QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant /x/

|

| Filed by a Party other than the Registrant / / |

Check the appropriate box: |

| / / | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| /x/ | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material Pursuant to §240.14a-12

|

GUITAR CENTER, INC. |

(Name of Registrant as Specified in Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| /x/ | | No fee required |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| / / | | Fee paid previously with preliminary materials. |

| / / | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

| | GUITAR CENTER, INC.

5795 Lindero Canyon Road

Westlake Village, California 91362 | |  |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 3, 2002

TO THE STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of Guitar Center, Inc. will be held at the Hyatt Westlake Plaza, 880 South Westlake Boulevard, Westlake Village, California 91361, on Friday, May 3, 2002, at 9:00 a.m. Pacific time, for the following purposes:

- •

- to elect a board of eight directors for the ensuing year or until the election and qualification of their respective successors; and

- •

- to transact any other business which is properly brought before the meeting or any adjournment or postponement thereof.

Please refer to the attached proxy statement, which forms a part of this Notice and is incorporated herein by reference, for further information with respect to the business to be transacted at the annual meeting.

Stockholders of record at the close of business on March 28, 2002 are entitled to notice of, and to vote at, the annual meeting or any adjournment or postponement thereof. The list of stockholders will be available for examination for ten days prior to the annual meeting at Guitar Center, Inc., 5795 Lindero Canyon Road, Westlake Village, California 91362. All stockholders are cordially invited to attend the annual meeting.

By Order of the Board of Directors

Bruce L. Ross

Executive Vice President, Chief Financial

Officer and Secretary

Westlake Village, California

April 2, 2002

GUITAR CENTER, INC.

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

May 3, 2002

INTRODUCTION

General

This proxy statement is furnished to our stockholders in connection with the solicitation of proxies for use at our annual meeting of stockholders to be held on May 3, 2002 at 9:00 a.m. Pacific time, for the purposes of:

- •

- electing a board of eight directors for the ensuing year or until the election and qualification of their respective successors; and

- •

- transacting any other business which is properly brought before the meeting or any adjournment or postponement thereof.

A copy of our Annual Report to Stockholders for the year ended December 31, 2001 and this proxy statement and accompanying proxy card will be first mailed to stockholders on or about April 2, 2002.

This solicitation is made on behalf of our Board of Directors and we will pay the costs of solicitation. Our directors, officers and employees may also solicit proxies by telephone, e-mail, fax or personal interview. We will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy material to our stockholders. We have retained Mellon Investors Services to assist in the solicitation of proxies with respect to shares of our common stock held of record by brokers, nominees and institutions for a customary fee.

Our principal executive offices are located at 5795 Lindero Canyon Road, Westlake Village, California 91362, telephone (818) 735-8800.

Shares Entitled to Vote and Required Vote

Our outstanding common stock constitutes the only class of securities entitled to vote at the meeting. Stockholders of record of the common stock at the close of business on March 28, 2002 are entitled to notice of, and to vote at, the meeting. On that date, 22,342,896 shares of our common stock were issued and outstanding.

The presence at the meeting, in person or by proxy, of a majority of the shares of the common stock issued and outstanding on March 28, 2002 will constitute a quorum. Abstentions and broker non-votes (proxies submitted by brokers that do not indicate a vote for a proposal because they do not have discretionary voting authority and have not received instructions as to how to vote on a proposal) are counted as present in determining whether the quorum requirement is satisfied.

There are no statutory or contractual rights of appraisal or similar remedies available to those stockholders who dissent from any matter to be acted on at the meeting. Cumulative voting is not available and each share of common stock is entitled to one vote.

Voting Procedures

A proxy card is enclosed for your use. We ask that you sign, date and return the proxy card in the accompanying envelope, which is postage prepaid if you mail it in the United States, or use the

Internet or telephone voting procedures as instructed on the proxy card. You may also vote in person at the meeting, or submit a signed proxy card at the meeting. All votes cast at the meeting will be tabulated by the persons appointed by us to act as inspectors of election for the meeting.

You have a choice regarding the matter to be voted upon at the meeting. Concerning the election of the directors, by checking the appropriate box on your proxy card you may:

- •

- vote for the director nominees; or

- •

- withhold authority to vote for some or all of the director nominees.

The candidates for director receiving the highest number of votes, up to the number of directors to be elected, shall be elected to the Board of Directors. Unless there are different instructions on the proxy, all shares represented by valid proxies (and not revoked before they are voted) will be voted at the meetingFOR the election of the director nominees listed in Proposal No. 1.

With respect to any other business which may properly come before the meeting and be submitted to a vote of stockholders, proxies will be voted in accordance with the best judgment of the designated proxy holders. With the exception of the election of directors and in certain other specific circumstances, Delaware law requires the affirmative vote of a majority of shares present in person or represented by proxy at a meeting at which a quorum is present for approval of proposals presented to stockholders. Broker non-votes will be treated as not present and not entitled to vote with respect to such proposals. Shares which are voted to abstain on such proposals will have the same effect as votes against the proposal since they are not affirmative votes for it.

Your vote is important. Accordingly, please sign and return the accompanying proxy card whether or not you plan to attend the meeting in person.

You may revoke your proxy at any time before it is actually voted at the meeting by:

- •

- delivering written notice of revocation to our Secretary at 5795 Lindero Canyon Road, Westlake Village, California 91362, or in person at the meeting;

- •

- submitting a later dated proxy; or

- •

- attending the meeting and voting in person.

Your attendance at the meeting will not, by itself, constitute revocation of your proxy. You may also be represented by another person present at the meeting by executing a form of proxy designating that person to act on your behalf. Shares may only be voted by or on behalf of the record holder of shares as indicated in our stock transfer records. If you are a beneficial stockholder but your shares are held of record by another person, such as a stock brokerage firm or bank, that person must vote the shares as the record holder.

2

PROPOSAL NO. 1:

ELECTION OF NOMINEES TO BOARD OF DIRECTORS

General Information

Directors are elected at each annual meeting and hold office until their resignation or removal and until their successors are duly elected and qualified at the next annual meeting. Our Amended and Restated Bylaws provide that our Board of Directors shall consist of nine directors. Currently, we have eight incumbent directors and one vacancy. As of the date of this proxy statement, we have no intention to fill this vacancy and, accordingly, only eight persons are nominated for election. Proxies cannot be voted for more than eight persons.

Each nominee for director has indicated his willingness to serve if elected. Proxies received by us will be voted for the nominees. Although we do not anticipate that any nominee will be unavailable for election, if a nominee is unavailable for election, we will vote the proxies for any substitute nominee we may designate.

Each nominee for election to the Board of Directors currently serves as one of our directors and has continually served as a director since the date he initially became a director of our company, or its predecessor, which is set forth below. In 2001, our Board of Directors met five times and each director attended at least 75% of those meetings. The following table sets forth information as of March 28, 2002 with respect to the eight persons nominated for election at the meeting.

Nominees for Director

| | Age

| | Position

| | Director

Since

|

|---|

| Larry Thomas | | 52 | | Chairman of the Board and Co-Chief Executive Officer | | 1984 |

| Marty Albertson | | 48 | | President, Co-Chief Executive Officer and Director | | 1996 |

| Robert Eastman | | 43 | | Director and Chief Executive Officer of Musician's Friend, Inc. | | 2001 |

| David Ferguson(1) | | 46 | | Director | | 1996 |

| Harvey Kibel(2) | | 64 | | Director | | 1997 |

| Larry Livingston | | 59 | | Director | | 2002 |

| Peter Starrett(1)(2) | | 54 | | Director | | 1997 |

| Jeffrey Walker(2) | | 46 | | Director | | 1996 |

- (1)

- member of compensation committee

- (2)

- member of audit committee

The principal occupations and positions for at least the past five years of the director nominees named above are as follows:

Larry Thomas has been with Guitar Center since 1977. In 1999, Mr. Thomas became our Chairman of the Board of Directors and Co-Chief Executive Officer. He has served as a director since 1984 and was our President and Chief Executive Officer since 1992. After working as a salesperson in the San Francisco, California store, Mr. Thomas became the store's manager. In 1980, Mr. Thomas became the San Francisco area regional manager. In 1984, Mr. Thomas assumed the role of Corporate General Manager and Chief Operating Officer. Mr. Thomas is currently a member of the Los Angeles Chapter of the Young Presidents' Organization and is a former board member of the National Association of Music Merchants.

Marty Albertson has been with Guitar Center since 1979. In 1999, Mr. Albertson became our President and Co-Chief Executive Officer. Mr. Albertson joined Guitar Center as a salesperson and has held various positions of increasing responsibility with Guitar Center since that time. In 1980, he served

3

as Advertising Director and in 1984 became National Sales Manager. Thereafter, in 1985 Mr. Albertson became Vice President of Corporate Development, and became the Vice President of Sales and Marketing in 1987. From 1990 to 1999, Mr. Albertson served as our Executive Vice President and Chief Operating Officer. Mr. Albertson was elected as a director in 1996. Since 1999, Mr. Albertson has been a member of the Board of the National Association of Music Merchants.

Robert Eastman has served as a director of Guitar Center since 2001. Mr. Eastman has been the Chief Executive Officer of Musician's Friend, Inc. since 1983 when he co-founded that company. Under Mr. Eastman's leadership, Musician's Friend, Inc. grew to over 500 employees, with revenues of $125 million by 1998. In 1999, Musician's Friend, Inc. completed a merger with Guitar Center and became a wholly-owned subsidiary.

David Ferguson has served as a director of Guitar Center since 1996. Mr. Ferguson has been a general partner of J.P. Morgan Partners, LLC (formerly known as Chase Capital Partners) since 1989. Prior to joining Chase Capital Partners, Mr. Ferguson was a member of the mergers and acquisitions group of Prudential Securities from 1987 to 1989 and Bankers Trust Company New York Corporation from 1985 to 1987. Mr. Ferguson is also a director of Wild Oats Markets, Inc. and several privately held companies.

Harvey Kibel has served as a director of Guitar Center since 1997. Mr. Kibel is the Chief Executive Officer of Kibel Green Issa, Inc., a privately held management consulting company which he co-founded in 1982. He became a director of Guitar Center in 1997. Mr. Kibel is currently on the Board of Directors of the UCLA Medical School and several privately held companies.

Larry Livingston has served as a director of Guitar Center since 2002. Mr. Livingston is the Dean of the Flora L. Thornton School of Music at the University of Southern California, a position he has held since 1986. From 1982 to 1986, Mr. Livingston was the Dean and Elma Schneider Professor of Conducting at the Shepherd School of Music at Rice University.

Peter Starrett has served as a director of Guitar Center since 1997. Mr. Starrett is President of Peter Starrett Associates, a retail advisory firm. From 1990 to 1998, Mr. Starrett was President of Warner Bros. Studio Stores. Prior to Warner Bros., Mr. Starrett held various executive positions with May Department Stores and Federated Department Stores, including serving as Chairman and CEO of Federated's Specialty Store Division. Mr. Starrett currently serves on the Board of Directors of The Pantry, Inc., AFC Enterprises, Inc. and several privately held companies.

Jeffrey Walker has served as a director of Guitar Center since 1996. Mr. Walker is the Managing Partner of J.P. Morgan Partners, LLC, the predecessor of which he co-founded in 1984, and member of the Executive Committee and Management Committee of J.P. Morgan Chase & Co. Mr. Walker is also a director of iXL, 1800Flowers.com, Doane Pet Care Enterprises, Inc. and several privately held companies.

Director Compensation

Each member of our Board of Directors who is not a full-time employee is paid $2,500 for attendance at each board meeting but does not receive any additional compensation for attending meetings of a committee of the Board of Directors, and all directors are reimbursed for reasonable out-of-pocket expenses arising from their service as a director. Non-employee directors may elect to receive options to purchase shares of our common stock, or a combination of stock options and cash, in lieu of cash compensation. The options to purchase shares of our common stock granted in lieu of cash compensation to our non-employee directors are granted under the terms of our 1997 Plan and are immediately exercisable. These options granted in lieu of cash compensation have an exercise price equal to 85% of the fair market value of our common stock on the date of the stock option grant, such

4

that the difference between the exercise price and the fair market value is equal to the amount of cash compensation otherwise due to such non-employee directors.

Our 1997 Plan also provides for the further grant of options to our non-employee directors on the following formula bases:

- •

- upon being elected to the Board of Directors, each non-employee director is granted an option to purchase 15,000 shares of our common stock; and

- •

- upon being re-elected to the Board of Directors on the date of each annual meeting, each non-employee director is granted an option to purchase 7,000 shares of our common stock, unless a director was initially elected to the Board of Directors within 120 days of the annual meeting.

Accordingly, each of Messrs. Ferguson, Kibel, Starrett and Walker, if elected at the meeting, will be granted options to purchase 7,000 shares of our common stock. All formula stock options granted to non-employee directors have a per share exercise price equal to the fair market value of a share of our common stock on the date of the grant and vest in three equal annual installments beginning on the first anniversary of the grant date.

Committees of the Board of Directors

Our Board of Directors has two standing committees, the audit committee and the compensation committee. We do not have a nominating committee. The audit committee has responsibility for reviewing and making recommendations regarding our employment of independent accountants, the annual audit of our financial statements, and our internal controls, accounting practices and policies. The members of the audit committee presently are Messrs. Kibel, Starrett and Walker. In 2001, the audit committee met four times and each member of the audit committee attended all of those meetings. The compensation committee has responsibility for determining the nature and amount of compensation for our management and for administering our employee benefit plans. The members of the compensation committee presently are Messrs. Ferguson and Starrett. In 2001, the compensation committee met four times and each member of the compensation committee attended all of those meetings.

Limitation of Liability and Indemnification Matters

Our Restated Certificate of Incorporation provides that to the fullest extent permitted by Delaware General Corporation Law we will indemnify and advance indemnification expenses on behalf of all of our directors and officers, and will indemnify such other persons as may be required by statute or our Amended and Restated Bylaws. To the fullest extent permitted by the Delaware General Corporation Law, a director will not be personally liable to us or our stockholders for monetary damages for any breach of his fiduciary duty as a director. This provision has no effect on any non-monetary remedies that may be available to us or our stockholders, nor does it relieve us or our directors from compliance with federal or state securities laws. Our Restated Certificate of Incorporation also permits us to (i) purchase and maintain insurance on behalf of any director or officer, or such other person as may be permitted by statute or our Amended and Restated Bylaws, against any liability which may be asserted against any such person, and (ii) enter into contracts providing for the indemnification of any director, officer or other person to the full extent permitted by Delaware law.

Our Amended and Restated Bylaws provide that we shall indemnify, in the manner and to the fullest extent permitted by law, any person (or estate of any person) who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit, or proceeding, whether or not in the right of the corporation, and whether civil, criminal, administrative, investigative or otherwise, by reason of the fact that such person is a director or officer of our company, and at the

5

discretion of the Board of Directors may indemnify any person (or the estate of any person) who is such a party or threatened to be made such a party by reason of the fact that such person is or was an employee or agent of our company or is or was serving at our request as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise (including employee benefit plans). To the fullest extent permitted by law, such indemnification shall include expenses (including attorneys' fees), judgments, fines and amounts paid in settlement, and, in the manner provided by law, any such expenses may be paid by us in advance of the final disposition of such action, suit or proceeding. This indemnification does not limit our right to indemnify any other person for any such expenses to the full extent permitted by law, nor is it exclusive of any other rights to which any person seeking indemnification for us may be entitled under any agreement, vote of stockholders or disinterested directors or otherwise, both as to action in his official capacity and as to action in another capacity while holding such office. We may also purchase and maintain liability insurance on behalf of directors, officers and other persons and we generally enter into indemnification contracts providing for mandatory indemnification of such persons and advancement of expenses to the fullest extent permitted by applicable law.

Compliance With Section 16(a) Under the Securities Exchange Act of 1934

Section 16(a) of the Exchange Act requires that our executive officers and directors, and persons who own more than ten percent of a registered class of our equity securities, file reports of ownership and changes in ownership (Forms 3, 4 and 5) with the Securities and Exchange Commission. Executive officers, directors and greater-than-ten-percent holders are required to furnish us with copies of all of these forms which they file.

Based solely on our review of these reports or written representations from certain reporting persons, we believe that during the fiscal year ended December 31, 2001, all filing requirements applicable to our officers, directors, greater-than-ten-percent beneficial owners and other persons subject to Section 16(a) of the Exchange Act were met, with the exception of one Form 4 for Harvey Kibel that was filed late.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTEFOR THE DIRECTORS

NOMINATED IN THIS PROPOSAL NO. 1.

6

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The information in the following table sets forth the ownership of our common stock as of March 28, 2002 by (i) each person who, to our knowledge, beneficially owns more than 5% of the outstanding shares of our common stock; (ii) each named executive officer (as listed on page 12); (iii) each of our directors; and (iv) all of our directors and executive officers, as a group. As of March 28, 2002, there were 22,342,896 shares of our common stock outstanding.

Name and Address of Beneficial Owner(1)

| | Number of Shares

Beneficially Owned(1)

| | Percentage

Ownership(1)

| |

|---|

J.P. Morgan Partners, LLC (2)

1221 Avenue of the Americas

New York, NY 10020 |

|

4,731,703 |

|

21.2 |

% |

Putnam Investments, Inc. (3)

One Post Office Square

Boston, MA 02109 |

|

2,909,149 |

|

13.0 |

|

Private Capital Management (4)

3003 Tamiami Trail North

Naples, FL 34103 |

|

1,672,100 |

|

7.5 |

|

Westfield Capital Management Co., LLC (5)

One Financial Center

Boston, MA 02111 |

|

1,622,150 |

|

7.3 |

|

Wellington Management Company, LLP (6)

75 State Street

Boston, MA 02109 |

|

1,325,400 |

|

5.9 |

|

FMR Corporation (7)

82 Devonshire Street

Boston, MA 02109 |

|

1,148,400 |

|

5.2 |

|

Larry Thomas (8) |

|

1,482,357 |

|

6.6 |

|

Marty Albertson (9) |

|

1,156,510 |

|

5.1 |

|

Bruce Ross (10) |

|

103,898 |

|

* |

|

Barry Soosman (11) |

|

210,700 |

|

* |

|

Robert Eastman (12) |

|

600,307 |

|

2.7 |

|

David Ferguson (13) |

|

4,701,652 |

|

21.1 |

|

Harvey Kibel (14) |

|

56,053 |

|

* |

|

Larry Livingston (15) |

|

0 |

|

* |

|

Peter Starrett (16) |

|

70,053 |

|

* |

|

Jeffrey Walker (17) |

|

4,240,651 |

|

19.0 |

|

All Executive Officers and Directors as a group (14 persons) |

|

8,705,122 |

|

39.0 |

|

- *

- Represents less than 1% of the issued and outstanding shares.

- (1)

- Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock subject to options and warrants which are currently exercisable, or will become exercisable within 60 days of March 28, 2002, are deemed outstanding for computing the percentage of the person or entity holding such securities but are not outstanding for computing the percentage of any other person or entity. Except as indicated by footnote, and subject to the

7

community property laws where applicable, to our knowledge the persons named in the table above have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. Unless otherwise indicated, the address for each person is care of our address at 5795 Lindero Canyon Road, Westlake Village, California 91362.

- (2)

- Based solely on a Form 4 filed on March 8, 2002 with the Securities and Exchange Commission, represents: (i) 4,210,600 shares held of record by J.P. Morgan Partners (SBIC), LLC ("JPMP SBIC") an affiliate of J.P. Morgan Partners, LLC, including 164,818 shares of our common stock subject to currently exercisable investor options (as described herein) granted by Chase Venture Capital Associates, L.L.C. (a predecessor in interest of JPMP SBIC) to certain members of our management; (ii) currently exercisable options to acquire 30,051 shares of common stock issued to Mr. Jeffrey Walker in his capacity as a director of Guitar Center; (iii) currently exercisable options to acquire 31,052 shares of common stock issued to Mr. David Ferguson in his capacity as a director of Guitar Center; (iv) 460,000 shares owned by Mr. Ferguson in his individual capacity. Excludes: (a) 6,999 shares of common stock issuable upon the exercise of options granted to Mr. Walker which are not currently exercisable and will not be exercisable within 60 days of March 28, 2002; and (b) 6,999 shares of common stock issuable upon the exercise of options granted to Mr. Ferguson which are not currently exercisable and will not be exercisable within 60 days of March 28, 2002. JPMP SBIC disclaims beneficial ownership of the shares of common stock held by Mr. Ferguson.

- (3)

- Based solely on a Schedule 13G filed on February 14, 2001 with the Securities and Exchange Commission.

- (4)

- Based solely on an amended Schedule 13G filed on September 18, 1998 with the Securities and Exchange Commission.

- (5)

- Based solely on a Schedule 13G filed on January 16, 2002 with the Securities and Exchange Commission.

- (6)

- Based solely on an amended Schedule 13G filed on February 12, 2002 with the Securities and Exchange Commission.

- (7)

- Based solely on a Schedule 13G filed on February 14, 2002 with the Securities and Exchange Commission.

- (8)

- Represents: (i) 468,567 shares of common stock held by a revocable trust for the benefit of Mr. Thomas and his spouse for which Mr. Thomas and his spouse serve as co-trustees; (ii) 409,000 shares of common stock held in a limited partnership for which Mr. Thomas serves as general partner; (iii) 82,895 shares of common stock held by a charitable remainder trust for the benefit of Mr. Thomas and his spouse for which Mr. Thomas and his spouse serve as co-trustees; (iv) 83,910 shares of common stock issuable upon the exercise of a currently exercisable option granted to Mr. Thomas by affiliates of J.P. Morgan Partners, LLC and two other venture capital funds which financed the 1996 recapitalization of Guitar Center (the "Investors"); (vi) 397,985 shares of common stock issuable upon the exercise of a currently exercisable option granted to Mr. Thomas by us; and (vii) 40,000 shares of common stock issuable upon the exercise of options exercisable within 60 days of March 28, 2002. Excludes: (a) 290,000 shares issuable upon exercise of options which are not currently exercisable and will not be exercisable within 60 days of March 28, 2002; (b) 12,632 shares of common stock held by a charitable foundation for which Mr. Thomas and his spouse serve as its sole directors and have the power to vote such shares; and (c) 170,000 shares issuable upon exercise of options that are exercisable upon the earlier of the attainment of price targets for the common stock, or five years. Mr. Thomas and his spouse disclaim beneficial ownership of the shares held by the charitable foundation.

8

- (9)

- Represents: (i) 462,711 shares of common stock held by a trust for the benefit of Mr. Albertson and his spouse for which Mr. Albertson and his spouse serve as co-trustees; (ii) 50,400 shares of common stock held by a limited partnership of which Mr. Albertson is a general partner; (iii) 52,602 shares of common stock held in trust for the benefit of Mr. Albertson and one of his children for which Mr. Albertson serves as trustee; (iv) 52,602 shares of common stock held in trust for the benefit of Mr. Albertson's spouse and one of his children for which Mr. Albertson serves as trustee; (v) 100,210 shares of common stock issuable upon the exercise of a currently exercisable option granted to Mr. Albertson by the Investors; (vi) 397,985 shares of common stock issuable upon the exercise of a currently exercisable option granted to Mr. Albertson by us; and (vii) 40,000 shares of common stock issuable upon the exercise of options exercisable within 60 days of March 28, 2002. Excludes: (a) 290,000 shares issuable upon exercise of options which are not currently exercisable and will not be exercisable within 60 days of March 28, 2002; and (b) 170,000 shares issuable upon exercise of options that are exercisable upon the earlier of the attainment of price targets for the common stock, or five years.

- (10)

- Represents 103,898 shares of common stock issuable upon the exercise of stock options that are currently exercisable or exercisable within 60 days of March 28, 2002, granted to Mr. Ross by us. Excludes 60,000 shares of common stock issuable upon the exercise of options granted to Mr. Ross which are not currently exercisable and will not be exercisable within 60 days of March 28, 2002.

- (11)

- Represents: (i) 30,910 shares of common stock held by a revocable trust for the benefit of Mr. Soosman and his spouse, for which Mr. Soosman and his spouse serve as co-trustees and share voting and investment control; (ii) 592 shares of common stock owned by Mr. Soosman, and (iii) 179,198 shares of common stock issuable upon the exercise of options that are currently exercisable, or exercisable within 60 days of March 28, 2002, granted to Mr. Soosman by us. Excludes 60,000 shares of common stock issuable upon the exercise of options granted to Mr. Soosman which are not currently exercisable and will not be exercisable within 60 days of March 28, 2002.

- (12)

- Represents: (i) 141,236 shares of common stock owned directly by Mr. Eastman; (ii) 371,625 shares of common stock held by various trusts for which Mr. Eastman serves as co-trustee; and (iii) 87,446 shares of common stock issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of March 28, 2002. Excludes 88,144 shares of common stock issuable upon the exercise of options granted to Mr. Eastman which are not currently exercisable and will not be exercisable within 60 days of March 28, 2002.

- (13)

- Represents: (i) 31,052 shares of common stock issuable upon the exercise of currently exercisable options granted to Mr. Ferguson by us; (ii) 460,000 shares of common stock owned by Mr. Ferguson in his individual capacity; and (iii) 4,210,600 shares of common stock owned by JPMP SBIC, including 164,818 shares of our common stock subject to Investor options granted by Chase Venture Capital Associates, L.L.C. (a predecessor in interest of JPMP SBIC). Excludes 6,999 shares of common stock issuable upon the exercise of options granted to Mr. Ferguson which are not currently exercisable and will not be exercisable within 60 days of March 28, 2002. Mr. Ferguson is a general partner of J.P. Morgan Partners, LLC, an affiliate of JPMP SBIC, and disclaims beneficial ownership of the shares owned by JPMP SBIC, except to the extent of his pecuniary interest therein.

- (14)

- Represents: (i) 6,000 shares of common stock owned directly by Mr. Kibel; and (ii) 50,053 shares of common stock issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of March 28, 2002, granted to Mr. Kibel by us. Excludes 6,999 shares of common stock issuable upon the exercise of options granted to Mr. Kibel which are not currently exercisable and will not be exercisable within 60 days of March 28, 2002.

9

- (15)

- Excludes 15,000 shares of common stock issuable upon the exercise of options granted to Mr. Livingston which are not currently exercisable and will not be exercisable within 60 days of March 28, 2002.

- (16)

- Represents: (i) 20,000 shares of common stock owned directly by Mr. Starrett; and (ii) 50,053 shares of common stock issuable upon the exercise of options that are currently exercisable or exercisable within 60 days of March 28, 2002, granted to Mr. Starrett by us. Excludes 6,999 shares of common stock issuable upon the exercise of options granted to Mr. Starrett which are not currently exercisable and will not be exercisable within 60 days of March 28, 2002.

- (17)

- Represents: (i) 30,051 shares of common stock issuable upon the exercise of currently exercisable options granted to Mr. Walker by us; and (ii) 4,210,600 shares of common stock owned by JPMP SBIC, including 164,818 shares of our common stock subject to Investor options granted by Chase Venture Capital Associates, L.L.C. (a predecessor in interest of JPMP SBIC). Excludes 6,999 shares of common stock issuable upon the exercise of options granted to Mr. Walker which are not currently exercisable and will not be exercisable within 60 days of March 28, 2002. Mr. Walker is the Managing Partner of J.P. Morgan Partners, LLC, an affiliate of JPMP SBIC, and disclaims beneficial ownership of the shares owned by JPMP SBIC, except to the extent of his pecuniary interest therein.

10

CERTAIN INFORMATION WITH RESPECT TO EXECUTIVE OFFICERS

Set forth below is information regarding each of our executive officers as of December 31, 2001. Further information with regard to Messrs. Thomas, Albertson and Eastman is presented under "Proposal No. 1: Election of Nominees to Board of Directors."

Name

| | Age

| | Position

|

|---|

| Larry Thomas | | 52 | | Chairman and Co-Chief Executive Officer |

| Marty Albertson | | 48 | | President and Co-Chief Executive Officer |

| Bruce Ross | | 53 | | Executive Vice President, Chief Financial Officer and Secretary |

| Barry Soosman | | 41 | | Executive Vice President, Chief Strategic Officer and General Counsel |

| Robert Eastman | | 43 | | Chief Executive Officer, Musician's Friend, Inc. |

| David Fleming | | 55 | | President and Chief Operating Officer, American Music |

| David Angress | | 52 | | Executive Vice President, General Merchandising Manager |

| Mark Laughlin | | 42 | | Executive Vice President, Chief Information Officer |

| Erick Mason | | 37 | | Senior Vice President of Operations and Finance |

The principal occupations and positions for at least the past five years of the executive officers named above, other than Messrs. Thomas, Albertson and Eastman, as are as follows:

Bruce Ross joined Guitar Center in July 1994 as Chief Financial Officer. In February 1998, Mr. Ross was promoted to Executive Vice President. Prior to joining Guitar Center, Mr. Ross was Chief Financial Officer of Fred Hayman Beverly Hills, Inc., a retailer of high end fashion clothing on Rodeo Drive in California and a wholesaler of men's and women's fragrances. From 1982 to 1990, Mr. Ross was employed by Hanimex Vivitar Corporation, a worldwide manufacturer and distributor of photographic products. Mr. Ross served in various capacities with Hanimex Vivitar in Australia, the United States and Europe. While working for Hanimex Vivitar in the United States, Mr. Ross was promoted to the position of Chief Financial Officer in 1986 and Chief Executive Officer for North America in 1988.

Barry Soosman joined Guitar Center in July 1996 as Vice President of Corporate Development and General Counsel. In January 1999, Mr. Soosman was promoted to Executive Vice President and in June 2001 he became our Chief Strategic Officer. Mr. Soosman had been a practicing attorney for twelve years specializing in real estate, commercial and corporate law. Since 1992 and prior to joining Guitar Center, Mr. Soosman had been our outside general counsel. From June 1996 to June 2000, Mr. Soosman was of counsel to the law firm of Buchalter, Nemer, Fields & Younger, a Professional Corporation. Mr. Soosman is a former Adjunct Professor at Southwestern School of Law.

David Fleming has been the President and Chief Operating Officer of the American Music division of Guitar Center since its acquisition by Guitar Center in April 2001. Previously, Mr. Fleming held various positions with American Music Group, Ltd. since 1975, most recently as Vice President of Marketing and Sales. In April 2001, American Music Group, Ltd. sold its assets to Guitar Center and it became a division of our rental business.

David Angress joined Guitar Center in January 1996 as our Vice President of Merchandising, Technology Products. In March 2000, Mr. Angress was promoted to Executive Vice President and General Merchandising Manager. From 1994 to December 1995, Mr. Angress was Vice President of Harman Pro North America, responsible for that company's North American marketing and sales operations. Prior to 1994, Mr. Angress was Vice President and General Manager of Sound Genesis, a provider professional audio equipment and integration services. Mr. Angress has over 30 years of experience in the music retail industry.

Mark Laughlin joined Guitar Center in 1991 as our Director of Information Services. In July 2000, Mr. Laughlin was promoted to Executive Vice President and Chief Information Officer. From 1997 to June 2000, Mr. Laughlin was our Vice President, Information Services. Prior to joining Guitar Center, Mr. Laughlin was a manager of information services for Clothestime, a retailer of fashion clothing.

Erick Mason joined Guitar Center in 1996 as our corporate controller. In January 1999, Mr. Mason was promoted to Senior Vice President, Finance, and in May 2001, Mr. Mason became our Senior Vice President of Operations and Finance. From 1986 to 1996, Mr. Mason was associated with KPMG LLP, most recently as senior manager. Mr. Mason is a certified public accountant.

11

EXECUTIVE COMPENSATION

The following table provides for the periods shown summary information concerning compensation paid or accrued by us to or on behalf of our Co-Chief Executive Officers and each of our three highest paid executive officers (collectively referred to as the "named executive officers").

Summary Compensation Table

| |

| | Annual Compensation ($)

| | Long Term

Compensation

| |

|

|---|

Name and Principal

Position

| | Year

| | Salary

| | Bonus

| | Other Annual

Compensation ($)(1)

| | Securities

Underlying

Options/SAR (#)(2)

| | All Other

Compensation ($)(3)

|

|---|

| Larry Thomas | | 2001 | | $ | 500,000 | | — | | — | | 250,000 | | $ | 3,400 |

| | Chairman and Co-Chief | | 2000 | | | 500,000 | | 500,000 | | — | | 80,000 | | | 3,200 |

| | Executive Officer | | 1999 | | | 500,000 | | 80,000 | | — | | — | | | 3,200 |

Marty Albertson |

|

2001 |

|

$ |

500,000 |

|

— |

|

— |

|

250,000 |

|

$ |

3,400 |

| | President and Co-Chief | | 2000 | | | 500,000 | | 500,000 | | — | | 80,000 | | | 3,200 |

| | Executive Officer | | 1999 | | | 500,000 | | 80,000 | | — | | — | | | 3,200 |

Bruce Ross |

|

2001 |

|

$ |

275,000 |

|

— |

|

— |

|

40,000 |

|

$ |

3,400 |

| | Executive Vice President and | | 2000 | | | 250,000 | | 125,000 | | — | | 40,000 | | | 3,200 |

| | Chief Financial Officer | | 1999 | | | 234,375 | | 20,000 | | — | | — | | | 3,200 |

Barry Soosman |

|

2001 |

|

$ |

300,000 |

|

— |

|

— |

|

40,000 |

|

$ |

3,400 |

| | Executive Vice President, | | 2000 | | | 250,000 | | 150,000 | | — | | 40,000 | | | 3,200 |

| | Chief Strategic Officer | | 1999 | | | 234,375 | | 20,000 | | — | | — | | | 3,200 |

| | and General Counsel | | | | | | | | | | | | | | |

Robert Eastman |

|

2001 |

|

$ |

300,000 |

|

— |

|

— |

|

30,000 |

|

$ |

3,400 |

| | Chief Executive Officer, | | 2000 | | | 300,000 | | 150,000 | | — | | 63,798 | | | — |

| | Musician's Friend, Inc. | | 1999 | | | 175,000 | | — | | — | | — | | | — |

- (1)

- Excludes perquisites and other personal benefits, securities or property aggregating less than $50,000 or 10% of the total annual salary and bonus reported for each named executive officer.

- (2)

- The securities underlying the options are shares of common stock.

- (3)

- All other compensation consists of contributions made by us to our profit sharing plan on behalf of each named executive officer.

During the periods indicated above, none of the named executive officers received any awards under any long-term incentive plan, and we do not have a pension plan.

Employment Agreements

Effective as of June 6, 2001, we entered into a five-year employment agreement with each of Larry Thomas and Marty Albertson. These agreements superceded the five-year employment agreements originally entered into in June 1996. The employment agreements provide each of Messrs. Thomas and Albertson with base salaries of $500,000 and an annual option grant to purchase 80,000 shares of our common stock which option shall vest in equal annual installments over three years. Each of these executive officers is entitled to participate in all insurance and benefit plans generally available to executives of Guitar Center and is eligible to receive an annual bonus based on criteria to be established by our compensation committee. In connection with the new agreements each of Messrs. Thomas and Albertson were also granted options under our 1997 Equity Participation Plan to purchase 170,000 shares of common stock at an exercise price of $15.31 per share. Such options vest upon the earlier of five years or pursuant to the following schedule: one-third of the shares subject to the options will vest upon the per share common stock price reaching each of $22.00, $27.00 and $32.00 for a

12

specified period of time. Messrs. Thomas and Albertson are also eligible to participate the compensation committee's plan providing for reimbursement of business expenses and designated perquisites.

Under the terms of Messrs. Thomas's and Albertson's employment agreements, if either of them is terminated without cause, resigns with reasonable justification or we do not elect to extend their contracts for an additional year (each, a "qualifying termination"), they will be entitled to receive their base salary as accrued through the date of termination and a cash bonus equal to 100% of their base salary pro-rated for any partial year ending on the date of such termination. In addition, for two years after such a qualifying termination the executive will be entitled to receive his base salary, an annual cash bonus equal to 100% of his base salary payable on each anniversary of the termination date, and continuation of his benefits. If a qualifying termination occurs within two years of the consummation of a sale of our company, for three years after such event the executive will be entitled to receive his base salary, an annual cash bonus equal to 100% of his base salary payable on each anniversary of the termination date, and continuation of his benefits. If the executive is terminated for any reason other than a qualifying termination he will be entitled to receive only his base salary as accrued through the date of such termination. In the event of a qualifying termination or the executive's death or disability all of his stock options will immediately vest and become fully exercisable. In the event that any benefits payable in connection with a sale of our company are subject to federal excise tax, we have agreed to make a "gross-up" payment with respect to any such taxes.

Effective as of July 1, 2001, we entered into three-year employment agreements with Barry Soosman and Bruce Ross. The employment agreements provide each of Messrs. Ross and Soosman with base salaries of $275,000 and $300,000, respectively. Each of these executive officers is entitled to participate in all insurance and benefit plans generally available to executives of Guitar Center and is eligible to receive a discretionary bonus.

Under the terms of Messrs. Soosman's and Ross's employment agreements, if either of them is terminated without cause or resigns with reasonable justification prior to July 1, 2003, the executive will be entitled to receive his base salary, an annual cash bonus equal to the last annual bonus received while employed (such bonus to be pro-rated for any partial year and excluding any portion that our Co-Chief Executive Officers consider extraordinary and non-recurring), and continuation of his benefits through June 30, 2004. If either Mr. Soosman or Mr. Ross is terminated without cause or resigns with reasonable justification on or after July 1, 2003, then the executive will be entitled to receive his base salary, an annual cash bonus equal to the last annual bonus received while employed (such bonus to be pro-rated for any partial year and excluding any portion that our Co-Chief Executive Officers consider extraordinary and non-recurring), and continuation of his benefits for a period of one year after such termination or resignation. If the executive is terminated for any reason other than cause or resigns without reasonable justification he will be entitled to receive only his base salary as accrued through the date of such termination or resignation. In the event of the executive's death, disability, termination without cause, resignation with reasonable justification, or the sale of our company, all of his stock options will immediately vest pursuant to the terms of the agreements by which such options were issued. If we consummate a sale of our company during the term of the executive's employment, he may resign within 90 days of such event by notifying us in writing.

On March 20, 2001, our subsidiary, Guitar Center Stores, Inc., entered into a three-year employment agreement with David Fleming which expires on April 1, 2004, unless renewed by mutual agreement of Mr. Fleming and Guitar Center Stores, Inc. This employment agreement provides Mr. Fleming with a base salary of $250,000 annually. Under this agreement, Mr. Fleming is entitled to participate in all insurance and benefit plans generally available to executives of Guitar Center Stores, Inc. and is eligible to receive a discretionary bonus. Under the terms of Mr. Fleming's agreement, if he is terminated without cause or resigns with reasonable justification, he will be entitled to receive his base salary and the continuation of his medical benefits through the term of the

13

agreement. If Mr. Fleming's employment with Guitar Center Stores, Inc. is terminated for any other reason, he will be entitled only to his accrued base salary through the date of termination.

On May 13, 1999, our subsidiary, Musician's Friend, Inc., entered into a four-year employment agreement with Robert Eastman which expires on June 1, 2003, unless renewed by mutual agreement of Mr. Eastman and Musician's Friend, Inc. This employment agreement provides Mr. Eastman with a base salary of $300,000 annually. Under this agreement, Mr. Eastman is entitled to participate in all insurance and benefit plans generally available to executives of Musician's Friend, Inc. and is eligible to receive a discretionary bonus. Under the terms of Mr. Eastman's agreement, if he is terminated without cause or resigns with reasonable justification, he will be entitled to receive his base salary and the continuation of his medical benefits through the term of the agreement. If Mr. Eastman's employment with Musician's Friend, Inc. is terminated for any other reason, he will be entitled only to his accrued base salary through the date of termination.

Management Stock Option Agreements

In June 1996, we granted options which we refer to as "management options" to each of Messrs. Thomas and Albertson to purchase 397,985 shares of common stock at an exercise price of $10.89. These options are fully vested and are exercisable through June 2006. In addition to their ten-year term, these management options also terminate upon the earlier of (i) the consummation of a sale of Guitar Center, as more fully described in the management option agreement; or (ii) the termination, either voluntarily or for cause, of the employment of the respective executive officer.

Other Option Arrangements

In December 1996, the three private equity firms which financed our 1996 recapitalization, affiliates of J.P. Morgan Partners, LLC, Norwest Equity Partners and Weston Presidio Capital Partners (the "Investors"), granted some members of management options to purchase an aggregate of 273,344 shares of common stock at a purchase price of $4.33 per share. Each option, which we refer to collectively as the "Investor options," is granted by each Investor in the following percentages: 75.00% by J.P. Morgan Partners, 14.29% by Norwest and 10.71% by Weston Presidio. Included in the Investor options are options to purchase 109,722 shares of common stock that were granted to each of Messrs. Thomas and Albertson and options to purchase 3,850 shares of common stock that were granted to each of Messrs. Soosman, Ross and one other executive officer. The Investor options were granted in December 1996, are presently exercisable and will expire on December 31, 2003. As of March 15, 2002, options to purchase 201,700 shares were still outstanding and exercisable under this agreement.

Option Grants in 2001

In 2001, we granted options to purchase 994,744 shares of common stock under our 1997 Plan, and granted options to acquire 610,000 of those shares to our named executive officers. As of March 28, 2002, options to purchase 3,498,320 shares of our common stock have been granted, and 708,413 shares remain available for grant under our 1997 Plan. In general, options granted under the 1997 Plan vest over four years and expire on the tenth anniversary of the date of grant.

14

The following table shows certain information regarding options granted to our named executive officers during the fiscal year ended December 31, 2001.

| |

| |

| |

| |

| | Potential Realizable Value

At Assumed Annual Rates of

Stock Price Appreciation

for Option Term(1)

|

|---|

| | Number of

Securities

Underlying

Options

Granted(#)

| | Individual Grants

% of Total

Options Granted

to Employees in

the Fiscal Year

| |

| |

|

|---|

Name

| | Exercise of

Base Price

($/Sh)

| |

|

|---|

| | Expiration Date

| | 5% ($)

| | 10% ($)

|

|---|

| Larry Thomas | | 250,000 | | 25.1 | % | $ | 15.31 | | August 8, 2011 | | $ | 6,235,000 | | $ | 9,928,000 |

| Marty Albertson | | 250,000 | | 25.1 | % | | 15.31 | | August 8, 2011 | | | 6,235,000 | | | 9,928,000 |

| Bruce Ross | | 40,000 | | 4.0 | % | | 15.31 | | August 8, 2011 | | | 998,000 | | | 1,588,000 |

| Barry Soosman | | 40,000 | | 4.0 | % | | 15.31 | | August 8, 2011 | | | 998,000 | | | 1,588,000 |

| Robert Eastman | | 30,000 | | 3.0 | % | | 15.31 | | August 8, 2011 | | | 748,000 | | | 1,191,000 |

- (1)

- Reflects the value of the stock option on the date of grant assuming (i) for the 5% column, a five-percent annual rate of appreciation in our common stock over the ten-year term of the option, and (ii) for the 10% column, a ten-percent annual rate of appreciation in our common stock over the ten-year term of the option. The 5% and 10% assumed rates of appreciation are based on the rules of the Securities and Exchange Commission and do not represent our estimate or projection of the future price of our common stock. The amounts in this table may not be achieved.

Aggregate Option Exercises in 2001; 2001 Year-End Option Values

The following table sets forth, on an aggregated basis, information regarding securities underlying unexercised options during the fiscal year ended December 31, 2001 by our named executive officers.

| |

| |

| | Option Values at December 31, 2001

|

|---|

| |

| |

| | Number of

Securities Underlying

Unexercised

Options at

Fiscal Year-End(#)(2)

| | Value of

Unexercised

In-The-Money

Options at

Fiscal Year-End($)(3)

|

|---|

Name

| | Shares Acquired

at Exercise(#)

| | Value Realized

($)(1)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Larry Thomas | | — | | | — | | 417,985 | | 310,000 | | $ | 1,140,658 | | $ | 138,600 |

| Marty Albertson | | — | | | — | | 417,985 | | 310,000 | | | 1,140,658 | | | 138,600 |

| Bruce Ross | | 26,300 | | $ | 64,868 | | 98,898 | | 70,000 | | | 271,969 | | | 92,400 |

| Barry Soosman | | — | | | — | | 169,198 | | 70,000 | | | 468,594 | | | 92,400 |

| Robert Eastman | | — | | | — | | 54,407 | | 121,183 | | | 30,800 | | | 92,400 |

- (1)

- Fair market value of our common stock on date of exercise minus the exercise price.

- (2)

- The securities underlying the options are shares of common stock.

- (3)

- The fair market value of our common stock on December 31, 2001 was $13.64. The values in this table represent the fair market value of our common stock minus the exercise price of the option.

Compensation Committee Interlocks and Insider Participation

During fiscal 2001, the compensation committee consisted of Messrs. Ferguson and Starrett, neither of whom (1) is a present or former officer or employee of Guitar Center, or (2) is engaged in any transactions described under the heading "Certain Transactions."

15

CERTAIN TRANSACTIONS

Transactions with Affiliates of Norwest Equity Partners

Wells Fargo Retail Credit, LLC, an affiliate of Norwest Equity Partners, leads a syndicate of lenders who provide our current senior credit facility, for which we pay interest and fees that we believe reflect market terms. Until October 2001, a representative of Norwest Equity Partners was a member of our Board of Directors.

Management Loans

We have loans outstanding to Bruce Ross, our Executive Vice President and Chief Financial Officer, under which the greatest aggregate principal amount outstanding during the 2001 fiscal year was approximately $99,000. As of December 31, 2001, the aggregate principal amount outstanding was approximately $50,000. One loan of approximately $49,000 was made under the terms of our Employee Loan Assistance Program, our program to loan money to certain of our employees to enable them to purchase shares of our common stock. This was a recourse loan bearing interest at the prime rate as established by Wells Fargo Bank, N.A. Mr. Ross repaid this loan in full in November 2001. The other loan, of approximately $50,000, is a demand note which bears interest at the rate of 6.42% per annum.

American Music Group Acquisition

In April 2001, we acquired the assets of American Music Group, Ltd. and related companies, a New York-based musical instrument retailer specializing in the sale and rental of band instruments and accessories (the "American Music Group"). In consideration of the purchase, we paid $28.5 million in net cash, issued 115,358 shares of Guitar Center common stock, valued at $2.1 million and assumed or repaid liabilities of $8.5 million. One of our current executive officers, David Fleming, was the Vice President of Marketing and Sales and a 17% stockholder of American Music Group. As a result of Mr. Fleming's ownership stake in American Music Group he received approximately $4.8 million of the purchase price we paid, payable in cash and shares of our common stock. Also in connection with the transaction we entered into a three-year employment agreement with Mr. Fleming which provides him with an annual base salary of $250,000, as described in more detail in the above section "Employment Agreements."

COMPENSATION COMMITTEE REPORT

During 2001, the compensation committee of the Board of Directors was comprised of Mr. Ferguson and Mr. Starrett, two non-employee directors, who administered our executive compensation programs and policies. Our executive compensation programs are designed to attract, motivate and retain the executive talent needed to optimize shareholder value in a competitive environment. The programs are intended to support the goal of increasing stockholder value while facilitating our business strategies and long-range plans.

The following is the compensation committee's report submitted to the Board of Directors addressing the compensation of our executive officers for fiscal 2001.

Compensation Policy and Philosophy

Our executive compensation policy is:

- •

- designed to establish an appropriate relationship between executive pay and our annual performance, our long term growth objectives and our ability to attract and retain qualified executive officers; and

16

- •

- based on the belief that the interests of the executives should be closely aligned with our stockholders.

The compensation committee attempts to achieve these goals by integrating competitive annual base salaries with:

- •

- annual incentive bonuses based on corporate performance and on the achievement of specified performance objectives set forth in our financial plan for the respective fiscal year; and

- •

- stock options through various plans.

In support of this philosophy, a meaningful portion of each executive's compensation is placed at-risk and linked to the accomplishment of specific results that are expected to lead to the creation of value for our stockholders from both the short term and long term perspectives. The compensation committee believes that cash compensation in the form of salary and performance-based incentive bonuses provides our executives with short term rewards for success in operations, and that long term compensation through the award of stock options encourages growth in management stock ownership which leads to expansion of management's stake in our long term performance and success. The compensation committee considers all elements of compensation and the compensation policy when determining individual components of pay.

The Board of Directors believes that leadership and motivation of our employees are critical to achieving the objective of maintaining our leadership position in musical products retailing in the United States. The compensation committee is responsible to the Board of Directors for ensuring that its executive officers are highly qualified and that they are compensated in a way that furthers our business strategies and which aligns their interests with those of our stockholders. To support this philosophy, the following principles provide a framework for executive compensation:

- •

- offer compensation opportunities that attract the best talent;

- •

- motivate individuals to perform at their highest levels;

- •

- reward outstanding achievement;

- •

- retain those with leadership abilities and skills necessary for building long-term shareholder value;

- •

- maintain a significant portion of executives' total compensation at risk, tied to both our annual and long-term financial performance and the creation of incremental shareholder value; and

- •

- encourage executives to manage from the perspective of owners with an equity stake in Guitar Center.

Executive Compensation Components

As discussed below, our executive compensation package is primarily comprised of three components: base salary, annual incentive bonuses and stock options.

Base Salary. In 2001, Messrs. Thomas, Albertson, Soosman and Ross were employed under contracts originally established in 1996, and Mr. Eastman was employed under a contract established in 1999. Mr. Albertson's contract was subject to an adjustment in base compensation approved in 1997 and the contracts of Messrs. Soosman and Ross were subject to extensions in the term of the agreements approved in 1998. Messrs. Thomas's, Albertson's, Soosman's and Ross's employment agreements expired in June 2001. Effective June 2001, we entered into amended and restated employment agreements with Messrs. Thomas and Albertson and effective July 2001, we entered into amended and restated employment agreements with Messrs. Soosman and Ross.

17

Annual Incentive Bonuses. No bonuses were paid to any of our executive officers for the 2001 fiscal year.

Long Term Incentive Compensation. We granted options to purchase 250,000 shares of our common stock to each of Larry Thomas and Marty Albertson, our Co-Chief Executive Officers. We granted options to purchase 40,000 shares of our common stock to each of Bruce Ross, our Chief Financial Officer and Barry Soosman, our Chief Strategic Officer. We granted options to purchase 30,000 shares of our common stock to Robert Eastman, Chief Executive Officer of Musician's Friend, Inc.

Compensation of Co-Chief Executive Officers

The compensation committee believes that Larry Thomas and Marty Albertson, our Co-Chief Executive Officers, provide valuable services and that their compensation should therefore be competitive with that paid to executives at comparable companies. In addition, the compensation committee believes that an important portion of their respective compensation should be based on our performance. Effective June 2001, we entered into new long-term contracts with Messrs. Thomas and Albertson, the terms of which were negotiated on our behalf by the compensation committee based to a substantial extent on the advice of an independent compensation consultant.

Mr. Thomas's annual base salary for fiscal 2001 was $500,000. Mr. Thomas's base salary for the first half of the year was determined by his previous employment agreement, which expired in June 2001, and determined for the second half of the year by his new employment agreement, which expires June 30, 2006. No annual incentive bonus was paid to Mr. Thomas for 2001.

Mr. Albertson's annual base salary for fiscal 2001 was $500,000. Mr. Albertson's base salary for the first half of the year was determined by his previous employment agreement, which expired in June 2001, and determined for the second half of the year by his new employment agreement, which expires June 30, 2006. No annual incentive bonus was paid to Mr. Albertson for 2001.

Internal Revenue Code Section 162(m)

Under Section 162(m) of the Internal Revenue Code, the amount of compensation paid to certain executives that is deductible with respect to our corporate taxes is limited to $1,000,000 annually. It is the current policy of the compensation committee to maximize, to the extent reasonably possible, our ability to obtain a corporate tax deduction for compensation paid to our executive officers to the extent consistent with the best interests of Guitar Center and our stockholders.

The compensation committee report on executive compensation shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act or the Exchange Act, and shall not otherwise be deemed filed under these acts.

18

AUDIT COMMITTEE REPORT

Our audit committee was established on January 15, 1997 and adopted its audit committee charter on February 17, 2000. During most of fiscal 2001, the audit committee of the Board of Directors was comprised of Messrs. Burge, Kibel and Walker. Mr. Burge resigned from the Board of Directors on October 25, 2001 and this vacancy was filled by the appointment of Mr. Starrett in January 2002. Each of the members of the audit committee is an "independent director," as determined in accordance with Rule 4200(a)(15) of the Nasdaq Stock Market's regulations.

Management is responsible for the Company's internal controls and the financial reporting process. The independent auditors are responsible for performing an independent audit of the Company's consolidated financial statements in accordance with generally accepted accounting principles and to issue a report thereon. The audit committee's responsibility is to monitor and oversee these processes. The following is the audit committee's report submitted to the Board of Directors for the fiscal year ended December 31, 2001.

The audit committee has:

- •

- reviewed and discussed the Company's audited financial statements with management and the independent accountants;

- •

- discussed with KPMG LLP, the Company's independent auditors, the matters required to be discussed by Statement on Auditing Standards No. 61, as may be modified or supplemented; and

- •

- received from KPMG LLP the written disclosures and the letter regarding their independence as required by Independence Standards Board Standard No. 1, as may be modified or supplemented, and discussed the auditors' independence with them.

In addition, based on the review and discussions referred to above, the audit committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2001, for filing with the Securities and Exchange Commission.

The audit committee report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act or the Exchange Act, and shall not otherwise be deemed filed under these acts.

19

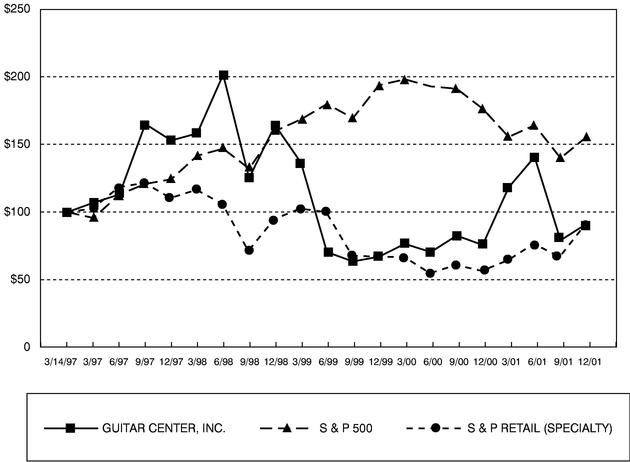

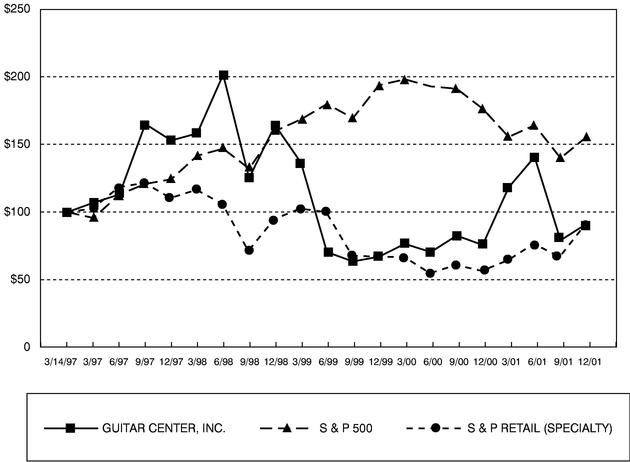

STOCK PERFORMANCE GRAPH

The following graph compares our cumulative total stockholder return on the common stock (no dividends have been paid thereon) with the cumulative total return of (1) the S&P 500 Index and (2) the S&P Retail (Specialty) Index, for 2000 and 2001.

The historical stock market performance of the common stock shown below is not necessarily indicative of future stock performance.

The stock performance graph above shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act or under the Exchange Act, except to the extent we specifically incorporate this information by reference, and shall not otherwise be deemed filed under these acts.

20

OTHER INFORMATION

Other Matters at the Meeting

We do not know of any matters to be presented at the annual meeting other than those mentioned in this proxy statement. If any other matters are properly brought before the annual meeting, it is intended that the proxies will be voted in accordance with the best judgment of the designated proxyholders.

Independent Public Accountants

Our auditors for the fiscal year ended December 31, 2001 were KPMG LLP. A representative of KPMG LLP will be present at the meeting, will have an opportunity to make a statement if he or she so desires and is expected to be available to respond to appropriate questions.

Audit Fees: The aggregate fees billed for professional services rendered for the audit of our annual financial statements for the fiscal year ended December 31, 2001, and the reviews of the financial statements included in our Forms 10-Q for that fiscal year were $200,000.

Financial Information Systems Design and Implementation Fees: For the fiscal year ended December 31, 2001, we paid no fees to our principal accountants for professional services rendered in connection with the operation, supervision or management of our information systems or local area network, or for the design or implementation of a hardware or software system for aggregating source data underlying our financial statements, or generating information that is significant to such statements, taken as a whole. Since we paid no fees to its principal accountants for information technology services, our audit committee did not consider whether the provision of such services to us is compatible with maintaining the auditor's independence.

All Other Fees: The aggregate fees billed for services rendered by our principal accountants, other than described above, for the fiscal year ended December 31, 2001, were $278,000.

Annual Report on Form 10-K; Available Information

Each stockholder receiving this proxy statement is being provided with a copy of our Annual Report to Stockholders. We have also filed with the Securities and Exchange Commission an Annual Report on Form 10-K. We will provide without charge a copy of our Form 10-K (without exhibits) upon written request to our Secretary. Copies of exhibits to our Form 10-K are available from us upon reimbursement of our reasonable costs in providing these documents and written request to our Secretary. Please address requests for these documents to: Secretary, Guitar Center, Inc., 5795 Lindero Canyon Road, Westlake Village, California 91362. Our filings with the Securities and Exchange Commission may be inspected at the offices of the Securities and Exchange Commission located in Washington, D.C. Documents filed electronically with the Securities and Exchange Commission may also be accessed through the website maintained by it at: www.sec.gov.

Stockholder Proposals for 2003 Annual Meeting

Any stockholder who meets the requirements of the proxy rules under the Exchange Act may submit to the Board of Directors proposals to be considered for submission to the stockholders at the annual meeting in 2003. Your proposal must comply with the requirements of Rule 14a-8 under the Exchange Act and be submitted in writing by notice delivered or mailed by first-class United States mail, postage prepaid, to our Secretary at Guitar Center, Inc., 5795 Lindero Canyon Road, Westlake Village, California 91362 and must be received no later than December 3, 2002. Your notice must include:

- •

- your name and address and the text of the proposal to be introduced;

21

- •

- the number of shares of stock you hold of record, beneficially own and represent by proxy as of the date of your notice; and

- •

- a representation that you intend to appear in person or by proxy at the meeting to introduce the proposal specified in your notice.

The chairman of the meeting may refuse to acknowledge the introduction of your proposal if it is not made in compliance with the foregoing procedures or the applicable provisions of our Amended and Restated Bylaws. Our Amended and Restated Bylaws also provide for separate advance notice procedures which must be complied with to recommend a person for nomination as a director or to propose business to be considered by stockholders at a meeting.

Westlake Village, California

April 2, 2002

22

GUITAR CENTER, INC.

Board of Directors Proxy for the Annual Meeting of Stockholders

at 9:00 a.m., Friday, May 3, 2002

Hyatt Westlake Plaza

880 South Westlake Boulevard

Westlake Village, California 91361

The undersigned stockholder of Guitar Center, Inc. hereby revokes any proxy or proxies previously granted and appoints Larry Thomas, Marty Albertson, Bruce Ross and Barry Soosman, or any of them, as proxies, each with full powers of substitution and resubstitution, to vote the shares of the undersigned at the above-stated Annual Meeting and at any adjournment or postponement thereof:

/*\ FOLD AND DETACH HERE /*\

| | | Please mark

your votes as

indicated in

this example | | /x/ |

| | | | | FOR all nominees listed below (except as marked to the contrary below) | | WITHHOLD AUTHORITY

to vote for all nominees below | | |

| 1. | | Election of Directors. | | / / | | / / | | |

| | | (01) Larry Thomas,

(02) Marty Albertson,

(03) Robert Eastman,

(04) David Ferguson,

(05) Harvey Kibel,

(06) Peter Starrett,

(07) Jeffrey Walker and

(08) Larry Livingston | | | | | | Signed proxies that do not otherwise indicate voting instructions will be voted FOR the election of the director nominees listed in Item 1. Such proxies will also be voted in accordance with the best judgment of the designated proxy holders with regard to any other business that may properly come before the meeting and be submitted to a vote of the stockholders. |

(INSTRUCTION: To withhold authority to vote for any individual nominee(s), write that nominee's name in the space provided below.) |

|

|

|

|

Please disregard if you have previously provided your consent decision. |

|

|

|

|

|

|

|

|

By checking the box to the right, I consent to future delivery of annual reports, proxy statements, prospectuses and other materials and stockholder communications electronically via the Internet at a webpage which will be disclosed to me. I understand that the Company may no longer distribute printed materials to me for any future stockholder meeting until such consent is revoked. I understand that I may revoke by consent at any time by contracting the Company's transfer agent, Mellon Investor Services LLC, Ridgefield Park, NJ and that costs normally associated with electronic delivery, such as usage and telephone charges as well as any costs I may incur in printing such documents, will by my responsibility.

|

(Signature of Stockholder(s)) |

|

|

|

Dated |

|

|

|

, 2002 |

| | |

| | | |

| | |

(Joint owners must EACH sign. Please sign EXACTLY as your name(s) appear(s) on this card. When signing as attorney, trustee, executor, administrator, guardian or corporate officer, please give your FULL title.)

|

/*\ FOLD AND DETACH HERE /*\

Vote by Internet or Telephone of Mail

24 Hours a Day, 7 Days a Week

Your telephone or Internet vote authorizes the named proxies to vote your shares in

the same manner as if you marked, signed and returned your proxy card.

Internet

http://www.eproxy.com/gtrc | | | | Telephone

1-800-435-6710 | | | | Mail |

Use the Internet to vote your proxy. Have your proxy card in hand when you access the web site. You will be prompted to enter your control number, located in the box below, to create and submit an electronic ballot |

|

OR |

|

Use any touch-tone telephone to vote your proxy. Have your proxy card in hand when you call. You will be prompted to enter your control number, located in the box below, and then follow the directions given. |

|

OR |

|

Mail, sign and date your proxy card and return it in the enclosed postage-paid envelope.

|

If you vote your proxy by internet or by telephone,

you do NOT need to mail back your proxy card.

QuickLinks

INTRODUCTIONPROPOSAL NO. 1: ELECTION OF NOMINEES TO BOARD OF DIRECTORSSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTCERTAIN INFORMATION WITH RESPECT TO EXECUTIVE OFFICERSEXECUTIVE COMPENSATIONSummary Compensation TableCERTAIN TRANSACTIONSCOMPENSATION COMMITTEE REPORTAUDIT COMMITTEE REPORTSTOCK PERFORMANCE GRAPHOTHER INFORMATION