FOR IMMEDIATE RELEASE Iron Mountain Reports Fourth Quarter and Full Year 2024 Results • Achieves record quarterly and full year revenue of $1.6 billion and $6.1 billion, respectively • Q4 2024 and Full Year 2024 revenue growth of 11.4% and 12.2%, respectively, driven by strong performances across global RIM, data center, and asset lifecycle management (ALM) businesses • Q4 2024 and Full Year 2024 Net Income of $106 million and $184 million, respectively • Delivers record quarterly and full year Adjusted EBITDA of $605 million and $2.2 billion, respectively • Issues strong 2025 guidance with Revenue growth of 8% to 11% and Adjusted EBITDA growth of 11% to 13% • Excluding the effects of foreign exchange, 2025 guidance for Revenue growth is 10% to 12% and Adjusted EBITDA growth is 12% to 14% • Increases quarterly dividend per share by 10% based on continued strong growth in AFFO PORTSMOUTH, N.H. – February 13, 2025 – Iron Mountain Incorporated (NYSE: IRM), a global leader in information management services, announces financial results for the fourth quarter and full year 2024. “We are pleased to report that our fourth quarter and full year 2024 results were an all-time record for Revenue, Adjusted EBITDA, and AFFO. We continue to execute well against our Project Matterhorn growth strategy, delivering double-digit revenue growth in Q4 with strength across each of our business segments. We are grateful to our Mountaineers for their continued dedication to serving our customers, which is driving our outstanding results,” said William L. Meaney, President and CEO of Iron Mountain. “As we look to 2025, we remain committed to continuing to deliver industry leading revenue growth of 8% to 11%, which is benefiting from our growth businesses representing an increasingly larger portion of our revenue, as well as adjusted EBITDA growth of 11% to 13%. With our strong performance in 2024 and continued growth outlook we are pleased to increase the dividend by 10%.” Financial Performance Highlights for the Fourth Quarter and Full Year 2024 ($ in millions, except per share data) Three Months Ended Y/Y % Change Full Year Y/Y % Change 12/31/24 12/31/23 Reported $ Constant Fx 12/31/24 12/31/23 Reported $ Constant Fx Storage Rental Revenue $942 $871 8% 9% $3,682 $3,371 9% 10% Service Revenue $639 $549 17% 17% $2,468 $2,109 17% 17% Total Revenue $1,581 $1,420 11% 12% $6,150 $5,480 12% 13% Net Income $106 $29 n/a $184 $187 (2)% Reported EPS $0.35 $0.10 n/a $0.61 $0.63 (3)% Adjusted EPS $0.50 $0.52 (4)% $1.77 $1.82 (3)% Adjusted EBITDA $605 $525 15% 16% $2,236 $1,962 14% 14% Adjusted EBITDA Margin 38.3% 37.0% 130 bps 36.4% 35.8% 60 bps AFFO $368 $328 12% $1,345 $1,211 11% AFFO per share $1.24 $1.11 12% $4.54 $4.12 10% 1

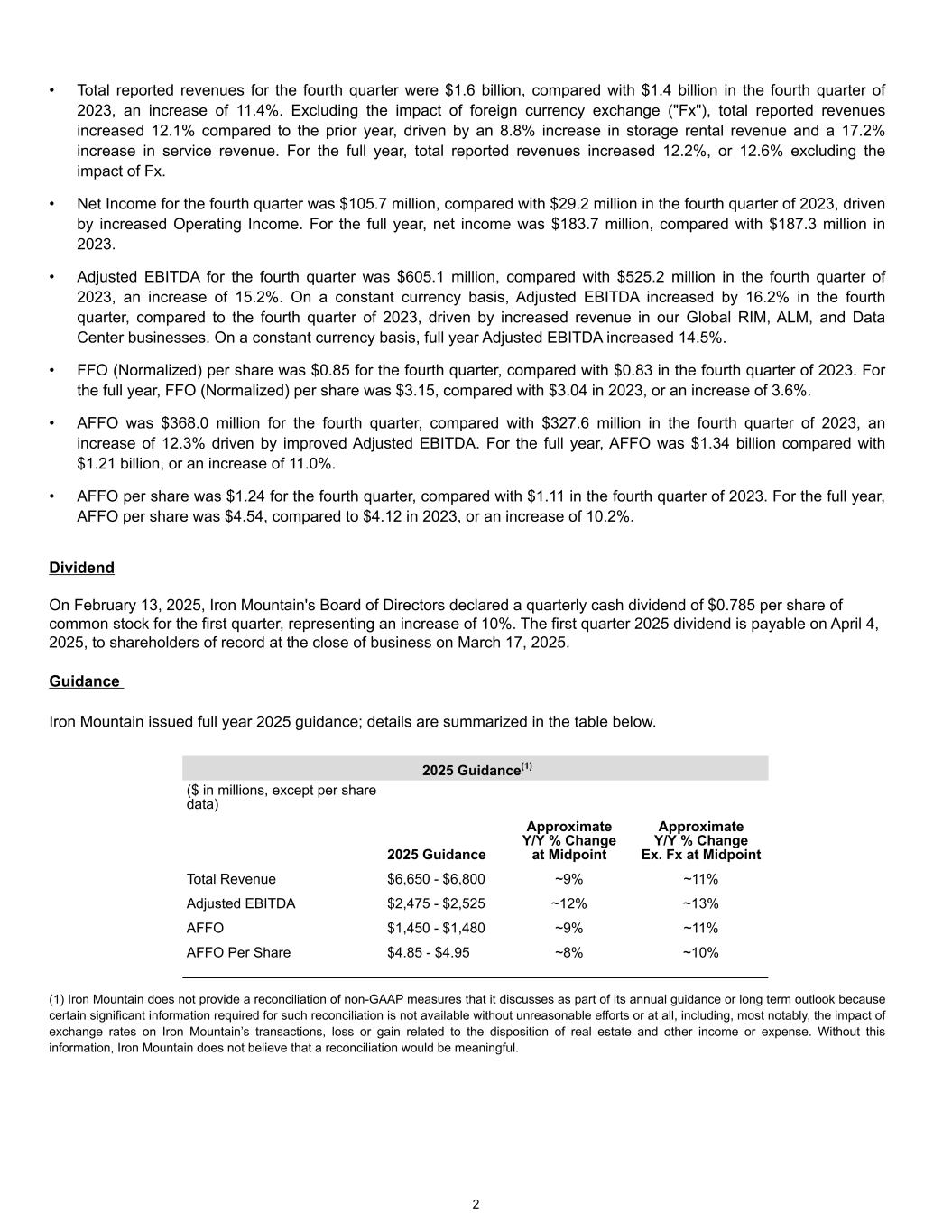

• Total reported revenues for the fourth quarter were $1.6 billion, compared with $1.4 billion in the fourth quarter of 2023, an increase of 11.4%. Excluding the impact of foreign currency exchange ("Fx"), total reported revenues increased 12.1% compared to the prior year, driven by an 8.8% increase in storage rental revenue and a 17.2% increase in service revenue. For the full year, total reported revenues increased 12.2%, or 12.6% excluding the impact of Fx. • Net Income for the fourth quarter was $105.7 million, compared with $29.2 million in the fourth quarter of 2023, driven by increased Operating Income. For the full year, net income was $183.7 million, compared with $187.3 million in 2023. • Adjusted EBITDA for the fourth quarter was $605.1 million, compared with $525.2 million in the fourth quarter of 2023, an increase of 15.2%. On a constant currency basis, Adjusted EBITDA increased by 16.2% in the fourth quarter, compared to the fourth quarter of 2023, driven by increased revenue in our Global RIM, ALM, and Data Center businesses. On a constant currency basis, full year Adjusted EBITDA increased 14.5%. • FFO (Normalized) per share was $0.85 for the fourth quarter, compared with $0.83 in the fourth quarter of 2023. For the full year, FFO (Normalized) per share was $3.15, compared with $3.04 in 2023, or an increase of 3.6%. • AFFO was $368.0 million for the fourth quarter, compared with $327.6 million in the fourth quarter of 2023, an increase of 12.3% driven by improved Adjusted EBITDA. For the full year, AFFO was $1.34 billion compared with $1.21 billion, or an increase of 11.0%. • AFFO per share was $1.24 for the fourth quarter, compared with $1.11 in the fourth quarter of 2023. For the full year, AFFO per share was $4.54, compared to $4.12 in 2023, or an increase of 10.2%. Dividend On February 13, 2025, Iron Mountain's Board of Directors declared a quarterly cash dividend of $0.785 per share of common stock for the first quarter, representing an increase of 10%. The first quarter 2025 dividend is payable on April 4, 2025, to shareholders of record at the close of business on March 17, 2025. Guidance Iron Mountain issued full year 2025 guidance; details are summarized in the table below. 2025 Guidance(1) ($ in millions, except per share data) 2025 Guidance Approximate Y/Y % Change at Midpoint Approximate Y/Y % Change Ex. Fx at Midpoint Total Revenue $6,650 - $6,800 ~9% ~11% Adjusted EBITDA $2,475 - $2,525 ~12% ~13% AFFO $1,450 - $1,480 ~9% ~11% AFFO Per Share $4.85 - $4.95 ~8% ~10% (1) Iron Mountain does not provide a reconciliation of non-GAAP measures that it discusses as part of its annual guidance or long term outlook because certain significant information required for such reconciliation is not available without unreasonable efforts or at all, including, most notably, the impact of exchange rates on Iron Mountain’s transactions, loss or gain related to the disposition of real estate and other income or expense. Without this information, Iron Mountain does not believe that a reconciliation would be meaningful. 2

Q4 2024 Earnings Conference Call and Related Materials The conference call / webcast details, earnings presentation and supplemental financial information, which includes definitions of certain capitalized terms used in this release, are available on Iron Mountain’s Investor Relations website. About Iron Mountain Iron Mountain Incorporated (NYSE: IRM) is trusted by more than 240,000 customers in 61 countries, including approximately 95% of the Fortune 1000, to help unlock value and intelligence from their assets through services that transcend the physical and digital worlds. Our broad range of solutions address their information management, digital transformation, information security, data center and asset lifecycle management needs. Our longstanding commitment to safety, security, sustainability and innovation in support of our customers underpins everything we do. To learn more about Iron Mountain, please visit www.IronMountain.com. Investor Relations Contacts: Mark Rupe Erika Crabtree SVP, Investor Relations Manager, Investor Relations Mark.Rupe@ironmountain.com Erika.Crabtree@ironmountain.com (215) 402-7013 (617) 535-2845 3

Forward Looking Statements We have made statements in this press release that constitute "forward-looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995 and other securities laws. These forward-looking statements concern our current expectations regarding our future results from operations, economic performance, financial condition, goals, strategies, investment objectives, plans and achievements. These forward-looking statements are subject to various known and unknown risks, uncertainties and other factors, and you should not rely upon them except as statements of our present intentions and of our present expectations, which may or may not occur. When we use words such as “believes”, “expects”, “anticipates”, “estimates”, “plans”, “intends”, “projects”, “pursue”, “will” or similar expressions, we are making forward-looking statements. Although we believe that our forward-looking statements are based on reasonable assumptions, our expected results may not be achieved, and actual results may differ materially from our expectations. In addition, important factors that could cause actual results to differ from expectations include, among others: (i) our ability or inability to execute our strategic growth plan, including our ability to invest according to plan, grow our businesses (including through joint ventures or other co-investment vehicles), incorporate alternative technologies (including artificial intelligence) into our offerings, achieve satisfactory returns on new product offerings, continue our revenue management, expand and manage our global operations, complete acquisitions on satisfactory terms, integrate acquired companies efficiently and transition to more sustainable sources of energy; (ii) changes in customer preferences and demand for our storage and information management services, including as a result of the shift from paper and tape storage to alternative technologies that require less physical space or services activity; (iii) the costs of complying with and our ability to comply with laws, regulations and customer requirements, including those relating to data privacy and cybersecurity issues, as well as fire and safety and environmental standards; (iv) the impact of attacks on our internal information technology (“IT”) systems, including the impact of such incidents on our reputation and ability to compete and any litigation or disputes that may arise in connection with such incidents; (v) our ability to fund capital expenditures; (vi) the impact of our distribution requirements on our ability to execute our business plan; (vii) our ability to remain qualified for taxation as a real estate investment trust for United States federal income tax purposes; (viii) changes in the political and economic environments in the countries in which we operate and changes in the global political climate; (ix) our ability to raise debt or equity capital and changes in the cost of our debt; (x) our ability to comply with our existing debt obligations and restrictions in our debt instruments; (xi) the impact of service interruptions or equipment damage and the cost of power on our data center operations; (xii) the cost or potential liabilities associated with real estate necessary for our business; (xiii) unexpected events, including those resulting from climate change or geopolitical events, could disrupt our operations and adversely affect our reputation and results of operations; (xiv) failures to implement and manage new IT systems; (xv) other trends in competitive or economic conditions affecting our financial condition or results of operations not presently contemplated; and (xvi) the other risks described in our periodic reports filed with the SEC, including under the caption “Risk Factors” in Part I, Item 1A of our Annual Report. Except as required by law, we undertake no obligation to update any forward-looking statements appearing in this press release. Reconciliation of Non-GAAP Measures Throughout this press release, Iron Mountain discusses (1) Adjusted EBITDA, (2) Adjusted EPS, (3) FFO (Nareit), (4) FFO (Normalized), (5) AFFO and (6) AFFO per share. These measures do not conform to accounting principles generally accepted in the United States (“GAAP”). These non-GAAP measures are supplemental metrics designed to enhance our disclosure and to provide additional information that we believe to be important for investors to consider in addition to, but not as a substitute for, other measures of financial performance reported in accordance with GAAP, such as operating income, net income (loss) attributable to Iron Mountain Incorporated or cash flows from operating activities (as determined in accordance with GAAP). The reconciliation of these measures to the appropriate GAAP measure, as required by Regulation G under the Securities Exchange Act of 1934, as amended, and their definitions are included later in this release. 4

Consolidated Balance Sheets (Audited; dollars in thousands) 12/31/2024 12/31/2023 ASSETS Current Assets: Cash and Cash Equivalents $155,716 $222,789 Accounts Receivable, Net 1,291,379 1,259,826 Prepaid Expenses and Other 244,127 252,930 Total Current Assets $1,691,222 $1,735,545 Property, Plant and Equipment: Property, Plant and Equipment $11,985,997 $10,373,989 Less: Accumulated Depreciation (4,354,398) (4,059,120) Property, Plant and Equipment, Net $7,631,599 $6,314,869 Other Assets, Net: Goodwill $5,083,817 $5,017,912 Customer and Supplier Relationships and Other Intangible Assets 1,274,731 1,279,800 Operating Lease Right-of-Use Assets 2,489,893 2,696,024 Other 545,853 429,652 Total Other Assets, Net $9,394,294 $9,423,388 Total Assets $18,717,115 $17,473,802 LIABILITIES AND EQUITY Current Liabilities: Current Portion of Long-term Debt $715,109 $120,670 Accounts Payable 678,716 539,594 Accrued Expenses and Other Current Liabilities 1,366,568 1,250,259 Deferred Revenue 326,882 325,665 Total Current Liabilities $3,087,275 $2,236,188 Long-term Debt, Net of Current Portion 13,003,977 11,812,500 Long-term Operating Lease Liabilities, Net of Current Portion 2,334,826 2,562,394 Other Long-term Liabilities 312,199 237,590 Deferred Income Taxes 205,341 235,410 Redeemable Noncontrolling Interests 78,171 177,947 Total Long-term Liabilities $15,934,514 $15,025,841 Total Liabilities $19,021,789 $17,262,029 (Deficit) Equity Total (Deficit) Equity $(304,674) $211,773 Total Liabilities and (Deficit) Equity $18,717,115 $17,473,802 5

Quarterly Consolidated Statements of Operations (Unaudited; dollars in thousands, except per-share data) Q4 2024 Q3 2024 Q/Q % Change Q4 2023 Y/Y % Change Revenues: Storage Rental $941,970 $935,701 0.7 % $871,144 8.1 % Service 639,309 621,657 2.8 % 548,685 16.5 % Total Revenues $1,581,279 $1,557,358 1.5 % $1,419,829 11.4 % Operating Expenses: Cost of Sales (excluding Depreciation and Amortization) $688,933 $678,390 1.6 % $601,329 14.6 % Selling, General and Administrative 333,307 341,929 (2.5) % 314,932 5.8 % Depreciation and Amortization 234,609 232,240 1.0 % 199,941 17.3 % Acquisition and Integration Costs 7,269 11,262 (35.5) % 12,860 (43.5) % Restructuring and Other Transformation 36,797 37,282 (1.3) % 53,853 (31.7) % (Gain) Loss on Disposal/Write-Down of PP&E, Net (2,074) 5,091 (140.7) % 6,157 (133.7) % Total Operating Expenses $1,298,841 $1,306,194 (0.6) % $1,189,072 9.2 % Operating Income (Loss) $282,438 $251,164 12.5 % $230,757 22.4 % Interest Expense, Net 194,452 186,067 4.5 % 151,784 28.1 % Other (Income) Expense, Net (36,243) 86,362 (142.0) % 40,761 (188.9) % Net Income (Loss) Before Provision (Benefit) for Income Taxes $124,229 $(21,265) n/a $38,212 n/a Provision (Benefit) for Income Taxes 18,544 12,400 49.5 % 9,018 105.6 % Net Income (Loss) $105,685 $(33,665) n/a $29,194 n/a Less: Net Income (Loss) Attributable to Noncontrolling Interests 1,753 (45) n/a 712 146.2 % Net Income (Loss) Attributable to Iron Mountain Incorporated $103,932 $(33,620) n/a $28,482 n/a Net Income (Loss) Per Share Attributable to Iron Mountain Incorporated: Basic $0.35 $(0.11) n/a $0.10 n/a Diluted $0.35 $(0.11) n/a $0.10 n/a Weighted Average Common Shares Outstanding - Basic 293,771 293,603 0.1 % 292,328 0.5 % Weighted Average Common Shares Outstanding - Diluted 297,201 293,603 1.2 % 295,014 0.7 % 6

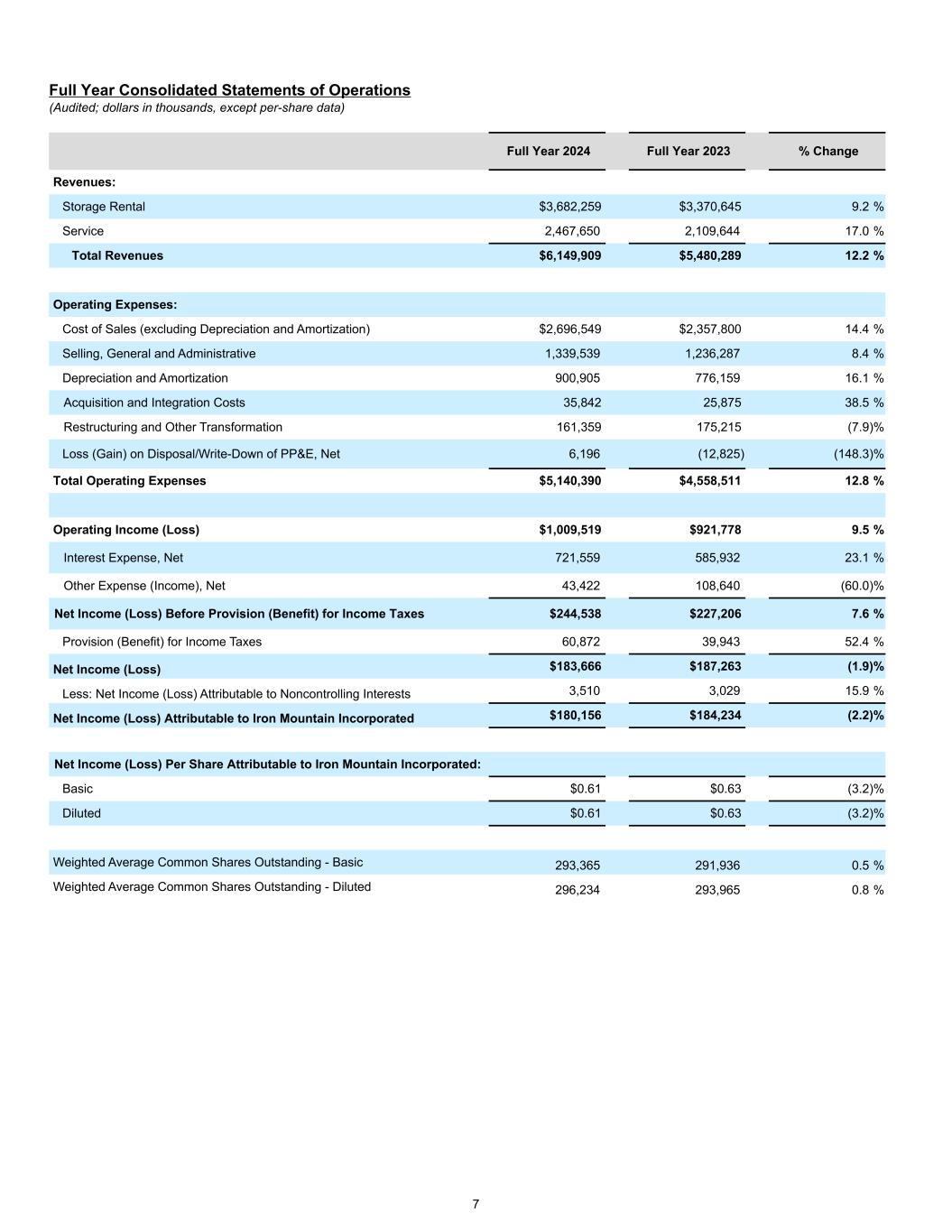

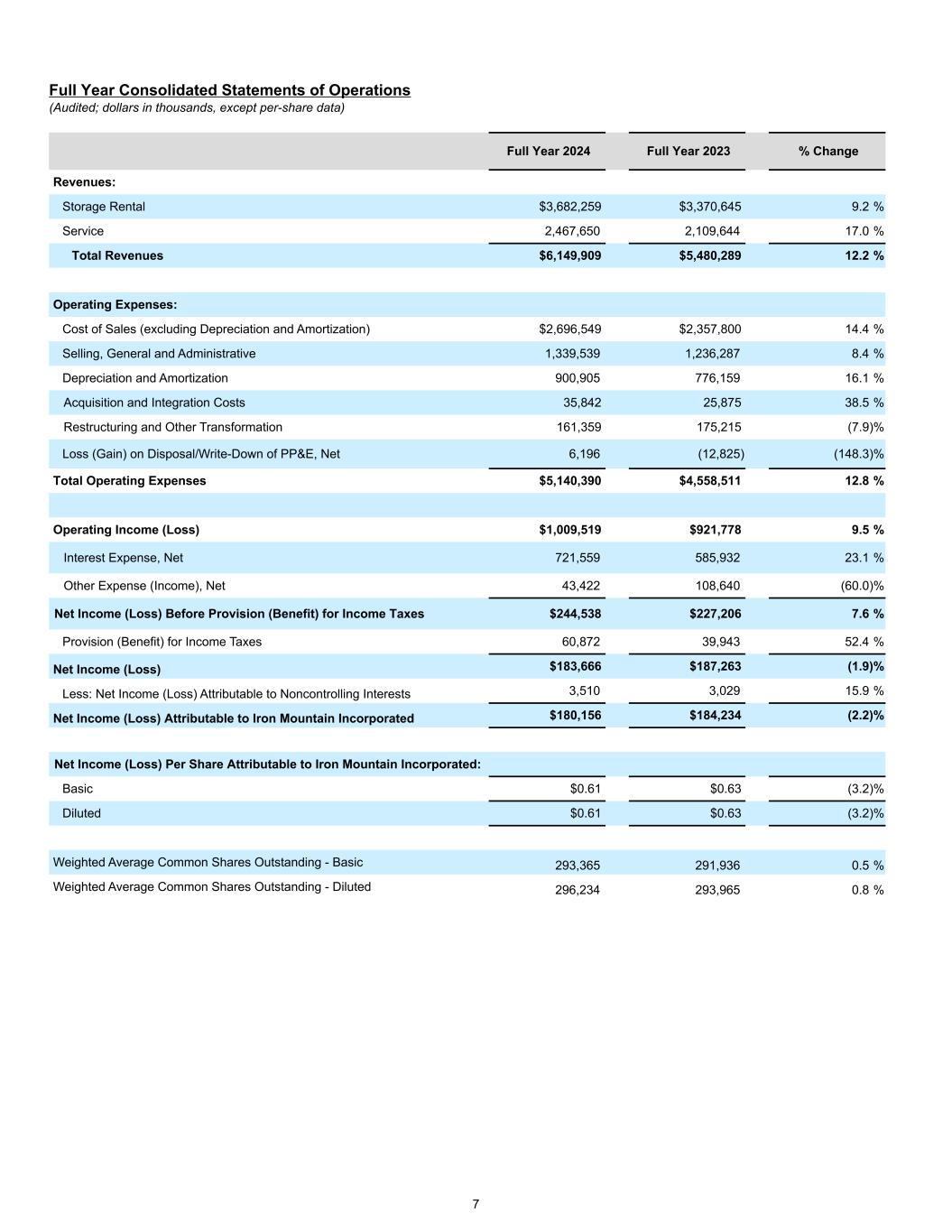

Full Year Consolidated Statements of Operations (Audited; dollars in thousands, except per-share data) Full Year 2024 Full Year 2023 % Change Revenues: Storage Rental $3,682,259 $3,370,645 9.2 % Service 2,467,650 2,109,644 17.0 % Total Revenues $6,149,909 $5,480,289 12.2 % Operating Expenses: Cost of Sales (excluding Depreciation and Amortization) $2,696,549 $2,357,800 14.4 % Selling, General and Administrative 1,339,539 1,236,287 8.4 % Depreciation and Amortization 900,905 776,159 16.1 % Acquisition and Integration Costs 35,842 25,875 38.5 % Restructuring and Other Transformation 161,359 175,215 (7.9) % Loss (Gain) on Disposal/Write-Down of PP&E, Net 6,196 (12,825) (148.3) % Total Operating Expenses $5,140,390 $4,558,511 12.8 % Operating Income (Loss) $1,009,519 $921,778 9.5 % Interest Expense, Net 721,559 585,932 23.1 % Other Expense (Income), Net 43,422 108,640 (60.0) % Net Income (Loss) Before Provision (Benefit) for Income Taxes $244,538 $227,206 7.6 % Provision (Benefit) for Income Taxes 60,872 39,943 52.4 % Net Income (Loss) $183,666 $187,263 (1.9) % Less: Net Income (Loss) Attributable to Noncontrolling Interests 3,510 3,029 15.9 % Net Income (Loss) Attributable to Iron Mountain Incorporated $180,156 $184,234 (2.2) % Net Income (Loss) Per Share Attributable to Iron Mountain Incorporated: Basic $0.61 $0.63 (3.2) % Diluted $0.61 $0.63 (3.2) % Weighted Average Common Shares Outstanding - Basic 293,365 291,936 0.5 % Weighted Average Common Shares Outstanding - Diluted 296,234 293,965 0.8 % 7

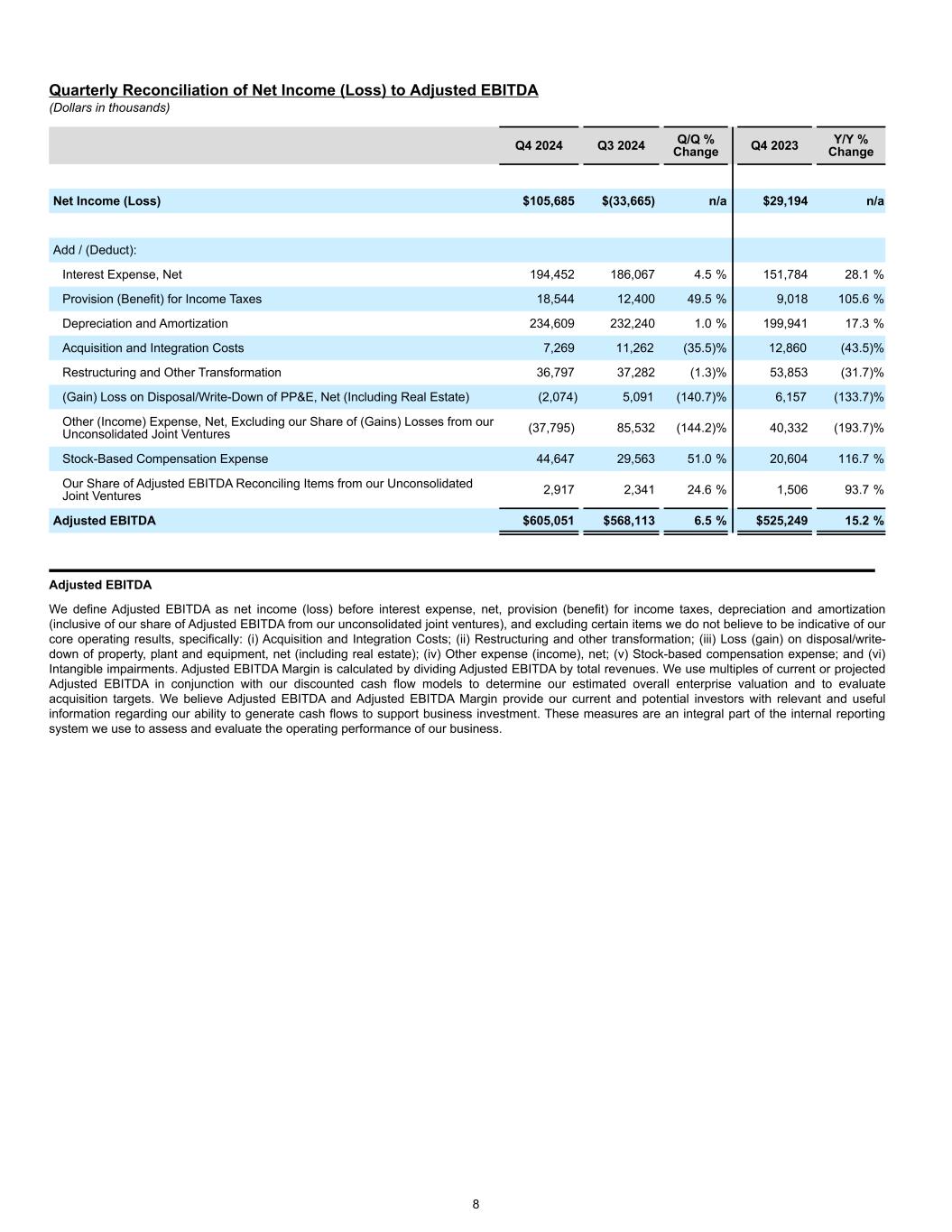

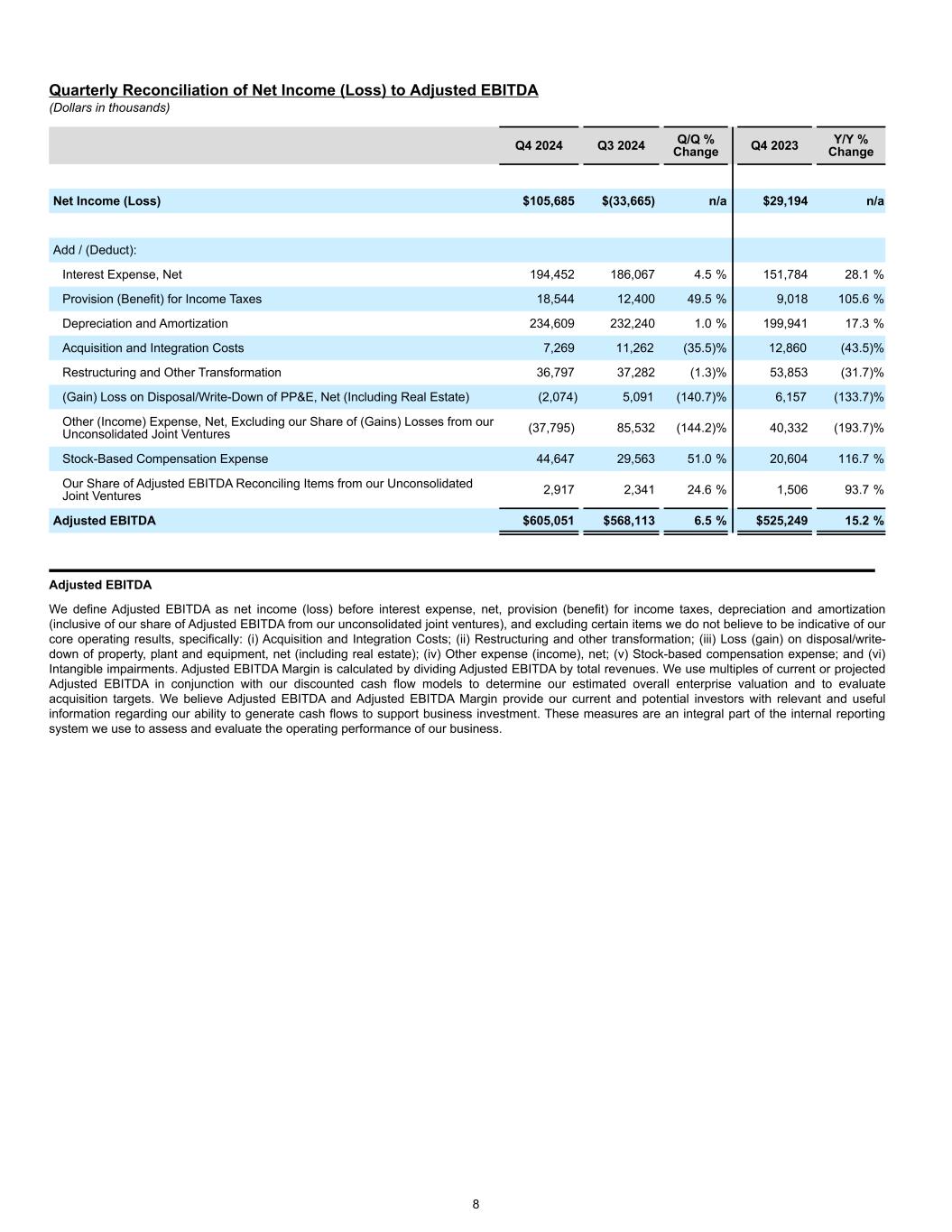

Quarterly Reconciliation of Net Income (Loss) to Adjusted EBITDA (Dollars in thousands) Q4 2024 Q3 2024 Q/Q % Change Q4 2023 Y/Y % Change Net Income (Loss) $105,685 $(33,665) n/a $29,194 n/a Add / (Deduct): Interest Expense, Net 194,452 186,067 4.5 % 151,784 28.1 % Provision (Benefit) for Income Taxes 18,544 12,400 49.5 % 9,018 105.6 % Depreciation and Amortization 234,609 232,240 1.0 % 199,941 17.3 % Acquisition and Integration Costs 7,269 11,262 (35.5) % 12,860 (43.5) % Restructuring and Other Transformation 36,797 37,282 (1.3) % 53,853 (31.7) % (Gain) Loss on Disposal/Write-Down of PP&E, Net (Including Real Estate) (2,074) 5,091 (140.7) % 6,157 (133.7) % Other (Income) Expense, Net, Excluding our Share of (Gains) Losses from our Unconsolidated Joint Ventures (37,795) 85,532 (144.2) % 40,332 (193.7) % Stock-Based Compensation Expense 44,647 29,563 51.0 % 20,604 116.7 % Our Share of Adjusted EBITDA Reconciling Items from our Unconsolidated Joint Ventures 2,917 2,341 24.6 % 1,506 93.7 % Adjusted EBITDA $605,051 $568,113 6.5 % $525,249 15.2 % Adjusted EBITDA We define Adjusted EBITDA as net income (loss) before interest expense, net, provision (benefit) for income taxes, depreciation and amortization (inclusive of our share of Adjusted EBITDA from our unconsolidated joint ventures), and excluding certain items we do not believe to be indicative of our core operating results, specifically: (i) Acquisition and Integration Costs; (ii) Restructuring and other transformation; (iii) Loss (gain) on disposal/write- down of property, plant and equipment, net (including real estate); (iv) Other expense (income), net; (v) Stock-based compensation expense; and (vi) Intangible impairments. Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by total revenues. We use multiples of current or projected Adjusted EBITDA in conjunction with our discounted cash flow models to determine our estimated overall enterprise valuation and to evaluate acquisition targets. We believe Adjusted EBITDA and Adjusted EBITDA Margin provide our current and potential investors with relevant and useful information regarding our ability to generate cash flows to support business investment. These measures are an integral part of the internal reporting system we use to assess and evaluate the operating performance of our business. 8

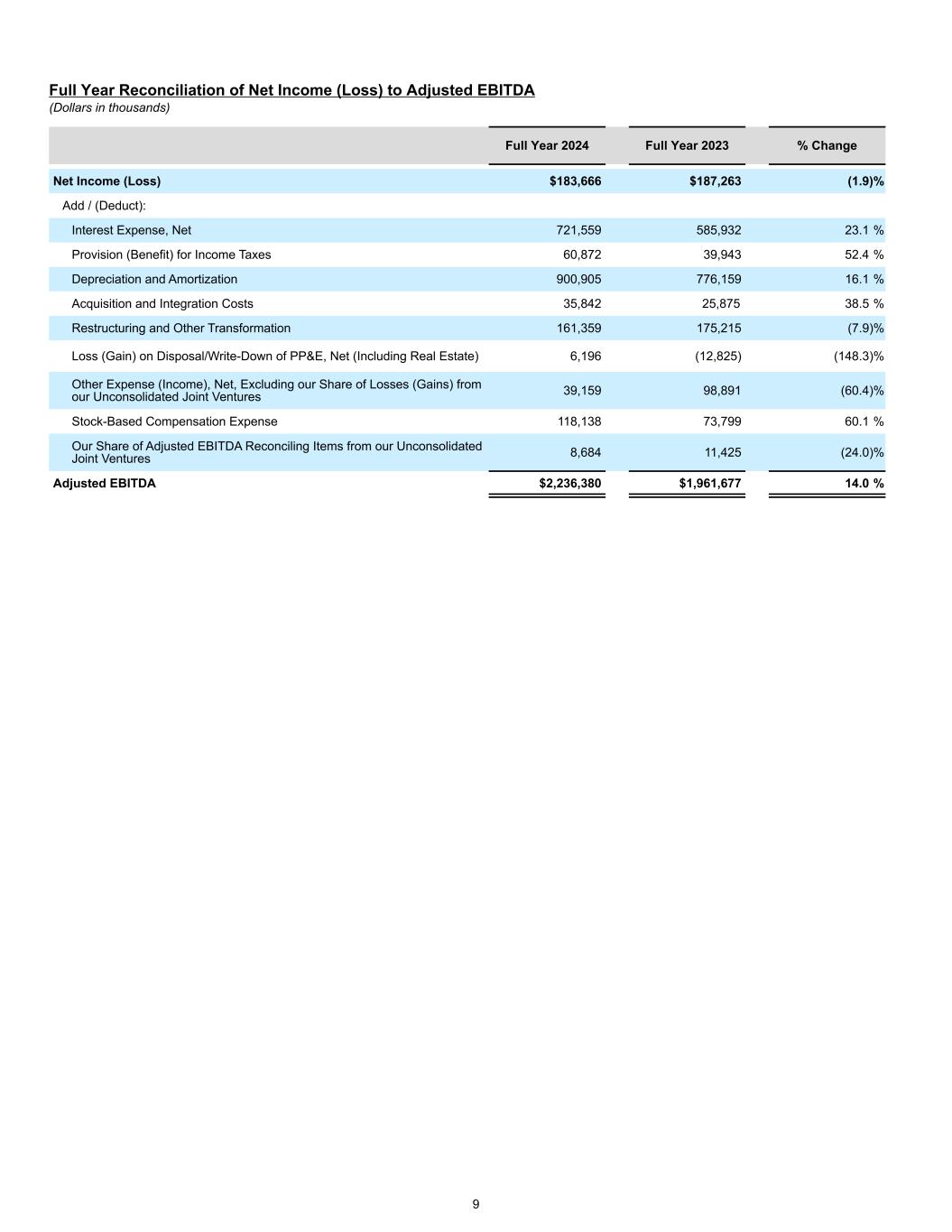

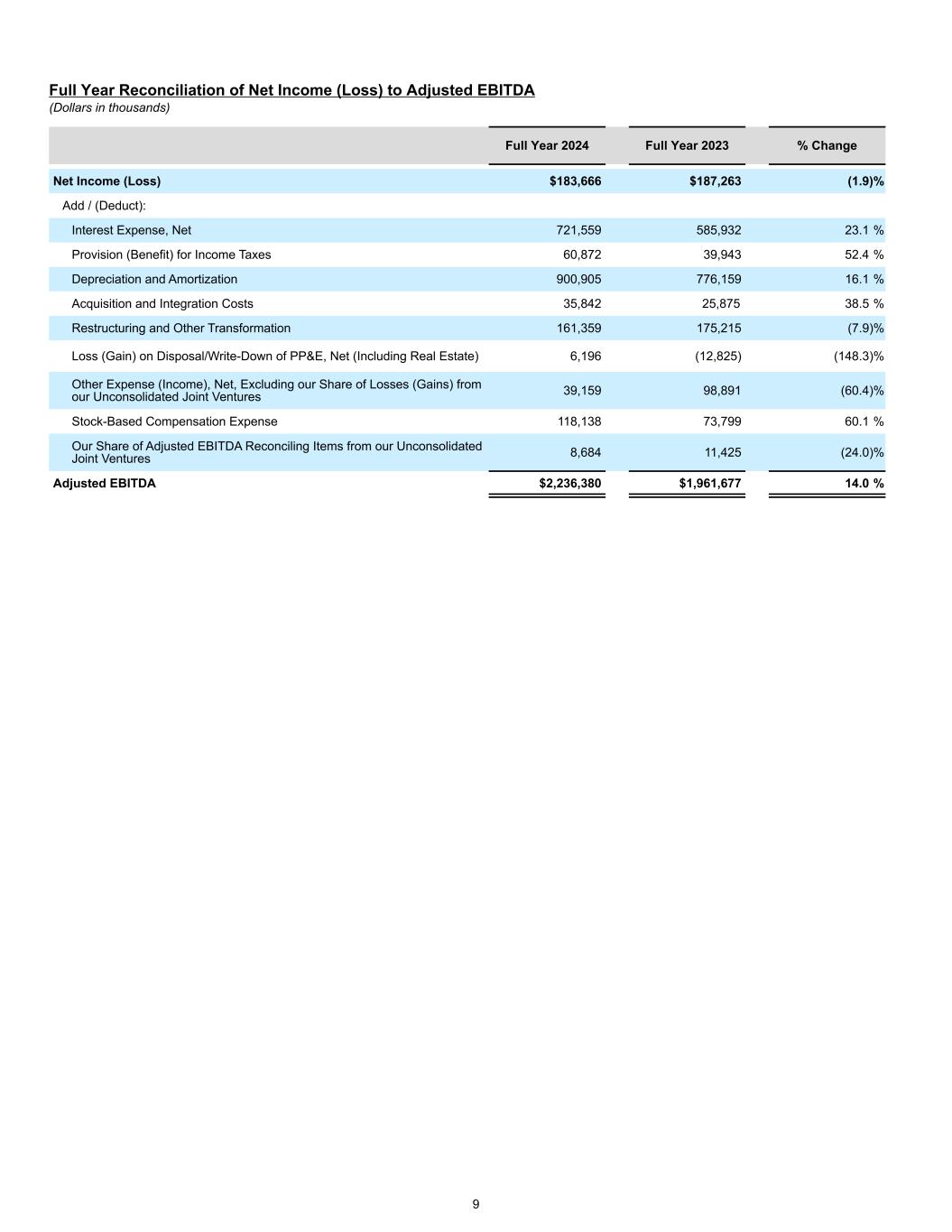

Full Year Reconciliation of Net Income (Loss) to Adjusted EBITDA (Dollars in thousands) Full Year 2024 Full Year 2023 % Change Net Income (Loss) $183,666 $187,263 (1.9) % Add / (Deduct): Interest Expense, Net 721,559 585,932 23.1 % Provision (Benefit) for Income Taxes 60,872 39,943 52.4 % Depreciation and Amortization 900,905 776,159 16.1 % Acquisition and Integration Costs 35,842 25,875 38.5 % Restructuring and Other Transformation 161,359 175,215 (7.9) % Loss (Gain) on Disposal/Write-Down of PP&E, Net (Including Real Estate) 6,196 (12,825) (148.3) % Other Expense (Income), Net, Excluding our Share of Losses (Gains) from our Unconsolidated Joint Ventures 39,159 98,891 (60.4) % Stock-Based Compensation Expense 118,138 73,799 60.1 % Our Share of Adjusted EBITDA Reconciling Items from our Unconsolidated Joint Ventures 8,684 11,425 (24.0) % Adjusted EBITDA $2,236,380 $1,961,677 14.0 % 9

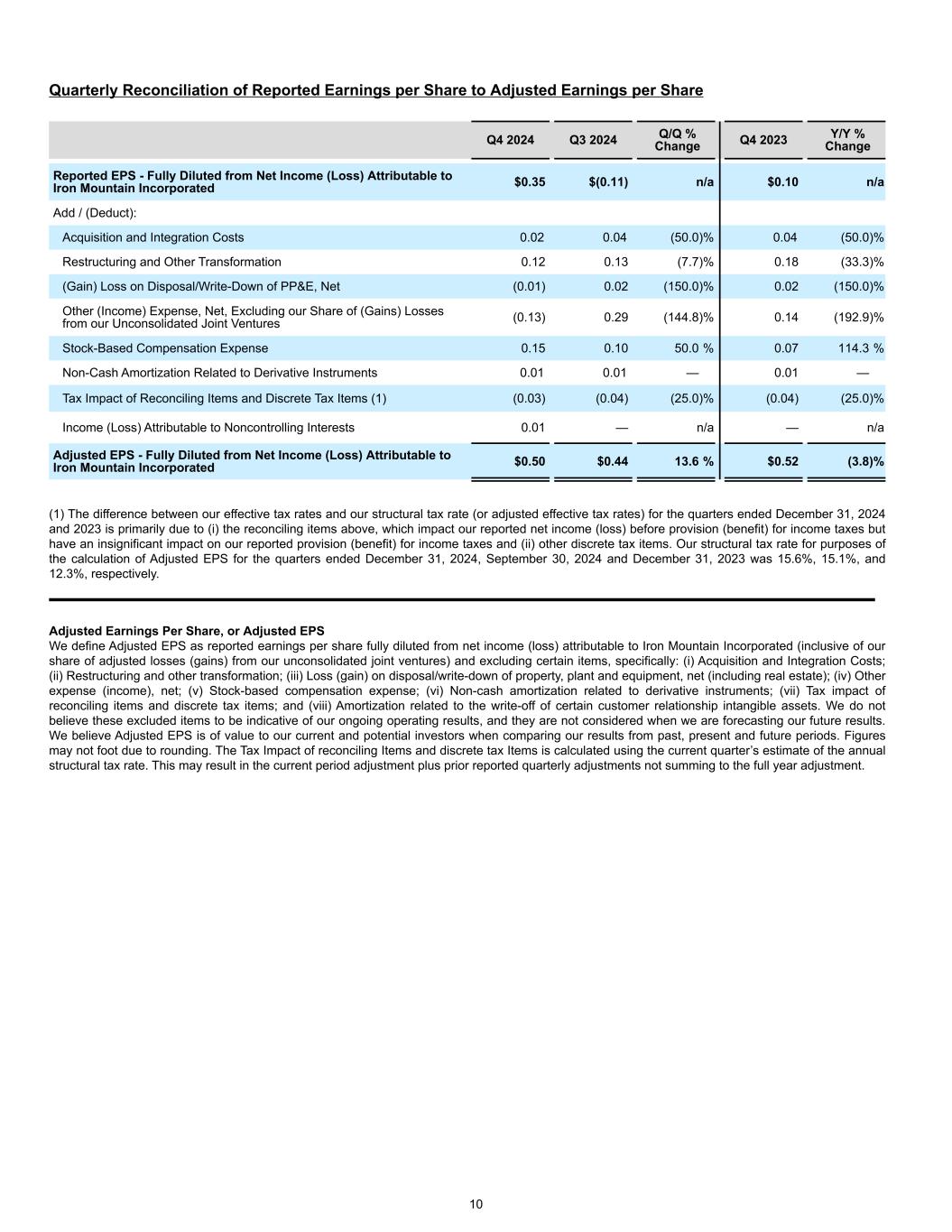

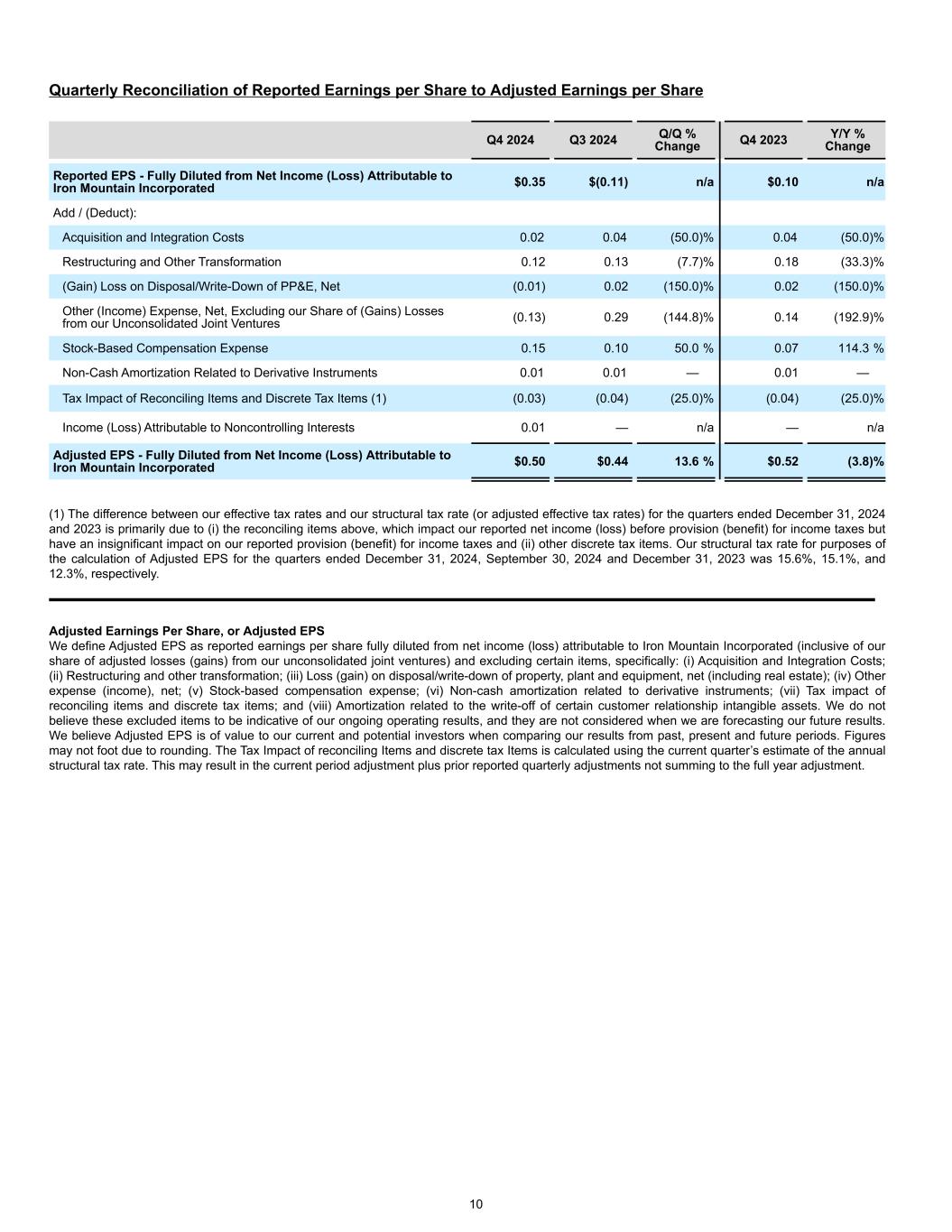

Quarterly Reconciliation of Reported Earnings per Share to Adjusted Earnings per Share Q4 2024 Q3 2024 Q/Q % Change Q4 2023 Y/Y % Change Reported EPS - Fully Diluted from Net Income (Loss) Attributable to Iron Mountain Incorporated $0.35 $(0.11) n/a $0.10 n/a Add / (Deduct): Acquisition and Integration Costs 0.02 0.04 (50.0) % 0.04 (50.0) % Restructuring and Other Transformation 0.12 0.13 (7.7) % 0.18 (33.3) % (Gain) Loss on Disposal/Write-Down of PP&E, Net (0.01) 0.02 (150.0) % 0.02 (150.0) % Other (Income) Expense, Net, Excluding our Share of (Gains) Losses from our Unconsolidated Joint Ventures (0.13) 0.29 (144.8) % 0.14 (192.9) % Stock-Based Compensation Expense 0.15 0.10 50.0 % 0.07 114.3 % Non-Cash Amortization Related to Derivative Instruments 0.01 0.01 — 0.01 — Tax Impact of Reconciling Items and Discrete Tax Items (1) (0.03) (0.04) (25.0) % (0.04) (25.0) % Income (Loss) Attributable to Noncontrolling Interests 0.01 — n/a — n/a Adjusted EPS - Fully Diluted from Net Income (Loss) Attributable to Iron Mountain Incorporated $0.50 $0.44 13.6 % $0.52 (3.8) % (1) The difference between our effective tax rates and our structural tax rate (or adjusted effective tax rates) for the quarters ended December 31, 2024 and 2023 is primarily due to (i) the reconciling items above, which impact our reported net income (loss) before provision (benefit) for income taxes but have an insignificant impact on our reported provision (benefit) for income taxes and (ii) other discrete tax items. Our structural tax rate for purposes of the calculation of Adjusted EPS for the quarters ended December 31, 2024, September 30, 2024 and December 31, 2023 was 15.6%, 15.1%, and 12.3%, respectively. Adjusted Earnings Per Share, or Adjusted EPS We define Adjusted EPS as reported earnings per share fully diluted from net income (loss) attributable to Iron Mountain Incorporated (inclusive of our share of adjusted losses (gains) from our unconsolidated joint ventures) and excluding certain items, specifically: (i) Acquisition and Integration Costs; (ii) Restructuring and other transformation; (iii) Loss (gain) on disposal/write-down of property, plant and equipment, net (including real estate); (iv) Other expense (income), net; (v) Stock-based compensation expense; (vi) Non-cash amortization related to derivative instruments; (vii) Tax impact of reconciling items and discrete tax items; and (viii) Amortization related to the write-off of certain customer relationship intangible assets. We do not believe these excluded items to be indicative of our ongoing operating results, and they are not considered when we are forecasting our future results. We believe Adjusted EPS is of value to our current and potential investors when comparing our results from past, present and future periods. Figures may not foot due to rounding. The Tax Impact of reconciling Items and discrete tax Items is calculated using the current quarter’s estimate of the annual structural tax rate. This may result in the current period adjustment plus prior reported quarterly adjustments not summing to the full year adjustment. 10

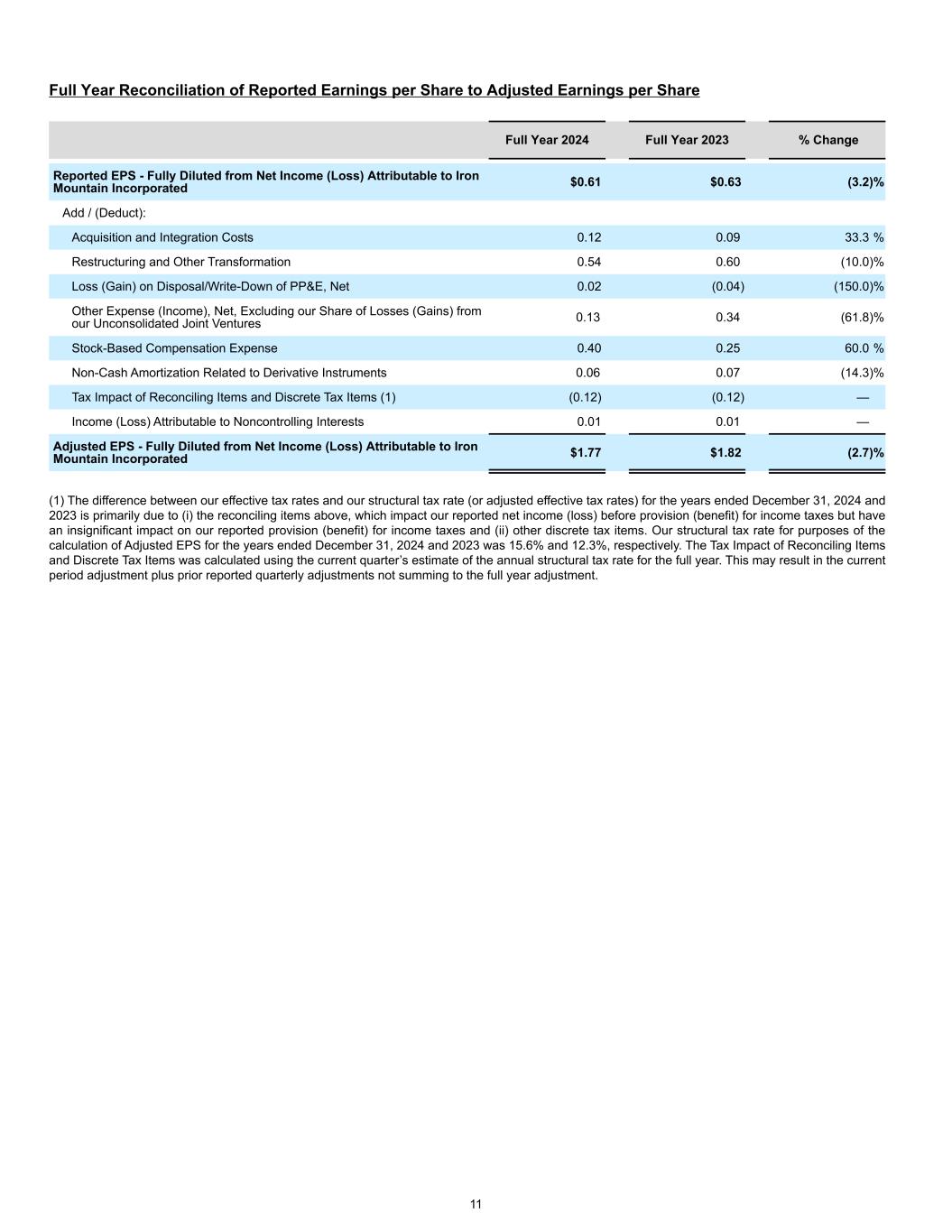

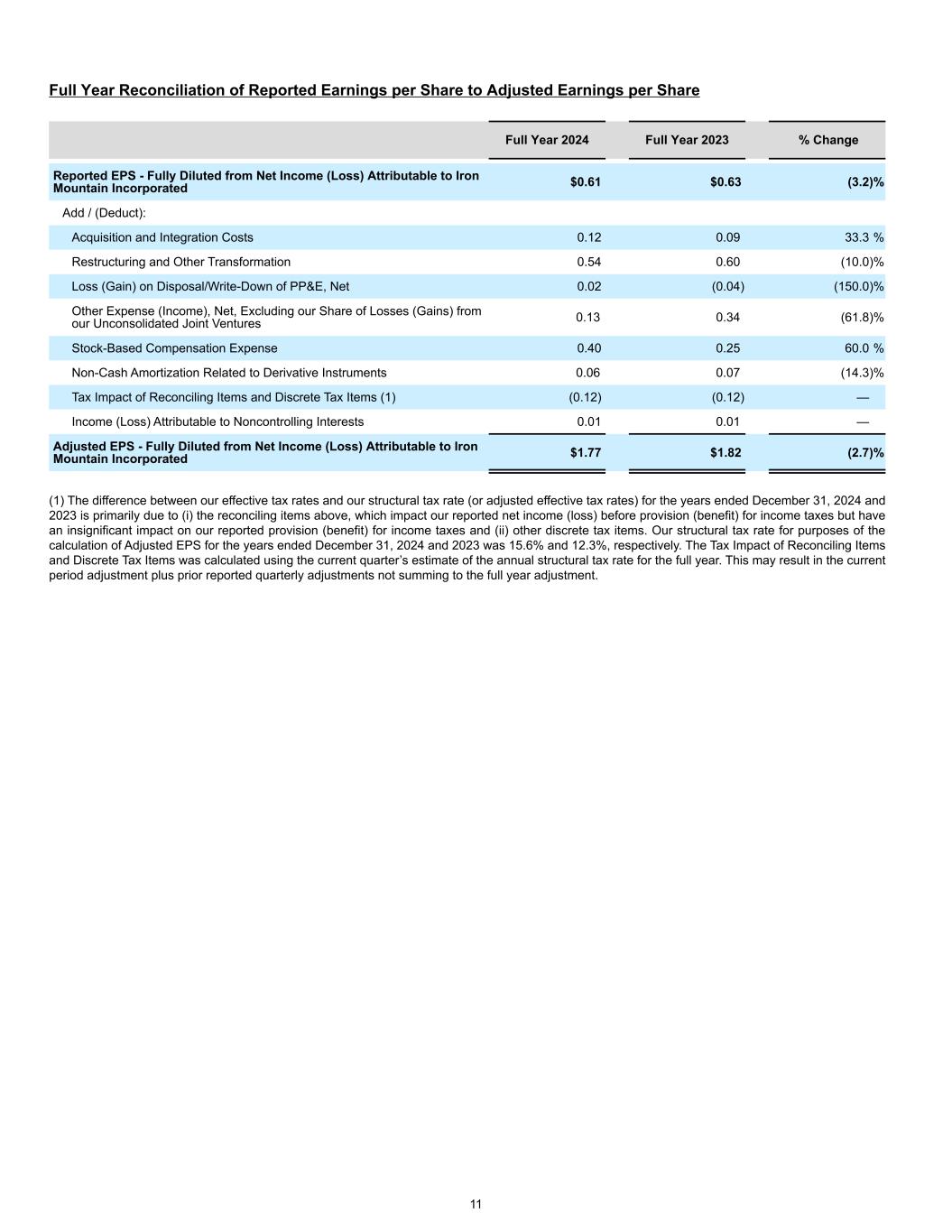

Full Year Reconciliation of Reported Earnings per Share to Adjusted Earnings per Share Full Year 2024 Full Year 2023 % Change Reported EPS - Fully Diluted from Net Income (Loss) Attributable to Iron Mountain Incorporated $0.61 $0.63 (3.2) % Add / (Deduct): Acquisition and Integration Costs 0.12 0.09 33.3 % Restructuring and Other Transformation 0.54 0.60 (10.0) % Loss (Gain) on Disposal/Write-Down of PP&E, Net 0.02 (0.04) (150.0) % Other Expense (Income), Net, Excluding our Share of Losses (Gains) from our Unconsolidated Joint Ventures 0.13 0.34 (61.8) % Stock-Based Compensation Expense 0.40 0.25 60.0 % Non-Cash Amortization Related to Derivative Instruments 0.06 0.07 (14.3) % Tax Impact of Reconciling Items and Discrete Tax Items (1) (0.12) (0.12) — Income (Loss) Attributable to Noncontrolling Interests 0.01 0.01 — Adjusted EPS - Fully Diluted from Net Income (Loss) Attributable to Iron Mountain Incorporated $1.77 $1.82 (2.7) % (1) The difference between our effective tax rates and our structural tax rate (or adjusted effective tax rates) for the years ended December 31, 2024 and 2023 is primarily due to (i) the reconciling items above, which impact our reported net income (loss) before provision (benefit) for income taxes but have an insignificant impact on our reported provision (benefit) for income taxes and (ii) other discrete tax items. Our structural tax rate for purposes of the calculation of Adjusted EPS for the years ended December 31, 2024 and 2023 was 15.6% and 12.3%, respectively. The Tax Impact of Reconciling Items and Discrete Tax Items was calculated using the current quarter’s estimate of the annual structural tax rate for the full year. This may result in the current period adjustment plus prior reported quarterly adjustments not summing to the full year adjustment. 11

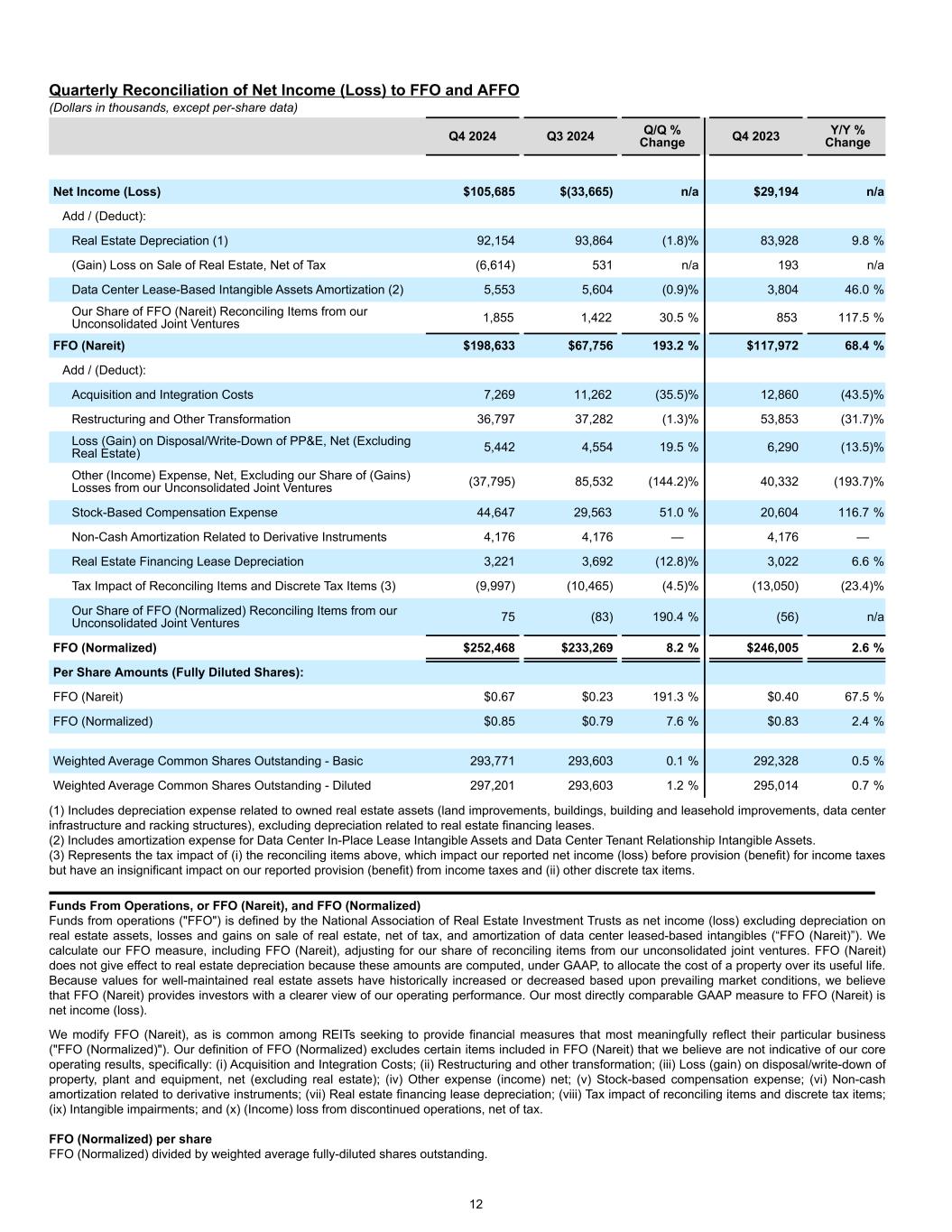

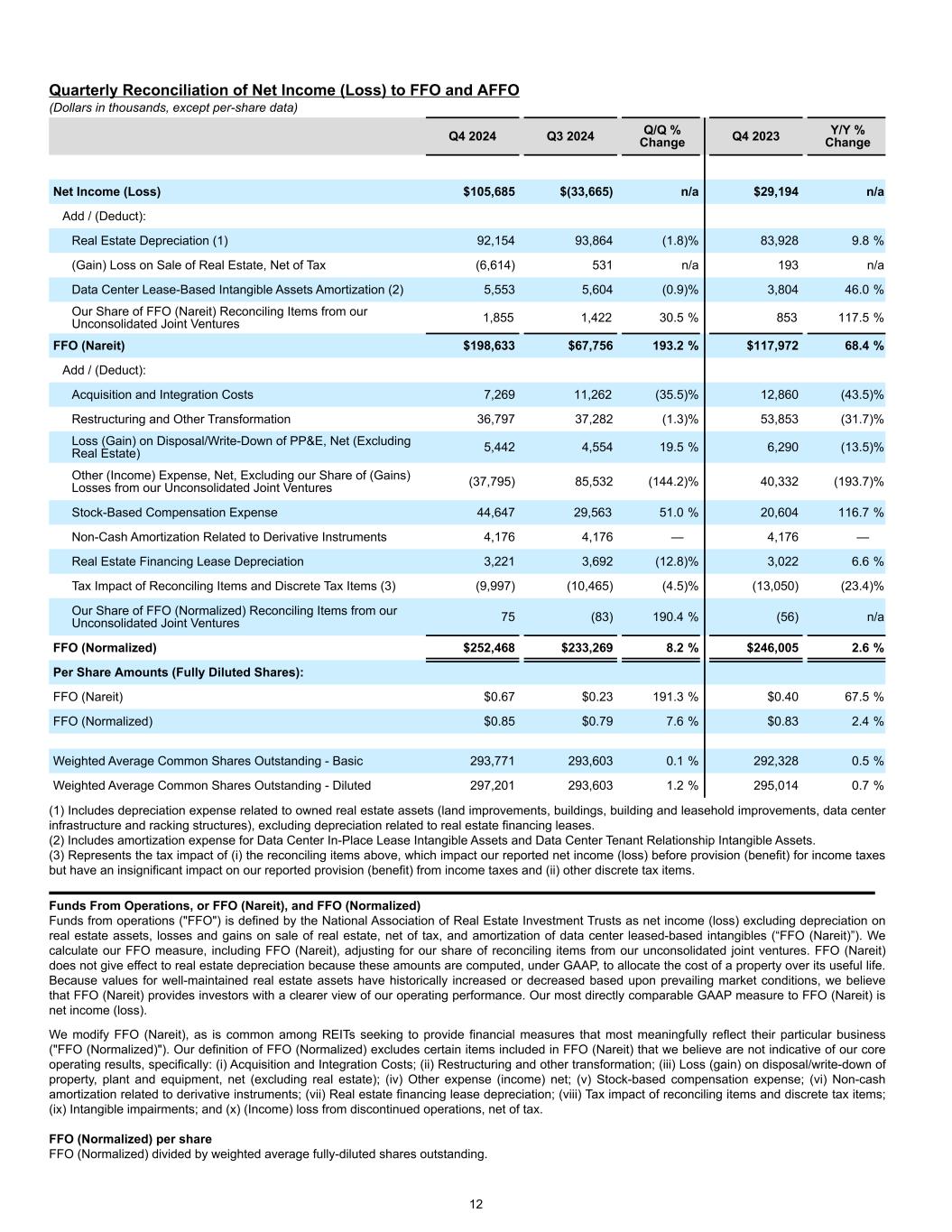

Quarterly Reconciliation of Net Income (Loss) to FFO and AFFO (Dollars in thousands, except per-share data) Q4 2024 Q3 2024 Q/Q % Change Q4 2023 Y/Y % Change Net Income (Loss) $105,685 $(33,665) n/a $29,194 n/a Add / (Deduct): Real Estate Depreciation (1) 92,154 93,864 (1.8) % 83,928 9.8 % (Gain) Loss on Sale of Real Estate, Net of Tax (6,614) 531 n/a 193 n/a Data Center Lease-Based Intangible Assets Amortization (2) 5,553 5,604 (0.9) % 3,804 46.0 % Our Share of FFO (Nareit) Reconciling Items from our Unconsolidated Joint Ventures 1,855 1,422 30.5 % 853 117.5 % FFO (Nareit) $198,633 $67,756 193.2 % $117,972 68.4 % Add / (Deduct): Acquisition and Integration Costs 7,269 11,262 (35.5) % 12,860 (43.5) % Restructuring and Other Transformation 36,797 37,282 (1.3) % 53,853 (31.7) % Loss (Gain) on Disposal/Write-Down of PP&E, Net (Excluding Real Estate) 5,442 4,554 19.5 % 6,290 (13.5) % Other (Income) Expense, Net, Excluding our Share of (Gains) Losses from our Unconsolidated Joint Ventures (37,795) 85,532 (144.2) % 40,332 (193.7) % Stock-Based Compensation Expense 44,647 29,563 51.0 % 20,604 116.7 % Non-Cash Amortization Related to Derivative Instruments 4,176 4,176 — 4,176 — Real Estate Financing Lease Depreciation 3,221 3,692 (12.8) % 3,022 6.6 % Tax Impact of Reconciling Items and Discrete Tax Items (3) (9,997) (10,465) (4.5) % (13,050) (23.4) % Our Share of FFO (Normalized) Reconciling Items from our Unconsolidated Joint Ventures 75 (83) 190.4 % (56) n/a FFO (Normalized) $252,468 $233,269 8.2 % $246,005 2.6 % Per Share Amounts (Fully Diluted Shares): FFO (Nareit) $0.67 $0.23 191.3 % $0.40 67.5 % FFO (Normalized) $0.85 $0.79 7.6 % $0.83 2.4 % Weighted Average Common Shares Outstanding - Basic 293,771 293,603 0.1 % 292,328 0.5 % Weighted Average Common Shares Outstanding - Diluted 297,201 293,603 1.2 % 295,014 0.7 % (1) Includes depreciation expense related to owned real estate assets (land improvements, buildings, building and leasehold improvements, data center infrastructure and racking structures), excluding depreciation related to real estate financing leases. (2) Includes amortization expense for Data Center In-Place Lease Intangible Assets and Data Center Tenant Relationship Intangible Assets. (3) Represents the tax impact of (i) the reconciling items above, which impact our reported net income (loss) before provision (benefit) for income taxes but have an insignificant impact on our reported provision (benefit) from income taxes and (ii) other discrete tax items. Funds From Operations, or FFO (Nareit), and FFO (Normalized) Funds from operations ("FFO") is defined by the National Association of Real Estate Investment Trusts as net income (loss) excluding depreciation on real estate assets, losses and gains on sale of real estate, net of tax, and amortization of data center leased-based intangibles (“FFO (Nareit)”). We calculate our FFO measure, including FFO (Nareit), adjusting for our share of reconciling items from our unconsolidated joint ventures. FFO (Nareit) does not give effect to real estate depreciation because these amounts are computed, under GAAP, to allocate the cost of a property over its useful life. Because values for well-maintained real estate assets have historically increased or decreased based upon prevailing market conditions, we believe that FFO (Nareit) provides investors with a clearer view of our operating performance. Our most directly comparable GAAP measure to FFO (Nareit) is net income (loss). We modify FFO (Nareit), as is common among REITs seeking to provide financial measures that most meaningfully reflect their particular business ("FFO (Normalized)"). Our definition of FFO (Normalized) excludes certain items included in FFO (Nareit) that we believe are not indicative of our core operating results, specifically: (i) Acquisition and Integration Costs; (ii) Restructuring and other transformation; (iii) Loss (gain) on disposal/write-down of property, plant and equipment, net (excluding real estate); (iv) Other expense (income) net; (v) Stock-based compensation expense; (vi) Non-cash amortization related to derivative instruments; (vii) Real estate financing lease depreciation; (viii) Tax impact of reconciling items and discrete tax items; (ix) Intangible impairments; and (x) (Income) loss from discontinued operations, net of tax. FFO (Normalized) per share FFO (Normalized) divided by weighted average fully-diluted shares outstanding. 12

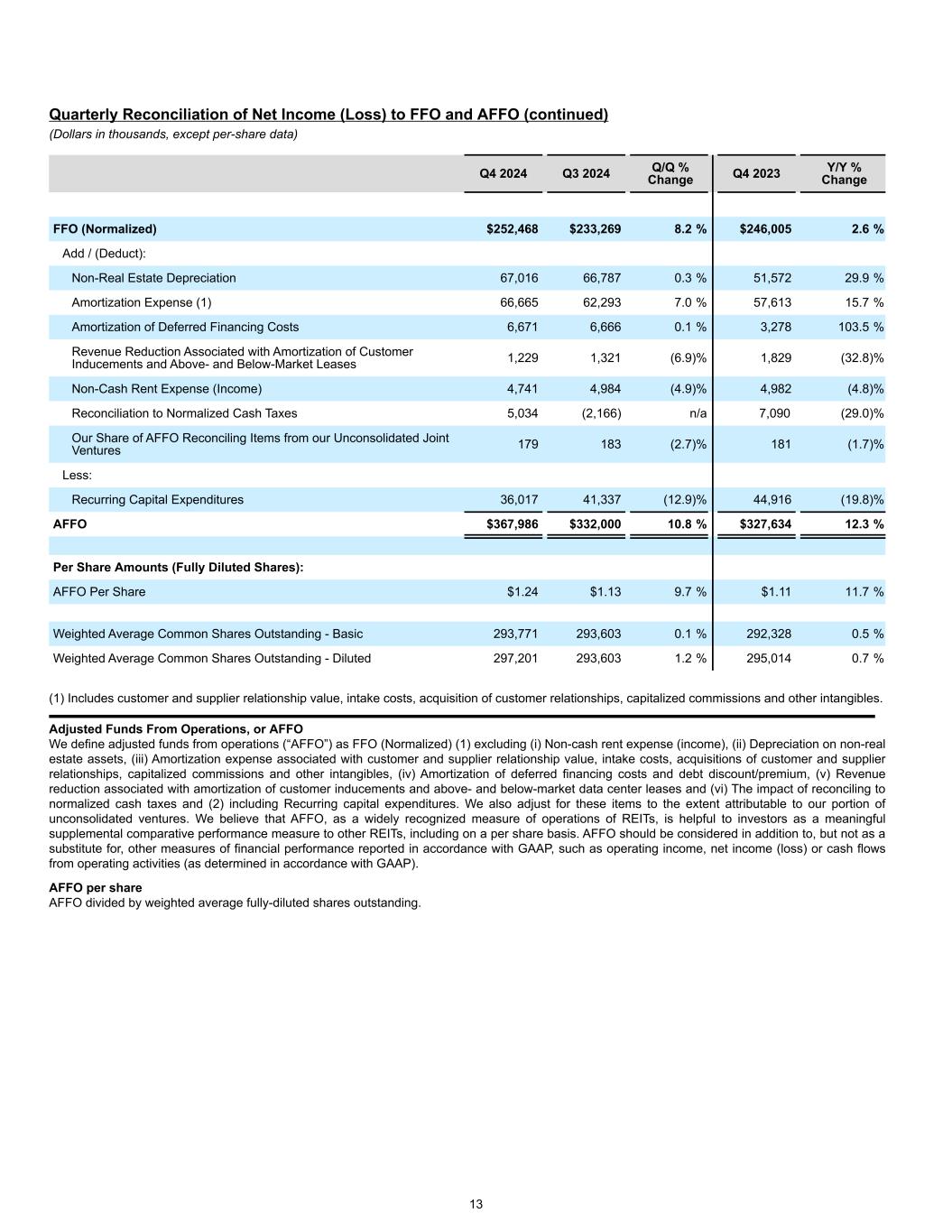

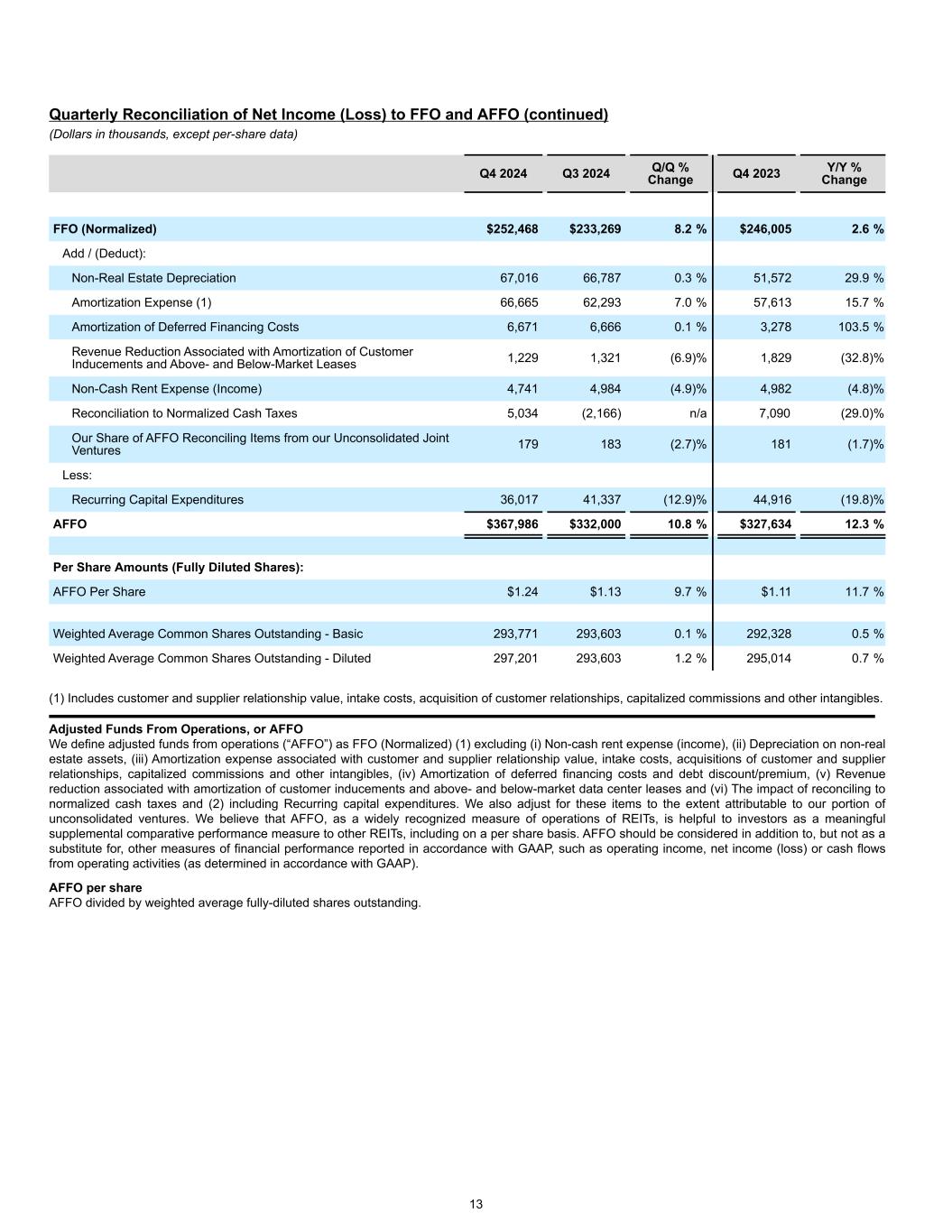

Quarterly Reconciliation of Net Income (Loss) to FFO and AFFO (continued) (Dollars in thousands, except per-share data) Q4 2024 Q3 2024 Q/Q % Change Q4 2023 Y/Y % Change FFO (Normalized) $252,468 $233,269 8.2 % $246,005 2.6 % Add / (Deduct): Non-Real Estate Depreciation 67,016 66,787 0.3 % 51,572 29.9 % Amortization Expense (1) 66,665 62,293 7.0 % 57,613 15.7 % Amortization of Deferred Financing Costs 6,671 6,666 0.1 % 3,278 103.5 % Revenue Reduction Associated with Amortization of Customer Inducements and Above- and Below-Market Leases 1,229 1,321 (6.9) % 1,829 (32.8) % Non-Cash Rent Expense (Income) 4,741 4,984 (4.9) % 4,982 (4.8) % Reconciliation to Normalized Cash Taxes 5,034 (2,166) n/a 7,090 (29.0) % Our Share of AFFO Reconciling Items from our Unconsolidated Joint Ventures 179 183 (2.7) % 181 (1.7) % Less: Recurring Capital Expenditures 36,017 41,337 (12.9) % 44,916 (19.8) % AFFO $367,986 $332,000 10.8 % $327,634 12.3 % Per Share Amounts (Fully Diluted Shares): AFFO Per Share $1.24 $1.13 9.7 % $1.11 11.7 % Weighted Average Common Shares Outstanding - Basic 293,771 293,603 0.1 % 292,328 0.5 % Weighted Average Common Shares Outstanding - Diluted 297,201 293,603 1.2 % 295,014 0.7 % (1) Includes customer and supplier relationship value, intake costs, acquisition of customer relationships, capitalized commissions and other intangibles. Adjusted Funds From Operations, or AFFO We define adjusted funds from operations (“AFFO”) as FFO (Normalized) (1) excluding (i) Non-cash rent expense (income), (ii) Depreciation on non-real estate assets, (iii) Amortization expense associated with customer and supplier relationship value, intake costs, acquisitions of customer and supplier relationships, capitalized commissions and other intangibles, (iv) Amortization of deferred financing costs and debt discount/premium, (v) Revenue reduction associated with amortization of customer inducements and above- and below-market data center leases and (vi) The impact of reconciling to normalized cash taxes and (2) including Recurring capital expenditures. We also adjust for these items to the extent attributable to our portion of unconsolidated ventures. We believe that AFFO, as a widely recognized measure of operations of REITs, is helpful to investors as a meaningful supplemental comparative performance measure to other REITs, including on a per share basis. AFFO should be considered in addition to, but not as a substitute for, other measures of financial performance reported in accordance with GAAP, such as operating income, net income (loss) or cash flows from operating activities (as determined in accordance with GAAP). AFFO per share AFFO divided by weighted average fully-diluted shares outstanding. 13

Full Year Reconciliation of Net Income (Loss) to FFO and AFFO (Dollars in thousands, except per-share data) Full Year 2024 Full Year 2023 % Change Net Income (Loss) $183,666 $187,263 (1.9) % Add / (Deduct): Real Estate Depreciation (1) 367,362 322,045 14.1 % (Gain) Loss on Sale of Real Estate, Net of Tax (6,698) (16,656) (59.8) % Data Center Lease-Based Intangible Assets Amortization (2) 22,304 22,322 (0.1) % Our Share of FFO (Nareit) Reconciling Items from our Unconsolidated Joint Ventures 4,830 2,226 117.0 % FFO (Nareit) $571,464 $517,200 10.5 % Add / (Deduct): Acquisition and Integration Costs 35,842 25,875 38.5 % Restructuring and Other Transformation 161,359 175,215 (7.9) % Loss (Gain) on Disposal/Write-Down of PP&E, Net (Excluding Real Estate) 14,025 4,307 n/a Other Expense (Income), Net, Excluding our Share of Losses (Gains) from our Unconsolidated Joint Ventures 39,159 98,891 (60.4) % Stock-Based Compensation Expense 118,138 73,799 60.1 % Non-Cash Amortization Related to Derivative Instruments 16,705 21,097 (20.8) % Real Estate Financing Lease Depreciation 13,135 12,019 9.3 % Tax Impact of Reconciling Items and Discrete Tax Items (3) (37,248) (35,307) 5.5 % Our Share of FFO (Normalized) Reconciling Items from our Unconsolidated Joint Ventures (17) (374) (95.5) % FFO (Normalized) $932,562 $892,722 4.5 % Per Share Amounts (Fully Diluted Shares): FFO (Nareit) $1.93 $1.76 9.7 % FFO (Normalized) $3.15 $3.04 3.6 % Weighted Average Common Shares Outstanding - Basic 293,365 291,936 0.5 % Weighted Average Common Shares Outstanding - Diluted 296,234 293,965 0.8 % (1) Includes depreciation expense related to owned real estate assets (land improvements, buildings, building and leasehold improvements, data center infrastructure and racking structures), excluding depreciation related to real estate financing leases. (2) Includes amortization expense for Data Center In-Place Lease Intangible Assets and Data Center Tenant Relationship Intangible Assets. (3) Represents the tax impact of (i) the reconciling items above, which impact our reported net income (loss) before provision (benefit) for income taxes but have an insignificant impact on our reported provision (benefit) from income taxes and (ii) other discrete tax items. 14

Full Year Reconciliation of Net Income (Loss) to FFO and AFFO (continued) (Dollars in thousands, except per-share data) Full Year 2024 Full Year 2023 % Change FFO (Normalized) $932,562 $892,722 4.5 % Add / (Deduct): Non-Real Estate Depreciation 248,799 191,785 29.7 % Amortization Expense (1) 249,305 227,987 9.4 % Amortization of Deferred Financing Costs 25,580 16,859 51.7 % Revenue Reduction Associated with Amortization of Customer Inducements and Above- and Below-Market Leases 5,347 7,036 (24.0) % Non-Cash Rent Expense (Income) 19,042 25,140 (24.3) % Reconciliation to Normalized Cash Taxes 6,248 (14,826) (142.1) % Our Share of AFFO Reconciling Items from our Unconsolidated Joint Ventures 724 4,868 (85.1) % Less: Recurring Capital Expenditures 143,067 140,406 1.9 % AFFO $1,344,540 $1,211,165 11.0 % Per Share Amounts (Fully Diluted Shares): AFFO Per Share $4.54 $4.12 10.2 % Weighted Average Common Shares Outstanding - Basic 293,365 291,936 0.5 % Weighted Average Common Shares Outstanding - Diluted 296,234 293,965 0.8 % (1) Includes customer and supplier relationship value, intake costs, acquisition of customer relationships, capitalized commissions and other intangibles. 15