UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-07797 |

| |

| SunAmerica Series, Inc. |

| (Exact name of registrant as specified in charter) |

| |

| Harborside 5, 185 Hudson Street, Jersey City, NJ | | 07311 |

| (Address of principal executive offices) | | (Zip code) |

| |

John T. Genoy

Senior Vice President

SunAmerica Asset Management, LLC

Harborside 5,

185 Hudson Street,

Jersey City, NJ 07311 |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | (201) 324-6414 | |

| |

| Date of fiscal year end: | October 31 | |

| |

| Date of reporting period: | October 31, 2020 | |

Item 1. Reports to Stockholders

This filing is on behalf of five of the six series of portfolios of SunAmerica Series, Inc.

n AIG Asset Allocation Funds

n AIG Focused Dividend Strategy Fund

n AIG Strategic Value Fund

n AIG Select Dividend Growth Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund's shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. At any time, you may elect to receive reports and other communications from a Fund electronically by calling 800-858-8850 or contacting your financial intermediary directly.

You may elect to receive all future reports in paper free of charge. If your account is held directly at the Fund, you can inform the Fund that you wish to receive paper copies of reports by calling 800-858-8850. If your account is held through a financial intermediary, please contact the financial intermediary to make this election. Your election to receive paper will apply to all AIG Funds in which you are invested and may apply to all funds held with your financial intermediary.

A Message from the President | | | 2 | | |

| Expense Example | | | 5 | | |

| Statement of Assets and Liabilities | | | 7 | | |

| Statement of Operations | | | 9 | | |

| Statement of Changes in Net Assets | | | 10 | | |

Financial Highlights | | | 12 | | |

| Portfolio of Investments | | | 17 | | |

| Notes to Financial Statements | | | 33 | | |

| Report of Independent Registered Public Accounting Firm | | | 53 | | |

| Statement Regarding Liquidity Risk Management Program | | | 55 | | |

| Approval of the Investment Advisory and Management Agreement | | | 56 | | |

| Director and Officer Information | | | 61 | | |

| Shareholder Tax Information | | | 64 | | |

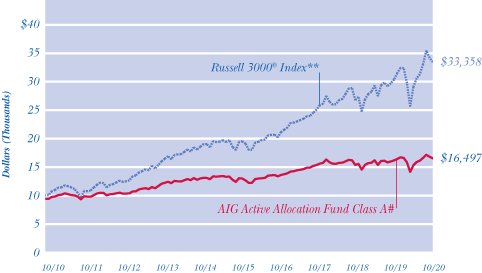

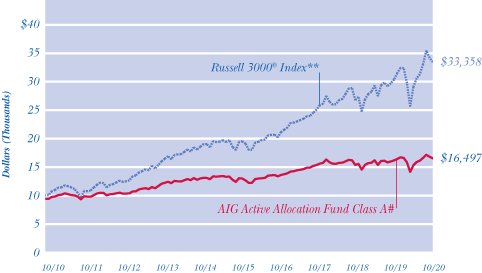

| Comparisons: Funds vs. The Indices | | | 65 | | |

A MESSAGE FROM THE PRESIDENT — (unaudited)

Dear Shareholders:

All of us at AIG and SunAmerica Asset Management, along with our Fund subadvisers, hope this annual report finds you and yours safe and well during these challenging times.

As the COVID-19 pandemic continues to evolve, know that we remain focused on serving our Fund shareholders. As such, we are pleased to present this annual update for SunAmerica Series, Inc. (the "Series"), including the AIG Multi-Asset Allocation Fund, AIG Active Allocation Fund, AIG Focused Dividend Strategy Fund, AIG Strategic Value Fund and AIG Select Dividend Growth Fund (the "Funds"), covering the 12-month period ended October 31, 2020.

Overall, global bonds and global equities advanced, while commodities generated negative returns. Virtually all asset classes saw volatility surge during the annual period.

Global equities rose as the annual period began in November 2019. In our view, waning recession fears and forecasts for improving global economic growth in 2020 helped bolster investor sentiment, while geopolitics and trade disputes, especially between the U.S. and China, persisted as major drivers of market volatility. In December 2019, the U.S. Administration announced that a "Phase One" trade deal with China had been agreed to in principle, providing significant relief to global markets. U.S. equities were further supported by accommodative U.S. Federal Reserve ("Fed") policy. The Fed had lowered interest rates by 25 basis points† in October 2019, its third interest rate cut of the calendar year, but then left rates unchanged for the remainder of the fourth quarter.

Most global equity markets continued to advance as 2020 began, with U.S. equities achieving record highs in February. However, as COVID-19 spread rapidly across the globe, it caused unprecedented disruption to financial markets and economies and soured trade deal optimism between the U.S. and China. Thus, global equities ended the first quarter of 2020 significantly lower. Exacerbating matters was the plunging of the price of oil to its lowest level since 2002, as the world's largest oil producers failed to agree on reducing output as demand collapsed. Most central banks and governments took extraordinary measures in an effort to limit financial market stress, mitigate the economic fallout and cushion household and business income. The U.S. Fed cut the targeted federal funds rate to near zero and increased the scope of its asset purchase program. Many other developed market central banks also added accommodation, while several emerging market central banks embarked on quantitative easing for the first time. On the fiscal front, the U.S. government enacted a $2 trillion relief bill, unleashing a massive stimulus plan to stem economic damage. For the quarter, U.S. equities, as represented by the S&P 500 Index*, suffered its fastest-ever decline into a bear market but surged to its best weekly gain in 11 years at the end of the March 2020 on Fed and U.S. government emergency stimulus action. Still, the late surge was not enough to pull the U.S. equity market out of significant losses for the quarter.

Then, in yet another sharp reversal, global equities saw their best quarterly return since December 1999 in the second quarter of 2020 and continued to rise during the third quarter of 2020. Markets were fueled by optimism around successful early-stage trials for a potential COVID-19 vaccine, ongoing fiscal and monetary stimulus and signs global economic activity was improving. As new COVID-19 cases declined in most countries, governments shifted their focus toward gradually lifting lockdown restrictions, even as new cases rose significantly in some areas of the U.S. and as India and much of Latin America struggled to bring the coronavirus under control. Also, oil prices rebounded as the global economy appeared to begin to recover. In the second calendar quarter, U.S. equities rallied to their largest quarterly gain since the fourth quarter of 1998, even as the National Bureau of Economic Research declared in June that a U.S. economic recession had officially begun in February 2020. U.S. equities extended their strong rally in the third calendar quarter, buoyed by better than consensus expected corporate earnings. Still, volatility remained high, as the U.S. grappled with political uncertainty ahead of the November presidential election and the lack of additional fiscal stimulus.

2

A MESSAGE FROM THE PRESIDENT — (unaudited) (continued)

The roller coaster continued, as global equity markets, including the U.S. equity market, then fell in October 2020. Corporate earnings results for many companies that reported in October came in above consensus expectations. However, expectations had been heightened by reports the U.S. economy had grown robustly in the third calendar quarter as businesses resumed activity postponed or restricted by COVID-19. Also, political uncertainty surrounding U.S. elections and spikes in COVID-19 positivity, hospitalization and mortality rates in the U.S. and around the world proved sources of volatility.

The broad global fixed income market posted a positive return for the annual period overall. Despite accommodative central bank policies, government bond yields increased across most markets in the last months of 2019, as global activity indicators stabilized and trade negotiations seemed to progress. Government bond yields in several developed markets, including the U.S., then fell to record lows in the first quarter of 2020, as the COVID-19 pandemic sparked fears of a global economic recession and major central banks engaged in an aggressive easing cycle. Most global government bond yields remained largely range-bound near record lows across most developed markets in the second quarter of 2020, supported by extremely accommodative central bank purchase programs. In the last four months of the annual period, yield curves steepened, led by increases in yields on longer-term maturities in several developed markets, while most other government bond yields generally drifted lower. The Fed extended its emergency liquidity provisions through the end of 2020 and unveiled a new inflation policy framework that will allow inflation to modestly exceed 2% without a hawkish†† policy response. This low-for-longer and inflation tolerance policy stance by the Fed prompted the sell-off in longer-dated securities, while strong demand for government bonds as a perceived "safe haven" kept short-to-intermediate-term yields low. In October, the 10-year U.S. Treasury yield rose, which seemed to reflect rising hopes of economic stimulus, and credit sectors and securitized sectors outperformed duration-equivalent government bonds. Most non-government bond sectors underperformed the broad fixed income market for the annual period overall, but still posted positive absolute returns. The primary exceptions were investment grade corporate bonds and Treasury inflation protected securities, which performed especially strongly during the annual period.

Commodities were challenged during the annual period overall. At the end of 2019, commodities gained across all four sectors. However, in the first quarter of 2020, commodities faced severe headwinds, led down by the energy sector, as oil prices fell sharply after an OPEC+††† agreement to curtail production disintegrated. Only precious metals gained, supported by an increase in gold prices, as investors flocked to what were perceived as "safe haven" assets. In the second and third quarters of 2020, commodities broadly advanced. Energy prices rose, supported by an improving global demand outlook as economies gradually began to reopen. Industrial metals rose as mine closures caused supply disruptions. Precious metals lifted despite the gradual reopening of economies, with gold prices closing above $1,800 per ounce for the first time in more than eight years, as low interest rates and a resurgence of COVID-19 cases increased demand. Commodities ended the month of October lower, with energy once again the weakest performing sector, as it was for the annual period overall. Agriculture and livestock also declined for the annual period as whole, while precious metals and industrial metals rose.

During the annual period overall, developed market equities, as measured by the 4.36% return of the MSCI World Index*, underperformed emerging market equities, as measured by the 8.25% return of the MSCI Emerging Markets Index*. Among the developed markets, U.S. equities, as measured by the 9.71% return of the S&P 500 Index*, significantly outperformed non-U.S. equities, as measured by the -6.86% return of the MSCI EAFE Index*. Within the U.S. equity market, large-cap stocks performed best, followed at some distance by mid-cap stocks. Small-cap stocks posted a modest negative return during the annual period. Growth stocks significantly outpaced valued stocks across the capitalization spectrum. U.S. bonds, as presented by the Bloomberg Barclays U.S. Aggregate Bond Index*, and global bonds, as represented by the Bloomberg Barclays Global Aggregate Bond Index*, posted returns of 6.19% and 5.63%, respectively, for the annual period overall. The Bloomberg Barclays U.S. Treasury Index*, returned 6.95%, while international government bonds, as represented by the FTSE Non-U.S. WGBI (USD, hedged)*, returned 3.06%. Commodities, as represented by the Bloomberg Commodity Index*, returned -8.75% for the same annual period.

3

A MESSAGE FROM THE PRESIDENT — (unaudited) (continued)

Whether you invest in any of our Funds separately or you invest in a mix of AIG Funds through our Asset Allocation Funds, we believe our mutual funds may provide valuable tools for investors and their financial professionals to help optimize their asset allocations amidst whatever market conditions may arise.

On the following pages, you will find financial statements and portfolio information for each of the Series Funds for the annual period ended October 31, 2020. You will also find a comprehensive review of the Funds' performance and management strategies.

Thank you for being a part of the Series Funds. We value your ongoing confidence in us and look forward to serving your investment needs in the future. As always, if you have any questions regarding your investments, please contact your financial professional or get in touch with us directly at 800-858-8850 or via our website at www.aig.com/funds.

Sincerely,

Sharon French

President & CEO

SunAmerica Asset Management, LLC

Past performance is no guarantee of future results. Diversification and asset allocation do not guarantee a profit nor protect against a loss.

Because focused mutual funds are less diversified than typical mutual funds, the performance of each holding in a focused fund has a greater impact upon the overall portfolio, which increases risk. The AIG Focused Dividend Strategy Fund holds up to 30 high dividend yielding common stocks selected annually from the Dow Jones Industrial Average and the broader market. The AIG Select Dividend Growth Fund holds up to 40 high-dividend yielding common stocks selected annually from the Russell 1000 Index. The AIG Active Allocation Fund and AIG Multi-Asset Allocation Fund are funds-of-funds, allocated and monitored by SunAmerica Asset Management, LLC.

* The MSCI World Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of 23 developed markets. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of 26 emerging markets. The S&P 500 Index is an unmanaged, weighted index of 500 large company stocks that is widely recognized as representative of the performance of the U.S. stock market. The MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of 21 developed markets, excluding the U.S. and Canada. The Bloomberg Barclays U.S. Aggregate Bond Index represented securities that are U.S. domestic, taxable and dollar denominated. The index covers components for government and corporate securities, mortgage pass-through securities and asset-backed securities. The Bloomberg Barclays Global Aggregate Bond Index provides a broad-based measure of the global investment-grade fixed income markets. The Bloomberg Barclays U.S. Treasury Index measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury. The FTSE WGBI (World Government Bond Index) (USD, hedged) is a market capitalization-weighted bond index consisting of the government bond markets of more than 20 countries, including all fixed-rate bonds with a remaining maturity of one year or longer and with amounts outstanding of at least the equivalent of US$50 billion. The Bloomberg Commodity Index is a broadly diversified index made up of 23 exchange-traded futures on physical commodities weighted to account for economic significance and market liquidity. Indices are not managed and an investor cannot invest directly into an index.

† A basis point is 1/100th of a percentage point.

†† Hawkish language tends to suggest higher interest rates; opposite of dovish.

††† OPEC+ is composed of the Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC oil-producing countries, most notably Russia.

4

EXPENSE EXAMPLE — October 31, 2020 — (unaudited)

Disclosure of Fund Expenses in Shareholder Reports

As a shareholder of a Fund in the SunAmerica Series, Inc. (the "Series"), you may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges and (2) ongoing costs, including management fees, distribution and account maintenance fees and other Fund expenses. The example set forth below is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at May 1, 2020 and held until October 31, 2020.

Actual Expenses

The "Actual" section of the table provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the column under the heading entitled "Expenses Paid During the Six Months Ended October 31, 2020" to estimate the expenses you paid on your account during this period. For shareholder accounts in classes other than Class W, the "Expenses Paid During the Six Months Ended October 31, 2020" column and the "Annualized Expense Ratio" column do not include small account fees that may be charged if your account balance is below $500 ($250 for retirement plan accounts). In addition, the "Expenses Paid During the Six Months Ended October 31, 2020" column and the "Annualized Expense Ratio" column do not include administrative fees that may apply to qualified retirement plan accounts. See the Funds' Prospectuses, your retirement plan document and/or materials from your financial adviser, for a full description of these fees. Had these fees been included, the "Expenses Paid During the Six Months Ended October 31, 2020" column would have been higher and the "Ending Account Value" column would have been lower.

Hypothetical Example for Comparison Purposes

The "Hypothetical" section of the table provides information about hypothetical account values and hypothetical expenses based on each Fund's actual expense ratio and an annual rate of return of 5% before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. For shareholder accounts in classes other than Class W, the "Expenses Paid During the Six Months Ended October 31, 2020" column and the "Annualized Expense Ratio" column do not include small account fees that may be charged if your account balance is below $500 ($250 for retirement plan accounts). In addition, the "Expenses Paid During the Six Months Ended October 31, 2020" column and the "Annualized Expense Ratio" column do not include administrative fees that may apply to qualified retirement plan accounts and accounts held through financial institutions. See the Funds' Prospectuses, your retirement plan document and/or materials from your financial adviser, for a full description of these fees. Had these fees been included, the "Expenses Paid During the Six Months Ended October 31, 2020" column would have been higher and the "Ending Account Value" column would have been lower.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, including sales charges on purchase payments, contingent deferred sales charges, small account fees and administrative fees, if applicable, to your account. Please refer to the Funds' Prospectuses, your retirement plan document and/or material from your financial adviser, for more information. Therefore, the "Hypothetical" example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs and other fees were included, your costs would have been higher.

5

EXPENSE EXAMPLE — October 31, 2020 — (unaudited) (continued)

| | | Actual | | Hypothetical | | | |

Fund | | Beginning

Account Value

At May 1,

2020 | | Ending Account

Value Using

Actual

Return at

October 31,

2020 | | Expenses Paid

During the

Six Months

Ended

October 31,

2020* | | Beginning

Account Value

At May 1,

2020 | | Ending Account

Value Using

a Hypothetical

5% Annual

Return at

October 31,

2020* | | Expenses Paid

During the

Six Months

Ended

October 31,

2020* | | Annualized

Expense

Ratio* | |

AIG Multi-Asset

Allocation Fund† | |

| Class A | | $ | 1,000.00 | | | $ | 1,088.49 | | | $ | 1.05 | | | $ | 1,000.00 | | | $ | 1,024.13 | | | $ | 1.02 | | | | 0.20 | % | |

| Class B# | | $ | 1,000.00 | | | $ | 1,082.61 | | | $ | 4.71 | | | $ | 1,000.00 | | | $ | 1,020.61 | | | $ | 4.57 | | | | 0.90 | % | |

| Class C# | | $ | 1,000.00 | | | $ | 1,085.39 | | | $ | 4.72 | | | $ | 1,000.00 | | | $ | 1,020.61 | | | $ | 4.57 | | | | 0.90 | % | |

AIG Active

Allocation Fund† | |

| Class A# | | $ | 1,000.00 | | | $ | 1,078.46 | | | $ | 1.31 | | | $ | 1,000.00 | | | $ | 1,023.88 | | | $ | 1.27 | | | | 0.25 | % | |

| Class B# | | $ | 1,000.00 | | | $ | 1,075.82 | | | $ | 4.70 | | | $ | 1,000.00 | | | $ | 1,020.61 | | | $ | 4.57 | | | | 0.90 | % | |

| Class C# | | $ | 1,000.00 | | | $ | 1,075.38 | | | $ | 4.70 | | | $ | 1,000.00 | | | $ | 1,020.61 | | | $ | 4.57 | | | | 0.90 | % | |

AIG Focused Dividend

Strategy Fund | |

| Class A | | $ | 1,000.00 | | | $ | 1,035.17 | | | $ | 5.63 | | | $ | 1,000.00 | | | $ | 1,019.61 | | | $ | 5.58 | | | | 1.10 | % | |

| Class B | | $ | 1,000.00 | | | $ | 1,031.87 | | | $ | 8.99 | | | $ | 1,000.00 | | | $ | 1,016.29 | | | $ | 8.92 | | | | 1.76 | % | |

| Class C | | $ | 1,000.00 | | | $ | 1,031.75 | | | $ | 8.94 | | | $ | 1,000.00 | | | $ | 1,016.34 | | | $ | 8.87 | | | | 1.75 | % | |

| Class W | | $ | 1,000.00 | | | $ | 1,036.93 | | | $ | 4.61 | | | $ | 1,000.00 | | | $ | 1,020.61 | | | $ | 4.57 | | | | 0.90 | % | |

AIG Strategic Value Fund | |

| Class A | | $ | 1,000.00 | | | $ | 1,031.12 | | | $ | 7.86 | | | $ | 1,000.00 | | | $ | 1,017.39 | | | $ | 7.81 | | | | 1.54 | % | |

| Class C | | $ | 1,000.00 | | | $ | 1,028.56 | | | $ | 12.34 | | | $ | 1,000.00 | | | $ | 1,012.97 | | | $ | 12.25 | | | | 2.42 | % | |

| Class W# | | $ | 1,000.00 | | | $ | 1,031.58 | | | $ | 7.76 | | | $ | 1,000.00 | | | $ | 1,017.50 | | | $ | 7.71 | | | | 1.52 | % | |

AIG Select Dividend

Growth Fund | |

| Class A# | | $ | 1,000.00 | | | $ | 1,100.03 | | | $ | 5.97 | | | $ | 1,000.00 | | | $ | 1,019.46 | | | $ | 5.74 | | | | 1.13 | % | |

| Class C# | | $ | 1,000.00 | | | $ | 1,096.22 | | | $ | 9.38 | | | $ | 1,000.00 | | | $ | 1,016.19 | | | $ | 9.02 | | | | 1.78 | % | |

| Class W# | | $ | 1,000.00 | | | $ | 1,100.78 | | | $ | 4.91 | | | $ | 1,000.00 | | | $ | 1,020.46 | | | $ | 4.72 | | | | 0.93 | % | |

* Expenses are equal to each Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by 184 days then divided by 366 days (to reflect the one-half year period). These ratios do not reflect transaction costs, including sales charges on purchase payments, contingent deferred sales charges, small account fees and administrative fees, if applicable to your account. Please refer to the Funds' prospectuses, your retirement plan document and/or materials from your financial adviser for more information.

# During the stated period, the investment adviser either waived a portion of or all of the fees and assumed a portion of or all expenses for the Funds or through recoupment provisions, recovered a portion of or all fees and expenses waived or reimbursed in the previous two fiscal years. As a result, if these fees and expenses had not been waived, the "Actual/Hypothetical Ending Account Value" would have been lower and the "Actual/Hypothetical Expenses Paid During the Six Months Ended October 31, 2020" and the "Annualized Expense Ratio" would have been higher. If these fees and expenses had not been recouped, the "Actual/Hypothetical Ending Account Value" would have been higher and the "Actual/Hypothetical Expenses Paid During the Six Months Ended October 31, 2020" and the "Annualized Expense Ratio" would have been lower.

† Does not include the expenses of the underlying funds that the Funds bear indirectly. If these indirect expenses had been included, the "Actual/Hypothetical Expenses Paid During the Six Months Ended October 31, 2020" and the "Annualized Expense Ratio" would have been higher and the "Actual/Hypothetical Ending Account Value" would have been lower.

6

STATEMENT OF ASSETS AND LIABILITIES — October 31, 2020

| | | AIG

Multi-Asset

Allocation

Fund | | AIG

Active

Allocation

Fund | | AIG

Focused

Dividend

Strategy

Fund | | AIG

Strategic

Value

Fund | | AIG

Select Dividend

Growth

Fund | |

ASSETS: | |

Investments at value (unaffiliated)* | | $ | — | | | $ | — | | | $ | 4,628,935,763 | | | $ | 152,618,811 | | | $ | 30,019,134 | | |

Investments at value (affiliated)* | | | 191,920,282 | | | | 112,827,291 | | | | — | | | | — | | | | — | | |

Repurchase agreements

(cost approximates value) | | | — | | | | — | | | | 13,883,000 | | | | 135,000 | | | | 115,000 | | |

Cash | | | — | | | | — | | | | 654 | | | | 365 | | | | 583 | | |

Receivable for: | |

Fund shares sold | | | 34,817 | | | | 47,040 | | | | 1,959,603 | | | | 7,254 | | | | 63 | | |

Dividends and interest | | | — | | | | — | | | | 11,752,839 | | | | 191,923 | | | | 45,779 | | |

Investments sold | | | — | | | | — | | | | 227,404,274 | | | | — | | | | — | | |

Prepaid expenses and other assets | | | 6,312 | | | | 6,130 | | | | 54,397 | | | | 8,138 | | | | 6,234 | | |

Due from investment adviser for

expense reimbursements/fee

waivers | | | 3,561 | | | | — | | | | — | | | | 1,796 | | | | 7,472 | | |

Total assets | | | 191,964,972 | | | | 112,880,461 | | | | 4,883,990,530 | | | | 152,963,287 | | | | 30,194,265 | | |

LIABILITIES: | |

Payable for: | |

Fund shares redeemed | | | 264,384 | | | | 19,069 | | | | 18,178,974 | | | | 32,443 | | | | 46,009 | | |

Investments purchased | | | — | | | | — | | | | 209,520,504 | | | | — | | | | — | | |

Investment advisory and

management fees | | | 16,849 | | | | 9,862 | | | | 2,064,693 | | | | 101,789 | | | | 19,985 | | |

Distribution and account

maintenance fees | | | 11,548 | | | | 8,957 | | | | 1,731,211 | | | | 49,046 | | | | 11,014 | | |

Service fees—Class W | | | — | | | | — | | | | 232,558 | | | | 530 | | | | 159 | | |

Transfer agent fees and expenses | | | 20,516 | | | | 10,209 | | | | 1,024,983 | | | | 45,450 | | | | 7,165 | | |

Directors' fees and expenses | | | — | | | | 5 | | | | 6,831 | | | | — | | | | 38 | | |

| Other accrued expenses | | | 106,492 | | | | 88,325 | | | | 886,729 | | | | 115,747 | | | | 90,308 | | |

Due to investment adviser for

expense recoupments | | | — | | | | 8,454 | | | | — | | | | — | | | | — | | |

| Total liabilities | | | 419,789 | | | | 144,881 | | | | 233,646,483 | | | | 345,005 | | | | 174,678 | | |

Net Assets | | $ | 191,545,183 | | | $ | 112,735,580 | | | $ | 4,650,344,047 | | | $ | 152,618,282 | | | $ | 30,019,587 | | |

*Cost | |

Investments (unaffiliated) | | $ | — | | | $ | — | | | $ | 4,758,606,711 | | | $ | 164,699,002 | | | $ | 29,989,889 | | |

Investments (affiliated) | | $ | 199,128,682 | | | $ | 114,025,858 | | | $ | — | | | $ | — | | | $ | — | | |

See Notes to Financial Statements.

7

STATEMENT OF ASSETS AND LIABILITIES — October 31, 2020 — (continued)

| | | AIG

Multi-Asset

Allocation

Fund | | AIG

Active

Allocation

Fund | | AIG

Focused

Dividend

Strategy

Fund | | AIG

Strategic

Value

Fund | | AIG

Select Dividend

Growth

Fund | |

NET ASSETS REPRESENTED BY: | |

Common stock, $0.0001 par value

(3 billion shares authorized) | | $ | 1,172 | | | $ | 722 | | | $ | 33,043 | | | $ | 633 | | | $ | 217 | | |

Paid-in capital | | | 203,497,939 | | | | 112,947,078 | | | | 5,405,687,329 | | | | 164,799,934 | | | | 31,230,827 | | |

| | | 203,499,111 | | | | 112,947,800 | | | | 5,405,720,372 | | | | 164,800,567 | | | | 31,231,044 | | |

Total accumulated earnings (loss) | | | (11,953,928 | ) | | | (212,220 | ) | | | (755,376,325 | ) | | | (12,182,285 | ) | | | (1,211,457 | ) | |

Net Assets | | $ | 191,545,183 | | | $ | 112,735,580 | | | $ | 4,650,344,047 | | | $ | 152,618,282 | | | $ | 30,019,587 | | |

Class A: | |

Net assets | | $ | 173,090,352 | | | $ | 98,205,386 | | | $ | 1,666,378,630 | | | $ | 144,370,270 | | | $ | 25,449,278 | | |

Shares outstanding | | | 10,581,778 | | | | 6,281,611 | | | | 118,030,591 | | | | 5,967,764 | | | | 1,834,810 | | |

Net asset value and redemption price

per share (excluding any applicable

contingent deferred sales charge) | | $ | 16.36 | | | $ | 15.63 | | | $ | 14.12 | | | $ | 24.19 | | | $ | 13.87 | | |

Maximum sales charge (5.75% of

offering price) | | | 1.00 | | | | 0.95 | | | | 0.86 | | | | 1.48 | | | | 0.85 | | |

Maximum offering price to public | | $ | 17.36 | | | $ | 16.58 | | | $ | 14.98 | | | $ | 25.67 | | | $ | 14.72 | | |

Class B: | |

Net assets | | $ | 9,643,913 | | | $ | 6,241,729 | | | $ | 175,030,580 | | | $ | — | | | $ | — | | |

Shares outstanding | | | 593,356 | | | | 403,494 | | | | 12,509,726 | | | | — | | | | — | | |

Net asset value, offering and

redemption price per share

(excluding any applicable contingent

deferred sales charge) | | $ | 16.25 | | | $ | 15.47 | | | $ | 13.99 | | | $ | — | | | $ | — | | |

Class C: | |

Net assets | | $ | 8,810,918 | | | $ | 8,288,465 | | | $ | 1,117,141,070 | | | $ | 4,275,280 | | | $ | 3,387,035 | | |

Shares outstanding | | | 541,536 | | | | 533,419 | | | | 79,870,558 | | | | 194,636 | | | | 245,433 | | |

Net asset value, offering and

redemption price per share

(excluding any applicable contingent

deferred sales charge) | | $ | 16.27 | | | $ | 15.54 | | | $ | 13.99 | | | $ | 21.97 | | | $ | 13.80 | | |

Class W: | |

Net assets | | $ | — | | | $ | — | | | $ | 1,691,793,767 | | | $ | 3,972,732 | | | $ | 1,183,274 | | |

Shares outstanding | | | — | | | | — | | | | 120,020,782 | | | | 164,376 | | | | 85,720 | | |

Net asset value, offering and

redemption price per share | | $ | — | | | $ | — | | | $ | 14.10 | | | $ | 24.17 | | | $ | 13.80 | | |

See Notes to Financial Statements.

8

STATEMENT OF OPERATIONS — For the year ended October 31, 2020

| | | AIG

Multi-Asset

Allocation

Fund | | AIG

Active

Allocation

Fund | | AIG

Focused

Dividend

Strategy

Fund | | AIG

Strategic

Value

Fund | | AIG

Select Dividend

Growth

Fund | |

INVESTMENT INCOME: | |

Dividends (unaffiliated) | | $ | — | | | $ | — | | | $ | 311,026,372 | | | $ | 5,147,312 | | | $ | 1,259,437 | | |

Dividends (affiliated) | | | 3,723,526 | | | | 2,124,716 | | | | — | | | | — | | | | — | | |

Interest (unaffiliated) | | | — | | | | — | | | | 42,196 | | | | 870 | | | | 351 | | |

Total investment income | | | 3,723,526 | | | | 2,124,716 | | | | 311,068,568 | | | | 5,148,182 | | | | 1,259,788 | | |

Expenses: | |

Investment advisory and management fees | | | 202,320 | | | | 116,853 | | | | 30,885,403 | | | | 1,303,916 | | | | 269,660 | | |

Distribution and account maintenance fees: | |

Class A | | | — | | | | — | | | | 6,521,122 | | | | 559,447 | | | | 103,152 | | |

Class B | | | 69,100 | | | | 45,221 | | | | 2,343,195 | | | | — | | | | — | | |

Class C | | | 85,469 | | | | 75,858 | | | | 17,926,597 | | | | 73,000 | | | | 38,940 | | |

Service fees—Class W | | | — | | | | — | | | | 4,053,991 | | | | 6,995 | | | | 2,943 | | |

Transfer agent fees and expenses: | |

Class A | | | 52,045 | | | | 23,784 | | | | 4,230,251 | | | | 395,855 | | | | 69,259 | | |

Class B | | | 6,301 | | | | 3,746 | | | | 533,665 | | | | — | | | | — | | |

Class C | | | 5,306 | | | | 5,243 | | | | 3,996,925 | | | | 19,043 | | | | 8,924 | | |

Class W | | | — | | | | — | | | | 6,022,582 | | | | 10,260 | | | | 4,369 | | |

Registration fees: | |

Class A | | | 23,932 | | | | 22,440 | | | | 47,133 | | | | 19,506 | | | | 20,636 | | |

Class B | | | 12,283 | | | | 12,285 | | | | 16,138 | | | | — | | | | — | | |

Class C | | | 12,547 | | | | 12,729 | | | | 35,860 | | | | 13,102 | | | | 13,803 | | |

Class W | | | — | | | | — | | | | 55,347 | | | | 12,746 | | | | 13,132 | | |

Custodian and accounting fees | | | 7,139 | | | | 7,052 | | | | 665,936 | | | | 28,106 | | | | 25,422 | | |

Reports to shareholders | | | 33,114 | | | | 17,789 | | | | 783,202 | | | | 37,114 | | | | 6,776 | | |

Audit and tax fees | | | 44,082 | | | | 44,105 | | | | 56,609 | | | | 56,065 | | | | 42,756 | | |

Legal fees | | | 31,610 | | | | 26,454 | | | | 471,520 | | | | 28,128 | | | | 23,269 | | |

Directors' fees and expenses | | | 15,112 | | | | 8,181 | | | | 581,625 | | | | 13,572 | | | | 3,005 | | |

Interest expense | | | — | | | | — | | | | 56,646 | | | | 857 | | | | 1,123 | | |

| Other expenses | | | 1,849 | | | | 8,748 | | | | 157,093 | | | | 87,360 | | | | 51,263 | | |

Total expenses before fee waivers, expense reimbursements,

and expense recoupments | | | 602,209 | | | | 430,488 | | | | 79,440,840 | | | | 2,665,072 | | | | 698,432 | | |

Net (fees waived and expenses reimbursed)/recouped by

investment advisor/distributor (Note 3) | | | (14,799 | ) | | | (15,681 | ) | | | — | | | | (639 | ) | | | (269,850 | ) | |

| Net expenses | | | 587,410 | | | | 414,807 | | | | 79,440,840 | | | | 2,664,433 | | | | 428,582 | | |

Net investment income (loss) | | | 3,136,116 | | | | 1,709,909 | | | | 231,627,728 | | | | 2,483,749 | | | | 831,206 | | |

NET REALIZED AND UNREALIZED GAIN (LOSS) ON

INVESTMENTS AND FOREIGN CURRENCIES: | |

Net realized gain (loss) on investments (unaffiliated) | | | — | | | | — | | | | (637,360,833 | ) | | | (1,906,167 | ) | | | 334,511 | | |

Net realized gain (loss) on investments (affiliated) | | | (3,020,518 | ) | | | (18,384 | ) | | | — | | | | — | | | | — | | |

Net realized gain from capital gain distributions from underlying

funds (affiliated) | | | 3,388,431 | | | | 3,233,153 | | | | — | | | | — | | | | — | | |

Net realized gain (loss) on investments and foreign currencies | | | 367,913 | | | | 3,214,769 | | | | (637,360,833 | ) | | | (1,906,167 | ) | | | 334,511 | | |

Change in unrealized appreciation (depreciation) on investments

(unaffiliated) | | | — | | | | — | | | | (532,491,386 | ) | | | (21,267,168 | ) | | | (2,779,308 | ) | |

Change in unrealized appreciation (depreciation) on investments

(affiliated) | | | (8,904,258 | ) | | | (2,497,618 | ) | | | — | | | | — | | | | — | | |

Net unrealized gain (loss) on investments and foreign currencies | | | (8,904,258 | ) | | | (2,497,618 | ) | | | (532,491,386 | ) | | | (21,267,168 | ) | | | (2,779,308 | ) | |

Net realized and unrealized gain (loss) on investments and foreign

currencies | | | (8,536,345 | ) | | | 717,151 | | | | (1,169,852,219 | ) | | | (23,173,335 | ) | | | (2,444,797 | ) | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING

FROM OPERATIONS | | $ | (5,400,229 | ) | | $ | 2,427,060 | | | $ | (938,224,491 | ) | | $ | (20,689,586 | ) | | $ | (1,613,591 | ) | |

See Notes to Financial Statements.

9

STATEMENT OF CHANGES IN NET ASSETS

| | | AIG Multi-Asset

Allocation Fund | | AIG Active

Allocation Fund | |

| | | For the

year ended

October 31,

2020 | | For the

year ended

October 31,

2019 | | For the

year ended

October 31,

2020 | | For the

year ended

October 31,

2019 | |

INCREASE (DECREASE) IN NET ASSETS | |

Operations: | |

Net investment income (loss) | | $ | 3,136,116 | | | $ | 3,606,388 | | | $ | 1,709,909 | | | $ | 2,022,180 | | |

Net realized gain (loss) on investments and foreign currencies | | | 367,913 | | | | 14,017,011 | | | | 3,214,769 | | | | 9,354,581 | | |

Net unrealized gain (loss) on investments and foreign currencies | | | (8,904,258 | ) | | | (8,372,164 | ) | | | (2,497,618 | ) | | | (5,267,524 | ) | |

Net increase (decrease) in net assets resulting from operations | | | (5,400,229 | ) | | | 9,251,235 | | | | 2,427,060 | | | | 6,109,237 | | |

Distributions to shareholders from: | |

Distributable earnings (Class A) | | | (14,570,028 | ) | | | (5,114,815 | ) | | | (8,862,383 | ) | | | (7,522,055 | ) | |

Distributable earnings (Class B) | | | (852,624 | ) | | | (286,748 | ) | | | (654,102 | ) | | | (678,465 | ) | |

Distributable earnings (Class C) | | | (1,081,606 | ) | | | (382,664 | ) | | | (1,067,129 | ) | | | (1,100,383 | ) | |

Distributable earnings (Class W) | | | — | | | | — | | | | — | | | | — | | |

Total distributions to shareholders | | | (16,504,258 | ) | | | (5,784,227 | ) | | | (10,583,614 | ) | | | (9,300,903 | ) | |

Net increase (decrease) in net assets resulting from capital share

transactions (Note 7) | | | (8,568,042 | ) | | | (20,813,439 | ) | | | (3,482,650 | ) | | | (6,854,455 | ) | |

Total increase (decrease) in net assets | | | (30,472,529 | ) | | | (17,346,431 | ) | | | (11,639,204 | ) | | | (10,046,121 | ) | |

NET ASSETS: | |

Beginning of period | | | 222,017,712 | | | | 239,364,143 | | | | 124,374,784 | | | | 134,420,905 | | |

End of period | | $ | 191,545,183 | | | $ | 222,017,712 | | | $ | 112,735,580 | | | $ | 124,374,784 | | |

See Notes to Financial Statements.

10

STATEMENT OF CHANGES IN NET ASSETS — (continued)

| | | AIG

Focused Dividend

Strategy Fund | | AIG Strategic

Value Fund | | AIG

Select Dividend

Growth Fund | |

| | For the

year ended

October 31,

2020 | | For the

year ended

October 31,

2019 | | For the

year ended

October 31,

2020 | | For the

year ended

October 31,

2019 | | For the

year ended

October 31,

2020 | | For the

year ended

October 31,

2019 | |

INCREASE (DECREASE) IN NET

ASSETS | |

Operations: | |

Net investment income (loss) | | $ | 231,627,728 | | | $ | 299,197,934 | | | $ | 2,483,749 | | | $ | 2,860,699 | | | $ | 831,206 | | | $ | 966,671 | | |

Net realized gain (loss) on investments

and foreign currencies | | | (637,360,833 | ) | | | 443,323,692 | | | | (1,906,167 | ) | | | 4,177,172 | | | | 334,511 | | | | (1,612,217 | ) | |

Net unrealized gain (loss) on

investments and foreign currencies | | | (532,491,386 | ) | | | (266,548,829 | ) | | | (21,267,168 | ) | | | 1,146,579 | | | | (2,779,308 | ) | | | 4,302,759 | | |

Net increase (decrease) in net assets

resulting from operations | | | (938,224,491 | ) | | | 475,972,797 | | | | (20,689,586 | ) | | | 8,184,450 | | | | (1,613,591 | ) | | | 3,657,213 | | |

Distributions to shareholders from: | |

Distributable earnings (Class A) | | | (151,258,569 | ) | | | (239,140,149 | ) | | | (6,599,545 | ) | | | (21,467,180 | ) | | | (730,038 | ) | | | (5,945,197 | ) | |

Distributable earnings (Class B) | | | (17,797,190 | ) | | | (24,214,120 | ) | | | — | | | | — | | | | — | | | | — | | |

Distributable earnings (Class C) | | | (138,592,258 | ) | | | (199,817,695 | ) | | | (324,877 | ) | | | (1,223,388 | ) | | | (71,306 | ) | | | (338,984 | ) | |

Distributable earnings (Class W) | | | (242,410,378 | ) | | | (368,354,793 | ) | | | (207,760 | ) | | | (435,879 | ) | | | (52,026 | ) | | | (227,018 | ) | |

Total distributions to shareholders | | | (550,058,395 | ) | | | (831,526,757 | ) | | | (7,132,182 | ) | | | (23,126,447 | ) | | | (853,370 | ) | | | (6,511,199 | ) | |

Net increase (decrease) in net assets

resulting from capital share

transactions (Note 7) | | | (3,062,747,155 | ) | | | (2,824,380,043 | ) | | | (19,554,806 | ) | | | 2,056,751 | | | | (11,092,008 | ) | | | 6,549,258 | | |

| Total increase (decrease) in net assets | | | (4,551,030,041 | ) | | | (3,179,934,003 | ) | | | (47,376,574 | ) | | | (12,885,246 | ) | | | (13,558,969 | ) | | | 3,695,272 | | |

NET ASSETS: | |

Beginning of period | | | 9,201,374,088 | | | | 12,381,308,091 | | | | 199,994,856 | | | | 212,880,102 | | | | 43,578,556 | | | | 39,883,284 | | |

End of period | | $ | 4,650,344,047 | | | $ | 9,201,374,088 | | | $ | 152,618,282 | | | $ | 199,994,856 | | | $ | 30,019,587 | | | $ | 43,578,556 | | |

See Notes to Financial Statements.

11

Period

Ended | | Net

Asset

Value

begin-

ning

of

period | | Net

invest-

ment

income

(loss)(1) | | Net

gain

(loss)

on

invest-

ments

(both

realized

and un-

realized) | | Total

from

invest-

ment

opera-

tions | | Divi-

dends

from

net

invest-

ment

income | | Distri-

butions

from

net

real-

ized

gains | | Total

distri-

butions | | Net

Asset

Value

end of

period | | Total

Return(2) | | Net

Assets

end of

period

(000's) | |

Ratio

of

expenses

to

average

net

assets(3) | | Ratio

of net

investment

income

(loss) to

average net

assets(3) | | Port-

folio

Turn-

over | |

AIG MULTI-ASSET ALLOCATION FUND | |

Class A | |

10/31/16 | | $ | 16.00 | | | $ | 0.18 | | | $ | 0.18 | | | $ | 0.36 | | | $ | (0.25 | ) | | $ | — | | | $ | (0.25 | ) | | $ | 16.11 | | | | 2.33 | % | | $ | 154,476 | | | | 0.20 | % | | | 1.14 | % | | | 18 | % | |

10/31/17 | | | 16.11 | | | | 0.22 | | | | 2.14 | | | | 2.36 | | | | (0.21 | ) | | | — | | | | (0.21 | ) | | | 18.26 | | | | 14.75 | | | | 169,484 | | | | 0.20 | | | | 1.26 | | | | 12 | | |

10/31/18 | | | 18.26 | | | | 0.25 | | | | (0.30 | ) | | | (0.05 | ) | | | (0.42 | ) | | | — | | | | (0.42 | ) | | | 17.79 | | | | (0.30 | ) | | | 203,084 | | | | 0.24 | | | | 1.35 | | | | 7 | | |

10/31/19 | | | 17.79 | | | | 0.29 | | | | 0.45 | | | | 0.74 | | | | (0.45 | ) | | | — | | | | (0.45 | ) | | | 18.08 | | | | 4.34 | | | | 193,502 | | | | 0.22 | | | | 1.67 | | | | 5 | | |

10/31/20 | | | 18.08 | | | | 0.27 | | | | (0.60 | ) | | | (0.33 | ) | | | (0.35 | ) | | | (1.04 | ) | | | (1.39 | ) | | | 16.36 | | | | (2.32 | ) | | | 173,090 | | | | 0.21 | | | | 1.63 | | | | 10 | | |

Class B | |

10/31/16 | | $ | 15.88 | | | $ | 0.07 | | | $ | 0.19 | | | $ | 0.26 | | | $ | (0.13 | ) | | $ | — | | | $ | (0.13 | ) | | $ | 16.01 | | | | 1.65 | % | | $ | 21,705 | | | | 0.88 | % | | | 0.45 | % | | | 18 | % | |

10/31/17 | | | 16.01 | | | | 0.10 | | | | 2.13 | | | | 2.23 | | | | (0.09 | ) | | | — | | | | (0.09 | ) | | | 18.15 | | | | 13.95 | | | | 19,438 | | | | 0.90 | (4) | | | 0.56 | (4) | | | 12 | | |

10/31/18 | | | 18.15 | | | | 0.13 | | | | (0.30 | ) | | | (0.17 | ) | | | (0.29 | ) | | | — | | | | (0.29 | ) | | | 17.69 | | | | (0.99 | ) | | | 15,408 | | | | 0.90 | (4) | | | 0.71 | (4) | | | 7 | | |

10/31/19 | | | 17.69 | | | | 0.18 | | | | 0.44 | | | | 0.62 | | | | (0.33 | ) | | | — | | | | (0.33 | ) | | | 17.98 | | | | 3.61 | | | | 12,599 | | | | 0.90 | (4) | | | 1.01 | (4) | | | 5 | | |

10/31/20 | | | 17.98 | | | | 0.16 | | | | (0.63 | ) | | | (0.47 | ) | | | (0.22 | ) | | | (1.04 | ) | | | (1.26 | ) | | | 16.25 | | | | (3.08 | ) | | | 9,644 | | | | 0.90 | (4) | | | 0.96 | (4) | | | 10 | | |

Class C | |

10/31/16 | | $ | 15.88 | | | $ | 0.08 | | | $ | 0.18 | | | $ | 0.26 | | | $ | (0.14 | ) | | $ | — | | | $ | (0.14 | ) | | $ | 16.00 | | | | 1.67 | % | | $ | 92,667 | | | | 0.84 | % | | | 0.50 | % | | | 18 | % | |

10/31/17 | | | 16.00 | | | | 0.11 | | | | 2.13 | | | | 2.24 | | | | (0.10 | ) | | | — | | | | (0.10 | ) | | | 18.14 | | | | 14.05 | | | | 83,432 | | | | 0.84 | | | | 0.62 | | | | 12 | | |

10/31/18 | | | 18.14 | | | | 0.15 | | | | (0.32 | ) | | | (0.17 | ) | | | (0.30 | ) | | | — | | | | (0.30 | ) | | | 17.67 | | | | (0.99 | ) | | | 20,872 | | | | 0.89 | | | | 0.78 | | | | 7 | | |

10/31/19 | | | 17.67 | | | | 0.18 | | | | 0.45 | | | | 0.63 | | | | (0.33 | ) | | | — | | | | (0.33 | ) | | | 17.97 | | | | 3.66 | | | | 15,916 | | | | 0.90 | (4) | | | 0.99 | (4) | | | 5 | | |

10/31/20 | | | 17.97 | | | | 0.16 | | | | (0.60 | ) | | | (0.44 | ) | | | (0.22 | ) | | | (1.04 | ) | | | (1.26 | ) | | | 16.27 | | | | (2.90 | ) | | | 8,811 | | | | 0.90 | (4) | | | 0.96 | (4) | | | 10 | | |

(1) Calculated based upon average shares outstanding.

(2) Total return does not reflect sales load. It does include expense reimbursements (recoupments).

(3) Does not include underlying fund expenses that the Funds bear indirectly.

(4) Net of the following expense reimbursements (recoupments) (based on average net assets):

| | 10/31/16 | | 10/31/17 | | 10/31/18 | | 10/31/19 | | 10/31/20 | |

| AIG Multi-Asset Allocation Class B | | | — | % | | | 0.01 | % | | | 0.07 | % | | | 0.09 | % | | | 0.09 | % | |

| AIG Multi-Asset Allocation Class C | | | — | | | | — | | | | — | | | | 0.04 | | | | 0.04 | | |

See Notes to Financial Statements

12

FINANCIAL HIGHLIGHTS — (continued)

Period

Ended | | Net

Asset

Value

begin-

ning

of

period | | Net

invest-

ment

income

(loss)(1) | | Net

gain

(loss)

on

invest-

ments

(both

realized

and un-

realized) | | Total

from

invest-

ment

opera-

tions | | Divi-

dends

from

net

invest-

ment

income | | Distri-

butions

from

net

real-

ized

gains | | Total

distri-

butions | | Net

Asset

Value

end of

period | | Total

Return(2) | | Net

Assets

end of

period

(000's) | | Ratio

of

expenses

to

average

net

assets(3) | | Ratio

of net

investment

income

(loss) to

average net

assets(3) | | Port-

folio

Turn-

over | |

AIG ACTIVE ALLOCATION FUND | |

Class A | |

10/31/16 | | $ | 15.43 | | | $ | 0.23 | | | $ | 0.16 | | | $ | 0.39 | | | $ | (0.31 | ) | | $ | — | | | $ | (0.31 | ) | | $ | 15.51 | | | | 2.59 | % | | $ | 79,796 | | | | 0.22 | % | | | 1.53 | % | | | 29 | % | |

10/31/17 | | | 15.51 | | | | 0.25 | | | | 2.03 | | | | 2.28 | | | | (0.24 | ) | | | — | | | | (0.24 | ) | | | 17.55 | | | | 14.81 | | | | 91,194 | | | | 0.23 | | | | 1.51 | | | | 12 | | |

10/31/18 | | | 17.55 | | | | 0.26 | | | | (0.23 | ) | | | 0.03 | | | | (0.45 | ) | | | — | | | | (0.45 | ) | | | 17.13 | | | | 0.10 | | | | 106,578 | | | | 0.25 | (4) | | | 1.49 | (4) | | | 17 | | |

10/31/19 | | | 17.13 | | | | 0.28 | | | | 0.51 | | | | 0.79 | | | | (0.44 | ) | | | (0.78 | ) | | | (1.22 | ) | | | 16.70 | | | | 5.06 | | | | 102,720 | | | | 0.25 | (4) | | | 1.69 | (4) | | | 14 | | |

10/31/20 | | | 16.70 | | | | 0.24 | | | | 0.15 | | | | 0.39 | | | | (0.28 | ) | | | (1.18 | ) | | | (1.46 | ) | | | 15.63 | | | | 2.28 | | | | 98,205 | | | | 0.25 | (4) | | | 1.56 | (4) | | | 18 | | |

Class B | |

10/31/16 | | $ | 15.29 | | | $ | 0.13 | | | $ | 0.17 | | | $ | 0.30 | | | $ | (0.21 | ) | | $ | — | | | $ | (0.21 | ) | | $ | 15.38 | | | | 1.98 | % | | $ | 14,091 | | | | 0.90 | %(4) | | | 0.85 | %(4) | | | 29 | % | |

10/31/17 | | | 15.38 | | | | 0.14 | | | | 2.01 | | | | 2.15 | | | | (0.13 | ) | | | — | | | | (0.13 | ) | | | 17.40 | | | | 14.02 | | | | 13,031 | | | | 0.90 | (4) | | | 0.84 | (4) | | | 12 | | |

10/31/18 | | | 17.40 | | | | 0.15 | | | | (0.24 | ) | | | (0.09 | ) | | | (0.34 | ) | | | — | | | | (0.34 | ) | | | 16.97 | | | | (0.56 | ) | | | 10,651 | | | | 0.90 | (4) | | | 0.85 | (4) | | | 17 | | |

10/31/19 | | | 16.97 | | | | 0.18 | | | | 0.49 | | | | 0.67 | | | | (0.33 | ) | | | (0.78 | ) | | | (1.11 | ) | | | 16.53 | | | | 4.35 | | | | 8,172 | | | | 0.90 | (4) | | | 1.06 | (4) | | | 14 | | |

10/31/20 | | | 16.53 | | | | 0.15 | | | | 0.14 | | | | 0.29 | | | | (0.17 | ) | | | (1.18 | ) | | | (1.35 | ) | | | 15.47 | | | | 1.66 | | | | 6,242 | | | | 0.90 | (4) | | | 0.93 | (4) | | | 18 | | |

Class C | |

10/31/16 | | $ | 15.35 | | | $ | 0.14 | | | $ | 0.16 | | | $ | 0.30 | | | $ | (0.21 | ) | | $ | — | | | $ | (0.21 | ) | | $ | 15.44 | | | | 2.01 | % | | $ | 52,428 | | | | 0.86 | % | | | 0.90 | % | | | 29 | % | |

10/31/17 | | | 15.44 | | | | 0.14 | | | | 2.02 | | | | 2.16 | | | | (0.13 | ) | | | — | | | | (0.13 | ) | | | 17.47 | | | | 14.06 | | | | 47,569 | | | | 0.88 | | | | 0.86 | | | | 12 | | |

10/31/18 | | | 17.47 | | | | 0.16 | | | | (0.26 | ) | | | (0.10 | ) | | | (0.34 | ) | | | — | | | | (0.34 | ) | | | 17.03 | | | | (0.61 | ) | | | 17,192 | | | | 0.90 | (4) | | | 0.86 | (4) | | | 17 | | |

10/31/19 | | | 17.03 | | | | 0.17 | | | | 0.51 | | | | 0.68 | | | | (0.33 | ) | | | (0.78 | ) | | | (1.11 | ) | | | 16.60 | | | | 4.39 | | | | 13,483 | | | | 0.90 | (4) | | | 1.06 | (4) | | | 14 | | |

10/31/20 | | | 16.60 | | | | 0.15 | | | | 0.14 | | | | 0.29 | | | | (0.17 | ) | | | (1.18 | ) | | | (1.35 | ) | | | 15.54 | | | | 1.64 | | | | 8,288 | | | | 0.90 | (4) | | | 0.94 | (4) | | | 18 | | |

(1) Calculated based upon average shares outstanding.

(2) Total return does not reflect sales load. It does include expense reimbursements (recoupments).

(3) Does not include underlying fund expenses that the Funds bear indirectly.

(4) Net of the following expense reimbursements (recoupments) (based on average net assets):

| | 10/31/16 | | 10/31/17 | | 10/31/18 | | 10/31/19 | | 10/31/20 | |

| AIG Active Allocation Class A | | | — | % | | | — | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | |

| AIG Active Allocation Class B | | | 0.08 | | | | 0.05 | | | | 0.12 | | | | 0.15 | | | | 0.16 | | |

| AIG Active Allocation Class C | | | — | | | | — | | | | 0.03 | | | | 0.09 | | | | 0.10 | | |

See Notes to Financial Statements

13

FINANCIAL HIGHLIGHTS — (continued)

Period

Ended | | Net

Asset

Value

begin-

ning

of

period | | Net

invest-

ment

income

(loss)(1) | | Net

gain

(loss)

on

invest-

ments

(both

realized

and un-

realized) | | Total

from

invest-

ment

opera-

tions | | Divi-

dends

from

net

invest-

ment

income | | Distri-

butions

from

net

real-

ized

gains | | Total

distri-

butions | | Net

Asset

Value

end of

period | | Total

Return(2) | | Net

Assets

end of

period

(000's) | | Ratio

of

expenses

to

average

net

assets | | Ratio

of net

investment

income

(loss) to

average net

assets | | Port-

folio

Turn-

over | |

AIG FOCUSED DIVIDEND STRATEGY FUND | |

Class A | |

10/31/16 | | $ | 17.61 | | | $ | 0.51 | | | $ | 0.12 | | | $ | 0.63 | | | $ | (0.42 | ) | | $ | (1.16 | ) | | $ | (1.58 | ) | | $ | 16.66 | | | | 4.38 | % | | $ | 4,849,219 | | | | 1.05 | % | | | 3.16 | % | | | 60 | % | |

10/31/17 | | | 16.66 | | | | 0.45 | | | | 2.28 | | | | 2.73 | | | | (0.54 | ) | | | (0.04 | ) | | | (0.58 | ) | | | 18.81 | | | | 16.57 | | | | 4,598,192 | | | | 1.04 | | | | 2.52 | | | | 45 | | |

10/31/18 | | | 18.81 | | | | 0.47 | | | | 0.15 | | | | 0.62 | | | | (0.44 | ) | | | (1.44 | ) | | | (1.88 | ) | | | 17.55 | | | | 3.03 | | | | 3,570,189 | | | | 1.04 | | | | 2.57 | | | | 38 | | |

10/31/19 | | | 17.55 | | | | 0.50 | | | | 0.39 | | | | 0.89 | | | | (0.49 | ) | | | (0.78 | ) | | | (1.27 | ) | | | 17.17 | | | | 5.42 | | | | 2,381,987 | | | | 1.05 | | | | 2.90 | | | | 37 | | |

10/31/20 | | | 17.17 | | | | 0.55 | | | | (2.42 | ) | | | (1.87 | ) | | | (0.60 | ) | | | (0.58 | ) | | | (1.18 | ) | | | 14.12 | | | | (11.33 | ) | | | 1,666,379 | | | | 1.09 | | | | 3.60 | | | | 68 | | |

Class B | |

10/31/16 | | $ | 17.49 | | | $ | 0.41 | | | $ | 0.13 | | | $ | 0.54 | | | $ | (0.32 | ) | | $ | (1.16 | ) | | $ | (1.48 | ) | | $ | 16.55 | | | | 3.79 | % | | $ | 381,223 | | | | 1.70 | % | | | 2.53 | % | | | 60 | % | |

10/31/17 | | | 16.55 | | | | 0.33 | | | | 2.25 | | | | 2.58 | | | | (0.43 | ) | | | (0.04 | ) | | | (0.47 | ) | | | 18.66 | | | | 15.73 | | | | 424,998 | | | | 1.69 | | | | 1.85 | | | | 45 | | |

10/31/18 | | | 18.66 | | | | 0.35 | | | | 0.15 | | | | 0.50 | | | | (0.32 | ) | | | (1.44 | ) | | | (1.76 | ) | | | 17.40 | | | | 2.37 | | | | 378,559 | | | | 1.69 | | | | 1.92 | | | | 38 | | |

10/31/19 | | | 17.40 | | | | 0.38 | | | | 0.39 | | | | 0.77 | | | | (0.38 | ) | | | (0.78 | ) | | | (1.16 | ) | | | 17.01 | | | | 4.72 | | | | 303,543 | | | | 1.70 | | | | 2.26 | | | | 37 | | |

10/31/20 | | | 17.01 | | | | 0.46 | | | | (2.40 | ) | | | (1.94 | ) | | | (0.50 | ) | | | (0.58 | ) | | | (1.08 | ) | | | 13.99 | | | | (11.93 | ) | | | 175,031 | | | | 1.75 | | | | 2.97 | | | | 68 | | |

Class C | |

10/31/16 | | $ | 17.48 | | | $ | 0.40 | | | $ | 0.13 | | | $ | 0.53 | | | $ | (0.32 | ) | | $ | (1.16 | ) | | $ | (1.48 | ) | | $ | 16.53 | | | | 3.75 | % | | $ | 3,628,575 | | | | 1.70 | % | | | 2.51 | % | | | 60 | % | |

10/31/17 | | | 16.53 | | | | 0.33 | | | | 2.26 | | | | 2.59 | | | | (0.43 | ) | | | (0.04 | ) | | | (0.47 | ) | | | 18.65 | | | | 15.80 | | | | 3,682,928 | | | | 1.69 | | | | 1.87 | | | | 45 | | |

10/31/18 | | | 18.65 | | | | 0.35 | | | | 0.14 | | | | 0.49 | | | | (0.32 | ) | | | (1.44 | ) | | | (1.76 | ) | | | 17.38 | | | | 2.31 | | | | 3,142,587 | | | | 1.69 | | | | 1.92 | | | | 38 | | |

10/31/19 | | | 17.38 | | | | 0.38 | | | | 0.39 | | | | 0.77 | | | | (0.37 | ) | | | (0.78 | ) | | | (1.15 | ) | | | 17.00 | | | | 4.78 | | | | 2,421,728 | | | | 1.70 | | | | 2.27 | | | | 37 | | |

10/31/20 | | | 17.00 | | | | 0.47 | | | | (2.40 | ) | | | (1.93 | ) | | | (0.50 | ) | | | (0.58 | ) | | | (1.08 | ) | | | 13.99 | | | | (11.89 | ) | | | 1,117,141 | | | | 1.74 | | | | 2.99 | | | | 68 | | |

Class W | |

10/31/16 | | $ | 17.60 | | | $ | 0.53 | | | $ | 0.14 | | | $ | 0.67 | | | $ | (0.46 | ) | | $ | (1.16 | ) | | $ | (1.62 | ) | | $ | 16.65 | | | | 4.60 | % | | $ | 3,523,472 | | | | 0.85 | % | | | 3.30 | % | | | 60 | % | |

10/31/17 | | | 16.65 | | | | 0.47 | | | | 2.29 | | | | 2.76 | | | | (0.58 | ) | | | (0.04 | ) | | | (0.62 | ) | | | 18.79 | | | | 16.80 | | | | 5,499,586 | | | | 0.84 | | | | 2.67 | | | | 45 | | |

10/31/18 | | | 18.79 | | | | 0.51 | | | | 0.15 | | | | 0.66 | | | | (0.49 | ) | | | (1.44 | ) | | | (1.93 | ) | | | 17.52 | | | | 3.21 | | | | 5,289,972 | | | | 0.84 | | | | 2.77 | | | | 38 | | |

10/31/19 | | | 17.52 | | | | 0.53 | | | | 0.39 | | | | 0.92 | | | | (0.52 | ) | | | (0.78 | ) | | | (1.30 | ) | | | 17.14 | | | | 5.66 | | | | 4,094,116 | | | | 0.85 | | | | 3.13 | | | | 37 | | |

10/31/20 | | | 17.14 | | | | 0.61 | | | | (2.44 | ) | | | (1.83 | ) | | | (0.63 | ) | | | (0.58 | ) | | | (1.21 | ) | | | 14.10 | | | | (11.11 | ) | | | 1,691,794 | | | | 0.88 | | | | 3.83 | | | | 68 | | |

(1) Calculated based upon average shares outstanding.

(2) Total return does not reflect sales load.

See Notes to Financial Statements

14

FINANCIAL HIGHLIGHTS — (continued)

Period

Ended | | Net

Asset

Value

begin-

ning

of

period | | Net

invest-

ment

income

(loss)(1) | | Net

gain

(loss)

on

invest-

ments

(both

realized

and un-

realized) | | Total

from

invest-

ment

opera-

tions | | Divi-

dends

from

net

invest-

ment

income | | Distri-

butions

from

net

real-

ized

gains | | Total

distri-

butions | | Net

Asset

Value

end of

period | | Total

Return(2) | | Net

Assets

end of

period

(000's) | | Ratio

of

expenses

to

average

net

assets | | Ratio

of net

investment

income

(loss) to

average net

assets | | Port-

folio

Turn-

over | |

AIG STRATEGIC VALUE FUND | |

Class A | |

10/31/16 | | $ | 25.74 | | | $ | 0.37 | | | $ | 0.10 | | | $ | 0.47 | | | $ | (0.36 | ) | | $ | — | | | $ | (0.36 | ) | | $ | 25.85 | | | | 1.88 | % | | $ | 175,724 | | | | 1.42 | % | | | 1.47 | % | | | 56 | % | |

10/31/17 | | | 25.85 | | | | 0.26 | | | | 4.63 | | | | 4.89 | | | | (0.36 | ) | | | — | | | | (0.36 | ) | | | 30.38 | | | | 19.04 | | | | 186,261 | | | | 1.42 | | | | 0.90 | | | | 52 | | |

10/31/18 | | | 30.38 | | | | 0.34 | | | | (0.08 | ) | | | 0.26 | | | | (0.25 | ) | | | — | | | | (0.25 | ) | | | 30.39 | | | | 0.82 | | | | 197,855 | | | | 1.45 | | | | 1.08 | | | | 46 | | |

10/31/19 | | | 30.39 | | | | 0.40 | | | | 0.63 | | | | 1.03 | | | | (0.37 | ) | | | (2.96 | ) | | | (3.33 | ) | | | 28.09 | | | | 4.08 | | | | 184,235 | | | | 1.45 | | | | 1.44 | | | | 54 | | |

10/31/20 | | | 28.09 | | | | 0.37 | | | | (3.25 | ) | | | (2.88 | ) | | | (0.43 | ) | | | (0.59 | ) | | | (1.02 | ) | | | 24.19 | | | | (10.76 | ) | | | 144,370 | | | | 1.50 | | | | 1.46 | | | | 47 | | |

Class C | |

10/31/16 | | $ | 23.81 | | | $ | 0.19 | | | $ | 0.10 | | | $ | 0.29 | | | $ | (0.21 | ) | | $ | — | | | $ | (0.21 | ) | | $ | 23.89 | | | | 1.24 | % | | $ | 52,036 | | | | 2.08 | % | | | 0.80 | % | | | 56 | % | |

10/31/17 | | | 23.89 | | | | 0.07 | | | | 4.28 | | | | 4.35 | | | | (0.20 | ) | | | — | | | | (0.20 | ) | | | 28.04 | | | | 18.26 | | | | 50,353 | | | | 2.08 | | | | 0.25 | | | | 52 | | |

10/31/18 | | | 28.04 | | | | 0.13 | | | | (0.11 | ) | | | 0.02 | | | | (0.07 | ) | | | — | | | | (0.07 | ) | | | 27.99 | | | | 0.07 | | | | 11,145 | | | | 2.15 | | | | 0.40 | | | | 46 | | |

10/31/19 | | | 27.99 | | | | 0.17 | | | | 0.57 | | | | 0.74 | | | | (0.17 | ) | | | (2.96 | ) | | | (3.13 | ) | | | 25.60 | | | | 3.26 | | | | 10,035 | | | | 2.20 | | | | 0.69 | | | | 54 | | |

10/31/20 | | | 25.60 | | | | 0.16 | | | | (2.94 | ) | | | (2.78 | ) | | | (0.26 | ) | | | (0.59 | ) | | | (0.85 | ) | | | 21.97 | | | | (11.35 | ) | | | 4,275 | | | | 2.32 | | | | 0.65 | | | | 47 | | |

Class W | |

04/20/17@-10/31/17 | | $ | 28.02 | | | $ | 0.09 | | | $ | 2.26 | | | $ | 2.35 | | | $ | — | | | $ | — | | | $ | — | | | $ | 30.37 | | | | 8.39 | % | | $ | 2,559 | | | | 1.52 | %(3)(4) | | | 0.58 | %(3)(4) | | | 52 | % | |

10/31/18 | | | 30.37 | | | | 0.31 | | | | (0.07 | ) | | | 0.24 | | | | (0.23 | ) | | | — | | | | (0.23 | ) | | | 30.38 | | | | 0.76 | | | | 3,881 | | | | 1.52 | (4) | | | 1.00 | (4) | | | 46 | | |

10/31/19 | | | 30.38 | | | | 0.36 | | | | 0.65 | | | | 1.01 | | | | (0.36 | ) | | | (2.96 | ) | | | (3.32 | ) | | | 28.07 | | | | 3.99 | | | | 5,725 | | | | 1.52 | (4) | | | 1.34 | (4) | | | 54 | | |

10/31/20 | | | 28.07 | | | | 0.37 | | | | (3.26 | ) | | | (2.89 | ) | | | (0.42 | ) | | | (0.59 | ) | | | (1.01 | ) | | | 24.17 | | | | (10.79 | ) | | | 3,973 | | | | 1.52 | (4) | | | 1.44 | (4) | | | 47 | | |

(1) Calculated based upon average shares outstanding.

(2) Total return is not annualized and does not reflect sales load. It does include expense reimbursements (recoupments).

(3) Annualized

(4) Net of the following expense reimbursements (recoupments) (based on average net assets):

| | | 10/31/17 | | 10/31/18 | | 10/31/19 | | 10/31/20 | |

AIG Strategic Value Class W | | | 3.25 | %(3) | | | (0.14 | )% | | | 0.08 | % | | | 0.01 | % | |

@ Inception date of class.

See Notes to Financial Statement

15

FINANCIAL HIGHLIGHTS — (continued)

Period

Ended | | Net

Asset

Value

begin-

ning

of

period | | Net

invest-

ment

income

(loss)(1) | | Net

gain

(loss)

on

invest-

ments

(both

realized

and un-

realized) | | Total

from

invest-

ment

opera-

tions | | Divi-

dends

from

net

invest-

ment

income | | Distri-

butions

from

net

real-

ized

gains | | Total

distri-

butions | | Net

Asset

Value

end of

period | | Total

Return(2) | |

Net

Assets

end of

period

(000's) | | Ratio

of

expenses

to

average

net

assets(3) | | Ratio

of net

investment

income

(loss) to

average net

assets(3) | | Port-

folio

Turn-

over | |

AIG SELECT DIVIDEND GROWTH FUND | |

Class A | |

10/31/16 | | $ | 15.68 | | | $ | 0.24 | | | $ | 0.71 | | | $ | 0.95 | | | $ | (0.24 | ) | | $ | (1.46 | ) | | $ | (1.70 | ) | | $ | 14.93 | | | | 7.20 | % | | $ | 39,422 | | | | 1.56 | % | | | 1.65 | % | | | 69 | % | |

10/31/17 | | | 14.93 | | | | 0.25 | | | | 2.29 | | | | 2.54 | | | | (0.27 | ) | | | (0.25 | ) | | | (0.52 | ) | | | 16.95 | | | | 17.19 | | | | 40,917 | | | | 1.63 | | | | 1.57 | | | | 72 | | |

10/31/18 | | | 16.95 | | | | 0.23 | | | | 0.40 | | | | 0.63 | | | | (0.24 | ) | | | (0.93 | ) | | | (1.17 | ) | | | 16.41 | | | | 3.54 | | | | 36,825 | | | | 1.68 | | | | 1.34 | | | | 77 | | |

10/31/19 | | | 16.41 | | | | 0.33 | | | | 0.65 | | | | 0.98 | | | | (0.33 | ) | | | (2.31 | ) | | | (2.64 | ) | | | 14.75 | | | | 7.51 | | | | 36,415 | | | | 1.16 | | | | 2.32 | | | | 66 | | |

10/31/20 | | | 14.75 | | | | 0.34 | | | | (0.87 | ) | | | (0.53 | ) | | | (0.35 | ) | | | — | | | | (0.35 | ) | | | 13.87 | | | | (3.46 | ) | | | 25,449 | | | | 1.13 | | | | 2.37 | | | | 47 | | |

Class C | |

10/31/16 | | $ | 15.62 | | | $ | 0.10 | | | $ | 0.74 | | | $ | 0.84 | | | $ | (0.12 | ) | | $ | (1.46 | ) | | $ | (1.58 | ) | | $ | 14.88 | | | | 6.36 | % | | $ | 1,161 | | | | 2.37 | % | | | 0.73 | % | | | 69 | % | |

10/31/17 | | | 14.88 | | | | 0.12 | | | | 2.29 | | | | 2.41 | | | | (0.16 | ) | | | (0.25 | ) | | | (0.41 | ) | | | 16.88 | | | | 16.34 | | | | 1,746 | | | | 2.37 | | | | 0.79 | | | | 72 | | |

10/31/18 | | | 16.88 | | | | 0.11 | | | | 0.39 | | | | 0.50 | | | | (0.12 | ) | | | (0.93 | ) | | | (1.05 | ) | | | 16.33 | | | | 2.79 | | | | 1,907 | | | | 2.37 | | | | 0.64 | | | | 77 | | |

10/31/19 | | | 16.33 | | | | 0.21 | | | | 0.67 | | | | 0.88 | | | | (0.24 | ) | | | (2.31 | ) | | | (2.55 | ) | | | 14.66 | | | | 6.84 | | | | 4,906 | | | | 1.79 | | | | 1.56 | | | | 66 | | |

10/31/20 | | | 14.66 | | | | 0.24 | | | | (0.85 | ) | | | (0.61 | ) | | | (0.25 | ) | | | — | | | | (0.25 | ) | | | 13.80 | | | | (4.08 | ) | | | 3,387 | | | | 1.78 | | | | 1.71 | | | | 47 | | |

Class W | |

10/31/16 | | $ | 15.65 | | | $ | 0.21 | | | $ | 0.75 | | | $ | 0.96 | | | $ | (0.26 | ) | | $ | (1.46 | ) | | $ | (1.72 | ) | | $ | 14.89 | | | | 7.25 | % | | $ | 241 | | | | 1.52 | % | | | 1.56 | % | | | 69 | % | |

10/31/17 | | | 14.89 | | | | 0.24 | | | | 2.32 | | | | 2.56 | | | | (0.29 | ) | | | (0.25 | ) | | | (0.54 | ) | | | 16.91 | | | | 17.37 | | | | 635 | | | | 1.52 | | | | 1.55 | | | | 72 | | |

10/31/18 | | | 16.91 | | | | 0.25 | | | | 0.40 | | | | 0.65 | | | | (0.27 | ) | | | (0.93 | ) | | | (1.20 | ) | | | 16.36 | | | | 3.70 | | | | 1,151 | | | | 1.52 | | | | 1.46 | | | | 77 | | |

10/31/19 | | | 16.36 | | | | 0.34 | | | | 0.67 | | | | 1.01 | | | | (0.37 | ) | | | (2.31 | ) | | | (2.68 | ) | | | 14.69 | | | | 7.76 | | | | 2,258 | | | | 0.95 | | | | 2.46 | | | | 66 | | |

10/31/20 | | | 14.69 | | | | 0.37 | | | | (0.88 | ) | | | (0.51 | ) | | | (0.38 | ) | | | — | | | | (0.38 | ) | | | 13.80 | | | | (3.33 | ) | | | 1,183 | | | | 0.93 | | | | 2.60 | | | | 47 | | |

(1) Calculated based upon average shares outstanding.

(2) Total return does not reflect sales load. It does include expense reimbursements (recoupments).

(3) Net of the following expense reimbursements (recoupments) (based on average net assets):

| | 10/31/16 | | 10/31/17 | | 10/31/18 | | 10/31/19 | | 10/31/20 | |

| AIG Select Dividend Growth Class A | | | 0.02 | % | | | 0.00 | % | | | 0.01 | % | | | 0.55 | % | | | 0.69 | % | |

| AIG Select Dividend Growth Class C | | | 0.64 | | | | 0.88 | | | | 0.47 | | | | 0.83 | | | | 0.93 | | |

| AIG Select Dividend Growth Class W | | | 5.19 | | | | 2.18 | | | | 1.01 | | | | 1.19 | | | | 1.26 | | |

See Notes to Financial Statements

16

AIG Multi-Asset Allocation Fund

PORTFOLIO PROFILE — October 31, 2020 — (unaudited)

Industry Allocation* | |

Domestic Equity Investment Companies | | | 50.2 | % | |

Domestic Fixed Income Investment Companies | | | 20.3 | | |

Commodity Strategy Investment Companies | | | 10.1 | | |

Global Strategies Investment Companies | | | 9.8 | | |

Foreign Equity Investment Companies | | | 9.8 | | |

| | | | 100.2 | % | |

* Calculated as a percentage of net assets

17

AIG Multi-Asset Allocation Fund@

PORTFOLIO OF INVESTMENTS — October 31, 2020

Security Description | |

Shares | | Value

(Note 2) | |

AFFILIATED REGISTERED INVESTMENT

COMPANIES#—100.2% | |

Commodity Strategy Investment

Companies—10.1% | |

SunAmerica Specialty Series,

AIG Commodity Strategy

Fund, Class A

(cost $23,058,269) | | | 3,289,459 | | | $ | 19,374,912 | | |

Domestic Equity Investment

Companies—50.2% | |

SunAmerica Series, Inc.,

AIG Focused Dividend Strategy

Fund, Class A | | | 395,972 | | | | 5,591,128 | | |

SunAmerica Series, Inc.,

AIG Select Dividend Growth

Fund, Class A | | | 972,890 | | | | 13,493,988 | | |

SunAmerica Series, Inc.,

AIG Strategic Value Fund,

Class A | | | 781,391 | | | | 18,909,652 | | |

SunAmerica Specialty Series,

AIG ESG Dividend Fund,

Class A | | | 1,358,569 | | | | 19,196,580 | | |

SunAmerica Specialty Series,

AIG Focused Alpha Large-Cap

Fund, Class A | | | 336,052 | | | | 9,611,093 | | |

SunAmerica Specialty Series,

AIG Focused Growth Fund,

Class A† | | | 319,508 | | | | 9,911,143 | | |

SunAmerica Specialty Series,

AIG Small-Cap Fund, Class A† | | | 1,281,103 | | | | 19,395,898 | | |

Total Domestic Equity Investment

Companies

(cost $94,215,577) | | | | | 96,109,482 | | |

Domestic Fixed Income

Investment Companies—20.3% | |

SunAmerica Income Funds,

AIG Flexible Credit Fund,

Class A | | | 2,461,147 | | | | 7,851,058 | | |

SunAmerica Income Funds,

AIG Strategic Bond Fund,

Class A | | | 2,634,251 | | | | 9,009,139 | | |

SunAmerica Income Funds,

AIG U.S. Government

Securities Fund, Class A | | | 2,001,812 | | | | 19,357,519 | | |

SunAmerica Senior Floating

Rate Fund, Inc., AIG Senior

Floating Rate Fund, Class A | | | 361,925 | | | | 2,732,531 | | |

Total Domestic Fixed Income

Investment Companies

(cost $38,858,892) | | | | | 38,950,247 | | |

Security Description | |

Shares | | Value

(Note 2) | |

Foreign Equity Investment

Companies—9.8% | |

SunAmerica Equity Funds,

AIG International Dividend

Strategy Fund, Class A | | | 1,880,547 | | | $ | 12,768,917 | | |

SunAmerica Equity Funds,

AIG Japan Fund, Class A | | | 900,578 | | | | 5,970,831 | | |

Total Foreign Equity Investment

Companies

(cost $22,197,328) | | | | | 18,739,748 | | |

Global Strategies Investment

Companies—9.8% | |

SunAmerica Specialty Series,

AIG Income Explorer

Fund, Class A

(cost $20,798,616) | | | 1,387,557 | | | | 18,745,893 | | |

TOTAL INVESTMENTS

(cost $199,128,682)(1) | | | 100.2 | % | | | 191,920,282 | | |

Liabilities in excess of other assets | | | (0.2 | ) | | | (375,099 | ) | |

NET ASSETS | | | 100.0 | % | | $ | 191,545,183 | | |

# See Note 5

@ The AIG Multi-Asset Allocation Fund invests in various AIG Mutual Funds, some of which are not presented in this report. Additional information on the underlying funds, including such funds' prospectuses and shareholder reports, are available on our website, www.aig.com/funds.

† Non-income producing security

(1) See Note 6 for cost of investments on a tax basis.

18

AIG Multi-Asset Allocation Fund@

PORTFOLIO OF INVESTMENTS — October 31, 2020 — (continued)

The following is a summary of the inputs used to value the Fund's net assets as of October 31, 2020 (see Note 2):

| | Level 1 — Unadjusted

Quoted Prices | | Level 2 — Other

Observable Inputs | | Level 3 — Significant

Unobservable Inputs | | Total | |

ASSETS: | |

Investments at Value:* | |

Affiliated Registered Investment Companies | | $ | 191,920,282 | | | $ | — | | | $ | — | | | $ | 191,920,282 | | |

* For a detailed presentation of investments, please refer to the Portfolio of Investments.

See Notes to Financial Statements

19

AIG Active Allocation Fund

PORTFOLIO PROFILE — October 31, 2020 — (unaudited)

Industry Allocation* | |

Domestic Equity Investment Companies | | | 48.1 | % | |

Domestic Fixed Income Investment Companies | | | 39.2 | | |

Foreign Equity Investment Companies | | | 8.4 | | |

Global Strategies Investment Companies | | | 3.7 | | |

Commodity Strategy Investment Companies | | | 0.7 | | |

| | | | 100.1 | % | |

* Calculated as a percentage of net assets

20

AIG Active Allocation Fund@

PORTFOLIO OF INVESTMENTS — October 31, 2020

Security Description | |

Shares | | Value

(Note 2) | |

AFFILIATED REGISTERED INVESTMENT

COMPANIES#—100.1% | |

Commodity Strategy Investment

Companies—0.7% | |

SunAmerica Specialty Series,

AIG Commodity Strategy

Fund, Class A

(cost $919,982) | | | 145,746 | | | $ | 858,444 | | |

Domestic Equity Investment

Companies—48.1% | |

SunAmerica Series, Inc.,

AIG Focused Dividend Strategy

Fund, Class A | | | 330,674 | | | | 4,669,112 | | |

SunAmerica Series, Inc.,

AIG Select Dividend Growth

Fund, Class A | | | 571,371 | | | | 7,924,913 | | |

SunAmerica Series, Inc.,

AIG Strategic Value Fund,

Class A | | | 415,174 | | | | 10,047,217 | | |

SunAmerica Specialty Series,

AIG ESG Dividend Fund,

Class A | | | 352,187 | | | | 4,976,398 | | |

SunAmerica Specialty Series,

AIG Focused Alpha Large-Cap

Fund, Class A | | | 398,815 | | | | 11,406,106 | | |

SunAmerica Specialty Series,

AIG Focused Growth Fund,

Class A† | | | 383,436 | | | | 11,894,173 | | |

SunAmerica Specialty Series,

AIG Small-Cap Fund, Class A† | | | 216,170 | | | | 3,272,815 | | |

Total Domestic Equity Investment

Companies

(cost $54,190,745) | | | | | 54,190,734 | | |

Domestic Fixed Income

Investment Companies—39.2% | |

SunAmerica Income Funds,

AIG Flexible Credit Fund,

Class A | | | 2,179,024 | | | | 6,951,087 | | |

SunAmerica Income Funds,

AIG Strategic Bond Fund,

Class A | | | 2,059,605 | | | | 7,043,848 | | |

SunAmerica Income Funds,

AIG U.S. Government

Securities Fund, Class A | | | 2,702,245 | | | | 26,130,708 | | |

SunAmerica Senior Floating Rate

Fund, Inc., AIG Senior Floating

Rate Fund, Class A | | | 534,609 | | | | 4,036,294 | | |

Total Domestic Fixed Income

Investment Companies

(cost $43,175,773) | | | | | 44,161,937 | | |

Security Description | |

Shares | | Value

(Note 2) | |

Foreign Equity Investment

Companies—8.4% | |

SunAmerica Equity Funds,

AIG International Dividend

Strategy Fund, Class A | | | 1,014,614 | | | $ | 6,889,228 | | |

SunAmerica Equity Funds,

AIG Japan Fund, Class A | | | 384,358 | | | | 2,548,295 | | |

Total Foreign Equity Investment

Companies

(cost $11,113,595) | | | | | 9,437,523 | | |

Global Strategies Investment

Companies—3.7% | |

SunAmerica Specialty Series,

AIG Income Explorer

Fund, Class A

(cost $4,625,763) | | | 309,301 | | | | 4,178,653 | | |

TOTAL INVESTMENTS

(cost $114,025,858)(1) | | | 100.1 | % | | | 112,827,291 | | |

Liabilities in excess of other assets | | | (0.1 | ) | | | (91,711 | ) | |

NET ASSETS | | | 100.0 | % | | $ | 112,735,580 | | |

# See Note 5

@ The AIG Active Allocation Fund invests in various AIG Mutual Funds, some of which are not presented in this report. Additional information on the underlying funds, including such funds' prospectuses and shareholder reports, are available on our website, www.aig.com/funds.

† Non-income producing security

(1) See Note 6 for cost of investments on a tax basis.

21

AIG Active Allocation Fund@

PORTFOLIO OF INVESTMENTS — October 31, 2020 — (continued)

The following is a summary of the inputs used to value the Funds's net assets as of October 31, 2020 (see Note 2):

| | Level 1 — Unadjusted

Quoted Prices | | Level 2 — Other

Observable Inputs | | Level 3 — Significant

Unobservable Inputs | | Total | |

ASSETS: | |

Investments at Value:* | |

Affiliated Investment Companies | | $ | 112,827,291 | | | $ | — | | | $ | — | | | $ | 112,827,291 | | |

* For a detailed presentation of investments, please refer to the Portfolio of Investments.

See Notes to Financial Statements

22

AIG Focused Dividend Strategy Fund

PORTFOLIO PROFILE — October 31, 2020

Industry Allocation* | |

Food-Misc./Diversified | | | 6.6 | % | |

Electronic Components-Semiconductors | | | 6.5 | | |

Cosmetics & Toiletries | | | 6.5 | | |

Medical-Drugs | | | 6.4 | | |

Consumer Products-Misc. | | | 6.2 | | |

Medical-Wholesale Drug Distribution | | | 4.9 | | |

Chemicals-Diversified | | | 4.5 | | |

Telephone-Integrated | | | 3.9 | | |

Retail-Consumer Electronics | | | 3.4 | | |

Data Processing/Management | | | 3.3 | | |

Diversified Banking Institutions | | | 3.2 | | |

Oil Companies-Integrated | | | 3.2 | | |

Beverages-Non-alcoholic | | | 3.2 | | |

Computer Services | | | 3.2 | | |

Medical-Biomedical/Gene | | | 3.1 | | |

Diversified Manufacturing Operations | | | 3.1 | | |

Computers | | | 3.1 | | |

Retail-Building Products | | | 3.1 | | |

Computers-Memory Devices | | | 3.1 | | |

Networking Products | | | 3.0 | | |

Retail-Drug Store | | | 3.0 | | |

Commercial Services-Finance | | | 3.0 | | |

Food-Confectionery | | | 3.0 | | |

Internet Security | | | 2.2 | | |

Auto-Heavy Duty Trucks | | | 1.4 | | |

Electric Products-Misc. | | | 1.2 | | |

Machinery-Construction & Mining | | | 0.9 | | |

Tobacco | | | 0.8 | | |

Advertising Agencies | | | 0.5 | | |

Repurchase Agreements | | | 0.3 | | |

| | | | 99.8 | % | |

* Calculated as a percentage of net assets

23

AIG Focused Dividend Strategy Fund

PORTFOLIO OF INVESTMENTS — October 31, 2020

Security Description | |

Shares | | Value

(Note 2) | |

COMMON STOCKS—99.5% | |

Advertising Agencies—0.5% | |

Omnicom Group, Inc. | | | 505,899 | | | $ | 23,878,433 | | |

Auto-Heavy Duty Trucks—1.4% | |

Cummins, Inc. | | | 292,500 | | | | 64,317,825 | | |

Beverages-Non-alcoholic—3.2% | |

Coca-Cola Co. | | | 3,069,446 | | | | 147,517,575 | | |

Chemicals-Diversified—4.5% | |

Dow, Inc. | | | 3,126,058 | | | | 142,204,379 | | |

LyondellBasell Industries NV,

Class A | | | 998,416 | | | | 68,341,575 | | |

| | | | 210,545,954 | | |

Commercial Services-Finance—3.0% | |

Automatic Data

Processing, Inc. | | | 876,011 | | | | 138,374,698 | | |

Computer Services—3.2% | |

International Business

Machines Corp. | | | 1,314,132 | | | | 146,735,979 | | |

Computers—3.1% | |

HP, Inc. | | | 8,057,813 | | | | 144,718,322 | | |

Computers-Memory Devices—3.1% | |

NetApp, Inc. | | | 3,264,332 | | | | 143,271,532 | | |

Consumer Products-Misc.—6.2% | |