QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to Rule14a-12

|

MIDWAY GAMES INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

MIDWAY GAMES INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 12, 2003

To the Stockholders of

MIDWAY GAMES INC.

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Midway Games Inc. ("Midway") will be held on Thursday, June 12, 2003, at 10:00 a.m. Central Time at the Harris Bank Building Auditorium, 8th Floor, 115 South La Salle Street, Chicago, Illinois 60603, to consider and act upon the following matters:

- 1.

- To adopt amendments to our Certificate of Incorporation and Bylaws to declassify our Board of Directors so that all the directors would stand for re-election annually;

- 2.

- (a) To elect nine directors to serve until our next annual meeting and until their successors are duly elected and shall qualify, in the event that Proposal 1 is adopted, or alternatively,

- (b)

- to elect three Class II directors to serve until their terms expire in 2006 and until their successors are duly elected and shall qualify, in the event that Proposal 1 is not adopted;

- 3.

- To ratify the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2003; and

- 4.

- To transact such other business as may properly come before the meeting or any adjournment or adjournments of the meeting.

The close of business on April 22, 2003 has been fixed as the record date for the determination of stockholders entitled to notice of and to vote at the meeting and any adjournments thereof. A list of the stockholders entitled to vote at the annual meeting will be open to the examination of any stockholder of Midway for any purpose germane to the annual meeting during regular business hours at the offices of Midway for the ten-day period prior to the annual meeting and will be available at the meeting.

YOU ARE REQUESTED, WHETHER OR NOT YOU PLAN TO BE PRESENT AT THE ANNUAL MEETING, TO MARK, DATE, SIGN AND RETURN PROMPTLY THE ACCOMPANYING PROXY IN THE ENCLOSED ENVELOPE. NO POSTAGE NEED BE AFFIXED IF MAILED IN THE UNITED STATES.

|

|

|

| | | By Order of the Board of Directors, |

| | | |

|

|

DEBORAH K. FULTON

Senior Vice President, Secretary and General Counsel |

Chicago, Illinois

April 28, 2003 |

|

|

ANNUAL MEETING OF STOCKHOLDERS

OF

MIDWAY GAMES INC.

PROXY STATEMENT

Introduction

Midway Games Inc. ("we", "us" or "Midway") is furnishing this proxy statement to you in connection with the solicitation by the Board of Directors of proxies to be voted at our Annual Meeting of Stockholders. The meeting is scheduled to be held at the Harris Bank Building Auditorium, 8th Floor, 115 South La Salle Street, Chicago, Illinois 60603, on Thursday, June 12, 2003, at 10:00 a.m. Central Time, or at any proper adjournments.

If you properly execute and return your proxy card, it will be voted in accordance with your instructions. If you return your signed proxy but give us no instructions as to one or more matters, the proxy will be voted on those matters in accordance with the recommendations of the Board as indicated in this proxy statement. You may revoke your proxy, at any time prior to its exercise, by written notice to us, by submission of another proxy bearing a later date or by voting in person at the meeting. Your revocation will not affect a vote on any matters already taken. Your mere presence at the meeting will not revoke your proxy.

The mailing address of our principal executive offices is 2704 West Roscoe Street, Chicago, Illinois 60618. We are mailing this proxy statement and the accompanying form of proxy to our stockholders on or about April 28, 2003.

Only holders of our common stock, $.01 par value per share, of record at the close of business on April 22, 2003 (the "Record Date") will be entitled to vote at our annual meeting or any adjournments. There were 46,469,310 shares of our common stock outstanding on the Record Date (excluding 2,930,000 treasury shares). Each share of our common stock entitles the holder to one vote on each matter at the meeting.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Principal Stockholders

The following table sets forth information as of the Record Date, except as otherwise footnoted, about persons that, to our knowledge, beneficially own more than 5% of the outstanding shares of our common stock:

Name and Address of Beneficial Owner

| | Number of

Shares of

Common Stock

Beneficially

Owned(1)

| | Percentage of

Outstanding

Common

Stock(1)

| |

|---|

Sumner M. Redstone and National Amusements, Inc.

200 Elm Street

Dedham, MA 02026 | | 13,822,853 | (2) | 29.7 | % |

Phyllis G. Redstone

c/o Marta B. van Dam, Esq.

Gadsby Hannah LLP

225 Franklin Street

Boston, MA 02110 |

|

3,659,783 |

(3) |

7.9 |

% |

Mellon Financial Corporation, et al.

One Mellon Center

Pittsburgh, PA 15258 |

|

3,664,464 |

(4) |

7.9 |

% |

Neil D. Nicastro

c/o Midway Games Inc.

2704 West Roscoe Street

Chicago, IL 60618 |

|

3,286,985 |

(5) |

6.7 |

% |

T. Rowe Price Associates, Inc.

100 East Pratt Street

Baltimore, MD 21202 |

|

3,077,918 |

(6) |

6.6 |

% |

Peconic Fund, Ltd., et al.

c/o Ramius Capital Group, L.L.C.

666 Third Avenue, 26th Floor

New York, NY 10017 |

|

2,430,977 |

(7) |

5.1 |

% |

- (1)

- Under Rule 13d-3(d)(1) of the Securities Exchange Act of 1934, shares underlying options are deemed to be beneficially owned if the holder of the option has the right to acquire beneficial ownership, of the underlying shares within 60 days. Percentage calculations are based on 46,469,310 shares outstanding on the Record Date.

- (2)

- Based upon a Form 4 filed with the SEC by Sumner M. Redstone on April 23, 2003. Mr. Redstone and National Amusements, Inc., a Maryland corporation, reported direct and indirect beneficial ownership of 9,700,082 and 4,122,771 shares, respectively, of our common stock. As a result of his stock ownership in National Amusements, Inc., Mr. Redstone is deemed the beneficial owner of the shares of common stock owned by National Amusements, Inc.

- (3)

- Based upon Schedule 13D filed with the SEC on August 8, 2002. The filer reported beneficial ownership, with sole dispositive and voting power, of 3,659,783 shares. The common shares were acquired by Ms. Redstone on July 30, 2002 pursuant to the terms of a Settlement of Divorce.

- (4)

- Based upon Schedule 13G Amendment No. 4 filed with the SEC on January 22, 2003 by Mellon Financial Corporation, as the parent company of The Boston Company, Inc. and The Boston Company, Asset Management, LLC in their various fiduciary capacities. The filer reported beneficial

2

ownership of 3,664,464 shares, sole voting power over 2,536,284 shares, shared voting power over 450,230 shares, sole dispositive power over 3,661,989 shares and shared dispositive power over 2,475 shares.

- (5)

- Represents 58,962 shares of common stock underlying convertible preferred stock, 50,000 shares of common stock underlying warrants, 2,187,602 shares of common stock underlying stock options and 990,421 shares of common stock owned outright.

- (6)

- Based upon Schedule 13G filed with the SEC on February 4, 2003. The filer reported beneficial ownership of 3,077,918 shares, sole voting power over 574,000 shares and sole dispositive power over 3,077,918 shares.

- (7)

- Represents 442,217 shares of common stock underlying convertible preferred stock, 375,000 shares of common stock underlying warrants and 1,613,760 shares of common stock owned outright. Ramius Capital Group, LLC is the investment adviser of Peconic Fund, Ltd. and consequently has voting control and investment discretion over securities held by Peconic. Ramius Capital disclaims beneficial ownership of the shares held by Peconic. Peter A. Cohen, Morgan B. Stark and Thomas W. Strauss are the sole managing members of C4S& Co., LLC, the sole managing member of Ramius Capital. As a result, Messrs. Cohen, Stark and Strauss may be considered beneficial owners of any shares deemed to be beneficially owned by Ramius Capital.

Security Ownership of Management

The following table sets forth, as of the Record Date, information about the beneficial ownership of our common stock by each of our directors and the executive officers named in the Summary Compensation Table below and by all of our directors and executive officers as a group:

Name of Beneficial Owner

| | Number of

Shares of

Common Stock

Beneficially

Owned(1)

| | Percentage of

Outstanding

Common

Stock(1)

| |

|---|

| Harold H. Bach, Jr. | | 299,774 | (2) | * | |

William C. Bartholomay |

|

110,722 |

(3) |

* |

|

Mark S. Beaumont |

|

25,000 |

(4) |

* |

|

Kenneth J. Fedesna |

|

323,583 |

(5) |

* |

|

William E. McKenna |

|

66,063 |

(3) |

* |

|

Norman J. Menell |

|

82,150 |

(6) |

* |

|

Louis J. Nicastro |

|

80,191 |

(6) |

* |

|

Neil D. Nicastro |

|

3,286,985 |

(7) |

6.7 |

% |

David W. Nichols |

|

76,091 |

(8) |

* |

|

Thomas E. Powell |

|

103,376 |

(9) |

* |

|

Harvey Reich |

|

81,245 |

(10) |

* |

|

Ira S. Sheinfeld |

|

86,445 |

(6) |

* |

|

Gerald O. Sweeney, Jr. |

|

64,644 |

(6) |

* |

|

Richard D. White |

|

64,992 |

(11) |

* |

|

Directors and Executive Officers as a group (16 persons) |

|

4,866,828 |

(12) |

9.7 |

% |

- *

- Less than 1%

3

- (1)

- Under Rule 13d-3(d)(1) of the Securities Exchange Act of 1934, shares underlying options are deemed to be beneficially owned if the holder of the option has the right to acquire beneficial ownership of the underlying shares within 60 days. Percentage calculations are based on 46,469,310 shares outstanding on the Record Date, excluding treasury shares.

- (2)

- Includes 253,486 shares of common stock underlying stock options.

- (3)

- Includes 65,352 shares of common stock underlying stock options.

- (4)

- Includes 25,000 shares of common stock underlying stock options.

- (5)

- Includes 271,377 shares of common stock underlying stock options.

- (6)

- Includes 64,644 shares of common stock underlying stock options.

- (7)

- Represents 58,962 shares of common stock underlying convertible preferred stock, 50,000 shares of common stock underlying warrants, 2,187,602 shares of common stock underlying stock options and 990,421 shares of common stock owned outright. Does not include an aggregate of 607,846 shares of our common stock issuable to Mr. Nicastro in monthly installments over the 10 years following his retirement or death, pursuant to the terms of his employment agreement. See "Employment Agreements" below.

- (8)

- Includes 72,872 shares of common stock underlying stock options.

- (9)

- Includes 102,876 shares of common stock underlying stock options.

- (10)

- Includes 64,968 shares of common stock underlying stock options.

- (11)

- Includes 64,992 shares of common stock underlying stock options

- (12)

- Includes an aggregate of 3,546,850 shares of common stock underlying stock options, 58,962 shares of common stock underlying convertible preferred stock and 50,000 shares of common stock underlying warrants.

PROPOSAL 1 — APPROVAL OF AMENDMENTS TO OUR

CERTIFICATE OF INCORPORATION AND BYLAWS

TO DECLASSIFY OUR BOARD OF DIRECTORS

Under our certificate of incorporation and bylaws, our Board of Directors is divided into three classes, as nearly equal in number as possible, with staggered three-year terms. This is sometimes referred to as a "classified" board structure.

The purpose of this Proposal 1 is to amend our certificate of incorporation and bylaws to declassify our Board of Directors so that each director will be elected annually. Our Board of Directors has unanimously voted to adopt these amendments, subject to stockholder approval, and to recommend these amendments to our stockholders.

Background of Proposal; Effect of Approval

Our stockholders adopted our classified board structure at our 1998 annual meeting. At that time, our stockholders also adopted several other provisions in our certificate of incorporation and bylaws designed to protect the classified Board structure. One of those provisions permits directors to be removed prior to the expiration of their terms only for cause and only by the affirmative vote of the holders of not less than a majority of all of the shares of stock outstanding and entitled to vote for the election of directors. This provision was adopted to conform to Delaware law, which provides that where a corporation's board of directors is classified, a director may be removed only for cause unless otherwise provided in the corporation's certificate of incorporation. In addition, we adopted supermajority voting requirements providing that the affirmative vote of the holders of not less than 80% of the voting power of our outstanding stock entitled to vote in an election of directors would be required for stockholders to amend the provisions of the certificate of incorporation and bylaws establishing the classified board structure

4

including the for-cause removal provision described above. The supermajority voting requirements also apply to the other anti-takeover provisions of the certificate of incorporation and bylaws adopted at the 1998 annual meeting.

If our stockholders approve this Proposal 1, the terms of all of our directors would be reduced to one year, and all of our directors have agreed, in that event, to stand for re-election for one-year terms at the annual meeting. Thereafter, each of our directors would be elected for one-year terms at each Annual Meeting of Stockholders. In addition, the proposal would eliminate the "only for cause" removal provision described above, and thereafter any or all directors could be removed with or without cause by the holders of a majority of the shares entitled to vote in an election of directors. Finally, because the supermajority voting requirements described above would no longer be necessary to protect the classified board structure, the proposal would delete those voting requirements with respect to the classified board structure.

The text of the proposed amendments is attached to this Proxy Statement as Appendix A.

Rationale for the Proposal

The adoption by Midway — and many other public companies — of a classified board structure and other "anti-takeover" provisions reflected widespread concern over hostile attempts to acquire control of corporations without first negotiating the acquisition with the Board of Directors. A classified board is widely viewed as one way of discouraging these attempts, because the extended and staggered terms of directors in a classified board generally operates to delay the acquisition of control of the board by a would-be acquirer for at least a year. During that time, the would-be acquirer would bear the risk of a large investment in a company that it did not control. A classified board may encourage a person seeking control of a corporation to negotiate with the board of directors of that corporation, which negotiations may result in a higher price or more favorable terms for stockholders or may give the board an opportunity to prevent a takeover that it believes is not in the best interests of the stockholders. A classified board has also been viewed by some corporations as promoting continuity of management and experience on the board, as most directors at any given time will have served for at least one year.

Some investors, however, have come to view classified boards as having the effect of insulating directors from being accountable to a corporation's stockholders. For example, a classified board of directors limits the ability of stockholders to elect all directors on an annual basis, or to remove directors without cause, rather than waiting up to two additional years to replace some directors. It may also discourage proxy contests in which stockholders have an opportunity to vote for a competing slate of nominees. The election of directors is the primary means for stockholders to influence corporate governance policies and to hold management accountable for its implementation of those policies. A number of major corporations have determined that, regardless of the merits of a classified board in deterring coercive takeover attempts, principles of good corporate governance dictate that all directors of a corporation be elected annually.

After due consideration of the various issues concerning the declassification of our Board, the Board of Directors unanimously determined to propose to the stockholders the declassification of the Board so that (i) each director would stand for re-election on an annual basis, (ii) directors would be subject to removal with or without cause by a majority of the voting power of our stock and (iii) the provisions in our certificate of incorporation relating to the election and term of directors would be subject to amendment by the holders of a majority of the voting power of our stock. This determination by the Board is in furtherance of its goal of ensuring that our corporate governance policies comply with applicable rules and regulations and maximize our accountability to our stockholders.

Voting Requirement and Recommendation

Adoption of this Proposal 1 requires the affirmative vote of not less than 80% of the voting power of our outstanding stock entitled to vote in an election of directors, voting together as a single class.

5

PROPOSAL 2 — ELECTION OF DIRECTORS

Under our bylaws, our Board of Directors consists of not more than 15 members, as fixed from time to time by the Board of Directors. Currently, our Board of Directors consists of 11 members. In connection with our upcoming election of directors, we propose to reduce the board to 9 members.

If our stockholders adopt Proposal 1 described above by the required vote, our Board of Directors will be declassified. In that event, our directors have each agreed to stand for election for a one-year term that will expire at our 2004 annual meeting of stockholders. See below: "2(a) Election of 9 Directors to Serve for One-Year Terms."

If our stockholders do not adopt Proposal 1 described above, our Board of Directors will not be declassified. In that event, only three Class II directors will stand for election for a three-year term, and the Class I and Class III directors will continue to serve their terms, except that Gerald O. Sweeney, Jr. will not continue on the Board after the annual meeting. See below: "2(b) Election of 3 Class II Directors to Serve for Three-Year Terms."

Recent emphasis on corporate governance reforms place heavy emphasis on the independence of directors. For instance, proposals by The New York Stock Exchange call for public companies to have boards of directors composed of a majority of independent directors. We intend to comply with this requirement in advance of the adoption of the NYSE proposals. To increase the proportion of independent directors on our Board of Directors, two of our current directors who we believe do not qualify as independent under NYSE rules have agreed to resign and will not continue on the Board of Directors after the annual meeting. Therefore, after the annual meeting, assuming that our nominees are elected, and regardless of whether Proposal 1 is adopted or not, our Board of Directors will consist of 6 directors who we believe qualify as independent under current and proposed NYSE rules, and only 3 directors who we believe do not.

If Proposal 1 is adopted, upon the recommendation of the Nominating and Corporate Governance Committee, the following nine (9) directors, who when elected will constitute our entire Board, are nominated for election to serve until the next annual meeting of stockholders and until their respective successors are elected and shall qualify or until their earlier resignation or removal. All of the nominees are currently directors. Neil D. Nicastro is the son of Louis J. Nicastro. If any of the nominees are unable to serve or refuse to serve as directors, an event which the Board does not anticipate, the proxies will be voted in favor of those nominees who do remain as candidates, except as you otherwise specify, and may be voted for substituted nominees. We intend to seek to increase our board again to eleven directors by adding, on or before December 31, 2003, two new directors who we intend will qualify as independent directors under the NYSE rules. No candidates are under consideration at the present time.

6

Name of Director

Nominee (Age)

| | Position with Company and

Principal Occupation

| | Director

Since

|

|---|

| Harold H. Bach, Jr. (70) | | Director | | 1996 |

William C. Bartholomay (74) |

|

Director; President of Near North

National Group |

|

1996 |

William E. McKenna (83) |

|

Director; General Partner, MCK

Investment Company |

|

1996 |

Norman J. Menell (71) |

|

Director; Vice Chairman of the

Board of WMS Industries Inc. |

|

1996 |

Louis J. Nicastro (74) |

|

Director; Chairman of the Board

of WMS Industries Inc. |

|

1988 |

Neil D. Nicastro (46) |

|

Chairman of the Board, President,

Chief Executive Officer and Chief

Operating Officer |

|

1988 |

Harvey Reich (73) |

|

Director; Attorney |

|

1996 |

Ira S. Sheinfeld (65) |

|

Director; Attorney, Hogan & Hartson L.L.P. |

|

1996 |

Richard D. White (49) |

|

Director; Private Investor |

|

1996 |

HAROLD H. BACH, JR. joined our Board in 1996 and served as our Chief Financial Officer and an Executive Vice President from 1996 to September 2001, when he retired. Mr. Bach served as our Senior Vice President — Finance and Chief Financial Officer from 1990 to 1996, and he served as our Treasurer from 1994 to April 2001. Mr. Bach also served as Vice President — Finance, Chief Financial and Chief Accounting Officer of WMS for over five years until September 1999. Mr. Bach was a partner in the accounting firms of Ernst & Young (1989-1990) and Arthur Young & Company (1967-1989).

WILLIAM C. BARTHOLOMAY joined our Board in 1996. He has been President of Near North National Group, insurance brokers in Chicago, Illinois for more than five years. He has served as Vice Chairman of Turner Broadcasting System, Inc., a division of AOL-Time Warner, Inc. since 1994, having also held that office during the period 1976-1992. He is Chairman of the Board of the Atlanta Braves baseball team. Mr. Bartholomay is a director of WMS.

WILLIAM E. MCKENNA joined our Board in 1996. He has served as a General Partner of MCK Investment Company, Beverly Hills, California for over five years. He also is a director of WMS and Drexler Technology Corporation, a developer and manufacturer of optical data storage products.

NORMAN J. MENELL joined our Board in 1996. He has been Vice Chairman of the Board of WMS since 1990 and is a director of WMS. He previously held various executive offices at WMS from 1981 to 1990, including President.

LOUIS J. NICASTRO joined our Board in 1988. He was the Chief Executive Officer of WMS from April 1998 until June 2001 and was also its President from April 1998 to April 2000. He has served as Chairman of the Board of WMS since its incorporation in 1974. Mr. Nicastro also served WMS as Chief Executive Officer or Co-Chief Executive Officer from 1974 to 1996 and as President (1985-1988, 1990-1991), among other executive positions. Mr. Nicastro also served as Chairman of the Board and Chief Executive Officer of WHG Resorts & Casinos Inc. and its predecessors from 1983 until January 1998. He also served as our Chairman of the Board and Chief Executive Officer or Co-Chief Executive Officer from 1988 to 1996 and our President from 1988 to 1991.

NEIL D. NICASTRO joined our Board in 1988 and has been our President and Chief Operating Officer since 1991. In 1996, Mr. Nicastro became Chairman of the Board and Chief Executive Officer, having served as Co-Chief Executive Officer since 1994. Mr. Nicastro also served in other executive positions for us in the past. Mr. Nicastro has served as a director of WMS Industries Inc., our former parent company,

7

since 1986 and as consultant to WMS since April 1998. Mr. Nicastro became sole Chief Executive Officer of WMS in 1996, Co-Chief Executive Officer in 1994, President in 1991 and Chief Operating Officer in 1991. Mr. Nicastro resigned from his offices with WMS in April 1998 to devote his full business time to Midway.

HARVEY REICH joined our Board in 1996. He was a member of the law firm of Robinson Brog Leinwand Greene Genovese & Gluck, P.C., New York, New York and its predecessor firms for over five years until his retirement from that firm in July 1998. He is a director of WMS.

IRA S. SHEINFELD joined our Board in 1996. He has been a partner of the law firm of Hogan & Hartson L.L.P. (the successor to Squadron, Ellenoff, Plesent & Sheinfeld LLP), New York, New York for over five years. He is a director of WMS.

RICHARD D. WHITE joined our Board in 1996. Mr. White is a private investor. He was a Managing Director of CIBC Capital Partners, New York, New York, an affiliate of CIBC World Markets Corp. and its predecessor, for over five years until May 2002. Mr. White is a director of G-III Apparel Group, Ltd., a manufacturer, designer and importer of outerwear. Mr. White is also a director of ActivCard, Inc., a software company.

Required Vote

The affirmative vote of a plurality of the shares of our common stock present in person or by proxy at the annual meeting is required to elect the directors. Proxies cannot be voted for more than 9 nominees.

THE BOARD RECOMMENDS THAT YOU VOTE "FOR" THE NOMINEES FOR ELECTION AS DIRECTORS.

If Proposal 1 isnot adopted, upon the recommendation of the Nominating and Corporate Governance Committee, the following three (3) directors are nominated for election to serve as Class II Directors until our 2006 annual meeting of stockholders and until their respective successors are elected and shall qualify. All of the nominees are currently Class II Directors, whose term expires at the annual meeting. If any of the nominees are unable to serve or refuse to serve as directors, an event which the Board does not anticipate, the proxies will be voted in favor of those nominees who do remain as candidates, except as you otherwise specify, and may be voted for substituted nominees.

Name of Class II Director

Nominee (Age)

| | Position with Company and

Principal Occupation

| | Director

Since

|

|---|

| William E. McKenna (83) | | Director; General Partner,

MCK Investment Company | | 1996 |

Harvey Reich (73) |

|

Director; Attorney |

|

1996 |

Ira S. Sheinfeld (65) |

|

Director; Attorney, Hogan & Hartson L.L.P. |

|

1996 |

WILLIAM E. MCKENNA joined our Board in 1996. He has served as a General Partner of MCK Investment Company, Beverly Hills, California for over five years. He also is a director of WMS and Drexler Technology Corporation, a developer and manufacturer of optical data storage products.

HARVEY REICH joined our Board in 1996. He was a member of the law firm of Robinson Brog Leinwand Greene Genovese & Gluck, P.C., New York, New York and its predecessor firms for over five years until his retirement from that firm in July 1998. He is a director of WMS.

IRA S. SHEINFELD joined our Board in 1996. He has been a partner of the law firm of Hogan & Hartson L.L.P. (the successor to Squadron, Ellenoff, Plesent & Sheinfeld LLP), New York, New York for over five years. He is a director of WMS.

8

The remaining continuing directors, whose terms of office have not expired, are as follows:

Class I Directors: Term expiring at our 2004 Annual Meeting

Name of Director (Age)

| | Position with Company and

Principal Occupation

| | Director

Since

|

|---|

| Neil D. Nicastro (46) | | Chairman of the Board, President, Chief Executive Officer and Chief Operating Officer | | 1988 |

William C. Bartholomay (74) |

|

Director; President of Near North National Group |

|

1996 |

Norman J. Menell (71) |

|

Director; Vice Chairman of the Board of WMS Industries Inc. |

|

1996 |

Louis J. Nicastro (74) |

|

Director; Chairman of the Board of WMS Industries Inc. |

|

1988 |

NEIL D. NICASTRO joined our Board in 1988 and has been our President and Chief Operating Officer since 1991. In 1996, Mr. Nicastro became Chairman of the Board and Chief Executive Officer, having served as Co-Chief Executive Officer since 1994. Mr. Nicastro also served in other executive positions for us in the past. Mr. Nicastro has served as a director of WMS Industries Inc., our former parent company, since 1986 and as consultant to WMS since April 1998. Mr. Nicastro became sole Chief Executive Officer of WMS in 1996, Co-Chief Executive Officer in 1994, President in 1991 and Chief Operating Officer in 1991. Mr. Nicastro resigned from his offices with WMS in April 1998 to devote his full business time to Midway.

WILLIAM C. BARTHOLOMAY joined our Board in 1996. He has been President of Near North National Group, insurance brokers in Chicago, Illinois for more than five years. He has served as Vice Chairman of Turner Broadcasting System, Inc., a division of AOL-Time Warner, Inc. since 1994, having also held that office during the period 1976-1992. He is Chairman of the Board of the Atlanta Braves baseball team. Mr. Bartholomay is a director of WMS.

NORMAN J. MENELL joined our Board in 1996. He has been Vice Chairman of the Board of WMS since 1990 and is a director of WMS. He previously held various executive offices at WMS from 1981 to 1990, including President.

LOUIS J. NICASTRO joined our Board in 1988. He was the Chief Executive Officer of WMS from April 1998 until June 2001 and was also its President from April 1998 to April 2000. He has served as Chairman of the Board of WMS since its incorporation in 1974. Mr. Nicastro also served WMS as Chief Executive Officer or Co-Chief Executive Officer from 1974 to 1996 and as President (1985-1988, 1990-1991), among other executive positions. Mr. Nicastro also served as Chairman of the Board and Chief Executive Officer of WHG Resorts & Casinos Inc. and its predecessors from 1983 until January 1998. He also served as our Chairman of the Board and Chief Executive Officer or Co-Chief Executive Officer from 1988 to 1996 and our President from 1988 to 1991.

9

Class III Directors: Term expiring at our 2005 Annual Meeting

Name of Director (Age)

| | Position with Company and

Principal Occupation

| | Director

Since

|

|---|

| Harold H. Bach, Jr. (70) | | Director | | 1996 |

Richard D. White (49) |

|

Director; Private Investor |

|

1996 |

HAROLD H. BACH, JR. joined our Board in 1996 and served as our Chief Financial Officer and an Executive Vice President from 1996 to September 2001, when he retired. Mr. Bach served as our Senior Vice President — Finance and Chief Financial Officer from 1990 to 1996, and he served as our Treasurer from 1994 to April 2001. Mr. Bach also served as Vice President — Finance, Chief Financial and Chief Accounting Officer of WMS for over five years until September 1999. Mr. Bach was a partner in the accounting firms of Ernst & Young (1989-1990) and Arthur Young & Company (1967-1989).

RICHARD D. WHITE joined our Board in 1996. Mr. White is a private investor. He was a Managing Director of CIBC Capital Partners, New York, New York, an affiliate of CIBC World Markets Corp. and its predecessor, for over five years until May 2002. Mr. White is a director of G-III Apparel Group, Ltd., a manufacturer, designer and importer of outerwear. Mr. White is also a director of ActivCard, Inc., a software company.

Required Vote

The affirmative vote of a plurality of the shares of our common stock present in person or by proxy at the annual meeting is required to elect the Class II directors. Proxies cannot be voted for more than 3 nominees.

THE BOARD RECOMMENDS THAT YOU VOTE "FOR" THE NOMINEES FOR ELECTION AS CLASS II DIRECTORS.

The Board of Directors

The Board of Directors is responsible for managing our overall affairs. To assist it in carrying out its duties, the Board has delegated specific authority to several committees. Eight of our nine nominees are neither officers nor employees of Midway.

During fiscal 2002, the Board held ten meetings. Each director attended at least 75% of the aggregate number of meetings of the Board and all committees on which he served during the fiscal year.

Director Compensation

We pay a fee of $32,500 per year to each director who is not also our employee. Each director who served as the chairman of any committee of the Board during fiscal 2002 received a further fee of $2,500 per year for his services in that capacity and each member of our Audit Committee received an additional fee of $2,500 per year. During fiscal 2002, each of our directors elected to reduce their fiscal 2003 fees under the salary and director fee reduction/stock option program in exchange for options to purchase our common stock. These options vest ratably over a one-year period commencing January 1, 2003.

10

Committees of the Board of Directors

TheAudit Committee is currently composed of four independent directors (as independence is defined in Section 303.01(B) of the NYSE listing standards): Messrs. McKenna (Chairman), Bartholomay, Sheinfeld and White. This Committee meets periodically with the independent auditors and internal personnel to consider the adequacy of internal accounting controls, to receive and review the recommendations of the independent auditors, to engage our independent and internal auditors, to review the scope of the audit and the compensation of the independent auditors, to pre-approve permitted non-audit fees, to review our consolidated financial statements and, generally, to review our accounting policies and to resolve potential conflicts of interest. The Board has adopted a written charter for this committee, and a copy of the charter was included as an appendix to the proxy statement for our 2001 annual meeting. The report of this committee is set forth later in this proxy statement. During fiscal 2002, this Committee held eight meetings.

TheNominating and Corporate Governance Committee is currently composed of Messrs. Menell (Chairman) and Bartholomay. This Committee makes recommendations about the nomination of candidates for election to the Board and does not consider recommendations from stockholders. In addition, this Committee makes recommendations regarding corporate governance matters. During fiscal 2002, this Committee did not hold any meetings, taking all action by the unanimous written consent of its members.

TheStock Option Committee is currently composed of Messrs. Reich (Chairman) and McKenna. This Committee determines the timing, pricing and the amount of option grants to be made under the provisions of our stock option plans. The joint report of this Committee and the Compensation Committee is set forth later in this proxy statement. During fiscal 2002, this Committee held two meetings.

TheCompensation Committee is currently composed of Messrs. Bartholomay (Chairman), McKenna and Reich. This Committee makes recommendations regarding the compensation of senior management personnel. The joint report of this Committee and the Stock Option Committee is set forth later in this proxy statement. During fiscal 2002, this Committee held one meeting.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee or Stock Option Committee is an employee or officer of Midway, and no officer, director or other person had any relationship required to be disclosed under this heading, except that Mr. Bartholomay, one of the members of our Compensation Committee, is President of Near North National Group, insurance brokers, which we retain to provide insurance services.

11

EXECUTIVE OFFICERS

The following individuals were elected to serve in the capacities set forth below until the 2003 Annual Meeting of the Board of Directors and until their respective successors are elected and shall qualify.

Name

| | Age

| | Position

|

|---|

| Neil D. Nicastro | | 46 | | Chairman of the Board of Directors, President, Chief Executive Officer and Chief Operating Officer |

| Kenneth J. Fedesna | | 53 | | Executive Vice President — Product Development |

| Thomas E. Powell | | 41 | | Executive Vice President — Finance, Treasurer and Chief Financial Officer |

| Mark S. Beaumont | | 47 | | Senior Vice President — Publishing |

| David W. Nichols | | 49 | | Senior Vice President — Administration and Operations |

The principal occupation and employment experience of Mr. Nicastro during the last five years is set forth on page 9 above.

KENNETH J. FEDESNA has been our Executive Vice President — Product Development since May 2000 and was our Executive Vice President — Coin-Op Video from 1996 until May 2000. Mr. Fedesna served as our Vice President and General Manager from 1988 to 1996. He also served as Vice President and General Manager of Williams Electronics Games, Inc. a subsidiary of WMS, for over five years until August 1999. Mr. Fedesna has been a member of our Board of Directors since 1996. He will not stand for re-election at our annual meeting.

THOMAS E. POWELL joined us as Executive Vice President — Finance and Treasurer in April 2001. In September 2001, he became our Executive Vice President — Finance, Treasurer and Chief Financial Officer. From 1997 to February 2001, Mr. Powell was employed by Dade Behring, Inc., a manufacturer of medical equipment, serving most recently as Vice President of Corporate Business Development, Strategic Planning. From 1991 to 1997, he was employed by Frito-Lay, a division of PepsiCo, Inc., ultimately serving as Director of Finance.

MARK S. BEAUMONT has served as our Senior Vice President — Publishing since January 30, 2002. He has served as Senior Vice President — Business Development of our wholly-owned subsidiary, Midway Games West Inc., since January 2000. Mr. Beaumont provided marketing and business development consulting services to Midway from October 1999 to January 2000. Prior to joining Midway, from 1996 to February 1999, Mr. Beaumont was Executive Vice President and General Manager of U.S. Operations for Psygnosis, a division of Sony Corporation of America.

DAVID W. NICHOLS has served as our Senior Vice President — Administration and Operations since January 30, 2002. He has served as Executive Vice President — Operations of our wholly-owned subsidiary, Midway Home Entertainment Inc., since February 2001. From May 2000 to February 2001, Mr. Nichols served as Vice President — Operations, of Midway Home Entertainment, after serving as that company's Vice President — Administration, from 1997 to May 2000. Mr. Nichols joined us in 1995 as Controller for Midway Home Entertainment.

EXECUTIVE COMPENSATION

The summary compensation table below sets forth the compensation earned during fiscal 2002, the transition period, fiscal 2001 and fiscal 2000 by our Chief Executive Officer and our four next most highly compensated executive officers. During fiscal 2000, Mr. Fedesna provided services to both WMS Industries and us. The table below reflects his compensation in those years for service in all capacities to both WMS and Midway. Compensation paid to him in these years was paid by either WMS or Midway and was reimbursed by, or to, us in amounts equal to our allocated cost under an agreement between WMS and us.

12

SUMMARY COMPENSATION TABLE

| | Annual Compensation

| | Long Term Compensation Awards

| |

|---|

Name and Principal Position

| | Fiscal

Year

| | Salary($)

| | Bonus($)

| | Other

| | Securities

Underlying

Options(#)

| | All Other

Compensation($)

| |

|---|

Neil D. Nicastro

Chairman of the Board and Chief Executive Officer, President and Chief Operating Officer | | 2002

2001

2001

2000 |

*

| 602,000

302,000

—

600,000 | (1)

(1)

(2)

| —

—

—

— |

(1) | 2,677

1,027

2,091

1,811 | (3)

(3)

(3)

(3) | 485,806

—

—

450,000 |

(2) | 167,472

83,736

167,868

134,300 | (4)

(4)

(4)

(4) |

Kenneth J. Fedesna

Executive Vice President —

Product Development |

|

2002

2001

2001

2000 |

*

|

325,000

162,500

325,000

325,000 |

|

—

—

—

— |

|

2,346

1,250

2,500

2,500 |

(3)

(3)

(3)

(3) |

119,677

—

—

50,000 |

|

—

—

—

— |

|

Thomas E. Powell

Executive Vice President — Finance, Treasurer and Chief Financial Officer(5) |

|

2002

2001

2001 |

*

|

300,000

129,231

46,154 |

|

—

87,692

— |

|

—

—

— |

|

142,903

—

100,000 |

|

—

—

— |

|

Mark S. Beaumont

Senior Vice President —

Publishing(6) |

|

2002 |

|

245,000 |

|

— |

|

— |

|

25,000 |

|

— |

|

David W. Nichols

Senior Vice President —

Administration and Operations(7) |

|

2002 |

|

225,000 |

|

— |

|

— |

|

30,676 |

|

— |

|

- *

- Six-month transition period ended December 31, 2001.

- (1)

- Mr. Nicastro's employment agreement with us permits him to receive advances against estimated bonus payments. Advances were made in the first six months of fiscal 2000 for bonuses accrued that were reversed in the second six months of fiscal 2000 totaling $984,000. Mr. Nicastro applied salary of $580,000 during fiscal 2002 and $302,000 during the transition period to the repayment of these advances. As of March 19, 2003, Mr. Nicastro had repaid these advances in full through deductions from his salary. See "Certain Relationships and Related Transactions — Other Related Party Transactions" below.

- (2)

- On May 4, 2000, our Board granted to Mr. Nicastro an option to purchase 300,000 shares of our common stock in lieu of his salary for fiscal 2001, which he has waived. The option expires on June 30, 2005. The exercise price is $7.00 per share.

- (3)

- Represents life insurance premiums.

- (4)

- Represents accruals for contractual retirement benefits. See "Employment Agreements" below.

- (5)

- Mr. Powell joined Midway on April 9, 2001.

- (6)

- Mr. Beaumont has served as our Senior Vice President — Publishing, since January 30, 2002.

- (7)

- Mr. Nichols has served as our Senior Vice President — Administration and Operations, since January 30, 2002.

13

Stock Options

During fiscal 2002, the following options to purchase common stock were granted under our stock option plans to the persons named in the Summary Compensation Table:

OPTION GRANTS IN LAST FISCAL YEAR

| |

| | Individual Grants

| |

| |

| |

|

|---|

| |

| |

| | Potential Realizable

Value at Assumed Annual Rates of Stock Price Appreciation For Option Term(1)

|

|---|

| |

| | % of Total

Options Granted

to Employees in

Fiscal Year

| |

| |

|

|---|

Name

| | Option

Granted(#)

| | Exercise

Price

($/Share)

| | Expiration

Date

|

|---|

| | 5%($)

| | 10%($)

|

|---|

| Neil D. Nicastro | | 300,000

185,806 | | 7.3

4.5 | | 13.70

5.29 | | 1/14/12

9/2/12 | | 2,584,757

618,149 | | 6,550,282

1,566,511 |

Kenneth J. Fedesna |

|

50,000

69,677 |

|

1.2

1.7 |

|

13.70

5.29 |

|

1/14/12

9/2/12 |

|

430,793

231,805 |

|

1,091,714

587,440 |

Thomas E. Powell |

|

50,000

92,903 |

|

1.2

2.3 |

|

13.70 5.29 |

|

1/14/12

9/2/12 |

|

430,793

309,075 |

|

1,091,714

783,256 |

Mark S. Beaumont |

|

25,000 |

|

0.6 |

|

13.70 |

|

1/14/12 |

|

215,396 |

|

545,857 |

David W. Nichols |

|

25,000

5,676 |

|

0.6

0.1 |

|

13.70

5.29 |

|

1/14/12

9/2/12 |

|

215,396

18,883 |

|

545,857

47,854 |

- (1)

- The assumed appreciation rates are set by rules promulgated under the Securities Exchange Act of 1934 and are not related to or derived from the historical or projected prices of our common stock.

The following table sets forth information with respect to the number and year-end values of options to purchase common stock owned by the executive officers named in the Summary Compensation Table.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCALYEAR-END OPTION VALUES

Name

| | Shares Acquired

on Exercise(#)

| | Value

Realized

($)

| | Number of Securities Underlying Unexercised Options at 12/31/02(#)

Exercisable/Unexercisable

| | Value of Unexercised

In-the-Money Options

at 12/31/02($)(1)

Exercisable/Unexercisable

|

|---|

| Neil D. Nicastro | | — | | — | | 2,011,850/485,806 | | $0/$0 |

Kenneth J. Fedesna |

|

— |

|

— |

|

219,229/129,677 |

|

$0/$0 |

Thomas E. Powell |

|

— |

|

— |

|

35,000/207,903 |

|

$0/$0 |

Mark S. Beaumont |

|

— |

|

— |

|

20,000/55,000 |

|

$0/$0 |

David W. Nichols |

|

— |

|

— |

|

59,756/64,176 |

|

$0/$0 |

- (1)

- Based on the closing price of our common stock on the NYSE on December 31, 2002, which was $4.17 per share.

We have adopted a 2002 Non-Qualified Stock Option Plan, a 2002 Stock Option Plan, a 2000 Non-Qualified Stock Option Plan, a 1999 Stock Option Plan, a 1998 Stock Incentive Plan, a 1998 Non-Qualified Stock Option Plan and a 1996 Stock Option Plan. The plans provide for the granting of stock options to our directors, officers, employees, consultants and advisors. During fiscal 2002, we adopted a salary and director fee reduction/stock option program under the 2002 Non-Qualified Stock Option Plan. Employees and Directors who elected to participate in the program voluntarily elected to reduce their base salary or director's fee for a one-year period beginning in January 2003. For each dollar of salary or fee reduction, employees and directors were granted options to purchase one and one-half

14

shares of our common stock. These options have an exercise price of $5.29 per share, vest in installments over the first calendar year and expire on September 2, 2012. The 1998 Stock Incentive Plan required that participants purchase shares of our common stock at the market price in order to be eligible to receive options. The plans are intended to encourage stock ownership by our directors, officers, employees, consultants and advisors and thereby enhance their proprietary interest in us. Subject to the provisions of the plans, the Stock Option Committee generally determines which of the eligible directors, officers, employees, consultants and advisors receive stock options, the terms, including applicable vesting periods, of the options, and the number of shares for which options are granted.

The option price per share with respect to each option is determined by the Stock Option Committee and generally is not less than 100% of the fair market value of our common stock on the date the option is granted. The Plans each have a term of ten years, unless terminated earlier.

The following is a summary of additional information about securities authorized for issuance under our equity compensation plans as of December 31, 2002:

EQUITY COMPENSATION PLAN INFORMATION

| | (a)

| | (b)

| | (c)

|

|---|

Plan category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | Weighted-average exercise price of outstanding options, warrants and rights

| | Number of securities remaining available for future issuance under equity compensation

plans (excluding securities reflected in column (a))

|

|---|

| Equity compensation plans approved by stockholders | | 3,460,250 | | $ | 14.82 | | 233,958 |

| Equity compensation plans not approved by stockholders | | 5,593,056 | | $ | 9.51 | | 2,507,300 |

| Total | | 9,053,306 | | $ | 10.21 | | 2,741,258 |

The average exercise price of outstanding options, as of the Record Date, was approximately $10.35 per share. See "Security Ownership of Certain Beneficial Owners and Management" above for information about options held by officers and directors of Midway.

Midway Management Bonus Incentive Plan

Our executive officers, as well as our other senior employees, are also eligible for participation under the Midway Management Bonus Incentive Plan. The plan offers participants the opportunity to receive bonuses based on a combination of the following factors: (1) base salary; (2) the achievement of targets set for Midway's financial performance; and (3) management's evaluation of the individual and the degree to which he or she meets individual performance goals.

JOINT REPORT OF THE COMPENSATION COMMITTEE AND STOCK OPTION COMMITTEE ON EXECUTIVE COMPENSATION FOR THE SIX-MONTH TRANSITION PERIOD ENDED DECEMBER 31, 2001 AND FOR FISCAL 2002

The Compensation Committee is responsible for making recommendations to the Board of Directors regarding the compensation of senior management personnel. To the extent that stock options form a portion of a compensation package, the Compensation Committee works together with the Stock Option Committee, which is responsible for making stock option grants and awards.

It is the policy of the Compensation and Stock Option Committees to provide attractive compensation packages to senior management so as to motivate them to devote their full energies to our success, to reward them for their services and to align the interests of senior management with the interests of stockholders. Our executive compensation packages are comprised primarily of base salaries, annual

15

contractual and discretionary cash bonuses, stock options, and retirement and other benefits. It is the philosophy of the Compensation Committee that Midway be staffed with a small number of well-compensated senior management personnel.

In general, the level of base salary is intended to provide appropriate basic pay to senior management taking into account their historical contributions to our success, each person's unique education, skills and value and the recommendation of the Chief Executive Officer. The amount of any discretionary bonus is subjective but is generally based on our actual financial performance in the preceding fiscal year, the special contribution of the executive to this performance and the overall level of the executive's compensation including other elements of the compensation package. Contractual bonuses are likewise designed to give effect to one or more of these factors. During 2003, we adopted the Midway Management Bonus Incentive Plan, as described above. This Plan did not affect compensation for fiscal 2002 or prior periods.

We also have used stock options, which increase in value only if our common stock increases in value, and which terminate a short time after an executive leaves our employ, as a means of long-term incentive compensation. Generally, the Stock Option Committee determines the size of stock option grants to our executive officers and other employees on an individual, discretionary basis in consideration of financial corporate results and each recipient's performance, contributions and responsibilities without assigning specific weight to any of these factors. During fiscal 2002, we adopted a salary and director fee reduction/stock option program under the 2002 Non-Qualified Stock Option Plan. Participants in the program voluntarily elected to reduce their base salary or director's fee for a one-year period beginning in January 2003. For each dollar of salary or fee reduction, options to purchase one and one-half shares of our common stock were granted to the participant.

Our CEO, Neil D. Nicastro, under a negotiated formula set forth in his employment agreement, receives a salary, a bonus of a percentage of our pre-tax income and various retirement and other benefits. He also participates in our stock option plans, and he participated in the salary and director fee reduction/stock option program. Mr. Nicastro's employment agreement reflects the same compensation philosophy described above.

The Omnibus Budget Reconciliation Act of 1993 (the "Budget Act") generally provides that publicly-held corporations will only be able to deduct, for income tax purposes, compensation paid to the chief executive officer or any of the four most highly paid senior executive officers in excess of one million dollars per year if it is paid pursuant to qualifying performance-based compensation plans approved by stockholders. Compensation as defined by the Budget Act includes, among other things, base salary, incentive compensation and gains on stock option transactions. Total compensation of some of our officers may be paid under plans or agreements that have not been approved by stockholders and may exceed one million dollars in a particular fiscal year. We will not be able to deduct these excess payments for income tax purposes. The Compensation Committee intends to consider, on a case by case basis, how the Budget Act will affect our compensation plans and contractual and discretionary cash compensation.

The Compensation Committee

William C. Bartholomay, Chairman

Harvey Reich

William E. McKenna | | The Stock Option Committee

Harvey Reich, Chairman

William E. McKenna |

16

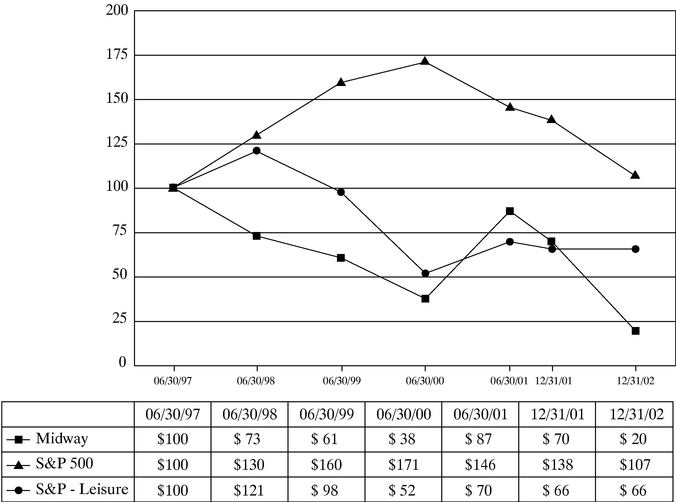

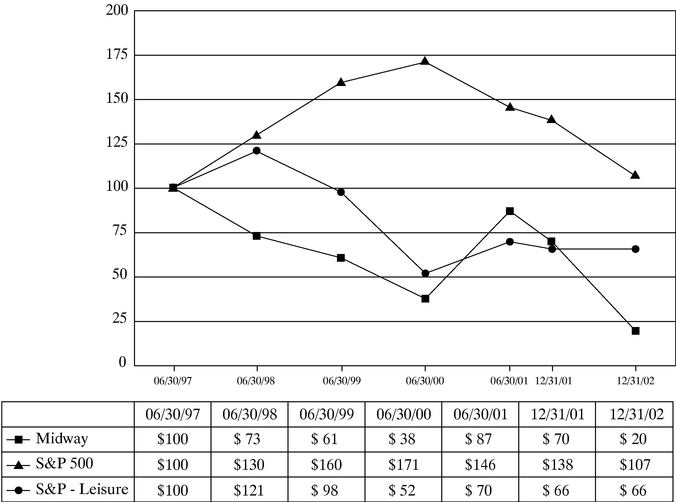

CORPORATE PERFORMANCE GRAPH

The following graph compares, for the period beginning June 30, 1997 and ending December 31, 2002, the percentage change during each period ending on the dates shown below in cumulative total stockholder return on our common stock with that of (1) the Standard and Poor's 500 Stock Index ("S&P 500") and (2) the Standard and Poor's Leisure Time Index ("S&P Leisure"). The graph assumes an investment of $100 on June 30, 1997 in our common stock and $100 invested at that time in each of the indexes and the reinvestment of dividends where applicable. Note that our fiscal year changed in 2001 from a fiscal year ending on June 30 to a fiscal year ending on December 31. Therefore, the data shown at December 31, 2001 reflects the six-month transition period ended on December 31, 2001.

17

EMPLOYMENT AGREEMENTS

We employ Neil D. Nicastro under the terms of an Employment Agreement dated as of July 1, 1996. The agreement was amended on March 5, 1998, November 5, 1999, May 4, 2000 and October 30, 2000. Mr. Nicastro's base salary is $600,000. The agreement provides for bonus compensation in an amount equal to two percent of our pre-tax income. The employment agreement is subject to automatic extensions in order that the term of Mr. Nicastro's employment shall at no time be less than three years. Upon Mr. Nicastro's retirement or death, Midway is required to deliver to Mr. Nicastro or his designee, or if no designation is made, to his estate, on the first day of each month, for a period of ten years, 5,065 shares of our common stock, subject to adjustment pursuant to the terms of the employment agreement. This benefit is payable notwithstanding Mr. Nicastro's termination of employment for any reason.

The employment agreement provides that Mr. Nicastro shall devote such time to our business and affairs as is reasonably necessary to perform the duties of his position. Mr. Nicastro may continue to serve as a director of and consultant to WMS as he deems appropriate.

The employment agreement also provides that Mr. Nicastro may participate and receive the benefits of all pension and retirement plans, bonus plans, health, life, hospital, medical and dental insurance, including reimbursement for all medical and dental expenses incurred by him, his spouse and his children under the age of twenty-one, to the extent that these expenses are not otherwise reimbursed by insurance provided by us, and all other employee benefits and perquisites generally made available to our employees. Additionally, we currently provide Mr. Nicastro with $2,000,000 of life insurance coverage in addition to the standard amount provided to our employees.

Mr. Nicastro's employment agreement further provides for full compensation during periods of illness or incapacity. We may, however, give 30 days' notice of termination if illness or incapacity disables Mr. Nicastro from performing his duties for a period of more than six months. The termination notice becomes effective if full performance is not resumed within 30 days after the notice is given and maintained for a period of two months thereafter. The employment agreement may be terminated at the election of Mr. Nicastro upon the occurrence without his consent or acquiescence of any one or more of the following events:

- •

- the placement of Mr. Nicastro in a position of lesser stature or the assignment to Mr. Nicastro of duties, performance requirements or working conditions significantly different from or at variance with those presently in effect;

- •

- the treatment of Mr. Nicastro in a manner which is in derogation of his status as a senior executive;

- •

- the cessation of service of Mr. Nicastro as a member of our board of directors;

- •

- the discontinuance or reduction of amounts payable or personal benefits available to Mr. Nicastro under the agreement; or

- •

- the requirement that Mr. Nicastro work outside his agreed upon metropolitan area.

In any such event, and in the event that we are deemed to have wrongfully terminated Mr. Nicastro's employment agreement under the terms thereof, we are obligated to make a lump sum payment to Mr. Nicastro equal in amount to the sum of:

- •

- the aggregate base salary during the remaining term of his employment agreement, but in no event less than three times the highest base salary payable to him during the one-year period prior to such event;

- •

- the aggregate bonus, assuming that Midway pre-tax income during the remainder of the term of the employment agreement is earned at the highest level achieved in any of the last five full fiscal years prior to such termination; and

- •

- the retirement benefit, assuming the date of termination is his retirement date, otherwise payable under the terms of the employment agreement.

18

Additionally, we would be obligated to purchase, at the election of Mr. Nicastro, all stock options held by him with respect to our common stock at a price equal to the spread between the option price and the fair market price of the stock as defined in the agreement. The employment agreement may also be terminated at the election of Mr. Nicastro if individuals who presently constitute the board of directors, or successors approved by board members, cease for any reason to constitute at least a majority of the board. Upon such an event, we may be required to purchase the stock options held by Mr. Nicastro and make payments similar to those described above.

If any portion of the amount paid to Mr. Nicastro is subject to the excise tax imposed by Section 4999 of the Internal Revenue Code, then we must pay additional compensation to Mr. Nicastro to the extent necessary to eliminate the economic effect on him of the resulting excise tax.

We employ Kenneth J. Fedesna under the terms of an employment agreement dated as of June 1, 1999. This agreement provides for salaried compensation at the rate of $325,000 per year, or a greater amount as may be determined by the board of directors. It also provides for, among other things, full participation in all benefit plans and perquisites generally available to executive employees. The agreement requires that we provide Mr. Fedesna with $400,000 in additional life insurance coverage. The agreement is subject to automatic extensions so that the term of Mr. Fedesna's employment shall at no time be less than three years. Either party may terminate the agreement effective upon expiration of the term upon written notice from the terminating party to the other party dated and received at least three years prior to the respective termination date. We may terminate the agreement upon 30 days' written notice for cause. Mr. Fedesna may terminate the agreement if:

- •

- he is placed in a position of lesser stature;

- •

- he is assigned duties significantly different from or incompatible with his position;

- •

- his performance requirements or working conditions change; or

- •

- the business facility at which he is required to work is relocated more than 50 miles from our present business location.

Mr. Fedesna may also terminate the agreement if the individuals who presently constitute the board of directors, or successors approved by these board members, cease for any reason to constitute at least a majority of the board. If this happens, and Mr. Fedesna gives us notice of termination within 60 days, then in lieu of any other rights under the agreement, all of Mr. Fedesna's unvested stock options will immediately vest, and we will be required to pay him a lump sum of three times his base salary. If any portion of the amount paid to Mr. Fedesna is subject to the excise tax imposed by Section 4999 of the Internal Revenue Code, then we must pay additional compensation to Mr. Fedesna to the extent necessary to eliminate the economic effect on him of the resulting excise tax.

We employ Thomas E. Powell as Executive Vice President — Finance, Treasurer and Chief Financial Officer. His current base annual salary is $300,000. Pursuant to the terms of our agreement with Mr. Powell dated March 21, 2001, Mr. Powell's initial grant of 100,000 stock options will automatically vest upon a change of control of Midway. The agreement also provides for, among other things, full participation in all benefit plans and perquisites generally available to executive employees. In addition, pursuant to the terms of our agreement with Mr. Powell dated February 10, 2003, if a change of control occurs within 5 years from the date of the agreement, and within 2 years thereafter, Mr. Powell's employment is terminated (a) by Midway without cause, (b) by Mr. Powell due to the relocation of his office location more than 50 miles from its present location, or (c) by Mr. Powell due to his placement in a position of lessor stature or the assignment of duties at variance with his current duties, then Mr. Powell will receive twenty-four months of severance payments at his then current salary rate.

We employ Mark S. Beaumont as our Senior Vice President — Publishing. His current base annual salary is $245,000. Pursuant to the terms of our agreement with Mr. Beaumont dated February 10, 2003, if a change of control occurs within 5 years from the date of the agreement, and within 2 years thereafter, Mr. Beaumont's employment is terminated (a) by Midway without cause, (b) by Mr. Beaumont due to the

19

relocation of his office location more than 50 miles from its present location, or (c) by Mr. Beaumont due to his placement in a position of lessor stature or the assignment of duties at variance with his current duties, then Mr. Beaumont will receive twenty-four months of severance payments at his then current salary rate.

We employ David W. Nichols as our Senior Vice President — Administration and Operations. His current base annual salary is $225,000. Pursuant to the terms of our agreement with Mr. Nichols dated February 10, 2003, if a change of control occurs within 5 years from the date of the agreement, and within 2 years thereafter, Mr. Nichols' employment is terminated (a) by Midway without cause, (b) by Mr. Nichols due to the relocation of his office location more than 50 miles from its present location, or (c) by Mr. Nichols due to his placement in a position of lessor stature or the assignment of duties at variance with his current duties, then Mr. Nichols will receive twenty-four months of severance payments at his then current salary rate.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Relationship with WMS

Until October 29, 1996, we were wholly owned by WMS Industries. On that date, we sold common stock in an initial public offering, but WMS continued to own 86.8% of our common stock. On April 6, 1998, WMS distributed all of its shares of our common stock to its stockholders. Seven of our directors are also directors of WMS, including our Chairman and Chief Executive Officer, Neil D. Nicastro, and his father, Louis J. Nicastro. Louis J. Nicastro is the Chairman of the Board of WMS. Neil D. Nicastro is also a consultant to WMS.

During June 2002, we terminated our lease with WMS and purchased the 2704 West Roscoe Street office building and 3289 N. California Ave. parking lot in Chicago, Illinois from WMS at an aggregate price of $2.3 million. In connection with the purchase, the parties also entered into agreements regarding the use of various parking lot areas near their Chicago facilities.

In connection with our spinoff from WMS, we entered into a number of agreements with WMS, each dated as of April 6, 1998. Under a Settlement and Temporary Services Agreement, dated as of August 31, 2001, we amended some of these agreements. The remaining material agreements between WMS and us dated as of April 6, 1998, as so amended, are described below:

Third Parties Agreement. This agreement governs the treatment of the various arrangements with third parties with respect to game development, licensing and other matters. Under the agreement, WMS and we allocate the rights and obligations under third party arrangements so that the party receiving the benefit will bear the burden of those agreements. The agreement shall remain in effect so long as any prior third party arrangements remain outstanding.

Tax Separation Agreement. Until April 1998, we were a member of the consolidated group of corporations of which WMS was the common parent for federal income tax purposes. Therefore, we are jointly and severally liable for any federal tax liability of the WMS group for the period that we were part of the WMS group. The agreement sets forth the parties' respective liabilities for federal, state and local taxes as well as other agreements regarding the separation of Midway and its subsidiaries from WMS. The agreement governs, among other things:

- •

- the filing of tax returns with federal, state and local authorities;

- •

- the carryover of any tax benefits of Midway;

- •

- the treatment of the deduction attributable to the exercise of stock options to purchase WMS common stock which are held by employees or former employees of Midway and any other similar compensation related tax deductions;

- •

- the treatment of specified net operating loss carrybacks;

- •

- the treatment of audit adjustments; and

20

- •

- procedures with respect to any proposed audit adjustment or other claim made by any taxing authority with respect to a tax liability of Midway or any of its subsidiaries.

We also have the following agreements with WMS:

Tax Sharing Agreement. This agreement is dated July 1, 1996 and remains in effect, except to the extent described in the Tax Separation Agreement referred to above. Under this agreement, WMS and we have agreed upon a method for:

- •

- determining the amount that we must pay to WMS in respect of federal income taxes;

- •

- compensating any member of the WMS Group for use of its net operating losses, tax credits and other tax benefits in arriving at the WMS Group tax liability as determined under the federal consolidated return regulations; and

- •

- providing for the receipt of any refund arising from a carryback of net operating losses or tax credits from subsequent taxable years and for payments upon subsequent adjustments.

Patent License Agreement. This agreement is dated July 1, 1996. WMS and we each license to the other, on a perpetual, royalty-free basis, some patents used in the development and manufacture of both coin-operated videogames and video lottery terminals and other gaming machines.

Other Related Party Transactions

Under his employment agreement with us, Neil D. Nicastro received $984,000 of advances for a bonus accrued in the first six months of fiscal 2000 and later reversed. As of March 19, 2003, Mr. Nicastro has repaid these advances in full through deductions from his salary.

Mr. Ira S. Sheinfeld, a member of our Board of Directors, is a partner of the law firm of Hogan & Hartson L.L.P. (the successor to Squadron, Ellenoff, Plesent & Sheinfeld LLP), which we retain to provide tax services.

Mr. Gerald O. Sweeney, Jr., a member of our Board of Directors, who will not continue on the Board after the annual meeting, is a member of the law firm of Lord, Bissell & Brook, which performs legal services for Midway from time to time.

William C. Bartholomay, a member of our Board of Directors, is President of Near North National Group, insurance brokers, which we retain to provide insurance services.

PROPOSAL 3 — APPOINTMENT OF INDEPENDENT AUDITORS

We propose that the stockholders ratify the appointment by the Board of Directors of Ernst & Young LLP as our independent auditors for fiscal 2003, ending December 31, 2003. We expect that representatives of Ernst & Young LLP will be present at the annual meeting and that they will be available to respond to appropriate questions submitted by stockholders at the meeting. Ernst & Young LLP will have the opportunity to make a statement if they desire to do so.

We were billed the following amounts by Ernst & Young LLP with respect to services rendered with respect to fiscal 2001, our six-month transition period ended December 31, 2001 and fiscal 2002:

Audit Fees. The aggregate fees billed by Ernst & Young LLP for professional services rendered for the audit of our annual financial statements for fiscal 2001, the six-month transition period ended December 31, 2001 and fiscal 2002, including the review of the financial statements included in our Quarterly Reports on Form 10-Q were $164,000, $168,000 and $217,500, respectively.

Audit-Related Fees. The aggregate fees for audit-related services for the same periods were $186,350, $50,500 and $59,100, respectively. These audit related services generally included fees for accounting consultations, additional audit procedures and Securities and Exchange Commission registration statements.

21

Tax Fees. The aggregate fees for tax services for the same periods were $0, $0 and $96,400, respectively. These tax services generally included fees for domestic and foreign tax consultation.

All Other Fees. None.

Pre-Approval Policies and Procedures. Our Audit Committee is responsible for approving the engagement of the independent auditors for audit services each year and for pre-approving all permitted non-audit services by our auditors. The independent auditors will verify to our Audit Committee annually that they have not performed and will not perform any prohibited non-audit services. Any permitted non-audit service must be pre-approved by either the full Audit Committee or a designated member of the Audit Committee.

In fiscal 2002, no fees of our independent auditors were approved under S-X Rule 2-01(c)(7)(i)(C).

The Audit Committee has considered whether the independent accountant's provision of non-audit services is compatible with maintaining the independent accountant's independence.

Approval by the stockholders of the appointment of independent auditors is not required, but the Board believes that it is desirable to submit this matter to the stockholders. If holders of a majority of our common stock present and entitled to vote on the matter do not approve the selection of Ernst & Young LLP at the meeting, the selection of independent auditors will be reconsidered by the Board.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE "FOR" THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT AUDITORS.

AUDIT COMMITTEE REPORT

The audit committee of the Board of Directors of Midway is composed of four independent directors and operates under a written charter adopted by the Board of Directors. Midway's management is responsible for its internal accounting controls and the financial reporting process. Midway's independent accountants, Ernst & Young LLP, are responsible for performing an independent audit of Midway's consolidated financial statements in accordance with auditing standards generally accepted in the United States and to issue a report thereon. The audit committee's responsibility is to monitor and oversee these processes.

In keeping with that responsibility, the audit committee has reviewed and discussed Midway's audited consolidated financial statements with management. In addition, the audit committee has discussed with Midway's independent accountants the matters required to be discussed by Statement on Auditing Standards No. 61, "Communications with Audit Committees", as amended.

The audit committee has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1, "Independence Discussions with Audit Committees," and has discussed with the independent accountants their independence.

Based on the audit committee's discussions with management and the independent accountants and the audit committee's review of the representations of management and the report of the independent accountants, the audit committee recommended to the Board of Directors that the audited consolidated financial statements be included in Midway's Transition Report on Form 10-K for the six-month transition period ended December 31, 2001 and in Midway's Annual Report on Form 10-K for the fiscal year ended December 31, 2002 for filing with the SEC.

This report is respectfully submitted by the audit committee of the Board of Directors.

William E. McKenna (Chairman)

William C. Bartholomay

Ira S. Sheinfeld

Richard D. White

22

OTHER MATTERS

Stockholder Proposals