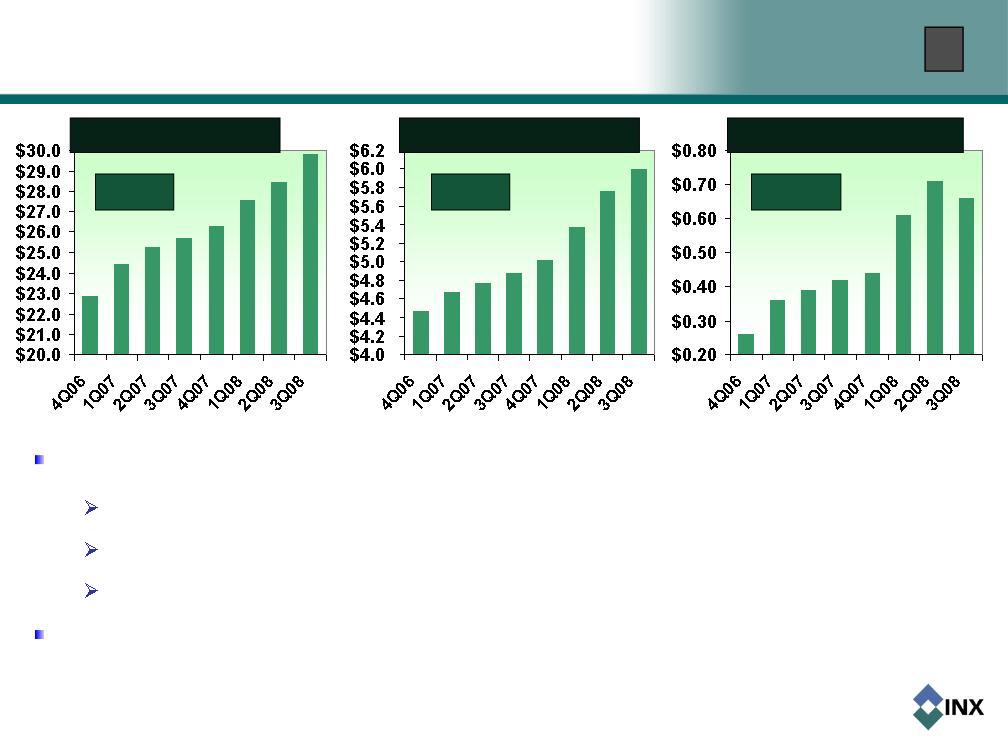

23

Q4-2008 Outlook Provided On November 6, 2008

& Update to Previous Guidance as of January 7, 2009

When we provided guidance on 11/6/2008 we expanded our range of expectations somewhat due

to lower visibility as compared to recent quarters, which reduced visibility was driven by macro-

economic and credit market uncertainty

For Q4-2008 ended December, 31, 2008 we expected:

Total revenue in the range of $61-$68 million, an increase of 8% to 20% compared to prior

year period revenue of $56.6 million

Services revenue in the range of $10-$12 million, an increase of 25%-50% compared to

prior year period service revenue of $8.0 million

Updated guidance: We currently expect Q4-2008 revenue to be above the low end of the

previous range of guidance, and possibly as high as the middle of the range of guidance

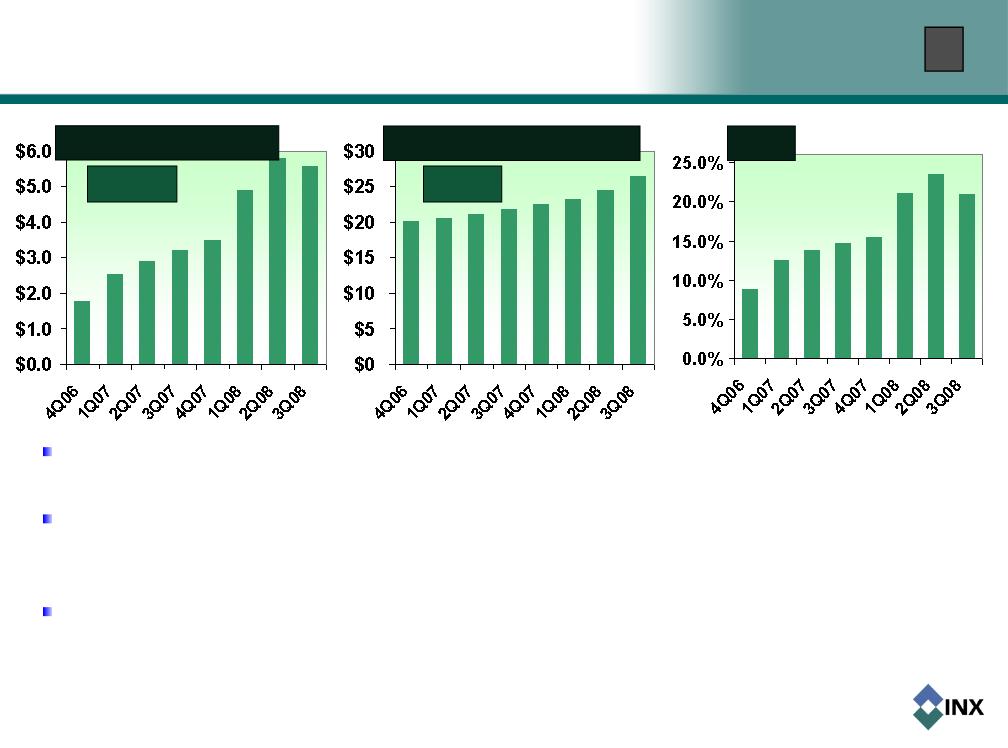

We continue to maintain our long-term target ranges for gross profit margin of 15%-19% for

products and 30%-35% for services, and for operating profit margin in the range of 4%-7%, the

achievement of which is dependent upon leveraging certain operating expenses against continued

revenue growth

While we do not provide earnings guidance, we do expect that for the next two to three quarters

that both gross margin percentage and operating profit margin percentage will be pressured

somewhat due to our efforts to expand newer practice areas and our efforts to aggressively gain

market share