UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811-07943 |

Nuveen Multistate Trust III

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

Mark J. Czarniecki

Nuveen Investments

333 West Wacker Drive

Chicago, Illinois 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917‑7700

Date of fiscal year end: May 31

Date of reporting period: May 31, 2024

| Item 1. | Reports to Stockholders. |

| | |

| |

Annual Shareholder Report

May 31, 2024 |

Nuveen Georgia Municipal Bond Fund

Class A Shares/FGATX

Annual Shareholder Report

This annual shareholder report contains important information about the Class A Shares of the Nuveen Georgia Municipal Bond Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | | Cost of a

$10,000 investment | | Costs paid as a percentage of $10,000 investment |

| Class A Shares | | $84 | | 0.84% |

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Georgia Municipal Bond Fund returned 2.84% for Class A shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund performed in line with the S&P Municipal Bond Georgia Index, which returned 2.98%. • Top contributors to relative performance » Duration positioning, primarily an overweight to bonds with durations of 12 years and longer, which outperformed as the yield curve flattened. » Overweight to the public power sector, which outperformed, and underweight to the multi-family housing sector, which underperformed. » Credit ratings allocation, especially an overweight to A rated bonds, which benefited from narrowing credit spreads, and an underweight to AAA rated bonds, which lagged. • Top detractors from relative performance » Sector allocation, particularly an underweight to the industrial development revenue (IDR) sector, which outperformed, and overweights to the ports and life care sectors, which underperformed. » Overweight to 10‑ to 12‑year duration bonds, which underperformed as the yield curve flattened. » Underweight to non‑rated bonds, which outperformed as credit spreads narrowed. | | Performance Attribution  12+ year duration bonds  Public power and multi-family housing sectors  Credit ratings allocation  IDR, ports and life care sectors  10‑ to 12‑year duration bonds  Non‑rated bonds |

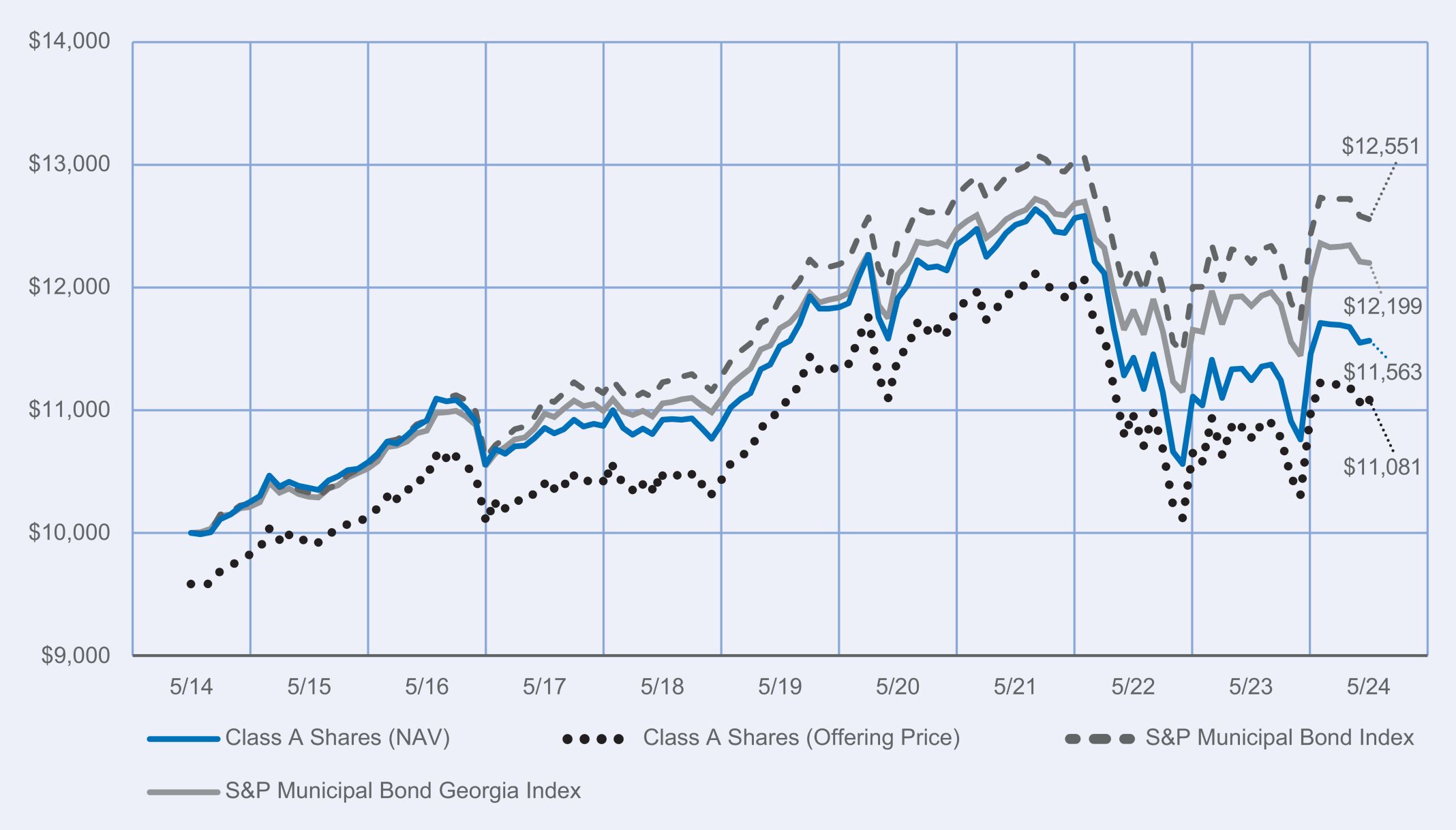

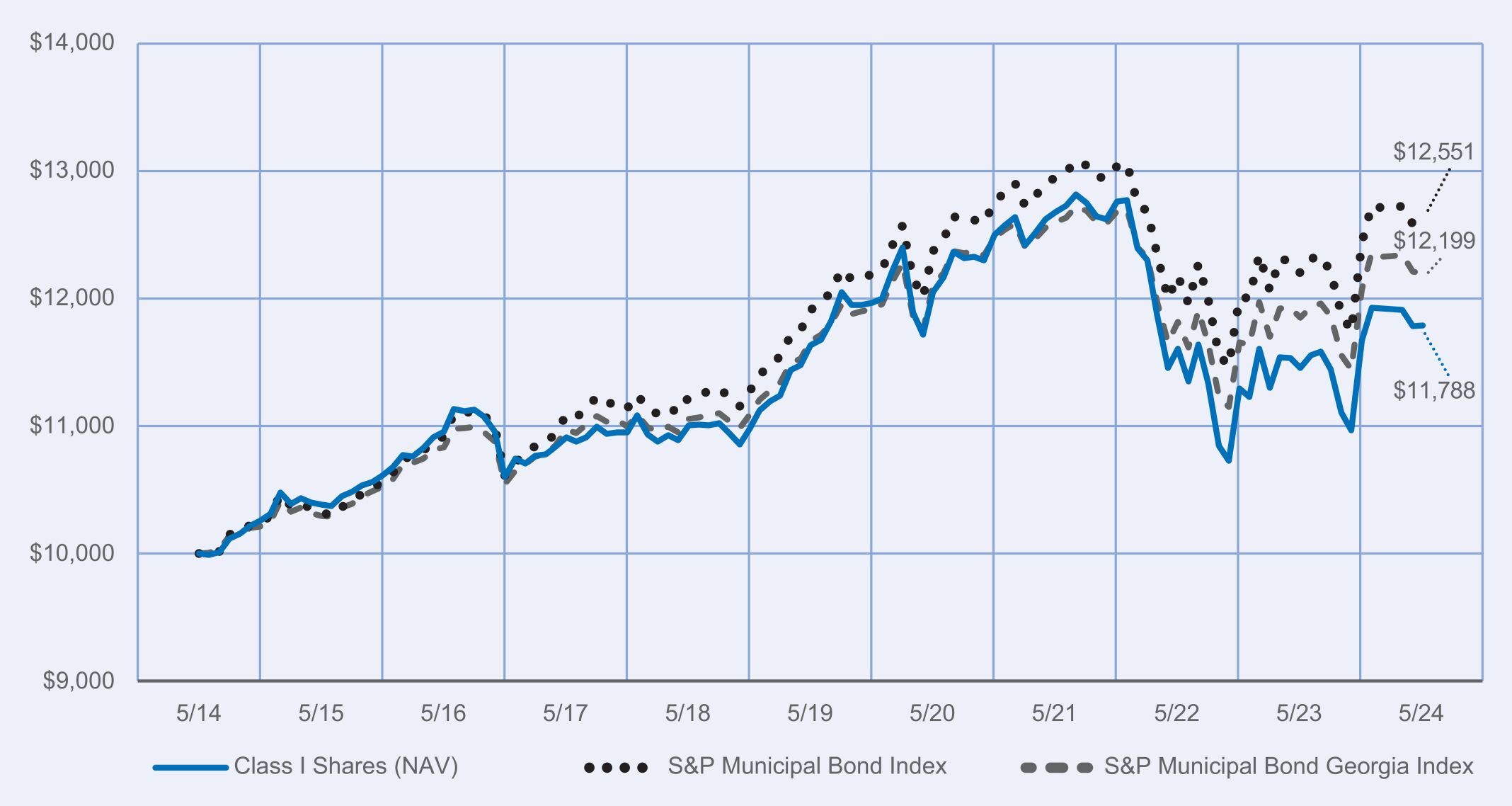

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| Class A Shares at NAV (excluding maximum sales charge) | | | 2.84 | % | | | 0.08 | % | | | 1.46 | % |

| Class A Shares at maximum sales charge (Offering Price) | | | (1.45 | )% | | | (0.77 | )% | | | 1.03 | % |

| S&P Municipal Bond Index | | | 2.88 | % | | | 1.06 | % | | | 2.30 | % |

| S&P Municipal Bond Georgia Index | | | 2.98 | % | | | 0.90 | % | | | 2.01 | % |

| Lipper Other States Municipal Debt Funds Classification Average | | | 2.59 | % | | | 0.29 | % | | | 1.56 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 178,096,651 | |

| Total number of portfolio holdings | | | 92 | |

| Portfolio turnover (%) | | | 13% | |

| Total advisory fees paid for the year | | $ | 921,884 | |

What did the Fund invest in? (as of May 31, 2024)

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

How has the Fund changed?

| | • | | Portfolio manager update: Effective October 13, 2023, Joel Levy and Timothy Ryan, CFA were added as portfolio managers of the Fund. | |

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67065P501_AR_0524 3668589-INV-Y-07/25 (A, C, I) | |  |

| | |

| |

Annual Shareholder Report

May 31, 2024 |

Nuveen Georgia Municipal Bond Fund

Class I Shares/FGARX

Annual Shareholder Report

This annual shareholder report contains important information about the Class I Shares of the Nuveen Georgia Municipal Bond Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of $10,000 investment |

| Class I Shares | | $64 | | 0.64% |

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Georgia Municipal Bond Fund returned 2.93% for Class I shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund performed in line with the S&P Municipal Bond Georgia Index, which returned 2.98%. • Top contributors to relative performance » Duration positioning, primarily an overweight to bonds with durations of 12 years and longer, which outperformed as the yield curve flattened. » Overweight to the public power sector, which outperformed, and underweight to the multi-family housing sector, which underperformed. » Credit ratings allocation, especially an overweight to A rated bonds, which benefited from narrowing credit spreads, and an underweight to AAA rated bonds, which lagged. • Top detractors from relative performance » Sector allocation, particularly an underweight to the industrial development revenue (IDR) sector, which outperformed, and overweights to the ports and life care sectors, which underperformed. » Overweight to 10‑ to 12‑year duration bonds, which underperformed as the yield curve flattened. » Underweight to non‑rated bonds, which outperformed as credit spreads narrowed. | | Performance Attribution  12+ year duration bonds  Public power and multi-family housing sectors  Credit ratings allocation  IDR, ports and life care sectors  10‑ to 12‑year duration bonds  Non‑rated bonds |

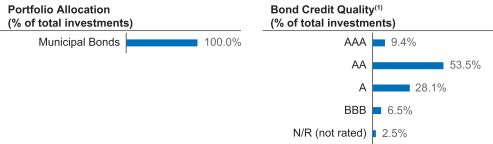

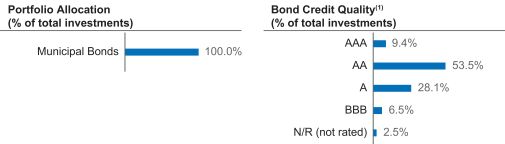

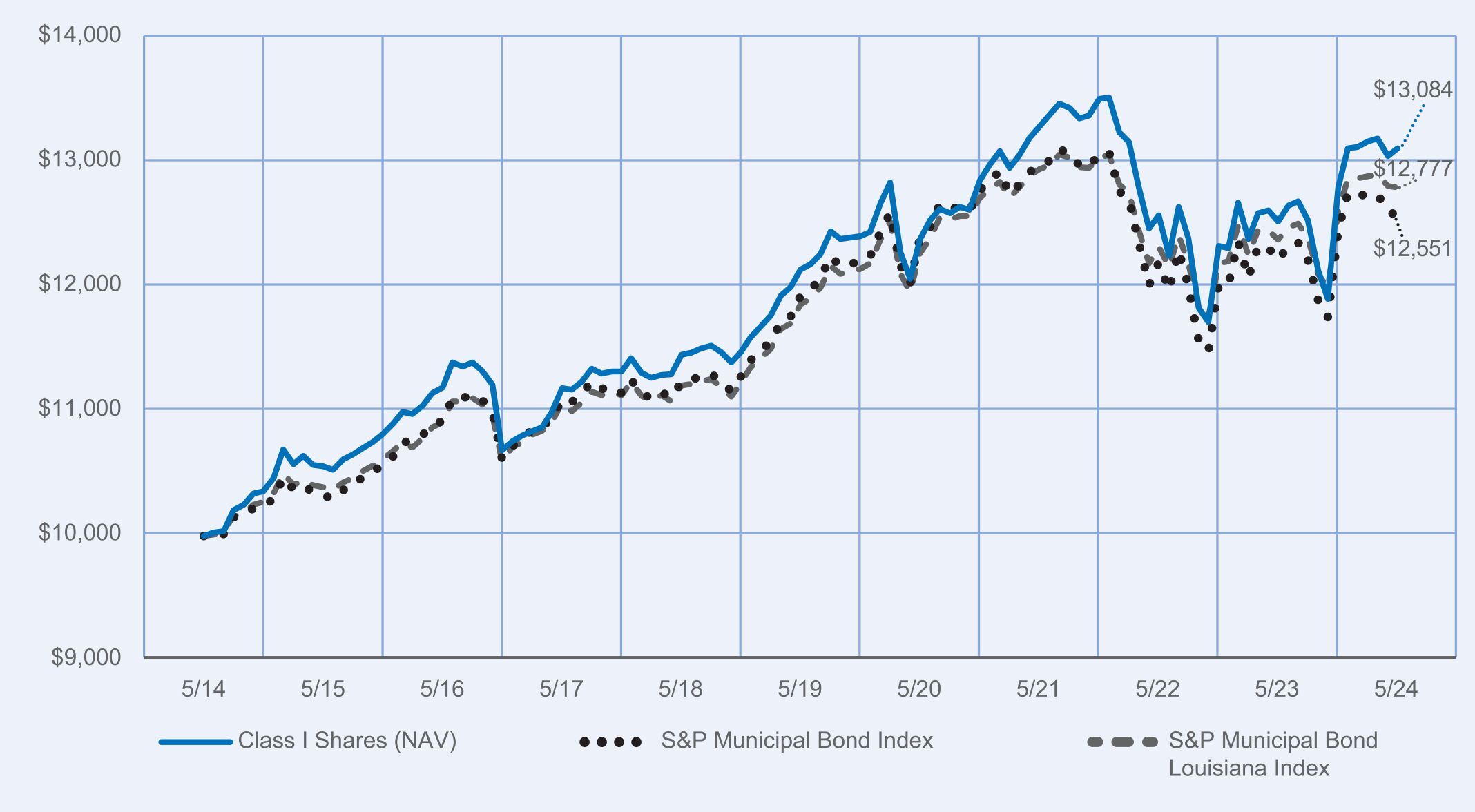

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| Class I at NAV | | | 2.93 | % | | | 0.27 | % | | | 1.66 | % |

| S&P Municipal Bond Index | | | 2.88 | % | | | 1.06 | % | | | 2.30 | % |

| S&P Municipal Bond Georgia Index | | | 2.98 | % | | | 0.90 | % | | | 2.01 | % |

| Lipper Other States Municipal Debt Funds Classification Average | | | 2.59 | % | | | 0.29 | % | | | 1.56 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 178,096,651 | |

| Total number of portfolio holdings | | | 92 | |

| Portfolio turnover (%) | | | 13% | |

| Total advisory fees paid for the year | | $ | 921,884 | |

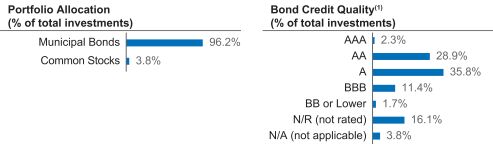

What did the Fund invest in? (as of May 31, 2024)

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

How has the Fund changed?

| | • | | Portfolio manager update: Effective October 13, 2023, Joel Levy and Timothy Ryan, CFA were added as portfolio managers of the Fund. | |

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

May 31, 2024

| | |

67065P808_AR_0524 3668589-INV-Y-07/25 (A, C, I) | |  |

| | |

| |

Annual Shareholder Report

May 31, 2024 |

Nuveen Georgia Municipal Bond Fund

Class C Shares/FGCCX

Annual Shareholder Report

This annual shareholder report contains important information about the Class C Shares of the Nuveen Georgia Municipal Bond Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | | Cost of a

$10,000 investment | | Costs paid as a percentage of

$10,000 investment |

| Class C Shares | | $164 | | 1.64% |

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Georgia Municipal Bond Fund returned 2.00% for Class C shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund underperformed the S&P Municipal Bond Georgia Index, which returned 2.98%. • Top detractors from relative performance » Sector allocation, particularly an underweight to the industrial development revenue (IDR) sector, which outperformed, and overweights to the ports and life care sectors, which underperformed. » Overweight to 10‑ to 12‑year duration bonds, which underperformed as the yield curve flattened. » Underweight to non‑rated bonds, which outperformed as credit spreads narrowed. • Top contributors to relative performance » Duration positioning, primarily an overweight to bonds with durations of 12 years and longer, which outperformed as the yield curve flattened. » Overweight to the public power sector, which outperformed, and underweight to the multi-family housing sector, which underperformed. » Credit ratings allocation, especially an overweight to A rated bonds, which benefited from narrowing credit spreads, and an underweight to AAA rated bonds, which lagged. | | Performance Attribution  IDR, ports and life care sectors  10‑ to 12‑year duration bonds  Non‑rated bonds  12+ year duration bonds  Public power and multi-family housing sectors  Credit ratings allocation |

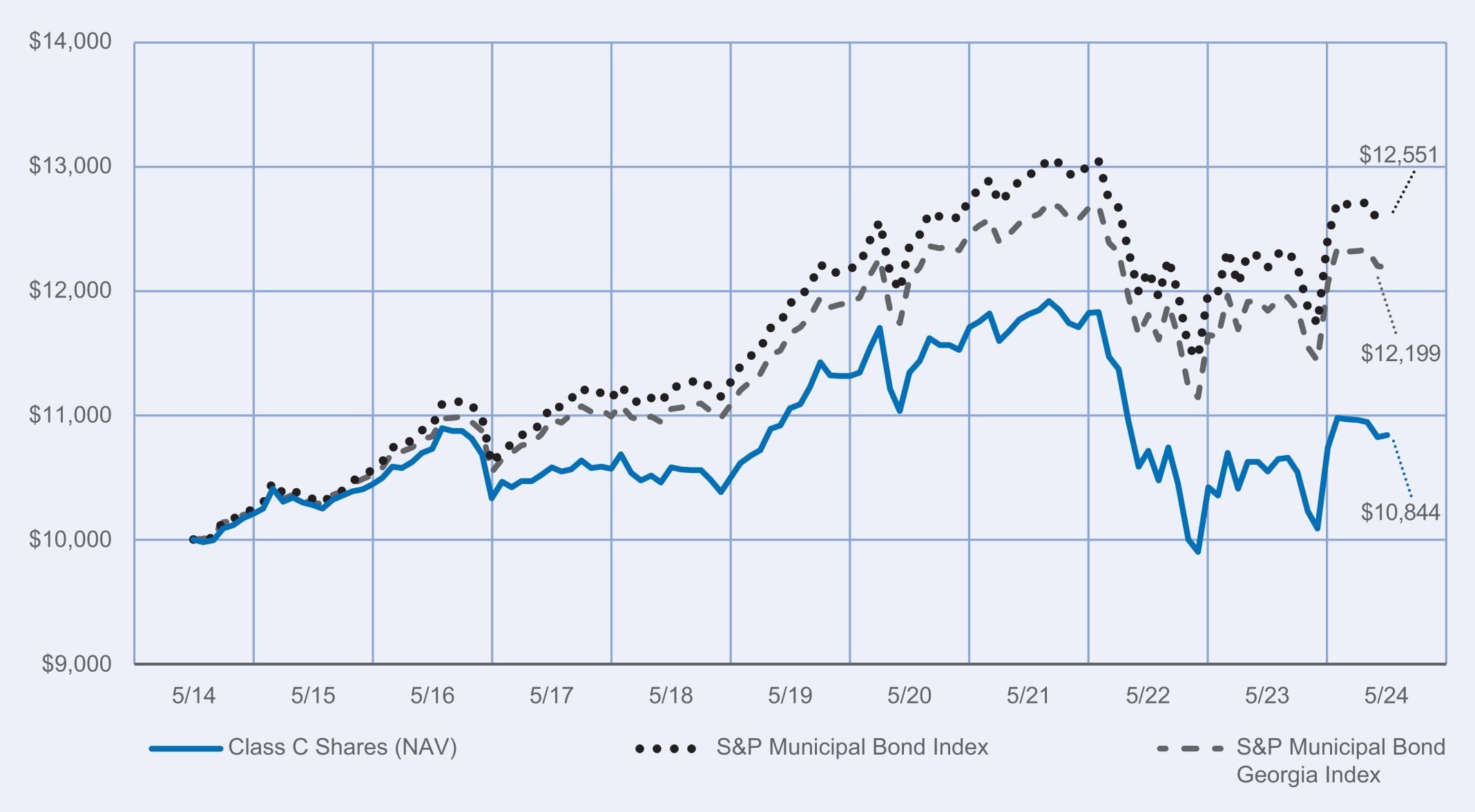

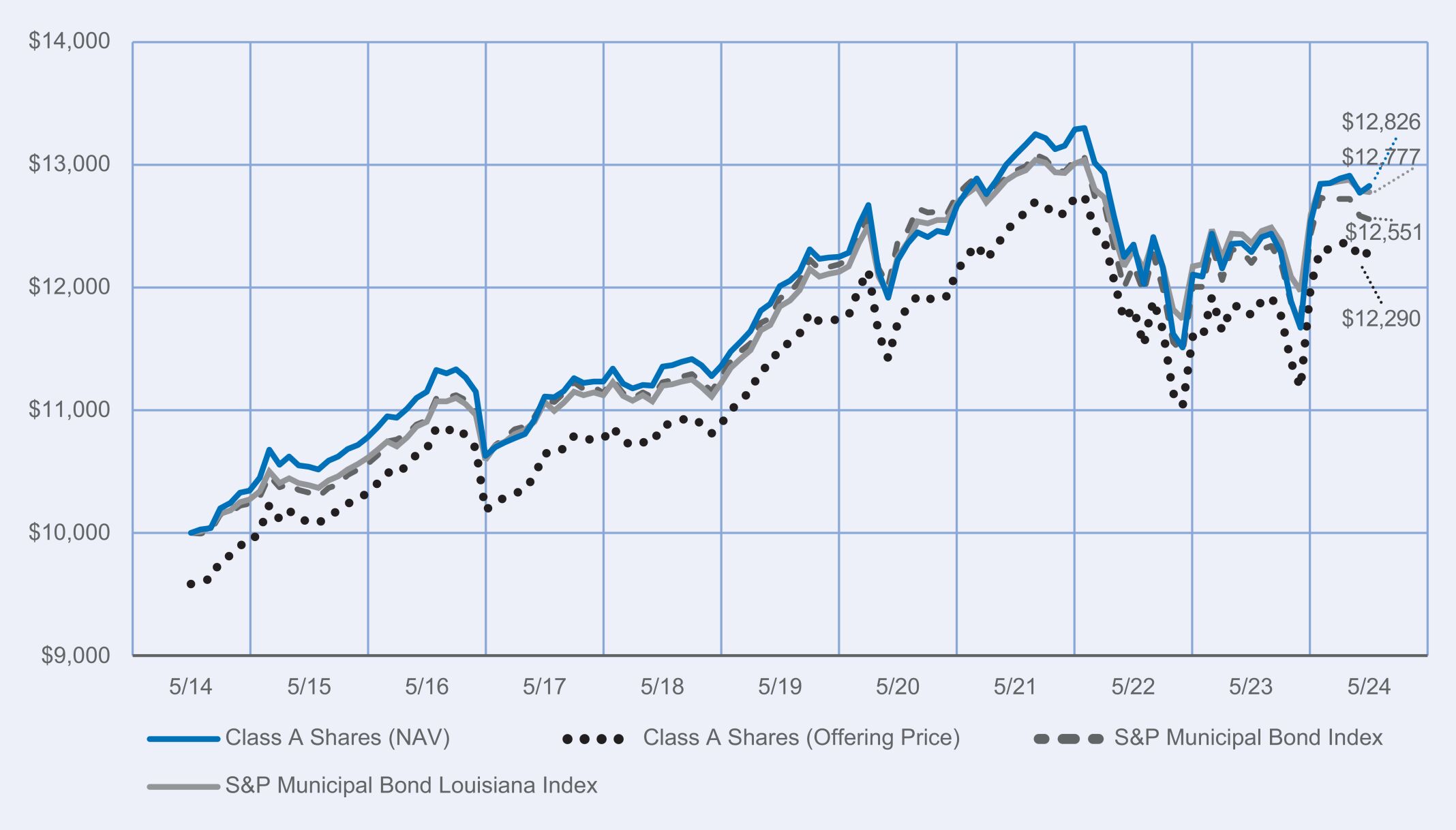

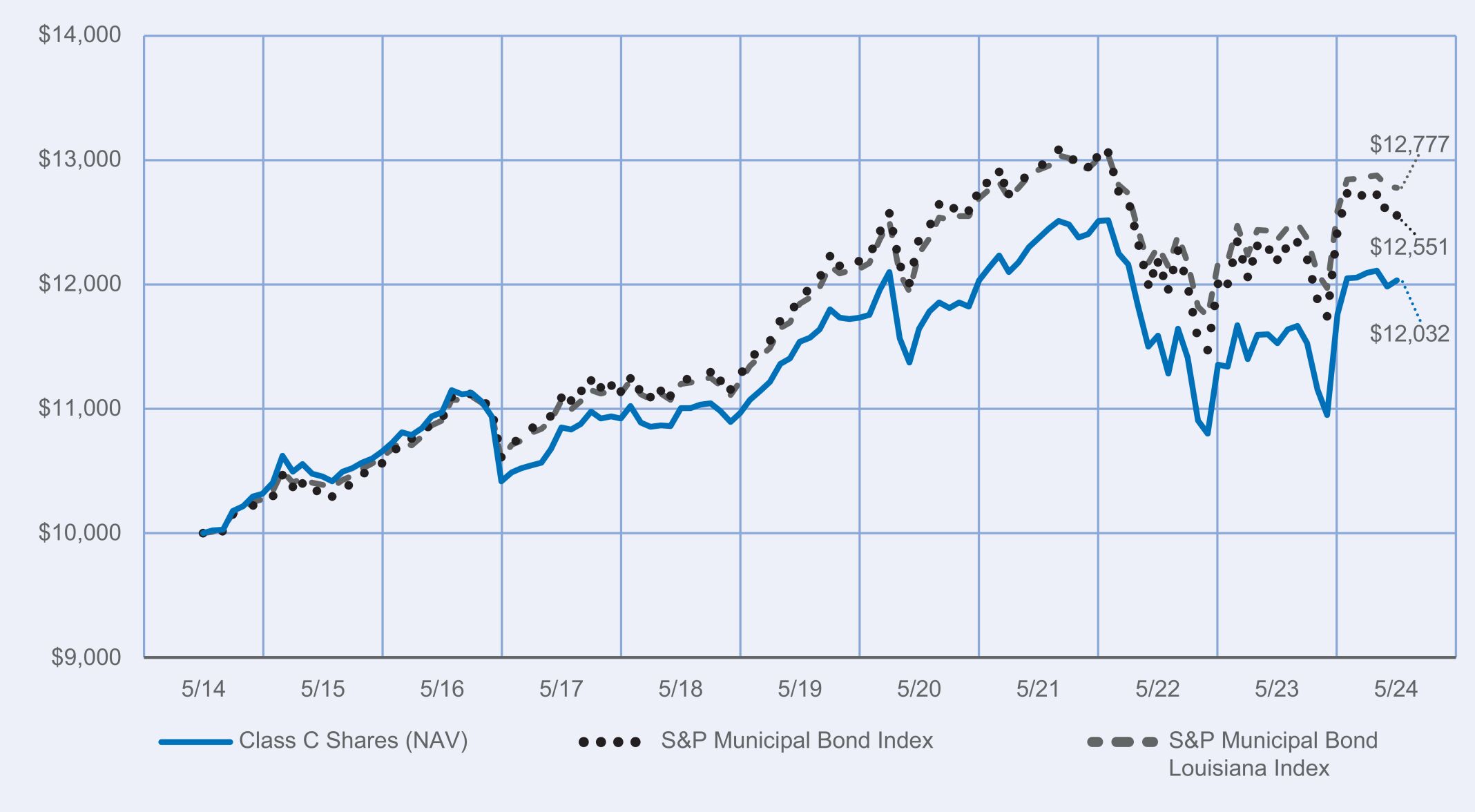

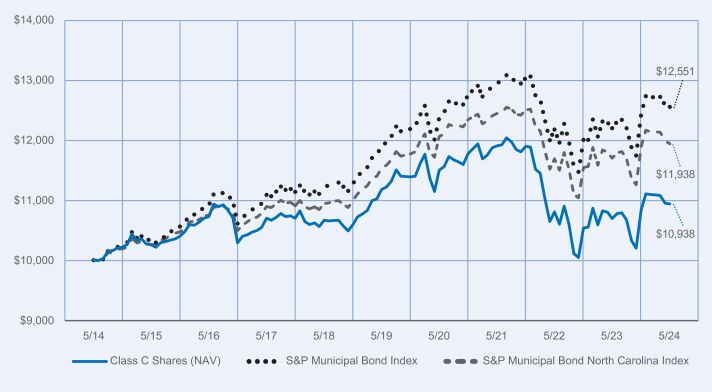

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| Class C Shares at NAV (excluding maximum sales charge) | | | 2.00 | % | | | (0.72 | )% | | | 0.81 | % |

| S&P Municipal Bond Index | | | 2.88 | % | | | 1.06 | % | | | 2.30 | % |

| S&P Municipal Bond Georgia Index | | | 2.98 | % | | | 0.90 | % | | | 2.01 | % |

| Lipper Other States Municipal Debt Funds Classification Average | | | 2.59 | % | | | 0.29 | % | | | 1.56 | % |

Class C Shares are subject to a contingent deferred sales charge if redeemed within 12 months of purchase, which will be reflected in total returns presented for less than one year.

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 178,096,651 | |

| Total number of portfolio holdings | | | 92 | |

| Portfolio turnover (%) | | | 13% | |

| Total advisory fees paid for the year | | $ | 921,884 | |

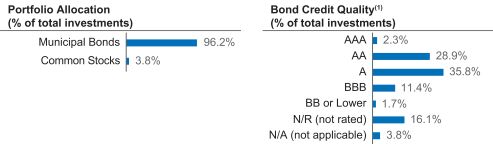

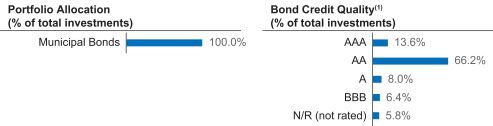

What did the Fund invest in? (as of May 31, 2024)

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

How has the Fund changed?

| | • | | Portfolio manager update: Effective October 13, 2023, Joel Levy and Timothy Ryan, CFA were added as portfolio managers of the Fund. | |

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

May 31, 2024

| | |

67065P717_AR_0524 3668589-INV-Y-07/25 (A, C, I) | |  |

| | |

| |

Annual Shareholder Report

May 31, 2024 |

Nuveen Louisiana Municipal Bond Fund

Class A Shares/FTLAX

Annual Shareholder Report

This annual shareholder report contains important information about the Class A Shares of the Nuveen Louisiana Municipal Bond Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of $10,000 investment |

| Class A Shares | | $80 | | 0.80% |

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Louisiana Municipal Bond Fund returned 4.41% for Class A shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund outperformed the S&P Municipal Bond Louisiana Index, which returned 3.38%. • Top contributors to relative performance » Yield curve positioning, particularly an allocation to longer-maturity bonds, which outperformed. » Credit ratings allocation, specifically an overweight to bonds rated BBB and below, which benefited from contracting spreads. » Sector allocation, primarily driven by an overweight to the industrial development revenue (IDR) sector. • Top detractors from relative performance » Overweight to the hospital sector, which underperformed. » Overweight to the tobacco sector, which underperformed. | | Performance Attribution  Yield curve positioning  Credit ratings allocation  Sector allocation  Hospital sector  Tobacco sector |

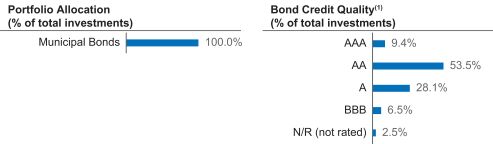

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| Class A Shares at NAV (excluding maximum sales charge) | | | 4.41 | % | | | 1.32 | % | | | 2.52 | % |

| Class A Shares at maximum sales charge (Offering Price) | | | (0.01 | )% | | | 0.45 | % | | | 2.08 | % |

| S&P Municipal Bond Index | | | 2.88 | % | | | 1.06 | % | | | 2.30 | % |

| S&P Municipal Bond Louisiana Index | | | 3.38 | % | | | 1.53 | % | | | 2.48 | % |

| Lipper Other States Municipal Debt Funds Classification Average | | | 2.59 | % | | | 0.29 | % | | | 1.56 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 213,713,461 | |

| Total number of portfolio holdings | | | 162 | |

| Portfolio turnover (%) | | | 15% | |

| Total advisory fees paid for the year | | $ | 1,074,719 | |

What did the Fund invest in? (as of May 31, 2024)

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

How has the Fund changed?

| | • | | Portfolio manager update: Effective October 13, 2023, Paul Brennan, CFA was added as a portfolio manager of the Fund. | |

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67065P881_AR_0524 3668607-INV-Y-07/25 (A, C, I) | |  |

| | |

| |

Annual Shareholder Report

May 31, 2024 |

Nuveen Louisiana Municipal Bond Fund

Class I Shares/FTLRX

Annual Shareholder Report

This annual shareholder report contains important information about the Class I Shares of the Nuveen Louisiana Municipal Bond Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | | Cost of a

$10,000 investment | | Costs paid as a percentage of $10,000 investment |

| Class I Shares | | $60 | | 0.60% |

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Louisiana Municipal Bond Fund returned 4.64% for Class I shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund outperformed the S&P Municipal Bond Louisiana Index, which returned 3.38%. • Top contributors to relative performance » Yield curve positioning, particularly an allocation to longer-maturity bonds, which outperformed. » Credit ratings allocation, specifically an overweight to bonds rated BBB and below, which benefited from contracting spreads. » Sector allocation, primarily driven by an overweight to the industrial development revenue (IDR) sector. • Top detractors from relative performance » Overweight to the hospital sector, which underperformed. » Overweight to the tobacco sector, which underperformed. | | Performance Attribution  Yield curve positioning  Credit ratings allocation  Sector allocation  Hospital sector  Tobacco sector |

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| Class I Shares at NAV | | | 4.64 | % | | | 1.54 | % | | | 2.72 | % |

| S&P Municipal Bond Index | | | 2.88 | % | | | 1.06 | % | | | 2.30 | % |

| S&P Municipal Bond Louisiana Index | | | 3.38 | % | | | 1.53 | % | | | 2.48 | % |

| Lipper Other States Municipal Debt Funds Classification Average | | | 2.59 | % | | | 0.29 | % | | | 1.56 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 213,713,461 | |

| Total number of portfolio holdings | | | 162 | |

| Portfolio turnover (%) | | | 15% | |

| Total advisory fees paid for the year | | $ | 1,074,719 | |

What did the Fund invest in? (as of May 31, 2024)

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

How has the Fund changed?

| | • | | Portfolio manager update: Effective October 13, 2023, Paul Brennan, CFA was added as a portfolio manager of the Fund. | |

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67065P857_AR_0524 3668607-INV-Y-07/25 (A, C, I) | |  |

| | |

| |

Annual Shareholder Report

May 31, 2024 |

Nuveen Louisiana Municipal Bond Fund

Class C Shares/FAFLX

Annual Shareholder Report

This annual shareholder report contains important information about the Class C Shares of the Nuveen Louisiana Municipal Bond Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of $10,000 investment |

| Class C Shares | | $160 | | 1.60% |

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen Louisiana Municipal Bond Fund returned 3.61% for Class C shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund performed in line with the S&P Municipal Bond Louisiana Index, which returned 3.38%. • Top contributors to relative performance » Yield curve positioning, particularly an allocation to longer-maturity bonds, which outperformed. » Credit ratings allocation, specifically an overweight to bonds rated BBB and below, which benefited from contracting spreads. » Sector allocation, primarily driven by an overweight to the industrial development revenue (IDR) sector. • Top detractors from relative performance » Overweight to the hospital sector, which underperformed. » Overweight to the tobacco sector, which underperformed. | | Performance Attribution  Yield curve positioning  Credit ratings allocation  Sector allocation  Hospital sector  Tobacco sector |

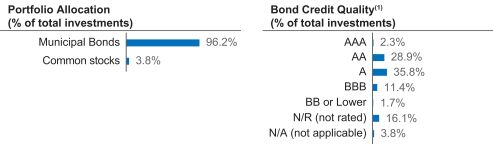

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| Class C Shares at NAV (excluding maximum sales charge) | | | 3.61 | % | | | 0.52 | % | | | 1.87 | % |

| S&P Municipal Bond Index | | | 2.88 | % | | | 1.06 | % | | | 2.30 | % |

| S&P Municipal Bond Louisiana Index | | | 3.38 | % | | | 1.53 | % | | | 2.48 | % |

| Lipper Other States Municipal Debt Funds Classification Average | | | 2.59 | % | | | 0.29 | % | | | 1.56 | % |

Class C Shares are subject to a contingent deferred sales charge if redeemed within 12 months of purchase, which will be reflected in total returns presented for less than one year.

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 213,713,461 | |

| Total number of portfolio holdings | | | 162 | |

| Portfolio turnover (%) | | | 15% | |

| Total advisory fees paid for the year | | $ | 1,074,719 | |

What did the Fund invest in? (as of May 31, 2024)

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

How has the Fund changed?

| | • | | Portfolio manager update: Effective October 13, 2023, Paul Brennan, CFA was added as a portfolio manager of the Fund. | |

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en-us/mutual-funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67065P691_AR_0524 3668607-INV-Y-07/25 (A, C, I) | |  |

| | |

| |

Annual Shareholder Report

May 31, 2024 |

Nuveen North Carolina Municipal Bond Fund

Class A Shares/FLNCX

Annual Shareholder Report

This annual shareholder report contains important information about the Class A Shares of the Nuveen North Carolina Municipal Bond Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of $10,000 investment |

| Class A Shares | | $78 | | 0.78% |

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen North Carolina Municipal Bond Fund returned 2.32% for Class A shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund outperformed the S&P Municipal Bond North Carolina Index, which returned 2.03%. • Top contributors to relative performance » Sector allocation, particularly an overweight to toll roads, which outperformed, and exposures to hospitals, dedicated tax and multi-family housing bonds. » Duration positioning, especially an overweight to longer-duration bonds, which benefited from the yield curve flattening. » Credit ratings allocation, driven by an overweight to A rated and non‑rated bonds, which outperformed as spreads narrowed, and an underweight to AAA rated bonds, which underperformed. • Top detractors from relative performance » Allocation to shorter-maturity bonds along with an overweight to intermediate-maturity bonds. » Underweight allocation to the life care sector, which outperformed, and overweight allocations to higher education and appropriation-backed bonds, which underperformed. » An overweight allocation to BBB rated bonds. | | Performance Attribution  Toll road, hospital, dedicated tax and multi-family housing sectors  Longer-duration bonds  Credit ratings allocation  Short- and intermediate-maturity bonds  Life care, higher education and appropriation sectors  BBB rated bonds |

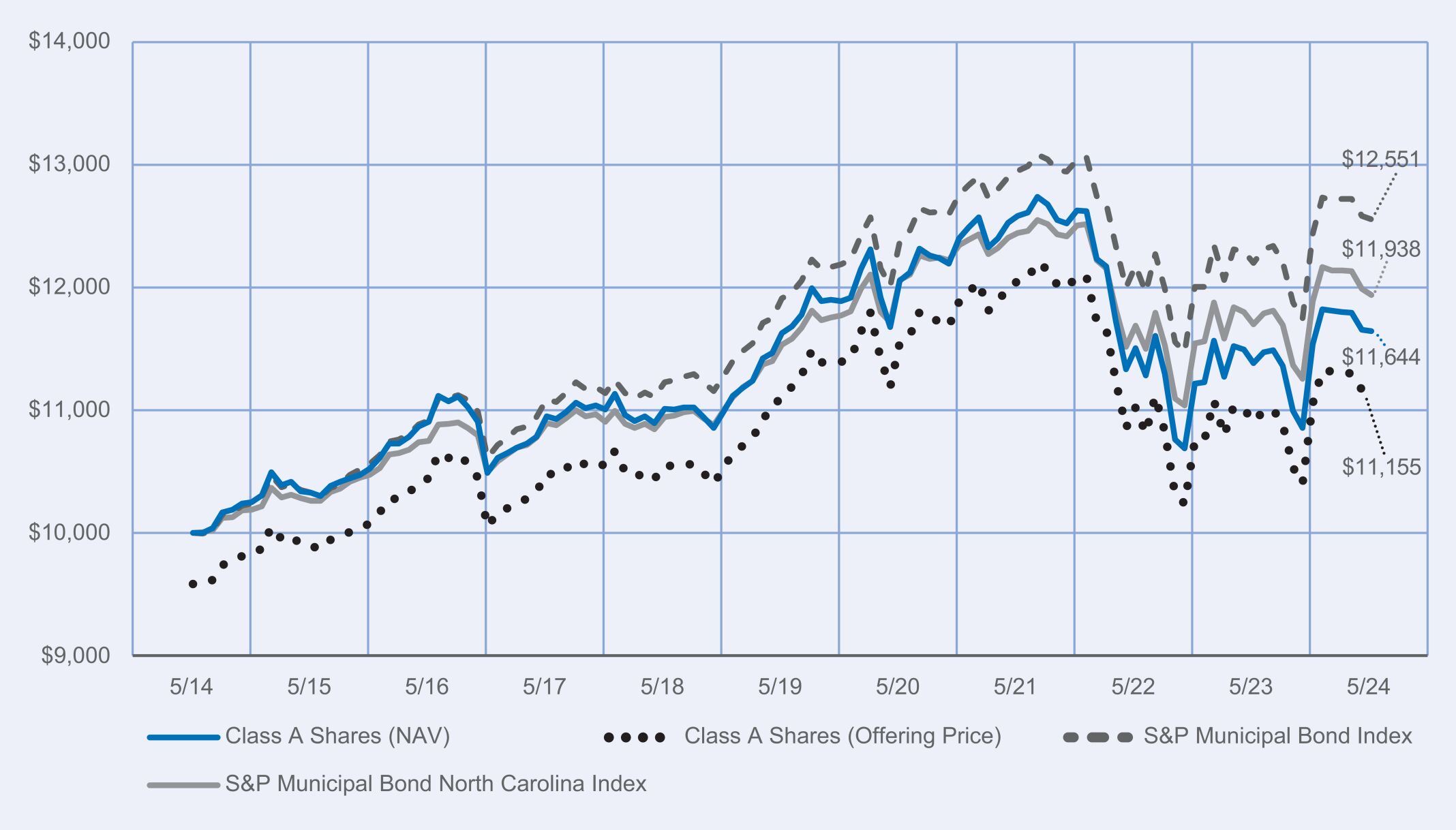

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| Class A Shares at NAV (excluding maximum sales charge) | | | 2.32 | % | | | 0.03 | % | | | 1.53 | % |

| Class A Shares at maximum sales charge (Offering Price) | | | (2.02 | )% | | | (0.82 | )% | | | 1.10 | % |

| S&P Municipal Bond Index | | | 2.88 | % | | | 1.06 | % | | | 2.30 | % |

| S&P Municipal Bond North Carolina Index | | | 2.03 | % | | | 0.70 | % | | | 1.79 | % |

| Lipper Other States Municipal Debt Funds Classification Average | | | 2.59 | % | | | 0.29 | % | | | 1.56 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 523,928,929 | |

| Total number of portfolio holdings | | | 221 | |

| Portfolio turnover (%) | | | 20% | |

| Total advisory fees paid for the year | | $ | 2,606,682 | |

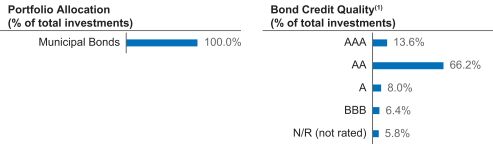

What did the Fund invest in? (as of May 31, 2024)

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

How has the Fund changed?

| | • | | Portfolio manager update: Effective October 13, 2023, Joel Levy and Timothy Ryan, CFA were added as portfolio managers of the Fund. | |

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67065P840_AR_0524 3668628-INV-Y-07/25 (A, C, I) | |  |

| | |

| |

Annual Shareholder Report

May 31, 2024 |

Nuveen North Carolina Municipal Bond Fund

Class I Shares/FCNRX

Annual Shareholder Report

This annual shareholder report contains important information about the Class I Shares of the Nuveen North Carolina Municipal Bond Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment |

| Class I Shares | | $58 | | 0.58% |

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen North Carolina Municipal Bond Fund returned 2.45% for Class I shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund outperformed the S&P Municipal Bond North Carolina Index, which returned 2.03%. • Top contributors to relative performance » Sector allocation, particularly an overweight to toll roads, which outperformed, and exposures to hospitals, dedicated tax and multi-family housing bonds. » Duration positioning, especially an overweight to longer-duration bonds, which benefited from the yield curve flattening. » Credit ratings allocation, driven by an overweight to A rated and non-rated bonds, which outperformed as spreads narrowed, and an underweight to AAA rated bonds, which underperformed. • Top detractors from relative performance » Allocation to shorter-maturity bonds along with an overweight to intermediate-maturity bonds. » Underweight allocation to the life care sector, which outperformed, and overweight allocations to higher education and appropriation-backed bonds, which underperformed. » An overweight allocation to BBB rated bonds. | | Performance Attribution  Toll road, hospital, dedicated tax and multi-family housing sectors  Longer-duration bonds  Credit ratings allocation  Short- and intermediate-maturity bonds  Life care, higher education and appropriation sectors  BBB rated bonds |

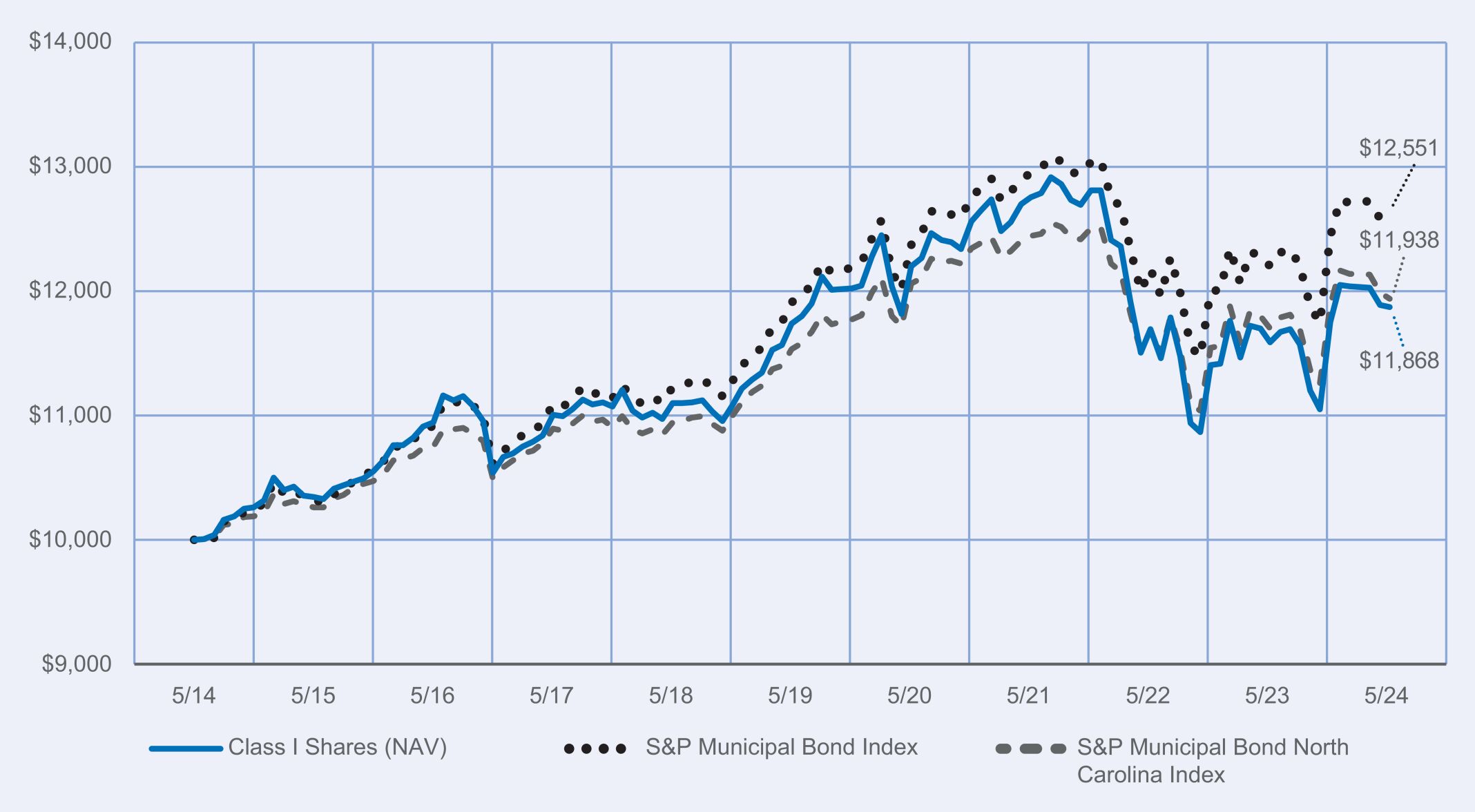

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| Class I Shares at NAV | | | 2.45 | % | | | 0.22 | % | | | 1.73 | % |

| S&P Municipal Bond Index | | | 2.88 | % | | | 1.06 | % | | | 2.30 | % |

| S&P Municipal Bond North Carolina Index | | | 2.03 | % | | | 0.70 | % | | | 1.79 | % |

| Lipper Other States Municipal Debt Funds Classification Average | | | 2.59 | % | | | 0.29 | % | | | 1.56 | % |

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 523,928,929 | |

| Total number of portfolio holdings | | | 221 | |

| Portfolio turnover (%) | | | 20% | |

| Total advisory fees paid for the year | | $ | 2,606,682 | |

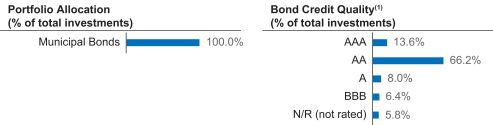

What did the Fund invest in? (as of May 31, 2024)

(1) The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

How has the Fund changed?

| | • | | Portfolio manager update: Effective October 13, 2023, Joel Levy and Timothy Ryan, CFA were added as portfolio managers of the Fund. | |

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67065P816_AR_0524 3668628-INV-Y-07/25 (A, C, I) | |  |

| | |

| |

Annual Shareholder Report

May 31, 2024 |

Nuveen North Carolina Municipal Bond Fund

Class C Shares/FDCCX

Annual Shareholder Report

This annual shareholder report contains important information about the Class C Shares of the Nuveen North Carolina Municipal Bond Fund for the period of June 1, 2023 to May 31, 2024. You can find additional information at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses. You can also request this information by contacting us at (800) 257‑8787.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| | | | |

| | | Cost of a

$10,000 investment | | Costs paid as a percentage of

$10,000 investment |

| Class C Shares | | $158 | | 1.58% |

How did the Fund perform last year? What affected the Fund’s performance?

| | |

Performance Highlights • The Nuveen North Carolina Municipal Bond Fund returned 1.43% for Class C shares at net asset value (NAV) for the 12 months ended May 31, 2024. The Fund underperformed the S&P Municipal Bond North Carolina Index, which returned 2.03%. • Top detractors from relative performance » Allocation to shorter-maturity bonds along with an overweight to intermediate-maturity bonds. » Underweight allocation to the life care sector, which outperformed, and overweight allocations to higher education and appropriation-backed bonds, which underperformed. » An overweight allocation to BBB rated bonds. • Top contributors to relative performance » Sector allocation, particularly an overweight to toll roads, which outperformed, and exposures to hospitals, dedicated tax and multi-family housing bonds. » Duration positioning, especially an overweight to longer-duration bonds, which benefited from the yield curve flattening. » Credit ratings allocation, driven by an overweight to A rated and non-rated bonds, which outperformed as spreads narrowed, and an underweight to AAA rated bonds, which underperformed. | | Performance Attribution  Toll road, hospital, dedicated tax and multi-family housing sectors  Longer-duration bonds  Credit ratings allocation  Short- and intermediate-maturity bonds  Life care, higher education and appropriation sectors  BBB rated bonds |

How did the Fund perform over the last 10 years?

Performance data shown represents past performance and does not predict or guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund Shares.

Fund Performance (June 1, 2014 through May 31, 2024) Initial Investment of $10,000

Average Annual Total Returns

| | | | | | | | | | | | |

| | | 1‑Year | | | 5‑Year | | | 10‑Year | |

| Class C Shares at NAV (excluding maximum sales charge) | | | 1.43 | % | | | (0.78 | )% | | | 0.90 | % |

| S&P Municipal Bond Index | | | 2.88 | % | | | 1.06 | % | | | 2.30 | % |

| S&P Municipal Bond North Carolina Index | | | 2.03 | % | | | 0.70 | % | | | 1.79 | % |

| Lipper Other States Municipal Debt Funds Classification Average | | | 2.59 | % | | | 0.29 | % | | | 1.56 | % |

Class C Shares are subject to a contingent deferred sales charge if redeemed within 12 months of purchase, which will be reflected in total returns presented for less than one year.

Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month‑end performance, go to https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or call (800) 257‑8787.

Fund Statistics (as of May 31, 2024)

| | | | |

| Fund net assets | | $ | 523,928,929 | |

| Total number of portfolio holdings | | | 221 | |

| Portfolio turnover (%) | | | 20% | |

| Total advisory fees paid for the year | | $ | 2,606,682 | |

What did the Fund invest in? (as of May 31, 2024)

(1)The ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national ratings agencies.

How has the Fund changed?

| | • | | Portfolio manager update: Effective October 13, 2023, Joel Levy and Timothy Ryan, CFA were added as portfolio managers of the Fund. | |

| | • | | Management fees: As of May 1, 2024, the Fund’s overall complex-level fee begins at a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion. | |

For more complete information, you may review the Fund’s next prospectus, which is expected to be available by October 1, 2024 at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses or upon request at (800) 257‑8787.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.nuveen.com/en‑us/mutual‑funds/prospectuses, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 257‑8787.

| | |

67065P683_AR_0524 3668628-INV-Y-07/25 (A, C, I) | |  |

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. There were no amendments to or waivers from the code during the period covered by this report. Upon request, a copy of the registrant’s code of ethics is available without charge by calling 800-257-8787.

| Item 3. | Audit Committee Financial Expert. |

As of the end of the period covered by this report, the registrant’s Board of Directors or Trustees (“Board”) had determined that the registrant has at least one “audit committee financial expert” (as defined in Item 3 of Form N-CSR) serving on its Audit Committee. The members of the registrant’s audit committee that have been designated as audit committee financial experts are Joseph A. Boateng, Albin F. Moschner, John K. Nelson, Loren M. Starr and Robert L. Young, who are “independent” for purposes of Item 3 of Form N-CSR.

Mr. Boateng has served as the Chief Investment Officer for Casey Family Programs since 2007. He was previously Director of U.S. Pension Plans for Johnson & Johnson from 2002-2006. Mr. Boateng is a board member of the Lumina Foundation and Waterside School, an emeritus board member of Year Up Puget Sound, member of the Investment Advisory Committee and former Chair for the Seattle City Employees’ Retirement System, and an Investment Committee Member for The Seattle Foundation. Mr. Boateng previously served on the Board of Trustees for the College Retirement Equities Fund (2018-2023) and on the Management Committee for TIAA Separate Account VA-1 (2019-2023).

Mr. Moschner is a consultant in the wireless industry and, in July 2012, founded Northcroft Partners, LLC, a management consulting firm that provides operational, management and governance solutions. Prior to founding Northcroft Partners, LLC, Mr. Moschner held various positions at Leap Wireless International, Inc., a provider of wireless services, where he was as a consultant from February 2011 to July 2012, Chief Operating Officer from July 2008 to February 2011, and Chief Marketing Officer from August 2004 to June 2008. Before he joined Leap Wireless International, Inc., Mr. Moschner was President of the Verizon Card Services division of Verizon Communications, Inc. from 2000 to 2003, and President of One Point Services at One Point Communications from 1999 to 2000. Mr. Moschner also served at Zenith Electronics Corporation as Director, President and Chief Executive Officer from 1995 to 1996, and as Director, President and Chief Operating Officer from 1994 to 1995.

Mr. Nelson formerly served on the Board of Directors of Core12, LLC from 2008 to 2023, a private firm which develops branding, marketing, and communications strategies for clients. Mr. Nelson has extensive experience in global banking and markets, having served in several senior executive positions with ABN AMRO Holdings N.V. and its affiliated entities and predecessors, including LaSalle Bank Corporation from 1996 to 2008, ultimately serving as Chief Executive Officer of ABN AMRO N.V. North America. During his tenure at the bank, he also served as Global Head of its Financial Markets Division, which encompassed the bank’s Currency, Commodity, Fixed Income, Emerging Markets, and Derivatives businesses. He was a member of the Foreign Exchange Committee of the Federal Reserve Bank of the United States and during his tenure with ABN AMRO served as the bank’s representative on various committees of The Bank of Canada, European Central Bank, and The Bank of England. Mr. Nelson previously served as a senior, external advisor to the financial services practice of Deloitte Consulting LLP. (2012-2014).

Mr. Starr was Vice Chair, Senior Managing Director from 2020 to 2021, and Chief Financial Officer, Senior Managing Director from 2005 to 2020, for Invesco Ltd. Mr. Starr is also a Director and member of the Audit Committee for AMG. He is former Chair and member of the Board of Directors, Georgia Leadership Institute for School Improvement (GLISI); former Chair and member of the Board of Trustees, Georgia Council on Economic Education (GCEE). Mr. Starr previously served on the Board of Trustees for the College Retirement Equities Fund and on the Management Committee for TIAA Separate Account VA-1 (2022-2023).

Mr. Young has more than 30 years of experience in the investment management industry. From 1997 to 2017, he held various positions with J.P. Morgan Investment Management Inc. (“J.P. Morgan Investment”) and its affiliates (collectively, “J.P. Morgan”). Most recently, he served as Chief Operating Officer and Director of J.P. Morgan Investment (from 2010 to 2016) and as President and Principal Executive Officer of the J.P. Morgan Funds (from 2013 to 2016). As Chief Operating Officer of J.P. Morgan Investment, Mr. Young led service, administration and business platform support activities for J.P. Morgan’s domestic retail mutual fund and institutional commingled and separate account businesses and co-led these activities for J.P. Morgan’s global retail and institutional

investment management businesses. As President of the J.P. Morgan Funds, Mr. Young interacted with various service providers to these funds, facilitated the relationship between such funds and their boards, and was directly involved in establishing board agendas, addressing regulatory matters, and establishing policies and procedures. Before joining J.P. Morgan, Mr. Young, a former Certified Public Accountant (CPA), was a Senior Manager (Audit) with Deloitte & Touche LLP (formerly, Touche Ross LLP), where he was employed from 1985 to 1996. During his tenure there, he actively participated in creating, and ultimately led, the firm’s midwestern mutual fund practice.

| Item 4. | Principal Accountant Fees and Services. |

The following tables show the amount of fees that PricewaterhouseCoopers, the Funds’ auditor, billed to the Funds during the Funds’ last two full fiscal years. The Audit Committee approved in advance all audit services and non-audit services that PricewaterhouseCoopers provided to the Funds, except for those non-audit services that were subject to the pre-approval exception under Rule 2-01 of Regulation S-X (the “pre-approval exception”). The pre-approval exception for services provided directly to the Funds waives the pre-approval requirement for services other than audit, review or attest services if: (A) the aggregate amount of all such services provided constitutes no more than 5% of the total amount of revenues paid by the Funds during the fiscal year in which the services are provided; (B) the Funds did not recognize the services as non-audit services at the time of the engagement; and (C) the services are promptly brought to the Audit Committee’s attention, and the Committee (or its delegate) approves the services before the audit is completed.

The Audit Committee has delegated certain pre-approval responsibilities to its Chair (or, in his absence, any other member of the Audit Committee).

| | | | | | | | | | | | | | | | |

| Fiscal Year Ended May 31, 2024 | | Audit Fees Billed to Funds1 | | | Audit-Related Fees Billed to Funds2 | | | Tax Fees Billed to Funds3 | | | All Other Fees Billed to Funds4 | |

Nuveen Georgia Municipal Bond Fund | | | $32,259 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

Nuveen Louisiana Municipal Bond Fund | | | $32,259 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

Nuveen North Carolina Municipal Bond Fund | | | $32,259 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

Total | | | $96,777 | | | | $0 | | | | $0 | | | | $0 | |

| 1 | “Audit Fees” are the aggregate fees billed for professional services for the audit of the Fund’s annual financial statements and services provided in connection with statutory and regulatory filings or engagements. |

| 2 | “Audit-Related Fees” are the aggregate fees billed for assurance and related services reasonably related to the performance of the audit or review of financial statements that are not reported under “Audit Fees”. These fees include offerings related to the Fund’s common shares and leverage. |

| 3 | “Tax Fees” are the aggregate fees billed for professional services for tax advice, tax compliance, and tax planning. These fees include: all global withholding tax services; excise and state tax reviews; capital gain, tax equalization and taxable basis calculations performed by the principal accountant. |

| 4 | “All Other Fees” are the aggregate fees billed for products and services other than “Audit Fees”, “Audit-Related Fees” and “Tax Fees”. These fees represent all “Agreed-Upon Procedures” engagements pertaining to the Fund’s use of leverage. |

| | | | | | | | | | | | | | | | |

| | | Percentage Approved Pursuant to Pre-approval Exception | |

| Fiscal Year Ended May 31, 2024 | | Audit Fees Billed to Funds | | | Audit-Related Fees Billed to Funds | | | Tax Fees Billed to Funds | | | All Other Fees Billed to Funds | |

| Nuveen Georgia Municipal Bond Fund | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | |

| Nuveen Louisiana Municipal Bond Fund | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | |

| Nuveen North Carolina Municipal Bond Fund | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | |

| Fiscal Year Ended May 31, 2023 | | Audit Fees Billed to Funds1 | | | Audit-Related Fees Billed to Funds2 | | | Tax Fees Billed to Funds3 | | | All Other Fees Billed to Funds4 | |

| Nuveen Georgia Municipal Bond Fund | | | $37,988 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen Louisiana Municipal Bond Fund | | | $37,988 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen North Carolina Municipal Bond Fund | | | $37,988 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

Total | | | $113,964 | | | | $0 | | | | $0 | | | | $0 | |

| 1 | “Audit Fees” are the aggregate fees billed for professional services for the audit of the Fund’s annual financial statements and services provided in connection with statutory and regulatory filings or engagements. |

| 2 | “Audit-Related Fees” are the aggregate fees billed for assurance and related services reasonably related to the performance of the audit or review of financial statements that are not reported under “Audit Fees”. These fees include offerings related to the Fund’s common shares and leverage. |

| 3 | “Tax Fees” are the aggregate fees billed for professional services for tax advice, tax compliance, and tax planning. These fees include: all global withholding tax services; excise and state tax reviews; capital gain, tax equalization and taxable basis calculations performed by the principal accountant. |

| 4 | “All Other Fees” are the aggregate fees billed for products and services other than “Audit Fees”, “Audit-Related Fees” and “Tax Fees”. These fees represent all “Agreed-Upon Procedures” engagements pertaining to the Fund’s use of leverage. |

| | | | | | | | | | | | | | | | |

| | | Percentage Approved Pursuant to Pre-approval Exception | |

| Fiscal Year Ended May 31, 2023 | | Audit Fees Billed to Funds | | | Audit-Related Fees

Billed to Funds | | | Tax Fees Billed to Funds | | | All Other Fees Billed to Funds | |

| Nuveen Georgia Municipal Bond Fund | | | 0 | % | | | 0% | | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | |

| Nuveen Louisiana Municipal Bond Fund | | | 0 | % | | | 0% | | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | |

| Nuveen North Carolina Municipal Bond Fund | | | 0 | % | | | 0% | | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | |

| Fiscal Year Ended May 31, 2024 | | Audit-Related Fees Billed to Adviser and Affiliated Fund

Service Providers | | | Tax Fees Billed to Adviser and Affiliated Fund

Service Providers | | | All Other Fees Billed to Adviser and Affiliated Fund

Service Providers | |

| Nuveen Multistate Trust III | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | |

| | | Percentage Approved Pursuant to Pre-approval Exception | |

| | | Audit-Related Fees Billed to Adviser and Affiliated Fund

Service Providers | | | Tax Fees Billed to Adviser and Affiliated Fund

Service Providers | | | All Other Fees Billed to Adviser and Affiliated Fund

Service Providers | |

| | | 0% | | | | 0% | | | | 0% | |

| | | |

| | | | | | | | | | | | |

| Fiscal Year Ended May 31, 2023 | | Audit-Related Fees Billed to Adviser and Affiliated Fund

Service Providers | | | Tax Fees Billed to Adviser and Affiliated Fund

Service Providers | | | All Other Fees Billed to Adviser and Affiliated Fund

Service Providers | |

| Nuveen Multistate Trust III | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | |

| | | Percentage Approved Pursuant to Pre-approval Exception | |

| | | Audit-Related Fees Billed to Adviser and Affiliated Fund

Service Providers | | | Tax Fees Billed to Adviser and Affiliated Fund

Service Providers | | | All Other Fees Billed to Adviser and Affiliated Fund

Service Providers | |

| | | 0% | | | | 0% | | | | 0% | |

| | | | | | | | | | | | | | | | |

| Fiscal Year Ended May 31, 2024 | | Total Non-Audit Fees

Billed to Fund | | | Total Non-Audit Fees Billed to Adviser and Affiliated Fund Service Providers (engagements related directly to the operations and financial

reporting of the Trust) | | | Total Non-Audit Fees

Billed to Adviser and Affiliated Fund Service

Providers (all other

engagements) | | | Total | |

| Nuveen Georgia Municipal Bond Fund | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen Louisiana Municipal Bond Fund | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Fiscal Year Ended May 31, 2024 | | Total Non-Audit Fees

Billed to Fund | | | Total Non-Audit Fees Billed to Adviser and Affiliated Fund Service Providers (engagements related directly to the operations and financial

reporting of the Trust) | | | Total Non-Audit Fees Billed to Adviser and Affiliated Fund Service Providers (all other engagements) | | | Total | |

| Nuveen North Carolina Municipal Bond Fund | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

Total | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

“Non-Audit Fees billed to Fund” for both fiscal year ends represent “Tax Fees” and “All Other Fees” billed to Fund in their respective amounts from the previous table.

Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

| | | | | | | | | | | | | | | | |

| Fiscal Year Ended May 31, 2023 | | Total Non-Audit Fees

Billed to Fund | | | Total Non-Audit Fees Billed to Adviser and Affiliated Fund Service Providers (engagements related directly to the operations and financial reporting of the Trust) | | | Total Non-Audit Fees Billed to Adviser and Affiliated Fund Service Providers (all other engagements) | | | Total | |

| Nuveen Georgia Municipal Bond Fund | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen Louisiana Municipal Bond Fund | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

| Nuveen North Carolina Municipal Bond Fund | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | |

Total | | | $0 | | | | $0 | | | | $0 | | | | $0 | |

“Non-Audit Fees billed to Fund” for both fiscal year ends represent “Tax Fees” and “All Other Fees” billed to Fund in their respective amounts from the previous table.

Audit Committee Pre-Approval Policies and Procedures. Generally, the Audit Committee must approve (i) all non-audit services to be performed for the Funds by the Funds’ independent accountant and (ii) all audit and non-audit services to be performed by the Funds’ independent accountant for the Affiliated Fund Service Providers with respect to the operations and financial reporting of the Funds. Regarding tax and research projects conducted by the independent accountant for the Funds and Affiliated Fund Service Providers (with respect to operations and financial reports of the Trust), such engagements will be (i) pre-approved by the Audit Committee if they are expected to be for amounts greater than $10,000; (ii) reported to the Audit Committee Chair for his verbal approval prior to engagement if they are expected to be for amounts under $10,000 but greater than $5,000; and (iii) reported to the Audit Committee at the next Audit Committee meeting if they are expected to be for an amount under $5,000.

Item 4(i) and Item 4(j) are not applicable to the registrant.

| Item 5. | Audit Committee of Listed Registrants. |

Not applicable to this registrant.

| (a) | Schedule of Investments is included as part of the financial statements filed under Item 7 of this Form N-CSR. |

| Item 7. | Financial Statements and Financial Highlights for Open-End Management Investment Companies. |

Item

7.

Financial

Statements

and

Financial

Highlights

for

Open-End

Management

Investment

Companies

Report

of

Independent

Registered

Public

Accounting

Firm

To

the

Board

of

Trustees

of

Nuveen

Multistate

Trust

III

and

Shareholders

of

Nuveen

Georgia

Municipal

Bond

Fund,

Nuveen

Louisiana

Municipal

Bond

Fund

and

Nuveen

North

Carolina

Municipal

Bond

Fund

Opinions

on

the

Financial

Statements

We

have

audited

the

accompanying

statements

of

assets

and

liabilities,

including

the

portfolios

of

investments,

of

Nuveen

Georgia

Municipal

Bond

Fund,

Nuveen

Louisiana

Municipal

Bond

Fund

and

Nuveen

North

Carolina

Municipal

Bond

Fund

(constituting

Nuveen

Multistate

Trust

III,

hereafter

collectively

referred

to

as

the

"Funds")

as

of

May

31,

2024,

the

related

statements

of

operations

for

the

year

ended

May

31,

2024,

the

statements

of

changes

in

net

assets

for

each

of

the

two

years

in

the

period

ended

May

31,

2024,

including

the

related

notes,

and

the

financial

highlights

for

each

of

the

five

years

in

the

period

ended

May

31,

2024

(collectively

referred

to

as

the

“financial

statements”).

In

our

opinion,

the

financial

statements

present

fairly,

in

all

material

respects,

the

financial

position

of

each

of

the

Funds

as

of

May

31,

2024,

the

results

of

each

of

their

operations

for

the

year

then

ended,

the

changes

in

each

of

their

net

assets

for

each

of

the

two

years

in

the

period

ended

May

31,

2024

and

each

of

the

financial

highlights

for

each

of

the

five

years

in

the

period

ended

May

31,

2024

in

conformity

with

accounting

principles

generally

accepted

in

the

United

States

of

America.

Basis

for

Opinions

These

financial

statements

are

the

responsibility

of

the

Funds’

management.

Our

responsibility

is

to

express

an

opinion

on

the

Funds’

financial

statements

based

on

our

audits.

We

are

a

public

accounting

firm

registered

with

the

Public

Company

Accounting

Oversight

Board

(United

States)

(PCAOB)

and

are

required

to

be

independent

with

respect

to

the

Funds

in

accordance

with

the

U.S.

federal

securities

laws

and

the

applicable

rules

and

regulations

of

the

Securities

and

Exchange

Commission

and

the

PCAOB.

We

conducted

our

audits

of

these

financial

statements

in

accordance

with

the

standards

of

the

PCAOB.

Those

standards

require

that

we

plan

and

perform

the

audit

to

obtain

reasonable

assurance

about

whether

the

financial

statements

are

free

of

material

misstatement,

whether

due

to

error

or

fraud.

Our

audits

included

performing

procedures

to

assess

the

risks

of

material

misstatement

of

the

financial

statements,

whether

due

to

error

or

fraud,

and

performing

procedures

that

respond

to

those

risks.

Such

procedures

included

examining,

on

a

test

basis,

evidence

regarding

the

amounts

and

disclosures

in

the

financial

statements.

Our

audits

also

included

evaluating

the

accounting

principles

used

and

significant

estimates

made

by

management,

as

well

as

evaluating

the

overall

presentation

of

the

financial

statements.

Our

procedures

included

confirmation

of

securities

owned

as

of

May

31,

2024

by

correspondence

with

the

custodian,

portfolio

company

and

brokers;

when

replies

were

not

received

from

the

brokers,

we

performed

other

auditing

procedures.

We

believe

that

our

audits

provide

a

reasonable

basis

for

our

opinions.

/s/

PricewaterhouseCoopers

LLP

Chicago,

Illinois

July

25,

2024

We

have

served

as

the

auditor

of

one

or

more

investment

companies

in

Nuveen

Funds

since

2002.

Nuveen

Georgia

Municipal

Bond

Fund

Portfolio

of

Investments

May

31,

2024

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

LONG-TERM

INVESTMENTS

-

97.6%

X

173,883,950

MUNICIPAL

BONDS

-

97.6%

X

173,883,950

Consumer

Discretionary

-

1.0%

$

2,200

Geo.

L.

Smith

II

Georgia

World

Congress

Center

Authority,

Georgia,

Convention

Center

Hotel

Revenue

Bonds, First

Tier

Series

2021A,

4.000%,

1/01/54

1/31

at

100.00

$

1,879,958

Total

Consumer

Discretionary

1,879,958

Education

and

Civic

Organizations

-

7.6%

750

Cobb

County

Development

Authority,

Georgia,

Charter

School

Revenue

Bonds,

Northwest

Classical

Academy,

Inc.

Project,

Series

2023A,

6.375%,

6/15/58

6/31

at

100.00

753,133

1,000

Fulton

County

Development

Authority,

Georgia,

General

Revenue

Bonds,

Spelman

College,

Refunding

Series

2015,

5.000%,

6/01/32

6/25

at

100.00

1,008,900

2,000

Fulton

County

Development

Authority,

Georgia,

Revenue

Bonds,

Robert

W.

Woodruff

Arts

Center,

Inc.

Project,

Refunding

Series

2015A,

5.000%,

3/15/36

3/26

at

100.00

2,034,299

2,000

Fulton

County

Development

Authority,

Georgia,

Revenue

Bonds,

Robert

W.

Woodruff

Arts

Center,

Inc.

Project,

Series

2019A,

5.000%,

3/15/44

3/29

at

100.00

2,059,660

2,750

Gwinnett

County

Development

Authority, Georgia,

Revenue

Bonds,

Georgia

Gwinnett

College

Student

Housing

Project,

Refunding

Series

2017B,

5.000%,

7/01/40

7/27

at

100.00

2,820,393

4,000

Private

Colleges

and

Universities

Authority,

Georgia,

Revenue

Bonds,

Emory

University,

Refunding

Series

2016A,

5.000%,

10/01/46

10/26

at

100.00

4,064,478

605

Private

Colleges

and

Universities

Authority,

Georgia,

Revenue

Bonds,

Mercer

University,

Series

2012B,

5.000%,

10/01/24

No

Opt.

Call

606,687

250

Private

Colleges

and

Universities

Authority,

Georgia,

Revenue

Bonds,

Mercer

University,

Series

2021,

4.000%,

10/01/50

10/31

at

100.00

235,508

Total

Education

and

Civic

Organizations

13,583,058

Health

Care

-

10.0%

5,590

Brookhaven

Development

Authority,

Georgia,

Revenue

Bonds,

Children's

Healthcare

of

Atlanta,

Inc.

Project,

Series

2019A,

4.000%,

7/01/49

7/29

at

100.00

5,279,240

550

Cobb

County

Kennestone

Hospital

Authority,

Georgia,

Revenue

Anticipation

Certificates,

Wellstar

Health

System,

Inc.

Project,

Series

2022A,

4.000%,

4/01/52

4/32

at

100.00

511,154

420

Cobb

County

Kennestone

Hospital

Authority,

Georgia,

Revenue

Anticipation

Certificates,

Wellstar

Health

System,

Series

2017A,

5.000%,

4/01/36

4/27

at

100.00

431,453

Columbia

County

Hospital

Authority,

Georgia,

Revenue

Anticipation

Certificates,

WellStar

Health

System,

Inc.

Project,

Series

2023B:

2,000

5.125%,

4/01/53

4/33

at

100.00

2,089,717

2,100

5.750%,

4/01/53

4/33

at

100.00

2,329,281

2,355

Fulton

County

Development

Authority,

Georgia,

Revenue

Bonds,

Piedmont

Healthcare,

Inc.

Project,

Series

2014A,

5.000%,

7/01/44

7/24

at

100.00

2,345,497

2,500

Fulton

County

Development