We have made statements in this press release that constitute "forward-looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995 and other securities laws. These forward-looking statements concern our operations, economic performance, financial condition, goals, beliefs, future growth strategies, investment objectives, plans and current expectations, such as our (1) 2022 guidance as well as our expectations for growth, including growth opportunities and growth rates for revenue by segment, organic revenue, organic volume and other metrics, including data center leasing, (2) expectations and assumptions regarding the impact from the COVID-19 pandemic on us and our customers, including on our businesses, financial position, results of operations and cash flows, (3) expected benefits related to Project Summit, (4) expectations as to our capital allocation strategy, including our future investments, leverage ratio, AFFO payout ratio, dividend payments and possible funding sources (including real estate monetization) and capital expenditures, (5) expectations regarding the closing of pending acquisitions and investments, and (6) other forward-looking statements related to our business, results of operations and financial condition. These forward-looking statements are subject to various known and unknown risks, uncertainties and other factors, and you should not rely upon them except as statements of our present intentions and of our present expectations, which may or may not occur. When we use words such as "believes," "expects," "anticipates," "estimates," "plans," "intends" or similar expressions, we are making forward-looking statements. Although we believe that our forward-looking statements are based on reasonable assumptions, our expected results may not be achieved, and actual results may differ materially from our expectations. In addition, important factors that could cause actual results to differ from expectations include, among others: (i) the severity and duration of the COVID-19 pandemic and its effects on the global economy, including its effects on us, the markets we serve and our customers and the third parties with whom we do business within those markets; (ii) our ability to remain qualified for taxation as a real estate investment trust for United States federal income tax purposes; (iii) changes in customer preferences and demand for our storage and information management services, including as a result of the shift from paper and tape storage to alternative technologies that require less physical space; (iv) our ability or inability to execute our strategic growth plan, including our ability to invest according to plan, incorporate new digital information technologies into our offerings, achieve satisfactory returns on new product offerings, continue our revenue management, expand internationally, complete acquisitions on satisfactory terms, integrate acquired companies efficiently and grow our business through joint ventures; (v) changes in the amount of our capital expenditures; (vi) our ability to raise debt or equity capital and changes in the cost of our debt; (vii) the cost and our ability to comply with, laws, regulations and customer demands, including those relating to data security and privacy issues, as well as fire and safety and environmental standards; (viii) the impact of litigation or disputes that may arise in connection with incidents in which we fail to protect our customers' information or our internal records or information technology systems and the impact of such incidents on our reputation and ability to compete; (ix) changes in the price for our storage and information management services relative to the cost of providing such storage and information management services; (x) changes in the political and economic environments in the countries in which our international subsidiaries operate and changes in the global political climate, particularly as we consolidate operations and move records and data across borders; (xi) our ability to comply with our existing debt obligations and restrictions in our debt instruments; (xii) the impact of service interruptions or equipment damage and the cost of power on our data center operations; (xiii) the cost or potential liabilities associated with real estate necessary for our business; (xiv) failures in our adoption of new IT systems; (xv) other trends in competitive or economic conditions affecting our financial condition or results of operations not presently contemplated; and (xvi) the other risks described in our periodic reports filed with the SEC, including under the caption “Risk Factors” in Part I, Item 1A of our Annual Report. Except as required by law, we undertake no obligation to update any forward-looking statements appearing in this report. Reconciliation of Non-GAAP Measures: Throughout this release, Iron Mountain discusses (1) Adjusted EBITDA, (2) Adjusted Earnings per Share (“Adjusted EPS”), (3) Funds from Operations (“FFO Nareit”), (4) FFO (Normalized), and (5) Adjusted Funds from Operations (“AFFO”). These measures do not conform to accounting principles generally accepted in the United States (“GAAP”). These non-GAAP measures are supplemental metrics designed to enhance our disclosure and to provide additional information that we believe to be important for investors to consider in addition to, but not as a substitute for, other measures of financial performance reported in accordance with GAAP, such as operating income, net income (loss) attributable to Iron Mountain Incorporated or cash flows from operating activities (as determined in accordance with GAAP). The reconciliation of these measures to the appropriate GAAP measure, as required by Regulation G under the Securities Exchange Act of 1934, as amended, and their definitions are included later in this release. 2 Forward looking statements

3FY 2021 accomplishments ● Full year net income increased 32%; record Revenue, AFFO and Adjusted EBITDA ● Organic storage rental revenue growth of +2.6% for the full year and +3.6% for the fourth quarter, reflecting continued benefit of pricing combined with positive volume trends ● Total global volume up +2.4% year over year, at a record 744 million cubic feet ● Full year Adjusted EBITDA growth of 11% year over year; in the fourth quarter, Adjusted EBITDA growth of 15% year over year ● Strong performance from GDS and asset lifecycle management revenue at over 20% year over year ● Global Data Center team leased 49 megawatts in the full year, far exceeding full year target of 30 megawatts, and 27 megawatts in the fourth quarter

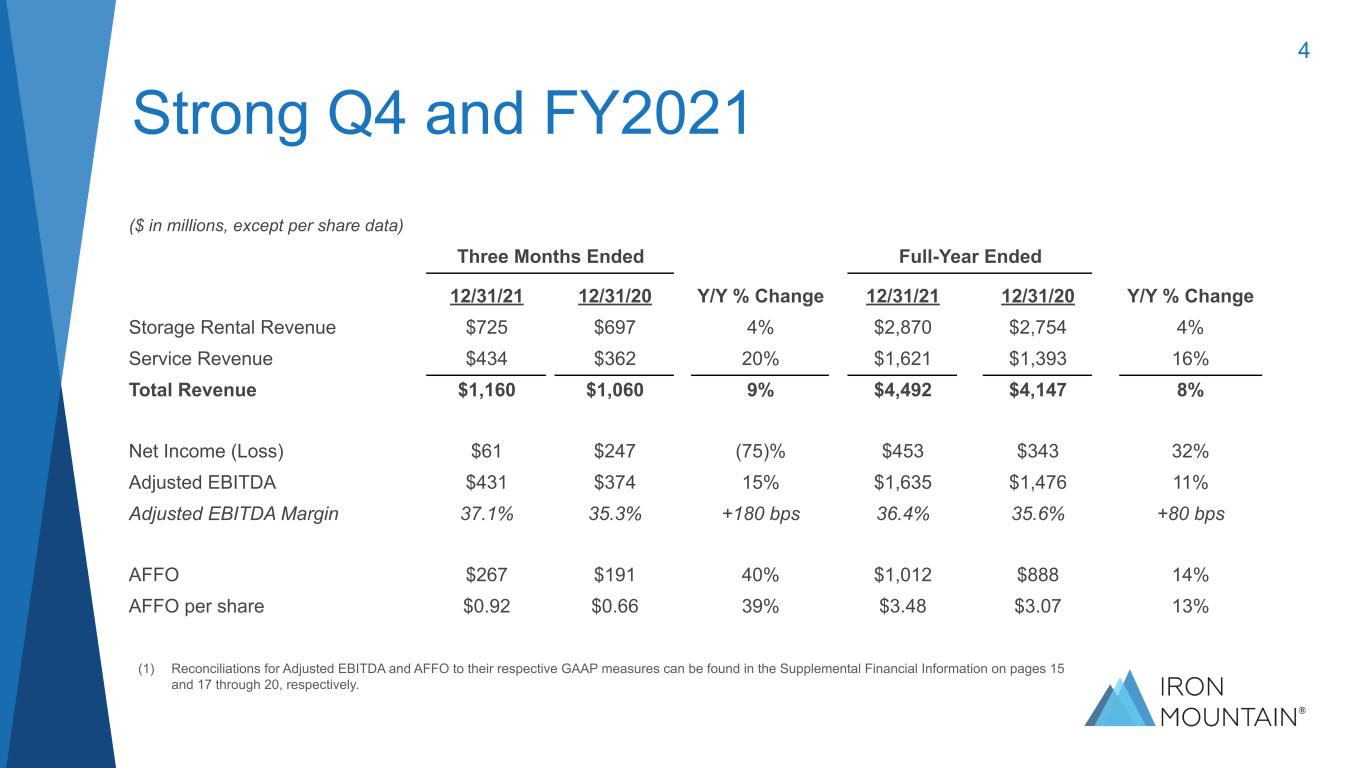

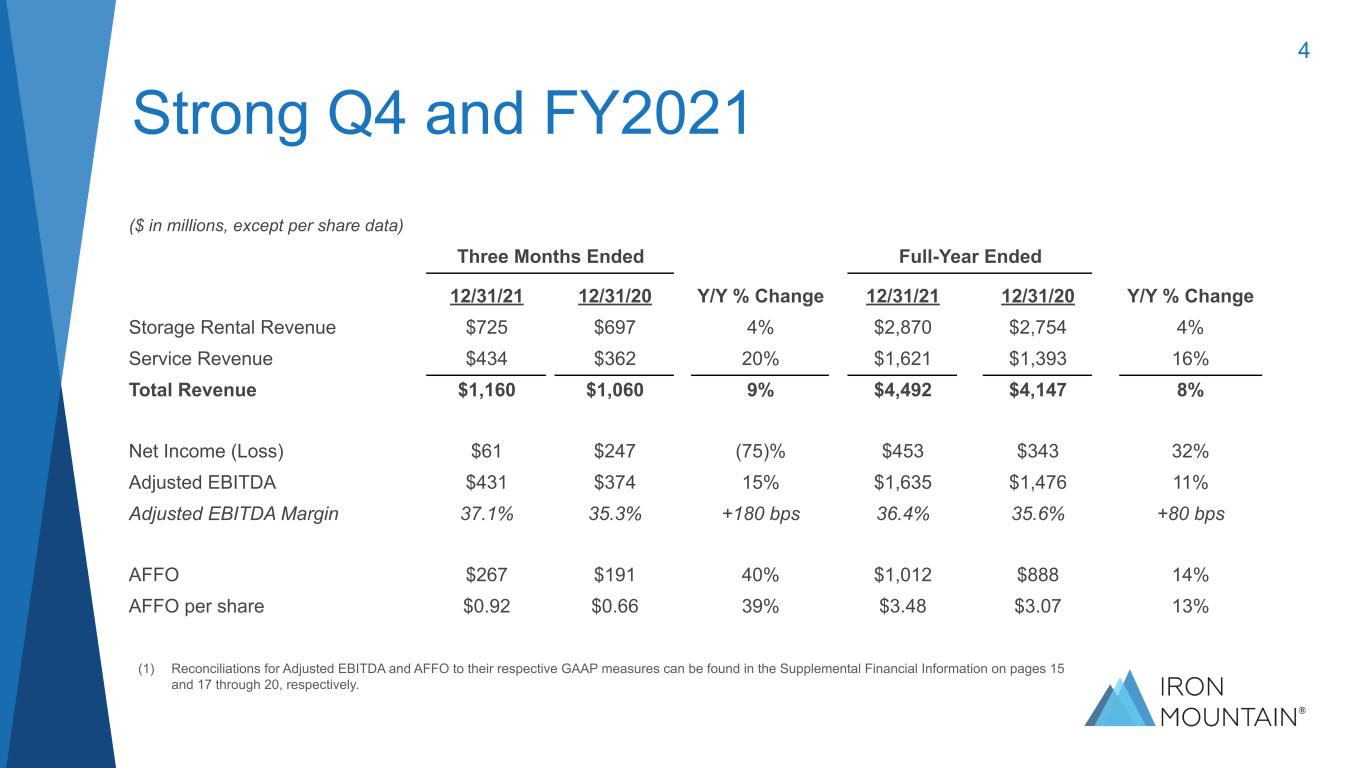

4 (1) Reconciliations for Adjusted EBITDA and AFFO to their respective GAAP measures can be found in the Supplemental Financial Information on pages 15 and 17 through 20, respectively. Strong Q4 and FY2021 ($ in millions, except per share data) Three Months Ended Full-Year Ended 12/31/21 12/31/20 Y/Y % Change 12/31/21 12/31/20 Y/Y % Change Storage Rental Revenue $725 $697 4% $2,870 $2,754 4% Service Revenue $434 $362 20% $1,621 $1,393 16% Total Revenue $1,160 $1,060 9% $4,492 $4,147 8% Net Income (Loss) $61 $247 (75)% $453 $343 32% Adjusted EBITDA $431 $374 15% $1,635 $1,476 11% Adjusted EBITDA Margin 37.1% 35.3% +180 bps 36.4% 35.6% +80 bps AFFO $267 $191 40% $1,012 $888 14% AFFO per share $0.92 $0.66 39% $3.48 $3.07 13%

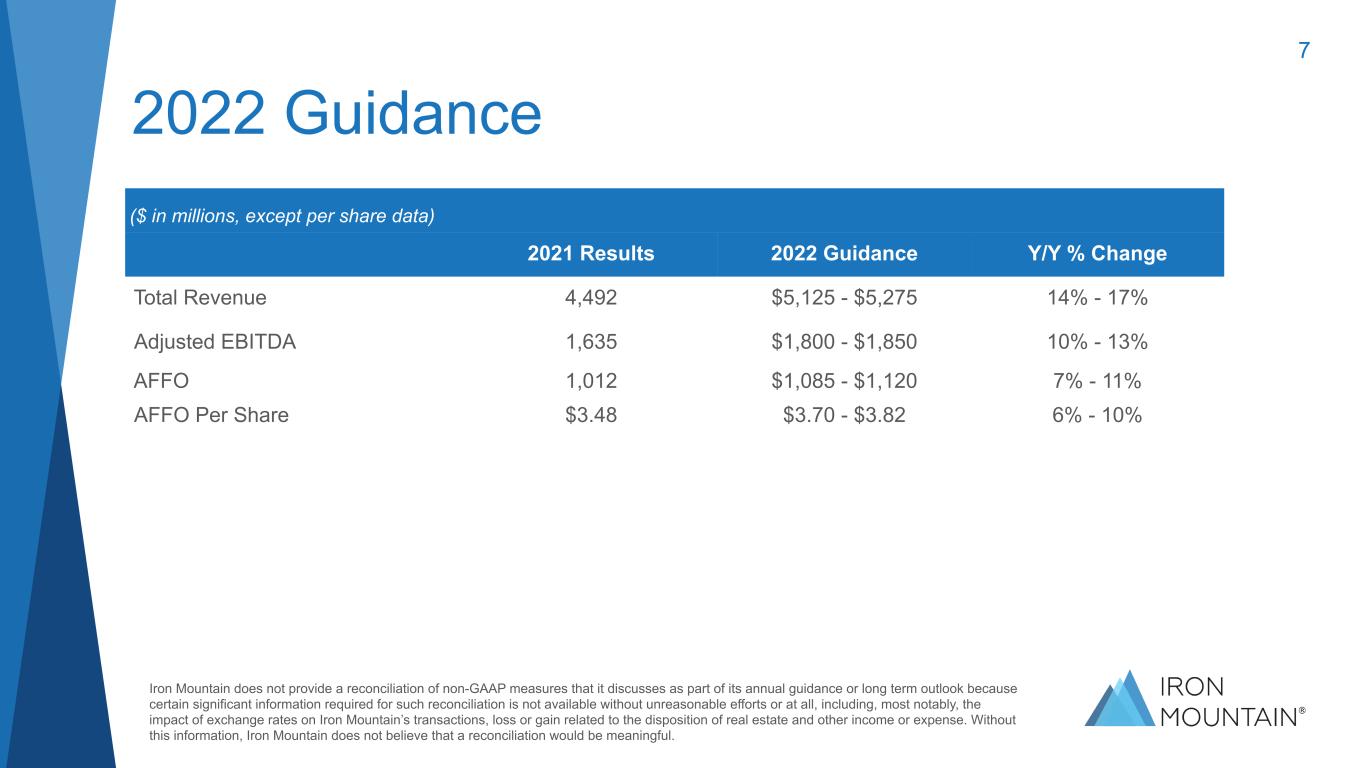

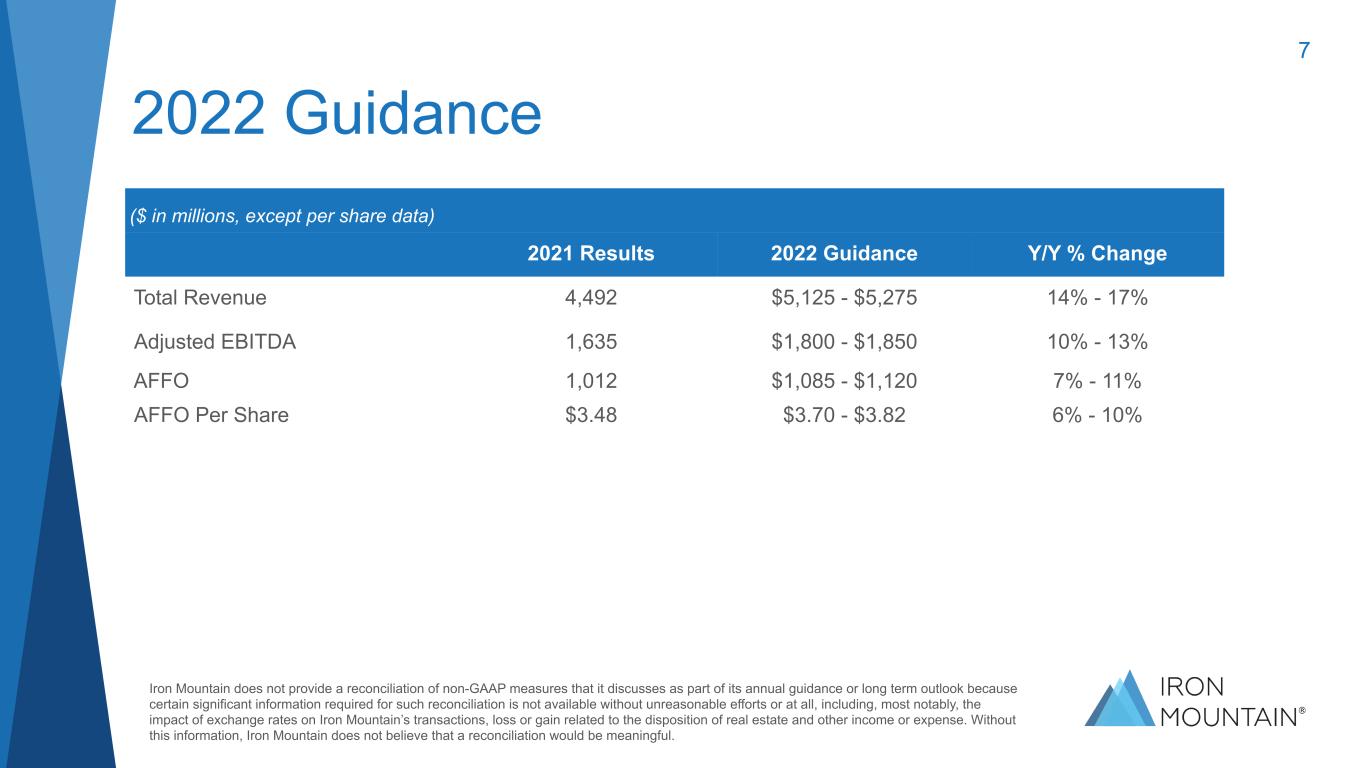

($ in millions, except per share data) 2021 Results 2022 Guidance Y/Y % Change Total Revenue 4,492 $5,125 - $5,275 14% - 17% Adjusted EBITDA 1,635 $1,800 - $1,850 10% - 13% AFFO 1,012 $1,085 - $1,120 7% - 11% AFFO Per Share $3.48 $3.70 - $3.82 6% - 10% 7 2022 Guidance Iron Mountain does not provide a reconciliation of non-GAAP measures that it discusses as part of its annual guidance or long term outlook because certain significant information required for such reconciliation is not available without unreasonable efforts or at all, including, most notably, the impact of exchange rates on Iron Mountain’s transactions, loss or gain related to the disposition of real estate and other income or expense. Without this information, Iron Mountain does not believe that a reconciliation would be meaningful.