UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE YEAR ENDED DECEMBER 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 1-12317

NOV INC.

(Exact name of registrant as specified in its charter)

| | |

Delaware |

| 76-0475815 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

10353 Richmond Avenue

Houston, Texas 77042-4103

(Address of principal executive offices)

(346) 223-3000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | NOV | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes☒ No☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act. Yes☐ No☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☒ No☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes☒ No☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | |

Large accelerated filer ☒ | Accelerated filer ☐ | Emerging growth company | ☐ |

Non-accelerated filer ☐ | Smaller Reporting Company ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes☐ No☒

The aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant as of June 30, 2024 was $7.4 billion. As of January 31, 2025, there were 380,819,811 shares of the Company’s common stock ($0.01 par value) outstanding.

Documents Incorporated by Reference

Portions of the Proxy Statement in connection with the 2025 Annual Meeting of Stockholders are incorporated in Part III of this report.

FORM 10-K

PART I

ITEM 1. BUSINESS

General

NOV Inc. (“NOV” or the “Company”) is a leading independent equipment and technology provider to the global energy industry. NOV and its predecessor companies have spent over 160 years helping transform oil and gas development and improving its cost-effectiveness, efficiency, safety, and environmental impact. Over the past few decades, the Company has pioneered and refined key technologies to improve the economic viability of frontier resources, including unconventional and deepwater oil and gas. More recently, by applying its deep expertise and technology, the Company has developed solutions to improve the economics of alternative energy sources.

NOV’s extensive proprietary technology portfolio supports the industry’s drilling, completion, and production needs. With unmatched cross-segment capabilities, scope, and scale, NOV continues to develop and introduce technologies that further enhance the economics and efficiencies of energy production, with a focus on digital solutions, including automation, predictive analytics, and condition-based maintenance.

NOV serves major-diversified, national, and independent service companies, contractors, and energy producers in 59 countries. NOV operates under two segments, Energy Equipment and Energy Products and Services.

Business Strategy and Competitive Strengths

NOV’s primary business objective is to generate above-average, long-term capital returns and further enhance its position as a leading independent global energy technology and equipment provider by delivering solutions that help lower the marginal cost and environmental footprint associated with energy development and production from oil, gas, and renewable sources. NOV’s strategy is to capitalize on economies of scale that arise from its position as a leading provider of equipment and technology to the global energy industry, proprietary technology it continues to develop, and core capabilities and competencies it can apply toward advancing alternative sources of energy. NOV also believes its manufacturing business model is less asset- and capital-intensive than most other participants in the energy industry.

Leverage NOV’s advantages of size, scope, scale, and market position

NOV’s position as a leading independent global energy technology and equipment provider affords several competitive advantages, including:

Economies of scale in procurement and manufacturing. NOV’s global leadership and footprint, spanning almost every major oil and gas market, provide the Company with economies of scale, enabling a unique global supply chain, which allows materials procurement from lower-cost sources. The Company’s global manufacturing footprint and diverse production flexibility also enable NOV to rapidly adapt to demand changes, efficiently leverage manufacturing capacity in high-demand areas, and manufacture goods in lower-cost jurisdictions. NOV’s geographic diversity also reduces potential revenue volatility from shifts in activity location, regional differences in energy prices, and adverse weather events.

Scope and scale for distribution and marketing. With operations in 59 countries, NOV has developed an efficient worldwide distribution network and relationships with virtually every oil and gas producer, service company, and contractor. NOV uses its customer relationships and distribution capabilities to accelerate the commercialization of new products and technologies. NOV also routinely develops technologies for the global marketplace where the Company’s infrastructure allows for quick market penetration and creation of a first-mover advantage with standardized operations around certain products.

Reputation, experience, and benefits of fleet standardization. NOV believes its reputation and experience make its products a lower-risk purchase for customers. The Company benefits from customer efforts to standardize training, maintenance, and spare parts, resulting in reduced downtime and inventory-stocking requirements, lower training costs, and better safety. Customers may prefer standardized equipment from NOV, a well-capitalized market leader with which they can enter into long-term service agreements that offer advanced analytics and condition monitoring to maximize uptime and reduce the total cost of equipment ownership.

Large installed base of equipment. As a leading original equipment manufacturer (“OEM”) for oil and gas operations, NOV believes it is well positioned to provide aftermarket support for its large base of installed equipment. Most service companies prefer, and many of their customers demand, OEM aftermarket support. Customers frequently encounter higher risk and cost when they purchase and use potentially incompatible products from different vendors, particularly where products must interact through complex interfaces, which are common sources of failures and unplanned costs. Additionally, certain past events have increased the industry’s risk profile with government regulatory bodies, which have shown a strong preference for OEM service contractor critical equipment maintenance.

Leverage NOV’s market position to accelerate the digitization of the energy industry

NOV’s experience, scale, and market position, along with its proficiencies in control systems, sensors, field instrumentation, and data acquisition makes the Company a logical choice to provide a digital platform for the energy industry that consumes all operational data, regardless of the service-provider. Additionally, NOV’s well-established, global field-service infrastructure affords the Company a distinct capability and advantage in the commercialization and support required to deploy digital solutions that must collect, aggregate, and transmit field-level data from complex machinery and equipment in harsh environments. NOV is investing considerable time and resources to develop its MaxTM platform and MaxTM edge devices, which enable large-scale collection, aggregation, and analytics of real-time equipment and process data, both at the edge and in the cloud. The Company’s Max platform and analytics services also allow users to apply artificial intelligence and machine learning to operational data, enabling better decision-making for more efficient, more productive, safer, and less carbon intensive operations.

Develop proprietary technologies and solutions that assist energy producers in reducing their marginal cost of supply

NOV strives to further develop its substantial technology portfolio and is known for developing innovative customer productivity solutions. The Company is well positioned to introduce breakthrough technologies that enhance efficiencies and address industry needs, to generate strong returns. The Company believes its cross-business-unit expertise uniquely positions NOV to pioneer proprietary technologies across its business lines. For example, NOV’s segments jointly introduced closed-loop drilling technologies, which link real-time data from the well bottom to drilling rig controls and use machine learning to drive greater efficiency. NOV works closely with customers to identify needs, and its technical experts use internal capabilities to develop value-added technologies.

Capitalize on and drive end-market fragmentation

Technology and product availability to all industry participants is a key tenet of NOV’s business model. To the extent NOV can provide equipment and technology products that are equal to or better than those developed by the major oilfield service providers, it will prevent any one organization from having a proprietary advantage and therefore drive fragmentation. This fragmentation expands NOV’s customer base and avoids customer concentration in most of its businesses. NOV has resisted the recent trend toward vertical integration, leaving the Company in an attractive and unique position as the largest global independent technology and equipment provider to the oilfield service sector. Governments in certain international markets are pursuing initiatives that drive local content and greater local employment. The Company expects that these actions will likely prompt more local startup enterprises, further expanding demand for NOV’s equipment.

Leverage core capabilities and competencies to assist customers in efforts to reduce their environmental footprint and improve the economics of alternative sources of energy

NOV’s engineering expertise, complex global supply chain management, low-cost manufacturing, and large-scale energy infrastructure development provide unique capabilities to help customers economically diversify the energy mix. The Company has pioneered numerous innovations that help reduce emissions in oilfield operations. NOV is also a leading geothermal equipment and technology provider, offering a broad array of tools and equipment specifically designed for the ultra-harsh conditions associated with geothermal development. Additionally, with expertise in offshore heavy-lift equipment and naval architectural design, the Company is the leading equipment and technology provider for purpose-built vessels used to build, install, and maintain offshore wind towers and turbines. The Company sees promise in development and commercialization of novel products and technologies to improve the efficiencies and economics of land and offshore-based wind, geothermal power generation, and carbon capture and sequestration.

Employ a capital-light business model with the ability to quickly scale operations

NOV’s manufacturing facilities require relatively low investment and maintenance expenses versus the sales they enable. NOV manufactures a diverse line of products and improves efficiency by shifting production runs to high-demand or lowest-cost facilities. The Company also benefits from a customer base requiring technically complex equipment for use in extreme environments.

NOV’s infrastructure leverages the energy industry’s cyclicality. As commodity prices rise, the industry typically enters an expansionary phase, and equipment orders increase. NOV is able to ramp up manufacturing capacity quickly to capture the up-cycle value while meeting customer demand. During down-cycles, the Company’s focus is internal efficiency and technological advancement. NOV’s continuous pursuit of cyclical technological initiatives enhances its ability to drive long-term customer and shareholder value. The Company also outsources non-critical machining operations with lower tolerance requirements during increased activity and brings the machining operations back into Company-owned facilities during down-cycles for lower cost and effective utilization.

Employ a conservative capital structure with ample liquidity to capitalize on volatility associated with the oil and gas industry

NOV maintains a conservative capital structure with an investment-grade credit rating and ample liquidity. The Company carefully manages its capital structure by continuously monitoring cash flow, capital spending, and debt capacity. Maintaining financial strength inspires confidence from customers who make large purchase commitments delivered over multi-year timeframes and who expect NOV to support their equipment with OEM aftermarket parts and services for decades to come. NOV’s strong balance sheet provides flexibility to execute its strategy, including advancing technological offerings, through industry volatility and commodity price cycles. The Company intends to maintain a conservative approach to balance sheet management to preserve operational and strategic flexibility.

Business Segment Overview

NOV operates under two reporting segments that are organized to optimize resource allocation, accelerate innovation, improve customer service, and drive stronger results. NOV executes its business strategy under the following two segments:

Energy Products and Services provides the critical tools, equipment, and services to safely maximize efficiency, reliability, and economics in the upstream oil and gas, renewables, and industrial markets. The segment’s offerings tend to be more transactional and shorter-cycle in nature. Revenues are derived from sales of consumable products, services and rentals, and sales of shorter-lived, or single-application, capital asset sales.

The segment’s offerings include:

•Drill Bits. NOV is a premier technical provider of performance-engineered drill bits and borehole enlargement products to help operators improve well construction efficiency and economics by breaking rock during rotary drilling operations. The Company designs, manufactures, sells, and rents high-quality, customized fixed cutter drill bits using industry-leading cutter technology. The portfolio also includes roller cone drill bits, borehole enlargement tools that excel in the most demanding applications, and coring tools and services.

•Downhole Tools. NOV is a leading independent drilling and intervention downhole tools equipment supplier with engineering teams, manufacturing facilities, supply hubs, and service centers situated in oil and gas activity regions. The Company’s constantly evolving product portfolio includes downhole drilling motors, agitator systems, and measurement-while-drilling, logging-while-drilling, fishing, and thru-tubing tools. NOV’s offerings enable significant efficiency increases for directional and extended lateral well drilling, workovers and intervention operations.

•Completion Tools. NOV offers a differentiated portfolio of proprietary products and solutions to support well construction and horizontal multistage completions. The company offers multistage frac technologies, including dissolvable frac plugs, frac sleeves, toe initiation burst port systems, and recyclable setting tools that enhance hydraulic fracturing efficiency. NOV also provides critical well construction components such as surface casing and liner hangers that ensure structural integrity and operational reliability.

•Artificial Lift Systems. NOV is a leading designer and manufacturer of electric submersible pumps, high viscosity pumps, and surface pumps designed to optimize productivity and reliability.

•Tubular Inspection & Coating Services. NOV is a leading provider of tubular coating and inspection services for drill-pipe and other oil country tubular goods (“OCTG”). The company has over 80 years of history offering these services and provides a fully-integrated inspection, coating, and repair process along with specialized composite sleeves and liners that protect tubulars from harsh downhole conditions, ensuring equipment durability throughout the entire well lifecycle.

•Solids Control and Waste Management Services. NOV is a leading provider of solids control and waste management equipment and services. The Company provides field services and manufactures, sells, and rents highly engineered solids control equipment that efficiently separates solid drill cuttings and reclaims drilling fluids for reuse. NOV also provides waste management (both onsite and at centralized locations), including transport and storage, and water management solutions. The Company incorporates proprietary technologies in the delivery of such solutions, including its thermal desorption systems that efficiently minimize and treat drilling waste at the source for safe on-site disposal, significantly improving the efficiency of costly activities such as barge vessel trips, crane lifts, and trucking transport while also reducing the carbon emissions from the same.

•MPD Equipment and Rentals. NOV is a leading provider of managed pressure drilling (MPD) equipment and services. The Company provides a broad spectrum of MPD solutions to help manage wellbore pressures and optimize drilling performance. Offerings include rotating control devices, managed pressure drilling manifolds, full drilling control network integration, and engineering services.

•Digital Solutions. NOV is a leading independent provider of data and digital solutions to the energy industry. Supported by a global field service infrastructure and technologically advanced equipment and sensors for harsh environments, the Company acquires, aggregates, and delivers real-time drilling, completion and production data to enable edge and cloud

analytics, which improve operational efficiencies, well productivity, and safety. Utilizing its proprietary wired drill pipe, NOV offers Downhole Broadband Solutions (DBS) to provide real-time, broadband data from the bottom-of-the-hole and along the drill string, to improve well placement, reduce well delivery times, and increase production.

•Drill Pipe. NOV is a leading provider of precision-engineered drill pipe and drill-stem equipment. The Company leverages its metallurgy expertise and premium connection technologies to offer an innovative drill pipe product portfolio for applications ranging from the simplest vertical land well to deepwater, extended-reach, high-pressure/high-temperature wells.

•Conductor Casing Connections. NOV provides proprietary connectors and integral thread solutions for oil and gas applications including conductor strings, surface casing, and liners, with diameters ranging from 16 to 72 inches. The Company’s advanced connectors are designed to withstand high fatigue loading and include connector products where threads are machined on high strength forging material then welded to pipe, and integral-threaded wedge connectors with pin and box threads that are machined directly on the ends of pipes.

•Composite Solutions. NOV is a leading provider of high-end composite pipe, tanks, and structures engineered to address complex corrosion and weight constraints across a diverse range of demanding applications, including oil and gas, chemical processing, industrial environments, wastewater management, fuel handling, marine and offshore industries, geothermal energy, and rare earth mineral extraction.

Energy Equipment designs, builds, and supports capital equipment and integrated systems used in oil and gas exploration and production, both onshore and offshore, as well as for industrial, marine, and renewable energy markets. Revenues are derived from sales of capital equipment and aftermarket spare parts, repair, and rentals, as well as comprehensive technical support, field service, and training. In addition to traditional aftermarket support, NOV offers subscription services including analytics, condition monitoring, and digital performance solutions that enhance operational efficiencies, increase up-time, and reduce the total cost of ownership of many of the Company’s products. Most of the segment’s capital equipment offerings are longer-lead-time products, requiring more than three months to manufacture and deliver, and meet the Company’s criteria to be reported as backlog when firm orders are received.

The segment’s offerings include:

•Drilling Equipment. NOV provides advanced land rigs, complete offshore drilling packages, and rig components designed to mechanize and automate complex drilling rig processes, including automation control systems and robotics solutions. The portfolio includes designs that changed the way rigs are operated, such as the TDS top drive drilling system and automated iron roughneck. Evolving with market needs, the portfolio includes solutions to reduce energy consumption and enable energy regeneration, resulting in reduced emissions profiles. Aftermarket offerings include upgrades of existing equipment and systems, spare parts, repair, and rentals, as well as comprehensive remote equipment monitoring, technical support, field service, and customer training through an extensive aftermarket facilities network strategically located in major drilling areas around the world.

•Intervention and Stimulation Equipment. NOV designs and manufactures capital equipment, related consumables, and digital products for hydraulic stimulation, coiled tubing, and wireline services. Hydraulic stimulation offerings include conventional and next-generation-technology configurations of high-pressure pumping units, along with process equipment such as hydration units, chemical additive systems, blenders, and control systems, along with consumables including centrifugal pumps, valves, seats, and flowline equipment. Coiled tubing equipment offerings include coiled tubing units, injector heads, tubing strings, pressure control and nitrogen support equipment. Wireline offerings include electric line and slickline trucks and skids, and pressure control equipment. Through NOV’s MaxTM digital platform, the Company leverages its integrated control and data acquisition systems to provide comprehensive equipment status and operational process insights, to optimize job efficiency and extend the equipment life. NOV supports all its equipment with comprehensive repair, recertification, and other services through a global aftermarket facility network.

•Marine Equipment. NOV provides heavy-lift cranes, a large range of knuckle-boom and lattice-boom cranes, with active heave capabilities, deck-handling machinery, mooring and anchoring systems, a full range of jacking systems for drilling rigs, wind turbine installation vessels, other offshore construction vessels, and specialized equipment and machinery for installing offshore wind towers, turbines, and blades, offshore pipelines and offshore power transmission cables. Additionally, NOV designs offshore jack-up and floating rigs, wind turbine and cable lay vessels, and floating offshore wind structures. NOV’s marine solutions serve the oil and gas industry as well as wind energy and other marine-based end markets.

•Process Systems. NOV provides integrated processing solutions for the separation and treatment of oil, gas, solids, seawater, and produced water production. Drawing on a deep understanding of gas and fluids behavior from more than 40 years of experience, NOV’s engineers and project managers design and build integrated systems that provide water treatment, separation, sand management, hydrate inhibition and gas processing for use both on and offshore. For deepwater

applications these systems come together to supply comprehensive solutions for floating production, storage, and offloading (“FPSO”) vessels. Leveraging processing expertise, NOV also offers carbon capture solutions, including amine-based carbon capture technologies, complementary processing systems, including CO2 dehydration, and mooring systems, to secure floating facilities used to process, condition, and inject CO2 into offshore subsurface geologic formations.

•Subsea Production Systems. NOV is a leading designer and manufacturer of flexible subsea pipe systems designed to convey hydrocarbon production from the wellhead to production facilities in demanding offshore conditions. Flexible pipes are highly engineered, complex, helically-wound structures composed of multiple unbonded steel and composite layers, allowing them to withstand the demanding pressures and tensile loads of deepwater production while remaining resistant to wave- and tidal-induced fatigue. NOV also offers an assortment of critical subsea production equipment, such as water injection and tie-in connector systems, subsea storage units, and other related products.

•Production and Midstream Equipment. NOV designs and manufactures a variety equipment used in production and midstream operations, including: reciprocating, multistage, and progressive cavity pumps, midstream products, such as closures, transfer pumps, chokes and valves; and artificial lift support systems, including production BOPs and stuffing boxes.

•Industrial Equipment. NOV provides specialized, technology-driven mixers, heat exchangers, and progressive cavity pumps to process high-viscosity liquids in a variety of end markets. Marketed under globally recognized brands known for quality and reliability and backed by more than 75 years of advanced fluid-handling experience, NOV’s industrial pumps and mixers serve a wide breadth of end markets, including biogas, food and beverage, water/wastewater, chemical, mineral processing, pulp and paper, pharmaceutical, and general industrial processes.

See Note 16 to the Consolidated Financial Statements for financial information by segment and a geographical revenue and long-lived asset breakout. We have also included a glossary of oilfield terms at the end of Item 1. “Business” of this Annual Report.

NOV Low-Carbon Solutions

As a leading independent global energy technology and equipment provider, NOV is focused on helping its customers improve efficiencies, lower costs, improve reliability, and reduce the environmental impact of producing energy. Lower-cost, cleaner sources of energy significantly contribute to raising the global standard of living by powering economic development, enabling better infrastructure, healthcare, and education, and facilitating the production of goods and services that improve quality of life. NOV leverages its core competencies to assist customers’ efforts to reduce their environmental impact and carbon emissions. While oil and gas will remain critical to many parts of the global economy, the drive to reduce emissions represents an enormous economic opportunity for organizations that can improve the economic competitiveness of renewable energy and lower-carbon solutions. NOV is working to develop proprietary solutions to improve project execution, drive higher capital returns, and lower levelized costs of energy (“LCOE,” which is a measure of the average net present cost of electricity generation over a source’s lifetime) associated with renewable energy and low-carbon solutions.

Offshore Wind

NOV is a value-added partner capable of meaningfully reducing offshore wind project execution risk. The Company has a broad and growing portfolio of relevant technology, an extensive track record of successfully managing complex marine projects, long-standing relationships with global shipyards, and a robust global supply chain accustomed to stringent quality and traceability.

Wind turbine installation vessels (WTIVs). NOV is the leading global equipment and design provider for offshore wind turbine installation vessels. NOV expects continued demand from the global offshore wind installation vessel market, driven primarily by the need for larger vessels required to support the installation of larger, higher-capacity wind turbines. The vessels required to install taller, heavier turbines are similar to those previously designed by NOV and are relatively consistent across global geographies.

Cable-lay systems for offshore wind infrastructure. NOV has leveraged its expertise in cable-lay systems to provide carousel designs for offshore interconnector and interarray cable-lay vessels that support the infrastructure buildout necessary to aggregate and transmit power from offshore wind farms to shore. The Company has received several recent orders and anticipates additional demand for cable-lay vessels, driven by international offshore renewable energy projects and electrification demand.

Floating wind. NOV believes that the nascent floating offshore wind market may present one of the great renewable resource opportunities of the next decade. NOV is actively developing new products and technologies to support this industry alongside its legacy portfolio, which includes cranes, winches, mooring systems, cable-lay systems, ballasting systems, and chain connectors and tensioners. NOV has developed a patent-pending Tri-Floater semi-submersible floating foundation that requires less steel than competing offerings. NOV is also designing several proprietary lifting and handling tools for streamlined turbine component installation. Today, the floating offshore wind market is in the pre-commercial development phase, with industry players focused on proofs of concept and mitigating execution risk.

Onshore Wind

NOV is developing technology to lower onshore wind’s LCOE by economically constructing increasingly tall wind towers. Taller wind towers improve wind farm economics by allowing larger turbines to reach stronger winds, significantly increasing energy capture, lowering energy cost, and expanding the regions where wind projects can be profitably developed.

The Company has developed a patented tapered spiral-welding process that enables automated wind tower section production. Now in the early stages of commercialization, this proprietary process could significantly decrease tower section production times and reduce costs. Additionally, in time the process could enable in-field manufacturing operations, which could reduce costs and eliminate many logistical limitations of transporting the larger-diameter sections necessary for tall tower developments.

To support taller tower wind farm construction, NOV is developing a fit-for-purpose onshore wind tower erection system, built upon the intellectual property, control systems, and experience developed through mobile desert and arctic drilling rig design. The patent-pending system creates a structurally-sound, mobile tower crane that is expected to significantly improve the safety, reliability, and efficiency of tall wind tower installation processes.

Geothermal

Today, many of NOV’s oil and gas products are used for drilling geothermal wells. NOV’s drill pipe, drill pipe coatings, liner hangers, completion tools, drill bits, and full land rig packages have been a critical part of global geothermal development. Further, with geothermal power generation’s recently renewed traction, NOV has developed new proprietary products that address many unique geothermal production challenges worldwide.

Carbon Capture and Sequestration

NOV is positioned to play a meaningful role in the growing carbon capture and sequestration industry. NOV’s gas processing technology enables CO2-from-hydrocarbon separation, dehydration, and liquification, all vital parts of the carbon capture chain. In addition, the business’s turret and mooring systems used in offshore production facilitate the development of offshore carbon re-injection sites.

Lowering the Carbon and Environmental Footprint of the Oil & Gas Industry

NOV is committed to providing products and services that economically reduce carbon intensity and deliver superior performance. The Company has pioneered numerous solutions for improving the industry’s safety and environmental footprint, including NOV’s closed-loop solids control systems, regenerative power systems, dual-containment flowline technologies, solar pumping systems, and hydrocarbon leak detection systems, among others. NOV remains committed to reducing emissions and improving industry sustainability and has recently commercialized several new offerings including:

NOV’s PowerBlade™ Kinetic Energy Recovery System is a regenerative braking technology that utilizes both flywheel energy and lithium-ion battery energy storage to significantly reduce fuel consumption and emissions associated with drilling and hoisting. The PowerBlade system captures and regenerates electrical energy that would have previously dissipated as heat when a drawworks, crane, or winch slows and stops. The PowerBlade system then returns this energy when needed.

NOV’s Maestro™ smart configurable power management system helps operators reduce fuel consumption while maintaining safe drilling operations. The Maestro system effectively calculates and determines the optimized and safe level of required power generation in real-time and optimizes power consumption on the rig to reduce emissions.

NOV’s EcoBooster™ system enables peak power shaving in hydraulic power systems and minimizes the number of active pumps needed for each operation, resulting in reduced fuel consumption and emissions savings of up to 80%. The short term power peaks are covered with flow from accumulators connected to the ringline piping by a smart valve. An added benefit of the EcoBooster™ system is improved equipment performances as the hydraulic response from accumulators is quicker than ramping up pumps.

NOV’s iNOVaTHERM™ waste management system incorporates thermal desorption technology that efficiently minimizes and treats drilling waste at the source for safe on-site disposal, significantly reducing costly carbon-emitting activities, such as barge vessel trips, crane lifts, and trucking transport. NOV’s advanced waste management systems with real-time monitoring play an integral role in reducing the risks associated with waste in transit and decreasing the industries’ overall emissions operations.

NOV’s Ideal eFrac™ pressure pumping equipment delivers advanced well stimulation technology to dramatically reduce emissions and decrease ownership cost. The patent-pending Ideal eFrac system enhances wellsite safety by reducing complexity and removing personnel from hazardous environments. In addition to lower operating emissions and greater power density, the Ideal eFrac system is less disruptive to neighboring communities because it reduces truckloads by 40 percent, enables a smaller footprint, and reduces noise.

NOV’s eDrive™ system for wireline skids and hybrid wireline trucks provides a more sustainable solution for interventions by making customers’ operations less impactful on the environment and strengthening regulatory compliance.

Markets and Competition

The Company’s customers are predominantly service companies, oil and gas companies, and shipyards. Products within Energy Products & Services are sold and rented worldwide through NOV’s sales force and through commissioned representatives. Substantially all of Energy Equipment’s capital equipment and spare parts sales, and a large portion of smaller pumps and parts sales, are made through NOV’s direct sales force and distribution service centers. Sales to foreign oil companies are often made with or through representative arrangements.

The Company’s competition consists primarily of publicly traded oilfield service and equipment companies and smaller independent equipment manufacturers in the oil and gas, industrial, and renewable energy equipment markets.

The Company’s foreign operations, which include significant operations in the Middle East, Africa, Latin America, the Far East, Canada and Europe are subject to the risks normally associated with conducting business in foreign countries, including foreign currency exchange risks and uncertain political and economic environments, which may limit or disrupt markets, restrict the movement of funds or result in the deprivation of contract rights or the taking of property without fair compensation. Government-owned oil and gas companies located in some of the countries in which the Company operates have adopted policies (or are subject to governmental policies) giving preference to the purchase of goods and services from companies that are majority-owned by local nationals. As a result of such policies, the Company relies on joint ventures, license arrangements, and other business combinations with local nationals in these countries. See Note 16 to the Consolidated Financial Statements for information regarding geographic revenue information.

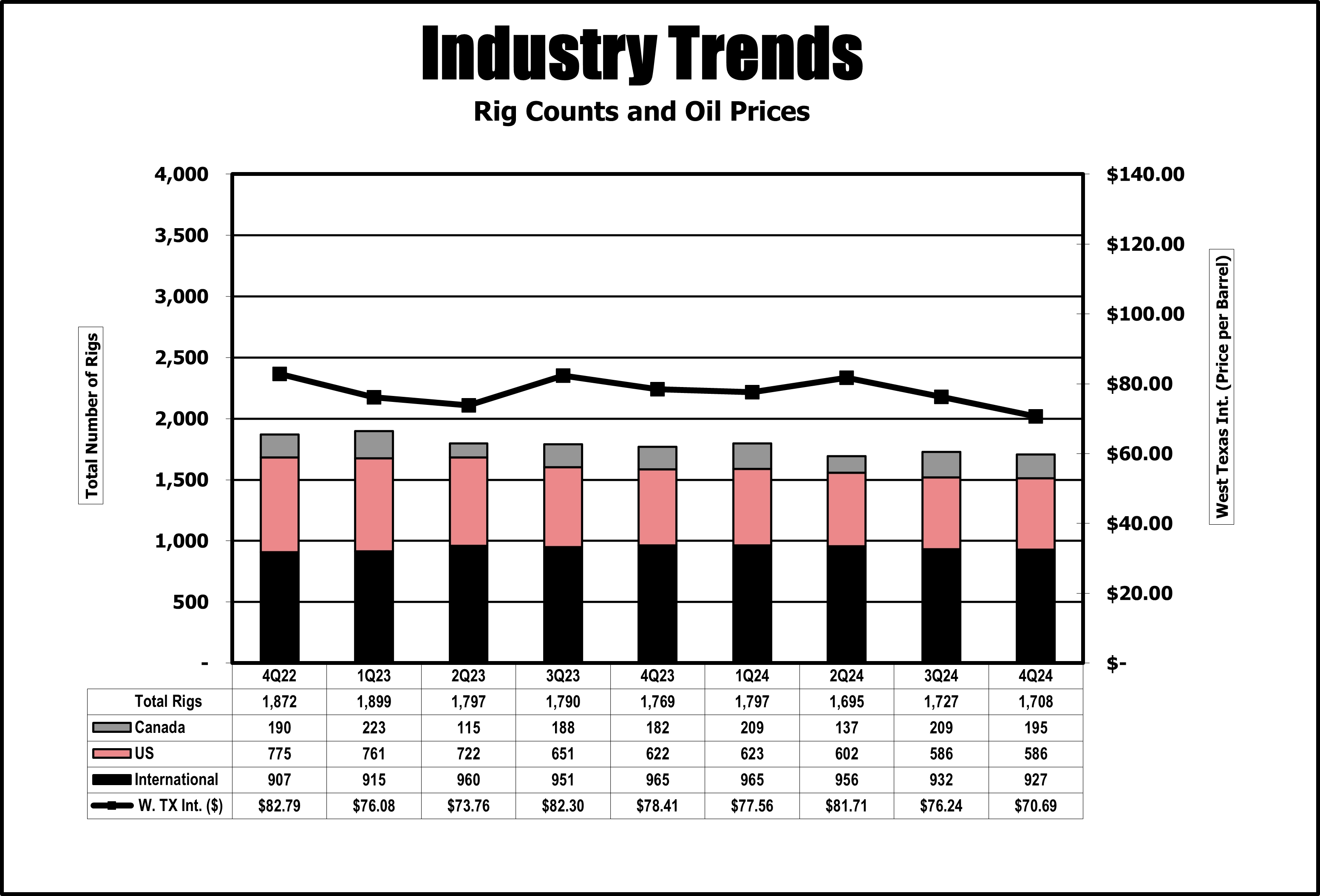

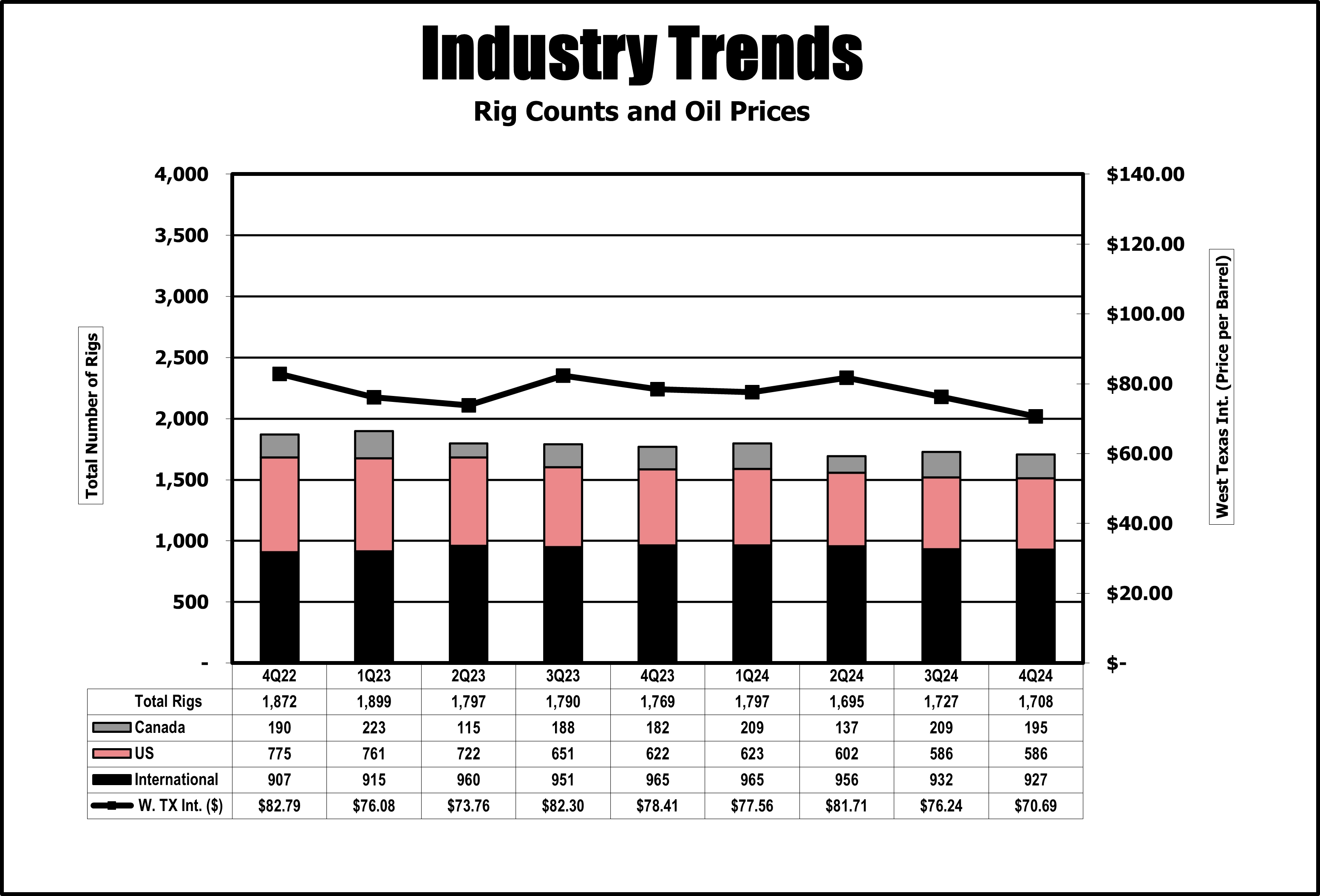

Influence of Oil and Gas Activity Levels on the Company’s Business

The oil and gas industry has historically experienced significant volatility. Demand for the Company’s products and services depends primarily upon the general level of activity in the oil and gas industry worldwide. Oil and gas activity is in turn heavily influenced by, among other factors, oil and gas prices worldwide. High levels of drilling and well remediation drive demand for the Company’s products and services. Additionally, high levels of oil and gas activity increase cash flows available for oil and gas companies, drilling contractors, oilfield service companies, and manufacturers of OCTG to invest in equipment that the Company sells.

See additional discussion on the current worldwide economic environment and related oil and gas activity levels in Item 1A. “Risk Factors” and Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Seasonal Nature of the Company’s Business

Historically, activity levels of some of the Company’s segments have followed seasonal trends to some degree. The Company typically realizes a more pronounced level of spending during the fourth quarter, and a decline in the first quarter, in certain of its businesses, which it believes is related to annual budgetary cycles and winter weather. On average, first quarter revenues through the past five years have declined 6.9% sequentially from the fourth quarter. Extremely harsh winter weather can reduce oilfield operations in far northern or high-altitude locations, including parts of Colorado, Canada and China, and the annual thaw (or “breakup”) in Canada makes some unimproved roads inaccessible to heavy equipment during part of each second quarter. Both situations temporarily reduce demand for the Company’s products and services in the affected geographic area, although revenues generally recover once conditions improve. Fluctuations in customers’ activity levels caused by national or customary holiday seasons and annual budgetary cycles can also affect their spending levels with the Company, leading to both temporary local decreases and increases in sales. While the Company anticipates that the seasonal and other trends described above may continue, there can be no guarantee that spending by the Company’s customers will continue to follow patterns seen in the past.

Research and New Product Development and Intellectual Property

The Company believes that it has been a leader in the development of new technology and equipment to enhance the safety and productivity of drilling and well servicing processes and that its sales and earnings have been dependent, in part, upon the successful introduction of new or improved products. It also invests in new technologies related to its non-oil and gas business as well as renewable energy-related technologies. Through its internal development programs and certain acquisitions, the Company has assembled an extensive array of technologies protected by a substantial number of trademarks, for both goods and services, patents, trade secrets, and other proprietary rights.

As of December 31, 2024, the Company held a substantial number of granted patents and pending patent applications worldwide, including U.S. patents and U.S. patent applications as well as patents and patent applications in a variety of other countries. Expiration dates of such patents range from 2025 to 2044. Additionally, the Company maintains a substantial number of trademarks for both goods and services and maintains a number of trade secrets.

Although the Company believes that this intellectual property has value, competitive products with different designs have been successfully developed and marketed by others. The Company considers the quality and timely delivery of its products, the service it provides to its customers, and the technical knowledge and skills of its personnel to be as important as its intellectual property in its ability to compete. While the Company stresses the importance of its research and development programs, the technical challenges and market uncertainties associated with the development and successful introduction of new products are such that there can be no assurance that the Company will realize future revenue from new products.

Manufacturing and Service Locations

The manufacturing processes for the Company’s products generally consist of machining, welding and fabrication, heat treating, assembly of manufactured and purchased components, and testing. See properties list in Item 2 for information regarding primary facilities.

Raw Materials

The Company believes that materials and components used in its operations are generally available from multiple sources. The prices paid by the Company for its raw materials may be affected by, among other things, energy, steel, and other commodity prices; tariffs and duties on imported materials; and foreign currency exchange rates. The Company has experienced rising, declining, and stable prices for milled steel and standard grades and has generally seen stainless alloy product prices continue to rise. The Company has generally been successful in its effort to mitigate the financial impact of higher raw materials costs on its operations by applying surcharges to, and adjusting prices on, the products it sells. Higher prices and lower availability of steel and other raw materials the Company uses in its business may adversely impact future periods.

Backlog

The Company monitors its backlog of orders to guide its planning. Backlog includes orders from the Company’s Energy Equipment segment that typically require more than three months to manufacture and deliver.

Backlog measurements are based on written orders that are firm but may be defaulted upon by the customer in some instances. Most require reimbursement to the Company for costs incurred in such an event. There can be no assurance that the backlog amounts will ultimately be realized as revenue, or that the Company will earn a profit on backlog work. Backlog at December 31, 2024, 2023 and 2022 was $4.4 billion, $4.1 billion and $3.8 billion, respectively.

Human Capital

NOV’s 34,010 global, diverse employees use their skill and expertise to provide the products and services that help our customers operate safely, efficiently, sustainably, and competitively. NOV’s team designs and manufactures a broad array of equipment and technology, from some of the heaviest, largest, and most complex mobile machines on earth (on and offshore drilling rigs, wind turbine installation vessels, and FPSOs) to very small precision sensors and measuring devices.

NOV’s employee base includes:

•Inventors, designers, scientists, and engineers (including mechanical, electrical, chemical, hydraulic, materials, computer, software, data analytics, and other disciplines) who design and improve the equipment, electronics, software, services and process that bring value to NOV’s customers;

•Technical sales, marketing and training professionals who educate customers, the industry, and our own organization about NOVs’ many products, services, and unique capabilities;

•Supply chain, logistics, warehousing, and quality testing professionals who ensure our factories, workshops, repair centers and field technicians have the right materials and tools to do their jobs efficiently;

•Production and service planners and schedulers, project managers, and process design and Quality Health Safety and Environmental professionals who plan, manage, and monitor the activities of our workforce to ensure high-quality, efficient, safe, and environmentally compliant operations;

•Machinists, metal fabricators, welders, assemblers, pipe fitters, riggers, electronics technicians, system integrators, composite material fabricators, paint and industrial coatings specialists, and other skilled trade professionals who use a wide variety of industrial processes, tools, and techniques to transform raw materials and purchased components into the many products NOV sells;

•Field service engineers, mechanics, and technicians who maintain, service, repair, and upgrade NOV equipment and, in some cases, assist customers with its operation;

•Business leaders and managers who create business strategies and targets, assess goals and priorities, and allocate resources to ensure NOV’s employees have the tools they need to get the job done and further build the Company’s competitive advantages; and

•Support function professionals, including: Information Technology, Human Resources, Legal, Compliance, Clerical, and Accounting and Finance who support operations to keep the business infrastructure and administrative burdens flowing.

34% percent of NOV employees work in the United States, 20% in Europe, 14% in Latin America, 13% in the Asia Pacific region, 13% in the Middle East and Africa, 3% in Canada and 3% in China. The Company’s 551 physical locations include manufacturing plants, research facilities, machine shops, office buildings, warehouses, and distribution centers where between 20 to 1,100 people work, and repair shops, rental tool bases, sales offices and other small locations where between 5 to 200 people work. Many NOV employees travel to work at customer locations, including onshore and offshore drilling sites, shipyards, and other industrial locations where equipment needs installation, commissioning, service, or repair, or where customers need training or technical support.

NOV’s success depends on these dedicated, skilled hardworking employees. The Company strongly believes that safeguarding and supporting the health, safety, diversity, respect, skills, career satisfaction, and wellbeing of NOV’s employees are critical to the success of the business. The Company’s Human Resources and Health Safety and Environmental organizations provide policies, oversight, monitoring, resources, training, and assistance companywide that are designed to foster a culture that embraces this belief.

Safety

Protecting the health and safety of all stakeholders is a core value. NOV maintains comprehensive monitoring and tracking of reportable injuries, reviewed each quarter by our operating Segment Presidents with the CEO, CFO, and Chief HSE Officer (including significant injuries, root cause analysis, and remediation measures). Successful safety programs and campaigns are also shared across the Company’s operations, including:

•Stop Work Authority – all NOV employees have the authority, responsibility, and duty to stop an unsafe act, practice, or job;

•Life Saving Rules – standardized rules aligning NOV with industry partners to reduce the risk of serious injury or death associated with critical hazards in the workplace;

•Safety Audits – programs coordinating safety walk-throughs, observations, and improvements at NOV facilities; and

•Safety stand downs – pausing normal operations for general safety meetings or to address a specific risk.

Health and wellbeing

The Company offers locally competitive health benefits, paid holidays and time off, and retirement benefits to our employees. In the US this includes health, vision and dental insurance, life insurance, disability insurance, a 401(k)-retirement savings plan, an employee assistance program, and a wellness program.

Diversity and inclusion

NOV recognizes that diversity of thought, insight and experiences, culture, talent, and education contribute to achieving the Company’s goals. NOV is committed to maintaining a diverse workforce, fostering inclusion, and providing equal opportunities based on merit and performance, which can lead to more innovative and creative business solutions, more informed decision-making, greater employee engagement, and better retention and recruitment of top talent.

In support of this commitment, NOV has implemented training programs covering the Company’s Code of Conduct and Business Ethics and Harassment in the Workplace.

Across NOV’s global workforce, women make up 16% of all employees, 23% of salaried employees, 20% of the C-Suite and hold 27% of the Company’s Board of Directors seats.

Career satisfaction and skills

NOV tracks and monitors data on the employee experience including hiring, turnover, and promotion trends. The Company also obtains employee feedback through ‘pulse’ surveys which measure employee engagement across several areas. Human resources managers and business managers across the Company review this information to identify areas for improvement and create remediation strategies.

The Company invests in opportunities for employee education, growth, and development, providing comprehensive training opportunities in technical, managerial, and leadership skills. Some programs include Powering Excellence designed for current and potential business leaders, Supervisor Training and Resources (STAR) and Leading Self and Others designed for new managers, as well as many other courses through the Company’s dedicated Technical Training Centers based in Houston, Singapore, UAE, Norway, UK, and South America.

Available Information

The Company’s principal executive offices are located at 10353 Richmond Avenue, Houston, Texas 77042. Its telephone number is (346) 223-3000. Further information about the Company’s products and services can be found on its website at: www.nov.com. The Company’s common stock is traded on the New York Stock Exchange under the symbol “NOV”. The Company’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all related amendments are available free of charge on the Investor Relations portion of the Company’s website, www.nov.com/investor, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”). The Company’s Code of Ethics is also posted on its website. The information posted on the Company’s website is not incorporated by reference into this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS

You should carefully consider the risks described below, in addition to other information contained or incorporated by reference herein. Realization of any of the following risks could have a material adverse effect on our business, financial condition, cash flows and results of operations.

Industry Environment and Operations Related

We are dependent upon the level of activity in the oil and gas industry, which is volatile and has caused, and may cause future, fluctuations in our operating results.

The oil and gas industry historically has experienced significant volatility. Demand for our products and services depends primarily upon the number of oil rigs in operation, the number of oil and gas wells being drilled, the depth and drilling conditions of these wells, the volume of production, the number of well completions, capital expenditures of other oilfield service companies and the level of workover activity. Drilling and workover activity can fluctuate significantly in a short period, particularly in the United States and Canada. The demand and pricing for our products and services will continue to be influenced by numerous factors over which we have no control, including:

•current and anticipated future prices for oil and natural gas and volatility in supply and demand and pricing for oil and natural gas;

•the impact on markets from the Organization of Petroleum Exporting Countries (“OPEC”) and other countries, such as Russia, based on voluntary production limits;

•interruptions in supply chains caused by war, geo-political conflict, trade sanctions or other restrictions placed on oil producing countries, such as Russia, Iran, and Venezuela or otherwise placed on trade and commerce;

•the level of production by non-OPEC countries including production from U.S. shale plays;

•the level of excess production capacity;

•the cost of exploring for and producing oil and gas;

•the level of drilling activity and drilling rig dayrates;

•catastrophic events, such as public health crises, e.g., the COVID-19 pandemic or other geopolitical events, such as war or terrorist activities,

•availability and access to potential hydrocarbon resources;

•governmental political requirements, regulation and energy policies;

•evolving environmental and climate change policies and regulations and fluctuations in political conditions in the United States and abroad which adversely impact exploration or development of oil or gas;

•increased capital requirements imposed upon the oil and gas industry to comply with heightened air emissions control requirements and regulations;

•currency exchange rate fluctuations and devaluations; and

•development of alternate energy sources.

Expectations for future oil and gas prices cause many shifts in the strategies and expenditure levels of oil and gas companies, drilling contractors, and other service companies, particularly with respect to decisions to purchase major capital equipment of the type we manufacture. Oil and gas prices, which are determined by the marketplace, may remain below a range that is acceptable to certain of our customers, which could continue the reduced demand for our products and have a material adverse effect on our financial condition, results of operations and cash flows.

There are risks associated with certain contracts for our equipment.

As of December 31, 2024, we had a backlog of capital equipment to be manufactured, assembled, tested and delivered by Energy Equipment in the amount of $4.43 billion. The following factors, in addition to others not listed, could reduce our margins on these contracts, adversely impact completion of these contracts, adversely affect our position in the market or subject us to contractual penalties:

•financial challenges for consumers of our capital equipment;

•credit market conditions for consumers of our capital equipment;

•our failure to adequately estimate costs for making this equipment;

•our inability to deliver equipment that meets contracted technical requirements;

•our inability to maintain our quality standards during the design and manufacturing process;

•our inability to secure parts made by third party vendors at reasonable costs and within required timeframes;

•unexpected increases in the costs of raw materials;

•our inability to manage unexpected delays due to weather, shipyard access, labor shortages, public health crises such as the COVID-19 pandemic or other factors beyond our control;

•the imposition of tariffs or duties between countries, which could materially affect our global supply chain. For example, section 232 tariffs on steel may increase our costs, reduce margins or otherwise adversely affect the Company; and

•trade or travel restrictions, including export sanctions, trade controls or other supply chain interruption, which could affect our ability to manufacture, sell, or receive payment for our equipment and/or services.

The Company’s existing contracts for rig and production equipment generally carry significant down payment and progress billing terms to facilitate the ultimate completion of these projects and the majority do not allow customers to cancel projects for convenience. However, unfavorable market conditions or financial difficulties experienced by our customers have in the past and may in the future result in cancellation of contracts or the delay or abandonment of projects. Any such developments could have a material adverse effect on our operating results and financial condition.

Competition in our industry, including the introduction of new products and technologies by our competitors, as well as the expiration of the intellectual property rights protecting our products and technologies, could ultimately lead to lower revenue and earnings.

The oilfield products and services industry is highly competitive. We compete with national, regional and foreign competitors in each of our current major product lines. Certain of these competitors may have greater financial, technical, manufacturing and marketing resources than us, and may be in a better competitive position. The following can each affect our revenue and earnings:

•improvements in the availability and delivery of products and services by our competitors;

•the introduction of new products and technologies by our competitors; and

•the expiration of intellectual property rights protecting our products and technologies.

We are a leader in the development of new technology and equipment to enhance the safety and productivity of drilling and well servicing processes. If we are unable to maintain our technology leadership position, it could adversely affect our competitive advantage for certain products and services. Our revenues and operating results have been dependent, in part, upon the successful introduction of new or improved products. Through our internal development programs and acquisitions, we have assembled an array of technologies protected by a substantial number of trade and service marks, patents, trade secrets, and other proprietary rights, which expire after a prescribed duration, some at varying times over the coming years. The expiration of these rights could have a material adverse effect on our operating results. Furthermore, while the Company stresses the importance of its research and development programs, the technical challenges and market uncertainties associated with the development and successful introduction of new products are such that there can be no assurance that the Company will realize future revenue from new products. We may also have disputes with competitors concerning our technology or payment for licenses of our technology. For example, we have on-going litigation concerning payments due under some of our technology licenses. See Note 12 to the Consolidated Financial Statements for further discussion.

The tools, techniques, methodologies, programs and components we use to provide our services may infringe upon the intellectual property rights of others. Infringement claims generally result in significant legal and other costs and may distract management from running our core business. Royalty payments under licenses from third parties, if available, could increase our costs. Additionally, developing non-infringing technologies could increase our costs. If a license were unavailable, we might be unable to continue providing a particular service or product, which could adversely affect our financial condition, results of operations and cash flows.

In addition, certain foreign jurisdictions and government-owned oil and gas companies located in some of the countries in which we operate have adopted policies or regulations which may give local nationals in these countries competitive advantages. Actions taken by our competitors and changes in local policies, preferences or regulations could impact our ability to compete in certain markets and adversely affect our financial results.

A significant portion of our revenue is derived from our non-United States operations, which exposes us to risks inherent in doing business in each of the many countries in which we operate.

Approximately 66% of our revenues in 2024 were derived from operations outside the United States (based on revenue destination). Our foreign operations include significant operations in every oil producing region in the world. Our revenues and operations are subject to the risks normally associated with conducting business in foreign countries, including:

•uncertain political, social and economic environments;

•social unrest, acts of terrorism, war and other armed conflict, such as the conflicts in Ukraine, Israel and the broader Middle East;

•public health crises and other catastrophic events, such as the COVID-19 pandemic;

•trade and economic sanctions, export controls, and other restrictions imposed by the United States, European Union or other countries;

•restrictions under the United States Foreign Corrupt Practices Act (“FCPA”) or similar legislation, as well as foreign anti-bribery and anti-corruption laws;

•confiscatory taxation, tax duties, complex and everchanging tax regimes or other adverse tax policies;

•exposure to expropriation of our assets and other actions by foreign governments;

•deprivation of contract rights;

•restrictions on the repatriation of income or capital;

•currency exchange rate fluctuations and devaluations.

Supply chain disruption and price escalation could have a material adverse effect on our business, liquidity, consolidated results of operations and consolidated financial condition.

Our business relies on a broad range of raw materials and commodities for the products we manufacture. Shortages, transportation and supply disruptions can adversely impact supply of our manufacturing raw materials, as well as delivery of finished goods and transportation of our personnel for services. To varying degrees, these problems persist and may continue to persist as a consequence of evolving geopolitical trends. Among the factors that can adversely affect our business and consolidated results of operations are the following:

•inability to access raw materials and components;

•suppliers’ allocating less of their supply to the Company than required or requested by the Company;

•higher prices for raw materials and components;

•delays and higher costs for shipping and transportation;

•labor shortages and absences;

•wage and other labor cost inflation;

•liabilities resulting from an inability to perform services due to limited manpower availability or an inability to travel to perform the services; and

•other contractual or other legal claims from our customers resulting from supply chain, transportation or other business disruption.

We sometimes provide engineered process packages and other engineered products for multi-year, fixed price contracts that may require us to assume risks associated with cost over-runs, operating cost inflation, labor availability, supplier and contractor pricing and performance, and potential claims for liquidated damages.

We sometimes provide engineered skid packages of processing equipment or complex equipment in the form of multi-year contracts, without price escalation clauses. Some of these contracts are required by our customers, including national oil companies (NOCs). These projects include acting as suppliers of skid packages or engineered products, as well as installation and commissioning services and may require us to assume additional risks associated with cost over-runs from our vendors or due to material or labor cost escalation. In addition, NOCs often possess substantial leverage in the event of dispute or disagreement regarding performance under an agreement and they often operate in countries with unsettled political conditions, war, civil unrest, or other types of community issues. These issues may also result in cost over-runs, delays, and project losses.

Providing skid packages and engineered products as well as services on an integrated basis may also require us to assume additional risks associated with operating cost inflation, labor availability and productivity, supplier pricing and performance, and potential claims for liquidated damages. We rely on third-party subcontractors, consortium partners and equipment providers to assist us with the completion of these types of contracts. To the extent that we cannot engage subcontractors or acquire equipment or materials in a timely manner and on reasonable terms, our ability to complete a project in accordance with stated deadlines or at a profit may be impaired. If the amount we are required to pay for these goods and services exceeds the amount we have estimated in bidding for fixed-price work, we could experience losses in the performance of these contracts. These delays and additional costs may be substantial, and we may be required to compensate our customers for these delays. This may reduce the profit to be realized or result in a loss on a project.

Cybersecurity risks and threats could adversely affect our business.

We rely heavily on information systems to conduct our business. Any failure, interruption, or breach in security of our information systems, or information systems owned by others that we use and rely on, could result in failures or disruptions in our customer relationship management, general ledger systems and other systems. While we have policies and procedures designed to prevent or limit the effect of the failure, interruption or security breach of our information systems, there can be no assurance that any such failures, interruptions or security breaches will not occur or, if they do occur, that any breach or interruption will be sufficiently limited. The occurrence of any failures, interruptions or security breaches of our information systems could damage our reputation, result in a loss of our intellectual property or other proprietary information, including customer data, result in a loss of customer business, subject us to additional regulatory scrutiny, or expose us to civil litigation and possible financial liability, any of which could have a material adverse effect on our financial position or results of operations.

We may suffer business disruption from direct or indirect cyber-attacks. These take many forms, including ransomware directed at us, our vendors or our customers. As with virtually all other large companies, we receive numerous phishing efforts, and other attempted cyber-attacks such as efforts to hack our systems or use distributed denial-of-service attacks. These cyber-security risks have not resulted in any material adverse interruption in our business to date but pose an ongoing threat of material interruption to our business activities.

Our ability to hire and retain qualified personnel at competitive cost could materially affect our operations and growth potential.

Many of the products we sell, and related services that we provide, are complex and technologically advanced, which enable them to perform in challenging conditions. Our ability to succeed is, in part, dependent on our success in attracting and retaining qualified personnel to provide service and to design, manufacture, use, install and commission our products. A significant increase in wages paid by competitors, both within and outside the energy industry, for such highly skilled personnel could result in insufficient availability of skilled labor or increase our labor costs, or both. If the supply of skilled labor is constrained or our costs increase, our margins could decrease, and our growth potential could be impaired.

Severe or unseasonable weather conditions may adversely affect our operations.

Our business may be materially and adversely affected by severe weather conditions in areas where we operate. Many experts believe global climate change could increase the frequency and severity of extreme weather conditions, including coastal storm surges, inland flooding from intense rainfall, hurricane-strength winds, and extreme temperature. Repercussions of severe or unseasonable weather conditions may entail the evacuation of personnel and stoppage of services, damage to our facilities and project work sites, as well as our customers’ platforms or structures and offshore drilling rigs, inability to deliver material to jobsites in accordance with contract schedules, decreases in demand for oil and natural gas during unseasonably warm winters, and loss of productivity. Additionally, severe weather events could result in a disruption or suspension of our customers’ operations, thereby reducing demand for our services. Any of these events could adversely affect our financial condition, results of operations and cash flows.

An impairment of goodwill or other indefinite lived intangible assets could reduce our earnings.

Goodwill represents the excess of acquisition price paid over the fair value of the tangible and identifiable intangible assets acquired and liabilities assumed. The Company has approximately $1.6 billion of goodwill and $0.2 billion of other intangible assets with

indefinite lives as of December 31, 2024. Generally accepted accounting principles require the Company to test goodwill and other indefinite lived intangible assets for impairment at least annually or more frequently whenever events or circumstances indicate they might be impaired. Events or circumstances which could indicate a potential impairment include (but are not limited to): a significant sustained reduction in worldwide oil and gas prices or drilling; a significant sustained reduction in profitability or cash flow of oil and gas companies or drilling contractors; a significant sustained reduction in the market capitalization of the Company; a significant sustained reduction in capital investment by drilling companies and oil and gas companies; or a significant increase in worldwide inventories of oil or gas. The timing and magnitude of any goodwill impairment charge, which could be material, would depend on the timing and severity of the event or events triggering the charge and would require a high degree of management judgment. If we were to determine that any of our remaining balance of goodwill or other indefinite lived intangible assets was impaired, we would record an immediate charge to earnings with a corresponding reduction in stockholders’ equity; resulting in a possible increase in balance sheet leverage as measured by debt to total capitalization.

See additional discussion on “Goodwill and Other Indefinite – Lived Intangible Assets” in Critical Accounting Estimates of Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

We have expanded and grown our businesses through acquisitions and continue to pursue a growth strategy, but we cannot assure that attractive acquisitions will be available to us at reasonable prices or that such acquisitions will result in the outcomes we anticipate.

We cannot assure that acquisitions will result in the financial, operational or other benefits that we anticipate, and we cannot assure that we will successfully integrate the operations and assets of any acquired business with our own or that our management will be able to effectively manage any new lines of business. Any inability on the part of management to integrate and manage acquired businesses and their assumed liabilities could adversely affect our business and financial performance. In addition, we may need to incur substantial indebtedness to finance future acquisitions. We cannot assure that we will be able to obtain this financing on terms acceptable to us or at all. Future acquisitions may result in increased depreciation and amortization expense, increased interest expense, increased financial leverage or decreased operating income for the Company, any of which could cause our business to suffer.

Legal and Regulatory Related

The adoption of any future federal, state, or local laws or implementing regulations imposing reporting obligations on, or limiting or banning, the hydraulic fracturing process could make it more difficult to complete natural gas and oil wells and could have a material adverse effect on our business, consolidated results of operations and consolidated financial condition.

Various federal and state legislative and regulatory initiatives, as well as actions in other countries, have been or could be undertaken which could result in additional requirements or restrictions being imposed on hydraulic fracturing operations. For example, legislation and/or regulations have been adopted in many U.S. states that require additional disclosure regarding chemicals used in the hydraulic fracturing process but that generally include protections for proprietary information. Legislation, regulations and/or policies have also been adopted at the state level that impose other types of requirements on hydraulic fracturing operations (such as limits on operations in the event of certain levels of seismic activity). Additional legislation and/or regulations are being considered at the state and local level that could impose further chemical disclosure or other regulatory requirements (such as prohibitions on hydraulic fracturing operations in certain areas) that could affect our operations. Four states (New York, Maryland, Washington, and Vermont) have banned the use of high-volume hydraulic fracturing. Oregon has adopted a five-year moratorium and Colorado has enacted legislation providing local governments with regulatory authority over hydraulic fracturing operations. Local jurisdictions in some states have adopted ordinances that restrict or in certain cases prohibit the use of hydraulic fracturing, although many of these ordinances have been challenged and some have been overturned. In addition, governmental authorities in various foreign countries where we have provided or may provide hydraulic fracturing services have imposed or are considering imposing various restrictions or conditions that may affect hydraulic fracturing operations. The adoption of any future federal, state, local, or foreign laws or regulations imposing reporting obligations on, or limiting or banning, the hydraulic fracturing process could make it more difficult to complete natural gas and oil wells and could have a material adverse effect on our business, consolidated results of operations, and consolidated financial condition.

Our failure to comply with existing or future U.S. and foreign laws and regulations could have a material adverse effect on our business and our results of operations.

Our ability to comply with various complex U.S. and foreign laws and regulations, such as the FCPA, the U.K. Bribery Act and other foreign anti-bribery and anti-corruption laws, various trade control regulations, and human rights and anti-slavery legislation is dependent on the success of our ongoing compliance program, including our ability to continue to effectively supervise and train our employees to deter prohibited practices. These various laws and regulations can change frequently and significantly. We may become involved in a governmental investigation even if the Company has complied with these laws. If we fail to comply with applicable laws and regulation, we could be subject to investigations, sanctions, and civil and criminal prosecution as well as fines and penalties, which could have a material adverse effect on our reputation and our business, financial condition, results of operations and cash flows. In addition, government disruptions could negatively impact our ability to conduct our business. Supply chain restrictions such as the U.K. Modern Slavery Act and other similar legislation could also materially affect our supply chain, cost of production, and ability to manufacture our products.