- TRKA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEFR14A Filing

Troika Media (TRKA) DEFR14ARevised proxy

Filed: 21 Nov 22, 9:24pm

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to

Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. 1)

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

| Payment of Filing Fee (Check the appropriate box): | ||

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

NOTICE OF

and

PROXY STATEMENT

| ||

2022 Annual Meeting

Thursday, December 15, 2022

Virtual-only meeting

Webcast registration access at

https://web.lumiagm.com/238744591 | Inside

CEO’s letter to stockholders

Information on three voting proposals: | |

| Election of eight directors | |

| Ratification of appointment of independent auditor for 2022 | |

| Advisory vote on 2022 executive compensation | |

| 25 West 39th Street New York, NY 10018 |

November 21 , 2022

Dear Fellow Stockholder:

It is my pleasure to invite you to attend the Annual Meeting of Stockholders of Troika Media Group, Inc. to be held on Thursday, December 15, 2022, at 10:00 a.m., Eastern time. This year’s Annual Meeting will be conducted virtually via live audio webcast. Each holder of common stock as of 5:00 p.m., Eastern time, on the record date of October 27, 2022, will be able to participate in the Annual Meeting via live webcast through the unique join link and password delivered to them prior to the meeting. Stockholders will also be able to vote their shares and submit questions via the Internet during the meeting by participating in the webcast.

During the Annual Meeting, stockholders will be asked to elect all of the members of the board of directors and to ratify the appointment of RBSM LLP as our independent auditor for the transition period July 1, 2022, to December 31, 2022. We also will be asking stockholders to approve, by an advisory vote, our 2022 executive compensation as disclosed in the Proxy Statement for the Annual Meeting (a “say-on-pay” vote). All of these matters are important, and we urge you to vote in favor of the election of each of the director nominees, the ratification of the appointment of our independent auditor, and the approval of our 2022 executive compensation.

Today we are sending to each of our stockholders the Amended and Restated Proxy Statement for the Annual Meeting, and our amended and restated 2022 Annual Report, as well as instructions on how to vote via proxy over the Internet. The Amended and Restated Proxy Statement has been amended principally to include on the slate of directors two directors who were appointed to the board subsequent to the initial distribution of the Proxy Statement.

It is important that you vote your shares of common stock virtually or by proxy, regardless of the number of shares you own. You will find the instructions for voting on your in the Proxy Statement and on the or proxy card. We appreciate your prompt attention.

The board invites you to participate in the Annual Meeting so that management can listen to your suggestions, answer your questions, and discuss business developments and trends with you. Thank you for your support, and we look forward to joining you at the Annual Meeting.

Sincerely,

Sid Toama

Chief Executive Officer

Notice of 2022 Annual Meeting of Stockholders

To Stockholders of Troika Media Group, Inc.: The board of directors is soliciting proxies for use at the Troika Media Group, Inc. 2022 Annual Meeting of Stockholders. You are receiving the Proxy Statement because you were a holder of common stock as of 5:00 p.m., Eastern time, on the record date of October 27, 2022, and therefore are entitled to vote at the Annual Meeting. The Annual Meeting will be held to vote upon:

In addition, any other business properly presented may be acted upon at the Annual Meeting. Each share of common stock is entitled to one vote for each director position and other proposal. In accordance with Securities and Exchange Commission (“SEC”) rules, we are mailing to stockholders, commencing on or about November 21 , 2022: ● our Proxy Statement; ● our Annual Report on Form 10-K, as amended, for the fiscal year ended June 30, 2022; and ● a proxy card. By Order of the Board of Directors, Michael Tenore Secretary November 21 , 2022 | When Thursday, December 15, 2022 10:00 a.m., Eastern time Where Webcast only Registration access at https://web.lumiagm.com/238744591 | |

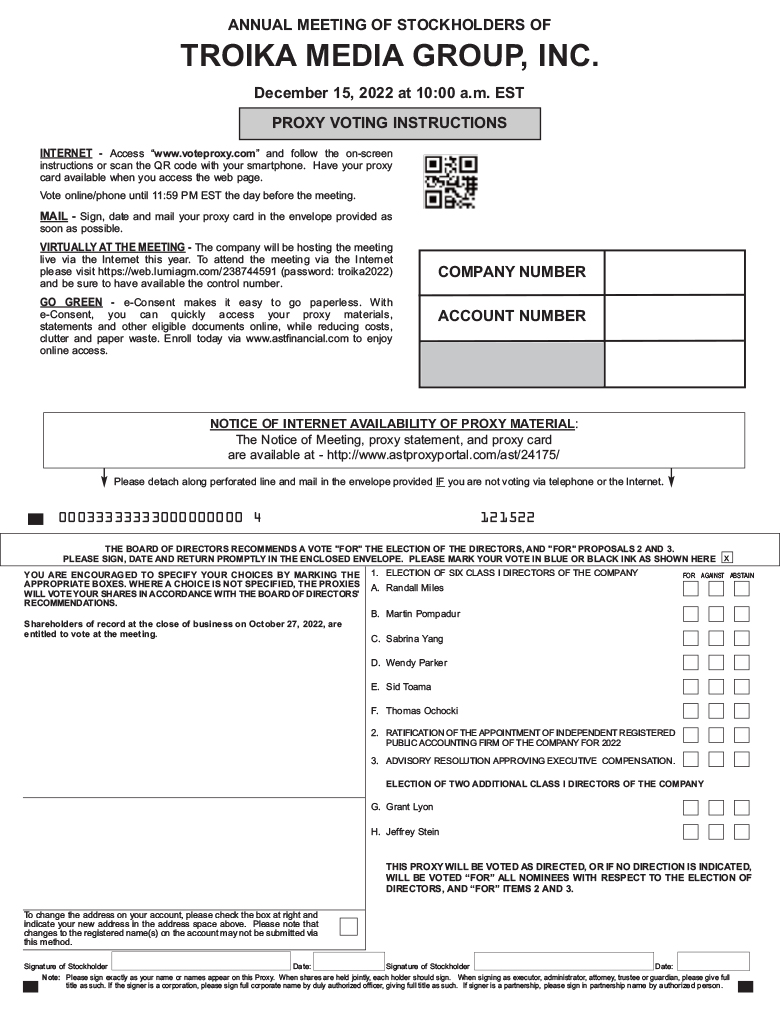

How to Vote in Advance Your vote is important. Please vote as soon as possible by one of the methods shown below. Your proxy card or voting instruction form should be readily available.

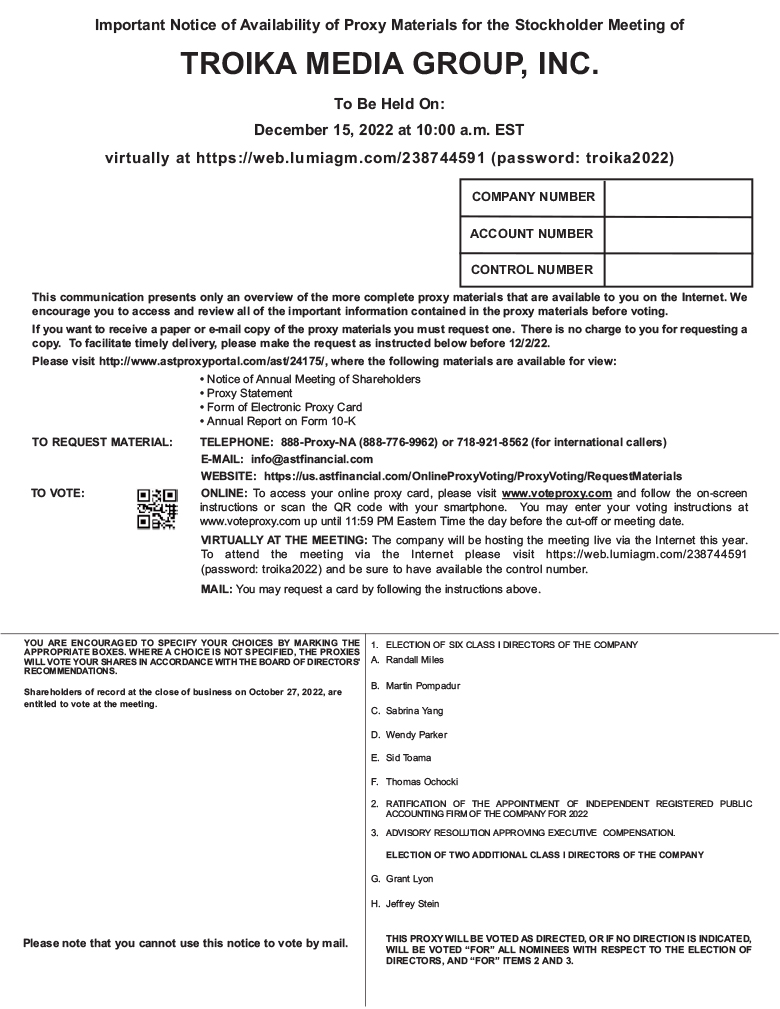

Via Internet (Any Web-Enabled Device) Vote online at: “www.voteproxy.com” and follow the on-screen instructions or scan the QR code with your smartphone. Have your proxy card available when you access the web page.

By Mail (Pursuant to Printed Materials) Vote by mailing a signed, completed proxy card in the postage-paid, pre-addressed envelope.

|

| 25 West 39th Street New York, NY 10018 |

Amended & Restated Proxy Statement dated November 21 , 2022

2022 Annual Meeting of Stockholders

Troika Media Group, Inc., a Nevada corporation, is furnishing this Proxy Statement and related proxy materials in connection with the solicitation by its board of directors of proxies to be voted at its 2022 Annual Meeting of Stockholders and any adjournments. Troika Media Group, Inc. is providing these materials to the holders of record of its common stock, $0.001 or par value per share, as of 5:00 p.m., Eastern time, on the record date of October 27, 2022, and is first making available or mailing the materials on or about November 21 , 2022. All stockholders are strongly encouraged to participate in the Annual Meeting.

The Annual Meeting is scheduled to be held as follows:

| Date | Thursday, December 15, 2022 |

| Time | 10:00 a.m., Eastern time |

| Webcast Registration Address | https://web.lumiagm.com/238744591 |

Your vote is important.

Please see the detailed information that follows in the Proxy Statement.

Explanatory Note

On November 4, 2022, Troika Media Group, Inc. filed with the Securities and Exchange Commission a definitive proxy statement for the 2022 Annual Meeting of Shareholders to be held on December 15, 2022. After the filing, the Board of Directors, upon the recommendation of its Nominating & Corporate Governance Committee appointed Grant Lyon and Jeffrey Stein to fill the vacancies on the board. We are amending and restating the Proxy Statement as those two directors have been added to the slate of directors for election at the Annual Meeting and to include information regarding the new directors. The proxy card being mailed to shareholders includes the new nominees for director. The Board recommends that stockholders vote FOR all eight nominees.

Contents

Page

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. References in this Proxy Statement to “TMG,” and to “we,” “us,” “our” and similar terms, refer to Troika Media Group, Inc.

Annual Meeting of Stockholders

| Time and Date | 10:00 a.m., Eastern time, on December 15, 2022 |

| Meeting Webcast Registration Address | https://web.lumiagm.com/238744591 |

| Record Date | 5:00 p.m., Eastern time, on October 27, 2022 |

| Voting | Stockholders will be entitled to one vote for each outstanding share of common stock they hold of record as of the record date. |

| Total Votes Per Proposal | 1 for 1 votes, based on 67,031,116 shares of common stock outstanding as of the record date. |

| Online Voting Deadline | 11:59 p.m., Eastern time, on December 14, 2022 |

| Meeting Access | Stockholders that have registered by the registration deadline will be able to access the Annual Meeting by following the unique join link and entering the password that was delivered to them. |

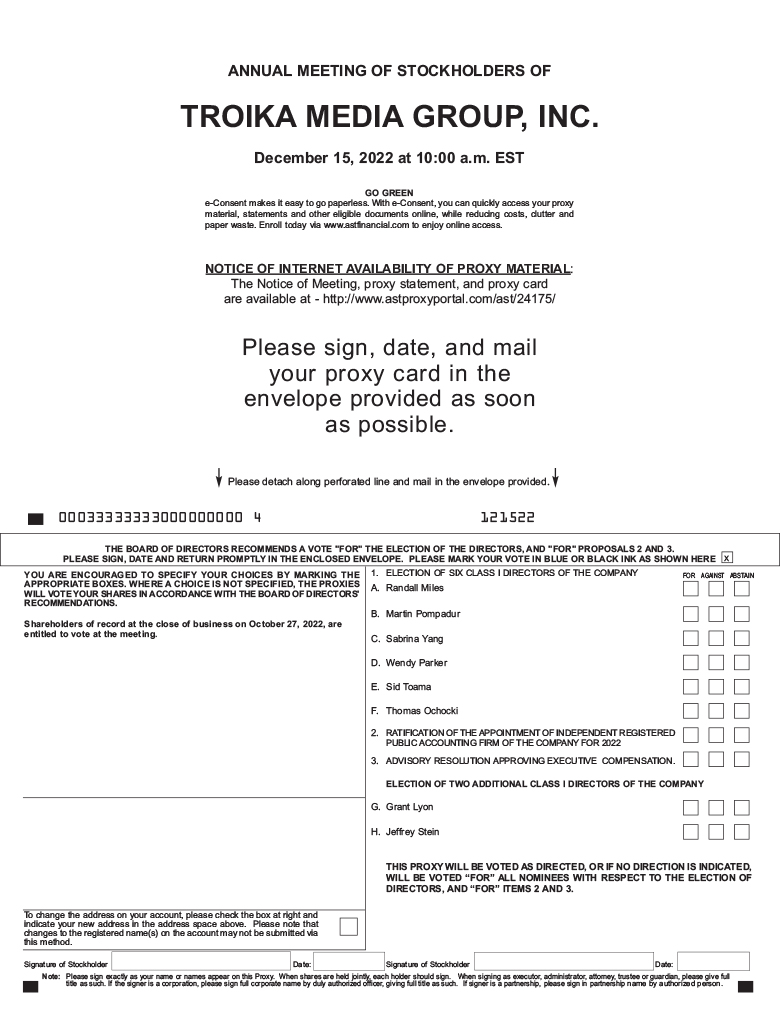

Annual Meeting Agenda

| Proposal | Board Recommendation | |

| Election of directors | FOR each nominee | |

| Ratification of appointment of independent auditor | FOR | |

| Advisory vote on 2022 executive compensation | FOR | |

How to Cast Your Vote

You can vote by any of the following methods:

| Until 11:59 p.m., Eastern time, on December 14, 2022 | At the Annual Meeting on December 15, 2022 | ||||

| ● Internet: | From any web-enabled device at “www.voteproxy.com” and follow the on-screen instructions or scan the QR code with your smartphone. Have your proxy card available when you access the web page.

| ● | Internet: Join the meeting at https://web.lumiagm.com/238744591 using the unique code provided to you on the Proxy Card. | ||

| ● Mail: | Return the completed and signed proxy card in a postage-paid return envelope that is provided with the proxy card. | ||||

| Election of Directors |

We are asking stockholders to elect the following eight director nominees, six of whom currently serve as members of the board of directors.

Director Since | Experience/ | Independent | Committee | ||||

| Name | Age | Occupation | Qualifications | Yes | No | Memberships | |

Randall Miles (Chair of the Board) | 66 | 2022 | Chairman & CEO of SCM Capital Group | ● Leadership

● Governance

● Business

● International

● Fund Raising

● Fiduciary Literacy

| ✓ | Compensation

Nominating and Governance

Audit Special | |

| Thomas Ochocki | 46 | 2018 | Chief Executive Officer and majority stockholder of Union Investment Management Ltd. | ● Business

● Finance

● Industry

| ✓ | None | |

Wendy Parker | 57 | 2022 | London, England based barrister and has been a member of Gatehouse Chambers’ Commercial, Property and Insurance Groups in London | ● Restructuring

● Business

● International

● Legal

| ✓ | Compensation | |

| Martin Pompadur | 87 | 2021 | Private Investor and Consultant | ● Industry

● Business

● Finance

● International

| ✓ | Audit

Compensation

Nominating and Governance | |

| Sadiq (Sid) Toama | 40 | 2022 | Chief Executive Officer of Troika Media Group, Inc. | ● Leadership

● Industry

● Business

● International

● Legal | ✓ | None | |

| Sabrina Yang | 43 | 2022 | Chief Financial Officer of Final Bell Holdings, Inc. | ● Business

● Finance

● Industry

| ✓ | Audit | |

| Grant Lyon | 59 | N/A | Co-founder and managing partner of Arete Capital Partners, LLC | ● Leadership

● Governance

● Business

● Fiduciary Literacy | ✓ | Special Committee | |

| Jeffrey S. Stein | 53 | N/A | Founder and Managing Partner of Stein Advisors LLC | ● Leadership

● Governance

● Business

● International

● Finance

● Risk Management

| ✓ | Special committee | |

Board Representation

| Independence: | 75% Independent Board |

| Diversity: | Two Women in the Boardroom |

Board Diversity Matrix

| Total Number of Current Directors | 8 | |||

| Gender Identity | Female | Male | Non-Binary | Did Not Disclose |

| Directors | 2 | 6 | 0 | 0 |

| Demographic Background | ||||

| Asian | 1 | 0 | 0 | 0 |

| White | 1 | 5 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 1 | 0 | 0 |

Director Skills Matrix

| Randall Miles | Thomas Ochocki | Wendy Parker | Martin Pompadur | Sadiq Toama | Sabrina Yang | Grant Lyon | Jeffrey S. Stein | |

| Senior leadership experience (CEO, President, CFO, etc.) | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Business development / M&A experience | ✓ | ✓ | ✓ | ✓ | ||||

| Financial literacy | ✓ | ✓ | ✓ | ✓ | ||||

| Board experience (not TMG) | ✓ | ✓ | ✓ | ✓ | ✓ | |||

| Diversity (Ethno-racial, sex, gender, age, etc.) | ✓ | ✓ | ✓ | |||||

| Independence | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Industry experience | ✓ | |||||||

| Global business experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Manufacturing experience | ✓ | |||||||

| Marketing / branding experience | ✓ | ✓ | ||||||

| Regulatory experience | ✓ | ✓ | ||||||

| Fundraising experience | ✓ | ✓ | ✓ | |||||

| Legal | ✓ | ✓ | ✓ | |||||

| Education, training, certification | ✓ | ✓ | ✓ |

Board Governance Practices

| Elections: | Classified Board | No |

| Frequency of Director Elections | Annual | |

| Voting Standard | Plurality | |

| Mandatory Retirement Age or Tenure | No | |

| Chair: | Separate Chair of the Board and CEO | Yes |

| Independent Chair of the Board | Yes | |

| Meetings: | Number of Board Meetings in FY 2022 | 4 |

| Directors Attending at Least 85% of Board Meetings in 2022 | All | |

| Independent Directors Meet without Management Present | Yes | |

| Number of Standing Committee Meetings Held in 2022 | 4 | |

| Director Status: | Directors “Overboarded” per ISS or Glass Lewis Voting Guidelines | None |

| Material Related-Party Transactions with Directors | None | |

| Family Relationships with Executive Officers or Other Directors | None | |

| Shares Pledged by Directors | None |

| Ratification of Appointment of Independent Auditor |

We are asking stockholders to ratify the audit committee’s retention of RBSM LLP, an independent registered public accounting firm, as our independent auditor to examine and report on our consolidated financial statements for the transition period from July 1, 2022, to December 31, 2022.

| Advisory Vote on 2022 Executive Compensation |

In accordance with rules of the Securities and Exchange Commission (“SEC”), we are asking stockholders for an advisory vote — known as a “say-on-pay” vote — of the 2022 compensation of our “named executive officers” as set forth in the compensation tables, related narrative discussion and other disclosures under “Executive Compensation” in this Proxy Statement. The following table summarizes information concerning the compensation paid to our named executive officers for the fiscal year 2022 and 2021:

SUMMARY COMPENSATION TABLE

Name and Principal Position | Year | Salary | *Bonus | Stock Awards ( 5 ) | Option Awards ( 6 ) | All Other Comp | Total | |||||||||

| Sadiq (Sid) Toama, | 2022 | $ | 115,000 | $ | — | $ | 2,625,000 | $ | — | $ | 13,000 | $ | 2,753,000 | |||

| President and CEO (1) | 2021 | N/A | N/A | N/A | N/A | N/A | N/A | |||||||||

| Robert Machinist, | 2022 | $ | 362,000 | $ | — | $ | 2,025,000 | $ | — | $ | 82,000 | $ | 2,469,000 | |||

| CEO & Chairman (2) | 2021 | $ | 270,000 | $ | 100,000 | $ | — | $ | 1,559,000 | $ | — | $ | 1,929,000 | |||

| Erica Naidrich, | 2022 | $ | 44,000 | $ | 100,000 | $ | 190,000 | $ | — | $ | 4,000 | $ | 338,000 | |||

| Chief Financial Officer (3) | 2021 | N/A | N/A | N/A | N/A | N/A | $ | — | ||||||||

| Chris Broderick, | 2022 | $ | 348,000 | $ | 62,500 | $ | 800,000 | $ | — | $ | 220,000 | $ | 1,430,500 | |||

| COO & CFO (4) | 2021 | $ | 350,000 | $ | 137,500 | $ | — | $ | — | $ | — | $ | 487,500 | |||

| (1) | Mr. Toama was elected President of the Company in March 2022 and was appointed Chief Executive Officer in May 2022. Mr. Toama was also granted 2,500,000 Restricted Stock Units “RSUs” on March 22, 2022. |

| (2) | Mr. Machinist was elected Chief Executive Officer in March 2018 and Chairman of the Board in July 2017. On January 1, 2021, he was awarded 500,000 warrants exercisable at $0.75 per share for six (6) years in fiscal 2020 and 2021, which had been forfeited by a former director. In 2022, Mr. Machinist was awarded 2,000,000 RSUs which have been converted. Mr. Machinist resigned as CEO from the Company on May 19, 2022, and stepped down as Chairman of the Board in July 2022. All Other Compensation includes approximately $63,000 in severance payments and an auto allowance of $12,000. Mr. Machinist also received a payment in fiscal year 2021 in an amount of approximately $159,000 consisting of salary that was earned and deferred by Mr. Machinist in periods prior to fiscal year 2021. |

| (3) | Ms. Naidrich was elected Chief Financial Officer of the Company in May 2022. Ms. Naidrich was also granted 200,000 RSUs on May 27, 2022. |

| (4) | Mr. Broderick served as Chief Operating Officer of the Company since July 2017. Mr. Broderick was appointed CFO of the Company in April 2021 and stepped down in May 2022 upon the appointment of Erica Naidrich. Mr. Broderick resigned as COO from the Company in June 2022. All Other Compensation includes an auto allowance of $12,000 and severance payments totaling $200,000. Mr. Broderick also received a payment in fiscal year 2021 in an amount of approximately $199,000 consisting of salary that was earned and deferred by Mr. Bressman in periods prior to fiscal year 2021. |

| ( 5 ) | The amounts in this column represent the aggregate grant-date fair value of awards granted to each named executive officer, computed in accordance with the Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. See Note 14. Stockholders Equity of the Notes to the Financial Statements included in the Annual Report on Form 10-K for the fiscal year ended June 30, 2022, for a discussion of the assumptions made in determining the grant-date fair value of the Company’s equity awards. |

| ( 6 ) | The amounts in this column represent the aggregate grant-date fair value of awards granted to each named executive officer, computed in accordance with the Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. See Note 14. Stockholders Equity of the Notes to the Financial Statements included in the Annual Report on Form 10-K for the fiscal year ended June 30, 2022, for a discussion of the assumptions made in determining the grant-date fair value of the Company’s equity awards. |

Participation in the Virtual Annual Meeting

The board of directors considers the appropriate format of our annual meetings of stockholders on an annual basis. This year the board chose a virtual meeting format for the Annual Meeting in an effort to facilitate stockholder attendance and participation by enabling stockholders to participate fully, and equally, from any location around the world, at no cost. The virtual meeting format will allow stockholders to engage with us at the Annual Meeting from any geographic location, using any convenient internet connected devices, including smart phones and tablets as well as laptop and desktop computers. We will be able to engage with all stockholders as opposed to just those who can afford to travel to an in-person meeting. The virtual format allows stockholders to submit questions and comments during the Annual Meeting.

Participation in the Annual Meeting, including listening, voting shares and submitting questions, will be limited to registered stockholders and proxyholders. To ensure they can participate, stockholders and proxyholders should visit https://web.lumiagm.com/238744591 and register to attend the Annual Meeting after 9:00 A.M. on the date of the meeting. Stockholders should be sure to follow the instructions on their proxy cards. Stockholders and proxyholders who intend to vote at the meeting will need to enter the virtual control number included on their proxy card. Stockholders who hold their shares in street name and who wish to participate in the Annual Meeting must provide, at registration, their legal proxy obtained from the broker, bank or other organization that holds their shares. Instructions on how to connect and participate via the Internet are posted at https://web.lumiagm.com/238744591 .

Stockholders who have registered at https://web.lumiagm.com/238744591 will be able to participate in the Annual Meeting via live webcast. We will answer any timely submitted questions on a matter to be voted on at the Annual Meeting before voting is closed on the matter. Following adjournment of the formal business of the Annual Meeting, we will address appropriate general questions from stockholders regarding our company in the order in which the questions are received. Questions relating to stockholder proposals or our company may be submitted in the field provided in the web portal at or before the time the questions are to be discussed. All questions received during the Annual Meeting will be presented as submitted, uncensored and unedited, except that we may omit certain personal details for data protection issues and we may edit profanity or other inappropriate language. If we receive substantially similar questions, we will group those questions together and provide a single response to avoid repetition. Additional information regarding the submission of questions during the Annual Meeting can be found in our 2022 Annual Meeting of Stockholders Rules of Conduct and Procedures, a copy of which is attached hereto as Appendix A. Any material changes or updates to the 2022 Rules of Conduct and Procedures will be posted on our website and disclosed in a Current Report on Form 8-K filed with the SEC.

Online check-in to the Annual Meeting webcast will begin at 9:00 a.m., Eastern time, on December 15, 2022, and you should allow ample time to log in to the meeting webcast and test your computer audio system.

We have designed our virtual format to enhance, rather than constrain, stockholder access, participation, and communication. For example, stockholders will be able to communicate with us during the Annual Meeting so they can ask questions. An audio replay of the Annual Meeting will be made publicly available at https://www.troikamedia.com/investor-relations until our 2023 annual meeting of stockholders. This audio replay will include each stockholder question addressed during the Annual Meeting. We are utilizing technology from American Stock Transfer & Trust Company, LLC (“AST”). The AST platform is expected to accommodate most, if not all, stockholders. Both we and AST will test the platform technology before going “live” for the Annual Meeting.

Questions and Answers About the Annual Meeting

| Q: | When and where will the Annual Meeting be held? | |

| A: | This year the Annual Meeting of Stockholders of Troika Media Group, Inc., will be held exclusively by webcast beginning at 10:00 a.m., Eastern time, on Thursday, December 15, 2022. In order to attend the Annual Meeting, please visit https://web.lumiagm.com/238744591 after 9:00 a.m., on December 15, 2022. Please be sure to follow the instructions on your proxy card. | |

| Q: | Who may join the Annual Meeting? | |

| A: | Participation in the Annual Meeting, including voting shares and submitting questions, will be limited to stockholders and proxyholders. To ensure they can participate, stockholders and proxyholders should visit https://web.lumiagm.com/238744591 after 9:00 a.m. on December 15, 2022. Please be sure to follow the instructions on your proxy card. Stockholders and proxyholders that intend to vote at the meeting will need to enter the virtual control number included on their proxy card. | |

| Online check-in to the Annual Meeting webcast will begin at 9:00 a.m., Eastern time, on December 15, 2022. We encourage you to allow ample time to log in to the meeting webcast and test your computer audio system. | ||

| Q: | How do I register and attend the Annual Meeting? | |

| A: | Participants can log in to attend the Annual Meeting virtually by visiting ttps://web.lumiagm.com/238744591 after 9:00 a.m. on December 15, 2022. You will need to enter your 11 digit Control Number as it appears on your proxy card, along with the password on the proxy card. | |

| If you wish to vote your shares electronically at the Annual Meeting, you will need your virtual control number included on your proxy card. | ||

| Q: | What materials have been prepared for stockholders in connection with the Annual Meeting? | |

| A: | We are furnishing you and other stockholders of record with the following proxy materials: | |

| ● | our Annual Report on Form 10-K , as amended, for the fiscal year ended June 30, 2022 (including our audited consolidated financial statements for 2022 and 2021), which we refer to as the 2022 Annual Report; and | |

| ● | This Amended and Restated Proxy Statement for the 2022 Annual Meeting, which we refer to as this Proxy Statement and which also includes a letter from our Chief Executive Officer to stockholders and a Notice of 2022 Annual Meeting of Stockholders . | |

| These materials were first made available on the Internet, on or about November 21 , 2022 and first mailed to stockholders on or about November 25 , 2022. | ||

| Q: | Are the proxy materials available via the Internet? |

| A: | You can access and review the proxy materials for the Annual Meeting at http://www.astproxyportal.com/ast/24175/. In order to submit your proxies, however, you will need to refer to the proxy card mailed to you to obtain your control number and other personal information needed to vote by proxy or in person. |

| Q: | What is a proxy? |

| A: | The term “proxy,” when used with respect to stockholder, refers to either a person or persons legally authorized to act on the stockholder’s behalf or a format that allows the stockholder to vote without being physically present at the Annual Meeting. Because it is important that as many stockholders as possible be represented at the Annual Meeting, the board of directors is asking that you review this Proxy Statement carefully and then vote by following the instructions set forth on the Notice of Internet Availability or the proxy card. In voting prior to the Annual Meeting, you will deliver your proxy to the Proxy Committee, which means you will authorize the Proxy Committee to vote your shares at the Annual Meeting in the way you instruct. The Proxy Committee consists of Catherine Akers and Brad Berman. All shares represented by valid proxies will be voted in accordance with the stockholder’s specific instructions. |

| Q: | What matters will the stockholders vote on at the Annual Meeting? |

| A: | Proposal |  | Election of the following eight director nominees: | |||||||

| ● | Randall Miles | ● | Thomas Ochocki | ● | Wendy Parker | ● | Grant Lyon | |||

| ● | Martin Pompadur | ● | Sadiq Toama | ● | Sabrina Yang | ● | Jeffrey S. Stein | |||

| Proposal |  | Ratification of the appointment of our independent auditor | ||||||||

| Proposal |  | Approval, as an advisory vote, of 2022 executive compensation disclosed in this Proxy Statement | ||||||||

| Q: | Who can vote at the Annual Meeting? |

| A: | Stockholders of record of common stock at 5:00 p.m., Eastern time, on October 27, 2022, the record date, who have registered at https://web.lumiagm.com/238744591 will be entitled to vote at the Annual Meeting. As of the record date, there were outstanding a total of 67,031,116 shares of common stock, each of which will be entitled to one vote on each proposal. As a result, up to a total of 67,031,116 votes can be cast on each proposal. |

| Q: | What is a stockholder of record? |

| A: | A stockholder of record is a stockholder whose ownership of common stock is reflected directly on the books and records of our transfer agent, American Stock Transfer & Trust Company, LLC (“AST”). |

| Q: | What does it mean for a broker or other nominee to hold shares in “street name”? |

| A: | If you beneficially own shares held in an account with a broker, bank, or similar organization, that organization is the stockholder of record and is considered to hold those shares in “street name.” An organization that holds your beneficially owned shares in street name will vote in accordance with the instructions you provide. If you do not provide the organization with specific voting instructions with respect to a proposal, the organization’s authority to vote your shares will, under the rules of The Nasdaq Stock Market or Nasdaq, depend upon whether the proposal is considered a “routine” or a non-routine matter. |

| ● | The organization generally may vote your beneficially owned shares on routine items for which you have not provided voting instructions to the organization. The only routine matter expected to be voted on at the Annual Meeting is the ratification of the appointment of our independent auditor for the transition period July 1, 2022, to December 31, 2022 (Proposal 2). | |

| ● | The organization generally may not vote on non-routine matters, including Proposals 1 and 3. Instead, it will inform the inspector of election that it does not have the authority to vote on those matters. This is referred to as a “broker non-vote.” | |

| For the purpose of determining a quorum, we will treat as present at the Annual Meeting any proxies that are voted on any of the three (3) proposals to be acted upon by the stockholders, including abstentions or proxies containing broker non-votes. | ||

| Q: | How do I vote my shares if I do not attend the Annual Meeting? |

| A: | If you are a stockholder of record, you may vote prior to the Annual Meeting as follows: |

| ● | Via the Internet: You may vote via the Internet by going to www.voteproxy.com in accordance with the voting instructions on the Notice of Internet Availability and the proxy card. Internet voting is available 24 hours a day until 11:59 p.m., Eastern time, on December 14, 2022. You will be given the opportunity to confirm that your instructions have been recorded properly. | |

| ● | By Mail: You may vote by returning the completed and signed proxy card in a postage-paid return envelope that is provided with the proxy card. |

| If you hold shares in street name, you may vote by following the voting instructions provided by your bank, broker, or other nominee. In general, you may vote prior to the Annual Meeting as follows: |

| ● | Via the Internet: You may vote via the Internet by going to www.proxyvote.com in accordance with the voting instructions on the proxy card. Internet voting is available 24 hours a day until 11:59 p.m., Eastern time, on December 14, 2022. You will be given the opportunity to confirm that your instructions have been recorded properly. |

| For your information, voting via the Internet is the least expensive for us with voting by mail being the most expensive. |

| Q: | Can I vote at the Annual Meeting? |

| A: | If you are a stockholder of record who registered at https://web.lumiagm.com/238744591 by December 15, 2022, you may vote in person at the Annual Meeting, whether or not you previously voted. If your shares are held in street name, you must provide a legal proxy from your bank or broker during registration and you will be assigned a virtual control number in order to vote your shares during the Annual Meeting. If you are unable to obtain a legal proxy to vote your shares, you will still be able to attend the Annual Meeting (but will not be able to vote your shares) so long as you demonstrate proof of stock ownership. Instructions on how to connect and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at http://www.astproxyportal.com/ast/24175/. On the day of the Annual Meeting, you may only vote during the meeting using the web portal during the meeting. |

| In order to attend the Annual Meeting, you must register at https://web.lumiagm.com/238744591 on the day of the meeting. In order to vote at the Annual Meeting, be sure to have your digit control number included on their proxy card. |

| Q: | Can I ask questions at the Annual Meeting? |

| A: | You may submit questions via the Internet during the Annual Meeting by participating in the webcast via the unique join link and password delivered to you after registration. We will answer any timely submitted questions on a matter to be voted on at the Annual Meeting before voting is closed on the matter in accordance with Appendix A. Following adjournment of the formal business of the Annual Meeting, we will address appropriate general questions from stockholders regarding our company in the order in which the questions are received. Questions relating to stockholder proposals or our company may be submitted in the field provided in the web portal at or before the time the questions are to be discussed. All questions received during the Annual Meeting will be presented as submitted, uncensored and unedited, except that we may omit certain personal details for data protection issues and we may edit profanity or other inappropriate language. If we receive substantially similar questions, we will group those questions together and provide a single response to avoid repetition. Additional information regarding the submission of questions during the Annual Meeting can be found in our 2022 Rules of Conduct and Procedure, a copy of which is attached hereto as Appendix A. |

| Q: | Why is the Annual Meeting being conducted as a virtual meeting? |

| A: | The board of directors considers the appropriate format of our annual meeting of stockholders on an annual basis. This year the board chose a virtual meeting format for the Annual Meeting in an effort to facilitate safe stockholder attendance and participation, by enabling stockholders to participate fully, and equally, from any location around the world, at no cost. The virtual meeting format will allow our stockholders to engage with us at the Annual Meeting from any geographic location, using any convenient internet-connected devices, including smart phones and tablet, laptop or desktop computers. The virtual meeting format will also allow stockholders to maintain their own personal safety in light of the continuing public health risks attributable to the COVID-19 (Coronavirus) pandemic. |

| The virtual format allows stockholders to submit questions during the meeting. We are utilizing technology from American Stock Transfer & Trust Company, LLC (“AST”). The AST platform is expected to accommodate most, if not all, stockholders. Both we and AST will test the platform technology before going “live” for the Annual. |

| Q: | If I am unable to participate in the live audio webcast of the Annual Meeting, may I listen at a later date? |

| A: | An audio replay of the Annual Meeting will be posted and publicly available at https://www.troikamedia.com/investor-relations following the Annual Meeting and will remain publicly available until our annual meeting of stockholders in 2023. This audio replay will cover the entire Annual Meeting, including each stockholder question addressed during the Annual Meeting. |

| Q: | May I change my vote or revoke my proxy? |

| A: | If you are a stockholder of record and previously delivered a proxy, you may subsequently change or revoke your proxy at any time before it is exercised by: |

| ● | voting via the Internet or telephone at a later time; | |

| ● | submitting a completed and signed proxy card with a later date; or | |

| ● | voting at the Annual Meeting. |

| If you are a beneficial owner of shares held in street name, you should contact your bank, broker, or other nominee for instructions as to whether, and how, you can change or revoke your proxy. |

| Q: | What happens if I do not give specific voting instructions? |

| A: | If you are a stockholder of record and you return a proxy card without giving specific voting instructions, the Proxy Committee will vote your shares in the manner recommended by the board of directors on all three proposals presented in this Proxy Statement and as the Proxy Committee may determine in its discretion on any other matters properly presented for a vote at the Annual Meeting. |

| If you are a beneficial owner of shares held in street name and do not provide specific voting instructions to the broker, bank or other organization that is the stockholder of record of your shares, the organization generally may vote on routine, but not non-routine, matters. The only routine matter expected to be voted on at the Annual Meeting is the ratification of the appointment of our independent auditor for the transition period July 1, 2022, to December 31, 2022 (Proposal 2). If the organization does not receive instructions from you on how to vote your shares on one or more of Proposals 1 and 3, your shares will be subject to a broker non-vote and no vote will be cast on those matters. See “Q. What does it mean for a broker or other nominee to hold shares in ‘street name’?” above. |

| Q: | What should I do if, during check-in or the meeting, I have technical difficulties or trouble accessing the virtual meeting website? |

| A: | Online check-in to the Annual Meeting webcast will begin at 9:00 a.m., Eastern time, on December 15, 2022. You should allow ample time to log in to the meeting webcast and test your computer audio system. Technical questions may also be addressed on the message board hosted by AST. |

| Q: | What if other matters are presented at the Annual Meeting? |

| A: | If a stockholder of record provides a proxy by voting in any manner described in this Proxy Statement, the Proxy Committee will have the discretion to vote on any matters, other than the three proposals presented in this Proxy Statement, that are properly presented for consideration at the Annual Meeting. We do not know of any other matters to be presented for consideration at the Annual Meeting. |

Vote Required for Election or Approval

Our only voting securities are the outstanding shares of common stock. As of the record date, which is 5:00 p.m., Eastern time, on October 27, 2022, there were outstanding 67,031,116 shares of common stock, each of which will be entitled to one vote on each proposal. Based on the number of votes for each share common stock, up to a total of 67,031,116 votes can be cast on each proposal.

Only stockholders of record as of the record date will be entitled to notice of, and to vote at, the Annual Meeting. A majority of the issued and outstanding shares of common stock entitled to vote, represented either in person or by proxy, constitutes a quorum at the Annual Meeting. For the purpose of determining a quorum, we will treat as present at the Annual Meeting any proxies that are voted on any matter to be acted upon by the stockholders, as well as votes to “withhold,” abstentions, or any proxies containing broker non-votes.

| Election of Directors |

| The affirmative vote of a plurality of votes cast by shares entitled to vote and present in person or represented by proxy at the Annual Meeting at which a quorum is present is required to elect each director. Broker non-votes will not have any effect on the outcome of the election of directors, since broker non-votes are not counted as “votes cast.” | |

| Ratification of Appointment of Independent Auditor |

| The ratification of RBSM LLP as our independent auditor for the transition period July 1, 2022 to December 31, 2022, must be approved by affirmative votes constituting a majority of the votes entitled to be voted and present in person or represented by proxy at the Annual Meeting. Abstentions will count as votes against this proposal because shares with respect to which the stockholder abstains will be deemed present and entitled to vote. Because this proposal is considered a routine matter, discretionary votes by brokers will be counted. | |

| Approval of 2022 Executive Compensation on an Advisory Basis |

| The advisory “say-on-pay” vote to approve our 2022 executive compensation must be approved by affirmative votes constituting a majority of the votes entitled to be voted and present in person or represented by proxy at the Annual Meeting. Abstentions will count as votes against this proposal because shares with respect to which the stockholder abstains will be deemed present and entitled to vote. Broker non-votes will have no effect on the outcome of this proposal, because they are not entitled to be cast on the matter. |

| Proposal |  | — Election of Directors |

At the Annual Meeting, stockholders will elect the entire board of directors to serve for the ensuing year and until their successors are elected and qualified. The board has designated as nominees for election the eight persons named below, each of whom currently serves as a director.

Shares of common stock that are voted as recommended by the board will be voted in favor of the election as directors of the nominees named below. If any nominee becomes unavailable for any reason or if a vacancy should occur before the election, which we do not anticipate, the shares represented by a duly completed proxy may be voted in favor of such other person as may be determined by the Proxy Committee.

The board of directors has determined that, as a whole, it must have the right mix of characteristics, skills, and experience to provide effective oversight of our company. The board considers recommendations for board nominees from the nominating and governance committee. Directors should have relevant expertise and experience and be able to offer advice and guidance to our Chief Executive Officer based on that expertise and experience. Each director should be able to read and understand basic financial statements, should have sufficient time to devote to our affairs, should have demonstrated excellence in his or her field, should have the ability to exercise sound business judgment, and should have the commitment to rigorously represent the long-term interests of our stockholders. In selecting directors, the nominating and corporate governance committee seeks to achieve a mix of directors that enhances the diversity of background, age, skills, and experience on the board to maintain a balance of knowledge, experience, and capability. A majority of directors should be independent under applicable Nasdaq listing standards, board and committee guidelines, and applicable laws and regulations.

The board also generally expects directors to have:

| ● | a high standard of personal and professional ethics, integrity, and values; |

| ● | the training, experience, and ability to make and oversee policy in business, government, and education sectors; |

| ● | the willingness and ability to keep an open mind when considering matters affecting our interests and the interests of our constituents; |

| ● | the willingness and ability to devote the required time and effort to effectively fulfill the duties and responsibilities related to board and committee membership; |

| ● | the willingness and ability to serve on the board for multiple terms, if nominated and elected, to enable development of a deeper understanding of our business affairs; |

| ● | the willingness not to engage in activities or interests that may create a conflict of interest with the director’s responsibilities and duties to us and our constituents; and |

| ● | the willingness to act in the best interests of our company and our constituents, and objectively assess board, committee, and management performance. |

The board seeks to maintain a membership comprised of directors who can productively contribute to our success. From time to time, the board may change the criteria for directorship to maximize the opportunity to achieve this success. When this occurs, existing directors will be evaluated according to the new criteria. A director who no longer meets the complete criteria for board membership may be asked to adjust his or her committee assignments or resign from the board.

The board does not believe that a fixed retirement age for directors or a limit on the number of director terms is appropriate. Directors who have served on the board for an extended period of time are able to provide continuity and valuable insight into our company, our operations, and our prospects based on their experience with, and understanding of, our history, policies and objectives. The board believes that, as an alternative to fixed term limits, it can ensure that the board continues to evolve and adopt new ideas and viewpoints through the director nomination process described above.

Identifying and Evaluating Nominees for Directors

When the board of directors or its nominating and governance committee identifies a need to add a new director with specific qualifications or to fill a vacancy on the board, the chair of the nominating and corporate governance committee will initiate a search, seeking input from other directors and senior management, review any candidates that the nominating and governance committee has previously identified, and, if necessary, hire a search firm. The nominating and governance committee then will identify the initial list of candidates who satisfy the specific criteria and otherwise qualify for membership on the board. Based on a satisfactory outcome of those interviews, the nominating and governance committee will make its recommendation on the candidate to the board.

Information Concerning Nominees for Election as Directors

The information appearing in the following table sets forth, for each nominee for election as a director:

| ● | the nominee’s professional experience for at least the past five (5) years; |

| ● | the year in which the nominee first became one of our directors; |

| ● | each standing committee of the board of directors on which the nominee currently serves; |

| ● | the nominee’s age as of the record date for the Annual Meeting; |

| ● | the relevant skills the nominee possesses that qualify him or her for nomination to the board; and |

| ● | directorships held by each nominee presently and at any time during the past five (5) years at any public company or registered investment company. |

| Randall Miles | ||

INDEPENDENT | TMG Board Service: ● Tenure: Since July 2022 ● Chair of the Board ● Committees: ○ Audit ○ Nominating and Governance ○ Compensation ○ Special Age: 66 | |

| Professional Experience | |

Mr. Miles serves as Chairman & CEO of SCM Capital Group, a global transaction and strategic advisory firm. In addition, Mr. Miles sits on the boards of eXp World Holdings, Inc. (NASDAQ:EXPI) as Vice Chairman, private equity-backed Arthur H Thomas Companies as Vice Chairman, and Kuity, Inc. as Chairman.

For over thirty (30) years, Mr. Miles has held senior executive leadership positions in global financial services, financial technology, and investment banking companies, including at bulge bracket, regional, and boutique firms. His extensive investment experience advising companies on strategic and financial needs has spanned many disciplines while serving as CEO, Executive Committee Chair, Head of FIG, Head of M&A, and other responsibilities across these industries. Mr. Miles’ transactional and advisory experience is complemented by leadership of public and private equity backed financial technology, specialty finance, and software companies: Chairman and CEO at LIONMTS, where he was nominated for the Ernst & Young Entrepreneur of the Year award, CEO at Syngence Corporation, COO of AtlasBanc Holdings Corp., and CEO of Advantage Funding / NAFCO Holdings. | |

| Education | |

| ● | BBA from the University of Washington and FINRA licenses Series 7, 24, 63, and 79. |

| Relevant Skills | |

| ● | Leadership |

| ● | Governance |

| ● | Business |

| ● | Fiduciary Literacy |

| ● | Fund Raising |

| ● | International |

| Thomas Ochocki | ||

| TMG Board Service: ● Tenure: Since 2018 ● Committees: ○ None

Age: 46 | |

| Professional Experience | |

| Mr. Ochocki is serving on the Board of Directors representing the Coates families’ equity interest and has over twenty (20) years of experience in stock brokering, private equity, and investment banking in the United Kingdom. He is currently Chief Executive Officer and majority stockholder of Union Investment Management Ltd., whose history dates back to The Union Discount Company of London (est. 1885). An Old Cholmeleian of Highgate School, Mr. Ochocki read Psychology & Computer Science at Liverpool University prior to working with Sony Interactive Entertainment on the PlayStation launch titles. He went on to manage and facilitate the development of over 50 published video games before switching to his predominant career in the capital markets. | |

| Education | |

| ● | Studied Psychology and Computer Science at Liverpool University. Studied at London SCT and Westminster University and obtained computer programming certification in C / C++ on Unix. |

| Relevant Skills | |

| ● | Business |

| ● | Finance |

| ● | Industry |

| Wendy Parker | ||

INDEPENDENT | TMG Board Service: ● Tenure: Since April 2022 ● Committees: ○ Compensation

Age: 57 | |

| Professional Experience | |

Ms. Parker is a London, England based barrister and has been a member of Gatehouse Chambers’ Commercial, Property and Insurance Groups in London where she undertakes most areas of work within those fields. She has developed a strong practice both as an adviser and advocate and has experience of appearing in the specialist commercial and property forums as well as Tribunals and the Court of Appeal.

Ms. Parker has been involved in many technically complex cases. She has a strong academic background which she combines with a practical and common sense approach in order to assist clients in achieving their objectives. Ms. Parker is a member of the United Kingdom Chancery Bar Association and the COMBAR (the Specialist Bar Association for Commercial Barristers advising the international business community). | |

| Relevant Skills | |

| ● | Restructuring |

| ● | Business |

| ● | International |

| ● | Legal |

| Martin Pompadur | ||

INDEPENDENT | TMG Board Service: ● Tenure: Since April 2021 ● Committees: ○ Audit ○ Nominating and Governance ○ Compensation

Age: 87 | |

| Professional Experience | |

Mr. Pompadur was elected to the Board of Directors in April 2021 upon the listing on the Nasdaq Capital Market. Mr. Pompadur is a private investor, senior advisor, consultant, and Board member. Mr. Pompadur entered the media field when in 1960, he joined American Broadcasting Companies, Inc. (“ABC, Inc.”). He remained at ABC, Inc. for 17 years, culminating with his becoming the youngest person ever appointed to the ABC, Inc. Board of Directors.

Mr. Pompadur is a board member of two additional public companies: Nexstar Broadcasting Group and Truli Media Group. Previously, he was a board member of many public and private companies including Imax Corporation, ABC, Inc., BSkyB, Sky Italia, Premier World, Fox Kids Europe, Metromedia International, and Elong. | |

| Education | |

| ● | BA from Williams College and LLB from the University of Michigan Law School |

| Relevant Skills | |

| ● | Business |

| ● | Finance |

● ● | Industry International |

| Sadiq (“Sid”) Toama | ||

CEO | TMG Board Service ● Tenure: Since March 2022 ● Committees: ○ None

Age: 40 | |

| Professional Experience | |

Sadiq (“Sid”) Toama was elected President of Troika Media Group, Inc. and joined the Company’s Board of Directors on March 21, 2022. Subsequently, Mr. Toama was elected Chief Executive Officer of the Company in May 2022. Mr. Toama joined Converge in 2016. He started his career as a commercial attorney in London, representing distressed brands through product liability and crisis management events.

Mr. Toama became Maclaren’s Global Chief Executive Officer in 2011, instigating its global corporate and operational restructuring. Mr. Toama expanded Maclaren’s Brand standing, in part, by implementing multi-year licensing and product development partnerships with brands such as BMW, Gucci, Liberty, Juicy Couture, Cath Kidston, and Emirates Airlines.

Beginning in 2016, Mr. Toama was the Chief Operating Officer of Converge. Since 2016, Mr. Toama spearheaded all ad-tech and mar-tech systems integrations and reporting for clients and internal teams to ensure on time delivery of data across all sales and marketing platforms. In particular, Mr. Toama has architected and implemented Converge’s proprietary business intelligence platform, Helix, to leverage disparate and unstructured and varied data points into actionable insights. | |

| Education | |

| ● | LLB (Law) with Honors from the University of London |

| Relevant Skills | |

| ● | Business |

| ● | Industry |

| ● | Leadership |

| ● | Legal |

| Sabrina Yang | ||

| TMG Board Service ● Tenure: Since April 2022 ● Committees: ○ Audit

Age: 43 | |

| INDEPENDENT | ||

| Professional Experience | |

Ms. Yang is a seasoned finance executive with over 17 years of experience in accounting, financial planning, and analysis (“FP&A”), M&A advisory, and corporate finance. Since 2021, Ms. Yang has served as CFO of Final Bell Holdings, Inc. (“Final Bell”), an industry leader in providing end-to-end product development and supply chain solutions to leading cannabis brands in the United States and Canada. During her tenure at Final Bell, she has led the reverse take-over transaction process, establishing a path for Final Bell to become a publicly traded company on the Canadian Stock Exchange. In conjunction with the reverse takeover, she also integrated and managed all of Final Bell’s administrative functions, including accounting, finance, legal, HR, and IT operations.

Prior to joining Final Bell and since 2018, Ms. Yang has served as CFO, on a part-time basis, of Apollo Program, a data-driven advertising technology company, where she ran all administrative and operating functions. She also served as deputy CFO for a private school with operations in both the United States and China. She has held prior roles in strategy, analytics, and FP&A at the Topps Company, a collectibles and licensing company, and at Undertone, a digital advertising company. Sabrina started her career with five (5) years at KPMG LLP in its transaction services team, in which she advised. | |

| Education | |

| ● | Louisiana State University, MS Accounting and Applied Statistics. |

| ● | Northeastern University of China BA English and International Business. |

| Relevant Skills | |

| ● | Business |

| ● | Finance |

| ● | Industry |

| Grant Lyon | ||

INDEPENDENT | TMG Board Service ● Tenure: Since November 2022 ● Committees: ○ Special

Age: 59 | |

| Professional Experience | |

| Mr. Lyon has over thirty (30) years of experience in corporate restructuring, expert testimony and corporate governance. Mr. Lyon has served as Co-founder and managing partner of Arete Capital Partners, LLC, a special situation advisory firm, since July 2020. He previously served as founder and managing director of Atera Capital, LLC, a Fiduciary and Financial Advisory Firm, from June 2017 to June 2020. Mr. Lyon also served as managing director of KRyS Global USA, a restructuring advisory and distressed investment consulting firm, from 2014 to June, 2017. Mr. Lyon has served as the financial advisor to the Government of the Commonwealth of the Bahamas. Mr. Lyon has served numerous times as a Chapter 11 Trustee, state-court receiver, chief executive officer, chief financial officer and chief restructuring officer. Mr. Lyon has testified many times in numerous jurisdictions, including bankruptcy court, federal district court and state court. | |

| Education | |

| ● | Mr. Lyon has a Masters of Business Administration degree and a Bachelor of Science degree in Accounting from Brigham Young University. |

| Relevant Skills | |

| ● | Leadership |

| ● | Finance |

| ● | Governance |

| ● | International |

| Jeffrey S. Stein | ||

INDEPENDENT

| TMG Board Service ● Tenure: Since November 2022 ● Committees: ○ Special

Age: 53

| |

Professional Experience |

| Mr. Stein is an accomplished corporate executive and director who provides the perspective of a successful investment professional with over 30 years of experience in both the debt and equity asset classes. Mr. Stein is Founder and Managing Partner of Stein Advisors LLC, a financial advisory firm that provides consulting services to public and private companies and institutional investors. Previously, Mr. Stein was a Co-Founder and Principal of Durham Asset Management LLC, a global event driven distressed debt and special situations equity asset management firm. From January 2003 through December 2009, Mr. Stein served as Co-Director of Research at Durham responsible for the identification, evaluation, and management of investments for the various Durham portfolios. Mr. Stein was a member of the Executive and Investment Committees at Durham responsible for oversight of the management company and investment funds, development and execution of the investment strategy, portfolio composition and risk management. Mr. Stein is a Certified Turnaround Professional (CTP) as designated by the Turnaround Management Association (TMA). |

| Education | |

| ● | Mr. Stein received an M.B.A. with Honors in Finance and Accounting from New York University and a B.A. in Economics from Brandeis University. |

| Relevant Skills | |

| ● | Leadership |

| ● | Governance |

| ● | Finance |

| ● | Risk Management |

| ● | Finance |

● ● | Restructuring Risk Management |

The board of directors recommends a vote

FOR

each of the eight nominees for election as directors.

| Proposal |  | — Ratification of Appointment of Independent Auditor |

The audit committee annually evaluates the performance of our independent auditor and determines whether to reengage the then-current independent auditor or to consider other audit firms.

This year the audit committee has again approved the retention of RBSM LLP, or RBSM, as our independent auditor to report on our consolidated financial statements for the transition period from July 1, 2022, to December 31, 2022. RBSM has served as our independent auditor since 2014. Factors considered by the audit committee in deciding to engage RBSM included:

| ● | RBSM’s technical expertise and knowledge of our company’s industry; |

| ● | RBSM’s objectivity and professional skepticism; |

| ● | the appropriateness of RBSM’s fees; and |

| ● | RBSM’s independence and the appropriateness of controls and processes in place that help ensure RBSM’s continued independence. |

The audit committee considers RBSM to be well qualified. Even if the proposal is approved, the audit committee may, in its discretion, appoint a different independent registered public accounting firm to serve as independent auditor at any time during the year.

Representatives of RBSM will participate in the Annual Meeting. The RBSM representatives will have the opportunity to make a statement if they desire to do so, and we expect that they will be available to respond to appropriate questions.

The board of directors recommends a vote

FOR

the ratification of the appointment of RBSM as our independent auditor.

| Proposal |  | — Advisory Vote on 2022 Executive Compensation |

Our stockholders have the opportunity at the Annual Meeting to vote to approve, on a non-binding, advisory basis, the compensation of our named executive officers in 2022 as disclosed in this Proxy Statement.

Our compensation program is intended to provide appropriate and balanced incentives toward achieving our annual and long-term strategic objectives and to create an alignment of interests between our executives and stockholders. This approach is intended to motivate our existing executives and to attract new executives with the skills and attributes that we need. Please refer to “Executive Compensation” for an overview of the compensation of our named executive officers.

We are asking for stockholder approval of the compensation of our named executive officers as disclosed in this Proxy Statement in accordance with SEC rules. Those disclosures include the information in the compensation tables and narrative disclosures included under “Executive Compensation.” This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the policies and practices described in this Proxy Statement.

Accordingly, stockholders are being asked to vote on the following resolution:

| Resolved: | That the stockholders approve the compensation paid to the “named executive officers” of Troika Media Group, Inc. with respect to the fiscal year ended June 30, 2022, as disclosed, pursuant to Item 402 of Regulation S-K promulgated by the Securities and Exchange Commission, in the Proxy Statement for the 2022 Annual Meeting of Stockholders, including the compensation tables and narrative discussion set forth under “Executive Compensation” therein. |

This vote is advisory and not binding on us, the board of directors or the compensation committee. The board and the compensation committee value the opinions of our stockholders; however, and to the extent there is any significant vote against the named executive officer compensation disclosed in this Proxy Statement, we will consider our stockholders concerns and the compensation committee will evaluate whether any actions are necessary or appropriate to address those concerns.

The board of directors recommends a vote

FOR

the approval of the compensation paid to our named executive officers with respect to 2022, as disclosed in the compensation tables and narrative discussion set forth under “Executive Compensation” and elsewhere in this Proxy Statement.

Board of Directors Overview

Under our Bylaws and the Nevada Business Corporation Act, our business and affairs are managed by or under the direction of the board of directors, which selectively delegates responsibilities to its standing committees.

The board currently operates under its current governance practices in accordance with applicable statutory and regulatory requirements, including those of the SEC and The Nasdaq Stock Market, or Nasdaq. Under such practices, we expect directors to regularly attend meetings of the board and of all committees on which they serve and to review the materials sent to them in advance of those meetings. While we do not maintain a formal policy on annual meeting attendance, we expect directors to participate in the Annual Meeting.

The board generally expects to hold four (4) regular meetings per year and to meet on other occasions when circumstances require. Directors spend additional time preparing for board and committee meetings, and we call upon directors for advice between meetings. We encourage our directors to attend director education programs.

The board held four (4) regular meetings in 2022, not including committee meetings, several of which included an executive session with only non-employee directors in attendance. Each of the then-serving directors participated in at least 85% of the meetings of the board during 2022.

The board maintains an audit committee, a compensation committee, and a nominating and corporate governance committee. The board has adopted charters for each of the committees, and those charters are reviewed annually by the committees and the board. Our governance documents listed below are all available online at https://www.troikamedia.com/investor-relations:

| ● | the audit committee charter |

| ● | the compensation committee charter |

| ● | the nominating and corporate governance committee charter |

In November 2022, the Board also formed a Special Committee.

The functions and responsibilities of the committees are described below.

Independence of Directors

The board of directors must consist of a majority of independent directors under the applicable requirements of the Nasdaq.

Under Nasdaq rules, independent directors must comprise a majority of a listed company’s board of directors. In addition, Nasdaq rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees be independent. Under Nasdaq rules, an individual will qualify as an “independent director” only if, in the opinion of the company’s board of directors, he or she does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

| ● | Audit committee members must also satisfy additional independence criteria, including those set forth in Rule 10A-3 under the Securities Exchange Act of 1934 or the Securities Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries, other than compensation for board or committee service, and may not be an affiliated person of the listed company or any of its subsidiaries. |

| ● | Compensation committee members must also satisfy additional independence criteria, including those set forth in Rule 10C-1 under the Securities Exchange Act. In determining independence requirements for members of compensation committees, Nasdaq and other national securities exchanges and national securities associations are to consider relevant factors that include (a) the source of compensation of a director, including any consulting, advisory or other compensatory fee paid by the listed company to the director, and (b) whether the director is affiliated with the listed company, a subsidiary of the listed company or an affiliate of a subsidiary of the listed company. |

The board annually reviews the independence of all non-employee directors. The board has determined that Grant Lyon , Randall Miles, Wendy Parker, Martin Pompadur, Jeffrey S. Stein and Sabrina Yang each qualifies as an independent director in accordance with the rules of Nasdaq and Rules 10C-1 and 10A-3 under the Securities Exchange Act. The independent members of the board hold separate, regularly scheduled executive sessions during board meetings at which only independent directors are present.

Corporate Code of Conduct

Our board of directors has adopted a Corporate Code of Conduct applicable to all of our officers and employees. We have posted the Corporate Code of Conduct on our website at https://www.troikamedia.com/s/Corporate-Code-of-Conduct-06162017.pdf. We will post any amendments to the Corporate Code of Conduct on our website. In accordance with the requirements of the SEC and Nasdaq, we will also post waivers applicable to any of our officers or directors from provisions of the Code of Business Conduct and Ethics on our website. We have not granted any such waivers to date.

We have implemented whistleblower procedures, which establish formal protocols for receiving and handling complaints from employees. We have posted copies of our whistleblower procedures on our website at https://static1.squarespace.com/static/5f692a99c24215543de3d40a/t/62953464e63d46218c2339fc/1653945444279/Whistleblower+Policy+06162017.pdf. Any concerns regarding accounting or auditing matters reported under these procedures are to be communicated to the audit committee.

Director, Officer, and Employee Hedging

Pursuant to our insider trading policy as most recently updated by the board of directors in June 2017, none of our directors, officers, or other employees (or specified entities or controlled entities), or Covered Persons, may hedge or pledge any of our securities that they hold directly. An exception to this prohibition may be granted where a Covered Person wishes to pledge our securities as collateral for a loan (not including margin debt) and clearly demonstrates the financial capacity to repay the loan without resort to the pledged securities.

Board Oversight of Risk

The board of directors has responsibility for the oversight of our risk management processes and, either as a whole or through its committees, regularly discusses with management our major risk exposures, their potential impact on our business, and the steps we take to manage them. The risk oversight process includes receiving regular reports from board committees and members of senior management to enable the board to understand our risk identification, risk management and risk mitigation strategies with respect to areas of potential material risk, including operations, finance, legal, regulatory, strategic, and reputational risk.

The audit committee reviews information regarding liquidity and operations and oversees our management of financial risks. Periodically, the audit committee reviews our policies with respect to risk assessment, risk management, loss prevention, and regulatory compliance. Oversight by the audit committee includes the Chief Financial Officer reporting directly to the audit committee at least quarterly to provide an update on management’s efforts to manage risk.

Matters of significant strategic risk, including cybersecurity risks and risks to the company and our employees due to the COVID-19 (Coronavirus) pandemic, are considered by the board as a whole.

Board Diversity

The board of directors is committed to a policy of inclusiveness. We endeavor to have a diverse board representing a range of experiences in areas that are relevant to TMG’s business and the needs of the board from time to time. The board believes that maintaining a diverse membership with varying backgrounds, skills, expertise, and other differentiating personal characteristics promotes the success of our business and represents stockholder interests through the exercise of sound judgment using the board’s diversity of experience and perspectives. In performing its responsibilities for identifying, screening, and recommending candidates to the board in connection each director search, the nominating and governance committee is committed to including in the initial candidate pool one or more highly qualified candidates who reflect diverse backgrounds, skills, and experiences, including individuals with diversity of gender identity, sexual orientation, race, ethnicity and national origin, and diversity of viewpoints, education, and professional experience (including individuals from non-executive corporate positions and non-traditional environments).

Board Leadership Structure

The board of directors recognizes that it is important to determine an optimal board leadership structure to ensure the independent oversight of management as we continue to grow. The Corporate Governance Guidelines provide that the board will select the Chair of the Board and the Chief Executive Officer in the manner it determines to be in the best interests of our stockholders and that it is our policy that those two positions not be held by the same person. In adopting that policy, the board has determined that separating the positions of Chair of the Board and Chief Executive Officer is the best structure to fit our current needs. This structure allows the Chief Executive Officer to focus on the strategic management of our day-to-day business, while allowing the Chair of the Board to focus on leading the board in its fundamental role of providing advice to, and independently overseeing, management. The board recognizes the time, effort, and energy that the Chief Executive Officer is required to devote to the position in the current business environment, as well as the commitment required to serve as the Chair of the Board, particularly as the board’s oversight responsibilities continue to grow. The board believes that having separate positions, with an independent, non-executive director serving as the Chair of the Board, is the appropriate leadership structure for our company and allows the board to fulfil its role with appropriate independence.

Audit Committee

The principal responsibilities of the audit committee are:

| ● | appoint, compensate, and oversee the work of any registered public accounting firm employed by us; |

| ● | resolve any disagreements between management and the auditor regarding financial reporting; |

| ● | pre-approve all auditing and non-audit services; |

| ● | retain independent counsel, accountants, or others to advise the audit committee or assist in the conduct of an investigation; |

| ● | seek any information it requires from employees-all of whom are directed to cooperate with the audit committee’s requests-or external parties; |

| ● | meet with our officers, external auditors, or outside counsel, as necessary; and |

| ● | oversee that management has established and maintained processes to assure our compliance with all applicable laws, regulations, and corporate policy. |

Our independent auditor is ultimately accountable to the audit committee. The audit committee has the ultimate authority and responsibility to select, evaluate, approve terms of retention and compensation of, and, where appropriate, replace the independent auditor.

The current members of the audit committee are Randall Miles, Martin Pompadur, and Sabrina Yang, with Mr. Miles serving as chair. Each of the current members of the audit committee is standing for re-election at the Annual Meeting. The board determined that each of the current audit committee members is (a) independent, as defined in the listing standards of Nasdaq, (b) a “non-employee director,” as defined in Rule 16b-3 under the Securities Exchange Act, (c) an “outside director,” as defined in Section 162(m) of the Internal Revenue Code of 1986, or the Code, and (d) financially literate. The board also determined that each of Martin Pompadur and Randall Miles is an audit committee financial expert in accordance with the standards of the SEC. The audit committee met once in 2022. The meeting was attended by all members.

Compensation Committee

The principal responsibilities of the compensation committee are to assist the board of directors in fulfilling its responsibilities relating to:

| ● | discharge the responsibilities of the Board of Directors relating to compensation of our directors, executive officers, and key employees; |

| ● | assist the Board of Directors in establishing appropriate incentive compensation and equity-based plans and to administer such plans; and |

| ● | oversee the annual process of evaluation of the performance of our management; and |

| ● | perform such other duties and responsibilities as enumerated in and consistent with compensation committee’s charter. |

The current members of the compensation committee are Martin Pompadur and Randall Miles, with Mr. Pompadur serving as chair. Each of the current members of the compensation committee is standing for re-election at the Annual Meeting. The board determined that each of the current compensation committee members is (a) independent, as defined in the listing standards of Nasdaq, (b) a “non-employee director,” as defined in Rule 16b-3 under the Securities Exchange Act and (c) an “outside director,” as that term is defined in Section 162(m) of the Code.

The compensation committee has the sole authority to retain, oversee, and terminate any compensation consultant to be used to assist in the evaluation of executive compensation and to approve the consultant’s fees and retention terms.

The compensation committee held one (1) meeting in 2022. Each of the then-serving members participated in all of the meetings of the compensation committee during 2022.

Compensation Committee Interlocks and Insider Participation

During 2022, none of the members of the compensation committee was an officer or employee of our company or any of our subsidiaries, and none of our executive officers served as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on the board or compensation committee.

Nominating and Governance Committee

The principal responsibilities of the nominating and governance committee are:

| ● | assist the Board of Directors by identifying qualified candidates for director nominees, and to recommend to the Board of Directors the director nominees for the next annual meeting of stockholders; |

| ● | lead the Board of Directors in its annual review of its performance; |

| ● | recommend to the Board of Directors nominees for each committee of the Board of Directors; and |

| ● | develop and recommend to the Board of Directors corporate governance guidelines applicable to us. |