Exhibit 13

Providing personal, prompt, efficient service is the goal of Bank of Walterboro. We are committed to the concept of “Hometown Banking” and hope we can be of service to you. “Strong roots – strong branches.”

Contents:

| | |

Shareholder Letter | | 2 |

Summary of Selected Financial Data | | 3 |

Financial Charts | | 4-7 |

Management’s Discussion and Analysis | | 8-24 |

Management’s Annual Report on Internal Control Over Financial Reporting | | 25 |

Report of Independent Registered Public Accounting Firm | | 26 |

Consolidated Balance Sheets | | 27 |

Consolidated Statements of Income | | 28 |

Consolidated Statements of Changes in Shareholders’ Equity and Comprehensive Income | | 29 |

Consolidated Statements of Cash Flows | | 30 |

Notes to Consolidated Financial Statements | | 31-50 |

Directors, Officers and Staff | | 51 |

Corporate Data | | 52 |

Services | | 53 |

Member FDIC

COMMUNITYCORP AND SUBSIDIARY

Dear Shareholder,

It is a pleasure to report the progress of Communitycorp and its subsidiary, Bank of Walterboro, during 2008. More detailed information follows, but we are pleased to report return on average assets of 0.91%, a sound capital to asset ratio of 10.75% and an allowance for loan losses to loans of 1.74%.

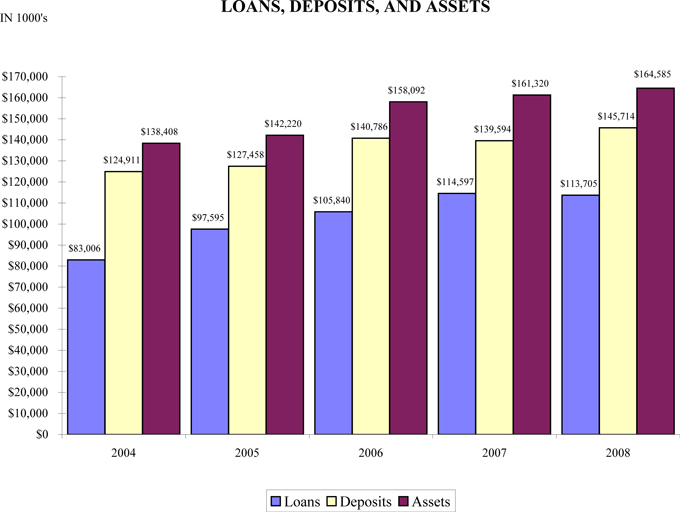

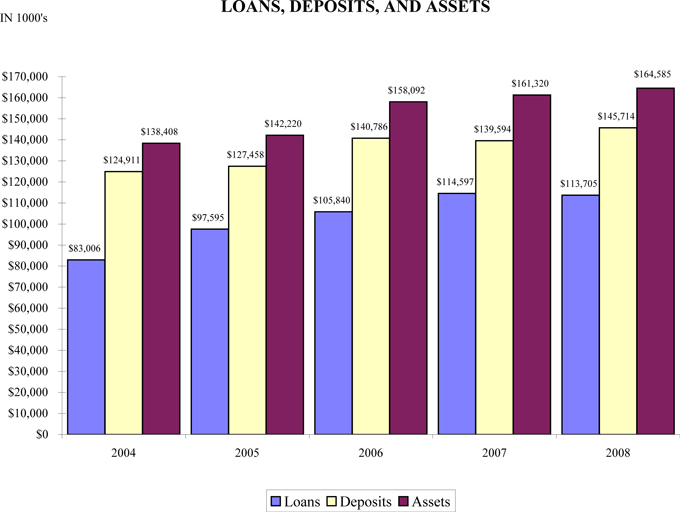

Deposits at year-end were $145,713,985 an increase of $6,119,673, or 4.38%, from 2007 year-end. Net loans decreased from $112,668,059 to $111,722,883, a decrease of $945,176, or 0.84%. The allowance for loan losses increased from a December 31, 2007 balance of $1,929,319 to $1,981,637 or 1.74% of gross loans. Total assets increased from $161,319,687 to a December 31, 2008 total of $164,585,287 an increase of $3,265,600, or 2.02%.

2008 was a challenging year for the banking industry and decreased earnings occurred through the industry.

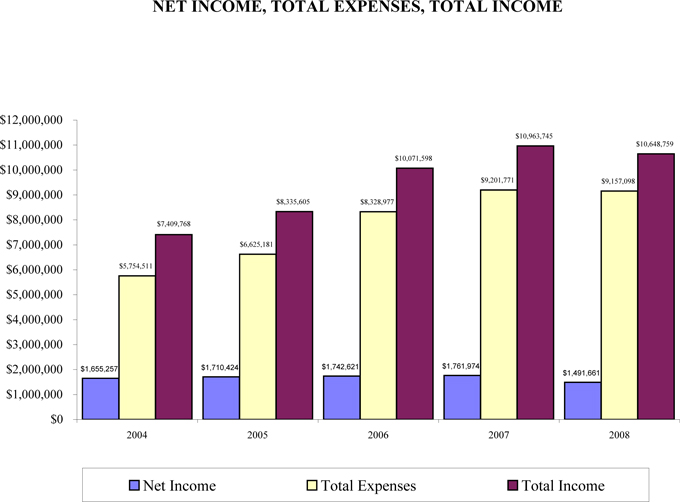

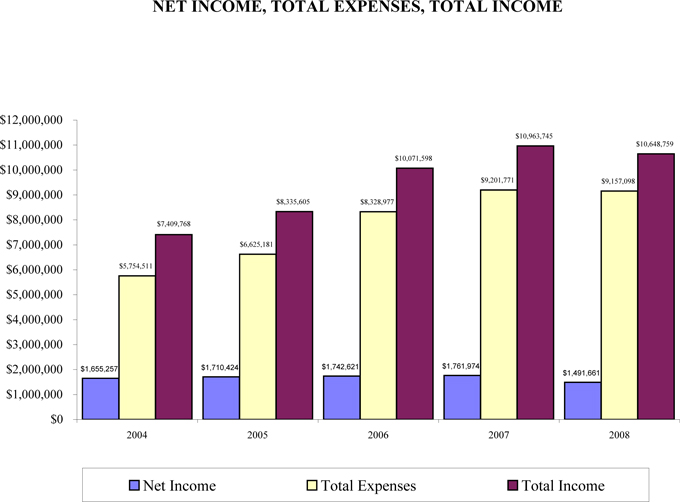

Earnings decreased in 2008 for the Company with net income of $1,491,661, a decrease of $270,253, or 15.34%, less than 2007 earnings of $1,761,914. For 2008 we earned $6.22 per share compared to $7.32 for 2007. Our net interest margin increased from 3.64% in 2007 to 3.69% in 2008.

Please read the following financial information so you may become aware of your Company’s progress. We believe the information contained in this Annual Report shows that a local, well-managed, independent bank can compete successfully in a deregulated market against national, regional, and state-wide banking institutions. Our success can be attributed to the teamwork of our shareholders, directors, officers, and employees. We most importantly want to thank our customers for allowing us to be of service to them.

The Board of Directors, officers, and employees thank you for your past support and solicit your continued support as we continue our efforts to provide prompt, efficient, and courteous service to our customers. We welcome any suggestions you may have.

We invite and encourage you to attend our Annual Meeting on Wednesday, April 29, 2009.

| | | | |

| Very truly yours, | | | | |

| | |

| | | | | |

| W. Roger Crook | | | | Peden B. McLeod |

| President and CEO | | | | Chairman of the Board |

2

COMMUNITYCORP AND SUBSIDIARY

SELECTED FINANCIAL DATA

The following selected consolidated financial data for the five years ended December 31, 2008 are derived from our consolidated financial statements and other data. The selected consolidated financial data should be read in conjunction with our consolidated financial statements, including the accompanying notes, and Management’s Discussion and Analysis of Financial Condition and Results of Operations, included elsewhere herein.

| | | | | | | | | | | | | | | | | | | | |

Year Ended December 31, (Dollars in thousands, except per share) | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

Results of Operations: | | | | | | | | | | | | | | | | | | | | |

Interest income | | $ | 9,958 | | | $ | 10,392 | | | $ | 9,358 | | | $ | 7,737 | | | $ | 6,831 | |

Interest expense | | | 4,213 | | | | 4,767 | | | | 3,871 | | | | 2,225 | | | | 1,607 | |

| | | | | | | | | | | | | | | | | | | | |

Net interest income | | | 5,745 | | | | 5,625 | | | | 5,487 | | | | 5,512 | | | | 5,224 | |

Provision for loan losses | | | 400 | | | | 202 | | | | 225 | | | | 381 | | | | 471 | |

| | | | | | | | | | | | | | | | | | | | |

Net interest income after provision for loan losses | | | 5,345 | | | | 5,423 | | | | 5,262 | | | | 5,131 | | | | 4,753 | |

Noninterest income | | | 691 | | | | 666 | | | | 713 | | | | 599 | | | | 579 | |

Noninterest expense | | | 3,845 | | | | 3,533 | | | | 3,411 | | | | 3,232 | | | | 2,875 | |

| | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 2,191 | | | | 2,556 | | | | 2,565 | | | | 2,498 | | | | 2,457 | |

Income tax expense | | | 699 | | | | 794 | | | | 823 | | | | 788 | | | | 802 | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 1,492 | | | $ | 1,762 | | | $ | 1,742 | | | $ | 1,710 | | | $ | 1,655 | |

| | | | | | | | | | | | | | | | | | | | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

Securities available-for-sale | | $ | 27,815 | | | $ | 34,585 | | | $ | 32,468 | | | $ | 30,856 | | | $ | 25,310 | |

Securities held-to-maturity | | | 1,320 | | | | 1,819 | | | | 1,574 | | | | 1,875 | | | | 2,181 | |

Allowance for loan losses | | | 1,982 | | | | 1,929 | | | | 1,857 | | | | 1,665 | | | | 1,456 | |

Net loans | | | 111,723 | | | | 112,668 | | | | 103,983 | | | | 95,930 | | | | 81,550 | |

Premises and equipment, net | | | 3,029 | | | | 2,989 | | | | 3,131 | | | | 3,266 | | | | 3,441 | |

Total assets | | | 164,585 | | | | 161,320 | | | | 158,092 | | | | 142,220 | | | | 138,408 | |

Noninterest-bearing deposits | | | 15,652 | | | | 16,461 | | | | 19,765 | | | | 18,021 | | | | 16,532 | |

Interest-bearing deposits | | | 130,062 | | | | 123,133 | | | | 121,021 | | | | 109,437 | | | | 108,379 | |

Total deposits | | | 145,714 | | | | 139,594 | | | | 140,786 | | | | 127,458 | | | | 124,911 | |

Short-term borrowings | | | — | | | | 3,068 | | | | 250 | | | | 370 | | | | 390 | |

Total liabilities | | | 146,892 | | | | 144,583 | | | | 142,955 | | | | 128,576 | | | | 125,772 | |

Total shareholders’ equity | | | 17,693 | | | | 16,736 | | | | 15,137 | | | | 13,643 | | | | 12,636 | |

Per Share Data: | | | | | | | | | | | | | | | | | | | | |

Weighted-average common shares outstanding | | | 239,634 | | | | 240,708 | | | | 242,636 | | | | 244,788 | | | | 247,446 | |

Net income | | $ | 6.22 | | | $ | 7.32 | | | $ | 7.18 | | | $ | 6.99 | | | $ | 6.69 | |

Cash dividends paid | | $ | 1.05 | | | $ | 1.00 | | | $ | 0.90 | | | $ | 0.82 | | | $ | 0.72 | |

Period end book value | | $ | 74.69 | | | $ | 69.60 | | | $ | 62.62 | | | $ | 56.13 | | | $ | 51.26 | |

Equity and Assets Ratios: | | | | | | | | | | | | | | | | | | | | |

Return on average assets | | | 0.91 | % | | | 1.08 | % | | | 1.11 | % | | | 1.23 | % | | | 1.29 | % |

Return on average equity | | | 8.70 | % | | | 11.24 | % | | | 12.35 | % | | | 13.11 | % | | | 14.04 | % |

Equity to assets ratio | | | 10.75 | % | | | 10.37 | % | | | 9.58 | % | | | 9.35 | % | | | 9.16 | % |

Dividend payout ratio | | | 16.93 | % | | | 13.65 | % | | | 12.57 | % | | | 11.79 | % | | | 10.85 | % |

3

4

5

6

7

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

GENERAL

Communitycorp is a South Carolina corporation organized on March 13, 1995 to be a bank holding company (the “Company”). The Company’s subsidiary, Bank of Walterboro, (the “Bank”) is a state-chartered commercial bank with four banking locations. The Bank’s main office and operations center is in Walterboro, South Carolina. In addition, the Bank has branches in Ravenel, and Ridgeland, South Carolina. The Company’s primary market area includes Colleton, Jasper and Charleston Counties. Depository accounts are insured by the Federal Deposit Insurance Corporation up to the maximum amount permitted by law. The Bank, which received its charter on October 11, 1988 and opened for business on May 1, 1989, is dedicated to providing prompt, efficient, personal service to its customers. The Bank offers a full range of deposit services for individuals and businesses. Deposit products include checking accounts, savings accounts, certificates of deposit, money market accounts, and IRA’s.

The Company primarily is engaged in the business of attracting deposits from the general public and using these deposits together with other funds to make commercial, consumer, and real estate loans. The Company’s operating results depend to a substantial extent on the difference between interest and fees earned on loans, investments, and services, and the Company’s interest expense, consisting principally of interest paid on deposits. Unlike most industrial companies, virtually all of the assets and liabilities of financial institutions are monetary. As a result, interest rates have a greater effect on the financial institution’s performance. In addition to competing with other traditional financial institutions, the Company also competes for savings dollars with nontraditional financial intermediaries such as mutual funds. This has resulted in a highly competitive market area, which demands the type of personal service and attention provided by the Bank.

The earnings and growth of the banking industry and the Company are and will be affected by general conditions of the economy and by the fiscal and monetary policies of the federal government and its agencies, including the Board of Governors of the Federal Reserve System (the “Board”). The Board regulates money and credit conditions and, as a result, has a strong influence on interest rates and on general economic conditions. The effect of such policies in the future on the business and earnings of the Company cannot be predicted with certainty.

As of December 31, 2008, the Company had forty-two full-time employees and five part time employees.

This discussion and analysis is intended to assist the reader in understanding the financial condition and results of operations of the Company and its subsidiary, the Bank. This commentary should be read in conjunction with the consolidated financial statements and the related notes and the other statistical information in this report.

CRITICAL ACCOUNTING POLICIES

The Company has adopted various accounting policies, which govern the application of account principles generally accepted in the United States of America in the preparation of the Company’s consolidated financial statements. The significant accounting policies of the Company are described in the notes to the consolidated financial statements.

Certain accounting policies involve significant judgments and assumptions by management, which have a material impact on the carrying value of certain assets and liabilities. Management considers such accounting policies to be critical accounting policies. The judgments and assumptions used by management are based on historical experience and other factors, which are believed to be reasonable under the circumstances. Because of the nature of the judgments and assumptions made by management, actual results could differ from these judgments and estimates, which could have a material impact on the carrying values of assets and liabilities and the results of operations of the Company.

The Company believes the allowance for loan losses is a critical accounting policy that requires the most significant judgments and estimates used in preparation of its consolidated financial statements. Refer to the section “Provision and Allowance for Loan Losses” and Note 1 to the consolidated financial statements for a detailed description of the Company’s estimation process and methodology related to the allowance for loan losses.

8

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

FORWARD-LOOKING STATEMENTS

Statements included in Management’s Discussion and Analysis which are not historical in nature are intended to be, and are hereby identified, as “forward looking statements” for purposes of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance and underlying assumptions and other statements which are other than statements of historical facts. Such forward-looking statements may be identified, without limitation, by the use of the words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” and similar expressions. The Company’s expectations, beliefs and projections are expressed in good faith and are believed by the Company to have a reasonable basis, including without limitation, management’s examination of historical operating trends, data contained in the Company’s records and other data available from third parties, but there can be no assurance that management’s expectations, beliefs or projections will result or be achieved or accomplished. The Company cautions readers that forward looking statements, including without limitation, those relating to future business prospects, revenues, working capital, liquidity, capital needs, interest costs, and income, are subject to certain risks and uncertainties that could cause actual results to differ materially from those indicated in the forward looking statements, due to several important factors herein identified, among others, and other risks and factors identified from time to time in the Company’s reports filed with the Securities and Exchange Commission.

RESULTS OF OPERATIONS

OVERVIEW

Net income for the year ended December 31, 2008 was $1,491,661 or $6.22 per share, compared to $1,761,914, or $7.32 per share, for the year ended December 31, 2007. Interest income decreased $433,756 from the 2007 amount of $10,391,728. Total interest expense also decreased $554,206 from the 2007 amount of $4,767,080. Net interest income increased $120,450 from the 2007 amount of $5,624,648. For the year ended December 31, 2008 net interest margin increased from 3.64% in 2007 to 3.69% in 2008. Non-interest income increased $24,366 from the 2007 amount of $666,421. Non-interest expense was $3,844,714, which is an increase of $311,532 over the 2007 amount.

9

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

NET INTEREST INCOME

General.The largest component of total income is net interest income, the difference between the income earned on assets and the interest accrued or paid on deposits and borrowings used to support such assets. The volume and mix of assets and liabilities and their sensitivity to interest rate movement determine changes in net interest income. Net interest margin is determined by dividing annualized net interest income by average earning assets. Net interest spread is derived from determining the weighted-average rate of interest paid on deposits and borrowings and subtracting it from the weighted-average yield on earning assets.

Net interest income for 2008 was $5,745,097 compared to $5,624,648 for 2007, an increase of 2.14%. The increase was mainly attributable to the increase in the average balances of our earning assets, which increased by 0.75% while our average interest bearing liabilities increased only 0.83%.

For 2008 average-earning assets totaled approximately $155,677,000 with an annualized average yield of 6.40% compared to approximately $154,524,000 and 6.73%, respectively, for 2007. Average interest-bearing liabilities totaled approximately $129,211,000 with an annualized average cost of 3.26% for 2008 compared to approximately $128,153,000 and 3.72%, respectively, for 2007.

Our net interest margin and net interest spread was 3.69% and 3.14%, respectively, for 2008 compared to 3.64% and 3.01% respectively for 2007.

Our annualized yield on average earning assets decreased 33 basis points for 2008 compared to 2007, while our annualized average cost of our interest-bearing liabilities decreased 46 basis points for 2008 compared to 2007. These decreases were reflective of the decreasing interest rate environment during 2008.

Details of certain components of our earning assets and interest-bearing liabilities are discussed in the following paragraphs.

Because loans often provide a higher yield than other types of earning assets, one of our goals it to maintain our loan portfolio as the largest component of total earning assets. Loans comprised approximately 72.33% and 70.42% of average earning assets for December 31, 2008 and 2007, respectively. Loan interest income for the years ended December 31, 2008 and 2007 was $8,322,422 and $8,270,237, respectively. The annualized average yield on loans was 7.39% and 7.60% for 2008 and 2007, respectively. Average balances of loans increased to approximately $112,597,000 during 2008, an increase of approximately $3,788,000 over the average of approximately $108,809,000 during 2007. The decrease in the annualized yield on loans is mainly attributable to the decline in market interest rates.

Investment securities averaged approximately $33,915,000 or 21.79% of average earning assets, for December 31, 2008 compared to approximately $36,961,000 or 23.92% of average earning assets, for 2007. Interest earned on investment securities amounted to $1,460,722 for the year ended December 31, 2008, compared to $1,667,782 for the same period last year. Investment securities yielded 4.31% and 4.51% for the period ended December 31, 2008 and 2007, respectively.

Total interest expense for the years ended December 31, 2008 and 2007 was $4,212,875 and $4,767,080, respectively. The largest component of interest expense is interest on deposit accounts. Interest expense on deposit accounts was $4,207,282 and $4,756,053, for the years ended December 31, 2008 and 2007, respectively. The average balance of interest bearing deposits increased to approximately $128,880,00 for the year ended December 31, 2008 from approximately $127,904,00 during the same period last year. The annualized average cost of deposits was approximately 3.26% for the year ended December 31, 2008 compared to 3.72% for the same period in 2007.

For the year ended December 31, 2008 and 2007, the total annualized average cost of funds was 3.26% and 3.72%, respectively.

10

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

NET INTEREST INCOME(continued)

Average Balances, Income, Expenses, Yields, and Rates. The following table sets forth, for the periods indicated, the weighted average yields earned, the weighted average rates paid, the net interest spread, and the net interest margin on earning assets. The table also indicates the average balance during the year and the interest income or expense by specific categories.

Average Balances, Income, Expenses, and Rates

| | | | | | | | | | | | | | | | | | | | |

| | | 2008 | | | 2007 | |

(Dollars in thousands) | | Average

Balance | | | Income/

Expense | | Yield/

Rate | | | Average

Balance | | | Income/

Expense | | Yield/

Rate | |

Assets: | | | | | | | | | | | | | | | | | | | | |

Earning assets: | | | | | | | | | | | | | | | | | | | | |

Securities, taxable (1) | | $ | 24,172 | | | $ | 1,070 | | 4.43 | % | | $ | 27,684 | | | $ | 1,305 | | 4.71 | % |

Securities, tax-exempt (1) | | | 9,278 | | | | 353 | | 3.80 | | | | 8,937 | | | | 344 | | 3.85 | |

Nonmarketable equity securities | | | 465 | | | | 38 | | 8.17 | | | | 340 | | | | 19 | | 5.59 | |

Federal funds sold | | | 8,954 | | | | 167 | | 1.87 | | | | 8,683 | | | | 444 | | 5.11 | |

Time deposits with other banks | | | 211 | | | | 8 | | 3.79 | | | | 71 | | | | 10 | | 14.08 | |

Loans (2) | | | 112,597 | | | | 8,322 | | 7.39 | | | | 108,809 | | | | 8,270 | | 7.60 | |

| | | | | | | | | | | | | | | | | | | | |

Total earning assets | | | 155,677 | | | | 9,958 | | 6.40 | | | | 154,524 | | | | 10,392 | | 6.73 | |

| | | | | | | | | | | | | | | | | | | | |

Cash and due from banks | | | 4,815 | | | | | | | | | | 5,268 | | | | | | | |

Allowance for loan losses | | | (1,933 | ) | | | | | | | | | (1,896 | ) | | | | | | |

Premises and equipment | | | 2,999 | | | | | | | | | | 3,064 | | | | | | | |

Accrued interest and other assets | | | 1,795 | | | | | | | | | | 1,962 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 163,353 | | | | | | | | | $ | 162,922 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Liabilities and Shareholders’ Equity: | | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits | | $ | 128,880 | | | $ | 4,207 | | 3.26 | % | | $ | 127,904 | | | $ | 4,756 | | 3.72 | % |

Short-term borrowings | | | 331 | | | | 6 | | 1.81 | | | | 249 | | | | 11 | | 4.42 | |

| | | | | | | | | | | | | | | | | | | | |

Total interest-bearing liabilities | | | 129,211 | | | | 4,213 | | 3.26 | | | | 128,153 | | | | 4,767 | | 3.72 | |

| | | | | | | | | | | | | | | | | | | | |

Noninterest-bearing deposits | | | 15,440 | | | | | | | | | | 17,495 | | | | | | | |

Accrued interest and other liabilities | | | 1,566 | | | | | | | | | | 1,603 | | | | | | | |

Shareholders’ equity | | | 17,136 | | | | | | | | | | 15,671 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 163,353 | | | | | | | | | $ | 162,922 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Net interest spread | | | | | | | | | 3.14 | % | | | | | | | | | 3.01 | % |

Net interest income | | | | | | $ | 5,745 | | | | | | | | | $ | 5,625 | | | |

| | | | | | | | | | | | | | | | | | | | |

Net interest margin | | | | | | | | | 3.69 | % | | | | | | | | | 3.64 | % |

| (1) | Averages for securities are stated at historical cost. |

| (2) | The effect of loans in nonaccrual status and fees collected is not significant to the computations. All loans and deposits are domestic. |

11

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

NET INTEREST INCOME(continued)

Analysis of Changes in Net Interest Income. Net interest income can also be analyzed in terms of the impact of changing rates and changing volume. The following table describes the extent to which changes in interest rates and changes in the volume of earning assets and interest-bearing liabilities have affected the Company’s interest income and interest expense during the periods indicated. Information on changes in each category attributable to (i) changes due to volume (change in volume multiplied by prior period rate), (ii) changes due to rates (changes in rates multiplied by prior period volume) and (iii) changes in rate and volume (change in rate multiplied by the change in volume) is provided as follows:

Analysis of Changes in Net Interest Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2008 Compared With 2007 | | | 2007 Compared With 2006 | |

| | | Variance Due to Changes in | | | Variance Due to Changes in | |

(Dollars in thousands) | | Volume | | | Rate | | | Volume/

Rate | | | Total | | | Volume | | | Rate | | | Volume/

Rate | | | Total | |

Earning Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Securities, taxable | | $ | (166 | ) | | $ | (80 | ) | | $ | 11 | | | $ | (235 | ) | | $ | 22 | | | $ | 215 | | | $ | 4 | | | $ | 241 | |

Securities, tax-exempt | | | 13 | | | | (4 | ) | | | 0 | | | | 9 | | | | 80 | | | | — | | | | — | | | | 80 | |

Nonmarketable equity securities | | | 7 | | | | 9 | | | | 3 | | | | 19 | | | | — | | | | 10 | | | | — | | | | 10 | |

Federal funds sold | | | 14 | | | | (282 | ) | | | (9 | ) | | | (277 | ) | | | (125 | ) | | | 17 | | | | (3 | ) | | | (111 | ) |

Time deposits with other banks | | | 20 | | | | (7 | ) | | | (15 | ) | | | (2 | ) | | | (5 | ) | | | 6 | | | | (2 | ) | | | (1 | ) |

Loans | | | 288 | | | | (228 | ) | | | (8 | ) | | | 52 | | | | 482 | | | | 313 | | | | 20 | | | | 815 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest income | | | 176 | | | | (592 | ) | | | (18 | ) | | | 434 | | | | 454 | | | | 561 | | | | 19 | | | | 1,034 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-Bearing Liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits | | | 36 | | | | (581 | ) | | | (4 | ) | | | (549 | ) | | | 161 | | | | 708 | | | | 30 | | | | 899 | |

Short-term borrowings | | | (4 | ) | | | (6 | ) | | | (3 | ) | | | (5 | ) | | | (6 | ) | | | 4 | | | | (1 | ) | | | (3 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest expense | | | 40 | | | | (587 | ) | | | (7 | ) | | | (554 | ) | | | 155 | | | | 712 | | | | 29 | | | | 896 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | $ | 136 | | | $ | (5 | ) | | $ | (11 | ) | | $ | 120 | | | $ | 299 | | | $ | (151 | ) | | $ | (10 | ) | | $ | 138 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest Sensitivity. The Company monitors and manages the pricing and maturity of its assets and liabilities in order to diminish the potential adverse impact that changes in interest rates could have on its net interest income. The principal monitoring technique employed by the Company is the measurement of the Company’s interest sensitivity “gap,” which is the positive or negative dollar difference between assets and liabilities that are subject to interest rate repricing within a given period of time. Interest rate sensitivity can be managed by repricing assets or liabilities, selling securities available-for-sale, replacing an asset or liability at maturity, or adjusting the interest rate during the life of an asset or liability. Managing the amount of assets and liabilities repricing in this same time interval helps to manage the risk and minimize the impact on net interest income of rising or falling interest rates.

12

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

NET INTEREST INCOME(continued)

The following table presents the Company’s rate sensitivity at each of the time intervals indicated as of December 31, 2008. The table may not be indicative of the Company’s rate sensitivity position at other points in time.

Interest Sensitivity Analysis

| | | | | | | | | | | | | | | | | | | |

(Dollars in thousands) | | Within

Three

Months | | | After Three

Through

Twelve

Months | | | After One

Through

Five

Years | | | Greater

Than

Five

Years | | | Total |

Assets | | | | | | | | | | | | | | | | | | | |

Earning assets: | | | | | | | | | | | | | | | | | | | |

Federal funds sold and securities purchased under agreements to resell | | $ | 13 146 | | | $ | — | | | $ | — | | | $ | — | | | $ | 13,146 |

Investment securities | | | 1,834 | | | | 2,086 | | | | 11,076 | | | | 14,647 | | | | 29,643 |

Loans (1) | | | 20,194 | | | | 34,829 | | | | 56,554 | | | | 152 | | | | 111,729 |

| | | | | | | | | | | | | | | | | | | |

Total earning assets | | | 35,174 | | | | 36,915 | | | | 67,630 | | | | 14,799 | | | | 154,518 |

| | | | | | | | | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits: | | | | | | | | | | | | | | | | | | | |

Demand | | | 21,065 | | | | — | | | | — | | | | — | | | | 21,065 |

Savings and money market | | | 16,442 | | | | — | | | | — | | | | — | | | | 16,442 |

Time | | | 25,696 | | | | 61,608 | | | | 5,214 | | | | 36 | | | | 92,554 |

| | | | | | | | | | | | | | | | | | | |

Total interest-bearing deposits and liabilities | | | 63,203 | | | | 61,608 | | | | 5,214 | | | | 36 | | | | 130,061 |

| | | | | | | | | | | | | | | | | | | |

Period gap | | $ | (28,029 | ) | | $ | (24,693 | ) | | $ | 62,416 | | | $ | 14,763 | | | | |

| | | | | | | | | | | | | | | | | | | |

Cumulative gap | | $ | (28,029 | ) | | $ | (52,722 | ) | | $ | 9,694 | | | $ | 24,457 | | | | |

| | | | | | | | | | | | | | | | | | | |

Ratio of cumulative gap to total earning assets | | | (18.14 | )% | | | (34.12 | )% | | | 6.27 | % | | | 15.83 | % | | | |

| (1) | Excludes nonaccrual loans. |

The above table reflects the balances of earning assets and interest-bearing liabilities at the earlier of their repricing or maturity dates. Overnight federal funds are reflected at the earliest pricing interval due to the immediately available nature of the instruments. Scheduled payment amounts of fixed rate amortizing loans are reflected at each scheduled payment date. Scheduled payment amounts of variable rate amortizing loans are reflected at each scheduled payment date until the loan may be repriced contractually; the unamortized balance is reflected at that point. Interest-bearing liabilities with no contractual maturity, such as savings deposits and interest-bearing transaction accounts, are reflected in the earliest repricing period due to contractual arrangements which give the Company the opportunity to vary the rates paid on those deposits within a thirty-day or shorter period. Fixed rate time deposits, principally certificates of deposit, are reflected at their contractual maturity date. Short-term borrowings are reflected in the earliest repricing period since these borrowings mature daily.

13

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

NET INTEREST INCOME(continued)

The Company generally would benefit from increasing market rates of interest when it has an asset-sensitive gap and generally would benefit from decreasing market rates of interest when it is liability sensitive. The Company currently is liability-sensitive over periods with maturity dates of less than twelve months. However, the Company’s gap analysis is not a precise indicator of its interest sensitive position. The analysis presents a static view of the timing of maturities and repricing opportunities, without taking into consideration that changes in interest rates do not affect all assets and liabilities equally. Net interest income is also impacted by other significant factors, including changes in the volume and mix of earning assets and interest-bearing liabilities.

PROVISION AND ALLOWANCE FOR LOAN LOSSES

We provide for loan losses using the allowance method. Increases to the allowance are charged by recording a provision for loan losses in the consolidated statement of income. Loan losses and recoveries are charged to the allowance. Charge-offs to the allowance are made when all or a portion of the loan is confirmed as a loss based on our review of the loan, through possession of the underlying security, or through a troubled debt restructuring transaction. Likewise, recoveries offset these increases through credits to the allowance.

The allowance is maintained at a level that we believe is sufficient to cover losses in the loan portfolio at a specific point in time. Assessing the adequacy of the allowance requires considerable judgment. The adequacy of the allowance is analyzed on a monthly basis using an internal analysis model. For purposes of this analysis, adequacy is defined as a level sufficient to absorb probable losses in the portfolio. This methodology relies upon our judgment. Our judgments are based on our assessment of various issues, including, but not limited to, the pace of loan growth, emerging portfolio concentrations, the risk management system relating to lending activities, entry into new markets, new product offerings, loan portfolio quality trends, and uncertainty in current economic and business conditions. An allowance model is used that takes into account factors including the composition of the loan portfolio such as risk grade classifications, historical asset quality trends including, but not limited to, previous loss experience ratios, our assessment of current economic conditions, and reviews of specific high risk sectors of the portfolio. Loans are graded at inception and are reviewed on a periodic basis to ensure that assigned risk grades are proper based on the definition of such classification. The value of underlying collateral is also considered during such analysis. The resulting monthly model and the related conclusions are reviewed and approved by Senior Management. Our analysis of allowance adequacy includes consideration for loan impairment. While we use the best information available to make evaluations, future adjustments to the allowance may be necessary if results differ substantially from the assumptions used in making the evaluations.

The methodology for assessing the adequacy of the allowance establishes both an allocated and unallocated component of the allowance. The allocated component is based principally on current loan grades and historical loss rates. The unallocated component is the result of the portion of the assessment that estimates probable losses in the portfolio that are not fully captured in the allocated allowance. This analysis includes, but is not necessarily limited to, industry concentrations, future market expansions, model imprecision, and the estimated impact of current economic conditions on historical loss rates. On a continual basis, we monitor trends within the portfolio, both quantitative and qualitative, and assess the reasonableness of the unallocated component.

The allowance is subject to examination and adequacy testing by regulatory agencies. In addition, such regulatory agencies could require allowance adjustments based on information available to them at the time of their examination.

The allowance for loan losses was 1.74% and 1.68% of total loans on December 31, 2008 and 2007, respectively. Although there has been an increase in classified loans from December 31, 2007 to December 31, 2008, we believe the allowance for loan losses at December 31, 2008 is reflective of the results of our allowance model methodology. We monitor and evaluate the adequacy of the allowance and loss exposure in the loan portfolio by considering the borrowers’ financial conditions and other factors in the unallocated component of the allowance. Accordingly, we believe the allowance as of December 31, 2008 is adequate, based on our assessment of probable losses, and available facts and circumstances then prevailing.

14

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

PROVISION AND ALLOWANCE FOR LOAN LOSSES(continued)

Allowance for Loan Losses

| | | | | | | | |

| | | Year ended December 31, | |

| | | 2008 | | | 2007 | |

Total loans outstanding at end of year | | $ | 113,704,520 | | | $ | 114,597,378 | |

| | | | | | | | |

Average loans outstanding | | $ | 112,596,835 | | | $ | 108,808,888 | |

| | | | | | | | |

Balance of allowance for loan losses at beginning of period | | $ | 1,929,319 | | | $ | 1,856,888 | |

Loan losses: | | | | | | | | |

Real estate - construction | | | — | | | | — | |

Real estate - mortgage | | | — | | | | — | |

Commercial and industrial | | | 261,094 | | | | 110,508 | |

Consumer | | | 102,037 | | | | 41,191 | |

| | | | | | | | |

Total loan losses | | | 363,131 | | | | 151,699 | |

| | | | | | | | |

Recoveries of previous loan losses: | | | | | | | | |

Real estate - construction | | | — | | | | — | |

Real estate - mortgage | | | — | | | | — | |

Commercial and industrial | | | 1,030 | | | | 10,537 | |

Consumer | | | 14,419 | | | | 11,593 | |

| | | | | | | | |

Total recoveries | | | 15,449 | | | | 22,130 | |

| | | | | | | | |

Net charge-offs | | | (347,682 | ) | | | (129,569 | ) |

Provision charged to operations | | | 400,000 | | | | 202,000 | |

| | | | | | | | |

Balance of allowance for loan losses at end of year | | $ | 1,981,637 | | | $ | 1,929,319 | |

| | | | | | | | |

Ratios: | | | | | | | | |

Net charge-offs to average loans outstanding | | | 0.31 | % | | | 0.12 | % |

Net charge-offs to loans at end of year | | | 0.31 | % | | | 0.11 | % |

Allowance for loan losses to average loans | | | 1.76 | % | | | 1.77 | % |

Allowance for loan losses to loans at end of year | | | 1.74 | % | | | 1.68 | % |

Net charge-offs to allowance for loan losses | | | 17.55 | % | | | 6.72 | % |

Net charge-offs to provisions for loan losses | | | 86.92 | % | | | 64.14 | % |

Nonperforming Assets.

The following table sets forth the Company’s nonperforming assets at the dates indicated:

| | | | | | | | |

| | | December 31, | |

| | | 2008 | | | 2007 | |

Impaired Loans | | $ | 4,712,038 | | | $ | 814,874 | |

Loans 90 days or more past due and still accruing interest | | | 2,951 | | | | 3,433 | |

| | | | | | | | |

Total impaired and nonperforming loans | | | 4,714,989 | | | | 818,307 | |

Other real estate owned | | | 75,000 | | | | — | |

| | | | | | | | |

Total impaired and nonperforming assets | | $ | 4,789,989 | | | $ | 818,307 | |

| | | | | | | | |

Impaired and nonperforming assets to year end loans | | | 4.21 | % | | | 0.71 | % |

Loans on the Company’s problem loan watch list are considered potentially impaired loans. These loans are evaluated in determining whether all outstanding principal and interest are expected to be collected. At December 31, 2008 and 2007 impaired totaled $4,712,038 and $814,874, respectively. Nonaccrual loans of $1,975,834 and $814,874 were included in impaired loans at December 31, 2008 and 2007, respectively. The impaired loans had specific valuation allowances of $275,548 and $122,146 at December 31, 2008 and 2007, respectively. The average balances of impaired loans during 2008 and 2007 were $3,940,498 and $808,868, respectively.

15

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

PROVISION AND ALLOWANCE FOR LOAN LOSSES(continued)

Potential Problem Loans. The following is a summary of potential problems loans at December 31, 2008 and 2007, which were identified through our internal review mechanisms.

| | | | | | |

| | | December 31, |

| | | 2008 | | 2007 |

Criticized loans | | $ | 1,872,889 | | $ | 90,586 |

Classified loans | | | 3,939,110 | | | 1,480,047 |

Criticized loans have potential weaknesses that deserve close attention and could, if uncorrected, result in deterioration of the prospects for repayment or the Bank’s credit position at a future date. Classified loans are inadequately protected by the sound worth and paying capacity of the borrower or any collateral and there is a distinct possibility or probability that the Bank will sustain a loss if the deficiencies are not corrected. During 2008, we employed a more robust process for reviewing and categorizing loans, which caused part of the increase of the levels of criticized, classified and impaired loans.

At December 31, 2008 real estate or other collateral secured practically all of the loans that were criticized and classified. In the event of foreclosure on these loans, there can be no assurance that in liquidation, the collateral can be sold for its estimated fair market value or even for an amount at least equal to or greater than the loan amount.

The results of this internal review process and applying the allowance model methodology are the primary determining factors in management’s assessment of the adequacy of the allowance for loan losses.

NONINTEREST INCOME AND EXPENSE

Noninterest Income. Noninterest income for the year ended December 31, 2008 was $690,787, an increase of $24,366 or 3.66% from the comparable period in 2007. Service charges on deposit accounts increased $62,054 or 12.97% from the year ended December 31, 2007 to $540,457 for the comparable period in 2008. This increase is primarily attributable to the increase in service charges on deposit accounts, which increased because of increasing the charge for non-sufficient checks. All other categories of noninterest income decreased 20.05% to $150,330 for the year ended December 31, 2008 when compared to the year ended December 31, 2007. The decline in other income is attributable to the decline in rates paid for certain types of miscellaneous income.

Noninterest Expense.Total noninterest expenses for the year ended December 31, 2008 were $3,844,714, an increase of $311,532 or 8.82%, higher when compared to total noninterest expenses of $3,533,182 for the year ended December 31, 2007. Salaries and employee benefits increased 4.52% from $1,924,825 for the year ended December 31, 2007 to $2,011,830 for the year ended December 31, 2008. This increase is primarily attributable to normal salary increases. Net occupancy and equipment expense increased 5.37% from $571,313 for the year ended December 31, 2007 to $601,965 for the year ended December 31, 2008. Other operating expenses increased $193,875 from the year ended December 31, 2007 to $1,230,921 for the year ended December 31, 2008. This increase is primarily attributable to the increase of $31,372 in our ATM networking fees due to increased usage of our ATM machines, a $41,464 increase in our FDIC deposit insurance premiums, and increased professional fees of $61,495, most of which were related to the cost of complying with the provisions of section 404 of the Sarbanes-Oxley Act.

16

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

NONINTEREST INCOME AND EXPENSE(continued)

Income Taxes. The Company’s income tax expense for 2008 was $699,509, a decrease of $94,464 over the 2007 expense of $793,973. The Company’s effective tax rates for the years ended December 31, 2008 and 2007 were 31.92% and 31.06%, respectively.

Net Income.The combination of the above factors resulted in net income for the year ended December 31, 2008 of $1,491,661 as compared to $1,761,914 for the same period in 2007. This represents a decrease of $270,253 or 15.34% over the same period in 2007.

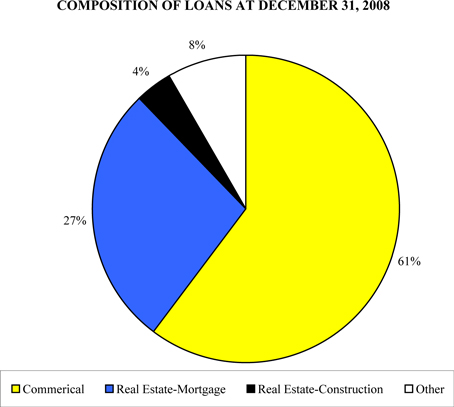

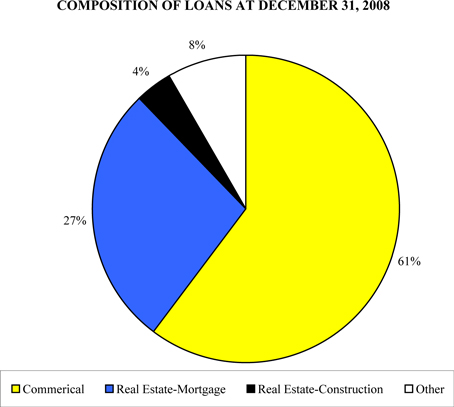

EARNING ASSETS

Loans. Loans are the largest category of earning assets and typically provide higher yields than other types of earning assets. Associated with the higher loan yields are the inherent credit and liquidity risks which management attempts to control and counterbalance. Loans averaged approximately $112,597,000 in 2008 compared to approximately $108,809,000 in 2007, an increase of approximately $3,788,000 or 3.48%. Total loans were $113,704,520 and $114,597,378 at December 31, 2008 and 2007, respectively. Fixed rates loans comprised approximately 98% and 99% of our loan portfolio at December 31, 2008 and 2007, respectively.

The Company’s ratio of loans to deposits was 78.03% at December 31, 2008 as compared to 82.09% at December 31, 2007. The loan to deposit ratio is used to monitor a financial institution’s potential profitability and efficiency of asset distribution and utilization. Generally, a higher loan to deposit ratio is indicative of higher interest income since loans yield a higher return than alternative investment vehicles. Management has concentrated on maintaining quality in the loan portfolio while continuing to increase the deposit base.

The Company extends credit primarily to consumers and small businesses in Walterboro, Ravenel and Ridgeland, South Carolina, and to customers in surrounding areas. The Company’s service area is mixed in nature. Walterboro is a regional business center whose economy contains elements of medium and light manufacturing, higher education, regional health care, and distribution facilities. Outside the incorporated city limits of Walterboro, the economy includes manufacturing, agriculture, timber, and recreational activities. Loan growth in the Ravenel and Ridgeland area is expected to come primarily from consumer loans and small businesses in neighboring Charleston and Jasper Counties. No particular category or segment of the economies previously described is expected to grow or contract disproportionately in 2008. Management believes that the loan portfolio is adequately diversified. There are no significant concentrations of loans in any particular individuals, industry, or group of related individuals or industries. The loan demand remains strong in the Company’s market area.

The Company considers a loan to be impaired when, based upon current information and events, Management believes it is probable that the Company will be unable to collect all amounts due according to the contractual terms of the loan agreement. The Company’s impaired loans include loans identified as impaired through review of the nonhomogeneous portfolio and troubled debt restructurings. Specific allowances are established on impaired loans, if deemed necessary, for the difference between the loan amount and the fair market value less estimated selling costs. Impaired loans may be left on accrual status during the period the Company is pursuing repayment of the loan. Impairment losses are recognized through an increase in the allowance for loan losses and a corresponding charge to the provision for loan losses. Adjustments to impairment losses due to changes in the fair market value of the collateral properties for impaired loans are also recognized through an increase in the allowance for loan losses and a corresponding charge to the provision for loan losses. When an impaired loan is sold, transferred to other real estate owned, or written-down, the loan is removed from the portfolio through a charge-off to the allowance for loan losses.

17

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

EARNING ASSETS(continued)

The following table sets forth the composition of the loan portfolio by category at December 31, 2008 and 2007 and highlights our general emphasis on commercial and mortgage lending.

Loan Portfolio Composition

| | | | | | | | | | | | | | |

| | | 2008 | | | 2007 | |

| | | Amount | | | Percent

of Total | | | Amount | | | Percent

of Total | |

Commercial and industrial | | $ | 68,540,891 | | | 60.28 | % | | $ | 65,995,943 | | | 57.59 | % |

Real estate | | | | | | | | | | | | | | |

Construction | | | 4,564,879 | | | 4.01 | | | | 4,791,125 | | | 4.18 | |

Mortgage | | | 31,204,675 | | | 27.44 | | | | 32,249,064 | | | 28.14 | |

Consumer and other loans | | | 9,394,075 | | | 8.26 | | | | 11,561,246 | | | 10.09 | |

| | | | | | | | | | | | | | |

Total loans | | | 113,704,520 | | | 100.00 | % | | | 114,597,378 | | | 100.00 | % |

| | | | | | | | | | | | | | |

Allowance for loan losses | | | (1,981,637 | ) | | | | | | (1,929,319 | ) | | | |

| | | | | | | | | | | | | | |

Net loans | | $ | 111,722,883 | | | | | | $ | 112,668,059 | | | | |

| | | | | | | | | | | | | | |

Commercial and industrial loans increased $2,544,948 or 3.86% from $65,995,943 at December 31, 2007. Real estate loans, including construction and mortgage loans, decreased $1,270,635 or 3.43% to $35,769,554 at December 31, 2008. Consumer and all other loans decreased $2,167,171 or 18.75% to $9,394,075 at December 31, 2008.

Maturities and Sensitivity of Loans to Changes in Interest Rates

The following table summarizes the loan maturity distribution, by type, at December 31, 2008 and related interest rate characteristics:

| | | | | | | | | | | | |

| | | One Year or

Less | | Over One Year

Through Five

Years | | Over Five

Years | | Total |

Real estate - construction | | $ | 3,782,344 | | $ | 782,535 | | $ | — | | $ | 4,564,879 |

Real estate - mortgage | | | 9,681,682 | | | 20,527,908 | | | 995,085 | | | 31,204,675 |

Commercial and industrial | | | 30,816,306 | | | 37,144,668 | | | 579,917 | | | 68,540,891 |

Consumer and other | | | 2,936,599 | | | 6,250,803 | | | 206,673 | | | 9,394,075 |

| | | | | | | | | | | | |

| | $ | 47,216,931 | | $ | 64,705,914 | | $ | 1,781,675 | | $ | 113,704,520 |

| | | | | | | | | | | | |

Loans maturing after one year with: | | | | | | | | | | | | |

Fixed interest rates | | | | | | | | | | | $ | 65,462,557 |

Floating interest rates | | | | | | | | | | | | 1,025,032 |

| | | | | | | | | | | | |

| | | | | | | | | | | $ | 66,487,589 |

| | | | | | | | | | | | |

18

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

EARNING ASSETS(continued)

The information presented in the above table is based on the contractual maturities of the individual loans, including loans, which may be subject to renewal at their contractual maturity. Renewal of such loans is subject to review and credit approval as well as modification of terms upon their maturity. Consequently, management believes the treatment shown in the above table presents fairly the maturity and repricing structure of the loan portfolio.

Short-Term Investments. Short-term investments, which consist of federal funds sold, averaged approximately $8,954,126 in 2008, compared to approximately $8,683,000 in 2007. At December 31, 2008, we had no short-term investments. Short-term investments are a primary source of the Company’s liquidity and are generally invested in an earning capacity on an overnight basis.

Investment Securities. The investment securities portfolio is a significant component of the Company’s total earning assets. Total investment securities, stated at carrying amount, averaged approximately $33,916,000 in 2008, compared to approximately $36,961,000 in 2007. At December 31, 2008, the carrying value of the securities portfolio was $29,643,306. Securities designated as available-for-sale totaled $27,815,275 and were recorded at estimated fair value. Securities designated as held-to-maturity totaled $1,319,596 and were recorded at amortized cost. Securities designated as nonmarketable equity securities totaled $508,435 at December 31, 2008. The investment objectives of the Company include maintaining and investing in a portfolio of high quality and highly liquid investments with competitive returns. Based on these objectives, the Company’s investments primarily consist of obligations of government-sponsored enterprises and obligations of states and local governments.

Investment Portfolio. The following tables summarize the carrying value of investment securities at December 31, 2008 and 2007 and the weighted average yields of those securities at December 31, 2008.

Investment Securities Portfolio Composition

| | | | | | |

| | | 2008 | | 2007 |

Available-for-Sale (1) | | | | | | |

Government-sponsored enterprises | | $ | 11,554,710 | | $ | 21,028,089 |

Obligations of states and local governments | | | 8,330,464 | | | 7,803,335 |

Other | | | 446,356 | | | 202,160 |

| | | | | | |

| | | 20,331,530 | | | 29,033,584 |

Mortgage-backed securities | | | 7,483,745 | | | 5,551,489 |

| | | | | | |

Total available-for-sale securities | | $ | 27,815,275 | | $ | 34,585,073 |

| | | | | | |

Held-to-Maturity (1) | | | | | | |

Government-sponsored enterprises | | $ | — | | $ | 300,000 |

Obligations of states and local governments | | | 1,319,596 | | | 1,519,481 |

| | | | | | |

Total held-to-maturity securities | | $ | 1,319,596 | | $ | 1,819,481 |

| | | | | | |

| (1) | Held-to-maturity securities are stated at amortized cost and available-for-sale securities are stated at estimated fair value. |

19

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

EARNING ASSETS(continued)

Investment Securities Maturity Distribution and Yields

Available-for-Sale

| | | | | | | | | | | | | | | | | | | | | | | | |

December 31, 2008 (Dollars in thousands) | | Within One Year | | | After One But

Within Five Years | | | After Five But

Within Ten Years | | | Over Ten Years | |

| | Amount | | Yield (1) | | | Amount | | Yield (1) | | | Amount | | Yield (1) | | | Amount | | Yield (1) | |

Government-sponsored enterprises (2) | | $ | 2,716 | | 3.16 | % | | $ | 8,086 | | 3.84 | % | | $ | 753 | | 5.42 | % | | $ | — | | — | % |

Obligations of states and local governments | | | 732 | | 6.31 | % | | | 1,243 | | 5.86 | % | | | 4,952 | | 5.51 | % | | | 1,403 | | 5.42 | % |

Other | | | — | | — | % | | | — | | — | % | | | 446 | | 7.22 | % | | | — | | — | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total available-for-sale securities | | $ | 3,448 | | 3.82 | % | | $ | 9,329 | | 4.11 | % | | $ | 6,152 | | 5.62 | % | | $ | 1,403 | | 5.42 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

|

| Held-to-Maturity | |

| | | | |

December 31, 2008 (Dollars in thousands) | | Within One Year | | | After One But

Within Five Years | | | After Five But

Within Ten Years | | | Over Ten Years | |

| | Amount | | Yield (1) | | | Amount | | Yield (1) | | | Amount | | Yield (1) | | | Amount | | Yield (1) | |

Obligations of states and local governments | | $ | 255 | | 6.41 | % | | $ | 765 | | 6.78 | % | | $ | 300 | | 6.18 | % | | $ | — | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Tax equivalent yield has been calculated using an incremental rate of 34%. |

| (2) | Excludes mortgage-backed securities totaling $7,483,745 with a yield of 4.77%. |

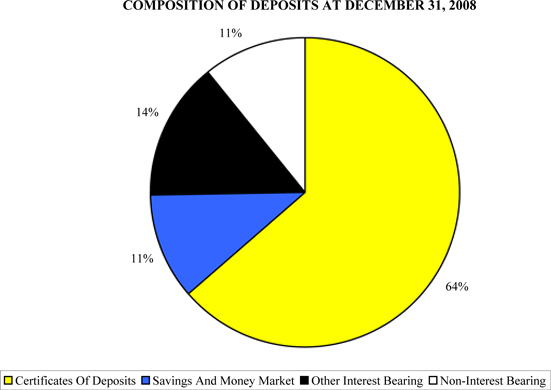

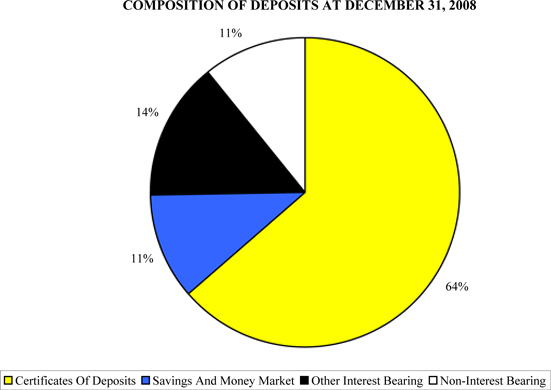

DEPOSITS AND OTHER INTEREST-BEARING LIABILITIES

Deposits. Deposits account for practically all of our interest bearing liabilities. Total average deposits decreased from approximately $145,399,000 in 2007 to approximately $144,320,000 in 2008. This represents a decrease of approximately $1,079 or 0.74% from the 2007 amount.

The following table summarizes the Company’s deposits for the years ended December 31, 2008 and 2007.

| | | | | | | | | | | | |

| | | 2008 | | | 2007 | |

| | | Amount | | Percent of

Deposits | | | Amount | | Percent of

Deposits | |

Noninterest-bearing demand | | $ | 15,652,393 | | 10.74 | % | | $ | 16,461,238 | | 11.79 | % |

Interest-bearing demand | | | 21,065,476 | | 14.46 | | | | 20,840,913 | | 14.93 | |

Savings accounts | | | 16,442,403 | | 11.28 | | | | 14,270,926 | | 10.22 | |

Time deposits of $100,000 or over | | | 53,994,171 | | 37.06 | | | | 55,118,795 | | 39.49 | |

Other time deposits | | | 38,559,542 | | 26.46 | | | | 32,902,440 | | 23.57 | |

| | | | | | | | | | | | |

Total deposits | | $ | 145,713,985 | | 100.00 | % | | $ | 139,594,312 | | 100.00 | % |

| | | | | | | | | | | | |

20

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

DEPOSITS AND OTHER INTEREST-BEARING LIABILITIES(continued)

Core deposits, which exclude certificates of deposit of $100,000 or more, provide a relatively stable funding source for the Company’s loan portfolio and other earning assets. The Company’s core deposits were $91,719,814 and $84,475,517 at December 31, 2008 and 2007, respectively. A stable base of deposits is expected to be the Company’s primary source of funding to meet both its short-term and long-term liquidity needs in the future.

Maturities of Certificates of Deposit of $100,000 or More

The maturity distribution of the Company’s time deposits of $100,000 or more at December 31, 2008, is shown in the following table.

| | | | | | | | | | | | | | | |

| | | Within Three

Months | | After Three

Through Six

Months | | After Six

Through Twelve

Months | | After Twelve

Months | | Total |

Certificates of deposit of $100,000 or more | | $ | 15,827,452 | | $ | 14,726,078 | | $ | 20,379,515 | | $ | 3,061,126 | | $ | 53,994,171 |

Large balance certificates of deposit customers tend to be extremely sensitive to interest rate levels, making these deposits less reliable sources of funding for liquidity planning purposes than core deposits. During 2008 and 2007, the Company did not have any certificates of deposits that were obtained through brokers.

Short-term Borrowings. At December 31, 2008 and 2007, the Company had securities sold under agreements to repurchase, which are classified as secured borrowings and generally mature within one to seven day periods. Either party may cancel the arrangement without penalty. Information concerning securities sold under agreements to repurchase is summarized as follows:

| | | | | | | | |

| | | Years ended December 31, | |

| | | 2008 | | | 2007 | |

Average balance during the year | | $ | 308,449 | | | $ | 249,074 | |

Average interest rate during the year | | | 1.81 | % | | | 4.29 | % |

Maximum month-end balance during the year | | $ | 515,000 | | | $ | 3,068,000 | |

End of period average interest rate | | | 0.25 | % | | | 4.72 | % |

CAPITAL

Total shareholders’ equity increased by $957,017 from $16,736,401 at December 31, 2007 to $17,693,418 at December 31, 2008. The increase is attributable to the sale of treasury stock of $24,000, the increase in other comprehensive income of $4,773 and net income of $1,491,661. The increase was offset by the purchase of treasury stock during the period of $310,880, and the payment of dividends of $252,537.

21

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

CAPITAL(continued)

The Bank is subject to various regulatory capital requirements administered by the federal banking agencies. Failure to meet minimum capital requirements can initiate certain mandatory, and possibly additional discretionary actions by regulators that, if undertaken, could have a direct material effect on the Bank’s financial statements. Under capital adequacy guidelines and the regulatory framework for prompt corrective action, the Bank must meet specific capital guidelines that involve quantitative measures of the Bank’s assets, liabilities, and certain off-balance-sheet items as calculated under regulatory accounting practices. The Bank’s capital amounts and classification are also subject to qualitative judgments by the regulators about components, risk weightings, and other factors.

Quantitative measures established by regulation to ensure capital adequacy require the Bank to maintain minimum ratios of Tier 1 and total capital as a percentage of assets and off-balance-sheet exposures, adjusted for risk weights ranging from 0% to 100%. Tier 1 capital consists of common shareholders’ equity, excluding the unrealized gain or loss on securities available for sale, minus certain intangible assets. Tier 2 capital consists of the allowance for loan losses subject to certain limitations. Total capital for purposes of computing the capital ratios consists of the sum of Tier 1 and Tier 2 capital. Total regulatory minimum requirements are 4% for Tier 1 and 8% for total risk-based capital.

As of December 31, 2008, management believes that the Bank is well capitalized under the regulatory framework for prompt-corrective action.

The following table summarizes the capital amounts and ratios of the Bank and the regulatory minimum requirements.

| | | | | | | | | | | | | | | | | | |

| | | Actual | | | For Capital

Adequacy Purposes | | | To Be Well-

Capitalized Under

Prompt Corrective

Action Provisions | |

| | | | | | | | Minimum | | | Minimum | |

| | | Amount | | Ratio | | | Amount | | Ratio | | | Amount | | Ratio | |

December 31, 2008 | | | | | | | | | | | | | | | | | | |

Total capital (to risk-weighted assets) | | $ | 19,125,823 | | 15.31 | % | | $ | 9,995,920 | | 8.00 | % | | $ | 12,494,900 | | 10.00 | % |

Tier 1 capital (to risk-weighted assets) | | | 17,563,961 | | 14.06 | | | | 4,997,960 | | 4.00 | | | | 7,496,940 | | 6.00 | |

Tier 1 capital (to average assets) | | | 17,563,961 | | 10.84 | | | | 6,481,960 | | 4.00 | | | | 8,102,450 | | 5.00 | |

December 31, 2007 | | | | | | | | | | | | | | | | | | |

Total capital (to risk-weighted assets) | | $ | 18,058,801 | | 15.08 | % | | $ | 9,578,000 | | 8.00 | % | | $ | 11,972,500 | | 10.00 | % |

Tier 1 capital (to risk-weighted assets) | | | 16,562,238 | | 13.83 | | | | 4,789,000 | | 4.00 | | | | 7,183,500 | | 6.00 | |

Tier 1 capital (to average assets) | | | 16,562,238 | | 10.19 | | | | 6,499,360 | | 4.00 | | | | 8,124,200 | | 5.00 | |

The Federal Reserve Board has similar requirements for bank holding companies. The Company is currently not subject to these requirements because the Federal Reserve guidelines contain an exemption for bank holding companies with less than $500,000,000 in consolidated assets.

LIQUIDITY MANAGEMENT

Liquidity is the ability to meet current and future obligations through liquidation or maturity of existing assets or the acquisition of additional liabilities. Adequate liquidity is necessary to meet the requirements of customers for loans and deposit withdrawals in the most timely and economical manner. Some liquidity is ensured by maintaining assets, which may be immediately converted into cash at minimal cost (amounts due from banks and federal funds sold). However, the most manageable sources of liquidity are composed of liabilities, with the primary focus of

22

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

LIQUIDITY MANAGEMENT(continued)

liquidity management being on the ability to obtain deposits within the Company’s market area. Core deposits (total deposits, less time deposits of $100,000 and over) provide a relatively stable funding base. At December 31, 2008 and 2007 core deposits represented 62.95% and 60.52%, respectively of total deposits.

The Bank had available at the end of 2008 unused short-term lines of credit to purchase up to $6,300,000 of federal funds from unrelated correspondent institutions. The Bank also has a credit availability agreement with the Federal Home Loan Bank totaling 15 percent of the Bank’s qualifying assets as of any quarter end. As of December 31, 2008, the available credit totaled approximately $24,686,000 and there were no borrowings outstanding. Any borrowings from the FHLB will be secured by a blanket lien on all of the Bank’s 1-4 family residential first lien mortgage loans and or investment securities.

Asset liquidity is provided from several sources, including amounts due from banks and federal funds sold. Available for sale securities, particularly those maturing within one year, provide a secondary source of liquidity. In addition, funds from maturing loans are a source of liquidity.

The Company’s ability to meet its cash obligations or to pay any possible future cash dividends to shareholders is dependent primarily on the successful operation of the Bank and its ability to pay cash dividends to the Company. Any of the Bank’s cash dividends in an amount exceeding current year-to-date earnings are subject to the prior approval of the South Carolina Commissioner of Banking and are generally allowable only from its undivided profits. In addition, dividends paid by the Bank to the Company would be prohibited if such payment would cause the Bank’s capital to be reduced below applicable minimum regulatory requirements. At December 31, 2008, the Bank’s available undivided profits totaled $14,332,252. Under Federal Reserve Board regulations, the amounts of loans or advances from the Bank to the Company are also restricted.

Management believes that the overall liquidity sources of both the Company the Bank are adequate to meet their operating needs in the ordinary course of business.

IMPACT OF OFF-BALANCE-SHEET INSTRUMENTS

The Company is a party to financial instruments with off-balance-sheet risk in the normal course of business to meet the financing needs of our customers. These financial instruments consist of commitments to extend credit and standby letters of credit. Commitments to extend credit are legally binding agreements to lend to a customer at predetermined interest rates as long as there is no violation of any condition established in the contract. Commitments generally have fixed expiration dates or other termination clauses and may require payment of a fee. A commitment involves, to varying degrees, elements of credit and interest rate risk in excess of the amount recognized in the balance sheet. Our exposure to credit loss in the event of nonperformance by the other party to the instrument is represented by the contractual notional amount of the instrument. Since certain commitments are expected to expire without being drawn upon, the total commitment amounts do not necessarily represent future cash requirements. Letters of credit are conditional commitments issued to guarantee a customer’s performance to a third party and have essentially the same credit risk as other lending facilities. Standby letters of credit often expire without being used. Management believes that through various sources of liquidity, they have the necessary resources to meet obligations arising from these financial instruments.

We use the same credit underwriting procedures for commitments to extend credit and standby letters of credit as we do for our on-balance-sheet instruments. The credit worthiness of each borrower is evaluated and the amount of collateral, if deemed necessary, is based on the credit evaluation. Collateral held for commitments to extend credit and standby letters of credit varies but may include accounts receivable, inventory, property, plant, equipment, and income-producing commercial properties.

There are no off-balance-sheet contractual relationships, other than those disclosed in this report, that could result in liquidity needs or other commitments or that could significantly impact earnings.

23

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

IMPACT OF OFF-BALANCE-SHEET INSTRUMENTS(continued)

Through its operations, the Bank has made contractual commitments to extend credit in the ordinary course of its business activities. These commitments are legally binding agreements to lend money to the Bank’s customers at predetermined interest rates for a specified period of time. At December 31, 2008, the Bank had issued commitments to extend credit of $10,580,736 and standby letters of credit of $1,112,932 through various types of commercial lending arrangements. Approximately $188,616 of these commitments to extend credit had variable rates.

The following table sets forth the length of time until maturity for unused commitments to extend credit and standby letters of credit at December 31, 2008.

| | | | | | | | | | | | | | | | | | |

| | | Within One

Month | | After One

Through

Three

Months | | After Three

Through

Twelve

Months | | Within One

Year | | Greater

Than One

Year | | Total |

Unused commitments to extend credit | | $ | 286,184 | | $ | 1,842,435 | | $ | 6,094,508 | | $ | 8,223,127 | | $ | 2,357,609 | | $ | 10,580,736 |

Standby letters of credit | | | — | | | 267,000 | | | 830,932 | | | 1,097,932 | | | 15,000 | | | 1,112,932 |

| | | | | | | | | | | | | | | | | | |

Totals | | $ | 286,184 | | $ | 2,109,435 | | $ | 6,925,440 | | $ | 9,321,059 | | $ | 2,372,609 | | $ | 11,693,668 |

| | | | | | | | | | | | | | | | | | |

The Bank evaluates each customer’s credit worthiness on a case-by-case basis. The amount of collateral obtained, if deemed necessary by the Bank upon extension of credit, is based on its credit evaluation of the borrower. Collateral varies but may include accounts receivable, inventory, property, plant and equipment, commercial and residential real estate.

IMPACT OF INFLATION

The consolidated financial statements and related financial data presented herein have been prepared in accordance with accounting principles generally accepted in the United States of America which require the measurement of financial position and operating results in terms of historical dollars, without considering changes in relative purchasing power over time due to inflation. Unlike most industrial companies, virtually all of the assets and liabilities of a financial institution are monetary in nature. As a result, interest rates generally have a more significant impact on a financial institution’s performance than does the effect of inflation.

While the effect of inflation on a bank is normally not as significant as its influence on those businesses that have large investments in plant and inventories, it does have an effect. Interest rates generally increase as the rate of inflation increases, but the magnitude of the change in rates may not be the same. While interest rates have traditionally moved with inflation, the effect on income is diminished because both interest earned on assets and interest paid on liabilities vary directly with each other. Also, increases in the price of goods and services will generally result in increased operating expenses.

IMPACT OF RECENT ACCOUNTING CHANGES

For a summary of recent authoritative pronouncements that affect accounting, reporting, and disclosure of financial information by the Company see Note 1 to the consolidated financial statements.

24

MANAGEMENT’S ANNUAL REPORT ON INTERNAL

CONTROL OVER FINANCIAL REPORTING

Our Management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined inRules 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934. Our internal control over financial reporting is a process designed to provide reasonable assurance that assets are safeguarded against loss from unauthorized use or disposition, transactions are executed in accordance with appropriate management authorization and accounting records are reliable for the preparation of financial statements in accordance with generally accepted accounting principles.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management assessed the effectiveness of our internal control over financial reporting as of December 31, 2008. Management based this assessment on criteria for effective internal control over financial reporting described in“Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission.”Management’s assessment included an evaluation of the design of our internal control over financial reporting and testing of the operational effectiveness of its internal control over financial reporting. Management reviewed the results of its assessment with the Audit Committee of the Board of Directors. Based on this assessment, management believes that Communitycorp maintained effective internal control over financial reporting as of December 31, 2008.

This annual report does not include an attestation report of the Company’s independent registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s independent registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this annual report

25

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors

Communitycorp and subsidiary

Walterboro, South Carolina

We have audited the accompanying consolidated balance sheets of Communitycorp and subsidiary as of December 31, 2008 and 2007 and the related consolidated statements of income, changes in shareholders’ equity and comprehensive income and cash flows for the years then ended. These consolidated financial statements are the responsibility of the company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Communitycorp and subsidiary as of December 31, 2008 and 2007 and the results of their operations and their cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

We were not engaged to examine management’s assertion about the effectiveness of Communitycorp and subsidiary’s internal control over financial reporting as of December 31, 2008, included in the accompanying Management’s Report on Internal Controls Over Financial Reporting, and, accordingly, we do not express an opinion thereon.

|

| /s/ Elliott Davis, LLC |

|

| Charleston, South Carolina |

| March 16, 2009 |

26

COMMUNITYCORP AND SUBSIDIARY

Consolidated Balance Sheets

| | | | | | | | |

| | | December 31, | |

| | | 2008 | | | 2007 | |

Assets: | | | | | | | | |

Cash and cash equivalents: | | | | | | | | |

Cash and due from banks | | $ | 3,468,965 | | | $ | 4,929,768 | |

Federal funds sold | | | 13,146,000 | | | | 1,991,000 | |

| | | | | | | | |

Total cash and cash equivalents | | | 16,614,965 | | | | 6,920,768 | |

| | | | | | | | |

Time deposits with other banks | | | 1,500,000 | | | | — | |

Investment securities: | | | | | | | | |

Securities available-for-sale | | | 27,815,275 | | | | 34,585,073 | |

Securities held-to-maturity (estimated fair value of $1,335,226 in 2008 and $1,836,967 in 2007) | | | 1,319,596 | | | | 1,819,481 | |

Nonmarketable equity securities | | | 508,435 | | | | 347,257 | |

| | | | | | | | |

Total investment securities | | | 29,643,306 | | | | 36,751,811 | |

| | | | | | | | |

Loans receivable | | | 113,704,520 | | | | 114,597,378 | |

Less allowance for loan losses | | | (1,981,637 | ) | | | (1,929,319 | ) |

| | | | | | | | |

Loans receivable, net | | | 111,722,883 | | | | 112,668,059 | |

Premises and equipment, net | | | 3,028,604 | | | | 2,989,119 | |

Accrued interest receivable | | | 1,125,714 | | | | 1,297,946 | |

Other real estate owned | | | 75,000 | | | | — | |

Other assets | | | 874,815 | | | | 691,984 | |

| | | | | | | | |

Total assets | | $ | 164,585,287 | | | $ | 161,319,687 | |

| | | | | | | | |

Liabilities: | | | | | | | | |

Deposits: | | | | | | | | |

Noninterest-bearing transaction accounts | | $ | 15,652,393 | | | $ | 16,461,238 | |

Interest-bearing transaction accounts | | | 21,065,476 | | | | 20,840,913 | |

Money market savings accounts | | | 3,251,083 | | | | 2,437,697 | |

Savings | | | 13,191,320 | | | | 11,833,229 | |

Time deposits $100,000 and over | | | 53,994,171 | | | | 55,118,795 | |

Other time deposits | | | 38,559,542 | | | | 32,902,440 | |

| | | | | | | | |

Total deposits | | | 145,713,985 | | | | 139,594,312 | |

Short-term borrowings | | | — | | | | 3,068,000 | |

Accrued interest payable | | | 953,278 | | | | 1,767,670 | |

Other liabilities | | | 224,606 | | | | 153,304 | |

| | | | | | | | |

Total liabilities | | | 146,891,869 | | | | 144,583,286 | |

| | | | | | | | |

Commitments and contingencies - Notes 4 and 10 | | | | | | | | |

Shareholders’ Equity: | | | | | | | | |

Preferred stock, $5 par value, 3,000,000 shares authorized and unissued | | | — | | | | — | |

Common stock, $5 par value, 3,000,000 shares authorized; 300,000 shares issued | | | 1,500,000 | | | | 1,500,000 | |

Capital surplus | | | 1,728,328 | | | | 1,723,196 | |

Retained earnings | | | 18,392,614 | | | | 17,153,490 | |

Accumulated other comprehensive income | | | 75,701 | | | | 70,928 | |

Treasury stock (63,123 shares in 2008 and 59,537 shares in 2007) | | | (4,003,225 | ) | | | (3,711,213 | ) |

| | | | | | | | |

Total shareholders’ equity | | | 17,693,418 | | | | 16,736,401 | |

| | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 164,585,287 | | | $ | 161,319,687 | |

| | | | | | | | |

The accompanying notes are an integral part of the consolidated financial statements.