Exhibit 2.4

Minco Gold Corporation

Condensed Interim Financial Statements

For the three and nine months ended September 30, 2017 and 2016

(Unaudited, expressed in Canadian dollars, unless otherwise stated)

NOTICE TO READER

Under National Instrument 51-102, Part 4, subsection 4.3(3) (a), if an auditor has not performed a review of condensed interim financial statements; they must be accompanied by a notice indicating that the financial statements have not been reviewed by an auditor.

The accompanying unaudited condensed interim financial statements of Minco Gold Corporation have been prepared by, and are the responsibility of, the Company’s management. The accompanying unaudited condensed interim financial statements have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board applicable to the preparation of interim financial statements, including IAS 34, Interim Financial Reporting.

Minco Gold Corporation’s independent auditor has not performed a review of these condensed interim financial statements in accordance with standards established by the Canadian Institute of Chartered Professional Accountants for a review of condensed interim financial statements by an entity’s auditor.

| | |

| Dr. Ken Cai | Larry Tsang, CPA, CA |

| Chief Executive Officer | Chief Financial Officer |

Vancouver, Canada

November 24, 2017

Index

Page

| Condensed Interim Financial Statements | 4 - 8 |

| |

| Condensed Interim Statements of Financial Position | 4 |

| Condensed Interim Statements of Loss | 5 |

| Condensed Interim Statements of Comprehensive Loss | 6 |

| Condensed Interim Statements of Changes in Equity | 7 |

| Condensed Interim Statements of Cash Flow | 8 |

| Notes to Condensed Interim Financial Statements | 9 - 15 |

| | |

| General information and change of business | 9 |

| Basis of preparation | 9 |

| Cash and cash equivalents | 9 |

| Short-term investment | 9 |

| Investments at fair value | 10 |

| Investment in an associate | 11 |

| Share capitals | 11 |

| Related party transactions | 13 |

| Fair value measurements | 14 |

Minco Gold Corporation

Condensed Interim Statements of Financial Position

(Unaudited, expressed in Canadian dollars, unless otherwise stated)

| | | |

| | September 30, | December 31, |

| | 2017 | 2016 |

| Assets | $ | $ |

| Current assets | | |

| Cash and cash equivalents (note 3) | 3,962,675 | 4,575,119 |

| Short-term investment (note 4) | 991,955 | 3,352,062 |

| Investments at fair value, current (note 5) | 11,913,765 | 11,770,000 |

| Receivables | 25,201 | 169,380 |

| Due from related parties (note 8) | 36,522 | 223,672 |

| Prepaid expenses and deposits | 58,476 | 72,035 |

| | 16,988,594 | 20,162,268 |

| | | |

| Non-current assets | | |

| Long-term deposit | 51,277 | 51,277 |

| Property, plant and equipment | 4,446 | 7,066 |

| Investments at fair value, non-current (note 5) | 499,144 | 537,860 |

| | 17,543,461 | 20,758,471 |

| Liabilities | | |

| Current liabilities | | |

| Accounts payable and accrued liabilities | 98,049 | 211,427 |

| | | |

| Equity | | |

| Equity attributable to owners of the parent | | |

| Share capital (note 7(a)) | 41,976,886 | 41,976,886 |

| Contributed surplus | 9,562,387 | 9,322,102 |

| Deficits | (34,093,861) | (30,751,944) |

| | 17,445,412 | 20,547,044 |

| | | |

| Total liabilities and equity | 17,543,461 | 20,758,471 |

| | | |

| | | |

| | | |

| Approved by the Board of Directors | | |

| (signed) Malcolm Clay | Director | | (signed) Robert Callander | Director |

The accompanying notes are an integral part of these condensed interim financial statements.

Minco Gold Corporation

Condensed Interim Statements of Loss

For the three and nine months ended September 30, 2017, and 2016

(Unaudited, expressed in Canadian dollars, unless otherwise stated)

| | | | | |

| | Three months ended | Nine months ended |

| | September 30, | September 30, |

| | 2017 | 2016 | 2017 | 2016 |

| | $ | $ | $ | $ |

Gain (loss) from investments at fair value(note 5) - Realized | - | - | 46,991 | - |

| - Unrealized | (3,221,925) | - | (2,198,050) | - |

| | (3,241,925) | - | (2,151,059) | - |

| | | | | |

| Operating expenses | | | | |

| Accounting and audit | 17,305 | 31,108 | 71,745 | 67,223 |

| Amortization | 873 | 464 | 2,620 | 2,489 |

| Consulting | 18,311 | 21,103 | 54,429 | 37,629 |

| Directors’ fees | 12,000 | 11,000 | 42,500 | 38,638 |

| Exploration cost | - | 49,788 | - | 169,556 |

| Gain on legal settlement | - | (38,657) | - | (527,657) |

| Investor relations | 722 | 457 | 10,507 | 11,413 |

| Legal and regulatory | 31,425 | 32,862 | 88,323 | 106,873 |

| Office and miscellaneous | 29,772 | 57,210 | 132,455 | 182,688 |

| Investment investigation | 15,464 | 45,396 | 99,095 | 111,846 |

| Salaries and benefits | 72,225 | 27,400 | 151,099 | 90,818 |

| Share-based compensation (note 7(b)) | 75,923 | 22,471 | 240,286 | 89,325 |

| Travel and transportation | 4,039 | 5,710 | 17,193 | 14,740 |

| Total operating expenses | 278,059 | 266,312 | 910,252 | 395,581 |

| Operating loss | (3,499,984) | (266,312) | (3,061,311) | (395,581) |

| Finance income | 8,276 | 15,465 | 26,750 | 48,087 |

| Foreign exchange gain (loss) | (155,351) | 72,739 | (307,356) | (253,539) |

| Share of loss from an associate (note 6) | - | (8,707) | - | (444,383) |

| Dilution loss | - | (27,353) | - | (94,478) |

| Net loss for the period | (3,647,059) | (214,168) | (3,341,917) | (1,139,894) |

| Loss per share | | | | |

| Basic and diluted | (0.07) | (0.00) | (0.07) | (0.02) |

Weighted average number of common shares outstanding Basic and diluted | 50,733,381 | 50,732,729 | 50,364,411 | 50,672,089 |

| | | | | |

| | | | | |

| | | | | | | |

The accompanying notes are an integral part of these condensed interim financial statements.

Minco Gold Corporation

Condensed Interim Statements of Comprehensive Loss

For the three and nine months ended September 30, 2017, and 2016

(Unaudited, expressed in Canadian dollars, unless otherwise stated)

| | Three months ended | Nine months ended |

| | September 30, | September 30, |

| | 2017 | 2016 | 2017 | 2016 |

| | $ | $ | $ | $ |

| Net loss for the period | (3,647,059) | (214,168) | (3,341,917) | (1,139,894) |

| Other comprehensive income (loss) | | | | |

| Items that may be reclassified subsequently to profit or loss: | | | | |

| Share of other comprehensive income (loss) of an equity investee | - | 149,744 | - | (1,219,477) |

| | | | | |

| Total comprehensive loss for the period | (3,647,059) | (64,424) | (3,341,917) | (2,359,371) |

The accompanying notes are an integral part of these condensed interim financial statements.

Minco Gold Corporation

Condensed Interim Statements of Changes in Equity

For the nine months ended September 30, 2017, and 2016

(Unaudited, expressed in Canadian dollars, unless otherwise stated)

| | Number of shares | Share capital | Contributed surplus | Accumulated other comprehensive income | Deficits | Subtotal |

| | | $ | $ | $ | $ | $ |

| | | | | | | |

| Balance - January 1, 2016 | 50,581,381 | 41,911,823 | 9,247,685 | 2,763,940 | (37,969,012) | 15,954,436 |

| Net loss for the period | - | - | - | - | (1,139,894) | (1,139,894) |

| Other comprehensive loss | - | - | - | (1,219,477) | - | (1,219,477) |

| Proceeds on issuance of shares from exercise of options | 152,000 | 65,063 | (26,276) | - | - | 38,787 |

| Share-based compensation | - | - | 89,325 | - | - | 89,325 |

| Balance - September 30, 2016 | 50,733,381 | 41,976,886 | 9,310,734 | 1,544,463 | (39,108,906) | 13,723,177 |

| | | | | | | |

Balance - January 1, 2017 | 50,733,381 | 41,976,886 | 9,322,102 | - | (30,751,944) | 20,547,044 |

| | | | | | | |

| Net loss for the period | - | - | - | - | (3,341,917) | (3,341,917) |

| Share-based compensation | - | - | 240,285 | - | - | 240,285 |

| Balance - September 30, 2017 | 50,733,381 | 41,976,886 | 9,562,387 | - | (34,093,861) | 17,445,412 |

The accompanying notes are an integral part of these condensed interim financial statements.

Minco Gold Corporation

Condensed Interim Statements of Changes in Equity

For the nine months ended September 30, 2017, and 2016

(Unaudited, expressed in Canadian dollars, unless otherwise stated)

| | | | |

| | Nine months ended September 30, |

| | 2017 | 2016 |

| Cash flow provided by (used in) | $ | $ |

| Operating activities | | |

| Net loss for the period | (3,341,917) | (1,139,894) |

| Adjustments for: | | |

| Amortization | 2,620 | 2,489 |

| Share of loss on equity investment in Minco Silver | - | 444,383 |

| Dilution loss | - | 94,478 |

| Foreign exchange loss | 307,356 | 253,539 |

| Gain on investment | (46,991) | - |

| Unrealized loss from investments at fair value | 2,198,050 | - |

| Share-based compensation (note 7 (b)) | 240,285 | 89,325 |

| Purchase of short-term investment (note 4) | (1,049,468) | - |

| Redemption of short-term investment (note 4) | 3,409,575 | 430,000 |

| Purchase of investments at fair value (note 5) | (2,387,333) | - |

| Disposition of investments at fair value (note 5) | 131,224 | - |

| Changes in items of working capital: | | |

| Receivables | 144,179 | (53,792) |

| Due from (to) related parties | 187,150 | (387,769) |

| Prepaid expenses and deposits | 13,559 | 89,935 |

| Accounts payable and accrued liabilities | (113,377) | (265,144) |

| Cash used in operating activities | (305,088) | (442,450) |

| | | |

| | | |

| Financing activities | | |

| Proceeds from stock option exercises | - | 38,787 |

| Cash generated from financing activities | - | 38,787 |

| Effect of exchange rate changes on cash and cash equivalents | (307,356) | (253,539) |

| Decrease in cash and cash equivalents | (612,444) | (657,202) |

| Cash and cash equivalents- Beginning of period | 4,575,119 | 5,593,669 |

| Cash and cash equivalents- End of period | 3,962,675 | 4,936,467 |

| Cash paid for income tax | - | - |

| | | | | |

The accompanying notes are an integral part of these condensed interim financial statements.

Minco Gold Corporation

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2017, and 2016

(Unaudited, expressed in Canadian dollars, unless otherwise stated)

| 1. | General information and change of business |

Minco Gold Corporation (“Minco Gold” or the “Company”) was incorporated in 1982 under the laws of British Columbia, Canada as Cap Rock Energy Ltd. The Company changed its name to Minco Gold in 2007. The registered office of the Company is 2772 - 1055 West Georgia Street, British Columbia, Canada.

The Company was previously an exploration stage enterprise that engaged in exploration and evaluation of gold-dominant mineral properties and projects. On November 11, 2016, the Company applied to the TSX for delisting from the TSX and listing on the TSX Venture Exchange (“TSX-V”) as an Investment Issuer. At the same time, the Company also has changed its business in making investment in privately held and publicly traded companies. The Company received approval from TSX-V and the Company’s common shares commenced to trade on the TSX Venture exchange (TSX-V) under the symbol MMM on May 1, 2017.

The Company determined it has met the definition of investment entity under IFRS 10Consolidated financial statementsas of November 11, 2016.As such, the Company commenced accounting for its investment in Minco Silver Corporation (“Minco Silver”) at fair value through profit or loss (“FVTPL”) starting November 11, 2016 in accordance with IAS 39Financial Instruments: recognition and measurement (“IAS 39”) (Note 5 and 6).

These condensed interim financial statements have been prepared under the historical cost convention, except for investments carried in FVTPL, and are in compliance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) applicable to the preparation of interim financial statements including IAS 34, Interim Financial Reporting. The condensed interim financial statements should be read in conjunction with the Company’s annual financial statements for the year ended December 31, 2016, which have been prepared in accordance with IFRS as issued by the IASB.

The accounting policies applied in these condensed interim financial statements are consistent with those applied in the preparation of the financial statements for the year ended December 31, 2016.

Certain financial information for the comparative period in 2016 has been reclassified to conform to the presentation in the current period ending September 30, 2017.

These condensed interim financial statements were approved by the board of directors for issue on November 24, 2017.

3. Cash and cash equivalents

Cash and cash equivalents comprise cash on hand and guaranteed investment certificates with initial maturities of less than three months. The Company did not have cash equivalents on September 30, 2017 or December 31, 2016.

As at September 30, 2017, the Company’s’ cash balance included USD$ 3,063,551 (or $3,822,882) (December 31, 2016 - USD$3,297,492 (or $4,433,972)).

4. Short-term investment

As at September 30, 2017, the Company’s short-term investments mainly consisted of a guaranteed investment certificates of $971,954 that will mature on August 29, 2018. The yield on th investment is 1.05%.

Minco Gold Corporation

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2017, and 2016

(Unaudited, expressed in Canadian dollars, unless otherwise stated)

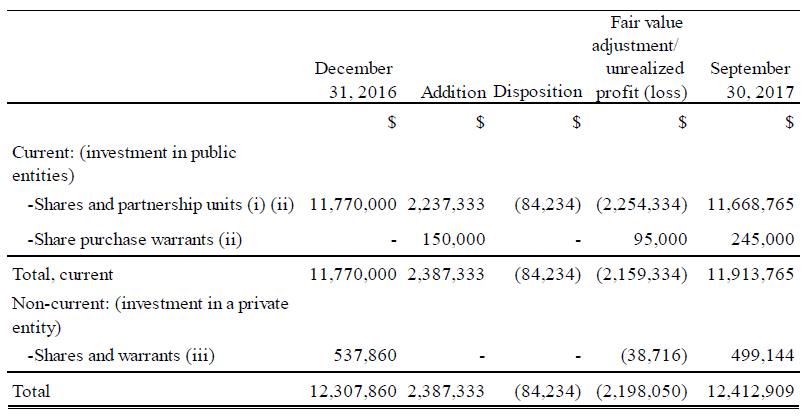

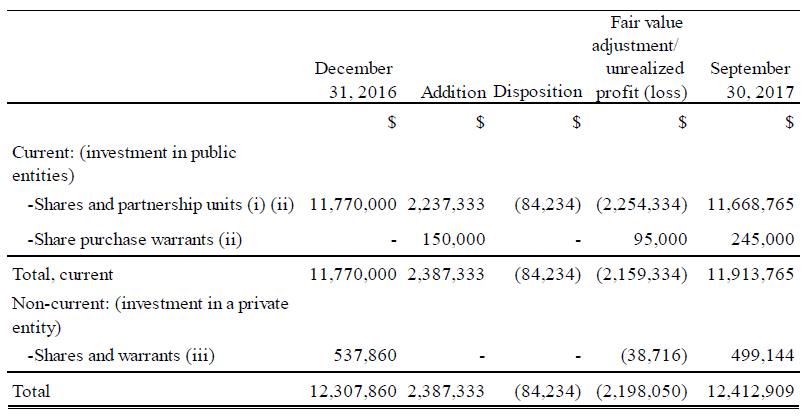

5. Investments at fair value

During the nine months ended September 30, 2017, the Company acquired and disposed common shares, partnership units, and warrants of public and private entities and realized a profit of $46,991. Other details are as follows:

(i) Including to the Company’s investment in public entities are 11,000,000 common shares of Minco Silver, a Canadian public company. The Company had an interest of 18.12 % on Minco Silver on September 30, 2017 (December 31, 2016 -18.26%) (Note 6).

(ii) The Company considers the closing price of the marketable securities issued by public entities at each reporting date as their fair values.

The Company apply Black-Scholes option pricing model to value public company’s share purchase warrants at the reporting date.

(iii) In December, 2016, the Company acquired 5.9% or 400,000 units (“Unit”) of El Olivar Imperial SAC (“El Olivar”), a privately held Peruvian corporation, for USD$ 400,000 ($537,860).

One director of the Company is also a director, an officer, and a controlling shareholder of EI Olivar.

The cost of the investment in EI Olivar $499,144 (USD$ 400,000) approximated its fair value as at September 30, 2017, Since EI Olivar did not have any significant changes that may cause a material change to El Olivar’s fair value after the Company’s acquisition of their shares.

Subsequent to the period ended September 30, 2017, the Company has used approximately $358,000 to acquire marketable securities of four public entities from open market with resources on hands.

Minco Gold Corporation

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2017, and 2016

(Unaudited, expressed in Canadian dollars, unless otherwise stated)

| 6. | Investment in an associate |

The Company is considered of having significantly influence on Minco Silver through common officers and a common director. The Company accounted for its investment in Minco Silver using the equity method up to November 11, 2016, when the Company met the definition of an investment entity and commenced accounting for this investment at FVTPL (Note 1 and 5).

As at November 11, 2016, September 30, 2016 and December 31, 2015, the Company owned 11,000,000 common shares of Minco Silver.

Following is a summary of Minco Silver’s income statement for the comparative three and nine months ended September 30, 2016.

| | Three months ended September 30, 2016 | Nine months ended September 30, 2016 |

| | $ | $ |

| Administrative expenses | (509,505) | (1,957,983) |

| Interest income | 50,600 | 412,874 |

| Net loss for the period | (102,824) | (2,555,364) |

| Other comprehensive loss for the period | (2,917,285) | (7,668,014) |

| Comprehensive loss for the period | (7,148,205) | (10,233,378) |

| a. | | Common shares and contributed surplus |

Authorized: 100,000,000 common shares without par value

Minco Gold may grant options to its directors, officers, employees and consultants under its stock option plan (the “Stock Option Plan”) which was recently revised and approved by shareholders on June 27, 2017 at the Company’s annual general meeting. The Company’s board of directors grants such options for periods of up to ten years, with vesting periods determined at its sole discretion and at prices not less than the closing price on the grant date less the maximum discount permitted under the TSX Policy applicable to options. These options are equity-settled. The maximum number of common shares reserved for issuance under the Stock Option Plan is 10,152,976.

Minco Gold Corporation

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2017, and 2016

(Unaudited, expressed in Canadian dollars, unless otherwise stated)

| 7. | Share capital(continued) |

During the nine months ended September 30, 2017, the Company granted stock options to employees, consultants and directors for the purchase of 2,400,000 common shares at an exercise price ranged from $0.19 to $0.24 per common share. These options vest over an 18-month period from the issue date and will expire on five years after issuance if unexercised.

A summary of the options outstanding is as follows:

| | Number outstanding | | Weighted average exercise price |

| | | | $ |

| January 1, 2016 | 6,589,834 | | 0.72 |

| Exercised | (152,000) | | 0.26 |

| Forfeited | (72,000) | | 0.47 |

| Expired | (1,122,500) | | 2.17 |

| Balance, December 31, 2016 | 5,243,334 | | 0.43 |

| Granted | 2,400,000 | | 0.23 |

| Expired | (1,245,000) | | 0.67 |

| Balance, September 30, 2017 | 6,398,334 | | 0.31 |

The weighted average share price on the date of exercise was $Nil during the nine months ended September 30, 2017 (2016 - $0.26). As at September 30, 2017, there was $133,528 (December 31, 2016- $6,662) of total unrecognized compensation cost relating to unvested stock options.

| | | | | | | | |

| Options outstanding | | Options exercisable |

| | | | | | | |

Range of exercise prices | Number outstanding | Weighted average remaining contractual life (years) | Weighted average exercise price | | Number exercisable | Weighted average exercise price |

| $ | | | $ | | | $ |

| 0.18 - 0.24 | 3,403,334 | 4.00 | 0.23 | | 1,669,996 | 0.24 |

| 0.25 - 0.42 | 895,000 | 1.29 | 0.26 | | 895,000 | 0.26 |

| 0.43 - 0.46 | 2,100,000 | 0.23 | 0.46 | | 2,100,000 | 0.46 |

| | 6,398,334 | 2.38 | 0.31 | | 4,664,996 | 0.34 |

| | | | | | | | | | | | | |

Minco Gold Corporation

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2017, and 2016

(Unaudited, expressed in Canadian dollars, unless otherwise stated)

| 7. | Share capital(continued) |

The Company uses the Black-Scholes option pricing model to determine the fair value of the options granted with the following assumptions:

| | September 30, 2017 |

| Risk-free interest rate | 0.78% - 1.74% |

| Dividend yield | 0% |

| Volatility | 85% - 97% |

| Forfeiture rate | 21% |

| Estimated expected lives | 5 years |

Option pricing models require the use of subjective estimates and assumptions including the expected stock price volatility. The stock price volatility is calculated based on the Company’s historical volatility. Changes in the underlying assumptions can materially affect the fair value estimates.

8. Related party transactions

Trust agreement with Minco Mining (China) Corp. (“Minco China”)

When the Company disposed its Chinese subsidiaries on July 31, 2015 to Minco Silver, the Company ceased to have subsidiaries in China. As a result, the Company entered into a trust agreement with Minco China, a subsidiary of Minco Silver, to hold the interest of certain remaining assets (the “Retained Assets”) in China on behalf of the Company. This trust agreement was eliminated on June 30, 2017 after the net proceeds from the disposition of the Retained Assets in 2016, that was previously held by Minco Silver under this trust agreement, was received by the Company.

Shared office expenses

Minco Silver, Minco Base Metals Corporation (“MBM”), a company with which the Company’s CEO has significant influence over, and Minco Gold share offices and certain administrative expenses in Vancouver.

Due from related parties

As at September 30, 2017, the Company had the following amounts due from related parties:

| • | $24,344 shared office expenses recoverable from Minco Silver (December 31, 2016 - $205,145). |

| • | $12,178 shared office expenses recoverable from MBM (December 31, 2016 - $18,527) |

The amounts due to and due from related parties are unsecured, non-interest bearing and payable on demand.

Minco Gold Corporation

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2017, and 2016

(Unaudited, expressed in Canadian dollars, unless otherwise stated)

8. Related party transactions(continued)

Key management compensation

Key management includes the Company’s directors and senior management. This compensation is included in exploration costs and administrative expenses.

For the three and nine month ended September 30, 2017 and 2016, the following compensation was paid and accrued for compensation to key management:

| | Three months ended September 30, | Nine months ended September 30 |

| | 2017 | 2016 | 2017 | 2016 |

| | $ | $ | $ | $ |

| Cash remuneration | 78,436 | 65,478 | 223,804 | 203,254 |

| Share-based compensation | 66,099 | 25,789 | 208,356 | 79,404 |

| Total | 144,535 | 91,267 | 432,160 | 282,658 |

The above transactions were conducted in the normal course of business.

| 9. | Financial instruments andfair value measurements |

Financial assets and liabilities have been classified into categories that determine their basis of measurement and, for items measured at fair value, whether changes in fair value are recognized in the statement of income or comprehensive income. Those categories are: loans and receivables, other financial liabilities and financial assets measured at fair value through profit or loss.

The following table summarizes the carrying value of financial assets and liabilities at September 30, 2017 and December 31, 2016:

| | | | September 30, 2017 | December 31, 2016 |

| | | | | $ | $ |

| Fair value through profit and loss | | |

| Investments at fair value, current and non-current (note 5) | 12,412,909 | 12,307,860 |

| Loans and receivables | | | |

| Cash | | | | 3,962,675 | 4,575,119 |

| Short-term investment | | 991,955 | 3,352,062 |

| Receivables | | | 25,201 | 169,380 |

| Due from related parties | | 36,522 | 223,672 |

| Other Financial Liabilities | | | |

| Accounts payables and accrued liabilities | 98,049 | 211,427 |

Minco Gold Corporation

Notes to the Condensed Interim Financial Statements

For the three and nine months ended September 30, 2017, and 2016

(Unaudited, expressed in Canadian dollars, unless otherwise stated)

| 9. | Financial instruments andfair value measurements(continued) |

Financial assets and liabilities that are recognized on the balance sheet at fair value can be classified in a hierarchy that is based on the significance of the inputs used in making the measurements. The levels in the hierarchy are:

Level 1 - quoted prices (unadjusted) in active markets for identical assets or liabilities;

Level 2 - inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly (that is, as prices) or indirectly (that is, derived from prices); and

Level 3 - inputs for the asset or liability that are not based on observable market data (that is, unobservable inputs).

As at September 30, 2017 and December 31, 2016, financial instruments that are not measured at fair value on the balance sheet are represented by cash, short-term investments, receivables, due from related parties, account payable and accrued liabilities. The fair values of these financial instruments approximate their carrying value due to their short-term nature

As at September 30, 2017 and December 31, 2016, the Company's financial assets measured at fair values through profit or loss are classified as follows:

| September 30, 2017 | Level 1 | Level 2 | Level 3 |

| | $ | $ | $ |

| Investments at fair value, current | 11,668,765 | - | 245,000(ii) |

| Investments at fair value, non-current | - | - | 499,144 (i) |

| | | | |

| December 31, 2016 | Level 1 | Level 2 | Level 3 |

| | $ | $ | $ |

| Investments at fair value, current | 11,700,000 | - | - |

| Investments at fair value, non-current | - | - | 537,860 (i) |

(i) The measurement of the fair value of investment in EI Olivar Imperial SAC was classified as level 3 as the fair value was estimated based on the latest market transaction value of this investment adjusted for the change in foreign exchange rate between US dollar and Canadian dollar.

(ii) The fair value of certain share purchase warrant has been calculated by using the Black-Scholes option pricing model with certain assumptions applied.