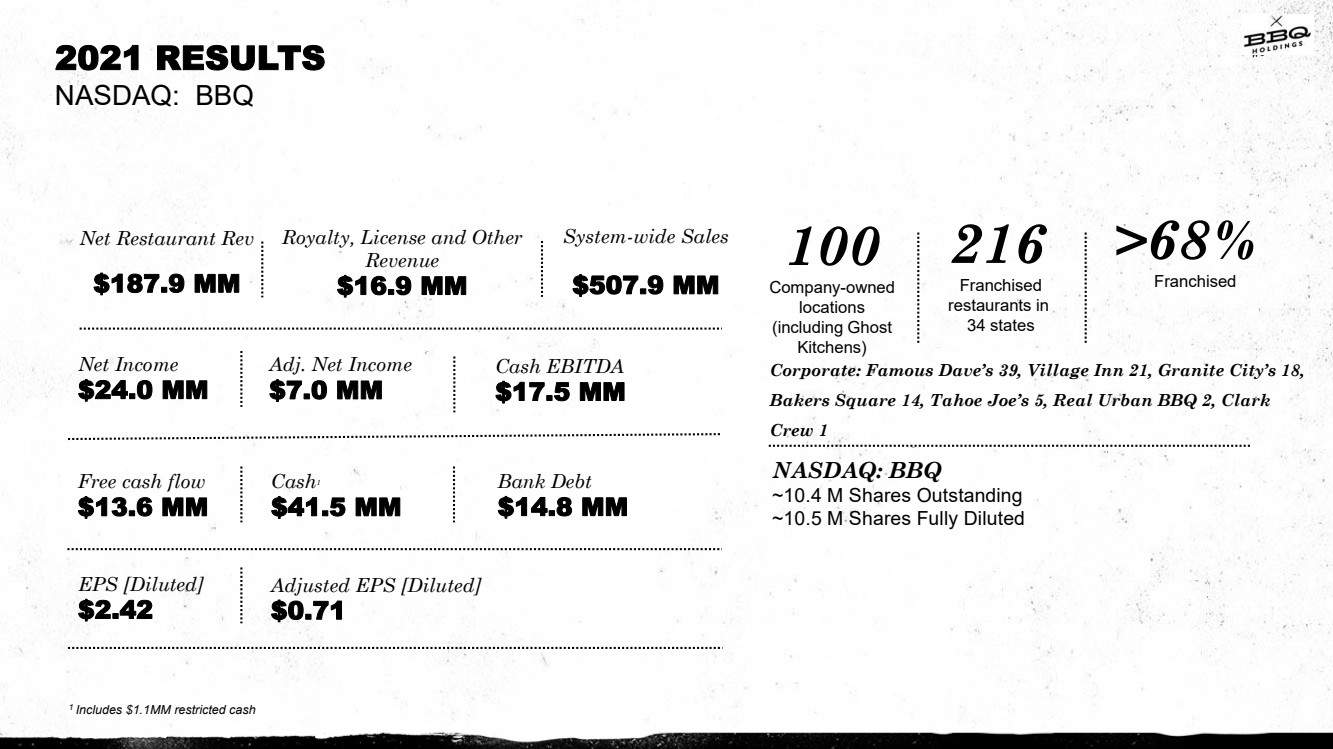

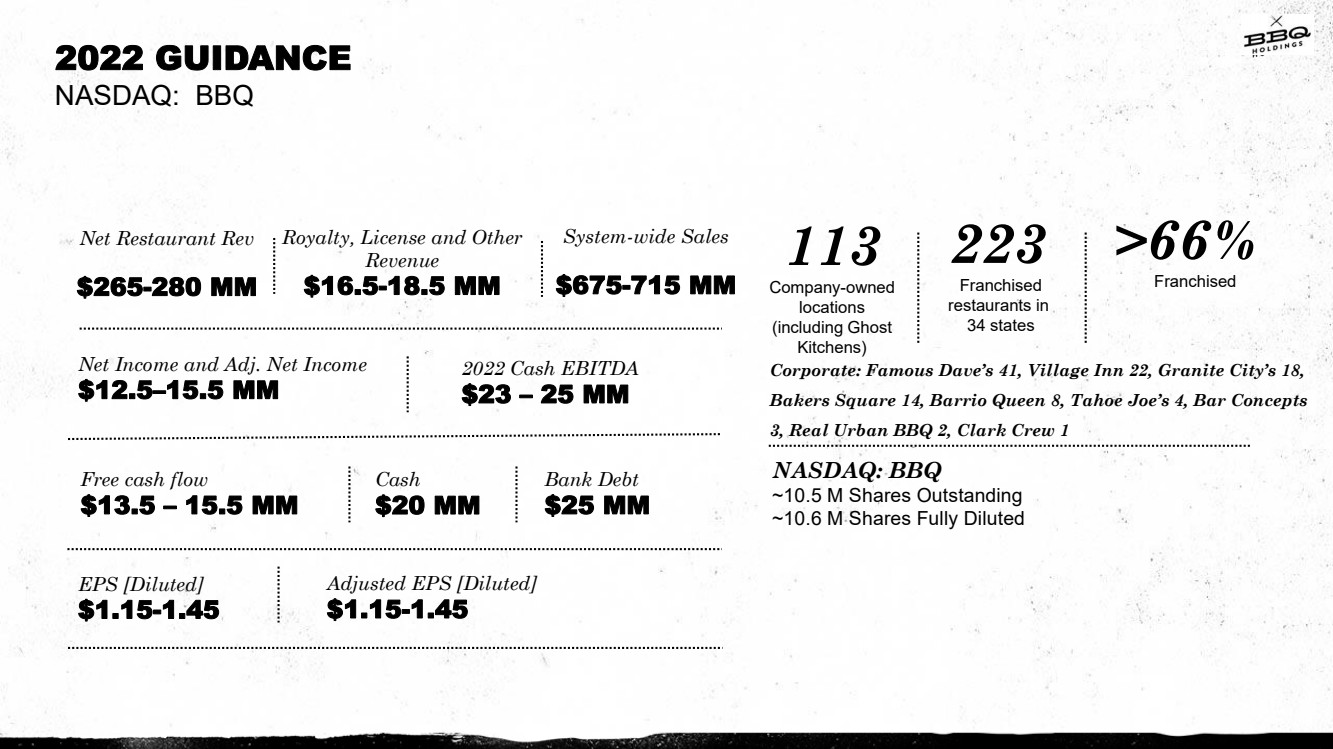

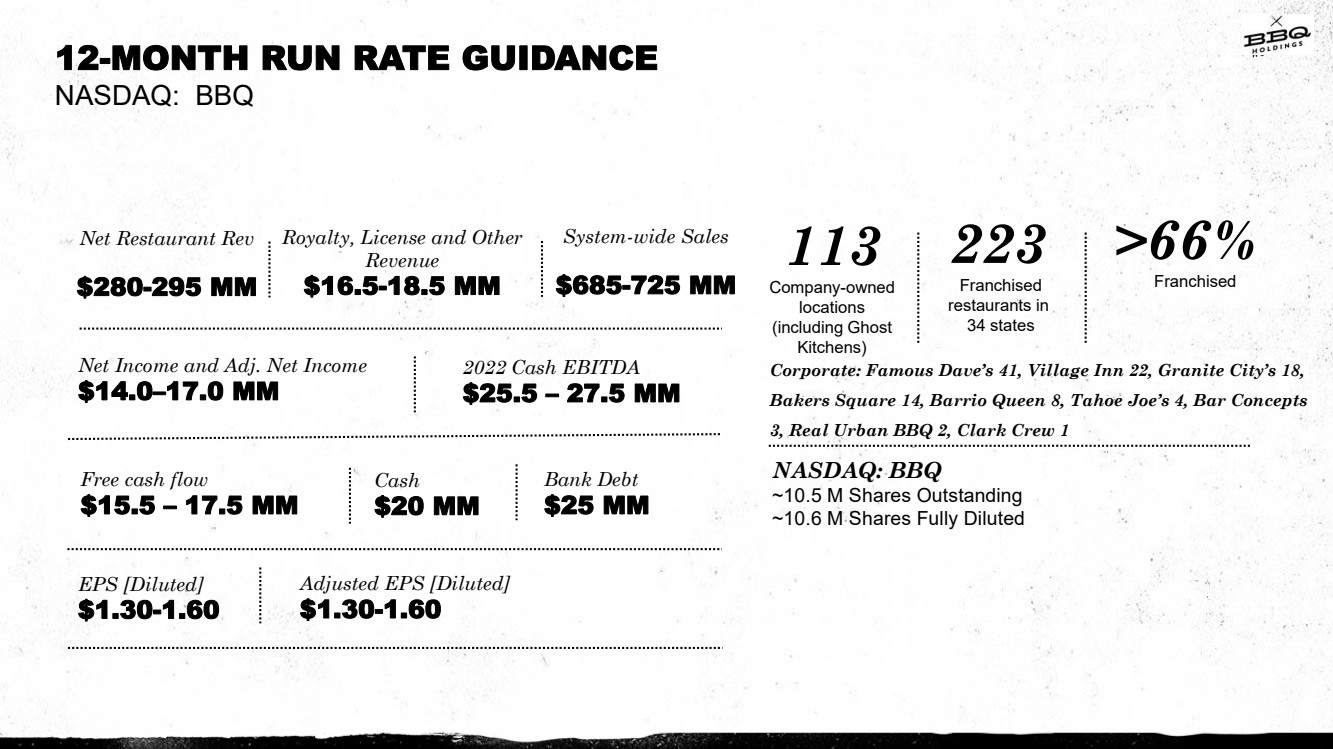

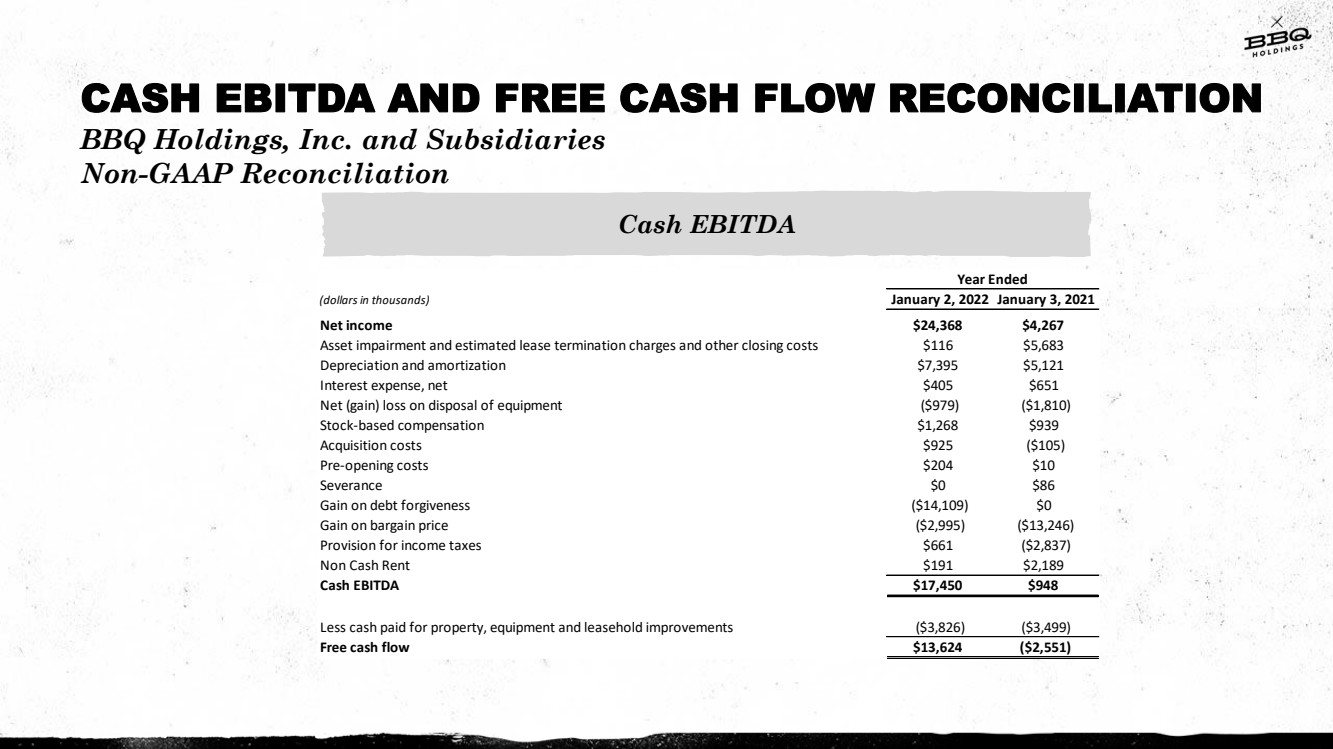

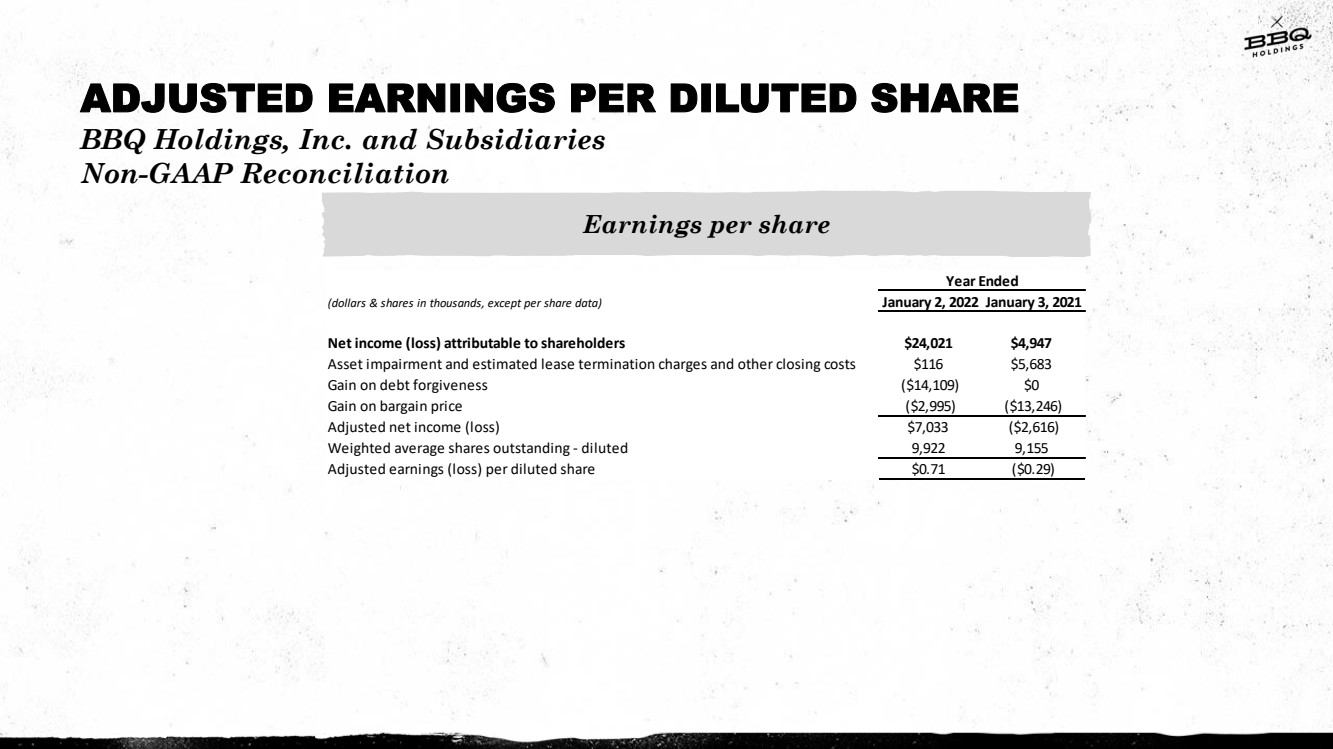

| CONFIDENTIAL AND PROPRIETARY INFORMATION Non - GAAP Financial Measures To supplement its condensed consolidated financial statements, which are prepared and presented in accordance with accounting pr inciples generally accepted in the United States (“GAAP”), the Company uses non - GAAP measures including those indicated below. These non - GAAP measures exclude significant expens es and income that are required by GAAP to be recorded in the Company’s consolidated financial statements and are subject to inherent limitations. By providing non - GAAP measures, together with a reconciliation to the most comparable GAAP measure, the Company believes that it is enhancing investors’ understanding of the Company’s business and res ult s of operations. These measures are not intended to be considered in isolation of, as substitutes for, or superior to, financial measures prepared and presented in a cco rdance with GAAP. The non - GAAP measures presented may be different from the measures used by other companies. The Company urges investors to review the reconciliation of its n on - GAAP measures to the most directly comparable GAAP measure, included in the accompanying financial tables. Cash EBITDA is net income plus asset impairment, estimated lease termination charges and other closing costs, depreciation an d a mortization, net interest expense, net (gain) loss on disposal of equipment, stock - based compensation, acquisition costs, pre - opening costs, severance, gain on debt forgiveness, gain on bargain purchase, and provision (benefit) for income taxes. Free cash flow is Cash EBITDA less cash paid for property, equipment and leasehold improvements. Adjusted net income (loss) is net income plus asset impairment, estimated lease termination charges and other closing costs, les s gain on debt forgiveness and gain on bargain purchase. Adjusted earnings per diluted share equals adjusted net income (loss) divided by the weighted average shares outstand ing, assuming dilution. Restaurant - level operating margins are equal to net restaurant sales, less restaurant - level food and beverage cost, labor and be nefit costs, and operating expenses. Forward - Looking Statements Statements in this press release that are not strictly historical, including but not limited to statements regarding the timi ng of the Company’s restaurant openings, the timing of refreshes and the timing or success of refranchising plans, are forward - looking statements within the meaning of the Private Securities Li tigation Reform Act of 1995. These forward - looking statements involve known and unknown risks, which may cause the Company’s actual results to differ materially from expected r esu lts. Although the Company believes the expectations reflected in any forward - looking statements are based on reasonable assumptions, it can give no assurance that its expectation will be attained. Factors that could cause actual results to differ materially from the Company’s expectation include the impact of the COVID - 19 virus pandemic, financial performance, restaurant industry conditions, execution of restaurant development and construction programs, franchisee performance, changes in local or national economic conditions , a vailability of financing, governmental approvals and other risks detailed from time to time in the Company’s SEC reports. SAFE HARBOR STATEMENT |