Investor Presentation August 3, 2021

Safe Harbor Statement Cautionary Note Regarding Forward-Looking Statements The information contained in this report may contain forward-looking statements. When used or incorporated by reference in disclosure documents, the words "believe" "anticipate," "estimate," "expect," "project," "target," "goal" and similar expressions are intended to identify forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements may include but are not limited to: statements of our goals, intentions and expectations; statements regarding our business plans, prospects, growth and operating strategies; statements regarding the quality of our loan and investment portfolios; and estimates of our risks and future costs and benefits. These forward-looking statements are based on current beliefs and expectations of our management and are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Such forward-looking statements are subject to certain risks, uncertainties and assumptions, including but not limited to those set forth below: • Operating, legal and regulatory risks; • Economic, political and competitive forces impacting various lines of business; • Legislative, regulatory and accounting changes; • Demand for our financial products and services in our market area; • Major catastrophes such as earthquakes, floods or other natural or human disasters and infectious disease outbreaks, including the current coronavirus (COVID-19) pandemic, the related disruption to local, regional and global economic activity and financial markets, and the impact that any of the foregoing may have on us and our customers and other constituencies; • Volatility in interest rates; • Fluctuations in real estate values in our market area; • The composition and credit quality of our loan and investment portfolios; • Changes in the level and direction of loan delinquencies, classified and criticized loans and charge-offs and changes in estimates of the adequacy of the allowance for credit losses; • Economic changes impacting the assumptions utilized to calculate the allowance for credit losses; • Our ability to access cost-effective funding; • Our ability to continue to implement our business strategies; • Our ability to manage market risk, credit risk and operational risk; • Timing of revenue and expenditures; • Adverse changes in the securities markets; • Our ability to enter new markets successfully and capitalize on growth opportunities; • Competition for loans, deposits and employees; • System failures or cyber-security breaches of our information technology infrastructure and those of our third-party service providers; • The failure to maintain current technologies and to successfully implement future information technology enhancements; • Our ability to retain key employees; • Other risks and uncertainties, including those occurring in the U.S. and world financial systems; and • The risk that our analysis of these risks and forces could be incorrect and/or that the strategies developed to address them could be unsuccessful. 2

Safe Harbor Statement (cont’d) Cautionary Note Regarding Forward-Looking Statements Given the ongoing and dynamic nature of the COVID-19 pandemic, it is difficult to predict the continuing impact of the COVID-19 outbreak on our business. The extent of such impact will depend on future developments, which are highly uncertain, including when the coronavirus can be controlled and abated. As a result of the COVID-19 pandemic and the related adverse local and national economic consequences, our forward-looking statements are also subject to the following risks, uncertainties and assumptions: • Demand for our products and services may decline, making it difficult to grow assets and income; • If the economy is unable to remain open, and high levels of unemployment exist for an extended period of time, loan delinquencies, problem assets, and foreclosures may increase, resulting in increased charge-offs and reduced income; • Collateral for loans, especially real estate, may decline in value, which could cause loan losses to increase; • Our allowance for credit losses on loans and leases may increase if borrowers experience financial difficulties, which will adversely affect our net income; • The net worth and liquidity of loan guarantors may decline, impairing their ability to honor commitments to us; • A sustained decline in our stock price or the occurrence of what management would deem to be a triggering event could occur, either of which could result in a goodwill or intangible impairment charge being recorded that would adversely impact our results of operations; • A material decrease in net income or a net loss over several quarters could result in the elimination of or a decrease in the rate of our quarterly cash dividend; • Our wealth management revenues may decline with continuing market turmoil; • Our cyber security risks are increased as a result of an increase in the number of employees working remotely; • We rely on third party vendors for certain services and the unavailability of a critical service due to the COVID-19 outbreak could have an adverse effect on us; • FDIC premiums may increase if the agency experiences additional resolution costs; and • Litigation, regulatory enforcement and reputation risk as a result of our participation in the PPP and the risk that the Small Business Administration may not fund some or all PPP loan guaranties. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated, expected or projected. These and other risk factors are more fully described in this report and in the Univest Financial Corporation Annual Report on Form 10-K for the year ended December 31, 2020 under the section entitled "Item 1A - Risk Factors," and from time to time in other filings made by the Corporation with the SEC. 3

Non-GAAP Financial Measures This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management uses these “non-GAAP” measures in its analysis of the Corporation’s performance. Management believes these non-GAAP financial measures allow for better comparability of period to period operating performance. Additionally, the Corporation believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. A reconciliation of the non-GAAP measures used in this presentation to the most directly comparable GAAP measures is provided in the Appendix to this presentation. 4

COMPANY OVERVIEW

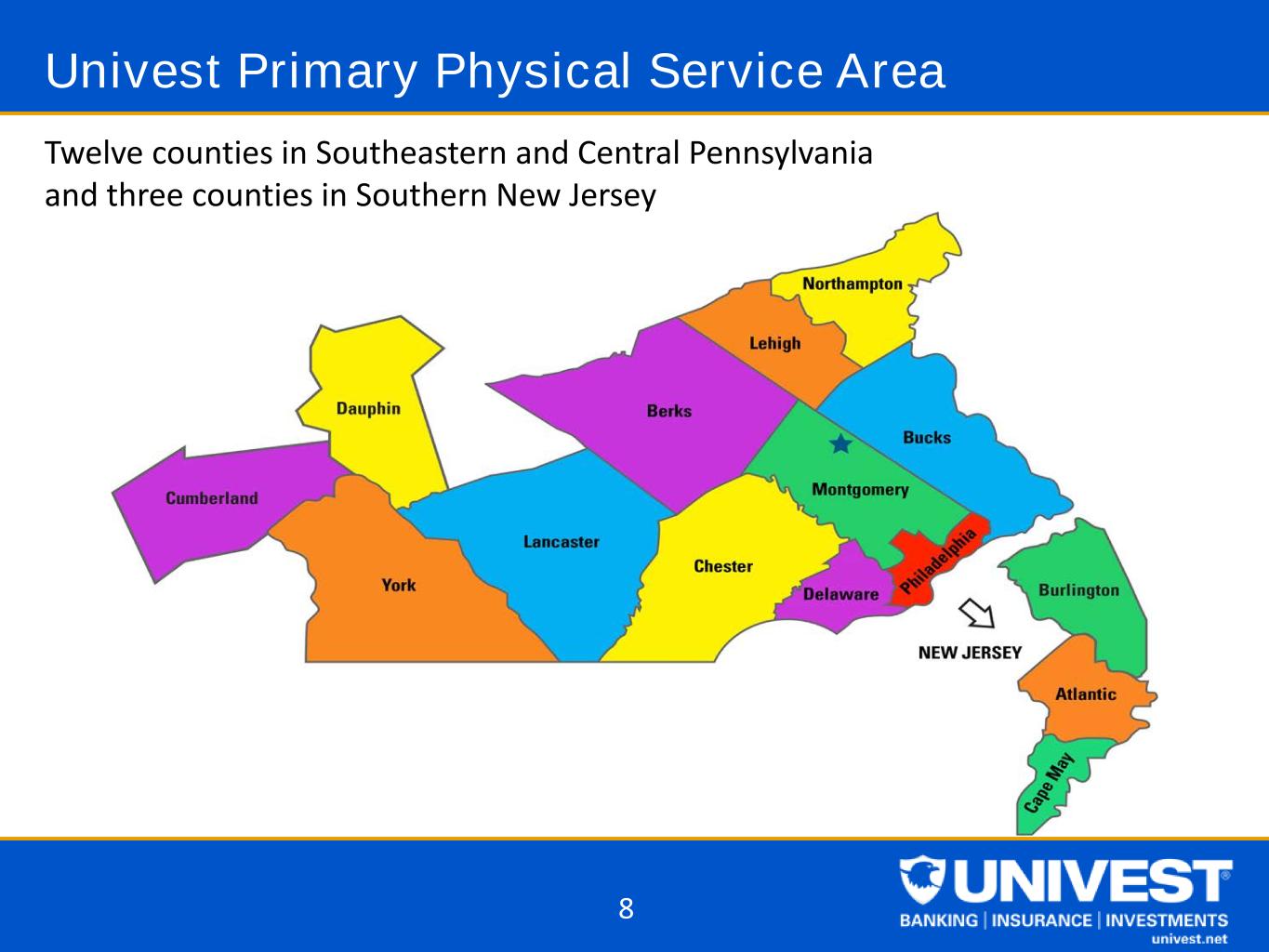

Univest Company Overview Headquartered in Souderton, Pennsylvania (Montgomery County) Bank founded in 1876, holding company formed in 1973 Engaged in financial services business, providing full range of banking, insurance and wealth management services Comprehensive financial solutions delivered locally Experienced management team with proven performance track record Physically serving twelve counties in the Southeastern and Central regions of Pennsylvania and three counties in Southern New Jersey Customer base primarily consists of individuals, businesses, municipalities and nonprofit organizations Operating leverage and scale with $6.4 billion of assets ($6.1 billion excluding Paycheck Protection Program (“PPP”) loans), $4.5 billion of assets under management and supervision and agent for $180 million of underwritten insurance premiums as of 6/30/21 6

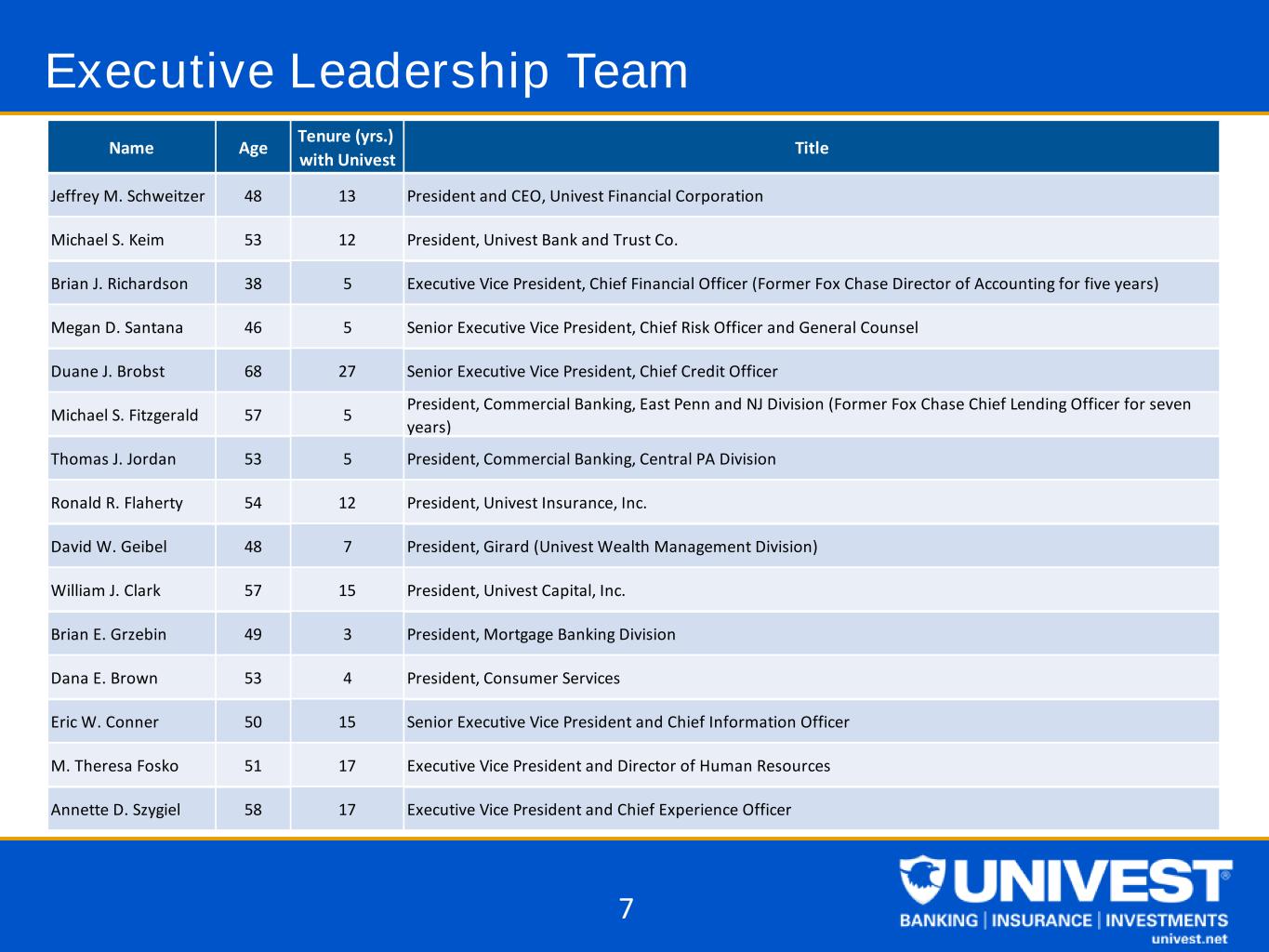

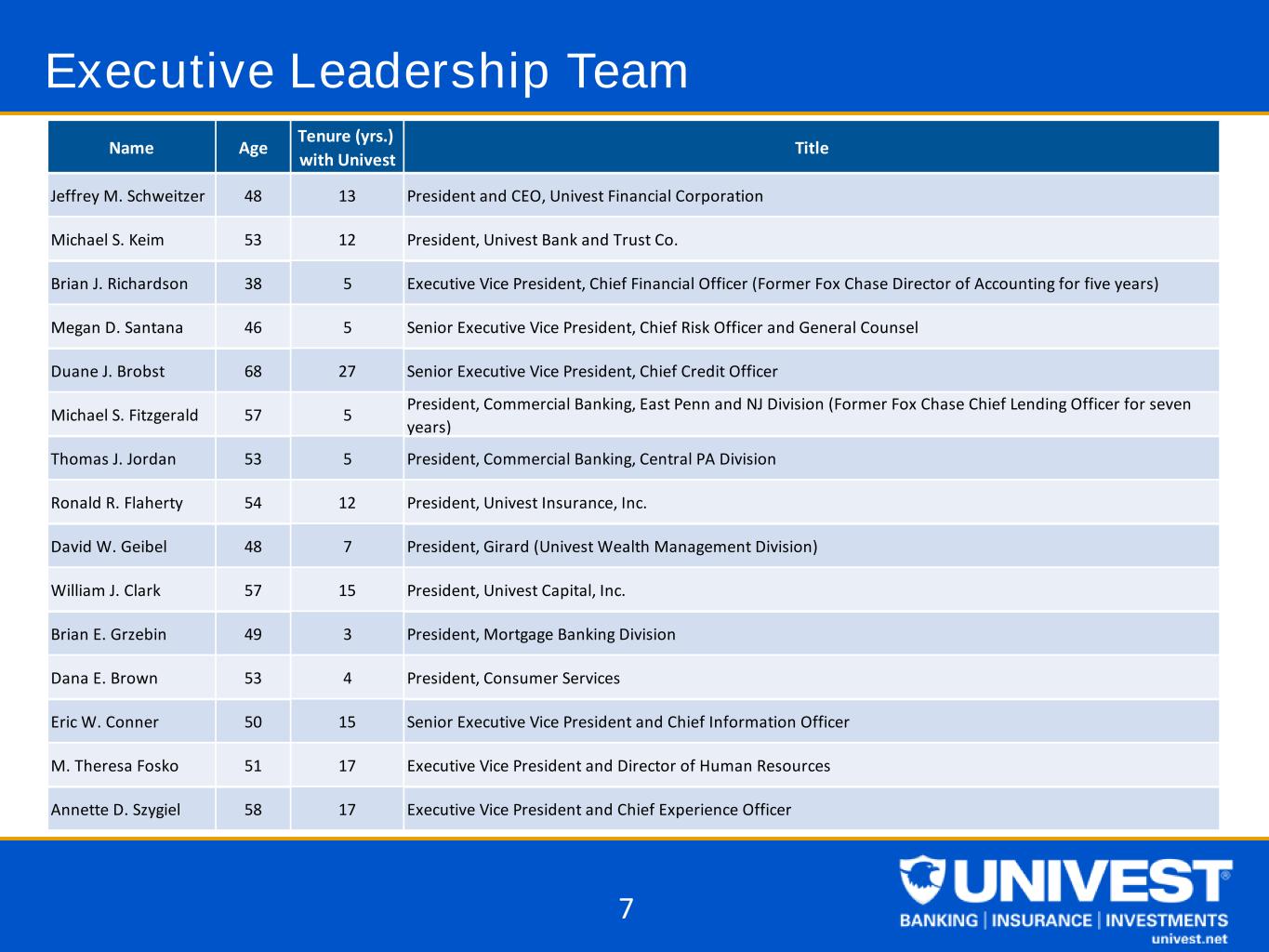

Executive Leadership Team 7 Name Age Tenure (yrs.) with Univest Title Jeffrey M. Schweitzer 48 13 President and CEO, Univest Financial Corporation Michael S. Keim 53 12 President, Univest Bank and Trust Co. Brian J. Richardson 38 5 Executive Vice President, Chief Financial Officer (Former Fox Chase Director of Accounting for five years) Megan D. Santana 46 5 Senior Executive Vice President, Chief Risk Officer and General Counsel Duane J. Brobst 68 27 Senior Executive Vice President, Chief Credit Officer Michael S. Fitzgerald 57 5 President, Commercial Banking, East Penn and NJ Division (Former Fox Chase Chief Lending Officer for seven years) Thomas J. Jordan 53 5 President, Commercial Banking, Central PA Division Ronald R. Flaherty 54 12 President, Univest Insurance, Inc. David W. Geibel 48 7 President, Girard (Univest Wealth Management Division) William J. Clark 57 15 President, Univest Capital, Inc. Brian E. Grzebin 49 3 President, Mortgage Banking Division Dana E. Brown 53 4 President, Consumer Services Eric W. Conner 50 15 Senior Executive Vice President and Chief Information Officer M. Theresa Fosko 51 17 Executive Vice President and Director of Human Resources Annette D. Szygiel 58 17 Executive Vice President and Chief Experience Officer

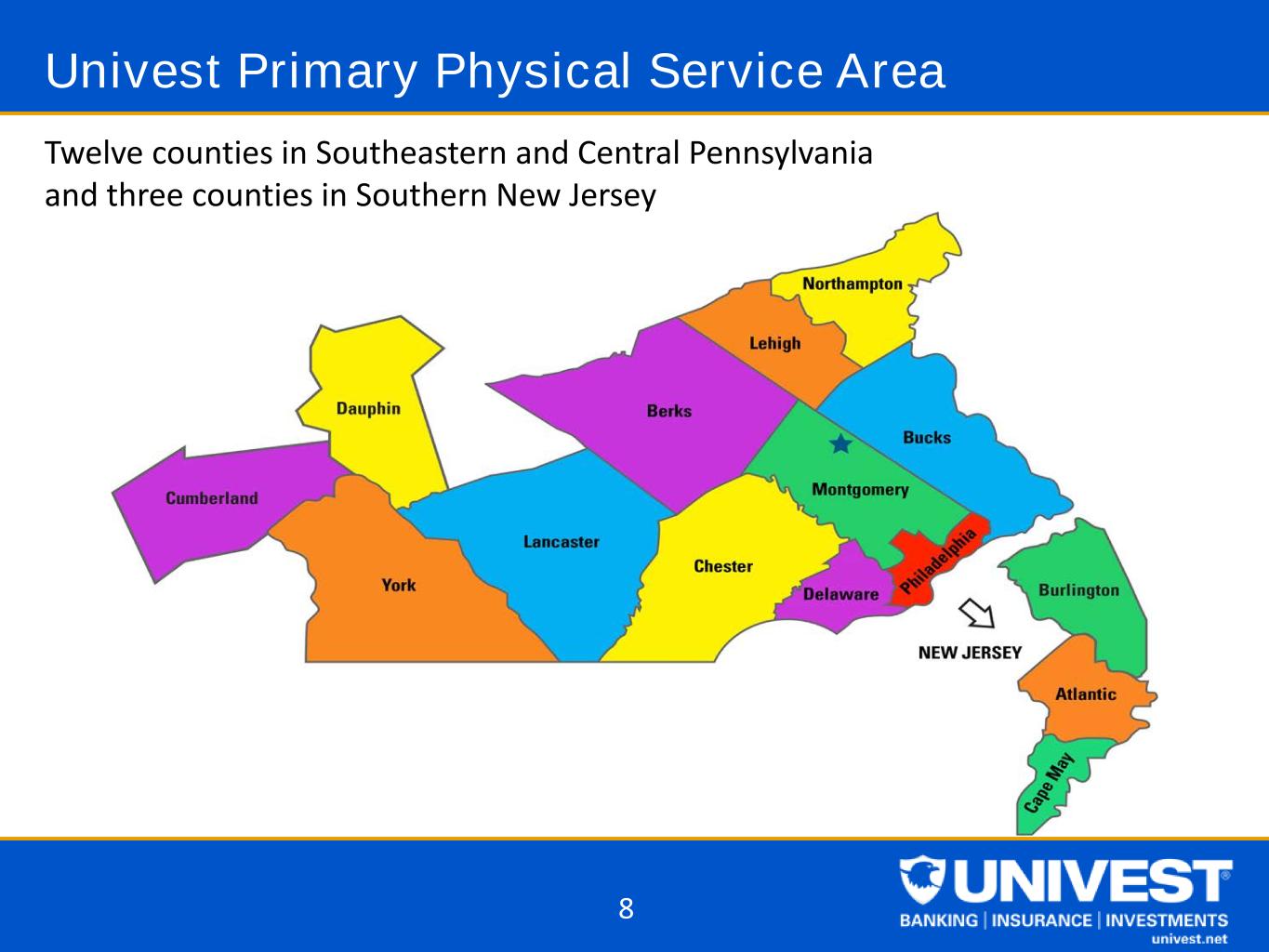

Univest Primary Physical Service Area Twelve counties in Southeastern and Central Pennsylvania and three counties in Southern New Jersey 8

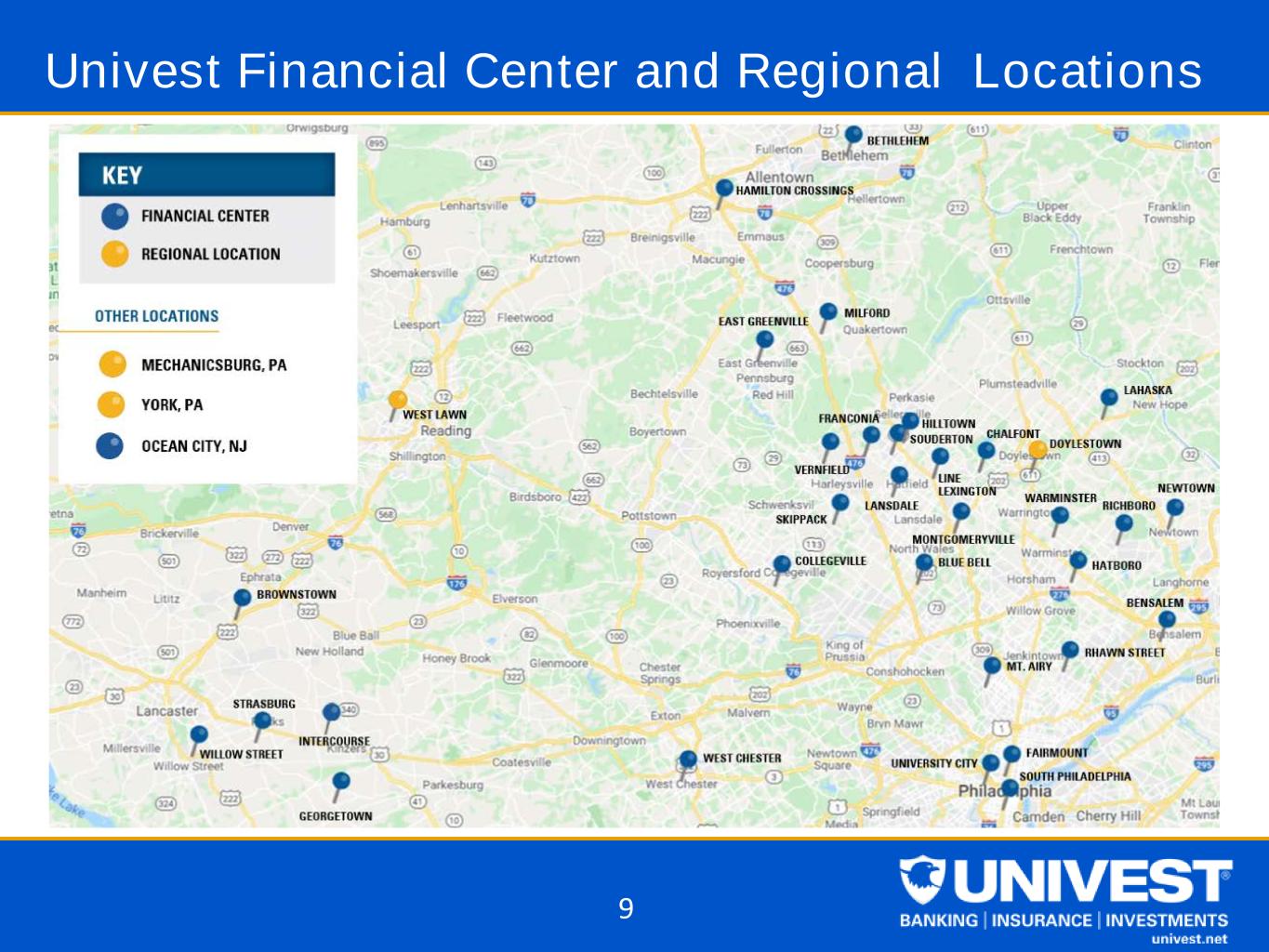

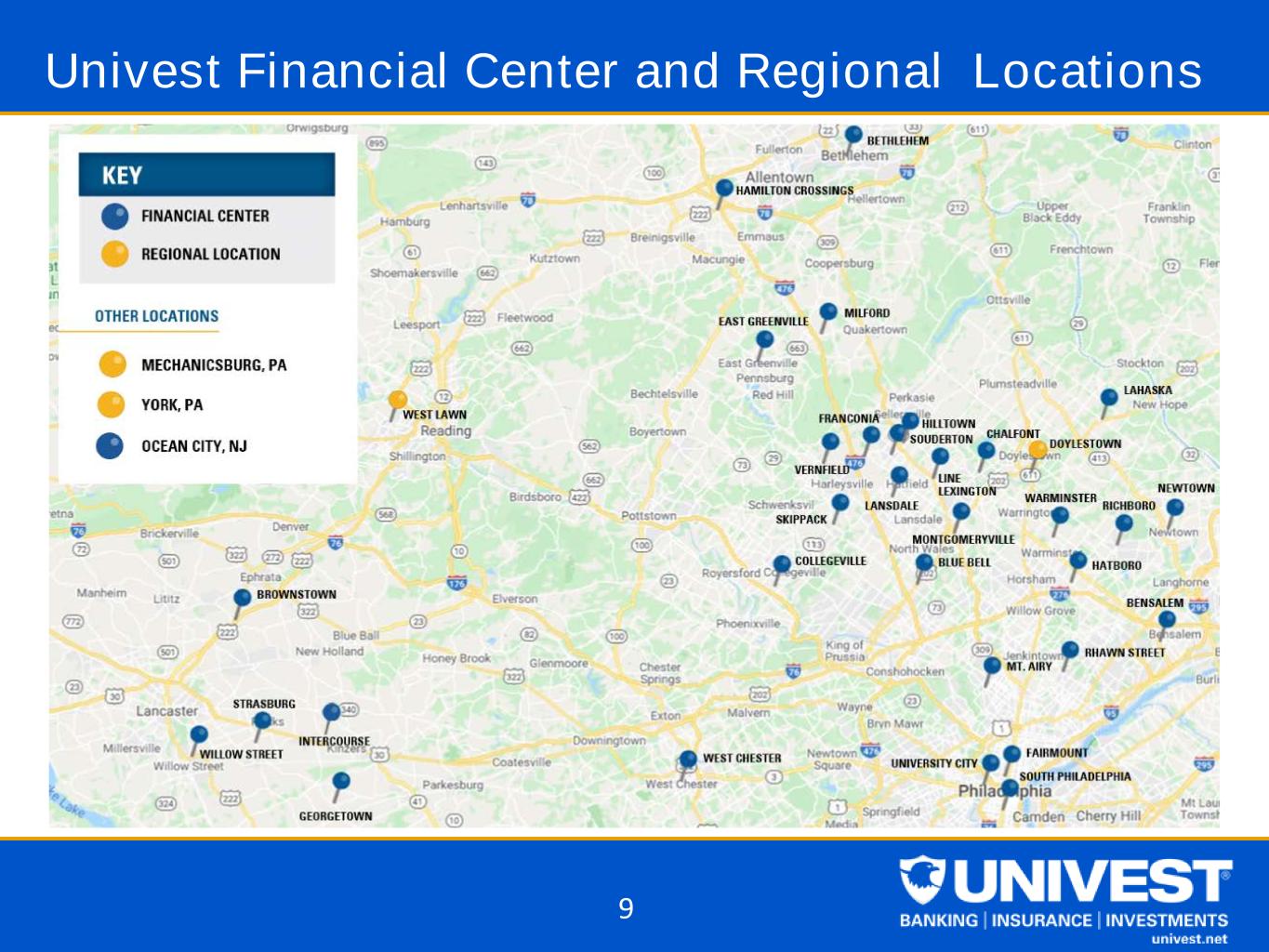

Univest Financial Center and Regional Locations 9

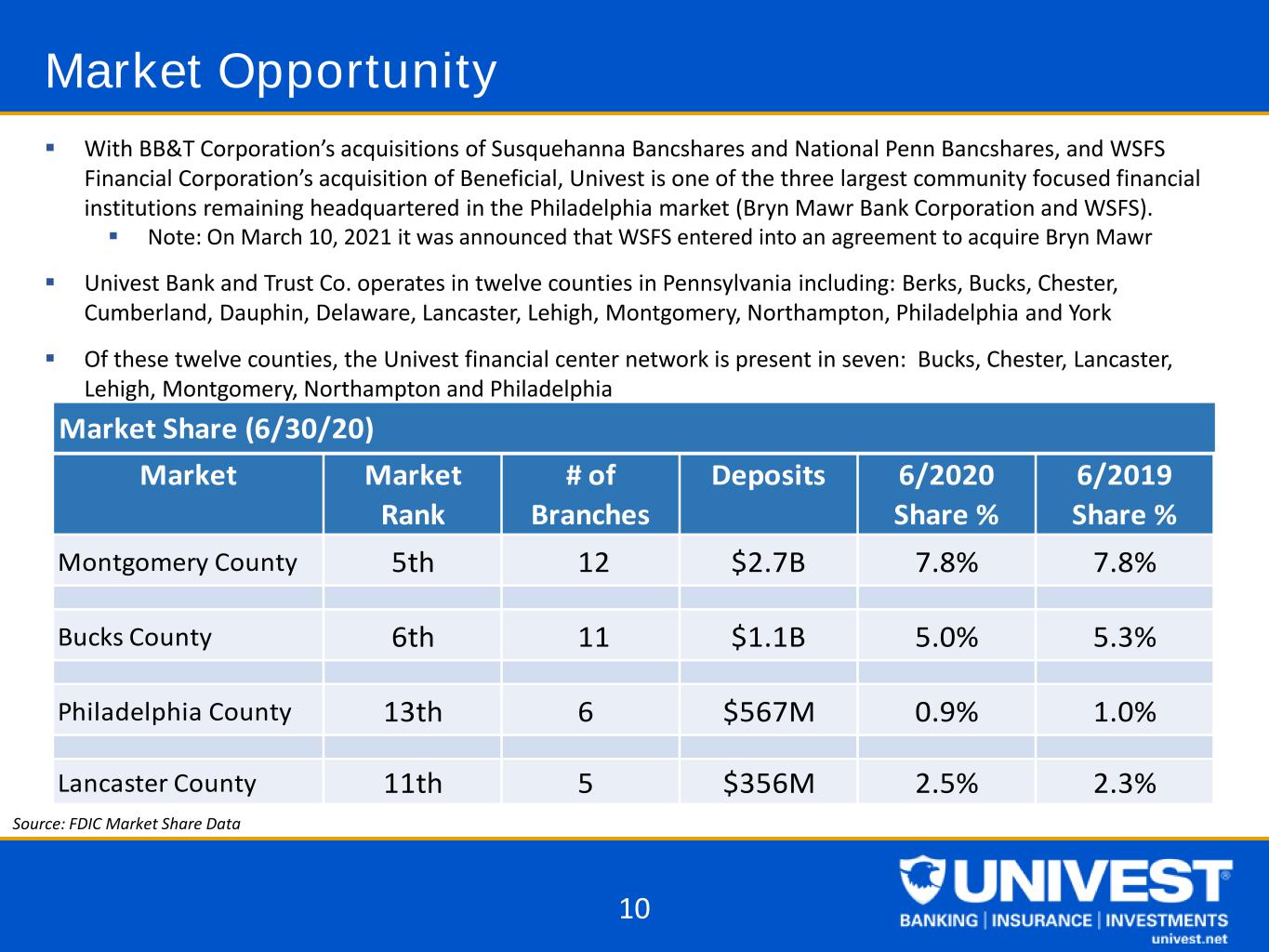

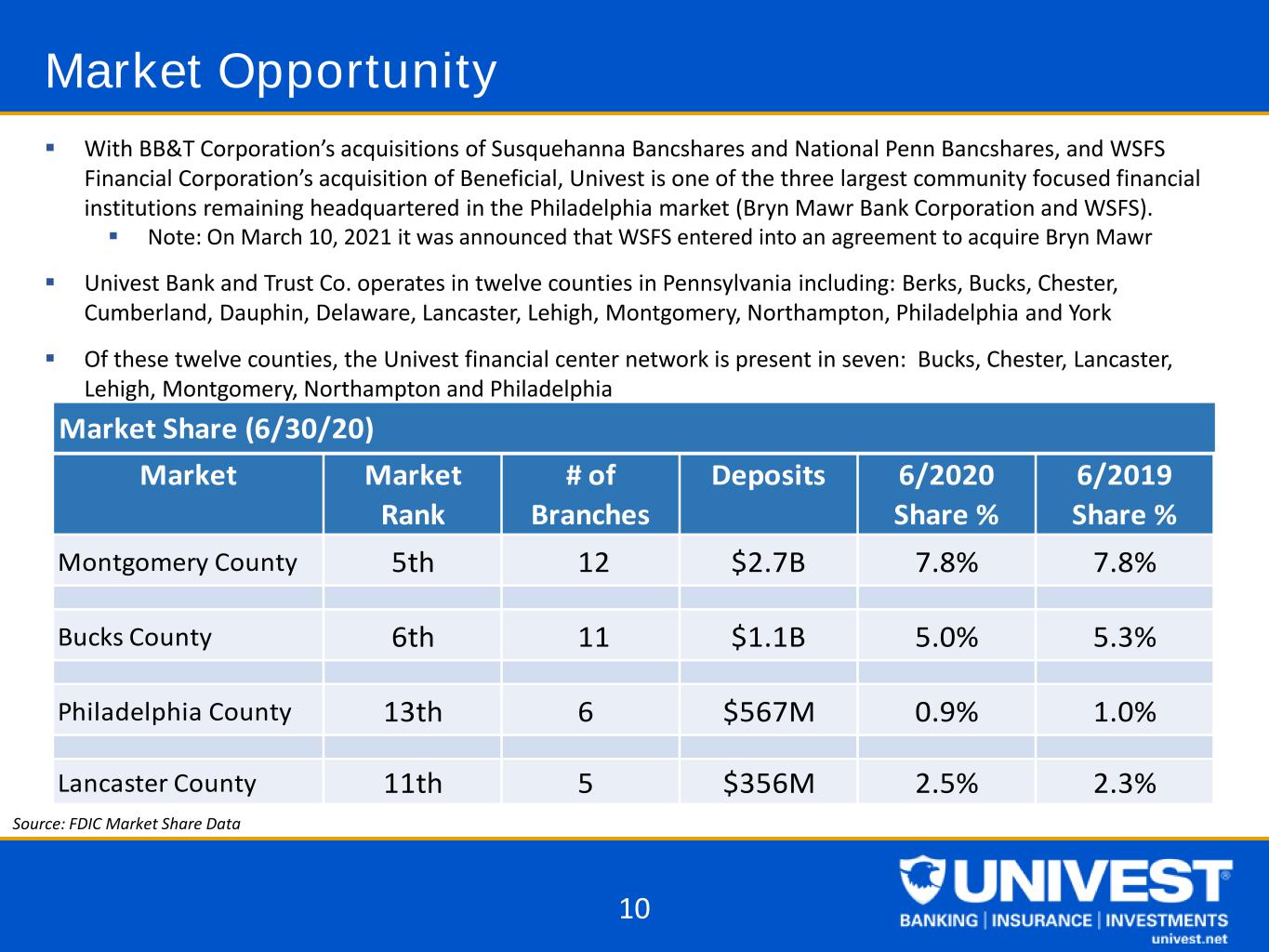

Market Opportunity With BB&T Corporation’s acquisitions of Susquehanna Bancshares and National Penn Bancshares, and WSFS Financial Corporation’s acquisition of Beneficial, Univest is one of the three largest community focused financial institutions remaining headquartered in the Philadelphia market (Bryn Mawr Bank Corporation and WSFS). Note: On March 10, 2021 it was announced that WSFS entered into an agreement to acquire Bryn Mawr Univest Bank and Trust Co. operates in twelve counties in Pennsylvania including: Berks, Bucks, Chester, Cumberland, Dauphin, Delaware, Lancaster, Lehigh, Montgomery, Northampton, Philadelphia and York Of these twelve counties, the Univest financial center network is present in seven: Bucks, Chester, Lancaster, Lehigh, Montgomery, Northampton and Philadelphia Source: FDIC Market Share Data 10 Market Market Rank # of Branches Deposits 6/2020 Share % 6/2019 Share % Montgomery County 5th 12 $2.7B 7.8% 7.8% Bucks County 6th 11 $1.1B 5.0% 5.3% Philadelphia County 13th 6 $567M 0.9% 1.0% Lancaster County 11th 5 $356M 2.5% 2.3% Market Share (6/30/20)

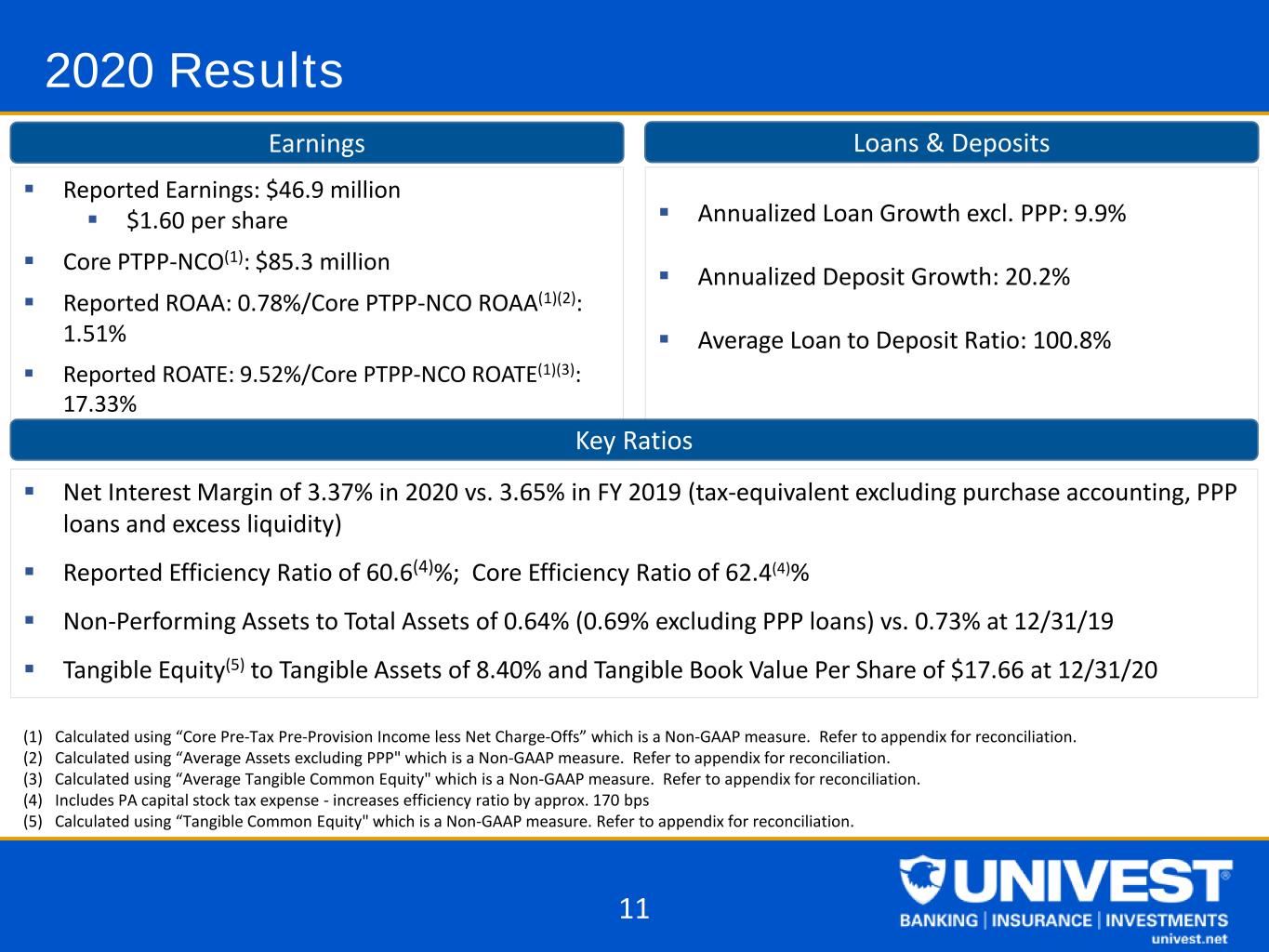

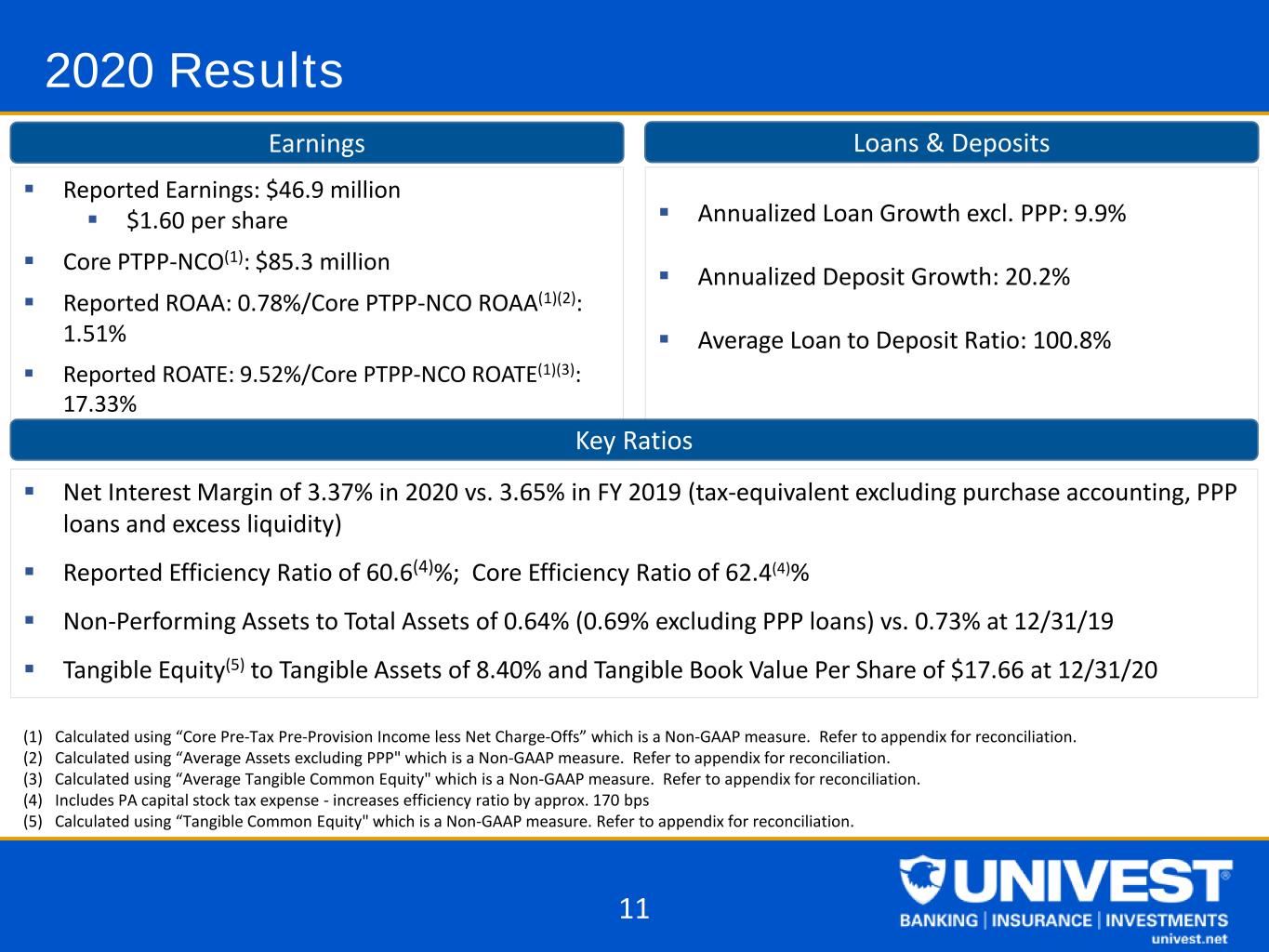

2020 Results Earnings Loans & Deposits Reported Earnings: $46.9 million $1.60 per share Core PTPP-NCO(1): $85.3 million Reported ROAA: 0.78%/Core PTPP-NCO ROAA(1)(2): 1.51% Reported ROATE: 9.52%/Core PTPP-NCO ROATE(1)(3): 17.33% Annualized Loan Growth excl. PPP: 9.9% Annualized Deposit Growth: 20.2% Average Loan to Deposit Ratio: 100.8% Key Ratios Net Interest Margin of 3.37% in 2020 vs. 3.65% in FY 2019 (tax-equivalent excluding purchase accounting, PPP loans and excess liquidity) Reported Efficiency Ratio of 60.6(4)%; Core Efficiency Ratio of 62.4(4)% Non-Performing Assets to Total Assets of 0.64% (0.69% excluding PPP loans) vs. 0.73% at 12/31/19 Tangible Equity(5) to Tangible Assets of 8.40% and Tangible Book Value Per Share of $17.66 at 12/31/20 (1) Calculated using “Core Pre-Tax Pre-Provision Income less Net Charge-Offs” which is a Non-GAAP measure. Refer to appendix for reconciliation. (2) Calculated using “Average Assets excluding PPP" which is a Non-GAAP measure. Refer to appendix for reconciliation. (3) Calculated using “Average Tangible Common Equity" which is a Non-GAAP measure. Refer to appendix for reconciliation. (4) Includes PA capital stock tax expense - increases efficiency ratio by approx. 170 bps (5) Calculated using “Tangible Common Equity" which is a Non-GAAP measure. Refer to appendix for reconciliation. 11

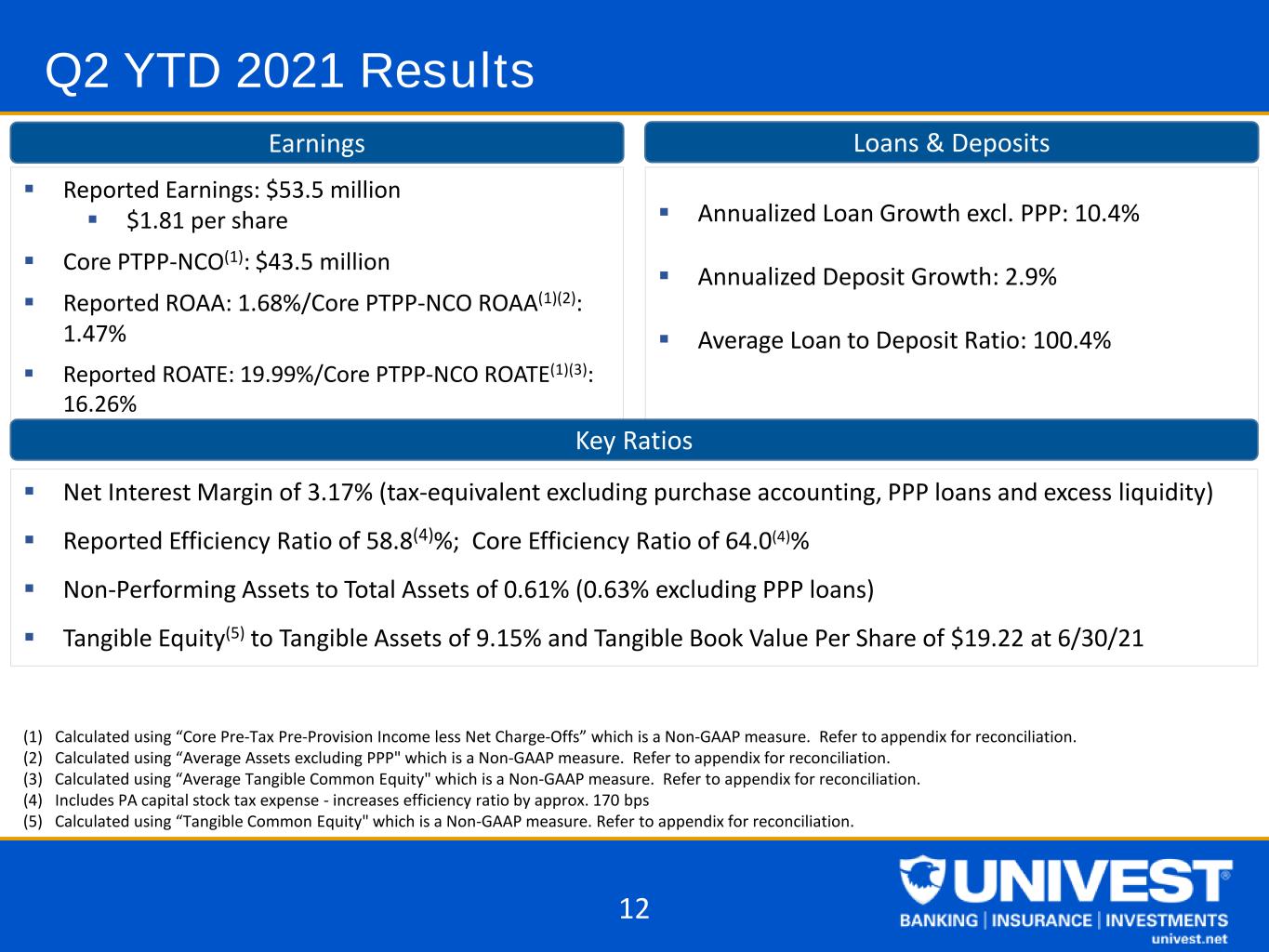

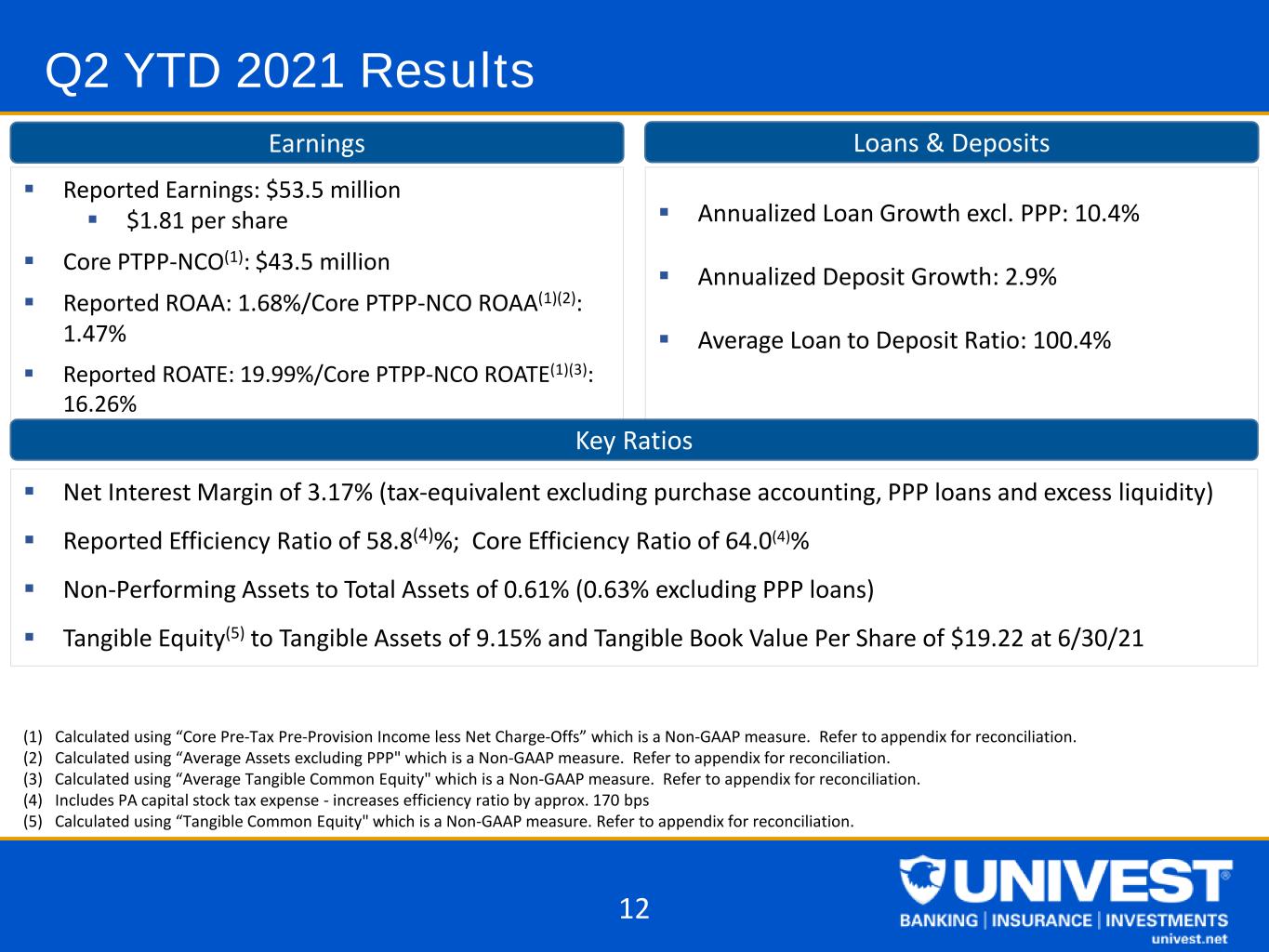

Q2 YTD 2021 Results Earnings Loans & Deposits Reported Earnings: $53.5 million $1.81 per share Core PTPP-NCO(1): $43.5 million Reported ROAA: 1.68%/Core PTPP-NCO ROAA(1)(2): 1.47% Reported ROATE: 19.99%/Core PTPP-NCO ROATE(1)(3): 16.26% Annualized Loan Growth excl. PPP: 10.4% Annualized Deposit Growth: 2.9% Average Loan to Deposit Ratio: 100.4% Key Ratios Net Interest Margin of 3.17% (tax-equivalent excluding purchase accounting, PPP loans and excess liquidity) Reported Efficiency Ratio of 58.8(4)%; Core Efficiency Ratio of 64.0(4)% Non-Performing Assets to Total Assets of 0.61% (0.63% excluding PPP loans) Tangible Equity(5) to Tangible Assets of 9.15% and Tangible Book Value Per Share of $19.22 at 6/30/21 (1) Calculated using “Core Pre-Tax Pre-Provision Income less Net Charge-Offs” which is a Non-GAAP measure. Refer to appendix for reconciliation. (2) Calculated using “Average Assets excluding PPP" which is a Non-GAAP measure. Refer to appendix for reconciliation. (3) Calculated using “Average Tangible Common Equity" which is a Non-GAAP measure. Refer to appendix for reconciliation. (4) Includes PA capital stock tax expense - increases efficiency ratio by approx. 170 bps (5) Calculated using “Tangible Common Equity" which is a Non-GAAP measure. Refer to appendix for reconciliation. 12

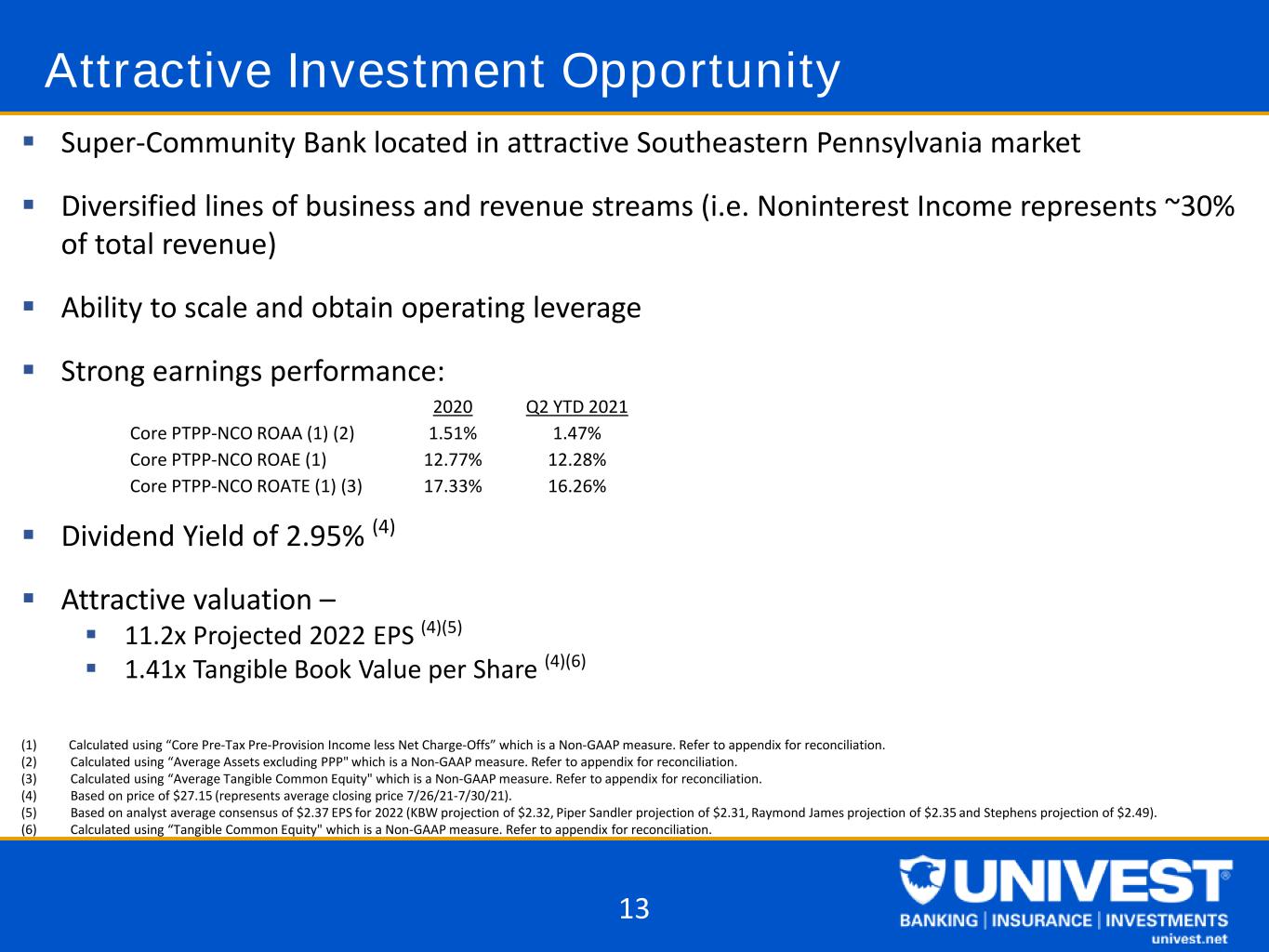

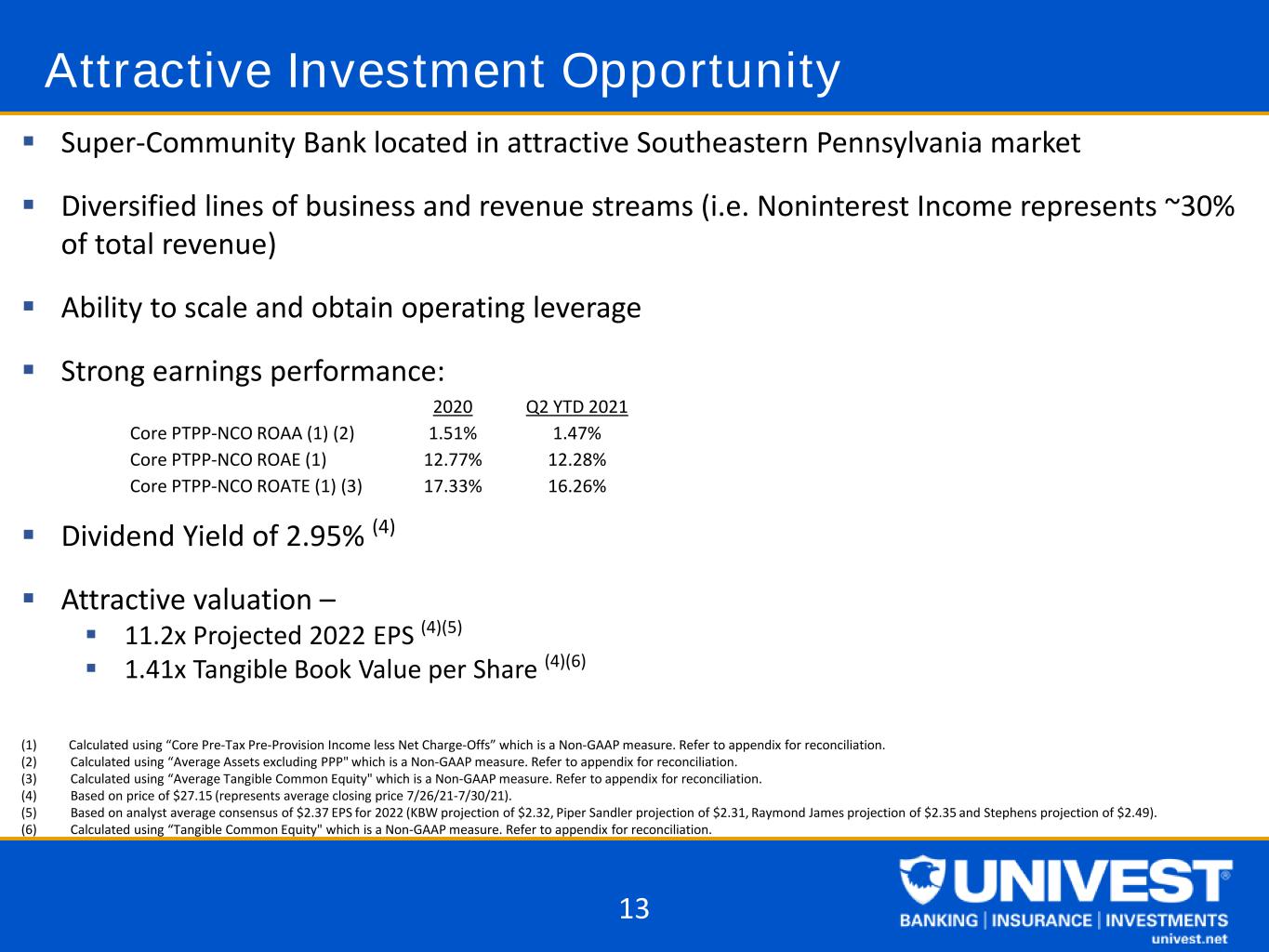

Super-Community Bank located in attractive Southeastern Pennsylvania market Diversified lines of business and revenue streams (i.e. Noninterest Income represents ~30% of total revenue) Ability to scale and obtain operating leverage Strong earnings performance: Dividend Yield of 2.95% (4) Attractive valuation – 11.2x Projected 2022 EPS (4)(5) 1.41x Tangible Book Value per Share (4)(6) (1) Calculated using “Core Pre-Tax Pre-Provision Income less Net Charge-Offs” which is a Non-GAAP measure. Refer to appendix for reconciliation. (2) Calculated using “Average Assets excluding PPP" which is a Non-GAAP measure. Refer to appendix for reconciliation. (3) Calculated using “Average Tangible Common Equity" which is a Non-GAAP measure. Refer to appendix for reconciliation. (4) Based on price of $27.15 (represents average closing price 7/26/21-7/30/21). (5) Based on analyst average consensus of $2.37 EPS for 2022 (KBW projection of $2.32, Piper Sandler projection of $2.31, Raymond James projection of $2.35 and Stephens projection of $2.49). (6) Calculated using “Tangible Common Equity" which is a Non-GAAP measure. Refer to appendix for reconciliation. Attractive Investment Opportunity 13 2020 Q2 YTD 2021 Core PTPP-NCO ROAA (1) (2) 1.51% 1.47% Core PTPP-NCO ROAE (1) 12.77% 12.28% Core PTPP-NCO ROATE (1) (3) 17.33% 16.26%

2021 Strategy Expand and Optimize the Capabilities of Univest: • Further develop digital lending and deposit solutions for small businesses and consumers Develop and execute on a Strategic Plan around Diversity, Equity, and Inclusion Grow Top Line Revenue: • Continue to identify strategies to increase the growth trajectory of non-interest lines of business • Optimize balance sheet to effectively manage excess liquidity and net interest margin Maximize Efficiency & Manage Costs: • Continue to improve long-term operating leverage • Execute previously announced financial center optimization plan 14

SUMMARY FINANCIAL HIGHLIGHTS

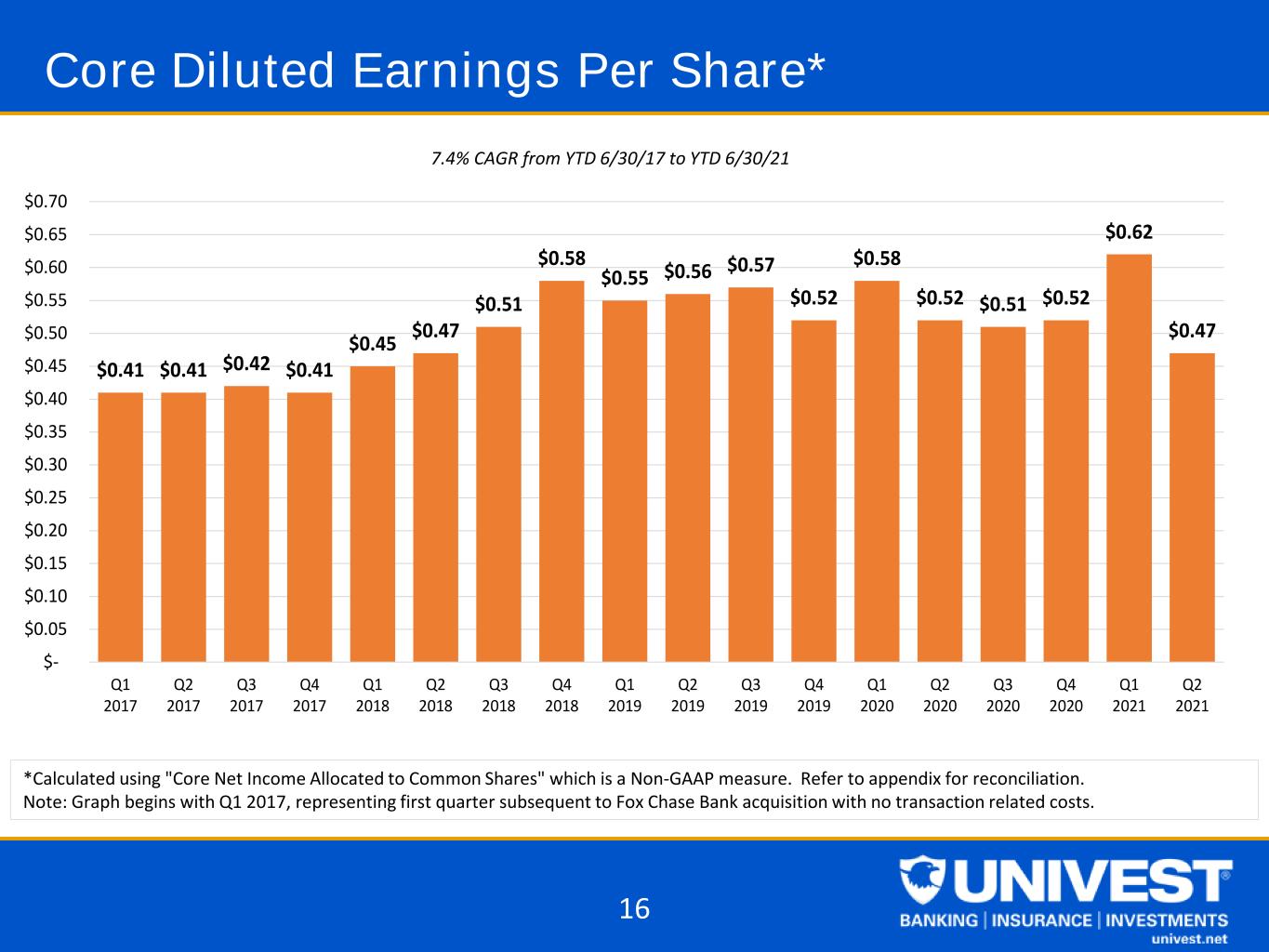

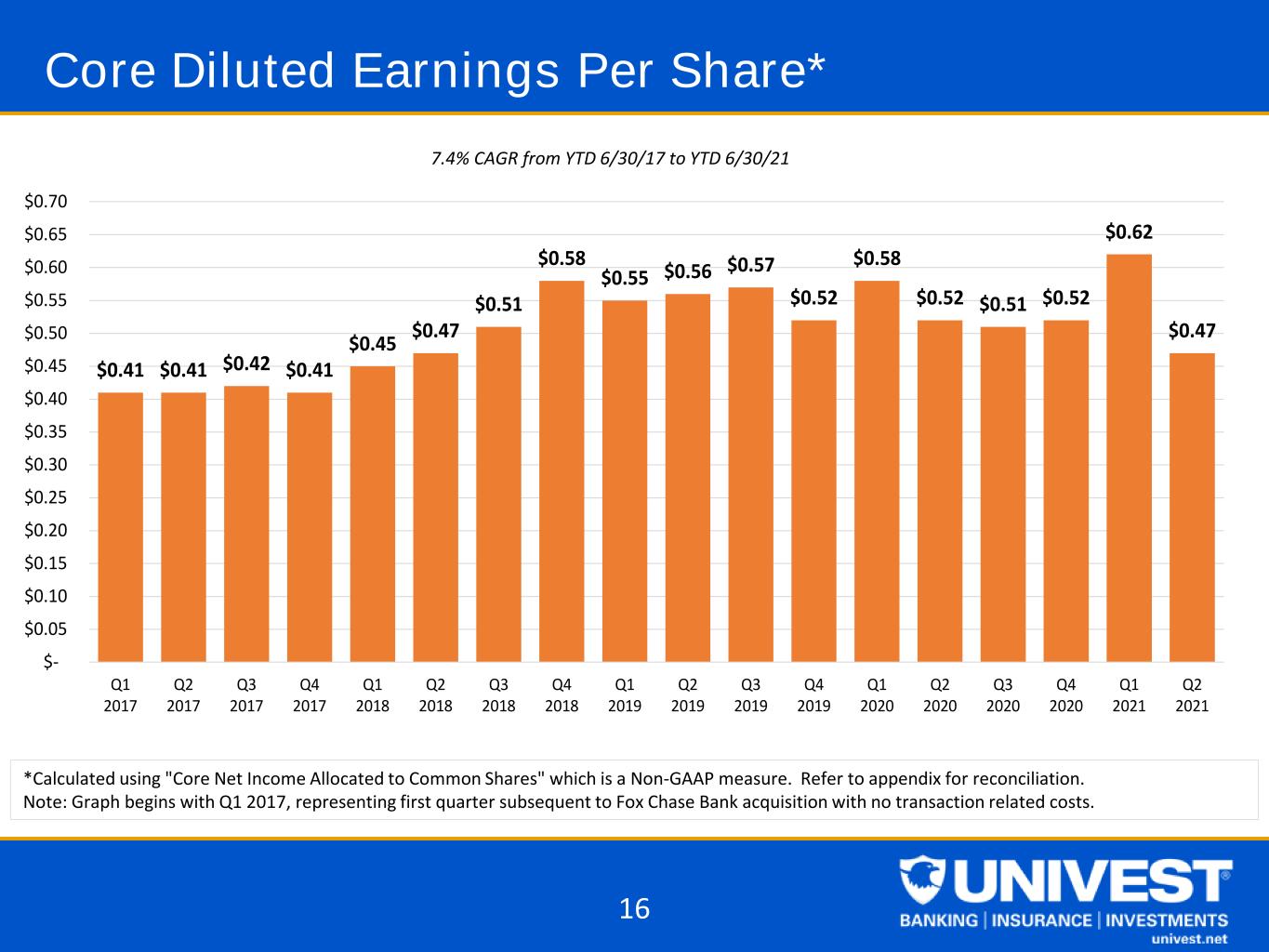

Core Diluted Earnings Per Share* *Calculated using "Core Net Income Allocated to Common Shares" which is a Non-GAAP measure. Refer to appendix for reconciliation. Note: Graph begins with Q1 2017, representing first quarter subsequent to Fox Chase Bank acquisition with no transaction related costs. 7.4% CAGR from YTD 6/30/17 to YTD 6/30/21 16 $0.41 $0.41 $0.42 $0.41 $0.45 $0.47 $0.51 $0.58 $0.55 $0.56 $0.57 $0.52 $0.58 $0.52 $0.51 $0.52 $0.62 $0.47 $- $0.05 $0.10 $0.15 $0.20 $0.25 $0.30 $0.35 $0.40 $0.45 $0.50 $0.55 $0.60 $0.65 $0.70 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021

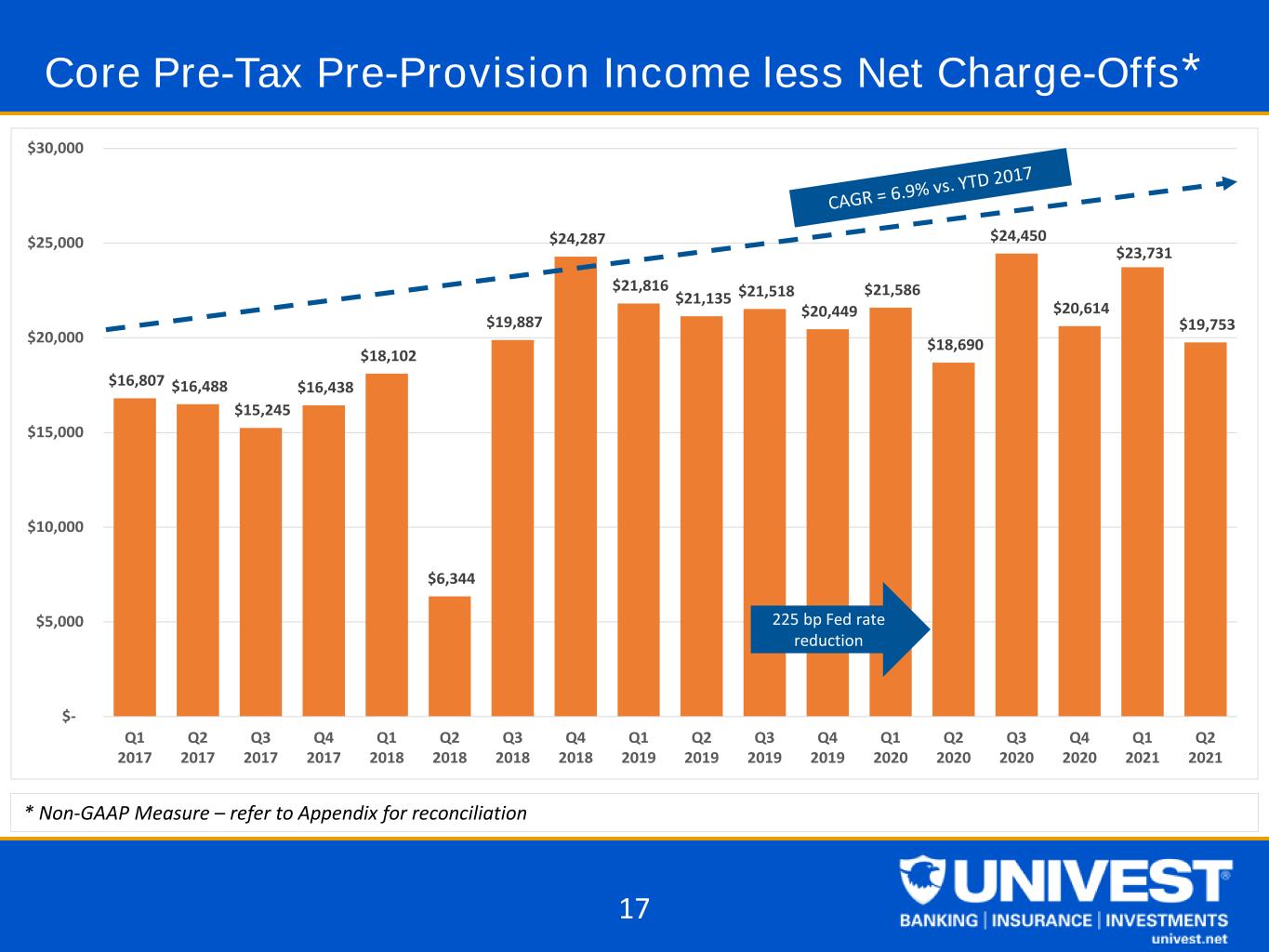

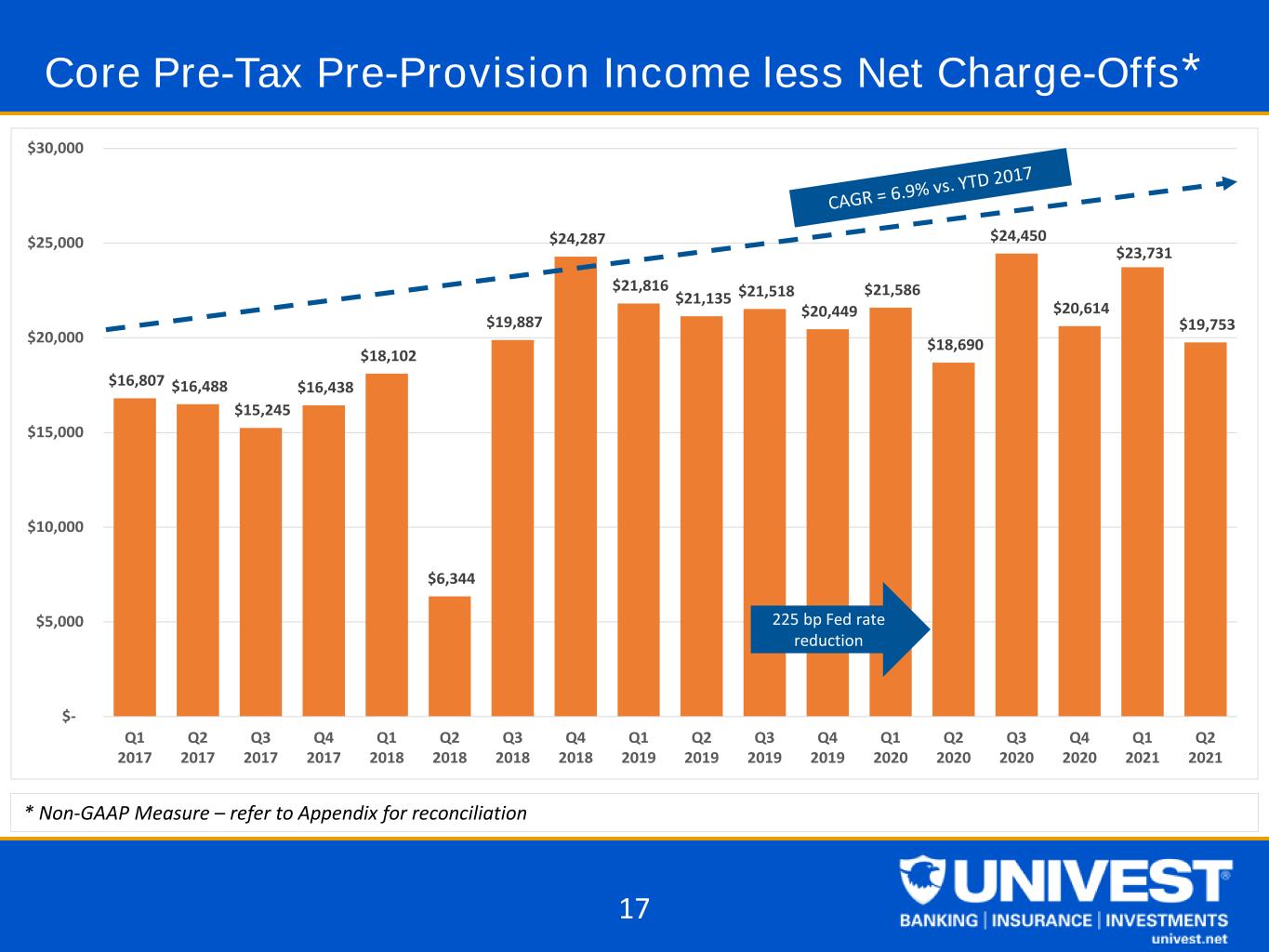

$16,807 $16,488 $15,245 $16,438 $18,102 $6,344 $19,887 $24,287 $21,816 $21,135 $21,518 $20,449 $21,586 $18,690 $24,450 $20,614 $23,731 $19,753 $- $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Core Pre-Tax Pre-Provision Income less Net Charge-Offs* * Non-GAAP Measure – refer to Appendix for reconciliation 225 bp Fed rate reduction 17

Tangible Book Value Per Share* *Calculated using "Tangible Common Equity" which is a Non-GAAP measure. Refer to appendix for reconciliation. (1) Assumes no Wealth Management or Insurance acquisitions. Target 8-10% Annual Growth(1) Benefit of 12/2017 Capital Raise = $1.21 18 $14.44

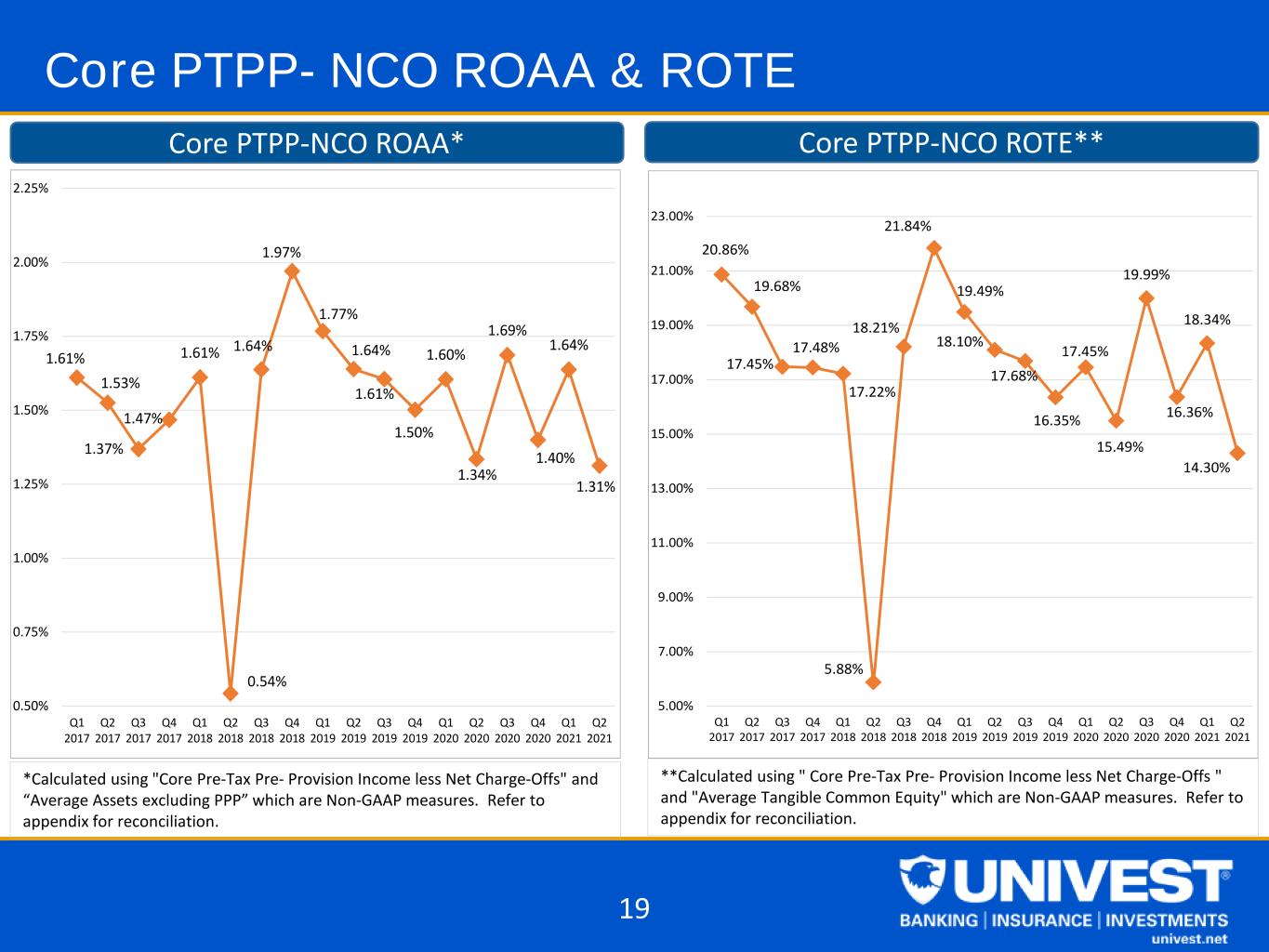

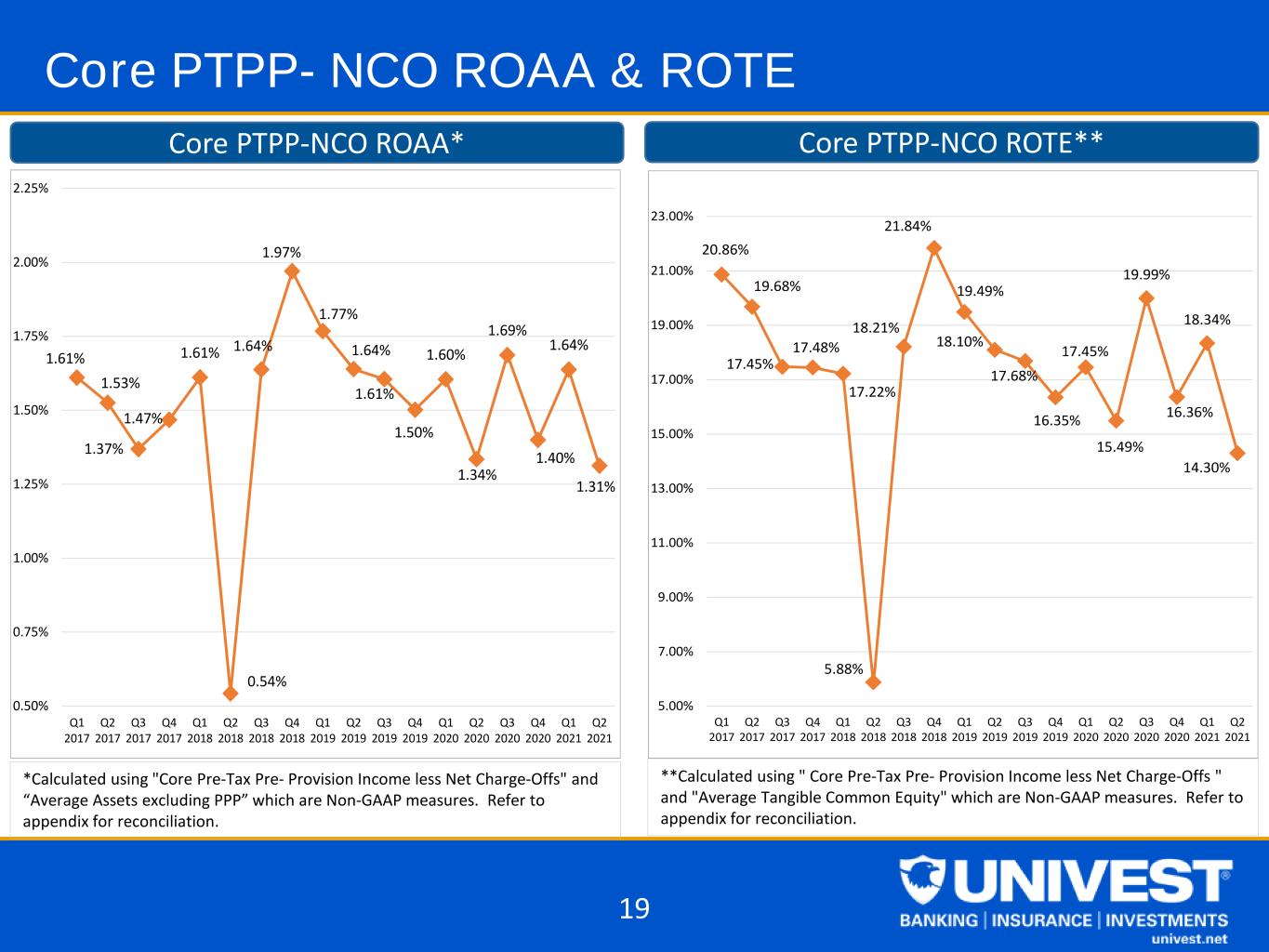

Core PTPP- NCO ROAA & ROTE *Calculated using "Core Pre-Tax Pre- Provision Income less Net Charge-Offs" and “Average Assets excluding PPP” which are Non-GAAP measures. Refer to appendix for reconciliation. **Calculated using " Core Pre-Tax Pre- Provision Income less Net Charge-Offs " and "Average Tangible Common Equity" which are Non-GAAP measures. Refer to appendix for reconciliation. Core PTPP-NCO ROAA* Core PTPP-NCO ROTE** 19 1.61% 1.53% 1.37% 1.47% 1.61% 0.54% 1.64% 1.97% 1.77% 1.64% 1.61% 1.50% 1.60% 1.34% 1.69% 1.40% 1.64% 1.31% 0.50% 0.75% 1.00% 1.25% 1.50% 1.75% 2.00% 2.25% Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 20.86% 19.68% 17.48% 17.45% 17.22% 5.88% 18.21% 21.84% 19.49% 18.10% 17.68% 16.35% 17.45% 15.49% 19.99% 16.36% 18.34% 14.30% 5.00% 7.00% 9.00% 11.00% 13.00% 15.00% 17.00% 19.00% 21.00% 23.00% Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021

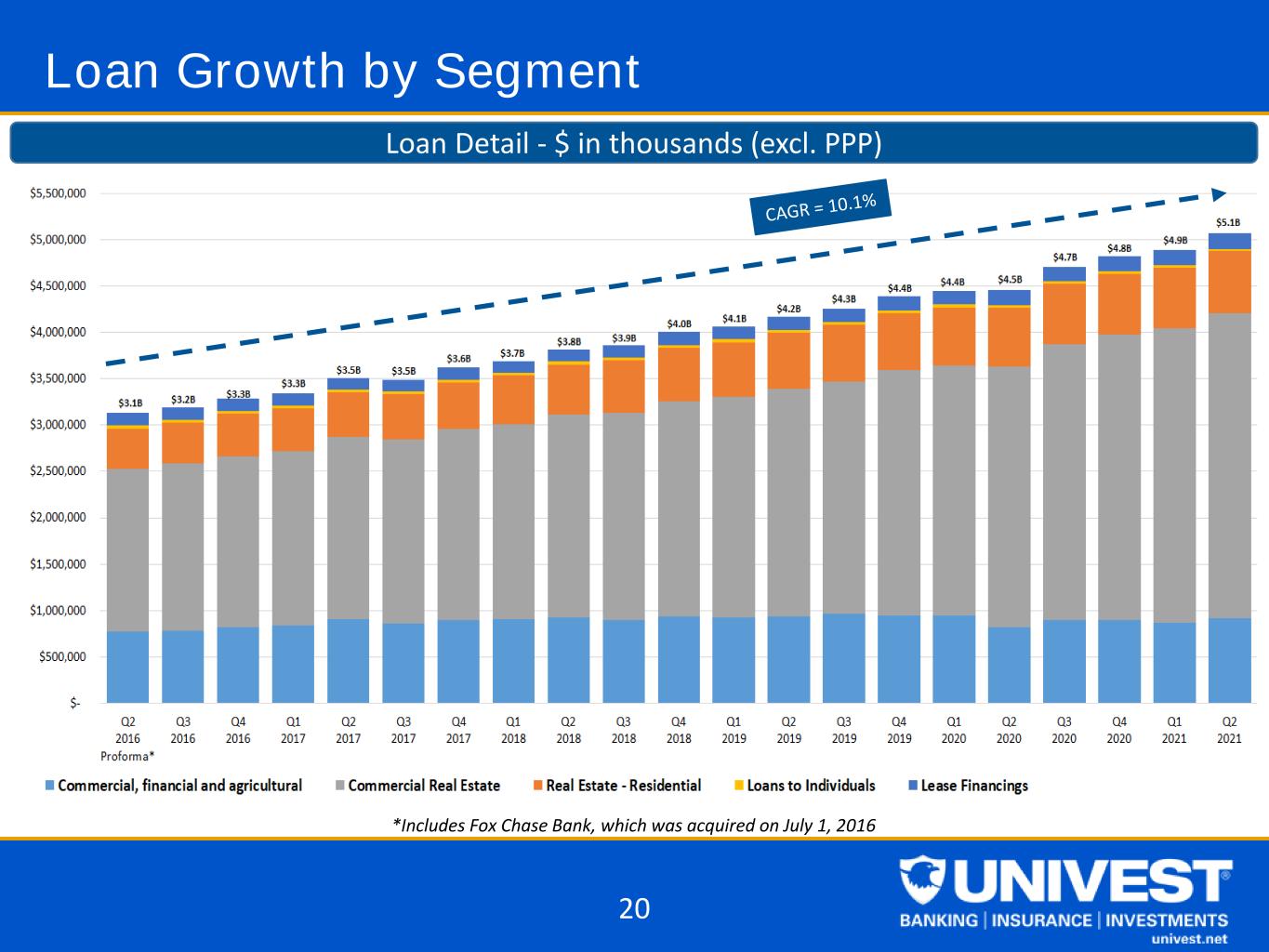

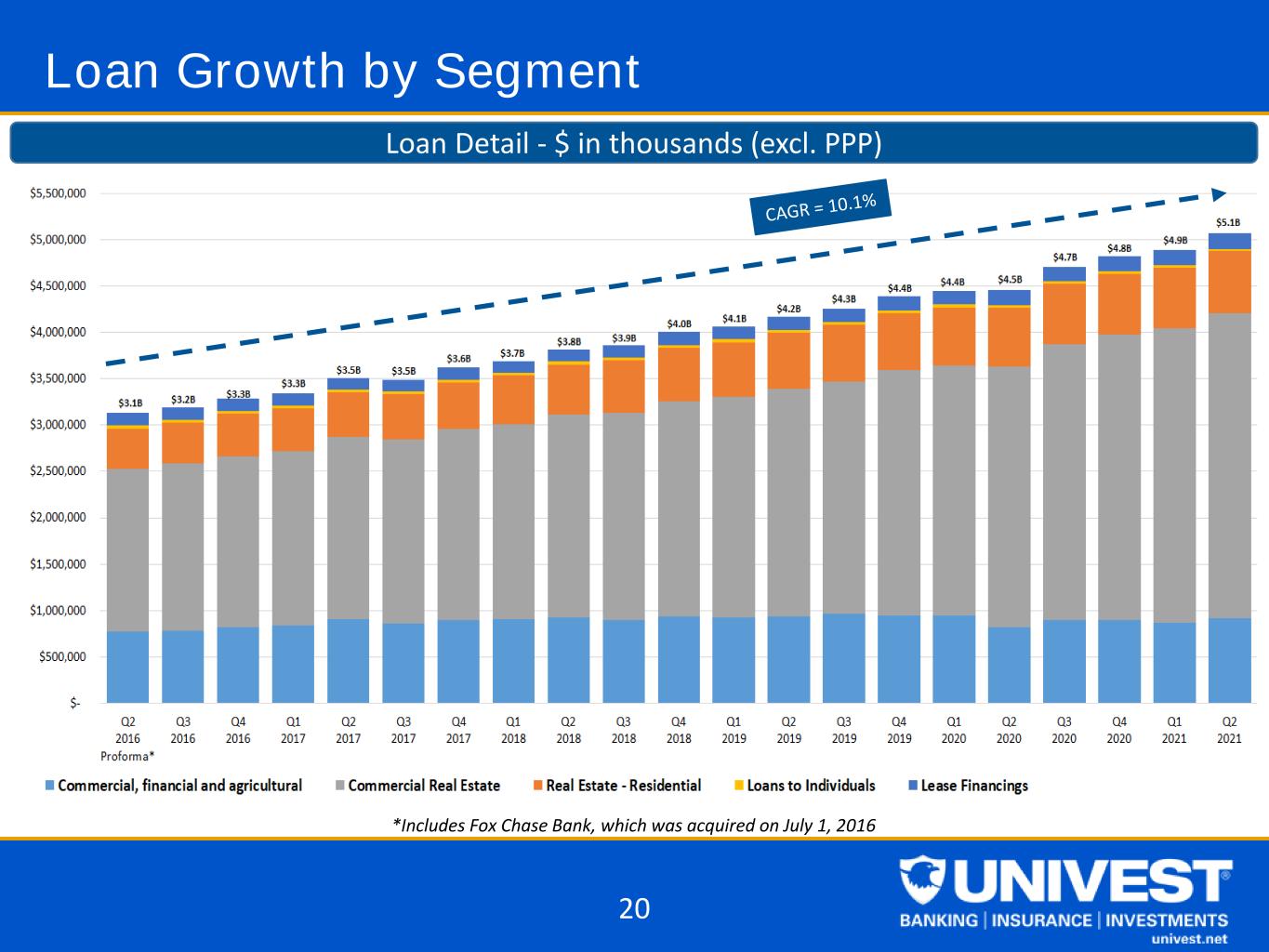

Loan Growth by Segment *Includes Fox Chase Bank, which was acquired on July 1, 2016 Loan Detail - $ in thousands (excl. PPP) 20

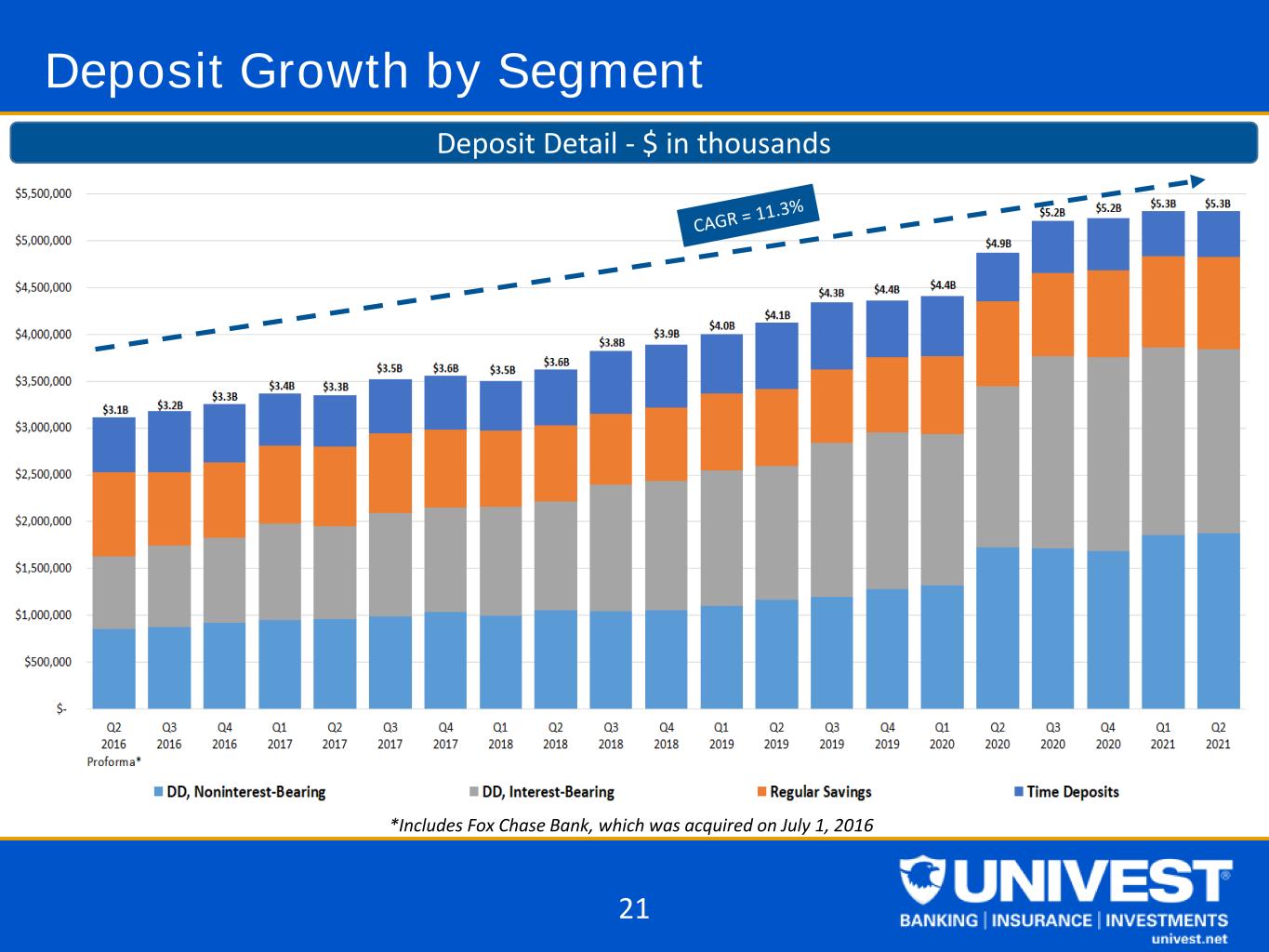

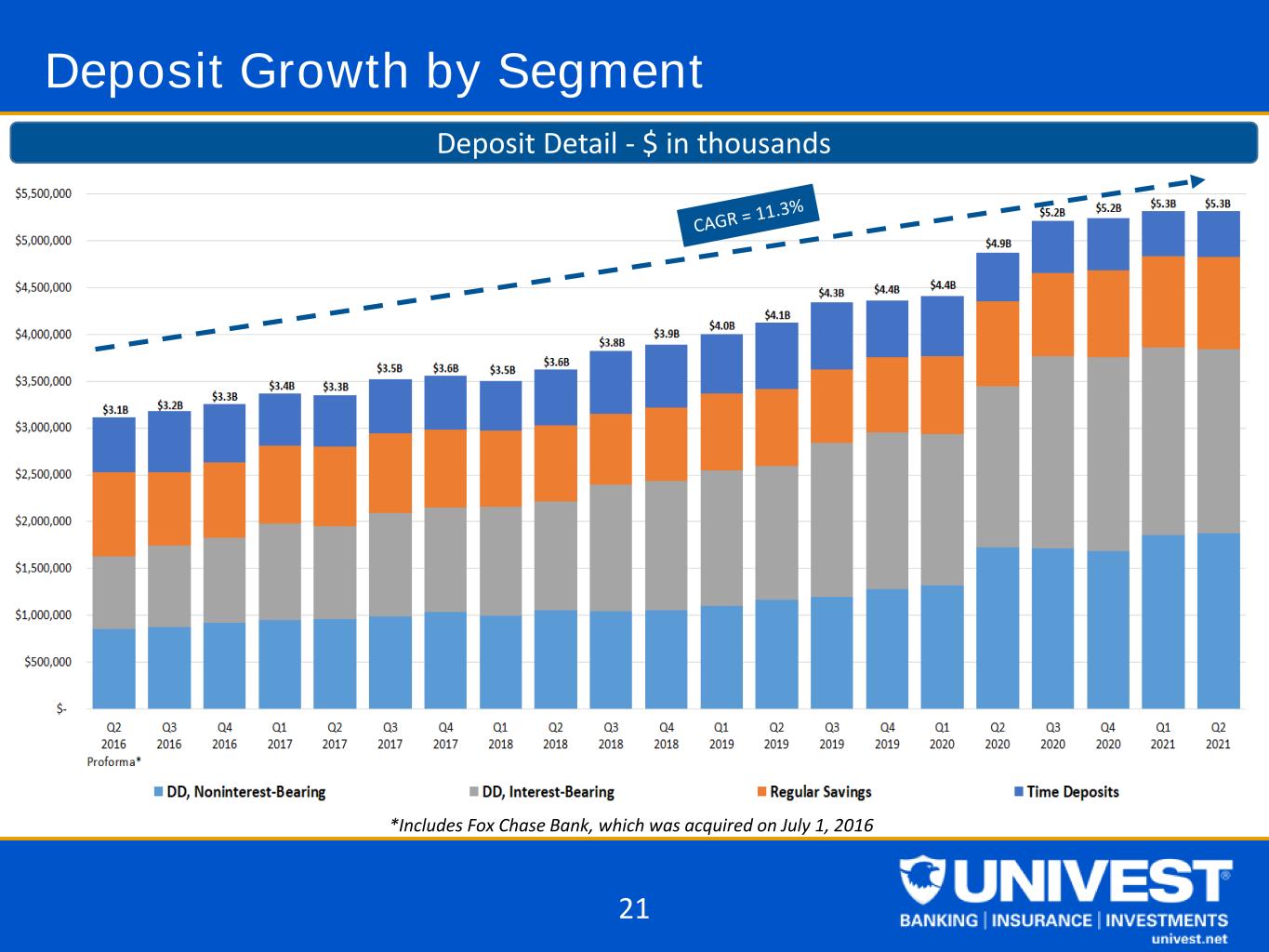

Deposit Growth by Segment *Includes Fox Chase Bank, which was acquired on July 1, 2016 Deposit Detail - $ in thousands 21

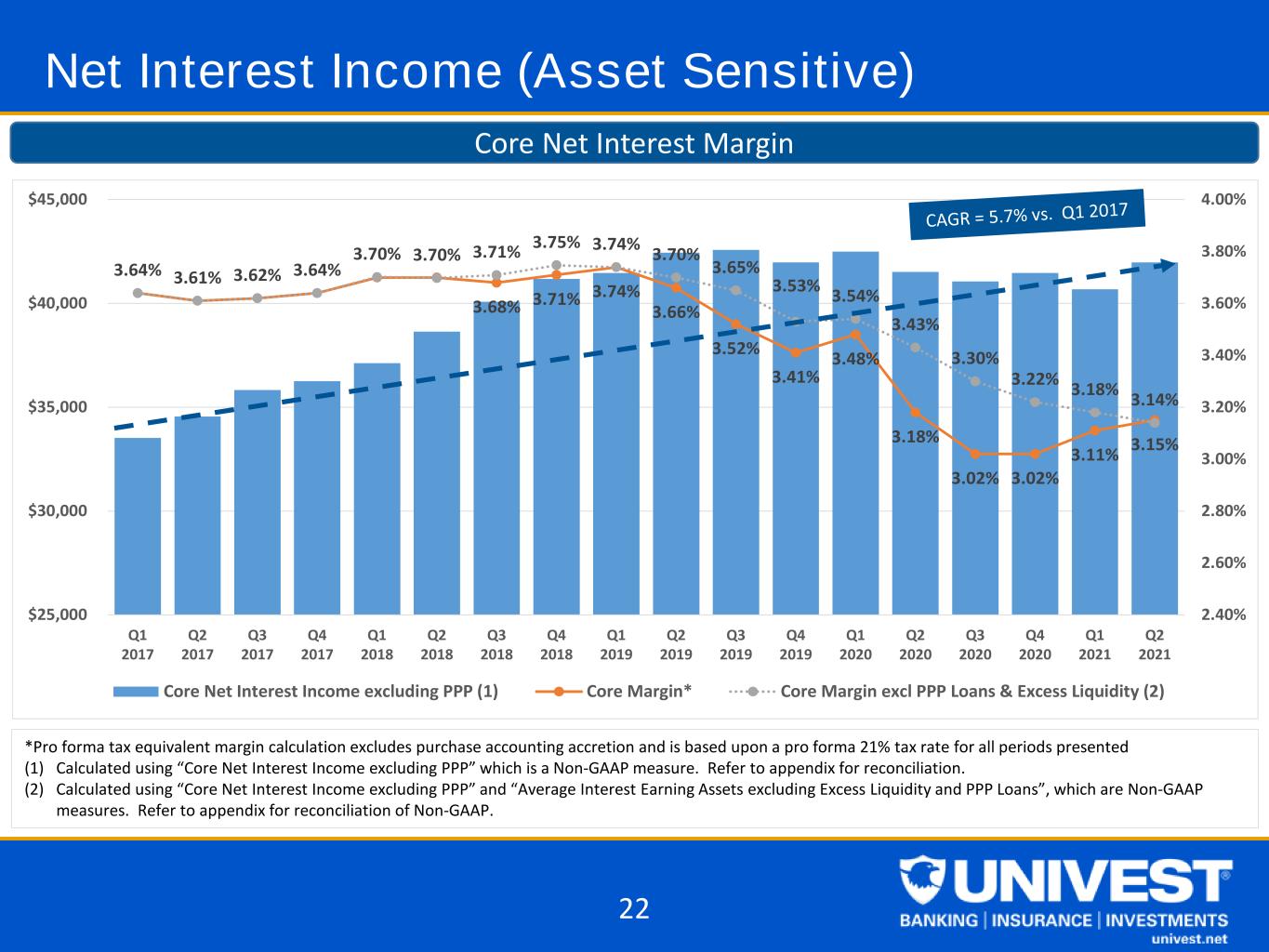

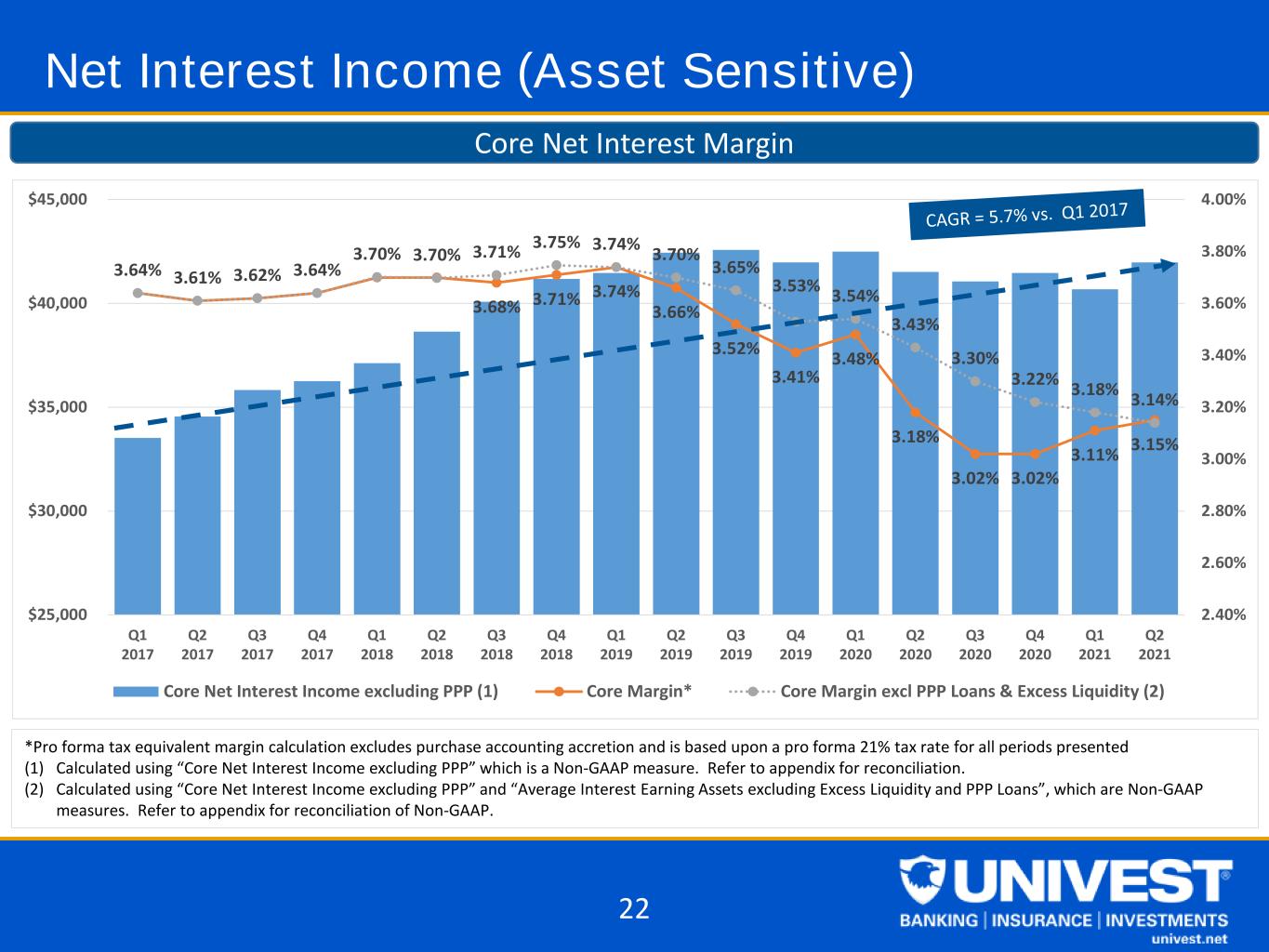

3.68% 3.71% 3.74% 3.66% 3.52% 3.41% 3.48% 3.18% 3.02% 3.02% 3.11% 3.15% 3.64% 3.61% 3.62% 3.64% 3.70% 3.70% 3.71% 3.75% 3.74% 3.70% 3.65% 3.53% 3.54% 3.43% 3.30% 3.22% 3.18% 3.14% 2.40% 2.60% 2.80% 3.00% 3.20% 3.40% 3.60% 3.80% 4.00% $25,000 $30,000 $35,000 $40,000 $45,000 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Core Net Interest Income excluding PPP (1) Core Margin* Core Margin excl PPP Loans & Excess Liquidity (2) Net Interest Income (Asset Sensitive) *Pro forma tax equivalent margin calculation excludes purchase accounting accretion and is based upon a pro forma 21% tax rate for all periods presented (1) Calculated using “Core Net Interest Income excluding PPP” which is a Non-GAAP measure. Refer to appendix for reconciliation. (2) Calculated using “Core Net Interest Income excluding PPP” and “Average Interest Earning Assets excluding Excess Liquidity and PPP Loans”, which are Non-GAAP measures. Refer to appendix for reconciliation of Non-GAAP. Core Net Interest Margin 22

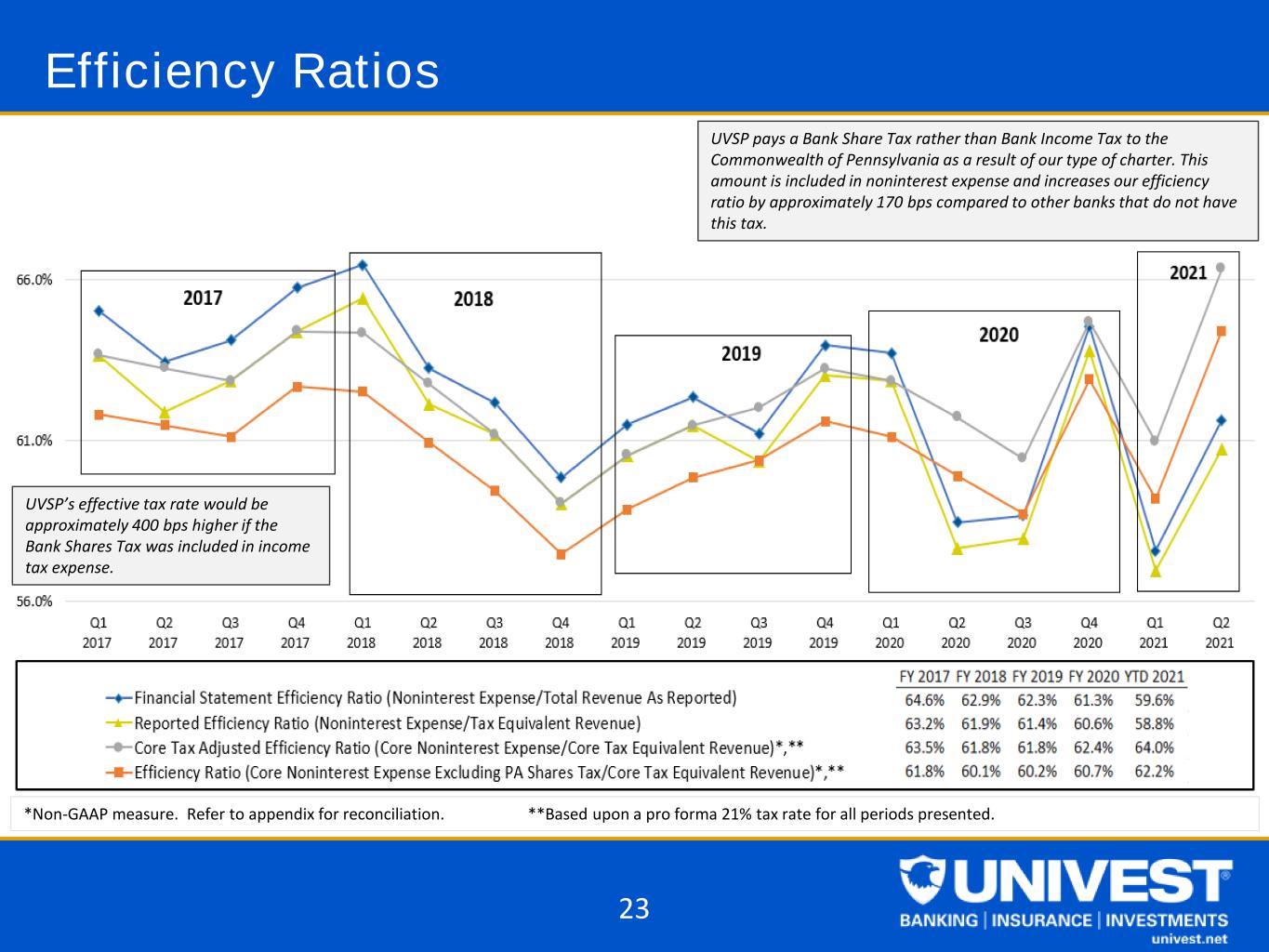

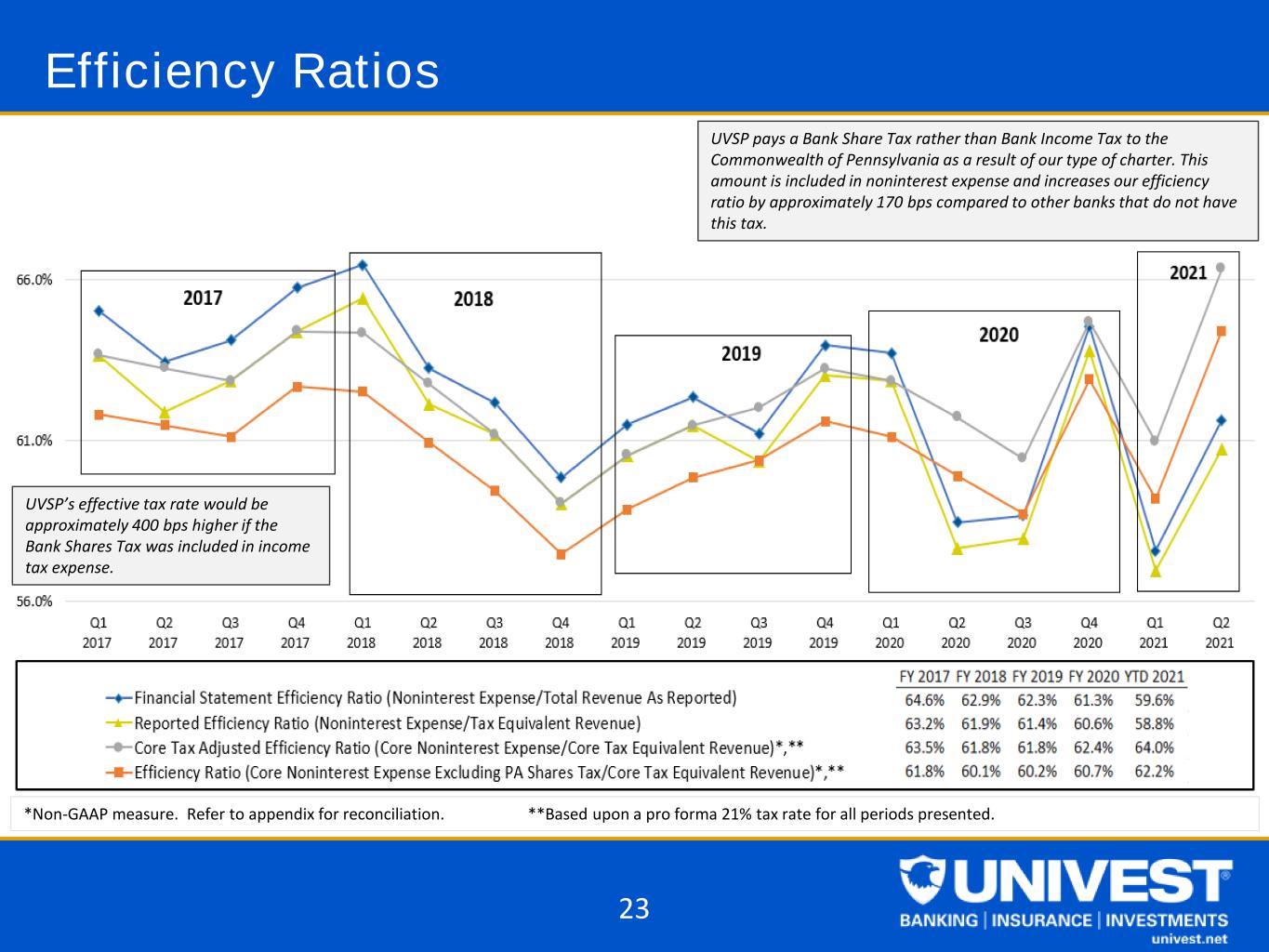

Efficiency Ratios UVSP pays a Bank Share Tax rather than Bank Income Tax to the Commonwealth of Pennsylvania as a result of our type of charter. This amount is included in noninterest expense and increases our efficiency ratio by approximately 170 bps compared to other banks that do not have this tax. UVSP’s effective tax rate would be approximately 400 bps higher if the Bank Shares Tax was included in income tax expense. *Non-GAAP measure. Refer to appendix for reconciliation. **Based upon a pro forma 21% tax rate for all periods presented. 23

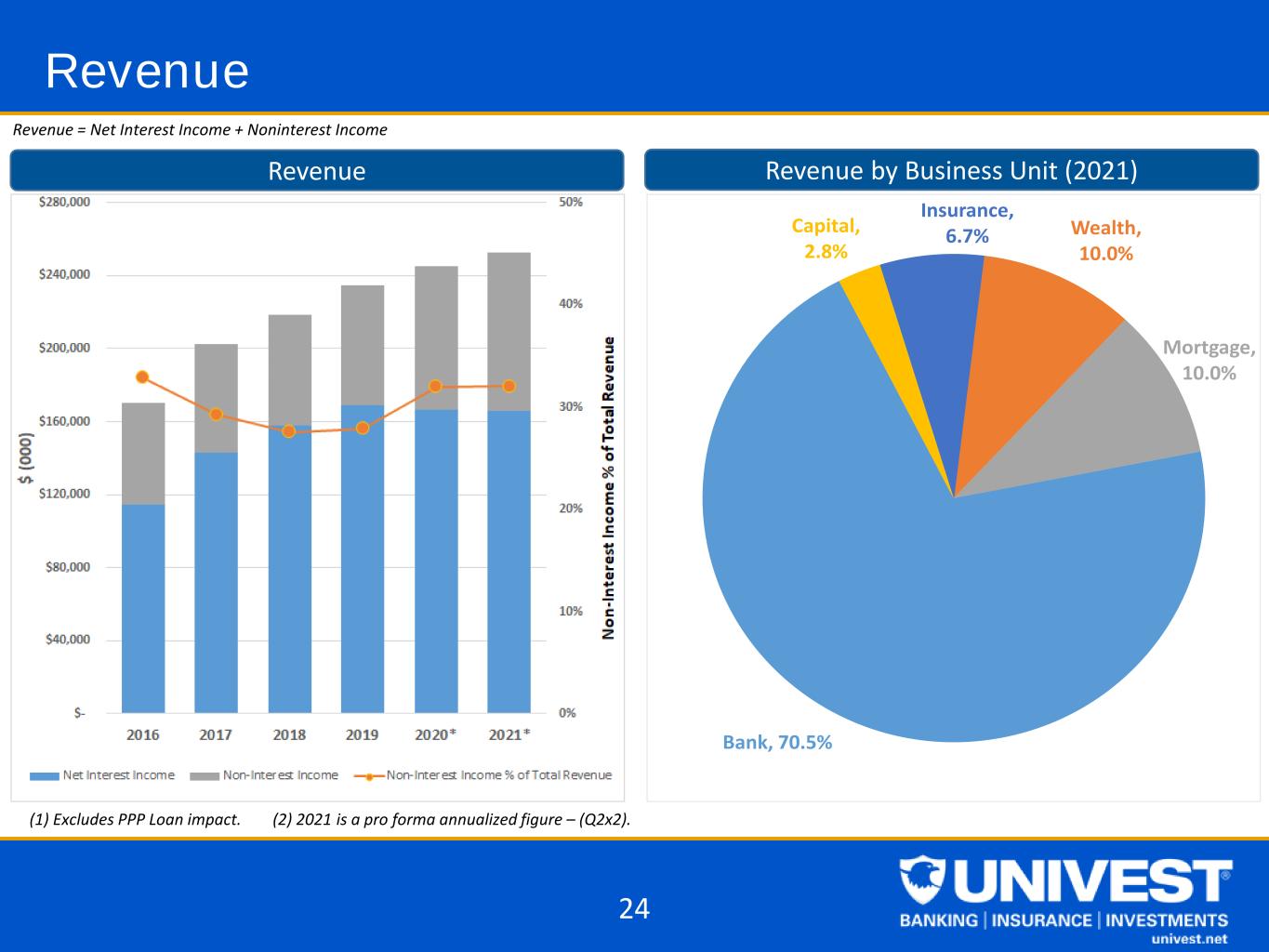

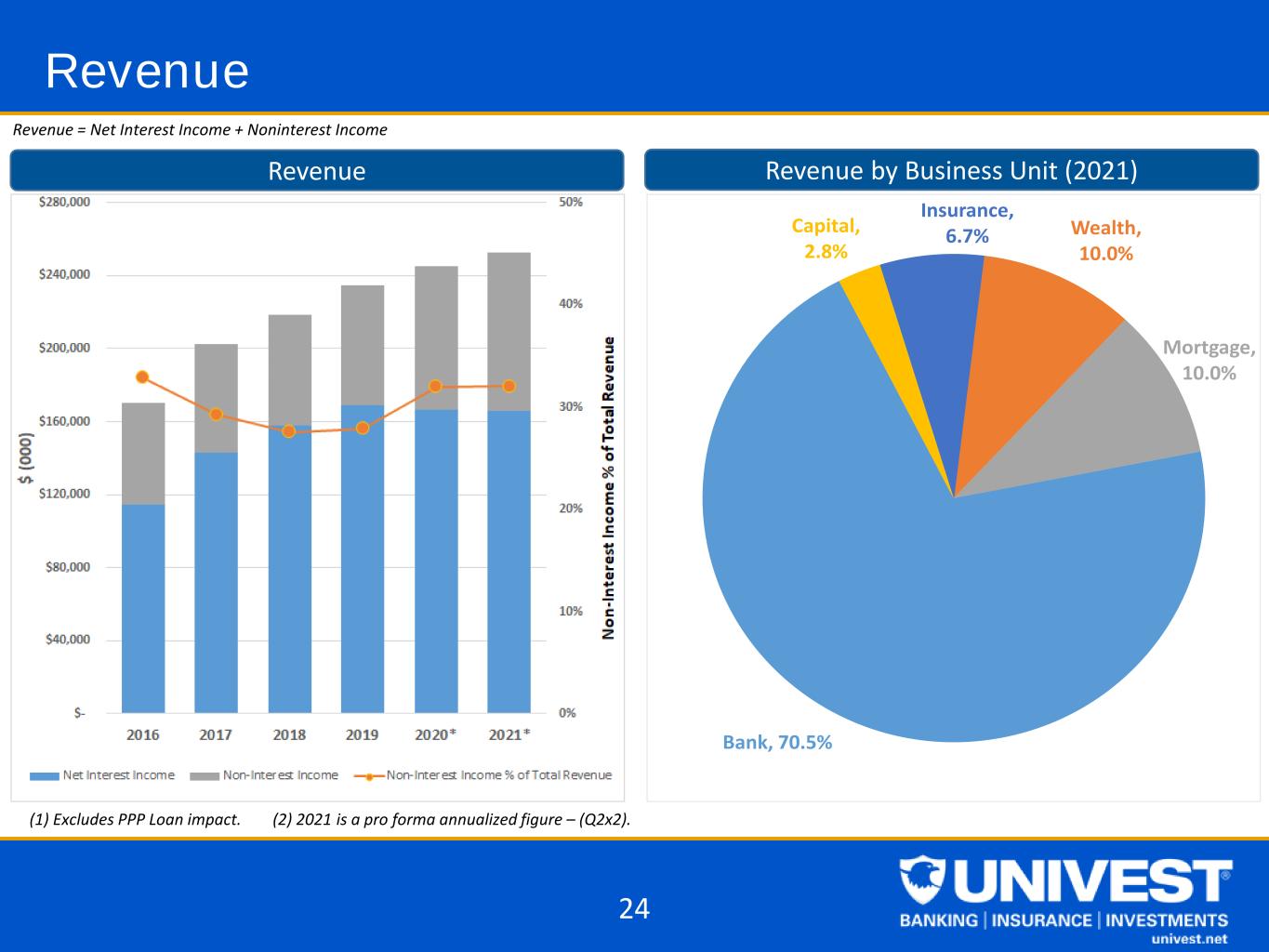

Revenue Revenue Revenue by Business Unit (2021) (1) Excludes PPP Loan impact. (2) 2021 is a pro forma annualized figure – (Q2x2). Revenue = Net Interest Income + Noninterest Income 24 Bank, 70.5% Capital, 2.8% Insurance, 6.7% Wealth, 10.0% Mortgage, 10.0%

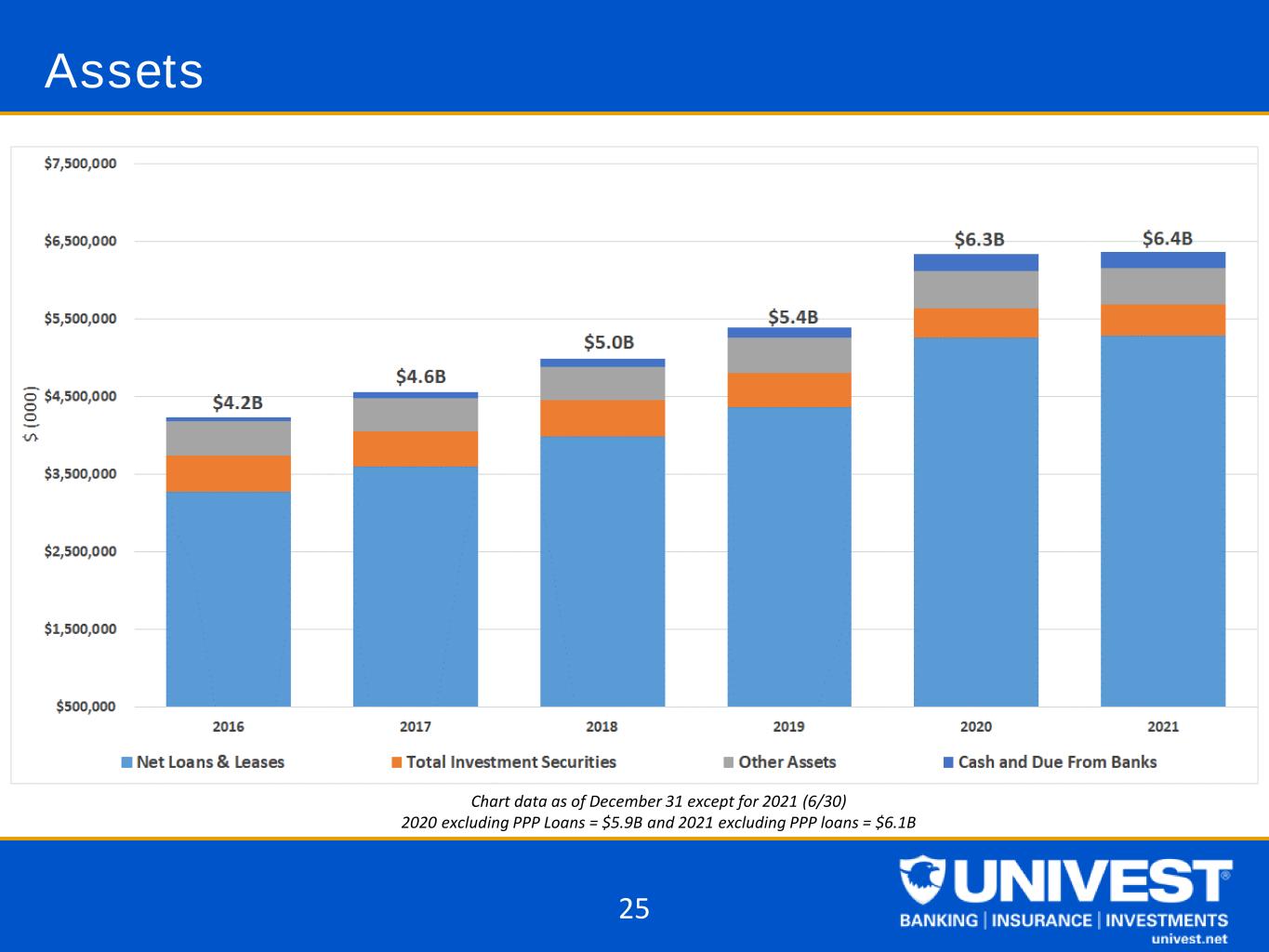

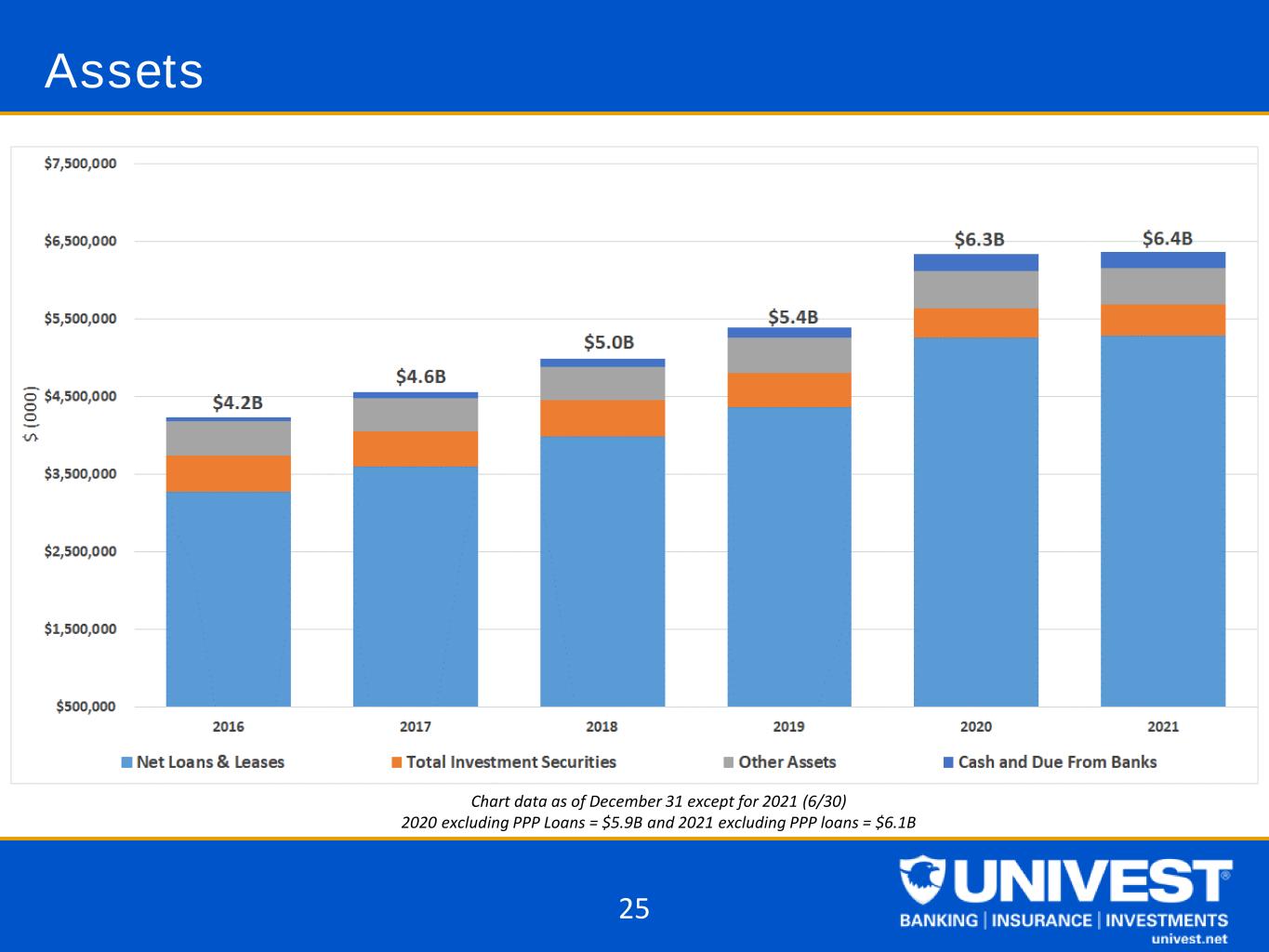

Assets Chart data as of December 31 except for 2021 (6/30) 2020 excluding PPP Loans = $5.9B and 2021 excluding PPP loans = $6.1B 25

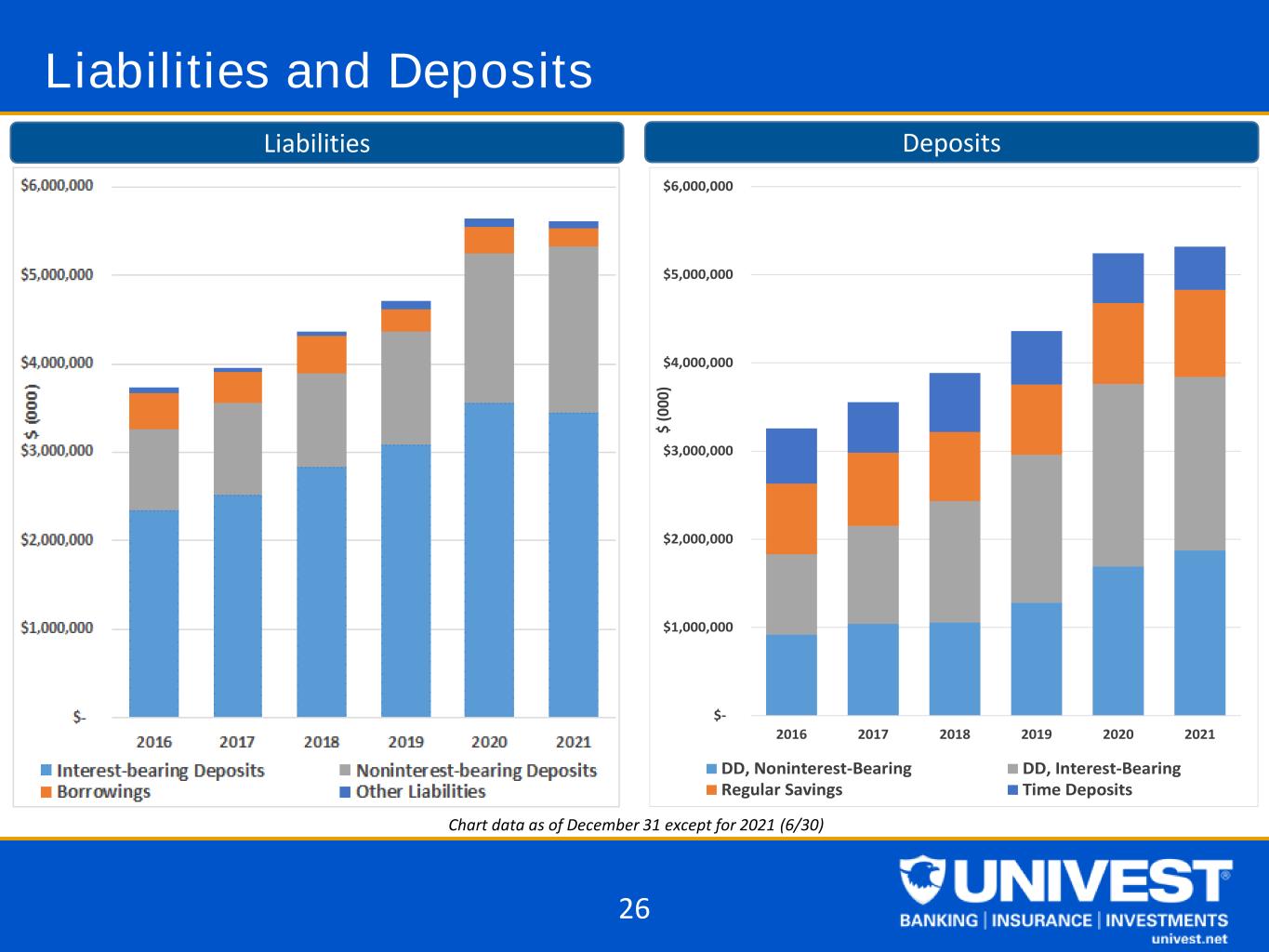

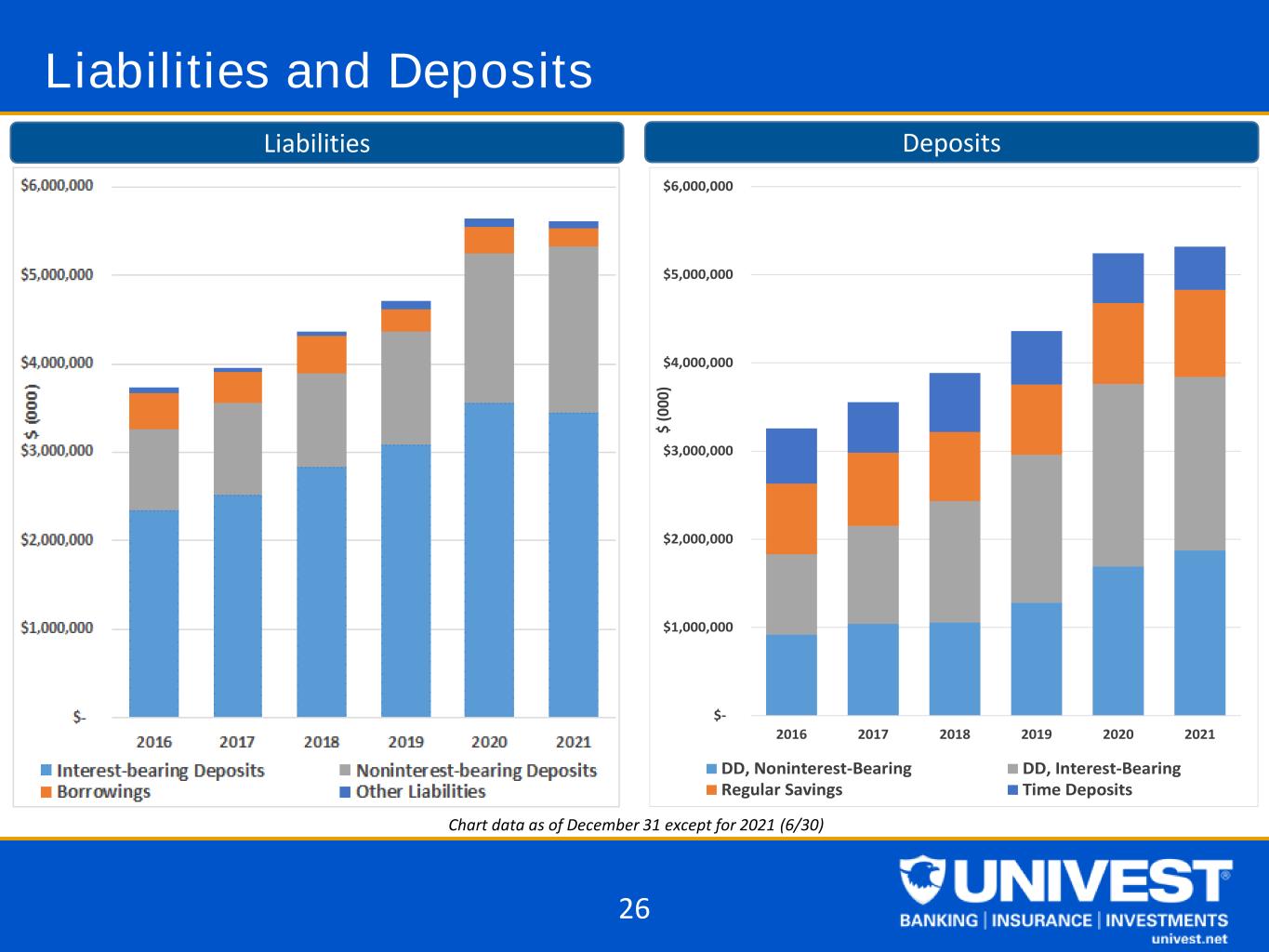

Liabilities and Deposits Chart data as of December 31 except for 2021 (6/30) Liabilities Deposits 26 $- $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 2016 2017 2018 2019 2020 2021 $ (0 00 ) DD, Noninterest-Bearing DD, Interest-Bearing Regular Savings Time Deposits

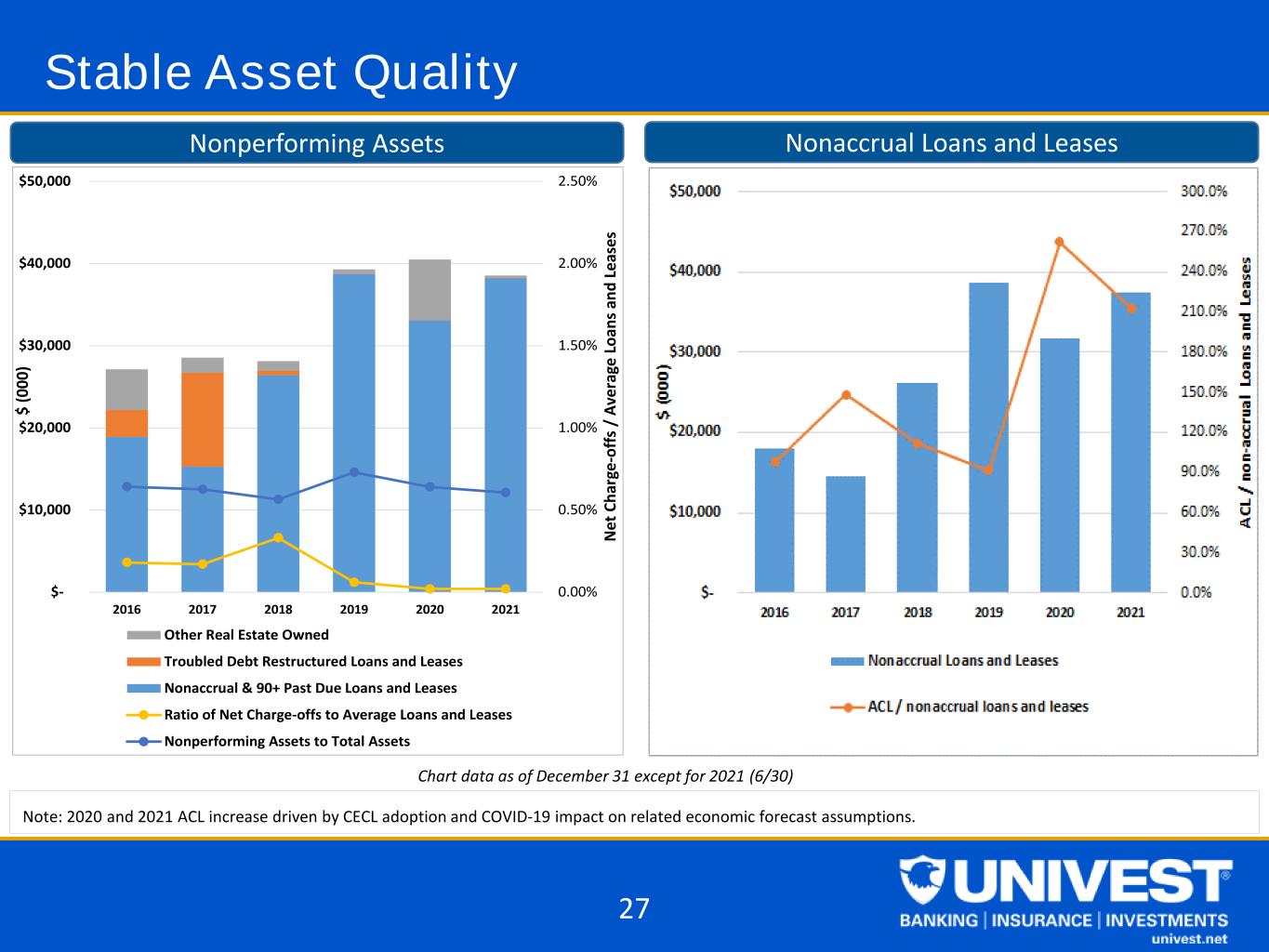

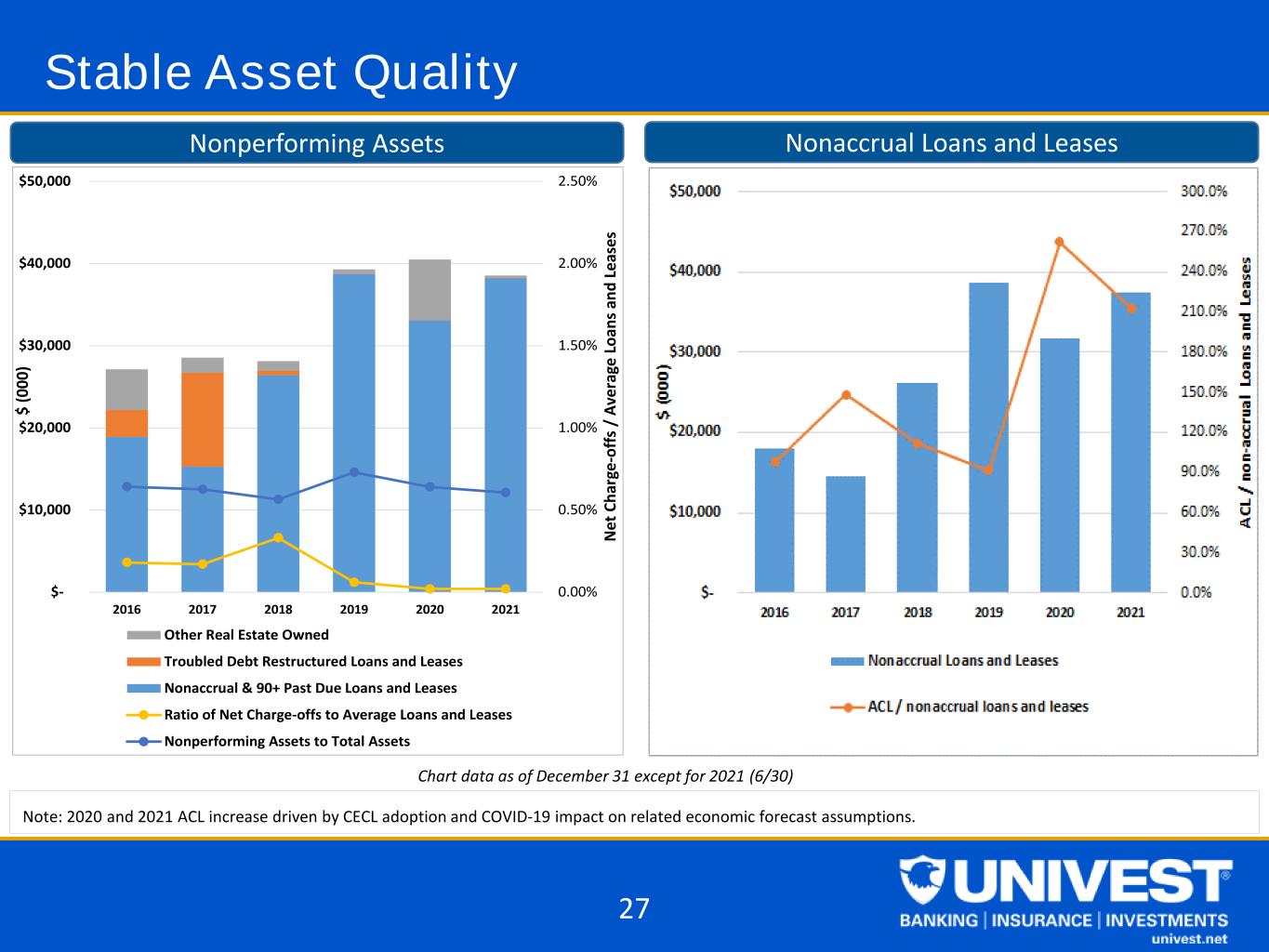

Stable Asset Quality Nonperforming Assets Nonaccrual Loans and Leases Chart data as of December 31 except for 2021 (6/30) Note: 2020 and 2021 ACL increase driven by CECL adoption and COVID-19 impact on related economic forecast assumptions. 27 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% $- $10,000 $20,000 $30,000 $40,000 $50,000 2016 2017 2018 2019 2020 2021 N et C ha rg e- of fs / A ve ra ge L oa ns a nd L ea se s Other Real Estate Owned Troubled Debt Restructured Loans and Leases Nonaccrual & 90+ Past Due Loans and Leases Ratio of Net Charge-offs to Average Loans and Leases Nonperforming Assets to Total Assets $ (0 00 )

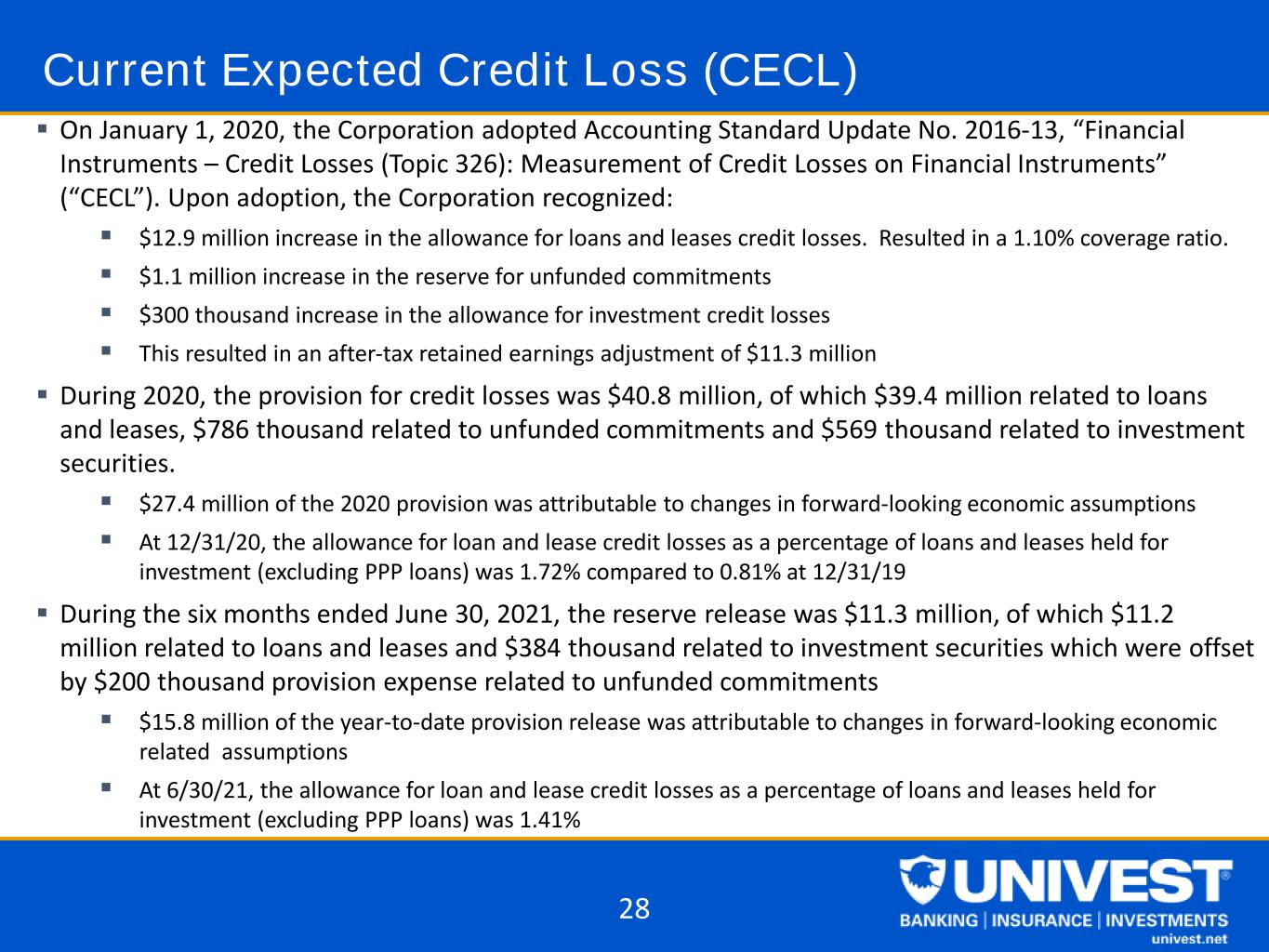

Current Expected Credit Loss (CECL) On January 1, 2020, the Corporation adopted Accounting Standard Update No. 2016-13, “Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” (“CECL”). Upon adoption, the Corporation recognized: $12.9 million increase in the allowance for loans and leases credit losses. Resulted in a 1.10% coverage ratio. $1.1 million increase in the reserve for unfunded commitments $300 thousand increase in the allowance for investment credit losses This resulted in an after-tax retained earnings adjustment of $11.3 million During 2020, the provision for credit losses was $40.8 million, of which $39.4 million related to loans and leases, $786 thousand related to unfunded commitments and $569 thousand related to investment securities. $27.4 million of the 2020 provision was attributable to changes in forward-looking economic assumptions At 12/31/20, the allowance for loan and lease credit losses as a percentage of loans and leases held for investment (excluding PPP loans) was 1.72% compared to 0.81% at 12/31/19 During the six months ended June 30, 2021, the reserve release was $11.3 million, of which $11.2 million related to loans and leases and $384 thousand related to investment securities which were offset by $200 thousand provision expense related to unfunded commitments $15.8 million of the year-to-date provision release was attributable to changes in forward-looking economic related assumptions At 6/30/21, the allowance for loan and lease credit losses as a percentage of loans and leases held for investment (excluding PPP loans) was 1.41% 28

LIQUIDITY AND CAPITAL

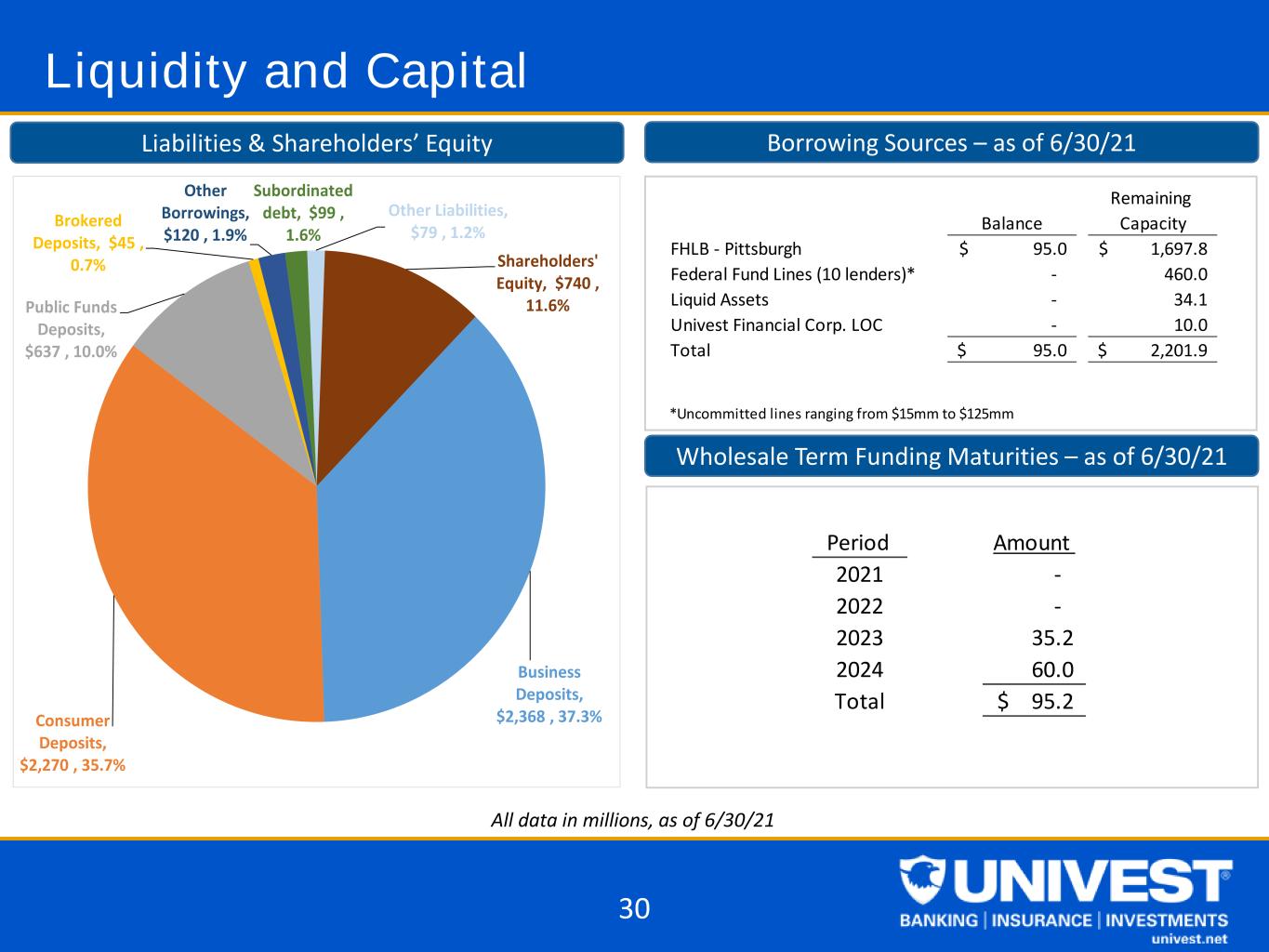

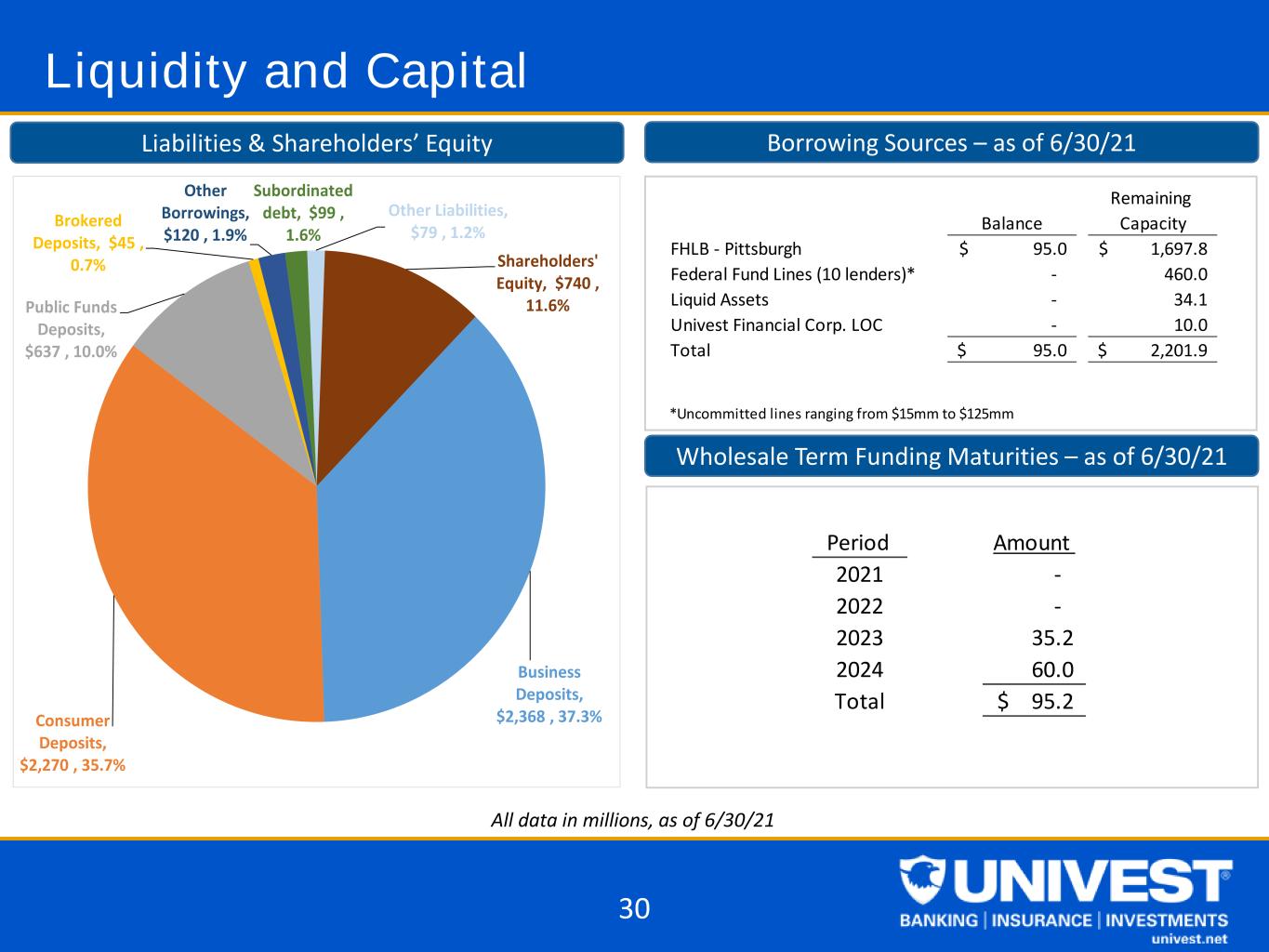

Liquidity and Capital Liabilities & Shareholders’ Equity Borrowing Sources – as of 6/30/21 Wholesale Term Funding Maturities – as of 6/30/21 All data in millions, as of 6/30/21 30 Period Amount 2021 - 2022 - 2023 35.2 2024 60.0 Total 95.2$ Balance Remaining Capacity FHLB - Pittsburgh 95.0$ 1,697.8$ Federal Fund Lines (10 lenders)* - 460.0 Liquid Assets - 34.1 Univest Financial Corp. LOC - 10.0 Total 95.0$ 2,201.9$ *Uncommitted lines ranging from $15mm to $125mm Business Deposits, $2,368 , 37.3%Consumer Deposits, $2,270 , 35.7% Public Funds Deposits, $637 , 10.0% Brokered Deposits, $45 , 0.7% Other Borrowings, $120 , 1.9% Subordinated debt, $99 , 1.6% Other Liabilities, $79 , 1.2% Shareholders' Equity, $740 , 11.6%

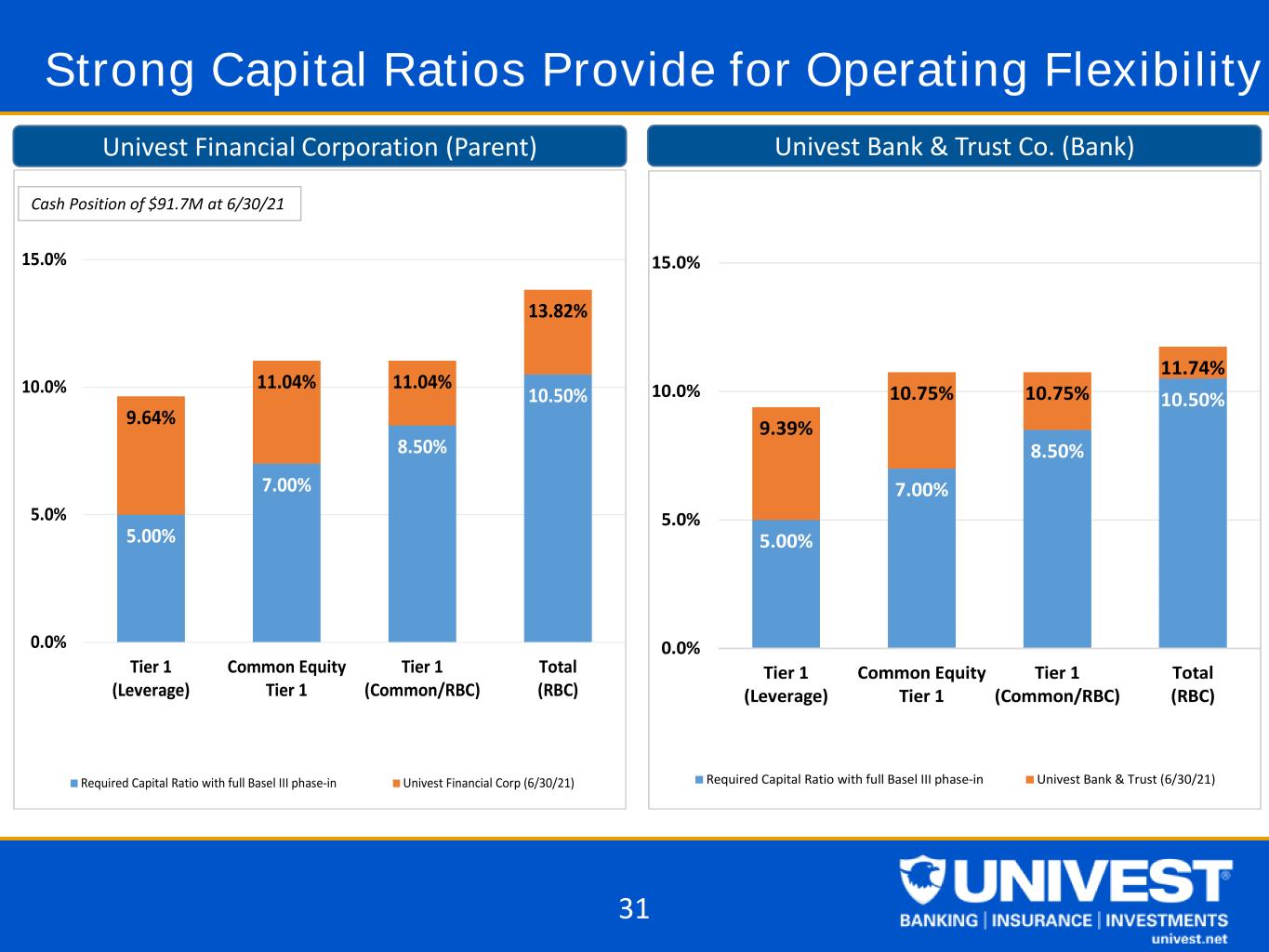

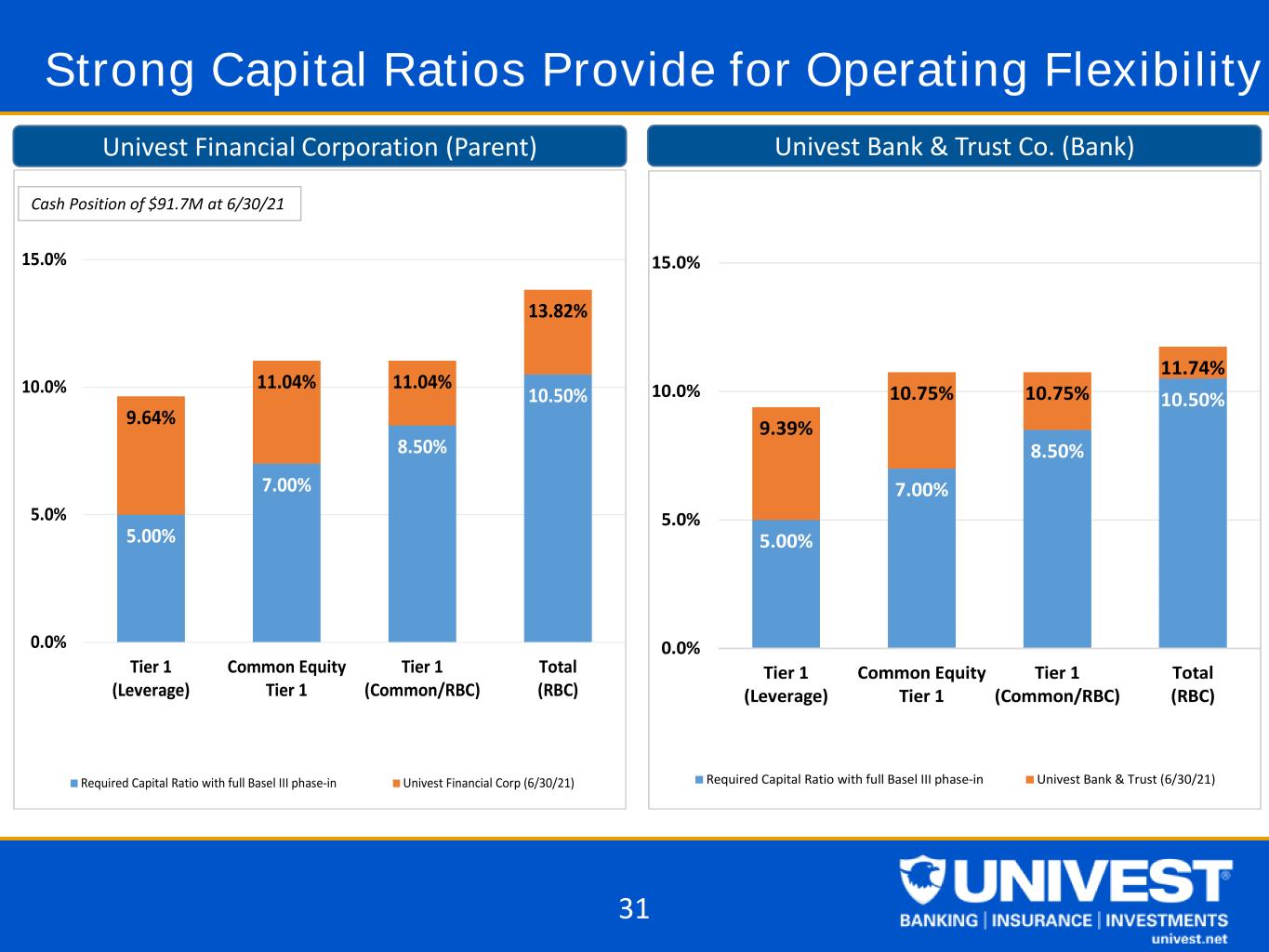

5.00% 7.00% 8.50% 10.50% 9.64% 11.04% 11.04% 13.82% 0.0% 5.0% 10.0% 15.0% Tier 1 (Leverage) Common Equity Tier 1 Tier 1 (Common/RBC) Total (RBC) Required Capital Ratio with full Basel III phase-in Univest Financial Corp (6/30/21) Strong Capital Ratios Provide for Operating Flexibility Univest Financial Corporation (Parent) Univest Bank & Trust Co. (Bank) Cash Position of $91.7M at 6/30/21 31 5.00% 7.00% 8.50% 10.50% 9.39% 10.75% 10.75% 11.74% 0.0% 5.0% 10.0% 15.0% Tier 1 (Leverage) Common Equity Tier 1 Tier 1 (Common/RBC) Total (RBC) Required Capital Ratio with full Basel III phase-in Univest Bank & Trust (6/30/21)

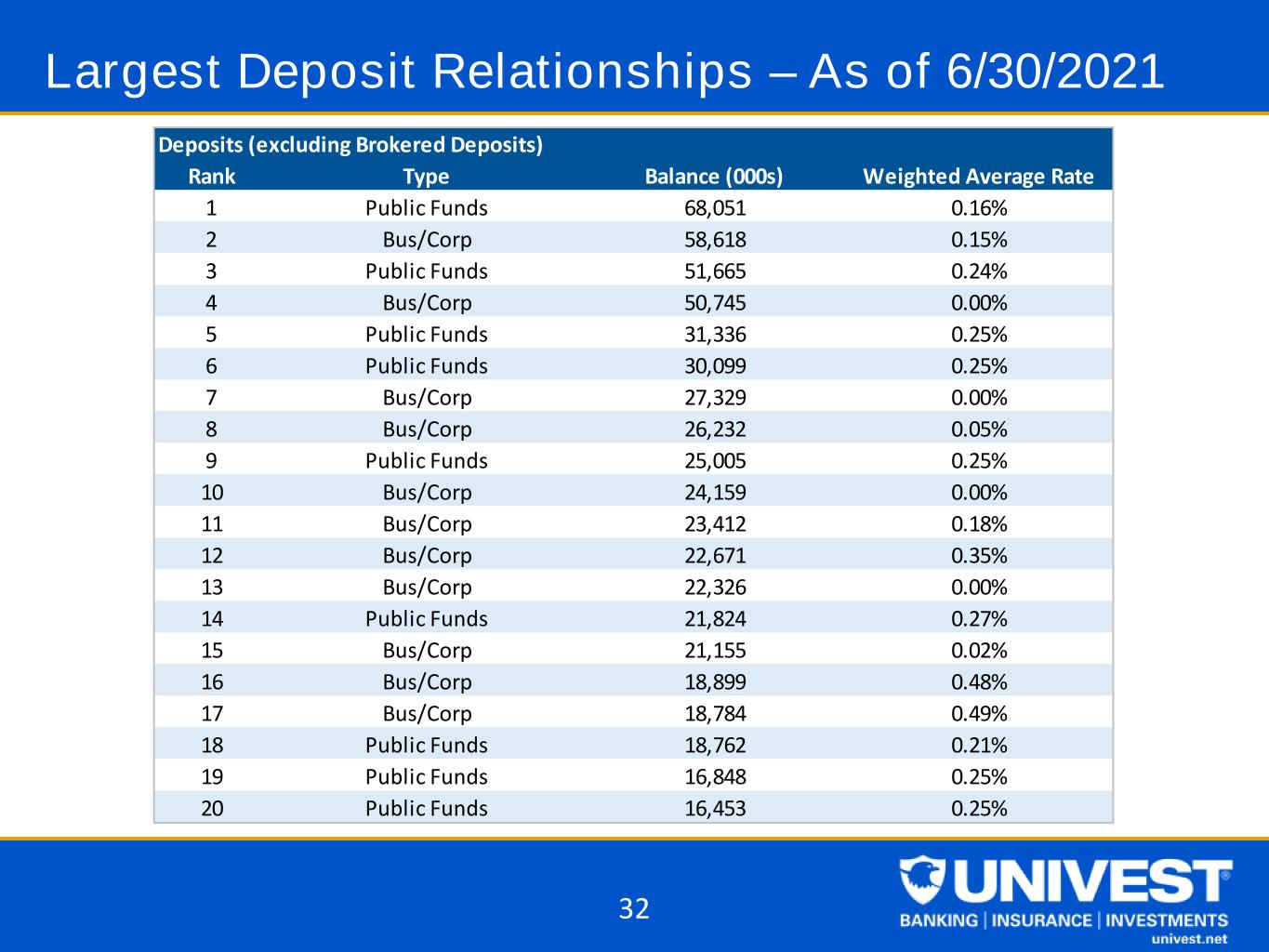

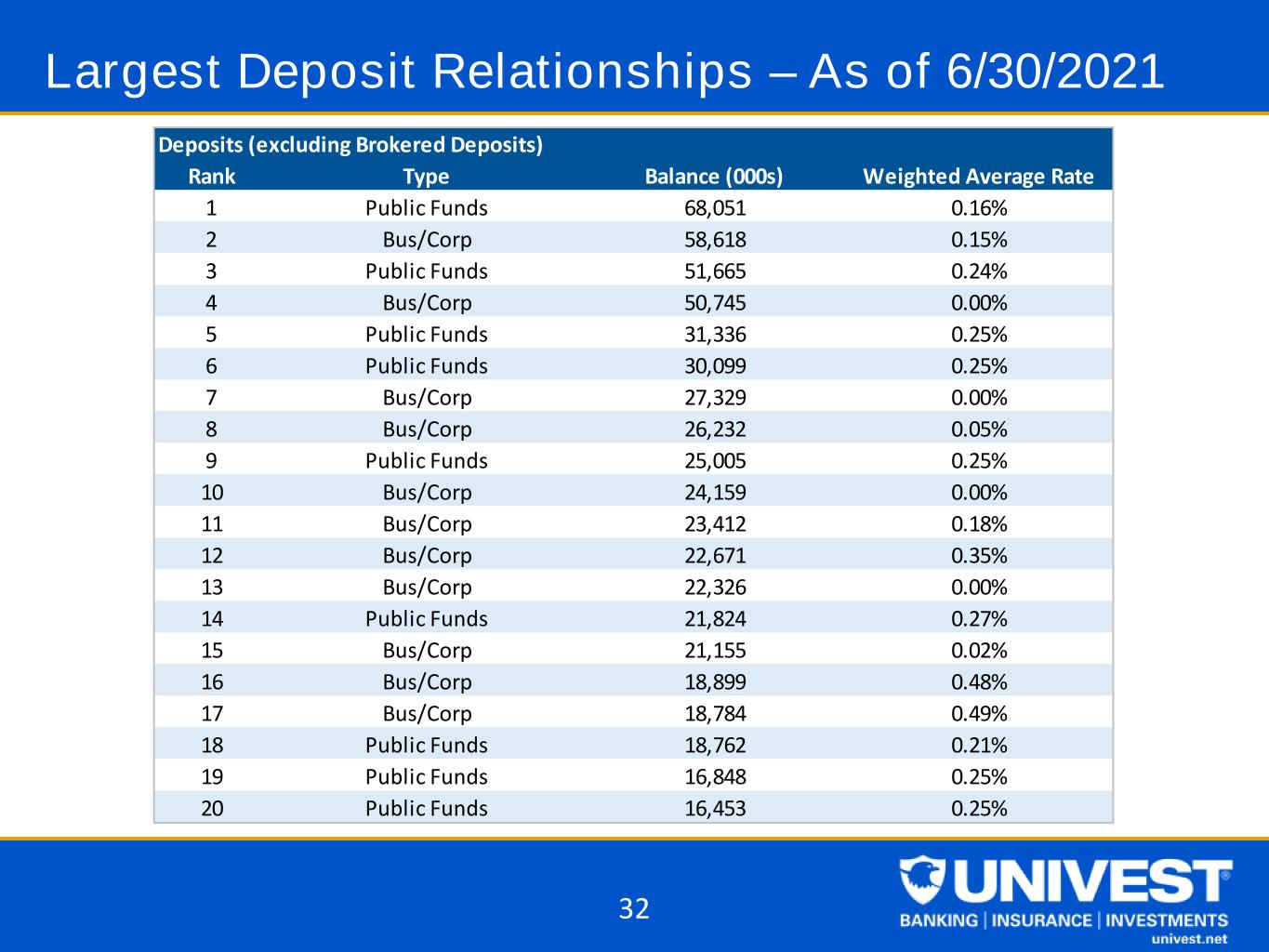

Largest Deposit Relationships – As of 6/30/2021 32 Rank Type Balance (000s) Weighted Average Rate 1 Public Funds 68,051 0.16% 2 Bus/Corp 58,618 0.15% 3 Public Funds 51,665 0.24% 4 Bus/Corp 50,745 0.00% 5 Public Funds 31,336 0.25% 6 Public Funds 30,099 0.25% 7 Bus/Corp 27,329 0.00% 8 Bus/Corp 26,232 0.05% 9 Public Funds 25,005 0.25% 10 Bus/Corp 24,159 0.00% 11 Bus/Corp 23,412 0.18% 12 Bus/Corp 22,671 0.35% 13 Bus/Corp 22,326 0.00% 14 Public Funds 21,824 0.27% 15 Bus/Corp 21,155 0.02% 16 Bus/Corp 18,899 0.48% 17 Bus/Corp 18,784 0.49% 18 Public Funds 18,762 0.21% 19 Public Funds 16,848 0.25% 20 Public Funds 16,453 0.25% Deposits (excluding Brokered Deposits)

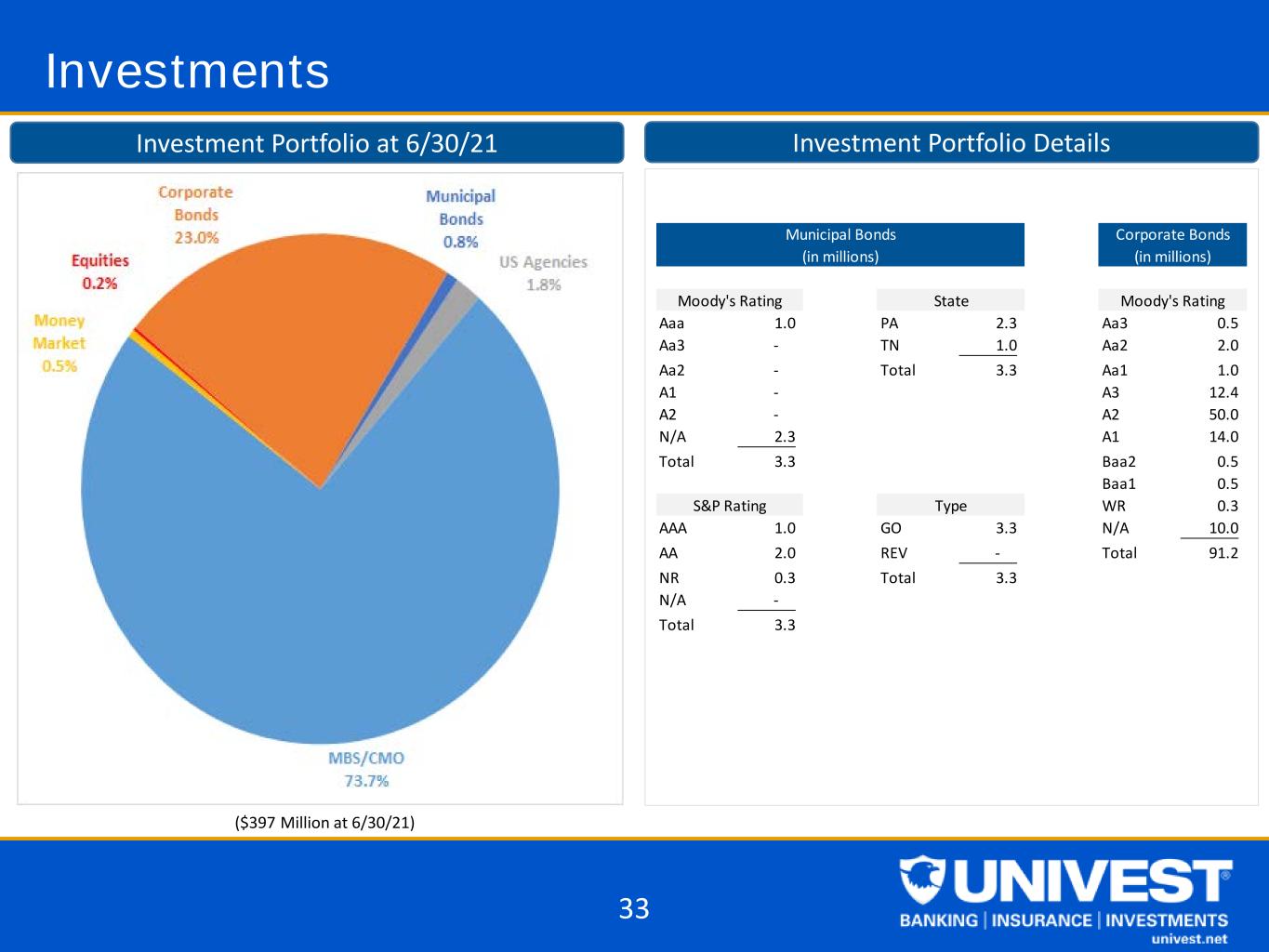

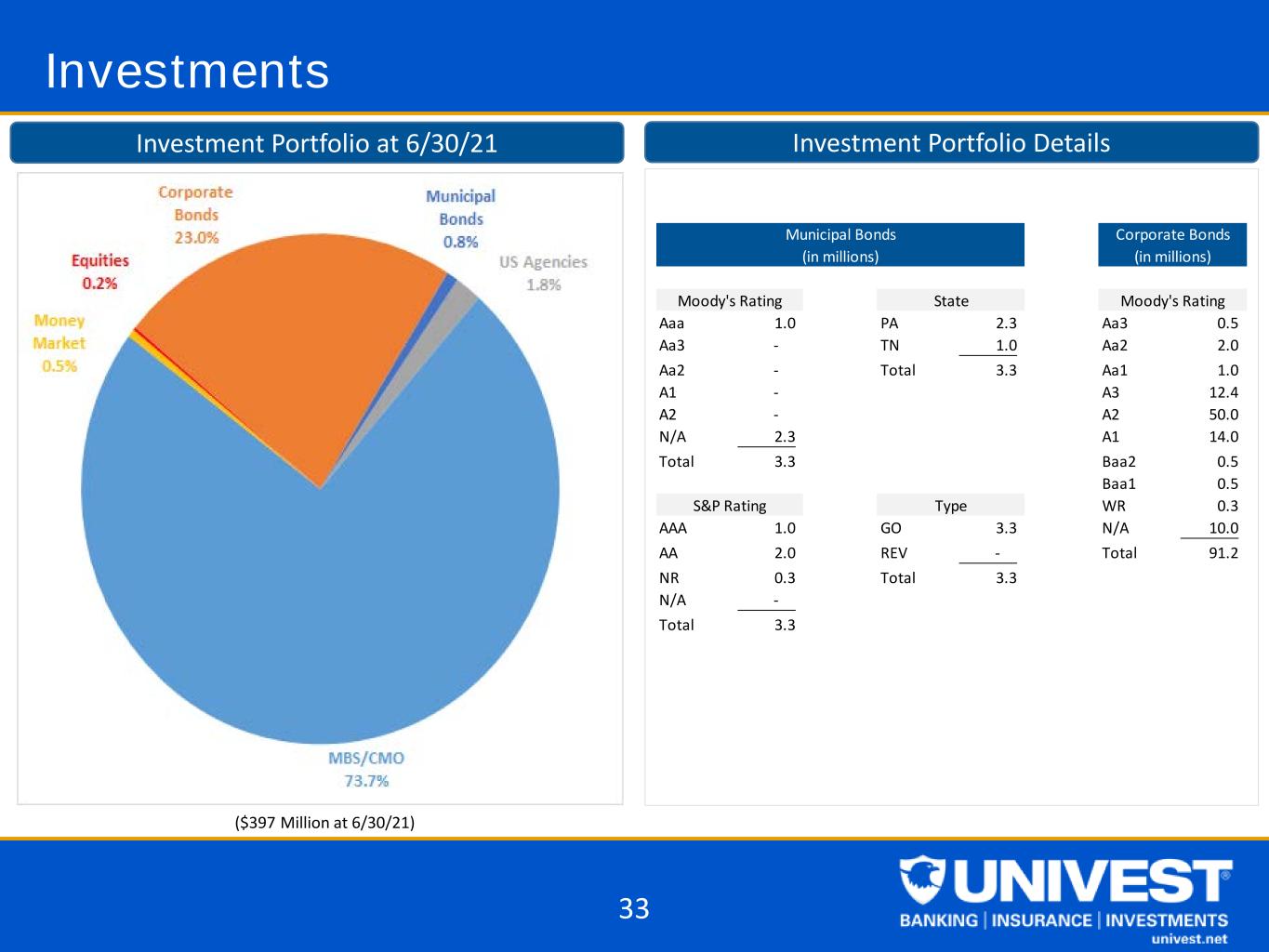

Investments ($397 Million at 6/30/21) Investment Portfolio at 6/30/21 Investment Portfolio Details 33 Aaa 1.0 PA 2.3 Aa3 0.5 Aa3 - TN 1.0 Aa2 2.0 Aa2 - Total 3.3 Aa1 1.0 A1 - A3 12.4 A2 - A2 50.0 N/A 2.3 A1 14.0 Total 3.3 Baa2 0.5 Baa1 0.5 WR 0.3 AAA 1.0 GO 3.3 N/A 10.0 AA 2.0 REV - Total 91.2 NR 0.3 Total 3.3 N/A - Total 3.3 S&P Rating Type Municipal Bonds Corporate Bonds (in millions) (in millions) Moody's Rating State Moody's Rating

LOAN PORTFOLIO DETAIL AND CREDIT OVERVIEW

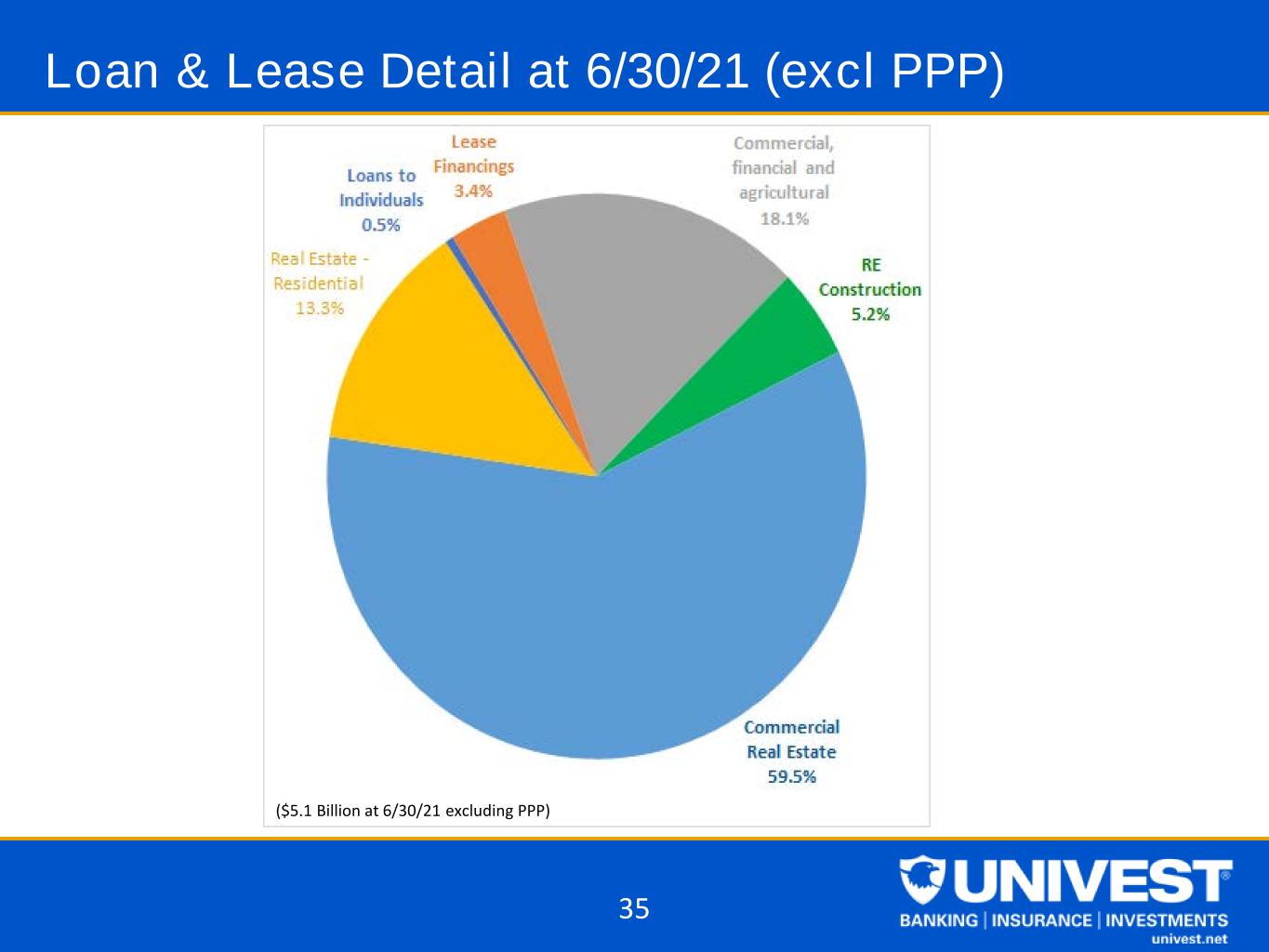

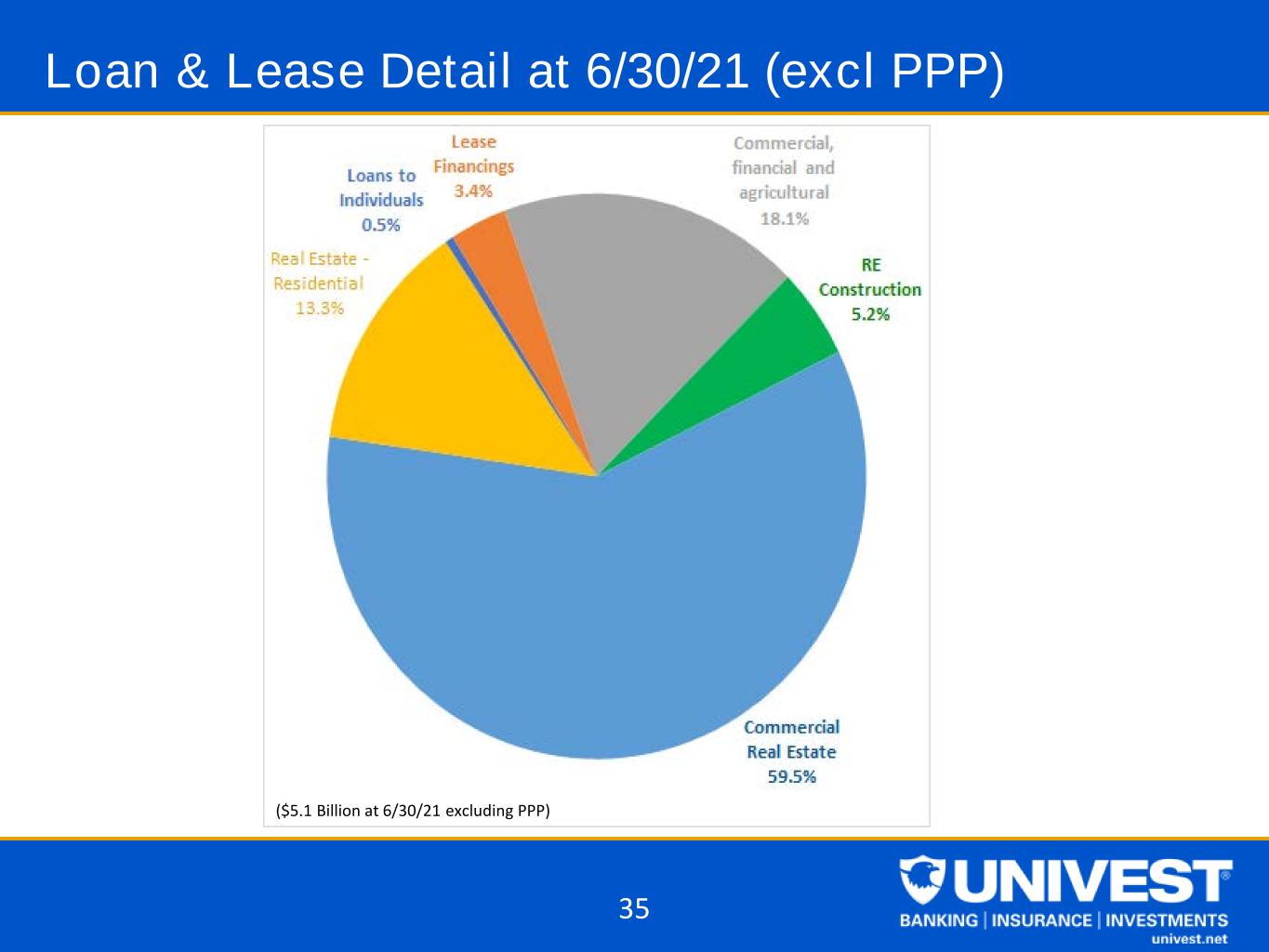

Loan & Lease Detail at 6/30/21 (excl PPP) ($5.1 Billion at 6/30/21 excluding PPP) 35

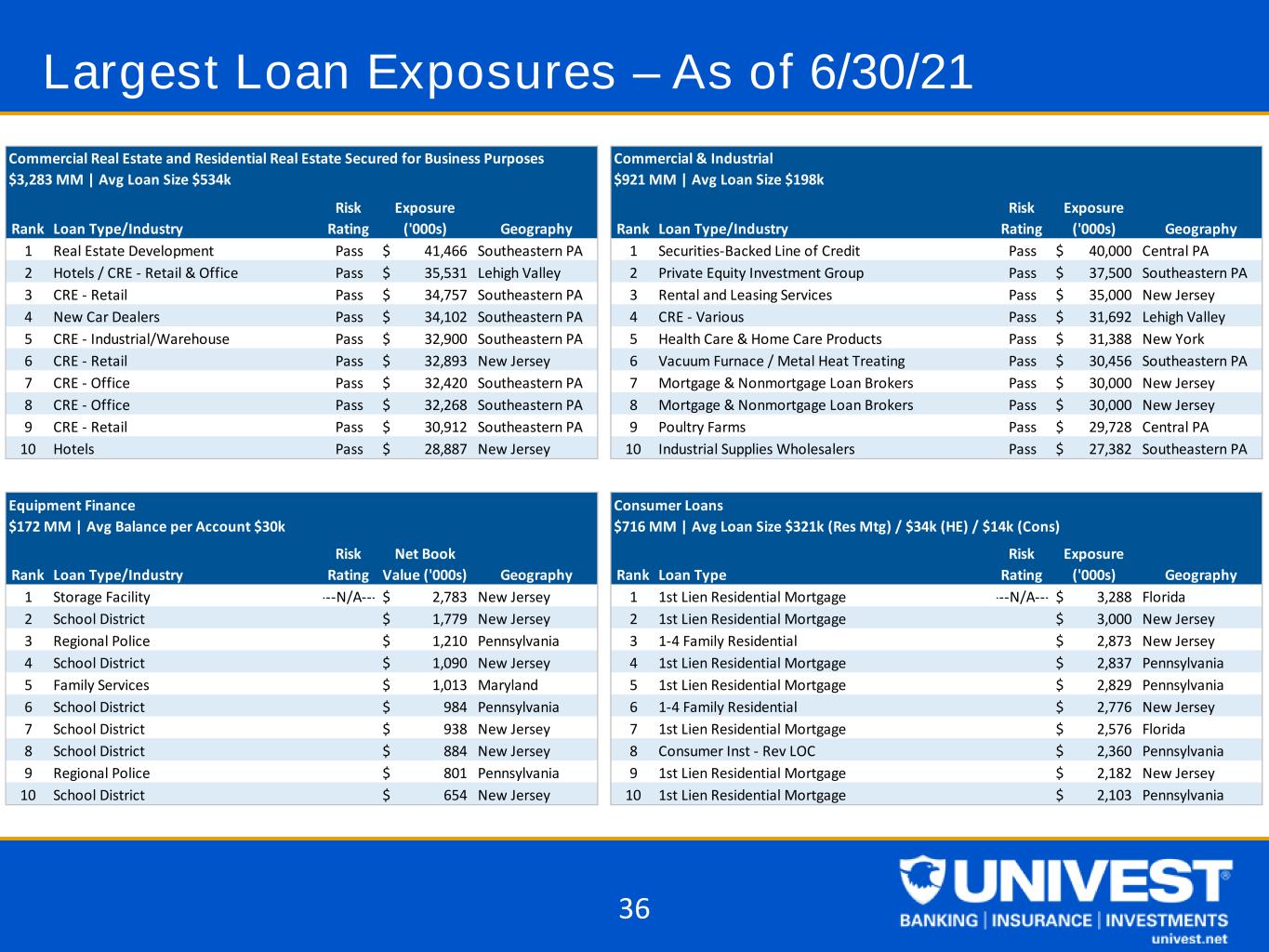

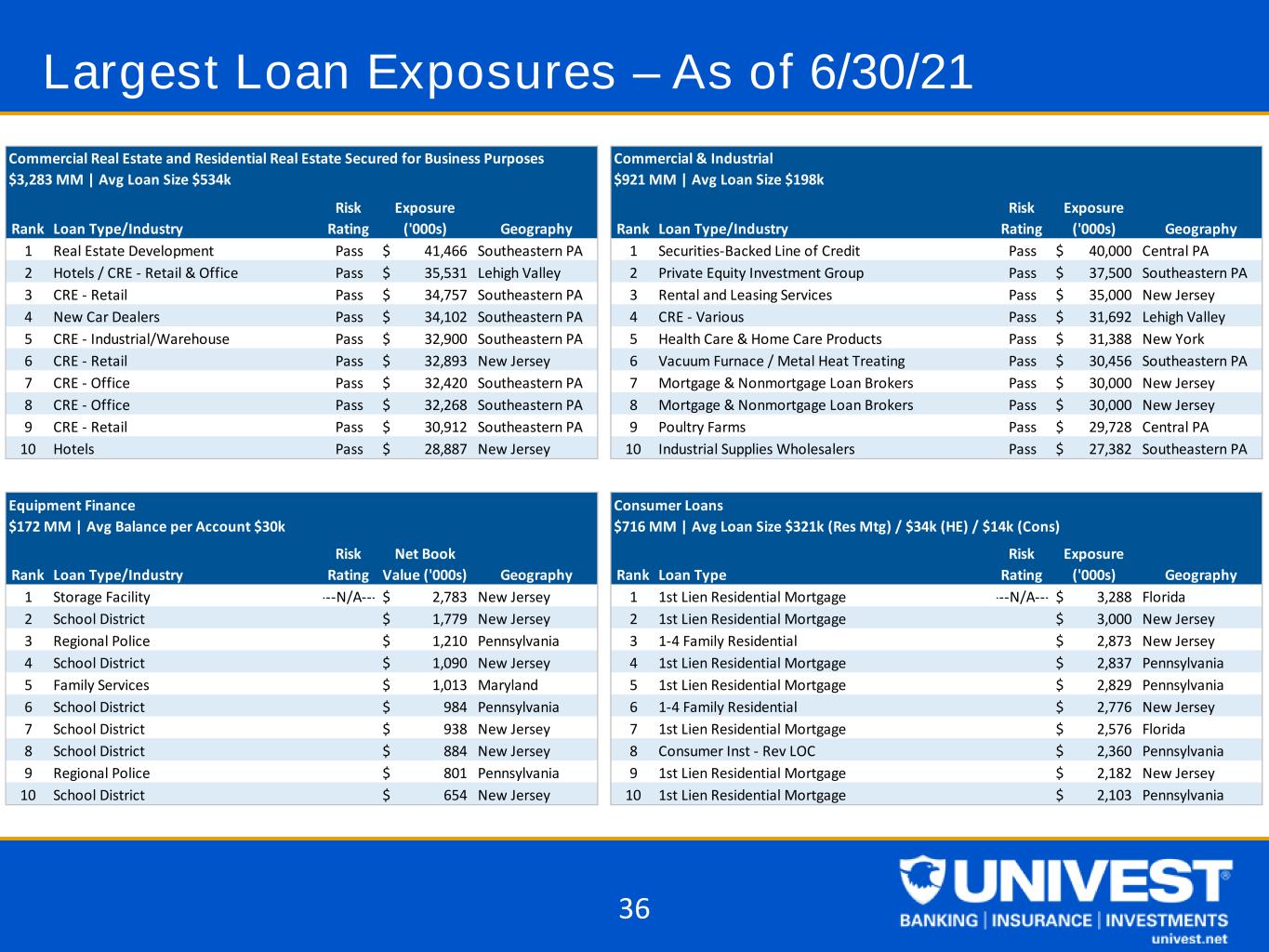

Largest Loan Exposures – As of 6/30/21 36 Rank Loan Type/Industry Risk Rating Exposure ('000s) Geography Rank Loan Type/Industry Risk Rating Exposure ('000s) Geography 1 Real Estate Development Pass 41,466$ Southeastern PA 1 Securities-Backed Line of Credit Pass 40,000$ Central PA 2 Hotels / CRE - Retail & Office Pass 35,531$ Lehigh Valley 2 Private Equity Investment Group Pass 37,500$ Southeastern PA 3 CRE - Retail Pass 34,757$ Southeastern PA 3 Rental and Leasing Services Pass 35,000$ New Jersey 4 New Car Dealers Pass 34,102$ Southeastern PA 4 CRE - Various Pass 31,692$ Lehigh Valley 5 CRE - Industrial/Warehouse Pass 32,900$ Southeastern PA 5 Health Care & Home Care Products Pass 31,388$ New York 6 CRE - Retail Pass 32,893$ New Jersey 6 Vacuum Furnace / Metal Heat Treating Pass 30,456$ Southeastern PA 7 CRE - Office Pass 32,420$ Southeastern PA 7 Mortgage & Nonmortgage Loan Brokers Pass 30,000$ New Jersey 8 CRE - Office Pass 32,268$ Southeastern PA 8 Mortgage & Nonmortgage Loan Brokers Pass 30,000$ New Jersey 9 CRE - Retail Pass 30,912$ Southeastern PA 9 Poultry Farms Pass 29,728$ Central PA 10 Hotels Pass 28,887$ New Jersey 10 Industrial Supplies Wholesalers Pass 27,382$ Southeastern PA Rank Loan Type/Industry Risk Rating Net Book Value ('000s) Geography Rank Loan Type Risk Rating Exposure ('000s) Geography 1 Storage Facility ---N/A--- 2,783$ New Jersey 1 1st Lien Residential Mortgage ---N/A--- 3,288$ Florida 2 School District 1,779$ New Jersey 2 1st Lien Residential Mortgage 3,000$ New Jersey 3 Regional Police 1,210$ Pennsylvania 3 1-4 Family Residential 2,873$ New Jersey 4 School District 1,090$ New Jersey 4 1st Lien Residential Mortgage 2,837$ Pennsylvania 5 Family Services 1,013$ Maryland 5 1st Lien Residential Mortgage 2,829$ Pennsylvania 6 School District 984$ Pennsylvania 6 1-4 Family Residential 2,776$ New Jersey 7 School District 938$ New Jersey 7 1st Lien Residential Mortgage 2,576$ Florida 8 School District 884$ New Jersey 8 Consumer Inst - Rev LOC 2,360$ Pennsylvania 9 Regional Police 801$ Pennsylvania 9 1st Lien Residential Mortgage 2,182$ New Jersey 10 School District 654$ New Jersey 10 1st Lien Residential Mortgage 2,103$ Pennsylvania Commercial Real Estate and Residential Real Estate Secured for Business Purposes $3,283 MM | Avg Loan Size $534k Commercial & Industrial $921 MM | Avg Loan Size $198k Equipment Finance $172 MM | Avg Balance per Account $30k Consumer Loans $716 MM | Avg Loan Size $321k (Res Mtg) / $34k (HE) / $14k (Cons)

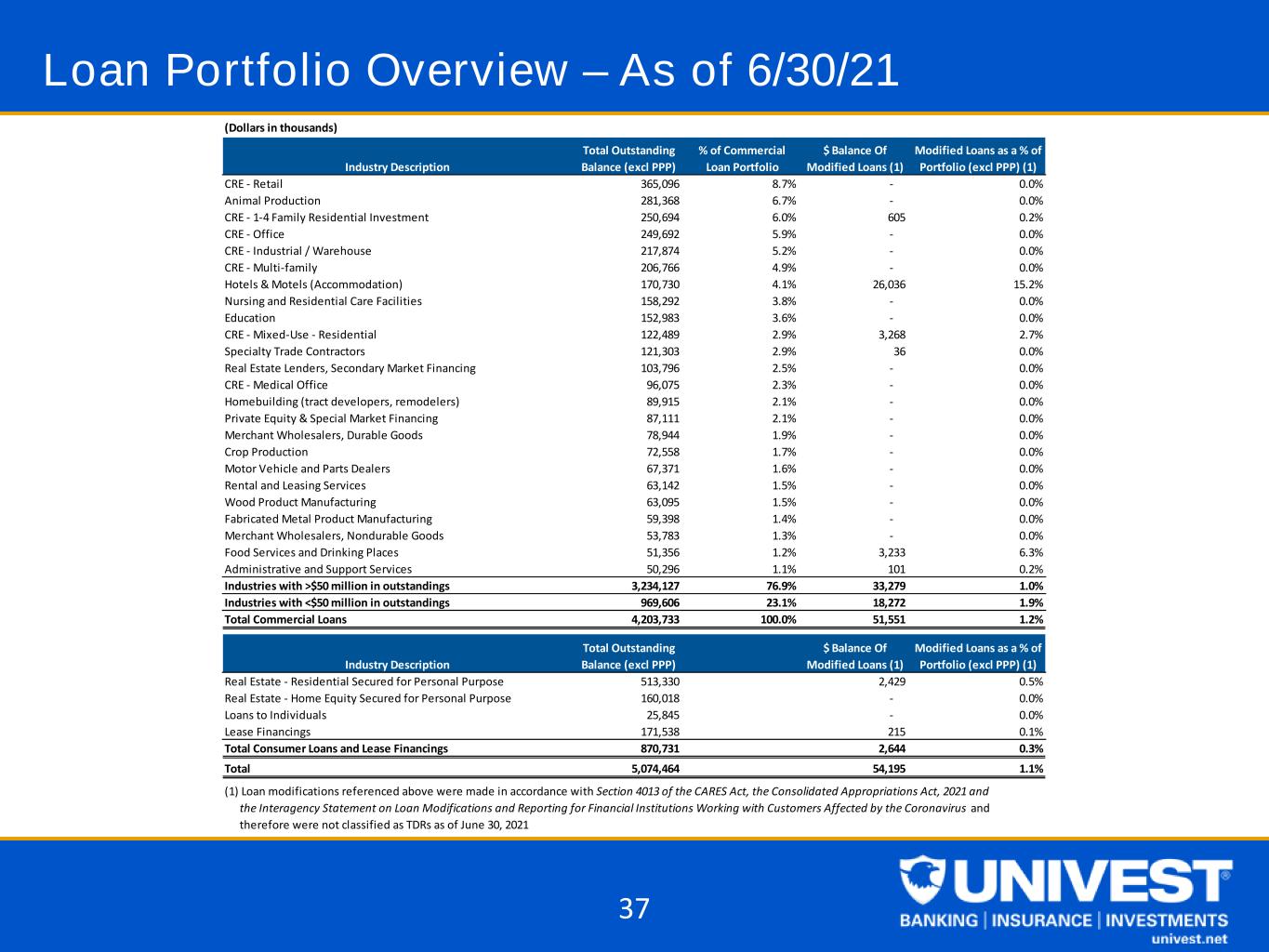

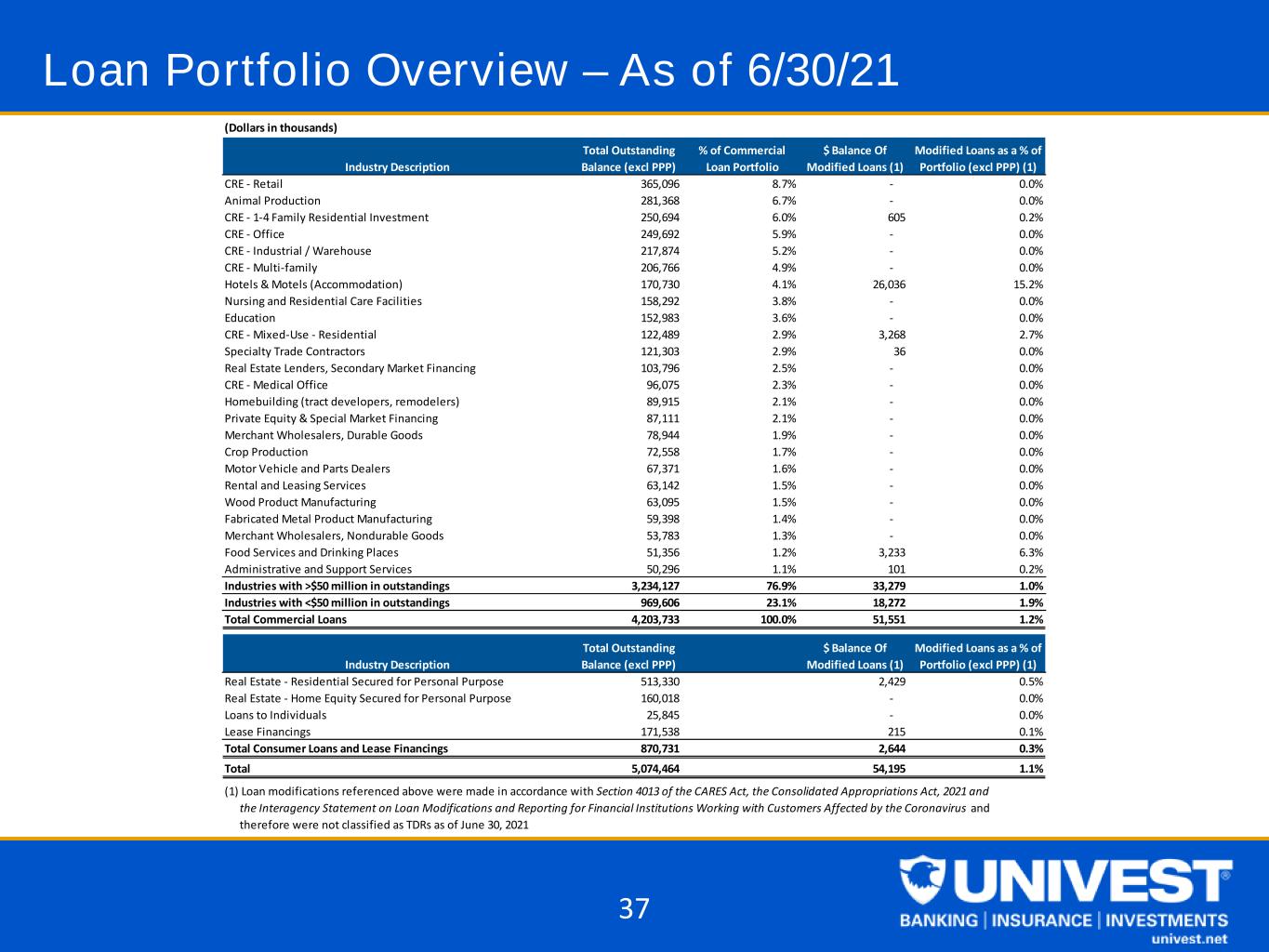

Loan Portfolio Overview – As of 6/30/21 37 (Dollars in thousands) Industry Description Total Outstanding Balance (excl PPP) % of Commercial Loan Portfolio $ Balance Of Modified Loans (1) Modified Loans as a % of Portfolio (excl PPP) (1) CRE - Retail 365,096 8.7% - 0.0% Animal Production 281,368 6.7% - 0.0% CRE - 1-4 Family Residential Investment 250,694 6.0% 605 0.2% CRE - Office 249,692 5.9% - 0.0% CRE - Industrial / Warehouse 217,874 5.2% - 0.0% CRE - Multi-family 206,766 4.9% - 0.0% Hotels & Motels (Accommodation) 170,730 4.1% 26,036 15.2% Nursing and Residential Care Facilities 158,292 3.8% - 0.0% Education 152,983 3.6% - 0.0% CRE - Mixed-Use - Residential 122,489 2.9% 3,268 2.7% Specialty Trade Contractors 121,303 2.9% 36 0.0% Real Estate Lenders, Secondary Market Financing 103,796 2.5% - 0.0% CRE - Medical Office 96,075 2.3% - 0.0% Homebuilding (tract developers, remodelers) 89,915 2.1% - 0.0% Private Equity & Special Market Financing 87,111 2.1% - 0.0% Merchant Wholesalers, Durable Goods 78,944 1.9% - 0.0% Crop Production 72,558 1.7% - 0.0% Motor Vehicle and Parts Dealers 67,371 1.6% - 0.0% Rental and Leasing Services 63,142 1.5% - 0.0% Wood Product Manufacturing 63,095 1.5% - 0.0% Fabricated Metal Product Manufacturing 59,398 1.4% - 0.0% Merchant Wholesalers, Nondurable Goods 53,783 1.3% - 0.0% Food Services and Drinking Places 51,356 1.2% 3,233 6.3% Administrative and Support Services 50,296 1.1% 101 0.2% Industries with >$50 million in outstandings 3,234,127 76.9% 33,279 1.0% Industries with <$50 million in outstandings 969,606 23.1% 18,272 1.9% Total Commercial Loans 4,203,733 100.0% 51,551 1.2% Industry Description Total Outstanding Balance (excl PPP) $ Balance Of Modified Loans (1) Modified Loans as a % of Portfolio (excl PPP) (1) Real Estate - Residential Secured for Personal Purpose 513,330 2,429 0.5% Real Estate - Home Equity Secured for Personal Purpose 160,018 - 0.0% Loans to Individuals 25,845 - 0.0% Lease Financings 171,538 215 0.1% Total Consumer Loans and Lease Financings 870,731 2,644 0.3% Total 5,074,464 54,195 1.1% (1) Loan modifications referenced above were made in accordance with Section 4013 of the CARES Act, the Consolidated Appropriations Act, 2021 and the Interagency Statement on Loan Modifications and Reporting for Financial Institutions Working with Customers Affected by the Coronavirus and therefore were not classified as TDRs as of June 30, 2021

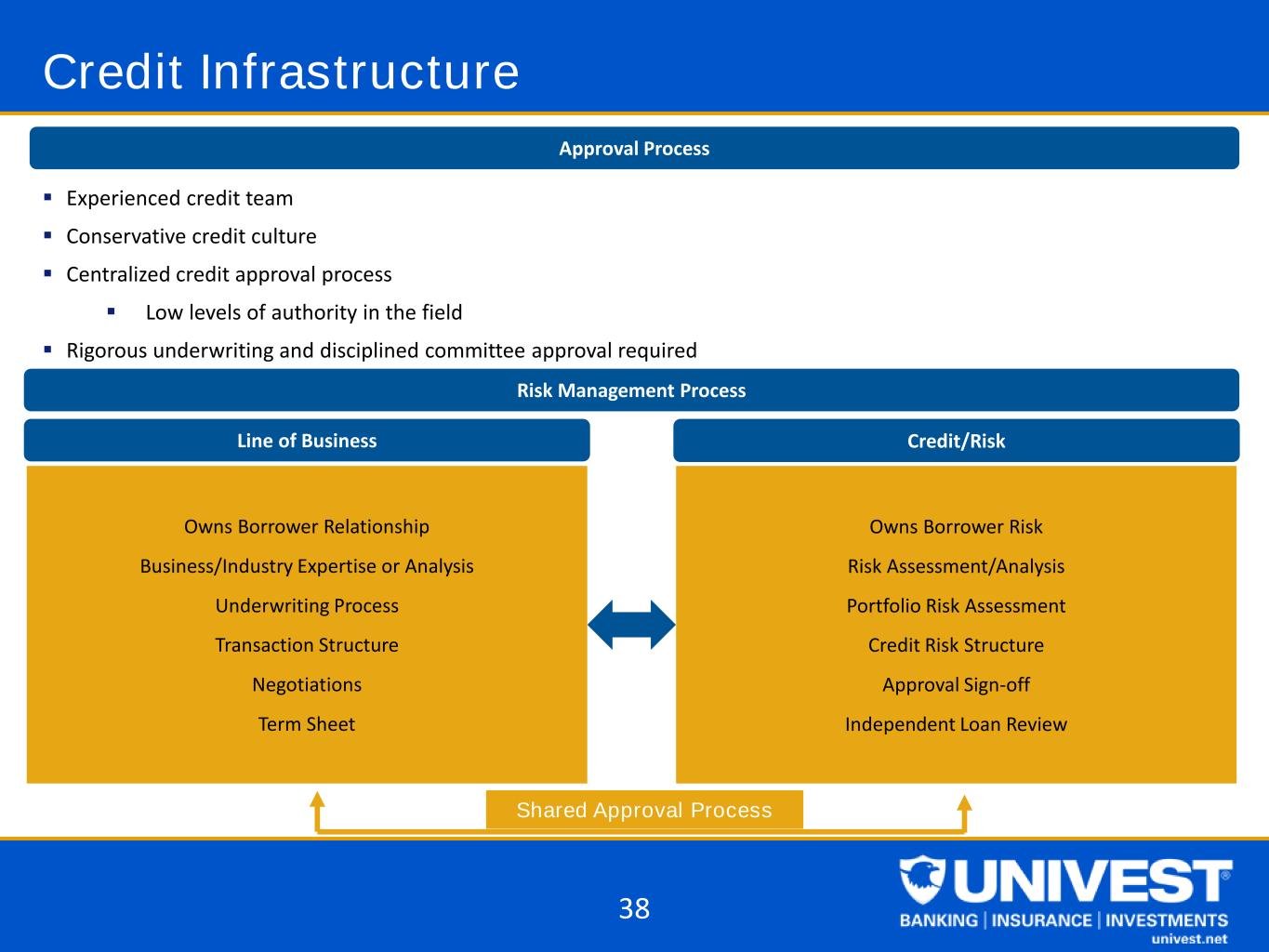

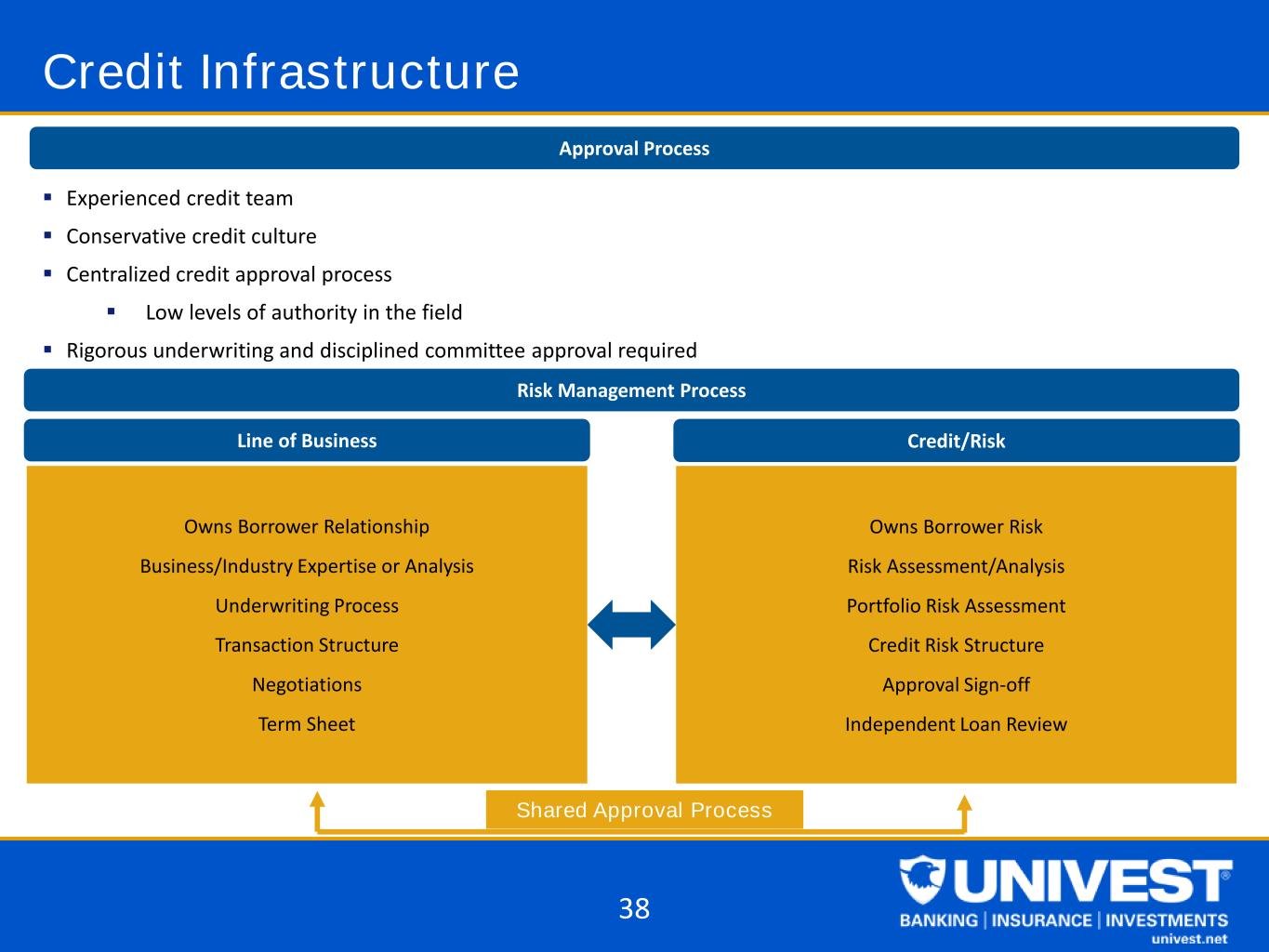

Credit Infrastructure Experienced credit team Conservative credit culture Centralized credit approval process Low levels of authority in the field Rigorous underwriting and disciplined committee approval required Approval Process Risk Management Process Owns Borrower Relationship Business/Industry Expertise or Analysis Underwriting Process Transaction Structure Negotiations Term Sheet Owns Borrower Risk Risk Assessment/Analysis Portfolio Risk Assessment Credit Risk Structure Approval Sign-off Independent Loan Review Shared Approval Process Line of Business Credit/Risk 38

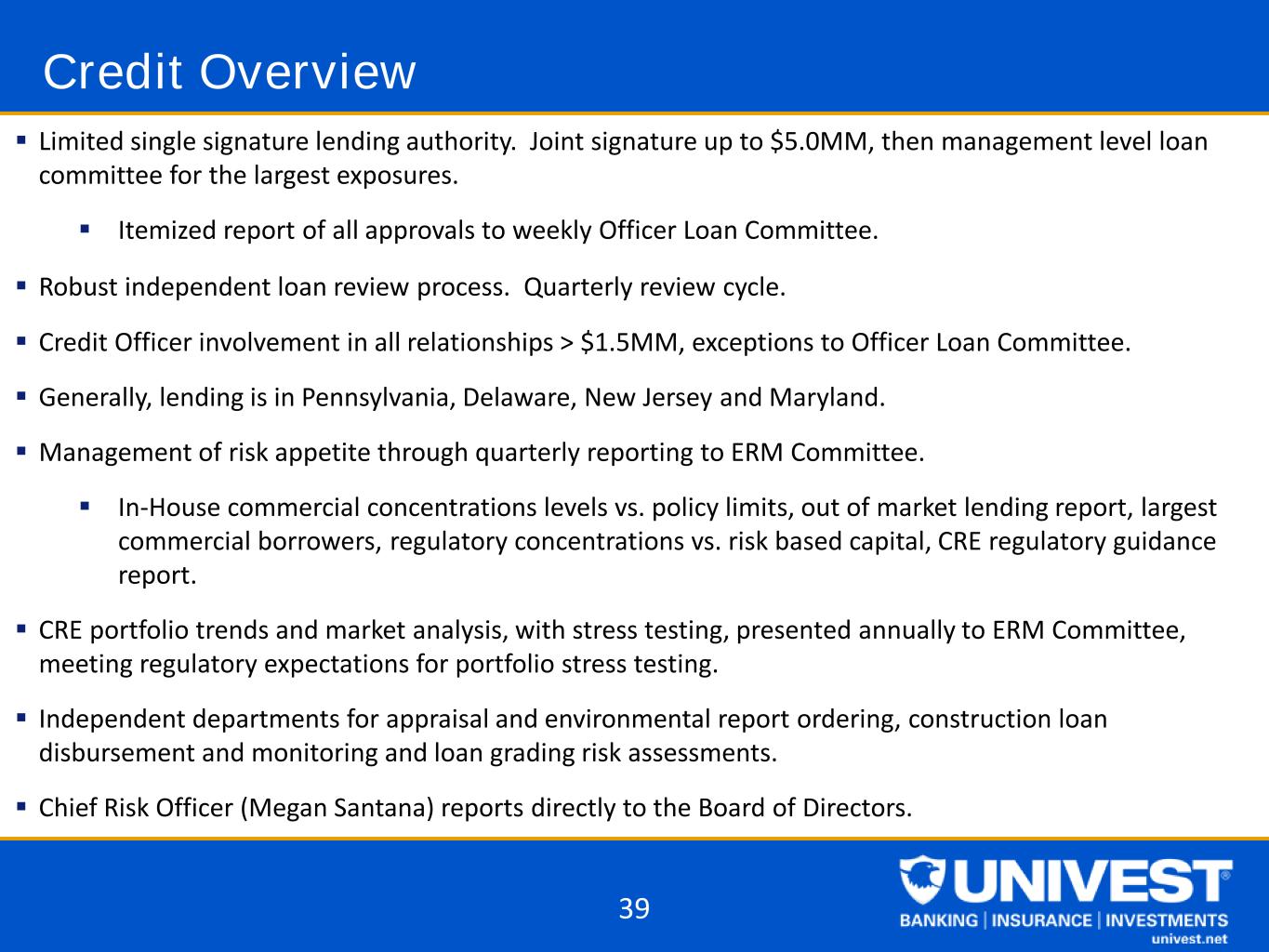

Limited single signature lending authority. Joint signature up to $5.0MM, then management level loan committee for the largest exposures. Itemized report of all approvals to weekly Officer Loan Committee. Robust independent loan review process. Quarterly review cycle. Credit Officer involvement in all relationships > $1.5MM, exceptions to Officer Loan Committee. Generally, lending is in Pennsylvania, Delaware, New Jersey and Maryland. Management of risk appetite through quarterly reporting to ERM Committee. In-House commercial concentrations levels vs. policy limits, out of market lending report, largest commercial borrowers, regulatory concentrations vs. risk based capital, CRE regulatory guidance report. CRE portfolio trends and market analysis, with stress testing, presented annually to ERM Committee, meeting regulatory expectations for portfolio stress testing. Independent departments for appraisal and environmental report ordering, construction loan disbursement and monitoring and loan grading risk assessments. Chief Risk Officer (Megan Santana) reports directly to the Board of Directors. Credit Overview 39

LINE OF BUSINESS OVERVIEW

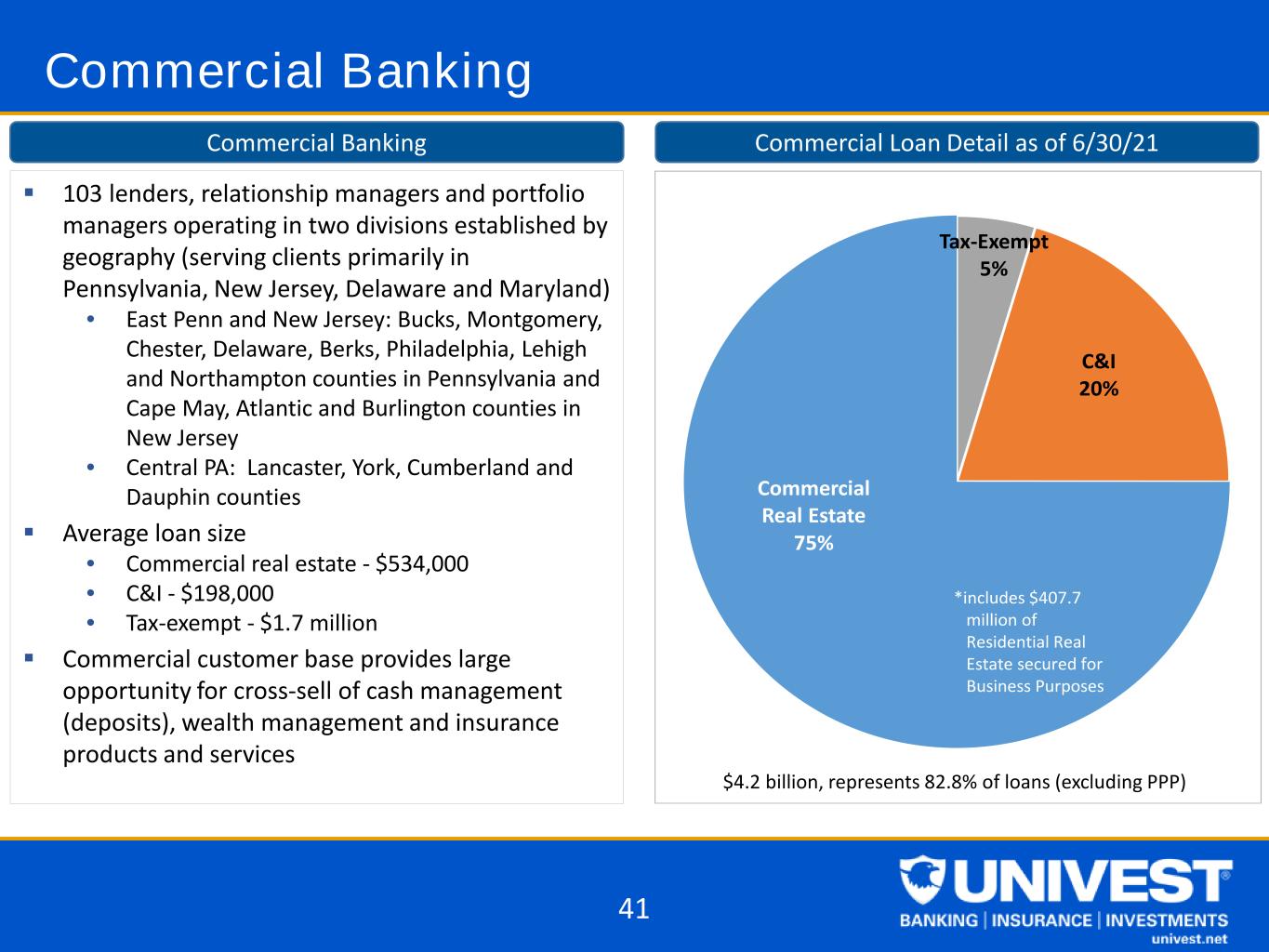

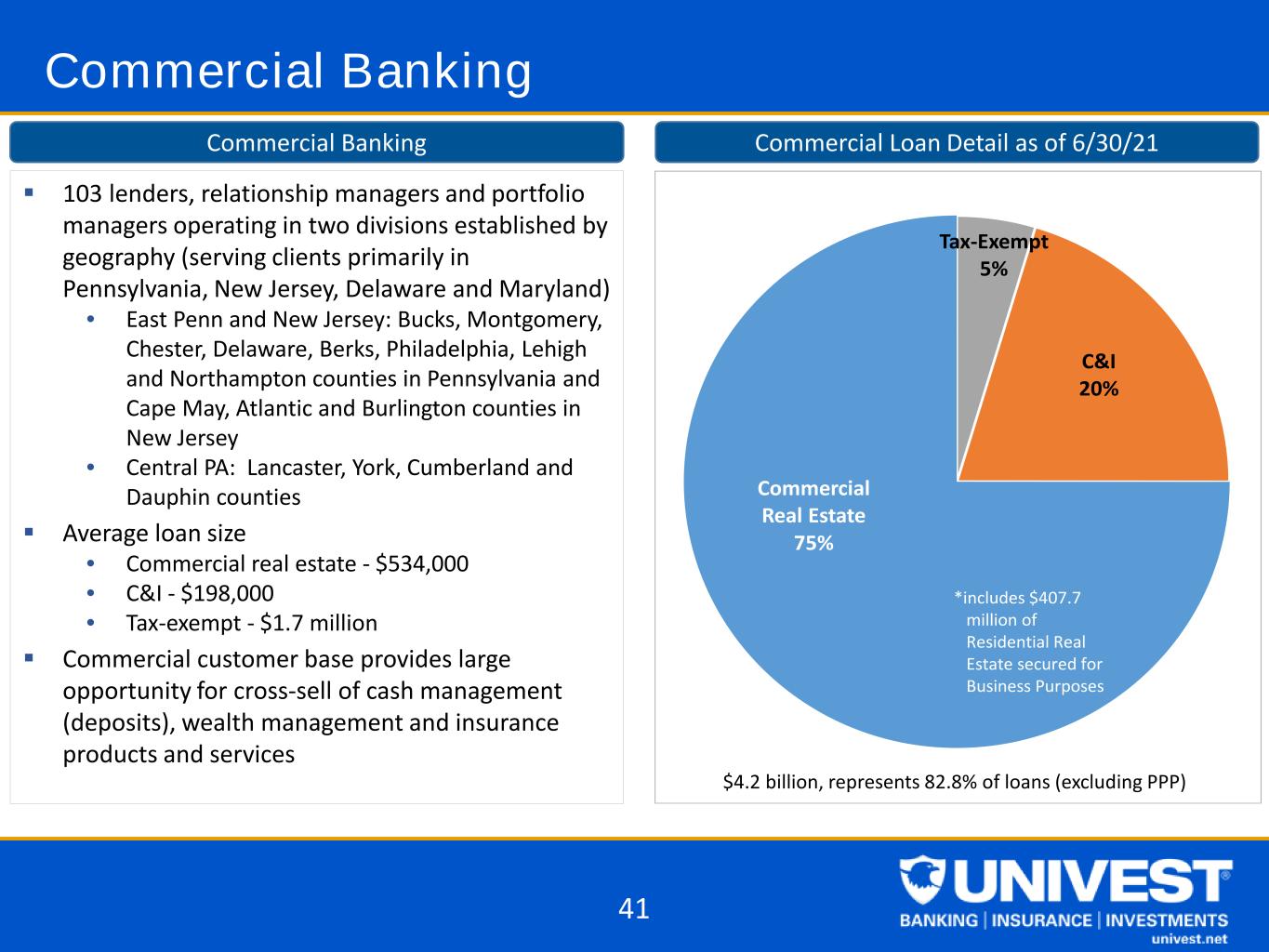

Tax-Exempt 5% C&I 20% Commercial Real Estate 75% *includes $407.7 million of Residential Real Estate secured for Business Purposes Commercial Banking 103 lenders, relationship managers and portfolio managers operating in two divisions established by geography (serving clients primarily in Pennsylvania, New Jersey, Delaware and Maryland) • East Penn and New Jersey: Bucks, Montgomery, Chester, Delaware, Berks, Philadelphia, Lehigh and Northampton counties in Pennsylvania and Cape May, Atlantic and Burlington counties in New Jersey • Central PA: Lancaster, York, Cumberland and Dauphin counties Average loan size • Commercial real estate - $534,000 • C&I - $198,000 • Tax-exempt - $1.7 million Commercial customer base provides large opportunity for cross-sell of cash management (deposits), wealth management and insurance products and services Commercial Loan Detail as of 6/30/21Commercial Banking 41 $4.2 billion, represents 82.8% of loans (excluding PPP)

Consumer Banking 33 financial service centers located in Bucks, Chester, Lancaster, Lehigh, Montgomery, Northampton, Philadelphia, Dauphin and York counties in PA and Ocean City, NJ; also operating 14 retirement centers in Bucks and Montgomery counties and 4 regional locations (Mechanicsburg/Berks/Bucks/York). Proactively addressed continued reduction in transactional volume by closing 21 financial centers since September 2015; Reinvesting savings in our digital solutions and expanded operating footprint Financial centers staffed by combination of personal bankers and tellers, providing both transaction and consultative services augmented by technology Focused on creating seamless customer experience between in-person and digital Growth strategy focused on obtaining consumer business from commercial customers and their employee base 42

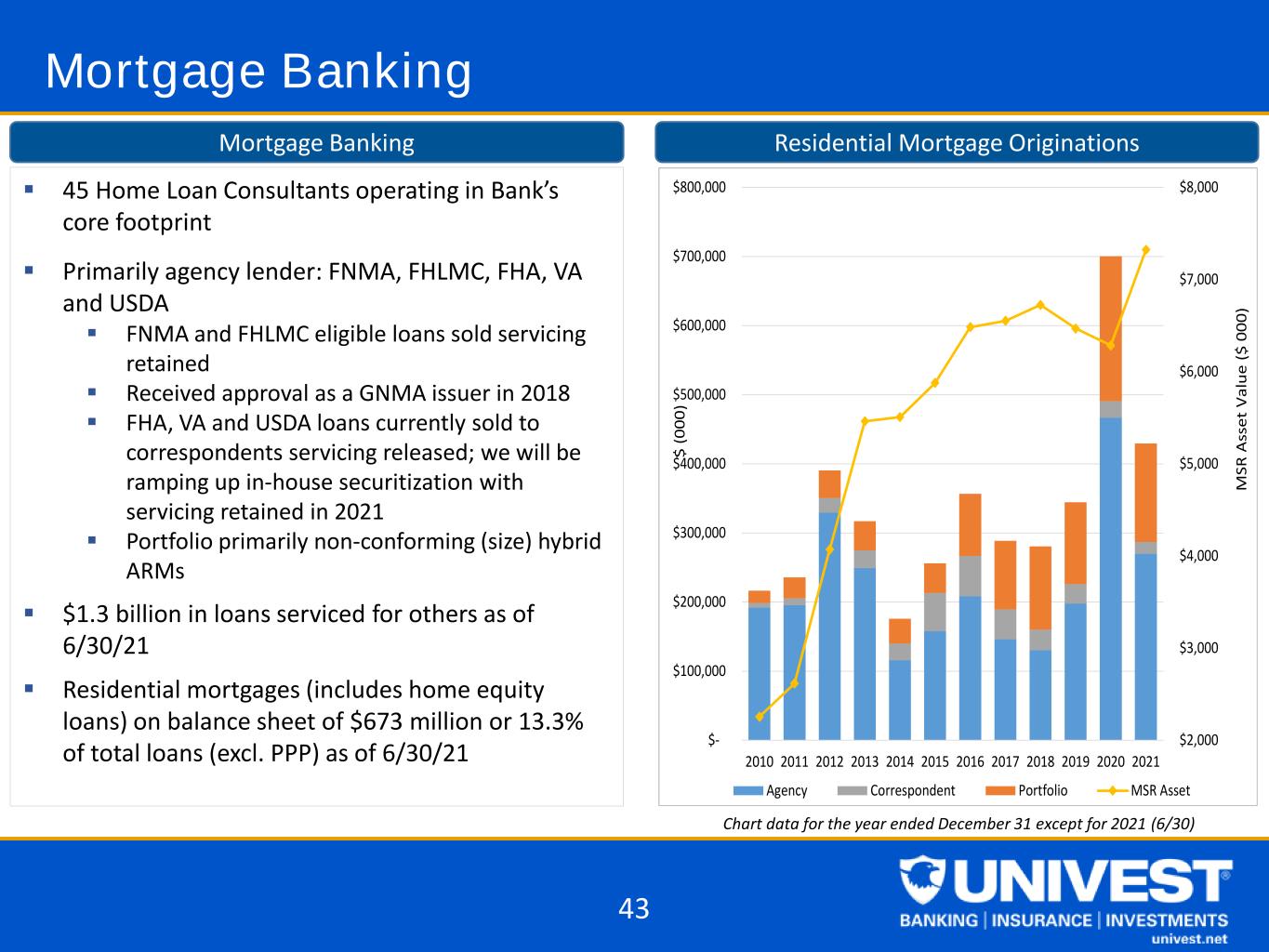

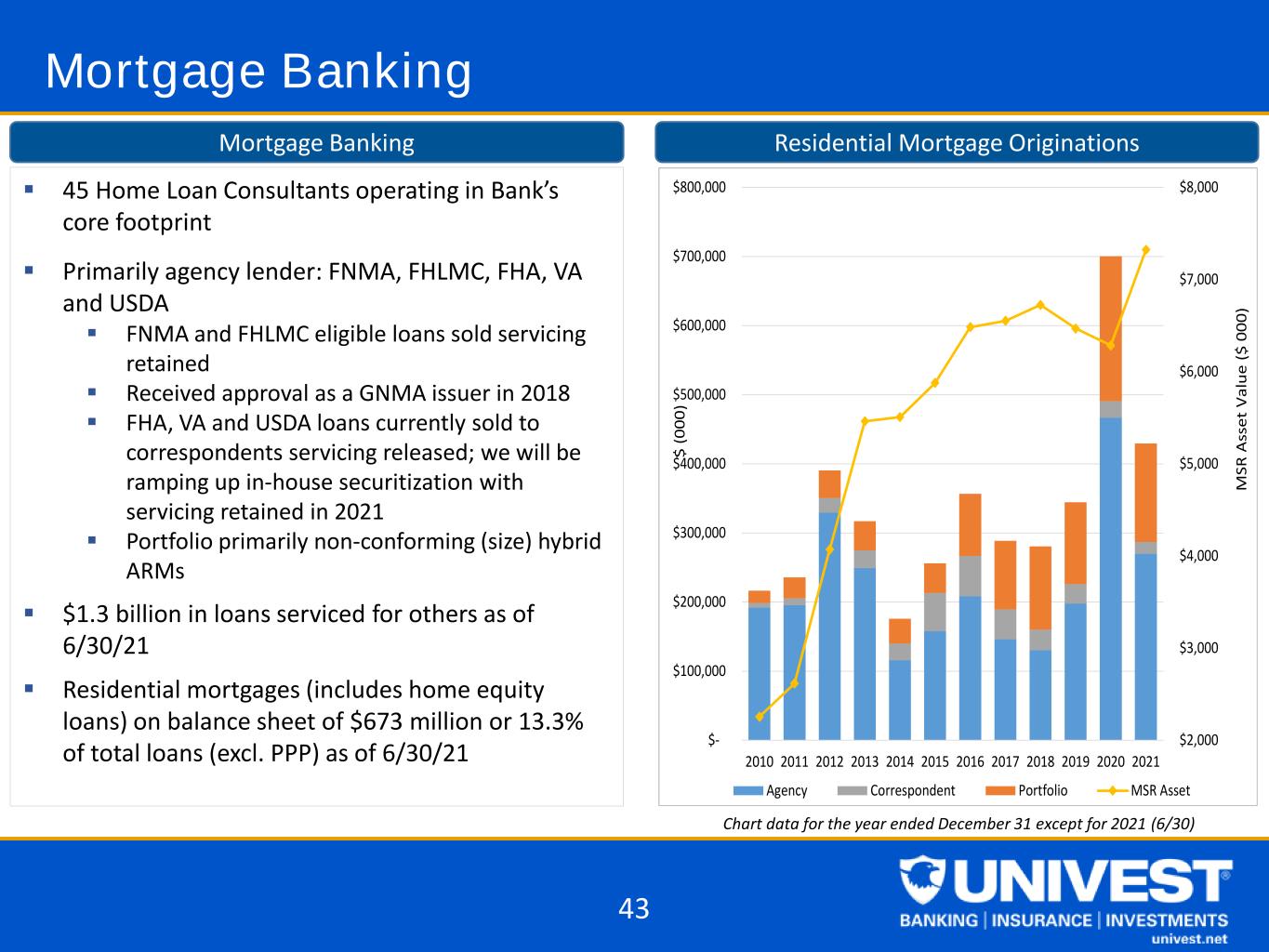

Mortgage Banking 45 Home Loan Consultants operating in Bank’s core footprint Primarily agency lender: FNMA, FHLMC, FHA, VA and USDA FNMA and FHLMC eligible loans sold servicing retained Received approval as a GNMA issuer in 2018 FHA, VA and USDA loans currently sold to correspondents servicing released; we will be ramping up in-house securitization with servicing retained in 2021 Portfolio primarily non-conforming (size) hybrid ARMs $1.3 billion in loans serviced for others as of 6/30/21 Residential mortgages (includes home equity loans) on balance sheet of $673 million or 13.3% of total loans (excl. PPP) as of 6/30/21 Chart data for the year ended December 31 except for 2021 (6/30) Residential Mortgage OriginationsMortgage Banking 43 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $- $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 M SR A ss et V al u e ($ 0 00 ) $ (0 00 ) Agency Correspondent Portfolio MSR Asset

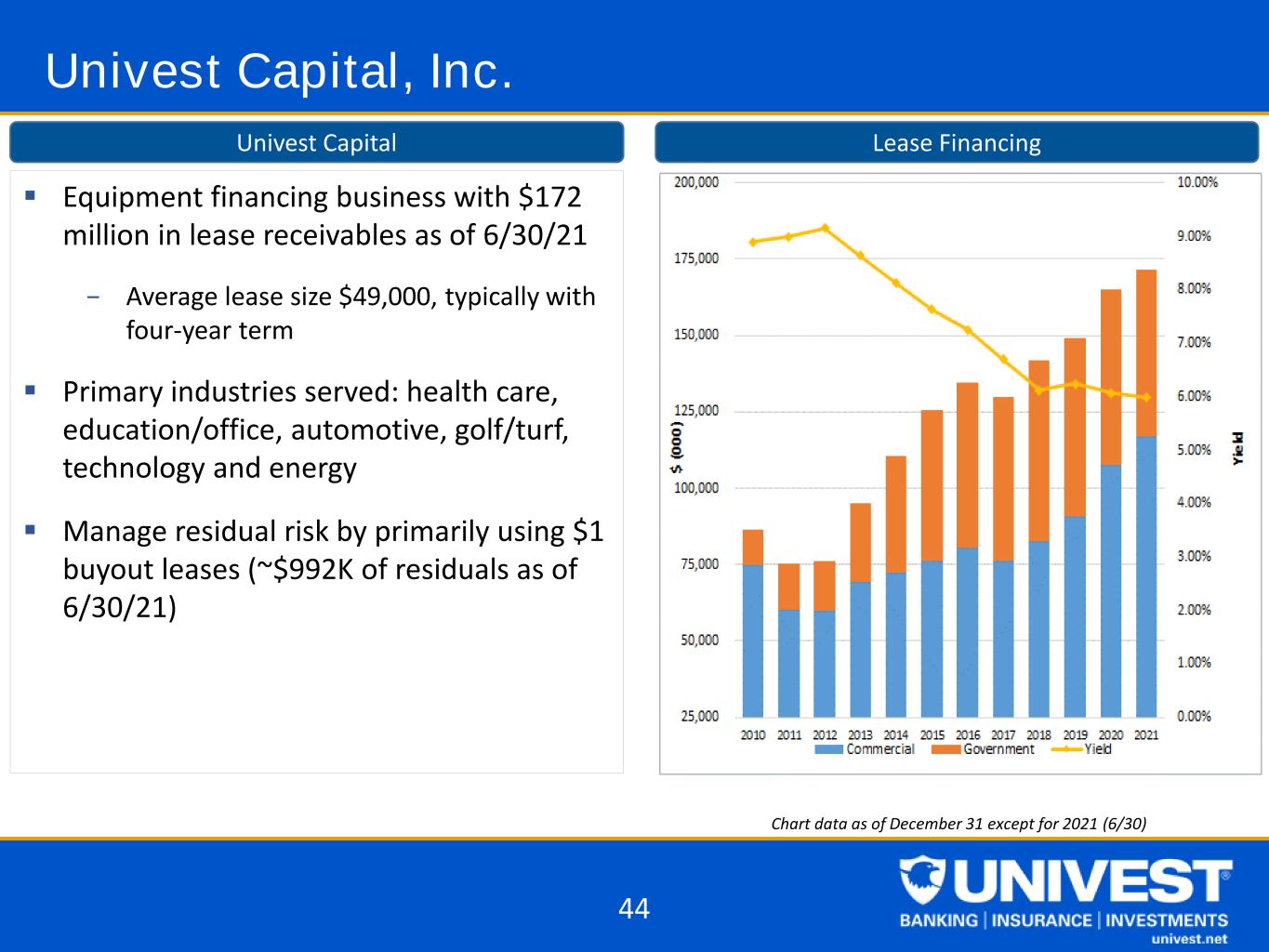

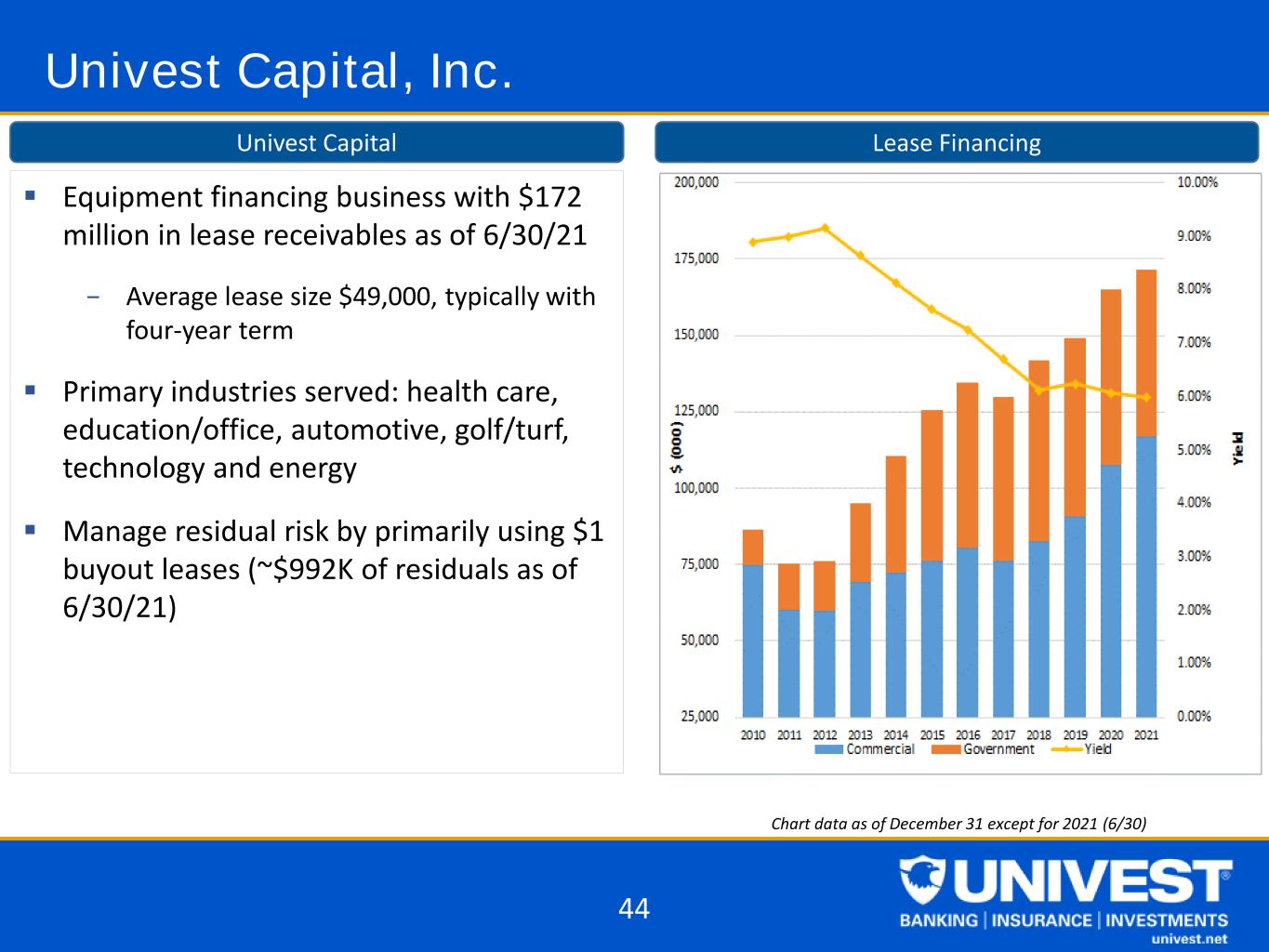

Univest Capital, Inc. Equipment financing business with $172 million in lease receivables as of 6/30/21 − Average lease size $49,000, typically with four-year term Primary industries served: health care, education/office, automotive, golf/turf, technology and energy Manage residual risk by primarily using $1 buyout leases (~$992K of residuals as of 6/30/21) Lease FinancingUnivest Capital 44 Chart data as of December 31 except for 2021 (6/30)

Wealth Management Comprehensive wealth management platform including broker / dealer, municipal pension services, registered investment advisor, retirement plan services and trust The wealth management division operates under the Girard brand (i.e. Girard Advisory Services, LLC, Girard Benefits Group, LLC, Girard Pension Services, LLC, Girard Investment Services, LLC) Organic growth supplemented by acquisition • Trust powers obtained in 1928 • Broker / Dealer acquired in 1999 • Municipal pension operation acquired in 2008 • Registered investment advisor, Girard Partners, acquired in 2014 $4.5 billion in assets under management/ supervision at 6/30/21 Assets Under ManagementWealth Management 45 Chart data as of December 31 except for 2021 (6/30)

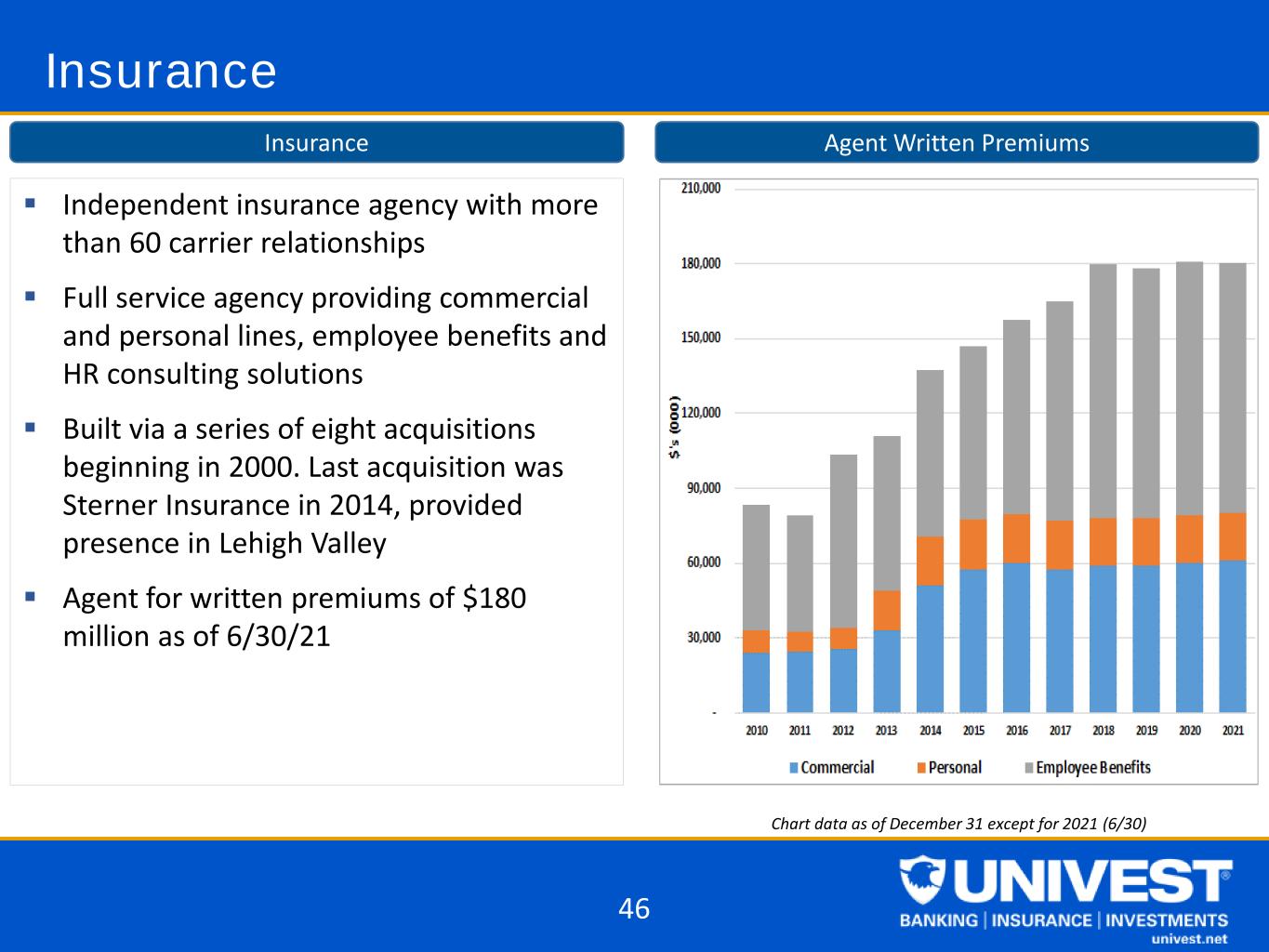

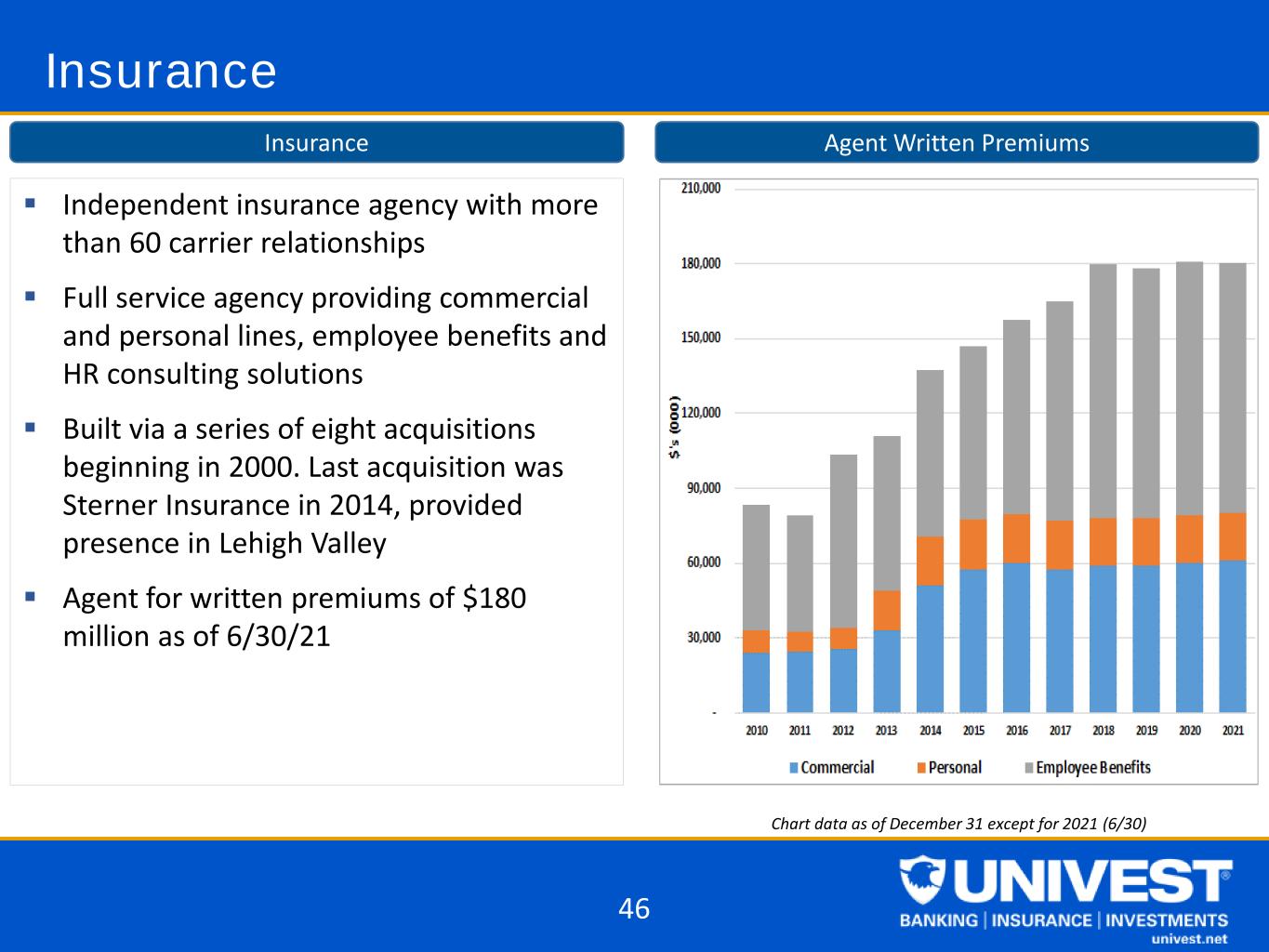

Insurance Independent insurance agency with more than 60 carrier relationships Full service agency providing commercial and personal lines, employee benefits and HR consulting solutions Built via a series of eight acquisitions beginning in 2000. Last acquisition was Sterner Insurance in 2014, provided presence in Lehigh Valley Agent for written premiums of $180 million as of 6/30/21 Agent Written PremiumsInsurance 46 Chart data as of December 31 except for 2021 (6/30)

APPENDIX (Non-GAAP Reconciliations)

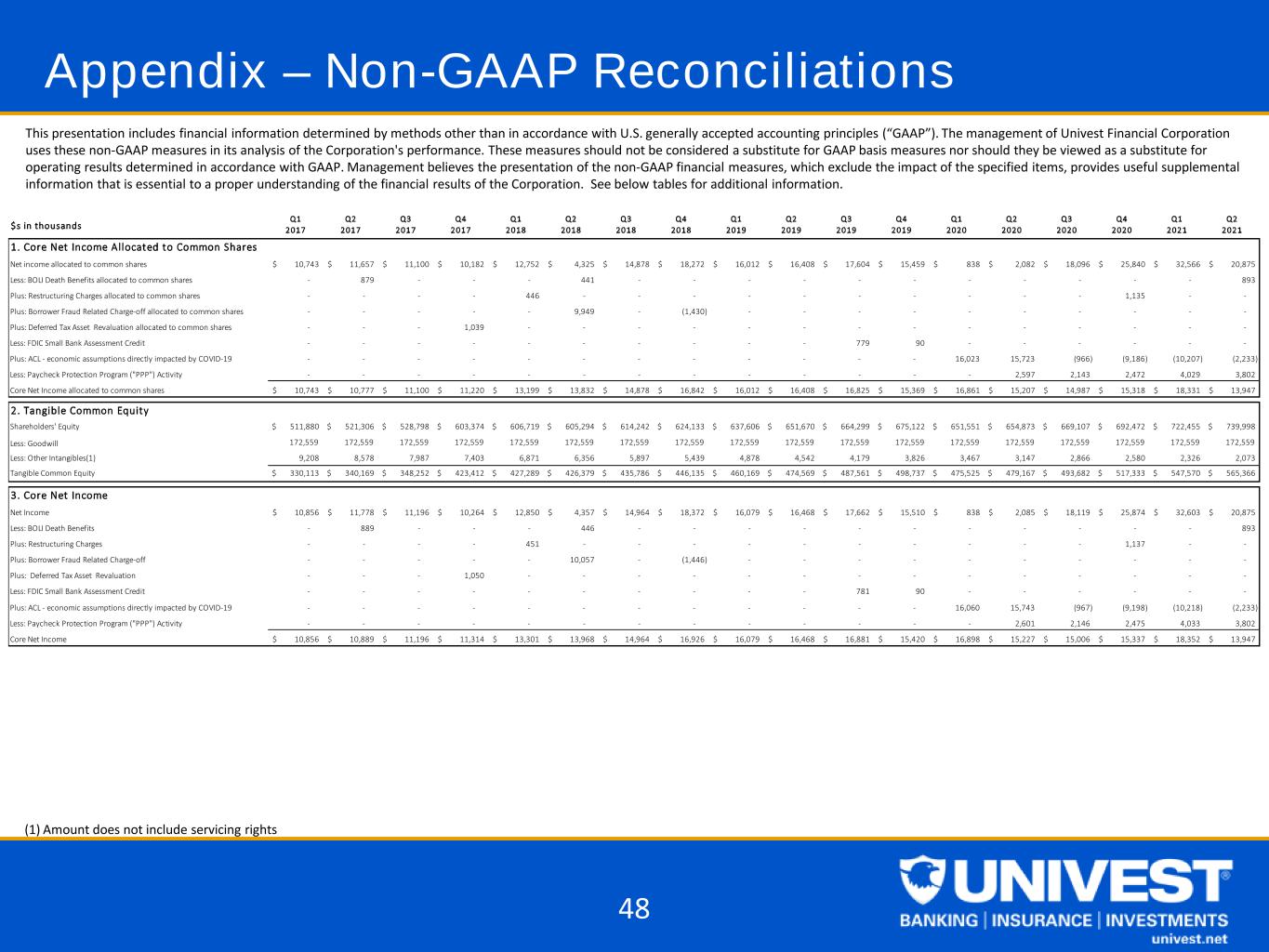

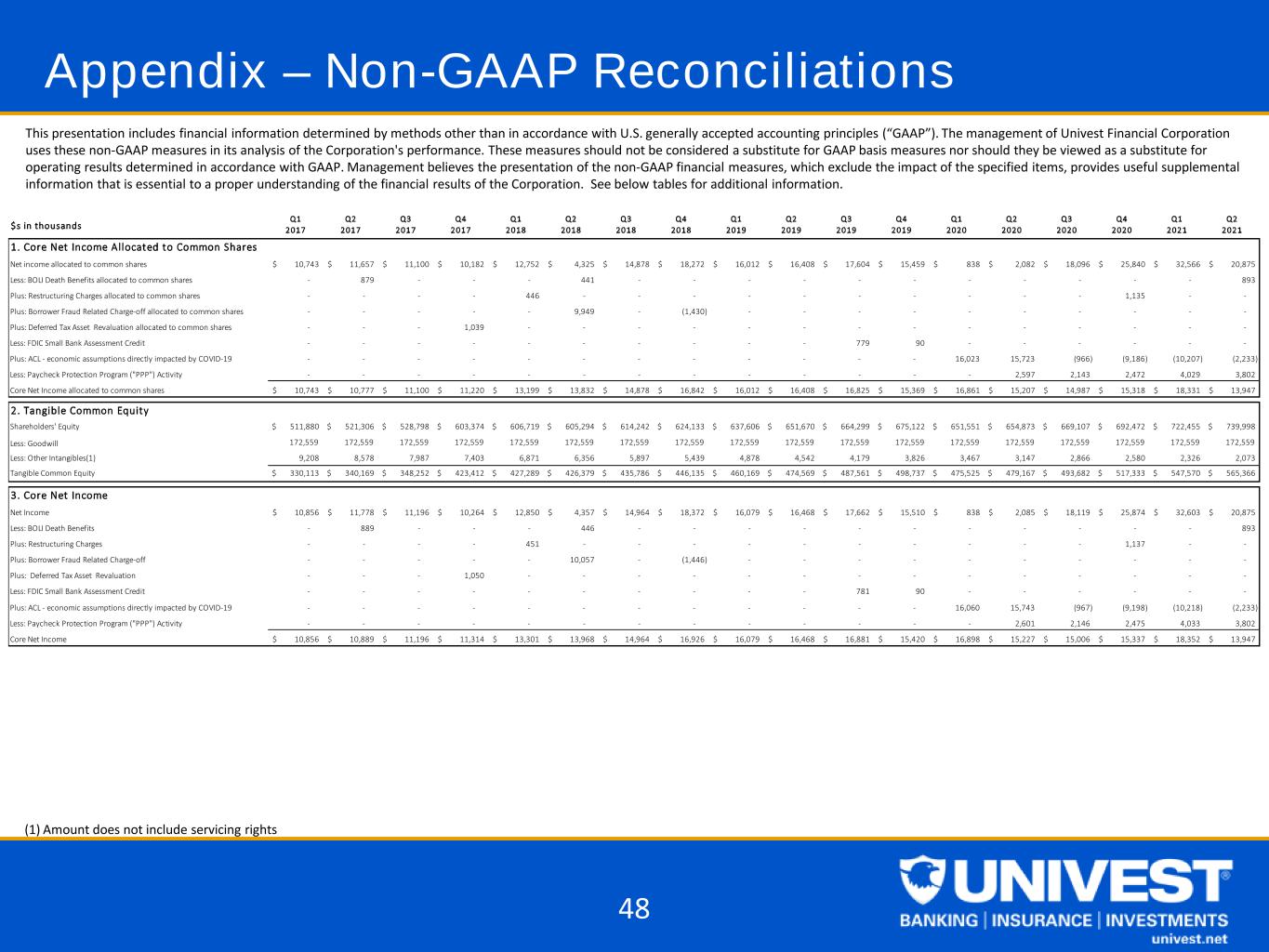

Appendix – Non-GAAP Reconciliations (1) Amount does not include servicing rights This presentation includes financial information determined by methods other than in accordance with U.S. generally accepted accounting principles (“GAAP”). The management of Univest Financial Corporation uses these non-GAAP measures in its analysis of the Corporation's performance. These measures should not be considered a substitute for GAAP basis measures nor should they be viewed as a substitute for operating results determined in accordance with GAAP. Management believes the presentation of the non-GAAP financial measures, which exclude the impact of the specified items, provides useful supplemental information that is essential to a proper understanding of the financial results of the Corporation. See below tables for additional information. 48 $s in thousands Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 1. Core Net Income Allocated to Common Shares Net income allocated to common shares 10,743$ 11,657$ 11,100$ 10,182$ 12,752$ 4,325$ 14,878$ 18,272$ 16,012$ 16,408$ 17,604$ 15,459$ 838$ 2,082$ 18,096$ 25,840$ 32,566$ 20,875$ Less: BOLI Death Benefits allocated to common shares - 879 - - - 441 - - - - - - - - - - - 893 Plus: Restructuring Charges allocated to common shares - - - - 446 - - - - - - - - - - 1,135 - - Plus: Borrower Fraud Related Charge-off allocated to common shares - - - - - 9,949 - (1,430) - - - - - - - - - - Plus: Deferred Tax Asset Revaluation allocated to common shares - - - 1,039 - - - - - - - - - - - - - - Less: FDIC Small Bank Assessment Credit - - - - - - - - - - 779 90 - - - - - - Plus: ACL - economic assumptions directly impacted by COVID-19 - - - - - - - - - - - - 16,023 15,723 (966) (9,186) (10,207) (2,233) Less: Paycheck Protection Program ("PPP") Activity - - - - - - - - - - - - - 2,597 2,143 2,472 4,029 3,802 Core Net Income allocated to common shares 10,743$ 10,777$ 11,100$ 11,220$ 13,199$ 13,832$ 14,878$ 16,842$ 16,012$ 16,408$ 16,825$ 15,369$ 16,861$ 15,207$ 14,987$ 15,318$ 18,331$ 13,947$ 2. Tangible Common Equity Shareholders' Equity $ 511,880 $ 521,306 $ 528,798 $ 603,374 $ 606,719 $ 605,294 $ 614,242 $ 624,133 $ 637,606 $ 651,670 $ 664,299 $ 675,122 $ 651,551 $ 654,873 $ 669,107 $ 692,472 $ 722,455 $ 739,998 Less: Goodwill 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 Less: Other Intangibles(1) 9,208 8,578 7,987 7,403 6,871 6,356 5,897 5,439 4,878 4,542 4,179 3,826 3,467 3,147 2,866 2,580 2,326 2,073 Tangible Common Equity $ 330,113 $ 340,169 $ 348,252 $ 423,412 $ 427,289 $ 426,379 $ 435,786 $ 446,135 $ 460,169 $ 474,569 $ 487,561 $ 498,737 $ 475,525 $ 479,167 $ 493,682 $ 517,333 $ 547,570 $ 565,366 3. Core Net Income Net Income 10,856$ 11,778$ 11,196$ 10,264$ 12,850$ 4,357$ 14,964$ 18,372$ 16,079$ 16,468$ 17,662$ 15,510$ 838$ 2,085$ 18,119$ 25,874$ 32,603$ 20,875$ Less: BOLI Death Benefits - 889 - - - 446 - - - - - - - - - - - 893 Plus: Restructuring Charges - - - - 451 - - - - - - - - - - 1,137 - - Plus: Borrower Fraud Related Charge-off - - - - - 10,057 - (1,446) - - - - - - - - - - Plus: Deferred Tax Asset Revaluation - - - 1,050 - - - - - - - - - - - - - - Less: FDIC Small Bank Assessment Credit - - - - - - - - - - 781 90 - - - - - - Plus: ACL - economic assumptions directly impacted by COVID-19 - - - - - - - - - - - - 16,060 15,743 (967) (9,198) (10,218) (2,233) Less: Paycheck Protection Program ("PPP") Activity - - - - - - - - - - - - - 2,601 2,146 2,475 4,033 3,802 Core Net Income 10,856$ 10,889$ 11,196$ 11,314$ 13,301$ 13,968$ 14,964$ 16,926$ 16,079$ 16,468$ 16,881$ 15,420$ 16,898$ 15,227$ 15,006$ 15,337$ 18,352$ 13,947$

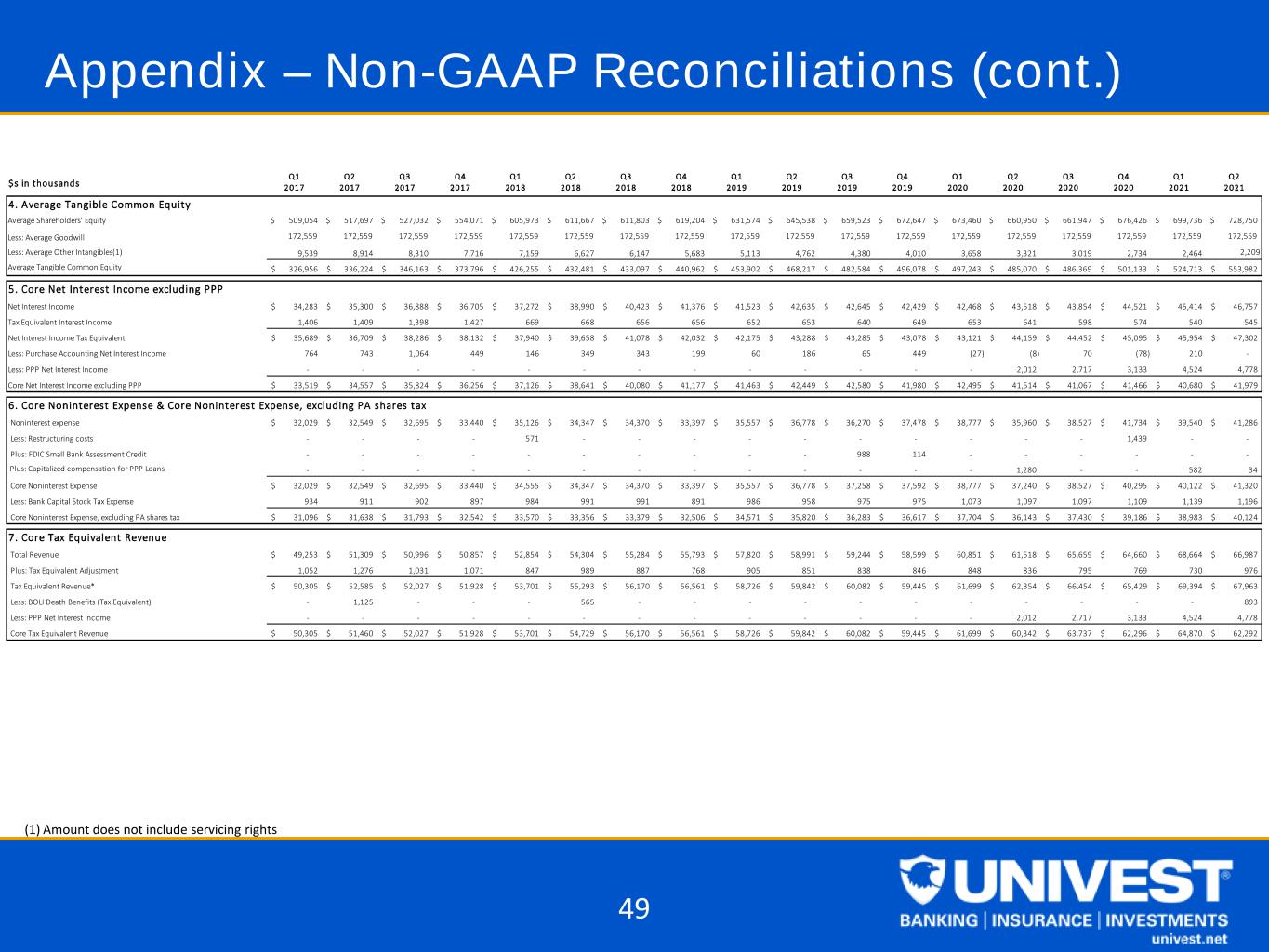

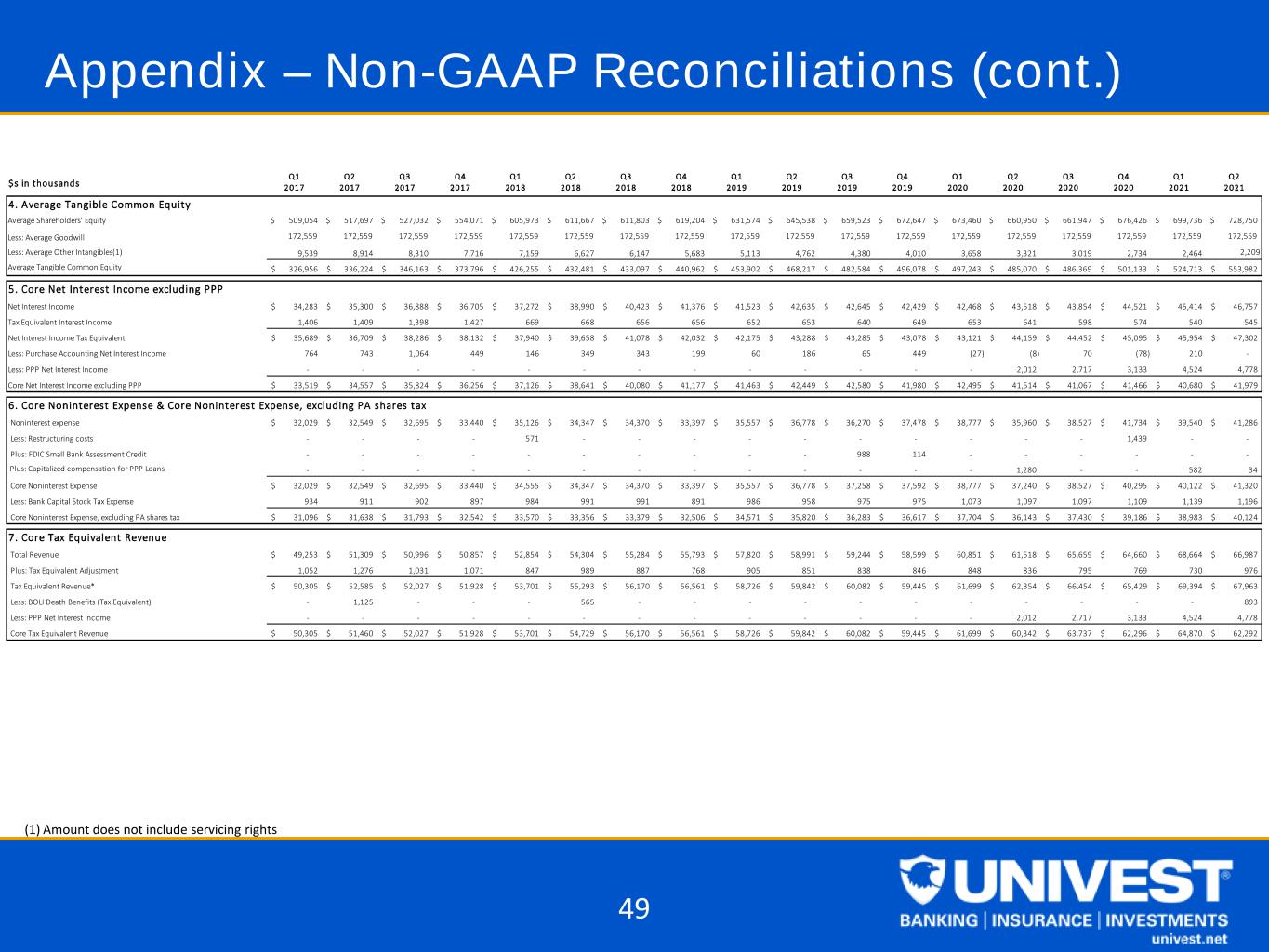

Appendix – Non-GAAP Reconciliations (cont.) (1) Amount does not include servicing rights 49 $s in thousands Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 4. Average Tangible Common Equity Average Shareholders' Equity $ 509,054 $ 517,697 $ 527,032 $ 554,071 $ 605,973 $ 611,667 $ 611,803 $ 619,204 $ 631,574 $ 645,538 $ 659,523 $ 672,647 $ 673,460 $ 660,950 $ 661,947 $ 676,426 $ 699,736 $ 728,750 Less: Average Goodwill 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 172,559 Less: Average Other Intangibles(1) 9,539 8,914 8,310 7,716 7,159 6,627 6,147 5,683 5,113 4,762 4,380 4,010 3,658 3,321 3,019 2,734 2,464 2,209 Average Tangible Common Equity 326,956$ 336,224$ 346,163$ 373,796$ 426,255$ 432,481$ 433,097$ 440,962$ 453,902$ 468,217$ 482,584$ 496,078$ 497,243$ 485,070$ 486,369$ 501,133$ 524,713$ 553,982$ 5. Core Net Interest Income excluding PPP Net Interest Income 34,283$ 35,300$ 36,888$ 36,705$ 37,272$ 38,990$ 40,423$ 41,376$ 41,523$ 42,635$ 42,645$ 42,429$ 42,468$ 43,518$ 43,854$ 44,521$ 45,414$ 46,757$ Tax Equivalent Interest Income 1,406 1,409 1,398 1,427 669 668 656 656 652 653 640 649 653 641 598 574 540 545 Net Interest Income Tax Equivalent 35,689$ 36,709$ 38,286$ 38,132$ 37,940$ 39,658$ 41,078$ 42,032$ 42,175$ 43,288$ 43,285$ 43,078$ 43,121$ 44,159$ 44,452$ 45,095$ 45,954$ 47,302$ Less: Purchase Accounting Net Interest Income 764 743 1,064 449 146 349 343 199 60 186 65 449 (27) (8) 70 (78) 210 - Less: PPP Net Interest Income - - - - - - - - - - - - - 2,012 2,717 3,133 4,524 4,778 Core Net Interest Income excluding PPP 33,519$ 34,557$ 35,824$ 36,256$ 37,126$ 38,641$ 40,080$ 41,177$ 41,463$ 42,449$ 42,580$ 41,980$ 42,495$ 41,514$ 41,067$ 41,466$ 40,680$ 41,979$ 6. Core Noninterest Expense & Core Noninterest Expense, excluding PA shares tax Noninterest expense 32,029$ 32,549$ 32,695$ 33,440$ 35,126$ 34,347$ 34,370$ 33,397$ 35,557$ 36,778$ 36,270$ 37,478$ 38,777$ 35,960$ 38,527$ 41,734$ 39,540$ 41,286$ Less: Restructuring costs - - - - 571 - - - - - - - - - - 1,439 - - Plus: FDIC Small Bank Assessment Credit - - - - - - - - - - 988 114 - - - - - - Plus: Capitalized compensation for PPP Loans - - - - - - - - - - - - - 1,280 - - 582 34 Core Noninterest Expense 32,029$ 32,549$ 32,695$ 33,440$ 34,555$ 34,347$ 34,370$ 33,397$ 35,557$ 36,778$ 37,258$ 37,592$ 38,777$ 37,240$ 38,527$ 40,295$ 40,122$ 41,320$ Less: Bank Capital Stock Tax Expense 934 911 902 897 984 991 991 891 986 958 975 975 1,073 1,097 1,097 1,109 1,139 1,196 Core Noninterest Expense, excluding PA shares tax 31,096$ 31,638$ 31,793$ 32,542$ 33,570$ 33,356$ 33,379$ 32,506$ 34,571$ 35,820$ 36,283$ 36,617$ 37,704$ 36,143$ 37,430$ 39,186$ 38,983$ 40,124$ 7. Core Tax Equivalent Revenue Total Revenue 49,253$ 51,309$ 50,996$ 50,857$ 52,854$ 54,304$ 55,284$ 55,793$ 57,820$ 58,991$ 59,244$ 58,599$ 60,851$ 61,518$ 65,659$ 64,660$ 68,664$ 66,987$ Plus: Tax Equivalent Adjustment 1,052 1,276 1,031 1,071 847 989 887 768 905 851 838 846 848 836 795 769 730 976 Tax Equivalent Revenue* 50,305$ 52,585$ 52,027$ 51,928$ 53,701$ 55,293$ 56,170$ 56,561$ 58,726$ 59,842$ 60,082$ 59,445$ 61,699$ 62,354$ 66,454$ 65,429$ 69,394$ 67,963$ Less: BOLI Death Benefits (Tax Equivalent) - 1,125 - - - 565 - - - - - - - - - - - 893 Less: PPP Net Interest Income - - - - - - - - - - - - - 2,012 2,717 3,133 4,524 4,778 Core Tax Equivalent Revenue 50,305$ 51,460$ 52,027$ 51,928$ 53,701$ 54,729$ 56,170$ 56,561$ 58,726$ 59,842$ 60,082$ 59,445$ 61,699$ 60,342$ 63,737$ 62,296$ 64,870$ 62,292$

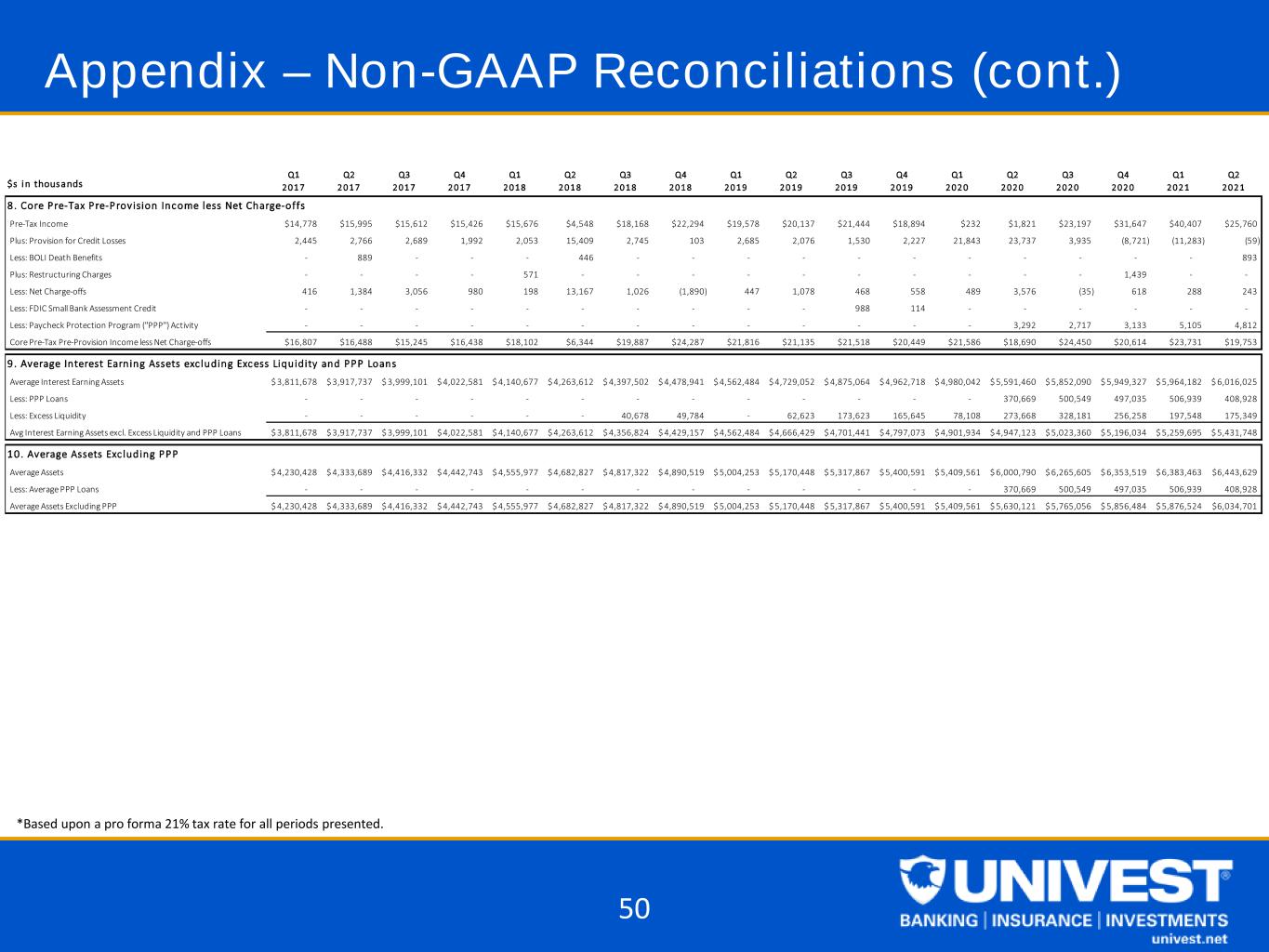

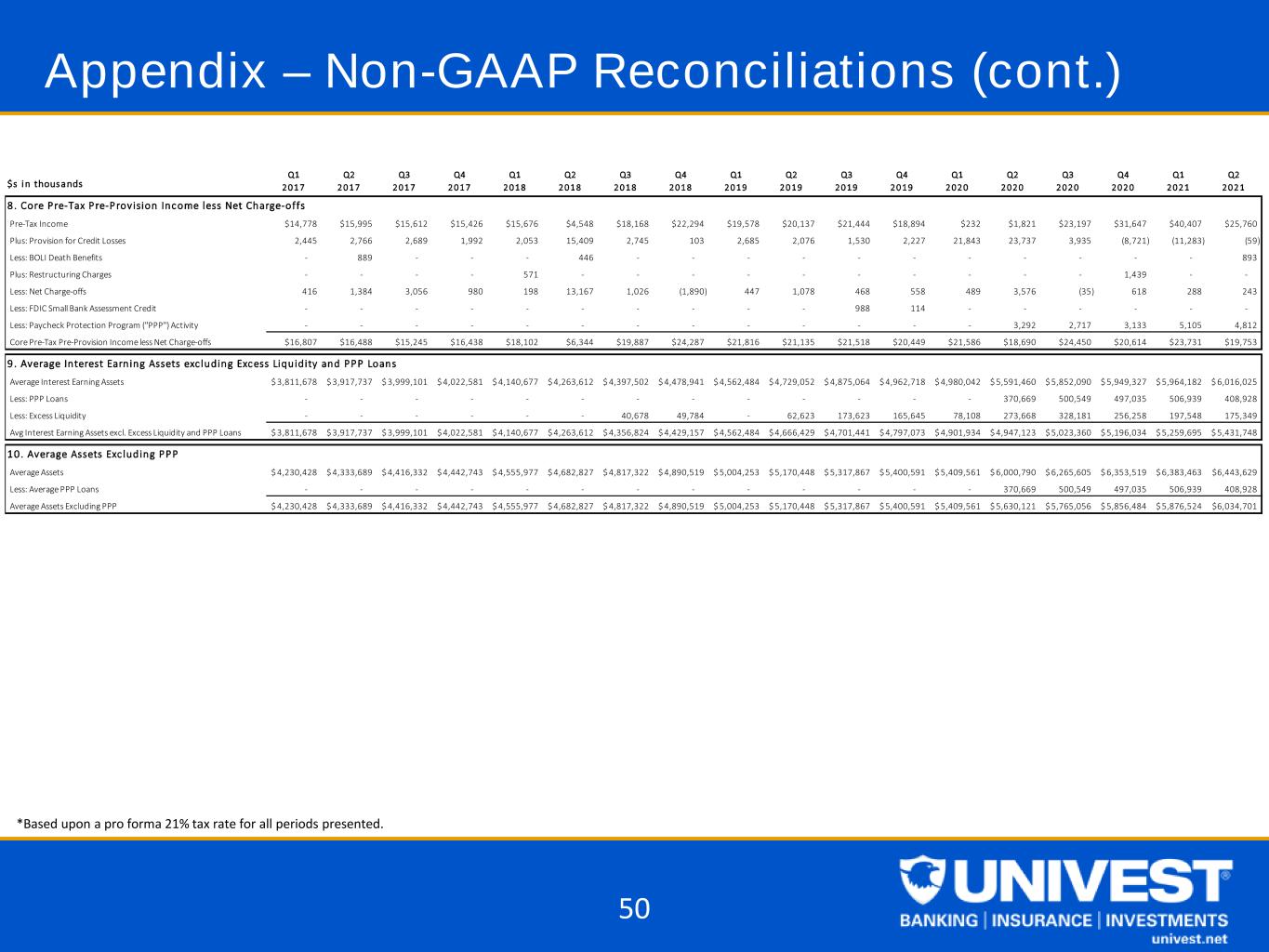

Appendix – Non-GAAP Reconciliations (cont.) *Based upon a pro forma 21% tax rate for all periods presented. 50 $s in thous ands Q1 2 0 1 7 Q2 2 0 1 7 Q3 2 0 1 7 Q4 2 0 1 7 Q1 2 0 1 8 Q2 2 0 1 8 Q3 2 0 1 8 Q4 2 0 1 8 Q1 2 0 1 9 Q2 2 0 1 9 Q3 2 0 1 9 Q4 2 0 1 9 Q1 2 0 2 0 Q2 2 0 2 0 Q3 2 0 2 0 Q4 2 0 2 0 Q1 2 0 2 1 Q2 2 0 2 1 8 . Core Pre-Tax Pre-Provision Inc ome less Net Charge-offs Pre-Tax Income $14,778 $15,995 $15,612 $15,426 $15,676 $4,548 $18,168 $22,294 $19,578 $20,137 $21,444 $18,894 $232 $1,821 $23,197 $31,647 $40,407 $25,760 Plus: Provision for Credit Losses 2,445 2,766 2,689 1,992 2,053 15,409 2,745 103 2,685 2,076 1,530 2,227 21,843 23,737 3,935 (8,721) (11,283) (59) Less: BOLI Death Benefits - 889 - - - 446 - - - - - - - - - - - 893 Plus: Restructuring Charges - - - - 571 - - - - - - - - - - 1,439 - - Less: Net Charge-offs 416 1,384 3,056 980 198 13,167 1,026 (1,890) 447 1,078 468 558 489 3,576 (35) 618 288 243 Less: FDIC Small Bank Assessment Credit - - - - - - - - - - 988 114 - - - - - - Less: Paycheck Protection Program ("PPP") Activity - - - - - - - - - - - - - 3,292 2,717 3,133 5,105 4,812 Core Pre-Tax Pre-Provision Income less Net Charge-offs $16,807 $16,488 $15,245 $16,438 $18,102 $6,344 $19,887 $24,287 $21,816 $21,135 $21,518 $20,449 $21,586 $18,690 $24,450 $20,614 $23,731 $19,753 9 . Average Interest Earning Assets exc luding Exc ess Liquidity and PPP Loans Average Interest Earning Assets 3,811,678$ 3,917,737$ 3,999,101$ 4,022,581$ 4,140,677$ 4,263,612$ 4,397,502$ 4,478,941$ 4,562,484$ 4,729,052$ 4,875,064$ 4,962,718$ 4,980,042$ 5,591,460$ 5,852,090$ 5,949,327$ 5,964,182$ 6,016,025$ Less: PPP Loans - - - - - - - - - - - - - 370,669 500,549 497,035 506,939 408,928 Less: Excess Liquidity - - - - - - 40,678 49,784 - 62,623 173,623 165,645 78,108 273,668 328,181 256,258 197,548 175,349 Avg Interest Earning Assets excl. Excess Liquidity and PPP Loans 3,811,678$ 3,917,737$ 3,999,101$ 4,022,581$ 4,140,677$ 4,263,612$ 4,356,824$ 4,429,157$ 4,562,484$ 4,666,429$ 4,701,441$ 4,797,073$ 4,901,934$ 4,947,123$ 5,023,360$ 5,196,034$ 5,259,695$ 5,431,748$ 10 . Average Assets Exc luding PPP Average Assets 4,230,428$ 4,333,689$ 4,416,332$ 4,442,743$ 4,555,977$ 4,682,827$ 4,817,322$ 4,890,519$ 5,004,253$ 5,170,448$ 5,317,867$ 5,400,591$ 5,409,561$ 6,000,790$ 6,265,605$ 6,353,519$ 6,383,463$ $6,443,629 Less: Average PPP Loans - - - - - - - - - - - - - 370,669 500,549 497,035 506,939 408,928 Average Assets Excluding PPP 4,230,428$ 4,333,689$ 4,416,332$ 4,442,743$ 4,555,977$ 4,682,827$ 4,817,322$ 4,890,519$ 5,004,253$ 5,170,448$ 5,317,867$ 5,400,591$ 5,409,561$ 5,630,121$ 5,765,056$ 5,856,484$ 5,876,524$ $6,034,701