- NOV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

NOV (NOV) 8-KNOV Reports third quarter 2024 REsults

Filed: 25 Oct 24, 8:59am

NOV Inc. Third Quarter 2024 Earnings Presentation October 25, 2024 Exhibit 99.2

Safe Harbor / Forward-Looking Statements / Non-GAAP Financial Measures Statements in this presentation, including statements regarding future financial performance, are forward-looking statements within the meaning of the federal securities laws. Statements of hopes, beliefs, expectations, and predictions of future performance are subject to numerous risks and uncertainties, many of which are beyond the Company’s control. Actual results may differ materially from the results expressed or implied by the statements made herein or during any presentation of these materials. There are numerous factors that could adversely impact actual results, which include but are not limited to changes in the demand for or price of oil and/or natural gas; potential catastrophic events related to our operations, including weather events such as the effects of hurricanes and tropical storms or climate regulation; protection of intellectual property rights and against cyber-attacks; compliance with environmental laws; changes in government regulations and regulatory requirements, particularly those related to oil and natural gas exploration; compliance with laws related to income taxes and assumptions regarding the generation of future taxable income; risks of international operations, including risks relating to unsettled political conditions, war, the effects of terrorism, foreign exchange rates and controls, international trade and regulatory controls and sanctions, and doing business with national oil companies; changes in capital spending by customers; and delays or failures by customers to make payments owed to us and the resulting impact on our liquidity. NOV’s latest Form 10-K, Form 10-Q for the quarter, and other Securities and Exchange Commission filings and published statements contain additional information concerning important risk factors which could cause the company’s results to differ materially from those described in the forward-looking statements. NOV is not undertaking any obligation to revise or update publicly any forward-looking statements for any reason. This presentation contains certain confidential, proprietary, technical and/or financial information related to the Company’s business and operations, including information concerning the Company’s business plans, contractual relationships and financial structure. No part of this presentation may be disclosed to any third party without the prior written consent of the Company. This presentation contains certain forward-looking non-GAAP financial measures, including Adjusted EBITDA. The Company has not provided a reconciliation of projected Adjusted EBITDA. Management cannot predict with a reasonable degree of accuracy certain of the necessary components of net income, such as other income (expense), which includes fluctuations in foreign currencies. As such, a reconciliation of projected Adjusted EBITDA to projected net income is not available without unreasonable effort. The actual amount of other income (expense), provision (benefit) for income taxes, equity income in unconsolidated affiliates, depreciation and amortization, and other amounts excluded from Adjusted EBITDA could have a significant impact on net income. Third Quarter 2024 Earnings Presentation © 2024 NOV Inc. All rights reserved.

NOV delivers technology-driven solutions to empower the global energy industry. For more than 150 years, NOV has pioneered innovations that enable its customers to safely produce abundant energy while minimizing environmental impact. The energy industry depends on NOV’s deep expertise and technology to continually improve oilfield operations and assist in efforts to advance the energy transition towards a more sustainable future. NOV powers the industry that powers the world. Third Quarter 2024 Earnings Presentation © 2024 NOV Inc. All rights reserved. 3

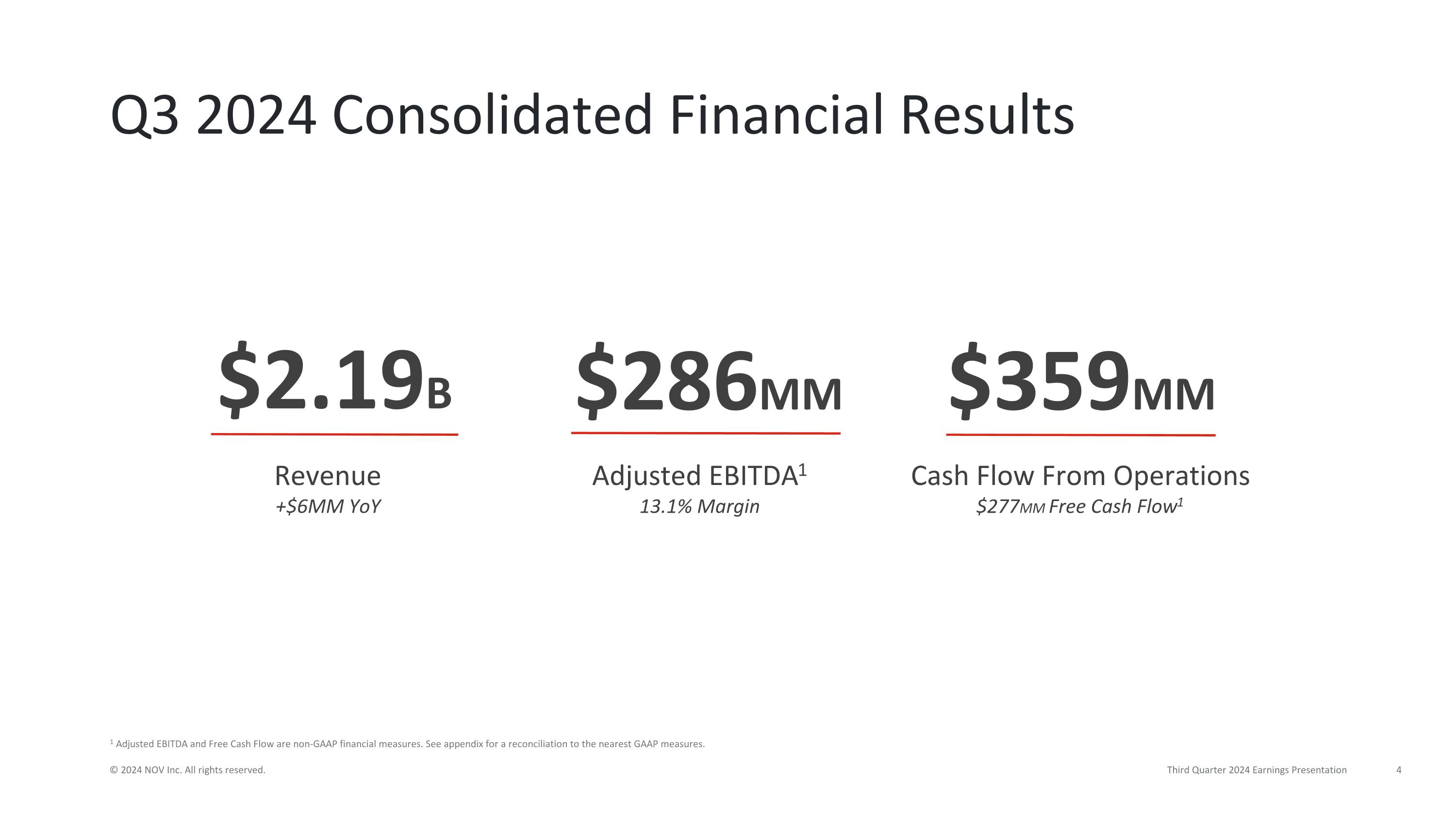

Q3 2024 Consolidated Financial Results 1 Adjusted EBITDA and Free Cash Flow are non-GAAP financial measures. See appendix for a reconciliation to the nearest GAAP measures. © 2024 NOV Inc. All rights reserved. Third Quarter 2024 Earnings Presentation Revenue +$6MM YoY $2.19B Adjusted EBITDA1 13.1% Margin $286MM Cash Flow From Operations $277MM Free Cash Flow1 $359MM

Revenue from international markets1 45% Offshore & International Offshore and international markets continue to recover Third Quarter 2024 Earnings Presentation © 2024 NOV Inc. All rights reserved. Revenue from offshore markets1 63% 1 For the quarter ended September 30, 2024

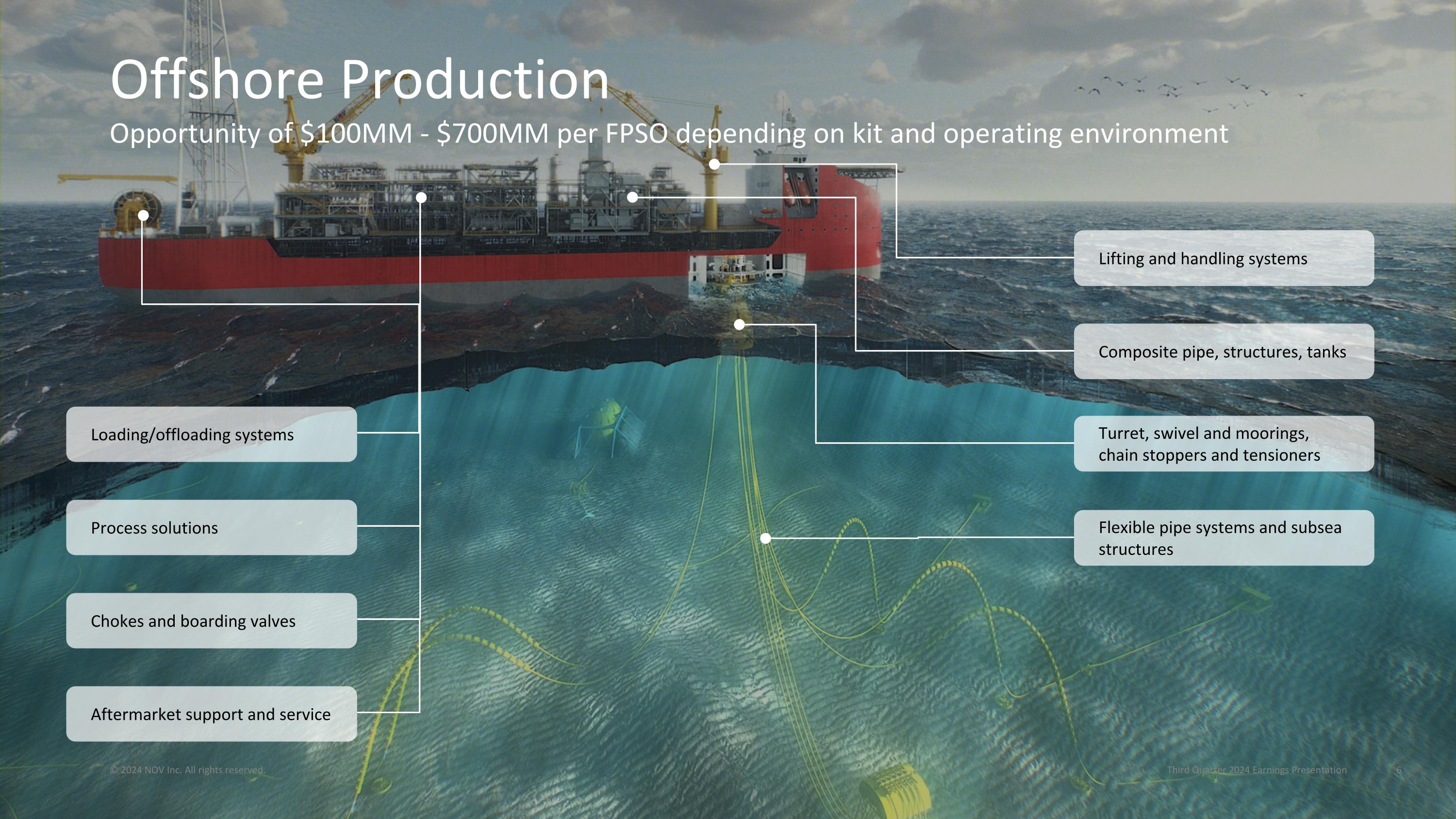

© 2024 NOV Inc. All rights reserved. Loading/offloading systems Process solutions Chokes and boarding valves Aftermarket support and service Lifting and handling systems Composite pipe, structures, tanks Turret, swivel and moorings, chain stoppers and tensioners Flexible pipe systems and subsea structures Offshore Production Opportunity of $100MM - $700MM per FPSO depending on kit and operating environment Third Quarter 2024 Earnings Presentation

Awarded contract to supply spread mooring tensioning systems for two FPSO vessels in Latin America NOV was awarded a contract to supply spread mooring tensioning systems for two floating production, storage, and offloading (FPSO) vessels in Latin America. With our extensive expertise and robust offshore production portfolio, NOV is well-positioned to meet the growing demands of the floating production market. Q3 Offshore Production Awards Secured orders for 14 cranes for offshore projects across Asia, Europe, and North America Orders include active-heave compensated subsea cranes for new offshore construction vessels and an all-electric crane and several electro-hydraulic cranes for offshore production applications. The orders further solidify NOV's long history as a global leader in providing innovative and reliable crane technologies. Awarded large subsea flexible pipe contract and received leading customer service, quality, and safety recognitions NOV’s Subsea Flexible Pipe business secured an order for 72 km of subsea flexible pipe. Also during the quarter, the business was named the Best Supplier in the Flexible Pipe category at the Rio Oil & Gas conference as well as the Foreign Company of the Year by the American Chamber of Commerce in Denmark. © 2024 NOV Inc. All rights reserved. Third Quarter 2024 Earnings Presentation

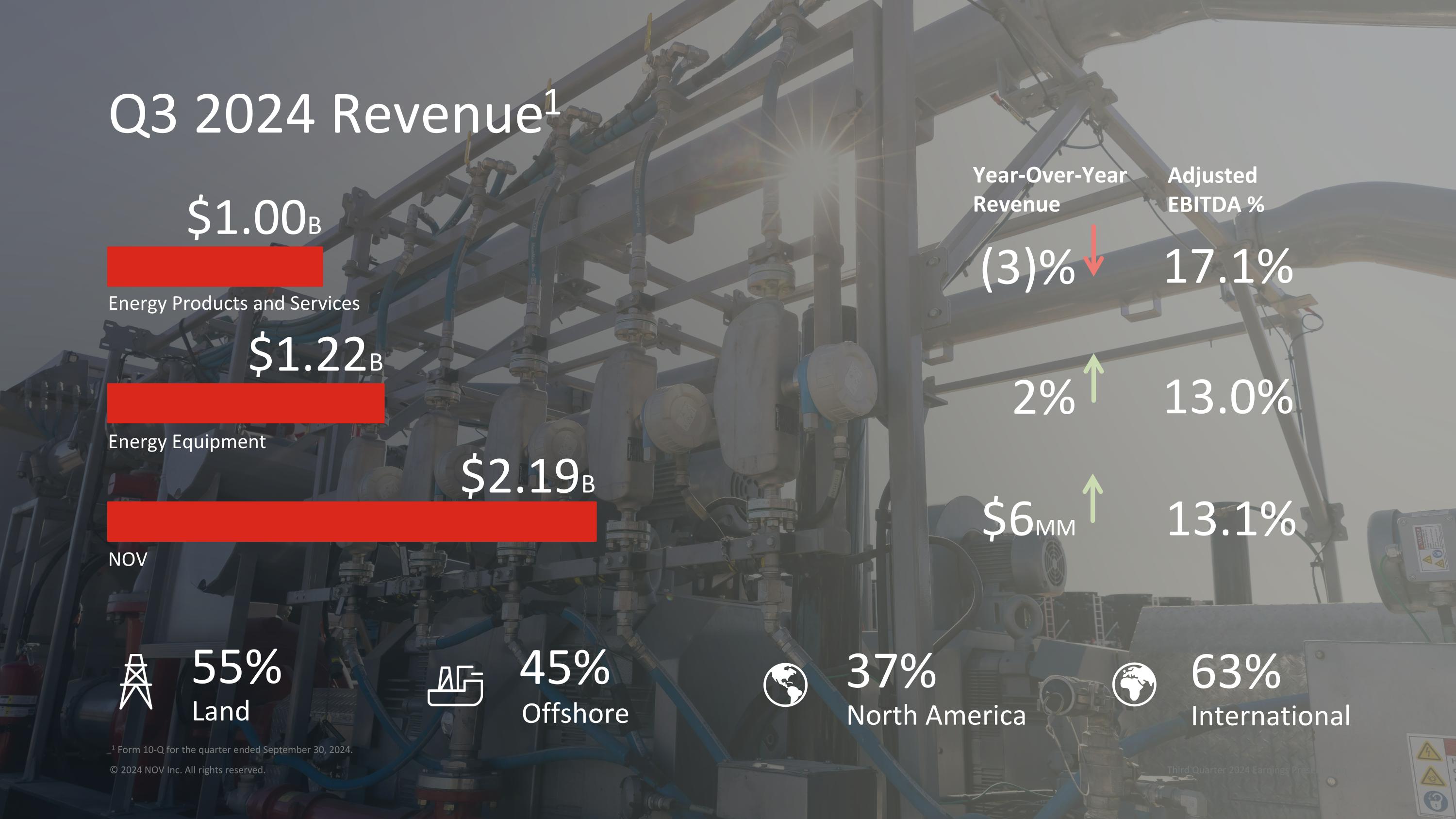

Q3 2024 Revenue1 $1.22B $1.00B Energy Products and Services Energy Equipment (3)% 17.1% 2% 13.0% Year-Over-Year Revenue Adjusted EBITDA % 37% North America 63% International 55% Land 45% Offshore © 2024 NOV Inc. All rights reserved. Third Quarter 2024 Earnings Presentation $2.19B NOV 13.1% $6MM 1 Form 10-Q for the quarter ended September 30, 2024.

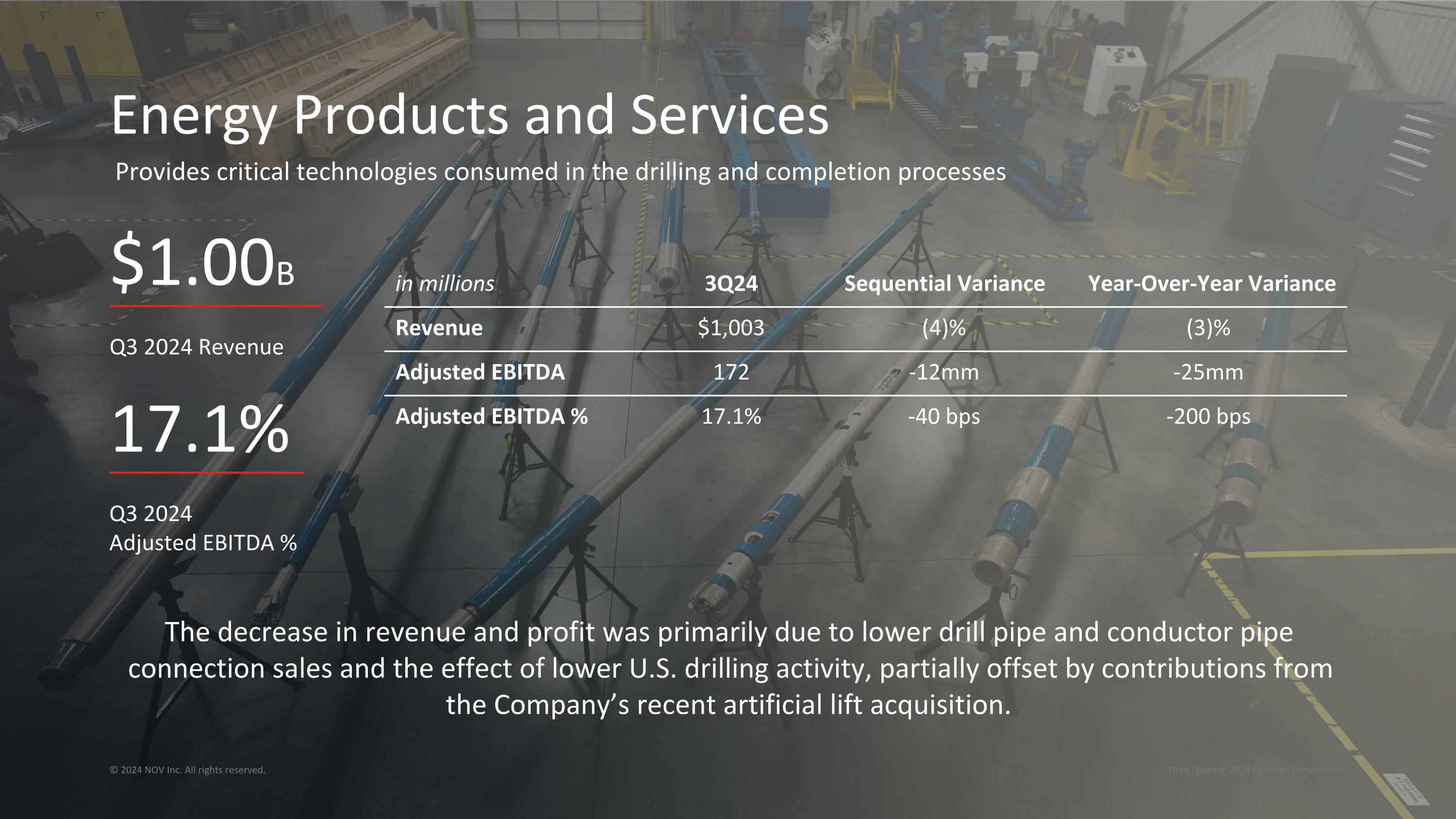

Q3 2024 Revenue $1.00B Q3 2024 Adjusted EBITDA % 17.1% Energy Products and Services in millions 3Q24 Sequential Variance Year-Over-Year Variance Revenue $1,003 (4)% (3)% Adjusted EBITDA 172 -12mm -25mm Adjusted EBITDA % 17.1% -40 bps -200 bps The decrease in revenue and profit was primarily due to lower drill pipe and conductor pipe connection sales and the effect of lower U.S. drilling activity, partially offset by contributions from the Company’s recent artificial lift acquisition. © 2024 NOV Inc. All rights reserved. Third Quarter 2024 Earnings Presentation Provides critical technologies consumed in the drilling and completion processes

Energy Products and Services © 2024 NOV Inc. All rights reserved. Third Quarter 2024 Earnings Presentation 51% Service & Rental 29% Capital Equipment 20% Product Sales Provides critical technologies consumed in the drilling, completion, and production processes

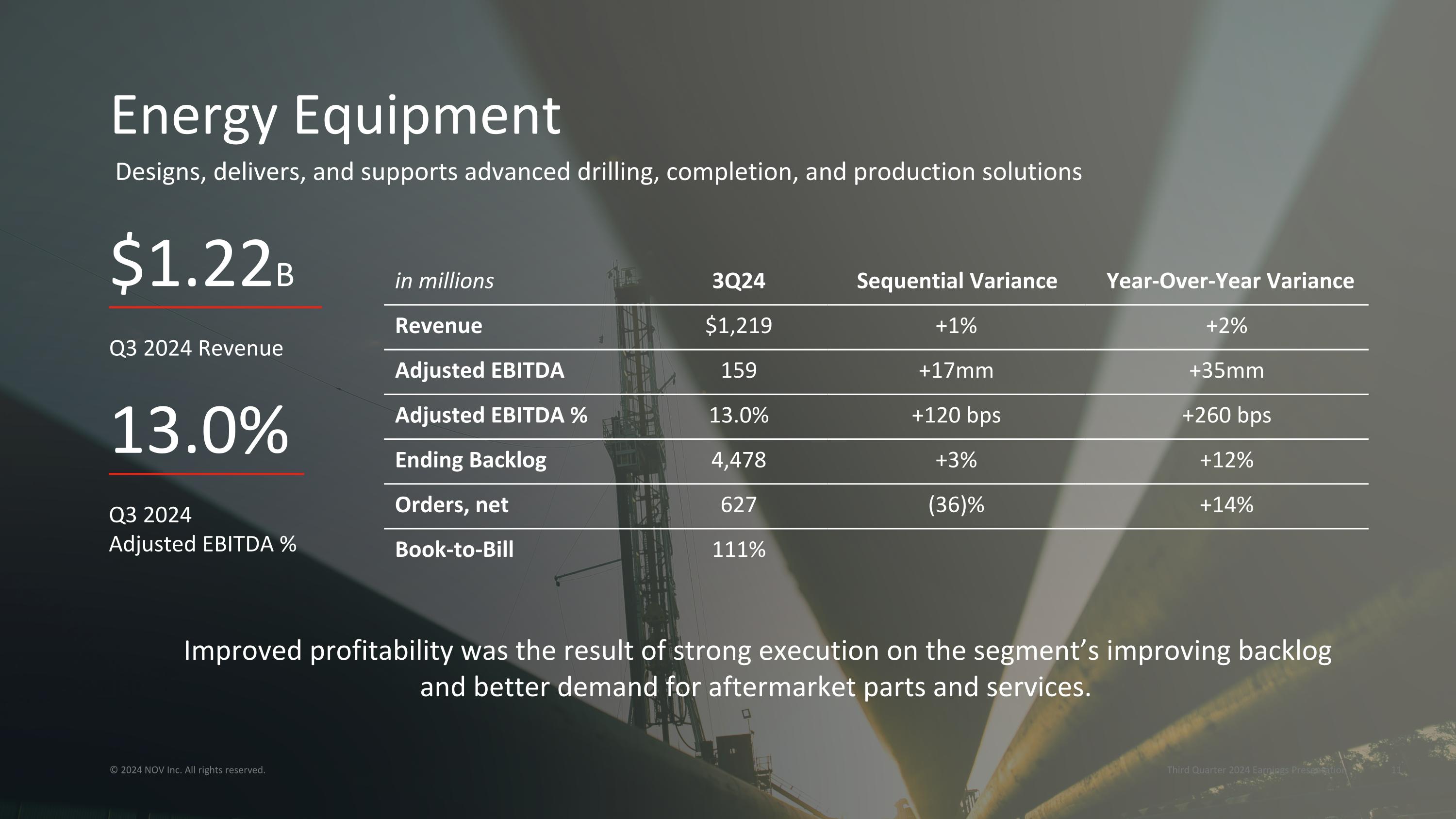

Improved profitability was the result of strong execution on the segment’s improving backlog and better demand for aftermarket parts and services. Energy Equipment in millions 3Q24 Sequential Variance Year-Over-Year Variance Revenue $1,219 +1% +2% Adjusted EBITDA 159 +17mm +35mm Adjusted EBITDA % 13.0% +120 bps +260 bps Ending Backlog 4,478 +3% +12% Orders, net 627 (36)% +14% Book-to-Bill 111% © 2024 NOV Inc. All rights reserved. Third Quarter 2024 Earnings Presentation Q3 2024 Revenue $1.22B Q3 2024 Adjusted EBITDA % 13.0% Designs, delivers, and supports advanced drilling, completion, and production solutions

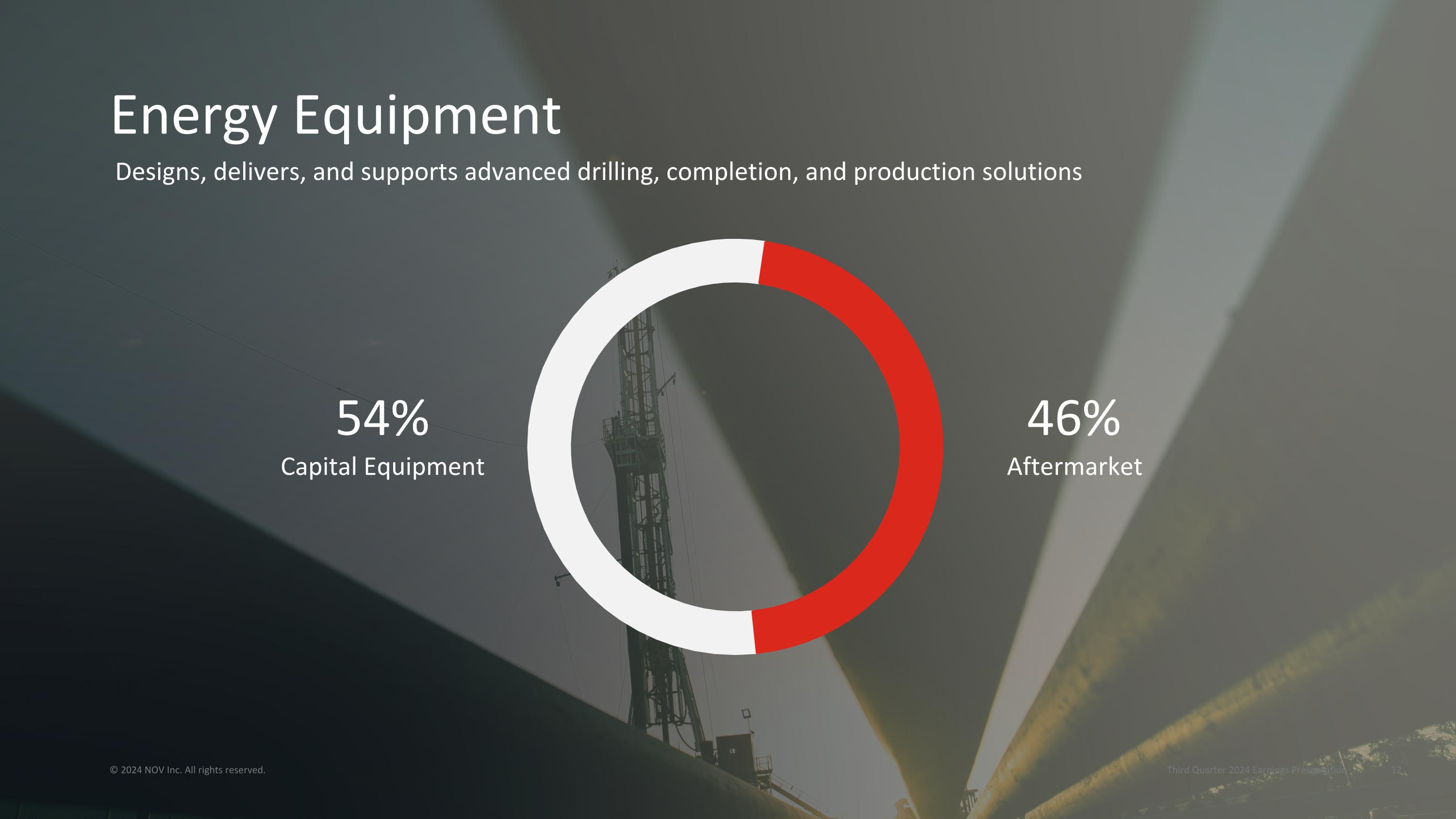

Energy Equipment © 2024 NOV Inc. All rights reserved. Third Quarter 2024 Earnings Presentation 54% Capital Equipment 46% Aftermarket Designs, delivers, and supports advanced drilling, completion, and production solutions

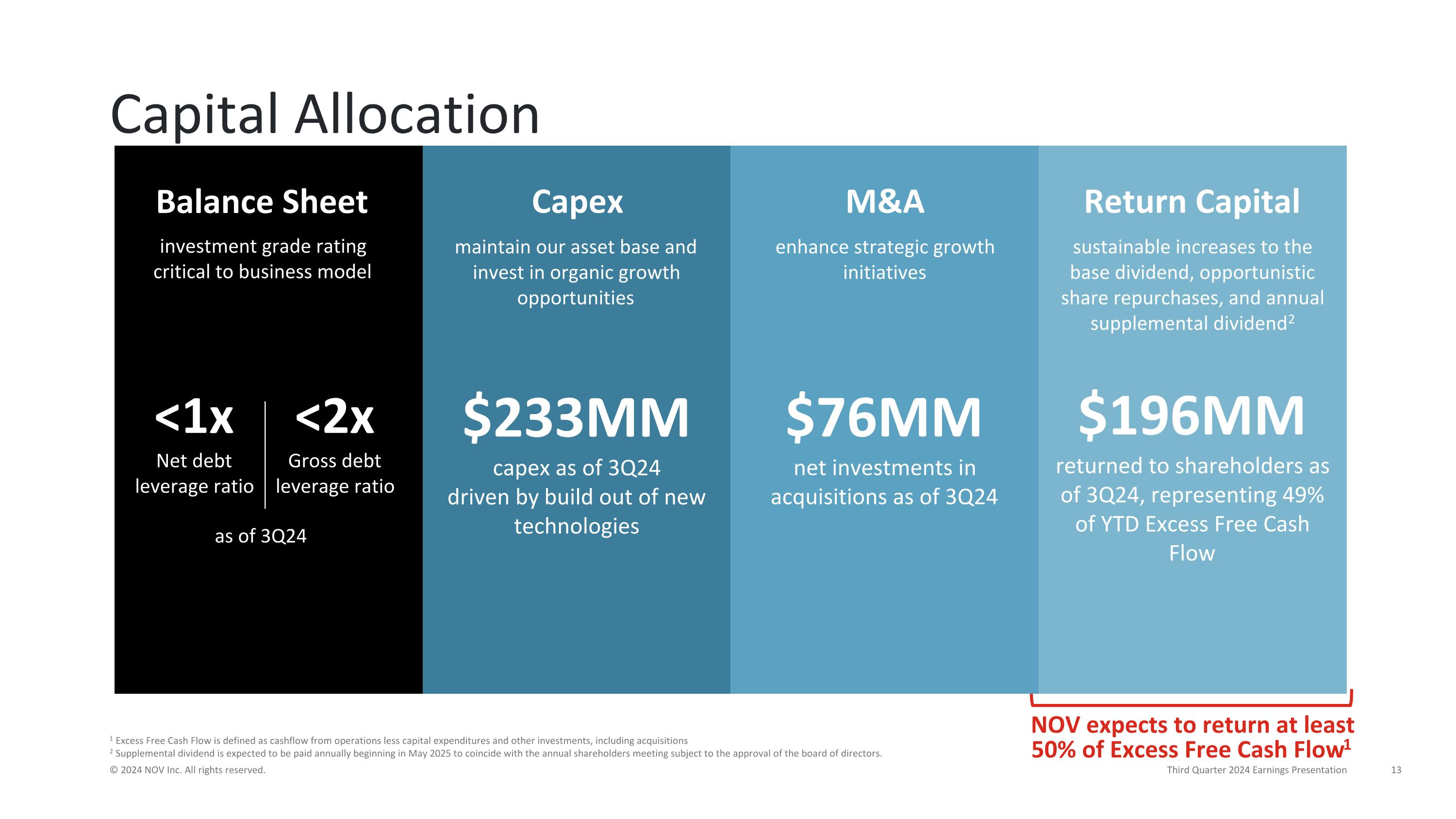

NOV expects to return at least 50% of Excess Free Cash Flow1 © 2024 NOV Inc. All rights reserved. 1 Excess Free Cash Flow is defined as cashflow from operations less capital expenditures and other investments, including acquisitions 2 Supplemental dividend is expected to be paid annually beginning in May 2025 to coincide with the annual shareholders meeting subject to the approval of the board of directors. Capital Allocation $196MM returned to shareholders as of 3Q24, representing 49% of YTD Excess Free Cash Flow maintain our asset base and invest in organic growth opportunities enhance strategic growth initiatives sustainable increases to the base dividend, opportunistic share repurchases, and annual supplemental dividend2 Balance Sheet Capex M&A Return Capital investment grade rating critical to business model $233MM capex as of 3Q24 driven by build out of new technologies $76MM net investments in acquisitions as of 3Q24 <1x Net debt leverage ratio <2x Gross debt leverage ratio as of 3Q24 Third Quarter 2024 Earnings Presentation

Q3 Significant Achievements Secured repeat orders for two additional ATOM™ RTX Robotics systems Destined for land rigs, the robotics technology will jointly integrate into the customer's rig layouts for automated piped handling, stabbing, doping, and mud containment, thereby removing personnel from the red zone and enhancing safety. Awarded two orders for hookload upgrades on two drillships as clients continue to advance fleet capabilities NOV received two orders for higher capacity hookload upgrades to convert two 6th generation drillships to 7th generation as clients continue to advance fleet capabilities and enhance the competitiveness of their ultra-deepwater assets. The upgrades include larger load path equipment, associated structural enhancements, and the latest rig controls and monitoring technology. © 2024 NOV Inc. All rights reserved. Third Quarter 2024 Earnings Presentation

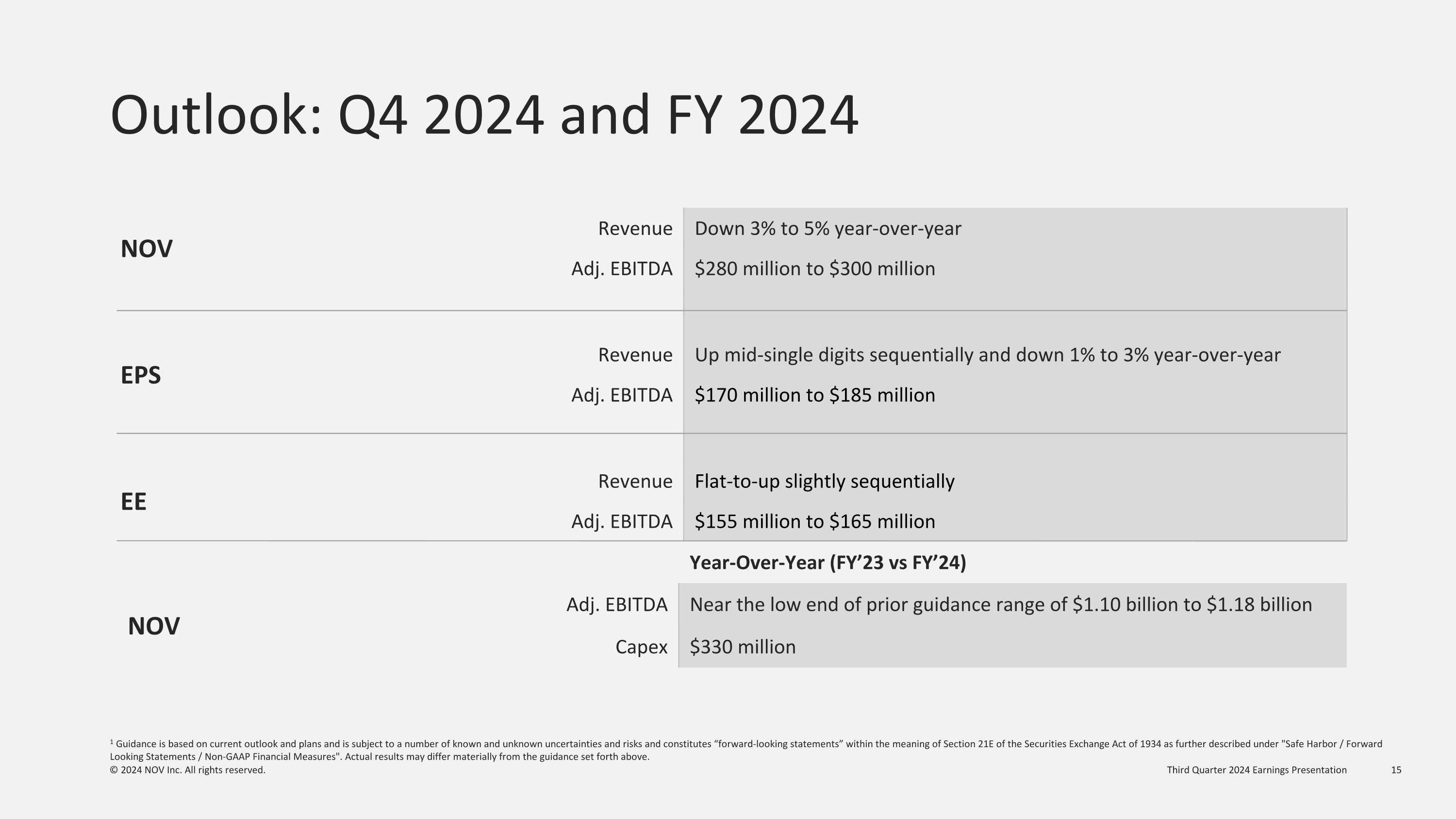

Outlook: Q4 2024 and FY 2024 NOV Revenue Down 3% to 5% year-over-year Adj. EBITDA $280 million to $300 million EPS Revenue Up mid-single digits sequentially and down 1% to 3% year-over-year Adj. EBITDA $170 million to $185 million EE Revenue Flat-to-up slightly sequentially Adj. EBITDA $155 million to $165 million © 2024 NOV Inc. All rights reserved. Third Quarter 2024 Earnings Presentation Year-Over-Year (FY’23 vs FY’24) NOV Adj. EBITDA Near the low end of prior guidance range of $1.10 billion to $1.18 billion Capex $330 million 1 Guidance is based on current outlook and plans and is subject to a number of known and unknown uncertainties and risks and constitutes “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934 as further described under "Safe Harbor / Forward Looking Statements / Non-GAAP Financial Measures". Actual results may differ materially from the guidance set forth above.

We power the industry that powers the world. © 2024 NOV Inc. All rights reserved. Third Quarter 2024 Earnings Presentation Employees1 34K Locations 548 Countries 60 Enterprise Value2 $6.7B Q3 2024 TTM Revenue $8.9B Q3 2024 TTM Adjusted EBITDA $1.1B 1 Full time equivalent workers. 2 Enterprise value recorded as of October 23, 2024.

© 2024 NOV Inc. All rights reserved. Third Quarter 2024 Earnings Presentation Appendix 17

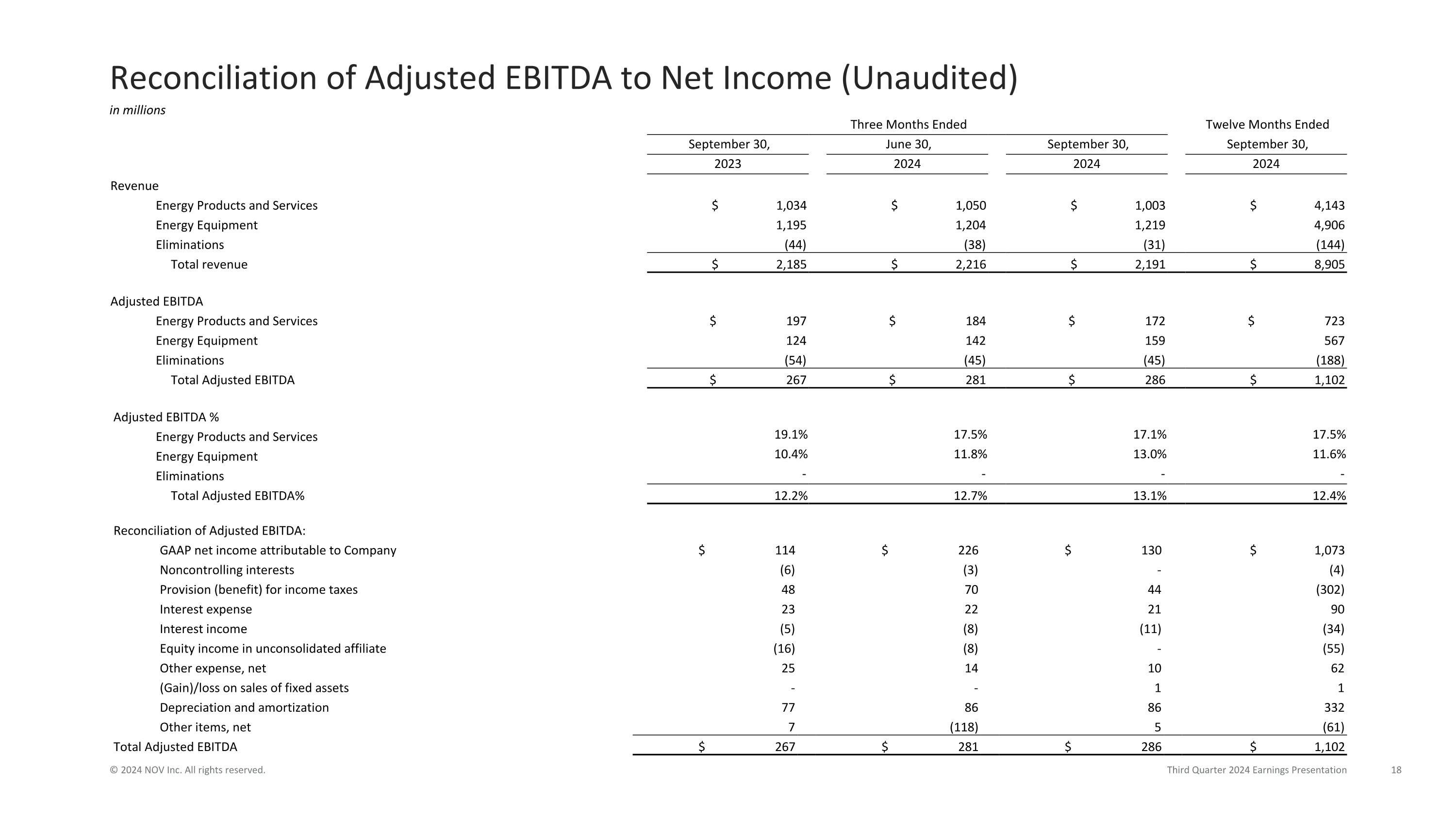

Three Months Ended Twelve Months Ended September 30, June 30, September 30, September 30, 2023 2024 2024 2024 Revenue Energy Products and Services $ 1,034 $ 1,050 $ 1,003 $ 4,143 Energy Equipment 1,195 1,204 1,219 4,906 Eliminations (44) (38) (31) (144) Total revenue $ 2,185 $ 2,216 $ 2,191 $ 8,905 Adjusted EBITDA Energy Products and Services $ 197 $ 184 $ 172 $ 723 Energy Equipment 124 142 159 567 Eliminations (54) (45) (45) (188) Total Adjusted EBITDA $ 267 $ 281 $ 286 $ 1,102 Adjusted EBITDA % Energy Products and Services 19.1% 17.5% 17.1% 17.5% Energy Equipment 10.4% 11.8% 13.0% 11.6% Eliminations - - - - Total Adjusted EBITDA% 12.2% 12.7% 13.1% 12.4% Reconciliation of Adjusted EBITDA to Net Income (Unaudited) © 2024 NOV Inc. All rights reserved. Third Quarter 2024 Earnings Presentation in millions Reconciliation of Adjusted EBITDA: GAAP net income attributable to Company $ 114 $ 226 $ 130 $ 1,073 Noncontrolling interests (6) (3) - (4) Provision (benefit) for income taxes 48 70 44 (302) Interest expense 23 22 21 90 Interest income (5) (8) (11) (34) Equity income in unconsolidated affiliate (16) (8) - (55) Other expense, net 25 14 10 62 (Gain)/loss on sales of fixed assets - - 1 1 Depreciation and amortization 77 86 86 332 Other items, net 7 (118) 5 (61) Total Adjusted EBITDA $ 267 $ 281 $ 286 $ 1,102

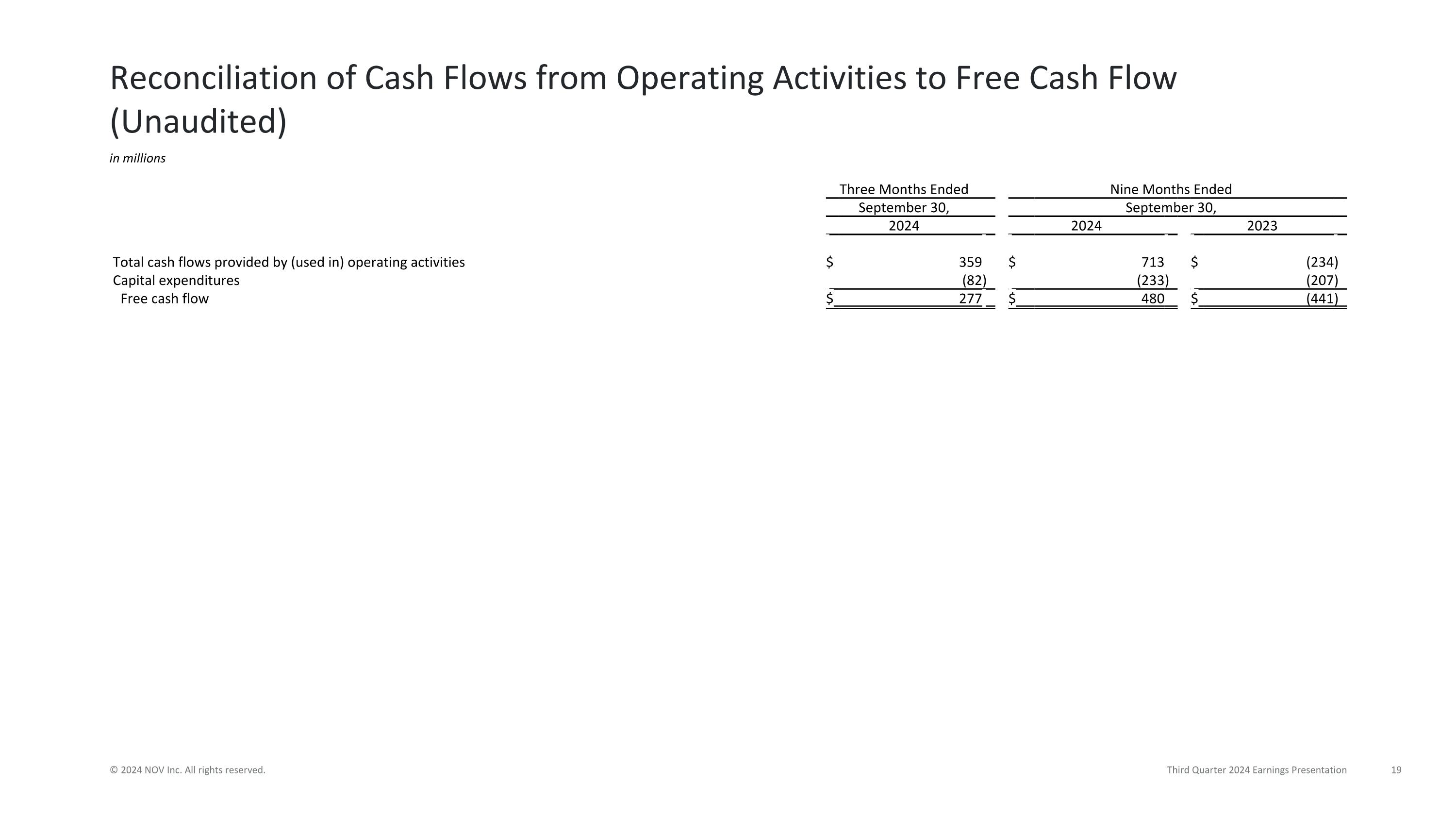

Reconciliation of Cash Flows from Operating Activities to Free Cash Flow (Unaudited) © 2024 NOV Inc. All rights reserved. Third Quarter 2024 Earnings Presentation in millions Three Months Ended Nine Months Ended September 30, September 30, 2024 2024 2023 Total cash flows provided by (used in) operating activities $ 359 $ 713 $ (234 ) Capital expenditures (82 ) (233 ) (207 ) Free cash flow $ 277 $ 480 $ (441 )

© 2024 NOV Inc. All rights reserved. Third Quarter 2024 Earnings Presentation