Q1 2017 Financial Results April 27, 2017

Safe Harbor Language and Reconciliation of Non-GAAP Measures 2 This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws and is subject to the safe- harbor created by such Act. Forward-looking statements include, but are not, limited to, our financial performance outlook and statements concerning our operations, economic performance, financial condition, goals, beliefs, future growth strategies, investment objectives, plans and current expectations, such as 2017 guidance, 2020 outlook, expected shareholder returns and cash available for distribution. These forward-looking statements are subject to various known and unknown risks, uncertainties and other factors. When Iron Mountain uses words such as "believes," "expects," "anticipates," "estimates" or similar expressions, it is making forward-looking statements. Although Iron Mountain believes that its forward-looking statements are based on reasonable assumptions, Iron Mountain’s expected results may not be achieved, and actual results may differ materially from its expectations. Iron Mountain’s expected results may not be achieved, and actual results may differ materially from its expectations. In addition, important factors that could cause actual results to differ from Iron Mountain’s expectations include, among others: (i) Iron Mountain’s ability to remain qualified for taxation as a real estate investment trust for United States federal income tax purposes; (ii) the adoption of alternative technologies and shifts by Iron Mountain’s customers to storage of data through non-paper based technologies; (iii) changes in customer preferences and demand for Iron Mountain’s storage and information management services; (iv) the cost to comply with current and future laws, regulations and customer demands relating to data security and privacy issues, as well as fire and safety standards; (v) the impact of litigation or disputes that may arise in connection with incidents in which we fail to protect Iron Mountain’s customers' information; (vi) changes in the price for Iron Mountain’s storage and information management services relative to the cost of providing such storage and information management services; (vii) changes in the political and economic environments in the countries in which Iron Mountain’s international subsidiaries operate and changes in the global political climate; (viii) Iron Mountain’s ability or inability to complete acquisitions on satisfactory terms and to integrate acquired companies efficiently; (ix) changes in the amount of Iron Mountain’s capital expenditures; (x) changes in the cost of Iron Mountain’s debt; (xi) the impact of alternative, more attractive investments on dividends; (xii) the cost or potential liabilities associated with real estate necessary for Iron Mountain’s business; (xiii) the performance of business partners upon whom Iron Mountain depends for technical assistance or management expertise outside the United States; (xiv) other trends in competitive or economic conditions affecting Iron Mountain’s financial condition or results of operations not presently contemplated; and (xv) other risks described more fully in our filings with the Securities and Exchange Commission, including under the caption “Risk Factors” in our periodic reports or incorporated therein. In addition, the benefits of the Recall transaction, including potential cost synergies, accretion and other synergies (including tax synergies), may not be fully realized or may take longer to realize than expected. You should not rely upon forward-looking statements except as statements of Iron Mountain’s present intentions and of its present expectations, which may or may not occur. Except as required by law, Iron Mountain undertakes no obligation to release publicly the result of any revision to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Reconciliation of Non-GAAP Measures: Throughout this presentation, Iron Mountain will discuss (1) Adjusted EBITDA, (2) Adjusted Earnings per Share (“Adjusted EPS”), (3) Funds from Operations (“FFO NAREIT”), (4) FFO (Normalized) and (5) Adjusted Funds from Operations (“AFFO”). These measures do not conform to accounting principles generally accepted in the United States (“GAAP”). These non- GAAP measures are supplemental metrics designed to enhance our disclosure and to provide additional information that we believe to be important for investors to consider in addition to, but not as a substitute for, other measures of financial performance reported in accordance with GAAP, such as operating income, income (loss) from continuing operations, net income (loss) or cash flows from operating activities from continuing operations (as determined in accordance with GAAP). The reconciliation of these measures to the appropriate GAAP measure, as required by Regulation G under the Securities Exchange Act of 1934, as amended, and the definitions are included in Supplemental Financial Information. Iron Mountain does not provide a reconciliation of non-GAAP measures that it discusses as part of its annual guidance or long term outlook because certain significant information required for such reconciliation is not available without unreasonable efforts or at all, including, most notably, the impact of exchange rates on Iron Mountain’s transactions, loss or gain related to the disposition property, plant and equipment (including of real estate) and other income or expense. Without this information, Iron Mountain does not believe that a reconciliation would be meaningful.

Q1 on Track with Short and Long-Term Financial Objectives 3 Q1 key financial results in line with expectations • Supported by durability of storage rental business Maintaining 2017 C$ guidance (based on January 2017 FX rates) • Business fundamentals remain strong Strong internal storage rental growth of 3.0% in Q1 • Volume growth in all segments Note: Definition of Non-GAAP measures and reconciliations to GAAP measures can be found in the Supplemental Financial Information

4 Q1 Plan Highlights Developed Markets – North America and Western Europe • +3.2 million cubic feet of net(1) new volume before business acquisitions • Maintained strong customer retention and generated durable storage rental growth Emerging Markets(2) • ~18% of total revenue; expanded presence through organic growth and acquisitions • Acquisition pipeline remains robust • Achieved 7% total internal growth Adjacent Businesses • Data center on track with expected full year internal growth of 25% • Expanded art storage through tuck-in acquisitions (1) Net volume represents incoming cubic volume of 33.7 mm from new and existing customers less outgoing cubic volume of 30.5 mm from destructions and customer terminations (2) Emerging Markets is Other International, excluding Australia and New Zealand

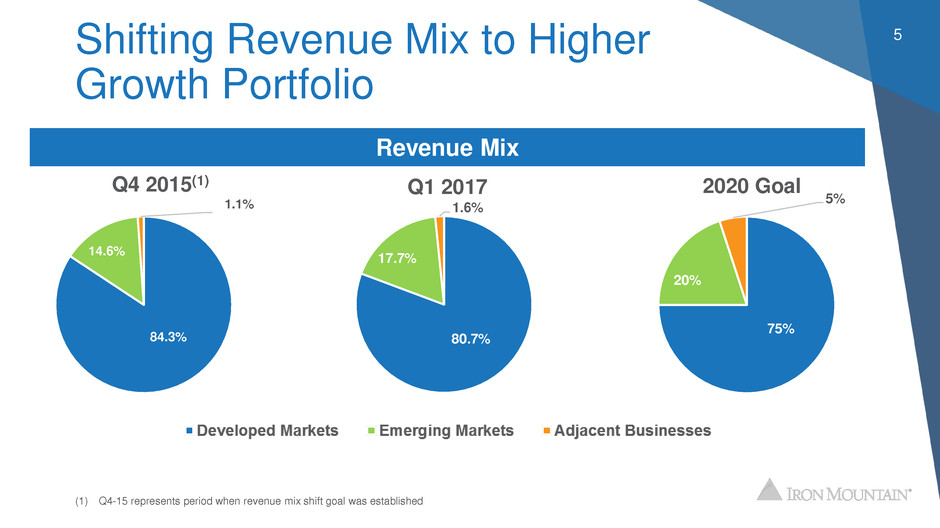

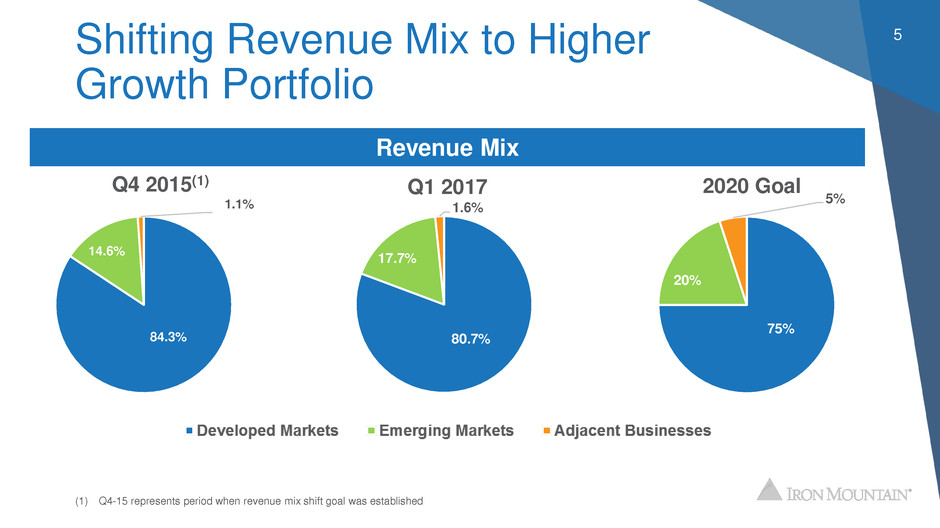

Shifting Revenue Mix to Higher Growth Portfolio 5 80.7% 17.7% 1.6% Q1 2017 84.3% 14.6% 1.1% Q4 2015(1) Revenue Mix 75% 20% 5% 2020 Goal (1) Q4-15 represents period when revenue mix shift goal was established

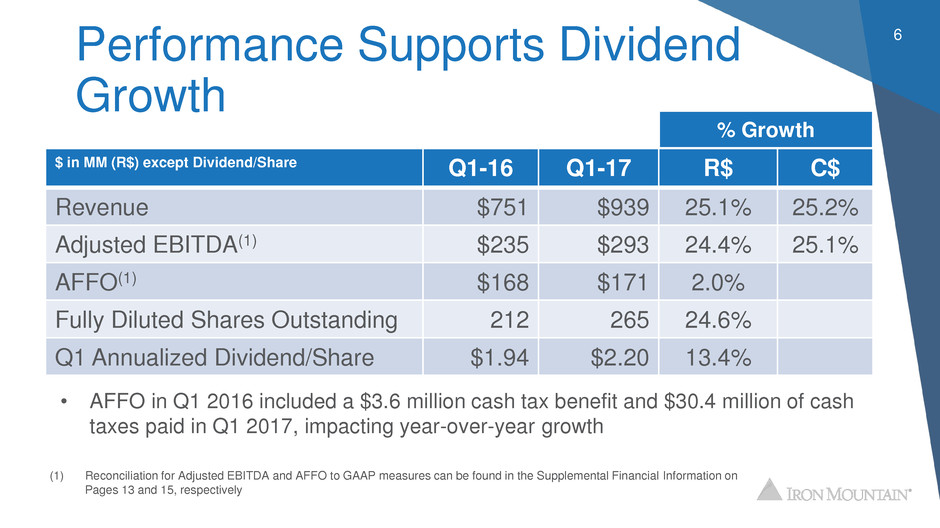

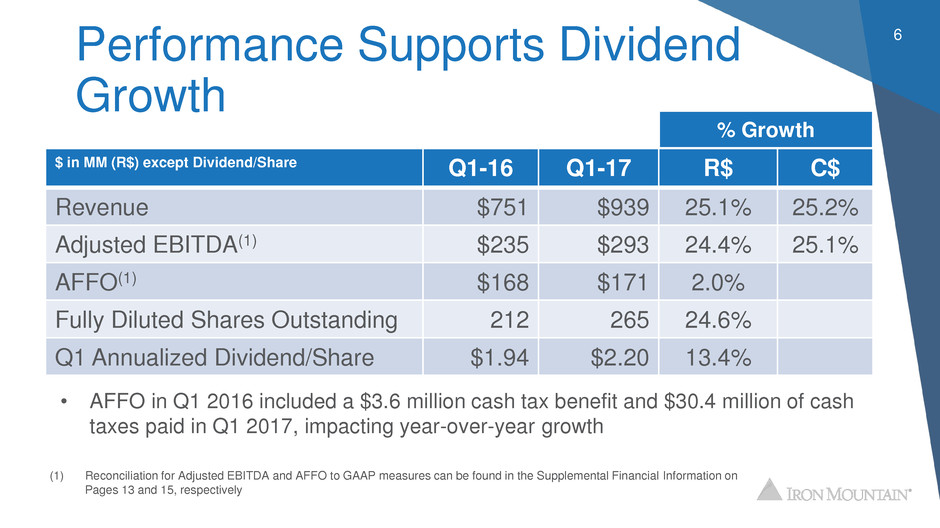

Performance Supports Dividend Growth 6 $ in MM (R$) except Dividend/Share Q1-16 Q1-17 R$ C$ Revenue $751 $939 25.1% 25.2% Adjusted EBITDA(1) $235 $293 24.4% 25.1% AFFO(1) $168 $171 2.0% Fully Diluted Shares Outstanding 212 265 24.6% Q1 Annualized Dividend/Share $1.94 $2.20 13.4% (1) Reconciliation for Adjusted EBITDA and AFFO to GAAP measures can be found in the Supplemental Financial Information on Pages 13 and 15, respectively % Growth • AFFO in Q1 2016 included a $3.6 million cash tax benefit and $30.4 million of cash taxes paid in Q1 2017, impacting year-over-year growth

Rising Interest Rates and Inflation Create Potential Benefit • Historically benefited from inflation, which supports higher pricing • High flow-through of pricing given ~75% storage gross margins • Relative insensitivity to higher interest rates compared with other REITs • Customers’ storage needs unaffected • Changes in value of operating real estate historically do not affect storage NOI • Effectively control real estate through ownership or long-term leases with multiple extension options 7

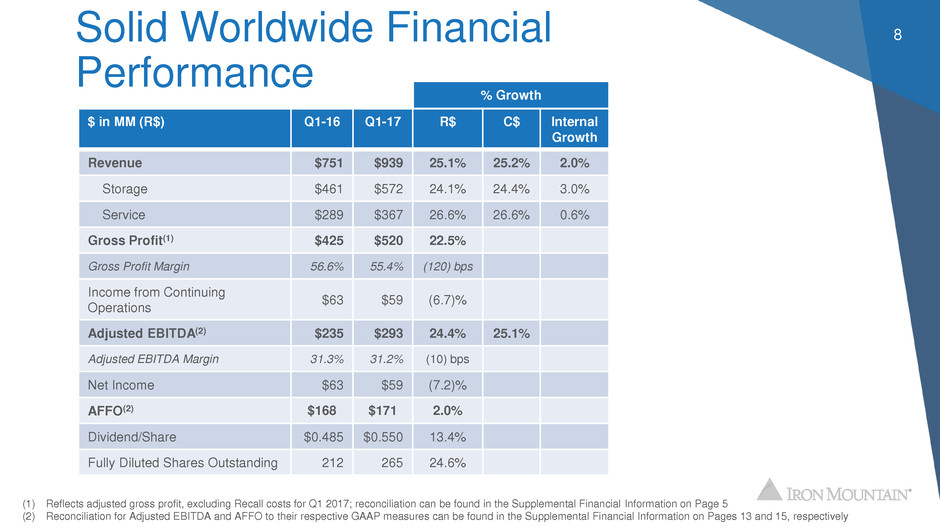

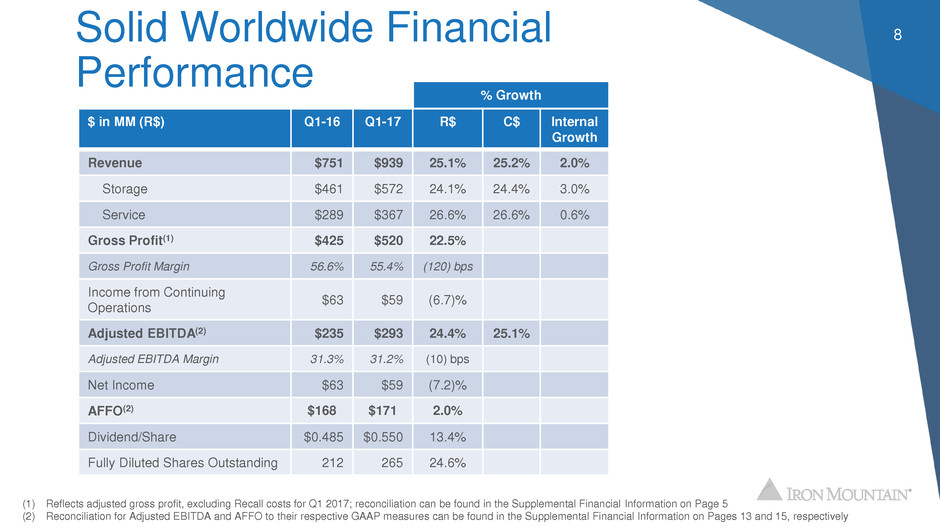

Solid Worldwide Financial Performance 8 $ in MM (R$) Q1-16 Q1-17 R$ C$ Internal Growth Revenue $751 $939 25.1% 25.2% 2.0% Storage $461 $572 24.1% 24.4% 3.0% Service $289 $367 26.6% 26.6% 0.6% Gross Profit(1) $425 $520 22.5% Gross Profit Margin 56.6% 55.4% (120) bps Income from Continuing Operations $63 $59 (6.7)% Adjusted EBITDA(2) $235 $293 24.4% 25.1% Adjusted EBITDA Margin 31.3% 31.2% (10) bps Net Income $63 $59 (7.2)% AFFO(2) $168 $171 2.0% Dividend/Share $0.485 $0.550 13.4% Fully Diluted Shares Outstanding 212 265 24.6% (1) Reflects adjusted gross profit, excluding Recall costs for Q1 2017; reconciliation can be found in the Supplemental Financial Information on Page 5 (2) Reconciliation for Adjusted EBITDA and AFFO to their respective GAAP measures can be found in the Supplemental Financial Information on Pages 13 and 15, respectively % Growth

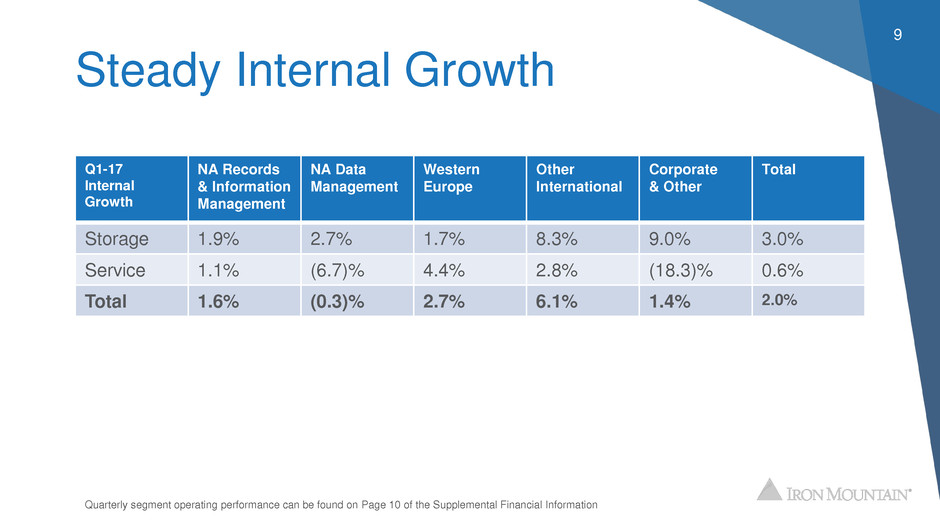

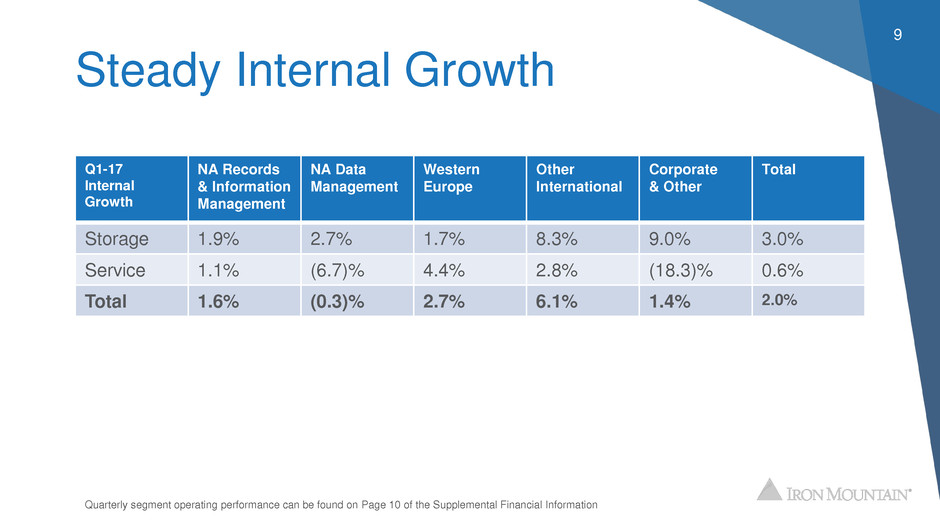

Steady Internal Growth Q1-17 Internal Growth NA Records & Information Management NA Data Management Western Europe Other International Corporate & Other Total Storage 1.9% 2.7% 1.7% 8.3% 9.0% 3.0% Service 1.1% (6.7)% 4.4% 2.8% (18.3)% 0.6% Total 1.6% (0.3)% 2.7% 6.1% 1.4% 2.0% 9 Quarterly segment operating performance can be found on Page 10 of the Supplemental Financial Information

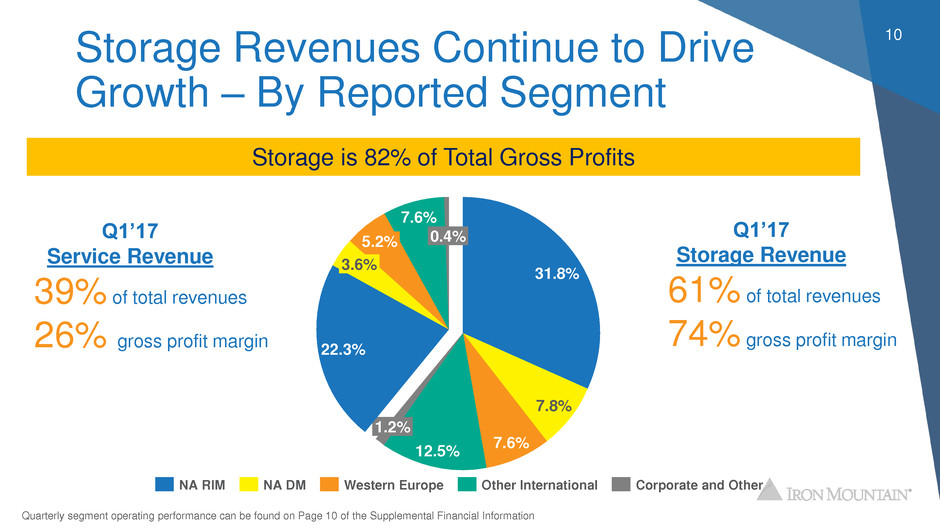

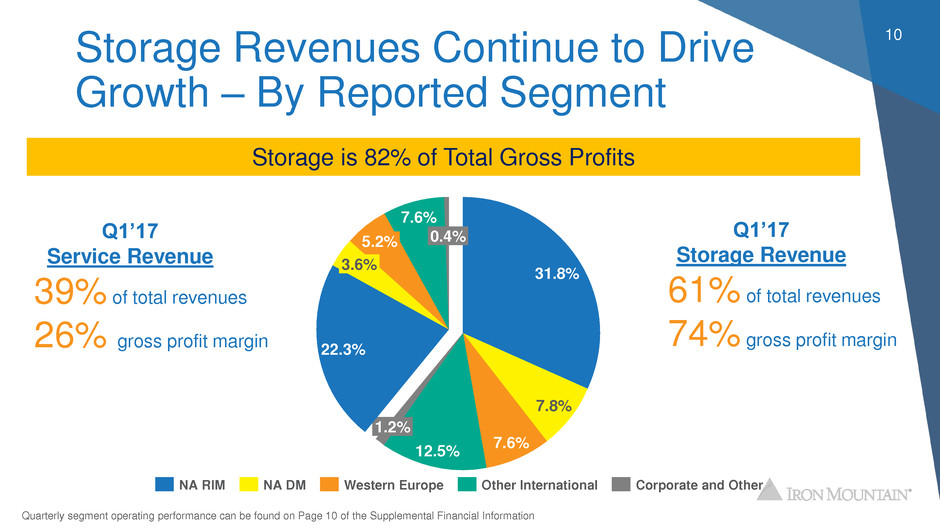

Storage Revenues Continue to Drive Growth – By Reported Segment 10 Storage is 82% of Total Gross Profits Quarterly segment operating performance can be found on Page 10 of the Supplemental Financial Information Q1’17 Service Revenue 39% of total revenues 26% gross profit margin Q1’17 Storage Revenue 61% of total revenues 74% gross profit margin 1.2% 12.5% 7.6% 7.8% 31.8% 0.4% 7.6% 5.2% 3.6% 22.3% Corporate and OtherOther InternationalWestern EuropeNA DMNA RIM

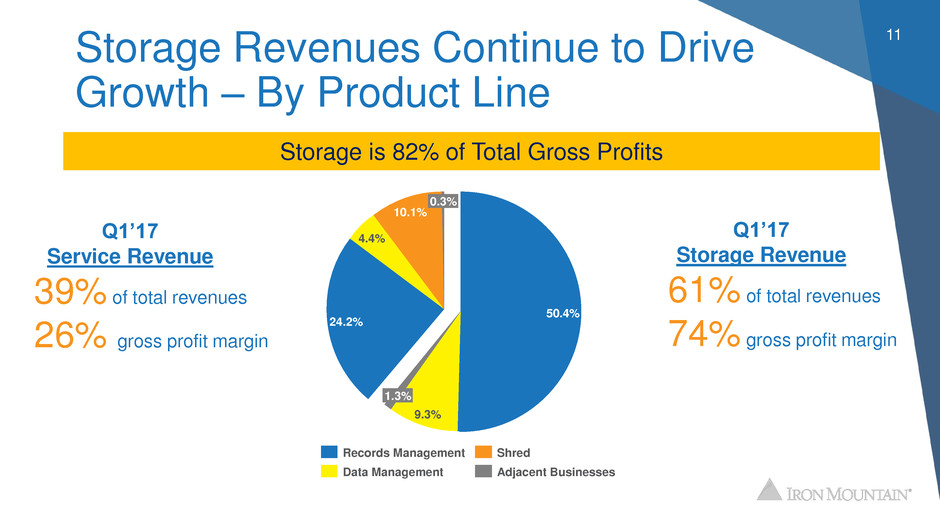

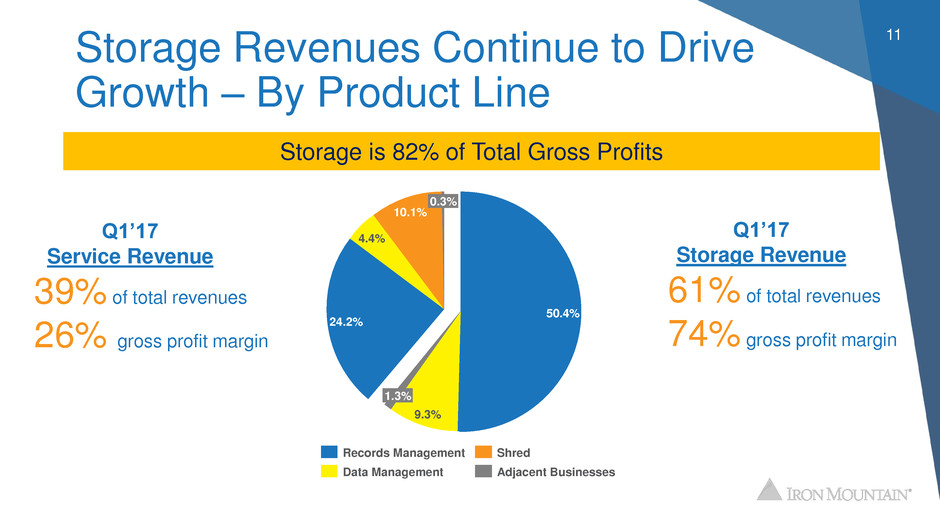

Storage Revenues Continue to Drive Growth – By Product Line 11 1.3% 9.3% 50.4% 0.3% 10.1% 4.4% 24.2% Adjacent Businesses Shred Data Management Records Management Storage is 82% of Total Gross Profits Q1’17 Service Revenue 39% of total revenues 26% gross profit margin Q1’17 Storage Revenue 61% of total revenues 74% gross profit margin

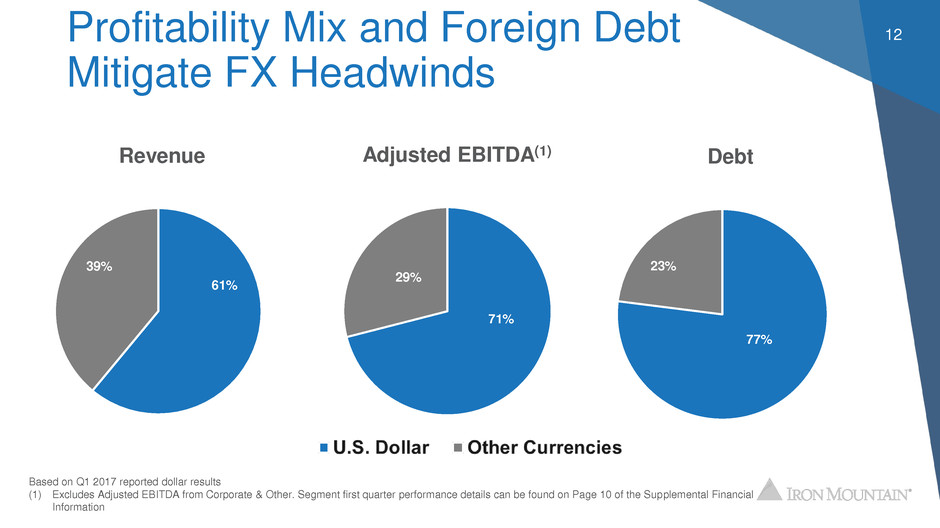

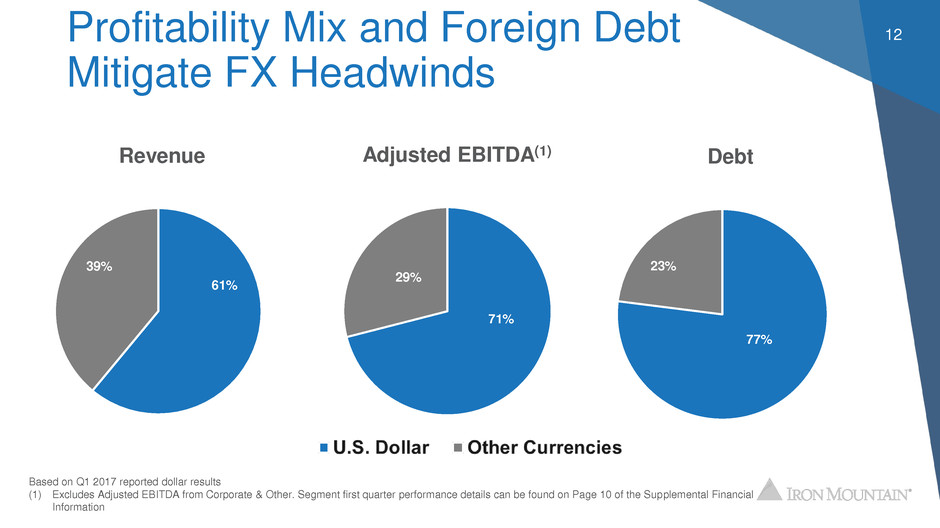

Profitability Mix and Foreign Debt Mitigate FX Headwinds 12 61% 39% Revenue 77% 23% Debt 71% 29% Adjusted EBITDA(1) Based on Q1 2017 reported dollar results (1) Excludes Adjusted EBITDA from Corporate & Other. Segment first quarter performance details can be found on Page 10 of the Supplemental Financial Information

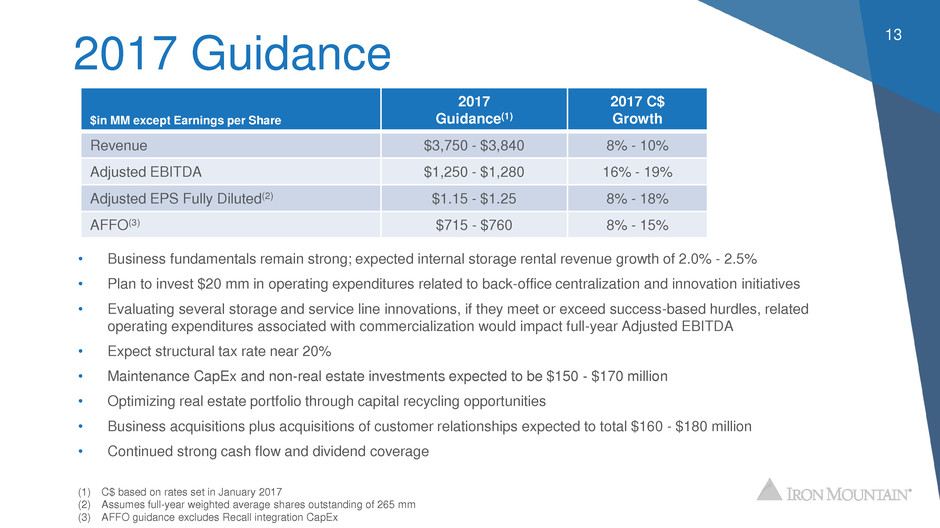

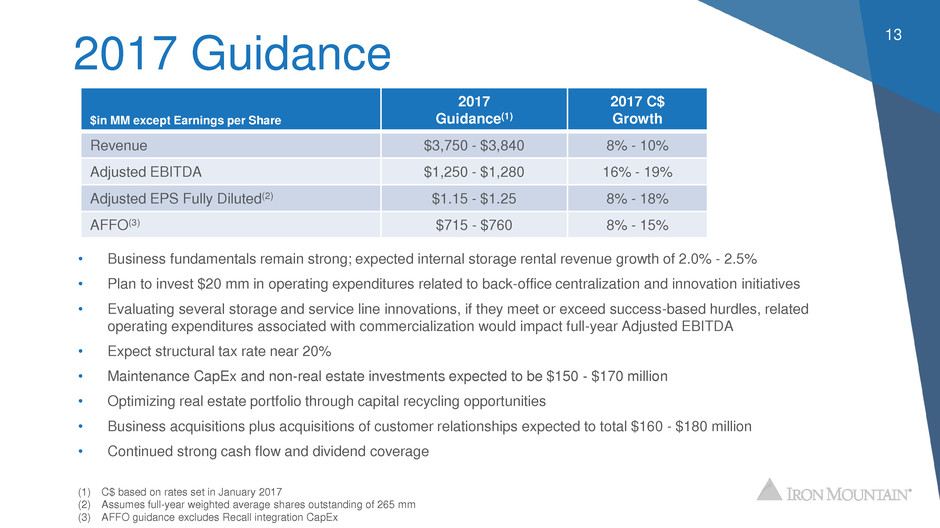

2017 Guidance 13 • Business fundamentals remain strong; expected internal storage rental revenue growth of 2.0% - 2.5% • Plan to invest $20 mm in operating expenditures related to back-office centralization and innovation initiatives • Evaluating several storage and service line innovations, if they meet or exceed success-based hurdles, related operating expenditures associated with commercialization would impact full-year Adjusted EBITDA • Expect structural tax rate near 20% • Maintenance CapEx and non-real estate investments expected to be $150 - $170 million • Optimizing real estate portfolio through capital recycling opportunities • Business acquisitions plus acquisitions of customer relationships expected to total $160 - $180 million • Continued strong cash flow and dividend coverage $in MM except Earnings per Share 2017 Guidance(1) 2017 C$ Growth Revenue $3,750 - $3,840 8% - 10% Adjusted EBITDA $1,250 - $1,280 16% - 19% Adjusted EPS Fully Diluted(2) $1.15 - $1.25 8% - 18% AFFO(3) $715 - $760 8% - 15% (1) C$ based on rates set in January 2017 (2) Assumes full-year weighted average shares outstanding of 265 mm (3) AFFO guidance excludes Recall integration CapEx

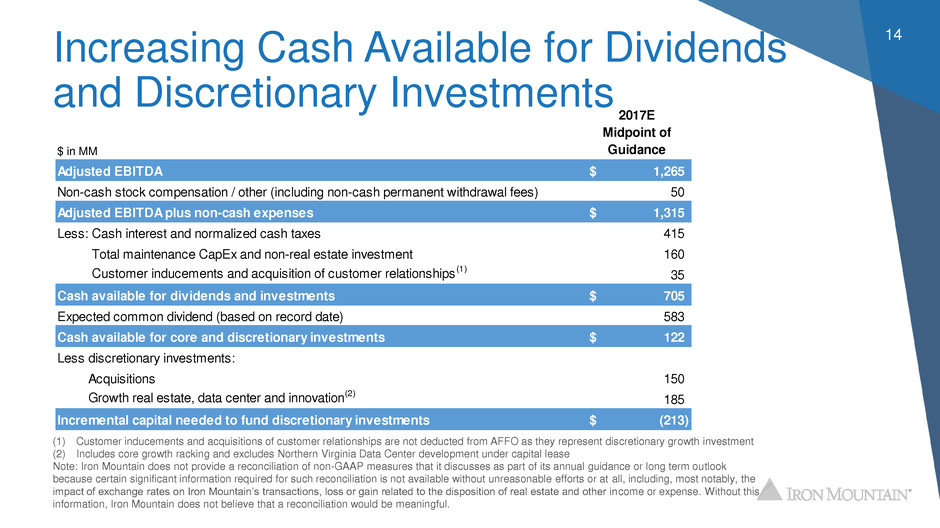

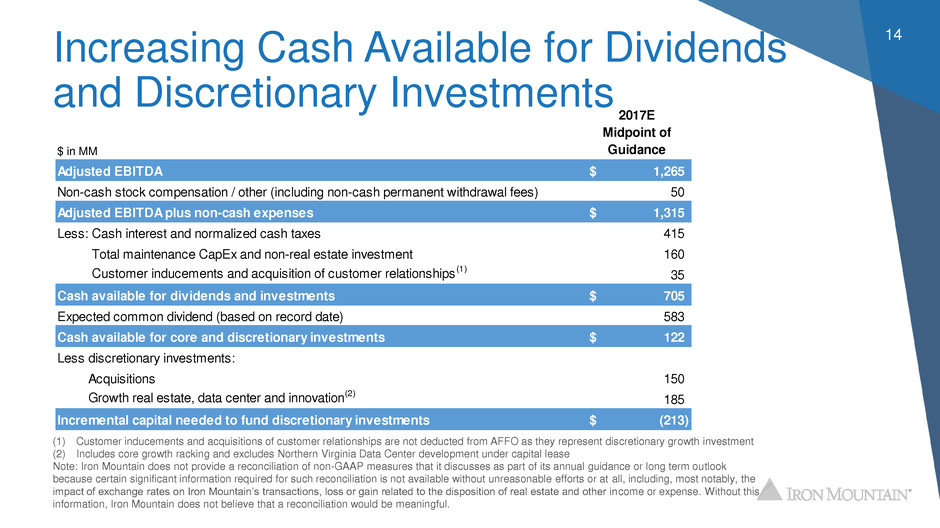

Increasing Cash Available for Dividends and Discretionary Investments 14 (1) Customer inducements and acquisitions of customer relationships are not deducted from AFFO as they represent discretionary growth investment (2) Includes core growth racking and excludes Northern Virginia Data Center development under capital lease Note: Iron Mountain does not provide a reconciliation of non-GAAP measures that it discusses as part of its annual guidance or long term outlook because certain significant information required for such reconciliation is not available without unreasonable efforts or at all, including, most notably, the impact of exchange rates on Iron Mountain’s transactions, loss or gain related to the disposition of real estate and other income or expense. Without this information, Iron Mountain does not believe that a reconciliation would be meaningful. $ in MM 2017E Midpoint of Guidance Adjusted EBITDA 1,265$ Non-cash stock compensation / other (including non-cash permanent withdrawal fees) 50 Adjusted EBITDA plus non-cash expenses 1,315$ Less: Cash interest and normalized cash taxes 415 Total maintenance CapEx and non-real estate investment 160 Customer inducements and acquisition of customer relationships (1) 35 Cash available for dividends and investments 705$ Expected common dividend (based on record date) 583 Cash available for core and discretionary investments 122$ Less discretionary investments: Acquisitions 150 Growth real estate, data center and innovation(2) 185 Incremental capital needed to fund discretionary investments (213)$

Summary 15 Q1 key financial results in line with expectations • Supported by durability of storage rental business Maintaining 2017 C$ guidance (based on January 2017 FX rates) • Business fundamentals remain strong Strong internal storage rental growth of 3.0% in Q1 • Volume growth in all segments Note: Definition of Non-GAAP measures and reconciliations to GAAP measures can be found in the Supplemental Financial Information