November 17, 2017

VIA EDGAR SUBMISSION

SECURITIES AND EXCHANGE COMMISSION

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

Attention: John Reynolds, Assistant Director

Dear Sir:

| Re: | Minco Gold Corporation (the "Company") |

Form 20-F for the Fiscal Year Ended December 31, 2016 (the "2016 20-F")

Filed March 31, 2017

File No. 001-32670

After reviewing the letter dated October 25, 2017 (the "Comment Letter") from the Securities and Exchange Commission regarding the Company’s 2016 20-F, we are providing the following information in response to your comments.

For your ease of reference, we have reproduced the numbering in the Comment Letter and have set out below, in italics, the text of your question followed by the Company's response thereto.

Form 20-F

D. Description of Properties

| 1. | Considering your disclosure on page 10 that your investment in Minco Silver is approximately 57% of your total assets, and your disclosure on page 15 that you continue to hold significant influence over Minco Silver, it appears you should provide mineral property disclosure with respect to Minco Silver material properties, including but not limited to the Fuwan Silver project and the Changkeng project. |

We agree with your conclusion that the Company should provide mineral property disclosure with respect to Minco Silver mineral properties, including but not limited to the Fuwan Silver project and the Changkeng project. We further confirm, pursuant to our discussion on November 15, 2017 between our representative, Ms. Rocio Echegaray and Mr. John Coleman at the SEC, that we will include such disclosure in the Company’s Annual Report on Form 20-F for the year ended December 31, 2017.

As requested in the Comment Letter and by Mr. Coleman, we have provided the mineral property disclosure relating to the Minco Silver mineral properties, based on the information relating to 2016, in Appendix A to this letter. We will update this information for the purpose of our 2017 Annual Report on Form 20-F.

Should you have any questions or concerns, please do not hesitate to contact the undersigned.

Yours truly,

/s/ Larry Tsang

Larry Tsang, CFO

Minco Gold Corporation

APPENDIX A

D.2 Mineral properties held by Minco Silver Corp.

The following is a brief description of Minco Silver’s Changkeng Gold Project. Technical Information respecting the Changkeng Gold Project is primarily derived from the NI 43-101 technical report entitled "Technical Report and Updated Resource Estimate on the Changkeng Gold Project Guangdong Province, China", dated effective February 21, 2009 and prepared by Tracy Armstrong, P. Geo Ontario, Eugene Puritch, P. Eng. Ontario and Antoine Yassa, P.Geo. Québec, all of P&E Mining Consultants Inc. of Brampton, Ontario ("P&E"), and all qualified persons for the purposes of NI 43-101. This technical report includes relevant information regarding the data, data validation and the assumptions, parameters and methods of the mineral resource estimates on the Changkeng Project.

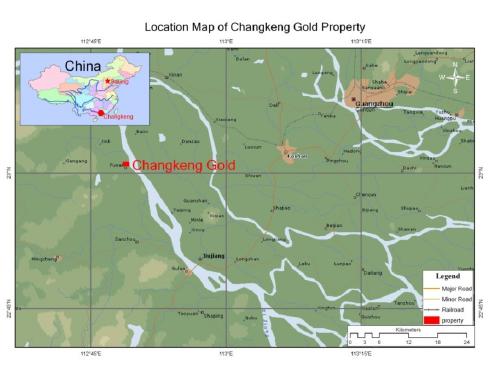

Location

The Changkeng gold deposit is located approximately 45 km southwest of Guangzhou, the fourth largest city in China with 13 million people and the capital city of Guangdong Province. The project is adjacent to Minco Silver's Fuwan Silver Deposit and situated close to well established water, power, and transportation infrastructure.

Ownership

Mingzhong, a joint venture company established among a Chinese subsidiary of Minco Silver, Guangdong Geological Bureau, Guangdong Gold Corporation and two private Chinese companies to jointly explore and develop the Changkeng Property, signed a purchase agreement in January 2008 to acquire a 100% interest in the Changkeng Exploration Permit on the Changkeng Project from 757 Exploration Team.

The transfer of the Changkeng Exploration Permit from 757 Exploration Team to Mingzhong was approved by MOLAR in 2009. This exploration permit expires on September 10, 2017 and the Company will apply for the renewal.

Exploration Activities

No exploration activities, except for maintaining the exploration permits in respect of the project, were conducted on the Changkeng gold project in the past three years (2014 to 2016).

Technical Information of the Changkeng Gold Project

Geology

The Changkeng Project is located at the northwest margin of a triangular upper paleozoic fault basin, at the margin with the northeast trending Shizhou fault to the northwest, the east-west trending Dashi fault to the south and the northwest trending Xijiang fault to the northeast. Precious and base metal occurrences and deposits are known to occur predominantly along the margins of the 550 km² basin. The Changkeng Gold Property is covered by the 1.18km2 area over the Changkeng permit.

The major structural control at Changkeng is an upright, open syncline with its axis trending northeast. The syncline is composed of Lower Carboniferous limestone and Triassic siliciclastic rocks. A low-angle fault zone is developed along the contact between the Lower Carboniferous unit and the Upper Triassic unit. The fault zone is from several meters to tens of meters in width and is occupied by lenticular, brecciated and silicified rocks, brecciated limestone, and silicified sandy conglomerate. The fault zone may have acted as both a feeder conduit and as a host structure for the gold and silver mineralization in the area. A set of second-order faults parallel to the major fault were developed in the limestone at the footwall, and silver mineralization is known to occur in the second-order faults on the Fuwan Property to the south. Gold was discovered at Changkeng in early 1990 by systematic follow up of stream sediment and soil geochemical anomalies identified from surveys completed by the Guangdong Provincial government. Illegal, small scale mining began in 1991 and removed most of the oxidized, near surface mineralization. Based on 13 surface trenches and 81 diamond drill holes, P&E prepared an initial NI 43-101 compliant resource estimate on the deposit in March of 2008 with a resource update in March 2009 (collectively, the "Changkeng Technical Reports"). The Changkeng Technical Reports can be found on SEDAR and are incorporated by reference herein. The detailed resource estimates are provided below.

The Changkeng Project is comprised of three mineralized zones, termed the CK1, CK2 and CK3 Zones. The overall strike length of the deposit, incorporating these zones, is approximately 1200 meters in a N065° direction, with a cross-strike width of between 110 to 380 meters. The deposit outcrops on surface and the deepest zone of mineralization intersected by drilling to date is approximately 280 meters below surface. The average width of a mineralized intersection is 10.4 meters (apparent thickness).

The Changkeng Project falls into the broad category of sediment hosted epithermal deposits. Gold mineralization occurs as lenticular bodies in the brecciated Triassic classic rocks at the upper portion of the synform zone. The gold zone tends to pinch out toward the hinge of the syncline where it is replaced by silver mineralization at the Fuwan Silver Deposit.

Drilling Program

The last comprehensive exploration program on the Changkeng Gold Project was done during 2007 to 2008. The exploration program consisted of drilling of 66 diamond holes and an extensive hydrological study as well as a geotechnical survey. The drilling program was designed to expand the known resources through step-out drilling, as well as increase the indicated resources through in-fill drilling, with the first 22 holes mainly testing the wider spaced drill targets throughout the entire property. Drilling was conducted on an approximately 40 meter section spacing with holes on section between 20 meters and 80 meters apart.

At the completion of the 2008 drilling program, the known gold mineralization at the Changkeng Property was extended by approximately 400 meters along strike to the east-northeast; from just less than 900 meters to approximately 1200 meters in length. Mineralization was also extended down dip in localized areas along the eastern end of the known mineralization.

Resource Estimates

A resource estimate was made by P&E for the Changkeng Gold Project by utilizing diamond drill data from a total of 127 drill holes and 13 surface trenches. On March 25, 2009, an updated NI 43-101 resource estimate for the Changkeng project, including the calculations of the distinct and separate gold dominant and silver dominant zones, was completed and published.

The following is a summary of the updated resource calculation prepared for the Changkeng Property. The definitions of Indicated and Inferred Resources are in compliance with the Canadian Institute of Mining Metallurgy and Petroleum CIM Definition Standards on Mineral Resources and Reserves (the "CIM Definition Standards"), which were adopted by the CIM Council on December 11, 2005.

March 2009 P&E Gold Dominant Portion of Resource Estimate @ 1.2 g/t AuEq Cut-Off

| Classification | Tonnes | Au

(g/t) | Au

(oz) | Ag

(g/t) | Ag

(oz) | AuEq **

(g/t) | AuEq **

(oz) |

| Indicated | 3,961,000 | 4.89 | 623,100 | 11.2 | 1,423,000 | 5.08 | 646,800 |

| Inferred | 4,001,000 | 3.01 | 386,800 | 9.5 | 1,218,000 | 3.16 | 407,000 |

**The AuEq grade was calculated from Au US$800/oz and Ag US$14/oz with respective recoveries of 95% and 90%. The calculated Au:Ag ratio was 60:1. Pb and Zn values were too low to be of economic interest for resource reporting purposes.

| 1. | Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. |

| 2. | The quantity and grade of reported inferred resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred resources as an indicated or measured mineral resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured mineral resource category. |

The Changkeng Project also contains a portion of a second distinct deposit, which is silver dominant. The deposit contains indicated resources of 5.6 million tonnes @ 170 g/t Ag for a total of 30,708,000 oz Ag and inferred resources of 1.1 million tonnes @ 220 g/t Ag for a total of 7,517,000 oz Ag.

March 2009 P&E Silver Dominant Portion of Resource Estimate @ 35 g/t Ag Cut-Off

| Classification | Tonnes | Ag

(g/t) | Ag

(oz) | Au

(g/t) | Pb

(%) | Zn

(%) |

| Indicated | 5,622,000 | 170 | 30,708,000 | 0.33 | 0.35 | 1.02 |

| Inferred | 1,063,000 | 220 | 7,517,000 | 0.24 | 0.61 | 1.36 |

| 1. | Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. |

| 2. | The quantity and grade of reported inferred resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred resources as an indicated or measured mineral resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured mineral resource category. |

The resource estimate prepared on the Changkeng Silver Project also includes minor amounts of lead (Pb) and zinc (Zn).

Technical information or other scientific information of the Fuwan Silver Project are disclosed in two Technical Reports, which are available on the System for Electronic Document Analysis and Retrieval (“SEDAR”) atwww.sedar.com under the Minco Silver’s profile or atwww.mincosilver.com. Following is a summary:

A National Instrument 43-101 (“NI 43-101”) compliant technical report entitled “Technical Report and Updated Resource Estimate on the Fuwan Property Guangdong Province, China”, dated January 25, 2008, was prepared by Eugene Puritch, P. Eng. Ontario, Tracy Armstrong, P. Geo Ontario, and Antoine Yassa, P.Geo. Québec. This technical report includes relevant information regarding the data, data validation and the assumptions, parameters, and methods of the mineral resource estimates on the Fuwan Silver Project.

NI 43-101 Technical Report titled “Fuwan Silver Project Feasibility Study Technical Report”, dated September 1, 2009 prepared by John Huang, P.Eng., S. Byron V. Stewart, P.Eng., Aleksandar Živković, P.Eng. and Scott Cowie, B.Eng, MAusIMM, all of Wardrop Engineering Inc. (“Wardrop”), and Eugene Puritch, P.Eng. of P&E, all qualified persons for NI 43-101. This technical report includes relevant information regarding the data, data validation and the assumptions, parameters and methods used in determining the ore reserves on the Fuwan Project.

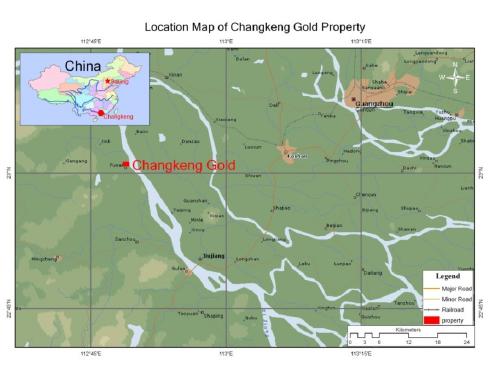

Location

The Fuwan Silver Deposit is adjacent to the Changkeng Gold Project, approximately 45 km southwest of Guangzhou, the capital city of Guangdong Province. Access to the property is via the Guangzhou - Zhuhai highway, which passes through Gaoming City. The property is located 2 km via gravel road northwest of the town of Fuwan (population 30,000). The town of Fuwan is well connected by paved highway and expressways to major cities, including Guangzhou (70 km), Gaoming (15 km), and Jiangmen (60 km). The Fuwan property is also accessible by water on the Xijiang River to major cities like Guangzhou, Zhaoqing and Jiangmen, as well as to international waterways in the South China Sea. Electrical power, water, telephone service, and supplies are available in Fuwan. The proposed mine site is large enough to accommodate tailings and waste disposal areas, and processing plant sites.

Ownership

On July 2005, MOLAR approved the transfer of Exploration Permit for the Fuwan Project ("Exploration Permit") to Minco China, a subsidiary of Minco Silver from 757 Exploration Team. The cost of the Exploration Permit in respect of the Fuwan Silver Project was independently appraised at approximately RMB10,330,000 ($1.47 million). Minco Silver paid the entire amount for the Exploration Permit to 757 Exploration Team.

Minco Silver has three reconnaissance survey exploration permits on the Fuwan Silver Deposit, having a total area of 125.74 sq. km, covering a major part of the northeast-trending Fuwan silver belt, which hosts the known gold and silver occurrences in the Sanzhou basin, including the Fuwan silver and Changkeng gold deposit. The exploration permit for the Fuwan main deposit area is the Luoke-Jilinggang (57.16 sq. km.) which will expire on July 20, 2017. Another two silver exploration permits on the Fuwan belt are Guyegang-Sanyatang Permit (55.88 sq. km.) that was expired on March 17, 2017 and Hecun Permit (12.7 sq. km.) that will expire on August 12, 2018. The renewal application of the Guyegang-Sanyatang Permit have been submitted and the Company will apply renewal for the Luoke-Jilinggang Permit when it is expired

Exploration Activities

No exploration activities, except for maintaining the exploration permits in respect of the project, were conducted on the Fuwan Silver project in the past three years (2014 to 2016).

During 2016, Minco Silver continued its focus on the Environmental Impact Assessment (“EIA”) report and the permitting process in order to apply for a mining license for the Fuwan Silver Project.

Minco Silver conducted a comprehensive exploration program on the Fuwan Project between 2005 and 2008. The exploration program included a six phases of drilling, totaling 260 drill holes, comprising 69,074 meters of diamond drilling over both the Fuwan Silver Deposit and the surrounding regional area, detailed hydrological studies for the Fuwan Silver Deposit area, metallurgical testing, and geotechnical studies. An exploration report was prepared on the Fuwan Silver Deposit at the end of the exploration program and was approved by MOLAR.

Geology

The Fuwan Silver Deposit is located at the northwest margin of a triangular Upper Paleozoic fault basin at the juncture of the northeast-trending Shizhou fault to the northwest, the east-west trending Dashi fault to the south, and the northwest trending Xijiang fault to the northeast. There are known precious and base metal occurrences and deposits that occur predominantly along the margins of the basin.

The basin contains Lower Carboniferous limestone and unconformable overlying Triassic siliciclastic rocks. A low-angle fault zone (from several to tens of meters in thickness) is developed along the contact between the Lower Carboniferous unit and the Upper Triassic unit, and is occupied by lenticular zones of brecciated limestone and silicified sandy conglomerate. The fault zone may have acted as both a conduit for mineralizing fluids and as a host for the silver mineralization in the area. Second order faults, parallel to the major fault and also containing silver mineralization, occur in the footwall limestone.

The Fuwan Silver Deposit falls into the broad category of sediment-hosted epithermal deposits and is characterized by vein and veinlet mineralization within zones of silicification. The predominant sulphide minerals are sphalerite and galena with lesser pyrite, as well as rare arsenopyrite, chalcopyrite, and bornite. The deposit is poor in gold (typically <0.2 ppm).

Resource Estimates

Diamond drill data from a total of 422 holes was used for the resource calculation in the updated resource estimate. These programs were conducted on a 60m x 60m diagonal spacing within the existing 80m x 80m rectangular drill grid spacing. The Fuwan Silver Deposit remains open along strike to the southwest and up and down its relatively flat dip to the northwest and southeast.

The resource estimate for the Fuwan Silver Deposit includes Au, Pb and Zn credits and has an indicated resource of approximately 16.0 million tonnes at 182g/t Ag, 0.20g/t Au, 0.20% Pb and 0.57% Zn and an inferred resource of 11.2 million tonnes at 174g/t Ag, 0.26g/t Au, 0.27% Pb and 0.73% Zn.

For the purposes of the resource update report, the resource was defined using the April 2008, 24 month trailing average metal prices of US$13.69/oz Ag, US$710/oz Au, US$1.01/lb Pb and US$1.48/lb Zn. Costs of $12.00/tonne for mining, $11.50/tonne for processing/tailings management and $5.50/tonne for G&A for a total of $29.00/tonne and a process recovery of 97% for Ag, along with Au, Pb & Zn credits of approximately $10.00/tonne were utilized to derive a cut-off grade of 40 g/t Ag.

Current Developments

Combination of Fuwan Silver Project and Changkeng Gold Project

During the year ended December 31, 2016, Minco Silver was in the process of combining the Fuwan Silver Project and the Changkeng Gold Project which adjoins each other. Minco Silver has engaged consultants to value these two projects to determine the appropriate percentage of interest that should be owned by Minco Silver in the combined property. The valuation and combination is pending approval from both Minco Silver and the business partners in the combined Fuwan-Changkeng project.

Permitting

Following is a summary of the significant progress made in permitting of the Fuwan Silver Project:

| • | The Mining Area Permit, which covers approximately 0.79 sq. km, defines the mining limits of the Fuwan Silver Project and restricts the use of this land to mining activities was approved by the Ministry of Land and Resources (“MOLAR”) .. This Mining Area Permit expires on April 10, 2018. |

| • | The development plan of the combined Fuwan Silver Project and Changkeng Gold Project has been completed and is ready to the submission to MOLAR. |

| • | The latest EIA report for the combined Fuwan-Changkeng Project expects to complete soon. |

2772 - 1055 W. Georgia St., Vancouver, BC, Canada V6E 3R5

Tel: (604)688-8002 Fax: (604)688-8030 Toll Free: (888)288-8288

E-mail: pr@mincomining.ca Website: www.mincogold.com