Exhibit 99.2

NOV Inc.

Selected Financial Data (A)

(In millions)

(Unaudited except where noted)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As reported prior to January 1, 2024 | | 2021 | | | 2022 | | | 2023 | | | | | | | | | | | | |

| | Q1 | | Q2 | | Q3 | | Q4 | | | Q1 | | Q2 | | Q3 | | Q4 | | | Q1 | | Q2 | | Q3 | | Q4 | | | 2019 | | 2020 | | 2021 | | 2022 | | 2023 | |

Revenue (Audited): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Wellbore Technologies | | $ | 413 | | $ | 463 | | $ | 507 | | $ | 576 | | | $ | 608 | | $ | 666 | | $ | 741 | | $ | 762 | | | $ | 745 | | $ | 804 | | $ | 799 | | $ | 824 | | | $ | 3,214 | | $ | 1,867 | | $ | 1,959 | | $ | 2,777 | | $ | 3,172 | |

Completion & Production Solutions | | | 439 | | | 497 | | | 478 | | | 549 | | | | 530 | | | 639 | | | 681 | | | 738 | | | | 718 | | | 753 | | | 760 | | | 803 | | | | 2,771 | | | 2,433 | | | 1,963 | | | 2,588 | | | 3,034 | |

Rig Technologies | | | 431 | | | 487 | | | 390 | | | 431 | | | | 441 | | | 462 | | | 511 | | | 620 | | | | 550 | | | 606 | | | 686 | | | 766 | | | | 2,682 | | | 1,919 | | | 1,739 | | | 2,034 | | | 2,608 | |

Eliminations | | | (34 | ) | | (30 | ) | | (34 | ) | | (39 | ) | | | (31 | ) | | (40 | ) | | (44 | ) | | (47 | ) | | | (51 | ) | | (70 | ) | | (60 | ) | | (50 | ) | | | (188 | ) | | (129 | ) | | (137 | ) | | (162 | ) | | (231 | ) |

Total | | $ | 1,249 | | $ | 1,417 | | $ | 1,341 | | $ | 1,517 | | | $ | 1,548 | | $ | 1,727 | | $ | 1,889 | | $ | 2,073 | | | $ | 1,962 | | $ | 2,093 | | $ | 2,185 | | $ | 2,343 | | | $ | 8,479 | | $ | 6,090 | | $ | 5,524 | | $ | 7,237 | | $ | 8,583 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA (B): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Wellbore Technologies | | $ | 34 | | $ | 63 | | $ | 77 | | $ | 88 | | | $ | 101 | | $ | 122 | | $ | 145 | | $ | 146 | | | $ | 133 | | $ | 164 | | $ | 166 | | $ | 160 | | | $ | 527 | | $ | 178 | | $ | 262 | | $ | 514 | | $ | 623 | |

Completion & Production Solutions | | | (4 | ) | | 4 | | | (5 | ) | | 2 | | | | 10 | | | 32 | | | 56 | | | 66 | | | | 54 | | | 69 | | | 67 | | | 86 | | | | 258 | | | 230 | | | (3 | ) | | 164 | | | 276 | |

Rig Technologies | | | 13 | | | 75 | | | 25 | | | 21 | | | | 36 | | | 41 | | | 52 | | | 88 | | | | 69 | | | 71 | | | 100 | | | 109 | | | | 347 | | | 117 | | | 134 | | | 217 | | | 349 | |

Eliminations and corporate costs | | | (43 | ) | | (38 | ) | | (41 | ) | | (42 | ) | | | (44 | ) | | (45 | ) | | (58 | ) | | (69 | ) | | | (61 | ) | | (59 | ) | | (66 | ) | | (61 | ) | | | (247 | ) | | (175 | ) | | (164 | ) | | (216 | ) | | (247 | ) |

Total | | $ | - | | $ | 104 | | $ | 56 | | $ | 69 | | | $ | 103 | | $ | 150 | | $ | 195 | | $ | 231 | | | $ | 195 | | $ | 245 | | $ | 267 | | $ | 294 | | | $ | 885 | | $ | 350 | | $ | 229 | | $ | 679 | | $ | 1,001 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA % (C): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Wellbore Technologies | | | 8.2 | % | | 13.6 | % | | 15.2 | % | | 15.3 | % | | | 16.6 | % | | 18.3 | % | | 19.6 | % | | 19.2 | % | | | 17.9 | % | | 20.4 | % | | 20.8 | % | | 19.4 | % | | | 16.4 | % | | 9.5 | % | | 13.4 | % | | 18.5 | % | | 19.6 | % |

Completion & Production Solutions | | | -0.9 | % | | 0.8 | % | | -1.0 | % | | 0.4 | % | | | 1.9 | % | | 5.0 | % | | 8.2 | % | | 8.9 | % | | | 7.5 | % | | 9.2 | % | | 8.8 | % | | 10.7 | % | | | 9.3 | % | | 9.5 | % | | -0.2 | % | | 6.3 | % | | 9.1 | % |

Rig Technologies | | | 3.0 | % | | 15.4 | % | | 6.4 | % | | 4.9 | % | | | 8.2 | % | | 8.9 | % | | 10.2 | % | | 14.2 | % | | | 12.5 | % | | 11.7 | % | | 14.6 | % | | 14.2 | % | | | 12.9 | % | | 6.1 | % | | 7.7 | % | | 10.7 | % | | 13.4 | % |

Eliminations and corporate costs | | | - | | | - | | | - | | | - | | | | - | | | - | | | - | | | - | | | | - | | | - | | | - | | | - | | | | - | | | - | | | - | | | - | | | - | |

NOV consolidated | | | 0.0 | % | | 7.3 | % | | 4.2 | % | | 4.5 | % | | | 6.7 | % | | 8.7 | % | | 10.3 | % | | 11.1 | % | | | 9.9 | % | | 11.7 | % | | 12.2 | % | | 12.5 | % | | | 10.4 | % | | 5.7 | % | | 4.1 | % | | 9.4 | % | | 11.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Completion & Production Solutions (D): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ending backlog | | $ | 810 | | $ | 1,003 | | $ | 1,107 | | $ | 1,287 | | | $ | 1,364 | | $ | 1,442 | | $ | 1,478 | | $ | 1,602 | | | $ | 1,601 | | $ | 1,586 | | $ | 1,626 | | $ | 1,822 | | | $ | 1,305 | | $ | 696 | | $ | 1,287 | | $ | 1,602 | | $ | 1,822 | |

Revenue out of backlog | | | 267 | | | 276 | | | 266 | | | 311 | | | | 308 | | | 401 | | | 425 | | | 472 | | | | 422 | | | 477 | | | 466 | | | 513 | | | | 1,625 | | | 1,526 | | | 1,120 | | | 1,606 | | | 1,878 | |

Order additions, net | | | 338 | | | 462 | | | 384 | | | 495 | | | | 339 | | | 530 | | | 493 | | | 557 | | | | 407 | | | 450 | | | 530 | | | 676 | | | | 2,055 | | | 915 | | | 1,679 | | | 1,919 | | | 2,063 | |

Adjustments (1) | | | 43 | | | 7 | | | (14 | ) | | (4 | ) | | | 46 | | | (51 | ) | | (32 | ) | | 39 | | | | 14 | | | 12 | | | (24 | ) | | 33 | | | | (19 | ) | | 2 | | | 32 | | | 2 | | | 35 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Rig Technologies (D): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ending backlog | | $ | 2,591 | | $ | 2,655 | | $ | 2,784 | | $ | 2,767 | | | $ | 2,893 | | $ | 2,839 | | $ | 2,781 | | $ | 2,793 | | | $ | 2,876 | | $ | 2,893 | | $ | 2,968 | | $ | 2,868 | | | $ | 2,994 | | $ | 2,669 | | $ | 2,767 | | $ | 2,793 | | $ | 2,868 | |

Revenue out of backlog | | | 190 | | | 168 | | | 158 | | | 188 | | | | 190 | | | 174 | | | 202 | | | 257 | | | | 179 | | | 205 | | | 248 | | | 314 | | | | 1,136 | | | 807 | | | 704 | | | 823 | | | 946 | |

Order additions, net | | | 112 | | | 232 | | | 300 | | | 191 | | | | 236 | | | 140 | | | 119 | | | 254 | | | | 251 | | | 222 | | | 178 | | | 214 | | | | 1,013 | | | 467 | | | 835 | | | 749 | | | 865 | |

Adjustments (1) | | | - | | | - | | | (13 | ) | | (20 | ) | | | 80 | | | (20 | ) | | 25 | | | 15 | | | | 11 | | | - | | | 145 | | | - | | | | - | | | 15 | | | (33 | ) | | 100 | | | 156 | |

| | | | | | | | | | | | | | | | | | | | |

Other items excluded from Adjusted EBITDA (2) (E): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Wellbore Technologies | | $ | 4 | | $ | 18 | | $ | 7 | | $ | 2 | | | $ | 23 | | $ | 7 | | $ | 31 | | $ | (1 | ) | | $ | - | | $ | (1 | ) | $ | 3 | | $ | 42 | | | $ | 3,794 | | $ | 840 | | $ | 31 | | $ | 60 | | $ | 44 | |

Completion & Production Solutions | | | (2 | ) | | (6 | ) | | 7 | | | 2 | | | | 16 | | | 1 | | | 19 | | | - | | | | (1 | ) | | - | | | 2 | | | 25 | | | | 2,042 | | | 1,138 | | | 1 | | | 36 | | | 26 | |

Rig Technologies | | | 3 | | | 8 | | | 8 | | | 3 | | | | 6 | | | (8 | ) | | 13 | | | (11 | ) | | | (3 | ) | | (7 | ) | | (3 | ) | | (18 | ) | | | 784 | | | 424 | | | 22 | | | - | | | (31 | ) |

Eliminations and corporate costs | | | 2 | | | - | | | 2 | | | 1 | | | | - | | | 14 | | | - | | | 4 | | | | - | | | 1 | | | 5 | | | 6 | | | | 11 | | | 40 | | | 5 | | | 18 | | | 12 | |

Total | | $ | 7 | | $ | 20 | | $ | 24 | | $ | 8 | | | $ | 45 | | $ | 14 | | $ | 63 | | $ | (8 | ) | | $ | (4 | ) | $ | (7 | ) | $ | 7 | | $ | 55 | | | $ | 6,631 | | $ | 2,442 | | $ | 59 | | $ | 114 | | $ | 51 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Proforma for re-segmentation (F) | | 2021 | | | 2022 | | | 2023 | | | | | | | | | | | | |

| | Q1 | | Q2 | | Q3 | | Q4 | | | Q1 | | Q2 | | Q3 | | Q4 | | | Q1 | | Q2 | | Q3 | | Q4 | | | 2019 | | 2020 | | 2021 | | 2022 | | 2023 | |

Revenue: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Energy Products and Services | | $ | 536 | | $ | 591 | | $ | 639 | | $ | 727 | | | $ | 750 | | $ | 859 | | $ | 943 | | $ | 985 | | | $ | 941 | | $ | 1,029 | | $ | 1,034 | | $ | 1,073 | | | $ | 4,064 | | $ | 2,665 | | $ | 2,493 | | $ | 3,537 | | $ | 4,077 | |

Energy Equipment | | | 735 | | | 848 | | | 726 | | | 819 | | | | 825 | | | 897 | | | 976 | | | 1,121 | | | | 1,052 | | | 1,117 | | | 1,195 | | | 1,305 | | | | 4,512 | | | 3,502 | | | 3,128 | | | 3,819 | | | 4,669 | |

Eliminations | | | (22 | ) | | (22 | ) | | (24 | ) | | (29 | ) | | | (27 | ) | | (29 | ) | | (30 | ) | | (33 | ) | | | (31 | ) | | (53 | ) | | (44 | ) | | (35 | ) | | | (97 | ) | | (77 | ) | | (97 | ) | | (119 | ) | | (163 | ) |

Total | | $ | 1,249 | | $ | 1,417 | | $ | 1,341 | | $ | 1,517 | | | $ | 1,548 | | $ | 1,727 | | $ | 1,889 | | $ | 2,073 | | | $ | 1,962 | | $ | 2,093 | | $ | 2,185 | | $ | 2,343 | | | $ | 8,479 | | $ | 6,090 | | $ | 5,524 | | $ | 7,237 | | $ | 8,583 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA (B): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Energy Products and Services | | $ | 32 | | $ | 65 | | $ | 76 | | $ | 90 | | | $ | 108 | | $ | 143 | | $ | 158 | | $ | 174 | | | $ | 154 | | $ | 198 | | $ | 197 | | $ | 193 | | | $ | 636 | | $ | 291 | | $ | 263 | | $ | 583 | | $ | 742 | |

Energy Equipment | | | 5 | | | 69 | | | 14 | | | 16 | | | | 34 | | | 46 | | | 81 | | | 115 | | | | 94 | | | 99 | | | 124 | | | 147 | | | | 423 | | | 197 | | | 104 | | $ | 276 | | | 464 | |

Eliminations and corporate costs | | | (37 | ) | | (30 | ) | | (34 | ) | | (37 | ) | | | (39 | ) | | (39 | ) | | (44 | ) | | (58 | ) | | | (53 | ) | | (52 | ) | | (54 | ) | | (46 | ) | | | (174 | ) | | (138 | ) | | (138 | ) | $ | (180 | ) | | (205 | ) |

Total | | | - | | $ | 104 | | $ | 56 | | $ | 69 | | | $ | 103 | | $ | 150 | | $ | 195 | | $ | 231 | | | $ | 195 | | $ | 245 | | $ | 267 | | $ | 294 | | | $ | 885 | | $ | 350 | | $ | 229 | | $ | 679 | | $ | 1,001 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA % (C): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Energy Products and Services | | | 6.0 | % | | 11.0 | % | | 11.9 | % | | 12.4 | % | | | 14.4 | % | | 16.6 | % | | 16.8 | % | | 17.7 | % | | | 16.4 | % | | 19.2 | % | | 19.1 | % | | 18.0 | % | | | 15.6 | % | | 10.9 | % | | 10.5 | % | | 16.5 | % | | 18.2 | % |

Energy Equipment | | | 0.7 | % | | 8.1 | % | | 1.9 | % | | 2.0 | % | | | 4.1 | % | | 5.1 | % | | 8.3 | % | | 10.3 | % | | | 8.9 | % | | 8.9 | % | | 10.4 | % | | 11.3 | % | | | 9.4 | % | | 5.6 | % | | 3.3 | % | | 7.2 | % | | 9.9 | % |

Eliminations and corporate costs | | | - | | | - | | | - | | | - | | | | - | | | - | | | - | | | - | | | | - | | | - | | | - | | | - | | | | - | | | - | | | - | | | - | | | - | |

NOV consolidated | | | 0.0 | % | | 7.3 | % | | 4.2 | % | | 4.5 | % | | | 6.7 | % | | 8.7 | % | | 10.3 | % | | 11.1 | % | | | 9.9 | % | | 11.7 | % | | 12.2 | % | | 12.5 | % | | | 10.4 | % | | 5.7 | % | | 4.1 | % | | 9.4 | % | | 11.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Energy Equipment (D): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ending Backlog | | $ | 3,109 | | $ | 3,338 | | $ | 3,522 | | $ | 3,633 | | | $ | 3,763 | | $ | 3,742 | | $ | 3,667 | | $ | 3,769 | | | $ | 3,840 | | $ | 3,859 | | $ | 3,993 | | $ | 4,149 | | | $ | 3,878 | | $ | 3,174 | | $ | 3,633 | | $ | 3,769 | | $ | 4,149 | |

Revenue out of backlog | | | 360 | | | 342 | | | 318 | | | 379 | | | | 387 | | | 407 | | | 465 | | | 541 | | | | 457 | | | 505 | | | 537 | | | 630 | | | | 2,080 | | | 1,744 | | | 1,399 | | | 1,800 | | | 2,129 | |

Order additions, net | | | 309 | | | 565 | | | 529 | | | 513 | | | | 391 | | | 457 | | | 396 | | | 595 | | | | 505 | | | 511 | | | 548 | | | 756 | | | | 2,346 | | | 1,023 | | | 1,916 | | | 1,839 | | | 2,320 | |

Adjustments | | | (14 | ) | | 6 | | | (27 | ) | | (23 | ) | | | 126 | | | (71 | ) | | (6 | ) | | 48 | | | | 23 | | | 13 | | | 123 | | | 30 | | | | (18 | ) | | 17 | | | (58 | ) | | 97 | | | 189 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other items excluded from Adjusted EBITDA (2) (E): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Energy Products and Services | | $ | 4 | | $ | 18 | | $ | 7 | | $ | 3 | | | $ | 24 | | $ | 9 | | $ | 39 | | $ | - | | | $ | - | | $ | (1 | ) | $ | 4 | | $ | 50 | | | $ | 4,231 | | $ | 1,145 | | $ | 32 | | $ | 72 | | $ | 53 | |

Energy Equipment | | | 1 | | | 2 | | | 15 | | | 4 | | | | 21 | | | (9 | ) | | 24 | | | (12 | ) | | | (4 | ) | | (7 | ) | | (2 | ) | | (1 | ) | | | 2,389 | | | 1,257 | | | 22 | | | 24 | | | (14 | ) |

Eliminations and corporate costs | | | 2 | | | - | | | 2 | | | 1 | | | | - | | | 14 | | | - | | | 4 | | | | - | | | 1 | | | 5 | | | 6 | | | | 11 | | | 40 | | | 5 | | | 18 | | | 12 | |

Total | | $ | 7 | | $ | 20 | | $ | 24 | | $ | 8 | | | $ | 45 | | $ | 14 | | $ | 63 | | $ | (8 | ) | | $ | (4 | ) | $ | (7 | ) | $ | 7 | | $ | 55 | | | $ | 6,631 | | $ | 2,442 | | $ | 59 | | $ | 114 | | $ | 51 | |

(1)includes cancelations, pricing on existing orders, and FX

(2)excludes (gains) and losses on sales of fixed assets

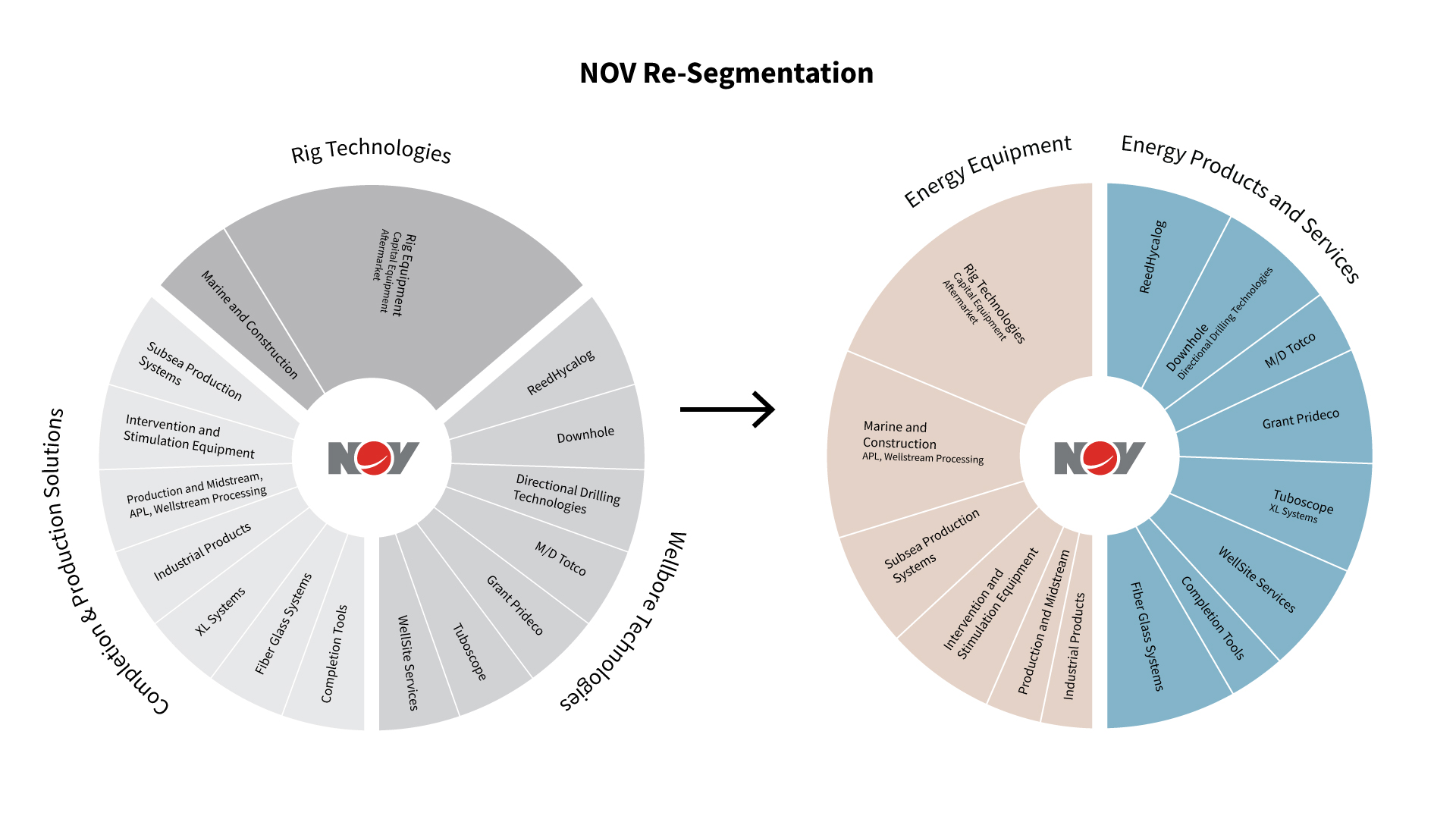

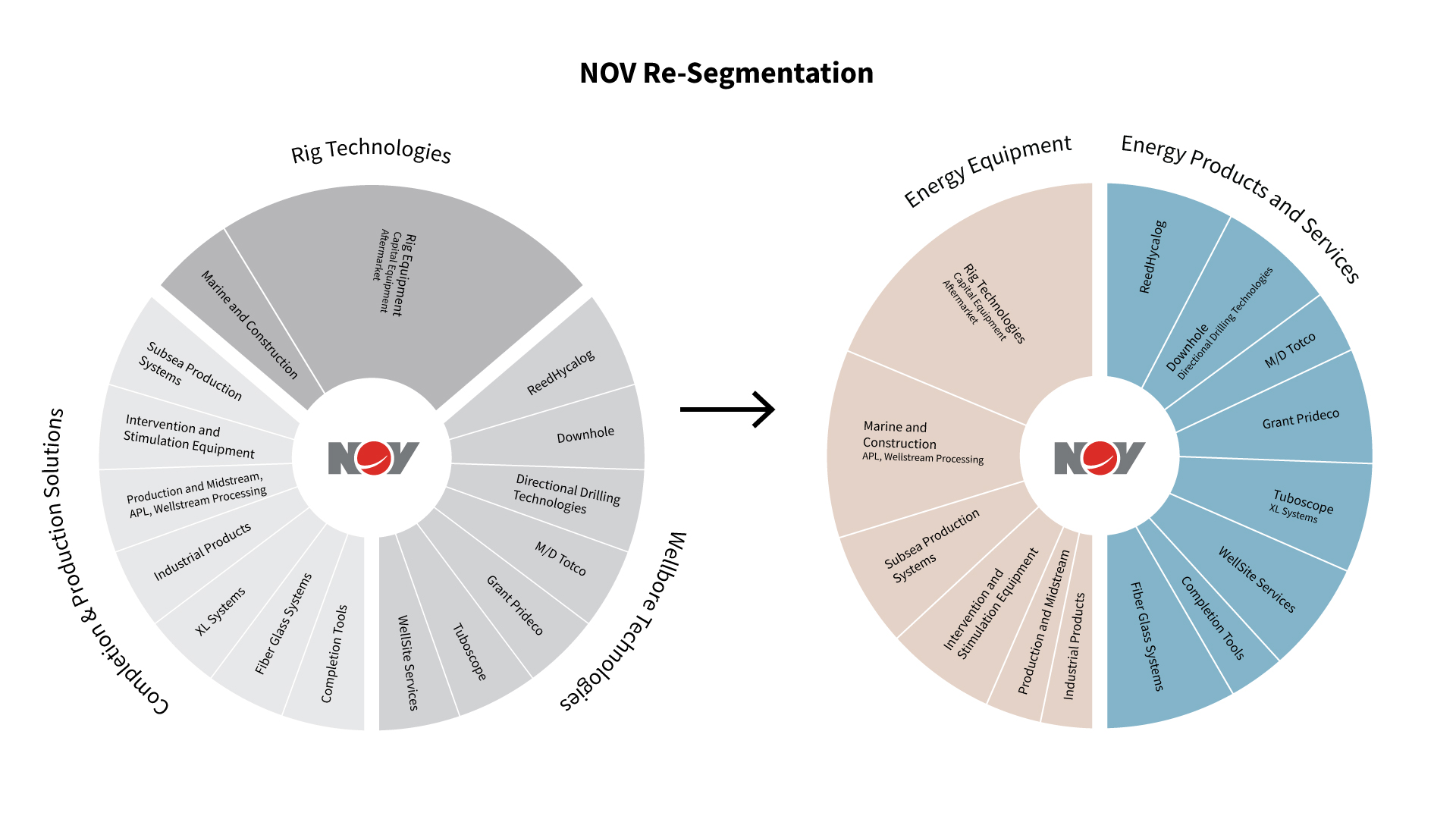

(A)The following presents certain actual selected financial data for the periods indicated, as well as certain unaudited pro forma financial data for the same periods which has been adjusted to show the pro forma results if presented in accordance with NOV’s previously announced re-segmentation. Pursuant to the re-segmentation, effective January 1, 2024, NOV will be consolidating its reporting structure into two segments: Energy Equipment and Energy Products and Services. Further detail regarding the re-segmentation can be found in the "Re-segmentation Diagram." The following contains certain non-GAAP financial measures. These measures should not be considered alternatives to the comparable GAAP financial measures as indicators of NOV’s financial performance.

(B)Adjusted EBITDA is a non-GAAP financial measure. See “Reconciliation of Adjusted EBITDA" attached for a reconciliation of the comparable GAAP financial measure to Adjusted EBITDA.

(C)Adjusted EBITDA % is a non-GAAP financial measure. Adjusted EBITDA % is a ratio showing Adjusted EBITDA as a percentage of sales. A presentation of the most comparable GAAP ratio can be found at “Reconciliation of Adjusted EBITDA."

(D)Backlog is not a term recognized under GAAP; however, it is a common measurement used in our industry. Our methodology for determining backlog may not be comparable to the methodologies used by other companies. New orders are added to backlog only when the Company receives a firm written order for major completion and production components or a contract related to a construction project. Projects that are delayed or suspended for more than 1 year with no firm delivery commitment are removed from backlog. [Our backlog estimates require substantial judgment and are based on a number of assumptions. These assumptions may turn out to be inaccurate, including for reasons outside of management's control.] Backlog should be considered in addition to, rather than as a substitute for, reported revenue .

(E)Reflects “Other items” excluded from the calculation of Adjusted EBITDA. Please refer to “Reconciliation of Adjusted EBITDA for a reconciliation of all items excluded from the calculation of Adjusted EBITDA.

(F)The unaudited pro forma financial data is presented for illustrative purposes only. The unaudited pro forma financial data is based upon available information and certain assumptions that management believes are reasonable under the circumstances.

NOV Inc.

Reconciliation of Adjusted EBITDA

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2021 | | | 2022 | | | 2023 | | | | | | | | | | | | |

Reconciliation of Adjusted EBITDA: | Q1 | | Q2 | | Q3 | | Q4 | | | Q1 | | Q2 | | Q3 | | Q4 | | | Q1 | | Q2 | | Q3 | | Q4 | | | 2019 | | 2020 | | 2021 | | 2022 | | 2023 | |

GAAP net income attributable to Company | $ | (115 | ) | $ | (26 | ) | $ | (69 | ) | $ | (40 | ) | | $ | (50 | ) | $ | 69 | | $ | 32 | | $ | 104 | | | $ | 126 | | $ | 155 | | $ | 114 | | $ | 598 | | | $ | (6,095 | ) | $ | (2,542 | ) | $ | (250 | ) | $ | 155 | | $ | 993 | |

Noncontrolling interests | | 1 | | | 3 | | | 4 | | | (3 | ) | | | 1 | | | 1 | | | 3 | | | (5 | ) | | | (1 | ) | | 2 | | | (6 | ) | | (3 | ) | | | 2 | | | 5 | | | 5 | | | - | | | (8 | ) |

Provision (benefit) for income taxes | | (6 | ) | | 2 | | | 5 | | | 14 | | | | 14 | | | (2 | ) | | 29 | | | 42 | | | | 20 | | | 19 | | | 48 | | | (460 | ) | | | (369 | ) | | (242 | ) | | 15 | | | 83 | | | (373 | ) |

Interest expense | | 20 | | | 19 | | | 19 | | | 19 | | | | 19 | | | 19 | | | 19 | | | 21 | | | | 21 | | | 21 | | | 23 | | | 23 | | | | 100 | | | 84 | | | 77 | | | 78 | | | 88 | |

Interest income | | (2 | ) | | (2 | ) | | (3 | ) | | (2 | ) | | | (1 | ) | | (5 | ) | | (6 | ) | | (7 | ) | | | (8 | ) | | (8 | ) | | (5 | ) | | (7 | ) | | | (20 | ) | | (7 | ) | | (9 | ) | | (19 | ) | | (28 | ) |

Equity income in unconsolidated affiliate | | 4 | | | - | | | 2 | | | (1 | ) | | | (6 | ) | | (14 | ) | | (12 | ) | | (36 | ) | | | (48 | ) | | (37 | ) | | (16 | ) | | (18 | ) | | | 13 | | | 260 | | | 5 | | | (68 | ) | | (119 | ) |

Other expense, net | | 10 | | | 16 | | | (1 | ) | | (2 | ) | | | 2 | | | - | | | (10 | ) | | 43 | | | | 16 | | | 29 | | | 25 | | | 28 | | | | 90 | | | 17 | | | 23 | | | 35 | | | 98 | |

(Gain) or Loss on Sales of Fixed Assets | | 2 | | | (5 | ) | | - | | | 1 | | | | 5 | | | (7 | ) | | 1 | | | 1 | | | | (4 | ) | | - | | | - | | | 1 | | | | - | | | (19 | ) | | (2 | ) | | - | | | (3 | ) |

Depreciation and amortization | | 79 | | | 77 | | | 75 | | | 75 | | | | 74 | | | 75 | | | 76 | | | 76 | | | | 77 | | | 71 | | | 77 | | | 77 | | | | 533 | | | 352 | | | 306 | | | 301 | | | 302 | |

Other items | | 7 | | | 20 | | | 24 | | | 8 | | | | 45 | | | 14 | | | 63 | | | (8 | ) | | | (4 | ) | | (7 | ) | | 7 | | | 55 | | | | 6,631 | | | 2,442 | | | 59 | | | 114 | | | 51 | |

Total Adjusted EBITDA | $ | - | | $ | 104 | | $ | 56 | | $ | 69 | | | $ | 103 | | $ | 150 | | $ | 195 | | $ | 231 | | | $ | 195 | | $ | 245 | | $ | 267 | | $ | 294 | | | $ | 885 | | $ | 350 | | $ | 229 | | $ | 679 | | $ | 1,001 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenue | $ | 1,249 | | $ | 1,417 | | $ | 1,341 | | $ | 1,517 | | | $ | 1,548 | | $ | 1,727 | | $ | 1,889 | | $ | 2,073 | | | $ | 1,962 | | $ | 2,093 | | $ | 2,185 | | $ | 2,343 | | | $ | 8,479 | | $ | 6,090 | | $ | 5,524 | | $ | 7,237 | | $ | 8,583 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA as a % of Revenue | | 0.0 | % | | 7.3 | % | | 4.2 | % | | 4.5 | % | | | 6.7 | % | | 8.7 | % | | 10.3 | % | | 11.1 | % | | | 9.9 | % | | 11.7 | % | | 12.2 | % | | 12.5 | % | | | 10.4 | % | | 5.7 | % | | 4.1 | % | | 9.4 | % | | 11.7 | % |