Centrue Financial Corporation Earnings Presentation March 31, 2016 NASDAQ: CFCB 1

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives, goals, strategies, expectations, intentions, projections, developments, future events, performance or products, underlying assumptions, and other statements which are other than statements of historical facts. In some cases, you can identify forward-looking statements by terminology such as ''may,'' ''will,'' ''should,'' “hope,'' "expects,'' ''intends,'' ''plans,'' ''anticipates,'' "contemplates," ''believes,'' ''estimates,'' ''predicts,'' ''projects,'' ''potential,'' ''continue,'' and other similar terminology or the negative of these terms. From time to time, we may publish or otherwise make available forward-looking statements of this nature. All such forward-looking statements, whether written or oral, and whether made by us or on our behalf, are expressly qualified by the cautionary statements described on this message including those set forth below. In addition, we undertake no obligation to update or revise any forward-looking statements to reflect events, circumstances, or new information after the date of the information or to reflect the occurrence or likelihood of unanticipated events, and we disclaim any such obligation. Forward-looking statements are only predictions that relate to future events or our future performance and are subject to known and unknown risks, uncertainties, assumptions, and other factors, many of which are beyond our control, that may cause actual results, outcomes, levels of activity, performance, developments, or achievements to be materially different from any future results, outcomes, levels of activity, performance, developments, or achievements expressed, anticipated, or implied by these forward-looking statements. As a result, we cannot guarantee future results, performance, developments, or achievements, and there can be no assurance that our expectations, intentions, anticipations, beliefs, or projections will result or be achieved or accomplished. These forward-looking statements are made as of the date hereof and are based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Centrue’s actual results could differ materially from those stated or implied in forward- looking statements. Past performance is not necessarily indicative of future results. We do not intend to update these forward looking statements even though our situation may change in the future. We encourage you to review the risks that we face and other information about us in our filings with the SEC, including our Annual Report on Form 10-K. These filings are available at www.SEC.gov. Non-GAAP Financial Measures: Certain financial information Included In this presentation may include Non-GAAP Financial Measures. Centrue’s management uses Non-GAAP Financial Measures to evaluate Centrue’s performance and provides is information as a supplement to Centrue’s reported results because management believes this information provides additional insight Into Centrue’s operating performance. Reconciliations for any Non-GAAP Financial Measures may be found in the schedules accompanying Centrue’s earnings releases. General Information and Limitations 2

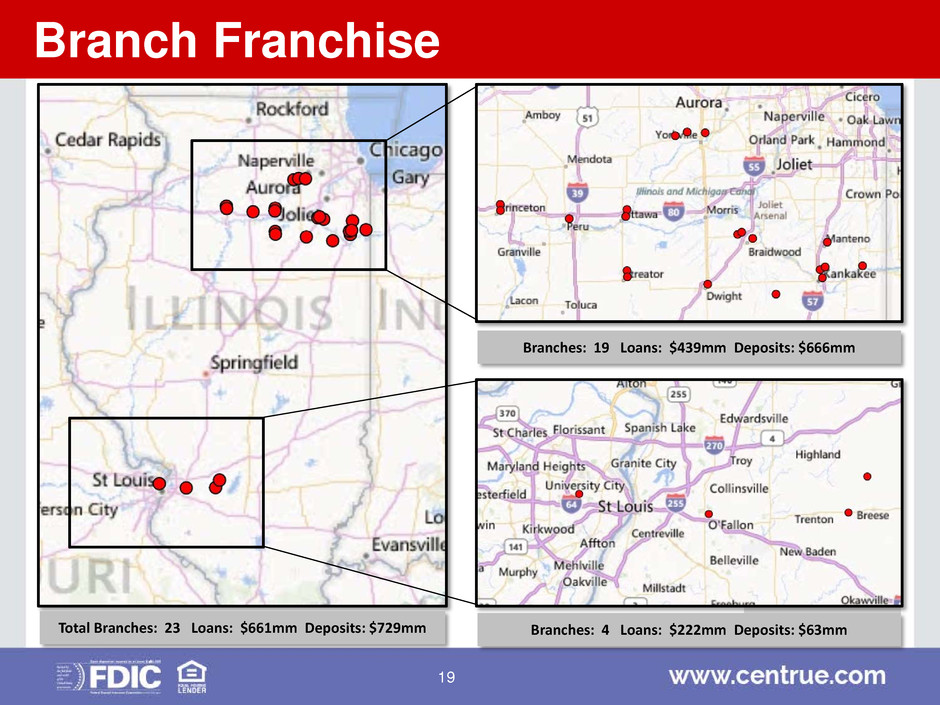

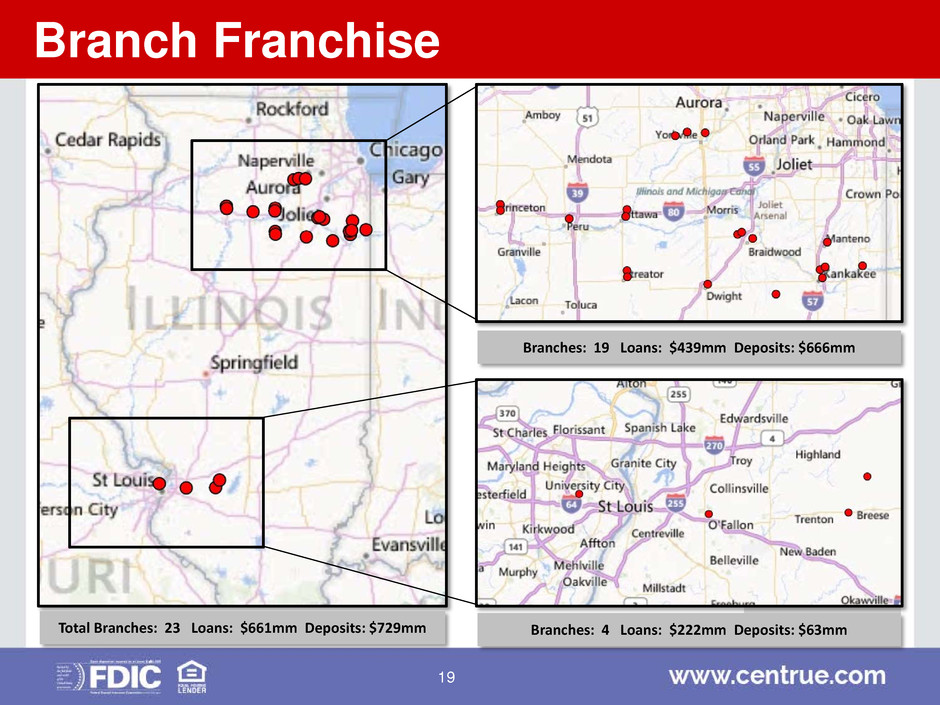

Corporate Profile – March 31, 2016 Platform Headquarters: Ottawa, IL Product Lines: Commercial, Retail, Mortgage, Treasury Management Branches: 23 20, assuming recently announced branch sales Employees (FTE): 232.5 221.5, assuming recently announced branch sales Market Data* NASDAQ Ticker: CFCB Market Cap: $112.6 million Price: $17.28 Tangible Book Value: $18.35 Price/ TBV: 94.2% 52 Week Range: $14.95 - $18.36 Shares Outstanding: 6,513,694 Market Makers: Boenning & Skattergood Keefe, Bruyette & Woods Sandler O'Neill + Partners *Market Data as of 4/26/2016 Balance Sheet Assets: $969 million Loans: $661 million Deposits: $729 million Profitability (YTD) Net Income: $0.9 million Return on Average Assets: 0.38% Return on Average Equity: 3.03% Net interest Margin: 3.48% (FTE) Efficiency Ratio: 79.96% Capital Ratios Risk-based Capital Ratio: 15.63% Leverage Ratio: 11.72% Texas Ratio: 10.13% Asset Quality NPA’s/ Assets: 1.34% Delinquency Ratio: 1.04% Allowance / Gross Loans: 1.36% Allowance / NPL’s: 158.97% 3

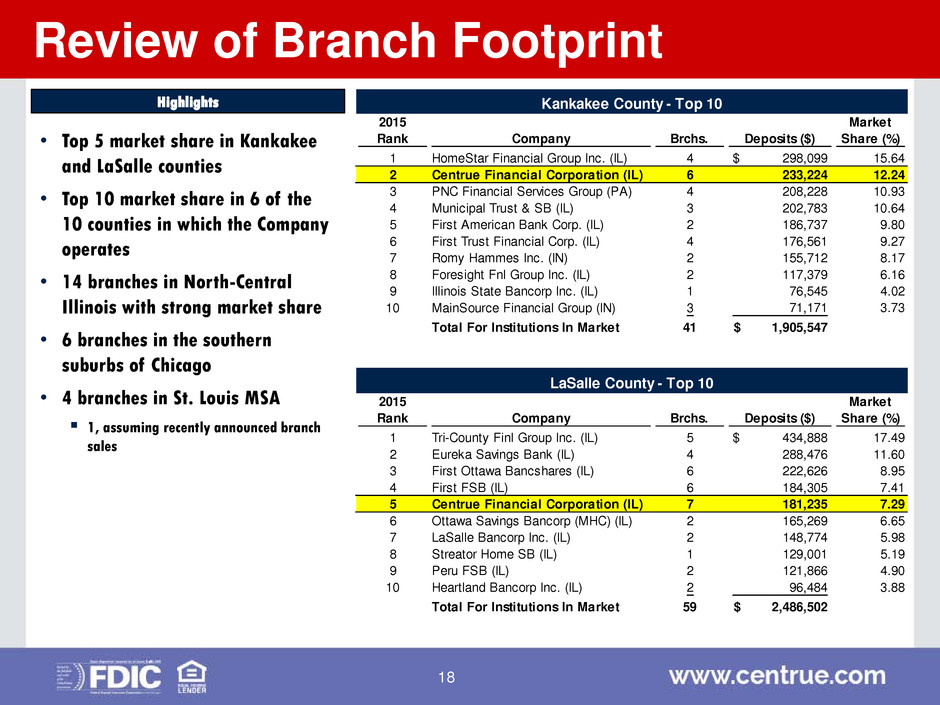

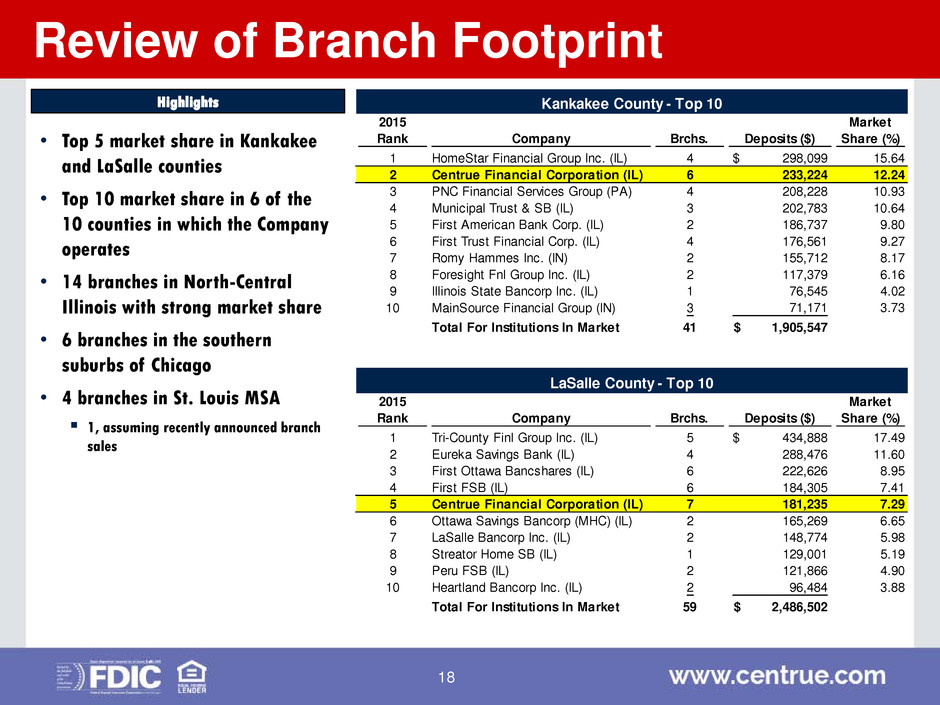

Franchise Value • One hundred forty-two year-old community bank offering commercial and retail banking services • Attractive branch network with solid market share in its core markets and a foothold in two large markets – Top 5 deposit market share in its two core markets (Kankakee and LaSalle County) – The Company has a portion of its branches in Chicago and St. Louis MSAs • Desirable deposit franchise with 15 bps cost of total deposits – Core deposits (checking, savings, NOW, and money markets) account for 72% of deposits – Weighted average life of core deposits is 6.9 years • Scalable bank platform – $969mm in assets and 23 total branches (6 branches in Chicago MSA) – Potential to further capitalize on attractive Chicago market • Experienced management team with proven track record • Diverse loan portfolio • Historically profitable core franchise • Strong credit underwriting and asset quality metrics 4

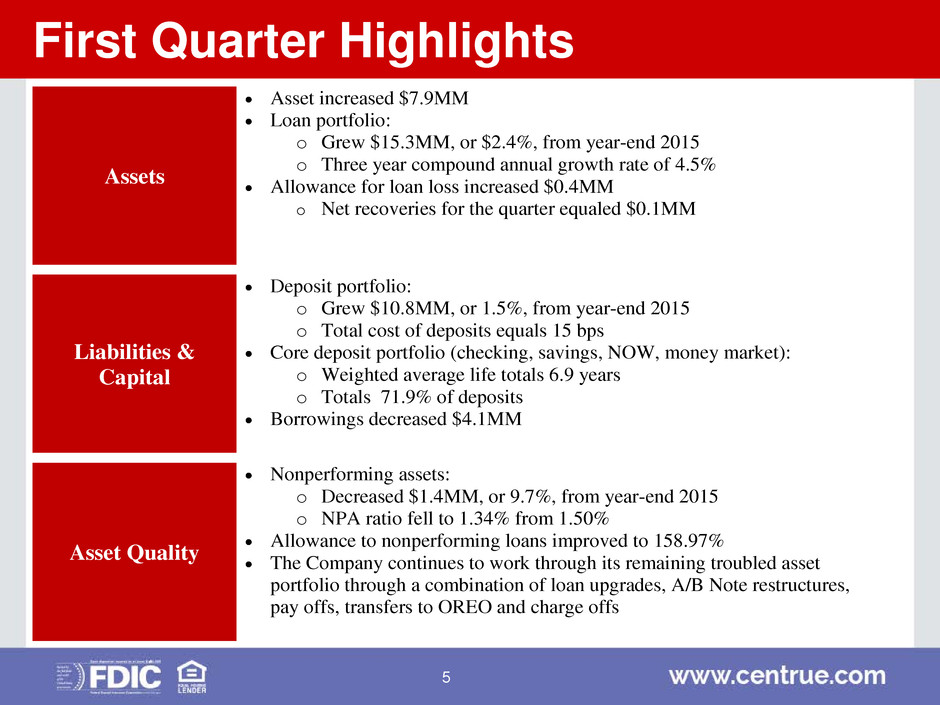

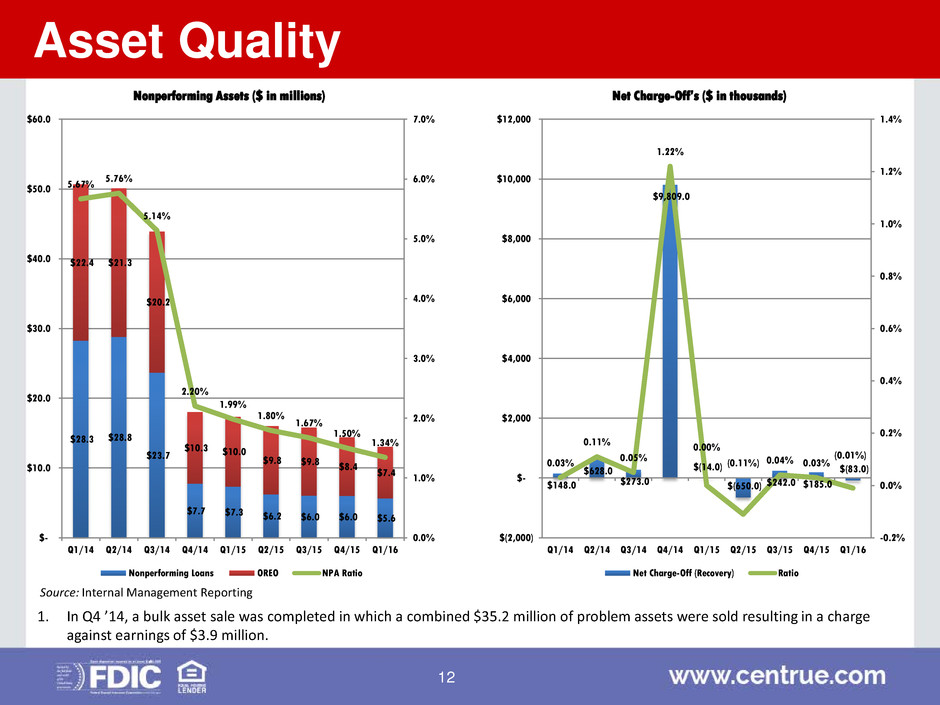

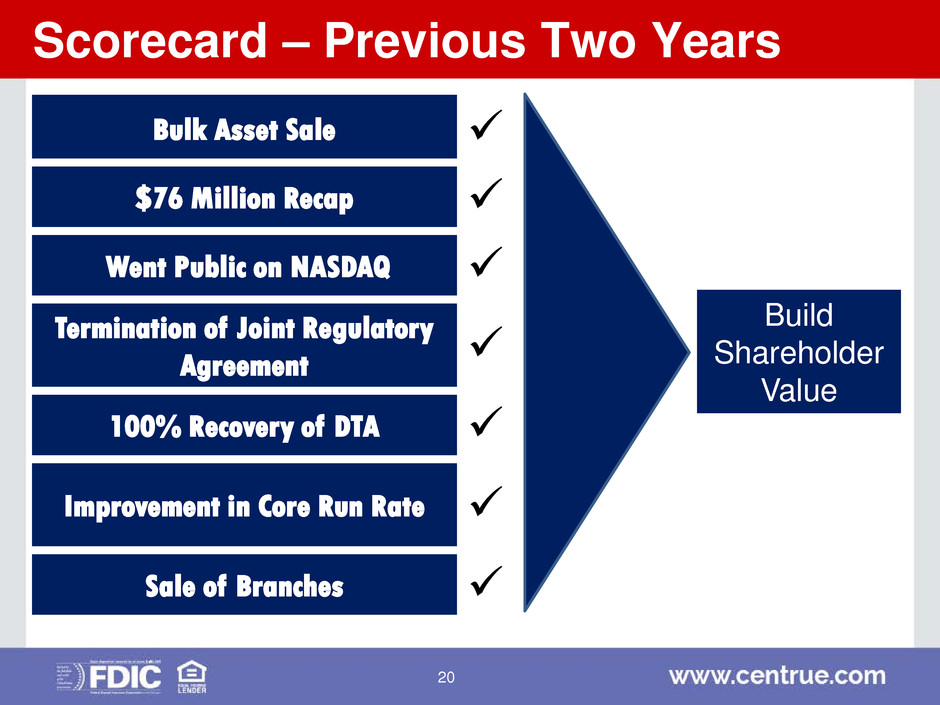

First Quarter Highlights Assets • Asset increased $7.9MM • Loan portfolio: o Grew $15.3MM, or $2.4%, from year-end 2015 o Three year compound annual growth rate of 4.5% • Allowance for loan loss increased $0.4MM o Net recoveries for the quarter equaled $0.1MM Liabilities & Capital • Deposit portfolio: o Grew $10.8MM, or 1.5%, from year-end 2015 o Total cost of deposits equals 15 bps • Core deposit portfolio (checking, savings, NOW, money market): o Weighted average life totals 6.9 years o Totals 71.9% of deposits • Borrowings decreased $4.1MM Asset Quality • Nonperforming assets: o Decreased $1.4MM, or 9.7%, from year-end 2015 o NPA ratio fell to 1.34% from 1.50% • Allowance to nonperforming loans improved to 158.97% • The Company continues to work through its remaining troubled asset portfolio through a combination of loan upgrades, A/B Note restructures, pay offs, transfers to OREO and charge offs 5

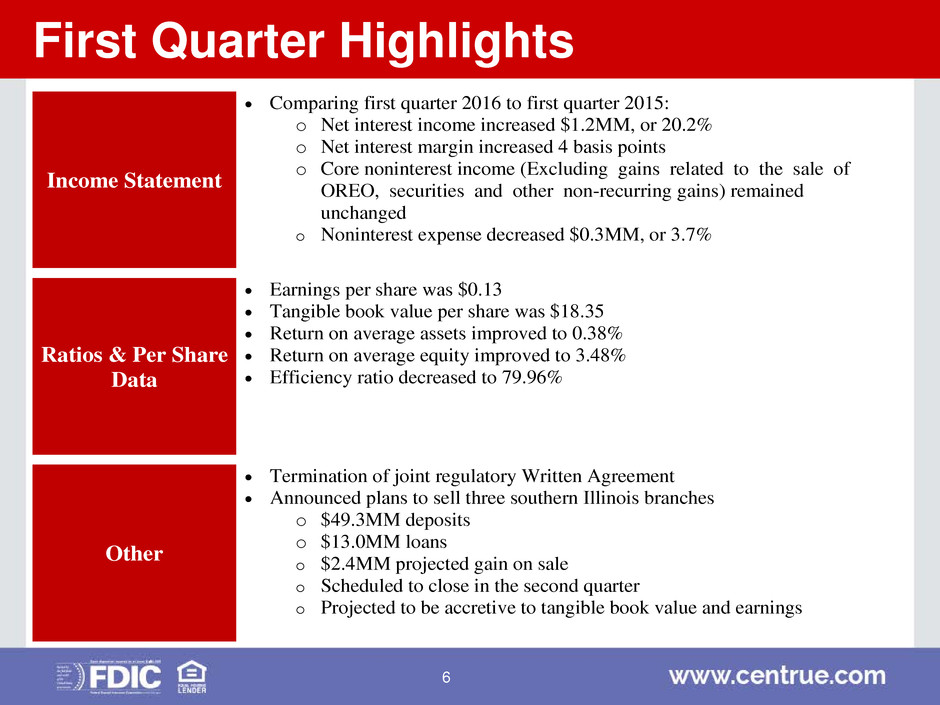

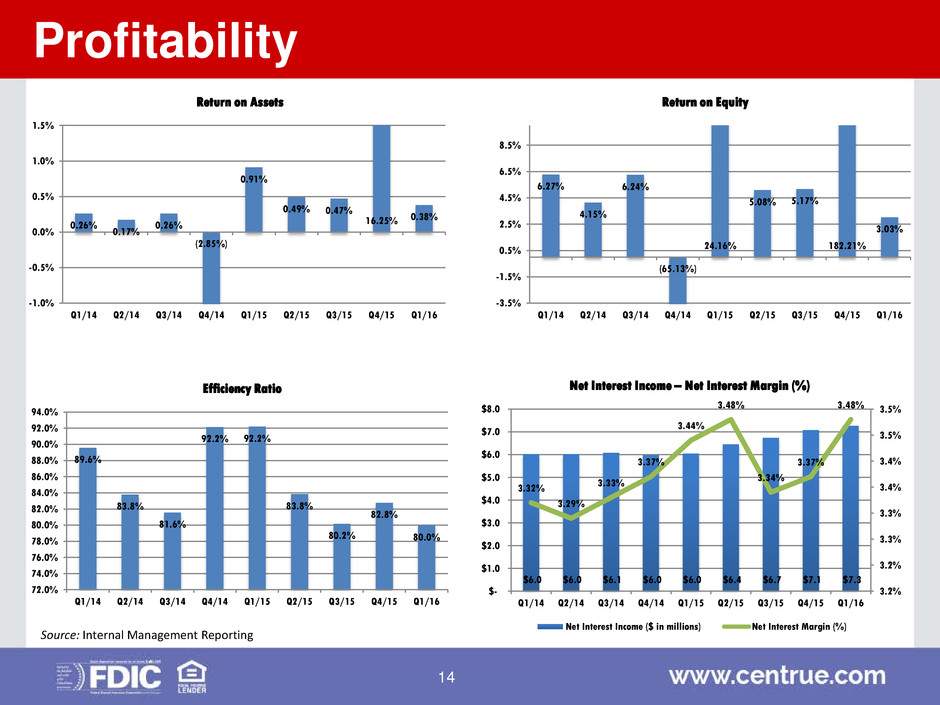

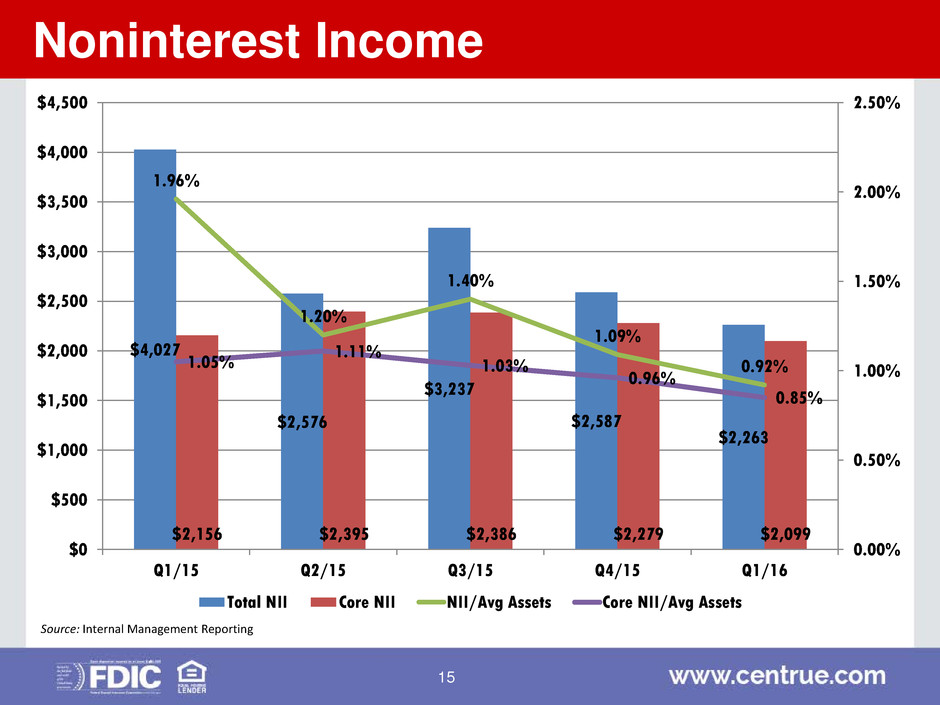

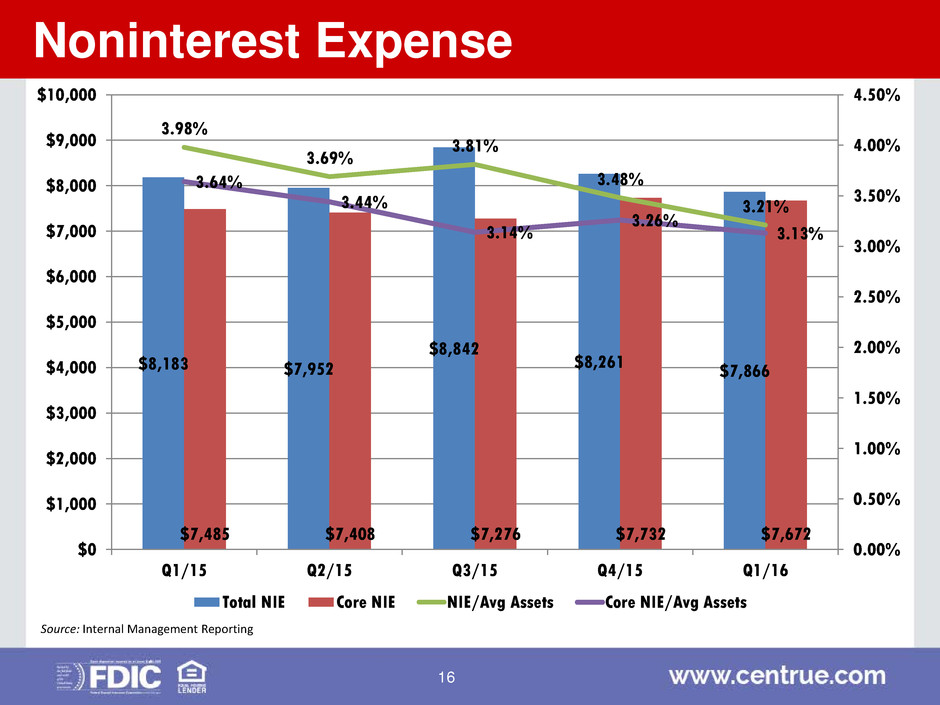

First Quarter Highlights Income Statement • Comparing first quarter 2016 to first quarter 2015: o Net interest income increased $1.2MM, or 20.2% o Net interest margin increased 4 basis points o Core noninterest income (Excluding gains related to the sale of OREO, securities and other non-recurring gains) remained unchanged o Noninterest expense decreased $0.3MM, or 3.7% Ratios & Per Share Data • Earnings per share was $0.13 • Tangible book value per share was $18.35 • Return on average assets improved to 0.38% • Return on average equity improved to 3.48% • Efficiency ratio decreased to 79.96% Other • Termination of joint regulatory Written Agreement • Announced plans to sell three southern Illinois branches o $49.3MM deposits o $13.0MM loans o $2.4MM projected gain on sale o Scheduled to close in the second quarter o Projected to be accretive to tangible book value and earnings 6

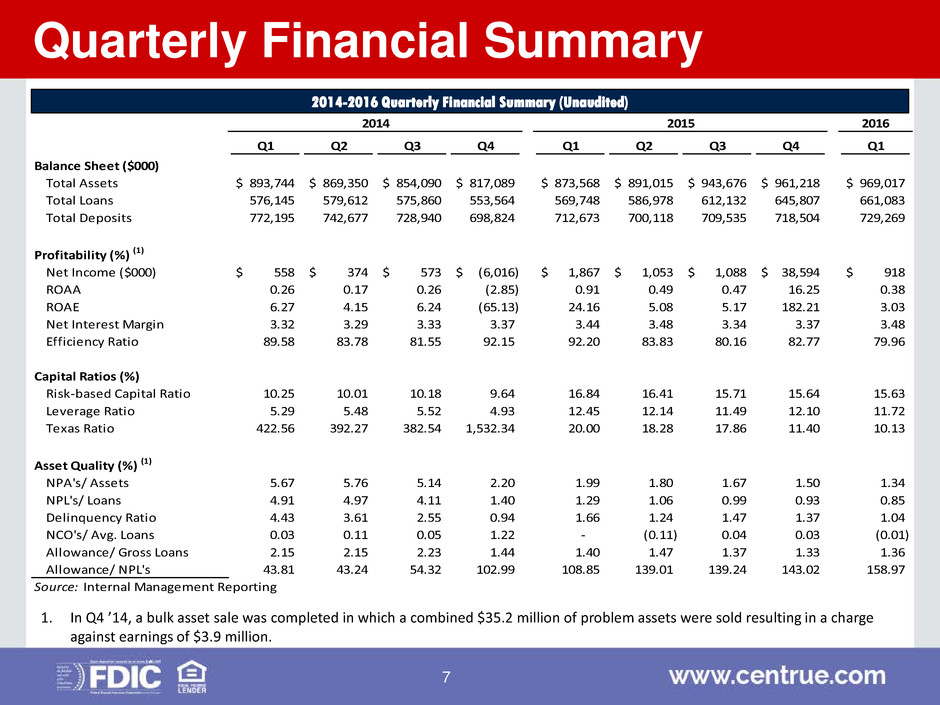

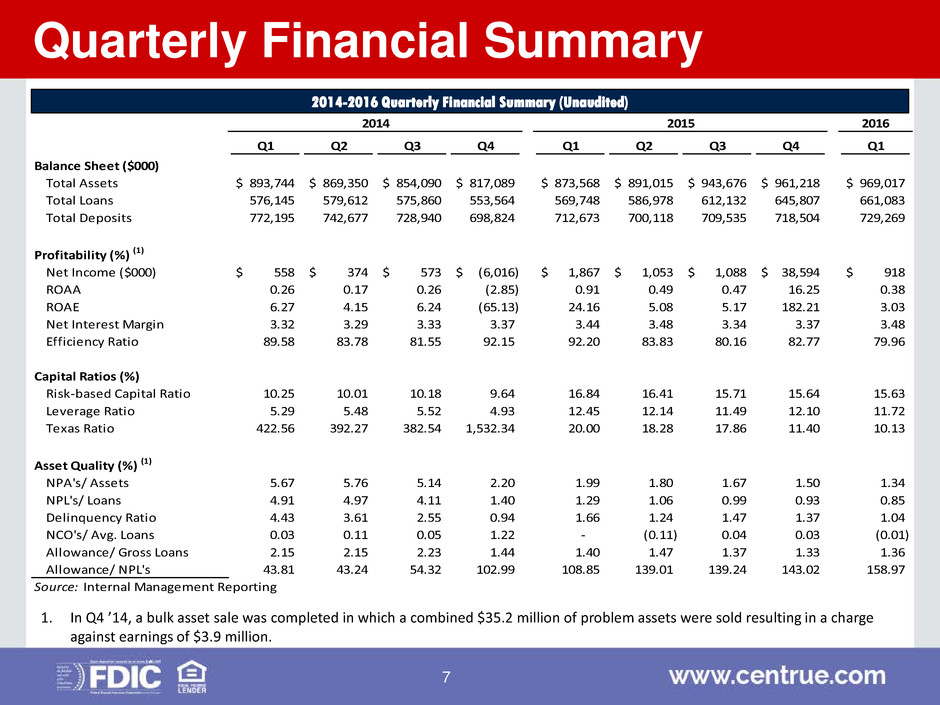

2014-2016 Quarterly Financial Summary (Unaudited) Quarterly Financial Summary 2016 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Balance Sheet ($000) Total Assets 893,744$ 869,350$ 854,090$ 817,089$ 873,568$ 891,015$ 943,676$ 961,218$ 969,017$ Total Loans 576,145 579,612 575,860 553,564 569,748 586,978 612,132 645,807 661,083 Total Deposits 772,195 742,677 728,940 698,824 712,673 700,118 709,535 718,504 729,269 Profitability (%) (1) Net Income ($000) 558$ 374$ 573$ (6,016)$ 1,867$ 1,053$ 1,088$ 38,594$ 918$ ROAA 0.26 0.17 0.26 (2.85) 0.91 0.49 0.47 16.25 0.38 ROAE 6.27 4.15 6.24 (65.13) 24.16 5.08 5.17 182.21 3.03 Net Interest Margin 3.32 3.29 3.33 3.37 3.44 3.48 3.34 3.37 3.48 Efficiency Ratio 89.58 83.78 81.55 92.15 92.20 83.83 80.16 82.77 79.96 Capital Ratios (%) Risk-based Capital Ratio 10.25 10.01 10.18 9.64 16.84 16.41 15.71 15.64 15.63 Leverage Ratio 5.29 5.48 5.52 4.93 12.45 12.14 11.49 12.10 11.72 Texas Ratio 422.56 392.27 382.54 1,532.34 20.00 18.28 17.86 11.40 10.13 Asset Quality (%) (1) NPA's/ Assets 5.67 5.76 5.14 2.20 1.99 1.80 1.67 1.50 1.34 NPL's/ Loans 4.91 4.97 4.11 1.40 1.29 1.06 0.99 0.93 0.85 Delinquency Ratio 4.43 3.61 2.55 0.94 1.66 1.24 1.47 1.37 1.04 NCO's/ Avg. Loans 0.03 0.11 0.05 1.22 - (0.11) 0.04 0.03 (0.01) Allowance/ Gross Loans 2.15 2.15 2.23 1.44 1.40 1.47 1.37 1.33 1.36 Allowance/ NPL's 43.81 43.24 54.32 102.99 108.85 139.01 139.24 143.02 158.97 Source: Internal Management Reporting 2014 2015 1. In Q4 ’14, a bulk asset sale was completed in which a combined $35.2 million of problem assets were sold resulting in a charge against earnings of $3.9 million. 7

2016 Versus 2015 Results (Unaudited) Financial Comparisons 2016 2015 $ % Balance Sheet ($000) Total Assets 969,017$ 873,568$ 95,449$ 10.93 Total Loans 661,083 569,748 91,335 16.03 Total Deposits 729,269 712,673 16,596 2.33 Profitability (%) (1) Net Income ($000) 918$ 1,867$ (949)$ (50.83) ROAA 0.38 0.91 (0.53) (58.24) ROAE 3.03 24.16 (21.13) (87.46) Net Interest Margin 3.48 3.44 0.04 1.16 Efficiency Ratio 79.96 92.20 (12.24) (13.28) Capital Ratios (%) Risk-based Capital Ratio 15.63 16.84 (1.21) (7.19) Leverage Ratio 11.72 12.45 (0.73) (5.86) Texas Ratio 10.13 20.00 (9.87) (49.35) Asset Quality (%) NPA's/ Assets 1.34 1.99 (0.65) (32.66) NPL's/ Loans 0.85 1.29 (0.44) (34.11) Delinquency Ratio 1.04 1.66 (0.62) (37.35) NCO's/ Avg. Loans (0.01) - (0.01) - Allowance/ Gross Loans 1.36 1.40 (0.04) (2.86) Allowance/ NPL's 158.97 108.85 50.12 46.05 Source: Internal Management Reporting Quarter Ended March 31 1. In Q1 ’15, as part of the Company’s recapitalization and debt settlement, a gain of $1.75 million was realized as a result of debt extinguishment. 8

Commercial 12.7% AG and AGRE 6.8% Commercial RE 68.4% 1-4 Family 11.6% Consumer 0.4% Loans Loan and Deposit Portfolios Source: Internal Management Reporting Checking 21.5% NOW 17.7% Money Market 14.7% Savings 18.1% Time 28.1% Deposits 9

Loan Portfolio Source: Internal Management Reporting $576.1 $579.6 $575.9 $553.6 $569.7 $587.0 $612.1 $645.8 $661.1 74.6% 78.0% 79.0% 79.2% 79.9% 83.8% 86.3% 89.9% 90.7% 60.0% 65.0% 70.0% 75.0% 80.0% 85.0% 90.0% 95.0% $480.0 $500.0 $520.0 $540.0 $560.0 $580.0 $600.0 $620.0 $640.0 $660.0 $680.0 Q1/14 Q2/14 Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 ($ in millions) Loans Loan/ Deposit Ratio 10

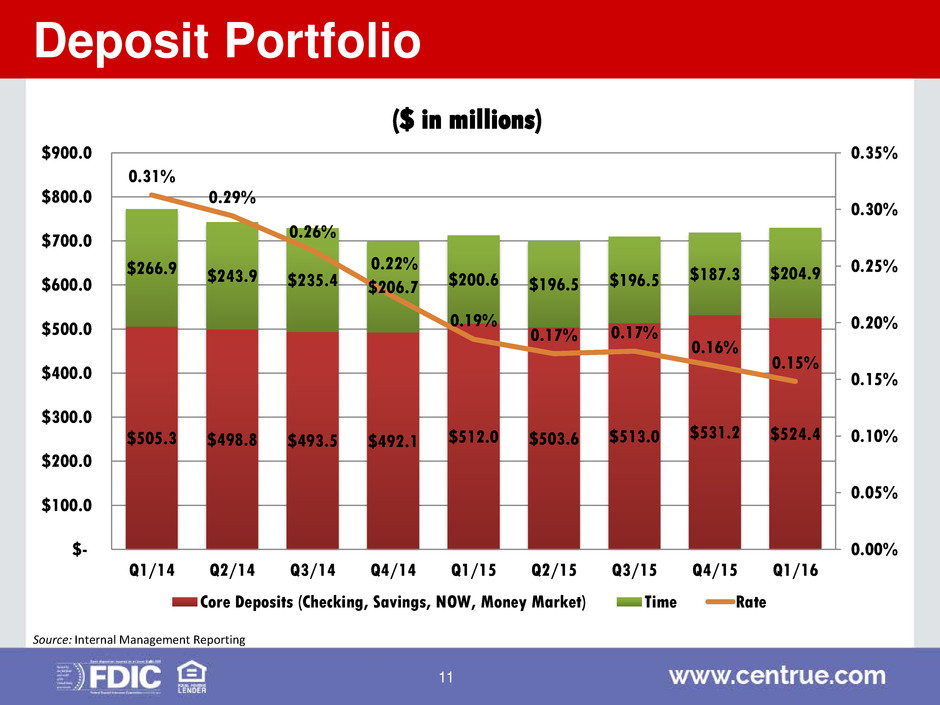

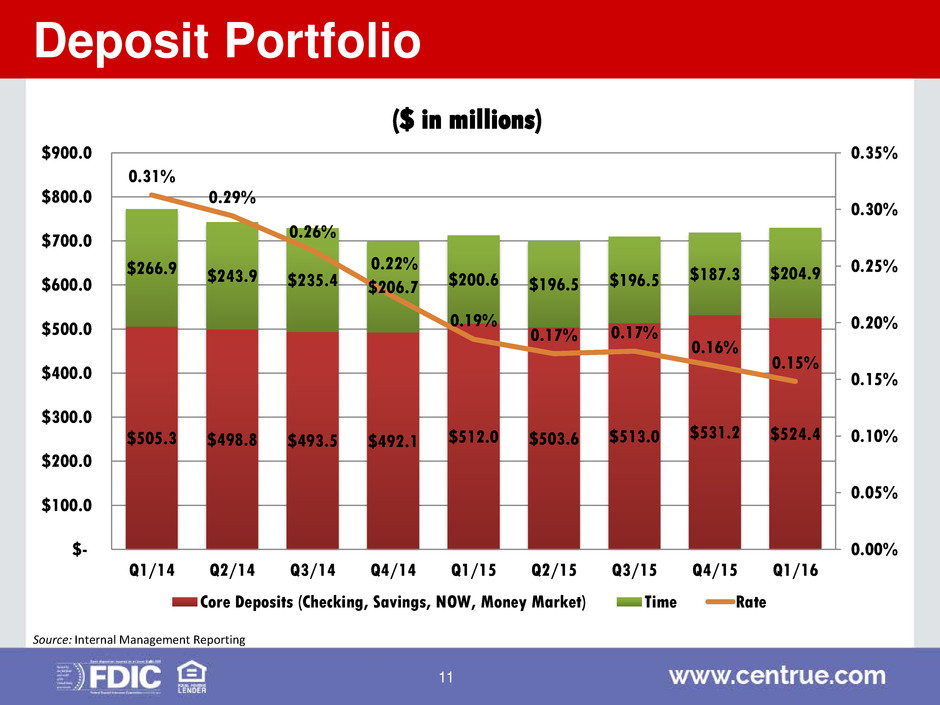

Deposit Portfolio $505.3 $498.8 $493.5 $492.1 $512.0 $503.6 $513.0 $531.2 $524.4 $266.9 $243.9 $235.4 $206.7 $200.6 $196.5 $196.5 $187.3 $204.9 0.31% 0.29% 0.26% 0.22% 0.19% 0.17% 0.17% 0.16% 0.15% 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 0.35% $- $100.0 $200.0 $300.0 $400.0 $500.0 $600.0 $700.0 $800.0 $900.0 Q1/14 Q2/14 Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 ($ in millions) Core Deposits (Checking, Savings, NOW, Money Market) Time Rate Source: Internal Management Reporting 11

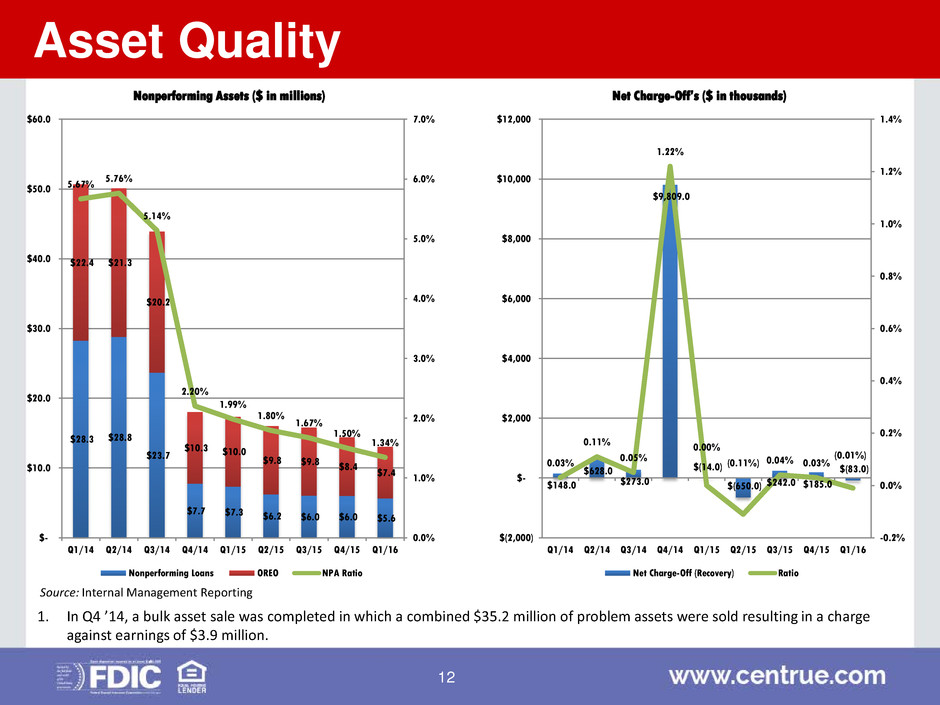

Asset Quality Source: Internal Management Reporting $28.3 $28.8 $23.7 $7.7 $7.3 $6.2 $6.0 $6.0 $5.6 $22.4 $21.3 $20.2 $10.3 $10.0 $9.8 $9.8 $8.4 $7.4 5.67% 5.76% 5.14% 2.20% 1.99% 1.80% 1.67% 1.50% 1.34% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% $- $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 Q1/14 Q2/14 Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Nonperforming Assets ($ in millions) Nonperforming Loans OREO NPA Ratio $148.0 $628.0 $273.0 $9,809.0 $(14.0) $(650.0) $242.0 $185.0 $(83.0) 0.03% 0.11% 0.05% 1.22% 0.00% (0.11%) 0.04% 0.03% (0.01%) -0.2% 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% $(2,000) $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 Q1/14 Q2/14 Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Net Charge-Off’s ($ in thousands) Net Charge-Off (Recovery) Ratio 1. In Q4 ’14, a bulk asset sale was completed in which a combined $35.2 million of problem assets were sold resulting in a charge against earnings of $3.9 million. 12

Capital 10.3% 10.0% 10.2% 9.6% 16.8% 16.4% 15.7% 15.6% 15.6% 7.0% 9.0% 11.0% 13.0% 15.0% 17.0% 19.0% Q1/14 Q2/14 Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Total Risk-Based Capital Ratio 5.3% 5.5% 5.5% 4.9% 12.5% 12.1% 11.5% 12.1% 11.7% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% Q1/14 Q2/14 Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Tier 1 Leverage Ratio (0.04%) 0.04% (0.16%) (0.84%) 9.03% 8.87% 8.49% 12.27% 12.35% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% Q1/14 Q2/14 Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Tangible Common Equity/ Tangible Assets 422.6% 392.3% 382.5% 1532.3% 20.0% 18.3% 17.9% 11.4% 10.1% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% Q1/14 Q2/14 Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Texas Ratio Source: Internal Management Reporting 13

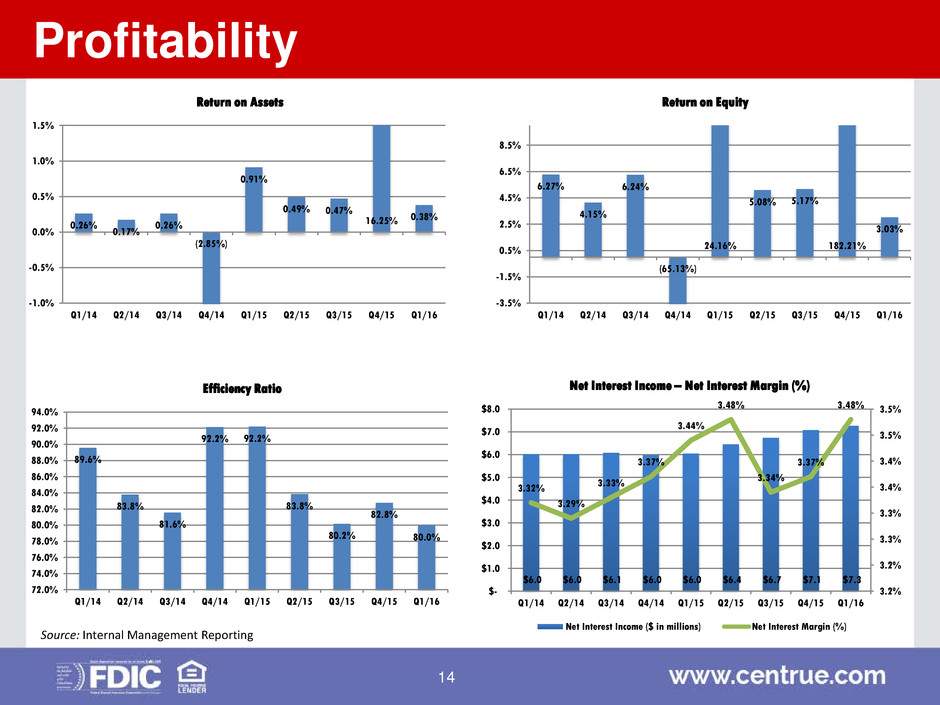

Profitability 0.26% 0.17% 0.26% (2.85%) 0.91% 0.49% 0.47% 16.25% 0.38% -1.0% -0.5% 0.0% 0.5% 1.0% 1.5% Q1/14 Q2/14 Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Return on Assets 89.6% 83.8% 81.6% 92.2% 92.2% 83.8% 80.2% 82.8% 80.0% 72.0% 74.0% 76.0% 78.0% 80.0% 82.0% 84.0% 86.0% 88.0% 90.0% 92.0% 94.0% Q1/14 Q2/14 Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Efficiency Ratio $6.0 $6.0 $6.1 $6.0 $6.0 $6.4 $6.7 $7.1 $7.3 3.32% 3.29% 3.33% 3.37% 3.44% 3.48% 3.34% 3.37% 3.48% 3.2% 3.2% 3.3% 3.3% 3.4% 3.4% 3.5% 3.5% $- $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 Q1/14 Q2/14 Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Net Interest Income – Net Interest Margin (%) Net Interest Income ($ in millions) Net Interest Margin (%) 6.27% 4.15% 6.24% (65.13%) 24.16% 5.08% 5.17% 182.21% 3.03% -3.5% -1.5% 0.5% 2.5% 4.5% 6.5% 8.5% Q1/14 Q2/14 Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Return on Equity Source: Internal Management Reporting 14

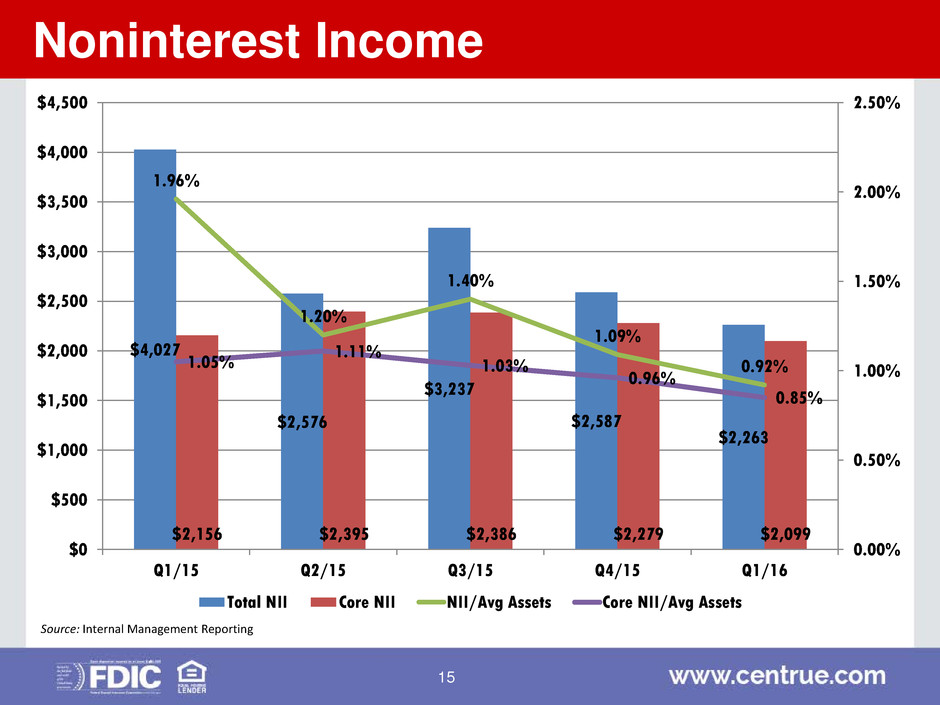

Noninterest Income Source: Internal Management Reporting $4,027 $2,576 $3,237 $2,587 $2,263 $2,156 $2,395 $2,386 $2,279 $2,099 1.96% 1.20% 1.40% 1.09% 0.92% 1.05% 1.11% 1.03% 0.96% 0.85% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Total NII Core NII NII/Avg Assets Core NII/Avg Assets 15

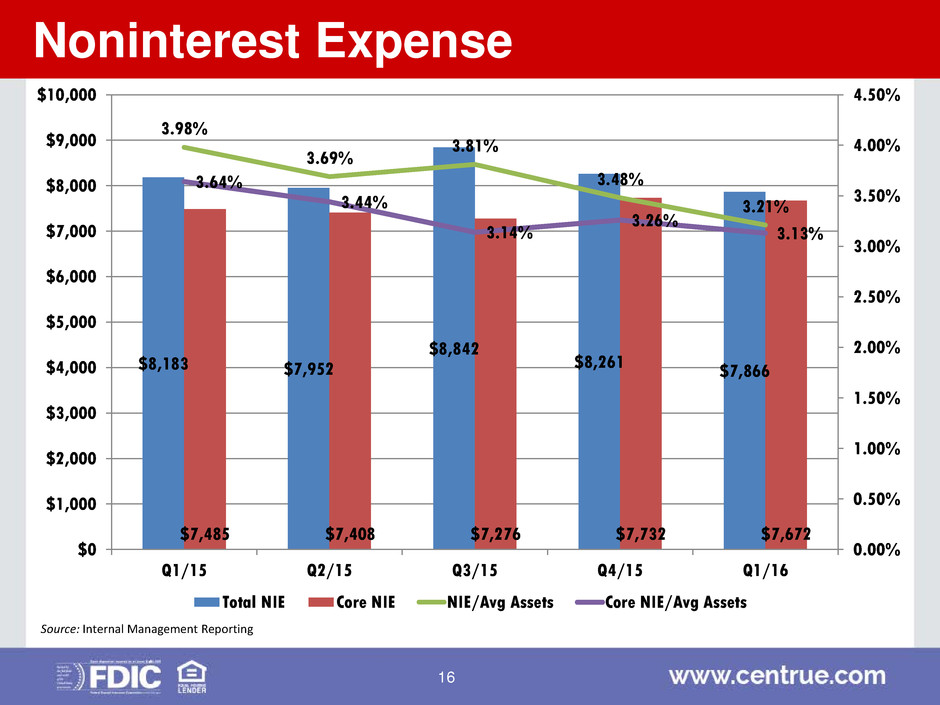

Noninterest Expense Source: Internal Management Reporting $8,183 $7,952 $8,842 $8,261 $7,866 $7,485 $7,408 $7,276 $7,732 $7,672 3.98% 3.69% 3.81% 3.48% 3.21% 3.64% 3.44% 3.14% 3.26% 3.13% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 $10,000 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Total NIE Core NIE NIE/Avg Assets Core NIE/Avg Assets 16

Stock Price $11.40 $15.00 $14.55 $16.64 $17.40 $12.14 $12.16 $12.33 $18.08 $18.35 93.9% 123.6% 139.8% 134.9% 96.2% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% 110.0% 120.0% 130.0% 140.0% 150.0% $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 $20.0 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Closing Stock Price Tangible Book Value Price/ TBV Source: Internal Management Reporting 17

Review of Branch Footprint • Top 5 market share in Kankakee and LaSalle counties • Top 10 market share in 6 of the 10 counties in which the Company operates • 14 branches in North-Central Illinois with strong market share • 6 branches in the southern suburbs of Chicago • 4 branches in St. Louis MSA 1, assuming recently announced branch sales Highlights 2015 Market Rank Company Brchs. Deposits ($) Share (%) 1 HomeStar Financial Group Inc. (IL) 4 298,099$ 15.64 2 Centrue Financial Corporation (IL) 6 233,224 12.24 3 PNC Financial Services Group (PA) 4 208,228 10.93 4 Municipal Trust & SB (IL) 3 202,783 10.64 5 First American Bank Corp. (IL) 2 186,737 9.80 6 First Trust Financial Corp. (IL) 4 176,561 9.27 7 Romy Hammes Inc. (IN) 2 155,712 8.17 8 Foresight Fnl Group Inc. (IL) 2 117,379 6.16 9 Illinois State Bancorp Inc. (IL) 1 76,545 4.02 10 MainSource Financial Group (IN) 3 71,171 3.73 Total For Institutions In Market 41 1,905,547$ 2015 Market Rank Company Brchs. Deposits ($) Share (%) 1 Tri-County Finl Group Inc. (IL) 5 434,888$ 17.49 2 Eureka Savings Bank (IL) 4 288,476 11.60 3 First Ottawa Bancshares (IL) 6 222,626 8.95 4 First FSB (IL) 6 184,305 7.41 5 Centrue Financial Corporation (IL) 7 181,235 7.29 6 Ottawa Savings Bancorp (MHC) (IL) 2 165,269 6.65 7 LaSalle Bancorp Inc. (IL) 2 148,774 5.98 8 Streator Home SB (IL) 1 129,001 5.19 9 Peru FSB (IL) 2 121,866 4.90 10 Heartland Bancorp Inc. (IL) 2 96,484 3.88 Total For Institutions In Market 59 2,486,502$ Kankakee County - Top 10 LaSalle County - Top 10 18

Branches: 19 Loans: $439mm Deposits: $666mm Branches: 4 Loans: $222mm Deposits: $63mm Total Branches: 23 Loans: $661mm Deposits: $729mm Branch Franchise 19

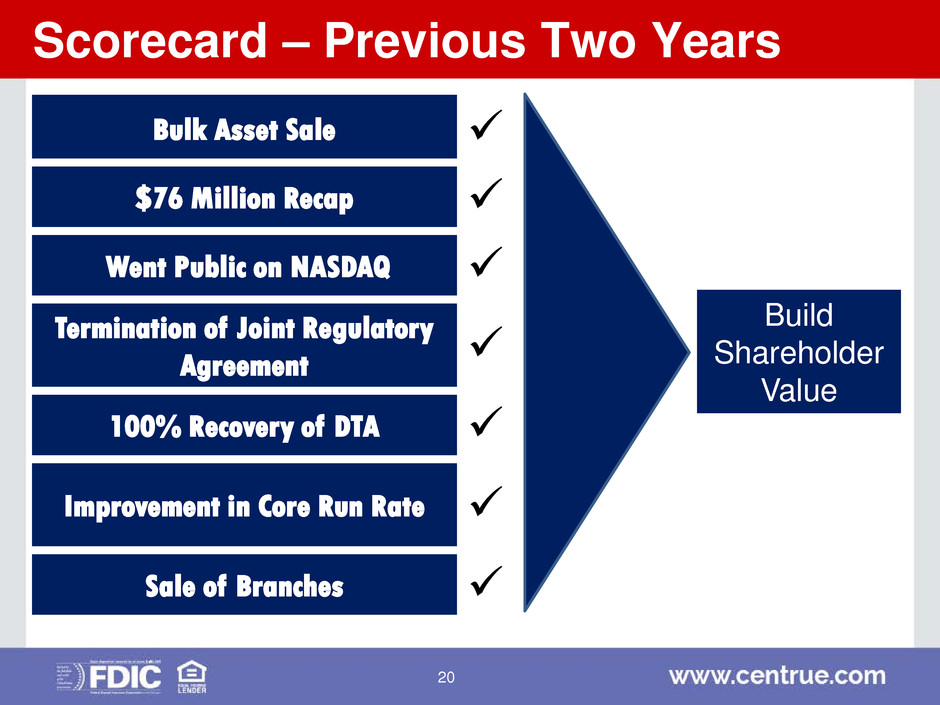

Scorecard – Previous Two Years Bulk Asset Sale $76 Million Recap Went Public on NASDAQ Termination of Joint Regulatory Agreement 100% Recovery of DTA Improvement in Core Run Rate Sale of Branches Build Shareholder Value 20

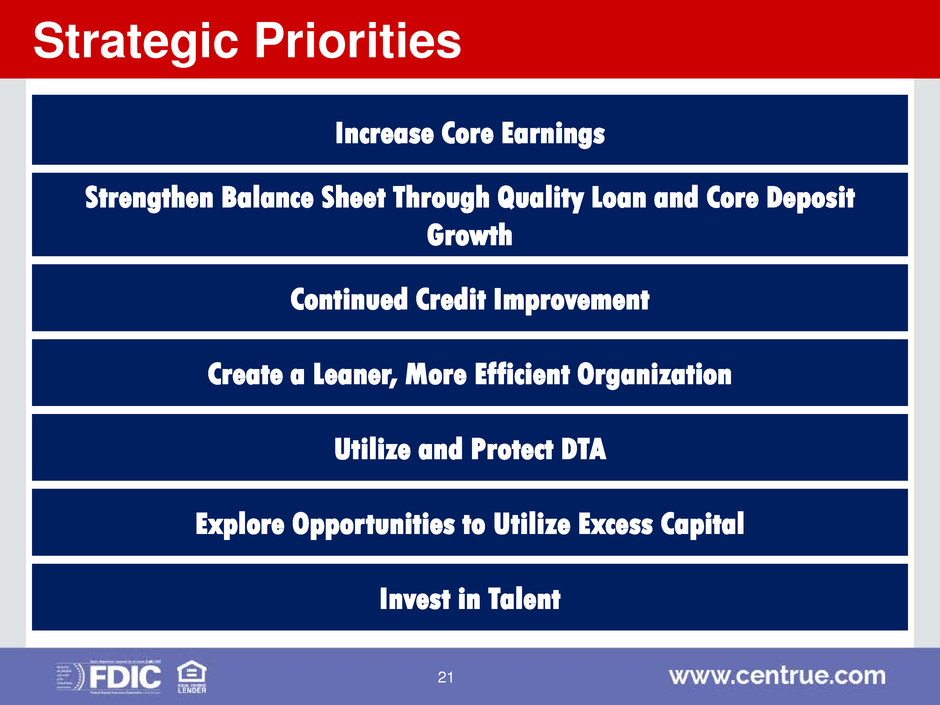

Strategic Priorities Increase Core Earnings Strengthen Balance Sheet Through Quality Loan and Core Deposit Growth Continued Credit Improvement Create a Leaner, More Efficient Organization Utilize and Protect DTA Explore Opportunities to Utilize Excess Capital Invest in Talent 21