- TGI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Triumph (TGI) DEF 14ADefinitive proxy

Filed: 9 Jun 17, 12:00am

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Triumph Group, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

| Triumph Group, Inc. |

To the holders of shares of our common stock:

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of Triumph Group, Inc. ("Triumph" or the "Company") will be held at899 Cassatt Road, Suite 210, Berwyn, Pennsylvania 19312, on Thursday, July 20, 2017, beginning at 9:00 a.m., local time, for the following purposes:

Management currently knows of no other business to be presented at the meeting. If any other matters come before the meeting, the persons named in the accompanying proxy will vote with their judgment on those matters.

On June 9, 2017, we began mailing to certain stockholders a Notice Regarding the Availability of Proxy Materials (the "Notice") for the 2017 Annual Meeting of Stockholders (the "Annual Meeting") to be held on July 20, 2017 containing instructions on how to access this proxy statement and our annual report and how to vote online. By furnishing the Notice instead of a printed copy of the proxy materials, we are lowering printing and mailing costs and reducing the environmental impact of the Annual Meeting. If you received the Notice, you will not receive a printed copy of the proxy materials unless you request it by following the instructions for requesting such materials contained in the Notice.

Only stockholders of record at the close of business on May 26, 2017 are entitled to notice of, and to vote at, the Annual Meeting and any postponement or adjournment thereof. All stockholders are cordially invited to attend the Annual Meeting in person. Any stockholder of record at the close of business on May 26, 2017 attending the Annual Meeting may vote in person even if such stockholder previously signed and returned a proxy. If you do attend the Annual Meeting, you may then withdraw your proxy and vote your shares in person. In any event, you may revoke your proxy prior to its exercise.

| By order of the Board of Directors, | ||

John B. Wright, II Secretary |

June 9, 2017

Berwyn, Pennsylvania

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. You may vote in person at the Annual Meeting, by telephone or Internet (instructions are on your proxy card, voter instruction form or the Notice, as applicable) or, if you received your materials by mail, by completing, signing and mailing the enclosed proxy card in the enclosed envelope.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2017

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 20, 2017.

Triumph Group, Inc.'s proxy statement for the 2017 Annual Meeting of Stockholders, the Annual Report on Form 10-K for the fiscal year ended March 31, 2017 and the 2017 Annual Report to Stockholders are available via the Internet atwww.proxyvote.com.

| | Page | |

|---|---|---|

GENERAL INFORMATION | 1 | |

VOTE REQUIRED FOR APPROVAL | 2 | |

PROPOSALS TO STOCKHOLDERS | 4 | |

Proposal No. 1—Election of Directors | 4 | |

Proposal No. 2—Advisory Vote on Compensation Paid to Named Executive Officers for Fiscal Year 2017 | 7 | |

Proposal No. 3—Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation | 9 | |

Proposal No. 4—Approval of the Triumph Group, Inc. 2016 Directors' Equity Compensation Plan | 10 | |

Proposal No. 5—Ratification of Selection of Registered Public Accounting Firm | 18 | |

OTHER MATTERS | 19 | |

GOVERNANCE OF TRIUMPH | 19 | |

Corporate Governance Guidelines | 19 | |

Code of Business Conduct | 19 | |

Anti-Hedging Policy | 19 | |

Board of Directors | 19 | |

AUDIT COMMITTEE REPORT | 27 | |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 28 | |

EXECUTIVE COMPENSATION | 29 | |

Compensation Discussion and Analysis | 29 | |

Other Compensation Matters | 54 | |

Compensation Committee Report | 55 | |

Executive Compensation Tables | 56 | |

EQUITY COMPENSATION PLAN INFORMATION | 66 | |

SECURITY OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT | 67 | |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 70 | |

STOCKHOLDER PROPOSALS—2018 ANNUAL MEETING OF STOCKHOLDERS | 70 | |

HOUSEHOLDING OF PROXY MATERIALS | 70 | |

ANNUAL REPORT ON FORM 10-K | 71 | |

APPENDIX A—2016 DIRECTORS' EQUITY COMPENSATION PLAN | A-1 | |

APPENDIX B—RECONCILIATION OF GAAP AND NON-GAAP FINANCIAL MEASURES AND ADJUSTMENTS MADE TO NON-GAAP PERFORMANCE METRICS | B-1 |

i

|

|

Triumph Group, Inc. ("Triumph", the "Company", "we", "us" or "our") first made these materials available to stockholders on or about June 9, 2017 on the Internet or, upon your request, has delivered printed proxy materials to you, in connection with the solicitation of proxies by the Board of Directors of the Company for use at our annual meeting of stockholders on Thursday, July 20, 2017 (the "Annual Meeting"), to be held at 9:00 a.m., local time, at899 Cassatt Road, Suite 210, Berwyn, Pennsylvania 19312, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting.

In accordance with rules adopted by the Securities and Exchange Commission ("SEC"), we may furnish proxy materials, including this proxy statement and our 2017 Annual Report to Stockholders, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice Regarding the Availability of Proxy Materials (the "Notice") for the Annual Meeting which was mailed to most of our stockholders, will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice also instructs you as to how you may submit your proxy on the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice. You may request printed copies up until one year after the date of the Annual Meeting.

The Notice provides you with instructions on how to view our proxy materials for the Annual Meeting on the Internet. The website on which you will be able to view our proxy materials will also allow you to choose to receive future proxy materials electronically, which will save the Company the cost of printing and mailing documents to you. If you choose to receive future proxy materials electronically, you will receive an email next year with instructions containing a link to the proxy voting site. Your election to receive proxy materials electronically will remain in effect until you terminate it.

Sending a signed proxy will not affect your right to attend the Annual Meeting and vote in person because the proxy is revocable. You have the power to revoke your proxy by, among other methods, giving written notice to the Secretary of the Company at any time before your proxy is exercised or by attending the Annual Meeting and voting in person. Directions to the Annual Meeting can be found on our website athttp://triumphgroup.com/contact-us/solutions.

In the absence of contrary instructions, your shares included on the Notice or the proxy card, as the case may be, will be voted:

"FOR" the eight nominees for director stated thereon;

"FOR" the approval, by advisory vote, of the compensation paid to our named executive officers for fiscal year 2017;

"ONE YEAR" for, the approval, by advisory vote, of the frequency of future advisory votes on executive compensation;

"FOR" the approval of the Triumph Group, Inc. 2016 Directors' Equity Compensation Plan; and

"FOR" the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2018.

We will pay for this proxy solicitation. Our officers and other regular employees may solicit proxies by mail, in person or by telephone or electronic communication. These officers and other regular employees will not receive additional compensation. We are required to pay, upon request, the reasonable expenses incurred by record holders of common stock who are brokers, dealers, banks, voting trustees or other nominees for mailing proxy material and annual stockholder reports to any beneficial owners of common stock they hold of record.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2017 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 20, 2017.

Triumph Group Inc.'s proxy statement for the 2017 Annual Meeting of Stockholders, the Annual Report on Form 10-K for the fiscal year ended March 31, 2017, and the 2017 Annual Report to Stockholders are available via the Internet atwww.proxyvote.com.

Holders of record of our common stock as of the close of business on May 26, 2017, the record date, will be entitled to notice of and to vote at the Annual Meeting and at any adjournments. Holders of shares of common stock are entitled to vote on all matters brought before the Annual Meeting.

As of the record date, there were 49,611,456 shares of common stock outstanding and entitled to vote on the election of directors and all other matters. Holders of common stock will vote on all matters as a class. Each outstanding share of common stock entitles the holder to one vote. All votes will be counted by Computershare, our transfer agent.

The presence in person or by proxy of the holders of a majority of the outstanding common stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes will be counted for the purpose of determining whether a quorum is present at the Annual Meeting.

Proposal No. 1—Election of Directors

In an uncontested election (which is the case for the election of directors at the Annual Meeting), directors will be elected by a majority of the votes cast by holders of common stock present in person or represented by proxy. A majority of the votes cast means that the number of votes cast "for" a director nominee must exceed the number of votes cast "against" that nominee. Abstentions and broker non-votes are not considered votes cast on this proposal and, therefore, will have no effect on the results of the vote on this proposal. Our Amended and Restated By-Laws (the "By-Laws") contain detailed procedures to be followed in the event that one or more directors do not receive a majority of the votes cast at the Annual Meeting.

Proposal No. 2—Approval, by Advisory Vote, of Compensation Paid to our Named Executive Officers for Fiscal Year 2017

Approval, by advisory vote, of the compensation paid to our named executive officers for fiscal year 2017 will require the favorable vote of holders of a majority of the shares having voting power present in person or represented by proxy. Abstentions are counted toward the tabulation of votes on this proposal and will have the same effect as a negative vote. Broker non-votes will have no effect on the results of the vote on this proposal. The vote on this proposal is advisory in nature and, therefore, not binding on the Company. However, our Board and the Compensation and Management Development Committee (the "Compensation Committee") will consider the outcome of this vote in its future deliberations regarding executive compensation.

Proposal No. 3—Approval, by Advisory Vote, of the Frequency of Future Advisory Votes on Executive Compensation

For the approval of the frequency of future advisory votes on executive compensation, stockholders may vote for "one year," "two years," or "three years," or may abstain from voting. The option of one year, two years or three years that receives the favorable vote of holders of a majority of the shares having voting power present in person or represented by proxy will be the frequency of the future advisory votes on executive compensation selected by our stockholders. Abstentions are counted toward the tabulation of votes on this proposal and will have the same effect as a negative vote. Broker non-votes will have no effect on the results of the vote on this proposal. In the absence of favorable vote of holders of a majority of the stock having voting power present in person or represented by proxy in support of any one frequency, the option of one year, two years, or three years that receives the greatest number of "for" votes will be considered the frequency selected by our stockholders. This

2

vote is advisory in nature and, therefore, not binding on the Company. However, our Board of Directors will consider the outcome of this vote in its future deliberations.

Proposal No. 4—Approval of the Triumph Group, Inc. 2016 Directors' Equity Compensation Plan

Approval of the Triumph Group, Inc. 2016 Directors' Equity Compensation Plan will require the favorable vote of holders of a majority of the shares having voting power present in person or represented by proxy. Abstentions are counted toward the tabulation of votes on this proposal and will have the same effect as a negative vote. Broker non-votes will have no effect on the results of the vote on this proposal. The calculation of the votes required to approve this proposal is consistent with the New York Stock Exchange's requirements for stockholder approval of an equity compensation plan.

Proposal No. 5—Ratification of Ernst & Young LLP as Our Independent Registered Public Accounting Firm for the Fiscal Year Ending March 31, 2018

Ratification of the audit committee's selection of our independent registered public accounting firm will require the favorable vote of holders of a majority of the shares having voting power present in person or represented by proxy. Abstentions are counted toward the tabulation of votes on this proposal and will have the same effect as a negative vote. The ratification of the selection of our independent registered public accounting firm is considered a routine matter. Therefore, no broker non-votes are expected with respect to this proposal.

3

Proposal No. 1—Election of Directors

The Board of Directors of the Company (the "Board" or the "Board of Directors") currently consists of ten directors: Paul Bourgon, Daniel J. Crowley, John G. Drosdick, Ralph E. Eberhart, Richard C. Gozon, Dawne S. Hickton, Richard C. Ill, William L. Mansfield, Adam J. Palmer and Joseph M. Silvestri. At the Annual Meeting, eight of the directors are being submitted as nominees for election by the stockholders for a term ending at the next annual meeting of stockholders and when each such director's successor is duly elected and qualified. Richard C. Ill, founder of the Company and former Chairman, President and Chief Executive Officer and director of the Company since its inception, is not standing for reelection. Also not standing for reelection is Richard C. Gozon, after 24 years of dedicated service as a director of the Company. Effective as of the Annual Meeting, the size of the Board will be decreased to eight.

The table below lists the name of each person nominated by the Board to serve as a director for the coming year. All of the nominees are currently members of our Board with terms expiring at the Annual Meeting. Each nominee has consented to be named as a nominee and, to our knowledge, is willing to serve as a director, if elected. Should any of the nominees not remain a nominee at the end of the Annual Meeting (a situation which is not anticipated), solicited proxies will be voted in favor of those who remain as nominees and may be voted for substitute nominees. Unless contrary instructions are given on the proxy, the shares represented by a properly executed proxy will be voted "FOR" the election of Paul Bourgon, Daniel J. Crowley, John G. Drosdick, Ralph E. Eberhart, Dawne S. Hickton, William L. Mansfield, Adam J. Palmer and Joseph M. Silvestri. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Nominees | Age | Year First Elected a Director | |||||

|---|---|---|---|---|---|---|---|

Paul Bourgon | 60 | 2008 | |||||

Daniel J. Crowley | 54 | 2016 | |||||

John G. Drosdick | 73 | 2012 | |||||

Ralph E. Eberhart | 70 | 2010 | |||||

Dawne S. Hickton | 59 | 2015 | |||||

William L. Mansfield | 69 | 2012 | |||||

Adam J. Palmer | 44 | 2010 | |||||

Joseph M. Silvestri | 55 | 2008 | |||||

The principal occupations of each nominee and the experience, qualifications, attributes or skills that led to the conclusion that such nominee should serve as a director for the coming year are as follows:

Paul Bourgon has been a Director of Triumph since October 2008. Mr. Bourgon has served as General Manager—Global Sales and Engineering for SKF Aeroengine since 2006. SKF Group supplies products, solutions and services within rolling bearings, seals, mechatronics, services and lubrication systems and SKF Aeroengine, a division of SKF Group, focuses on providing services in bearing repair and overhaul. Prior to joining SKF Aeroengine, Mr. Bourgon served as Vice President—Marketing of Heroux-Devtex Inc., a company which then supplied the commercial and military sectors with landing gear, airframe structural components, including kits, and aircraft engine components. Mr. Bourgon also serves on the board of directors of Venture Aerobearing LLC. Mr. Bourgon's current experience as a president of a significant aerospace business and his past experience within the aerospace industry enable him to serve as an additional point of reference on trends and developments affecting Triumph's business and its customers, suppliers and competitors. In addition, his background as a Chartered Accountant, member of the Canadian Institute of Chartered Accountants since 1983, articling with Coopers & Lybrand in Montreal in the Auditing and Taxes departments, as well as his ongoing

4

responsibility for the financial statements of the business he manages, enables him to lend additional financial expertise to the deliberations of the Board.

Daniel J. Crowley has been a Director of Triumph since January 2016. Mr. Crowley has served Triumph's President and Chief Executive Officer since January 4, 2016. Mr. Crowley served as a corporate vice president and President of Integrated Defense Systems at Raytheon Company from 2013 until 2015, and as President of Network Centric Systems at Raytheon Company from 2010 until 2013. Prior to joining Raytheon Company, Mr. Crowley served as Chief Operating Officer of Lockheed Martin Aeronautics after holding a series of increasingly responsible assignments across its space, electronics, and aeronautics sectors. Mr. Crowley brings to the Board 33 years of industry experience during which he has held key leadership roles in the development, production and deployment of some of the largest and most complex aerospace and defense products. He also provides the Board with detailed information about Triumph's businesses and communicates management's perspective on important matters to the Board.

John G. Drosdick has been a Director of Triumph since 2012. Mr. Drosdick served as Chairman, President, Chief Executive Officer of Sunoco, Inc. from June 2000 through August 2008, and as the Chairman of Sunoco Partners, LLC, a subsidiary of Sunoco, Inc. and the general partner of Sunoco Logistics Partners, L.P., a publicly traded master limited partnership, from February 2002 through December 2008. Mr. Drosdick also serves as a director of United States Steel Corporation and PNC Funds. Mr. Drosdick's long experience as the chief executive officer of a major public company with multiple operations provides the Board with a source of significant expertise in managing complex business operations, and his service on other boards provides the Board with another source of information on best practices in corporate governance.

Ralph E. Eberhart has been a Director of Triumph since June 2010 and its non-executive Chairman since April 2015. Gen. Eberhart served as Commander of the North American Aerospace Defense Command (NORAD) and U.S. Northern Command from October 2002 to January 2005. Since January 2005, he has also been the Chairman and President of the Armed Forces Benefit Association. Gen. Eberhart's active military career spanned 36 years. He is also a member of the board of directors of Rockwell Collins, Inc., Jacobs Engineering Group, Inc. and VSE Corporation and is a director of two private companies. Gen. Eberhart joined the Board as part of an arrangement in connection with the Company's acquisition (the "Vought Acquisition") of Vought Aircraft Industries, Inc. ("Vought") in 2010. Given the significant share of Triumph's business focused on serving the militaries of the United States and other countries, Gen. Eberhart provides the Board with valuable insight into military operations that enables the Company to better serve its military customers. The Company also benefits from his experience as a director of other aerospace and defense companies. Moreover, his senior leadership experience enables him to provide management with valuable advice on governance and management issues.

Dawne S. Hickton has been a Director of Triumph since 2015. Ms. Hickton is the former Vice Chair, President and Chief Executive Officer of RTI International Metals, Inc., a New York Stock Exchange listed vertically integrated global supplier of advanced titanium and specialty metals products that meet the requirements of technologically sophisticated applications in commercial aerospace, defense, propulsion, medical device, energy and other markets. Ms. Hickton served as CEO from April 2007 until July 2015, when RTI was acquired by Alcoa Inc. ("Alcoa"), and served as a member of RTI's Board of Directors from 2007 until the acquisition by Alcoa. Prior to becoming RTI's CEO, she was Senior Vice President Administration and Principal Financial Officer. Ms. Hickton is currently President and founding partner of Cumberland Highstreet Partners. Ms. Hickton has over 30 years of diversified metals experience, including more than 15 years in the titanium industry spanning several business cycles. Ms. Hickton is the Deputy Chair of the Board of the Federal Reserve Bank of Cleveland and serves as a director of Jacobs Engineering Group, Inc. She is the immediate past president of the International Titanium Association. In 2016, Ms. Hickton was appointed to the Board

5

of Directors of Norsk Titanium AS, a supplier of aerospace grade, additive manufactured, structural titanium components. In addition, she is a member of the University of Pittsburgh's Board of Trustees, serving on the student affairs and property and facilities committees. She is also a member of the Board of Directors of the Smithsonian National Air and Space Museum, and serves on the board of the Wings Club. The Board believes that Ms. Hickton's substantial experience as the CEO of a public company with extensive and diversified manufacturing operations and broad exposure to the aerospace markets contributes significantly to the Board's deliberations on issues of corporate development, leadership and governance.

William L. Mansfield has been a Director of Triumph since 2012. Mr. Mansfield served as the Chairman of the Board of The Valspar Corporation from August 2007 through June 2012 and served as that company's Chief Executive Officer from February 2005 to June 2011 and as its President from February 2005 through February 2008. Mr. Mansfield also serves as a director of Bemis Company, Inc. and served as Non-Executive Chairman of the Board of Axiall Corporation until August 2016. Mr. Mansfield brings to the Board deep management experience as a former chief executive officer of a significant, publicly-traded manufacturing business with diverse operations spread across the globe as well as a track record of enhancing growth through acquisition. Likewise, his continuing service as a director of other public companies is a source of additional insight into developments in corporate management and governance.

Adam J. Palmer has been a Director of Triumph since June 2010. Mr. Palmer is currently a Managing Director and Head of the Global Aerospace, Defense and Government Services Group at The Carlyle Group ("Carlyle"), a global alternative asset management firm. Prior to joining Carlyle in 1996, Mr. Palmer was with Lehman Brothers focusing on mergers, acquisitions and financings for aerospace, defense and information services companies. Mr. Palmer also currently serves on the boards of directors of Sequa Corporation, Wesco Aircraft Holdings, Inc., Global Jet Capital, LLC, Dynamic Precision Group, Inc. and Novetta Solutions. Mr. Palmer served as a member of Vought's board of directors from 2000 until the Vought Acquisition and led the negotiations on behalf of Carlyle that culminated in Triumph's acquisition of Vought from equity funds affiliated with Carlyle. Mr. Palmer was a director of Landmark U.S. Holdings, LLC from October 2012 until February 2016. Mr. Palmer joined the Board as part of an arrangement in connection with the Vought Acquisition. The Board benefits from Mr. Palmer's deep familiarity with Vought's business acquired through his years of involvement in developing its business as a Carlyle investment. The Board also benefits from Mr. Palmer's knowledge and understanding of the aerospace and defense industry, acquired through his years of active involvement as an investor, as well as his understanding of management issues derived from his participation on corporate boards.

Joseph M. Silvestri has been a Director of Triumph since October 2008 and previously served as a Director of Triumph from 1995 to 2005. Mr. Silvestri is currently a Managing Partner of Court Square Capital Partners, an independent private equity firm, and has been employed by Court Square Capital Partners and its predecessors since 1990. Mr. Silvestri also serves on the board of directors of numerous private companies. Through his two periods of service on the Board, Mr. Silvestri has acquired a deep understanding of Triumph's background and development. He also lends to the Board's deliberations the benefit of his own knowledge and understanding of the operation of the capital markets, financial matters and mergers and acquisitions generally gained through his years of participation in private equity investments. In addition, as an experienced private equity investor, he is able to share with the Board insights on corporate management and best practices derived from his experience with the many portfolio companies with which he has been associated.

The Board recommends that stockholders vote "FOR" each of the nominees. The nominees receiving a majority of the votes cast in favor of their election will be elected as directors.

6

Proposal No. 2—Advisory Vote on Compensation Paid to Named Executive Officers for Fiscal Year 2017

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") added Section 14A to the Securities Exchange Act of 1934, as amended (the "Exchange Act"), which requires that we provide our stockholders with the opportunity to vote to approve, on a nonbinding, advisory basis, the compensation paid to our named executive officers for fiscal year 2017 as disclosed in this proxy statement in accordance with the compensation disclosure rules of the SEC.

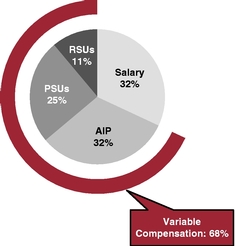

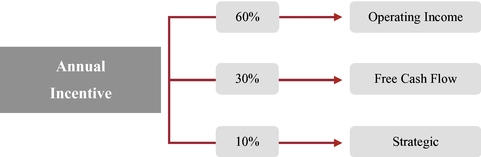

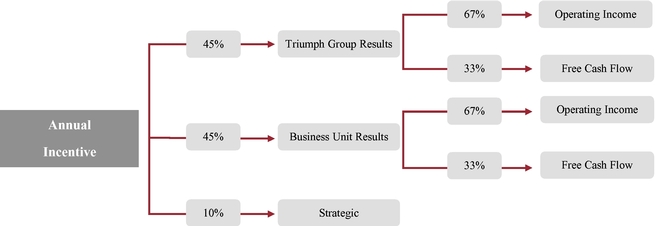

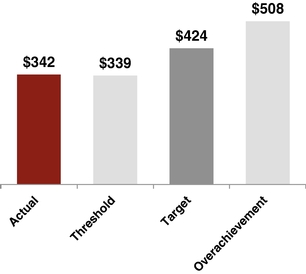

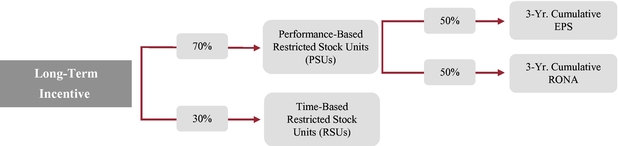

We seek to closely align the interests of our named executive officers with the interests of our stockholders. Our executive compensation programs are intended to achieve several business objectives, including: (i) recruiting and retaining our executives with the talent required to successfully manage our business; (ii) motivating our executives to achieve our business objectives; (iii) instilling in our executives a long-term commitment to the Company's success by providing elements of compensation that align the executives' interests with those of our stockholders; (iv) providing compensation that recognizes individual contributions as well as overall business results; and (v) avoiding or minimizing the risks of incentivizing management behavior that is inconsistent with the interests of our stockholders. Our Compensation Discussion and Analysis (the "CD&A"), which begins on page 29 of this proxy statement, describes in detail the components of our executive compensation program, the process by which our Board of Directors makes executive compensation decisions, and the compensation paid to our named executive officers for fiscal year 2017. Highlights of our executive compensation program include the following:

The vote on this proposal is advisory, which means that the approval of the compensation paid to our named executive officers is not binding on the Company, the Board of Directors or the Compensation Committee. The vote on this resolution is not intended to address any specific element of compensation, but rather relates to the overall compensation of our named executive officers for fiscal year 2017, as described in this proxy statement in accordance with the compensation disclosure rules of the SEC. To the extent there is a significant vote against the compensation paid to our named executive officers as disclosed in this proxy statement, the Compensation Committee will evaluate

7

whether any actions are necessary to address our stockholders' concerns. Accordingly, we ask our stockholders to vote on the following resolution at the Annual Meeting:

RESOLVED, that the compensation paid to the Company's named executive officers for fiscal year 2017, as disclosed pursuant to Item 402 of Regulation S-K, including the CD&A, compensation tables, and narrative discussion, is hereby APPROVED, on a non-binding, advisory basis.

The Board recommends that stockholders vote "FOR" the approval of the compensation paid to our named executive officers, as disclosed in this proxy statement.

8

Proposal No. 3—Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation

Section 14A of the Exchange Act, which was added by the Dodd-Frank Act, also requires that we provide stockholders with the opportunity to vote, on a non-binding, advisory basis, for their preference as to how frequently to vote on future advisory votes on the compensation of our named executive officers as disclosed in accordance with the compensation disclosure rules of the Securities and Exchange Commission.

Stockholders may indicate whether they would prefer that we conduct future advisory votes on executive compensation once every one, two, or three years. Stockholders also may abstain from casting a vote on this proposal. At the Company's 2011 annual meeting of stockholders, stockholders voted to have the advisory vote on executive compensation every one year.

The Board of Directors has determined that an advisory vote on executive compensation that occurs every year is the most appropriate alternative for the Company and, therefore, the Board recommends that you vote for a one-year interval for the advisory vote on executive compensation. In determining to recommend that stockholders vote for a frequency of once every year, the Board of Directors considered that an advisory vote on executive compensation every year allows our stockholders to provide us with their direct input on our compensation philosophy, policies and practices as disclosed in the proxy statement every year. Setting a one-year period for holding this stockholder vote enhances stockholder communication by providing a clear, simple means for the Company to obtain information on investor sentiment about our executive compensation philosophy.

This vote is advisory, which means that the vote on executive compensation is not binding on the Company, the Board of Directors, or the Compensation Committee. The Company recognizes that stockholders may have different views as to the best approach for the Company, and therefore we look forward to hearing from our stockholders as to their preferences on the frequency of future advisory votes on executive compensation. The Board of Directors and the Compensation Committee will take into account the outcome of the vote; however, when considering the frequency of future advisory votes on executive compensation, the Board of Directors may decide that it is in the best interests of our stockholders and the Company to hold an advisory vote on executive compensation more or less frequently than the frequency receiving the favorable vote of holders of a majority of the shares having voting power present in person or represented by proxy. Also, in accordance with applicable law, at least every six years stockholders will have the opportunity to recommend the frequency of future advisory votes on executive compensation.

Stockholders may cast a vote on the preferred voting frequency by selecting the option of one year, two years, or three years (or abstain) when voting in response to the resolution set forth below.

RESOLVED, that the stockholders determine, on an advisory basis, whether the preferred frequency of an advisory vote on the executive compensation of the Company's named executive officers as set forth in the Company's proxy statement should be every year, every two years, or every three years.

The enclosed proxy card provides stockholders with the opportunity to choose among four options (holding the vote every one, two, or three years, or abstain from voting) and, therefore, stockholders will not be voting to approve or disapprove the recommendation of the Board of Directors.

The Board recommends that stockholders vote for the option of every "ONE YEAR" as the preferred frequency for future advisory votes on executive compensation.

9

Proposal No. 4—Approval of the Triumph Group, Inc. 2016 Directors' Equity Compensation Plan

The Company is requesting that the stockholders approve the terms of the new Triumph Group, Inc. 2016 Directors' Equity Compensation Plan, as amended (also referred to as the "2016 Directors' Plan"). During fiscal year 2017, the Board of Directors approved recommendations of the Nominating and Corporate Governance Committee (the "Governance Committee") to amend the non-employee director compensation program.

The compensation for our non-employee directors was evaluated in the context of the Board's overall assessment of management and director compensation in connection with the corporate organizational changes implemented during fiscal year 2017. As the Company looked forward, it recognized that the compensation paid to its non-employee directors was below the median for similarly situated companies, and that there was a lack of alignment between the one-year term of service on the Board and the three-year vesting cycle for deferred stock unit awards issued in the past. The Company also determined that it is likely to add new and/or additional members to the Board of Directors over the next few years. With the assistance of Semler Brossy Consulting Group LLC ("Semler Brossy"), the independent compensation consultant retained by the Compensation Committee for executive compensation advice, the Governance Committee evaluated the mix of cash and equity-based compensation paid to non-employee directors, the structure of the compensation paid, annual compensation as compared to peer group companies, and the link between the non-employee director compensation program and the Company's stock ownership guidelines for non-employee directors in structuring the updated 2016 Directors' Plan. See the description of the fiscal year 2017 non-employee director compensation program under the heading "Director Compensation" beginning on page 23 of this proxy statement.

The prior plan used for making equity awards to non-employee directors was the Company's Directors' Equity Incentive Plan, which expired by its terms during 2016. The 2016 Directors' Plan is being submitted to stockholders for approval at the Annual Meeting, and adds restricted stock units to the types of awards that may be made under the 2016 Directors' Plan, adds a prohibition on repricing of stock options and aligns the forfeiture restrictions and lapse events to those in the Company's 2013 Equity and Cash Incentive Plan for executive officers and employees. Please see the description of various 2016 Directors' Plan elements below under the heading "Description of the Triumph Group, Inc. 2016 Directors' Equity Compensation Plan." The 2016 Directors' Plan is substantially similar to the prior plan. The Governance Committee elected to retain a number of different award types, including stock options, deferred stock units, restricted stock units and stock awards under the 2016 Directors' Plan to allow for future flexibility in the types of awards made.

In conjunction with the approval of the 2016 Directors' Plan in November 2016, the Governance Committee recommended, and the Board approved, a separate Triumph Group, Inc. Directors' Deferred Compensation Plan (the "Deferred Compensation Plan"). Under the Deferred Compensation Plan, each non-employee director can elect to defer some or all of his or her equity awards on an annual basis, in accordance with applicable law. We believe this deferral opportunity allows for individual choice in the timing and receipt of payment of Board compensation, while encouraging increased equity ownership by non-employee directors. We are not seeking approval of the Deferred Compensation Plan in this Proposal No. 4.

In November 2016, at the time the 2016 Directors' Plan was recommended by the Governance Committee and approved by the Board, initial awards were made under the 2016 Directors' Plan to the non-employee directors then in office as the fiscal year 2017 annual awards of an aggregate of 45,315 restricted stock units, subject to receipt of stockholder approval of the 2016 Directors' Plan. If the stockholders approve the 2016 Directors' Plan at the Annual Meeting, such approval shall include

10

approval of those awards made in November 2016. If the 2016 Directors' Plan is not approved by stockholders at the Annual Meeting, the November 2016 awards will be void.

Non-Employee Director Compensation and Use of the 2016 Directors' Plan

The provisions of the 2016 Directors' Plan that relate to the changes in the Company's prior non-employee director compensation program are:

The 2016 Directors' Plan will be the equity compensation plan under which the Company makes grants to its non-employee directors in the future. The Company believes that the ability to grant stock options, stock awards, restricted stock units and deferred stock units to non-employee directors provides it with additional flexibility to recognize the value and service which non-employee directors provide in a manner that is cost-effective to both the director and to the Company. The Company does not currently intend to use stock option awards as a form of equity compensation, but believes the flexibility to use such award type in the future may be helpful.

Currently, the value of the annual restricted stock unit awards to non-employee directors is $140,000, which the Company believes is competitive with similarly situated companies. The Board does have the discretion to change the value and form of the annual awards, and to make individual one-time awards, subject to limitations set forth in the 2016 Directors' Plan of $600,000 for annual awards, and up to an additional $250,000 for one-time discretionary awards. Any awards exceeding such maximums will require stockholder approval. Standard "sign-on" awards are eliminated under the 2016 Directors' Plan. The Company believes these changes and added flexibility will assist in allowing it to offer more competitive non-employee director compensation and in recruiting new or additional qualified independent directors.

Description of the Triumph Group, Inc. 2016 Directors' Equity Compensation Plan

The following description of the 2016 Directors' Plan is only a summary of the material features of the Directors' Plan and does not describe all of its provisions. The 2016 Directors' Plan is attached to this proxy statement asAppendix A. This summary is qualified in its entirety by reference to the text of the 2016 Directors' Plan.

11

Administration

The 2016 Directors' Plan is administered by the Board.

Eligibility

Each director of the Company who is not an officer or employee of the Company or any of its subsidiaries may be granted awards under the 2016 Directors' Plan. As of May 26, 2017, there were nine directors eligible to participate in the 2016 Directors' Plan.

Share Limitations

The aggregate number of shares of common stock subject to awards granted under the 2016 Directors' Plan is 500,000 shares. The Company believes this number of reserved shares provides sufficient shares for the recruitment of new or additional independent directors over the next few years and for coverage for the annual awards, without eliminating the need to come back to stockholders for additional approvals during the term of the 2016 Directors' Plan. The Board has full authority to select the eligible directors to whom such awards are to be granted and to determine the number of shares of common stock to be covered by each award. The Board shall have full authority to determine whether an award is a stock option, stock award, a deferred stock unit or a restricted stock unit, and the number of each type of award to be granted, subject to the limitations of the 2016 Directors' Plan. Unissued shares subject to awards that are cancelled, expired or are terminated will be available for re-grant under the 2016 Directors' Plan.

Terms and Conditions of Stock Options

Each stock option must be evidenced by a stock option certificate executed by the Company and is subject to the following additional terms and conditions. Each stock option shall be a non-qualified stock option.

Exercise Price. The exercise price of an option is the fair market value of the common stock on the date of grant. The fair market value of the common stock is the closing price of a share in the New York Stock Exchange Composite Transactions on the previous regular trading day or, if no sale has been made on the New York Stock Exchange on such date, or if such common stock was not listed or reported on such date, the fair market value shall be as determined under the regulations under Section 409A of the Internal Revenue Code of 1986, as amended (the "Code").

No Repricing. The 2016 Directors' Plan does not allow for repricing of any stock options, or similar transactions, such as exchange transactions, without the consent of stockholders.

Exercise of Stock Option; Form of Consideration. The vesting period for any stock options is at least one year after the date of grant; otherwise, the Board determines when stock options become exercisable and in its discretion may accelerate the vesting of any outstanding stock option. The 2016 Directors' Plan permits payment to be made by cash or check and, with the consent of the Board, other shares of common stock of the Company or by a reduction in the number of shares of common stock otherwise issuable upon such exercise.

Term of Stock Option. The term of a stock option will be seven years from the date of grant, which is a shorter period than under the prior plan. A stock option may not be exercised after the expiration of its term.

Termination. Unless otherwise determined by the Board, if a participant ceases to be a member of the Board for any reason other than death or disability, then all stock options held by the participant under the 2016 Directors' Plan will terminate 90 days after the date on which the participant ceases to be a member of the Board; provided, however, that the Board may extend the exercise period based on

12

factors deemed appropriate by the Board, but not beyond the expiration of the stated term of the stock option.

Death or Disability. Unless otherwise determined by the Board, if a participant ceases to be a member of the Board as a result of the participant's death, then all of such participant's vested options will remain exercisable after time of death, or on such accelerated basis as the Board may determine, until expiration of the stated term or on such earlier time as the Board may determine. Unless otherwise determined by the Board, if a participant ceases to be a member of the Board as a result of the participant's disability, then all of such participant's vested options will remain exercisable after the incurrence of the disability, or on such accelerated basis as the Board may determine, until expiration of the stated term or such earlier time as the Board may determine.

Other Provisions. The stock option certificate may contain other terms, provisions and conditions not inconsistent with the 2016 Directors' Plan as may be determined by the Board.

Terms and Conditions of Stock Awards

Stock awards may be granted to any eligible director. Each stock award will be evidenced by a stock award agreement between the Company and the participant and is subject to the following additional terms and conditions.

Lapse of Forfeiture Restrictions. Stock awards shall vest at such time and in such installments as determined by the Board.

Forfeiture. Unless otherwise provided in the stock award agreement, if a participant ceases to be a member of the Board for any reason other than death, disability or retirement of the director, or a divestiture transaction impacting the director's service on the Board, the shares subject to a stock award that have not become vested pursuant to the stock award agreement shall be forfeited.

Death, Disability or Retirement of Participant. Unless otherwise provided in the stock award agreement, if a participant ceases to be a member of the Board due to the participant's death, disability or retirement, all outstanding stock awards granted to such participant shall accelerate and vest; provided, however, that the conditions of the non-competition covenant set forth in the 2016 Directors' Plan are met.

Divestiture. If a participant ceases to be a member of the Board because of a divestiture by the Company, prior to such termination of membership, the Board may, in its sole discretion, accelerate the vesting of all or a portion of any outstanding stock awards granted to such participant and provide that all forfeiture provisions with respect to such stock awards shall lapse. The determination of whether a divestiture will occur will be made by the Board in its sole discretion.

Other Provisions. The stock award agreement may contain other terms, provisions and conditions not inconsistent with the 2016 Directors' Plan as may be determined by the Board.

Terms and Conditions of Deferred Stock Units

The Board may grant deferred stock units to any eligible director. Each deferred stock unit will be evidenced by a deferred stock unit agreement between the Company and the participant and is subject to the following additional terms and conditions.

Lapse of Forfeiture Restrictions. Deferred stock units shall vest at such time and in such installments as determined by the Board; provided, however, that the minimum forfeiture period shall be at least one year from the date of grant.

13

Forfeiture. Unless otherwise provided in the deferred stock unit agreement, if a participant ceases to be a member of the Board for any reason other than death, disability or retirement of the director or a divestiture transaction impacting the director's service on the Board, the shares subject to a deferred stock unit that have not become vested pursuant to the deferred stock unit agreement shall be forfeited.

Death, Disability or Retirement of Participant. Unless otherwise provided in the deferred stock unit agreement, if a participant ceases to be a member of the Board due to the participant's death, disability or retirement, all forfeiture restrictions on all outstanding deferred stock units granted to such participant will lapse; provided, however, that the conditions of the non-competition covenant set forth in the 2016 Directors' Plan are met.

Divestiture. If a participant ceases to be a member of the Board because of a divestiture by the Company, prior to such termination of membership, the Board may, in its sole discretion, accelerate the lapse of forfeiture restrictions of all or a portion of any outstanding deferred stock unit granted to such participant; provided, however, that the conditions of the non-competition covenant set forth in the 2016 Directors' Plan are met. The determination of whether a divestiture will occur will be made by the Board in its sole discretion.

Dividend Equivalents. The deferred stock unit agreement may provide that the holder of a deferred stock unit will be entitled to receive payment from us at such times as set forth in the deferred stock unit agreement in an amount equal to each cash dividend that we would have paid to such holder had he or she, on the record date for payment of such dividend, been the holder of record of shares of common stock equal to the number of deferred stock units which had been awarded to such holder as of the record date.

Other Provisions. The deferred stock unit agreement may contain other terms, provisions and conditions not inconsistent with the 2016 Directors' Plan as may be determined by the Board.

Terms and Conditions of Restricted Stock Units

The Board may grant restricted stock units to any eligible director. Each restricted stock unit will be evidenced by a restricted stock unit agreement between the Company and the participant and is subject to the following additional terms and conditions.

Lapse of Forfeiture Restrictions. Restricted stock units shall vest at such time and in such installments as determined by the Board; provided, however, that the minimum forfeiture period shall be at least one year from the date of grant and that, if the participant makes a deferral election with respect to any restricted stock units under the Deferred Compensation Plan, the terms of the Deferred Compensation Plan will apply to the payment of such deferred award.

Forfeiture. Unless otherwise provided in the restricted stock unit agreement, if a participant ceases to be a member of the Board for any reason other than death, disability or retirement of the director or a divestiture transaction impacting the director's service on the Board, the shares subject to a restricted stock unit that have not become vested pursuant to the restricted stock unit agreement shall be forfeited.

Death, Disability or Retirement of Participant. Unless otherwise provided in the restricted stock unit agreement, if a participant ceases to be a member of the Board due to the participant's death, disability or retirement, all forfeiture restrictions on all outstanding unvested restricted stock units granted to such participant will lapse; provided, however, that the conditions of the non-competition covenant set forth in the 2016 Directors' Plan are met.

14

Divestiture. If a participant ceases to be a member of the Board because of a divestiture by the Company, prior to such termination of membership, the Board may, in its sole discretion, accelerate the lapse of forfeiture restrictions of all or a portion of any outstanding unvested restricted stock unit granted to such participant and provide that all forfeiture provisions with respect to such restricted stock units shall lapse. The determination of whether a divestiture will occur will be made by the Board in its sole discretion.

Dividend Equivalents. The restricted stock unit agreement may provide that the holder of a restricted stock unit will be entitled to receive payment from us in an amount equal to each cash dividend that we would have paid to such holder had he or she, on the record date for payment of such dividend, been the holder of record of shares of common stock equal to the number of restricted stock units which had been awarded to such holder as of the record date.

Other Provisions. The restricted stock unit agreement may contain other terms, provisions and conditions not inconsistent with the 2016 Directors' Plan as may be determined by the Board.

Nontransferability

Except as otherwise provided in the award agreement, any award granted under the 2016 Directors' Plan and the rights and privileges conferred by the award may not be sold, transferred, assigned, pledged or hypothecated in any way (whether by operation of law or otherwise), and will not be subject to execution, attachment or similar process. Upon any attempt to transfer, assign, pledge, hypothecate or otherwise dispose of any such award, right or privilege, or upon the levy of any attachment or similar process, the award and the rights and privileges conferred by the award will immediately terminate and the award will immediately be forfeited to the Company.

Adjustments Upon Changes in Capitalization, Merger or Sale of Assets

Subject to any required action by stockholders, the number and kind of shares covered by each outstanding award, in the minimum and maximum limits set forth in the 2016 Directors' Plan, will be adjusted as determined by the Board in the event of a reorganization, recapitalization, stock split, reverse stock split, spin-off, split-off, split-up, stock dividend, issuance of stock rights, merger, consolidation, combination of the Company's stock, or any other change in the corporate structure of the Company affecting the Company's stock.

If during the term of any award, the Company will be, with the prior approval of a majority of the members of the Board, merged into or consolidated with or otherwise combined with or acquired by a person or entity, or there is a liquidation of the Company, then at the election of the Board, the Company may take such other action as the Board determines to be reasonable under the circumstances to permit a participant to realize the value of such award, including paying cash to the participant equal to the value of the award or requiring the acquiring corporation to grant options or stock to the participant having a value equal to the value of the award.

In the event of a change in control of the Company, as defined in the 2016 Directors' Plan, when a participant ceases to be a director of the Company in connection with such change in control, each award then outstanding shall become immediately vested or have full lapse of forfeiture restrictions, and in the case of stock options, exercisable to the full extent of the shares of common stock. If the participant continues to provide services on the Board of the successor entity, the 2016 Directors' Plan provides that any outstanding awards will be assumed and converted into awards to acquire equivalent equity of the successor entity.

15

Amendment and Termination of the 2016 Directors' Plan

The Board may amend, discontinue or terminate the 2016 Directors' Plan, or any part thereof, at any time and for any reason; provided, however, that any "material revision" to the Directors' Plan, including, without limitation, any repricing or exchange of stock options, requires approval by stockholders. No such action by the Board may alter or impair any award previously granted under the 2016 Directors' Plan without the consent of the participants. Unless terminated earlier, the 2016 Directors' Plan shall terminate on November 10, 2026, which is ten years after the date the 2016 Directors' Plan was approved by the Board.

Federal Income Tax Consequences

Stock Options. Each stock option issued under the 2016 Directors' Plan will be a nonqualified stock option. A participant will not recognize any taxable income at the time a stock option is granted under the 2016 Directors' Plan. Upon exercise, the participant will recognize taxable income generally measured by the excess of the then fair market value of the common stock to be received upon exercise over the exercise price. The participant's tax basis in the shares acquired upon exercise of the options in such shares will be equal to their fair market value on the date of exercise of the option, and the participant's holding period for those shares will begin on that date. Upon a participant's sale of shares acquired pursuant to the exercise an option, any difference between the sale price and the fair market value of the shares on the date when the stock option was exercised will be treated as long-term or short-term capital gain or loss, depending on the holding period. Upon a participant's exercise of an option, the Company will generally be entitled to a deduction for U.S. federal income tax purposes at such time and in the same amount recognized as ordinary income to the participant.

Stock Awards. Generally, a participant granted a stock award will recognize ordinary income at the time the stock is received equal to the excess, if any, of the fair market value of the common stock received over any amount paid by the participant in exchange for the common stock. If, however, the common stock is not vested when it is received, the participant generally will not recognize taxable income until the common stock becomes vested, at which time the participant will recognize ordinary income equal to the excess, if any, of the fair market value of the common stock on the date it becomes vested over any amount paid by the participant in exchange for the common stock. A participant may, however, file a "Section 83(b) election" with the Internal Revenue Service, within 30 days of his or her receipt of the stock award, to recognize ordinary income at the time the shares are awarded in an amount equal to their fair market value at that time, notwithstanding that such shares are not vested and may be subsequently forfeited. If a participant makes such an election, the participant will not recognize any additional taxable income at the time the shares become vested, but if the shares are later forfeited, the participant will not be allowed a tax deduction for the forfeited shares.

The participant's basis for the determination of gain or loss upon the subsequent disposition of shares acquired as stock awards will be the amount paid for such shares plus any ordinary income recognized either when the stock is received or when the stock becomes vested. Upon the disposition of any of the common stock, the difference between the sales price and the participant's basis in the shares will be treated as a capital gain or loss and generally will be characterized as long-term capital gain or loss if the shares have been held for more than one year from the date as of which he or she would be required to recognize any income. The Company will be entitled to a deduction for U.S. federal income tax purposes equal to the amount of ordinary income taxable to the participant.

Deferred Stock Units and Restricted Stock Units. A participant generally will not recognize any taxable income at the time a deferred stock unit or restricted stock unit is granted under the 2016 Directors' Plan. A participant will recognize taxable income on deferred stock units or restricted stock units as the deferred stock units or restricted stock units become vested, and the shares of common

16

stock represented by the deferred stock units or restricted stock units are issued to the participant. A participant will also recognize taxable income when he or she receives cash representing dividend equivalents. The Company will be entitled to a federal income tax deduction in the same amount as and at the same time the participant recognizes ordinary income for federal income tax purposes.

Section 409A of the Code. Section 409A of the Code governs the taxation of deferred compensation. Awards received under the 2016 Directors' Plan are intended to be exempt from the requirements of Section 409A where possible. However, there can be no assurance that awards designed to be exempt from Section 409A will in fact be exempt. An award that is subject to Section 409A and fails to satisfy its requirements will subject the holder of the award to immediate taxation, an interest penalty and an additional 20% tax on the amount underlying the award.

The foregoing is only a summary of the material U.S. federal income tax considerations relating to the grant and exercise of awards under the 2016 Directors' Plan. It does not purport to be complete and does not discuss the tax consequences relevant to a participant, and does not address state, local, foreign or estate tax consequences. All participants are urged to consult their own tax advisors regarding the U.S. federal, state, local and foreign income, estate and other tax consequences of participating in the 2016 Directors' Plan.

The Board has unanimously approved, and recommends that stockholders vote "FOR" the approval of the 2016 Directors' Plan for all purposes described in this Proposal No. 4.

17

Proposal No. 5—Ratification of Selection of Registered Public Accounting Firm

The Audit Committee has selected Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2018, and the stockholders are asked to ratify this selection. Ernst & Young LLP has served as our independent registered public accounting firm since 1993. All audit and non-audit services provided by Ernst & Young LLP are approved by the Audit Committee. Ernst & Young LLP has advised us that it has no direct or material indirect interest in us or our affiliates. Representatives of Ernst & Young LLP are expected to attend the Annual Meeting, will have the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions.

Fees to Independent Registered Public Accounting Firm for Fiscal Years 2017 and 2016

Audit Fees

Ernst & Young LLP's fees associated with the annual audit of financial statements, the audit of internal control of financial reporting, the reviews of the Company's quarterly reports on Form 10-Q, statutory audits, assistance with and review of documents filed with the SEC, issuance of consents and accounting consultations for the fiscal years ended March 31, 2017 and March 31, 2016 were $4.2 million and $3.7 million, respectively.

Audit-Related Fees

Ernst & Young LLP's fees for the fiscal years ended March 31, 2017 and March 31, 2016 for assurance and related services that were reasonably related to the performance of the audits of our financial statements were $0.8 million and $0.1 million, respectively. For the fiscal year ended March 31, 2017 and March 31, 2016, respectively, these audit-related services were primarily related to due diligence services and defined benefit plan audits.

Tax Fees

Ernst & Young LLP's fees for the fiscal years ended March 31, 2017 and March 31, 2016 for tax compliance, tax advice and tax planning were $0.2 million and $0.1 million, respectively. These services consisted primarily of the review of the Company's U.S. Federal income tax return Form 1120 and consultation regarding transfer pricing.

All Other Fees

Ernst & Young LLP did not perform any material professional services other than those described above in the fiscal years ended March 31, 2017 and March 31, 2016.

Audit Committee Pre-Approval Policy

The Audit Committee pre-approved the engagement of Ernst & Young LLP to render all of the audit and the permitted non-audit services described above. The Audit Committee has determined that Ernst & Young LLP's rendering of all other non-audit services is compatible with maintaining auditor independence. The Audit Committee has delegated to its chair or, if he is unavailable, any other member of the Audit Committee, the right to pre-approve all audit services, between regularly scheduled meetings, subject to presentation to the full Audit Committee at its next meeting.

The Board recommends that stockholders vote "FOR" the ratification of Ernst & Young LLP as independent registered public accounting firm for the fiscal year ending March 31, 2018.

18

The Board knows of no matter, other than as referred to in this proxy statement, that will be presented at the Annual Meeting. However, if other matters properly come before the Annual Meeting, or any of its adjournments, the person or persons voting the proxies will vote them with their judgment in those matters.

Pursuant to the Delaware General Corporation Law and the By-Laws, our business is managed under the direction of our Board. Members of the Board are kept informed of our business through reports from and discussions with our President and Chief Executive Officer and other officers, through a yearly meeting with our executive officers and senior management from our operating locations, by reviewing materials provided to them and by participating in meetings of the Board and its committees. In addition, to promote open discussion among our non-employee directors, those directors meet in regularly scheduled executive sessions without management participation. These sessions are presided over by our Chairman, who is one of our independent directors.

Corporate Governance Guidelines

We have adopted Corporate Governance Guidelines which are posted on our website atwww.triumphgroup.com and are available in print to any stockholder upon request.

Our Board has adopted a Code of Business Conduct which applies to each of our employees, officers and directors, including, but not limited to, our Chief Executive Officer, Chief Financial Officer and Controller (principal accounting officer). The Code of Business Conduct is reviewed at least annually by the Governance Committee and amended as the Board deems appropriate upon the recommendation of the Governance Committee. A copy of the Code of Business Conduct is posted on our website atwww.triumphgroup.com under "Investor Relations—Corporate Governance" and is available in print to any stockholder upon request.

We believe that the issuance of incentive and compensatory equity awards to our officers and directors, including non-employee directors, along with our stock ownership guidelines, help to align the interests of such officers and directors with our stockholders. As part of our insider trading policy, we prohibit any officers and directors from engaging in hedging activities with respect to any owned shares or outstanding equity awards. The policy also discourages pledges of any Company stock by officers and directors, and requires Company notice and approval. None of our officers and directors pledged any shares of Company stock during fiscal year 2017.

The Board currently consists of ten directors: Paul Bourgon, Daniel J. Crowley, John G. Drosdick, Ralph E. Eberhart, Richard C. Gozon, Dawne S. Hickton, Richard C. Ill, William L. Mansfield, Adam J. Palmer and Joseph M. Silvestri. Richard C. Gozon and Richard C. Ill are not standing for reelection.

Director Independence

The Board has determined that Messrs. Bourgon, Drosdick, Eberhart and Gozon, Ms. Hickton, and Messrs. Mansfield, Palmer and Silvestri are all independent, as independence is defined in the

19

listing standards of the New York Stock Exchange and in our Independence Standards for Directors, which are posted on our website atwww.triumphgroup.com under "Investor Relations—Corporate Governance."

Meetings and Committees of the Board of Directors

The Board held seven meetings during our fiscal year ended March 31, 2017 and also acted by unanimous consent in writing. Each of our directors attended at least 75% of the meetings of the Board and committees of the Board of which he or she was a member during the fiscal year ended March 31, 2017. We encourage all of our directors to attend the Annual Meeting. For the Annual Meeting, we expect all of our directors standing for reelection will attend. Last year, all of the directors attended the annual meeting of stockholders.

As a non-executive Chairman and an independent director, Gen. Eberhart chairs the meetings of the Board, generally attends meetings of the Board's committees (without a vote) and provides leadership of the independent directors. Our Chairman is elected annually by the Board upon a recommendation by the Governance Committee. Executive sessions of the independent directors are held at every Board meeting (which sessions are not attended by management except upon invitation by the Chairman). While the Board believes this leadership structure is appropriate, the Board may decide to change it in the future.

The standing committees of the Board are the Audit Committee, the Compensation Committee, the Governance Committee, the Finance Committee and the Executive Committee. All members of the Audit Committee, the Compensation Committee and the Governance Committee are independent, as independence for such committee members is defined in the listing standards of the New York Stock Exchange and in our Independence Standards for Directors, which are posted on our website atwww.triumphgroup.com under "Investor Relations—Corporate Governance."

The Board has adopted a written charter for each of the standing committees, each of which is reviewed at least annually by the relevant committee. A copy of the charter of each standing Board committee is posted on our website atwww.triumphgroup.com under "Investor Relations—Corporate Governance" and is available in print to any stockholder upon request.

Audit Committee

The Audit Committee, currently consisting of Messrs. Drosdick, Gozon, Ms. Hickton and Messrs. Mansfield (Chair) and Silvestri, met eight times during the last fiscal year. The Audit Committee assists the Board in its oversight of the integrity of our financial statements, the operations and effectiveness of our internal controls, our compliance with legal and regulatory requirements, the independent registered public accounting firm's qualifications and independence, and the performance of our internal audit function and the independent registered public accounting firm. The Audit Committee is also responsible for reviewing and approving all related person transactions in accordance with the Company's policy.

Compensation Committee

The Compensation Committee, currently consisting of Messrs. Bourgon, Drosdick (Chair) and Gozon, Ms. Hickton and Mr. Palmer, met four times during the last fiscal year. The Compensation Committee periodically reviews and evaluates the compensation of our officers and other members of senior management, administers the incentive plans under which the executive officers receive their compensation, establishes guidelines for compensation of other personnel and oversees our management development and succession plans.

20

The Compensation Committee determines the compensation of the Chief Executive Officer. The Compensation Committee also reviews and approves the compensation proposed by the Chief Executive Officer to be awarded to Triumph's other executive officers, as well as certain key senior officers of each of Triumph's operating companies and divisions. The Chief Executive Officer generally attends Compensation Committee meetings, but does not attend executive sessions or any discussion of his own compensation. The Compensation Committee also considers the results of the most recent stockholder advisory vote on executive compensation in determining executive compensation. The Compensation Committee may delegate any of its responsibilities to one or more subcommittees consisting solely of one or more members of the Compensation Committee as it may deem appropriate, provided, that the Compensation Committee does not delegate any power or authority required by law, regulation or listing standard to be exercised by the Compensation Committee as a whole.

As further described in the CD&A, for fiscal year 2017, the Compensation Committee engaged Semler Brossy, a compensation consultant, whose selection and fees or charges were recommended and approved by the Compensation Committee, to assist the Compensation Committee and the Chief Executive Officer in modifying the peer group, reviewing select officer pay recommendations, providing recommendations for fiscal year 2018's long-term incentive plan design, and assisting with the preparation of the CD&A included in this proxy statement. Semler Brossy did not recommend, and was not involved in determining, the amount of any named executive officer's compensation for fiscal year 2017 other than Mr. Crowley, the Chief Executive Officer.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is an officer or employee of us or any of our subsidiaries, nor were any of them an officer or employee of the Company or any of our subsidiaries during the fiscal year ended March 31, 2017. None of our executive officers served as a member of the compensation committee of another entity, one of whose executive officers served as one of our directors.

Governance Committee

The Governance Committee, currently consisting of Messrs. Bourgon, Gozon (Chair), Ms. Hickton, Messrs. Mansfield and Silvestri, met four times during the last fiscal year. The Board has determined that, upon Mr. Gozon's retirement from the Board at the Annual Meeting, Ms. Hickton will be appointed Chair of the Governance Committee. The Governance Committee assists the Board in identifying individuals qualified to become Board members, recommending the nominees for directors, developing and recommending our Corporate Governance Guidelines and overseeing the evaluation of the Board and management. In addition to these responsibilities, the committee also advises the Board on non-employee director compensation matters. As further described in Proposal No. 4, during fiscal year 2017, the committee received input from the Compensation Committee's independent compensation consultant, Semler Brossy, in evaluating and structuring the non-employee director compensation program.

Finance Committee

The Finance Committee, currently consisting of Messrs. Bourgon, Ill, Mansfield, Palmer (Chair) and Silvestri, met one time during the last fiscal year. The Finance Committee reviews our capital structure and policies, financial forecasts, operations and capital budgets, pension fund investments and employee savings plans and corporate insurance coverage, as well as other financial matters deemed appropriate by the Board.

21

Executive Committee

The Executive Committee, currently consisting of Messrs. Crowley, Drosdick, Eberhart (Chair), Gozon, Mansfield and Palmer, exercises the powers and duties of our Board of Directors between Board meetings and while our Board is not in session. The Executive Committee has the authority to exercise all powers and authority of our Board, except for certain matters such as the review and approval or disapproval of related party transactions, matters which cannot be delegated by the Board of Directors to a committee of the Board pursuant to the Delaware General Corporation Law, the rules and regulations of the New York Stock Exchange, our Certificate of Incorporation or our By-Laws and matters that are reserved for another committee of the Board. The Executive Committee met one time during the last fiscal year.

Risk Oversight