Q3 2018 Quarterly Results Conference Call October 25, 2018

Safe Harbor Language and 2 Reconciliation of Non-GAAP Measures This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Actof 1995 and other securities laws and is subject to the safe- harbor created by such Act. Forward-looking statements include, but are not limited to, our financial performance outlook and statements concerning our operations, economic performance, financial condition, goals, beliefs, future growth strategies, investment objectives, plans and current expectations, such as 2018 guidance, expected impact of the adoption of the revenue recognition standards, expectations for 2019, 2020 plan, trends in our business and expected shifts in customer behavior, and statements about our investment and other goals. These forward-looking statements are subject to various known and unknown risks, uncertainties and other factors. When we use words such as "believes," "expects," "anticipates," "estimates" or similar expressions, we are making forward-looking statements. Although we believe that our forward-looking statements are based on reasonable assumptions, our expected results may not be achieved, and actual results may differ materially from our expectations. In addition, important factors that could cause actual results to differ from expectations include, among others: (i) our ability to remain qualified for taxation as a real estate investment trust for U.S. federal income tax purposes ("REIT");(ii) the adoption of alternative technologies and shifts by our customers to storage of data through non-paper based technologies; (iii) changes in customer preferences and demand for our storage and information management services; (iv) the cost to comply with current and future laws, regulations and customer demands relating to data security and privacy issues, as well as fire and safety standards; (v) the impact of litigation or disputes that may arise in connection with incidents in which we fail to protect our customers' information or our internal records or IT systems and the impact of such incidents on our reputation and ability to compete; (vi) changes in the price for our storage and information management services relative to the cost of providing such storage and information management services; (vii) changes in the political and economic environments in the countries in which our international subsidiaries operate and changes in the global political climate; (viii) our ability or inability to manage growth, expand internationally, complete acquisitions on satisfactory terms, to close pending acquisitions and to integrate acquired companies efficiently; (ix) changes in the amount of our growth and maintenance capital expenditures and our ability to invest according to plan; (x) our ability to comply with our existing debt obligations and restrictions in our debt instruments or to obtain additional financing to meet our working capital needs; (xi) the impact of service interruptions or equipment damage and the cost of power on our data center operations; (xii) changes in the cost of our debt; (xiii) the impact of alternative, more attractive investments on dividends; (xiv) the cost or potential liabilities associated with real estate necessary for our business; (xv) the performance of business partners upon whom we depend for technical assistance or management expertise outside the United States; (xvi) other trends in competitive or economic conditions affecting our financial condition or results of operations not presently contemplated; and (xvii) other risks described more fully in our filings with the Securities and Exchange Commission, including under the caption “Risk Factors” in our periodic reports, or incorporated therein. You should not rely upon forward-looking statements except as statements of our present intentions and of our present expectations, which may or may not occur. You should read these cautionary statements as being applicable to all forward-looking statements wherever they appear. Except as required by law, we undertake no obligation to release publicly the result of any revision to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Reconciliation of Non-GAAP Measures: Throughout this presentation, Iron Mountain will discuss (1) Adjusted EBITDA, (2) Adjusted Earnings per Share (“Adjusted EPS”), (3) Funds from Operations (“FFO Nareit”), (4) FFO (Normalized) and (5) Adjusted Funds from Operations (“AFFO”). These measures do not conform to accounting principles generally accepted in the United States (“GAAP”). These non- GAAP measures are supplemental metrics designed to enhance our disclosure and to provide additional information that we believe to be important for investors to consider in addition to, but not as a substitute for, other measures of financial performance reported in accordance with GAAP, such as operating income, income (loss) from continuing operations, net income (loss) or cash flows from operating activities from continuing operations (as determined in accordance with GAAP). The reconciliation of these measures to the appropriate GAAP measure, as required by Regulation G under the Securities Exchange Act of 1934, as amended, and the definitions are included later in this document (see Table of Contents). Iron Mountain does not provide a reconciliation of non-GAAP measures that it discusses as part of its annual guidance or long term outlook because certain significant information required for such reconciliation is not available without unreasonable efforts or at all, including, most notably, the impact of exchange rates on Iron Mountain’s transactions, loss or gain related to the disposition property, plant and equipment (including of real estate) and other income or expense. Without this information, Iron Mountain does not believe that a reconciliation would be meaningful. Selected metrics definitions are available in the Appendix.

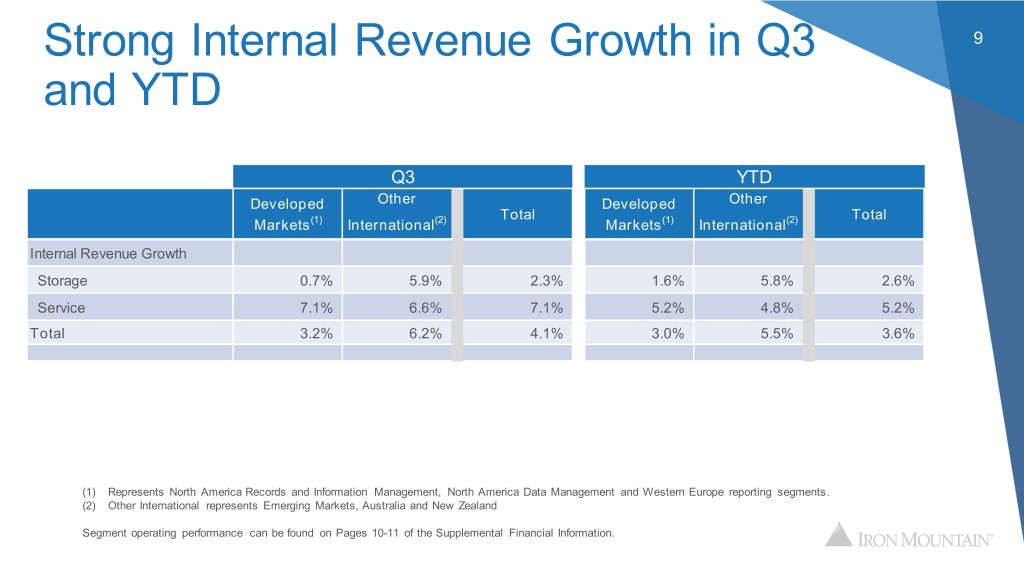

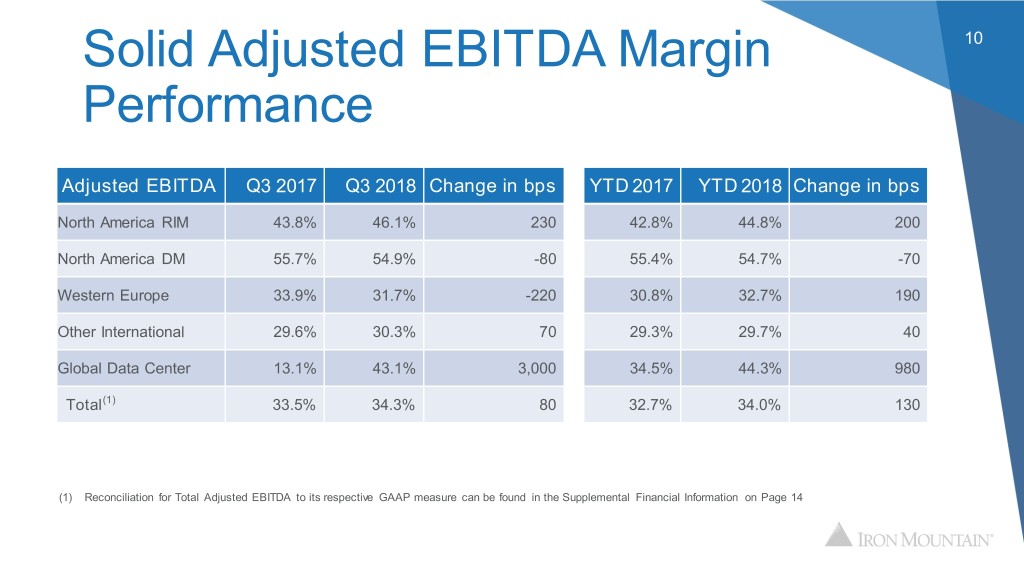

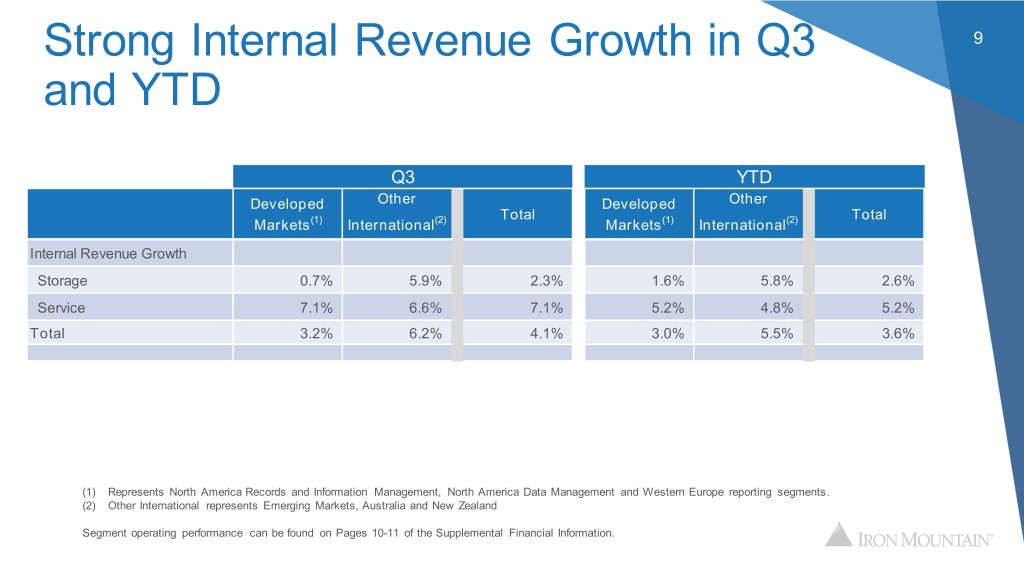

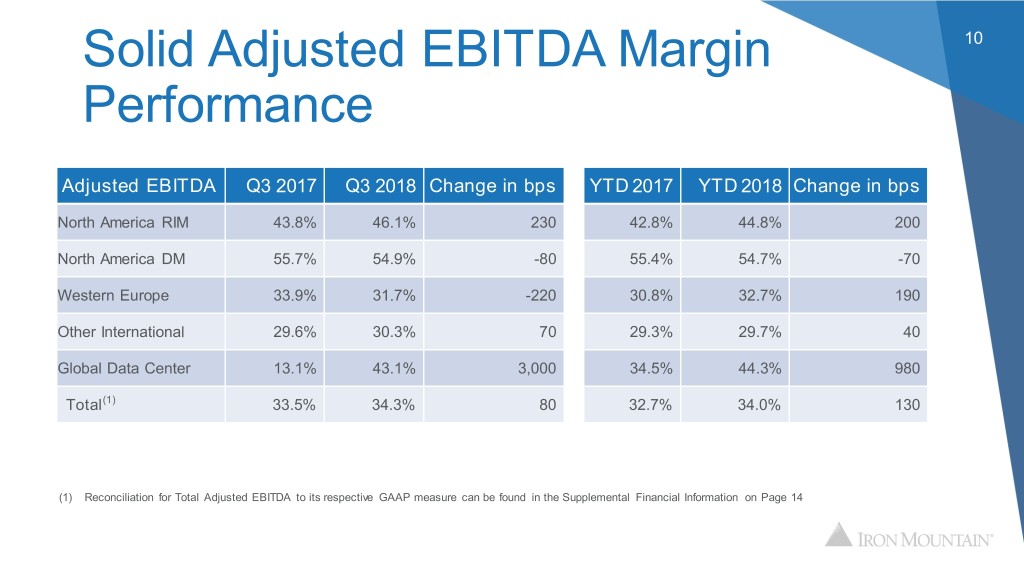

3 Strong Q3 & YTD Financial Performance Strong Q3 financial performance supported by internal storage rental revenue and margin expansion • Revenue up 12% and Adjusted EBITDA up 15%, both on a constant dollar basis; AFFO up 9% • 80 bps expansion in Adjusted EBITDA margin to 34.3% • Declared 4% dividend per share increase for Q4; increased AFFO guidance implies payout ratio of sub-80% Steady growth in key operating metrics • Total internal revenue(1) growth of 4.1% for Q3 and 3.6% YTD • Internal storage rental revenue growth of 2.6% YTD; full year target of 2.5% - 2.75% • Continued solid internal revenue growth of 5.9% in Other International segment in Q3 • Strong YTD internal service revenue growth of 5.2% reflects growth in Shred business, digitization and special projects Continued execution of strategic plan • Increase in NOI/sf driven by revenue management as well as growth in data center and adjacent businesses • Yield management focus continues to drive total internal storage revenue growth, more than offsetting volume declines • Increased revenue and AFFO guidance ranges Note: Definition of Non-GAAP and other measures and reconciliations of Non-GAAP to GAAP measures can be found in the Supplemental Financial Information (1) All internal revenue growth metrics exclude the impact of adoption of Revenue Recognition standard

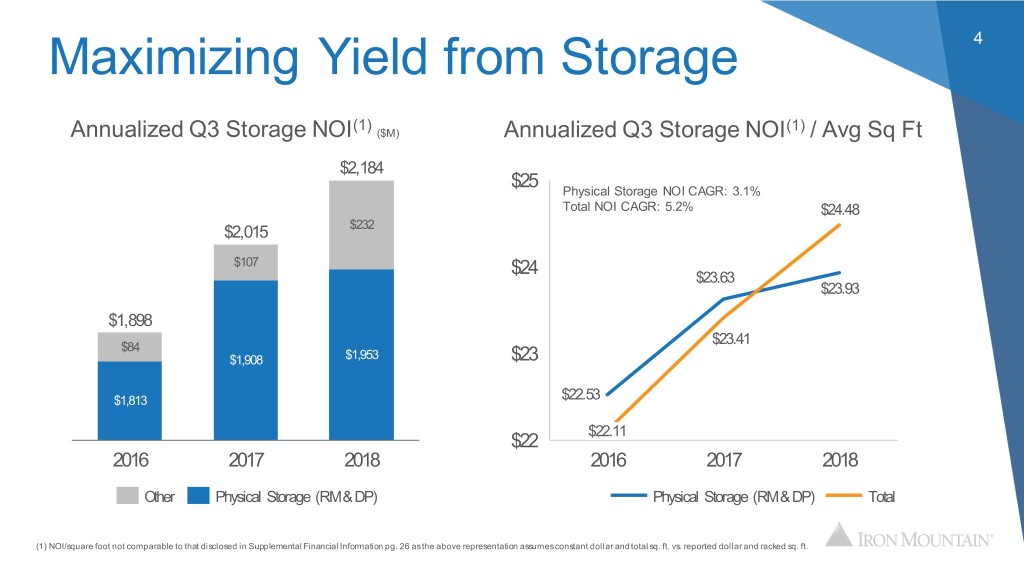

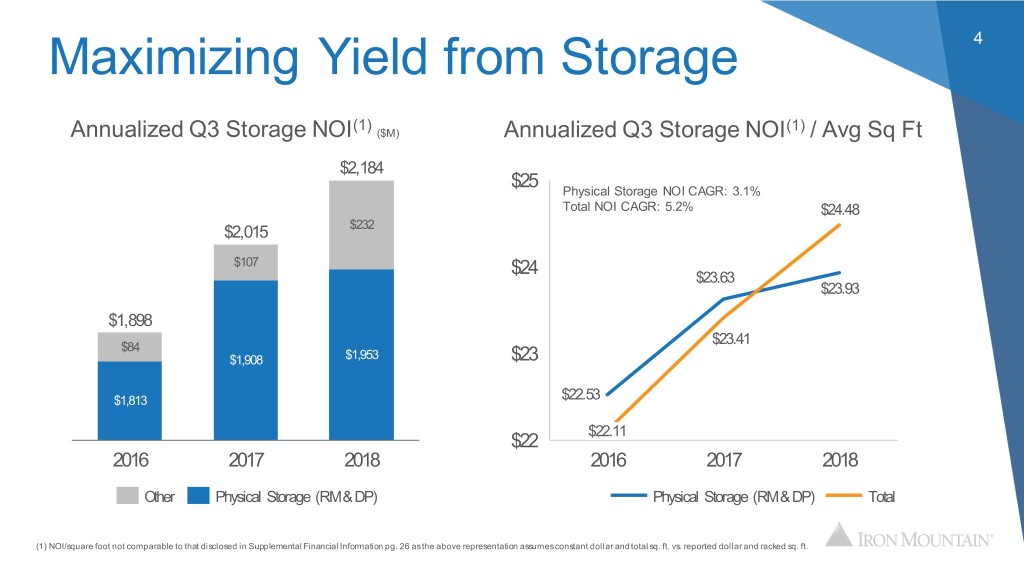

Maximizing Yield from Storage 4 (1) (1) Annualized Q3 Storage NOI ($M) Annualized Q3 Storage NOI / Avg Sq Ft $2,184 $25 Physical Storage NOI CAGR: 3.1% Total NOI CAGR: 5.2% $24.48 $2,015 $232 $107 $24 $23.63 $23.93 $1,898 $23.41 $84 $1,908 $1,953 $23 $1,813 $22.53 $22.11 $22 2016 2017 2018 2016 2017 2018 Other Physical Storage (RM & DP) Physical Storage (RM & DP) Total (1) NOI/square foot not comparable to that disclosed in Supplemental Financial Information pg. 26 as the above representation assumes constant dollar and total sq. ft. vs. reported dollar and racked sq. ft.

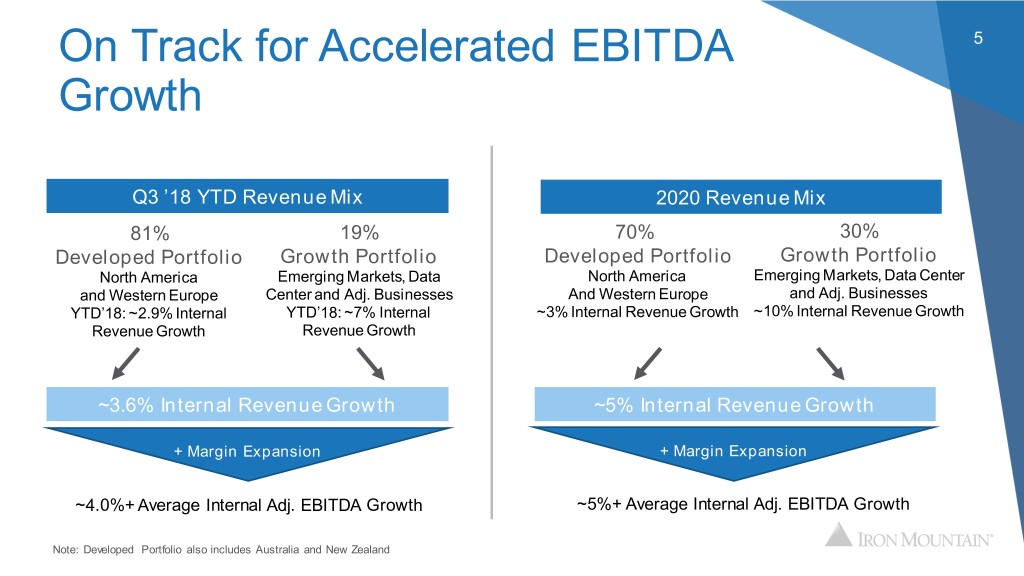

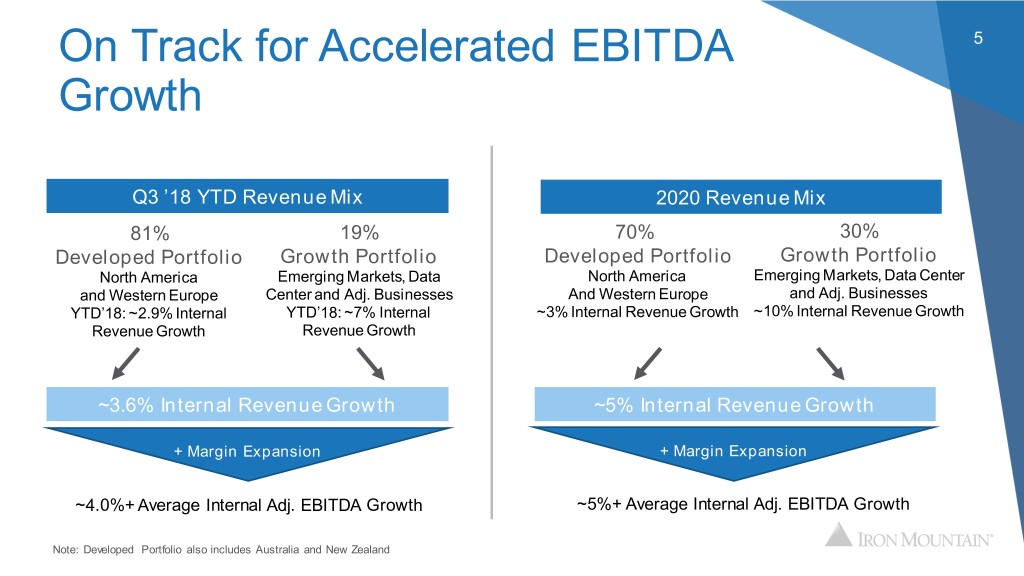

On Track for Accelerated EBITDA 5 Growth Q3 ’18 YTD Revenue Mix 2020 Revenue Mix 81% 19% 70% 30% Developed Portfolio Growth Portfolio Developed Portfolio Growth Portfolio North America Emerging Markets, Data North America Emerging Markets, Data Center and Western Europe Center and Adj. Businesses And Western Europe and Adj. Businesses YTD’18: ~2.9% Internal YTD’18: ~7% Internal ~3% Internal Revenue Growth ~10% Internal Revenue Growth Revenue Growth Revenue Growth ~3.6% Internal Revenue Growth ~5% Internal Revenue Growth + Margin Expansion + Margin Expansion ~4.0%+ Average Internal Adj. EBITDA Growth ~5%+ Average Internal Adj. EBITDA Growth Note: Developed Portfolio also includes Australia and New Zealand

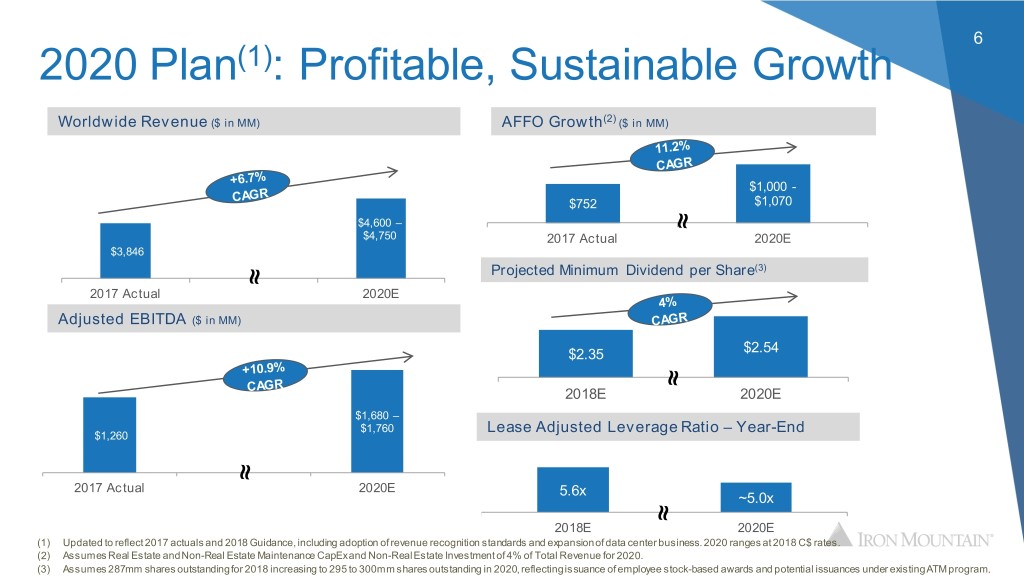

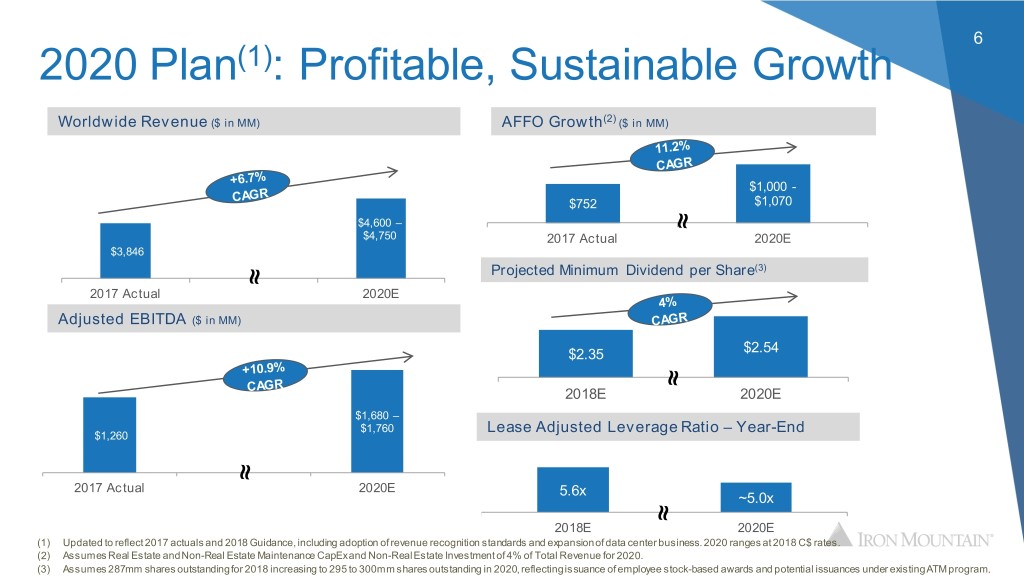

6 2020 Plan(1): Profitable, Sustainable Growth Worldwide Revenue ($ in MM) AFFO Growth(2) ($ in MM) $1,000 - $752 $1,070 $4,600 – $4,750 2017 Actual 2020E $3,846 Projected Minimum Dividend per Share(3) 2017 Actual 2020E Adjusted EBITDA ($ in MM) $2.35 $2.54 2018E 2020E $1,680 – $1,760 Lease Adjusted Leverage Ratio – Year-End $1,260 2017 Actual 2020E 5.6x ~5.0x 2018E 2020E (1) Updated to reflect 2017 actuals and 2018 Guidance, including adoption of revenue recognition standards and expansion of data center business. 2020 ranges at 2018 C$ rates. (2) Assumes Real Estate and Non-Real Estate Maintenance CapEx and Non-Real Estate Investment of 4% of Total Revenue for 2020. (3) Assumes 287mm shares outstanding for 2018 increasing to 295 to 300mm shares outstanding in 2020, reflecting issuance of employee stock-based awards and potential issuances under existing ATM program.

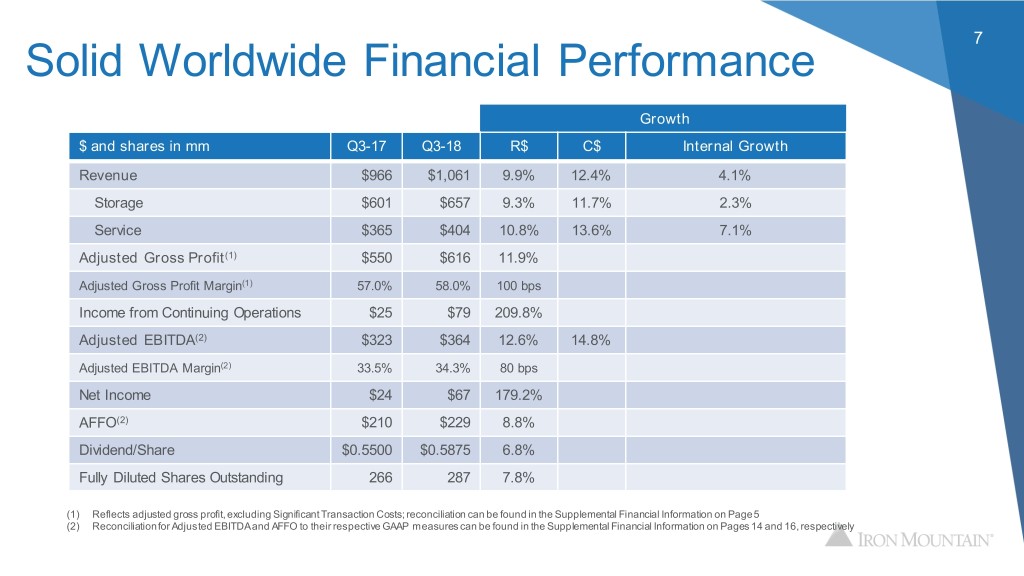

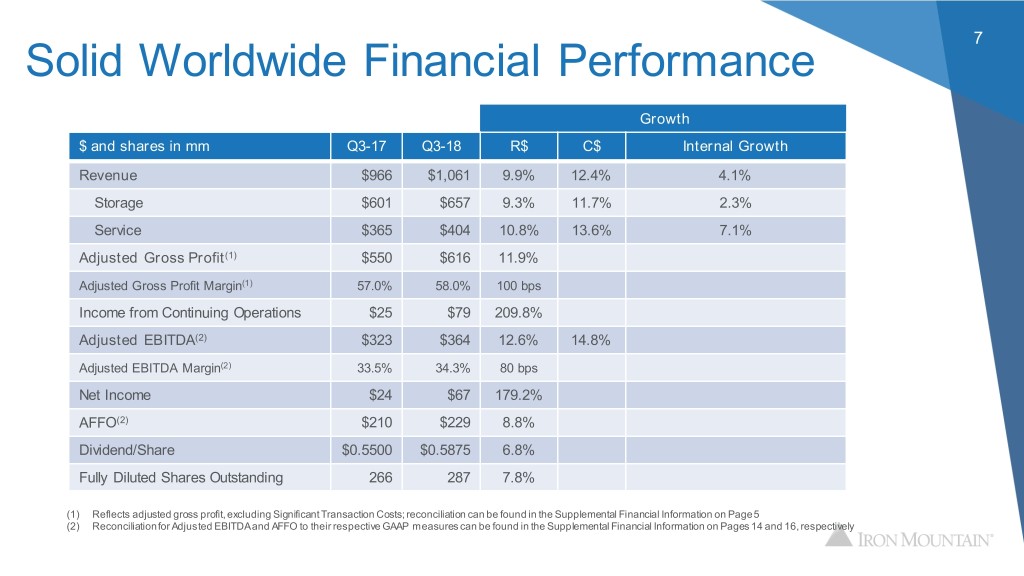

7 Solid Worldwide Financial Performance Growth $ and shares in mm Q3-17 Q3-18 R$ C$ Internal Growth Revenue $966 $1,061 9.9% 12.4% 4.1% Storage $601 $657 9.3% 11.7% 2.3% Service $365 $404 10.8% 13.6% 7.1% Adjusted Gross Profit(1) $550 $616 11.9% Adjusted Gross Profit Margin(1) 57.0% 58.0% 100 bps Income from Continuing Operations $25 $79 209.8% Adjusted EBITDA(2) $323 $364 12.6% 14.8% Adjusted EBITDA Margin(2) 33.5% 34.3% 80 bps Net Income $24 $67 179.2% AFFO(2) $210 $229 8.8% Dividend/Share $0.5500 $0.5875 6.8% Fully Diluted Shares Outstanding 266 287 7.8% (1) Reflects adjusted gross profit, excluding Significant Transaction Costs; reconciliation can be found in the Supplemental Financial Information on Page 5 (2) Reconciliation for Adjusted EBITDA and AFFO to their respective GAAP measures can be found in the Supplemental Financial Information on Pages 14 and 16, respectively

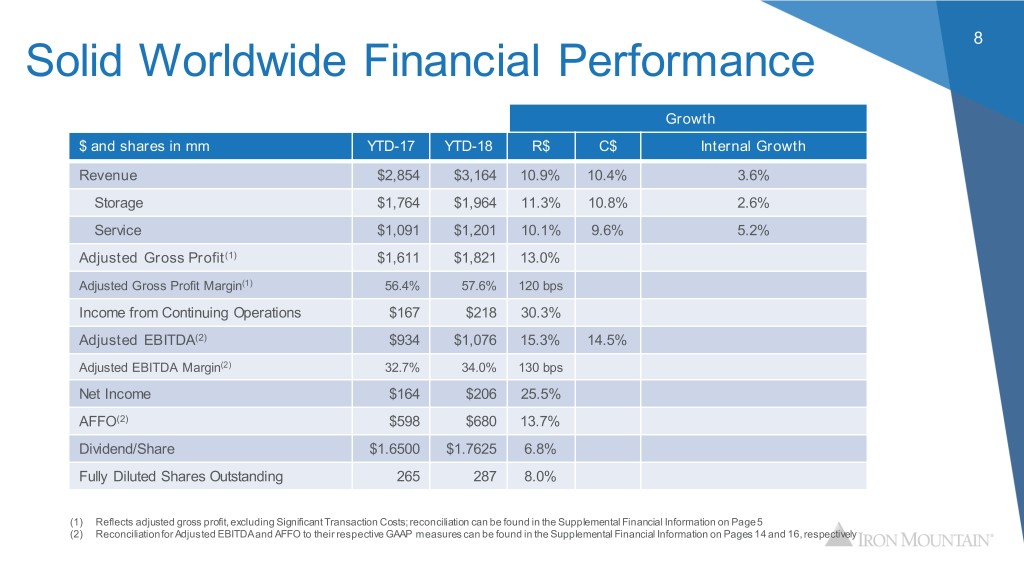

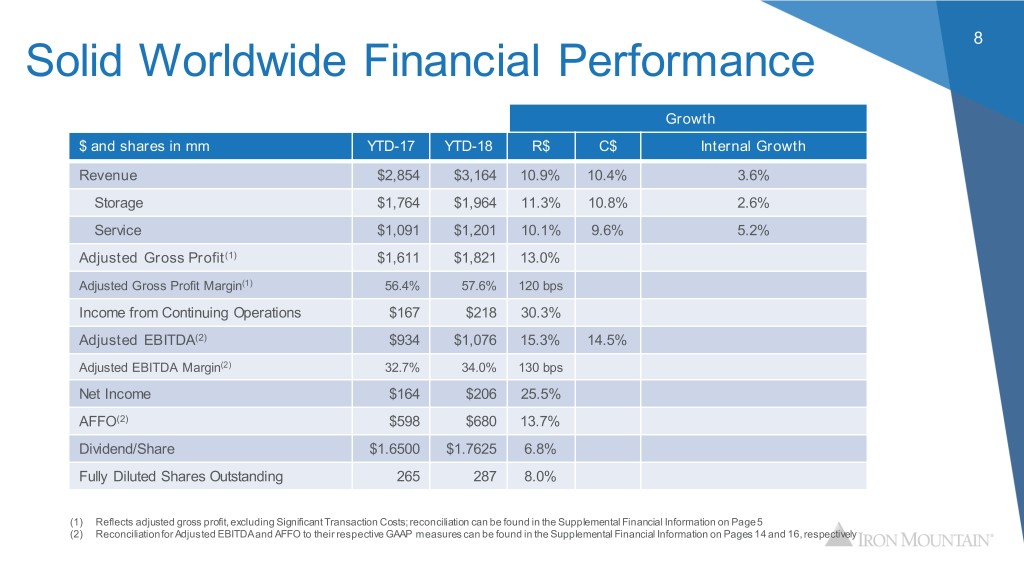

8 Solid Worldwide Financial Performance Growth $ and shares in mm YTD-17 YTD-18 R$ C$ Internal Growth Revenue $2,854 $3,164 10.9% 10.4% 3.6% Storage $1,764 $1,964 11.3% 10.8% 2.6% Service $1,091 $1,201 10.1% 9.6% 5.2% Adjusted Gross Profit(1) $1,611 $1,821 13.0% Adjusted Gross Profit Margin(1) 56.4% 57.6% 120 bps Income from Continuing Operations $167 $218 30.3% Adjusted EBITDA(2) $934 $1,076 15.3% 14.5% Adjusted EBITDA Margin(2) 32.7% 34.0% 130 bps Net Income $164 $206 25.5% AFFO(2) $598 $680 13.7% Dividend/Share $1.6500 $1.7625 6.8% Fully Diluted Shares Outstanding 265 287 8.0% (1) Reflects adjusted gross profit, excluding Significant Transaction Costs; reconciliation can be found in the Supplemental Financial Information on Page 5 (2) Reconciliation for Adjusted EBITDA and AFFO to their respective GAAP measures can be found in the Supplemental Financial Information on Pages 14 and 16, respectively

Strong Internal Revenue Growth in Q3 9 and YTD Q3 YTD Developed Other Developed Other Total Total Markets(1) International(2) Markets(1) International(2) Internal Revenue Growth Storage 0.7% 5.9% 2.3% 1.6% 5.8% 2.6% Service 7.1% 6.6% 7.1% 5.2% 4.8% 5.2% Total 3.2% 6.2% 4.1% 3.0% 5.5% 3.6% (1) Represents North America Records and Information Management, North America Data Management and Western Europe reporting segments. (2) Other International represents Emerging Markets, Australia and New Zealand Segment operating performance can be found on Pages 10-11 of the Supplemental Financial Information.

Solid Adjusted EBITDA Margin 10 Performance Adjusted EBITDA Q3 2017 Q3 2018 Change in bps YTD 2017 YTD 2018 Change in bps North America RIM 43.8% 46.1% 230 42.8% 44.8% 200 North America DM 55.7% 54.9% -80 55.4% 54.7% -70 Western Europe 33.9% 31.7% -220 30.8% 32.7% 190 Other International 29.6% 30.3% 70 29.3% 29.7% 40 Global Data Center 13.1% 43.1% 3,000 34.5% 44.3% 980 Total(1) 33.5% 34.3% 80 32.7% 34.0% 130 (1) Reconciliation for Total Adjusted EBITDA to its respective GAAP measure can be found in the Supplemental Financial Information on Page 14

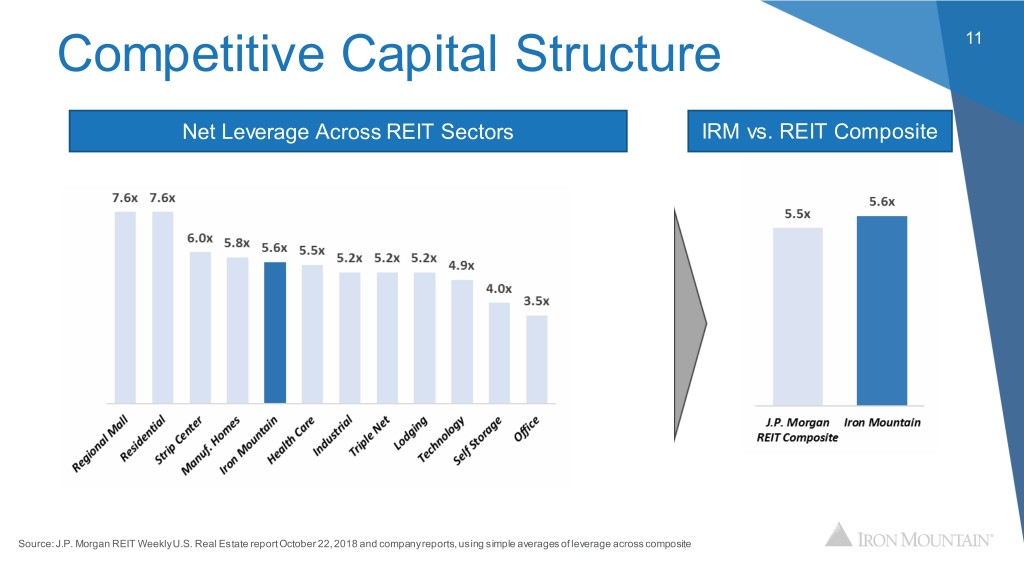

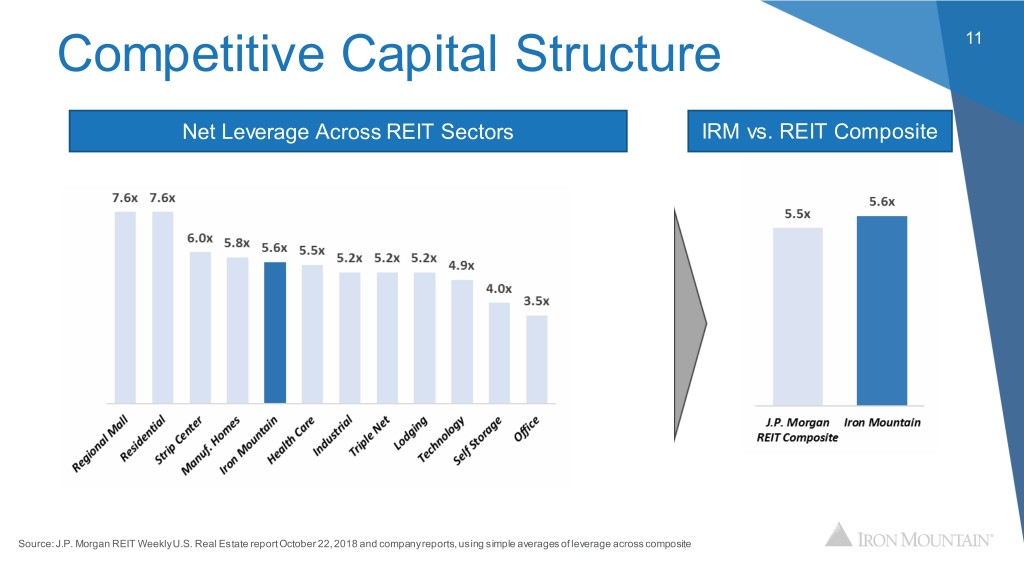

Competitive Capital Structure 11 Net Leverage Across REIT Sectors IRM vs. REIT Composite Source: J.P. Morgan REIT Weekly U.S. Real Estate report October 22, 2018 and company reports, using simple averages of leverage across composite

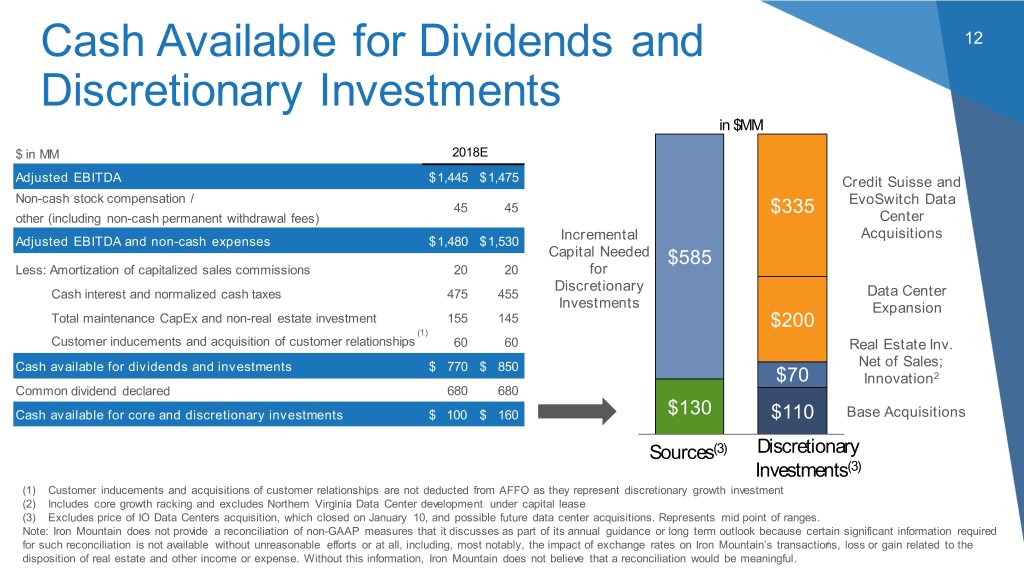

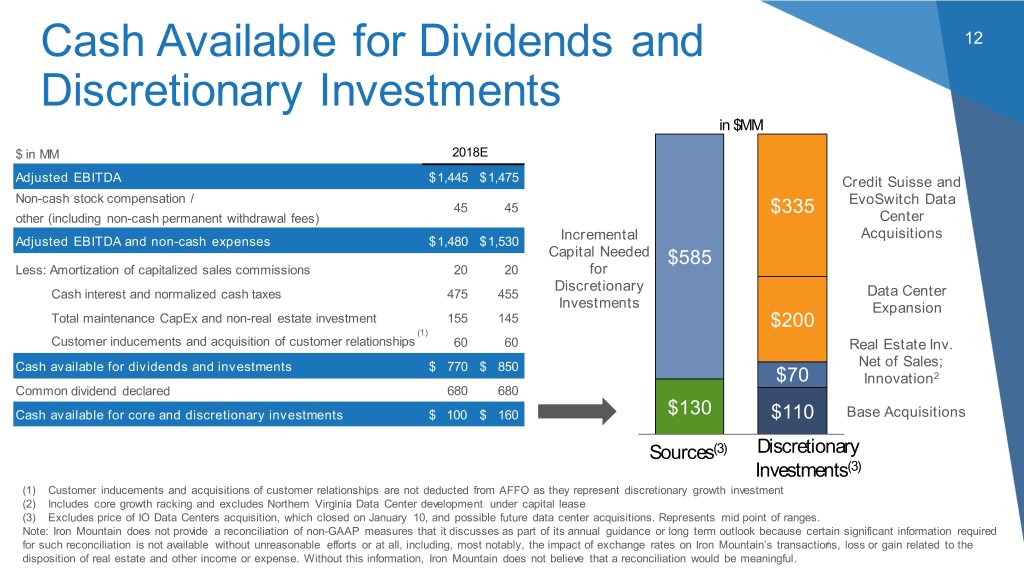

Cash Available for Dividends and 12 Discretionary Investments in $MM $ in MM 2018E $335 Adjusted EBITDA $1,445 $1,475 Credit Suisse and Non-cash stock compensation / EvoSwitch Data 45 45 $335 other (including non-cash permanent withdrawal fees) Center Acquisitions Adjusted EBITDA and non-cash expenses $1,480 $1,530 Incremental $185 Capital Needed $585 Less: Amortization of capitalized sales commissions 20 20 for $490 Discretionary Cash interest and normalized cash taxes 475 455 Data Center Investments Expansion Total maintenance CapEx and non-real estate investment 155 145 $155 (1) $200 Customer inducements and acquisition of customer relationships 60 60 Real Estate Inv. Cash available for dividends and investments $ 770 $ 850 Net of Sales; $70 Innovation2 Common dividend declared 680 680 $150 Cash available for core and discretionary investments $ 10 0 $ 160 $100$130 $110 Base Acquisitions Sources(3) Discretionary Investments(3) (1) Customer inducements and acquisitions of customer relationships are not deducted from AFFO as they represent discretionary growth investment (2) Includes core growth racking and excludes Northern Virginia Data Center development under capital lease (3) Excludes price of IO Data Centers acquisition, which closed on January 10, and possible future data center acquisitions. Represents mid point of ranges. Note: Iron Mountain does not provide a reconciliation of non-GAAP measures that it discusses as part of its annual guidance or long term outlook because certain significant information required for such reconciliation is not available without unreasonable efforts or at all, including, most notably, the impact of exchange rates on Iron Mountain’s transactions, loss or gain related to the disposition of real estate and other income or expense. Without this information, Iron Mountain does not believe that a reconciliation would be meaningful.

13 Key Takeaways Quarter punctuated by strong YTD internal total revenue growth of 3.6% Driving continued improvement in Adjusted EBITDA margins – up 80 bps year over year Accelerating expansion in Data Center supports 2020 plan and creates long-term growth platform Shift in revenue mix already contributing to 4% growth in Adjusted EBITDA, prior to acquisitions Announced 4% increase in dividend per share, improving dividend payout ratio Financial plan remains on track; revenue management offsetting moderating volumes in Developed Markets

Appendix

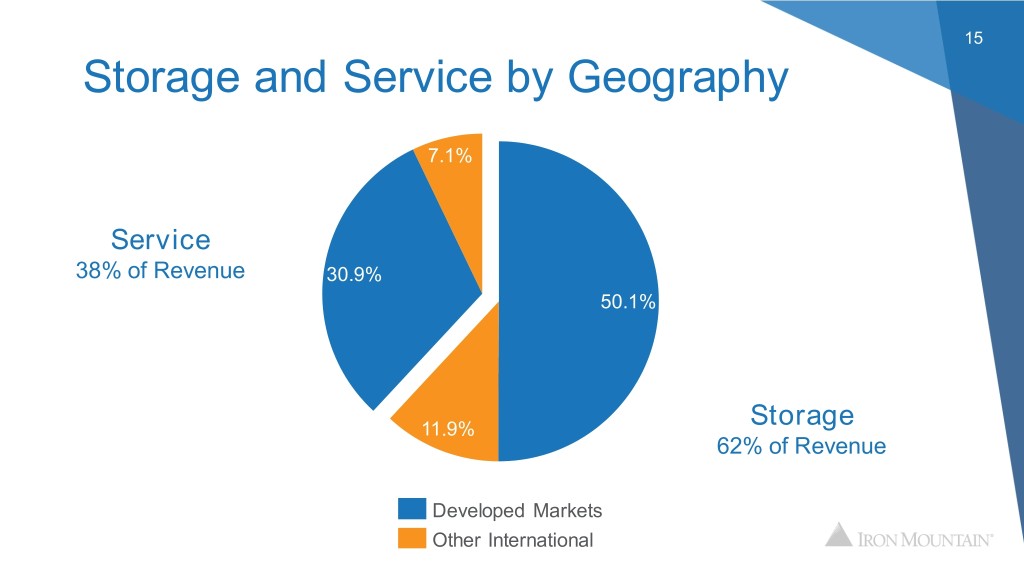

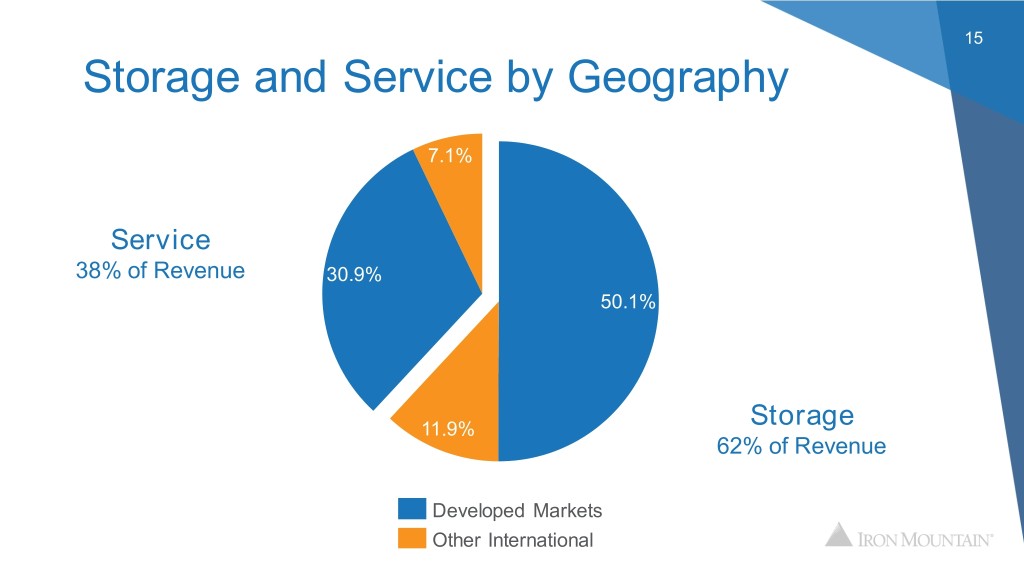

15 Storage and Service by Geography 7.1% Service 38% of Revenue 30.9% 50.1% 11.9% Storage 62% of Revenue Developed Markets Other International

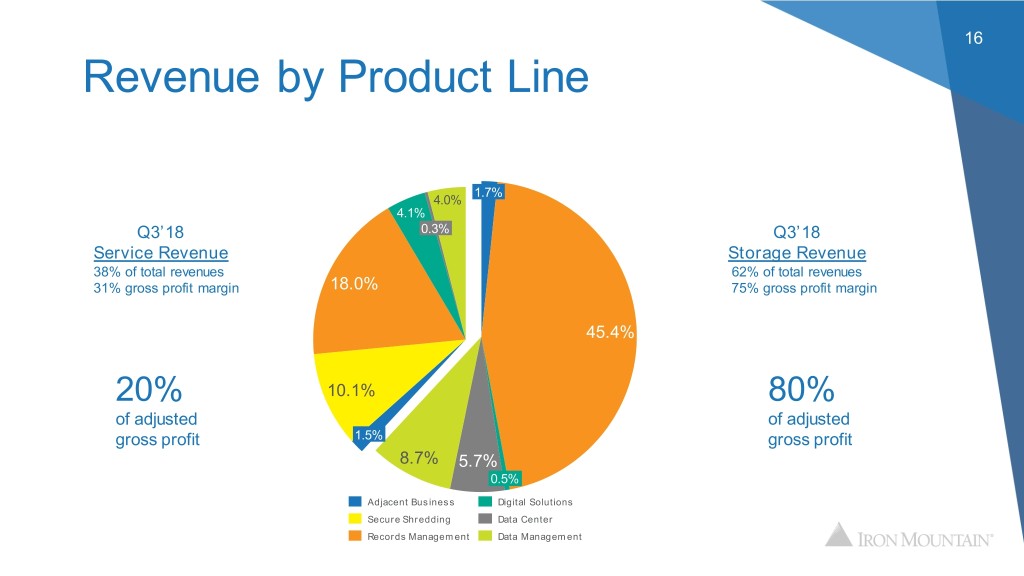

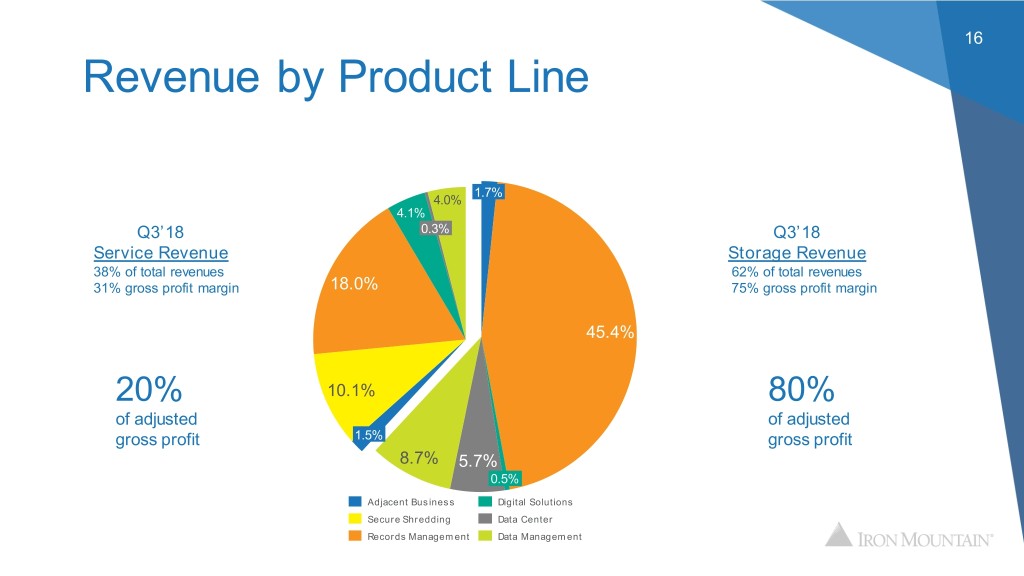

16 Revenue by Product Line 1.7% 4.0% 4.1% Q3’18 0.3% Q3’18 Service Revenue Storage Revenue 38% of total revenues 62% of total revenues 31% gross profit margin 18.0% 75% gross profit margin 45.4% 20% 10.1% 80% of adjusted of adjusted gross profit 1.5% gross profit 8.7% 5.7% 0.5% Adjacent Business Digital Solutions Secure Shredding Data Center Records Management Data Management

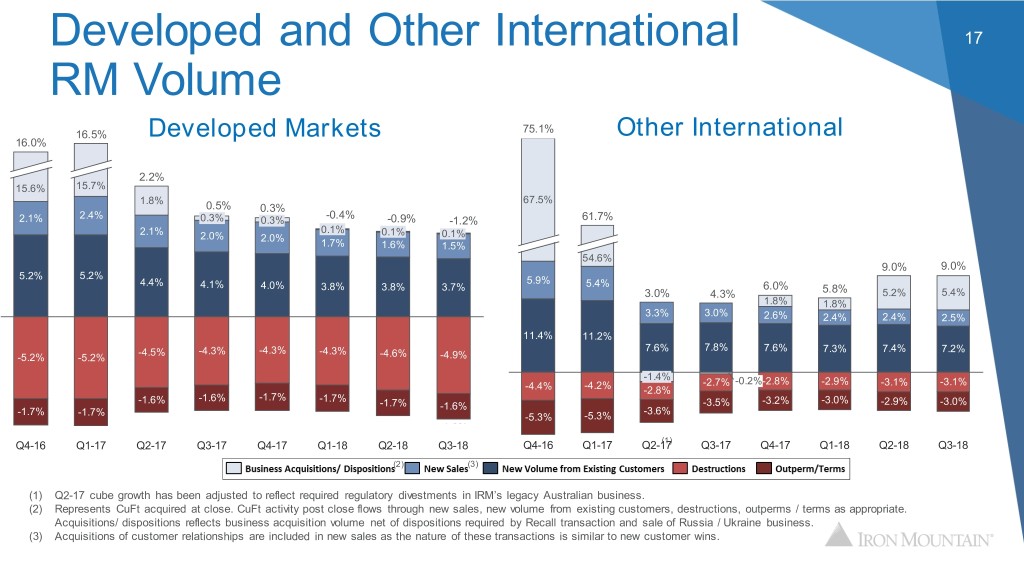

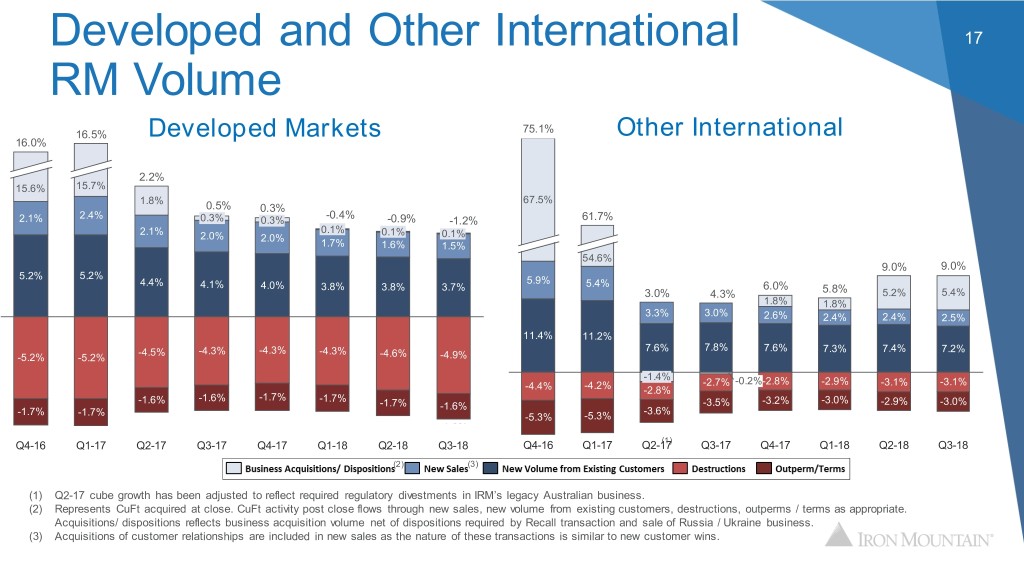

Developed and Other International 17 RM Volume 75.1% 16.5% 16.0% Developed Markets Other International 2.2% 15.6% 15.7% 1.8% 67.5% 0.5% 0.3% 2.4% -0.4% 2.1% 0.3% 0.3% -0.9% -1.2% 61.7% 2.1% 0.1% 0.1% 2.0% 2.0% 0.1% 1.7% 1.6% 1.5% 54.6% 9.0% 9.0% 5.2% 5.2% 5.9% 4.4% 4.1% 4.0% 3.8% 3.8% 3.7% 5.4% 6.0% 3.0% 4.3% 5.8% 5.2% 5.4% 1.8% 1.8% 3.3% 3.0% 2.6% 2.4% 2.4% 2.5% 11.4% 11.2% -4.5% -4.3% -4.3% -4.3% 7.6% 7.8% 7.6% 7.3% 7.4% 7.2% -5.2% -5.2% -4.6% -4.9% -1.4% -2.7% -0.2%-2.8% -2.9% -3.1% -3.1% -4.4% -4.2% -2.8% -1.6% -1.6% -1.7% -1.7% -3.2% -3.0% -1.7% -1.6% -3.5% -2.9% -3.0% -1.7% -1.7% -5.3% -3.6% -0.4% -5.3% -0.9% -1.2% (1) Q4-16 Q1-17 Q2-17 Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Q4-16 Q1-17 Q2-17 Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 (2) (3) (1) Q2-17 cube growth has been adjusted to reflect required regulatory divestments in IRM’s legacy Australian business. (2) Represents CuFt acquired at close. CuFt activity post close flows through new sales, new volume from existing customers, destructions, outperms / terms as appropriate. Acquisitions/ dispositions reflects business acquisition volume net of dispositions required by Recall transaction and sale of Russia / Ukraine business. (3) Acquisitions of customer relationships are included in new sales as the nature of these transactions is similar to new customer wins.