On January 1, 2006, we adopted Statement of Financial Accounting Standards No. 123 (revised 2004), “Share-Based Payment” (“SFAS 123(R)”) which requires the measurement and recognition of compensation expense based on estimated fair values for all share-based payment awards made to employees and directors. SFAS 123(R) supersedes Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees” (“APB 25”), for periods beginning in fiscal 2006. In March 2005, the Securities and Exchange Commission issued Staff Accounting Bulletin No. 107 (“SAB 107”) relating to SFAS 123(R). We have applied the provisions of SAB 107 in its adoption of SFAS 123(R).

SFAS 123(R) requires companies to estimate the fair value of equity-based payment awards on the date of grant using an option-pricing model. The value of the portion of the award that is ultimately expected to vest is recognized as an expense over the requisite service periods in our consolidated income statement. Prior to the adoption of SFAS 123(R), the our accounted for equity-based awards to employees and directors using the intrinsic value method in accordance with APB 25 as allowed under Statement of Financial Accounting Standards No. 123, “Accounting for Stock-Based Compensation” (“SFAS 123”).

We adopted SFAS 123(R) using the modified prospective transition method, which requires the application of the accounting standard starting from January 1, 2006, the first day of our fiscal year 2006. Under that transition method, compensation cost recognized in the year ended December 31, 2006, includes compensation cost for all share-based payments granted subsequent to January 1, 2006, based on the grant-date fair value estimated in accordance with the provisions of Statement 123(R). Results for prior periods have not been restated.

We recognize compensation expenses for the value of its awards, which have graded vesting based on the straight line method over the requisite service period of each of the awards, net of estimated forfeitures. Estimated forfeitures are based on actual historical pre-vesting forfeitures.

As a result of adopting SFAS 123(R) on January 1, 2006, our income before income taxes and net income for the year ended December 31, 2006, is $ 145 lower than if it had continued to account for stock-based compensation under APB 25. Basic and diluted net loss per share for the year ended December 31, 2006, are $ 0.03 lower, than if we had continued to account for share-based compensation under APB 25.

Prior to January 1, 2006, we applied the intrinsic value method of accounting for stock options as prescribed by APB 25, whereby compensation expense is equal to the excess, if any, of the quoted market price of the stock over the exercise price at the grant date of the award.

We estimate the fair value of stock options granted using the Monte-Carlo option-pricing model. The option-pricing model requires a number of assumptions, of which the most significant are, expected stock price volatility, and the expected option term. Expected volatility was calculated based upon actual historical stock price movements over the most recent periods ending on the grant date, equal to the contractual term of the option. We have historically not paid dividends and has no foreseeable plans to issue dividends. The risk-free interest rate is based on the yield from U.S. Treasury zero-coupon bonds with an equivalent term.

In July 2006, the FASB issued FASB Interpretation 48, “Accounting for Income Tax Uncertainties” (“FIN 48”). FIN 48 defines the threshold for recognizing the benefits of tax return positions in the financial statements as “more-likely-than-not” to be sustained by the taxing authority. The recently issued literature also provides guidance on derecognition, measurement and classification of income tax uncertainties, along with any related interest and penalties. FIN 48 also includes guidance concerning accounting for income tax uncertainties in interim periods and increases the level of disclosures associated with any recorded income tax uncertainties. FIN 48 is effective for fiscal years beginning after December 15, 2006. The differences between the amounts recognized in the statements of financial position prior to the adoption of FIN 48 and the amounts reported after adoption will be accounted for as a cumulative-effect adjustment recorded to the beginning balance of retained earnings. Because the guidance was recently issued, we have not yet determined the impact, if any, of adoption of the provisions of FIN 48 on its financial position, results of operations and cash flows. We are currently evaluating the impact of FIN 48 on our consolidated financial statements.

In September 2006, FASB issued SFAS no. 157, “Fair Value Measurements” (“SFAS No. 157”). SFAS No. 157 defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles and expands disclosures about fair value measurements. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. We believe SFAS No. 157 will not have a material effect on our financial statements.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities” (“SFAS No. 159”). SFAS No. 159 permits companies to choose to measure certain financial instruments and certain other items at fair value. SFAS No. 159 requires that unrealized gains and losses on items for which the fair value option has been elected be reported in earnings. SFAS No. 159 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years, although earlier adoption is permitted. We are currently evaluating the impact that SFAS No. 159 will have on its consolidated financial statements.

Results of Operations

The following discussion and analysis should be read in conjunction with the section herein entitled “Selected Financial Data” and the consolidated financial statements, related notes and other financial information included herein.

Year Ended December 31, 2006 Compared to Year Ended December 31, 2005

Revenues. Total revenues for the year ended December 31, 2006 amounted to $20,224,000 compared to $ 16,820,000 for the year ended December 31, 2005, an increase of 20%. Product sales increased by $2,256,000 or 23%, from $9,888,000 in 2005 to $12,144,000 in 2006, mainly because of an increase in our sales in Japan and success in our AP workflow projects, mainly in Europe. Service revenues increased by $1,148,000, or approximately 17%, from $6,932,000 in the year ended December 31, 2005 to $8,080,000 in the year ended December 31, 2006. The increase is mostly attributable to our increase in AP workflow services in Europe, mainly in the SAP environment.

Cost of Revenues. Cost of revenues increased by $885,000, or 13%, from $6,763,000 in the year ended December 31, 2005 to $7,648,000 in the year ended December 31, 2006. The increase is a result of growth in expenses to third party service providers.

Research and Development. During 2006, we continued to focus efforts in enhancing our software recognition and core capabilities. Research and development expenses in the year ended December 31, 2006 amounted to $1,792,000 compared to $1,312,000 for the year ended December 31, 2005.

Selling, General and Administrative Expenses. Selling, general and administrative expenses in the year ended December 31, 2006 amounted to $10,263,000 compared to $8,866,000 for the year ended December 31, 2005. This increase of $1,397,000, or 16%, is mainly attributable to the expansion our sales force and establishing roots for major sales centers in several locations worldwide.

Financing Income, net. Financing income for the year ended December 31, 2006 amounted to $325,000 , compared to financing expense of $146,000 for the year ended December 31, 2005. The move from financing expense was primarily due to an increase of exchange currencies gain in 2006, which is a product of the strengthening of the Euro and British Pound against the U.S. Dollar. Net expenses from forward facilities transactions in 2006 was $61,000.

Net income (loss). As a result of the foregoing, our net income for the year ended December 31, 2006 was $801,000, compared to a net loss of $461,000 in year ended December 31, 2005.

- 28 -

Year Ended December 31, 2005 Compared to Year Ended December 31, 2004

Revenues. Total revenues for the year ended December 31, 2005 amounted to $16,820,000 compared to $11,178,000 for the year ended December 31, 2004, an increase of 50%. Product sales increased by $2,924,000 or 42%, from $6,964,000 in 2004 to $9,888,000 in 2005, mainly because of a large sale to a customer in Australia. Service revenues increased by $2,718,000, or approximately 64%, from $4,214,000 in the year ended December 31, 2004 to $6,932,000 in the year ended December 31, 2005. This significant increase is attributable mainly to services performed by TISJ, our subsidiary in Japan, which was established in 2004.

Cost of Revenues. Cost of revenues increased by $3,291,000, or 95%, from $3,472,000 in the year ended December 31, 2004 to $6,763,000 in the year ended December 31, 2005. The increase is a result of growth in demand for our products and services and for more comprehensive solutions, which required us to allocate and invest more resources to meet such demand and meet the software and other requirements of the more comprehensive solutions.

Research and Development. During 2005, we continued to focus efforts in enhancing our software recognition and core capabilities. Research and development expenses in the year ended December 31, 2005 amounted to $1,312,000 compared to $929,000 for the year ended December 31, 2004.

Selling, General and Administrative Expenses. Selling, general and administrative expenses in the year ended December 31, 2005 amounted to $8,866,000 compared to $7,123,000 for the year ended December 31, 2004. This increase of $1,743,000 or 24%, is mainly attributable to the expansion our sales force and establishing roots for major sales centers in several locations worldwide and our annual customers conference in the amount of $211,000 which took place in February 2005, and had not been held in 2004.

Liquidated Damages Related to September 2004 Private Placement. In 2005, we paid liquidated damages in the amount of $164,000 as part of our registration commitment to investors in the September 2004 private placement. No such amounts were paid in 2004.

Financing Income, net. Financing expense for the year ended December 31, 2005 amounted to $146,000, compared to financing income of $178,000 for the year ended December 31, 2004. The move to financing expense was primarily due to a decrease of exchange gain in 2005, which is a product of the weakening of the Euro and British Pound against the U.S. Dollar. During the second quarter of 2005, we initiated some investments in forward investments facilities (forwards) in order to reduce our balance and transactions exposure against the Euro, GBP and JPY. The net savings from these transactions in 2005 was $109,000.

Net Loss. As a result of the foregoing, our net loss for the year ended December 31, 2005 was $461,000, compared to a net loss of $168,000 in year ended December 31, 2004.

Impact of Currency Fluctuation and Inflation

We maintain operations and generate revenues in a number of countries. The results of operations and the financial position of our local operations are generally reported in the relevant local currencies and then translated into U.S. dollars at the applicable exchange rates for inclusion in our consolidated financial statements, exposing us to currency translation risk. In addition, we are exposed to currency transaction risk because some of our expenses are incurred in a different currency from the currency in which our revenues are received. Our most significant currency exposures are to the Euro, New Israeli Shekel, UK Pound and Japanese yen. In periods when the U.S. dollar strengthens against these other currencies, our reported results of operations may be adversely affected.

- 29 -

In the early to mid 1980s, Israel’s economy was subject to a period of very high inflation. However, inflation was significantly reduced by the late 1980s due primarily to government intervention. The annual rate of inflation in Israel was 1.21% and 2.4% in 2004 and 2005, respectively. The dollar cost of our operations in Israel is influenced by the extent to which any increase in the rate of inflation in Israel is not offset (or is offset on a lagging basis) by devaluation of the NIS in relation to the U.S. dollar. For example, during the years 2004 and 2005, the devaluation of the NIS against the dollar, which amounted to 1.62% and 6.8% accordingly, exceeded the inflation rate for the same periods. On the other hand, the negative inflation rate in 2003 of 1.9% and 2006 of 0.1% exceeded the devaluation of the dollar against the NIS, which amounted to 7.56% and 8.2% respectively. The increase in the dollar cost of our operations in Israel relates primarily to the costs of salaries in Israel, which constitute a significant portion of our expenses and are paid in NIS. In addition, inflation in Israel will have a negative effect on the profitability of our contracts under which we are to receive payment in dollars or other non-Israeli currencies while incurring expenses in NIS (some of which are linked to the Israeli consumer price index), unless such inflation is offset by a devaluation of the NIS. Inflation in Israel and currency fluctuations will also have a negative effect on the profitability resulting from our fixed price contracts under which we are to receive payment in NIS. A devaluation of the NIS in relation to the dollar will have the effect of decreasing the dollar value of any of our assets, which consist of receivables payable in NIS (unless such receivables are linked to the dollar). Such a devaluation would also have the effect of reducing the dollar amount of our liabilities which are payable in NIS (unless such payables are linked to the dollar). Conversely, any increase in the value of the NIS in relation to the dollar will have the effect of increasing the dollar value of any of our unlinked NIS assets and the dollar amounts of any unlinked NIS liabilities.

From time to time we purchase forward exchange contracts to reduce currency transaction risk. However, these purchases will not eliminate translation risk or all currency risk.

Political and Economic Conditions in Israel Affecting our Business

Because our principal offices and manufacturing facilities and many of our suppliers are located in Israel, political, economic and military conditions in Israel directly affect our operations. Since the establishment of the State of Israel in 1948, a number of armed conflicts have taken place between Israel and its Arab neighbors, the most recent confrontation taking place in July-August 2006. A state of hostility, varying in degree and intensity, has led to security and economic problems for Israel. There has been a marked increase in such hostility and a significant deterioration of Israel’s relationship with the Palestinian community since October 2000. In addition, we cannot predict the effect on Israel or the Middle East generally of the recent elections in the Palestinian Authority in which Hamas, an Islamic movement responsible for many attacks against Israelis, has formed the new government. Continuing or escalating hostilities in the region may have an adverse affect on our business, including our ability to develop, manufacture and market our products.

Some of our executive officers and employees in Israel are obligated to perform up to 36 days of military reserve duty annually. Moreover, in light of escalating hostilities and threats of armed conflict in the Middle East since October 2000, our executive officers and employees may be called for active military duty for an unlimited period of time. Our operations could be disrupted by the absence for a significant period of our executive officers or key employees as a result of military service. Any disruption in our operations could adversely affect our ability to develop and market products.

Economic Conditions

Israel’s economy has experienced numerous destabilizing factors, including a period of rampant inflation in the early to mid 1980s, low foreign exchange reserves, fluctuations in world commodity prices, military conflicts and civil unrest. The Israeli government has, for these and other reasons, intervened in the economy by utilizing fiscal and monetary policies, import duties, foreign currency restrictions and control of wages, prices and exchange rates. The Israeli government has periodically changed its policies in all these areas.

The Israeli government’s monetary policy contributed to relative price and exchange rate stability in recent years, despite fluctuating rates of economic growth and a high rate of unemployment. We cannot assure you that the Israeli government will be successful in its attempts to keep prices and exchange rates stable. Price and exchange rate instability may have a material adverse effect on our business.

Trade Relations

Israel is a member of the United Nations, the International Monetary Fund, the International Bank for Reconstruction and Development and the International Finance Corporation. Israel is also a member of the World Trade Organization and is a signatory of the Global Agreement on Trade in Services and the Agreement on Basic Telecommunications Services. In addition, Israel has been granted preferences under the Generalized System of Preferences from the United States, Australia, Canada and Japan. These preferences allow Israel to export the products covered by such programs either duty-free or at reduced tariffs.

- 30 -

Israel and the European Economic Community, now known as the European Union, concluded a Free Trade Agreement in 1975. This agreement confers advantages on Israeli exports to most European countries and obligates Israel to lower its tariffs on imports from these countries over a number of years. In 1985, Israel and the United States entered into an agreement to establish a free trade area. The free trade area has eliminated all tariff and some non-tariff barriers on most trade between the two countries. On January 1, 1993, an agreement between Israel and the EFTA, which includes Austria, Norway, Finland, Sweden, Switzerland, Iceland and Liechtenstein, established a free trade zone between Israel and the EFTA nations. In recent years, Israel has established commercial and trade relations with a number of other nations, including Russia, China, Turkey and other nations in Eastern Europe and Asia. We cannot assure you that the recent increase of armed conflict and hostility and the significant deterioration of Israel’s relationship with the Palestinian community will not have an adverse affect on our ability to conduct trade in the international market.

Liquidity and Capital Resources

As of December 31, 2006, our cash, cash equivalents, bank deposits and marketable securities were $21,792,000, compared to $10,005,000 as of December 31, 2005.

Net cash provided by operating activities for the year ended December 31, 2006 was $439,000 as compared to $421,000 used in operating activities in the corresponding period in 2005. This increase was attributable primarily to the increase in our sales and the results of improvement in our collection efforts. Our trade receivables increased to $7,642,000 at December 31, 2006 from $6,802,000 at December 31, 2005. This increase reflects our increased sales in 2006. In addition, stronger collections in 2006 than in previous years reduced our days of sales outstanding. While the effect of increasing sales on our cash flows will continue if we succeed in further sales growth, we believe that the cash flows from operations and other resources will be sufficient to support such growth. We expect trade receivables to continue to increase as our sales grow and to represent a significant portion of our working capital for the foreseeable future. For the year ended December 31, 2006, the aggregate amount of our capital expenditures was $252,000. These expenditures were principally for the purchases of computer hardware and software and facilities improvements. In December 2006 through the issuance of convertible debentures, we raised net proceeds of $13,510,000. Subsequently on December 31, 2006, we reduced our short term bank loan to $339,000.

As of December 31, 2005, our cash, cash equivalents, bank deposits and marketable securities were $10,005,000, compared to $10,415,000 as of December 31, 2004.

Net cash used in operating activities for the year ended December 31, 2005 was $421,000 as compared to $1,074,000 for the corresponding period in 2004. This decrease was attributable primarily to the increase in our sales and the results of improvement in our collection efforts. Our trade receivables increased to $6,802,000 at December 31, 2005 from $5,541,000 at December 31, 2004. This increase reflected our increased sales in 2005.

For the year ended December 31, 2006, the aggregate amount of our capital expenditures was $252,000. These expenditures were principally for the purchases of computer hardware and software and facilities improvements.

Convertible debentures

On December 27, 2006, we completed a public offering of approximately NIS 61.9 million (approximately $14.8 million) aggregate principal amount of convertible debentures on the Tel Aviv Stock Exchange. The public offering was comprised of 112,500 convertible debentures of NIS 528 (approximately $124) par value each. The convertible debentures are linked to the US Dollar and will bear interest at the annual rate of six-month LIBOR minus 0.3%. The interest is payable semi-annually commencing on June 30, 2007, and the principal is repayable in four annual installments commencing on December 31, 2009. After taking into account a concurrent private placement to the underwriter of NIS 500,000 aggregate principal amount of convertible debentures and an original issue discount of 4% on all the convertible debentures, the gross proceeds to TIS were NIS 59.87 million (approximately $14.8 million).

- 31 -

The debentures may be converted at the election of the holder into our ordinary shares at the conversion price of NIS 20.30 (approximately $4.81) per share. We also have the right to force conversion on or after October 1, 2009 if our share fair market value (as defined in the debenture documents) reaches NIS 25.50 (approximately $6.04) in the last 30 trading days in TASE on or after October 1, 2009. This offering was made in Israel to residents of Israel only. The convertible debentures offered were not and will not be registered under the U.S. Securities Act of 1933, as amended.

Private Placement

On September 24, 2004, we sold 2,524,351 of our ordinary shares at a purchase price of $3.16 per share to institutional investors for gross proceeds to us of approximately $8 million.

Pursuant to our agreements with the investors, we were obligated to use the net proceeds from the sale of our ordinary shares for working capital purposes and not (i) for the satisfaction of any portion of our debt (other than payment of trade payables and accrued expenses in the ordinary course of our business and consistent with prior practices), (ii) to redeem any equity or equity-equivalent securities in TIS, or (iii) to settle any outstanding litigation.

The investors also received warrants to purchase up to an additional 1,262,188 ordinary shares, with an exercise price of $4.26 per share. The warrants expire on September 23, 2007. The investors may only transfer the warrants to the investor’s affiliates, qualified institutional buyers, or in the event of our dissolution or winding down. The warrants contain a provision preventing a holder from exercising a warrant where the exercise would result in such holder beneficially owning more than 4.999% of our outstanding ordinary shares. Accordingly, no selling shareholder could be rendered a beneficial holder of more than 4.999% of our ordinary shares solely because of shares issuable to such shareholder upon exercise of such warrants held by the holder.

We have the right, but not the obligation, to call upon prior notice all or part of the warrants if the market price for our ordinary shares is equal to $8.52 for 20 consecutive days. Our calling the warrants would require the holders of the warrants to timely exercise the warrants. Failure to so exercise would result in our cancellation of the warrants. If we call any warrants, we must issue to each holder exercising in response to our call notice replacement warrants to purchase a number of shares equal to the number of shares acquired upon such exercise, with an exercise price equal to 120% of the closing price on the day prior to the call notice we provide to the holders.

Our shareholders approved the transaction at a special shareholders meeting held on August 24, 2004.

In connection with the private placement, we filed a resale registration statement covering the shares purchased in the private placement (including the shares underlying the warrants). The registration statement became effective on March 1, 2005. However, we did not obtain effectiveness of the registration statement within the timeframe set forth in our agreements with the investors. Because of this failure, the agreements with the investors required us to pay liquidated damages in the amount of 1% of the amount invested and an additional 1% for every month in which the failure was not cured, which obligation amounted to $164,000. In addition, any future failure to maintain effectiveness of the registration statement could subject us to additional liquidated damages under the same formula, including if we fail to file an amendment to the registration statement within ten days of the Securities and Exchange Commission’s having notified us that an amendment is necessary for the registration statement to continue to be effective, or if we fail to maintain the listing of our ordinary shares on the NASDAQ Capital Market.

- 32 -

Line of Credit

We currently have a short-term line of credit with First International Bank of Israel. The total amount available under this line of credit is the lesser of $2,300,000 and 75% of certain eligible trade receivables. As of December 31, 2006, we had approximately $339,000 outstanding credit in US dollars. The revolving line of credit in NIS bears interest at a rate of Prime + 1% (as of December 31, 2006, the prime rate was 6.5%) however no amount was outstanding as of December 31, 2006. The line of credit in US dollars bears interest at a rate of Libor + 2% (as of December 31, 2006, the Libor rate was 5.36%). Any indebtedness under this credit line is payable on demand and secured by a floating charge on our assets. Our ability to issue securities is restricted. In the event that we default under the line of credit, the bank could declare our indebtedness immediately due and payable and, if we are unable to make the required payments, foreclose on our assets. Moreover, to the extent that our assets continue to secure such indebtedness, such assets will not be available to secure additional indebtedness unless approved by the Bank.

Research and Development, Patents and Licenses, etc.

The main focus of our research and development in 2006 was the design and development of the neweFLOW version,eFLOW4, which will be released during the first quarter of 2007. The new abilities introduced to eFLOW 4 were presented at our international conference in Berlin and we were encouraged by the positive feedback we got from our customers and partners. The main features we developed in 2006 are:

| |

1. | Supporting Mailroom projects: eFLOW4 provides a better classifier with enhanced analysis tools which will result in better results with less implementation efforts. We have seen much interest from our customers, including at the conference we held in Berlin, for such solutions and we are intending to invest more in this direction. |

| |

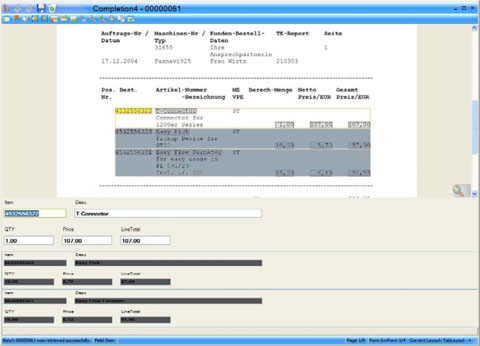

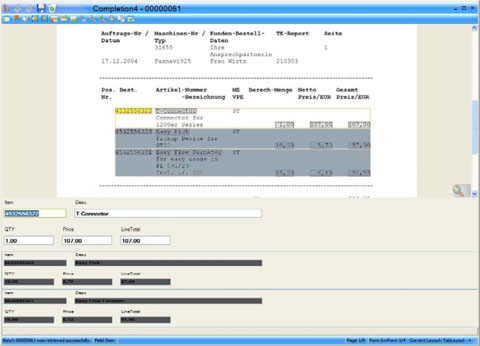

2. | Completion4: This new Data Entry module is now in the final stages of development and testing. Completion4 offers greater efficiency and productivity, new usability concepts, better performance and the new look of modern OS systems. In this screen shot you can see an example of Completion4: |

- 33 -

| | |

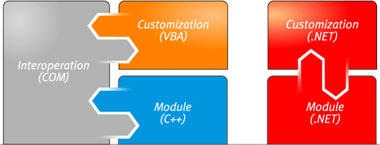

3. | Supporting the latest development technology from Microsoft,Microsoft .Net 2.0. |

| |

| a. | Faster Code execute |

| | |

| b. | Group templates: a user can use a bank of templates (for example, German address), export it and use it later with other applications, as shown here: |

- 34 -

| |

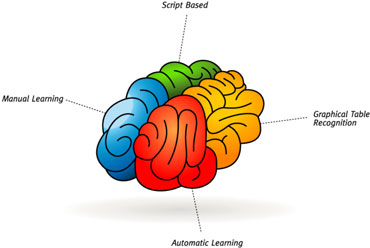

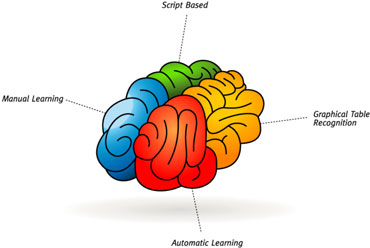

4. | Two new additional recognition algorithms were added to be part of Freedom, Graphical Table Recognition and Automatic Learning. |

| |

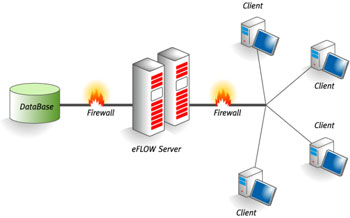

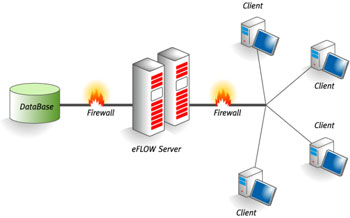

5. | Generic connectivity to databases usingeFLOW server side connection. |

Improved development process:

| |

1. | Microsoft’s Team System 2005 is part of the R&D process.Together with Microsoft’s technical team and one of our partners we replaced the older version control system with Microsoft’s system. |

| |

2. | Agile development.We have used advanced design and development concepts, including detailed unit tests at the developer level. |

| |

3. | Automatic Tests. This is now a standard part of our quality assurance process. The use of automatic tools dramatically reduces the amount of time needed to test the released version, where most of the tests are being done automatically by the QA machine. This allows much faster iterations of Development-QA and an overall higher quality of the product, with fewer bugs released initially and quicker convergence to stable product. |

- 35 -

Trends

We expect that semi-structured technology will become a central part of the document management market. We are addressing this trend by strengthening and further developing our semi-structured technology, mainly in the Business Process Outsourcing, or BPO, environment.

We anticipate that growth will continue in the data capture market. We expect that new recognition and classification technologies combined with more vertical market integration will expend the main markets. However, we believe that there will be a move toward integrated software solutions, such asFreedom, oureFLOWplug-in for semi-structured content, instead of individual data capture products and semi-structured technology. As of today, there is a great demand for our Integra technology, especially in large intensive government projects. We also anticipate that the need for applications will increase substantially, mainly in the Accounts Payables workflow area, . We expect outsourcing with respect to documents solutions to increase due to its cost efficiency and improved quality and for the date capture industry to continue to move toward consolidation. We are addressing these trends by solidifying our relationships with our existing partners and seeking to become the preferred data capture solution provider for many large integrated system providers.

Tabular disclosure of contractual obligations

The following is a summary of our significant contractual obligations as of December 31, 2006:

| | | | | | | | | | | | | | | | |

Contractual Obligation | | Total | | Less Than 1

Year | | 1-3 Years | | 3-5 Years | | More than

5 Years | |

| |

| |

| |

| |

| |

| |

Operating Lease Obligation | | | 1,873,000 | | | 734,000 | | | 671,000 | | | 312,000 | | | 156,000 | |

Convertible debenture | | | 14,197,000 | | | - | | | 3,549,250 | | | 10,647,750 | | | - | |

We also have a long-term liability on our balance sheet as of December 31, 2006 in the amount of $1,016,000 related to employee severance obligations mandated by Israeli law. As we cannot determine the period, if any, during which we will be required to make any payments in respect of that liability, it is not reflected in the table above.

Our contractual obligations and commitments at December 31, 2006 principally include obligations associated with our outstanding indebtedness, future minimum operating lease obligations, a right to use a third party software (see below) and contractual and legal obligations to employees and officers’ severance expense. Such obligations are detailed in Notes 10 to the consolidated financial statements for the year ended December 31, 2006 as well as the section entitled “Compensation” herein. We expect to finance these contractual commitments from cash on hand and cash generated from operations.

With respect to our short term loan, please see the discussion under “Line of Credit” in “Liquidity and Capital Resources” above.

| |

ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

Directors and Senior Management

The following table sets forth the identity of our directors, and senior management. The mailing address for each of the individuals below is c/o Top Image Systems Ltd. at our address set forth herein.

- 36 -

Update

| | | | |

Name | | Age | | Title |

| |

| |

|

|

Izhak Nakar | | 55 | | Chairman of the Board |

| | | | |

Ido Schechter | | 46 | | Chief Executive Officer and Director |

| | | | |

Arie Rand | | 47 | | Chief Financial Officer |

| | | | |

Gideon Shmuel | | 35 | | Vice President of Sales |

| | | | |

Oded Leiba | | 36 | | Vice President of Engineering |

| | | | |

Ofir Shalev | | 35 | | Vice President of Research and Development |

| | | | |

Victor Halpert | | 46 | | Director |

| | | | |

Sivan Sadan | | 33 | | Director |

| | | | |

Elie Housman | | 70 | | Director |

| | | | |

William M. Landuyt | | 51 | | Director |

| | | | |

Yehezkel Yeshurun | | 58 | | Director |

Izhak Nakar founded TIS and served as its Chief Executive Officer from inception until December 2001. He has been a director of ours since 1991. In 1997 he initiated an entrepreneurial venture, TopGuard that was later sold to Elron. Mr. Nakar served in the Israel Air Force from 1970 to 1987, where he led various large-scale highly technical development projects, including leading a development team that worked in cooperation with the U.S. Air Force. He received his B.Sc. in Computer Science from Bar Ilan University in 1982, and an MBA from Tel-Aviv University in 1984. Mr. Nakar is a recipient of the “Israel Defense Award,” bestowed annually by the President of Israel, for the development of high-tech systems in the field of intelligence for the Israeli Defense Forces. He also received the “Man of the Year Award” in Business and Management (‘95-’96) in recognition of his business accomplishments and contributions to the growth and development of Israeli high-tech companies.

Ido Schechter has been the CEO of TIS since January 2002 and has been a director since December 2004. From January 2001 until he became CEO, Dr. Schechter was Vice President of TIS’ ASP2, an initiative of TIS to offer data collection services via the Internet, using theeFLOW platform solution. Prior to that Dr. Schechter had been the TIS’s Vice President of Sales since August 1996. From January 1995 until August 1996, Dr. Schechter served as General Manager of Super Image, a former affiliate of ours, which operated a form processing service bureau. From August 1993 to December 1994, Dr. Schechter oversaw the start-up of automatic form processing services at Israel Credit Cards, Ltd. From 1991 to 1993, Dr. Schechter was a research scientist at the Horticultural Research Institute of Ontario, Canada. Dr. Schechter is the recipient of eight Honors and Scholarships, has published or presented more than twenty-five articles and is a Captain in the Israeli Air Force. Dr. Schechter received his Ph.D. and M.Sc. in Plant Physiology from the University of Guelph in Ontario, Canada and his B.Sc. from the Hebrew University in Israel.

Arie Rand joined TIS as its Chief Financial Officer in April 2001 from Tescom, a high tech company with 600 employees and several subsidiaries worldwide, where he served as Chief Financial Officer from September 1996 through March 2001. Prior to Tescom, from September 1991 to June 1996 Mr. Rand served as a senior manager in the finance department of Delta Galil Industries, a major industrial company. Mr. Rand also has several years of experience at Almagor & Co., one of Israel’s leading accounting firms. He holds an MBA in Finance from Bar Ilan University.

Gideon Shmuel joined us as our Vice President of Sales for Europe, Middle East and Asia during 2001 from Pangea Ltd (UK), where he was a Senior Vice President. Pangea provides telecommunications infrastructure throughout Europe. Prior to that, Mr. Shmuel was Managing Director of LCR Telecom UK, a company that provides aggregated data, voice, Internet and mobile communications services to the corporate market during the years 1998 to 2000. Mr. Shmuel holds an MA in Marketing Management from Middlesex University Business School in London.

- 37 -

Oded Leiba is Vice President of Engineering, and has held that position since May 2001. From May 1999 to May 2001, Mr. Leiba was our representative in Japan and worked with its exclusive distributor, EDMS for a period of three years. Before joining TIS, Mr. Leiba was employed as a senior level programmer at VISA where he was involved in the installation of the first of our forms-processing system (AFPS) from the client side. Oded Leiba holds a Bachelor of Arts in Computer Science and Business Management from Tel Aviv University.

Ofir Shalev has served as Vice President of Research and Development since October 2002. Prior to his promotion to Vice President of Research and Development, Mr. Shalev served as our Director of Recognition for three years. During this period, Mr. Shalev was responsible for the development of TIS’ semi-structured data module that plugs into theeFLOW Unified Content Platform™. In this position, Mr. Shalev was responsible for maintaining TIS’ technological advantages over its competitors in the recognition arena. Before joining TIS, Mr. Shalev served as a senior development leader at the Israeli Defense Force. Mr. Shalev holds a Bachelor of Science degree from the Technion, the Israeli Institute of Technology, and is a candidate for a Master of Science degree in Computer Science from the Open University in Israel.

Victor Halpert was elected to serve as an external director of TIS at the shareholders’ meeting in December 2003. Mr. Halpert has served in various positions in the field of equity research. From June 1999 through January 2003 Mr. Halpert served as director for Salomon Smith Barney in New York, NY. From January 1998 through May 1999 Mr. Halpert served as vice president (equity research, telecommunications and technology) for Robertson Stephens, New York, NY. From January 1995 through December 1997, Mr. Halpert served as vice president for Salomon Brothers Inc. New York, New York. Mr. Halpert has a bachelor’s of science degree in Accounting from State University of New York, College at New Paltz, NY, a Master of Science in Accounting from the University of Illinois at Chicago, Graduate Business School and an MBA from the University of Chicago Graduate Business School.

Sivan Sadan has served in various positions at Tamir Fishman entities from 1997 to 2005. Ms. Sadan acted as Managing Director and head of Corporate Finance of Tamir Fishman and Co., and served as a Partner at Tamir Fishman Ventures. Ms. Sadan is the founder and CEO of Or Capital Ltd. which was established in 2006. Ms Sadan serves as a member of the Advisory Board of Micronet Ltd. Ms. Sadan has a Bachelor degree with honors in Economics and Management and a Master in Business Administration and Finance from Tel Aviv University.

Elie Housman has been a director of TIS since May 2000. Mr. Housman joined InkSure in February 2002 as Chairman. Mr. Housman was a principal at and consultant to Charterhouse from 1989 until June 2001. At Charterhouse, Mr. Housman was involved in the acquisition of a number of companies with total sales of several hundred million dollars. Prior to Charterhouse, he was co-owner of AP Parts, a $250 million automotive parts manufacturer. Mr. Housman was also the Chairman of Novo Plc. in London, a leading company in the broadcast storage and services industry. At present, Mr. Housman is a director of three public companies, deltathree, Inc., ICTS International, N.V., a prominent aviation security company and EVCI Career Colleges Incorporated. In addition, Mr. Housman serves as a director of Jazz Photo, Inc., and Bartech Systems International, Inc., which are both privately held companies in the United States.

William M. Landuyt, has been a director of TIS since March 2, 2004. Mr. Landuyt is a Senior Partner at Charterhouse Group, Inc., having joined the New York City-based private equity firm in December 2003. He served as Chairman of the Board and Chief Executive Officer of Millennium Chemicals Inc. from its demerger from Hanson Plc (“Hanson”) in October 1996 until July 2003. He had served as the President of that company from June 1997 until that date. Mr. Landuyt was Director, President and Chief Executive Officer of Hanson Industries (which managed the United States operations of Hanson until the demerger) from June 1995 until the demerger, a Director of Hanson from 1992 until September 29, 1996, Finance Director of Hanson from 1992 to May 1995, and Vice President and Chief Financial Officer of Hanson Industries from 1988 to 1992. He joined Hanson Industries in 1983. He was a director of Bethlehem Steel Corporation from April 1997 until October 2003.

- 38 -

Yehezkel Yeshurun has been a director of TIS since December 2004. He brings to Top Image Systems’ Board of Directors over 25 years of technical and management experience. He is a faculty member in the School of Computer Science at Tel Aviv University, and his research areas are Computer Vision, Pattern Recognition and Computational Neuroscience. He authored more than 80 scientific publications and served on numerous international program committees. Professor Yeshurun has co-founded several technology companies including us and TapGuard (provider of QoS solutions over the internet, acquired by Elron Software (NASDAQ: ELRN)), and is the Chairman of the Board of ForeScout Technology (Internet Security startup). Among other positions, he served as the chairman of the Department of Computer Science at Tel Aviv University, chairman of the Israeli National Committee for IT, a member of the board of the Israeli chapter of W3C, a board member of the US-Israel Science and Technology Commission and a member of the board of governors of the International Association for Pattern Recognition. Professor Yeshurun holds a Ph.D. in Mathematics from Tel Aviv University and held visiting positions at New York University, McGill University and the University of Paris.

There are no familial relationships between any of the persons named above. Elie Housman was initially appointed to the Board seat by Charter pursuant to the terms of the investment by Charter in us and a voting agreement with Mr. Nakar. For further details, see the sections entitled “Major Shareholders” and “ Related Party Transactions” in this report. Mr. Housman left the employ of Charterhouse in 2001.

Compensation

For the year ended December 31, 2006, the compensation paid, and value of benefits in kind granted, to Ido Schechter, our Chief Executive Officer, was $306,000, which was composed of a base salary and bonus of $237,000, and $69,000 paid to provide for automobile allowance, pension, retirement, severance, vacation or similar benefits. The compensation paid to all other persons, as a group, who were, on December 31, 2006, directors or members of our administrative, supervisory or management bodies during that time was $1,028,000. In addition, in 2006, members of that group, together with our Chief Executive Officer, were granted an aggregate of options to purchase 286,600 ordinary shares under our Employee Share Option Plan 2003 with an average exercise price of $3.78 per share. The compensation paid to all persons other than Ido Schechter include (i) $84,000 reimbursement of directors’ expenses, (ii) $195,000 which has been accrued to provide pension, retirement, severance, vacation or similar benefits, and allowance for automobiles made available to our officers, and does not include other expenses (including business travel, and professional and business association dues and expenses) reimbursed to officers and (iii) $102,000 for business development services rendered by Mr. Nakar.

On December 27, 2006, our shareholders approved the grant of an option to purchase 125,000 ordinary shares to several members of the board, at an exercise price of $ 3.84 and vesting term of 2 years.

Board Practices

Board of Directors

All directors (other than external directors) currently hold office until the next annual meeting of shareholders and until their successors are duly elected and qualified. External directors currently hold office for three years from their appointment (in December 2006) and until their successors are duly elected and qualified at the relevant annual meeting. The external directors may be elected for additional three-year periods as more fully detailed under the title “External Directors”. At our shareholders meeting held on December 27, 2006, the shareholders approved a payment to the members of the Audit Committee, Compensation Committee and the board of directors, in the amount per director of 15,750 NIS per annum. In addition each of the above directors receives an amount of 3,000 NIS for each Board and/or Audit committee or Compensation Committee meeting attended. Mr. Izhak Nakar receives compensation for his service as a member of the board of directors, in the amount of 19,841 NIS per annum and 993 NIS for each Board and/or committee meeting attended. We reimburse all of the directors for reasonable travel expenses incurred in connection with their activities on our behalf. Mr. Yehezkel Yeshurun is entitled to compensation in the amount of 19,841 NIS per year for his service as a member of the Board of Directors and 993 NIS for each Board and/or committee meeting attended.

- 39 -

In addition to the above, based on the resolution of the shareholders in a meeting held on December 18, 2003 as further clarified in the shareholders extraordinary meeting held on August 24, 2004, and as confirmed again in the General Shareholders’ Meeting held on November 15, 2005, relating to our establishment of TISJ, Mr. Nakar has become entitled to receive a one time payment of $100,000 and, in addition, an annual fee of $100,000 as consideration for consulting services to be provided one week per month for our operation in Japan, which was paid to Mr. Nakar in 2005 and 2006. In addition, Mr. Nakar was paid a fee of $1,000, plus reimbursement of any expenses, for every business day invested by him in consideration for his active involvement with any other TIS business throughout 2006. During 2006, we recorded an expense of $102,000 for Mr. Nakar’s services.

Independent Directors

The rules of the NASDAQ Stock Market require that a majority of our directors be “independent” as defined in Rule 4200(a)(15) thereof. The board of directors has determined that Sivan Sadan, William Landuyt, Elie Housman, Yehezkel Yeshurun, and Victor Halpert are each independent directors for purposes of the NASDAQ rules.

Israeli law requires that a public company, such as TIS, have at least two external directors. As of January 2006, the Israeli Companies Law -1999 requires as a general principle that at least one statutory external director have financial and accounting expertise, and that the other statutory external director have professional competence, as determined by our board of directors; under the recently amended Companies Regulations (Allowances for Companies with Securities Listed on an Exchange Outside Israel) ��� 2000, TIS as a company whose securities are listed both on the Tel Aviv Exchange and on NASDAQ as a foreign exchange meeting Israeli statutory requirements, is exempt from having an external director possessing financial and accounting expertise in the sense of the Israel Companies Law – 1999, provided that the company has a director possessing financial and accounting expertise as an independent member of the audit committee under the foreign law, so that all external directors may be directors possessing professional competence; under the Companies Regulations (Qualifications of Director Having Financial and Accounting Expertise and of Director Having Professional Competence) – 2005, a director having financial and accounting expertise is a person who, due to his or her education, experience and talents is highly skilled in respect of, and understands, business and accounting matters and financial reports, in a manner that enables him or her to deeply understand the company’s financial statements and to arouse discussion in respect of the manner in which the financial data is presented. The board of directors has determined that Victor Halpert is an audit committee financial expert pursuant to the rules of the NASDAQ Stock Market. Under the regulations, a director having professional competence is a person who has an academic degree in either economics, business administration, accounting, law or public administration or an academic degree in an area relevant to the company’s business, or has at least five years experience in a senior position in the business management of a corporation with a substantial scope of business, in a senior position in the public service or in the field of the company’s business. The two external directors of the Company are Sivan Sadan and Victor Halpert.

Audit Committee

The Israeli Companies Law (5759-1999), which became effective February 1, 2000, requires that public companies appoint an audit committee. The responsibilities of the audit committee include identifying irregularities in the management of the company’s business and approving related party transactions as required by law. An audit committee must consist of at least three directors, including all of the external directors of the Company. The chairman of the board of directors, any director employed by or otherwise providing services to the Company, and a controlling shareholder or any relative of a controlling shareholder, may not be members of the audit committee. Our audit committee is governed by an audit committee charter, which is an exhibit to our registration statement on Form F-1 which became effective on March 1, 2005.

We are also required by the rules of the NASDAQ Stock Market to establish an audit committee, all of whose members are independent of management, and to adopt an audit committee charter. Our two external directors, Victor Halpert and Sivan Sadan, serve on the audit committee of the board of directors, along with Elie Housman. The board of directors has determined that Victor Halpert is an audit committee financial expert pursuant to the rules of the NASDAQ Stock Market.

Compensation Committee

In August 2004, the board of directors authorized the establishment of a Compensation Committee. The current members of the Committee are William M. Landuyt, Yehezkel Yeshurun and Victor Halpert. At the time of establishing the Committee, the board of directors also adopted a Compensation Committee Charter to govern the operation of the Committee. Notwithstanding the provisions of the Compensation Committee Charter, the board of directors resolved to require the Committee to submit its recommendations to the board of directors, which shall be solely authorized to approve the recommendations of the Compensation Committee.

- 40 -

Employees

As of December 31, 2006, we employed the following employees:

| | | | |

Company Name | | No of Employees | |

| |

| |

TIS Israel | | 52 | | |

TIS Germany | | 18 | | |

TIS Japan | | 19 | | |

TIS UK | | 15 | | |

TIS USA | | 4 | | |

| |

| | |

Total | | 108 | | |

Certain provisions of the collective bargaining agreements between the Histadrut (General Federation of Labor in Israel) and the Coordination Bureau of Economic Organizations (including the Industrialists’ Associations) are applicable to our employees in Israel by order of the Israeli Ministry of Labor. These provisions concern principally the length of the workday, minimum daily wages for professional workers, insurance for work-related accidents, procedures for dismissing employees, determination of severance pay, and other conditions of employment. We generally provide our employees with benefits and working conditions beyond the required minimums.

Pursuant to Israeli law, we are legally required, subject to certain exceptions, to pay severance benefits upon the retirement or death of an employee or the termination of employment of an employee without due cause. We satisfy the majority of this obligation by contributing funds to a fund known as “Managers’ Insurance.” This fund provides a combination of savings plans, insurance, and severance pay benefits to the employee, giving the employee a lump sum payment upon retirement and a severance payment, if legally entitled, upon termination of employment. The remaining portion of this obligation is represented on our balance sheet as “Provision for severance pay.” The Israeli law has recently been amended to address some of the issues that were in the past addressed only by the collective bargaining agreements mentioned above, such as procedures for dismissing employees, minimum wages and other issues. In the event of contradiction between a provision of the law and that of a collective bargaining agreement, the principle for interpretation is that the provision which is more favorable to the employee will prevail.

Share Ownership

Board of Directors, Senior Management and Certain Employees

Mr. Izhak Nakar currently holds in his name 59,174 ordinary shares. These shares represent 0.7% (0.4% on a fully diluted basis) of our outstanding share capital. In addition, Mr. Nakar and members of his immediate family own Nir 4 You Technologies Ltd., an Israeli company that holds 280,000 ordinary shares amounting to 3.2% (1.9% on a fully diluted basis) of our outstanding share capital. None of the ordinary shares discussed in this section have different voting rights than those of other outstanding ordinary shares.

Charter owns 2,000,000 ordinary shares representing 22.6% (13.3% on a fully diluted basis) of our outstanding share capital.

Stock Options

In order to attract, retain and motivate employees (including officers) who perform services for or on behalf of us, we maintain three Employee Share Option Plans, one established in 1996 (“ESOP 1996”), the second in 2000 (“ESOP 2000”) and the third in 2003 (“ESOP 2003”). Upon adoption of ESOP 2003, all shares previously available for grant under ESOP 1996 and ESOP 2000 that were not the subject of outstanding options were transferred to such new plan (see below) and are subject to the terms of the new plan. We have filed registration statements on Form S-8 covering our Employee Share Option Plans.

- 41 -

Employee Share Option Plan (1996)

In September 1996, the board of directors adopted, and our shareholders approved, the Employee Share Option Plan (1996). ESOP 1996 is administered by a committee appointed by the board of directors or alternatively the Board itself. The Committee has discretion as to when and to whom and upon what terms to grant options under ESOP 1996. Options under the plan may be granted to any officer or employee of us or of any of our subsidiaries. The Committee will examine various factors when determining to whom to grant options and upon what terms; however, these factors shall always include the grantee’s salary and duration of employment with us or our subsidiary. ESOP 1996 authorized the granting of options to purchase up to 250,000 ordinary shares, consisting of options intended to qualify as “incentive stock options” within the meaning of Section 422 of the United States Internal Revenue Code of 1986, as amended, and options not intended to satisfy the requirements for incentive stock options. At December 31, 2006, options to purchase 82,625 ordinary shares were outstanding under the plan at exercise prices between $2.31 and $4.13 per share.

Options granted under ESOP 1996 have terms of up to ten years, provided, however, that options that are intended to qualify as incentive stock options and that are granted to an employee who on the date of grant is a 10% shareholder of us or any subsidiary corporation or parent corporation shall be for no more than a five-year term. Ordinary shares issuable upon the exercise of the options granted under ESOP 1996 will be held in trust for the benefit of the optionee for a period of at least two years after the grant of the options. The exercise price of options granted under ESOP 1996 may not be less than 100% of the fair market value of the ordinary shares on the date of the grant and the exercise price of options granted under future employee share options shall not be less than 85% of the fair market value of the ordinary shares on the date of grant, in each case, as determined by the Board (or the Share Option Committee, if the Board elects to appoint one). In the case of options that are intended to be incentive stock options granted to an employee who, at the date of such grant, is a 10% shareholder of us or any subsidiary corporation or parent corporation, the exercise price for such options may not be less than 110% of the fair market value of the ordinary shares on the date of such grant. The number of shares covered by an option granted under ESOP 1996 is subject to adjustment for stock splits, mergers, consolidations, reorganizations and recapitalizations. Options are non-assignable except by will or by the laws of descent and distribution, and may be exercised only so long as the optionee continues to be employed by us. If the optionee dies, becomes disabled or retires, the right to exercise the option will be determined by the Board (or the Share Option Committee) in its sole discretion. The optionee is responsible for all personal tax consequences of the grant and the exercise thereof. For so long as we are not a U.S. taxpayer, we believe that, other than a 1% stamp tax, no tax consequences will result to us in connection with the grant or exercise of options pursuant to ESOP 1996.

Upon termination of employment, other than for death or disability, grantees may exercise vested options for three months following termination. ESOP 1996 contains similar provisions in relation to a grantee that becomes disabled or dies, only in these cases, the vested options may be exercised for a period of one year.

Employee Share Option Plan (2000)

The Employee Share Option Plan (2000) is designed to benefit from, and is made pursuant to, the provisions of Section 102 of the Israeli Income Tax Ordinance (New Version) 1961 and the rules promulgated thereunder (“Section 102”), as applied prior to the implication of the tax reform in Israel, described elsewhere herein. Except as required by Section 102, the terms of ESOP 2000 are substantially the same as those of ESOP 1996.

A total of 240,000 of authorized but unissued shares were reserved for issuance upon the exercise of options granted pursuant to ESOP 2000 and, as of December 31, 2006, options to purchase an aggregate of 118,500 shares were outstanding. All options are exercisable and have exercise prices between $0.99 and $4.125 per share.

- 42 -

Employee Share Option Plan (2003)

An additional share option plan was approved by the board of directors on May 13, 2003 and by our shareholders at our annual meeting on December 18, 2003. The terms of ESOP 2003 are substantially the same as those of ESOP 2000. All the shares reserved for grant under ESOP 2000 and ESOP 1996 that were not granted or that were not the subject of outstanding options under those plans were transferred to the new plan. Further, all options under such old plans that expire prior to their exercise according to the conditions detailed therein will be transferred into the new plan. We filed the necessary documents with the Israeli tax authorities for the approval of the new option plan on June 4, 2003. Such approval provides the grantees the eligibility for certain benefits under Section 102 of the Israeli Income Tax Ordinance (New Version) 1961 and the rules promulgated thereunder as revised by the Israeli tax reform.

During 2004, the board of directors and the shareholders of the Company approved the issuance of options to purchase an additional 650,000 ordinary shares pursuant to ESOP 2003. During 2006, the board of directors and the shareholders of the Company approved the issuance of options to purchase an additional 700,000 ordinary shares pursuant to ESOP 2003.

On December 27, 2006, the shareholders of the Company approved the grant of an option to purchase 125,000 ordinary shares to several members of the board, at an exercise price of $ 3.84 and vesting term of 2 years.

As of December 31, 2006 options to purchase 643,317 ordinary shares were available for future grant.

On December 30, 2005, we decided to accelerate the vesting of 304,830 of our unvested share options previously awarded to employees and officers (other than executive officers) of the Company to purchase the Company’s shares pursuant to ESOP 1996, ESOP 2000 or ESOP 2003, such that, as of December 31, 2005, these outstanding options to purchase any of the Company’s ordinary shares were fully vested.

As a result of the acceleration, we recorded in 2005 additional compensation expenses of $44,000, included in general and administrative expenses.

Our decision to accelerate the vesting of those options and to grant fully vested options, was based primarily on the issuance of SFAS No. 123(R), which requires the Company to treat all unvested stock options as compensation expense, effective January 1, 2006. We believe that the accelerated vesting of those options will enable the Company to avoid recognizing stock-based compensation expense associated with these options in future periods. Additional purposes for the fully vested grant and for the acceleration were to make the options more attractive to recipients and to avoid discrimination between groups of option holders, respectively.

Non-Plan Options

We have reserved 115,000 ordinary shares for issuance upon the exercise of outstanding non-plan share options all of which have been granted by the Company to certain executive officers and key employees.

As of December 31, 2006, no non-plan options are outstanding.

| |

ITEM 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

As of December 31, 2006, Charter held 2,000,000 ordinary shares, or 22.6% (13.3% on a fully diluted basis) of our outstanding share capital. At that time, Izhak Nakar held in his name 59,174 ordinary shares, or 0.7% (0.4% on a fully diluted basis) of the outstanding share capital, and Nir 4 You Technologies Ltd., a company owned by Mr. Nakar and his immediate family, held 280,000 ordinary shares, or 3.2% (1.9% on a fully diluted basis) of our outstanding share capital. Except as provided in the Share Purchase Agreement described below, none of these shares have special voting rights attached to them.

Charter acquired its ordinary shares in May 2000 in exchange for a $15,000,000 investment. Under the terms of the Share Purchase Agreement, the board of directors appointed by the shareholders meeting to serve immediately following the closing was composed of seven members out of whom Charter designated four. Charter obtained the right to demand registration of its shares on three separate occasions, Charter was granted pre-emptive rights with respect to future issuances of securities by us, and certain informational rights. Charter’s right to appoint four of our seven directors was a one-time right only. This right is not attached to the shares purchased by Charter and the entire Board faces re-election at each annual general meeting. Currently, one person nominated by Charter, William Landuyt, serves on the Board.

- 43 -

In connection with the investment by Charter, certain rights were granted to Mr. Nakar, our then Chief Executive Officer. These included the modification of Mr. Nakar’s compensation, as well as the granting to Mr. Nakar of the right to demand registration of any or all of the shares held by him in the event that his employment was terminated under certain specific conditions. These rights to demand registration have come into effect following the termination of Mr. Nakar’s employment. The grant of these rights was approved by our board of directors, Audit Committee and shareholders. Charter and Mr. Nakar requested the registration of the resale of the ordinary shares held by them or their affiliates. We registered the resale of those shares in our registration statement on Form F-1 which became effective on March 1, 2005.

In accordance with the foregoing and as a result of Mr. Nakar’s resignation from employment, we recorded a non-recurring severance expense in our financial statements in the amount of approximately $759,000 during prior years. During 2006, we recorded on our books an amount of $102,000 for Mr. Nakar’s services.

Twenty-one record holders of ordinary shares have declared postal addresses in the United States. These twenty-one record holders hold, between them, 95.2% of our outstanding share capital. These numbers are not representative of the number of beneficial holders of our shares nor is it representative of where such beneficial holders reside since many of these ordinary shares were held of record by brokers or other nominees (including one U.S. nominee company, CEDE & Co., which held approximately 68.5% of our outstanding ordinary shares as of said date). There are no arrangements known to us that may at a subsequent date result in a change in control of us.

| |

ITEM 8. | FINANCIAL INFORMATION |

Consolidated statements and other financial information

Consolidated Financial Statements

See Item 18.

Other Financial Information

The amount of export revenues constitutes a significant portion of our total revenues. The following is a table giving details of our export revenues, as well as the breakdown of revenues between products and services.

| | | | | | | | | | |

| | 2006 | | 2005 | | 2004 | |

| |

| |

| |

| |

Export Revenues | | | | | | | | | | |

Export Revenues | | | 20,150,000 | | | 16,682,000 | | | 10,994,226 | |

Total Revenues | | | 20,224,000 | | | 16,820,000 | | | 11,178,448 | |

Percentage of Total Revenues | | | 99 | % | | 99 | % | | 98 | % |

| | | | | | | | | | |

Breakdown of Revenues | | | | | | | | | | |

Product Revenues | | | 60 | % | | 59 | % | | 62 | % |

Service Revenues | | | 40 | % | | 41 | % | | 38 | % |

- 44 -

Legal Proceedings

During 2003, we were named as a defendant in a case brought by a patent holder, Millennium LP in the district court for the Southern District of New York. In that case Millennium was asserting that certain image processing systems sold or offered for sale by the Company in the U.S. infringe certain U.S. patents held by Millennium. Subsequent to the reporting period, the Company has settled the matter for $ 250,000, which will be paid as follows: $ 100,000 at the time the settlement agreement was finalized and a monthly payment of $ 6,250 for 24 months. According to the settlement agreement, the abovementioned payment was for the release for past and covenant for the future. The settlement gave the Company a full release and discharge under the patents for all the company’s products sold by the company or its customers up to the date of the settlement agreement and from then on until the last patent expires.

Dividend Policy

To date, we have not paid any dividends on our ordinary shares. The payment of dividends in the future, if any, is within the discretion of the Board of Directors and will depend upon our earnings, our capital requirements and financial condition and other relevant factors. We do not anticipate declaring or paying any dividend in the foreseeable future.

A. Offer and Listing Details.

Effective November 1996, our ordinary shares have been quoted on the NASDAQ Capital Market, under the symbol “TISAF.” Effective April 29, 1999, the symbol for the ordinary shares was changed to “TISA” on the NASDAQ Capital Market.

The following table sets forth, for the periods indicated, the high and low closing prices of our ordinary shares, as reported on the NASDAQ Capital Market.

Stock price history

The annual high and low market prices for the ordinary shares for the five most recent full financial years are set forth below:

| | | | |

Year Ending | | | | NASDAQ

Capital Market |

| | | |

|

December 31, 2006 | | Hi | | 4.44 |

| | Lo | | 2.80 |

| | | | |

December 31, 2005 | | Hi | | 4.11 |

| | Lo | | 2.13 |

| | | | |

December 31, 2004 | | Hi | | 5.00 |

| | Lo | | 2.13 |

| | | | |

December 31, 2003 | | Hi | | 3.14 |

| | Lo | | 0.42 |

| | | | |

December 31, 2002 | | Hi | | 3.92 |

| | Lo | | 0.42 |

- 45 -

The high and low market prices for the ordinary shares for each full financial quarter over the two most recent full financial years and any subsequent period are set forth below:

| | | | |

Quarter Ending | | | | NASDAQ

Capital Market |

| | | |

|

December 31, 2006 | | Hi | | 4.44 |

| | Lo | | 3.07 |

| | | | |

September 30, 2006 | | Hi | | 3.50 |

| | Lo | | 2.87 |

| | | | |

June 30, 2006 | | Hi | | 4.04 |

| | Lo | | 3.07 |

| | | | |

March 31, 2006 | | Hi | | 4.00 |

| | Lo | | 2.80 |

| | | | |

December 31, 2005 | | Hi | | 3.29 |

| | Lo | | 2.31 |

| | | | |

September 30, 2005 | | Hi | | 3.59 |

| | Lo | | 2.47 |

| | | | |

June 30, 2005 | | Hi | | 3.74 |

| | Lo | | 2.67 |

| | | | |

March 31, 2005 | | Hi | | 4.11 |

| | Lo | | 2.89 |

For the most recent six months, the high and low market prices of the ordinary shares for each month are set forth below:

| | | | |

Month Ending | | | | NASDAQ

Capital Market |

| | | |

|

February 28, 2007 | | Hi | | 4.00 |

| | Lo | | 3.57 |

| | | | |

January 31, 2007 | | Hi | | 4.25 |

| | Lo | | 3.50 |

| | | | |

December 31, 2006 | | Hi | | 3.99 |

| | Lo | | 3.45 |

| | | | |

November 30, 2006 | | Hi | | 4.44 |

| | Lo | | 3.07 |

| | | | |

October 31, 2006 | | Hi | | 3.68 |

| | Lo | | 3.20 |

| | | | |

September 30, 2006 | | Hi | | 3.50 |

| | Lo | | 2.97 |

Our ordinary shares have been dual-listed for trading on the Tel Aviv Stock Exchange since December 3, 2006. Since the date of listing, there has been only limited and sporadic trading activity.

- 46 -

Markets

Effective November 1996, our ordinary shares were quoted on the Nasdaq Capital Market, under the symbol “TISAF” and listed on the Boston Stock Exchange, under the symbol “TPM.” Effective April 29, 1999, the symbol for the ordinary shares was changed to “TISA” on the Nasdaq Capital Market. The ordinary shares are not publicly traded outside the United States.

In March of 2005, our board of directors determined that we derived no material benefit from continued listing on the Boston Stock Exchange, as there had been no trading activity in our ordinary shares on that exchange since November 1999, and authorized and directed management to commence voluntary delisting procedures. The Securities and Exchange Commission subsequently approved our application to delist, and our voluntary delisting became effective in March 2005.

Our ordinary shares were dual-listed on the Tel Aviv Stock Exchange on December 3, 2006, in addition to being listed on the NASDAQ Stock Market. Effective January 1, 2007, the Tel Aviv Stock Exchange included our shares in the Tel Aviv Tel-Tech index, which tracks the performance of the top Israeli technology companies by market cap.

On December 27, 2006, we completed a public offering of approximately NIS 61.9 million (approximately $14.7 million) aggregate principal amount of convertible debentures on the Tel Aviv Stock Exchange. The public offering was composed of 112,500 convertible debentures of NIS 528 (approximately $124) par value each. The convertible debentures are linked to the US Dollar and will bear interest at the annual rate of six-month LIBOR minus 0.3%. The interest is payable semi-annually commencing on June 30, 2007, and the principal is repayable in four annual installments commencing on December 31, 2009. After taking into account a concurrent private placement to the underwriter of NIS 500,000 aggregate principal amount of convertible debentures and an original issue discount of 4% on all the convertible debentures, the gross proceeds to TIS were NIS 59.87 million (approximately $14.1 million).

The debentures may be converted at the election of the holder into our ordinary shares at the conversion price of NIS 20.30 (approximately $4.81). We also have the right to force conversion on or after October 1, 2009 if our share fair market value (as defined in the debenture documents) reaches NIS 25.50 (approximately $6.04). This offering was made in Israel to residents of Israel only. The convertible debentures offered were not and will not be registered under the U.S. Securities Act of 1933, as amended.

| |

ITEM 10. | ADDITIONAL INFORMATION |

Memorandum and Articles of Association

General

TIS is registered with the Israeli Registrar of Companies. The registration number issued to TIS by the Registrar of Companies is 52-004294-6. The objectives for which we were founded are set out in Section 2 of the Memorandum of Association as follows: “The Company is permitted to deal with any activity that is meant to advance the interests of the Company and to act in any field which the Company’s management believes is beneficial to the Company.” In our December 18, 2003 shareholders meeting, we adopted new Articles of Association to provide for changes in the Companies Law.

Directors and other Office Holders

General

A director’s ability to vote on a proposal, arrangement or contract in which the director is materially interested is codified, along with the fiduciary duties of all “office holders,” in the Israeli Companies Law. Under the Israeli Companies Law, the term “office holders,” is defined to mean, a director, chief executive officer, president, chief business manager, deputy chief executive officer, vice chief executive officer, executive vice president, vice president, another manager directly subordinate to the managing director or any other person assuming the responsibilities of any of the forgoing positions without regard to such person’s title. An office holder’s fiduciary duties consist of a duty of care and a duty of loyalty. The duty of care includes avoiding negligent acts and acting skillfully as a reasonable office holder would act. The duty of loyalty includes avoiding any conflict of interest between the office holder’s position in the company and his personal affairs, avoiding any competition with the company, avoiding exploiting any business opportunity of the company in order to receive personal advantage for himself or others, and revealing to the company any information or documents relating to the company’s affairs which the office holder has received due to his position as an office holder of the company.

- 47 -

The Israeli Companies Law requires that an office holder promptly disclose any personal interest that he or she may have and all related material information known to him or her, in connection with any existing or proposed transaction by the company.

In the case of a transaction in which an office holder has a personal interest, that is not an extraordinary transaction, as defined under Israeli law, and after the office holder complies with the above disclosure requirement, only board approval is required unless our Articles of Association provide otherwise. Members of the board having a personal interest should not be present at the vote or exercise their vote unless a majority of the board has a personal interest. The transaction must not be adverse to the company’s interest. If such transaction is an extraordinary transaction or if we intend to provide an undertaking to indemnify, exempt or insure an office holder, with regard to their duties, then, in addition to any approval required by the board of directors or by the Articles of Association, it also must be approved by the audit committee prior to the approval by the board of directors, and, under specified circumstances, by a meeting of the shareholders. An office holder who has a personal interest in the approval of a transaction brought before the board of directors or the audit committee may not be present at this meeting or vote on this matter unless most of the members have a personal interest in approving the transaction or the occurrence of specific circumstances defined in the law.

Arrangements regarding the compensation of directors of a public company (whether regarding in their capacity as directors or regarding the provision of other services) require audit committee, board of directors and shareholder approval.

External Directors