June 2017 Shareholder Outreach Business, Executive Compensation, and Governance Overview

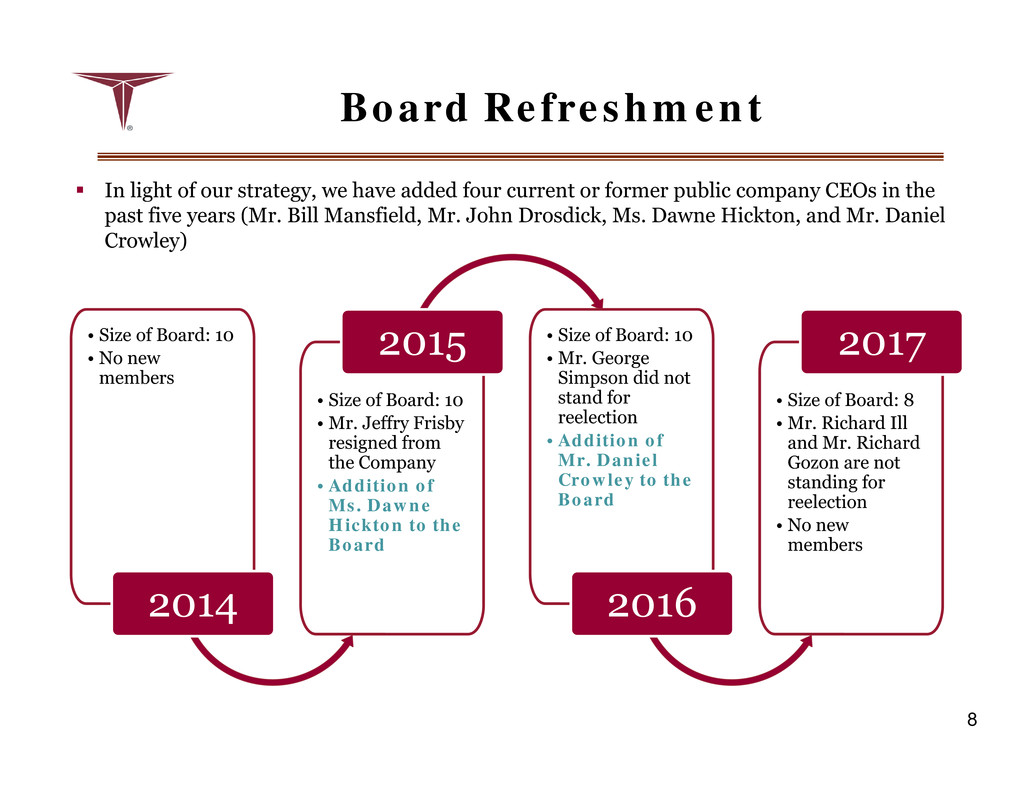

Introduction 2 Large Scale Transformation Underway. The implementation of our transformation plan in fiscal 2017 and significant progress to date better positions us for fiscal 2018. Executive Compensation Program Aligned with Company Strategy. Our fiscal 2017 incentive awards focused on key outcomes critical to driving the transformation. Our annual incentive program brings compensation in line with peers and maintains strong alignment between pay and performance. Non-Employee Director Compensation Program Aligned with Market Practice. The changes to our non-employee director compensation program provide market competitive levels of pay and encourage meaningful stock ownership. Ongoing Board Refreshment. At the 2017 Annual Meeting, two legacy directors are stepping down. Six of the eight directors have joined the Board in the last seven years. We request your support at our Annual Meeting on July 20th, 2017. This presentation addresses how our Board manages our executive compensation and non-employee director compensation programs.

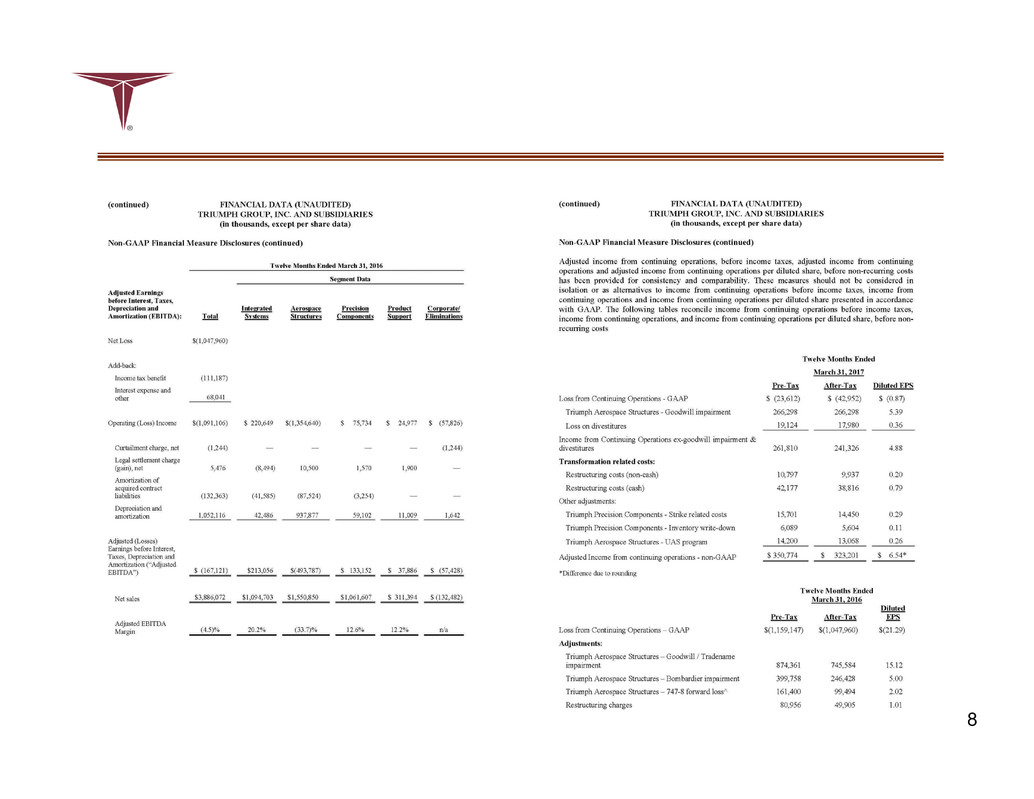

Company Overview 3 NYSE: TGI Headquarters: Berwyn, PA Incorporated: 1993 Employees: ~14,000 Fiscal year ending March 31 Market cap as of 6/15/17: $1.6 billion Shares outstanding: 49.6 million FY 2017 revenues: $3.5 billion FY 2017 adjusted EPS: $6.54** Backlog as of 3/31/17: $4.0 billion **Non-GAAP financial measure. See Appendix A for a reconciliation to GAAP financial measure and other information. Key Statistics

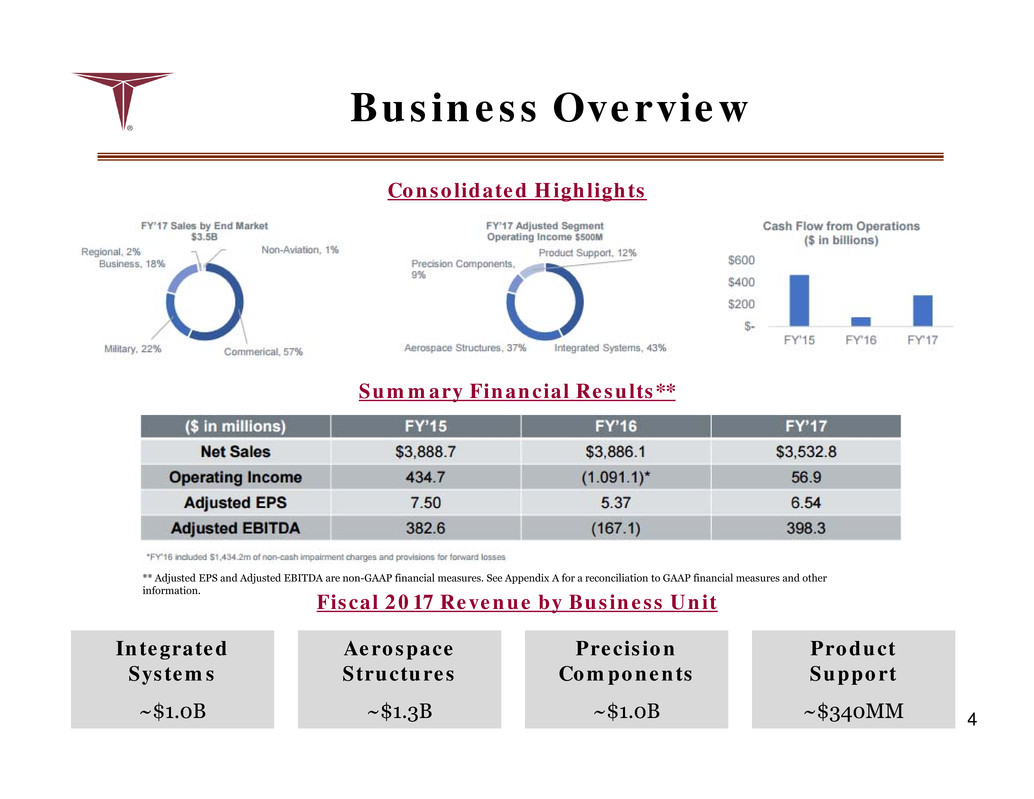

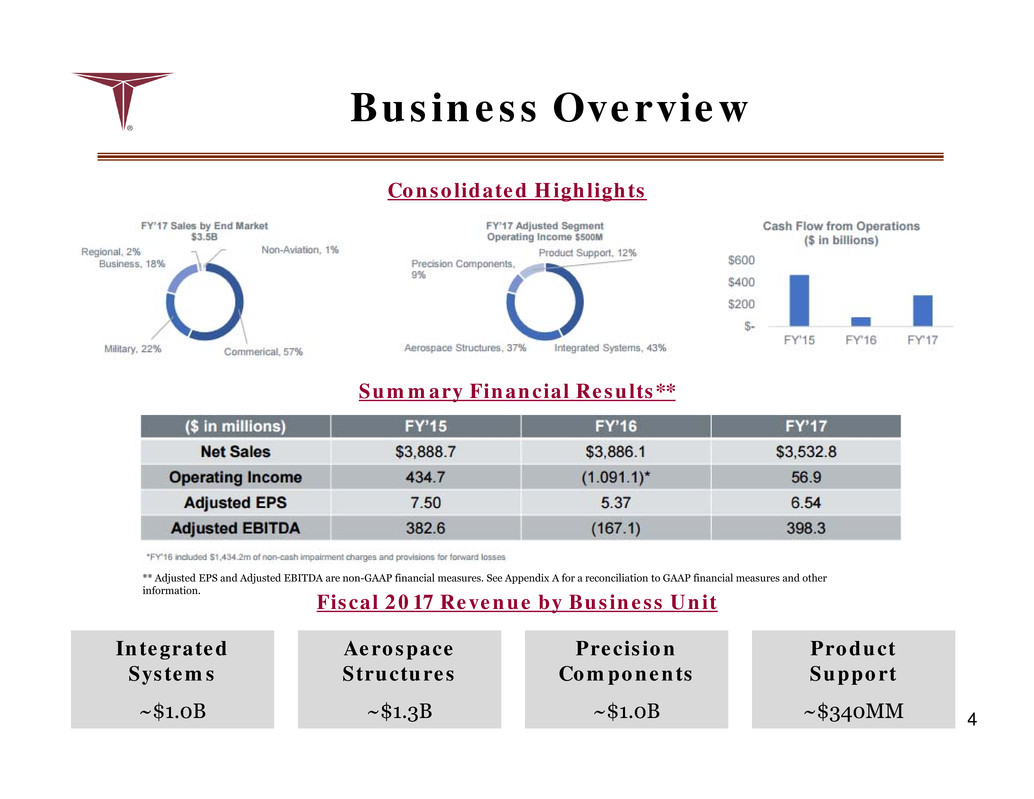

Business Overview 4 Fiscal 2017 Revenue by Business Unit Consolidated Highlights Integrated Systems ~$1.0B Aerospace Structures ~$1.3B Precision Components ~$1.0B Product Support ~$340MM Summary Financial Results** ** Adjusted EPS and Adjusted EBITDA are non-GAAP financial measures. See Appendix A for a reconciliation to GAAP financial measures and other information.

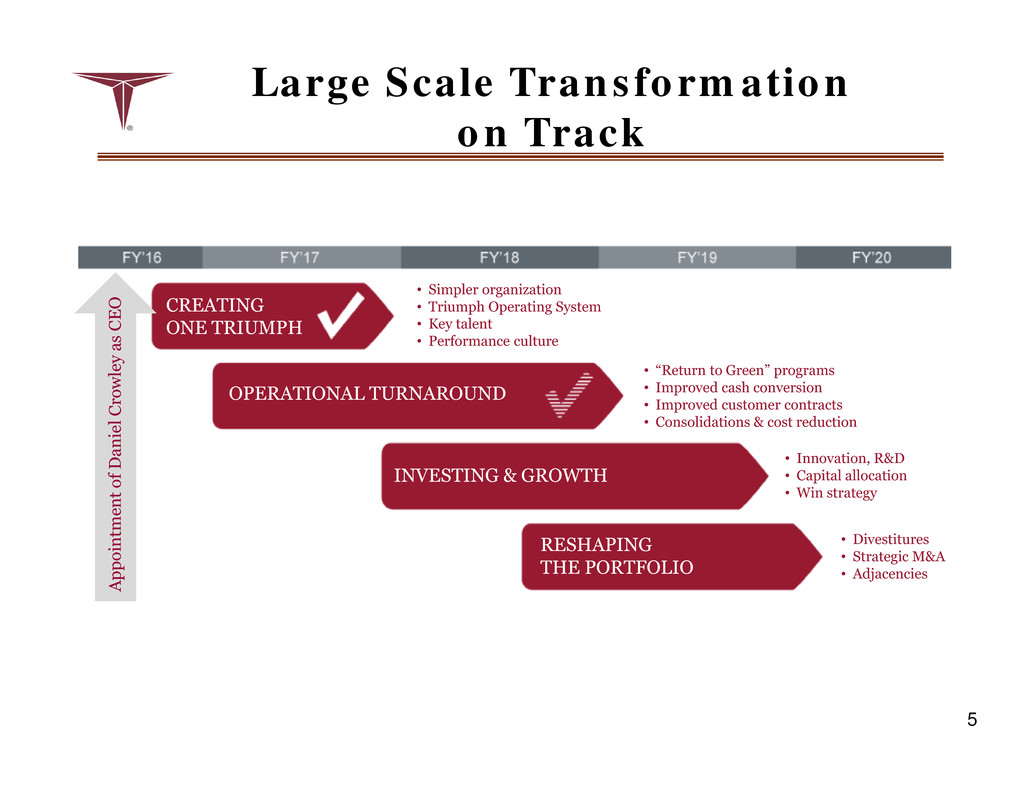

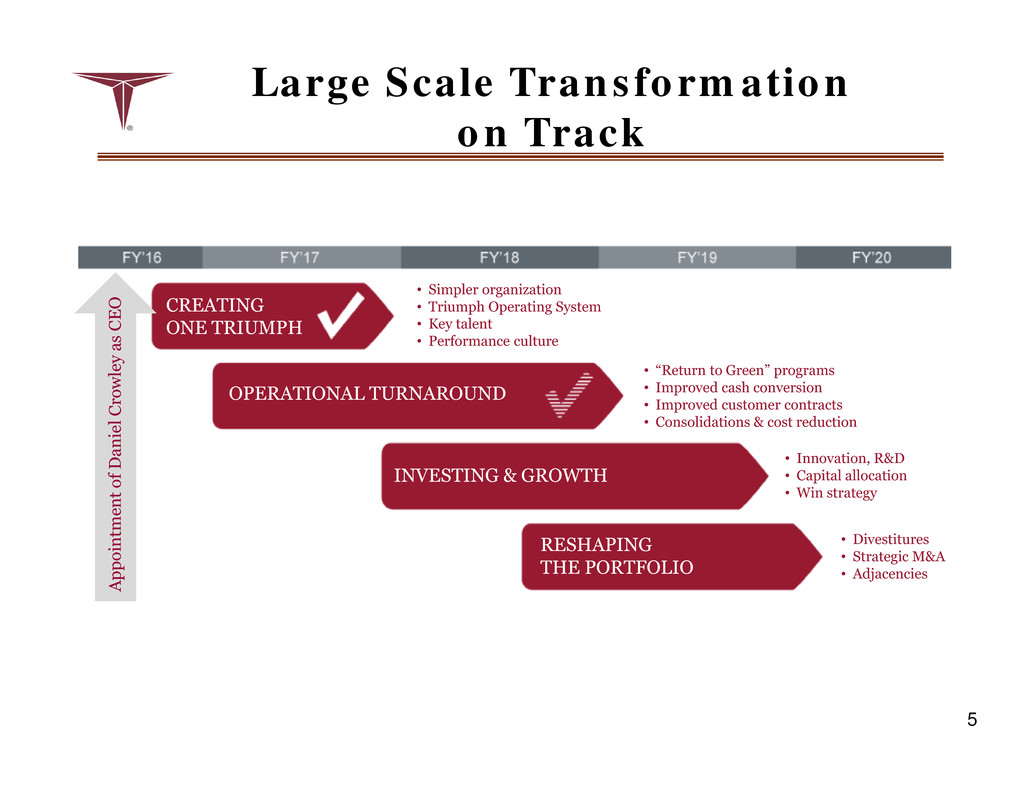

Large Scale Transformation on Track 5 RESHAPING THE PORTFOLIO INVESTING & GROWTH OPERATIONAL TURNAROUND CREATING ONE TRIUMPH • Innovation, R&D • Capital allocation • Win strategy • Divestitures • Strategic M&A • Adjacencies • “Return to Green” programs • Improved cash conversion • Improved customer contracts • Consolidations & cost reduction • Simpler organization • Triumph Operating System • Key talent • Performance culture A p p o i n t m e n t o f D a n i e l C r o w l e y a s C E O

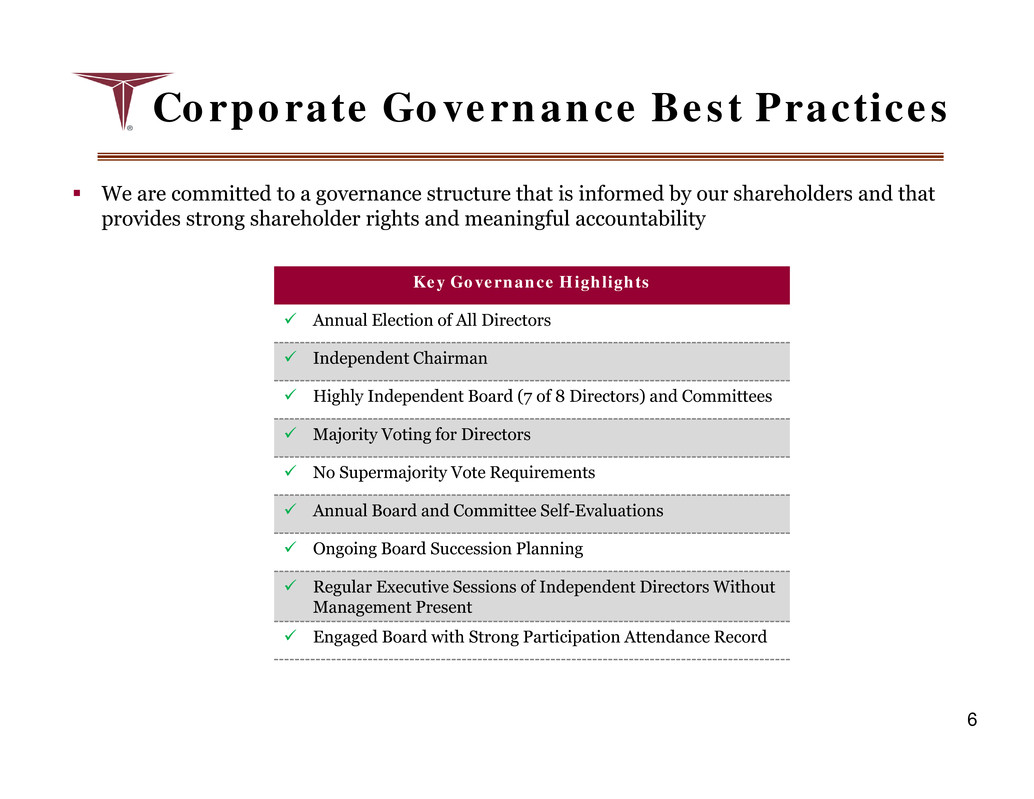

Corporate Governance Best Practices Key Governance Highlights Annual Election of All Directors Independent Chairman Highly Independent Board (7 of 8 Directors) and Committees Majority Voting for Directors No Supermajority Vote Requirements Annual Board and Committee Self-Evaluations Ongoing Board Succession Planning Regular Executive Sessions of Independent Directors Without Management Present Engaged Board with Strong Participation Attendance Record 6 We are committed to a governance structure that is informed by our shareholders and that provides strong shareholder rights and meaningful accountability

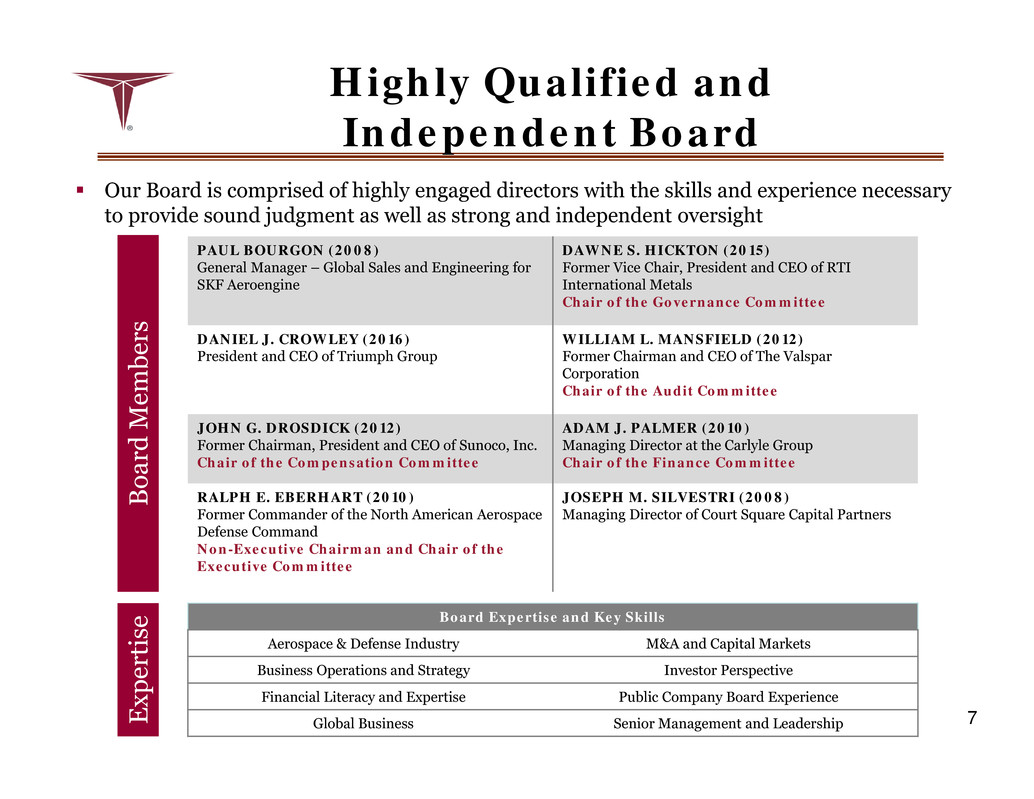

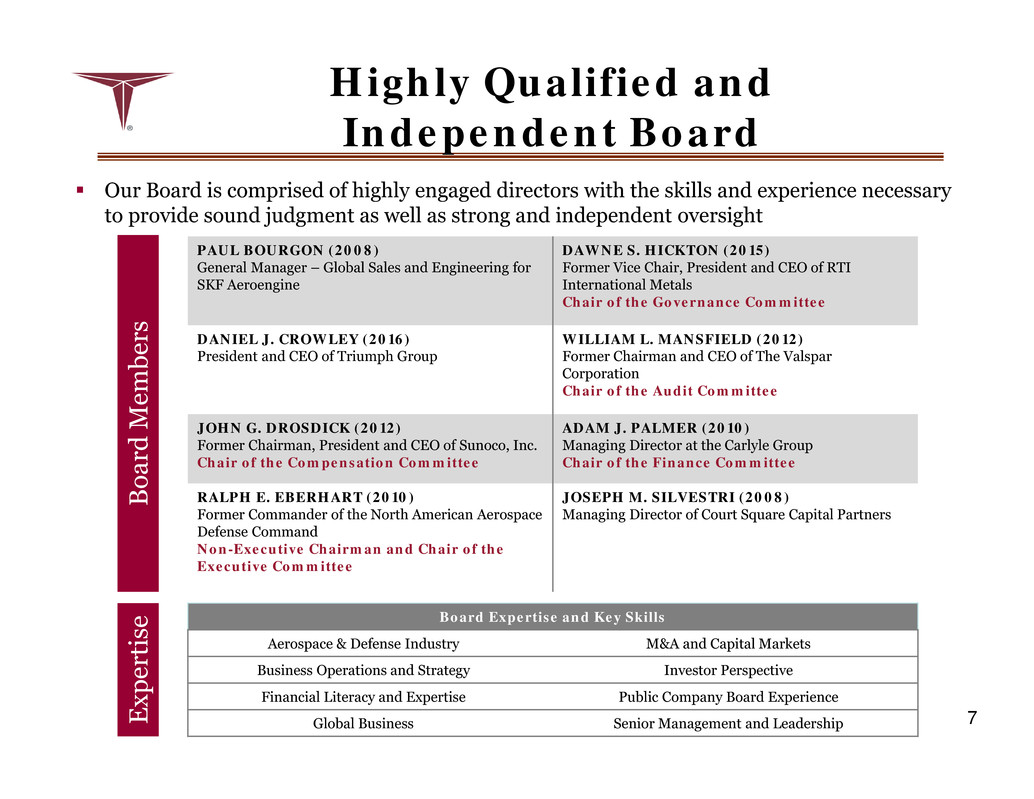

7 Our Board is comprised of highly engaged directors with the skills and experience necessary to provide sound judgment as well as strong and independent oversight Highly Qualified and Independent Board B o a r d M e m b e r s E x p e r t i s e Board Expertise and Key Skills Aerospace & Defense Industry M&A and Capital Markets Business Operations and Strategy Investor Perspective Financial Literacy and Expertise Public Company Board Experience Global Business Senior Management and Leadership PAUL BOURGON (2008) General Manager – Global Sales and Engineering for SKF Aeroengine DAWNE S. HICKTON (2015) Former Vice Chair, President and CEO of RTI International Metals Chair of the Governance Committee DANIEL J. CROWLEY (2016) President and CEO of Triumph Group WILLIAM L. MANSFIELD (2012) Former Chairman and CEO of The Valspar Corporation Chair of the Audit Committee JOHN G. DROSDICK (2012) Former Chairman, President and CEO of Sunoco, Inc. Chair of the Compensation Committee ADAM J. PALMER (2010) Managing Director at the Carlyle Group Chair of the Finance Committee RALPH E. EBERHART (2010) Former Commander of the North American Aerospace Defense Command Non-Executive Chairman and Chair of the Executive Committee JOSEPH M. SILVESTRI (2008) Managing Director of Court Square Capital Partners

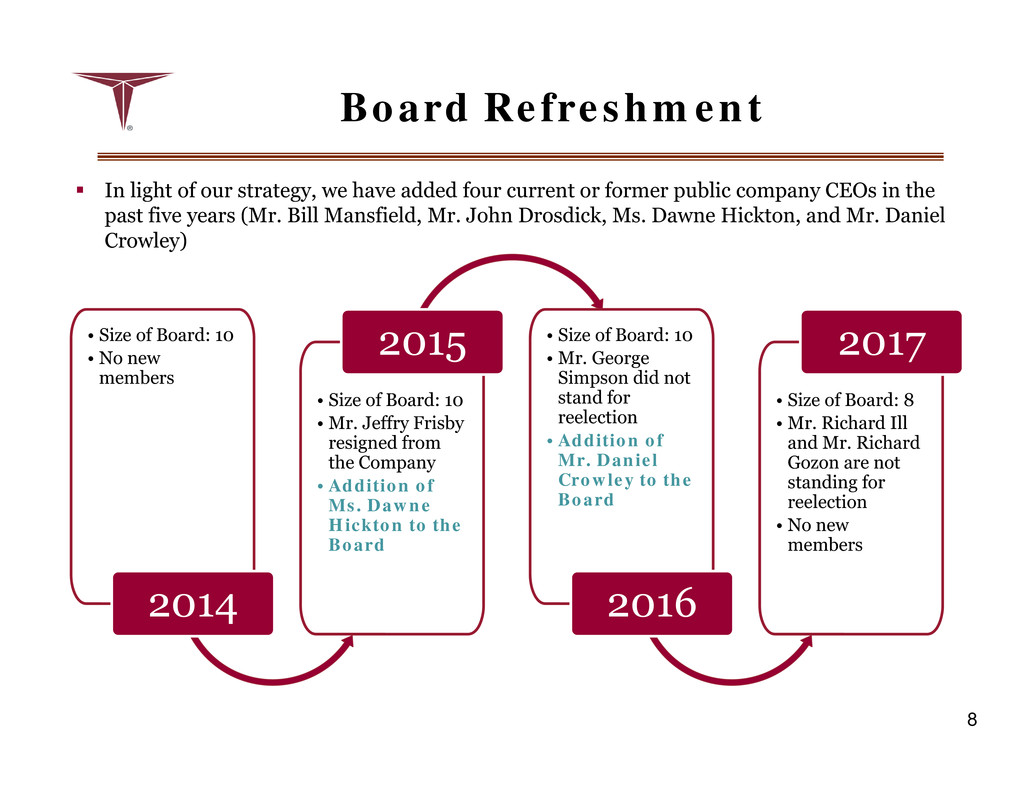

Board Refreshment • Size of Board: 10 • No new members 2014 • Size of Board: 10 • Mr. Jeffry Frisby resigned from the Company • Addition of Ms. Dawne Hickton to the Board 2015 • Size of Board: 10• Mr. George Simpson did not stand for reelection • Addition of Mr. Daniel Crowley to the Board 2016 • Size of Board: 8 • Mr. Richard Ill and Mr. Richard Gozon are not standing for reelection • No new members 2017 8 In light of our strategy, we have added four current or former public company CEOs in the past five years (Mr. Bill Mansfield, Mr. John Drosdick, Ms. Dawne Hickton, and Mr. Daniel Crowley)

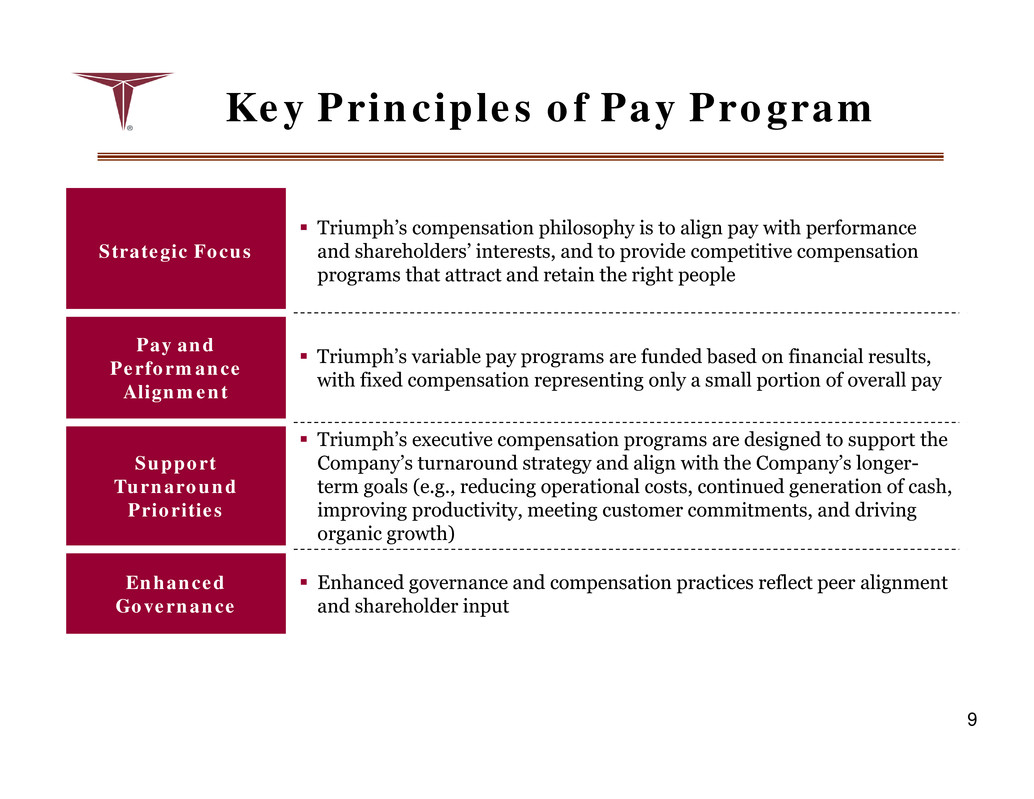

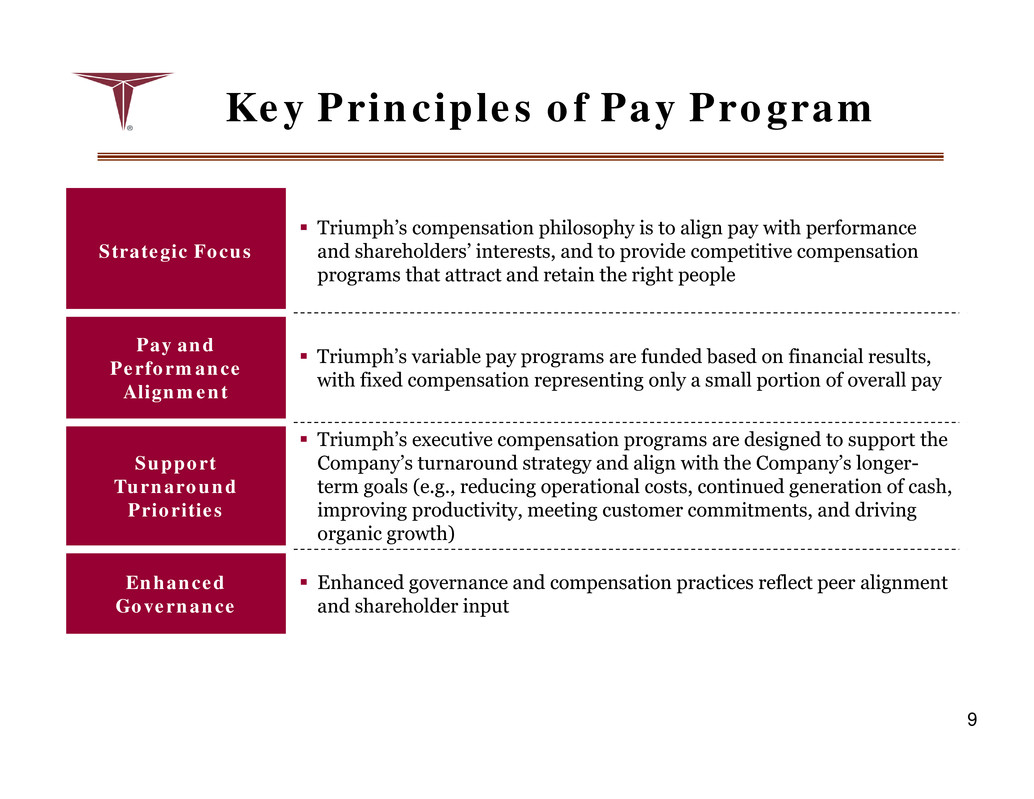

Key Principles of Pay Program 9 Strategic Focus Triumph’s compensation philosophy is to align pay with performance and shareholders’ interests, and to provide competitive compensation programs that attract and retain the right people Pay and Performance Alignment Triumph’s variable pay programs are funded based on financial results, with fixed compensation representing only a small portion of overall pay Support Turnaround Priorities Triumph’s executive compensation programs are designed to support the Company’s turnaround strategy and align with the Company’s longer- term goals (e.g., reducing operational costs, continued generation of cash, improving productivity, meeting customer commitments, and driving organic growth) Enhanced Governance Enhanced governance and compensation practices reflect peer alignment and shareholder input

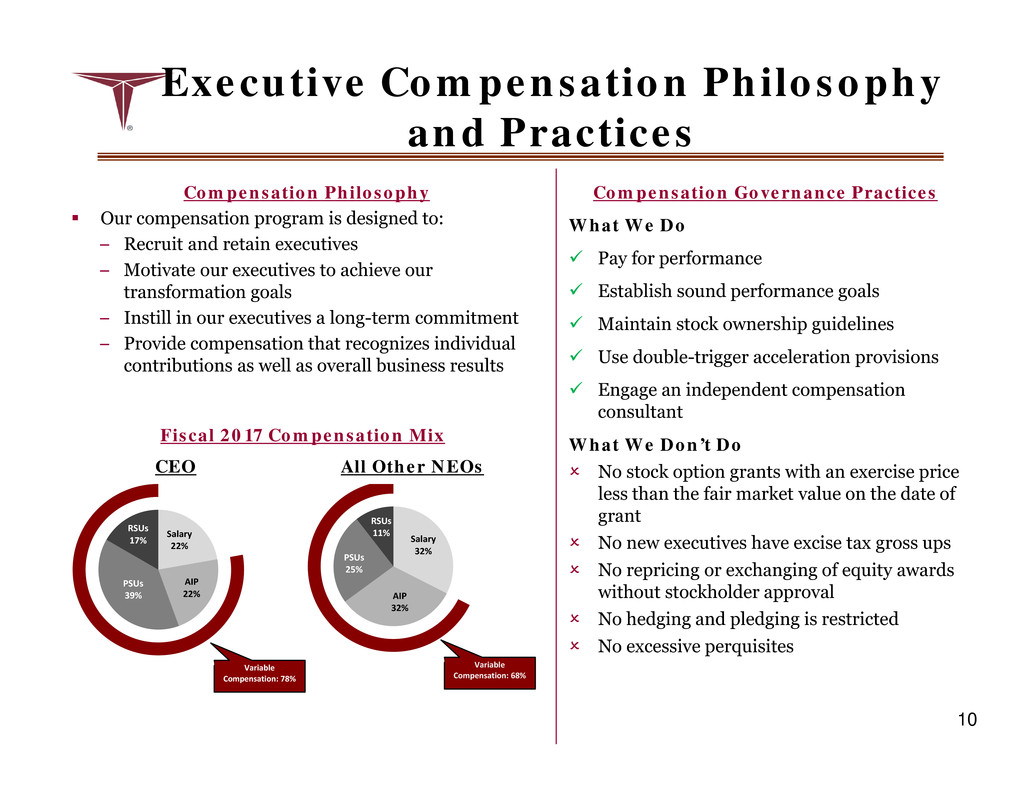

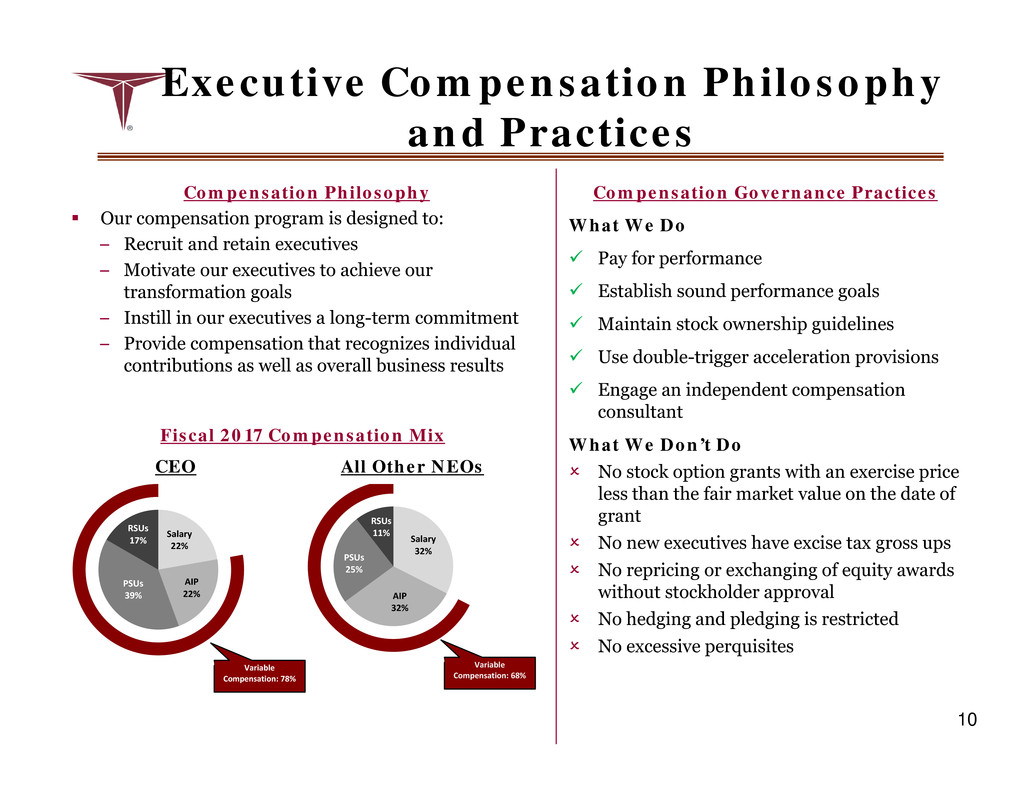

Executive Compensation Philosophy and Practices 10 Compensation Philosophy Our compensation program is designed to: – Recruit and retain executives – Motivate our executives to achieve our transformation goals – Instill in our executives a long-term commitment – Provide compensation that recognizes individual contributions as well as overall business results Fiscal 2017 Compensation Mix CEO All Other NEOs Compensation Governance Practices What We Do Pay for performance Establish sound performance goals Maintain stock ownership guidelines Use double-trigger acceleration provisions Engage an independent compensation consultant What We Don’t Do No stock option grants with an exercise price less than the fair market value on the date of grant No new executives have excise tax gross ups No repricing or exchanging of equity awards without stockholder approval No hedging and pledging is restricted No excessive perquisites Salary 22% AIP 22% PSUs 39% RSUs 17% Variable Compensation: 78% Salary 32% AIP 32% PSUs 25% RSUs 11% Variable Compensation: 68%

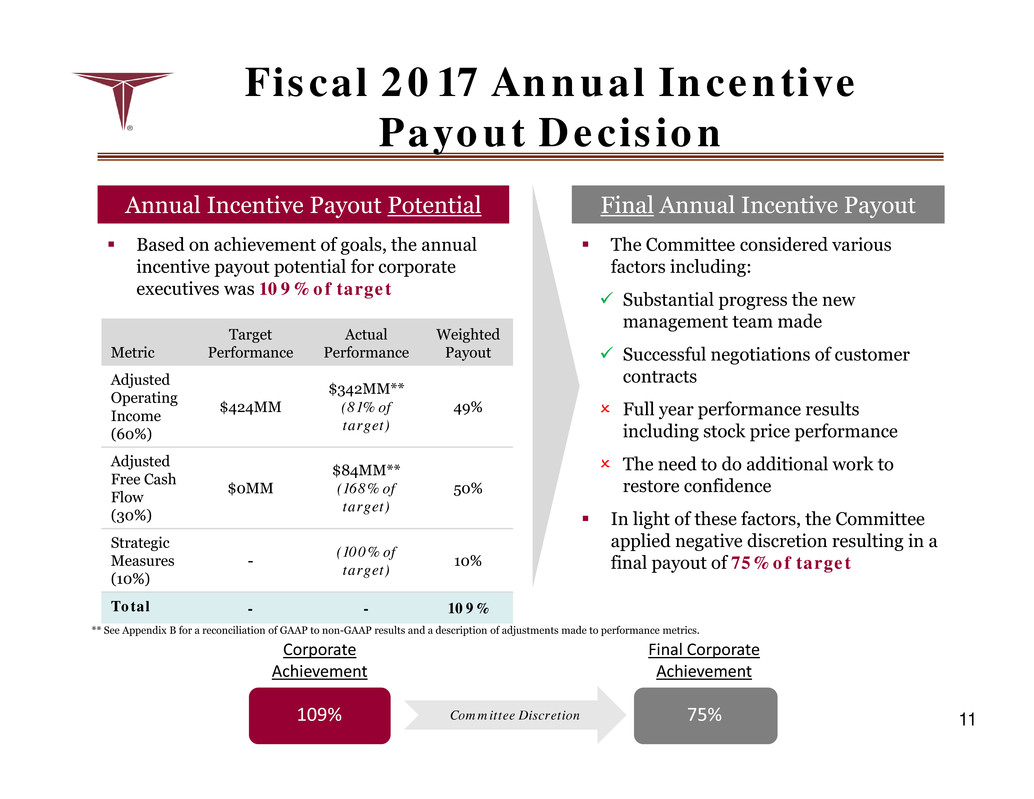

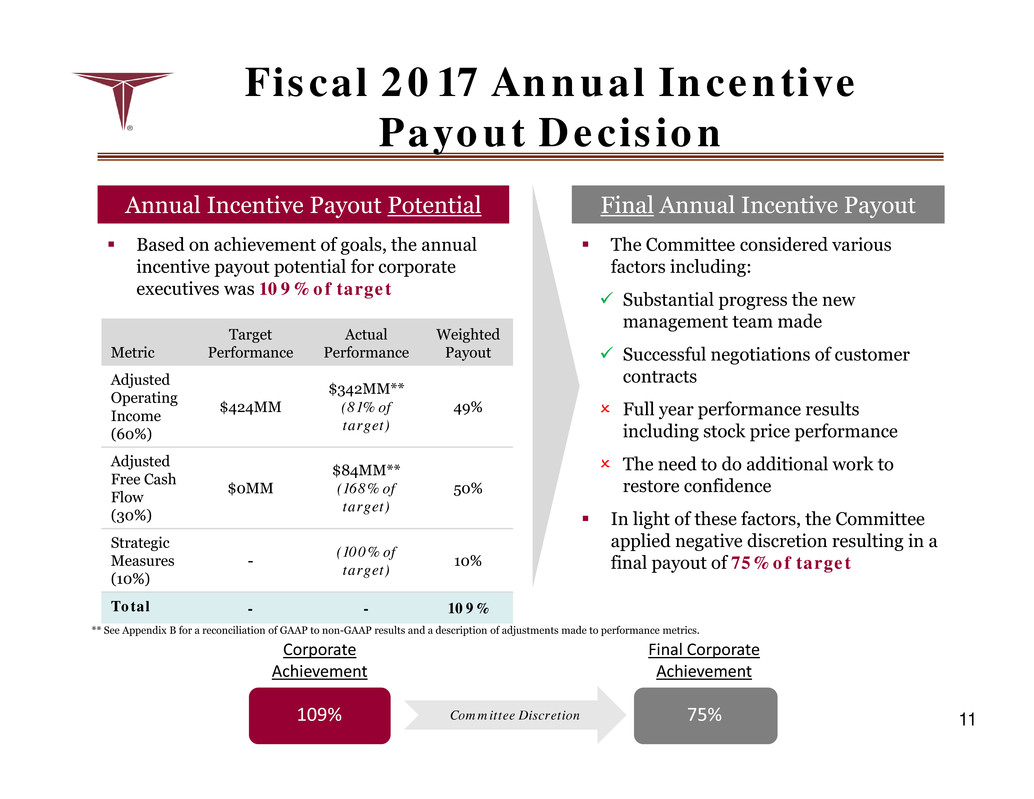

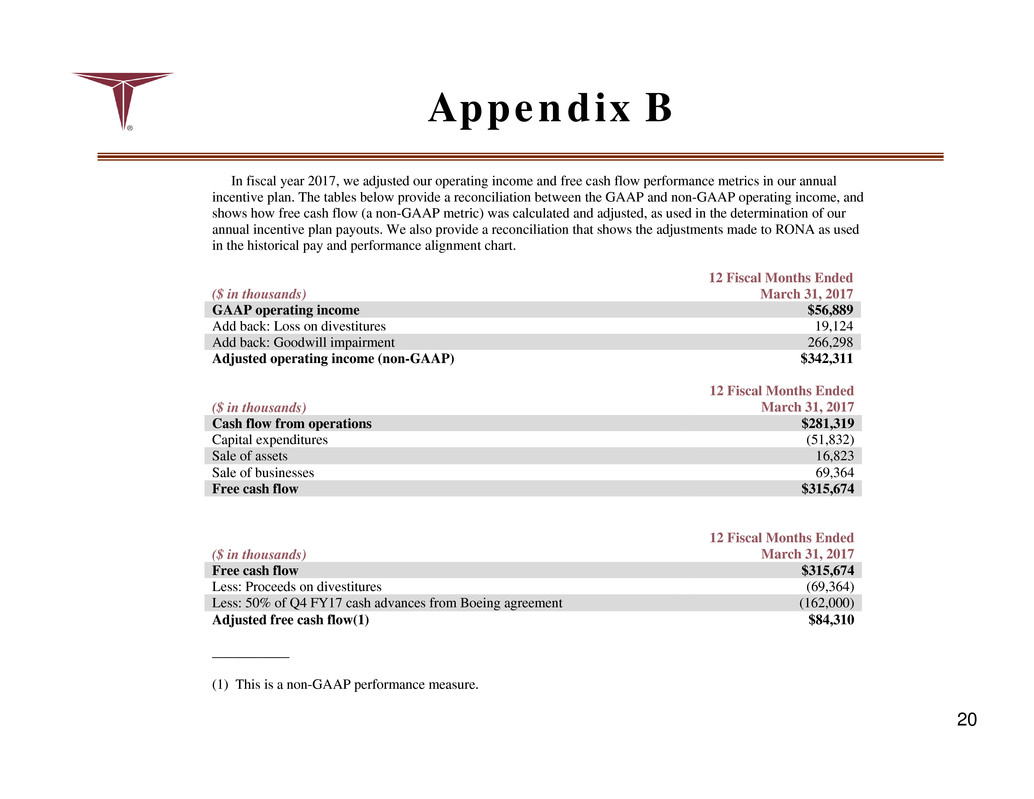

Fiscal 2017 Annual Incentive Payout Decision 11 Annual Incentive Payout Potential Final Annual Incentive Payout Based on achievement of goals, the annual incentive payout potential for corporate executives was 109% of target The Committee considered various factors including: Substantial progress the new management team made Successful negotiations of customer contracts Full year performance results including stock price performance The need to do additional work to restore confidence In light of these factors, the Committee applied negative discretion resulting in a final payout of 75% of target Metric Target Performance Actual Performance Weighted Payout Adjusted Operating Income (60%) $424MM $342MM** (81% of target) 49% Adjusted Free Cash Flow (30%) $0MM $84MM** (168% of target) 50% Strategic Measures (10%) - (100% of target) 10% Total - - 109% 109% Corporate Achievement Final Corporate Achievement 75%Committee Discretion ** See Appendix B for a reconciliation of GAAP to non-GAAP results and a description of adjustments made to performance metrics.

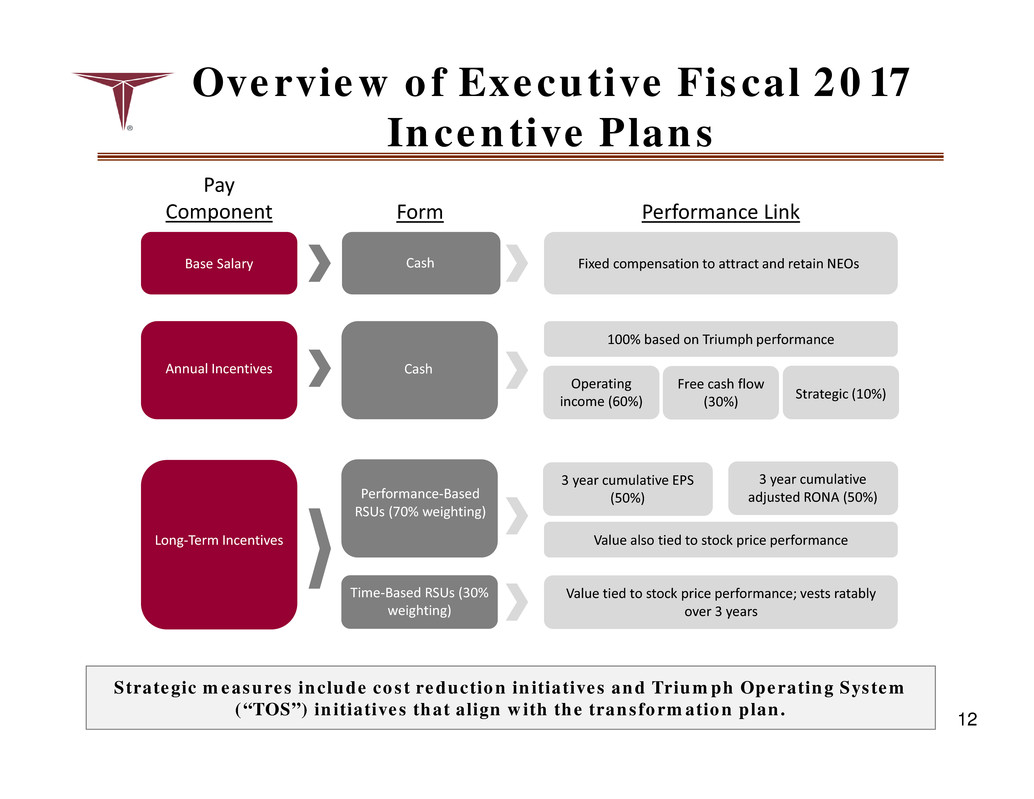

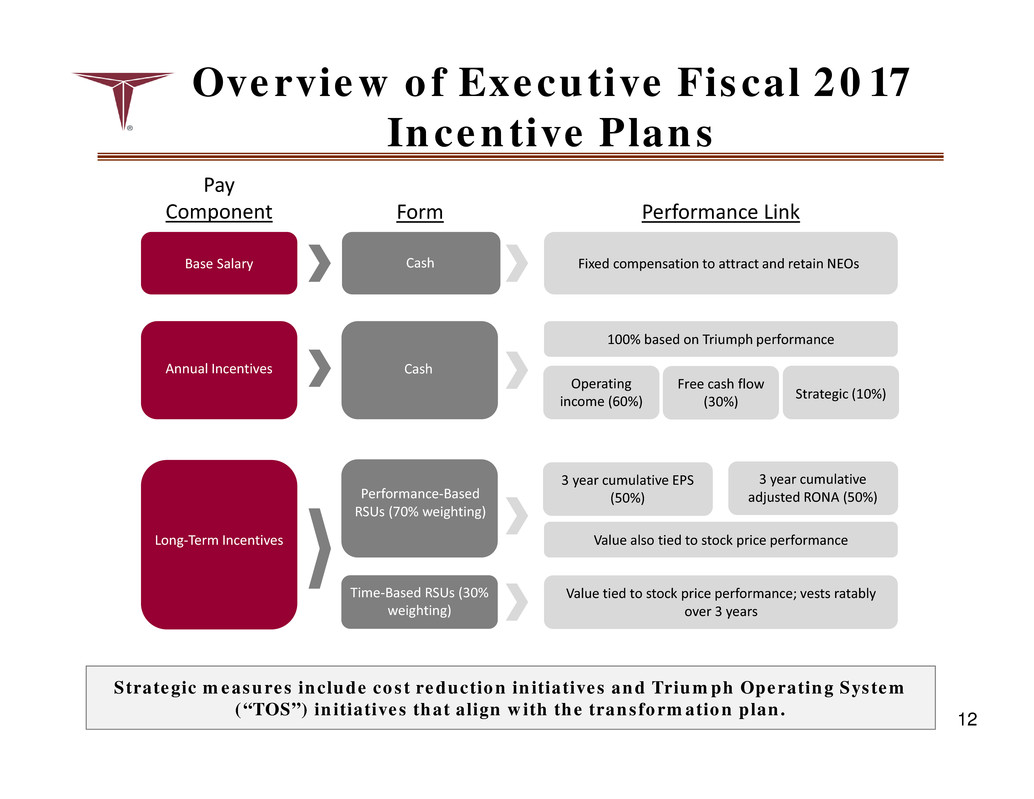

Overview of Executive Fiscal 2017 Incentive Plans 12 Performance‐Based RSUs (70% weighting) Base Salary Annual Incentives Long‐Term Incentives Pay Component Form Performance Link Cash Cash Time‐Based RSUs (30% weighting) Fixed compensation to attract and retain NEOs 100% based on Triumph performance Value tied to stock price performance; vests ratably over 3 years Operating income (60%) Free cash flow (30%) Strategic (10%) Value also tied to stock price performance 3 year cumulative EPS (50%) 3 year cumulative adjusted RONA (50%) Strategic measures include cost reduction initiatives and Triumph Operating System (“TOS”) initiatives that align with the transformation plan.

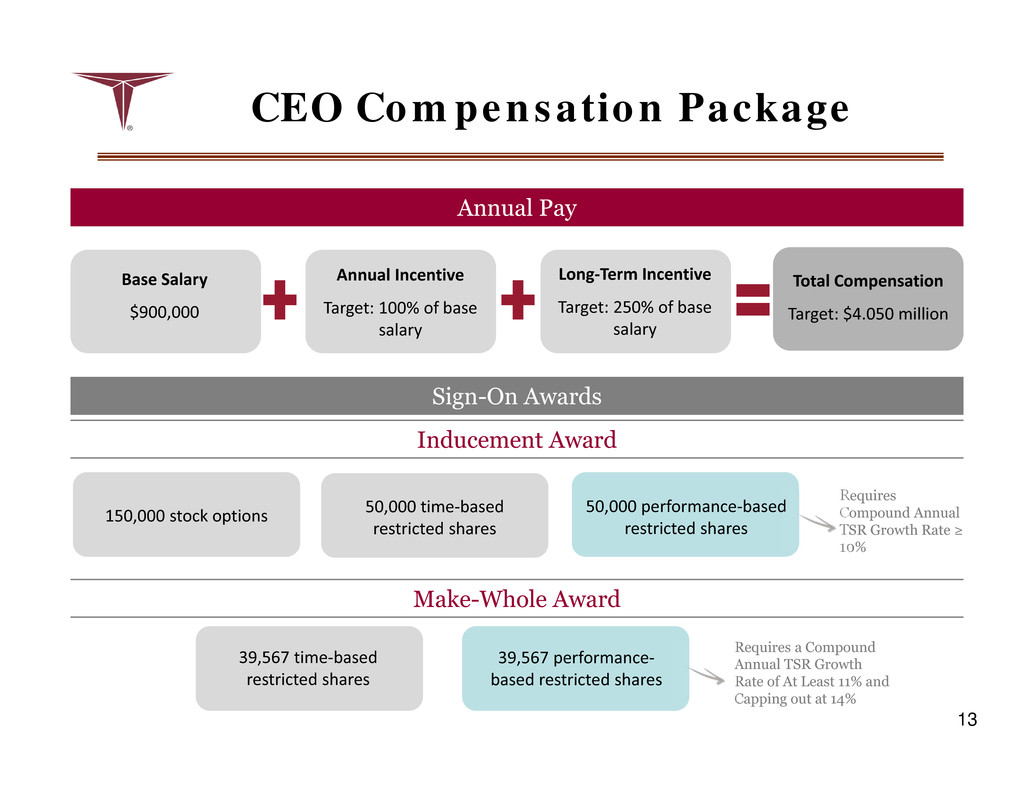

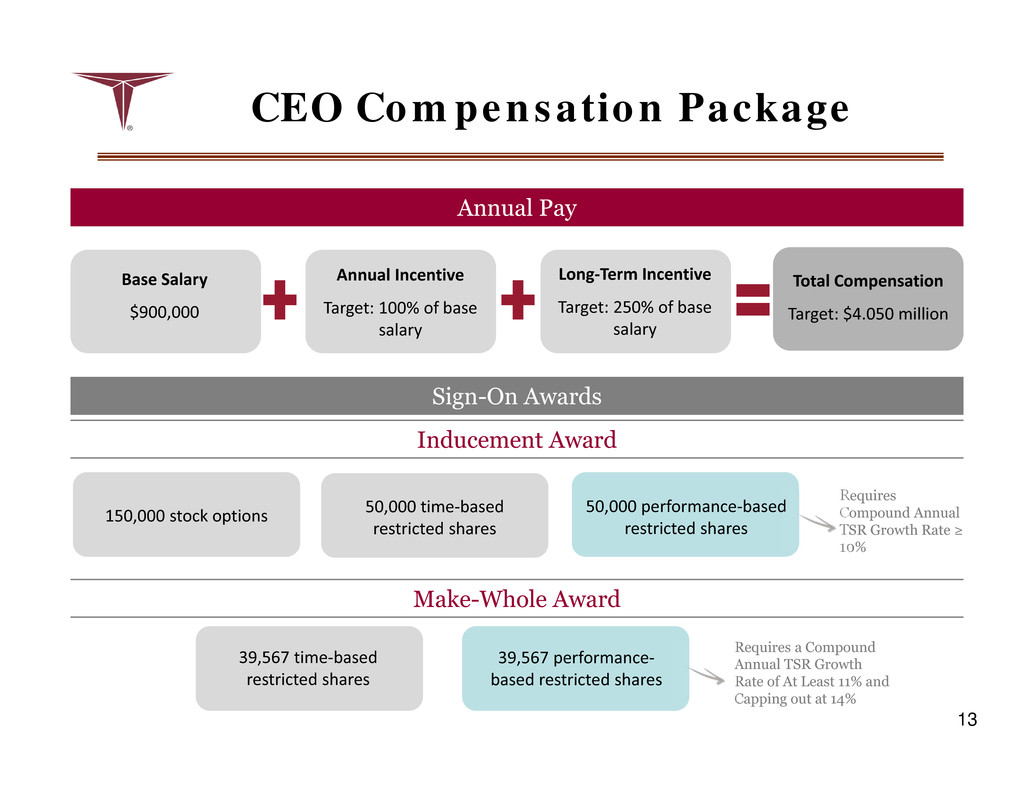

CEO Compensation Package 13 Annual Pay Base Salary $900,000 Annual Incentive Target: 100% of base salary Long‐Term Incentive Target: 250% of base salary Total Compensation Target: $4.050 million Sign-On Awards 150,000 stock options Inducement Award Make-Whole Award 50,000 time‐based restricted shares 50,000 performance‐based restricted shares 39,567 time‐based restricted shares 39,567 performance‐ based restricted shares Requires Compound Annual TSR Growth Rate ≥ 10% Requires a Compound Annual TSR Growth Rate of At Least 11% and Capping out at 14%

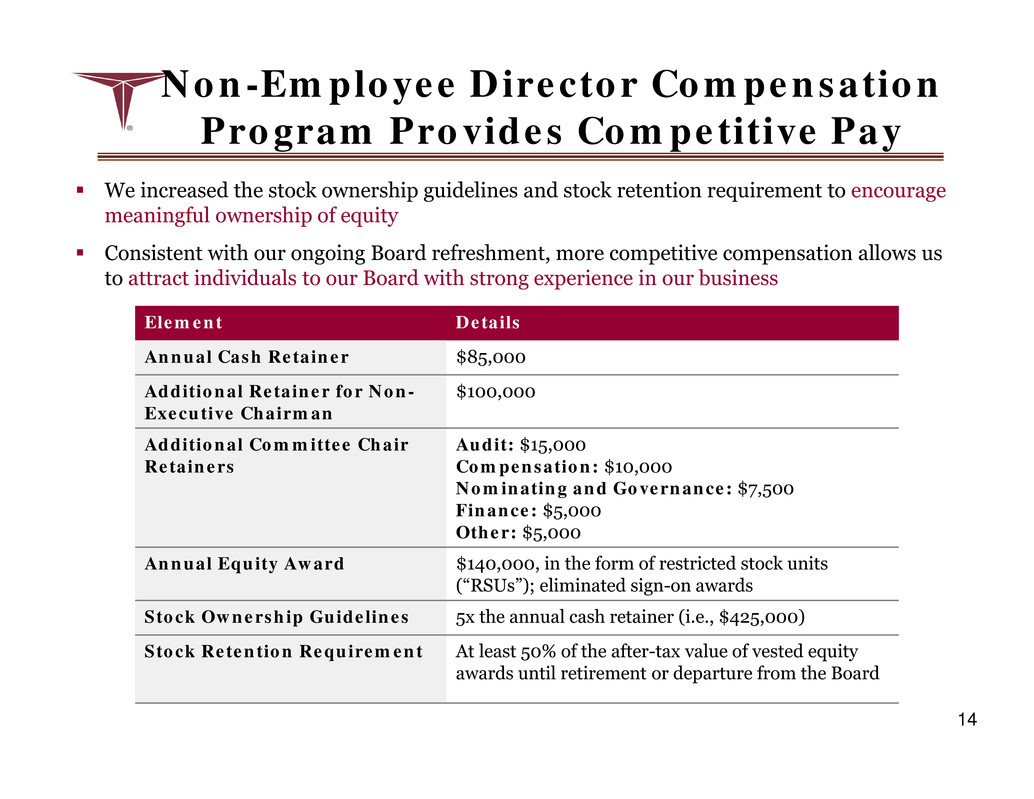

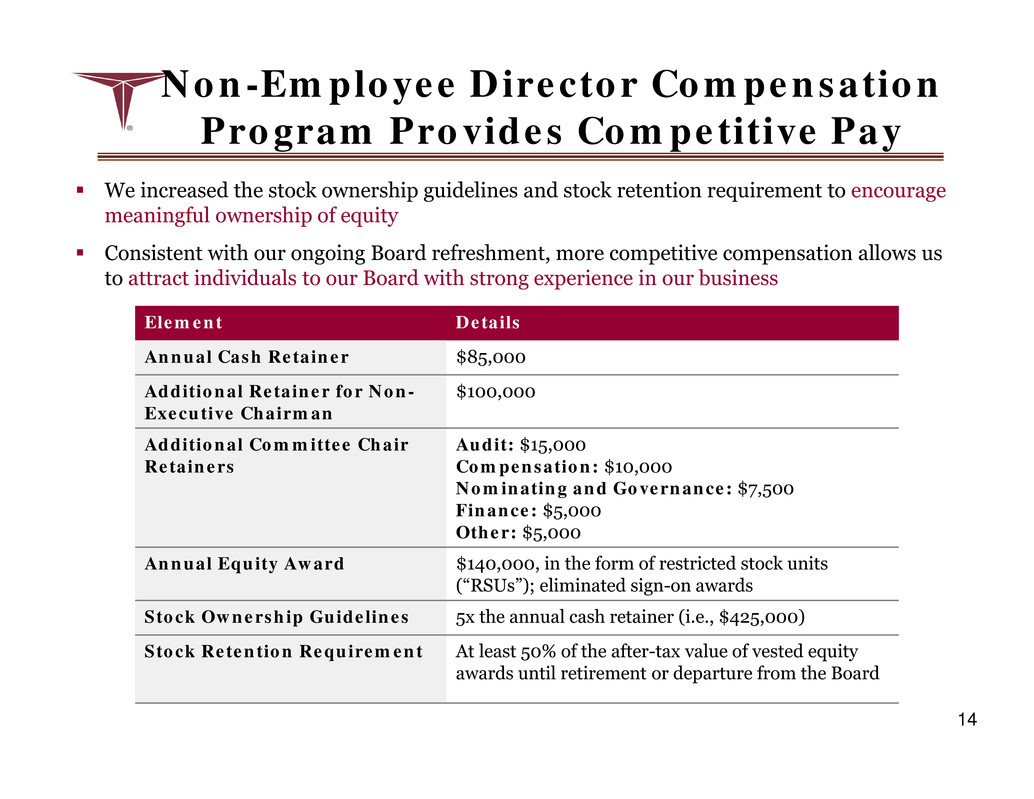

Non-Employee Director Compensation Program Provides Competitive Pay Element Details Annual Cash Retainer $85,000 Additional Retainer for Non- Executive Chairman $100,000 Additional Committee Chair Retainers Audit: $15,000 Compensation: $10,000 Nominating and Governance: $7,500 Finance: $5,000 Other: $5,000 Annual Equity Award $140,000, in the form of restricted stock units (“RSUs”); eliminated sign-on awards Stock Ownership Guidelines 5x the annual cash retainer (i.e., $425,000) Stock Retention Requirement At least 50% of the after-tax value of vested equity awards until retirement or departure from the Board 14 We increased the stock ownership guidelines and stock retention requirement to encourage meaningful ownership of equity Consistent with our ongoing Board refreshment, more competitive compensation allows us to attract individuals to our Board with strong experience in our business

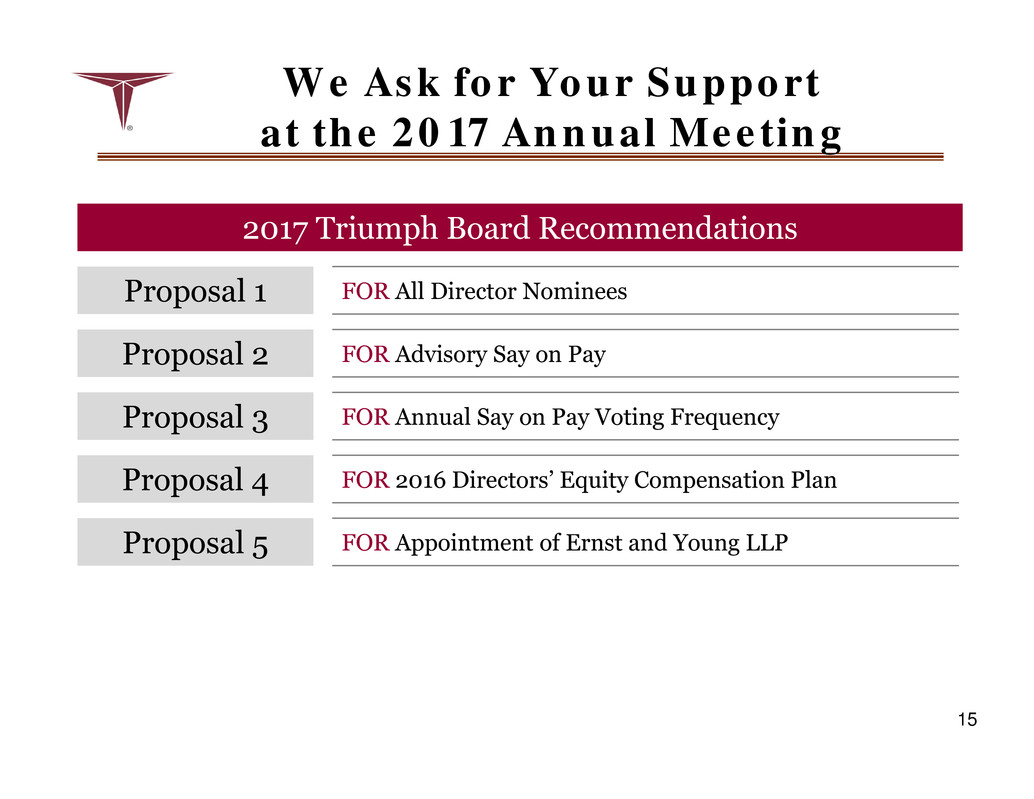

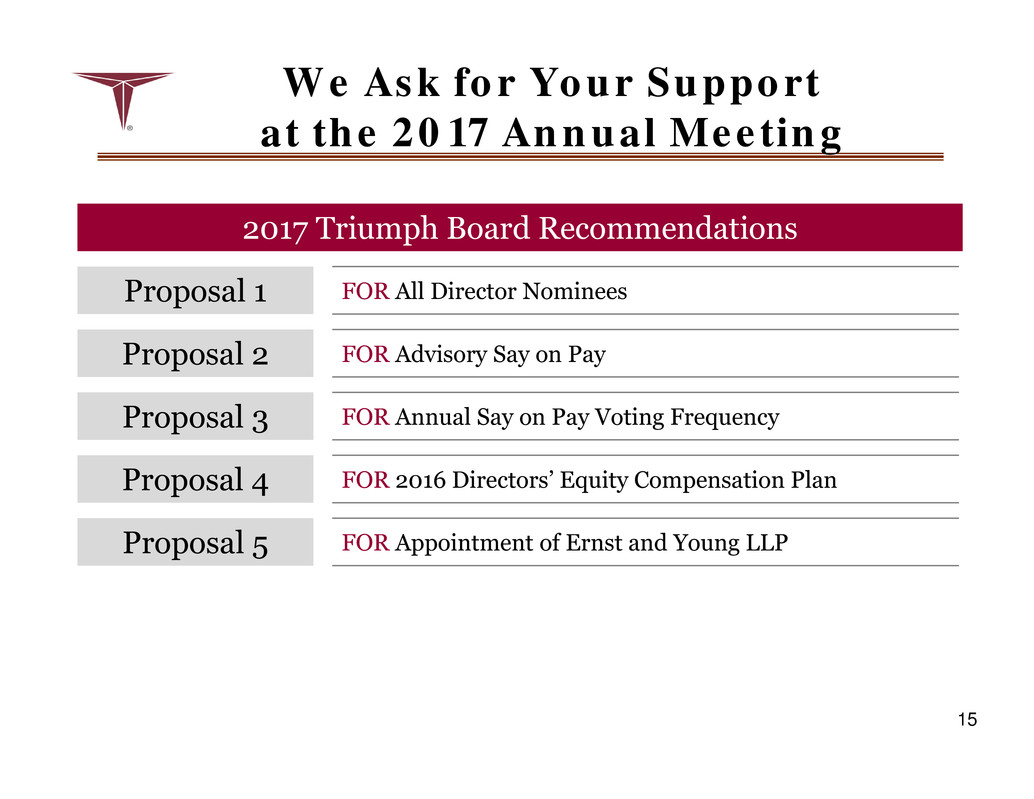

We Ask for Your Support at the 2017 Annual Meeting 15 2017 Triumph Board Recommendations Proposal 1 FOR All Director Nominees Proposal 2 FOR Advisory Say on Pay Proposal 3 FOR Annual Say on Pay Voting Frequency Proposal 4 FOR 2016 Directors’ Equity Compensation Plan Proposal 5 FOR Appointment of Ernst and Young LLP

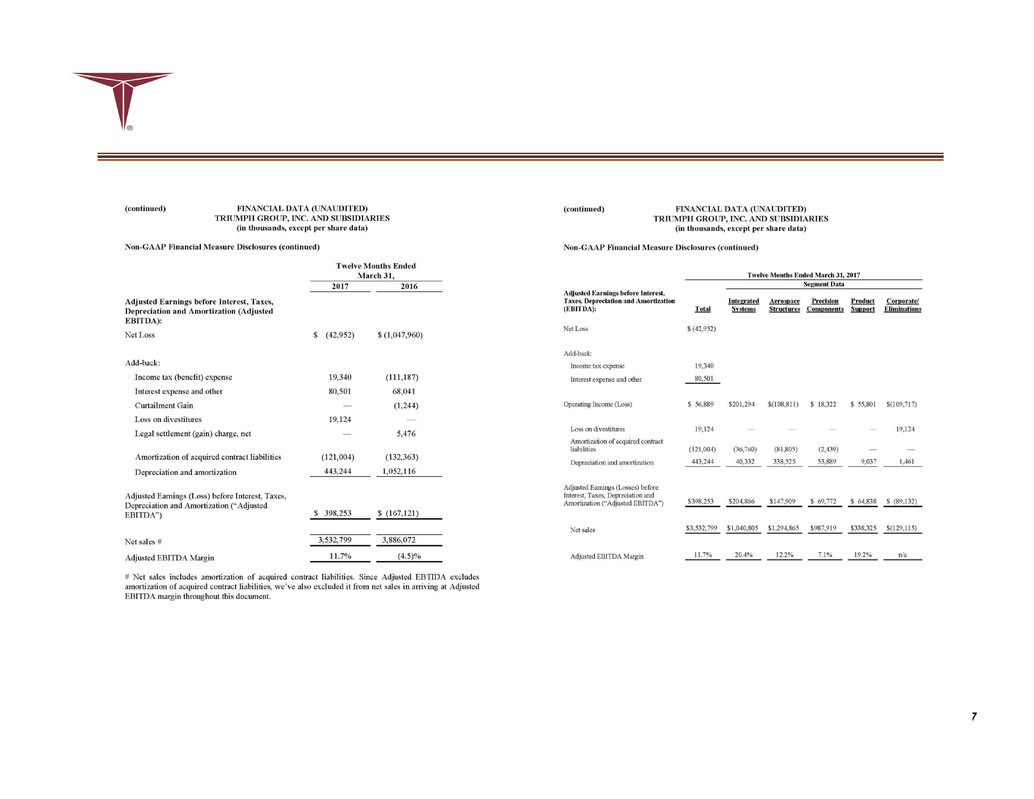

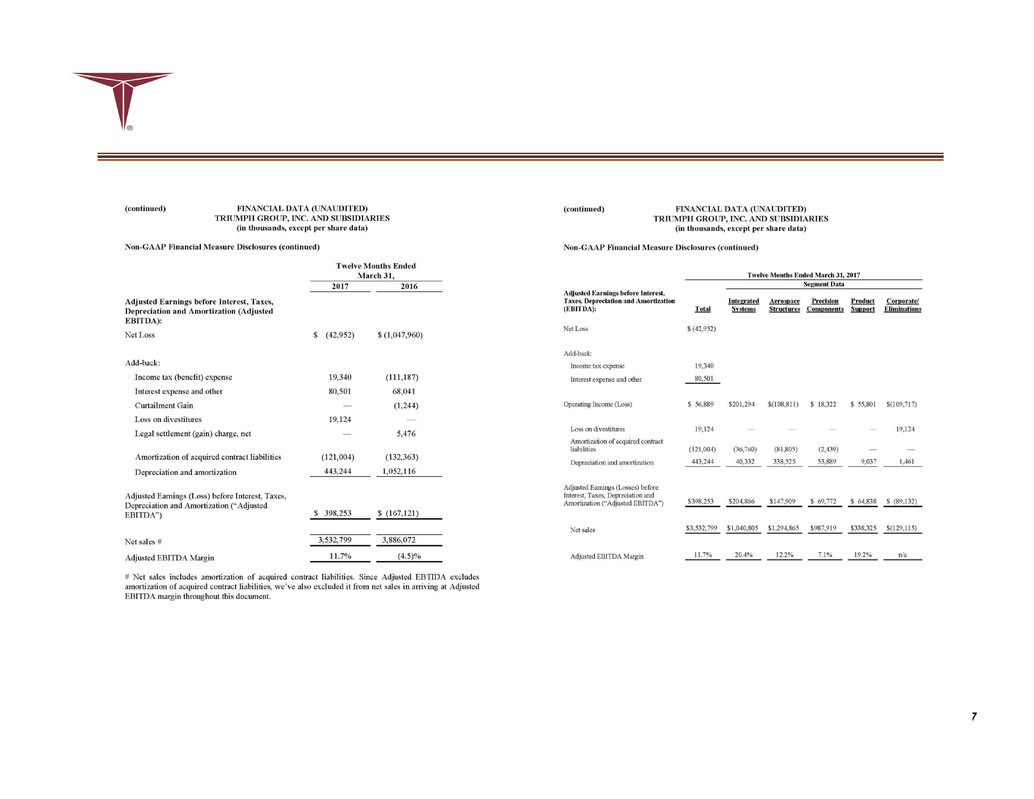

Appendix A 16

17

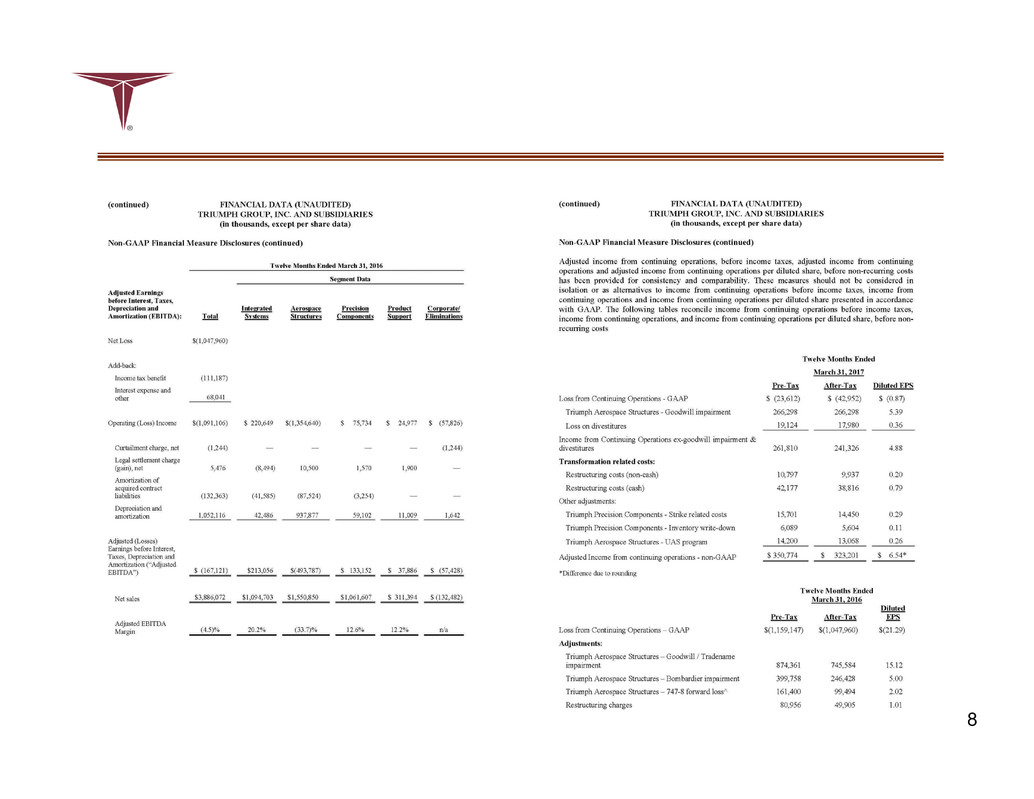

18

19

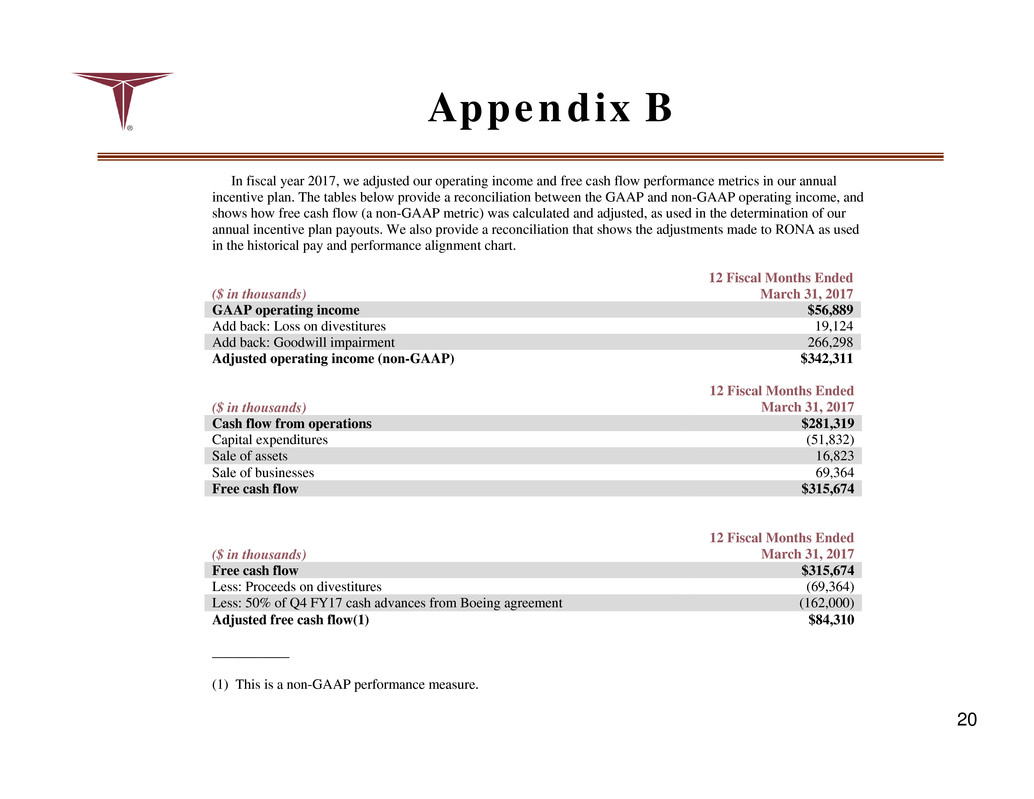

Appendix B 20 In fiscal year 2017, we adjusted our operating income and free cash flow performance metrics in our annual incentive plan. The tables below provide a reconciliation between the GAAP and non-GAAP operating income, and shows how free cash flow (a non-GAAP metric) was calculated and adjusted, as used in the determination of our annual incentive plan payouts. We also provide a reconciliation that shows the adjustments made to RONA as used in the historical pay and performance alignment chart. ($ in thousands) 12 Fiscal Months Ended March 31, 2017 GAAP operating income $56,889 Add back: Loss on divestitures 19,124 Add back: Goodwill impairment 266,298 Adjusted operating income (non-GAAP) $342,311 ($ in thousands) 12 Fiscal Months Ended March 31, 2017 Cash flow from operations $281,319 Capital expenditures (51,832) Sale of assets 16,823 Sale of businesses 69,364 Free cash flow $315,674 ($ in thousands) 12 Fiscal Months Ended March 31, 2017 Free cash flow $315,674 Less: Proceeds on divestitures (69,364) Less: 50% of Q4 FY17 cash advances from Boeing agreement (162,000) Adjusted free cash flow(1) $84,310 ___________ (1) This is a non-GAAP performance measure.