As filed with the Securities and Exchange Commission on July 22, 2009

Securities Act File No. 333-

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Pre-Effective Amendment No.

Post-Effective Amendment No.

(Check appropriate box or boxes)

SUNAMERICA FOCUSED SERIES, INC.

(Exact Name of Registrant as Specified in the Articles of Incorporation)

Harborside Financial Center

3200 Plaza 5

Jersey City, NJ 07311-4992

(Address of Principal Executive Offices)

Telephone Number: (800) 858-8850

(Area Code and Telephone Number)

Gregory N. Bressler

General Counsel

SunAmerica Asset Management Corp.

Harborside Financial Center

3200 Plaza 5

Jersey City, NJ 07311-4992

(Name and Address of Agent for Service)

Copies to:

Margery K. Neale, Esq.

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New York, New York 10019-6099

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933.

Title of securities being registered: Shares of common stock, par value $0.0001 per share. Calculation of Registration Fee under the Securities Act of 1933: No filing fee is required because of reliance on Section 24(f) and Rule 24f-2 under the Investment Company Act of 1940.

It is proposed that this filing will become effective August 21, 2009, pursuant to Rule 488 under the Securities Act of 1933.

SUNAMERICA FOCUSED SERIES, INC.

Focused Mid-Cap Value Portfolio

Harborside Financial Center

3200 Plaza 5

Jersey City, NJ 07311-4992

(800) 858-8850

August [26], 2009

Dear Shareholder:

You are cordially invited to attend a special shareholders meeting (the “Special Meeting”) of the Focused Mid-Cap Value Portfolio (the “Mid-Cap Value Portfolio”), a series of SunAmerica Focused Series, Inc. (the “Corporation”), to be held on Friday, October 16, 2009. Before the Special Meeting, I would like to provide you with additional background information and ask for your vote on an important proposal affecting the Mid-Cap Value Portfolio.

We are asking for your vote to approve a proposed reorganization of the Mid-Cap Value Portfolio with the Focused Small-Cap Value Portfolio (the “Small-Cap Value Portfolio”), also a series of the Corporation. In this reorganization, your shares of the Mid-Cap Value Portfolio would, in effect, be exchanged for the same class of shares of the Small-Cap Value Portfolio with the same aggregate net asset value of the Mid-Cap Value Portfolio shares that you currently hold. It is currently anticipated that the reorganization should be effected on a tax-free basis for federal income tax purposes.

The reorganization is being proposed because SunAmerica Asset Management Corporation (“SAAMCo”), the Mid-Cap Value Portfolio’s and the Small-Cap Value Portfolio’s investment adviser, believes that shareholders of each fund will benefit more from the potential operating efficiencies and economies of scale that may be achieved by combining the funds’ assets in the reorganization, than by continuing to operate the two funds separately. SAAMCo further believes that it is in the best interests of the Mid-Cap Value Portfolio’s shareholders to combine its assets with a fund that has a generally better performance history and lower expense structure. SAAMCo believes that the Small-Cap Value Portfolio’s investment objective and strategies make it a compatible fund within the SunAmerica complex for a reorganization with the Mid-Cap Value Portfolio. Each of the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio has identical investment objectives to seek long-term growth of capital, follows a value oriented philosophy, which involves investing in securities believed to be undervalued in the market, engages in the active trading of equity securities selected to achieve their investment objectives and uses a focused strategy.

The Board of Directors of the Corporation has determined that the proposed reorganization of the Mid-Cap Value Portfolio with the Small-Cap Value Portfolio is in the best interests of the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio, and the interests of the Mid-Cap Value Portfolio’s and the Small-Cap Value Portfolio’s existing shareholders will not be diluted as a result of the reorganization. If the reorganization is approved by shareholders, it is expected that the proposed reorganization will take effect during the fourth quarter of 2009. Included in this booklet is information about the upcoming Special Meeting:

| | • | | A Notice of a Special Meeting of Shareholders, which summarizes the matter on which you are being asked to vote; and |

| | • | | The Combined Prospectus/Proxy Statement, which provides detailed information on the Small-Cap Value Portfolio, the specific proposal being considered at the Special Meeting, and why the proposal is being made. |

I encourage you to review the enclosed materials carefully. As a shareholder, your vote is important, and we hope that you will respond today to ensure that your shares will be represented at the Special Meeting. You may vote in one of the following ways:

| | • | | By calling us toll-free at the telephone number listed on the enclosed proxy card; |

| | • | | By Internet at the website address listed on the enclosed proxy card; |

| | • | | By returning the enclosed proxy card in the postage-paid envelope; or |

| | • | | In person at the Special Meeting. |

As always, we appreciate your support.

|

| Sincerely, |

|

| /s/ John T. Genoy |

| John T. Genoy |

| President |

Please vote proxy now. Your vote is important.

To avoid the wasteful and unnecessary expense of further solicitation, we urge you to promptly indicate your vote on the enclosed proxy card, date and sign it and return it in the envelope provided, or record your voting instructions by telephone or via the internet, no matter how large or small your holdings may be. If you submit a properly executed proxy but do not indicate how you wish your shares to be voted, your shares will be voted “For” the reorganization. If your shares are held through a broker, you must provide voting instructions to your broker about how to vote your shares in order for your broker to vote your shares at the Special Meeting.

QUESTIONS & ANSWERS

We recommend that you read the complete Combined Prospectus/Proxy Statement. For your convenience, we have provided a brief overview of the issue to be voted on.

| Q: | Why is a shareholder meeting being held? |

| A: | You are being asked to approve an agreement and plan of reorganization (the “Reorganization Agreement”) between SunAmerica Focused Series, Inc. (the “Corporation”), on behalf of its series, the Focused Mid-Cap Value Portfolio (the “Mid-Cap Value Portfolio”), and the Corporation, on behalf of its series, the Focused Small-Cap Value Portfolio (the “Small-Cap Value Portfolio” and together with the Mid-Cap Value Portfolio, the “Funds” and each, a “Fund”). The investment objectives of the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio are identical in that each Fund seeks long-term growth of capital. The Funds also engage in similar investment strategies in seeking to achieve their investment objective, including following a value oriented philosophy and using a focused strategy. If the proposed reorganization (the “Reorganization”) is approved and completed, an account at the Small-Cap Value Portfolio will be set up in your name, you will become a shareholder of the Small-Cap Value Portfolio, and the Mid -Cap Value Portfolio will be terminated as a series of the Corporation. Please refer to the Combined Prospectus/Proxy Statement for a detailed explanation of the proposed Reorganization and for a more complete description of the Small-Cap Value Portfolio. |

| Q: | How does the Board of Directors suggest that I vote? |

| A: | After careful consideration, the Board of Directors of the Corporation (the “Board of Directors”), on behalf of the Mid-Cap Value Portfolio, has determined that the proposed Reorganization is in the best interests of the Mid-Cap Value Portfolio and the interests of the Mid-Cap Value Portfolio’s existing shareholders will not be diluted as a result of the Reorganization and, therefore, recommends that you cast your vote “For” the proposed Reorganization. The Board of Directors has determined that shareholders of the Mid-Cap Value Portfolio may benefit from (i) the possible operating efficiencies from the larger net asset size of the combined fund, (ii) the expectation that the combined fund will have gross and net operating expenses equal to or below those of the Mid-Cap Value Portfolio prior to the Reorganization, (iii) the compatibility of the types of portfolio securities held by the Funds, the identical investment objectives of each Fund, the identical value oriented philosophy and focused strategy of each Fund and certain other similarities between the investment strategies and risks of each Fund, and (iv) being invested in a Fund with a generally better performance history. |

| Q: | How will the Reorganization affect me? |

| A: | If shareholders of the Mid-Cap Value Portfolio approve the proposed Reorganization, all the assets and liabilities of the Mid-Cap Value Portfolio will be combined with those of the Small-Cap Value Portfolio, an account will be set up in your name at the Small-Cap Value Portfolio and you will receive shares of the Small-Cap Value Portfolio. You will receive the same class of shares of the Small-Cap Value Portfolio as you currently hold of the Mid-Cap Value Portfolio. The aggregate net asset value of the shares you receive in the Reorganization will equal the aggregate net asset value of the shares you own immediately prior to the Reorganization. As a result of the Reorganization, however, a shareholder of the Mid-Cap Value Portfolio will hold a smaller percentage of ownership in the combined fund than he or she held in the Mid-Cap Value Portfolio prior to the Reorganization. |

| Q: | In the Reorganization, will I receive shares of the Small-Cap Value Portfolio of the same class as the shares of the Mid-Cap Value Portfolio that I now hold? |

| A: | Yes. You will receive shares of the Small-Cap Value Portfolio of the same class as the shares you own of the Mid-Cap Value Portfolio. |

1

| Q: | Will I own the same number of shares of the Small-Cap Value Portfolio as I currently own of the Mid-Cap Value Portfolio? |

| A: | No. You will receive shares of the Small-Cap Value Portfolio with the same aggregate net asset value as the shares of the Mid-Cap Value Portfolio you own prior to the Reorganization. However, the number of shares you receive will depend on the relative net asset value of the shares of the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio on the closing date. Thus, on the closing date, if the net asset value of a share of the Small-Cap Value Portfolio is lower than the net asset value of the corresponding share class of the Mid-Cap Value Portfolio, you will receive a greater number of shares of the Small-Cap Value Portfolio in the Reorganization than you held in the Mid-Cap Value Portfolio before the Reorganization. On the other hand, if the net asset value of a share of the Small-Cap Value Portfolio is higher than the net asset value of the corresponding share class of the Mid-Cap Value Portfolio, you will receive fewer shares of the Small-Cap Value Portfolio in the Reorganization than you held in the Mid-Cap Value Portfolio before the Reorganization. The aggregate net asset value of your Small-Cap Value Portfolio shares immediately after the Reorganization will be the same as the aggregate net asset value of your Mid-Cap Value Portfolio shares immediately prior to the Reorganization. |

| Q: | Will my privileges as a shareholder change after the Reorganization? |

| A: | Your rights as a shareholder will not change in any substantial way as a result of the Reorganization, but you will be a shareholder of the Small-Cap Value Portfolio rather than of the Mid-Cap Value Portfolio. The shareholder services available to you after the Reorganization will be identical. |

| Q: | Who will advise the Small-Cap Value Portfolio once the Reorganization is completed? |

| A: | As you know, the Mid-Cap Value Portfolio is advised by SunAmerica Asset Management Corp. (“SAAMCo”) and is subadvised by Delafield Asset Management, LLC, a division of Reich & Tang Asset Management, LLC. The Small-Cap Value Portfolio is also advised by SAAMCo and is not subadvised. SAAMCo will continue to serve as the Small-Cap Value Portfolio’s investment adviser following the completion of the Reorganization. |

| Q: | Will I have to pay any sales load, commission or other similar fee in connection with the Reorganization? |

| A: | No, you will not pay any sales load, commission or other similar fee in connection with the Reorganization. As more fully discussed in the Combined Prospectus/Proxy Statement, the holding period with respect to any contingent deferred sales charge that applies to shares of the Small-Cap Value Portfolio acquired by you in the Reorganization will be measured from the earlier of the time (i) you purchased your Mid-Cap Value Portfolio shares or (ii) you purchased your shares of any other fund advised by SAAMCo and subsequently exchanged them for shares of the Mid-Cap Value Portfolio. |

| Q: | How do operating expenses paid by the Small-Cap Value Portfolio compare to those payable by the Mid-Cap Value Portfolio? |

| A: | Following the Reorganization, the Small-Cap Value Portfolio’s gross projected operating expenses are expected to be below those of the Mid-Cap Value Portfolio. The net operating expenses of the Small-Cap Value Portfolio are also expected to be equal to or below those of the Mid-Cap Value Portfolio after taking into account the contractual fee waivers and expense reimbursement arrangements for each of the Small-Cap Value Portfolio and the Mid-Cap Value Portfolio. The contractual expense caps under the expense limitation agreement between the Corporation, on behalf of certain series of the Companies, and SAAMCo, with respect to the Small-Cap Value Portfolio are identical to those of the Mid-Cap Value Portfolio. |

2

| Q: | What will I have to do to open an account in the Small-Cap Value Portfolio? What happens to my account if the Reorganization is approved? |

| A: | If the Reorganization is approved, an account will be set up in your name and your shares automatically will be converted into shares of the Small-Cap Value Portfolio. We will send you written confirmation that this change has taken place. You will receive the same class of shares of the Small-Cap Value Portfolio as you currently hold of the Mid-Cap Value Portfolio. The aggregate net asset value of the shares you receive in the Reorganization will be equal to the aggregate net asset value of the shares you own immediately prior to the Reorganization. No certificates for shares will be issued in connection with the Reorganization. If you currently hold certificates representing your shares of the Mid-Cap Value Portfolio, it is not necessary to surrender such certificates. |

| Q: | I have received other proxy statements from other funds in the SunAmerica complex. Is this a duplicate proxy statement and do I have to vote again? |

| A: | This is not a duplicate proxy statement. You are being asked to vote separately for each fund in which you own shares. |

| Q: | What happens if the Reorganization is not approved? |

| A: | If the Reorganization is not approved by shareholders of the Mid-Cap Value Portfolio, the Board of Directors will consider other alternatives. |

| Q: | Will I have to pay any federal taxes as a result of the Reorganization? |

| A: | The Reorganization of the Mid-Cap Value Portfolio is currently expected to qualify as a tax-free “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended. If the Reorganization so qualifies, in general, the Mid-Cap Value Portfolio will not recognize any gain or loss as a result of the transfer of all of its assets and liabilities in exchange solely for shares of the Small-Cap Value Portfolio and the assumption of its liabilities by the Small-Cap Value Portfolio, or as a result of its liquidation, and you will not recognize any gain or loss upon your receipt solely of shares of the Small-Cap Value Portfolio in connection with the Reorganization. |

To the extent that prior to the Reorganization the portfolio holdings of the Mid-Cap Value Portfolio are sold by the Mid-Cap Value Portfolio in connection with the Reorganization, the tax impact of such sales will depend on the difference between the price at which such portfolio holdings are sold and the Mid-Cap Value Portfolio’s basis in such holdings. Any capital gains recognized in these sales on a net basis will be distributed, if required, to the Mid-Cap Value Portfolio’s shareholders as either capital gain dividends (to the extent of net realized long-term capital gains) or ordinary dividends (to the extent of net realized short-term capital gains) during or with respect to the year of sale, and such distributions will be taxable to shareholders.

| Q: | Who will pay for the Reorganization? |

| A: | SAAMCo or its affiliates will pay the expenses incurred in connection with the preparation of the Combined Prospectus/Proxy Statement, including all direct and indirect expenses and out-of-pocket costs other than any transaction costs relating to the sale of the Mid-Cap Value Portfolio’s portfolio securities prior to or after the Reorganization. |

| Q: | What if I redeem or exchange my shares before the Reorganization takes place? |

| A: | If you choose to redeem or exchange your shares before the Reorganization takes place, the redemption or exchange will be treated as a normal redemption or exchange of shares and, generally, will be a taxable transaction and any applicable redemption fees will be applied. Also, in the case of redemptions, you will be responsible for payment of any applicable contingent deferred sales charges. |

3

| Q: | How do I vote my proxy? |

| A: | You may cast your vote by mail, telephone or internet or in person at the special shareholders meeting. To vote by mail, please mark your vote on the enclosed proxy card and sign, date and return the card in the postage-paid envelope provided. To vote by telephone or over the internet, please have the proxy card in hand and call the telephone number or go to the website address listed on the enclosed form and follow the instructions. |

| Q: | When will the Reorganization occur? |

| A: | If approved by shareholders, the Reorganization is expected to occur during the fourth quarter of 2009. The Reorganization will not take place if the Reorganization is not approved by the Mid-Cap Value Portfolio’s shareholders. |

| Q: | Whom do I contact for further information? |

| A: | You may call Computershare, Inc., our proxy solicitation firm at the telephone number listed on the enclosed proxy card. |

Important additional information about the proposal is set forth in the accompanying Combined Prospectus/Proxy Statement. Please read it carefully.

4

SUNAMERICA FOCUSED SERIES, INC.

Focused Mid-Cap Value Portfolio

Harborside Financial Center

3200 Plaza 5

Jersey City, NJ 07311-4992

(800) 858-8850

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON OCTOBER 16, 2009

To the Shareholders of the Focused Mid-Cap Value Portfolio:

This is to notify you that a Special Meeting of Shareholders (the “Special Meeting”) of the Focused Mid-Cap Value Portfolio (the “Mid-Cap Value Portfolio”), a series of SunAmerica Focused Series, Inc., a Maryland Corporation (the “Corporation”), will be held on Friday, October 16, 2009 at 9:00 a.m., Eastern time, at the offices of SunAmerica Asset Management Corp., located at Harborside Financial Center, 3200 Plaza 5, Jersey City, New Jersey 07311 for the following purposes:

1. To consider a proposal to approve an Agreement and Plan of Reorganization (the “Reorganization Agreement”) pursuant to which the Mid-Cap Value Portfolio would transfer all of its assets to the Focused Small-Cap Value Portfolio (the “Small-Cap Value Portfolio”), also a series of the Corporation, in exchange solely for the assumption of the Mid-Cap Value Portfolio’s liabilities by the Small-Cap Value Portfolio and Class A, Class B and Class C shares of the Small-Cap Value Portfolio, which shares will be distributed by the Mid-Cap Value Portfolio to the holders of its shares in complete liquidation thereof; and

2. To transact such other business as may properly be presented at the Special Meeting or any adjournment or postponement thereof.

The Board of Directors of the Corporation has fixed the close of business on July 31, 2009 as the record date for determination of shareholders of the Mid-Cap Value Portfolio entitled to notice of, and to vote at, the Special Meeting and any adjournments or postponements thereof.

It is very important that your vote be received prior to the Special Meeting date. Voting instructions for shares held of record in the name of a nominee, such as a broker-dealer or director of an employee benefit plan, may be subject to earlier cut-off dates established by such intermediaries for receipt of such instructions.

Your vote is important regardless of the size of your holdings in the Mid-Cap Value Portfolio. Whether or not you expect to be present at the Special Meeting, please complete and sign the enclosed proxy card and return it promptly in the enclosed envelope. Certain shareholders may also vote by telephone or over the internet; please see pages 32-33 of the enclosed Combined Prospectus/Proxy Statement for details. If you vote by proxy and then desire to change your vote or vote in person at the Special Meeting, you may revoke your proxy at any time prior to the votes being tallied at the Special Meeting. Please refer to the section of the enclosed Combined Prospectus/Proxy Statement entitled “Voting Information and Requirements—Manner of Voting” for more information.

|

| By Order of the Board of Directors, |

|

| /s/ Gregory N. Bressler |

| Gregory N. Bressler |

| Secretary |

Jersey City, New Jersey

August [26], 2009

SUBJECT TO COMPLETION, DATED JULY 22, 2009

COMBINED PROSPECTUS/PROXY STATEMENT

SUNAMERICA FOCUSED SERIES, INC.

Focused Mid-Cap Value Portfolio

Focused Small-Cap Value Portfolio

Harborside Financial Center

3200 Plaza 5

Jersey City, NJ 07311-4992

(800) 858-8850

This Combined Prospectus/Proxy Statement is furnished to you as a shareholder of the Focused Mid-Cap Value Portfolio (the “Mid-Cap Value Portfolio”), a series of SunAmerica Focused Series, Inc., a Maryland Corporation (the “Corporation”). A special meeting of shareholders of the Mid-Cap Value Portfolio (the “Special Meeting”) will be held at the offices of SunAmerica Asset Management Corp. (“SAAMCo”), located at Harborside Financial Center, 3200 Plaza 5, Jersey City, New Jersey 07311, on Friday, October 16, 2009 at 9:00 a.m., Eastern time, to consider the items that are listed below and discussed in greater detail elsewhere in this Combined Prospectus/Proxy Statement. Shareholders of record of the Mid-Cap Value Portfolio at the close of business on July 31, 2009 (the “Record Date”) are entitled to notice of, and to vote at, the Special Meeting or any adjournments or postponements thereof. This Combined Prospectus/Proxy Statement, proxy card and accompanying Notice of Special Meeting of Shareholders were first sent or given to shareholders of the Mid-Cap Value Portfolio on or about August [26], 2009. Whether or not you expect to attend the Special Meeting or any adjournment or postponement thereof, the Board of Directors of the Corporation (the “Board of Directors”) requests that shareholders vote their shares by completing and returning the enclosed proxy card.

The purposes of the Special Meeting are:

1. To consider a proposal to approve an Agreement and Plan of Reorganization (the “Reorganization Agreement”) pursuant to which the Mid-Cap Value Portfolio would transfer all of its assets to the Focused Small-Cap Value Portfolio (the “Small-Cap Value Portfolio”), also a series of the Corporation, in exchange solely for the assumption of the Mid-Cap Value Portfolio’s liabilities by the Small-Cap Value Portfolio and for Class A, Class B and Class C shares of the Small-Cap Value Portfolio, which shares will be distributed by the Mid-Cap Value Portfolio to the holders of its shares in complete liquidation thereof; and

2. To transact such other business as may properly be presented at the Special Meeting or any adjournment or postponement thereof.

The Board of Directors has approved a reorganization (the “Reorganization”) by which the Mid-Cap Value Portfolio, a separate series of the Corporation, an open-end management investment company, would be acquired by the Small-Cap Value Portfolio, also a series of the Corporation. The investment objectives of the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio are identical. Each Fund seeks long-term growth of capital. Each Fund follows a “value” oriented philosophy and engages in the active trading of securities selected to achieve long-term growth of capital. Each Fund also uses a focused strategy, which is one in which an investment adviser actively invests in a small number of holdings which constitute its favorite stock-picking ideas at any given moment. The Mid-Cap Value Portfolio and the Small-Cap Value Portfolio, however, employ certain differing investment strategies to achieve their objectives. The key principal difference between the Funds is that the Mid-Cap Value Portfolio invests at least 80% of its net assets in securities of mid-cap companies, while the Small-Cap Value Portfolio invests at least 80% of its net assets in small-cap companies with characteristics similar to those contained in the Russell 2000® Value Index, its benchmark index. While the Funds have differing 80% investment policies, there is substantial overlap in the Funds’ investment programs. The Small-Cap Value Portfolio also has certain other strategies that are compatible with those of the Mid-Cap Value Portfolio. For more information on each Fund’s investment strategies see “Summary – Investment Objectives and Principal Investment Strategies” below.

1

If the Mid-Cap Value Portfolio’s shareholders approve the Reorganization, the Mid-Cap Value Portfolio will transfer its assets to the Small-Cap Value Portfolio. The Small-Cap Value Portfolio will assume the liabilities of the Mid-Cap Value Portfolio and will issue shares to the Mid-Cap Value Portfolio in an amount equal to the aggregate net asset value of the outstanding shares of the Mid-Cap Value Portfolio. Immediately thereafter, the Mid-Cap Value Portfolio will distribute these shares of the Small-Cap Value Portfolio to its shareholders. After distributing these shares, the Mid-Cap Value Portfolio will be terminated as a series of the Corporation. When the Reorganization is complete, the Mid-Cap Value Portfolio’s shareholders will hold the same class of shares of the Small-Cap Value Portfolio as they currently hold of the Mid-Cap Value Portfolio. The aggregate net asset value of the Small-Cap Value Portfolio shares received in the Reorganization will equal the aggregate net asset value of the Mid-Cap Value Portfolio shares held by Mid-Cap Value Portfolio shareholders immediately prior to the Reorganization. As a result of the Reorganization, however, a shareholder of the Mid-Cap Value Portfolio will hold a smaller percentage of ownership in the combined fund than such shareholder held in the Mid-Cap Value Portfolio prior to the Reorganization.

This Combined Prospectus/Proxy Statement sets forth concisely the information shareholders of the Mid-Cap Value Portfolio should know before voting on the Reorganization and constitutes an offering of Class A, Class B and Class C shares of the Small-Cap Value Portfolio only. Please read it carefully and retain it for future reference.

The following documents containing additional information about the Funds, each having been filed with the Securities and Exchange Commission (the “SEC”), are incorporated by reference into (legally considered to be part of) this Combined Prospectus/Proxy Statement:

| | • | | the Statement of Additional Information dated August [26], 2009 (the “Reorganization SAI”), relating to this Combined Prospectus/Proxy Statement; |

| | • | | the Small-Cap Value Portfolio Statement of Additional Information for Class A, Class B and Class C shares (the “Small-Cap Value Portfolio SAI”) dated February 27, 2009 (and as currently supplemented); |

| | • | | the Mid-Cap Value Portfolio Prospectus and Statement of Additional Information containing additional information about the Mid-Cap Value Portfolio (the “Mid-Cap Value Portfolio Prospectus” and “Mid-Cap Value Portfolio SAI,” respectively), each dated February 27, 2009 (and as currently supplemented); and |

| | • | | the Semi-Annual Report to Shareholders of the Small-Cap Value Portfolio for the fiscal period ended April 30, 2009 (the “Small-Cap Value Portfolio Semi-Annual Report”). |

In addition, the following documents have been filed with the SEC and are incorporated by reference into (legally considered to be part of) and also accompany this Combined Prospectus/Proxy Statement:

| | • | | the Small-Cap Value Portfolio Prospectus for Class A, Class B and Class C shares (the “Small-Cap Value Portfolio Prospectus”) dated February 27, 2009 (and as currently supplemented); and |

| | • | | the Annual Report to Shareholders of the Small-Cap Value Portfolio for the fiscal year ended October 31, 2008 (the “Small-Cap Value Portfolio Annual Report”). |

Except as otherwise described herein, the policies and procedures set forth under “Shareholder Account Information” in the Small-Cap Value Portfolio Prospectus will apply to the Class A, Class B and Class C shares to be issued by the Small-Cap Value Portfolio in connection with the Reorganization. These documents are on file with the SEC. Each of the Funds is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), and in accordance therewith, file reports and other information, including proxy materials and charter documents, with the SEC.

2

Copies of the foregoing and any more recent reports filed after the date hereof may be obtained without charge by calling or writing:

| | |

Focused Small-Cap Value Portfolio c/o SunAmerica Focused Series, Inc. Harborside Financial Center 3200 Plaza 5 Jersey City, NJ 07311-4992 (800) 858-8850 | | Focused Mid-Cap Value Portfolio c/o SunAmerica Focused Series, Inc. Harborside Financial Center 3200 Plaza 5 Jersey City, NJ 07311-4992 (800) 858-8850 |

If you wish to request the Reorganization SAI, please ask for the “Reorganization SAI.” The Reorganization SAI may also be obtained without charge at www.sunamericafunds.com.

You also may view or obtain these documents from the SEC:

| | |

| In Person: | | At the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. |

| |

| By Phone: | | 1-202-551-8090 |

| |

| By Mail: | | Public Reference Section Office of Consumer Affairs and Information Services Securities and Exchange Commission 100 F Street, N.E. Washington, DC 20549 (duplicating fee required) |

| |

| By E-mail: | | publicinfo@sec.gov (duplicating fee required) |

| |

| By Internet: | | www.sec.gov |

The Board of Directors knows of no business other than that discussed above that will be presented for consideration at the Special Meeting. If any other matter is properly presented, it is the intention of the persons named in the enclosed proxy to vote in accordance with their best judgment.

No person has been authorized to give any information or make any representation not contained in this Combined Prospectus/Proxy Statement and, if so given or made, such information or representation must not be relied upon as having been authorized. This Combined Prospectus/Proxy Statement does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which, or to any person to whom, it is unlawful to make such offer or solicitation.

Neither the SEC nor any state regulator has approved or disapproved of these securities or passed upon the adequacy of this Combined Prospectus/Proxy Statement. Any representation to the contrary is a criminal offense.

The date of this Combined Prospectus/Proxy Statement is August [26], 2009.

3

TABLE OF CONTENTS

4

SUMMARY

The following is a summary of certain information contained elsewhere in this Combined Prospectus/Proxy Statement and is qualified in its entirety by reference to the more complete information contained herein. Shareholders should read the entire Combined Prospectus/Proxy Statement carefully.

The Corporation is an open-end management investment company registered with the SEC. Each of the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio (each, a “Fund,” and together, the “Funds”) is a separate series of the Corporation. The Corporation is organized as a corporation under the laws of the State of Maryland. The investment objectives of the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio are identical. Each Fund seeks long-term growth of capital. Each Fund follows a “value” oriented philosophy, which involves investing in securities believed to be undervalued in the market, and engages in the active trading of securities selected to achieve long-term growth of capital. Each Fund also uses a focused strategy, which is one in which an investment adviser actively invests in a small number of holdings which constitute its favorite stock-picking ideas at any given moment. Each Fund is “non-diversified,” as such term is defined in the 1940 Act, which means it can invest a larger portion of its assets in the stock of fewer companies or a single company than can some other mutual funds. By concentrating in a smaller number of stocks, a Fund’s risk is increased because the effect of each stock on the Fund’s performance is greater. The key principal difference between the Funds is that the Mid-Cap Value Portfolio invests at least 80% of its net assets in securities of mid-cap companies, while the Small-Cap Value Portfolio invests at least 80% of its net assets in small-cap companies with characteristics similar to those contained in the Russell 2000 Value Index, its benchmark index. While the Funds have differing 80% investment policies, there is substantial overlap in the Funds’ investment programs.

SunAmerica Asset Management Corp. (“SAAMCo”) serves as the investment adviser of each of the Funds. The Mid-Cap Value Portfolio is currently subadvised by Delafield Asset Management, LLC (“Delafield”), a division of Reich & Tang Asset Management, LLC, while the Small-Cap Value Portfolio has no subadviser. Each of the Funds publicly offers its shares on a continuous basis, and shares may be purchased through each Fund’s distributor, SunAmerica Capital Services, Inc. (the “Distributor”), and numerous intermediaries. Shareholders of each Fund have the right to exchange their shares for shares of the same class of other funds distributed by the Distributor, except the SunAmerica Senior Floating Rate Fund, Inc. (where the exchange privilege applies to Class A and Class C shares only), at net asset value per share at the time of exchange, subject to certain limitations. Each Fund permits its shareholders to redeem their shares at any time upon proper notice (subject, in certain cases, to redemption fees and/or contingent deferred sales charges).

The Proposed Reorganization

The Board of Directors, including the Directors who are not “interested persons” of the Corporation (as defined in the 1940 Act) (the “Independent Directors”), has unanimously approved the Reorganization, on behalf of each of the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio. Subject to approval by the Mid-Cap Value Portfolio shareholders, the Reorganization provides for:

| | • | | the transfer of all the assets of the Mid-Cap Value Portfolio to the Small-Cap Value Portfolio in exchange for the assumption of the Mid-Cap Value Portfolio’s liabilities by the Small-Cap Value Portfolio and Class A, Class B and Class C shares of the Small-Cap Value Portfolio; |

| | • | | the distribution of such Class A, Class B and Class C shares of the Small-Cap Value Portfolio to the Mid-Cap Value Portfolio’s shareholders; and |

| | • | | the termination of the Mid-Cap Value Portfolio as a series of the Corporation. |

If the proposed Reorganization is approved and completed, the Mid-Cap Value Portfolio’s shareholders would hold shares of the same class of the Small-Cap Value Portfolio as they currently hold of the Mid-Cap Value Portfolio with an aggregate net asset value equal to the aggregate net asset value of Mid-Cap Value Portfolio shares owned immediately prior to the Reorganization.

5

Background and Reasons for the Proposed Reorganization

SAAMCo believes that the shareholders of each Fund will benefit more from the potential operating efficiencies and economies of scale that may be achieved by combining the Funds’ assets in the Reorganization, than by continuing to operate the two Funds separately. SAAMCo further believes that it is in the best interests of the Mid-Cap Value Portfolio’s shareholders to combine its assets with a Fund that has a generally better performance history and lower expense structure. It is anticipated that the gross and net operating expense ratios for the Combined Fund will be equal to or lower than the current gross and net operating expense ratios for the Mid-Cap Value Portfolio. SAAMCo believes that continuing to operate the Mid-Cap Value Portfolio as currently constituted is not in the best interests of the Mid-Cap Value Portfolio’s shareholders. The Small-Cap Value Portfolio, following completion of the Reorganization, may be referred to as the “Combined Fund” in this Combined Prospectus/Proxy Statement.

In approving the Reorganization, the Board of Directors, including the Independent Directors, determined that participation in the Reorganization is in the best interests of the Mid-Cap Value Portfolio and that the interests of the Mid-Cap Value Portfolio’s shareholders will not be diluted as a result of the Reorganization. The Board of Directors considered the Reorganization proposal at meetings held in April and May 2009, and at a meeting held on June 2, 2009, the entire Board of Directors, including the Independent Directors, unanimously approved the Reorganization. The approval determinations were made on the basis of each Director’s judgment after consideration of all of the factors taken as a whole, though individual Directors may have placed different weight on various factors and assigned different degrees of materiality to various conclusions.

The factors considered by the Board of Directors with regard to the Reorganization include, but are not limited to, the following:

| | • | | The fact that the investment objectives of the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio are identical and certain strategies of the Mid-Cap Value Portfolio and Small-Cap Value Portfolio are similar and compatible, while others are different. The Directors considered the fact that each Fund follows a value oriented philosophy and uses a focused strategy. The Directors considered that the Mid-Cap Value Portfolio invests at least 80% of its net assets in securities of mid-cap companies; while the Focused Small-Cap Value Portfolio invests at least 80% of its net assets in small-cap companies with characteristics similar to those contained in the Russell 2000 Value Index, its benchmark index. The Directors noted that while the Funds have differing 80% investment policies, there is substantial overlap in the Funds’ investment programs and that investing in securities of small-cap companies is a significant part of the Mid-Cap Value Portfolio’s investment strategy and investing in securities of mid-cap companies is a significant part of the Small-Cap Value Portfolio’s investment strategies. See “Summary—Investment Objectives and Principal Investment Strategies.” |

| | • | | The possibility that the Combined Fund may achieve certain operating efficiencies and economies of scale from its larger net asset size. |

| | • | | The expectation that the Combined Fund will have gross operating expenses (i.e., operating expenses before taking into account waivers and reimbursements) below those of the Mid-Cap Value Portfolio; and that the Combined Fund will have net operating expenses (i.e., operating expenses after taking into account each Fund’s contractual fee waivers and expense reimbursement arrangements) equal to or below those of the Mid-Cap Value Portfolio. In particular, the contractual expense caps under the Expense Limitation Agreement between the Corporation, on behalf of certain series of the Corporation, and SAAMCo (the “Expense Limitation Agreement”) for the Small-Cap Value Portfolio are identical to those of the Mid-Cap Value Portfolio. While each Fund’s contractual waivers and expense reimbursements are contractually required by agreement with the relevant Board, there is no guarantee that these waivers/reimbursements will not be terminated by the Board at some point in the future. |

| | • | | The personnel of SAAMCo who will manage the Combined Fund. The Directors considered that SAAMCo will continue to serve as the investment adviser of the Combined Fund after the Reorganization. The Directors also considered that the Mid-Cap Value Portfolio is currently subadvised by Delafield, while the Small-Cap Value Portfolio has no subadviser. The Directors noted that the Combined Fund will not be subadvised following the completion of the Reorganization. See “Comparison of the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio—Management of the Funds.” |

6

| | • | | The relative performance histories of each Fund over different time periods compared with each other and to the relative benchmarks applicable to each Fund. While not predictive of future results, the Directors considered that the Small-Cap Value Portfolio has generally had better historical performance compared with the Mid-Cap Value Portfolio. The Directors also considered the individual performance of the Funds’ portfolio managers in the context of their management of the Funds both as the sole adviser and the adviser of a sleeve of the Funds’ portfolios. |

| | • | | The fact that it is currently anticipated that there will be no gain or loss recognized by shareholders for federal income tax purposes as a result of the Reorganization, as the Reorganization is expected to be a tax-free transaction. |

| | • | | The fact that SAAMCo or its affiliates will pay the expenses incurred in connection with the preparation of this Combined Prospectus/Proxy Statement, including all direct and indirect expenses and out-of-pocket costs other than any transaction costs relating to the sale of the Mid-Cap Value Portfolio’s portfolio securities prior to or after the Reorganization as described in the Reorganization Agreement. |

If the Reorganization is not approved by shareholders of the Mid-Cap Value Portfolio, the Board of Directors may consider other alternatives. If no such suitable alternatives can be found, the Board of Directors may consider the liquidation of the Mid-Cap Value Portfolio. Any such liquidation could be a taxable event for certain shareholders.

The Board of Directors unanimously recommends that you vote “For” the Reorganization.

Investment Objectives and Principal Investment Strategies

Investment Objectives. The investment objectives of each of the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio are identical. Each Fund seeks long-term growth of capital. The Combined Fund will pursue the Small-Cap Value Portfolio’s investment objective.

Principal Investment Strategies and Techniques. Each Fund follows a “value” oriented philosophy. A “value” oriented philosophy—that of investing in securities believed to be undervalued in the market – reflects a contrarian approach, in that the potential for superior relative performance is believed to be the highest when stocks of fundamentally solid companies are out of favor. The selection criteria is usually calculated to identify stocks of large, well known companies with solid financial strength and generous dividend yields that have low price-earnings ratios and have generally been overlooked by the market. Each Fund uses a focused strategy. A focused strategy is one in which the investment adviser/subadviser actively invests in a small number of holdings which constitute its favorite stock-picking ideas at any given moment. A focus philosophy reflects the belief that, over time, the performance of most investment managers’ “highest confidence” stocks exceeds that of their more diversified portfolios. The Fund will generally hold between 30 to 50 securities, although the investment adviser/subadviser may, in its discretion, hold less than 30 securities. Examples of when the Fund may hold more than the specified number of securities include, but are not limited to, re-balancing or purchase and sale transactions, including where a new adviser is selected to manage the Fund or a portion of the Fund’s assets. The investment adviser/subadviser may invest in additional financial instruments for the purpose of cash management or to hedge a security portfolio position. Each Fund is “non-diversified,” as such term is defined in the 1940 Act, which means it can invest a larger portion of its assets in the stock of fewer companies or a single company than can some other mutual funds. By concentrating in a smaller number of stocks, a Fund’s risk is increased because the effect of each stock on the Fund’s performance is greater.

The Mid-Cap Value Portfolio’s primary investment technique is the active trading of equity securities selected on the basis of value criteria and principally invests in equity securities. In addition, under normal market conditions, at least 80% of the Fund’s net assets, plus any borrowing for investment purposes, will be invested in

7

mid-cap companies. Mid-cap companies will generally include companies whose market capitalizations, at time of purchase, range from the smallest company included in the Russell Midcap Index to the largest company in the Russell Midcap Index during the most recent 12-month period. During the 12-month period ended December 31, 2008, the smallest company in the Russell Midcap Index had a market-cap of $24 million and the largest company in the Russell Midcap Index had a market-cap of $14.9 billion.

The Small-Cap Value Portfolio’s primary investment technique is the active trading of equity securities selected on the basis of value criteria and principally invests in equity securities. In addition, under normal market conditions, at least 80% of the Fund’s net assets, plus any borrowing for investment purposes, will be invested in small-cap companies with characteristics similar to those contained in the Russell 2000 Value Index. Small-cap companies will generally include companies whose market capitalizations, at time of purchase, are equal to or less than the largest company in the Russell 2000 Index during the most recent 12-month period. During the 12-month period ended December 31, 2008, the largest company in the Russell 2000 Index had a market-cap of $3.28 billion.

Each Fund engages in the active trading of equity securities meaning that a Fund may engage in frequent trading of portfolio securities to achieve its investment goal. In addition, because a Fund may sell a security without regard to how long it has held the security, active trading may have tax consequences for certain shareholders, involving a possible increase in short-term capital gains or losses. Active trading may result in high portfolio turnover and correspondingly greater brokerage commissions and other transaction costs, which will be borne directly by a Fund and could affect performance. For the fiscal year ended October 31, 2008, the portfolio turnover rate for the Small-Cap Value Portfolio was 240%, and for the fiscal year ended October 31, 2008, the portfolio turnover rate for the Mid-Cap Value Portfolio was 101%. Higher portfolio turnover may decrease the after tax return to shareholders if it results in the realization of net capital gains, which may be taxable when distributed to shareholders. In addition, because a Fund may sell a security without regard to how long it has held the security, active trading may involve a possible increase in short-term capital gains or losses. Distributions of a Fund’s net realized short-term capital gains are taxable to shareholders as ordinary income. During periods of increased market volatility, active trading may be more pronounced.

Each Fund may invest in short-term investments and defensive instruments, may invest in foreign securities and may make special situations investments. Each Fund may borrow to enhance investment performance, up to 50% of its net assets and may borrow for temporary or emergency purposes up to 33 1/ 3% of its total assets.

The Mid-Cap Value Portfolio may invest in securities of small- and large-cap companies as part of its significant, but non-principal, investment strategy. The Small-Cap Value Portfolio may invest in securities of mid-cap companies as part of its significant, but non-principal, investment strategy. In addition, the Small-Cap Value Portfolio may invest in options and futures.

Each Fund’s principal investment strategies and techniques may be changed without shareholder approval; however, shareholders of each Fund will receive at least 60 days’ notice prior to any change to the Fund’s 80% investment policy.

The Combined Fund’s principal investment strategies and techniques will be those of the Small-Cap Value Portfolio.

Comparison. The investment strategies and techniques of the Funds are similar; however, there are certain important differences. The key principal difference between the Funds is that the Mid-Cap Value Portfolio invests at least 80% of its net assets in securities of mid-cap companies, while the Small-Cap Value Portfolio invests at least 80% of its net assets in small-cap companies with characteristics similar to those contained in the Russell 2000 Value Index, its benchmark index. While the Funds have differing 80% investment policies, there is substantial overlap in the Funds’ investment programs. In particular, there is generally a certain degree of overlap in the eligibility criteria with respect to “mid-cap” and “small-cap” companies, as described below, and, as of May 14, 2009, approximately 84% of the Mid-Cap Value Portfolio’s holdings could qualify as “small-cap” companies, as defined in the Funds’ prospectus. In addition, investing in securities of small-cap companies is a significant part of the Mid-Cap Value Portfolio’s investment strategy and investing in securities of mid-cap companies is a significant part of the Small-Cap Value Portfolio’s investment strategies. As part of its significant, but non-principal investment strategies, the Mid-Cap Value Portfolio may invest in large-cap companies, while the Small-Cap Value Portfolio

8

does not invest in large-cap companies as part of its principal or non-principal investment strategy. In addition, the Small-Cap Value Portfolio may also invest in options and futures; however, investing in options and futures is not a principal or other significant investment of the Mid-Cap Value Portfolio.

While the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio have certain differences in strategies and techniques, the Funds pursue identical investment objectives and utilize many compatible investment strategies and techniques. For a discussion of the principal and other investment risks associated with an investment in the Small-Cap Value Portfolio and, therefore, the Combined Fund, please see “Comparison of the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio—Principal and Other Investment Risks” below.

9

Fees and Expenses

If the Reorganization is approved and completed, holders of the Mid-Cap Value Portfolio Class A Shares will receive Small-Cap Value Portfolio Class A Shares, holders of Mid-Cap Value Portfolio Class B Shares will receive Small-Cap Value Portfolio Class B Shares, and holders of Mid-Cap Value Portfolio Class C Shares will receive Small-Cap Value Portfolio Class C Shares.

Fee Table of the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio

and the Pro Forma Combined Fund*

(as of April 30, 2009 (unaudited))

The fee tables below provide information about the fees and expenses attributable to each class of shares of the Funds, assuming the Reorganization had taken place on April 30, 2009 and the estimated pro forma fees and expenses attributable to each class of shares of the Pro Forma Combined Fund. Future fees and expenses may be greater or less than those indicated below.

| | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Actual | | | | |

| | | Mid-Cap

Value

Portfolio | | | Small-Cap

Value

Portfolio | | | Pro Forma

Combined

Fund* | | | Mid-Cap

Value

Portfolio | | | Small-Cap

Value

Portfolio | | | Pro Forma

Combined

Fund* | |

| | | Class A | | | Class A | | | Class A | | | Class B | | | Class B | | | Class B | |

Shareholder Fees (fees paid directly from a shareholder’s investment): | | | | | | | | | | | | | | | | | | |

Maximum Sales Charge (Load) imposed on purchases (as a percentage of offering price)(1) | | 5.75 | % | | 5.75 | % | | 5.75 | % | | None | | | None | | | None | |

Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of the amount redeemed or original purchase cost)(2) | | None | | | None | | | None | | | 4.00 | % | | 4.00 | % | | 4.00 | % |

Maximum Sales Charge (Load) Imposed on Reinvested Dividends | | None | | | None | | | None | | | None | | | None | | | None | |

Redemption Fee(3) | | None | | | None | | | None | | | None | | | None | | | None | |

Exchange Fee | | None | | | None | | | None | | | None | | | None | | | None | |

Annual Fund Operating Expenses (expenses that are deducted from Fund assets): | | | | | | | | | | | | | | | | | | |

Management Fees | | 1.00 | % | | 0.88 | %(8) | | 0.75 | % | | 1.00 | % | | 0.88 | %(8) | | 0.75 | % |

Distribution and/or Service (12b-1) Fees(4) | | 0.35 | % | | 0.35 | % | | 0.35 | % | | 1.00 | % | | 1.00 | % | | 1.00 | % |

Other Expenses | | 0.54 | % | | 0.40 | %(9) | | 0.36 | %(9) | | 2.24 | % | | 0.49 | %(9) | | 0.47 | %(9) |

| | | | | | | | | | | | | | | | | | |

Total Annual Fund Operating Expenses | | 1.89 | % | | 1.63 | % | | 1.46 | % | | 4.24 | % | | 2.37 | % | | 2.22 | % |

| | | | | | | | | | | | | | | | | | |

Fee Waiver and Expense Reimbursements (Recoupment) | | 0.17 | %(7) | | (0.01 | )%(7) | | (0.01 | )%(7) | | 1.87 | %(7) | | 0.00 | %(7) | | (0.10 | )%(7) |

Net Total Annual Fund Operating Expenses | | 1.72 | %(5)(6) | | 1.64 | %(5)(6) | | 1.47 | %(5)(6) | | 2.37 | %(5)(6) | | 2.37 | %(5)(6) | | 2.32 | %(5)(6) |

| | | | | | | | | | | | | | | | | | |

Footnotes begin on the next page.

10

| | | | | | | | | |

| | | Actual | | | | |

| | | Mid-Cap

Value

Portfolio | | | Small-Cap

Value

Portfolio | | | Pro Forma

Combined

Fund* | |

| | | Class C | | | Class C | | | Class C | |

Shareholder Fees (fees paid directly from a shareholder’s investment): | | | | | | | | | |

Maximum Sales Charge (Load) imposed on purchases (as a percentage of offering price)(1) | | None | | | None | | | None | |

Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of the amount redeemed or original purchase cost)(2) | | 1.00 | % | | 1.00 | % | | 1.00 | % |

Maximum Sales Charge (Load) Imposed on Reinvested Dividends | | None | | | None | | | None | |

Redemption Fee(3) | | None | | | None | | | None | |

Exchange Fee | | None | | | None | | | None | |

Annual Fund Operating Expenses (expenses that are deducted from Fund assets): | | | | | | | | | |

Management Fees | | 1.00 | % | | 0.88 | %(8) | | 0.75 | % |

Distribution and/or Service (12b-1) Fees(4) | | 1.00 | % | | 1.00 | % | | 1.00 | % |

Other Expenses | | 1.00 | % | | 0.42 | %(9) | | 0.41 | %(9) |

| | | | | | | | | |

Total Annual Fund Operating Expenses | | 3.00 | % | | 2.30 | % | | 2.16 | % |

| | | | | | | | | |

Fee Waiver and Expense Reimbursements (Recoupment) | | 0.63 | %(7) | | (0.02 | )%(7) | | (0.02 | )%(7) |

Net Total Annual Fund Operating Expenses | | 2.37 | %(5)(6) | | 2.32 | %(5)(6) | | 2.18 | %(5)(6) |

| | | | | | | | | |

| * | Assumes the Reorganization had taken place on April 30, 2009. |

| (1) | The front-end sales charge on Class A shares decreases with the size of the purchase to 0% for purchases of $1 million or more. |

| (2) | Purchases of Class A shares of $1 million or more will be subject to a contingent deferred sales charge (“CDSC”) on redemptions made within two years of purchase. The CDSC on Class B shares applies only if shares are redeemed within six years of their purchase. The CDSC on Class C shares applies only if shares are redeemed within twelve months of their purchase (for purchases prior to February 20, 2004, the CDSC applies only if shares are redeemed within eighteen months of their purchase). CDSC is calculated as a percentage of amount redeemed or of original purchase cost, whichever is lower. |

| (3) | A $15.00 fee will be imposed on wire and overnight mail redemptions. |

| (4) | Because these fees are paid out of a Fund’s assets on an ongoing basis, over time these fees will increase the cost of an investment and may cost more than paying other types of sales charges. |

| (5) | Through directed brokerage arrangements, a portion of the Mid-Cap Value Portfolio’s, the Small-Cap Value Portfolio’s and the Pro Forma Combined Fund’s expenses have been reduced. “Other Expenses” do not take into account this expense reduction and are therefore higher than the actual expenses of the Funds. Had the expense reductions been taken into account “Net Expenses” for each class would have been 1.68% for Class A shares, 2.33% for Class B shares and 2.33% for Class C shares of the Mid-Cap Value Portfolio, 1.61% for Class A shares, 2.34% for Class B shares and 2.29% for Class C shares of the Small-Cap Value Portfolio and 1.44% for Class A shares, 2.29% for Class B shares and 2.15% for Class C shares of the Pro Forma Combined Fund. |

| (6) | Pursuant to an Expense Limitation Agreement, SAAMCo is contractually obligated to waive its fees and/or reimburse expenses to the extent that the Total Annual Fund Operating Expenses exceed 1.72% for Class A shares, 2.37% for Class B shares and 2.37% for Class C shares of the Mid-Cap Value Portfolio, the Small-Cap Value Portfolio and the Pro Forma Combined Fund. These fee waivers and expense reimbursements will continue indefinitely, subject to the termination by the Board of Directors, including a majority of the Independent Directors. |

| (7) | Any waivers or reimbursements made by SAAMCo with respect to the Fund are subject to recoupment from the Fund within the following two years, provided that the Fund is able to effect such payment to SAAMCo and remain in compliance with the foregoing expense limitations. |

| (8) | The management fee for the Small-Cap Value Portfolio was decreased effective August 22, 2008. |

| (9) | “Other Expenses” for the Fund include “acquired fund fees and expenses” (i.e., fees and expenses incurred indirectly by the Fund as a result of the investments in shares of one or more “acquired funds,” as defined in the registration form applicable to the Fund, which generally include investments in other mutual funds, hedge funds, private equity funds and other pooled investment vehicles). |

11

EXAMPLES:

These examples assume that an investor invests $10,000 in the relevant Fund for the time periods indicated (for the periods ended April 30, 2009), that the investment has a 5% return each year, that the investor pays the sales charges, if any, that apply to the particular class and that the Fund’s operating expenses remain the same. These assumptions are not meant to indicate that the investor will receive a 5% annual rate of return. The annual return may be more or less than the 5% used in these examples. Although actual costs may be higher or lower, based on these assumptions, an investor’s costs would be:

ASSUMING THE INVESTOR REDEEMS HIS OR HER SHARES:

| | | | | | | | | | | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

Class A | | | | | | | | | | | | |

Mid-Cap Value Portfolio | | $ | 740 | | $ | 1,086 | | $ | 1,455 | | $ | 2,488 |

Small-Cap Value Portfolio | | $ | 732 | | $ | 1,063 | | $ | 1,415 | | $ | 2,407 |

Pro Forma Combined Fund* | | $ | 716 | | $ | 1,013 | | $ | 1,332 | | $ | 2,231 |

Class B | | | | | | | | | | | | |

Mid-Cap Value Portfolio ** | | $ | 640 | | $ | 1,039 | | $ | 1,465 | | $ | 2,545 |

Small-Cap Value Portfolio ** | | $ | 640 | | $ | 1,039 | | $ | 1,465 | | $ | 2,525 |

Pro Forma Combined Fund* | | $ | 635 | | $ | 1,024 | | $ | 1,440 | | $ | 2,443 |

Class C | | | | | | | | | | | | |

Mid-Cap Value Portfolio | | $ | 340 | | $ | 739 | | $ | 1,265 | | $ | 2,706 |

Small-Cap Value Portfolio | | $ | 335 | | $ | 724 | | $ | 1,240 | | $ | 2,656 |

Pro Forma Combined Fund* | | $ | 321 | | $ | 682 | | $ | 1,170 | | $ | 2,513 |

ASSUMING THE INVESTOR DOES NOT REDEEM HIS OR HER SHARES:

| | | | | | | | | | | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

Class A | | | | | | | | | | | | |

Mid-Cap Value Portfolio | | $ | 740 | | $ | 1,086 | | $ | 1,455 | | $ | 2,488 |

Small-Cap Value Portfolio | | $ | 732 | | $ | 1,063 | | $ | 1,415 | | $ | 2,407 |

Pro Forma Combined Fund* | | $ | 716 | | $ | 1,013 | | $ | 1,332 | | $ | 2,231 |

Class B | | | | | | | | | | | | |

Mid-Cap Value Portfolio ** | | $ | 240 | | $ | 739 | | $ | 1,265 | | $ | 2,545 |

Small-Cap Value Portfolio ** | | $ | 240 | | $ | 739 | | $ | 1,265 | | $ | 2,525 |

Pro Forma Combined Fund* | | $ | 235 | | $ | 724 | | $ | 1,240 | | $ | 2,443 |

Class C | | | | | | | | | | | | |

Mid-Cap Value Portfolio | | $ | 240 | | $ | 739 | | $ | 1,265 | | $ | 2,706 |

Small-Cap Value Portfolio | | $ | 235 | | $ | 724 | | $ | 1,240 | | $ | 2,656 |

Pro Forma Combined Fund* | | $ | 221 | | $ | 682 | | $ | 1,170 | | $ | 2,513 |

| * | Assumes the Reorganization had taken place on April 30, 2009. |

| ** | Class B shares generally convert to Class A shares approximately eight years after purchase. Therefore, expense information for years 9 and 10 is the same for both Class A and B shares. |

Federal Tax Consequences

The Reorganization is expected to qualify as a tax-free “reorganization” for U.S. federal income tax purposes. If the Reorganization so qualifies, in general, the Mid-Cap Value Portfolio, the Small-Cap Value Portfolio, or their respective shareholders, will not recognize gain or loss for U.S. federal income tax purposes in the transactions contemplated by the Reorganization. As a condition to the closing of the Reorganization, the Corporation, on behalf of each of the Small-Cap Value Portfolio and the Mid-Cap Value Portfolio, will receive an opinion from Willkie Farr & Gallagher LLP to that effect. An opinion of counsel is not binding on the Internal Revenue Service (“IRS”) or any court and thus does not preclude the IRS from asserting, or a court from rendering, a contrary position.

To the extent that the portfolio holdings of the Mid-Cap Value Portfolio are sold by the Mid-Cap Value Portfolio in connection with the Reorganization, the tax impact of such sales will depend on the difference between the price at which such portfolio holdings are sold and the Mid-Cap Value Portfolio’s basis in such holdings. Any gains will be distributed, if required, to the Mid-Cap Value Portfolio’s shareholders as either capital gain dividends (to the extent of long-term capital gains) or ordinary income dividends (to the extent of short-term capital gains) during or with respect to the year of sale, and such distributions will be taxable to shareholders.

12

At any time prior to the consummation of the Reorganization, a shareholder may redeem shares, likely resulting in recognition of a gain or loss to such shareholder for U.S. federal and state income tax purposes. For more information about the U.S. federal income tax consequences of the Reorganization, see “Material U.S. Federal Income Tax Consequences of the Reorganization.”

Purchase, Exchange, Redemption and Valuation of Shares

Procedures for the purchase, exchange, redemption and valuation of shares of the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio are identical.

13

COMPARISON OF THE MID-CAP VALUE PORTFOLIO

AND THE SMALL-CAP VALUE PORTFOLIO

Principal and Other Investment Risks

Because of their identical investment objectives, value oriented philosophies, focused strategies and other similar investment strategies and techniques, the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio are each subject to the same principal and non-principal investment risks associated with an investment in the relevant Fund; however, small-market capitalization risk is a principal risk of the Small-Cap Value Portfolio and a non-principal risk of the Mid-Cap Value Portfolio and mid-capitalization risk is a principal risk of the Mid-Cap Value Portfolio and a non-principal risk of the Small-Cap Value Portfolio. The following discussion describes the principal and certain other risks that may affect the Small-Cap Value Portfolio and, therefore, the Combined Fund. You will find additional descriptions of specific risks in the Mid-Cap Value Portfolio Prospectus and the Small-Cap Value Portfolio Prospectus, a copy of which accompanies this Combined Prospectus/Proxy Statement.

Shares of the Small-Cap Value Portfolio are not bank deposits and are not guaranteed or insured by any bank, government entity or the Federal Deposit Insurance Corporation. As with any mutual fund, there is no guarantee that the Small-Cap Value Portfolio will be able to achieve its investment goals. If the value of the assets of the Small-Cap Value Portfolio go down, you could lose money.

The following are the principal investment risks associated with the Small-Cap Value Portfolio and, therefore, also with the Combined Fund:

Stock Market Volatility. The stock market as a whole could go up or down (sometimes dramatically). This could affect the value of the securities in the Small-Cap Value Portfolio’s portfolio.

Securities selection. A strategy used by the Small-Cap Value Portfolio, or securities selected by its portfolio manager, may fail to produce the intended return.

Non-Diversification. By concentrating in a smaller number of stocks, the Small-Cap Value Portfolio’s risk is increased because the effect of each stock on the Fund’s performance is greater.

Small and Mid-Market Capitalization. Companies with smaller market capitalizations (particularly under $1 billion depending on the market) tend to be at early stages of development with limited product lines, market access for products, financial resources, access to new capital, or depth in management. It may be difficult to obtain reliable information and financial data about these companies. Consequently, the securities of smaller companies may not be as readily marketable and may be subject to more abrupt or erratic market movements. Mid-cap companies are subject to these risks to a lesser extent.

The following are the non-principal investment risks associated with the Small-Cap Value Portfolio and therefore, also with the Combined Fund:

Foreign Exposure. Investments in foreign countries are subject to a number of risks. A principal risk is that fluctuations in the exchange rates between the U.S. dollar and foreign currencies may negatively affect the value of an investment. In addition, there may be less publicly available information about a foreign company and it may not be subject to the same uniform accounting, auditing and financial reporting standards as U.S. companies. Foreign governments may not regulate securities markets and companies to the same degree as the U.S. government. Foreign investments will also be affected by local political or economic developments and governmental actions. Consequently, foreign securities may be less liquid, more volatile and more difficult to price than U.S. securities. These risks are heightened when the issuer is in an emerging market.

Derivatives. Derivatives, including options and futures, are subject to general risks relating to heightened sensitivity to market volatility, interest rate fluctuations, illiquidity and creditworthiness of the counterparty to the derivatives transactions.

14

Hedging. Hedging is a strategy in which SAAMCo uses a derivative in an effort to reduce certain risk characteristics of an underlying security or portfolio of securities. While hedging strategies can be very useful and inexpensive ways of reducing risk, they are sometimes ineffective due to unexpected changes in the market or exchange rates. Moreover, while hedging can reduce or eliminate losses, it can also reduce or eliminate gains.

Fundamental Investment Restrictions

Each of the Funds has identical investment restrictions (and exclusions). If the shareholders of the Mid-Cap Value Portfolio approve the Reorganization, SAAMCo will manage the Combined Fund pursuant to the investment restrictions of the Small-Cap Value Portfolio. The complete list of the fundamental investment restrictions of the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio is set out in Appendix A.

Performance Information

The following bar charts and tables illustrate the past performance of an investment in each Fund. The information shows you how each Fund’s performance has varied year by year and provides some indication of the risks of investing in each Fund. Past performance is not predictive of future performance. For more information concerning the performance of the Mid-Cap Value Portfolio, please refer to the Mid-Cap Value Portfolio Prospectus, the Annual Report to Shareholders of the Mid-Cap Value Portfolio for the fiscal year ended October 31, 2008 (the “Mid-Cap Value Portfolio Annual Report”) and the Semi-Annual Report to Shareholders of the Mid-Cap Value Portfolio for the fiscal period ended April 30, 2009 (the “Mid-Cap Value Portfolio Semi-Annual Report”). For more information concerning the performance of the Small-Cap Value Portfolio, please refer to the Small-Cap Value Portfolio Prospectus, the Small-Cap Value Portfolio Annual Report and the Small-Cap Value Portfolio Semi-Annual Report.

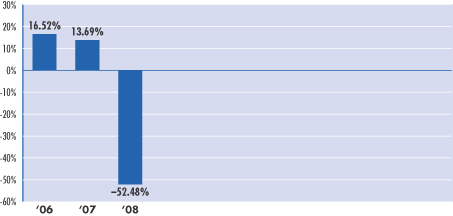

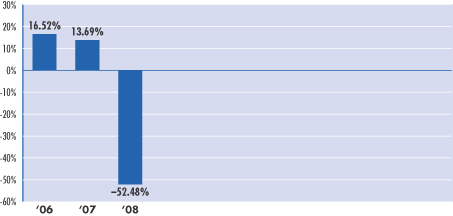

Calendar Year Total Returns, as of 12/31 each year for

Class A Shares of the Mid-Cap Value Portfolio

FOCUSED MID-CAP VALUE PORTFOLIO (CLASS A)

Best Quarter: 9.92% (quarter ended March 31, 2006)

Worst Quarter: –31.59% (quarter ended December 31, 2008)

Year to Date Return as of June 30, 2009: 7.80%

Mid-Cap Value Portfolio

Average Annual Total Return

For The Calendar Year Ended December 31, 2008(1)

| | | | | | |

| | | 1 Year | | | Since

Inception(5) | |

Class A Shares—Return Before Taxes | | -55.22 | % | | -12.77 | % |

Return After Taxes on Distributions | | -55.22 | % | | -13.26 | % |

Return After Taxes on Distributions and Sale of Fund Shares(2) | | -35.89 | % | | -10.34 | % |

Class B Shares—Return Before Taxes | | -54.69 | % | | -12.54 | % |

Class C Shares—Return Before Taxes | | -53.24 | % | | -11.80 | % |

Russell Midcap Value Index (3)(4) | | -38.44 | % | | -8.56 | % |

| (1) | Includes sales charges. |

| (2) | When the return after taxes on distributions and sales of Mid-Cap Value Portfolio shares is higher, it is because of realized losses. If realized losses occur upon the sale of Mid-Cap Value Portfolio shares, the capital loss is recorded as a tax benefit, which increases the return. |

| (3) | The Russell Midcap® Value Index measures the performance of those Russell Midcap Value companies with lower price-to-book ratios and lower forecasted growth value. |

| (4) | You may not invest directly in the Russell Midcap® Value Index, and unlike the Portfolio, categories and benchmark indices do not incur fees and expenses. |

| (5) | Class A, B and C shares commenced offering on August 2, 2005. |

15

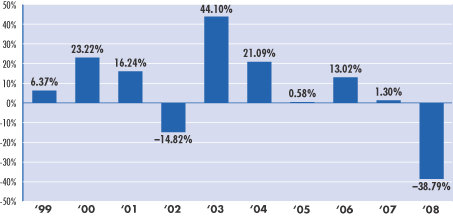

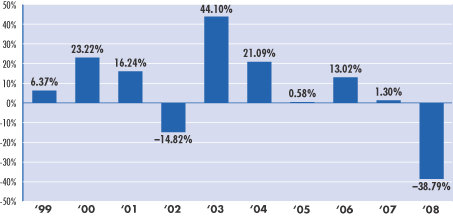

Calendar Year Total Returns, as of 12/31 each year for

Class A Shares of the Small-Cap Value Portfolio

FOCUSED SMALL-CAP VALUE PORTFOLIO (CLASS A)

Best Quarter: 20.51% (quarter ended June 30, 1999)

Worst Quarter: –26.56% (quarter ended December 31, 2008)

Year to Date Return as of June 30, 2009: 9.51%

Small-Cap Value Portfolio

Average Annual Total Return

For The Calendar Year Ended December 31, 2008(1)

| | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Class A Shares—Return Before Taxes | | -42.30 | % | | -4.25 | % | | 4.17 | % |

Return After Taxes on Distributions | | -42.33 | % | | -6.13 | % | | 2.81 | % |

Return After Taxes on Distributions and Sale of Fund Shares(2) | | -27.47 | % | | -3.68 | % | | 3.39 | % |

Class B Shares—Return Before Taxes | | -41.64 | % | | -4.01 | % | | 4.24 | % |

Class C Shares—Return Before Taxes | | -39.81 | % | | -3.77 | % | | 4.12 | % |

Russell 2000 Value Index(3)(4) | | -28.92 | % | | 0.27 | % | | 6.11 | % |

| (1) | Includes sales charges. |

| (2) | When the return after taxes on distributions and sale of Small-Cap Value Portfolio shares is higher, it is because of realized losses. If realized losses occur upon the sale of Small-Cap Value Portfolio shares, the capital loss is recorded as a tax benefit, which increases the return. |

| (3) | The Russell 2000® Value Index measures the performance of those Russell 2000 companies with lower price–to-book ratios and lower forecasted growth values. |

| (4) | You may not invest directly in the Russell 2000® Value Index, and unlike the Portfolio, benchmark indices do not incur fees and expenses. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class A Shares of each of the Mid-Cap Value Portfolio and the Small-Cap Value Portfolio; after-tax returns for other classes of shares will vary.

Because the Combined Fund will most closely resemble the Small-Cap Value Portfolio, the Small-Cap Value Portfolio will be the accounting survivor of the Reorganization. The Combined Fund will also maintain the performance history of the Small-Cap Value Portfolio at the closing of the Reorganization.

Management of the Funds

Mid-Cap Value Portfolio. SAAMCo, located at Harborside Financial Center, 3200 Plaza 5, Jersey City, New Jersey 07311, serves as the investment adviser to the Mid-Cap Value Portfolio. SAAMCo provides various administrative services and supervises the daily business of the Mid-Cap Value Portfolio, and receives a management fee as compensation for its services. SAAMCo is a wholly-owned subsidiary of AIG Retirement Services, Inc., which in turn is a wholly-owned subsidiary of American International Group, Inc. (“AIG”).

Delafield, a division of Reich & Tang, located at 600 Fifth Avenue, New York, New York 10020, serves as the subadviser to the Mid-Cap Value Portfolio. Reich & Tang is a registered investment adviser under the Investment Advisers Act of 1940, as amended. Reich & Tang is an indirect subsidiary of Natixis Global Asset Management, L.P. (formerly IXIS Asset Management US Group, L.P.).

J. Dennis Delafield and Vincent Sellecchia are the portfolio managers the Mid-Cap Value Portfolio and are primarily responsible for the day-to-day management of the Mid-Cap Value Portfolio. Mr. Delafield and Mr. Sellecchia have been the portfolio managers of the Mid-Cap Value Portfolio since August 2005.

Mr. Delafield is the Chief Executive Officer and a Managing Director at Delafield. Mr. Delafield has been in the industry for over 40 years. He merged a member firm of the New York Stock Exchange of which he was a director and shareholder with Sterling, Grace & Co. in New York in 1959. Subsequently, he became a partner in

16

charge of research in investment advisory services for Sterling, Grace. In 1970, he joined David J. Greene & Co. He became a managing partner of David J. Greene, leaving there in 1980, to found Delafield Asset Management Inc. Mr. Delafield is currently a Managing Director of Reich & Tang, Chairman and co-manager of Delafield Fund, Inc. and Chief Executive Officer of Delafield. Mr. Delafield is a graduate of Princeton University and is a Chartered Financial Analyst.