Centrue Financial Corporation Earnings Presentation September 30, 2016 NASDAQ: CFCB 1

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives, goals, strategies, expectations, intentions, projections, developments, future events, performance or products, underlying assumptions, and other statements which are other than statements of historical facts. In some cases, you can identify forward-looking statements by terminology such as ''may,'' ''will,'' ''should,'' “hope,'' "expects,'' ''intends,'' ''plans,'' ''anticipates,'' "contemplates," ''believes,'' ''estimates,'' ''predicts,'' ''projects,'' ''potential,'' ''continue,'' and other similar terminology or the negative of these terms. From time to time, we may publish or otherwise make available forward-looking statements of this nature. All such forward-looking statements, whether written or oral, and whether made by us or on our behalf, are expressly qualified by the cautionary statements described on this message including those set forth below. In addition, we undertake no obligation to update or revise any forward-looking statements to reflect events, circumstances, or new information after the date of the information or to reflect the occurrence or likelihood of unanticipated events, and we disclaim any such obligation. Forward-looking statements are only predictions that relate to future events or our future performance and are subject to known and unknown risks, uncertainties, assumptions, and other factors, many of which are beyond our control, that may cause actual results, outcomes, levels of activity, performance, developments, or achievements to be materially different from any future results, outcomes, levels of activity, performance, developments, or achievements expressed, anticipated, or implied by these forward- looking statements. As a result, we cannot guarantee future results, performance, developments, or achievements, and there can be no assurance that our expectations, intentions, anticipations, beliefs, or projections will result or be achieved or accomplished. These forward-looking statements are made as of the date hereof and are based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Centrue’s actual results could differ materially from those stated or implied in forward-looking statements. Past performance is not necessarily indicative of future results. We do not intend to update these forward looking statements even though our situation may change in the future. We encourage you to review the risks that we face and other information about us in our filings with the SEC, including our Annual Report on Form 10-K. These filings are available at www.SEC.gov. Non-GAAP Financial Measures: Certain financial information Included In this presentation may include Non-GAAP Financial Measures. Centrue’s management uses Non-GAAP Financial Measures to evaluate Centrue’s performance and provides is information as a supplement to Centrue’s reported results because management believes this information provides additional insight Into Centrue’s operating performance. Reconciliations for any Non-GAAP Financial Measures may be found in the schedules accompanying Centrue’s earnings releases. General Information and Limitations 2

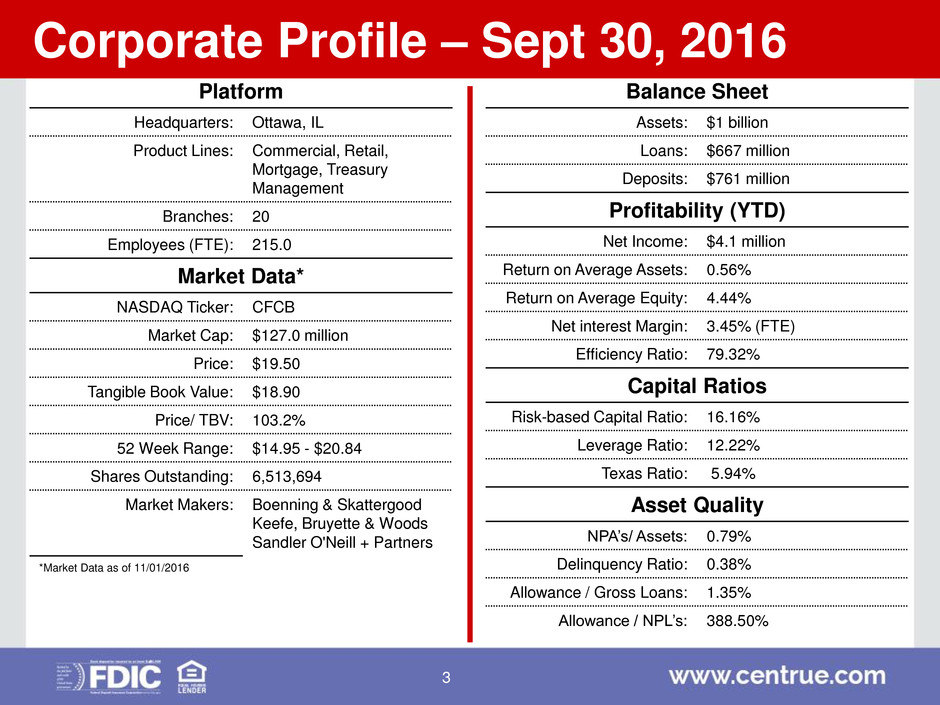

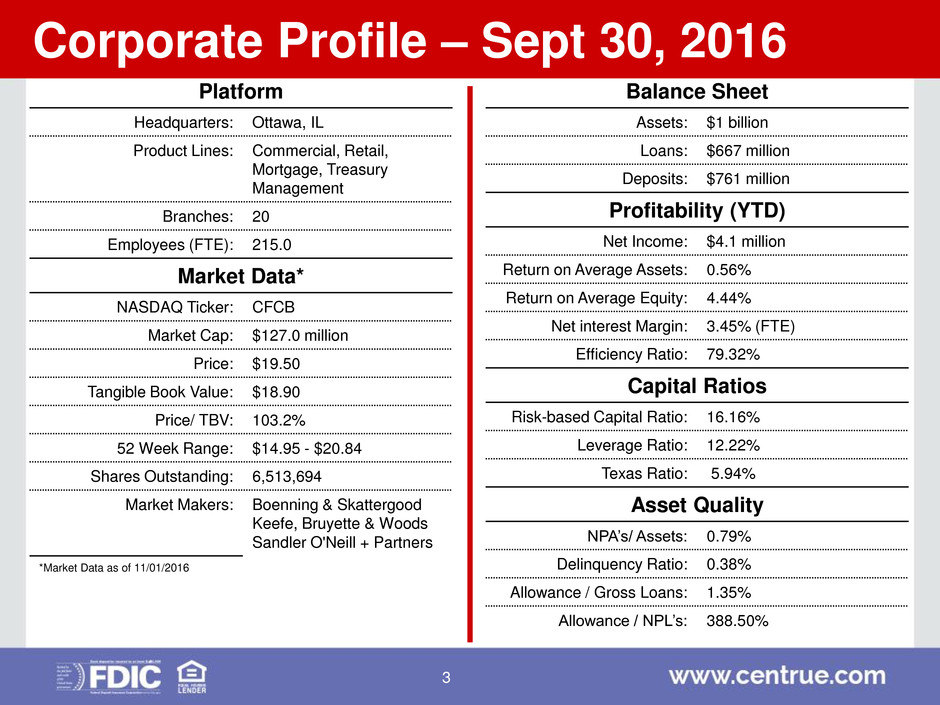

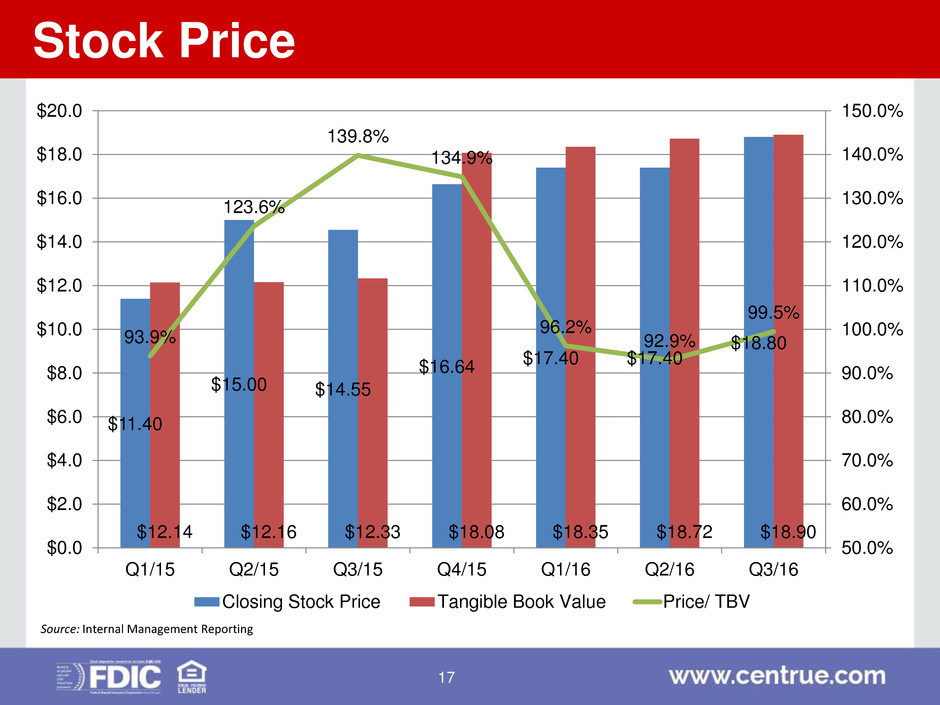

Corporate Profile – Sept 30, 2016 Platform Headquarters: Ottawa, IL Product Lines: Commercial, Retail, Mortgage, Treasury Management Branches: 20 Employees (FTE): 215.0 Market Data* NASDAQ Ticker: CFCB Market Cap: $127.0 million Price: $19.50 Tangible Book Value: $18.90 Price/ TBV: 103.2% 52 Week Range: $14.95 - $20.84 Shares Outstanding: 6,513,694 Market Makers: Boenning & Skattergood Keefe, Bruyette & Woods Sandler O'Neill + Partners *Market Data as of 11/01/2016 Balance Sheet Assets: $1 billion Loans: $667 million Deposits: $761 million Profitability (YTD) Net Income: $4.1 million Return on Average Assets: 0.56% Return on Average Equity: 4.44% Net interest Margin: 3.45% (FTE) Efficiency Ratio: 79.32% Capital Ratios Risk-based Capital Ratio: 16.16% Leverage Ratio: 12.22% Texas Ratio: 5.94% Asset Quality NPA’s/ Assets: 0.79% Delinquency Ratio: 0.38% Allowance / Gross Loans: 1.35% Allowance / NPL’s: 388.50% 3

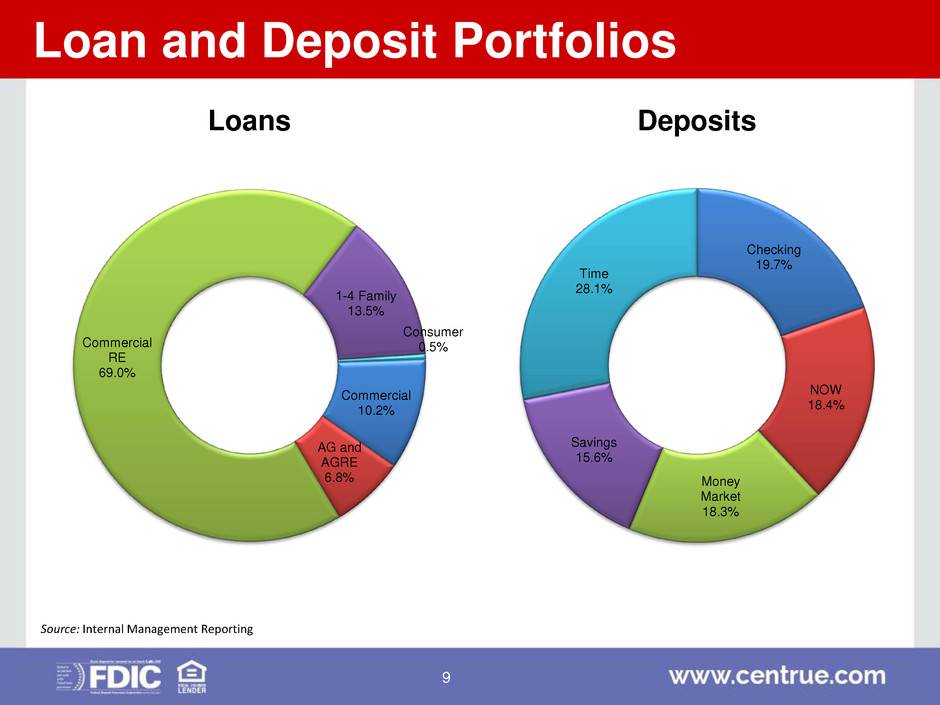

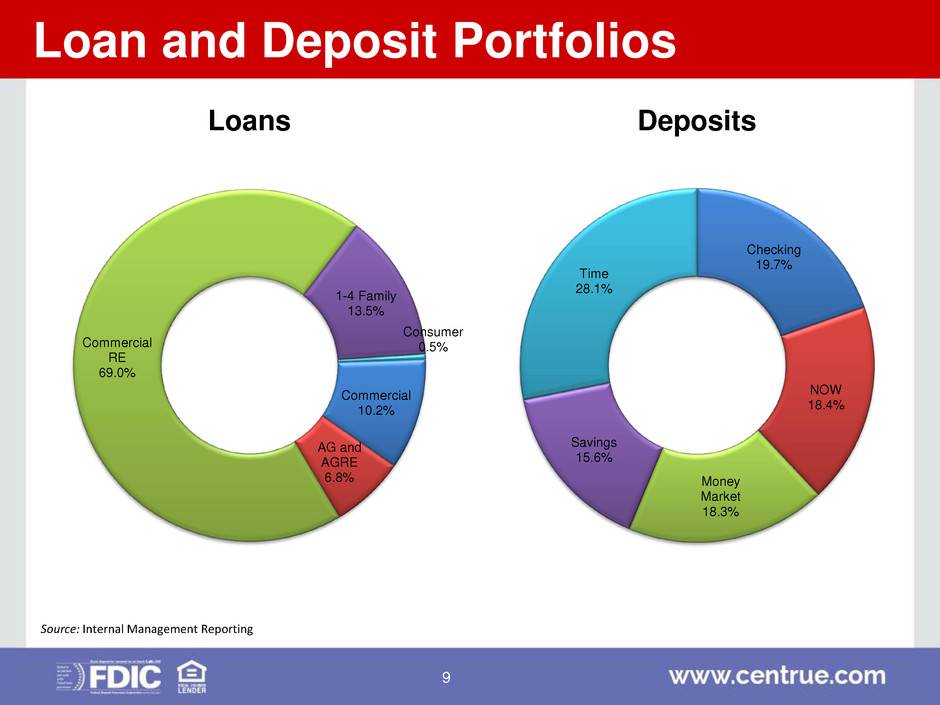

Franchise Value • One hundred forty-two year-old community bank offering commercial, retail, and mortgage banking services • Attractive branch network with solid market share in its core markets and a foothold in two large markets – Top 5 deposit market share in its two core markets (Kankakee and LaSalle County) – The Company has a portion of its branches in Chicago (6) and St. Louis (1) MSAs • Desirable deposit franchise with 17 bps cost of total deposits – Core deposits (checking, savings, NOW, and money markets) account for 71.9% of deposits – Weighted average life of core deposits is 7.3 years • Scalable bank platform – $1 billion in assets and 20 total branches (6 branches in Chicago MSA) – Potential to further capitalize on attractive Chicago market • Experienced management team with proven track record • Historically profitable core franchise • Strong credit underwriting and asset quality metrics • Diverse loan portfolio 4

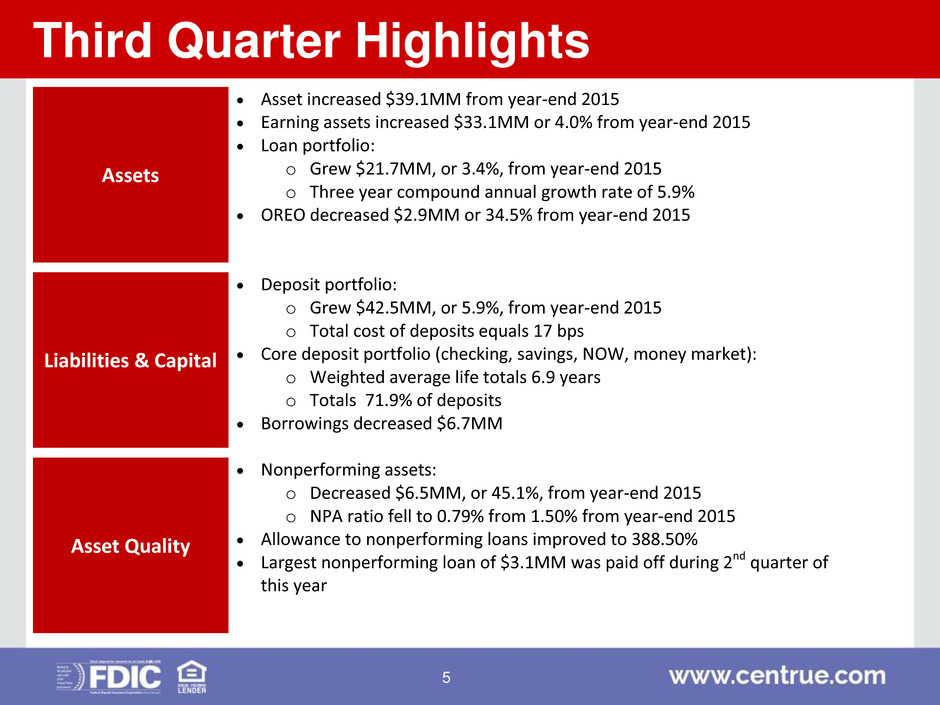

Third Quarter Highlights Assets Asset increased $39.1MM from year-end 2015 Earning assets increased $33.1MM or 4.0% from year-end 2015 Loan portfolio: o Grew $21.7MM, or 3.4%, from year-end 2015 o Three year compound annual growth rate of 5.9% OREO decreased $2.9MM or 34.5% from year-end 2015 Liabilities & Capital Deposit portfolio: o Grew $42.5MM, or 5.9%, from year-end 2015 o Total cost of deposits equals 17 bps Core deposit portfolio (checking, savings, NOW, money market): o Weighted average life totals 6.9 years o Totals 71.9% of deposits Borrowings decreased $6.7MM Asset Quality Nonperforming assets: o Decreased $6.5MM, or 45.1%, from year-end 2015 o NPA ratio fell to 0.79% from 1.50% from year-end 2015 Allowance to nonperforming loans improved to 388.50% Largest nonperforming loan of $3.1MM was paid off during 2nd quarter of this year 5

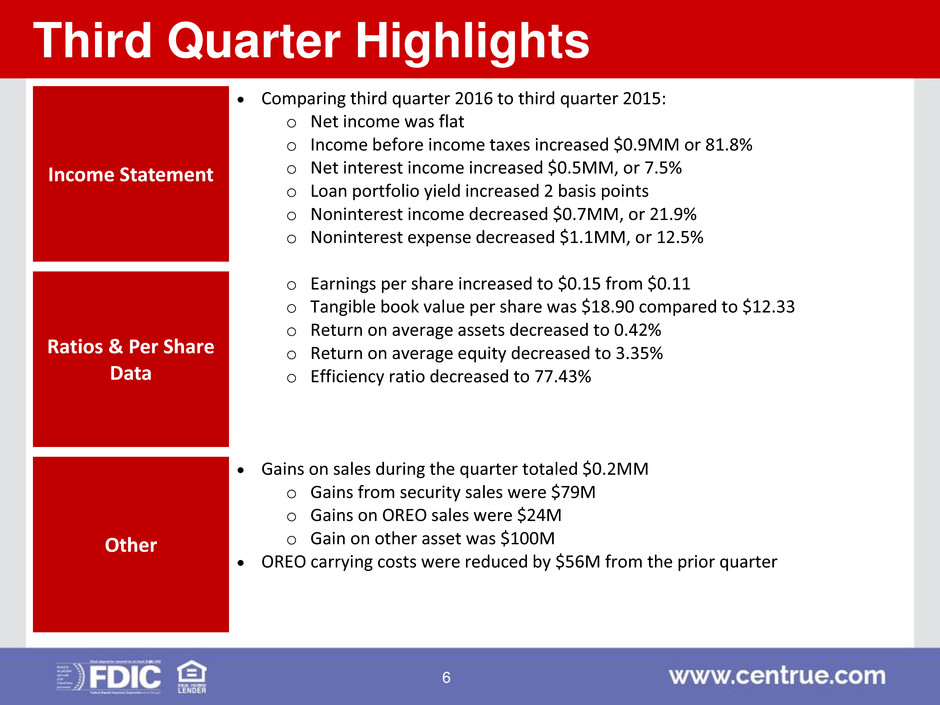

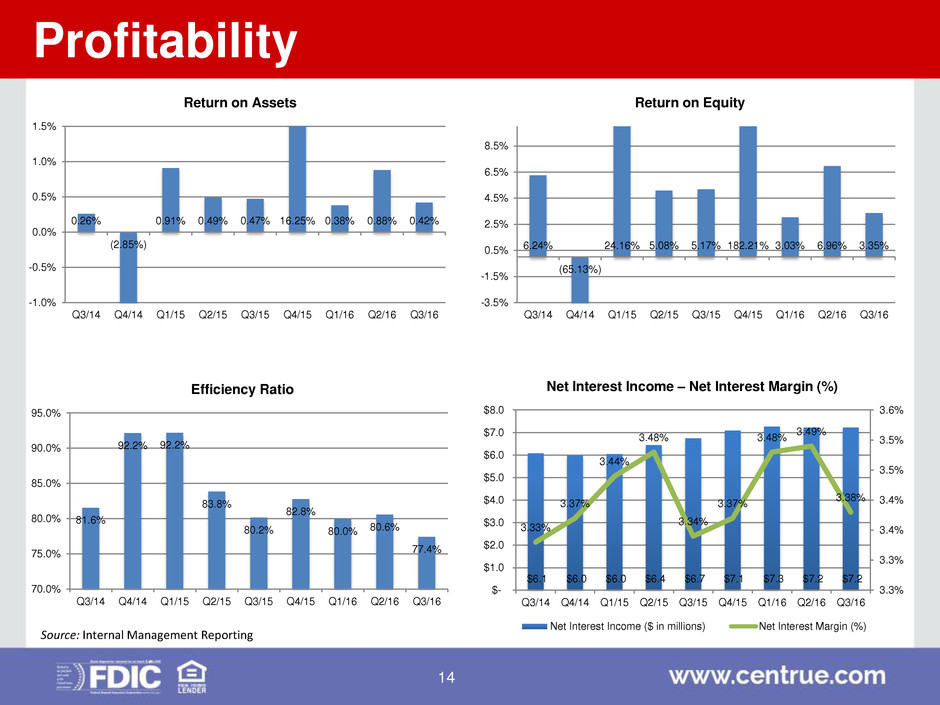

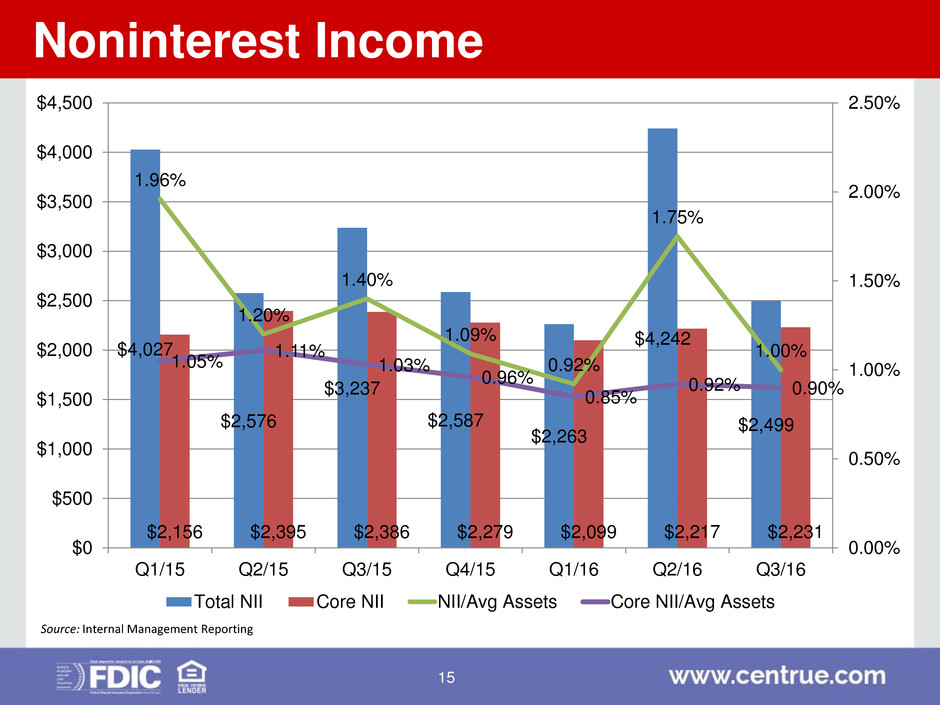

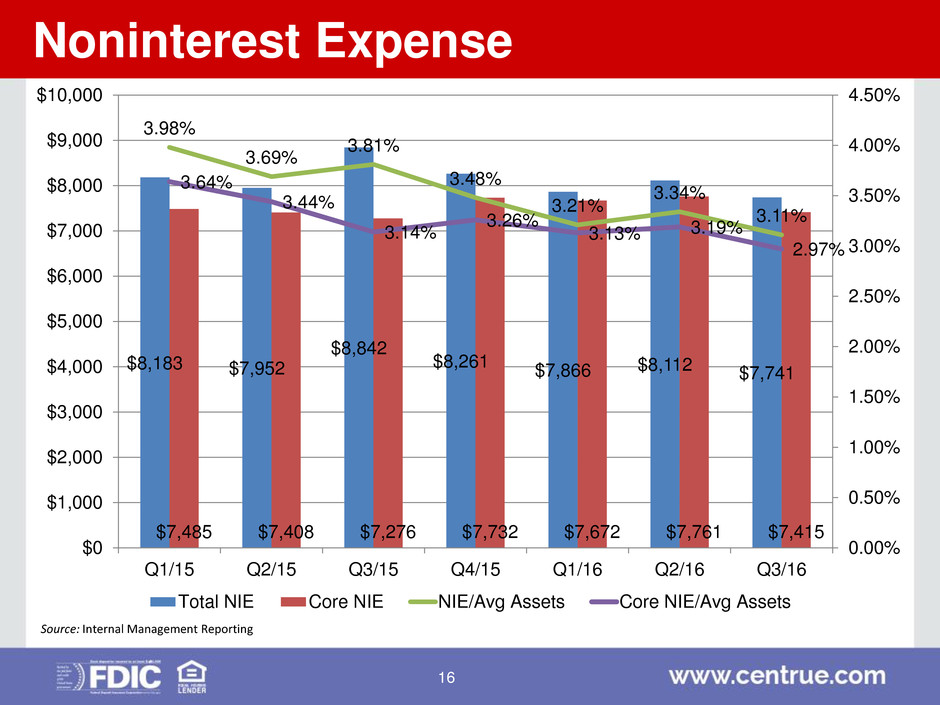

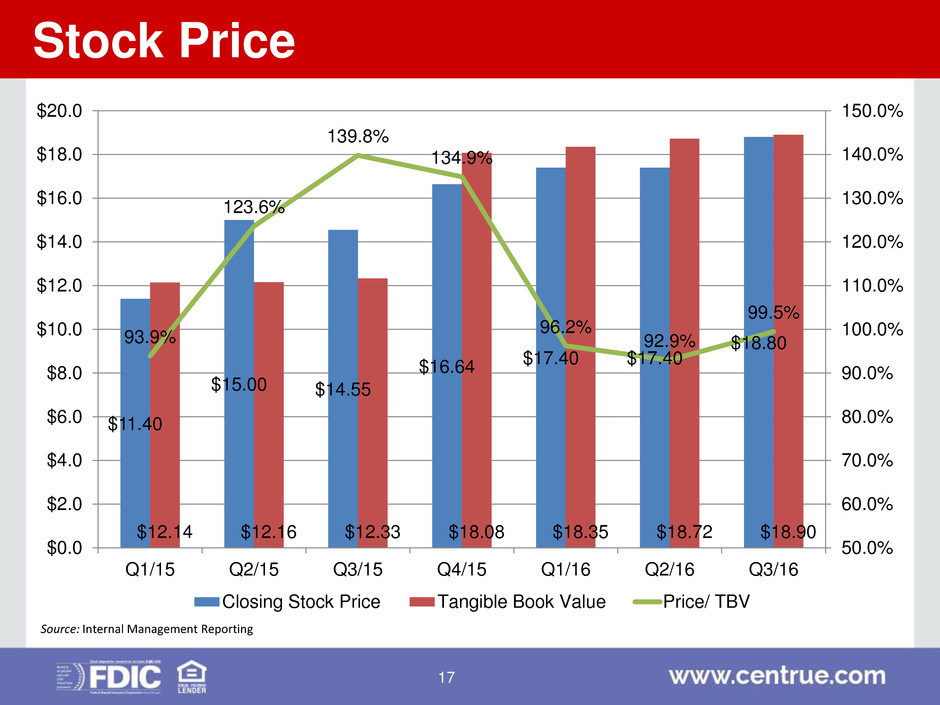

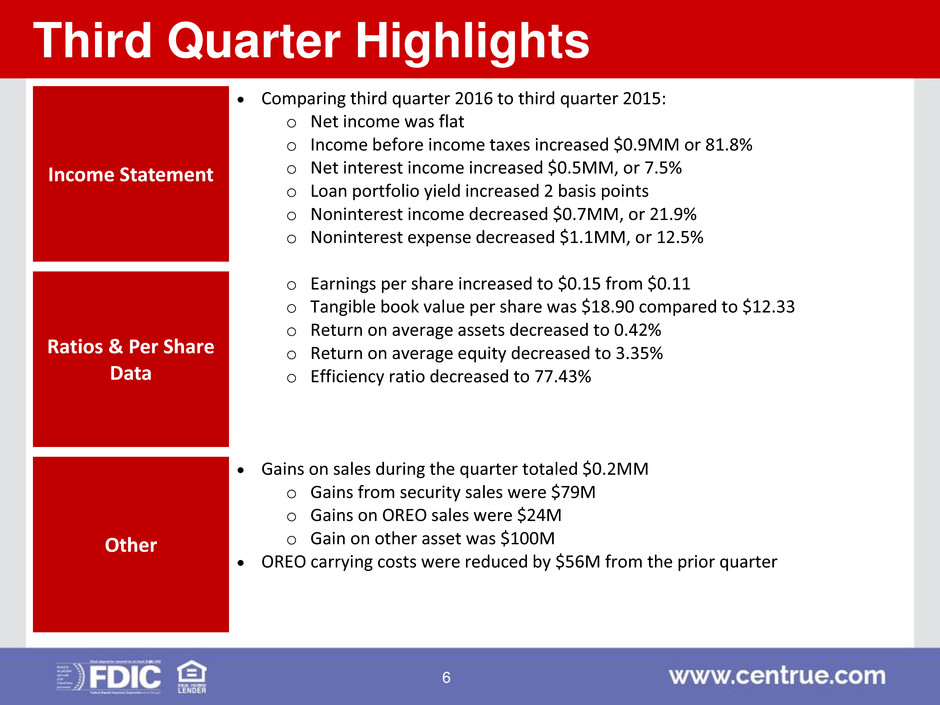

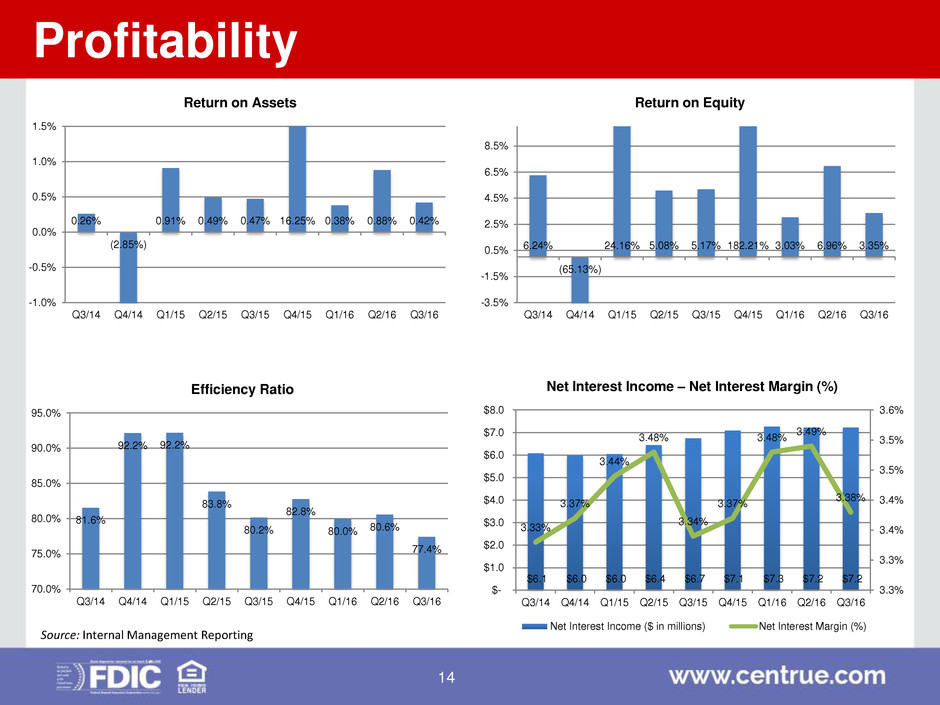

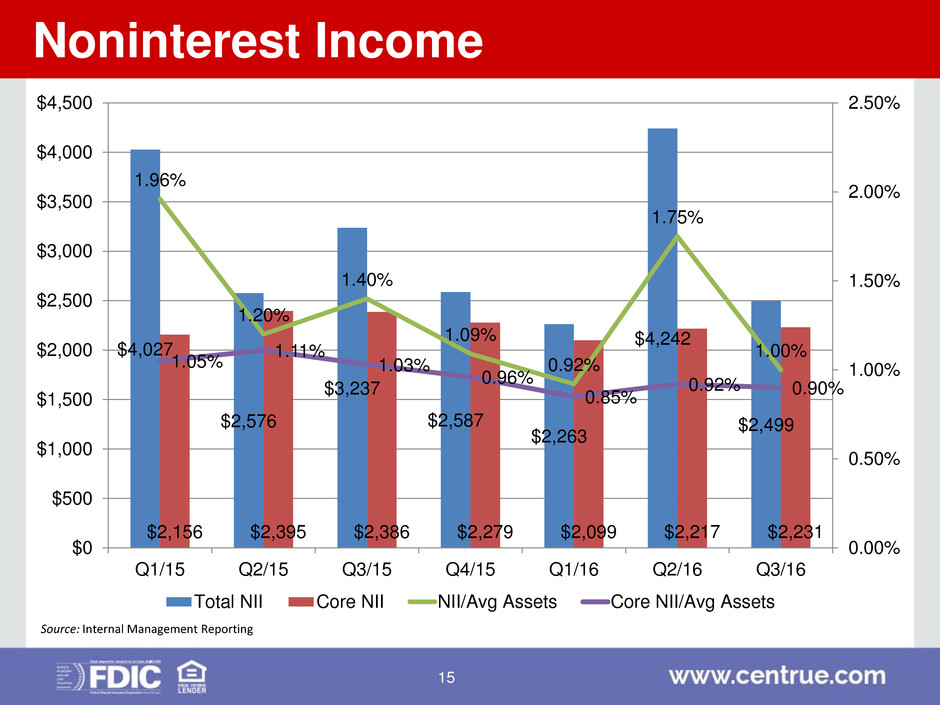

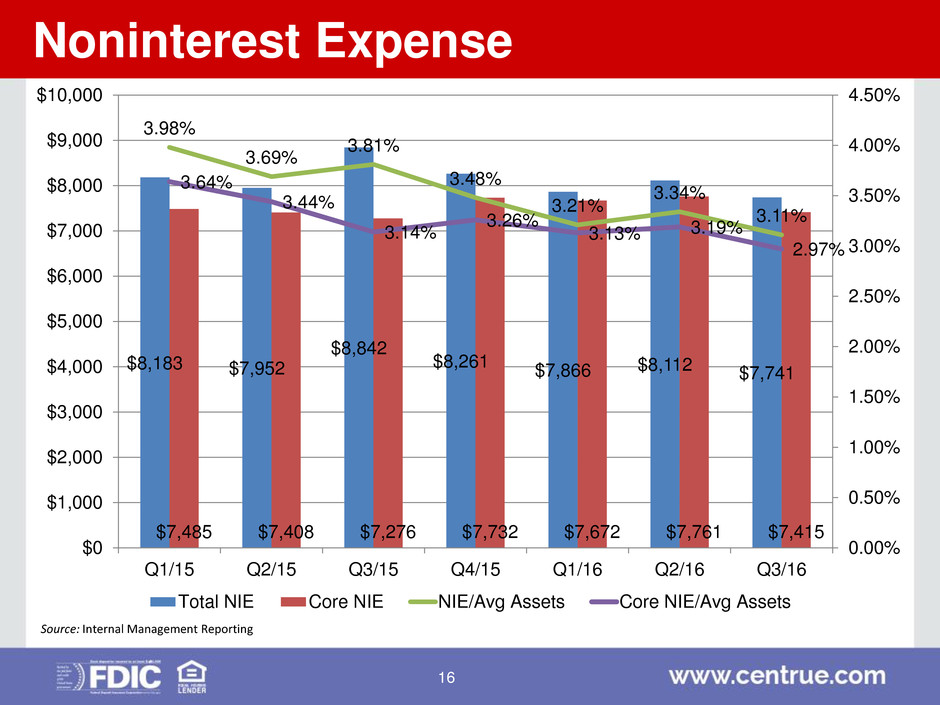

Third Quarter Highlights Income Statement Comparing third quarter 2016 to third quarter 2015: o Net income was flat o Income before income taxes increased $0.9MM or 81.8% o Net interest income increased $0.5MM, or 7.5% o Loan portfolio yield increased 2 basis points o Noninterest income decreased $0.7MM, or 21.9% o Noninterest expense decreased $1.1MM, or 12.5% Ratios & Per Share Data o Earnings per share increased to $0.15 from $0.11 o Tangible book value per share was $18.90 compared to $12.33 o Return on average assets decreased to 0.42% o Return on average equity decreased to 3.35% o Efficiency ratio decreased to 77.43% Other Gains on sales during the quarter totaled $0.2MM o Gains from security sales were $79M o Gains on OREO sales were $24M o Gain on other asset was $100M OREO carrying costs were reduced by $56M from the prior quarter 6

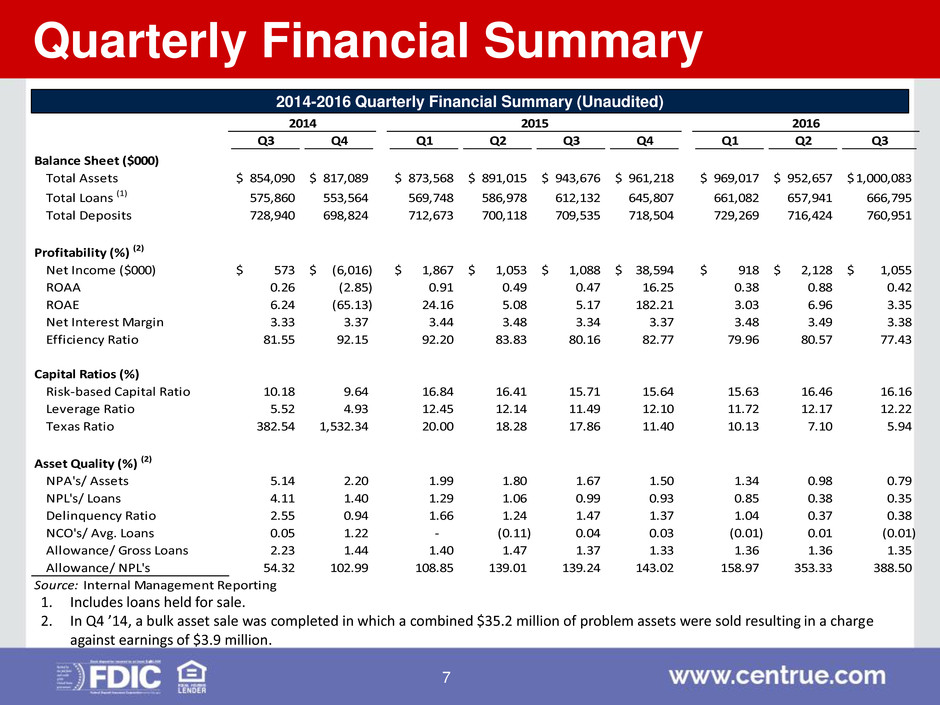

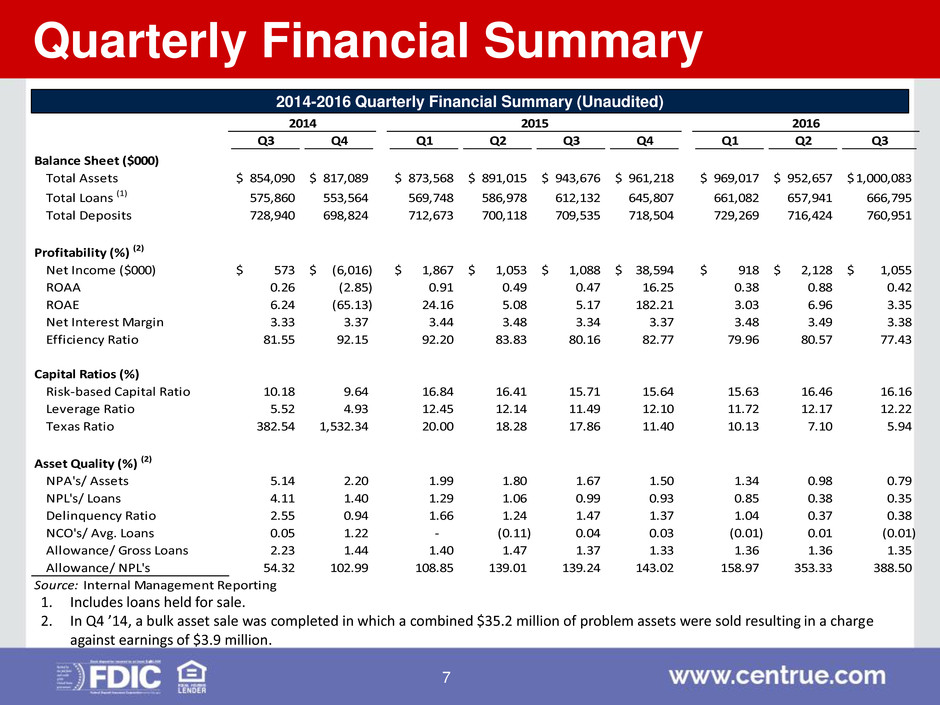

2014-2016 Quarterly Financial Summary (Unaudited) Quarterly Financial Summary Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Balance Sheet ($000) Total Assets 854,090$ 817,089$ 873,568$ 891,015$ 943,676$ 961,218$ 969,017$ 952,657$ 1,000,083$ Total Loans (1) 575,860 553,564 569,748 586,978 612,132 645,807 661,082 657,941 666,795 Total Deposits 728,940 698,824 712,673 700,118 709,535 718,504 729,269 716,424 760,951 Profitability (%) (2) Net Income ($000) 573$ (6,016)$ 1,867$ 1,053$ 1,088$ 38,594$ 918$ 2,128$ 1,055$ ROAA 0.26 (2.85) 0.91 0.49 0.47 16.25 0.38 0.88 0.42 ROAE 6.24 (65.13) 24.16 5.08 5.17 182.21 3.03 6.96 3.35 Net Interest Margin 3.33 3.37 3.44 3.48 3.34 3.37 3.48 3.49 3.38 Efficiency Ratio 81.55 92.15 92.20 83.83 80.16 82.77 79.96 80.57 77.43 Capital Ratios (%) Risk-based Capital Ratio 10.18 9.64 16.84 16.41 15.71 15.64 15.63 16.46 16.16 Leverage Ratio 5.52 4.93 12.45 12.14 11.49 12.10 11.72 12.17 12.22 Texas Ratio 382.54 1,532.34 20.00 18.28 17.86 11.40 10.13 7.10 5.94 Asset Quality (%) (2) NPA's/ Assets 5.14 2.20 1.99 1.80 1.67 1.50 1.34 0.98 0.79 NPL's/ Loans 4.11 1.40 1.29 1.06 0.99 0.93 0.85 0.38 0.35 Delinquency Ratio 2.55 0.94 1.66 1.24 1.47 1.37 1.04 0.37 0.38 NCO's/ Avg. Loans 0.05 1.22 - (0.11) 0.04 0.03 (0.01) 0.01 (0.01) Allowance/ Gross Loans 2.23 1.44 1.40 1.47 1.37 1.33 1.36 1.36 1.35 Allowance/ NPL's 54.32 102.99 108.85 139.01 139.24 143.02 158.97 353.33 388.50 Source: Internal Management Reporting 2014 2015 2016 1. Includes loans held for sale. 2. In Q4 ’14, a bulk asset sale was completed in which a combined $35.2 million of problem assets were sold resulting in a charge against earnings of $3.9 million. 7

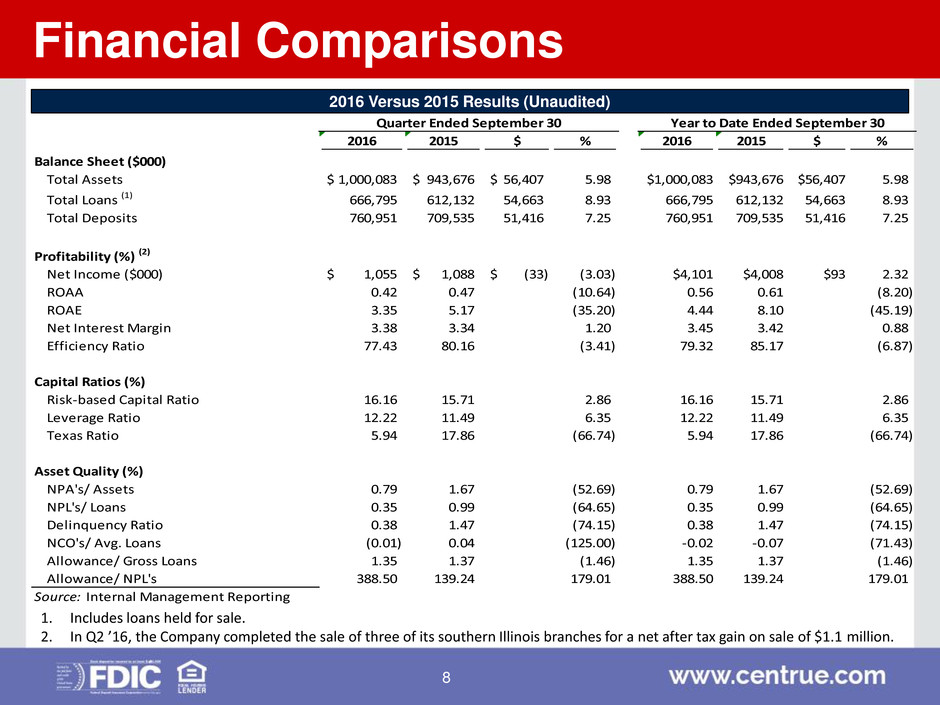

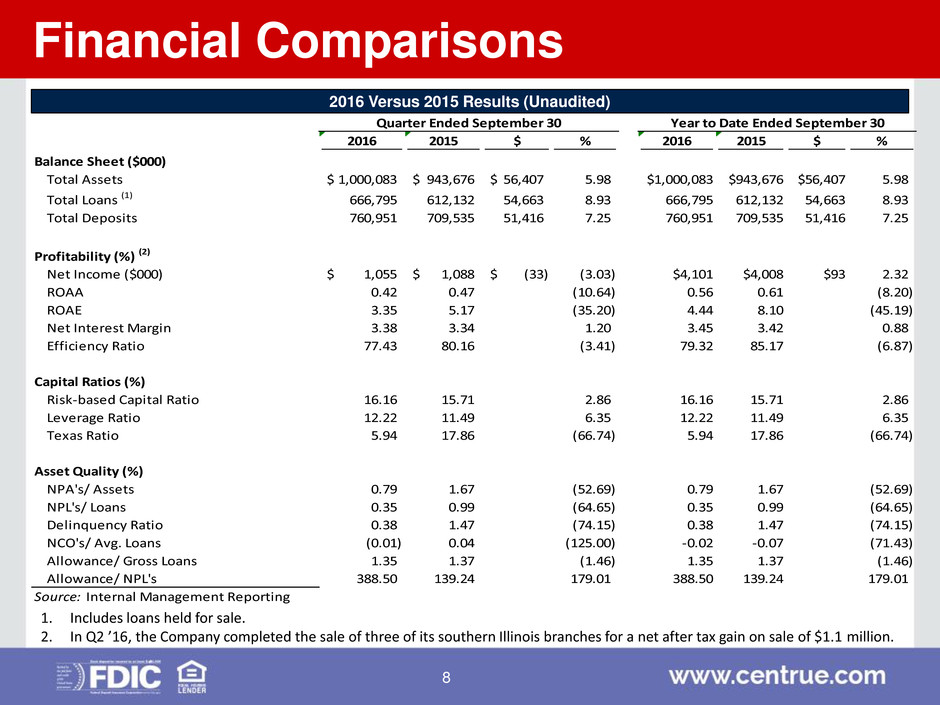

2016 Versus 2015 Results (Unaudited) Financial Comparisons 2016 2015 $ % 2016 2015 $ % Balance Sheet ($000) Total Assets 1,000,083$ 943,676$ 56,407$ 5.98 $1,000,083 $943,676 $56,407 5.98 Total Loans (1) 666,795 612,132 54,663 8.93 666,795 612,132 54,663 8.93 Total Deposits 760,951 709,535 51,416 7.25 760,951 709,535 51,416 7.25 Profitability (%) (2) Net Income ($000) 1,055$ 1,088$ (33)$ (3.03) $4,101 $4,008 $93 2.32 ROAA 0.42 0.47 (0.05) (10.64) 0.56 0.61 -0.05 (8.20) ROAE 3.35 5.17 (1.82) (35.20) 4.44 8.10 -3.66 (45.19) Net Interest Margin 3.38 3.34 0.04 1.20 3.45 3.42 0.03 0.88 Efficiency Ratio 77.43 80.16 (2.73) (3.41) 79.32 85.17 -5.85 (6.87) Capital Ratios (%) Risk-based Capital Ratio 16.16 15.71 0.45 2.86 16.16 15.71 0.45 2.86 Leverage Ratio 12.22 11.49 0.73 6.35 12.22 11.49 0.73 6.35 Texas Ratio 5.94 17.86 (11.92) (66.74) 5.94 17.86 -11.92 (66.74) Asset Quality (%) NPA's/ Assets 0.79 1.67 (0.88) (52.69) 0.79 1.67 -0.88 (52.69) NPL's/ Loans 0.35 0.99 (0.64) (64.65) 0.35 0.99 -0.64 (64.65) Delinquency Ratio 0.38 1.47 (1.09) (74.15) 0.38 1.47 -1.09 (74.15) NCO's/ Avg. Loans (0.01) 0.04 (0.05) (125.00) -0.02 -0.07 0.05 (71.43) Allowance/ Gross Loans 1.35 1.37 (0.02) (1.46) 1.35 1.37 -0.02 (1.46) Allowance/ NPL's 388.50 139.24 249.26 179.01 388.50 139.24 249.26 179.01 Source: Internal Management Reporting Quarter Ended September 30 Year to Date Ended September 30 1. Includes loans held for sale. 2. In Q2 ’16, the Company completed the sale of three of its southern Illinois branches for a net after tax gain on sale of $1.1 million. 8

Commercial 10.2% AG and AGRE 6.8% Commercial RE 69.0% 1-4 Family 13.5% Consumer 0.5% Loans Loan and Deposit Portfolios Source: Internal Management Reporting Checking 19.7% NOW 18.4% Money Market 18.3% Savings 15.6% Time 28.1% Deposits 9

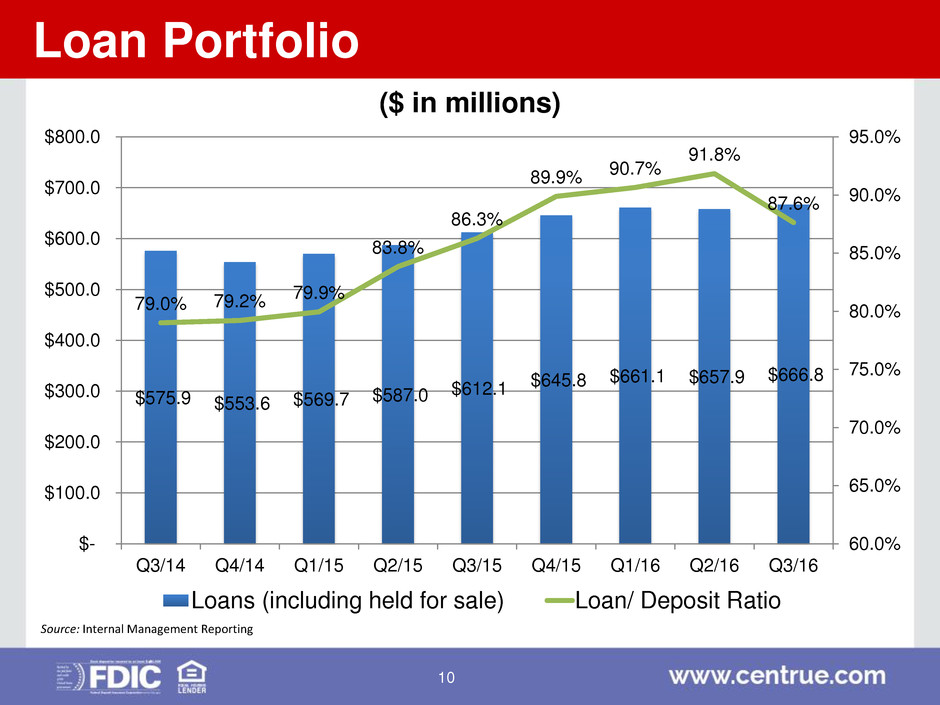

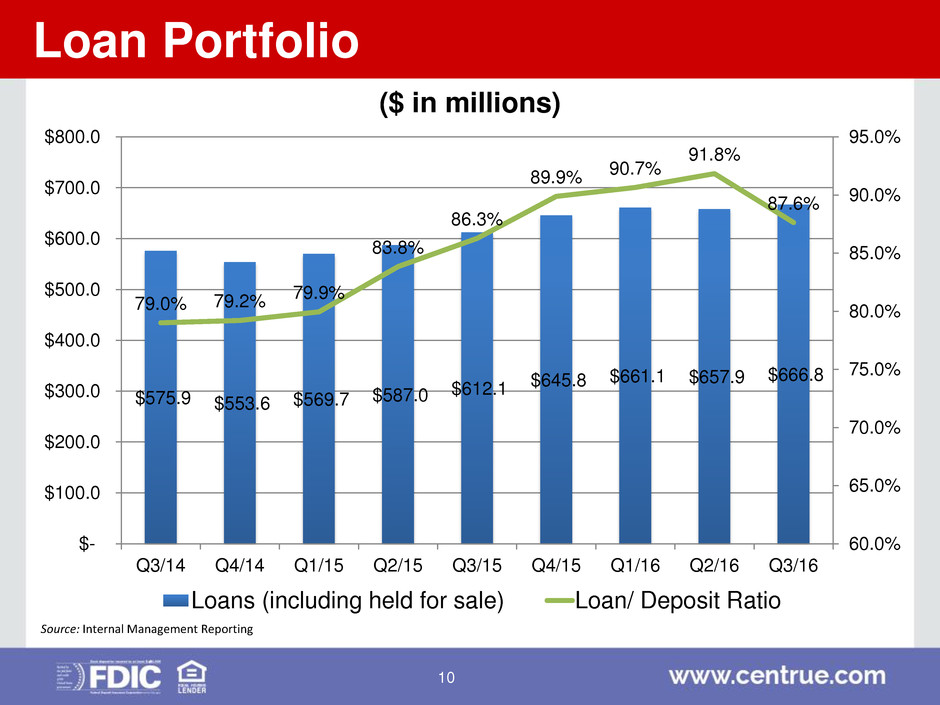

Loan Portfolio Source: Internal Management Reporting $575.9 $553.6 $569.7 $587.0 $612.1 $645.8 $661.1 $657.9 $666.8 79.0% 79.2% 79.9% 83.8% 86.3% 89.9% 90.7% 91.8% 87.6% 60.0% 65.0% 70.0% 75.0% 80.0% 85.0% 90.0% 95.0% $- $100.0 $200.0 $300.0 $400.0 $500.0 $600.0 $700.0 $800.0 Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Q2/16 Q3/16 ($ in millions) Loans (including held for sale) Loan/ Deposit Ratio 10

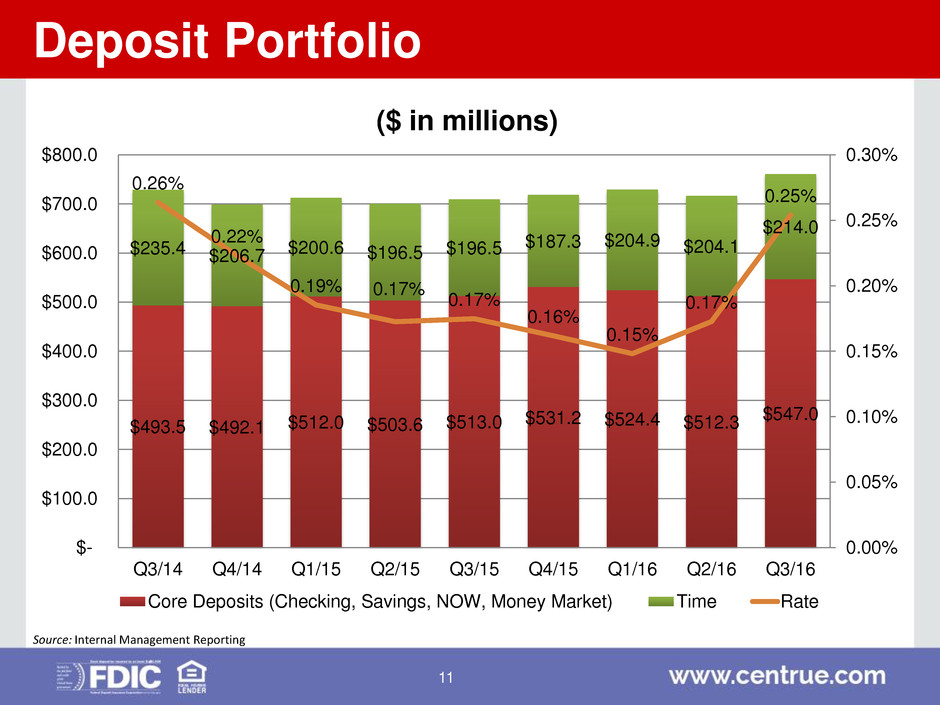

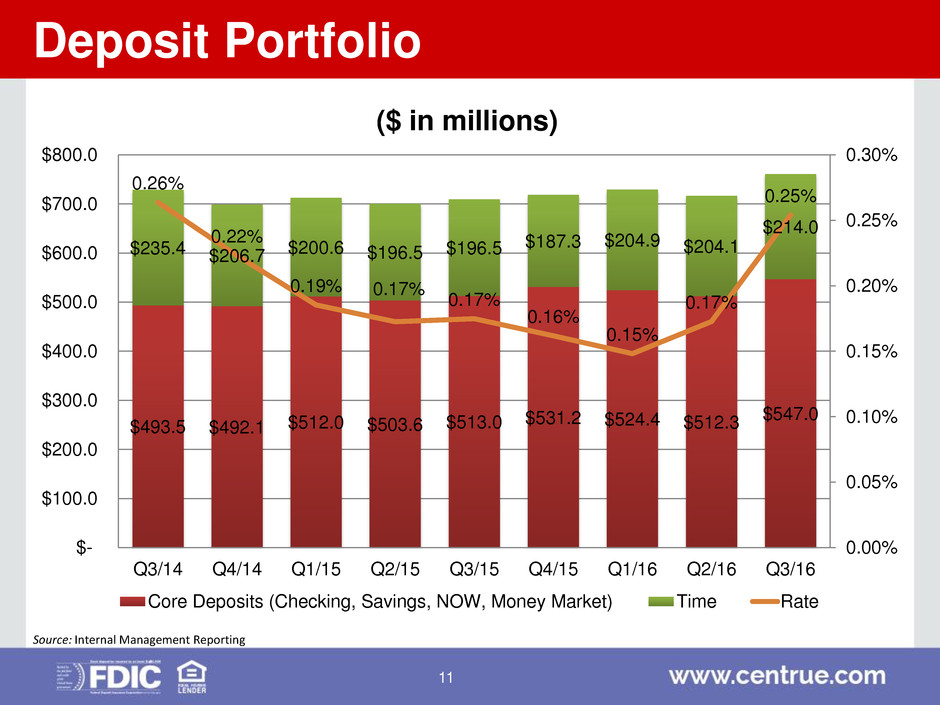

Deposit Portfolio $493.5 $492.1 $512.0 $503.6 $513.0 $531.2 $524.4 $512.3 $547.0 $235.4 $206.7 $200.6 $196.5 $196.5 $187.3 $204.9 $204.1 $214.0 0.26% 0.22% 0.19% 0.17% 0.17% 0.16% 0.15% 0.17% 0.25% 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% $- $100.0 $200.0 $300.0 $400.0 $500.0 $600.0 $700.0 $800.0 Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Q2/16 Q3/16 ($ in millions) Core Deposits (Checking, Savings, NOW, Money Market) Time Rate Source: Internal Management Reporting 11

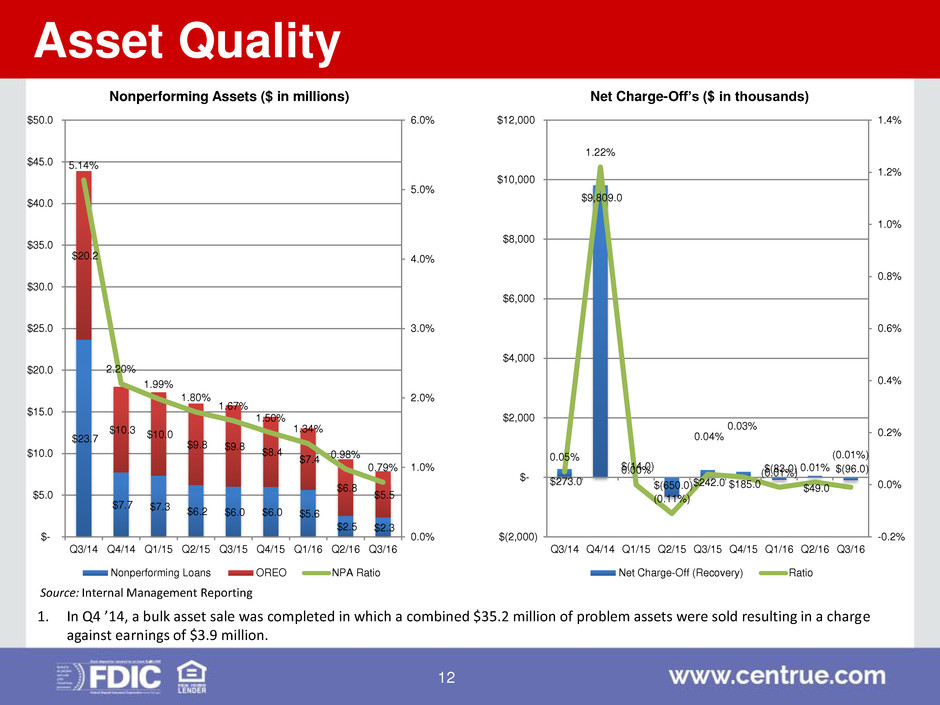

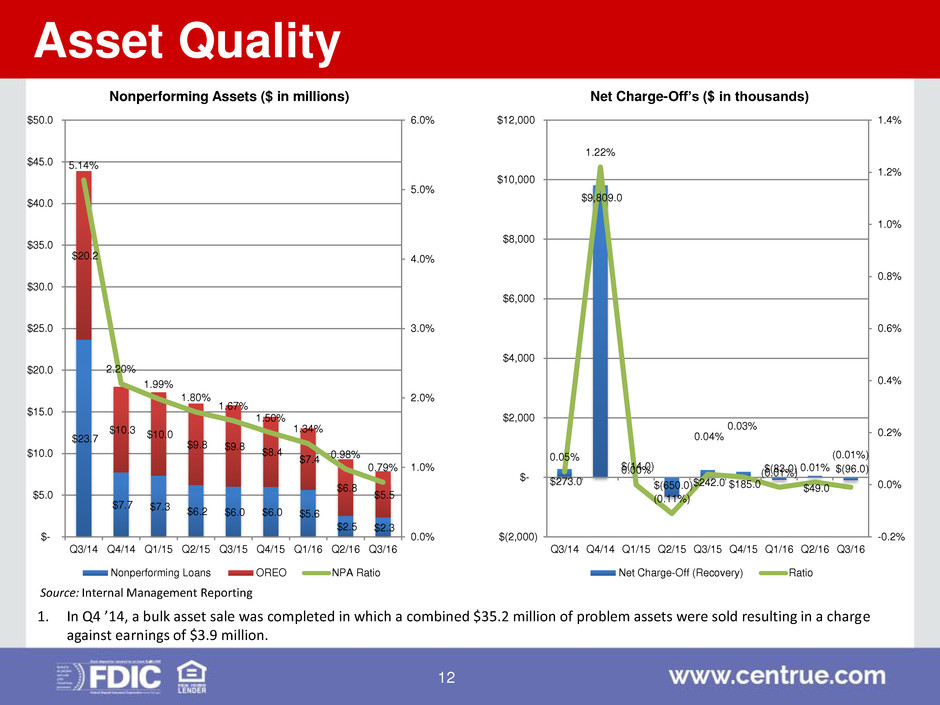

Asset Quality Source: Internal Management Reporting $23.7 $7.7 $7.3 $6.2 $6.0 $6.0 $5.6 $2.5 $2.3 $20.2 $10.3 $10.0 $9.8 $9.8 $8.4 $7.4 $6.8 $5.5 5.14% 2.20% 1.99% 1.80% 1.67% 1.50% 1.34% 0.98% 0.79% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 $50.0 Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Q2/16 Q3/16 Nonperforming Assets ($ in millions) Nonperforming Loans OREO NPA Ratio $273.0 $9,809.0 $(14.0) $(650.0) $242.0 $185.0 $(83.0) $49.0 $(96.0) 0.05% 1.22% 0.00% (0.11%) 0.04% 0.03% (0.01%) 0.01% (0.01%) -0.2% 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% $(2,000) $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Q2/16 Q3/16 Net Charge-Off’s ($ in thousands) Net Charge-Off (Recovery) Ratio 1. In Q4 ’14, a bulk asset sale was completed in which a combined $35.2 million of problem assets were sold resulting in a charge against earnings of $3.9 million. 12

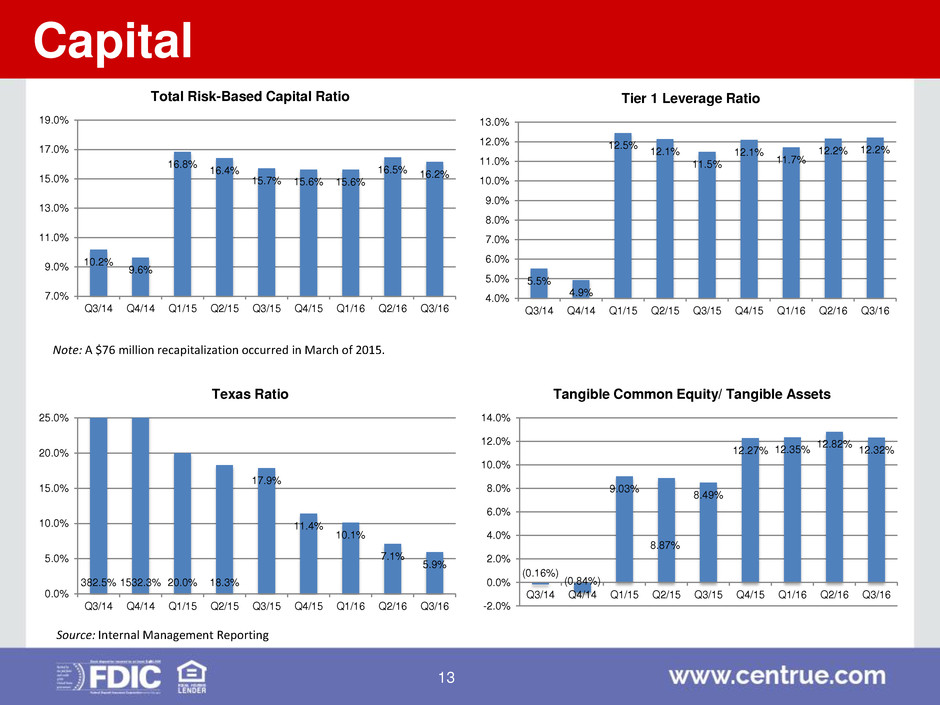

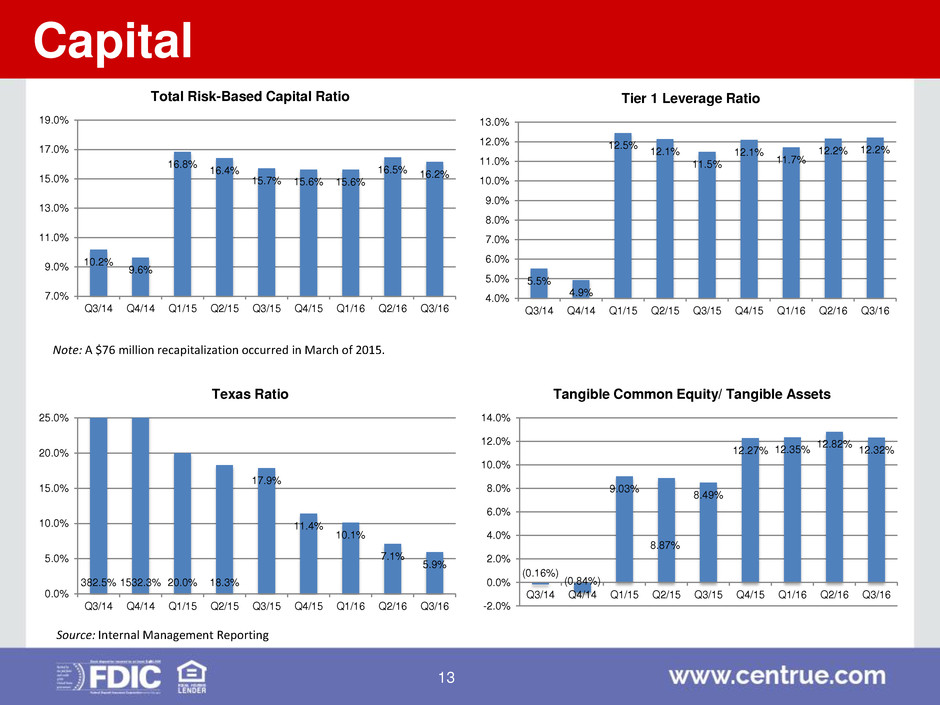

Capital 10.2% 9.6% 16.8% 16.4% 15.7% 15.6% 15.6% 16.5% 16.2% 7.0% 9.0% 11.0% 13.0% 15.0% 17.0% 19.0% Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Q2/16 Q3/16 Total Risk-Based Capital Ratio 5.5% 4.9% 12.5% 12.1% 11.5% 12.1% 11.7% 12.2% 12.2% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Q2/16 Q3/16 Tier 1 Leverage Ratio (0.16%) (0.84%) 9.03% 8.87% 8.49% 12.27% 12.35% 12.82% 12.32% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Q2/16 Q3/16 Tangible Common Equity/ Tangible Assets 382.5% 1532.3% 20.0% 18.3% 17.9% 11.4% 10.1% 7.1% 5.9% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Q2/16 Q3/16 Texas Ratio Note: A $76 million recapitalization occurred in March of 2015. 13 Source: Internal Management Reporting

Profitability 0.26% (2.85%) 0.91% 0.49% 0.47% 16.25% 0.38% 0.88% 0.42% -1.0% -0.5% 0.0% 0.5% 1.0% 1.5% Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Q2/16 Q3/16 Return on Assets 81.6% 92.2% 92.2% 83.8% 80.2% 82.8% 80.0% 80.6% 77.4% 70.0% 75.0% 80.0% 85.0% 90.0% 95.0% Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Q2/16 Q3/16 Efficiency Ratio $6.1 $6.0 $6.0 $6.4 $6.7 $7.1 $7.3 $7.2 $7.2 3.33% 3.37% 3.44% 3.48% 3.34% 3.37% 3.48% 3.49% 3.38% 3.3% 3.3% 3.4% 3.4% 3.5% 3.5% 3.6% $- $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Q2/16 Q3/16 Net Interest Income – Net Interest Margin (%) Net Interest Income ($ in millions) Net Interest Margin (%) 6.24% (65.13%) 24.16% 5.08% 5.17% 182.21% 3.03% 6.96% 3.35% -3.5% -1.5% 0.5% 2.5% 4.5% 6.5% 8.5% Q3/14 Q4/14 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Q2/16 Q3/16 Return on Equity Source: Internal Management Reporting 14

Noninterest Income Source: Internal Management Reporting $4,027 $2,576 $3,237 $2,587 $2,263 $4,242 $2,499 $2,156 $2,395 $2,386 $2,279 $2,099 $2,217 $2,231 1.96% 1.20% 1.40% 1.09% 0.92% 1.75% 1.00% 1.05% 1.11% 1.03% 0.96% 0.85% 0.92% 0.90% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Q2/16 Q3/16 Total NII Core NII NII/Avg Assets Core NII/Avg Assets 15

Noninterest Expense Source: Internal Management Reporting $8,183 $7,952 $8,842 $8,261 $7,866 $8,112 $7,741 $7,485 $7,408 $7,276 $7,732 $7,672 $7,761 $7,415 3.98% 3.69% 3.81% 3.48% 3.21% 3.34% 3.11% 3.64% 3.44% 3.14% 3.26% 3.13% 3.19% 2.97% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 $10,000 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Q2/16 Q3/16 Total NIE Core NIE NIE/Avg Assets Core NIE/Avg Assets 16

Stock Price $11.40 $15.00 $14.55 $16.64 $17.40 $17.40 $18.80 $12.14 $12.16 $12.33 $18.08 $18.35 $18.72 $18.90 93.9% 123.6% 139.8% 134.9% 96.2% 92.9% 99.5% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% 110.0% 120.0% 130.0% 140.0% 150.0% $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 $20.0 Q1/15 Q2/15 Q3/15 Q4/15 Q1/16 Q2/16 Q3/16 Closing Stock Price Tangible Book Value Price/ TBV Source: Internal Management Reporting 17

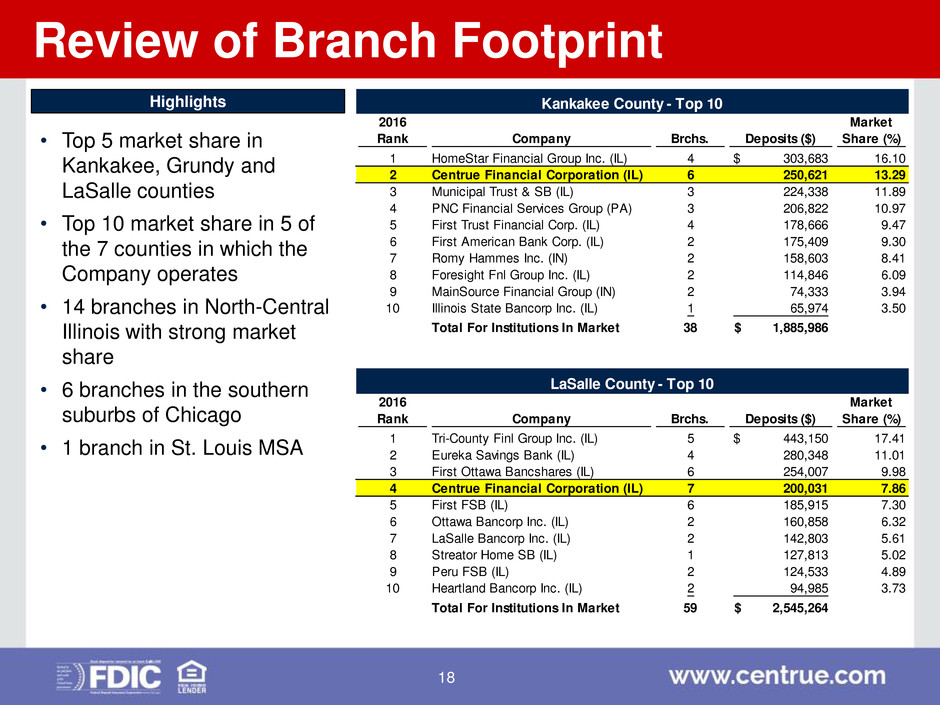

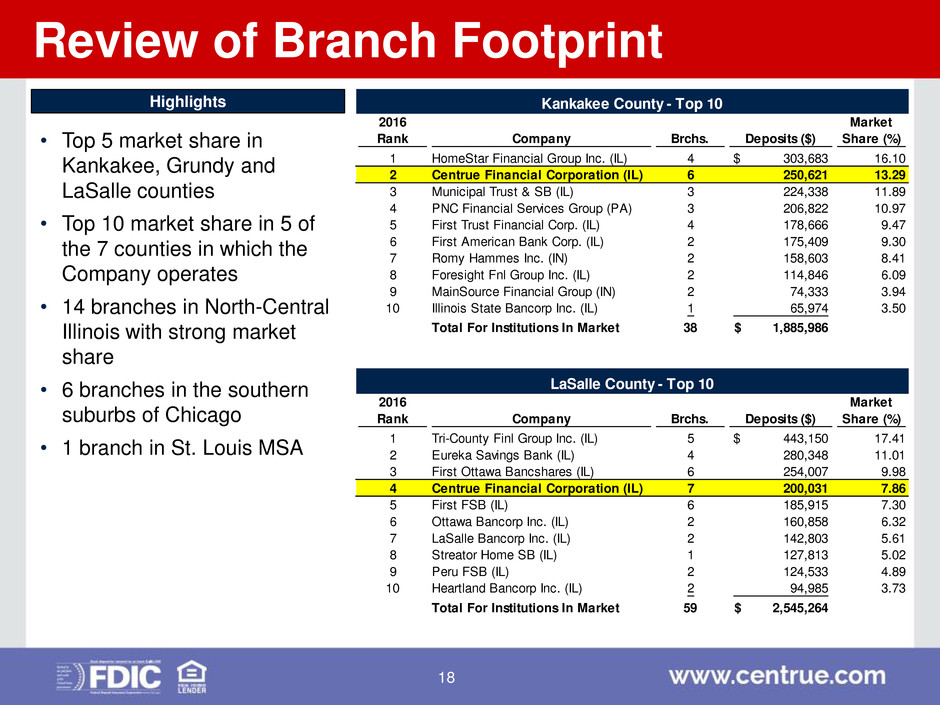

Review of Branch Footprint • Top 5 market share in Kankakee, Grundy and LaSalle counties • Top 10 market share in 5 of the 7 counties in which the Company operates • 14 branches in North-Central Illinois with strong market share • 6 branches in the southern suburbs of Chicago • 1 branch in St. Louis MSA Highlights 2016 Market Rank Company Brchs. Deposits ($) Share (%) 1 HomeStar Financial Group Inc. (IL) 4 303,683$ 16.10 2 Centrue Financial Corporation (IL) 6 250,621 13.29 3 Municipal Trust & SB (IL) 3 224,338 11.89 4 PNC Financial Services Group (PA) 3 206,822 10.97 5 First Trust Financial Corp. (IL) 4 178,666 9.47 6 First American Bank Corp. (IL) 2 175,409 9.30 7 Romy Hammes Inc. (IN) 2 158,603 8.41 8 Foresight Fnl Group Inc. (IL) 2 114,846 6.09 9 MainSource Financial Group (IN) 2 74,333 3.94 10 Illinois State Bancorp Inc. (IL) 1 65,974 3.50 Total For Institutions In Market 38 1,885,986$ 2016 Market Rank Company Brchs. Deposits ($) Share (%) 1 Tri-County Finl Group Inc. (IL) 5 443,150$ 17.41 2 Eureka Savings Bank (IL) 4 280,348 11.01 3 First Ottawa Bancshares (IL) 6 254,007 9.98 4 Centrue Financial Corporation (IL) 7 200,031 7.86 5 First FSB (IL) 6 185,915 7.30 6 Ottawa Bancorp Inc. (IL) 2 160,858 6.32 7 LaSalle Bancorp Inc. (IL) 2 142,803 5.61 8 Streator Home SB (IL) 1 127,813 5.02 9 Peru FSB (IL) 2 124,533 4.89 10 Heartland Bancorp Inc. (IL) 2 94,985 3.73 Total For Institutions In Market 59 2,545,264$ Kankakee County - Top 10 LaSalle County - Top 10 18

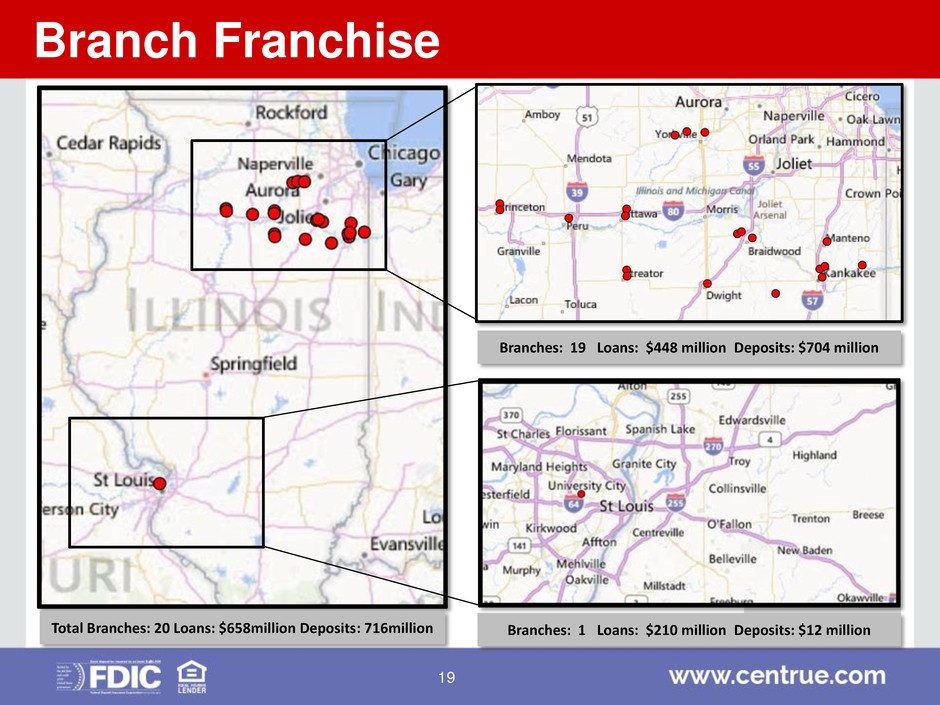

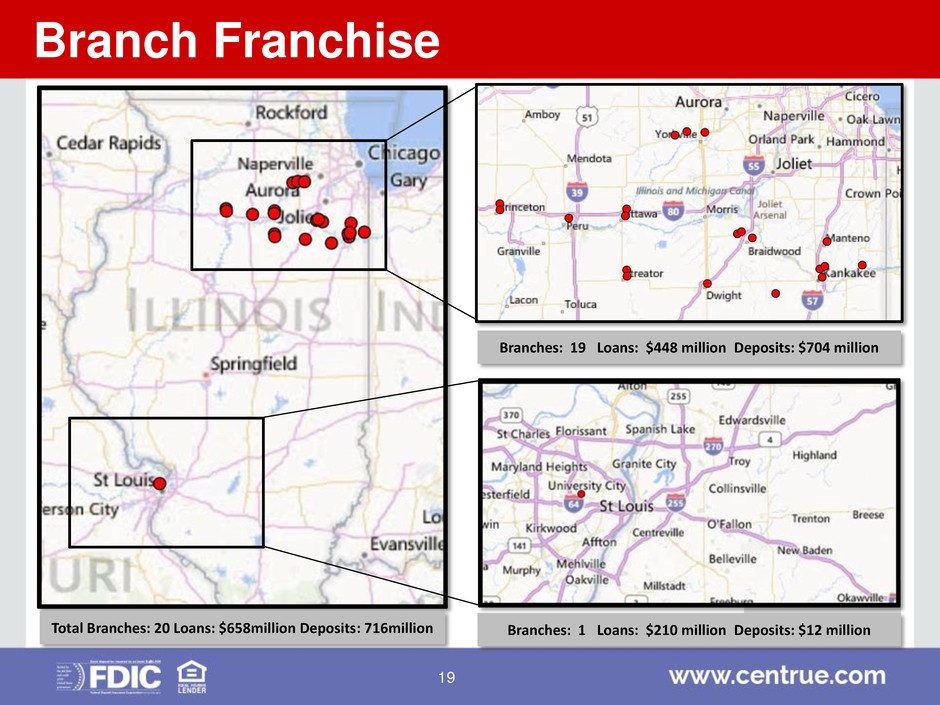

Branches: 19 Loans: $448 million Deposits: $704 million Branches: 1 Loans: $210 million Deposits: $12 million Total Branches: 20 Loans: $658million Deposits: 716million Branch Franchise 19

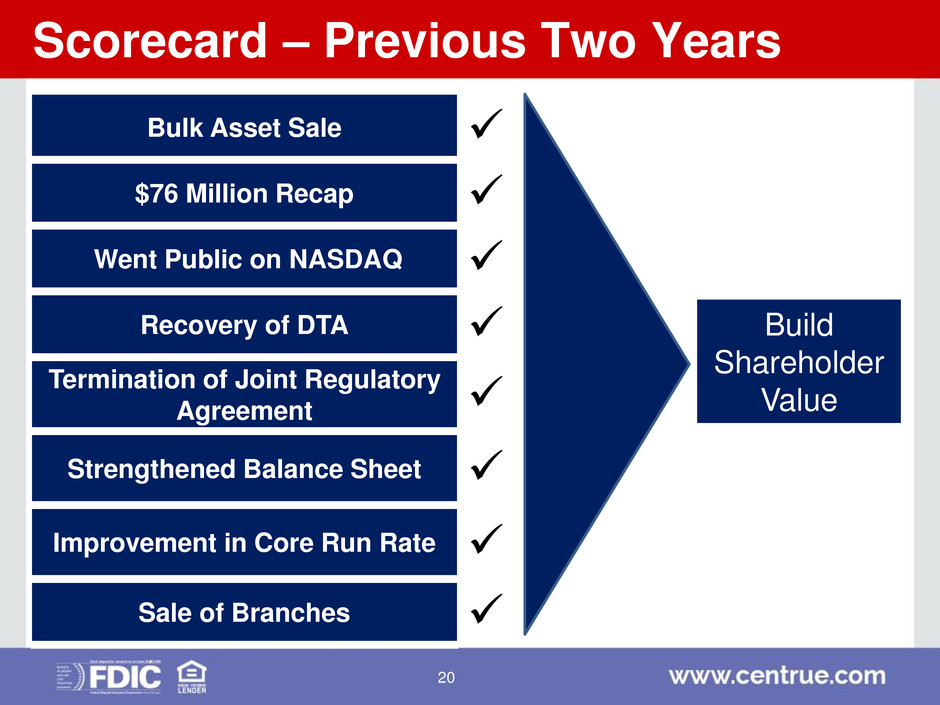

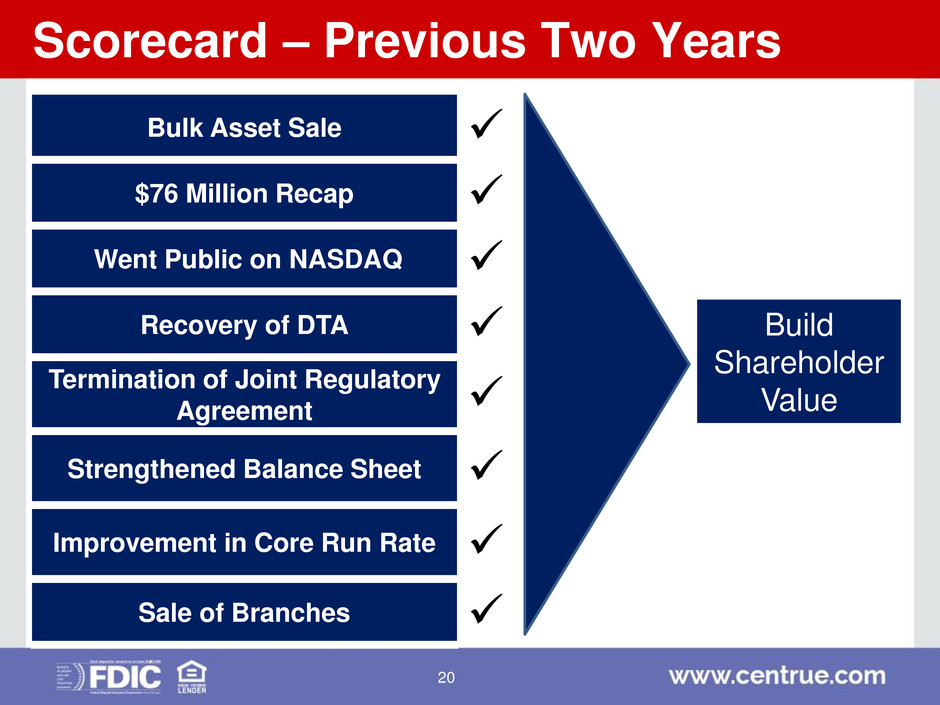

Scorecard – Previous Two Years Bulk Asset Sale $76 Million Recap Went Public on NASDAQ Recovery of DTA Termination of Joint Regulatory Agreement Strengthened Balance Sheet Improvement in Core Run Rate Sale of Branches Build Shareholder Value 20

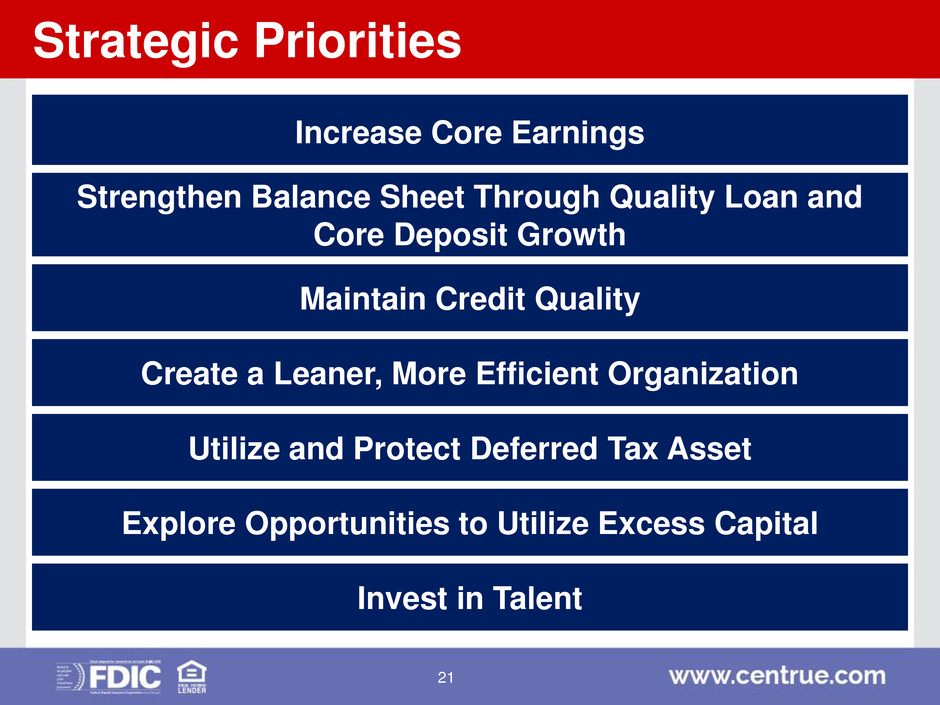

Strategic Priorities Increase Core Earnings Strengthen Balance Sheet Through Quality Loan and Core Deposit Growth Maintain Credit Quality Create a Leaner, More Efficient Organization Utilize and Protect Deferred Tax Asset Explore Opportunities to Utilize Excess Capital Invest in Talent 21