QuickLinks -- Click here to rapidly navigate through this document

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2001 COMMISSION FILE NUMBER:000-21429

ARQULE, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

DELAWARE

(STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION) | | 04-3221586

(I.R.S. EMPLOYER IDENTIFICATION NO.) |

19 PRESIDENTIAL WAY, WOBURN, MASSACHUSETTS 01801

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES INCLUDING ZIP CODE)

REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE:

(781) 994-0300

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| (TITLE OF EACH CLASS) | | NAME OF EACH EXCHANGE ON WHICH REGISTERED |

| None | | None |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

COMMON STOCK, $.01 PAR VALUE

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

The aggregate market value of voting stock held by non-affiliates of the registrant as of March 1, 2002 was: $250,782,374.

There were 20,140,238 shares of the registrant's Common Stock outstanding as of March 1, 2002.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement of the Registrants 2001 Annual Meeting of Shareholder to be held on May 16, 2002, which definitive proxy statement will be filed with the Securities and Exchange Commission not later that 120 days after the registrant's fiscal year of December 31, 2001, are incorporated by reference into Part III of the Form 10-K.

PART I

ITEM 1. BUSINESS

ArQule, Inc. is a drug discovery company with approximately 385 employees in four locations worldwide (Woburn and Medford, Massachusetts, Menlo Park, California and Cambridge, England). ArQule engages in drug discovery programs with partners and for its own account under agreements providing for shared and exclusive commercial rights to chemical compounds with therapeutic potential.

IMPORTANT FACTORS REGARDING FORWARD-LOOKING STATEMENTS

You should carefully consider the risks described below together with all of the other information included in this Form 10-K before making an investment decision. An investment in our common stock involves a high degree of risk. We operate in a dynamic and rapidly changing industry that involves numerous uncertainties. The risks and uncertainties described below are not the only ones we face. Other risks and uncertainties, including those that we do not currently consider material, may impair our business. If any of the risks discussed below actually occur, our business, financial condition, operating results or cash flows could be materially adversely affected. This could cause the trading price of our common stock to decline, and you may lose all or part of your investment.

This Form 10-K contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those projected in the forward-looking statements or historical performance due to numerous risks and uncertainties that exist in ArQule's operations, development efforts and the business environment, including without limitation: the ability to transition successfully from chemistry services to drug discovery, to satisfy milestones, and to deliver compounds to corporate collaborators; the ability to predict consistently and successfully absorption, distribution, metabolism, elimination, and toxicity ("ADMET") properties and to design optimized chemical entities; the progress of product research and development activities and projected expenditures; the ability to enter into future collaborations with pharmaceutical and biotechnology companies; and difficulties and costs associated with the integration of the acquired businesses and the risks and uncertainties described this document. The forward-looking statements contained herein represent the judgment of ArQule as of the date of this Form 10-K. ArQule disclaims any intent or obligation to update any forward-looking statement except to the extent required by law.

BUSINESS OVERVIEW

With the possibility of fundamental molecular understanding of the nature and causes of diseases a reality, and recent scientific advances in both the chemistry and biological aspects of drug design, ArQule has broadened the scope of its objectives. In the past we sought to become the premier partner of pharmaceutical companies for lead generation, qualification and optimization programs. While we will continue to forge strategic alliances that encompass these elements, our primary goal will be to design and produce independently small molecules that become medicines.

Before a molecule can become a medicine it must effectively interact with proteins or other large molecules. In order to be valid biological targets, these large molecules must play fundamental roles in the onset or progression of particular diseases. It is not enough that a small molecule drug candidate effectively interacts with one of these targets. It must also have a combination of characteristics that produce an acceptable risk-benefit profile in humans.

Until recently, pharmaceutical researchers were limited to studying how approximately 400 biological targets interact with chemical compounds. Genomics, the science of identifying genes and their role in biological processes, including disease, have created a wealth of potential new targets for drug discovery. Scientists now use genomics to identify specific genes and the proteins they encode,

2

which they believe are involved in a disease process and, therefore, may be suitable drug discovery targets.

The drug discovery and development process includes:

- •

- target identification and validation—confirmation that a specific target plays an important role in a given disease process;

- •

- compound discovery;

- •

- lead generation—identification of chemical compounds that interact with the target;

- •

- lead qualification—selection of compounds which have sufficient drug-like characteristics to justify further evaluation;

- •

- lead optimization—refinement and evaluation of compounds for potential as clinical candidates, that is:

- •

- effectiveness against the target;

- •

- specificity for the target;

- •

- "ADMET" characteristics:

- •

- Absorption: whether the compound will be absorbed properly in the body;

- •

- Distribution: once absorbed, how the compound will be distributed throughout the body;

- •

- Metabolism: how the compound will change within the body;

- •

- Elimination: whether the compound will be removed from the body in a harmless way; and

- •

- Toxicity: whether the compound might be toxic to the body and cause harmful side effects.

- •

- minimization or elimination of adverse characteristics and maximization of potency and selectivity.

ArQule's opportunity to participate fully in the process of discovery and optimization of small molecules that will become medicines arises from its collaborative relationships with preeminent pharmaceutical, biotechnology, and genomics-based drug discovery companies. By combining the demonstrated expertise of our partners in human disease pathways and processes with our own biologically relevant chemistry capabilities, we are well positioned to address the twin industry challenges of producing significantly greater numbers of chemically relevant drug candidates affecting novel and traditional targets and substantially reducing the time and cost of bringing a drug to market. Overcoming these challenges is a pre-requisite for success in drug discovery.

As a drug discovery company we are focused on:

- •

- continued development of our internal portfolio of research and development programs aimed at production of small molecules with optimal, drug-like characteristics;

- •

- expansion of our technology platform and process improvements;

- •

- integration of high-throughput, automated chemistry technology with predictive, computational design and experimental biology techniques;

3

- •

- initiation of additional strategic collaborations centered around our integrated technology platform including:

- •

- delivery of relevant chemical compounds,

- •

- predictive modeling for ADMET characteristics,

- •

- program rescue for drug candidates which have failed because of poor ADMET qualities, and

- •

- technology transfer of our computational and informatics compound design tools.

Strategic collaborations, such as the one we have with Pfizer, are important to ArQule. We believe the exchanges of information and technology between collaborators inherent in these relationships enhance the internal capabilities of both parties and create opportunities for breakthroughs in the drug discovery process. In addition, such alliances generate free cash flow for us to reinvest in our drug discovery portfolio and technology platform.

ArQule's Competitive Advantage

We believe that the fundamental processes of drug development must be changed. We believe ArQule's primary competitive advantage lies in our integrated technology platform which consists of the following:

- (1)

- high-throughput automated chemistry;

- (2)

- predictive ADMET models;

- (3)

- computational and informatics capabilities for intelligent design of compounds; and experimental biology techniques incorporating in-vitro ADMET screening.

(1) High-throughput Automated Chemistry

Our Automated Molecular Assembly Plant ("AMAP") Chemistry Operating System, which forms the foundation of our compound production technology, is a highly automated and integrated series of chemistry workstations and processes designed to enable rapid, parallel generation of thousands of novel, pure, diverse and spatially-addressed arrays of compounds. It allows us to perform high-throughput, automated production of new chemical compounds. The drug discovery process requires efficient production of a vast number and wide range of chemical compounds. Lead generation requires a large number of screening compounds; lead optimization requires the rapid creation of structurally similar compounds. The growth in available targets will only increase these needs.

�� The AMAP System represents the integration of proprietary and patented technologies in seven areas that results in a consistent, well-defined, well-monitored, reproducible and flexible process consisting of the following steps:

- •

- library design;

- •

- process chemistry;

- •

- production;

- •

- purification;

- •

- quality control;

- •

- culling and reformatting; and

- •

- replication.

4

With the AMAP system we believe we can:

- •

- deliver discrete compounds of known structure and high purity in sufficient quantity for lead optimization;

- •

- quickly understand how variations in chemical structure alter compound profiles;

- •

- design and produce compound libraries with pre-selected characteristics for increased likelihood of generating marketable drugs;

- •

- reduce screening costs by utilizing smaller, more focused compound libraries; and

- •

- perform cost-efficient profiling of compounds for desirable ADMET and other characteristics.

Because the AMAP Chemistry Operating System incorporates proprietary processes, software and equipment and relies on highly trained operators, we believe that duplication of the system by others would be difficult.

(2) Predictive ADMET Models

We have developed various computational models for ADMET characterization of compounds based on their structure. We use our ADMET models to screen compounds to predict their ADMET properties before they are synthesized. Early access to predictive data is designed to optimize compounds for multiple ADMET properties in parallel, in order to expedite the optimization process and reduce late stage failures. These models will enable ArQule to profile "virtual libraries" of compounds in order to determine which compounds to make from among the thousands or millions of compounds that we could make. These models are also useful for compound redesign during lead optimization.

Currently, our suite of computer programs model human intestinal absorption, blood brain barrier penetration and metabolism by the isoenzymes of cytochrome P450. Additional components are constantly being added to this integrated suite.

(3)(a) Computational and Informatics Capabilities

Our library design and lead optimization capabilities are supported by several software products that have been developed at ArQule. Currently, these consist of MapMaker, ALOFT (ArQule Lead Optimization Framework and Toolkit) and AQUIRE (ArQule United Information Repository and Exchange).

MapMaker allows scientists to design combinatorial libraries in an efficient manner, automating a series of tasks often performed by a computational chemist. Once presented with a novel chemistry, MapMaker provides easy access to reagent selection algorithms, creates a combinatorial expansion based on those selections, calculates a number of physical properties, and then selects the most diverse set of molecules from the resulting set for actual synthesis.

ALOFT provides our scientists with a powerful and extensible framework for the design of new chemical compounds with drug-like properties. A modular design allows new computational approaches to be easily included in the suite of tools provided. ALOFT presents not only access to all relevant experimental information, but through the use of an increasing number of predictive models, provides guidance in "what to make next."

AQUIRE tracks all information generated on any ArQule compound throughout its design, creation and use against a biological target. A key component of AQUIRE is a suite of tools to query the growing database of information generated by ArQule and its drug discovery partners. AQUIRE supports a number of tools for both structured and ad hoc queries by ArQule scientists to mine this

5

information and to generate further insights into the interaction of ArQule chemistry and biological targets.

(3)(b) Experimental Biology Techniques

In addition to the computational models we have developed, we have produced "in vitro" experimental ADMET ("eADMET") models to rapidly screen compounds for ADMET characterization. Our platform has capabilities for high-throughput screening of compounds for activity against selected targets. ArQule's biochemistry function supports these screening efforts and provides the additional capability of in-depth characterization of the mechanism of action and biological effects for specific compounds.

While many companies possess some or all of this technology, or technology of similar function, we believe that our advantage is the high degree of integration being incorporated in our platform.

Chemistry in the Post-Genomic Era

Producing small molecule drugs requires expertise in biologically relevant chemistry. Access to small molecules and chemistry expertise is essential to target-rich companies without small molecule chemistry capabilities, because what ultimately is approved for market is the molecule - i.e., the chemistry - not a target or a gene sequence. Most prescription medicines are (and we believe will continue to be) small molecules due to ease of administration and relatively low production cost. These qualities compare favorably to injectible proteins and monoclonal antibodies which are larger in size and more costly to manufacture.

Small molecules are chemical structures. Most medicines will therefore derive from designing and producing small molecules which effectively interact with the selected biological target and have an appropriate mix of characteristics required to produce an acceptable risk-benefit profile in humans. Before a molecule can become a medicine, it must have:

- •

- Appropriate physicochemical and biochemical properties;

- •

- Affinity, potency, and selectivity for the intended target or disease pathways, and a favorable ADMET profile in humans.

Optimizing a selected chemical entity requires using a variety of technologies that together comprise biologically relevant chemistry. These technologies should give us the ability to recognize early in the drug discovery process, and therefore cost-effectively, which chemical entity should be optimized for drug development. Such technologies should also reveal those circumstances in which no acceptable optimized chemical entity can be made. In our view, this should permit early reallocation of resources to a different discovery program with an increased therapeutic potential.

Currently, the number of small molecules that, in theory, could be made into medicines is estimated at 1060. This number is so large that predictive/computer modeling, including predictive ADMET and structure-based design approaches, will be a prerequisite for selection of the right molecule for the right target.

In summary, biologically relevant chemistry focused on the abundance of targets generated from genomics efforts will turn molecules into medicines.

ArQule's Integrated Science and Technology Strategy:

- 1)

- Invest in ArQule's drug discovery platform;

- 2)

- Advance our wholly-owned and partnered drug discovery portfolio;

- 3)

- Improve the drug discovery process;

6

- 4)

- Leverage existing relationships; and

- 5)

- Out-license or sell drug candidates at key value points on the inflection curve.

1) Invest in ArQule's Discovery Platform

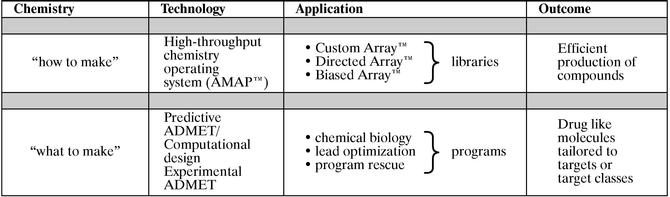

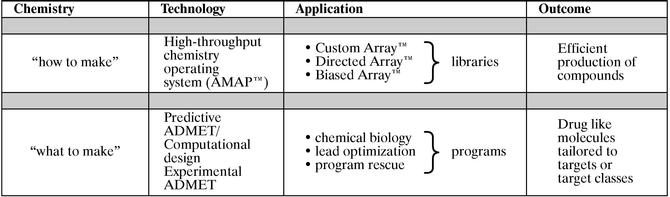

We believe ArQule has built a strong scientific foundation. We believe that we possess a broad set of core competencies: established leadership in small molecule chemistry; expertise in high throughput automated chemistry; high quality design tools; and integrated technology platform including predictive ADMET modeling. (Fig 1.)

Fig 1. Summary of ArQule's Core Competencies

With our mature "how to make" technology and applications, ArQule can develop, synthesize, purify, and characterize large numbers of molecules rapidly and reliably with reproducibility. With our emerging "what to make" technology and applications, ArQule aims to predict the structure and characteristics of select drug-like small molecules that will have an increased likelihood of surviving through the lead optimization process. Integrating our mature and emerging technologies will be required to achieve the purpose of ArQule's technology—the efficient production of potent and selective drug candidates. We will continue to improve our drug-discovery technology platform through in-licensing opportunities, alliances and acquisitions.

2) Advance our wholly-owned and partnered drug discovery portfolio

To improve our design capabilities for optimal chemical entities ArQule uses a multi-disciplinary approach that combines high-throughput, automated chemistry and intelligent formulation of molecules with parallel evaluation of ADMET parameters.

These optimal chemical entities are intended to have the right balance of physicochemical characteristics, affinity for a relevant biological target, selectivity for the target and appropriate ADMET characteristics in humans. These optimal chemical entities will be target-relevant chemical structures whose drug-like characteristics have been optimized prior to their entry into pre-clinical studies and, as such, potentially have a greater likelihood of success in clinical trials.

Through this parallel approach to optimal chemical entity design, ArQule intends to avoid the typical causes of compound failure and compress the current discovery timelines in order to develop a portfolio of drug candidates for less than the average industry cost.

We also hope to embark on drug rescue programs with partners for compounds that have been shelved due to poor ADMET characteristics. By utilizing our predictive ADMET models we propose to analyze existing data to optimize alternative compounds in order to reduce or eliminate the ADMET liabilities. This strategy is advantageous because generally these compounds have already demonstrated selectivity and potency for their biological targets.

7

3) Improve the discovery process

The shortcomings in the current compound discovery process create two major problems for pharmaceutical researchers. First, due in part to the lack of early information about lead compounds and the lack of alternative chemotypes, very few lead compounds meet the minimum criteria to become clinical candidates. Second, of the lead compounds that meet the minimum criteria, too many are only marginally acceptable and are therefore more likely to fail during clinical development. Without improvements in this process, the current failure rate of drug candidates will continue and there will not be enough new drugs to fuel continued revenue and profit growth of the major pharmaceutical companies.

Because researchers conduct lead optimization in sequential rather than parallel steps, the traditional compound discovery process is long and expensive. In the conventional lead optimization process, medicinal chemists analyze a lead compound's structure and use their experience to suggest changes that might produce the desired result for potency or ADMET characteristics. Because changes to a compound's structure that enhance one desired feature may impair other features, the traditional, sequential lead optimization process is inefficient, time-consuming and unpredictable.

ArQule is increasing the efficiency of drug discovery by complementing internal chemistry competencies with newly-acquired biology competencies. By utilizing computational design, predictive ADMET modeling and other aspects of our integrated technology platform we believe we can render obsolete the sequential process described above used in drug discovery today and implement a parallel process for identifying and optimizing lead compounds.

We believe that efficiently generating drug-like molecules requires moving from random, trial and error, time consuming, sequential drug discovery to a predictive, parallel approach. A predictive, parallel approach should rule out potential failure of drug candidates earlier in the discovery process as well as save time and cost.

4) Leverage existing relationships

ArQule engages in both partnered and wholly-owned drug discovery programs resulting in shared and exclusive commercial rights for molecules that may advance into clinical trials. In addition, ArQule has collaborations with partners centered on our delivery of custom chemical compounds. We will utilize the cash flow, if any, generated by these alliances to invest further in our drug discovery portfolio and platform.

5) Out-license or sale at key value inflection points

We intend to capitalize on our internal drug discovery efforts and certain external collaborations to capture more value by advancing drug candidates into clinical trials through third party licensees or purchasers of our rights. If this effort is successful, ArQule could receive lump sum payments, milestone payments and/or royalties.

ARQULE'S BUSINESS STRATEGY

ArQule's strategy is based on aligning internal goals with industry demand in a manner that will sustain growth for ArQule over the long term. Our internal goals include the following:

- •

- improving lead generation position i.e., produce biologically relevant and diverse compound libraries that increase hit rates for selected targets;

- •

- advancing lead optimization efforts by developing programs with significant ownership interest;

- •

- integrating our technologies to design and implement an improved process for delivering IND candidates.

8

We believe this business strategy will enable ArQule to pursue a higher value position over time. ArQule's short and medium term focus is on core business performance with efforts towards chemistry-based drug discovery, and investment in building a drug discovery portfolio while improving aspects of efficiency in drug discovery and investing in our technology platform. In the longer term, advances in efficiency can then be applied to improving the overall productivity of pharmaceutical research and development, which we believe could transition ArQule to a leadership position.

Transition from a chemistry service based business to a drug discovery company

ArQule will continue to pursue strategic collaborations with biotechnology and pharmaceutical companies. While we generate revenue from chemistry capabilities (compound libraries and technology transfer), we will continue improvement of our integrated technology platform, i.e., target-biased arrays of chemical compounds, in-vitro-biology for ADMET screening, computational design tools and predictive ADMET modeling, with the intent to develop a broader based platform.

Partnerships and shared technology arrangements provide ArQule with access to targets, supplementing internal chemistry expertise with external biology expertise. Using this combined experience with its diversified "what to make" technology, ArQule will attempt to integrate its efforts to deliver chemically relevant biological candidates with drug-like qualities.

Process Redesign

By expanding our biology expertise in connection with our chemistry strength, we believe we will broaden our technology platform for integrated drug discovery. Our focus in the medium term will be to use this broader platform to build and enhance our drug discovery portfolio.

By building and driving the integration of our technology platform, we are attempting to redesign a more efficient drug discovery process. A better process for drug discovery could result in more innovation and a competitive advantage.

MARKET OPPORTUNITY

The challenge that lies in the post-genomic era is for drug discovery efforts to deliver chemically relevant drug candidates for novel and traditional targets.

Industry demands improvement in the productivity of pharmaceutical research and development. ArQule's primary focus is on efficiency in drug discovery. We believe by establishing a fully integrated drug discovery company yielding a more efficient drug discovery process we will raise the industry standard, raise ArQule's current position from industry player/contributor to potential industry leader, and potentially attract sustainable revenue-generating strategic alliances. In addition we believe if we are successful we can potentially establish ArQule as a supplier for large pharmaceutical companies and biotechnology companies which may cost effectively deliver an increased volume of low risk IND candidates. These candidates may address unmet medical needs benefiting patients, doctors and the medical community, and provide stability, growth, and profitability for the Company over the long term.

Pharmaceutical Industry

We believe pharmaceutical companies may be unable to commit the chemistry resources for internal efforts that will be optimal in the post-genomic era. As a result, they may collaborate with companies like ArQule to access integrated drug discovery capabilities. While medicinal chemistry might be considered the core competency of the largest pharmaceutical companies, there has been a significant trend towards outsourcing to the best chemistry companies.

9

Biotechnology Industry

We believe many biotechnology companies depend on co-development efforts and partners for lead discovery/optimization, diversity and depth of pipeline in order to thrive independently. ArQule is and should be a good partner in such efforts.

KEY DRUG DISCOVERY PRODUCTS & PROGRAMS

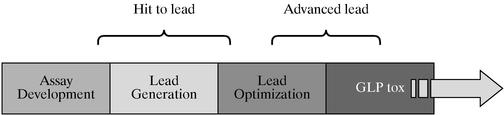

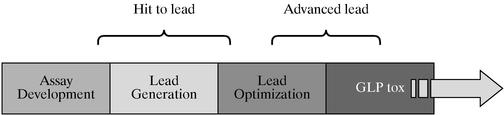

To support ArQule's strategy, ArQule's existing and new drug discovery programs encompass several phases of drug discovery; assay development, lead generation, lead optimization, hit to advanced lead, and qualification of GLP tox and IND candidates.

To sustain growth and profitability over the long term drug discovery efforts include multiple programs with multiple entry points.

Compound Discovery Products

ArQule is an established market leader for producing compounds with high throughput technology. In 2001, ArQule added computational design tools and predictive modeling capabilities. Using a platform approach, ArQule has collaborations in three defined areas that we believe have enhanced our ability to become an emerging drug discovery company:

- •

- chemistry operating system (AMAP™);

- •

- diverse libraries of chemical compounds; and

- •

- technology for intelligent design of compounds.

Lead Generation/Optimization Programs

ArQule has discovery programs that encompass utilization of our integrated technology platform (biased libraries of compounds, computational design tools, and predictive modeling). These consist of wholly owned programs focused on ion channel and kinase target classes and shared risk programs with genomic based companies which give ArQule access to targets and assays to match with our chemically diverse libraries. Additionally, ArQule has shared and partnered programs that may result in advanced leads providing ArQule the opportunity to pursue discovery in defined therapeutic areas.

ArQule also is engaged in co-development efforts with a partner giving us access to the GPCR target class area and relevant structural target information. The GPCR target class area represents the largest target class of known drugs on the market.

To advance our portfolio ArQule may collaborate with target rich biotechnology companies which should give ArQule access to different classes of targets.

Additionally, ArQule is seeking a strategic alliance with a large pharmaceutical company to progress late stage compounds to investigational new drug (IND) status.

10

ArQule intends to access certain targets from the public domain for certain disease states or target classes and/or in-license or generate internal targets, all in order to progress compounds towards IND status & Phase I development.

Process Redesign Programs

ArQule is attempting to redesign integrated systems and processes that improve the overall efficiency and cost effectiveness of drug discovery. Integrating drug discovery science and technology provides the opportunity to redefine a new process that should generate an internal pipeline of IND candidates.

OUR COLLABORATIONS

The following table summarizes our collaborations with pharmaceutical companies:

COMPANY

| | PRODUCTS/SERVICES PROVIDED

|

|---|

| Pfizer Inc | | Technology transfer of AMAP Chemistry Operating System, Design Tools, Lead Generation Capabilities and Custom Array libraries |

| Bayer AG | | Custom Array libraries |

| Wyeth Pharmaceuticals | | Mapping Array and Directed Array libraries |

| Solvay Pharmaceuticals B.V. | | Mapping Array, Compass Array and Directed Array Libraries and a non-exclusive license to our AMAP Chemistry Operating System |

| G.D. Searle, a division of Pharmacia Corp. | |

Mapping Array, Compass Array and Directed Array libraries and lead optimization services |

| Sankyo Company, Ltd. | | Mapping Array, Compass Array and Directed Array libraries |

| Johnson & Johnson, Inc. | | Mapping Array libraries and Compass Array libraries |

| GlaxoSmithKline | | Compass Array libraries and Lead Optimization services |

| Abbott Laboratories | | Mapping Array and Directed Array libraries |

| Roche Bioscience | | Directed Array libraries |

Pfizer. In July 1999, we entered into a four and one-half year technology acquisition agreement with Pfizer Inc. We manage and staff a dedicated facility containing an AMAP Chemistry Operating System for Pfizer in Medford, Massachusetts. The facility produces Custom Array libraries exclusively for Pfizer. Pfizer owns all rights in compounds produced at this facility. In addition, we have trained Pfizer staff to use our AMAP Chemistry Operating System. On December 31, 2003, Pfizer will receive a non- exclusive license to the AMAP Chemistry Operating System. In December 2001, we entered into a new seven year agreement with Pfizer which superceded our July 1999 agreement. In addition to continuing to provide custom array libraries for Pfizer, we will also transfer our library design tools on a non-exclusive basis to Pfizer. Pfizer has also committed to perform one lead optimization program with ArQule. We may earn up to $345 million over the length of the contract, depending on the achievement of certain delivery milestones. Pfizer has committed to maintain certain cash payments resulting from our prior collaboration as it relates to the transfer of our AMAP chemistry operation system. As of March 1, 2002, we have received $80.5 million under these agreements. Pfizer has also agreed to make equity investments totaling $18 million depending on the achievement of certain delivery milestones. Pfizer made a $10 million equity investment in December 2001. Pfizer may terminate the new agreement after four years for any reason. Pfizer will pay no milestones or royalties to us on compounds that they develop and market.

11

Bayer. In October 1999, we entered into a three-year collaboration with Bayer AG to produce Custom Array libraries. In October 2001, we extended the production period until June 30, 2003. Bayer will own all rights in compounds for an initial period, after which we will co-own rights in compounds that Bayer has not claimed in a patent application. We received a $3 million upfront payment and will receive up to an additional $27 million during the term of the agreement for delivery and success fees. As of March 1, 2002, we have received $17.5 million under this agreement. Bayer will pay no milestones or royalties to us on compounds that they develop and market.

Wyeth Pharmaceuticals. In July 1997, we entered into a four and one half year agreement with Wyeth Pharmaceuticals ("Wyeth"). Under this agreement, Wyeth subscribed to our Mapping Array and Directed Array Programs. We discontinued our Mapping Array program as of 2002, and as a consequence and in agreement with Wyeth, we did not renew our collaboration. Wyeth made a $2 million equity investment in ArQule in June 1998. As of March 1, 2002, we have received all $26.1 million that we are due under this agreement. Wyeth has agreed to pay us development milestones and royalties from the sales of products resulting from compounds we shipped during the collaboration. To date, we have not received any milestone or royalty payments.

Solvay. In November 1995, we entered into a five-year agreement with Solvay Duphar B.V. Under this agreement, Solvay subscribed to our Mapping Array and Directed Array programs and received a non-exclusive license to our AMAP Chemistry Operating System. This agreement was superseded by an amended and restated agreement with Solvay Pharmaceuticals B.V., which became effective on January 1, 2001. The amended agreement extends the collaboration through December 31, 2003. Under the amended agreement, Solvay receives our Compass Array libraries and continues to access our Mapping Array libraries and Directed Array programs. We discontinued our Mapping Array program as of 2002 as planned. The remainder of the contract was not affected. As of March 1, 2002, we have received $19.9 million under these agreements. Solvay has also agreed to make additional payments if we achieve certain development milestones and to pay royalties on sales of any drugs that result from the relationship. To date, we have not received any milestone or royalty payments. In connection with the original collaboration, signed in November 1995, an affiliate of Solvay, Physica B.V., made a $7 million equity investment in ArQule.

Pharmacia. We entered into a five-year collaboration with Monsanto Company (now Pharmacia Corporation) in December 1996. Under this agreement, we provided Monsanto with access to our Mapping and Directed Array programs for use in the development of agrochemicals. In January 2000, we expanded this collaboration to cover life science applications, including pharmaceutical use by Monsanto's G.D. Searle division, and extended the term until December 2002. We also agreed to provide Monsanto with Compass Array and Mapping Array libraries through 2001 and Compass Array libraries only through December 2002. We also converted the Monsanto agrochemical Directed Array Program into a credit for pharmaceutical lead optimization services. Pharmacia is committed to make payments totaling $13.0 million under this agreement. In addition, Monsanto has agreed to pay us development milestones and royalties from the sales of products resulting from the collaboration. In July 1998, we received a milestone payment for a Mapping Array compound selected by Monsanto for entry into field trials. On June 30, 2000, in connection with the merger between Monsanto and Pharmacia, we replaced our existing collaboration agreement with a new collaboration agreement with G.D. Searle & Co., a division of Pharmacia. The financial terms of the new agreement are substantially the same as the prior agreement. However, we expanded the scope of the agreement to enable Pharmacia and its affiliates to screen our compounds, which may result in milestone and royalty payments in the future. To date, we have received $12.4 million under this agreement. In March 2002, we entered into a one year technical access agreement with Pharmacia which granted them non-exclusive access to our proprietary ADMET simulation technology.

12

Sankyo. In November 1997, we entered into a three-year agreement with Sankyo Company, Ltd. to discover and optimize drug candidates. Under the terms of the agreement, Sankyo received a subscription to our Mapping Array program to discover new lead compounds. Sankyo also committed to a minimum number of Directed Array Programs during the term of the agreement. In April 2001, we extended our agreement with Sankyo through 2004 to include the Compass Array libraries in addition to continuing to use our Directed Array program. The total value of the extended agreement is up to $14.8 million in committed payments. To date, we have received $11.1 million under both agreements. Sankyo has also agreed to pay us developmental milestones and royalties resulting from sales of any products resulting from this collaboration. To date, we have not received any milestone or royalty payments under this agreement.

Johnson & Johnson. In December 1998, we entered into a three-year collaboration with R.W. Johnson Pharmaceutical Research Institute, a division of Johnson & Johnson, Inc., in which R.W. Johnson subscribed to our Mapping Array program. We discontinued our Mapping Array program as of 2002, and, as a consequence and in agreement with R.W. Johnson, we did not renew our collaboration. As of March 1, 2002, we have received all $8.6 million that we are due under this agreement. In addition, R.W. Johnson has agreed to pay us developmental milestones and royalties from sales of any products resulting from this collaboration. To date, we have not received any milestone or royalty payments.

GlaxoSmithKline. In November 2000, we entered into a five-year collaboration and license agreement with SmithKline Beecham Corporation (now GlaxoSmithKline). Under the terms of the agreement, GlaxoSmithKline receives access to our Compass Array libraries and Mapping Array libraries for screening primarily in the anti-infective field. In addition, we have initiated the first of potentially two drug discovery programs based on a lead compound discovered in a GlaxoSmithKline compound library. GlaxoSmithKline receives all rights in compounds developed in these drug discovery programs. As of March 1, 2002, we have received $1.2 million under this collaboration. GlaxoSmithKline may terminate the agreement before the end of the five-year term. GlaxoSmithKline has agreed to pay us development milestones and royalties on sales of products resulting from the collaboration. To date, we have not received any milestone or royalty payments.

Abbott Laboratories. In June 1995, we entered into an agreement with Abbott Laboratories. Under this agreement Abbott subscribed to our Mapping Array and Directed Array programs. This collaboration was extended on two occasions and ended successfully in March 1999. Abbott has agreed to pay us developmental milestones and royalties from sales of any products resulting from this collaboration. We have not received any milestone or royalty payments from Abbott.

Roche Bioscience. In September 1996, we entered into an agreement with Roche Bioscience. Under this agreement, we synthesized Directed Array compounds. Our obligations under this agreement ended in March 1999. Roche Bioscience has agreed to pay us developmental milestones and royalties from sales of any products resulting from this collaboration. In May 1999, we received a milestone payment from Roche Bioscience for a Directed Array compound that was chosen for Investigational New Drug application, or IND, enabling toxicology studies.

In the past, we have entered into a number of collaborations with biotechnology companies, primarily providing them with access to our Mapping Array libraries. Going forward, we intend to enter into only a select number of focused biotechnology collaborations with companies that can contribute significant numbers of important targets, generally around a specific target class or therapeutic area. These collaborations should pool the necessary resources from each company to conduct a drug discovery program aimed at delivering at least one IND candidate per collaboration.

13

Genome Therapeutics Corporation. On October 17, 2000, we entered into a collaborative drug discovery agreement with Genome Therapeutics Corporation to discover and develop anti-infective drug candidates. Under the agreement, we will use our Parallel Track Drug Discovery program to screen and optimize compounds against a significant number of proprietary validated anti-infective targets which Genome Therapeutics has derived from its PathoGenome(TM) Database. We will share equally in all downstream value created by the collaboration, including future milestone, royalty and upfront payments resulting from the outlicensing of clinical candidates or later stage compounds derived from the collaboration.

ACADIA Pharmaceuticals. On December 18, 2000, ArQule and ACADIA Pharmaceuticals entered into a drug discovery collaboration. Under the agreement, ACADIA offers its functional genomics platform and ArQule contributes its Parallel Track™ Drug Discovery program to discover novel small molecule drug candidates directed at individual G-protein coupled receptor (GPCR) targets. We will share intellectual property resulting from the collaboration, and equally contribute to at least one joint drug discovery program. We will share any revenues resulting from the commercialization of joint drug discovery programs. In addition to these joint drug discovery programs, each of us will receive exclusive rights to certain compounds that we have decided not to develop in a joint drug discovery program, subject to a royalty payment to the other party. On April 7, 1998, we entered into a material transfer and screening agreement with ACADIA. Under this agreement, we provided to ACADIA access to certain ArQule compound arrays for screening against their target collection. On May 10, 2000, we entered into a compound license agreement with ACADIA. Under this agreement, we granted to ACADIA an exclusive license to certain of our compounds having activity against certain of their targets, in return for milestone payments and royalties.

PATENTS AND PROPRIETARY RIGHTS

We have sixteen issued U.S. utility patents, one issued U.S. design patent, seven granted foreign patents, and numerous patent applications in the U.S. and other countries. We depend, in part, on these patents to protect our technology and products. We also rely upon our trade secrets, know-how and continuing technological advances to develop and maintain our competitive position. In an effort to maintain the confidentiality and ownership of our trade secrets and proprietary information, we require our employees and consultants to sign confidentiality and invention assignment agreements. We intend these agreements to protect our proprietary information by controlling the disclosure and use of technology to which we have rights. These agreements also provide that we will own all the proprietary technology developed at ArQule or developed using our resources.

14

COMPETITION

The biotechnology industry is highly competitive. Our services and products face competition based on several factors, including size, diversity and ease of use of compound libraries. We also face competition related to the speed and costs of identifying and optimizing potential lead compounds and our patent position. We compete with many organizations that are engaged in attempting to identify and optimize compounds. Our competitors include Discovery Partners International, Array Biopharma and Albany Molecular Research Institute. In addition we compete with Vertex Pharmaceuticals, Neurogen, and 3-Dimensional Pharmaceuticals for chemistry-based drug discovery. We also compete with academic and scientific institutions, governmental agencies and public and private research organizations.

Smaller companies may also prove to be significant competitors, particularly through arrangements with large corporate collaborators. In addition to competition for our customers, these organizations also compete with us in recruiting and retaining highly qualified scientific and management personnel.

Historically, pharmaceutical companies have maintained close control over their research activities, including the synthesis, screening and optimization of chemical compounds. Many of these companies, which represent a significant potential market for our products and services, are developing in-house combinatorial chemistry and other methodologies to improve productivity, including major investments in robotics technology to permit the automated parallel synthesis of compounds and computational chemistry skills. In addition, these companies may already have large collections of compounds previously synthesized or ordered from chemical supply catalogs or other sources against which they may screen new targets. Other sources of compounds include extracts from natural products such as plants and microorganisms and compounds created using rational design. Academic institutions, governmental agencies and other research organizations are also conducting research in areas in which we are working either on their own or through collaborative efforts.

GOVERNMENT REGULATION

Our research and development processes involve the controlled use of hazardous materials and controlled substances. Although we are subject to federal, state and local laws and regulations governing the use, manufacture, storage, handling and disposal of these materials and waste products, the license or sale of our products is not subject to significant government regulations. Our future profitability, however, depends on our collaborators selling pharmaceuticals and other products developed from our compounds that may be subject to government regulation.

Virtually all pharmaceutical and biotechnology products developed by our collaborative partners will require regulatory approval by governmental agencies prior to commercialization. The nature and the extent to which these regulations apply to our collaborative partners varies depending on the nature of their products. In particular, human pharmaceutical products and biologics are subject to rigorous preclinical and clinical testing and other approval procedures by the FDA and by foreign regulatory authorities. Various federal and, in some cases, state statutes and regulations also govern or influence the manufacturing, safety, labeling, storage, record keeping and marketing of these products. The process of obtaining these approvals and the subsequent compliance with appropriate federal and foreign statutes and regulations are time consuming and require substantial resources.

Generally, in order to gain FDA approval, a company first must conduct preclinical studies in the laboratory and in animal models to gain preliminary information on a compound's efficacy and to identify any safety problems. The results of these studies are submitted as a part of an IND that the FDA must review before human clinical trials of an investigational drug can start. In order to commercialize any products, we or our collaborator will be required to sponsor and file an IND and will be responsible for initiating and overseeing the clinical studies to demonstrate the safety and efficacy that are necessary to obtain FDA approval. Clinical trials are normally done in three phases and generally take several years, but may take longer to complete. After completion of clinical trials of

15

a new product, FDA and foreign regulatory authority marketing approval must be obtained. If the product is classified as a new pharmaceutical, we or our collaborator will be required to file a New Drug Application, or NDA, and receive approval before commercial marketing of the drug. Similarly, if the product is a new biologic, a biological license application, BLA, must be filed and must receive approval prior to commercial marketing of the product. The testing and approval processes require substantial time and effort. NDAs and BLAs submitted to the FDA can take several years to obtain approval.

Even if FDA regulatory clearances are obtained, a marketed product is subject to continual review. If and when the FDA approves any of our or our collaborators' products under development, the manufacture and marketing of these products will be subject to continuing regulation, including compliance with current Good Manufacturing Practices, known as GMPs, adverse event reporting requirements and prohibitions on promoting a product for unapproved uses. Later discovery of previously unknown problems or failure to comply with the applicable regulatory requirements may result in restrictions on the marketing of a product or withdrawal of the product from the market as well as possible civil or criminal sanctions.

For marketing outside the United States, we or our partners will be subject to foreign regulatory requirements governing human clinical trials and marketing approval for pharmaceutical products and biologics. The requirements governing the conduct of clinical trials, product licensing, pricing and reimbursement vary widely from country to country.

EMPLOYEES

As of March 1, 2002, we employed 385 people worldwide, 325 in Woburn and Medford, Massachusetts, 40 in Menlo Park, California, and 20 in Cambridge, United Kingdom. Of the 385 employees, 105 have Ph.D. degrees. 198 of our employees were engaged in operations, 131 were engaged in research and development, and 56 were engaged in marketing and general administration. None of our employees are covered by collective bargaining agreements. We believe that we have good relations with our employees.

OUR TRADEMARKS

The terms "ArQule", "Mapping Array", and "Directed Array" are trademarks of ArQule that are registered in the U.S. Patent and Trademark Office. The terms "Compass Array", "AMAP", "Custom Array", "ArQule Reactor", "MapMaker", "Parallel Track", and "PrepQule" are trademarks of ArQule.

16

ITEM 1A. EXECUTIVE OFFICERS AND DIRECTORS OF THE REGISTRANT

Set forth below is certain information regarding our current executive officers and directors, including their respective ages, as of March 1, 2002. L. Patrick Gage, a director since January 1998, tendered his resignation from the Board of Directors effective January 4, 2002.

NAME

| | AGE

| | POSITION

|

|---|

| Dr. Stephen A. Hill | | 43 | | President, Chief Executive Officer and a Director |

Philippe Bey, Ph.D |

|

59 |

|

Senior Vice President of Research and Development and Chief Scientific Officer |

David C. Hastings |

|

40 |

|

Vice President, Chief Financial Officer and Treasurer |

Harold E. Selick, Ph.D |

|

47 |

|

President, Chief Executive Officer of Camitro Corporation |

Michael Rosenblatt, M.D. |

|

53 |

|

Director |

Werner Cautreels, Ph.D. |

|

49 |

|

Director |

Laura Avakian |

|

56 |

|

Director |

Tuan Ha-Ngoc |

|

49 |

|

Director |

Ariel Elia |

|

66 |

|

Director, Chairman of the Board |

Timothy C. Barabe |

|

49 |

|

Director |

STEPHEN A. HILL, M.D. Stephen A. Hill, B.M., B.Ch., M.A., F.R.C.S. has served as our President and CEO since April 1999. Prior to his employment with us, and since 1997, Dr. Hill was the Head of Global Drug Development at F. Hoffmann-La Roche Ltd. He joined Roche in 1989 as Medical Adviser to Roche Products in the United Kingdom. He held several senior positions there, including that of Medical Director, with responsibility for clinical trials of compounds across a broad range of therapeutic areas, including those of CNS, HIV, cardiovascular, metabolic, and oncology products. Dr. Hill also served as Head of International Drug Regulatory Affairs at Roche headquarters in Basel, Switzerland, where he led the regulatory submissions for seven major new chemical entities globally. He also was a member of Roche's Portfolio Management, Research, Development and Pharmaceutical Division Executive Boards. Prior to Roche, Dr. Hill served for seven years with the National Health Service in the United Kingdom, in General and Orthopedic Surgery. Dr. Hill is a Fellow of the Royal College of Surgeons of England, and holds his scientific and medical degrees from St. Catherine's College at Oxford University.

PHILIPPE BEY, PH.D. Philippe Bey, Ph.D. has served as our Chief Scientific Officer and Senior Vice President of Research and Development since August 1999. Dr. Bey has previously held various senior management positions at Hoechst Marion Roussel (HMR), Marion Merrell Dow, Inc. and Selectide, a combinatorial chemistry company fully owned by HMR. While at HMR, he coordinated U.S. research & development programs and participated in a task force that defined HMR's strategic plans (1996–1999). At Marion Merrell Dow, where he served as Vice President of Global Research, he designed research strategies to incorporate new technologies and internal organizational competencies while improving productivity. Dr. Bey also served as President of Selectide. Dr. Bey earned his BS and Ph.D. Chemistry qualifications at the Louis Pasteur University in Strasbourg, France, and conducted post-doctoral training at the California Institute of Technology in Pasadena.

DAVID C. HASTINGS David C. Hastings has served as our Vice President and Chief Financial Officer since February 2000. Prior to his employment with us, Mr. Hastings was at Genzyme, Inc. (1997–2000) where his final position was Vice President and Corporate Controller, responsible for the management of the finance department. Prior to his employment with Genzyme, Mr. Hastings was the

17

Director of Finance at Sepracor, Inc. where he was primarily responsible for Sepracor's internal and external reporting. Mr. Hastings is a Certified Public Accountant and received his BA in Economics at the University of Vermont.

HAROLD E. SELICK, PH.D Harold E. Selick has served as President and Chief Executive Officer of Camitro, which we acquired in January 2001, since November 1999. Dr. Selick has tendered his resignation and will be leaving the Company effective March 31, 2002. Prior to his employment with Camitro, Dr., Selick was, from January 1995 to July 1997, a Director of Research Affymax Research Institute. From July 1997 to December 1998, he was Vice President of Research of Affymax where he directed activities in combinatorial chemistry-based drug discovery, with particular emphasis on the development of technologies for improving the process of lead optimization. Prior to joining Affymax, Dr. Selick held scientific positions in two other biotechnology companies, one of which was Protein Design Labs, where he was co-inventor of the technology underlying the creation of fully humanized antibodies. He applied this technology to the creation of the "Smart anti-TAC" antibody, which was successfully developed by Roche as "Zenapax", for treating kidney transplant rejection. Prior to working at Protein Design Labs, he was a Damon Runyon-Walter Winchell Cancer Fund Fellow with Professor Bruce Alberts and an American Cancer Society Fellow at the University of California, San Francisco, School of Medicine. Dr. Selick holds a Ph.D. in Molecular Biology and a B.A. in Biophysics from the University of Pennsylvania.

MICHAEL ROSENBLATT, M.D. Michael Rosenblatt, M.D. has been a director since April 1998. From 1992-1998, Dr. Rosenblatt served as the Robert H. Ebert Professor of Molecular Medicine at the Harvard Medical School, Chief of the Division of Bone and Mineral Metabolism at Beth Israel Hospital, and the director of the Harvard MIT Division of Health Sciences and Technology. From 1996-1999, he was the executive director of the Carl J. Shapiro Institute for Education and Research at Harvard Medical School and Beth Israel Deaconess Medical Center. From 1996-1999, he was Harvard faculty dean for academic programs at the Beth Israel Deaconess Medical Center. From 1999 - 2000, he was President of Beth Israel Deaconess Medical Center. He currently serves as the George R. Minot Professor of Medicine at Harvard Medical School. Prior to 1992, Dr. Rosenblatt was the Senior Vice President for Research at Merck Research Laboratories, a pharmaceutical company. Dr. Rosenblatt serves as a director of several privately held companies.

WERNER CAUTREELS, PH.D. Werner Cautreels, Ph.D. has been a director since September 1999. Since May 1998, Dr. Cautreels has been the Global Head of Research and Development of Solvay Pharmaceuticals. Prior to that, Dr. Cautreels had been employed by Nycomed Amersham Ltd., Sterling Winthrop, and Sanofi in a variety of positions in Research and Development. Dr. Cautreels received his Ph.D. in Chemistry from the University of Antwerp, Belgium.

LAURA AVAKIAN Laura Avakian has been a director since March 2000. Ms. Avakian is currently and since 1999 has been Vice President for Human Resources for the Massachusetts Institute of Technology where she directs all human resource programs and oversees the institution's Medical Department. Prior to joining MIT, she was Senior Vice President, Human Resources, for Beth Israel Deaconess Medical Center and for its parent corporation CareGroup (1996–1999). She has previously served as President of the American Society for Healthcare Human Resources Administration, and has received the distinguished service award, literature award and chapter leadership award from that society. She received the 1996 Award for Professional Excellence in Human Resources Management from the Society for Human Resource Management. She has also served as editor of the Yearbook of Healthcare Management and authored numerous chapters and articles on human resources management. Ms. Avakian received her BA degree from the University of Missouri at Columbia and her MA degree from Northwestern University.

TUAN HA-NGOC Tuan Ha-Ngoc has been a director since March 2000. Dr. Ha-Ngoc is the founder, and was Chief Executive Officer and a director of deNovis, Inc., an advanced business to

18

business financial transactions platform for health care benefits administration. Mr. Ha-Ngoc was previously the Vice President of Strategic Development at American Home Products Corporation. Prior to joining AHP, he was an Executive Vice President for Genetics Institute, Inc. Dr. Ha-Ngoc is a member of the Board of Fellows and Chairman of the Executive Research Committee at the Harvard School of Dental Medicine. He received an MBA from INSEAD and received a Master's Degree in Pharmacy from the University of Paris, France.

ARIEL ELIA Ariel Elia has been a director since September 2000, and was named Chairman of the Board in March 2001. Currently, and since 1999, Mr. Elia serves as Chairman of the European Advisory Board of E.Med Securities, a private, U.S.-based company providing investment banking services to emerging growth companies in the life science industry. Mr. Elia is and since 1995 has been a director of Altamir S.A., a French venture capital company, and is and since 1999 has been a director of Yissum, the research and development company of the Hebrew University of Jerusalem in Israel. Mr. Elia also serves as a Governor of both the Ben Gurion University (since 1992) and the Hebrew University of Jerusalem (since 1998), in Israel. Prior to his current positions, Mr. Elia was the Chief Executive Officer of Jouveinal Laboratories, a privately held, French pharmaceutical company. Mr. Elia also spent 17 years with Merck & Co., serving both in Europe and in the U.S., most recently as Senior Vice President, International Division. Before joining Merck & Co., Mr. Elia spent 12 years with American Home Products Corp., serving as President of the International Household Products Division prior to his departure. Mr. Elia is a U.S. citizen born in Alexandria, Egypt. He graduated from Victoria College in Alexandria, Egypt with an Oxford and Cambridge degree as a Bachelor of Arts. His honors include Knight of the Order of the Crown in Belgium, and Doctor of Philosophy Honoris Causa of Ben Gurion University, Israel.

TIMOTHY C. BARABE Timothy C. Barabe has been a director since November 2001. Mr. Barabe has been employed by Novartis AG since April 1982 in various capacities. From 1993 through January 2002, Mr. Barabe was the Chief Financial Officer of CIBA Vision Corp., a subsidiary of Novartis. Since February 2002, Mr. Barabe has been Group Vice President and President, Specialty Lenses of CIBA Vision. Mr. Barabe received his B.B.A. degree from the University of Massachusetts (Amherst) and his M.B.A. degree from the University of Chicago. Mr. Barabe is a Trustee and Treasurer of Fernbank Natural History Museum.

RISKS RELATING TO OUR BUSINESS AND STRATEGY

We are at an early stage of development.

From our inception in 1993 through December 31, 2001, we have incurred cumulative losses of approximately $71.7 million. These losses have resulted principally from the costs of our research activities and enhancements to our technology. We have derived our revenue primarily from:

- •

- license fees;

- •

- payments for product deliveries;

- •

- milestone payments; and

- •

- research and development funding paid under our agreements with our collaboration partners.

To date, except for 1997 and 2000, these revenues have not generated profits, nor have we realized any revenue from royalties from the sale by any of our collaboration partners of a commercial product developed using our technology. We cannot be certain that we will ever become profitable on a sustainable basis.

We cannot guarantee that our strategy of using our integrated compound discovery technologies in the development of new drugs and other products will ever be commercially successful.

19

Our approach to compound discovery has not yet yielded a commercially successful drug.

Our strategy is to use our technology platform to rapidly identify, optimize and obtain financial interest in as many compounds with commercial potential as possible. This approach has not yet yielded a commercially successful drug, either in our collaborations or in our internal development programs. In addition, we have recently reoriented our business and technology strategies to offer an integrated compound discovery solution, in addition to combinatorial chemistry products and services. Our new strategy may not be accepted by our potential customers. In particular, we have not proven that we can use our products successfully to assist our customers to conduct lead optimization. Our ability to succeed depends in the near term on our potential customers accepting our approach to combinatorial chemistry and integrated compound discovery as an effective tool in the discovery and development of compounds with commercial potential. If we cannot demonstrate that our approach can result in successful products, we may not be able to attract additional customers or to retain our existing customers.

Furthermore, since our suite of predictive ADMET models are still in the early stage of development, we do not know if we can successfully integrate these models into our technology platform.

Because of the specialized nature and high price of our services, our potential customer base is limited, and these potential customers may decide to try to use our approach themselves without our assistance or try other methods.

Because we offer specialized assistance in the development of drugs, our potential customer base consists of a limited number of pharmaceutical and biotechnology companies and research institutions. These organizations have historically conducted lead compound identification and optimization within their own research departments. Because of the high cost of our products and programs, they may decide to conduct these activities without our assistance.

RISKS RELATING TO COLLABORATORS

We depend on collaboration arrangements with third parties for our revenue and cannot be sure whether our collaborations will succeed or whether we will realize much of the potential revenue from our collaborations.

We depend on our collaborations for all of our revenues, and we will only realize much of the potential revenue under these collaborations if we meet compound delivery targets, satisfy milestones and earn royalties.

Our revenue stream and our business strategy depend largely on the formation of collaborative arrangements with third parties, initially pharmaceutical and biotechnology companies and research institutions. In implementing our strategy, we have concentrated on a limited number of collaborations involving extensive, multi-faceted research and development activities. Much of the potential revenue from our collaborations consists of contingent payments, such as payments for achieving development milestones and royalties payable on sales of drugs developed using our products. We cannot guarantee that these milestones will be achieved or that commercial drugs or other products will be developed on which royalties will be payable.

If we do not achieve milestones as expected, our revenue will be reduced and our stock price may decline. For planning purposes, we estimate the timing of the accomplishment of various scientific, clinical, regulatory and other milestones, such as the commencement or completion of scientific studies and clinical trials and the submission of regulatory filings. These estimates are based on a variety of assumptions. The actual timing of these milestones can vary dramatically compared to our estimates, in many cases for reasons beyond our control.

20

Our ability to realize potential revenue from milestones and royalties from our collaborations depends, in large part, on the efforts of our partners, over which we have little control.

Much of the revenue from milestones and royalties that we may receive under these collaborations will depend upon our partners' ability to successfully develop, license, introduce, market and sell new drugs developed using our products. Each of our collaborators has significant discretion in determining the efforts and resources that it will apply to the alliance. Our products will result in commercialized drugs generating milestone payments and royalties only after, among other things:

- •

- significant preclinical and clinical development efforts or the completion of preliminary field trials;

- •

- the receipt of the required regulatory approvals;

- •

- developing manufacturing capabilities; and

- •

- successful marketing efforts.

With the exception of certain aspects of preclinical drug development, we do not currently intend to perform any of these activities. Accordingly, we will depend on our partners having the necessary expertise and dedicating sufficient resources to develop and commercialize products. Our collaboration partners may fail to develop or commercialize a compound or product to which they have obtained rights from us, because, among other reasons:

- •

- they decide not to devote the necessary resources because of internal constraints or other development priorities;

- •

- they decide to pursue a competitive potential drug or compound developed outside of the collaboration;

- •

- they cannot obtain the necessary regulatory approvals; or

- •

- they may exercise limited rights to terminate these collaborations with us.

To be successful, we must expand the number of our collaborations both by maintaining existing collaborations, as well as continuing to enter into agreements with new partners to use our technology to develop potential drugs. We face significant competition in seeking appropriate collaborators. Moreover, these collaborative arrangements are complex to negotiate and time-consuming to document. We may not be able to maintain our existing collaborations or establish new collaborations, and we cannot guarantee that any collaboration will be on commercially acceptable terms. Moreover, such collaborations or other arrangements may not be scientifically or commercially successful.

RISKS ASSOCIATED WITH COMPETITION

Our competitors may have greater resources or research and development capabilities than we have and we may not have the resources required to successfully compete with them.

Our competitors may have greater research and development capabilities for drug discovery.

The drug development business is highly competitive. We compete with many organizations that are engaged in attempting to identify and optimize compounds as potential drugs. Many of these competitors have greater financial and human resources and more experience in research and development than we have. Competitors include:

- •

- biotechnology, pharmaceutical, combinatorial chemistry and other companies;

- •

- academic and scientific institutions;

- •

- governmental agencies; and

21

- •

- public and private research organizations.

Historically, pharmaceutical companies have maintained close control over their research activities, including the synthesis, screening and optimization of potential drugs. Many of these companies, which represent a significant potential market for our products and services, have developed or are developing internal combinatorial chemistry and other capabilities to improve productivity. We anticipate that we will face increased competition in the future as new companies enter the market and alternative technologies become available.

Our competitors may have greater resources for recruiting and business development.

These organizations also compete with us to attract qualified personnel and for acquisitions, joint ventures or other collaborations. They also compete with us to attract academic research institutions as partners and to license these institutions' proprietary technology. If our competitors successfully enter into partnering arrangements or license agreements with academic research institutions, we will then be precluded from pursuing those specific opportunities. Since each of these opportunities is unique, we may not be able to find a substitute. Many biotechnology companies have already begun drug development programs, some of which may target diseases that we are also targeting, and have already entered into partnering and licensing arrangements with academic research institutions, reducing the pool of available opportunities.

While universities and public and private research institutions primarily have educational or basic research objectives, they may develop proprietary technology and acquire patents that we may need for the development of our products. We will attempt to license this proprietary technology, if available. These licenses may not be available to us on acceptable terms, if at all.

We compete with many organizations for scientific and managerial personnel.

Competition for scientific and managerial personnel in our industry is intense; we will not be able to execute our strategy, grow and manage our growth if we are not able to attract additional qualified personnel.

We face intense competition for qualified personnel in our industry. Our future success will depend heavily on our ability to continue to hire, train, retain and motivate additional skilled managerial and scientific personnel. The pool of personnel with the skills that we require is limited. Competition to hire from this limited pool is intense. Our success depends on the expansion and proper management of our operations. To be cost-effective in our delivery of services and products, we must enhance productivity by further automating our processes and technology. We may not succeed in our efforts to further automate these processes. We also must successfully structure and manage multiple collaborative relationships. Further, we may not succeed in managing and meeting the staffing requirements of additional collaborative relationships.

RISKS RELATING TO OUR FINANCIAL RESULTS AND NEED FOR FINANCING

We face uncertainty in raising additional funds that may be necessary to fund our operations.

Our capital requirements depend on many factors. If our operations do not become profitable on a sustainable basis before we exhaust existing resources, we will need to obtain additional financing, either through public or private financings, including debt or equity financings, or through collaboration or other arrangements with corporate partners. We may not be able to obtain adequate funds for our operations from these sources when needed or on acceptable terms. If we raise additional capital through the sale of equity, or securities convertible into equity, your proportionate ownership in ArQule may be diluted. If we cannot obtain additional financing, we could be forced to delay or scale back our research and development programs. If adequate funds are not available, we may be required

22

to curtail operations significantly or to obtain funds by entering into arrangements with collaboration partners or others that may require that we relinquish rights to certain technologies, product candidates, products or potential markets.

Moreover, our fixed expenses such as rent, license payments and other contractual commitments are substantial and will increase in the future. These fixed expenses will increase because we may enter into:

- •

- Additional construction or lease expense for new facilities and capital equipment;

- •

- Additional licenses and collaborative agreements;

- •

- Additional contracts for consulting, maintenance and administrative services; and

- •

- Additional contracts for product manufacturing.

We believe that our cash, cash equivalents and short-term investment securities balances as of March 1, 2002 will be sufficient to meet our operating and capital requirements for the next several years. This estimate is based on assumptions and estimates, which may prove to be wrong. As a result, we may need or choose to obtain additional financing during that time.

RISKS ASSOCIATED WITH TECHNOLOGY DEVELOPMENT

We will not be able to successfully grow our business if we are unable to expand and integrate new technologies as we acquire them.

Our success depends on the integration and expansion of various chemistry-based drug discovery technologies in both our internal and collaborative programs. In order for us to achieve our goal of reducing materially the cost and time currently incurred by the pharmaceutical industry for identifying investigational new drug candidates, or IND candidates, we will have to integrate and acquire complimentary technologies. We also must successfully structure and manage multiple collaborative relationships. If we do not, we could fail to achieve such goal and lose significant amounts of revenues. Further, we may not succeed in managing and meeting the staffing requirements of additional collaborative relationships.

Integration will include several technical and administrative challenges, including managing information transfer, integrating certain of technical staff into our research and development structure and managing multiple operations in different countries. If we do not accomplish this integration effectively, our programs could be delayed and our operating and research and development expenditures could increase beyond anticipated levels. Additionally, the integration could require a significant time commitment from our senior management.

One aspect of our plan to obtain access to new technologies involves acquisition of other companies. We will not be successful if we are unable to consummate the acquisition of other companies, integrate acquired companies with our other operations or if the acquired technology or personnel of acquired companies do not meet our expectations.