Exhibit 99.04

BEFORE THE CORPORATION COMMISSION OF OKLAHOMA

| IN THE MATTER OF THE APPLICATION OF | ) | |

| OKLAHOMA GAS AND ELECTRIC COMPANY | ) | |

| FOR AN ORDER GRANTING PRE-APPROVAL | ) | |

| TO CONSTRUCT THE CROSSROADS WIND | ) | CAUSE NO. PUD 201000037 |

| FARM, AND AUTHORIZING A RECOVERY | ) | |

| RIDER | ) | ORDER NO. |

| HEARING: | July 14, 2010, in Courtroom 301 |

| | 2101 North Lincoln Blvd., Oklahoma City, OK 73105 |

| | Before the Commission en banc and Jacqueline T. Miller, Referee |

| APPEARANCES: | James L. Myles, Deputy General Counsel, representing Public |

| | Utility Division, Oklahoma Corporation Commission |

| | William J. Bullard, Kimber L. Shoop, and Stephanie G. Houle, Attorneys, |

| | representing Oklahoma Gas and Electric Company |

| | William L. Humes and Elizabeth Ryan, Assistant Attorneys General, |

| | representing Office of Attorney General, State of Oklahoma |

| | Thomas P. Schroedter, James D. Satrom, and J. Fred Gist, Attorneys, |

| | representing Oklahoma Industrial Energy Consumers |

| | Jack G. Clark, Jr. and Ronald E. Stakem, Attorneys, representing OG&E |

| | Shareholders Association |

| | Richard K. Goodwin, Attorney, representing Chermac Energy |

| | Corporation |

FINAL ORDER APPROVING JOINT STIPULATION

AND SETTLEMENT AGREEMENT

BY THE COMMISSION:

This cause comes before the Oklahoma Corporation Commission (“Commission”) on the Referee’s recommendation for Final Order Approving Joint Stipulation and Settlement Agreement executed between Oklahoma Gas and Electric Company (“OG&E” or “Company”), the Public Utility Division (“PUD”) of the Commission, the Office of the Attorney General, State of Oklahoma (“Attorney General”), the OG&E Shareholders Association (“OG&E Shareholders”), Chermac Energy Corporation (“Chermac”) and the Oklahoma Industrial Energy Consumers (“OIEC”) all collectively referred to as the “Stipulating Parties.” A copy of the Joint Stipulation and Settlement Agreement (“Settlement Agreement”) is attached hereto as Att achment “A” and incorporated herein by reference.

SUMMARY OF PARTIES’ ALLEGATIONS

Applicant

| 1. | Applicant OG&E, requested in its Application that the Commission find that Crossroads is a prudent investment for OG&E; that the Crossroads Wind Farm Facility will be “used and useful” when placed in service; that OG&E be permitted to implement a recovery rider so that the costs of Crossroads can be recovered as the turbines are placed in service; and that it is appropriate to approve a waiver from the Commission’s competitive procurement rules. |

| 2. | Applicant submitted pre-filed testimony of Jesse B. Langston, K. Wayne Walker and Bryan J. Scott in this cause; supplemental testimonies of Mr. Langston and Mr. Scott supporting and recommending approval of the Settlement Agreement; testimony summaries of all testimony filed by its witnesses in this cause; and oral testimony of Mr. Langston and Mr. Scott supporting approval of the Settlement Agreement. |

| 3. | Mr. Langston testified that the company believes the terms of the Settlement Agreement represent a fair, just and |

| PUD 201000037-FINAL ORDER | Page 2 of 13 |

reasonable resolution of the matters in this cause, that there is a demonstrated need for Crossroads and that approval of the Settlement Agreement and Crossroads would be in the public interest.

Public Utility Division

| 1. | PUD submitted pre-filed testimony of Frank Mossburg and Craig Roach in this cause and also filed supplemental testimony of Mr. Roach supporting and recommending approval of the Settlement Agreement and testimony summaries of the pre-filed testimonies of Mr. Roach and Mr. Mossburg, and Mr. Roach’s supplemental testimony. |

| 2. | PUD provided the oral testimony of Mr. Roach recommending approval of the Settlement Agreement as a fair, just and reasonable resolution of the matters in this cause and stating that the Settlement Agreement is in the public interest and that OG&E has demonstrated a need for Crossroads. |

Attorney General

| 1. | William L. Humes, Assistant Attorney General, on behalf of the Attorney General, filed the pre-filed testimony of Mr. Daniel Peaco. |

| 2. | The Attorney General did not submit testimony addressing the Settlement Agreement, but recommended approval of the Settlement Agreement as a fair, just and reasonable resolution of the matters in this cause and stated that the record demonstrates a need for Crossroads and that approval of the Settlement Agreement is in the public interest. |

Intervenors

| 1. | OIEC, Intervenor, submitted pre-filed testimony of Mr. Scott Norwood and participated in the hearing. |

| 2. | OIEC did not submit testimony addressing the Settlement Agreement, but recommended approval of the Settlement Agreement as a fair, just and reasonable resolution of the matters in this cause and stated that the record demonstrates a need for Crossroads and that approval of the Settlement Agreement is in the public interest. |

| 3. | Ronald E. Stakem, Attorney, representing OG&E Shareholders, Intervenor, filed a Statement of Position and participated in the hearing. |

| 4. | OG&E Shareholders recommended approval of the Settlement Agreement as a fair, just and reasonable resolution of the matters in this cause and stated that the record demonstrates a need for Crossroads and that approval of the Settlement Agreement is in the public interest. |

| 5. | Chermac, Intervenor, filed a Statement of Position. |

| 6. | Chermac recommended approval of the Settlement Agreement as a fair, just and reasonable resolution of the matters in this cause. |

DATES AND PLACES OF HEARINGS

Hearings in this cause were conducted:

April 15, 2010 – Motion to Intervene – OG&E Shareholders Association

in Courtroom B, 2101 North Lincoln Blvd., Oklahoma City, OK 73105

April 15, 2010 – Motion to Assess Attorney General’s Expert Costs to OG&E

in Courtroom B, 2101 North Lincoln Blvd., Oklahoma City, OK 73105

April 15, 2010 – Motion for Protective Order

in Courtroom B, 2101 North Lincoln Blvd., Oklahoma City, OK 73105

April 15, 2010 – Motion to Establish Procedural Schedule

in Courtroom B, 2101 North Lincoln Blvd., Oklahoma City, OK 73105

April 15, 1010 – Motion for Assessment of Costs of the Commission to OG&E

in Courtroom B, 2101 North Lincoln Blvd., Oklahoma City, OK 73105

April 15, 2010 – Motion to Intervene—OIEC

| PUD 201000037-FINAL ORDER | Page 3 of 13 |

in Courtroom B, 2101 North Lincoln Blvd., Oklahoma City, OK 73105

May 13, 2010 – Motion to Intervene—Chermac Energy Corp.

in Courtroom B, 2101 North Lincoln Blvd., Oklahoma City, OK 73105

May 20, 2010 – Motion to Determine Notice Requirements

in Courtroom B, 2101 North Lincoln Blvd., Oklahoma City, OK 73105

July 13, 2010—Pre-Hearing Conference

In Courtroom 301, 2101 North Lincoln Blvd., Oklahoma City, OK 73105

July 14, 2010 – Hearing on the Merits en banc with Referee

in Courtroom 301, 2101 North Lincoln Blvd., Oklahoma City, OK 73105

PROCEDURAL HISTORY

On April 8, 2010, OG&E filed its Application initiating this proceeding seeking an order of the Commission determining that the costs to OG&E for the construction of Crossroads and related facilities are prudent, and that the Crossroads Wind Farm Facility will be used and useful when placed in service; authorizing OG&E to implement a recovery rider to be effective until Crossroads is placed in rate base by order of the Commission; approving a waiver from the Commission’s competitive procurement rules; and granting such other and further relief as the Commission may determine to be fair, just and equitable in the premises. Concurrently with its Application OG&E also filed the Redacted and Unredacted Direct Testimony of K. Wayne Walker; the Direct Testimonies of Jesse B. Langston and Bryan J. Scott; its Motion to Establish Procedural Schedule and a Motion for Protective Order. OIEC filed its Motion to Intervene on April 12, 2010. On April 13, 2010, the Attorney General filed his Entry of Appearance. Also on April 13, 2010, the PUD Staff filed its Motion for Assessment of Costs to OG&E. On April 15, 2010, OG&E Shareholders entered an oral motion to intervene before the ALJ. On April 21, 2010, the Commission issued Order No. 574909 granting OG&E’s Motion for Protective Order. The Commission issued Order Nos. 574971 and 574972 granting OIEC’s Motion to Intervene and OG&E Shareholders Oral Motion to Intervene, respectively, on April 22, 2010. The Commission issued Order Nos. 575044 and 575045 granting PUD Staff’s Motion for Assessment of Costs and the Attorney General’s Motion to Assess Expert Costs, respectively, on April 26, 2010.

Chermac filed a Motion to Intervene on May 4, 2010. The Commission issued Order No. 575455 on May 12, 2010, granting OG&E’s Motion to Establish Procedural Schedule. On May 13, 2010, OG&E filed its Motion to Determine Notice Requirements. On May 21, 2010, OG&E filed the Redacted Service and Maintenance Agreement by and between OG&E and Siemens Energy; the Redacted Agreement for Supply, Erection, Installation and Commissioning of Wind Turbine Generators by and between Siemens Energy and OG&E; the Redacted Balance of Plant Engineering, Procurement and Construction Agreement by and between Res America Construction, Inc. and OG&E; and the Redacted Asset Purchase Agreement by and between Crossroads Wind Energy, LLC and OG&a mp;E.

On June 11, 2010 the Attorney General filed the Redacted and Unredacted Responsive Testimony of Daniel Peaco; the OIEC filed the Responsive Testimony of Scott Norwood; PUD filed the Unredacted and Redacted Direct Testimonies of Frank Mossburg and Craig R. Roach; Chermac filed its Statement of Position; and OG&E Shareholders filed its Statement of Position. Also on June 11, 2010, the Commission issued Order Nos. 576086 and 576087 granting OG&E’s Motion to Determine Notice Requirements and directing OG&E to publish the Notice of Hearing once each week for two consecutive weeks with the first publication being at least fifteen days prior to the hearing on the merits in The Oklahoman and Tulsa World and also in newspapers of general circulation in the following Oklahoma counties in which OG&E has customers: Alfalfa, Bryan, Dewey, Ellis, Grant, Jefferson, Johnston, Love, Major, Marshall, Woods, and Woodward; and granting Chermac’s Motion to Intervene, respectively. On June 29, 2010, the Stipulating Parties filed an executed Joint Stipulation. On June 21, 2010, OG&E filed its Affidavit of Publication from The Cherokee Messenger & Republican. On June 23, 2010, OG&E filed its Affidavit of Publication from The Daily Ardmoreite. On June 28, 2010, OG&E filed its Affidavit of

| PUD 201000037-FINAL ORDER | Page 4 of 13 |

Publication from the Poteau Daily News. On June 30, 2010, OG&E filed its Affidavit of Publication from The Ellis County Capital. On July 2, 2010, OG&E filed its Affidavits of Publication from the Johnston County Capital-Democrat and the Sequoyah County Times. On July 7, 2010, OG&E filed its Affidavit of Publication from the Alva Review-Courier. On July 8, 2010, OG&E filed its Affidavit of Publication from the Medford Patriot-Star and the Dir ect Testimony Summaries of Jesse B. Langston, K. Wayne Walker and Bryan Scott; the Supplemental Testimonies in Support of the Joint Stipulation and Settlement Agreement of Jesse B. Langston and Bryan Scott; the Supplemental Testimony Summaries of Jesse B. Langston and Bryan Scott; and its Exhibit and Witness List. Also on July 8, 2010, the PUD filed its Exhibit and Witness List and the Responsive Testimony Summaries of Frank Mossburg and Craig Roach. The OIEC filed its Exhibit and Witness List and the Responsive Testimony Summary of Scott Norwood on July 8, 2010. On July 9, 2010, OG&E filed Exhibit JBL-1 to the Supplemental Testimony of Jesse B. Langston. Additionally, PUD filed Redacted and Unredacted Supplemental Testimony of Craig Roach and the Supplemental Testimony Summary of Craig Roach. On July 13, 2010, the Referee conducted a Pre-Hearing Conference, pursuant to the approved procedural schedule in this matter. Also on July 13, 2010 , OG&E filed its Affidavits of Publication for The Tahlequah Daily Press, Woodward News, Enid News and Eagle, Dewey County Record, Tulsa World, Medford Patriot-Star, The Oklahoman, and the Durant Daily Democrat. On July 19, 2010, OG&E filed original copies of Affidavits of Publication for The Oklahoman and the Durant Daily Democrat.

The Hearing on the Merits for this cause commenced before the Commission en banc with Referee on July 14, 2010, pursuant to the Notice of Hearing. The Commission accepted evidence and testimony of witnesses sworn and examined in connection with the Settlement Agreement. Thereafter, the Referee took the matter under advisement.

SUMMARY OF PARTIES’ EVIDENCE

Applicant

| 1. | Kimber L. Shoop, attorney for the Applicant, announced that notice of this cause was published in accordance with the notice requirements directed by the Commission in Order No. 576086. |

| 1. | Jesse Langston, Vice-President, Utility Commercial Operations, filed pre-filed Direct Testimony on behalf of OG&E on April 8, 2010, and Supplemental Testimony Supporting the Joint Stipulation and Settlement Agreement on July 8, 2010. He stated that the purpose of his Supplemental Testimony was to sponsor the Joint Stipulation and Settlement Agreement executed by the Stipulating Parties on June 28, 2010. In addition, during the hearing, Mr. Langston provided some background on the Crossroads project. |

| 2. | First, Mr. Langston described the Crossroads project. He testified that Crossroads is an 86-turbine, 197.8 MW wind-powered electric generation facility located in Dewey County, Oklahoma. He stated that the Crossroads facility is expected to come on-line during the second half of 2011 and will interconnect to OG&E’s new 345 kV Woodward to Oklahoma City transmission line (“Windspeed”). He testified that the Crossroads facilities will utilize Siemens Energy SWT-2.3-101 wind turbine generators each with a nameplate rating of 2.3 MW. Mr. Langston further testified that each turbine will have a 101-meter rotor diameter and will be supported by an 80-meter tower (262 feet). Mr. Langston explained that this 101 meter rotor diameter is larger than the 93 meter rotor diameter on the OU Spirit turbines and such additional length blades impro ves the energy output for each unit. Mr. Langston testified that a separate interconnection request has been made with the Southwest Power Pool (“SPP”) for an incremental 29.7 MWs of wind turbines to be located on the same site. He stated that if the additional 29.7 MWs are included, the Crossroads facility would have a capacity of 227.5 MW. |

| 3. | Mr. Langston explained that OG&E has executed definitive agreements with Siemens for the supply and erection of turbines and with RES Americas for the preparation of the site and construction of the balance of the plant (“Balance of Plant”). He also gave a brief description of both RES Americas and Siemens. With regard to the agreement with Siemens, Mr. Langston explained that under the Siemens Turbine Supply Agreement, Siemens is obligated to solicit bids to manufacture components of the turbines in Oklahoma, including a specific requirement related to DMI Industries, which has manufacturing facilities for the production of wind towers in Tulsa, Oklahoma and is a Siemens qualified vendor. In addition, Mr. Langston explained that Siemens has agreed to jointly engage in discussions with Oklahoma State University, the University of Oklahoma, and the High Plains Technology Center Tech Partnership, and potentially |

| PUD 201000037-FINAL ORDER | Page 5 of 13 |

other institutions concerning potential internship programs for students in connection with the operations of Crossroads and OU Spirit.

| 4. | Mr. Langston testified that the Crossroads turbines will begin delivering wind energy as they come on-line during the second half of 2011. The entire facility is expected to be in service by the end of 2011. Mr. Langston testified that this large, approximately 20,000-acre site possesses the necessary attributes to support a successful large scale commercial wind energy project. He explained that the land agreements are in place to construct and interconnect the project and three meteorological towers have been collecting wind speed data during the last two years. He explained that the favorable wind speed conditions at this particular site, when combined with the large contiguous site, allow OG&E to optimize turbine placement that he believes will produce an exceptional capacity factor. In addition, Mr. Langston testified t hat the site is located close to major transmission facilities. Mr. Langston also explained that the Oklahoma Department of Wildlife Conservation (“ODWC”) recently determined that the Crossroads site lies outside the current range of the Lesser Prairie Chicken (“LPC”) and that negative impacts to the LPC is not a concern. Mr. Langston stated that OG&E does not believe it will need to perform any environmental remediation at the site and has not included any such remediation costs in this request. |

| 5. | Mr. Langston testified that OG&E is requesting a waiver of the competitive procurement rules because the exceptional pricing and other attractive terms negotiated by OG&E are contingent upon the execution of contracts in a period of time which made it unrealistic to attempt to adhere to the process set out in the Commission’s competitive procurement rules. Also, Mr. Langston explained that OG&E was obligated to seek a waiver of the competitive procurement rules because of commitments made in Cause No. PUD 200900167 and adopted by the Commission in Order No. 571788 (“OU Spirit Proceeding”). |

| 6. | Mr. Langston testified that all parties in this case executed the Settlement Agreement. He explained that the signatories of the Stipulation were OG&E, the Public Utility Division of the Oklahoma Corporation Commission, the Attorney General, Chermac Energy Corporation, the Oklahoma Industrial Energy Consumers, and the OG&E Shareholders Association. |

| 7. | Mr. Langston described the agreements reached by the Stipulating Parties regarding whether construction of the Crossroads facility is prudent. He testified that in Section III.A, the Stipulating Parties request that the Commission issue an order granting preapproval of the Crossroads facility as described in the Settlement Agreement and finding that Crossroads is a prudent investment. Mr. Langston further testified that the Stipulating Parties also request that the Commission issue an order finding that Crossroads, when constructed, placed in service and interconnected to Windspeed, will be used and useful to OG&E’s customers, subject to material compliance with expected operations. He testified that the Stipulating Parties further agreed that the operational performance of Crossroads shall be reviewed pursuant to the regular Commission reviews provided for in OAC 165:3 5-39 and OAC 165:35-35. |

| 8. | Mr. Langston provided further testimony on the agreements reached by the Stipulating Parties regarding the recovery mechanism for costs associated with the Crossroads project. He testified that in Section III.B, the Stipulating Parties agreed on the Crossroads Rider as the mechanism through which OG&E would recover costs associated with the Crossroads project. |

| 9. | Mr. Langston further testified that in Section III.C, the Stipulating Parties request that the Commission grant OG&E’s request for a waiver from the Commission’s competitive bidding requirements. He testified that the Stipulating Parties agreed that their recommendation is based on: (i) OG&E’s representations that the Crossroads project will deliver significantly greater benefit to customers than other top bidders in its most recent RFP and other wind resource opportunities available to OG&E at this time, and that the opportunity to realize these benefits may be lost if action is not taken at this time; and (ii) the agreements described in the Settlement Agreement. |

| 10. | Mr. Langston further testified on the agreements that were reached regarding Crossroads’ construction costs. He testified that the Stipulating Parties, in Section III.D of the Settlement Agreement, agreed to cap OG&E’s capital costs for which it is entitled recovery (“Capped Investment Amount”). He testified that this Capped Investment Amount for the 197.8 MW facility will be the lesser of (i) $389 million as adjusted for the Krone/Dollar exchange rate on the date a Commission order is issued in this cause, plus a variance which does not exceed three percent; or (ii) a maximum cost of $416.2 million. Mr. Langston testified that the Krone/Dollar exchange rate provision impacts approximately 40 percent of the Turbine Service Agreement. He further testified that the Capped Investment Amount approved by a Commission order adopting the Settlement Agreement will be calculated using the Danish Krone/U.S. Dollar exchange rate posted on the Yahoo Financial web site as of 9:00 a.m. Central time on the date of the Commission’s action. At the hearing, Mr. |

| PUD 201000037-FINAL ORDER | Page 6 of 13 |

Langston stated that, on July 13, 2010, the Krone/U.S. Dollar exchange rate was 5.89 to 1. He explained that, if this is the exchange rate on the date of a final Commission order in this proceeding, the Capped Investment Amount would actually be $391.6 million plus a 3 percent variance for the 197.8 MW project and $451.3 million plus a 3 percent variance for the 227.5 MW project. Mr. Langston stated that the three percent variance is intended to recognize potential increases in construction costs and possible movement in the exchange rate between the date of the Commission order and the date when OG&E can exercise its rights under the Turbine Supply Agreement.

| 11. | Mr. Langston further testified that there is a limitation on the Capped Investment Amount. He stated that the Stipulating Parties have agreed to a “walk-away” provision should the Capped Investment Amount as of the date of the final Commission order exceed $416.2 million. He testified that this provision is intended to reflect an adverse movement in the Danish Krone/U.S. Dollar exchange rate before the date of a Commission order that is so extraordinary as to significantly change the value to be provided by Crossroads. |

| 12. | Mr. Langston testified as to what would happen if OG&E’s actual construction costs exceeded the Capped Investment Amount. He testified that to the extent OG&E’s total investment in Crossroads exceeds the Capped Investment Amount, the Stipulating Parties have agreed that OG&E has the option to seek recovery of any excess above the Capped Investment Amount in a general rate case. He further testified that the Settlement Agreement specifies that any construction costs incurred by OG&E in excess of the Capped Investment Amount will not be eligible for cost recovery prior to OG&E’s next general rate case and in no circumstances may that recovery include interim carrying costs on the excess Plant in Service. |

| 13. | Mr. Langston further testified that the Capped Investment Amount discussed in Section III.D is related to the Crossroads project at 197.8 MW. He stated that the Crossroads site is large enough to support a 98-turbine, 227.5 MW wind farm, but the developer, RES Americas, initially requested interconnection service for only 197.8 MW. Mr. Langston testified that OG&E is working within the SPP interconnection study process to determine what interconnection costs an incremental 29.7 MWs would add to the project. He testified that the Stipulating Parties agreed that if those additional 29.7 MWs (twelve additional turbines including nine 2.3 MW turbines and three 3 MW turbines) can be added to the Crossroads site with incremental interconnection costs below $4.7 million, this incremental quality of wind generation capacity would be beneficial to OG&E’s customers. � 0;He testified that consequently, the Settlement Agreement provides that, subject to this contingency and other limitations described therein, OG&E’s decision to proceed with the construction of those additional twelve turbines is prudent, the turbines will be used and useful when placed in service, and the costs and associated recovery for these additional turbines shall be included in the Crossroads Rider. |

| 14. | Mr. Langston testified that the three 3MW turbines were next generation turbines that OG&E would be one of the first in the country to own and operate. He explained that OG&E was successful in negotiating a price for these new turbines that matched the price for the 2.3 MW turbines. |

| 15. | Mr. Langston testified that if OG&E constructs Crossroads as a 227.5 MW project the Capped Investment Amount would change. He stated that Section III.O specifies that if OG&E moves forward with the additional twelve turbines and constructs Crossroads as a 227.5 MW project, the Capped Investment Amount calculation will be the lesser of (i) $448.8 million as adjusted for the Krone/Dollar exchange rate on the date a Commission Order; plus a variance which does not exceed three (3) percent; or (ii) a maximum cost of $480.2 million. He further testified that in the same manner as with the Capped Investment Amount for the 197.8 MW project, the Company will have the option to request recovery of any actual costs in excess of that amount. Mr. Langston testified that there is also a Maximum Stipulated Cost associated with the 227.5 MW project. He stated that Secti on III.O specifies that the Settlement Agreement will not become effective if the 227.5 MW Capped Investment Amount on the date of the final order exceeds $480.2 million and this is referred to in the Settlement Agreement as the “Alternative Maximum Stipulated Cost.” |

| 16. | Mr. Langston further testified that an agreement has been reached regarding the recovery of Operation and Maintenance (“O&M”) costs. He testified that as specified in Section III.L of the Settlement Agreement, O&M cost recovery will be capped until after OG&E’s 2013 general rate case. He further testified that since the O&M expense cap will depend on whether the Crossroads project is constructed at 197.8 MW or 227.5 MW, Stipulation Exhibit BJS-2 identifies the capped O&M expense in 2012 and 2013 for both projects. He testified that after 2013, the appropriate level of O&M cost recovery will be determined by the Commission in the periodic rate case process. |

| 17. | Mr. Langston testified that in Section III.F of the Settlement Agreement, OG&E has agreed to pass through to Oklahoma retail customers one hundred percent of the Oklahoma jurisdictional Renewable Energy Credit (“REC”) proceeds (after |

| PUD 201000037-FINAL ORDER | Page 7 of 13 |

deduction of third-party transaction costs if applicable) generated by Crossroads’ RECs during the term of and through the Crossroads Rider.

| 18. | Mr. Langston testified that in Section III.G of the Settlement Agreement, OG&E agreed to file an application with the Commission within sixty days of a final Commission order in this proceeding requesting amendments to the current Minimum Filing Requirements (OAC 165:35-39) for the purpose of providing additional information regarding electric utility wind generation facilities and wind energy purchase power agreements (“PPAs”). He further testified that the Stipulating Parties agree to collaborate in developing the requested amendments, but agreed that this additional information shall at a minimum include the amount of Production Tax Credits (“PTCs”) utilized in the reporting year. He testified that OG&E has also agreed to provide the additional information simultaneously with the filing of its Minimum Filing Requirements until such time as the proposed amendments are either adopted or rejected by the Commission. |

| 19. | Mr. Langston further testified that the Stipulating Parties reached agreement regarding the treatment of PTCs. He testified that in Section III.H, the Stipulating Parties agreed that OG&E’s Oklahoma retail customers will be credited with one hundred percent of the Oklahoma jurisdictional share of the actual Crossroads’ PTCs created during the term of, and as specified in, the Crossroads Rider. He further testified that at the end of the Crossroads Rider and for the remaining life of the Crossroads project PTCs, OG&E will continue to credit its Oklahoma retail customers with one hundred percent of the Oklahoma jurisdictional share of the actual test year benefits of the PTCs (as adjusted for known and measurable changes) in the determination of the revenue requirements in each general rate proceeding. |

| 20. | Mr. Langston testified that the Stipulating Parties agreed on how damage payments received from or bonus payments made to the wind developer or turbine manufacturer should be treated through the Crossroads Rider. He stated that the agreements with RES Americas Construction, Inc. and Siemens include certain incentive and penalty provisions that protect the interests of OG&E and its customers. He further testified that the Stipulating Parties agreed that OG&E will pass through to Oklahoma retail customers the Oklahoma jurisdictional share of all net damage payments received from the wind developer or the turbine manufacturer. He further stated that it was acknowledged by the Stipulating Parties that these damage payments would not exceed $85 million. Mr. Langston testified that the Stipulating Parties further agreed that, in light of the benefits to custome rs associated with higher achieved Crossroads output and the early completion of the Crossroads project, OG&E will pass through to Oklahoma customers the Oklahoma jurisdictional share of all bonuses paid to the wind developer or the turbine manufacturer pursuant to contract and it was acknowledged by the Stipulating Parties that these bonuses would not exceed $3.2 million. |

| 21. | Mr. Langston testified that as described in Section III. J, one hundred percent of all margins from incremental sales of capacity and energy into the SPP Energy Imbalance Services (“EIS”) market will be credited to customers. He testified that these incremental sales represent the net proceeds from sales of coal or natural gas-fired generation made possible by the availability of Crossroads. |

| 22. | Mr. Langston further testified that in Section III.K, the Stipulating Parties agreed that OG&E would agree to certain obligations if the three-year rolling average of Crossroads megawatt-hours of production (including a credit for energy not produced due to curtailments or other events caused by system emergencies, force majeure events or transmission system issues) falls below a specified level. He stated that this level corresponds to a 41.14 percent capacity factor for the facility. Mr. Langston testified that under such circumstances, OG&E agreed to file testimony demonstrating the prudent operation of the Crossroads facility simultaneously with its filing of Minimum Filing Requirements pursuant to OAC 165:35-39. Mr. Langston testified that as he explained in his direct testimony, using probability analysis, OG&E determined that there is a ten percent probability that the capacity factor could be 41.14 percent or lower. He further testified that the Company contends that if a 41.14 percent capacity factor is achieved Crossroads will produce significant production cost savings for customers; nevertheless, OG&E agreed to provide testimony specifically addressing the prudency of its operations if Crossroads’ output fails to meet the agreed upon standard. Mr. Langston also stated that output levels below 41.14 percent would not necessarily be considered imprudent, but merely the agreed on level of output where OG&E would provide testimony demonstrating the facility’s prudent operation. |

| 23. | Mr. Langston testified that the Stipulating Parties reached an agreement regarding the Company’s Integrated Resource analysis. He testified that in Section III.M of the Settlement Agreement, OG&E agreed to submit an interim, updated Integrated Resource Plan (“IRP”) as contemplated by Subsection 37 of Chapter 35 of the Commission’s Rules. He testified that for this interim updated IRP, OG&E agreed that the updated IRP analysis will specifically address the need and timing for additional wind resources in OG&E’s system, including but not limited to various amounts of wind and |

| PUD 201000037-FINAL ORDER | Page 8 of 13 |

timing of additional wind, including assessments of the benefits based on consideration of the operation of the SPP day-ahead market, transmission limitations/requirements for expanded wind resource development, the added costs for fossil fuel-fired power plants when those fossil fuel plants are used to accommodate variable wind generation, current expectation of the impacts of regional haze rules on OG&E’s coal generation, and a range of scenarios for natural gas prices and climate legislation and other factors which may impact the amounts and timing of wind resource additions over the next ten years. He further testified that OG&E agreed to hold a collaborative technical conference for all stakeholders in order to allow all stakeholders the opportunity to provide input regarding utility objectives, assumptio ns, and planning scenarios to be contained in the updated IRP analysis. He stated that this technical conference will be held no less than sixty days prior to the submittal of the updated IRP. He further testified that the Stipulating Parties also agreed that OG&E shall pay for and be able to recover costs associated with third party consultants needed by the Attorney General and/or the Commission Staff to participate in the stakeholder technical conference.

| 24. | Mr. Langston further testified that the Stipulating Parties agreed that the agreements described in Section III.M do not constitute an admission by the Stipulating Parties that OG&E has a need for future wind resources nor is it intended to relieve OG&E of its burden of proof to demonstrate that any agreements it enters into to acquire future wind energy assets or to purchase additional wind energy are reasonable or prudent. |

| 25. | Mr. Langston also testified that in Section III.N of the Settlement Agreement, OG&E agreed not to seek Commission preapproval for the construction or acquisition of any new wind generation asset or for a long term wind purchase power agreement until it finalizes and submits a new IRP described in Section III.M of the Settlement Agreement. He stated that the Stipulating Parties agreed that this restriction would not apply to (i) preapproval of the Crossroads expansion from 197.8 MW to 227.5 MW identified in Section III.O of the Settlement Agreement; or (ii) the procurement of the Company’s next incremental amount of wind energy (at least 100 MW and no more than 150 MW), which shall be awarded through a competitive procurement process. Mr. Langston further testified that the Stipulating Parties agreed that for the purposes of the wind energy competitive procurement process agreed to in Section III.N of the Settlement Agreement, the Independent Evaluator selected to participate in the process shall be either: a) a Commission staff member or a third party agreed to by OG&E, the Attorney General and Public Utility Division staff; or b) if OG&E, the Attorney General and Public Utility Division staff cannot agree to an Independent Evaluator pursuant to (a), a Commission staff member or third party appointed by the Commission after notice and hearing. |

| 26. | Mr. Langston testified as to the evidence in the record which he believes supports a finding by the Commission that there is a need for the Crossroads project, including the substantial economic benefits accruing almost immediately to customers as well as the hedge the Crossroads project provides against prospective environmental costs and future fluctuations in natural gas costs. Mr. Langston stated that because OG&E is able to obtain the turbines at such a favorable price, the addition of Crossroads to the OG&E portfolio will provide exceptional production cost savings which will benefit OG&E’s customers almost immediately and continue throughout the life of the facility. Mr. Langston testified that OG&E’s analyses demonstrate that Crossroads, after taking into consideration various risk factors, will provide production cost savings to OG&E’s customer s under a wide range of scenarios, including under varying natural gas prices, carbon costs and capacity factors. Further, Mr. Langston testified that if approved, Crossroads would increase the amount of wind capacity in OG&E’s portfolio from 554 MW (including OU Spirit and the CPV Keenan and Taloga PPAs) to 751 MW (or approximately 780 MW if Crossroads is constructed at 227.5 MW). Mr. Langston testified that this would bring the overall amount of OG&E’s renewable energy to approximately 10 percent of its total resource portfolio. Mr. Langston further testified that the Company strongly believes that the addition of wind energy provides OG&E and its customers with an effective hedge against higher and volatile fuel prices, the cost imposed by the creation of a Federal renewable portfolio standard and costly carbon tax regulations, whether imposed by new laws or the Environmental Protection Agency. Mr. Langston further testified that the appl ication was consistent with the need demonstrated in the 2010 IRP for additional wind generation by 2012, as reflected in his Direct Testimony in this cause. He also testified that the Crossroads project will help the State of Oklahoma meet the new renewable energy goal of 15 percent by 2015 that was adopted in recently enacted Oklahoma House Bill 3028. |

| 27. | Mr. Langston concluded by testifying that, in his opinion, the Settlement Agreement is in the public interest. |

1. Bryan Scott, Director of Pricing and Load, filed pre-filed Direct Testimony on behalf of OG&E on April 8, 2010 and Supplemental Testimony Supporting the Joint Stipulation and Settlement Agreement on July 8, 2010. He stated that the purpose of his Supplemental Testimony was to sponsor two exhibits attached to the Settlement Agreement which are: (1)

| PUD 201000037-FINAL ORDER | Page 9 of 13 |

the Crossroads Rider recommended by the Stipulating Parties; and (2) an exhibit that presents the capped O&M expense amounts for Crossroads during 2012 and 2013 agreed to by the Stipulating Parties for Crossroads.

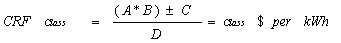

| 2. | Mr. Scott testified that the Crossroads Rider is attached to the Settlement Agreement as Stipulation Exhibit BJS-1 and is designed to begin recovering the annual revenue requirement associated with the Crossroads site assets as each asset is placed in service or otherwise becomes used and useful. He further testified that this would include the turbines, roads, generation lead, building and other supporting infrastructure. He stated that the Crossroads Rider will become effective upon the issuance of the final order approving this Settlement Agreement and the submission to and approval of the Crossroads Rider tariff by the Director of the Public Utility Division. Mr. Scott testified that upon its effective date, the Crossroads Rider is designed to begin recovering the annual revenue requirement associated with each Crossroads wind turbine placed in service and the Crossroads Ride r will be effective until new rates are implemented after OG&E’s 2013 general rate case. He testified that in the 2013 general rate proceeding, the net depreciated balance of Crossroads’ plant costs will be included in rate base. He further testified that as agreed to in the Settlement Agreement, the rate of return utilized for the Crossroads Rider will initially be calculated using the capital structure, return on equity, interest costs and tax effect as approved in Order No. 516261 in Cause No. PUD 200500151. He further testified that this rate of return will be adjusted to reflect the rate of return approved by the Commission in OG&E’s 2011 rate case and the new rate of return will be applied on the effective date of the rates approved in the 2011 rate case. |

| 3. | Mr. Scott testified that some turbines may be placed in service as early as the third quarter of 2011, but most of the turbines are expected to be placed in service during the fourth quarter of 2011 and the facility is expected to be fully operational by December 31, 2011. Mr. Scott further testified regarding why it is appropriate for the Crossroads Rider to be implemented before all of the turbines are placed in service. He stated that first, customers will benefit from the energy produced by each individual turbine as it is placed in service by lowering fuel costs. He further testified that when a turbine is placed in service, the accumulation of Allowance for Funds Used during Construction (“AFUDC”) ceases. Therefore, synchronizing the recovery of costs with each turbine becoming operational (used and useful) is reasonable and fair to all parties. |

| 4. | Mr. Scott further testified that OG&E expects to file a rate case with a test year of 2012 and implement new rates in January 2014. He testified that these new rates will include the revenue requirement for Crossroads. He further testified that the rider should be in existence from sometime in 2011 through December 2013. |

| 5. | Mr. Scott testified regarding what is included in the Crossroads Rider. He testified that the rider will recover from OG&E’s Oklahoma retail customers a revenue requirement based on the return on rate base and income taxes, O&M expense, depreciation, insurance and property taxes associated with the Crossroads project. He further testified that as agreed to in the Settlement Agreement, the Crossroads Rider also will be used to credit Oklahoma retail customers with one hundred percent of the Oklahoma jurisdictional share of the actual Crossroads PTCs created during the term of the Crossroads Rider. He further testified that the Crossroads Rider allows for the Oklahoma jurisdictional share of all net damage payments received from the wind developer or the turbine manufacturer to pass through to Oklahoma retail customers and also allows OG&E to pass through to Oklah oma customers the Oklahoma jurisdictional share of all bonuses paid to the wind developer or the turbine manufacturer pursuant to contract. |

| 6. | Mr. Scott testified that the rider has a true-up provision to align actual costs with revenues recovered. He further testified that the rider also contains a mechanism for crediting Oklahoma retail customers for one hundred percent of the Oklahoma jurisdictional RECs proceeds (after deduction of third-party transaction costs, if applicable) generation by Crossroads’ RECs during the term of and through the Crossroads Rider. He stated that the REC proceeds will be allocated to jurisdictions and customer classes using an energy allocator. |

| 7. | Mr. Scott further testified that the proceeds from the sale of Crossroads’ RECs will help offset the revenue requirement for the project and will be credited to customers. He testified that OG&E originally proposed that the Crossroads’ REC revenues be credited to customers under the New Renewable Energy Credits (“NREC”) portion of the Renewable Transmission System Additions (“RTSA”) rider, which was approved September 11, 2008, in Cause No. PUD 200800148, Commission Order No. 559353. He testified that the RTSA specifies that eighty percent of the REC revenues from new wind facilities, like Crossroads, will be credited back to customers. Mr. Scott testified that in the Settlement Agreement, the Stipulating Parties agreed that OG&E will credit customers with one hundred percent of the proceeds from sales of Crossroads’ RECs through the Crossroads Rider instead of the RTSA. |

| 8. | Mr. Scott testified that the final estimated cost of the project cannot be finally determine at this time given the Danish Krone/U.S. Dollar exchange rate and the possibility of Crossroads moving from 197.8 MW to 227.5 MW. He testified |

| PUD 201000037-FINAL ORDER | Page 10 of 13 |

that Attachment 1 to Stipulation Exhibit BJS-1 contains an illustration of the estimated revenue requirement for the 197.8 MW Crossroads project at a total capital cost of $389 million in 2012 and 2013. He stated that this $389 million in capital cost was included as utility plant in rate base and then rate base was adjusted for accumulated depreciation, Asset Retirement Obligation (“ARO”) and deferred income taxes before calculating a return using the capital structure, return on equity, interest costs and tax effect as approved in Order No. 516261 in Cause No. PUD 200500151. He further testified that OG&E’s calculation also included the capped amount of O&M expense contained in Stipulation Exhibit BJS-2 of the Settlement Agreement, as well as estimated amounts for depreciation expense, ARO, insurance and ad valorem taxes. He further testified that after adding the expenses to the return on rate base, OG&E subtracted the estimated amount of PTCs from this annual amount to determine the annual revenue requirement. He stated that based on the assumptions utilized in the illustration, the approximate total company annual revenue requirement would be $38,533,487 in 2012 and $31,559,059 in 2013.

| 9. | Mr. Scott further testified that Attachment 2 to Stipulation Exhibit BJS-1 contains an illustration of the estimated revenue requirement for the 227.5 MW Crossroads project at a total capital cost of $448.8 million in 2012 and 2013. He testified that this $448.8 million in capital cost was included as utility plant in rate base and then adjusted for accumulated depreciation, ARO and deferred income taxes before calculating a return using the capital structure, return on equity, interest costs and tax effect as approved in Order No. 516261 in Cause No. PUD 200500151. He further testified that OG&E’s calculation also included the capped amount of O&M expense contained in the Settlement Agreement, as well as estimated amounts for depreciation expense, insurance, ARO and ad valorem taxes. He testified that after adding the expense to the return on rate base, OG&E su btracted the estimated amount of the PTCs from this annual amount to determine the annual revenue requirement. Mr. Scott testified that based on the assumptions utilized in the illustration, the approximate total company annual revenue requirement would be $44,326,049 in 2012 and $36,313,057 in 2013. |

| 10. | Mr. Scott testified that the annual revenue requirement will be based on actual costs. He stated that this annual revenue requirements shown in the illustrations are calculated on a total company basis and do not reflect the Oklahoma jurisdictional portion of the revenue requirement. |

| 11. | Mr. Scott testified that OG&E used its resource planning models to compare a portfolio that included Crossroads to a portfolio that did not include Crossroads. He further testified that the addition of Crossroads to the OG&E portfolio will provide production cost savings as wind energy displaces more expensive generation resources. |

| 12. | Mr. Scott testified that, as demonstrated in Chart 1 in his Supplemental Testimony and based on the assumptions therein, there is an estimated net cost of $1.7 million for the 197.8 MW project in 2012 and of $1.2 million for the 227.5 MW project in 2012. He further testified that there is an estimated net savings of $10.7 million for the 197.8 MW project in 2013 and of $12.9 million for the 227.5 MW project in 2013. |

| 13. | Mr. Scott testified regarding the estimated overall impact of Crossroads on an average Oklahoma residential retail customer during the first three years of the project. He testified that for the 197.8 MW project, the estimated overall impact on an average residential customer using 1,100 kWh is a $0.54 per month increase in 2012, a $0.04 per month reduction in 2013 and additional monthly reductions in each year subsequent to 2013. He further testified that the estimated impact of the 227.5 MW project to an average residential customer using 1,100 kWh a month is $0.60 per month in 2012, a reduction of $0.07 per month in 2013 and additional monthly reductions in each year subsequent to 2013. Mr. Scott testified that the calculation of estimated impacts for the major customer classes is shown by Chart 2 in his supplemental testimony. At the hearing, Mr. Scott explained th at OG&E would be willing to create a revised chart for the Commission website that illustrates the estimated customer impact for not only 2012 and 2013, but also during 2011 when the Crossroads facility will be constructed. |

| 14. | Finally, Mr. Scott testified that the Stipulating parties have agreed to actions which shifted certain risks of the project from ratepayers to OG&E’s shareowners, including treatment of RECs and cap on construction costs. He also testified that, in addition, OG&E retained the risk related to regulatory lag between the period it incurs cost and the date it begins recovery under the Crossroads Rider. The parties attempted to rebalance the potential risks of Crossroads in the Settlement Agreement. |

| PUD 201000037-FINAL ORDER | Page 11 of 13 |

Public Utility Division

| 1. | Craig R. Roach, President, Boston Pacific Company, filed pre-filed Direct Testimony on behalf of the PUD of the Commission and also filed Supplemental Testimony in support of the Settlement Agreement. |

| 2. | Mr. Roach testified that the purpose of his testimony was to provide his opinion on the Settlement Agreement. |

| 3. | He testified that he supported the Settlement Agreement for three reasons. He stated that his first reason was that the Crossroads project, under OG&E’s assumptions, appears to provide a levelized cost that is substantially lower than that for current market alternatives. He further testified that the second reason was the Settlement Agreement provides an adequate level of ratepayer risk protection against the three key risks created by utility-owned wind projects. He further stated that these three risks are: (i) that capital expenditures will be higher than originally estimated, (ii) that the electricity generated will be lower than predicted and (iii) that the utility will not be able to use the PTCs generated by the project because they do not have sufficient tax liability elsewhere in the company. Finally, Mr. Roach testified that he supported the Settlement Agreem ent because it reflects a proper definition of prudence for this case; it acknowledges Crossroads must beat the next-best alternatives to be found to be prudent. And, he further explained, that the capital cost caps and performance thresholds were driven by that definition of prudence. |

| 4. | Mr. Roach further testified that there was a need for the Crossroads project. He testified that there was evidence in the record that there was a need for wind in the most recent OG&E IRP and that the cost-benefit analysis performed by OG&E for Crossroads and the pricing comparison between Crossroads and other recent wind projects confirmed that need for Crossroads. Mr. Roach testified that the need for wind energy is different from the need for generation capacity for serving customer load; that the need for wind is based on economic benefits associated with wind energy in a resource portfolio and is always essentially “economic need”; and that need was satisfied in this case because the evidence established the project was the least cost project when compared to the next best alternative.” |

| 1. | The Attorney General filed Responsive Testimony of Daniel Peaco, participated in the settlement discussions on June 15, 16, 22, and 24, 2010, and appeared at the hearing on the merits. The Attorney General agrees with and signed the Settlement Agreement, and recommends that the Commission approve the Settlement Agreement. The Attorney General also stated that OG&E has demonstrated a need for the Crossroads project. |

| 1. | OIEC filed Responsive Testimony of Scott Norwood, participated in the settlement discussions on June 15, 16, 22, and 24, 2010, and appeared at the hearing on the merits. OIEC agrees with and signed the Settlement Agreement, and recommends that the Commission approve the Settlement Agreement. In addition, at the hearing, OIEC stated that OG&E has demonstrated a need for the Crossroads project. |

| 2. | OG&E Shareholders Association filed a Statement of Position, participated in the settlement discussions on June 15, 16, 22, and 24, 2010, and appeared at the hearing on the merits. The OG&E Shareholders agrees with and signed the Settlement Agreement, and recommends that the Commission approve the Settlement Agreement. In addition, at the hearing, the OG&E Shareholders stated that OG&E has demonstrated a need for the Crossroads project. |

| 3. | Chermac Energy Corporation, filed a Statement of Position, participated in the settlement discussions on June 15, 16, 22, and 24, 2010, and appeared at the hearing on the merits. Chermac agrees with and signed the Settlement Agreement, and recommends that the Commission approve the Settlement Agreement. |

FINDINGS OF FACT

| 1. | The Commission finds that notice has been properly given in accordance with Order No. 576086, issued in this cause, with due and proper notice by publication having been made and proof of publication having been filed with the office of |

| PUD 201000037-FINAL ORDER | Page 12 of 13 |

the Court Clerk at the Commission.

| 2. | The Commission further finds that the Stipulating Parties executed a Settlement Agreement, hereto attached as Attachment “A,” and incorporated herein by reference. |

| 3. | The Commission further finds that the Settlement Agreement reflects a full, final, and complete settlement of all issues in this proceeding. |

| 4. | The Commission further finds that based upon the record, the Settlement Agreement is in the public interest and should be adopted as the order of this Commission. |

| 5. | The Commission further finds that based upon the record, there is a need for the Crossroads project. |

| 6. | The Commission further finds that based upon the record, that the Crossroads Wind Farm, as described in the Settlement Agreement is fair, just and reasonable and represents a prudent investment by OG&E. The Commission further finds that, when constructed and placed in service, Crossroads will be used and useful to OG&E’s customers, subject to material compliance with expected operations. |

| 7. | The Commission further finds that based upon the record and consistent with the Settlement Agreement, that OG&E is authorized to recover the costs associated with Crossroads through the Crossroads Rider attached to the Settlement Agreement as Stipulation Exhibit BJS-1, which shall become effective with the issuance of the final order approving this Settlement Agreement and the submission to and approval of the Crossroads Rider tariff by the Director of the Public Utility Division. The Crossroads Rider will be effective until new rates are implemented after OG&E’s 2013 general rate case and, in that 2013 general rate proceeding, the net depreciated balance of Crossroads’ plant costs will be included in rate base. |

| 8. | The Commission further finds that the Capped Investment Amount (as defined in the Settlement Agreement and as calculated pursuant to the Settlement Agreement) shall be $407.66 million for the 198.7 MW project and $469.68 million for the 227.5 MW project. |

| 9. | The Commission further finds that based on the record, $407.66 million for the 198.7 MW project and $469.68 million for the 227.5 MW project represents an investment that is fair, just and reasonable and in the public interest and is deemed prudent and will be included in the revenue requirement in OG&E’s planned 2013 general rate case. |

| 10. | The Commission further finds that any finding of fact stated herein which should properly be included as a conclusion of law is so included. |

CONCLUSIONS OF LAW

| 1. | The Commission finds that it has jurisdiction with respect to the issues presented in this proceeding by virtue of Article IX, § 18 of the Oklahoma Constitution; 17 O.S. §§ 151-152; and 17 O.S. §286(C). |

| 2. | The Commission further finds that notice has been properly given and is in compliance with OAC 165:50-5-3(1) and OAC 165:5-7-51(b) of the Commission’s Rules of Practice. |

| 3. | The Commission further finds that, under 17 O.S. §§ 151-152; and 17 O.S. §286(C), Crossroads should be pre-approved and is fair, just and reasonable and represents a prudent investment by OG&E. The Commission further finds that, when constructed and placed in service, Crossroads will be used and useful to OG&E’s customers, subject to material compliance with expected operations. |

| 4. | The Commission further finds that the approval of the Settlement Agreement and the pre-approval of Crossroads is in the public interest. |

| 5. | Any conclusion of law stated herein which should properly be a finding of fact is so included. |

ORDER

THE COMMISSION THEREFORE ORDERS that notice has been properly given in accordance with Order No. 576086, issued in this cause, with due and proper notice by publication having been made and proof of publication having been filed with the office of the Court Clerk at the Commission.

THE COMMISSION FURTHER ORDERS that the findings of fact and conclusions of law herein, are hereby adopted as the findings of fact and conclusions of law of the Commission.

THE COMMISSION FURTHER ORDERS that the Joint Stipulation and Settlement Agreement, attached hereto as Attachment “A,” should be and the same is hereby approved and adopted by the Commission.

THIS ORDER SHALL BE EFFECTIVE immediately.

| PUD 201000037-FINAL ORDER | Page 13 of 13 |

| | OKLAHOMA CORPORATION COMMISSION |

| | | |

| | /s/ Bob Anthony | |

| | BOB ANTHONY, Chairman | |

| | | |

| | /s/ Jeff Cloud | |

| | JEFF CLOUD, Vice-Chairman | |

| | | |

| | /s/ Dana L. Murphy | |

| | DANA L. MURPHY, Commissioner | |

CERTIFICATION

DONE AND PERFORMED by the Commissioners participating in the making of this order, as shown by their signatures above this 29th day of July, 2010.

[seal]

| | /s/ Peggy Mitchell | |

| | PEGGY MITCHELL, Secretary | |

REPORT OF THE REFEREE

The foregoing findings, conclusions and order are the report and recommendations of the undersigned Referee.

| /s/ Jacqueline T. Miller | | July 26, 2010 | |

| JACQUELINE T. MILLER | | Date | |

| Referee, Administrative Law Judge | | | |

ATTACHMENT A

BEFORE THE

CORPORATION COMMISSION OF OKLAHOMA

IN THE MATTER OF THE APPLICATION OF )

OKLAHOMA GAS AND ELECTRIC COMPANY )

FOR AN ORDER GRANTING PRE-APPROVAL )

TO CONSTRUCT THE CROSSROADS WIND ) CAUSE NO. PUD 201000037

FARM, AND AUTHORIZING A RECOVERY )

RIDER )

JOINT STIPULATION AND SETTLEMENT AGREEMENT

June 28, 2010

I. Introduction

The undersigned parties believe it is in the public interest to effectuate a settlement of the issues in Cause No. PUD 201000037.

Therefore, now the undersigned parties to the above entitled cause present the following Joint Stipulation and Settlement Agreement (“Joint Stipulation”) for the Oklahoma Corporation Commission’s (“Commission”) review and approval as a compromise and settlement of all issues in this proceeding between the parties to this Joint Stipulation (“Stipulating Parties”). The Stipulating Parties represent to the Commission that the Joint Stipulation represents a fair, just, and reasonable settlement of these issues, that the terms and conditions of the Joint Stipulation are in the public interest, and the Stipulating Parties urge the Commission to issue an Order in this Cause adopting this Joint Stipulation.

The Stipulating Parties agree that the Commission has jurisdiction with respect to the issues presented in this proceeding by virtue of Article IX, §18 et seq. of the Oklahoma Constitution, 17 O.S. §152 and 17 O.S. §286(C).

It is hereby stipulated and agreed by and between the Stipulating Parties as follows:

II. Stipulated Facts

A. On April 8, 2010, Oklahoma Gas and Electric Company (“OG&E” or the “Company”) filed an application requesting that the Commission issue an order (i) determining that the costs to OG&E for the construction of the new Crossroads Wind Farm (“Crossroads”) and related facilities are prudent, and that the Crossroads facility will be used and useful when placed in service; (ii) authorizing OG&E to implement a recovery rider to be effective until Crossroads is placed in rate base by order of the Commission; and (iii) approving a waiver from the Commission’s competitive bidding rules (“Application”).

Joint Stipulation & Settlement Agreement

Cause No. PUD 201000037

Page 2 of 8

B. Crossroads is an 86-turbine, 197.8 MW wind-powered electric generation facility located in Dewey County, Oklahoma. The Crossroads facility is expected to come on-line during the second half of 2011. Crossroads will interconnect to OG&E’s new 345 kV Woodward to Oklahoma City transmission line (“Windspeed”). The Crossroads facilities will utilize Siemens Energy SWT-2.3-101 wind turbine generators each with a nameplate rating of 2.3 MW. Each turbine will have a 101-meter rotor diameter and will be supported by an 80-meter tower (262 feet). A separate interconnection request has been made with the Southwest Power Pool (“SP P”) for an incremental 29.7 MW. With these additional 29.7 MW, the Crossroads facility would be 227.5 MW.

III. Settlement Agreement

A. The Stipulating Parties request that the Commission issue an order granting pre-approval of Crossroads and finding that Crossroads is a prudent investment. The Stipulating Parties also request that the Commission issue an order finding that Crossroads, when constructed, placed in service and interconnected to Windspeed, will be used and useful to OG&E’s customers, subject to material compliance with expected operations. The Stipulating Parties agree that the operational performance of Crossroads shall be reviewed pursuant to OAC 165:35-39 and OAC 165:35-35.

B. The Stipulating Parties also request that the Commission authorize the recovery of costs associated with Crossroads through a recovery rider (“Crossroads Rider,” which is attached hereto as Stipulation Exhibit BJS-1, and which includes illustrations of the revenue requirement calculations) that will become effective upon the issuance of the final order approving this Joint Stipulation and the submission to and approval of the Crossroads Rider tariff by the Director of the Public Utility Division. The Crossroads Rider will be effective until new rates are implemented after OG&E’s 2013 general rate case. In that 2013 general rate proceeding, the net depreciated balance of Crossroads’ plant costs will be included in rate base. The Stipulating Parties further agree that the rate of return utilized for the Crossroads Rider will initially be calculated using the capital structure, return on equity, interest costs and tax effect as approved in Order No. 516261 in Cause No. PUD 200500151. This rate of return will be adjusted to reflect the rate of return approved by the Commission in OG&E’s 2011 rate case; and the new rate of return will be applied on the effective date of the rates approved in the 2011 rate case.

C. The Stipulating Parties request that the Commission grant OG&E’s request for a waiver from the Commission’s competitive bidding requirements. This waiver is based on: (i) OG&E’s representations that the Crossroads project will deliver significantly greater benefit to customers than other top bidders in its most recent RFP and other wind resource opportunities available to OG&E at this time, and that the opportunity to realize these benefits may be lost if action is not taken at this time; and (ii) the agreements described in this Joint Stipulation.

D. Except as otherwise provided in Paragraph O, the Stipulating Parties agree that OG&E’s projected capital cost for the Crossroads project is $389 million, based in part on a Danish Krone/U.S. Dollar exchange rate of 6.00 and the projected capital cost is subject to an

Joint Stipulation & Settlement Agreement

Cause No. PUD 201000037

Page 3 of 8

adjustment at the closing of OG&E’s Turbine Supply Agreement with Siemens. The Stipulating Parties further agree that OG&E’s capital costs for which it is entitled recovery (“Capped Investment Amount”) shall not exceed the lesser of: 1) an amount equal to: (i) $389 million as adjusted for the Krone/Dollar exchange rate at 9:00 am central time on the date a Commission Order is issued in this cause according to the Yahoo Finance website; plus (ii) a variance which does not exceed three (3) percent of the amount calculated pursuant to (i); or 2) the Maximum Stipulated Cost as described in Paragraph E.

E. The Stipulating Parties further agree that the Capped Investment Amount described in Paragraph D represents an investment that is fair, just and reasonable and in the public interest and is deemed prudent and will be included in the revenue requirement in OG&E’s planned 2013 general rate case. To the extent OG&E’s total investment in Crossroads exceeds the Capped Investment Amount, OG&E shall be entitled to offer evidence and seek to establish that the excess above the Capped Investment Amount was prudently incurred and should be included in OG&E’s rate base. Any construction costs incurred by OG&E in excess of the Capped Investment Amount shall not include interim carrying costs on the P lant in Service and will not be eligible for cost recovery until OG&E’s next general rate case. The Stipulating Parties further agree that neither this Joint Stipulation nor any of the provisions hereof shall become effective in the event the Capped Investment Amount is more than $416.2 million (“Maximum Stipulated Cost”) on the date of a final Commission order approving this Joint Stipulation.

F. The Stipulating Parties agree that OG&E shall pass through to Oklahoma retail customers 100 percent of the Oklahoma jurisdictional Renewable Energy Credits (“RECs”) proceeds (after deduction of third-party transaction costs if applicable) generated by Crossroads RECs during the term of and through the Crossroads Rider. The REC proceeds will be allocated to jurisdictions and customer classes using an energy allocator.

G. The Stipulating Parties agree that OG&E shall file an application with the Commission within sixty (60) days of a final Commission order in this proceeding requesting amendments to the current Minimum Filing Requirements (OAC 165:35-39) for the purpose of providing additional information regarding electric utility wind generation facilities and wind energy purchase power agreements. This additional information shall include, but not be limited to, the amount of production tax credits utilized in the reporting year. The Stipulating Parties agree to collaborate in developing the requested amendments. OG&E agrees to provide the additional information simultaneously with the filing of its Minimum Filing Require ments until such time as the proposed amendments are adopted or rejected by the Commission.

H. The Stipulating Parties agree that OG&E’s Oklahoma retail customers shall be credited with one hundred (100) percent of the Oklahoma jurisdictional share of the actual Crossroads production tax credits (“PTCs”) created during the term of, and as specified in, the Crossroads Rider. Likewise, at the end of the Crossroads Rider and for the remaining life of the Crossroads project PTCs, OG&E will continue to credit its Oklahoma retail customers with one hundred (100) percent of the Oklahoma jurisdictional share of the actual test year benefits of the

Joint Stipulation & Settlement Agreement

Cause No. PUD 201000037

Page 4 of 8

PTCs (as adjusted for known and measurable changes) in the determination of the revenue requirement in each general rate proceeding.

I. The Stipulating Parties further agree that OG&E will pass through to Oklahoma retail customers the Oklahoma jurisdictional share of all net damage payments received from the wind developer or the turbine manufacturer. The Stipulating Parties further understand that, under the terms of the contracts with these entities, this damage payment amount will not exceed $85 million. The Stipulating Parties further agree that, in light of the benefits to customers associated with higher achieved Crossroads output and the early completion of the Crossroads project, OG&E will pass through to Oklahoma customers the Oklahoma jurisdictional share of all bonuses paid to the wind developer or the turbine manufacturer pursuant to contract. The Stipulating Parties further understand that, under the terms of the contracts with these entities, this bonus amount will not exceed $3.2 million.

J. The Stipulating Parties agree that, to the extent that Crossroads makes additional amounts of OG&E’s coal or natural gas-fired generation capacity or energy available for sale in the SPP’s Energy Imbalance Service (“EIS”) market, all revenues associated with these increased EIS market sales will continue to be credited to OG&E’s retail customers.

K. Except as otherwise provided in Paragraph O, the Stipulating Parties further agree that, if the three-year rolling average of Crossroads megawatt-hours of production (including a credit for energy not produced due to curtailments or other events caused by system emergencies, force majeure events, or transmission system issues) falls below 712,844 MWhs, OG&E shall file testimony demonstrating the prudent operation of Crossroads when it files its Minimum Filing Requirements pursuant to OAC 165:35-39.

L. The Stipulating Parties agree that Crossroads’ O&M expense will be capped at the amounts contained in Stipulation Exhibit BJS-2 until rates are implemented after the next general rate case.

M. The Stipulating Parties agree that on or before May 1, 2011, OG&E will submit an interim, updated Integrated Resource Plan (“IRP”) as contemplated by Subsection 37 of Chapter 35 of the Commission’s Rules, provided that:

1) The updated IRP analysis will specifically address the need and timing for additional wind resources in OG&E’s system, including but not limited to various amounts of wind and timing of additional wind including assessments of the benefits based on consideration of the operation of the SPP day-ahead market, transmission limitations/requirements for expanded wind resource development, the added costs for fossil fuel-fired power plants when those fossil fuel plants are used to accommodate variable wind generation, current expectation of the impacts of regional haze rules on OG&E’s coal generation, and a range of scenarios for natural gas prices and climate legislation and other factors which may impact the amounts and timing of wind resource additions over the next ten (10) years.

2) No less than sixty (60) days prior to the filing of the updated integrated resource

Joint Stipulation & Settlement Agreement

Cause No. PUD 201000037

Page 5 of 8

plan, the Stipulating Parties further agree that OG&E will hold a collaborative technical conference for all stakeholders in order to allow all stakeholders the opportunity to provide input regarding utility objectives, assumptions, and planning scenarios to be contained in the updated IRP analysis.

The Stipulating Parties agree that OG&E shall pay for and be able to recover costs associated with third party consultants needed by the Attorney General and/or the Commission Staff to participate in the stakeholder technical conference. This Paragraph M is not an admission by the Stipulating Parties that OG&E has a need for additional wind resources nor is it intended to relieve OG&E of its burden of proof to demonstrate that any agreements it enters into to acquire wind energy assets or to purchase wind energy are reasonable or prudent.

N. The Stipulating Parties agree that, except as otherwise provided herein, OG&E will not seek Commission preapproval for the construction or acquisition of any new wind generation asset or for a long term wind purchase power agreement until it finalizes and submits a new IRP described in Paragraph M; provided that this restriction does not apply to preapproval of the Crossroads expansion identified in Paragraph O or the procurement of the Company’s next incremental amount of wind energy (at least 100 MW and no more than 150 MW), which shall be awarded through a competitive procurement process. If OG&E conducts such a competitive procurement process before completion of the IRP specified in Paragraph M, OG&E will include in its preapproval application the analysis specified in Paragraph M.1 above. The Stipulating Parties further agree that, for the purposes of such wind energy competitive procurement process, the Independent Evaluator selected to participate in the process shall be either: a) a Commission staff member or a third party agreed to by OG&E, the Attorney General and Public Utility Division staff; or b) if OG&E, the Attorney General and the Commission Staff cannot agree to an Independent Evaluator pursuant to (a), a Commission Staff member or third party appointed by the Commission after notice and hearing. This Paragraph N is not an admission by the Stipulating Parties that OG&E has a need for additional wind resources nor is it intended to relieve OG&E of its burden of proof to demonstrate that any agreements it enters into to acquire wind energy assets or to purchase wind energy are reasonable or prudent.

O. The Stipulating Parties recognize that OG&E has the opportunity to expand Crossroads by an additional 29.7 MW (twelve (12) additional turbines including nine (9) 2.3 MW wind turbines and three (3) 3 MW turbines). The Stipulating Parties agree that, subject to the conditions set forth in this Paragraph O, this incremental quantity of wind generation capacity would be beneficial to OG&E customers. Therefore, the Stipulating Parties agree that if the pending SPP interconnection study concludes on or before September 1, 2010, that these additional turbines can be interconnected at incremental costs below $4.7 million as confirmed by the Attorney General and the Commission Staff, OG&E’s decision to proceed with t he construction of these additional twelve (12) turbines shall be prudent, the turbines will be used and useful when placed in service, and the costs and associated recovery for these additional turbines shall be included in the Crossroads Rider. In such a case, the Capped Investment Amount shall not exceed the lesser of: 1) an amount equal to: (i) $448.8 million as adjusted for the Krone/Dollar exchange rate at 9:00 am central time on the date a Commission Order is issued in this cause according to the Yahoo Finance website; plus (ii) a variance which does not exceed three (3) percent of the amount calculated pursuant to (i); or 2) the Alternative Maximum

Joint Stipulation & Settlement Agreement

Cause No. PUD 201000037

Page 6 of 8

Stipulated Cost as described below. The Stipulating Parties further agree that neither this Joint Stipulation nor any of the provisions hereof shall become effective in the event the Capped Investment Amount is more than $480.2 million (“Alternative Maximum Stipulated Cost”) on the date of a final Commission order approving this Joint Stipulation. If OG&E constructs these additional turbines, the three-year rolling average of Crossroads’ megawatt-hours of production (for purposes of Paragraph K above) will be 819,879 MWhs.

IV. General Reservations.

The Stipulating Parties represent and agree that, except as specifically provided:

A. Negotiated Settlement. This Joint Stipulation represents a negotiated settlement for the purpose of compromising and resolving the issues presented in this Cause.

B. Authority to Execute. Each of the undersigned counsel of record affirmatively represents to the Commission that he or she has fully advised his or her respective clients(s) that the execution of this Joint Stipulation constitutes a resolution of issues which were raised in this proceeding; that no promise, inducement or agreement not herein expressed has been made to any Stipulating Party; that this Joint Stipulation constitutes the entire agreement between and among the Stipulating Parties; and each of the undersigned counsel of record affirmatively represents that he or she has full authority to execute this Joint Stipulation on behalf of his or her client(s).

C. Balance/Compromise of Positions. The Stipulating Parties stipulate and agree that the agreements contained in this Joint Stipulation have resulted from negotiations among the Stipulating Parties. The Stipulating Parties hereto specifically state and recognize that this Joint Stipulation represents a balancing of positions of each of the Stipulating Parties in consideration for the agreements and commitments made by the other Stipulating Parties in connection therewith. Therefore, in the event that the Commission does not approve and adopt all of the terms of this Joint Stipulation, this Joint Stipulation shall be void and of no force and effect, and n o Stipulating Party shall be bound by the agreements or provisions contained herein. The Stipulating Parties agree that neither this Joint Stipulation nor any of the provisions hereof shall become effective unless and until the Commission shall have entered an Order approving all of the terms and provisions as agreed to by the parties to this Joint Stipulation.

D. Admissions and Waivers. The Stipulating Parties agree and represent that the provisions of this Joint Stipulation are intended to relate only to the specific matters referred to herein, and by agreeing to this settlement, no Stipulating Party waives any claim or right which it may otherwise have with respect to any matters not expressly provided for herein. In addition, none of the signatories hereto shall be deemed to have approved or acquiesced in any ratemaking principle, valuation method, cost of service determination, depreciation principle or cost allocation method underlying or allegedly underlying any of the information submitted by the parties to this C ause and except as specifically provided in this Joint Stipulation, nothing contained herein shall constitute an admission by any Stipulating Party that any allegation or contention in this proceeding is true or valid or shall constitute a determination by the

Joint Stipulation & Settlement Agreement

Cause No. PUD 201000037

Page 7 of 8