,063,085 | ||

| 1,000 | Independent Cities Finance Authority, California, Mobile Home Park Revenue Bonds, Palomar Estates West, Refunding Series 2015, 5.000%, 9/15/36 | 9/25 at 100.00 | N/R | 1,047,420 | ||

| 2,570 | Independent Cities Finance Authority, California, Mobile Home Park Revenue Bonds, Santa Rosa Leisure Mobile Home Park, Refunding Series 2016, 5.000%, 8/15/46 | 8/26 at 100.00 | A | 2,836,843 | ||

| 1,340 | Independent Cities Lease Finance Authority, California, Mobile Home Park Refunding Bonds, Rancho Feliz and Las Casitas De Sonoma, Series 2012, 5.000%, 10/15/47 | No Opt. Call | BBB | 1,418,886 | ||

| 315 | La Verne, California, Mobile Home Park Revenue Bonds, Copacabana Mobile Home Park, Refunding Series 2014, 5.000%, 6/15/49 | 6/24 at 100.00 | A | 339,765 | ||

| 2,110 | Palmdale Housing Authority, California, Multifamily Housing Revenue Bonds, Impression, La Quinta, Park Vista & Summerwood Apartments, Series 2015, 5.250%, 6/01/45 | 6/25 at 100.00 | N/R | 2,133,780 | ||

| 465 | Santa Clara County Housing Authority, California, Multifamily Housing Revenue Bonds, Blossom River Project, Series 1998A, 6.500%, 9/01/39 (Alternative Minimum Tax) | 5/17 at 100.00 | N/R | 465,391 | ||

| 542 | Ventura County Area Housing Authority, California, Mira Vista Senior Apartments Project, Junior Subordinate Series 2006C, 6.500%, 12/01/39 (Alternative Minimum Tax) | 12/17 at 100.00 | N/R | 495,063 |

| Portfolio of Investments | February 28, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Housing/Multifamily (continued) | ||||||

| $ 480 | Wilson County Health and Educational Facilities Board, Tennessee, Senior Living Revenue Bonds, Rutland Place Inc. Project, Series 2015A, 5.500%, 1/01/46 | No Opt. Call | N/R | $ 421,152 | ||

| 23,652 | Total Housing/Multifamily | 25,099,091 | ||||

| Housing/Single Family–0.0% | ||||||

| 250 | California Housing Finance Agency, California, Home Mortgage Revenue Bonds, Series 2007E, 4.800%, 8/01/37 (Alternative Minimum Tax) | 5/17 at 100.00 | AA- | 250,220 | ||

| Industrials–0.4% | ||||||

| 3,000 | California Pollution Control Financing Authority, Solid Waste Disposal Revenue Bonds, Aemerge Redpak Services, LLC., Series 2016, 7.000%, 12/01/27 (Alternative Minimum Tax) | 12/23 at 102.00 | N/R | 2,880,720 | ||

| 750 | Western Reserve Port Authority, Ohio, Solid Waste Facility Revenue Bonds, Central Waste Inc., Series 2007A, 6.350%, 7/01/27 (Alternative Minimum Tax) (4) | 7/17 at 102.00 | N/R | 8 | ||

| 3,750 | Total Industrials | 2,880,728 | ||||

| Long-Term Care–1.2% | ||||||

| 3,000 | ABAG Finance Authority for Nonprofit Corporations, California, Revenue Bonds, Episcopal Senior Communities, Series 2012A, 5.000%, 7/01/47 | No Opt. Call | BBB+ | 3,158,850 | ||

| 3,700 | California Statewide Communities Development Authority, Revenue Bonds, 899 Charleston Project, Refunding Series 2014A, 5.250%, 11/01/44 | 11/24 at 100.00 | N/R | 3,756,906 | ||

| 520 | California Statewide Communities Development Authority, Revenue Bonds, American Baptist Homes of the West, Series 2010, 6.250%, 10/01/39 | 10/19 at 100.00 | BBB+ | 567,122 | ||

| 1,000 | California Statewide Communities Development Authority, Revenue Bonds, Terraces San Joaquin Gardens, Series 2012A, 5.625%, 10/01/32 | 10/22 at 100.00 | N/R | 1,056,800 | ||

| 450 | California Statewide Community Development Authority, Revenue Bonds, Los Angeles Jewish Home for the Aging-Fountainview Gonda, Series 2014D, 4.750%, 8/01/20 | 11/17 at 100.00 | N/R | 450,198 | ||

| 1,000 | Wisconsin Public Finance Authority, Revenue Bonds, SearStone Retirement Community of Cary North Carolina, Series 2012A, 8.625%, 6/01/47 | 6/22 at 100.00 | N/R | 1,139,320 | ||

| 9,670 | Total Long-Term Care | 10,129,196 | ||||

| Tax Obligation/General–7.1% | ||||||

| 1,000 | Aromas-San Juan Unified School District, San Benito, Santa Cruz and Monterey Counties, California, General Obligation Bonds, Series 2013B, 0.000%, 8/01/52 – AGM Insured | 8/37 at 100.00 | AA | 527,970 | ||

| Bakersfield City School District, Kern County, California, General Obligation Bonds, Series 2012C: | ||||||

| 1,700 | 0.000%, 5/01/37 (7) | No Opt. Call | Aa2 | 908,038 | ||

| 6,925 | 0.000%, 5/01/42 (7) | 5/40 at 100.00 | Aa2 | 3,859,095 | ||

| 5,500 | 0.000%, 5/01/47 (7) | 5/40 at 100.00 | Aa2 | 3,049,145 | ||

| 1,250 | California State, General Obligation Bonds, Tender Option Bond Trust 2015-XF1039, 16.080%, 10/01/44 (IF) (5) | 10/24 at 100.00 | AA- | 1,909,800 | ||

| 1,630 | California State, General Obligation Bonds, Various Purpose Series 2013, 5.000%, 4/01/43 | 4/23 at 100.00 | AA- | 1,824,671 | ||

| 1,500 | California State, General Obligation Bonds, Various Purpose Series 2015, 5.000%, 3/01/45 (UB) (5) | 3/25 at 100.00 | AA- | 1,684,905 | ||

| 1,250 | California State, General Obligation Bonds, Various Purpose, Tender Option Bond Trust 2015-XF1037, 16.031%, 8/01/35 (IF) (5) | 8/24 at 100.00 | AA- | 1,936,050 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Tax Obligation/General (continued) | ||||||

| California State, General Obligation Bonds, Various Purpose, Tender Option Bond Trust 2015-XF1041: | ||||||

| $ 750 | 12.096%, 11/01/44 (IF) (5) | 11/24 at 100.00 | AA- | $819,600 | ||

| 545 | 11.612%, 11/01/44 (IF) (5) | 11/24 at 100.00 | AA- | 595,576 | ||

| 1,250 | 11.612%, 11/01/44 (IF) (5) | 11/24 at 100.00 | AA- | 1,366,000 | ||

| 1,005 | 11.599%, 11/01/44 (IF) (5) | 11/24 at 100.00 | AA- | 1,098,143 | ||

| 4,610 | Central Unified School District, Fresno County, California, General Obligation Bonds, Election 2008 Series 2013B, 0.000%, 8/01/37 – AGM Insured | 8/22 at 44.31 | AA | 1,706,852 | ||

| 11,090 | Cupertino Union School District, Santa Clara County, California, General Obligation Bonds, Election 2012, Series 2016C, 4.000%, 8/01/40 (UB) (5) | 8/26 at 100.00 | AA+ | 11,558,885 | ||

| 1,115 | Denair Unified School District, Stanislaus County, California, General Obligation Bonds, Series 2002A, 0.000%, 8/01/26 – FGIC Insured | No Opt. Call | AA- | 805,353 | ||

| 1,205 | Jamul Dulzura Union School District, San Diego County, California, General Obligation Bonds, Election 1995 Series 2004A, 0.000%, 11/01/28 – NPFG Insured | No Opt. Call | AA- | 817,580 | ||

| 1,000 | Montebello Unified School District, Los Angeles County, California, General Obligation Bonds, Election 1998 Series 2004, 0.000%, 8/01/26 – FGIC Insured | No Opt. Call | AA- | 729,360 | ||

| 650 | Newman-Crows Landing Unified School District, Stanislaus County, California, General Obligation Bonds, 2008 Election, Series 2010B, 0.000%, 8/01/49 – AGM Insured | No Opt. Call | AA | 411,327 | ||

| 2,250 | Orland Joint Unified School District, Glenn and Tehama Counties, California, General Obligation Bonds, 2008 Election, Series 2012B, 0.000%, 8/01/51 – AGM Insured (8) | 8/37 at 100.00 | AA | 1,242,675 | ||

| 970 | Orland Joint Unified School District, Glenn and Tehama Counties, California, General Obligation Bonds, 2008 Election, Series 2013C, 0.000%, 8/01/43 – BAM Insured | 8/38 at 100.00 | AA | 506,738 | ||

| 1,350 | Paso Robles Joint Unified School District, San Luis Obispo and Monteray Counties, California, General Obligation Bonds, Election 2006 Series 2010A, 0.000%, 9/01/34 | No Opt. Call | A1 | 650,930 | ||

| 10,000 | San Diego Unified School District, San Diego County, California, General Obligation Bonds, Election of 2012 Series 2013C, 4.000%, 7/01/42 (UB) | 7/23 at 100.00 | Aa2 | 10,173,500 | ||

| 1,980 | San Diego Unified School District, San Diego County, California, General Obligation Bonds, Tender Option Bond 2016-XF2355, 12.490%, 7/01/38 (IF) (5) | 7/23 at 100.00 | AA- | 2,126,362 | ||

| 7,655 | Savanna Elementary School District, Orange County, California, General Obligation Bonds, Election 2008 Series 2012B, 0.000%, 2/01/52 – AGM Insured (7) | No Opt. Call | AA | 4,741,277 | ||

| 5,730 | Southwestern Community College District, San Diego County, California, General Obligation Bonds, Election of 2008, Series 2011C, 0.000%, 8/01/46 | No Opt. Call | Aa2 | 1,550,939 | ||

| 1,880 | Walnut Valley Unified School District, Los Angeles County, California, General Obligation Bonds, Election 2000 Series 2003D, 0.000%, 8/01/28 – FGIC Insured | No Opt. Call | Aa2 | 1,278,287 | ||

| 75,790 | Total Tax Obligation/General | 57,879,058 | ||||

| Tax Obligation/Limited–39.3% | ||||||

| 1,000 | Adelanto Community Facilities District Number 2006-2, San Bernadino County, California, Special Tax Bonds, Series 2015A, 5.000%, 9/01/45 | 9/25 at 100.00 | N/R | 1,024,360 | ||

| 1,650 | Alameda Community Facilities District No. 13-1, California, Alameda Landing Public Improvements, Special Tax Bonds, Series 2016, 5.000%, 9/01/46 | 9/24 at 102.00 | N/R | 1,753,933 | ||

| Anaheim Public Financing Authority, California, Lease Revenue Bonds, Public Improvement Project, Series 1997C: | ||||||

| 330 | 0.000%, 9/01/28 – AGM Insured | No Opt. Call | AA | 216,774 | ||

| 240 | 0.000%, 9/01/30 – AGM Insured | No Opt. Call | AA | 144,240 | ||

| 4,475 | 0.000%, 9/01/34 – AGM Insured | No Opt. Call | AA | 2,204,474 | ||

| 4,305 | 0.000%, 9/01/35 – AGM Insured | No Opt. Call | AA | 2,000,103 |

| Portfolio of Investments | February 28, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Tax Obligation/Limited (continued) | ||||||

| $ 435 | Arvin Community Redevelopment Agency, California, Tax Allocation Bonds, Arvin Redevelopment Project, Series 2005, 5.125%, 9/01/35 | 5/17 at 100.00 | N/R | $435,300 | ||

| 1,000 | Azusa Redevelopment Agency, California, Tax Allocation Refunding Bonds, Merged West End Development, Series 2007B, 5.300%, 8/01/36 | 8/17 at 100.00 | N/R | 1,004,230 | ||

| 940 | Azusa, California, Special Tax Bonds, Community Facilities District 2005-1 Rosedale Improvement Area 1, Series 2007, 5.000%, 9/01/37 | 9/17 at 100.00 | N/R | 944,333 | ||

| 1,035 | Beaumont Financing Authority, California, Local Agency Revenue Bonds, Improvement Area 17A, Series 2013B, 5.000%, 9/01/34 | 9/23 at 100.00 | N/R | 1,089,141 | ||

| 1,875 | Beaumont Financing Authority, California, Local Agency Revenue Bonds, Improvement Area 19A, Series 2015B, 5.000%, 9/01/35 | 9/25 at 100.00 | N/R | 2,002,125 | ||

| 1,000 | Beaumont Financing Authority, California, Local Agency Revenue Bonds, Improvement Area 20 Series 2012B, 5.950%, 9/01/35 | 9/22 at 100.00 | N/R | 1,095,030 | ||

| 2,600 | Beaumont Financing Authority, California, Local Agency Revenue Bonds, Improvement Area 7A-1, Series 2015A, 5.000%, 9/01/45 | 9/25 at 100.00 | N/R | 2,751,320 | ||

| 1,000 | Beaumont Financing Authority, California, Local Agency Revenue Bonds, Improvement Area 8C, Series 2007E, 6.250%, 9/01/38 | 5/17 at 100.00 | N/R | 1,001,850 | ||

| Beaumont Financing Authority, California, Local Agency Revenue Bonds, Improvement Area 8D & 17B, Series 2009B: | ||||||

| 60 | 8.875%, 9/01/34 | 5/17 at 100.00 | N/R | 60,241 | ||

| 125 | 8.625%, 9/01/39 | 5/17 at 100.00 | N/R | 125,465 | ||

| 1,900 | Blythe Redevelopment Agency Successor Agency, California, Tax Allocation Bonds, Redevelopment Project 1, Refunding Series 2015, 5.000%, 5/01/38 | 11/25 at 100.00 | N/R | 1,964,733 | ||

| Brea Redevelopment Agency, Orange County, California, Tax Allocation Bonds, Project Area AB, Series 2003: | ||||||

| 1,500 | 0.000%, 8/01/28 – AMBAC Insured | No Opt. Call | AA- | 947,670 | ||

| 2,300 | 0.000%, 8/01/29 – AMBAC Insured | No Opt. Call | AA- | 1,382,599 | ||

| 6,710 | 0.000%, 8/01/30 – AMBAC Insured | No Opt. Call | AA- | 3,859,458 | ||

| 4,700 | Brentwood Infrastructure Financing Authority, California, Infrastructure Revenue Bonds, Refunding Subordinated Series 2014B, 5.000%, 9/02/36 | 9/24 at 100.00 | N/R | 5,076,141 | ||

| 5,600 | California Community College Financing Authority, Lease Revenue Bonds, Refunding Series 2003, 0.000%, 6/01/33 – AMBAC Insured | No Opt. Call | A+ | 2,503,424 | ||

| 2,000 | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, Series 2013I, 5.000%, 11/01/38 | 11/23 at 100.00 | A+ | 2,244,120 | ||

| 2,000 | California Statewide Communities Development Authority, Lease Revenue Bonds, Community Center Project, Series 2014, 5.000%, 10/01/34 – AGM Insured | 10/24 at 100.00 | AA | 2,233,740 | ||

| 2,500 | California Statewide Communities Development Authority, Special Tax Bonds, Community Facilities District 15-2 Rio Bravo, Series 2015A, 5.625%, 9/01/45 | 9/25 at 100.00 | N/R | 2,477,200 | ||

| 1,000 | California Statewide Communities Development Authority, Special Tax Bonds, Community Facilities District 2007-1 Orinda Wilder Project, Refunding Series 2015, 5.000%, 9/01/37 | No Opt. Call | N/R | 1,067,050 | ||

| 1,000 | California Statewide Communities Development Authority, Special Tax Bonds, Community Facilities District 2012-01, Fancher Creek, Series 2013A, 5.700%, 9/01/43 | 9/23 at 100.00 | N/R | 1,075,620 | ||

| California Statewide Communities Development Authority, Special Tax Bonds, Community Facilities District 2012-02, Manteca Lifestyle Center, Series 2013A: | ||||||

| 1,000 | 5.000%, 9/01/33 | No Opt. Call | N/R | 1,059,150 | ||

| 2,000 | 5.125%, 9/01/42 | No Opt. Call | N/R | 2,110,800 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Tax Obligation/Limited (continued) | ||||||

| California Statewide Communities Development Authority, Statewide Community Infrastructure Program Revenue Bonds, Refunding Series 2015R-1: | ||||||

| $ 3,650 | 5.000%, 9/02/35 | 9/25 at 100.00 | N/R | $3,829,543 | ||

| 1,200 | 5.000%, 9/02/40 | No Opt. Call | N/R | 1,250,064 | ||

| 1,020 | California Statewide Communities Development Authority, Statewide Community Infrastructure Program Revenue Bonds, Series 2011A, 8.000%, 9/02/41 | 9/21 at 100.00 | N/R | 1,076,110 | ||

| 2,275 | California Statewide Communities Development Authority, Statewide Community Infrastructure Program Revenue Bonds, Series 2014A, 5.000%, 9/02/43 | 9/22 at 100.00 | N/R | 2,344,888 | ||

| 2,060 | California Statewide Communities Development Authority, Statewide Community Infrastructure Program Revenue Bonds, Series 2014B, 5.000%, 9/02/44 | 9/24 at 100.00 | N/R | 2,141,432 | ||

| California Statewide Communities Development Authority, Statewide Community Infrastructure Program Revenue Bonds, Series 2016A: | ||||||

| 1,030 | 5.000%, 9/02/36 | 9/26 at 100.00 | N/R | 1,083,601 | ||

| 2,250 | 5.000%, 9/02/45 | 9/26 at 100.00 | N/R | 2,327,445 | ||

| California Statewide Communities Development Authority, Statewide Community Infrastructure Program Revenue Bonds, Series 2016B: | ||||||

| 1,690 | 5.000%, 9/02/36 | 9/26 at 100.00 | N/R | 1,749,927 | ||

| 3,310 | 5.000%, 9/02/46 | 9/26 at 100.00 | N/R | 3,398,211 | ||

| 650 | Cathedral City Public Financing Authority, California, Tax Allocation Bonds, Merged Redevelopment Project Area, Series 2007A, 4.500%, 8/01/35 – AMBAC Insured | 8/17 at 100.00 | BBB+ | 650,637 | ||

| 850 | Cathedral City Public Financing Authority, California, Tax Allocation Bonds, Merged Redevelopment Project Area, Series 2007C, 4.500%, 8/01/35 | 5/17 at 100.00 | BBB- | 789,506 | ||

| 315 | Chino Public Financing Authority, California, Revenue Bonds, Refunding Series 2012, 5.000%, 9/01/38 | 9/22 at 100.00 | N/R | 330,911 | ||

| 1,000 | Compton Community Redevelopment Agency, California, Tax Allocation Revenue Bonds, Redevelopment Projects, Housing Second Lien Series 2010A, 5.500%, 8/01/30 | 8/20 at 100.00 | N/R | 1,039,850 | ||

| 500 | Compton Community Redevelopment Agency, California, Tax Allocation Revenue Bonds, Redevelopment Projects, Second Lien Series 2010B, 5.750%, 8/01/26 | 8/20 at 100.00 | N/R | 529,495 | ||

| Compton Public Finance Authority, California, Lease Revenue Bonds, Refunding & Various Capital Projects, Series 2008: | ||||||

| 590 | 5.000%, 9/01/22 – AMBAC Insured | 9/18 at 100.00 | N/R | 615,270 | ||

| 500 | 5.250%, 9/01/27 – AMBAC Insured | 9/18 at 100.00 | N/R | 522,470 | ||

| 210 | 5.000%, 9/01/32 – AMBAC Insured | 9/18 at 100.00 | N/R | 216,777 | ||

| 670 | Corona, California, Special Tax Bonds, Community Facilities District 2002-1 Dos Lagos Improvement Area 1, Refunding Series 2017, 5.000%, 9/01/37 | 9/24 at 103.00 | N/R | 713,396 | ||

| 855 | Corona, California, Special Tax Bonds, Community Facilities District 2002-1 Dos Lagos, Refunding Series 2017, 5.000%, 9/01/34 | 9/24 at 103.00 | N/R | 918,142 | ||

| Corona-Norco Unified School District, Riverside County, California, Special Tax Bonds, Community Facilities District 05-1, Series 2016: | ||||||

| 500 | 5.000%, 9/01/36 | 9/26 at 100.00 | N/R | 536,765 | ||

| 1,000 | 4.000%, 9/01/45 | 9/26 at 100.00 | N/R | 947,830 | ||

| Dana Point, California, Special Tax Bonds, Community Facilities District No. 2006-1, Series 2014: | ||||||

| 250 | 5.000%, 9/01/38 | 9/23 at 100.00 | N/R | 263,760 | ||

| 1,250 | 5.000%, 9/01/45 | 9/23 at 100.00 | N/R | 1,310,050 |

| Portfolio of Investments | February 28, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Tax Obligation/Limited (continued) | ||||||

| $ 990 | Davis Redevelopment Agency, California, Tax Allocation Bonds, Davis Redevelopment Project, Subordinate Series 2011A, 7.000%, 12/01/36 | 12/21 at 100.00 | A+ | $1,200,900 | ||

| Desert Hot Springs Redevelopment Agency, California, Tax Allocation Bonds, Merged Redevelopment Project, Series 2008A-2: | ||||||

| 1,610 | 5.000%, 9/01/23 | 9/18 at 100.00 | B- | 1,437,859 | ||

| 2,010 | 5.600%, 9/01/38 | 9/18 at 100.00 | B- | 1,665,245 | ||

| 1,800 | Eastern Municipal Water District, California, Special Tax Bonds, Community Facilities District 2001-01 French Valley Improvement Area A, Series 2015, 5.000%, 9/01/36 | 9/25 at 100.00 | N/R | 1,955,700 | ||

| 250 | El Dorado County, California, Special Tax Bonds, Community Facilities District 2005-2, Series 2006, 5.100%, 9/01/36 | 9/17 at 100.00 | N/R | 251,303 | ||

| 430 | Fairfield, California, Community Facilities District 2007-1 Special Tax Bonds, Fairfield Commons Project, Series 2008, 6.875%, 9/01/38 | 9/18 at 100.00 | N/R | 447,918 | ||

| Fillmore, California, Special Tax Bonds, Community Facilities District 5, Improvement Area, Series 2015A: | ||||||

| 1,500 | 5.000%, 9/01/40 | 9/23 at 102.00 | N/R | 1,591,710 | ||

| 2,530 | 5.000%, 9/01/45 | 9/23 at 102.00 | N/R | 2,677,246 | ||

| 1,350 | Fontana, California, Community Facilities District No. 22, Special Tax Refunding Bonds, Sierra Hills South, Series 2014, 5.000%, 9/01/34 | No Opt. Call | N/R | 1,435,914 | ||

| 1,000 | Fontana, California, Special Tax Bonds, Community Facilities District 31 Citrus Heights North, Series 2006, 5.000%, 9/01/36 | 9/17 at 100.00 | N/R | 1,005,430 | ||

| 2,305 | Fullerton, California, Special Tax Bonds, Community Facilities District 2 Amerige Heights, Series 2014, 5.000%, 9/01/44 | 9/23 at 100.00 | N/R | 2,413,058 | ||

| Golden State Tobacco Securitization Corporation, California, Enhanced Tobacco Settlement Asset-Backed Revenue Bonds, Refunding Series 2015A: | ||||||

| 5,000 | 5.000%, 6/01/40 (UB) (5) | 6/25 at 100.00 | A+ | 5,541,150 | ||

| 2,000 | 5.000%, 6/01/45 (UB) (5) | 6/25 at 100.00 | A+ | 2,208,920 | ||

| 3,750 | Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Bonds, Tender Option Bond Trust 2015-XF1038, 15.268%, 6/01/45 (IF) (5) | 6/25 at 100.00 | A+ | 5,316,787 | ||

| 500 | Government of Guam, Business Privilege Tax Bonds, Series 2012B-1, 5.000%, 1/01/42 | 1/22 at 100.00 | A | 514,025 | ||

| Guam Government Department of Education, Certificates of Participation, John F. Kennedy High School Project, Series 2010A: | ||||||

| 880 | 6.625%, 12/01/30 | 12/20 at 100.00 | B+ | 925,593 | ||

| 1,175 | 6.875%, 12/01/40 | 12/20 at 100.00 | B+ | 1,244,572 | ||

| Hercules Redevelopment Agency, California, Tax Allocation Bonds, Merged Project Area, Series 2005: | ||||||

| 1,000 | 5.000%, 8/01/25 – AMBAC Insured | 5/17 at 100.00 | N/R | 1,002,760 | ||

| 1,000 | 5.000%, 8/01/35 – AMBAC Insured | 5/17 at 100.00 | N/R | 1,002,040 | ||

| Hercules Redevelopment Agency, California, Tax Allocation Bonds, Merged Project Area, Series 2007A: | ||||||

| 365 | 4.625%, 8/01/37 – AMBAC Insured | 2/18 at 100.00 | N/R | 365,398 | ||

| 745 | 4.750%, 8/01/42 – AMBAC Insured | 2/18 at 100.00 | N/R | 745,976 | ||

| 150 | 5.000%, 8/01/42 – AMBAC Insured | 2/18 at 100.00 | N/R | 150,330 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Tax Obligation/Limited (continued) | ||||||

| Hesperia Public Financing Authority, California, Redevelopment and Housing Projects Tax Allocation Bonds, Series 2007A: | ||||||

| $ 1,250 | 5.500%, 9/01/22 – SYNCORA GTY Insured | 9/17 at 100.00 | N/R | $1,270,688 | ||

| 1,000 | 5.500%, 9/01/27 – SYNCORA GTY Insured | No Opt. Call | N/R | 1,013,950 | ||

| 1,105 | 5.000%, 9/01/31 – SYNCORA GTY Insured | 9/17 at 100.00 | N/R | 1,112,978 | ||

| 1,920 | 5.000%, 9/01/37 – SYNCORA GTY Insured | 9/17 at 100.00 | N/R | 1,928,947 | ||

| 3,935 | Hesperia Unified School District, San Bernardino County, California, Certificates of Participation, Refunding Series 2016, 5.000%, 2/01/41 – BAM Insured | 2/26 at 100.00 | AA | 4,403,226 | ||

| 1,990 | Hesperia, California, Special Tax Bonds, Community Facilities District 2005-1 Belgate Development Restructuring Series 2014, 5.000%, 9/01/35 | 9/24 at 100.00 | N/R | 2,111,330 | ||

| 1,035 | Imperial, California, Special Tax Bonds, Community Facilities District 2005-1 Springfield, Series 2015A, 5.000%, 9/01/36 | No Opt. Call | N/R | 1,105,173 | ||

| 500 | Indio Redevelopment Agency, California, Tax Allocation Bonds, Merged Area Redevelopment Project, Subordinate Lien Refunding Series 2008A, 5.250%, 8/15/28 | 8/18 at 100.00 | BBB- | 526,965 | ||

| 625 | Indio, California, Special Tax Bonds, Community Facilities District 2004-3 Terra Lago, Improvement Area 1, Series 2015, 5.000%, 9/01/35 | 9/25 at 100.00 | N/R | 667,375 | ||

| Inglewood Public Financing Authority, California, Lease Revenue Bonds, Refunding Series 2012: | ||||||

| 2,530 | 0.000%, 8/01/23 | No Opt. Call | A2 | 2,074,119 | ||

| 1,600 | 0.000%, 8/01/25 | No Opt. Call | A2 | 1,129,936 | ||

| 1,050 | 0.000%, 8/01/28 | 8/22 at 66.37 | A2 | 589,964 | ||

| 2,430 | 0.000%, 8/01/33 | No Opt. Call | A2 | 920,071 | ||

| 1,650 | 0.000%, 8/01/35 | No Opt. Call | A2 | 531,531 | ||

| 795 | Irvine, California, Limited Obligation Improvement Bonds, Reassessment District 15-2, Series 2015, 5.000%, 9/02/42 | 9/25 at 100.00 | N/R | 843,034 | ||

| 745 | Irvine, California, Special Tax Bonds, Community Facilities District 2004-1 Central Park, Series 2015A, 5.000%, 9/01/45 | 9/25 at 100.00 | N/R | 790,005 | ||

| 500 | Irvine, California, Special Tax Bonds, Community Facilities District 2013-3 Great Park, Improvement Area 1, Refunding Series 2014, 5.000%, 9/01/39 | 9/24 at 100.00 | N/R | 529,160 | ||

| Jurupa Community Services District, California, Special Tax Bonds, Community Facilities District 37 Eastvale Improveement Area 1,Series 2016: | ||||||

| 600 | 3.125%, 9/01/40 | 9/21 at 103.00 | N/R | 487,356 | ||

| 500 | 3.250%, 9/01/46 | 9/21 at 103.00 | N/R | 403,370 | ||

| Jurupa Community Services District, California, Special Tax Bonds, Community Facilities District 37 Eastvale Improveement Area 2,Series 2016A: | ||||||

| 500 | 3.125%, 9/01/40 | 9/21 at 103.00 | N/R | 406,130 | ||

| 700 | 3.250%, 9/01/46 | 9/21 at 103.00 | N/R | 564,718 | ||

| 1,400 | Jurupa Community Services District, California, Special Tax Bonds, Community Facilities District 43, Series 2016, 5.000%, 9/01/45 | 9/26 at 100.00 | N/R | 1,489,306 | ||

| 1,000 | Jurupa Public Financing Authority, California, Special Tax Revenue Bonds, Series 2015A, 5.000%, 9/01/43 | 9/25 at 100.00 | BBB+ | 1,084,270 | ||

| 3,380 | Jurupa Unified School District, California, Special Tax Bonds, Community Facilities District 9, Series 2015A, 5.000%, 9/01/45 | 9/25 at 100.00 | N/R | 3,576,716 | ||

| 335 | Lake Elsinore Public Financing Authority, California, Local Agency Revenue Bonds, Canyon Hills Improvement Area C, Series 2012C, 5.000%, 9/01/37 | No Opt. Call | N/R | 350,236 |

| Portfolio of Investments | February 28, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Tax Obligation/Limited (continued) | ||||||

| $ 1,400 | Lake Elsinore Public Financing Authority, California, Local Agency Revenue Bonds, Refunding Series 2015, 5.000%, 9/01/40 | 9/25 at 100.00 | N/R | $1,477,714 | ||

| 1,220 | Lake Elsinore Unified School District, California, Special Tax Bonds, Community Facilities District 2004-2, Series 2005, 5.350%, 9/01/35 | No Opt. Call | N/R | 1,227,869 | ||

| 3,000 | Lammersville Joint Unified School District, Special Tax Bonds, California, Community Facilities District 2002, Mountain House, Series 2013, 5.000%, 9/01/37 | 9/22 at 100.00 | N/R | 3,137,940 | ||

| 2,000 | Lammersville School District, California, Special Tax Refunding Bonds, Community Facilities District 2002 Mountain House, Series 2012, 5.375%, 9/01/32 | 9/22 at 100.00 | N/R | 2,082,800 | ||

| 710 | Lancaster Redevelopment Agency, California, Tax Allocation Bonds, Combined Redevelopment Project Areas Housing Programs, Series 2009, 6.875%, 8/01/39 | No Opt. Call | BBB | 789,470 | ||

| Lancaster Redevelopment Agency, California, Tax Allocation Bonds, Combined Redevelopment Project Areas Housing Programs, Subordinate Refunding Series 2003: | ||||||

| 500 | 4.750%, 8/01/27 – NPFG Insured | 5/17 at 100.00 | AA- | 502,265 | ||

| 1,000 | 4.750%, 8/01/33 – NPFG Insured | 8/17 at 100.00 | AA- | 1,002,760 | ||

| 1,000 | Lathrop, California, Limited Obligation Improvement Bonds, Crossroads Assessment District, Series 2015, 5.000%, 9/02/40 | 9/25 at 100.00 | N/R | 993,160 | ||

| Lee Lake Public Financing Authority, California, Junior Lien Revenue Bonds, Series 2013B: | ||||||

| 795 | 5.125%, 9/01/28 | 9/23 at 100.00 | N/R | 865,906 | ||

| 395 | 5.250%, 9/01/32 | 9/23 at 100.00 | N/R | 425,861 | ||

| Lincoln, California, Special Tax Bonds, Community Facilities District 2005-1 Sorrento Project, Series 2014A: | ||||||

| 600 | 5.000%, 9/01/34 | 9/24 at 100.00 | N/R | 638,184 | ||

| 935 | 5.000%, 9/01/39 | 9/24 at 100.00 | N/R | 987,051 | ||

| 1,825 | 5.000%, 9/01/43 | 9/24 at 100.00 | N/R | 1,904,241 | ||

| 1,545 | Long Beach, California, Marina Revenue Bonds, Alamitos Bay Marina Project, Series 2015, 5.000%, 5/15/45 | 5/25 at 100.00 | BBB | 1,658,882 | ||

| 2,615 | Los Alamitos Unified School District, Orange County, California, Certificates of Participation, Series 2012, 0.000%, 8/01/42 (7) | 8/29 at 100.00 | AA- | 2,193,593 | ||

| 1,715 | Lower Magnolia Green Community Development Authority, Virginia, Special Assessment Bonds, Series 2015, 5.000%, 3/01/45 | 3/25 at 100.00 | N/R | 1,715,772 | ||

| 1,275 | Lynwood Redevelopment Agency, California, Project A Revenue Bonds, Subordinate Lien Series 2011A, 7.250%, 9/01/38 | 9/21 at 100.00 | A- | 1,539,550 | ||

| 2,022 | Manteca Unified School District, San Joaquin County, California, Certificates of Participation, Series 2004, 0.000%, 9/15/33 – NPFG Insured | No Opt. Call | AA- | 977,677 | ||

| Menifee Union School District Public Financing Authority, California, Special Tax Revenue Bonds, Series 2016A: | ||||||

| 735 | 5.000%, 9/01/36 – BAM Insured | 9/25 at 100.00 | AA | 822,980 | ||

| 1,100 | 5.000%, 9/01/38 – BAM Insured | 9/25 at 100.00 | AA | 1,228,227 | ||

| Menifee Union School District, Riverside County, California, Special Tax Bonds, Community Facilities District 2006-1, Series 2014: | ||||||

| 500 | 4.125%, 9/01/39 | 9/17 at 100.00 | N/R | 493,495 | ||

| 500 | 4.250%, 9/01/44 | 9/44 at 100.00 | N/R | 500,635 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Tax Obligation/Limited (continued) | ||||||

| Menifee Union School District, Riverside County, California, Special Tax Bonds, Community Facilties District 2011-1, Improvement Area 1, Series 2015: | ||||||

| $ 2,000 | 5.000%, 9/01/39 | No Opt. Call | N/R | $2,111,340 | ||

| 500 | 4.250%, 9/01/44 | 9/24 at 100.00 | N/R | 500,635 | ||

| 1,000 | 5.000%, 9/01/44 | No Opt. Call | N/R | 1,053,030 | ||

| Merced Redevelopment Agency, California, Tax Allocation Bonds, Merced Redevelopment Project 2, Series 2003A: | ||||||

| 1,890 | 0.000%, 12/01/21 – AMBAC Insured | No Opt. Call | N/R | 1,556,982 | ||

| 1,055 | 0.000%, 12/01/23 – AMBAC Insured | No Opt. Call | N/R | 758,102 | ||

| 1,080 | Merced, California, Community Facilities District 2005-1, Improvement Area 1 Special Tax Bonds, Bellevue Ranch West, Series 2006, 5.300%, 9/01/36 | 9/17 at 100.00 | N/R | 1,002,424 | ||

| 945 | Moorpark, California, Special Tax Bonds, Community Facilities District 2004-1, Refunding Junior Lien Series 2014B, 5.000%, 9/01/33 | 9/24 at 100.00 | N/R | 1,008,296 | ||

| 65 | Moreno Valley Unified School District, Riverside County, California, Special Tax Bonds, Community Facilities District 2004-5, Series 2006, 5.200%, 9/01/36 | 9/17 at 100.00 | N/R | 65,417 | ||

| 1,000 | Moreno Valley, California, Special Tax Bonds, Community Facilities District 5, Series 2007, 5.000%, 9/01/37 | 9/17 at 100.00 | N/R | 1,004,660 | ||

| 1,310 | Murrieta Valley Unified School District Public Finance Authority, Riverside County, California, Refunding Bonds Series 2013, 5.000%, 9/01/33 | 9/23 at 100.00 | N/R | 1,387,486 | ||

| 825 | Murrieta, California, Special Tax Bonds, Community Facilities District 2005-5 Golden City Improvement Area A, Series 2017, 5.000%, 9/01/46 (WI/DD, Settling 3/08/17) | 9/27 at 100.00 | N/R | 871,167 | ||

| 415 | Novato Redevelopment Agency, California, Tax Allocation Bonds, Hamilton Field Redevelopment Project, Series 2011, 6.750%, 9/01/40 | 9/21 at 100.00 | BBB+ | 487,820 | ||

| 1,265 | Oakdale Public Financing Authority, California, Revenue Bonds, Refunding Series 2015, 5.000%, 9/01/35 | 9/25 at 100.00 | N/R | 1,360,811 | ||

| 2,500 | Oakley Public Financing Authority, Contra Costa County, California, Revenue Bonds, Refundinf Series 2014, 5.000%, 9/02/36 – BAM Insured | 9/24 at 100.00 | AA | 2,789,500 | ||

| 1,250 | Oceanside, California, Special Tax Bonds, Community Facilities District 2006-1, Pacific Coast Business Park, Series 2017, 5.000%, 9/01/38 | 9/25 at 102.00 | N/R | 1,334,250 | ||

| Ontario, California, Special Tax Bonds, Community Facilities District 24 Park Place Facilities Phase I, Series 2016: | ||||||

| 1,000 | 5.000%, 9/01/41 | 9/26 at 100.00 | N/R | 1,066,220 | ||

| 1,300 | 5.000%, 9/01/46 | 9/26 at 100.00 | N/R | 1,381,887 | ||

| 2,000 | Orange County, California, Special Tax Bonds, Community Facilities District 2015-1 Esencia Village, Series 2015A, 5.250%, 8/15/45 | 8/25 at 100.00 | N/R | 2,157,120 | ||

| 3,530 | Palm Desert, California, Limited Obligation Improvement Bonds, Section 29 Assessment District 2004-02, Series 2007, 5.100%, 9/02/37 | 9/17 at 101.00 | N/R | 3,557,640 | ||

| Palm Desert, California, Special Tax Bonds, Community Facilities District 2005-1 University Park, Series 2006: | ||||||

| 235 | 5.000%, 9/01/21 | 9/17 at 100.00 | N/R | 238,353 | ||

| 285 | 5.300%, 9/01/32 | 9/17 at 100.00 | N/R | 287,012 | ||

| 740 | 5.450%, 9/01/32 | 9/17 at 100.00 | N/R | 745,772 | ||

| 1,095 | 5.500%, 9/01/36 | 9/17 at 100.00 | N/R | 1,102,884 | ||

| 1,600 | Palm Drive Health Care District, Sonoma County, California, Certificates of Participation, Parcel Tax Secured Financing Program, Series 2010, 7.500%, 4/01/35 | 5/17 at 100.00 | CCC+ | 1,505,728 |

| Portfolio of Investments | February 28, 2017 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Tax Obligation/Limited (continued) | ||||||

| $ 1,395 | Palm Drive Health Care District, Sonoma County, California, Parcel Tax Revenue Bonds, Series 2005, 5.250%, 4/01/30 | 5/17 at 100.00 | CCC+ | $1,292,021 | ||

| 500 | Palm Springs Financing Authority, California, Lease Revenue Bonds, Downtown Revitalization Project, Series 2012B, 5.000%, 6/01/35 | No Opt. Call | AA | 553,415 | ||

| 1,230 | Palmdale Community Redevelopment Agency, California, Tax Allocation Bonds, Merged Redevelopment Project Areas, Series 2002, 0.000%, 12/01/30 – AMBAC Insured | No Opt. Call | A | 671,986 | ||

| 1,230 | Palmdale, California, Special Tax Bonds, Community Facilities District 2005-1, Series 2005, 6.750%, 9/01/35 | 5/17 at 100.00 | N/R | 1,153,383 | ||

| 985 | Patterson Public Financing Authority, California, Revenue Bonds, Community Facilities District 2001-1, Senior Series 2013A, 5.750%, 9/01/39 | 9/23 at 100.00 | N/R | 1,051,123 | ||

| 985 | Perris Joint Powers Authority, California, Local Agency Revenue Bonds, Community Facilities District 2001-1 May Farms Improvement Area 6 &7, Refunding Series 2014E, 4.250%, 9/01/38 | 9/24 at 100.00 | N/R | 990,664 | ||

| 1,110 | Perris Joint Powers Authority, California, Local Agency Revenue Bonds, Community Facilities District 2006-1, Meritage Homes, Refunding Series 2014B, 5.000%, 9/01/38 | 9/23 at 100.00 | N/R | 1,166,555 | ||

| Pittsburg Redevelopment Agency, California, Tax Allocation Bonds, Los Medanos Community Development Project, Series 1999: | ||||||

| 2,990 | 0.000%, 8/01/27 – AMBAC Insured | No Opt. Call | A+ | 2,064,266 | ||

| 2,500 | 0.000%, 8/01/28 – AMBAC Insured | No Opt. Call | A+ | 1,635,300 | ||

| 1,445 | Poway Unified School District Public Financing Authority, Califirnia, Special Tax Revenue Refunding Bonds, Series 2015B, 4.000%, 9/01/36 – BAM Insured | 9/25 at 100.00 | AA | 1,480,634 | ||

| 1,000 | Poway Unified School District Public Financing Authority, California, Special Tax Revenue Bonds, Series 2014, 5.000%, 10/01/41 – BAM Insured | 10/23 at 100.00 | AA | 1,091,890 | ||

| 560 | Poway Unified School District, San Diego County, California, Special Tax Bonds, Community Facilities District 15 Del Sur East Improvement Area C, Series 2016, 5.000%, 9/01/41 | 9/26 at 100.00 | N/R | 594,070 | ||

| 2,000 | Rancho Cardova, California, Special Tax Bonds, Community Facilities District 2004-1 Sunridge Park Area, Series 2007, 6.125%, 9/01/37 | 9/17 at 100.00 | N/R | 2,021,020 | ||

| 1,200 | Rancho Cardova, California, Special Tax Bonds, Community Facilities District 2005-1 Sunridge North Douglas Series 2015, 5.000%, 9/01/40 | 9/25 at 100.00 | N/R | 1,266,612 | ||

| 3,000 | Rancho Cordova, California, Special Tax Bonds, Community Facilities District 2003-1 Sunridge Anatolia Area, Junior Lien Series 2014, 5.650%, 10/01/38 | 5/17 at 100.00 | N/R | 3,003,360 | ||

| Redwood City Redevelopment Agency, California, Tax Allocation Bonds, Project Area 2, Series 2003A: | ||||||

| 1,755 | 0.000%, 7/15/29 – AMBAC Insured | No Opt. Call | A- | 1,068,058 | ||

| 1,260 | 0.000%, 7/15/31 – AMBAC Insured | No Opt. Call | A- | 699,451 | ||

| 1,250 | Riverside County Asset Leasing Corporation, California, Lease Revenue Bonds, Capital Project, Tender Option Bond Trust 2015-XF1020, 16.494%, 11/01/45 (Alternative Minimum Tax) (IF) (5) | 11/25 at 100.00 | AA- | 1,976,000 | ||

| 1,295 | Riverside County Asset Leasing Corporation, California, Leasehold Revenue Bonds, Riverside County Hospital Project, Series 1997, 0.000%, 6/01/26 – NPFG Insured | No Opt. Call | AA- | 980,665 | ||

| Riverside County Redevelopment Agency Successor Agency, California, Tax Allocation Bonds, Desert Communities Redevelopment Project, Refunding Series 2014A: | ||||||

| 650 | 5.000%, 10/01/30 – AGM Insured | 10/24 at 100.00 | AA | 745,973 | ||

| 1,380 | 5.000%, 10/01/32 – AGM Insured | 10/24 at 100.00 | AA | 1,564,106 |

| Principal Amount (000) | Description (1) | Optional Call Provisions (2) | Ratings (3) | Value | ||

| Tax Obligation/Limited (continued) | ||||||

| $ 3,160 | Riverside County Redevelopment Agency Successor Agency, California, Tax Allocation Bonds, Interstate 215 Corridor Redevelopment Project Area, Refunding Series 2014E, 4.000%, 10/01/37 – AGM Insured | 10/24 at 100.00 | AA | $3,232,680 | ||

| 955 | Riverside County Redevelopment Agency Successor Agency, California, Tax Allocation Bonds, Redevelopment Project Area 1, Refunding Series 2014A, 5.000%, 10/01/30 – AGM Insured | 10/24 at 100.00 | AA | 1,096,006 | ||

| 2,000 | Riverside County Redevelopment Agency Successor Agency, California, Tax Allocation Bonds, Refunding Series 2014A, 5.000%, 10/01/34 – AGM Insured | 10/24 at 100.00 | AA | 2,248,040 | ||

| 500 | Riverside County Redevelopment Agency, California, Tax Allocation Bonds, Interstate 215 Corridor Redevelopment Project Area, Series 2010E, 6.500%, 10/01/40 | 10/20 at 100.00 | A- | 577,400 | ||

| 205 | Riverside County Redevelopment Agency, California, Tax Allocation Housing Bonds, Series 2011A, 7.125%, 10/01/42 | 10/21 at 100.00 | A | 248,485 | ||

| 2,115 | Riverside County, California, Special Tax Bonds, Community Facilities District 03-1 Newport Road, Series 2014, 5.000%, 9/01/30 | 9/24 at 100.00 | N/R | 2,287,563 | ||

| 870 | Riverside County, California, Special Tax Bonds, Community Facilities District 04-2 Lake Hill Crest, Series 2012, 5.000%, 9/01/35 | 9/22 at 100.00 | N/R | 910,438 | ||

| Riverside County, California, Special Tax Bonds, Community Facilities District 05-8 Scott Road, Series 2013: | ||||||

| 660 | 5.000%, 9/01/32 | 9/22 at 100.00 | N/R | 696,340 | ||

| 2,000 | 5.000%, 9/01/42 | 9/22 at 100.00 | N/R | 2,082,940 | ||

| Riverside Public Financing Authority, California, Tax Allocation Bonds, University Corridor, Series 2007C: | ||||||

| 2,000 | 4.500%, 8/01/30 – NPFG Insured | No Opt. Call | AA- | 2,021,440 | ||

| 510 | 5.000%, 8/01/37 – NPFG Insured | 8/17 at 100.00 | AA- | 516,278 | ||

| Rocklin Unified School District, Placer County, California, Special Tax Bonds, Community Facilities District 2, Series 2007: | ||||||

| 1,010 | 0.000%, 9/01/34 – NPFG Insured | No Opt. Call | AA- | 454,359 | ||

| 1,155 | 0.000%, 9/01/35 – NPFG Insured | No Opt. Call | AA- | 495,518 | ||

| 1,000 | Rocklin, Placer County, California, Special Tax Bonds, Community Facilities District 10 Whitney Ranch, Series 2015, 5.000%, 9/01/39 | 9/25 at 100.00 | N/R | 1,061,880 | ||