UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-12147

DELTIC TIMBER CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 71-0795870 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| | |

| 210 East Elm Street, P. O. Box 7200, El Dorado, Arkansas | | 71731-7200 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (870) 881-9400

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common Stock, $.01 Par Value | | New York Stock Exchange, Inc. |

Series A Participating Cumulative Preferred Stock Purchase Rights | | New York Stock Exchange, Inc. |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | x |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a small reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the Common Stock held by non-affiliates of the registrant, based on the closing price of the Common Stock on the New York Stock Exchange as of June 30, 2008, was $256,713,208. For purposes of this computation, all officers, directors, and 5% beneficial owners of the registrant (as indicated in Item 12) are deemed to be affiliates. Such determination should not be deemed an admission that such directors, officers, or 5% beneficial owners are, in fact, affiliates of the registrant.

Number of shares of Common Stock, $.01 Par Value, outstanding at February 13, 2009, was 12,395,913.

Documents incorporated by reference:

The Registrant’s definitive Proxy Statement relating to the Annual Meeting of Stockholders on April 23, 2009.

TABLE OF CONTENTS - 2008 FORM 10-K REPORT

2

PART I

Introduction

Deltic Timber Corporation (“Deltic” or the “Company”) is a natural resources company engaged primarily in the growing and harvesting of timber and the manufacture and marketing of lumber. Deltic owns approximately 438,600 acres of timberland, primarily in Arkansas and north Louisiana. The Company’s sawmill operations are located at Ola in central Arkansas (the “Ola Mill”) and at Waldo in south Arkansas (the “Waldo Mill”). In addition to its timber and lumber operations, the Company is engaged in real estate development in central Arkansas. The Company also holds a 50 percent interest in Del-Tin Fiber L.L.C. (“Del-Tin Fiber”), a joint venture to manufacture and market medium density fiberboard (“MDF”). Deltic is a calendar-year company for both financial and income tax reporting.

The Company is organized into four segments: (1) Woodlands, which manages all aspects of the Company’s timberlands including harvesting and sale of timber, timberland sales and acquisitions, oil and gas mineral revenue, and hunting land leases; (2) Mills, which consists of Deltic’s two sawmills that manufacture a variety of softwood lumber products; (3) Real Estate, which includes the Company’s three active real estate developments and a related country club operation; and (4) Corporate, which consists of executive management, accounting, information systems, human resources, purchasing, treasury, income tax, and legal staff functions that provide support services to the operating business units. The Company currently does not allocate the cost of maintaining these support functions to its operating units.

The Company’s timberlands consist primarily of Southern Pine, known in the industry as a type of “softwood”. Deltic considers its timberlands to be the Company’s most valuable asset and the harvest of stumpage to be its most significant source of income; accordingly, Deltic actively manages its timberlands to increase productivity and maximize the long-term value of these timber assets. The Company harvests timber from the timberlands in accordance with its harvest plans and sells such timber in the domestic market or converts it to lumber in its sawmills. Stumpage supplied to the Company’s sawmills is transferred at prices that approximate market in its operating area. The Company implemented a timberland acquisition program in late 1996. Thus far, the Company has focused its acquisition program on timberland in its current operating area. The Company also initiated a program in 1999 to identify, for possible sale, non-strategic timberland and higher and better use lands.

The Company’s two sawmills employ modern technology in order to improve efficiency, reduce labor costs, maximize utilization of the timber resource, and maintain high standards for production quality with safety being one of the highest priorities. In addition, each mill is strategically located near significant portions of the Company’s timberlands. The mills can produce a variety of lumber products, including dimension lumber, boards, and timbers. These lumber products are sold primarily to wholesale distributors, lumber treaters, and truss manufacturers in the South and Midwest and are used mainly in residential construction, roof trusses, and laminated beams. Combined annual permitted capacity of the two mills at December 31, 2008, was 390 million board feet (“MMBF”). The Company’s total finished lumber production was 246 MMBF in 2008 compared to 213 MMBF in 2007 and 253 MMBF in 2006.

The Company’s real estate operations were started in 1985 to add value to higher and better use timberland strategically located in the growth corridor of west Little Rock, Arkansas. Since that time, the Company has been developing Chenal Valley, a premier planned community consisting of 4,700 acres of residential and commercial properties. The property is being developed in stages, and real estate sales to-date have consisted primarily of residential lots, which are sold to builders or individuals, and commercial sites. In addition to Chenal Valley, Deltic has developed Chenal Downs, a 400-acre development located just outside Chenal Valley, and is developing Red Oak Ridge, an 800-acre development in Hot Springs, Arkansas. During 2007, the Company and Central Arkansas Water entered into a full and complete settlement of a pending condemnation litigation involving 680 acres of undeveloped real estate within the watershed of Lake

3

Maumelle in western Pulaski County, Arkansas. Approximately 640 acres were part of a planned development of the Company, which has since been suspended. (For additional information, See Note 21 – Commitments and Contingencies.)

The Del-Tin Fiber plant is located near El Dorado, Arkansas. Construction of the plant was completed, and initial production began, in 1998. The plant is designed to have an annual capacity of 150 million square feet (“MMSF”) on a 3/4 inch basis, making it one of the largest plants of its type in North America. MDF, which is used primarily in the furniture, flooring, store fixture, and molding industries, is manufactured from sawmill residuals such as chips, shavings, and sawdust, pressed and held together by an adhesive bond.

From the time production began at Del-Tin Fiber in 1998 until the fourth quarter of 2003, both operating and financial performance were below the expectations established at the time the decision to construct the plant was made. As a result, on April 25, 2002, Deltic announced that Banc One Capital Markets, Inc. had been retained as financial advisor to assist in the evaluation of strategic alternatives for the Company’s investment in Del-Tin Fiber. Subsequently, Deltic’s management and Board of Directors completed its review of these strategic alternatives and announced the Company intended to exit the MDF business upon the earliest and most reasonable opportunity provided by the market. As a result of this decision, the Company’s evaluation of possible impairment of the carrying value of its investment in the joint-venture was based primarily upon the estimated cash flows from a sale of the Company’s interest during 2003 and resulted in a determination that the Company’s investment was impaired as of December 31, 2002. The investment was written off to zero.

Due to the Company’s commitment to fund its share of any of the facility’s operating working capital needs until the facility was able to consistently generate sufficient funds to meet its cash requirements or Deltic’s ownership was sold, the Company recognized losses in Del-Tin Fiber equal to the extent of these advances during 2003. For the year of 2003, such advances approximated the Company’s equity share of losses for the plant; accordingly, the investment in Del-Tin Fiber at December 31, 2003, was zero. The Company also continued to utilize its management resources to work with Del-Tin’s management and the joint-venture partner to improve operating performance at the plant. As a result of these improvements, on December 11, 2003, Deltic’s Board of Directors revised its intent regarding the Company’s investment in Del-Tin Fiber and ceased efforts to sell the Company’s interest in the joint venture, while continuing to focus on improving operating and financial results of the plant. Due to this decision, the 2003 evaluation of fair value for the investment was based primarily upon the future net cash flows from Del-Tin Fiber’s operations over the remaining life of the plant. From 2004 through 2008, the Company has recorded its equity share of the operating results of the joint venture.

Forest Products Industry

Deltic is primarily a wood products producer operating in a commodity-based business environment, with a major diversification in real estate development. This environment is affected by a number of factors, including general economic conditions, interest rates, availability and costs of credit, imports, foreign exchange rates, housing starts, unsold new and existing home inventories, home foreclosures, residential repair and remodeling, commercial construction, industry capacity and production levels, the availability of raw material, fuel cost, and weather conditions. The Mills segments have been affected by the decreased number of housing starts in the U.S., which declined to its lowest level in 50 years. Several factors influencing the decrease were stricter lending practices brought about by subprime loan failures, construction loan delinquencies that are causing lenders to tighten credit for new developments, increased new and existing home inventory levels, and economic concerns with the U.S. economy and overall weakness in the banking industry. Consequently, the demand and pricing level for softwood lumber products have steadily declined for the past three years.

Lumber prices have historically been, and will remain, volatile. Sawtimber prices have generally been more stable than lumber prices, but have seen price reductions due to the closure of several mills in Deltic’s operating area.

4

The southern U.S., in which all of the Company’s operations are located, is a major timber and lumber producing region. There are an estimated 215 million acres of forestland in the region, of which approximately 97 million acres contain softwood, predominately Southern Pine. Unlike other major timber-producing areas in North America, most of this acreage is privately held. The estimated breakdown of ownership of softwood timberland in the southern U.S. is 88 percent private, six percent national forest, and six percent other public. Although there can be no assurance, management anticipates that the southern U.S. timber resource will be subject to strong demand for the foreseeable future and also believes that the South will have a strategic advantage over other U.S. timber-producing regions due to regulatory, geographic, and other factors.

Woodlands

The Company owns approximately 438,600 acres of timberland, primarily in Arkansas and north Louisiana, stocked principally with Southern Pine. Management considers the timberlands to be Deltic’s most valuable asset and the harvest of this stumpage to be the Company’s most significant source of income.

The approximate breakdown of the Company’s timberland acreage at year-end 2008 consisted of the following:

| | |

| | | Acres |

Pine forest | | 184,000 |

Pine plantation | | 191,000 |

Hardwood forest | | 20,000 |

Other | | 43,600 |

| | |

Total | | 438,600 |

| | |

The Company’s timberlands are well diversified by age class. The timberland classified as pine forest is primarily managed on an all-aged basis and contains mature timber that is ready to be harvested over the next several years and includes stream-management zones. Pine plantations are primarily less than 30 years old, with the majority ranging in age from 5 to 25 years. At the approximate age of 20 years, pine plantations begin building a significant amount of pine sawtimber tonnage.

Timber Inventory. The Company’s estimated standing timber inventory is calculated for each tract by utilizing growth formulas based on representative sample tracts and tree counts for various diameter classifications. The calculation of pine inventory is subject to periodic adjustments based on sample cruises and actual volumes harvested. The hardwood inventory shown in the following table is only an approximation; therefore, the physical quantity of such timber may vary significantly from this approximation. Estimated inventory of standing timber as of December 31, 2008, consisted of the following:

| | |

| | | Estimated

Volume

(Tons) |

Pine timber | | |

Sawtimber | | 11,567,000 |

Pulpwood | | 4,568,000 |

| |

Hardwood timber | | |

Sawtimber | | 1,682,000 |

Pulpwood | | 994,000 |

5

The Company’s pine sawtimber is either used in its sawmills or sold to third parties. Over the past few years, the annual harvest has been used primarily in the Company’s Mills segment. Products that can be manufactured from this resource include dimension lumber, boards, timbers, and decking, used primarily in residential construction. Deltic’s hardwood sawtimber is sold to third parties and is primarily used in the production of railroad ties, flooring, and pallets. Pulpwood consists of logs with a diameter of less than nine inches. Both pine and hardwood pulpwood are sold to third parties for use primarily in the manufacture of paper.

Timber Growth. Timber growth rate is an important variable for forest products companies since it ultimately determines how much timber can be harvested on a sustainable basis. A higher growth rate permits larger annual harvests as replacement timber regenerates. Growth rates vary depending on species, location, age, and forestry management practices. The growth rate, net of mortality, for Deltic’s Southern Pine averages five to six percent of standing inventory per annum. The Company considers a 30 to 35 year rotation optimal for most pine plantations.

Timberland Management. Forestry practices vary by geographic region and depend on factors such as soil productivity, weather, terrain, and timber species, size, age, and stocking. The Company actively manages its timberlands based on these factors and other relevant information to increase productivity and maximize the long-term value of its timber assets. In general, the Company’s timberland management involves harvesting and thinning operations, reforestation, cull timber removal programs, and the introduction of genetically improved seedlings.

Deltic has developed and operates its own seed orchard. Seeds from the orchard are grown by third parties to produce genetically improved seedlings for planting. These seedlings are developed through selective cross-pollination to produce trees with preferred characteristics, including higher growth rates, fewer limbs, straighter trunks, and greater resistance to disease. However, this process does not involve genetic engineering. The seedlings are planted in all-aged stands, or a site is completely replanted in the case of a final harvest of mature stands. During 2008, about 17,000 acres were planted, primarily using seedlings grown from seeds produced at the orchard facility, with another approximately 6,500 acres scheduled to be planted in 2009 as the Company continues to reforest understocked tracts. The Company meets or exceeds, in all material respects, the reforestation recommendations of the Arkansas Forestry Commission’s Best Management Practices. In addition, the Company has been certified under the Sustainable Forestry Initiative (“SFI”) program with regards to its timberland management practices.

The Company actively utilizes commercial thinning practices. Thinning operations consist of the selective removal of trees within a stand, usually a plantation, and improve overall productivity by enhancing the growth of the remaining trees while generating revenues.

The Company’s silviculture program is designed to control undesirable, competitive vegetation in its forests and to increase pine growth rates and reproduction. Deltic treated about 18,000 acres, 13,400 acres, and 13,000 acres under this program in 2008, 2007, and 2006, respectively.

Harvest Plans. Management views the timberlands as assets with substantial inherent value apart from the sawmills and intends to manage the timberlands on a basis that permits regeneration of the timberlands over time. The Company intends to continue to manage the timberlands on a sustainable-yield basis and has no plans to harvest timber on an ongoing basis at levels that would diminish its timber inventory. In 2008, the Company harvested 579,770 tons of pine sawtimber from its timberlands. Under the current plan, Deltic intends to harvest approximately 575,000 tons of pine sawtimber in 2009.

The Company’s harvest plans are generally designed to project multi-year harvest schedules. In addition, harvest plans are updated at least annually and reviewed on a monthly basis to monitor performance and to make any necessary modifications to the plans in response to changing forestry conditions, market conditions, contractual obligations, regulatory limitations, and other relevant factors.

Since harvest plans are based on projections of demand, price, availability of timber from other sources, and other factors that may be outside of the Company’s control, actual harvesting levels may vary. Management believes that the Company’s harvest plans are sufficiently flexible to permit modification in response to fluctuations in the markets for logs and lumber.

6

Access. Substantially all of the timberlands are accessible by a system of low impact and low maintenance roads. Deltic generally uses third-party road crews to conduct construction and maintenance of these roads, and the Company regularly exchanges access easements and cooperates with other area forest products companies and the U.S. Forest Service.

Wildlife Management. The Company has an active wildlife management program for its properties. Deltic leased approximately 427,000, 420,000, and 422,000 acres to hunting clubs in 2008, 2007, and 2006, respectively. The Company’s wildlife biologist conducts white-tail deer management clinics throughout Arkansas. In addition, Deltic cooperates with federal, state, and private agencies in various wildlife studies.

Client-Land Management. In addition to managing its own timberlands, Deltic also manages timberlands owned by others under management contracts with one-year renewable terms. This program provided harvest planning, silvicultural improvements, and maintenance work for approximately 67,600 acres in 2008.

Timberland Acquisitions.The Company implemented a timberland acquisition program in late 1996. This ongoing program is designed to enable the Company to continue to increase harvest levels, while expanding its timber inventory. In addition, it will allow the Company to maintain or increase the volume of logs supplied to its sawmills from its own timberlands, when economically feasible.

The Company intends to continue to focus its acquisition program on timberlands that range from fully-stocked to cutover tracts. Unlike other timber-producing areas of North America, most of the timberland in the southern U.S. is privately held, making it potentially available for acquisition. There can be no assurance that timber properties suitable for acquisition will be identified by the Company, or that once identified, such properties will ultimately be acquired by the Company.

Deltic formed an acquisition team to implement its timberland acquisition program. Lands considered for purchase are evaluated based on location, site index, timber stocking, and growth potential. Approximately 130,000 acres of strategically located pine timberlands have been added since the inception of the program. Individual land purchases have ranged from three acres to 21,700 acres.

Land Sales. In 1999, the Company initiated a program to identify for possible sale non-strategic timberlands and higher and better use lands. Sales totaled 3,315 acres in 2001; 3,418 acres in 2002; 4,130 acres in 2003; 1,150 acres in 2004; 45 acres in 2005; 40 acres in 2006; 893 acres in 2007; and 5,062 acres in 2008.

Leasing. The Company also generates revenue from the leasing of hunting, oil and gas, and other rights on its timberlands. For the years ended 2008, 2007, and 2006, the Company had hunting lease revenues totaling $1,782,000, $1,695,000, and $1,599,000, respectively. During 2008, 2007, and 2006, the Company had leased net mineral acres of approximately 39,500, 37,600, and 30,700 acres, respectively, and recorded oil and gas lease revenues of $1,977,000, $1,352,000, and $918,000, respectively.

Royalty Income. The Company receives royalty income from oil and gas leases once production begins on leased mineral acres. For the years ended 2008, 2007, and 2006, Deltic earned $1,566,000, $260,000, and $196,000, respectively from oil and gas royalties.

Mills

The Company’s two sawmills are located at Ola in central Arkansas and at Waldo in south Arkansas, near significant portions of the timberlands. The mills employ modern technology in order to improve efficiency, reduce labor costs, maximize utilization of the timber resource, and maintain high quality standards of production with safety being one of the highest priorities. Logs processed into lumber are obtained from the

7

Company’s timberlands and from public and private landowners. The Company selects logs for processing in its mills based on size, grade, and the prevailing market price. The Ola Mill is equipped for maximum utilization of smaller diameter logs, while the Waldo Mill can process both smaller and larger diameter logs. The mills produce a variety of softwood lumber products, including dimension lumber, boards, and timbers. The lumber is sold primarily to wholesale distributors, lumber treaters, and truss manufacturers in the South and Midwest and is used in residential construction, roof trusses, and laminated beams.

Combined permitted annual production capacity of the two mills is 390 MMBF at year-end 2008 following the completion of upgrades at both mills. The Company’s lumber output increased during 2008, with production totaling 246 MMBF compared to 213 MMBF in 2007. The low volume in 2007 was due primarily to a fire that occurred in the planer section at the Company’s Waldo Mill on August 9, 2007. The mill was shut down while repairs were made, but was fully operational in late October 2007. (For additional information, see Note 20 – Business Interruption and Involuntary Conversion.) With the softwood lumber market on the decline since 2006, the Company has closely managed production, focusing on increasing efficiencies, and reducing controllable manufacturing cost.

Capital Projects. Deltic has invested significant capital in its sawmills in recent years to increase production capacity and efficiency, decrease costs, and expand the product mix. Major capital projects completed at the Ola Mill over the past several years include: (1) installation of a curve-sawing gang and double-length infeed to improve log recovery, increase hourly output, and expand product mix; (2) the installation of an optimized edger system to increase lumber recovery; (3) replacement of the planer mill with a high-speed planer mill and automated sorting system to increase mill output; (4) construction of a small log processing system which allows for the efficient usage of small diameter logs, thus reducing average log costs; (5) addition of a boiler system and steam dry kilns to increase mill capacity and provide the capability to produce higher value lumber; (6) expansion of log storage capacity; (7) redesign and rebuild of the sawmill primary breakdown processing equipment to improve the infeed of logs and overall flow of green lumber; (8) installation of a stick laying stacker to improve lumber drying quality and reduce labor cost; (9) gang control upgrade to improve operating efficiencies; (10) safety improvements including upgrades to the planer blow system; and (11) installation of a new log bucking deck to improve log recovery and increase throughput capacity.

At the Waldo Mill, major capital projects completed over the past several years include: (1) installation of a curve-sawing gang to improve log recovery, increase hourly output, and expand product mix; (2) installation of a new edger and optimizer to improve recovery; (3) installation of a log optimization system to improve lumber recovery; (4) extension of the green lumber sorter to increase sawmill throughput; (5) replacement of the planer that was destroyed by fire in August 2007; (6) installation of a second log debarker in order to further improve hourly throughput capability; (7) addition of a boiler and an upgrade of the lumber drying kilns to increase the mill’s lumber drying capacity; (8) addition of an automatic stick-laying system and stacker/package maker; (9) installation of a new planer hog system to move scrap material away from the planer mill more efficiently and to allow for increased throughput of finished lumber; and (10) various safety improvements including upgrades to planer blow system.

Raw Materials. In 2008, the Company’s two sawmills processed 1,105,944 tons of logs, either obtained from the timberlands or purchased from public and private landowners. The timberlands supplied 54 percent, or 597,721 tons, of the mills’ raw material receipt requirements, while the mills obtained 99 percent of the 579,770 tons of pine sawtimber harvested from the timberlands.

Various factors, including environmental and endangered species concerns, have limited, and will likely continue to limit, the amount of timber offered for sale by U.S. government agencies. Because of this reduced availability of federal timber for harvesting, the Company believes that its supply of timber from the timberlands is a significant competitive advantage. Deltic has historically supplied a significant portion of the timber processed in the sawmills from its timberlands.

In order to operate its sawmills economically, the Company relies on purchases of timber from third parties to supplement timber harvests from its own timberlands. The Company has an active timber procurement function for each of its sawmills. As of December 31, 2008, the Company had under contract

8

107,207 tons of timber on land owned by other parties, including the U.S. Forest Service, which is expected to be harvested over the next three years. During 2008, the Company harvested third-party stumpage and purchased logs from third parties totaling 539,020 tons. Of this volume, purchases from the U.S. Forest Service represented 12 percent. The balance of such purchased volume was acquired from private lands.

Due to the closure of several mills which were in close proximity to the Company’s mills, there has been a higher availability of privately owned pine timber at lower stumpage prices due to the decreased demand. As a result, Deltic’s sources of private timber are many and diverse. The key factors in a landowner’s determination of whether to sell timber to the Company are price, the Company’s relationships with logging contractors, and the ability of the Company to demonstrate the quality of its logging practices to landowners. As a result, a landowner will be more likely to sell timber to a forest products company whose own land has been responsibly managed and harvested. There is a substantial amount of other private timber acreage in proximity to each of Deltic’s sawmills.

Residual Wood Products. The Company pursues waste minimization practices at both of its sawmills. Wood chips are usually sold to paper mills, wood shavings and chips are usually sold to Del-Tin Fiber, and bark is frequently sold for use as fuel. Bark, sawdust, shavings, and wood chips that cannot be sold are used as “hog fuel” to fire the boilers that heat the drying kilns. The Company expects to continue to sell a significant portion of its Waldo Mill’s residual wood shavings and chip production to Del-Tin Fiber pursuant to a fiber supply agreement which is renegotiated annually.

Transportation. Each mill facility has the capability to ship its lumber by truck or rail.

Cyclical Market. While the cyclicality of the lumber market may occasionally require the interruption of operations at one or both of the Company’s sawmills, suspension of milling activities is unusual. Management is not currently anticipating any interruption of operations at either of Deltic’s sawmills, but no assurance can be given that market conditions or other factors will not render such an action economically advisable in the future.

Real Estate

The Company’s real estate operations were started in 1985 to add value to former timberland strategically located in the growth corridor of west Little Rock, Arkansas. Development activities began with the construction of Chenal Ridge, the initial, 85-lot neighborhood in Chenal Valley on the western edge of the Little Rock city limits in 1985. Since that time the Company has been developing the remainder of Chenal Valley, a premier planned community, centered around two Robert Trent Jones, Jr. designed championship golf courses with approximately 4,700 acres of residential and commercial properties. The first golf course was completed in 1990. Construction of the second course began in 2001, and was opened for play in the summer of 2003. The property has been developed in stages, and real estate sales to date have consisted primarily of residential lots sold to builders or individuals and commercial tracts. In addition to Chenal Valley, Deltic has developed Chenal Downs, located just outside of Chenal Valley, and is developing Red Oak Ridge, in Hot Springs, Arkansas. Chenal Downs is a 400-acre equestrian development with controlled access, featuring secluded, five-acre lots. Red Oak Ridge, Deltic’s first development outside the Little Rock area, is an 800-acre upscale community designed for residential, resort, or retirement living. During 2007, the Company and Central Arkansas Water entered into a full and complete settlement of a pending condemnation litigation involving 680 acres of undeveloped real estate within the watershed of Lake Maumelle in western Pulaski County, Arkansas. Approximately 640 acres were part of a planned development of the Company that has since been suspended. (For additional information See Note 21 – Commitments and Contingencies.)

Chenal Valley is a premier upscale residential and commercial development in the Little Rock real estate market. All developed acreage in Chenal Valley has been annexed by the City of Little Rock. Red Oak Ridge has been similarly annexed by the City of Hot Springs. Chenal Downs is located just outside the Little Rock city limits.

9

Residential Development. Lots were offered for sale in Chenal Valley during the second half of 1986 with closings beginning in 1987. As of December 31, 2008, 2,676 lots have been developed in 32 neighborhoods and 2,501 lots have been sold, with about 2,282 residences constructed or under construction. When fully developed, Chenal Valley will include approximately 4,600 single-family residences. However, the actual number of residences in Chenal Valley will depend on final land usages and lot densities. The Company has developed lots in a wide variety of market segments. Lot size has ranged from 0.2 acres to 2.25 acres, and lot price has ranged from $25,000 per lot to over $335,000 per lot.

The first phase of Chenal Downs was opened in December 1997, followed by a second phase in November 2000. By the end of 2008, 63 of the 76 developed lots were sold. Lot prices in Chenal Downs range from $89,000 to approximately $187,000. In Red Oak Ridge, the first two neighborhoods were offered for sale in 1998, with a third neighborhood offered in late 2005. These neighborhoods offer a choice of either estate-sized homesites, many of which overlook one of two Deltic-constructed lakes, or garden-home lots. As of the end of 2008, 81 of the 135 lots offered have been sold, and prices for lots currently offered range from about $30,000 to almost $183,000.

Commercial Development. Commercial development in Chenal Valley began with the construction of a Company-owned, 50,000-square-foot office building, which was sold during 2000. Commercial activity to-date has consisted of the sale of approximately 300 acres, including 55 acres in 2006, 26 acres in 2007, and no acres in 2008. Commercial property sales to-date have consisted of retail store locations, an office building constructed by the Company on a nine-acre site, multi-family residence sites, convenience store locations, a bank office building site, a site for a 38-acre open-air shopping center, and outparcels surrounding a retail center constructed and owned by the Company. Under current development plans, Chenal Valley will include approximately 900 acres of commercial property when fully developed.

In 2006, the Company sold approximately 38 acres to RED Development LLC for the development of “The Promenade at Chenal”, an upscale lifestyle shopping center. Construction of “The Promenade at Chenal” began in 2007 and was completed in May 2008. This project is expected to further increase interest in the Company’s additional 135 acres of commercially-zoned property adjacent to the site.

The 1998 completion of construction of the initial section of Rahling Road, a major connector street to Chenal Parkway, provided greater access to Chenal Valley’s commercial acreage. Located at the center of this commercial property is a Company-owned 35,000-square-foot retail center. The retail center was completed in early 2000 and offers retail space for lease. The center is surrounded by 16 outparcels, ranging in size from 0.2 to 1.8 acres. To-date, 11 of these outparcels have been sold.

No commercial acreage is included in Chenal Downs and Red Oak Ridge is planned to include a small amount of commercial property. The Company will begin to develop and offer commercial sites as population density increases.

Infrastructure. Infrastructure and other improvements to support the development and sale of residential and commercial property are funded directly by the Company and/or through real property improvement districts. Such properties are developed only when sufficient demand exists and substantially all infrastructure is completed. Future infrastructure investments are primarily for the development and sale of additional property.

Development Amenities. In connection with its Chenal Valley development, the Company developed Chenal Country Club, consisting of the earlier-described golf courses, a clubhouse, and related facilities for use by club members. Since its original construction, Deltic has undertaken substantial remodeling and expansion of the clubhouse as the club membership level has increased. In addition, the Company has built three community parks within the Chenal Valley development for the benefit of the residents of the developed residential areas.

Chenal Downs has been developed around an equestrian center, consisting of stables and a training facility, and also includes bridle trails throughout the development. Red Oak Ridge’s primary amenities currently consist of two lakes and a community park constructed by the Company.

10

Home Construction. Historically, the Company’s focus with regards to residential real estate development has been on lot development only. However, Deltic has constructed a limited number of speculative homes within its Red Oak Ridge development located in Hot Springs, Arkansas.

Future Development. A number of factors have added significant value to the undeveloped portion of Chenal Valley. Such factors include: (1) the overall success of Chenal Valley as a residential development and its image as one of the premier developments in central Arkansas, (2) the continued westward growth of Little Rock, (3) the Company’s investment in infrastructure in the area, and (4) the established residential base which is now large enough to support commercial development. Management expects the undeveloped portion of Chenal Valley to provide growth and development opportunities in the future.

Chenal Downs has been fully developed, but development of Red Oak Ridge is in the early stages, currently consisting of two man-made lakes as the core amenity, initial infrastructure placement, and the first three of several planned neighborhoods.

Continued development in the Highway 10 growth corridor of west Little Rock has significantly affected land values in the area, and is expected to create real estate development opportunities for the Company’s approximately 57,000 mostly contiguous acres located two miles west of Chenal Valley.

Undeveloped Acreage. The success of Chenal Valley has increased the value of the Company’s undeveloped real estate surrounding and within the development. Sales of undeveloped real estate amounted to no acres in 2006, 680 acres in 2007, and no acres in 2008.

Del-Tin Fiber

Deltic owns 50 percent of the membership interest of Del-Tin Fiber, a joint venture to manufacture and market MDF. The Del-Tin Fiber plant is located near El Dorado, Arkansas. Construction of the plant was completed, and initial production began, in 1998. The plant is designed to have an annual capacity of 150 million square feet (“MMSF”), on a 3/4-inch basis, making it one of the largest plants of its type in North America.

From the time production began at Del-Tin Fiber in 1998 until the fourth quarter of 2003, both operating and financial performances were below the expectations established at the time that the decision to construct the plant was made. As a result, on April 25, 2002, Deltic announced that Banc One Capital Markets, Inc. had been retained as financial advisor to assist in the evaluation of strategic alternatives for the Company’s investment in Del-Tin Fiber. Subsequently, Deltic’s management and Board of Directors completed its review of these strategic alternatives and announced the Company intended to exit the MDF business upon the earliest and most reasonable opportunity provided by the market. As a result of this decision, the Company’s evaluation of possible impairment of the carrying value of its investment in the joint-venture was based primarily upon the estimated cash flows from a sale of the Company’s interest during 2003 and resulted in a determination that the Company’s investment was impaired as of December 31, 2002. The investment was written off to zero.

Due to the Company’s commitment to fund its share of any of the facility’s operating working capital needs until the facility was able to consistently generate sufficient funds to meet its cash requirements or Deltic’s ownership was sold, the Company recognized losses in Del-Tin Fiber equal to the extent of these advances during 2003. For the year of 2003, such advances approximated the Company’s equity share of losses for the plant; accordingly, the investment in Del-Tin Fiber at December 31, 2003, was zero. The Company also continued to utilize its management resources to work with Del-Tin’s management and the joint-venture partner to improve operating performance at the plant. As a result of these improvements, on December 11, 2003, Deltic’s Board of Directors revised its intent regarding the Company’s investment in Del-Tin Fiber and ceased efforts to sell the Company’s interest in the joint venture, while continuing to focus on improving operating and financial results of the plant. Due to this decision, the 2003 evaluation of fair value for the investment was based primarily upon the future net cash flows from Del-Tin Fiber’s operations over the remaining life of the plant. Since 2004, the Company has recorded its equity share of the operating results of the joint venture.

11

Medium Density Fiberboard. MDF, which is used primarily in the furniture, laminate flooring, store fixture, and molding industries, is manufactured from sawmill residuals such as chips, shavings, and sawdust, pressed and held together by an adhesive bond. Although the technology has existed for decades, continued improvements in the manufacture of MDF have increased both the quality and market acceptance of the product. MDF, with its “real wood” appearance and the ability to be finely milled and accept a variety of finishes, competes primarily with lumber.

Production. The plant produced 115 MMSF of MDF in 2008 versus 117 MMSF of MDF in 2007 and 147 MMSF of MDF in 2006. Due to market conditions in 2008, plant production was reduced. Prior to 2003, start-up difficulties and operational problems with the plant’s press and heat energy system limited production to levels significantly below capacity. The problems with the press were corrected in mid-1999. As natural gas prices escalated during the last half of 2000, the decision was made in late January 2001 to temporarily suspend operations until the heat energy system could be modified. Following completion of a capital project to modify this system, the plant resumed operations in June 2001. Rectification of the heat energy system has enabled the plant’s operations to increase production levels closer to the plant’s capacity of 150 MMSF per year, as market conditions improved. In addition, manufacturing cost per thousand square feet has decreased, as certain variable costs of manufacturing have been lowered and fixed costs for the facility are being allocated to the increased production.

Raw Materials. The Del-Tin plant provides an additional outlet for wood chip production from the Waldo Mill. Pursuant to a fiber supply agreement which is renegotiated annually, the Company has agreed to sell, and Del-Tin Fiber to buy, a substantial amount of residual shavings and wood chips from the Waldo Mill. In addition, Del-Tin Fiber has an option to purchase residual wood chips from the Ola Mill. During 2008, 2007, and 2006, Deltic sold approximately $4,593,000, $3,772,000, and $3,939,000, respectively, of these lumber manufacturing by-products to Del-Tin Fiber.

Products and Competition

The Company’s principal forest products are timber, timberland, softwood lumber products (primarily finished lumber), residual wood products, and real estate.

Timber. Timber harvested from the timberlands is utilized by the Company’s sawmills or sold to third parties. The Company’s timber sales to third parties accounted for approximately five percent of consolidated net sales in 2008, eight percent in 2007, and six percent in 2006.

The Company competes in the domestic timber market with numerous private industrial and non-industrial land and timber owners. Competitive factors with respect to the domestic timber market generally include price, species and grade, proximity to wood manufacturing facilities, and accessibility.

Land Sales. Timberland sold by the Company to third parties consists of both non-strategic timberland, including hardwood bottomland suitable for recreational use, and lands with potential for higher and better use, and amounted to three percent of consolidated net sales in 2008, one percent in 2007, and less than one percent in 2006.

Lumber Products. The Company’s sawmills produce a wide variety of products, including dimension lumber, boards, and timbers. Lumber is sold primarily to wholesaler distributors, lumber treaters, and truss manufacturers in the South and Midwest and is used in residential construction, roof trusses, and laminated beams. During 2008, 2007, and 2006 lumber sales as a percentage of consolidated net sales were approximately 54 percent, 50 percent, and 56 percent, respectively.

The forest products market is highly competitive with respect to price and quality of products. In particular, competition in the commodity-grade lumber market in which the Company competes is primarily

12

based on price. Deltic competes with other publicly held forest products companies operating in the U.S., many of which have significantly greater financial resources than the Company, as well as privately held lumber producers. The Company also competes with producers in Canada and overseas. In addition, Deltic’s management expects the Company’s products to experience additional increased competition from engineered wood products and other substitute products. Due to the geographic location of Deltic’s timberlands and its high-quality timber, in addition to the Company’s active timber management program, strategically located and efficient sawmill operations, and highly motivated workforce, Deltic has been able to compete effectively.

Residual Wood Products. The Company’s sawmills produce wood chips, shavings, sawdust, and bark as by-products of the conversion process. During 2008, 2007, and 2006, sales of these residual products accounted for 13 percent, nine percent, and eight percent, respectively, of Deltic’s consolidated net sales. Wood chips are the primary source of residual sales and are typically sold to Del-Tin Fiber or to paper mills. In 2008, Deltic’s sawmills produced 341,296 tons of wood chips. The Company expects to continue to sell a significant portion of its wood chip production to Del-Tin Fiber for use in the production of MDF.

Real Estate. The Company develops and markets residential lots and commercial sites. Deltic generally provides the supporting infrastructure. Residential lots are sold to homebuilders and individuals, while commercial sites are sold to developers and businesses. The Company also sells undeveloped acreage. During 2008, 2007, and 2006, the sales of residential lots, commercial sites, and undeveloped acreage as a percentage of consolidated net sales were two percent, 17 percent, and 17 percent, respectively. The sale of commercial property can have a significant impact on the Company’s sales, but is unpredictable and irregular.

Seasonality

The Company’s operating segments are subject to variances in financial results due to several seasonal factors. The majority of timber sales are typically generated in the first half of the year due primarily to weather conditions and historically stronger timber prices. Increased housing starts during the spring usually push lumber prices up. Forestry operations generally incur expenses related to silvicultural treatments, which are applied during the fall season to achieve maximum effectiveness.

Business Segment Data

Information concerning net sales, operating income, and identifiable assets attributable to each of the Company’s business segments is set forth in Item 7, “Management’s Discussion and Analysis”; and Note 22 to the consolidated financial statements in Item 8, “Financial Statements and Supplementary Data,” of Part II of this report.

Environmental Matters

The Company is subject to extensive and changing federal, state, and local environmental laws and regulations relating to the protection of human health and the environment, including laws relating to air and water emissions, the use of herbicides on timberlands, regulation of “wetlands”, and the protection of endangered species. Environmental legislation and regulations, and the interpretation and enforcement thereof, are expected to become increasingly stringent. The Company has made, and will continue to make, expenditures to comply with such requirements in the ordinary course of its operations. Historically, these expenditures have not been material and the Company expects that this will continue to be the case. Liability under certain environmental regulations may be imposed without regard to fault or the legality of the original actions, and may be joint and several with other responsible parties. As a result, in addition to ongoing compliance costs, the Company may be subject to liability for activities undertaken on its properties prior to its ownership or operation and by third parties, including tenants. The Company is not involved with any such sites as of this time. The Company leases the rights to drill for oil and gas on some of its lands to third parties.

13

Pursuant to these leases, the lessee indemnifies the Company from environmental liability relating to the lessee’s operations. Based on its present knowledge, including the fact the Company is not currently aware of any facts that indicate the Company will be required to incur any material costs relating to environmental matters, and currently applicable laws and regulations, the Company believes environmental matters are not likely to have a material adverse effect on the Company’s financial condition, results of operations, or liquidity.

In addition, the federal “Endangered Species Act” protects species threatened with possible extinction and restricts timber harvesting activities on private and federal lands. Certain of the Company’s timberlands are subject to such restrictions due to the presence on the lands of the red-cockaded woodpecker, a species protected under the Act. There can be no assurance that the presence of this species or the discovery of other protected species will not subject the Company to future harvesting restrictions. However, based on the Company’s knowledge of its timberlands, the Company does not believe that its ability to harvest its timberlands will be materially adversely effected by the protection of endangered species.

Access to SEC Filings

The Company maintains an internet website at www.deltic.com. The Company makes available free of charge under the Investor Relations section of its website its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to any of those reports and other filings, as soon as reasonably practicable after providing such reports to the Securities and Exchange Commission.

Employees

As of January 31, 2009, the Company had 466 employees.

14

Cyclicality of Forest Products Industry

The Company’s results of operations are, and will continue to be, affected by the cyclical nature of the forest products industry. Prices and demand for logs and manufactured wood products have been, and in the future can be expected to be, subject to cyclical fluctuations. The demand for logs and lumber is primarily affected by the level of new residential construction activity, which activity is subject to fluctuations due to changes in economic conditions, availability and cost of financing for developers, mortgage interest rates, new and existing housing inventory levels, population growth, weather conditions and other factors. Decreases in the level of residential construction activity usually will be reflected in reduced demand for logs and lumber resulting in lower prices for the Company’s products and lower revenues, profits, and cash flows. In addition to housing starts, demand for wood products is also significantly affected by repair and remodeling activities and industrial uses, demand for which has historically been less cyclical. Furthermore, changes in industry supply of timber have an effect on prices. Although the Company believes sales of timber by United States government agencies will remain at relatively low levels for the foreseeable future, any reversal of policy that substantially increase such sales could significantly reduce prices for logs and lumber, which could have a material adverse effect on the Company. Furthermore, increased imports from Canada and other foreign countries could reduce the prices the Company receives for its products.

Limitations on the Company’s Ability to Harvest Timber

Revenues from the Company’s future operations will depend to a significant extent on its ability to harvest timber pursuant to its harvest plans from its 438,600 acres of timberlands (the “Timberlands”). Harvesting of the Timberlands may be affected by various natural factors, including damage by fire, insect infestation, disease, prolonged drought, severe weather conditions including ice storms and other causes. The effects of such natural disasters may be particularly damaging to young timber. To the extent possible, the Company implements measures to limit the risk of damage from such natural causes. The Company is a participant with state agencies and other timberland owners in cooperative fire fighting and fire surveillance programs. In addition, the Timberlands’ extensive system of access roads and the physical separation of various tracts provide some protection against fire damage. Nonetheless, one or more major fires on the Timberlands could adversely affect Deltic’s operating results. In addition, the Timberlands may also be affected by insect infestation, particularly by the southern pine beetle, and disease. Additionally, the Timberlands may be affected by severe weather conditions, especially ice storms, tornados, and heavy winds. Although damage from such natural causes usually is localized and affects only a limited percentage of the timber, there can be no assurance that any damage affecting the Timberlands will, in fact, be so limited. As is typical in the forest products industry, the Company does not maintain insurance coverage with respect to damage to the Timberlands. The Company does, however, maintain insurance for loss of logs due to fire and other occurrences following their receipt at the Company’s sawmills.

Operation of Sawmills

The Company’s sawmills are located at Ola in central Arkansas and Waldo in southern Arkansas. The operations of the sawmills are dependent on various factors and there can be no assurance that the Company will be able to continue such operations at current levels of production or that suspension of such operations may not be required in the future. One such factor is the ability of the Company to procure sufficient logs at suitable prices. The Company obtains logs for its sawmills from the Timberlands, other private sources, and federal lands. As discussed above, prices for logs are cyclical and affected primarily by demand for lumber and other products produced from logs. Another such factor is the ability of the Company to find an outlet for the large volume of residual wood products that result from the milling process. The company currently markets such products to third parties for the production of paper and other uses. The Company sells a significant portion of its residual wood chips to Del-Tin Fiber L.L.C. (“Del-Tin”), a joint venture medium density fiberboard plant near El Dorado, Arkansas, in which the Company owns a 50-percent interest. In addition, the continued operation of the sawmills is subject generally to the risk of business interruption in the event of a fire or other natural disaster, regulatory actions, or other causes. The Company mitigates this risk through the procurement of casualty and business interruption insurance.

15

Del-Tin Fiber

Deltic owns 50 percent of the membership interest of Del-Tin Fiber, a joint venture to manufacture and market MDF. The Del-Tin Fiber plant is located near El Dorado, Arkansas. Construction of the plant was completed, and initial production began, in 1998. From the time production began at Del-Tin Fiber until the fourth quarter of 2003, both operating and financial performances were below the expectations established at the time the decision to construct the plant was made. Contributions to Del-Tin Fiber by the Company through the third quarter of 2003 amounted to $60.7 million. The operating and financial performance of the joint venture has improved significantly since 2004, when compared to prior years. These advances were the result of price improvements in the MDF market, product mix, and the Company’s utilization of its management resources to work with Del-Tin’s management and the joint-venture partner to improve operating performance at the plant. As a result, the impact of Del-Tin Fiber on the Company’s results of operations and cash flows was significantly reduced during the years of 2004 through 2008. Although the Company remains focused on the efficient operations of the facility, changes in MDF prices or disruptions in manufacturing operations at the plant could impact the Company’s results of operations and cash flows in future periods, as well as Deltic’s ability to exit the MDF business if desired in the future.

Competition

The forest products industry is highly competitive in terms of price and quality. The products of the Company are subject to increasing competition from a variety of non-wood and engineered wood products. In addition, the Company is subject to a potential increase in competition from lumber products and logs imported from foreign sources. Any significant increase in competitive pressures from substitute products or other domestic or foreign suppliers could have a material adverse effect on the Company.

Federal and State Environmental Regulations

The Company is subject to extensive and changing federal, state, and local environmental laws and regulations relating to the protection of human health and the environment, the provisions and enforcement of which are expected to become more stringent in the future. The Company has made and will continue to make non-material expenditures to comply with such provisions. Based on currently available information, including the fact that the Company is not presently aware of any facts that indicate the Company will be required to incur any material costs relating to environmental matters, the Company believes environmental regulation will not materially adversely effect the Company, but there can be no assurances that environmental regulation will not have a material adverse effect on the financial condition, results of operations, or liquidity of the Company in the future.

Geographic Concentration and Risk Associated with Real Estate Development

The Company’s real estate development projects are located in central Arkansas, specifically, in and west of, Little Rock, Arkansas, and in Hot Springs, Arkansas. Accordingly, the Company’s real estate operations are particularly vulnerable to any economic downturns or other adverse events that may occur in this region and to competition from nearby residential housing developments. The Company’s results of operations may be affected by the cyclicality of the homebuilding and real estate industries generally. Factors include changes in general and local economic conditions, such as employment levels, consumer confidence and income, housing demand, new and existing housing inventory levels, availability and cost of financing, mortgage interest rates, and changes in government regulation regarding the environment, zoning, real estate taxes, and other local government fees.

16

Reliance on Key Personnel

The Company believes that its continued success will depend in large part on its ability to attract and retain highly skilled and qualified personnel. The Company offers management incentives in a manner that are directly linked to the Company’s performance, which the Company believes will facilitate the attraction, retention, and motivation of highly skilled and qualified personnel. In this regard, the Company has taken steps to retain its key personnel, including the provision of competitive employee benefit programs. Although the Company will seek to employ qualified individuals in the event that officers or other key employees of the Company cease to be associated with the Company, there can be no assurance that such individuals could be engaged by the Company.

Dividend Policy

The Company currently intends to pay modest quarterly cash dividends. However, the Company anticipates that future earnings will, for the most part, be used to support operations and finance growth of the business. The payment of any dividends will be at the discretion of the Company’s Board of Directors (the “Company Board”). The declaration of dividends and the amount thereof will depend on a number of factors, including the Company’s financial condition, capital requirements, funds from operations, future business prospects, and such other factors as the Company Board may deem relevant, and no assurance can be given as to the timing or amount of any dividend payments.

Anti-Takeover Effects of Certain Statutory, Charter, Bylaw and Contractual Provisions

Several provisions of the Company’s Certificate of Incorporation and Bylaws and of the Delaware General Corporation Law could discourage potential acquisition proposals and could deter or delay unsolicited changes in control of the Company, including provisions creating a classified Board of Directors, limiting the stockholders’ powers to remove directors, and prohibiting the taking of action by written consent in lieu of a stockholders’ meeting. The preferred stock purchase rights attached to the Company’s common stock could have similar anti-takeover effects. In addition, the Company’s Board has the authority, without further action by the stockholders, to fix the rights and preferences of and to issue preferred stock. The issuance of preferred stock could adversely affect the voting power of the owners of Company’s common stock, including the loss of voting control to others. Transactions subject to these restrictions will include, among other things, the liquidation of the Company, the merger, consolidation or other combination or affiliation of the Company with another company, discontinuance of or material change in the conduct of a material portion of its businesses independently and with its own employees, redemption or other reacquisition of Company’s common stock, and the sale, distribution, or other disposition of assets of the Company out of the ordinary course of business.

These provisions and others that could be adopted in the future could discourage unsolicited acquisition proposals or delay or prevent changes in control or management of the Company, including transactions in which stockholders might otherwise receive a premium for their shares over then current market prices. In addition, these provisions could limit the ability of stockholders to approve transactions that they may deem to be in their best interests.

General Economic Conditions

The recent deterioration of the global credit markets and general economic conditions could adversely affect the Company’s access to capital. Financial and credit markets have been experiencing a period of turmoil that has included the failure, restructuring, or sale of various financial institutions and has led to an unprecedented level of intervention from the United States government. While it is difficult to predict the ultimate results of these events, they may impair the Company’s ability to borrow money. Similarly, the Company’s customers and suppliers ability to obtain financing could adversely affect its business if their ability to operate or fund transactions is impaired.

17

| Item 1B. | Unresolved Staff Comments |

None.

The Company’s properties, primarily located in Arkansas and north Louisiana, consist principally of fee timber and timberlands, purchased stumpage inventory, two sawmills, and residential and commercial real estate held for development and sale. As of December 31, 2008, the Company’s gross investment in timber and timberlands; gross property, plant, and equipment; and investment in real estate held for development and sale consisted of the following:

| | | |

| (Thousands of dollars) | | |

Timberlands | | $ | 85,524 |

Fee timber and logging facilities | | | 213,327 |

Purchased stumpage inventory | | | 2,277 |

Real estate held for development and sale | | | 54,081 |

Land and land improvements | | | 5,319 |

Buildings and structures | | | 10,722 |

Machinery and equipment | | | 95,226 |

| | | |

| | $ | 466,476 |

| | | |

“Timberlands” consist of the historical cost of land on which fee timber is grown and related land acquisitions stated at acquisition cost. “Fee timber” consists of the historical cost of company standing timber inventory, including capitalized reforestation costs, and related timber acquisitions stated at acquisition cost. “Logging facilities” consist primarily of the costs of roads constructed and other land improvements. “Purchased stumpage inventory” consists of the purchase price paid for third-party timber, net of amounts harvested. “Real estate held for development and sale” consist primarily of the unamortized costs, including amenities, incurred to develop the real estate for sale and a retail center held for sale. “Land and land improvements” consist primarily of improvements at the Company’s two sawmill locations. “Buildings and structures” and “Machinery and equipment” primarily consist of the sawmill buildings and equipment and the Company’s two real estate sales offices.

The Company owns all of the properties discussed above. The Company’s properties are not subject to mortgages or other forms of debt financing. (For further information on the location and type of the Company’s properties, see the descriptions of the Company’s operations in Item 1.)

From time to time, the Company is involved in litigation incidental to its business. Currently, there are no material legal proceedings.

| Item 4. | Submission of Matters to a Vote of Security Holders |

None.

18

Executive Officers of the Registrant

The age (at January 1, 2009), present corporate office, and length of service in office of each of the Company’s executive officers and persons chosen to become officers are reported in the following listing. Executive officers are elected annually but may be removed from office at any time by the Board of Directors.

Ray C. Dillon - Age 53; President and Chief Executive Officer and a director of the Company effective July 1, 2003. Prior to joining the Company, Mr. Dillon was employed at Gaylord Container Corporation, where from April, 2000 through December, 2002, he was Executive Vice President, and preceding his election as Executive Vice President, he was Vice President, Primary Product Operations from April 1997.

Kenneth D. Mann - Age 49; Vice President, Treasurer, and Chief Financial Officer, effective May 1, 2007. From September 1, 2004 to April 30, 2007, Mr. Mann was Controller. From September 1, 2002, to September 2004, Mr. Mann was Manager of Corporate Governance and Investor Relations. From January 1997 to September 2002, Mr. Mann was Assistant Controller.

Phillip A. Pesek - Age 52; Vice President, General Counsel, and Secretary effective October 22, 2007. Prior to joining the Company, Mr. Pesek was Vice President, General Counsel, and Secretary of Anthony Forest Products Company, and before that, worked in various legal roles for The Home Depot, Inc., Wal-Mart Stores, Inc., and Dillard’s, Inc.

Kent L. Streeter - Age 48; Vice President of Operations effective November 16, 2003. Prior to joining the Company, Mr. Streeter was Operations Manager of a large paper mill located in the Southeastern United States from January 1997, which has been owned since April 2002, by Temple-Inland, Inc. and prior to that by Gaylord Container Corporation.

David V. Meghreblian - Age 50; Vice President of Real Estate effective November 16, 2003. From May 2000 to November 2003, Mr. Meghreblian was Vice President of Operations for the Company. From November 1996 to April 2000, Mr. Meghreblian was General Manager of Planning and Investor Relations for Deltic. Prior to such time, Mr. Meghreblian was General Manager of Project Development, a position he held beginning in November 1995.

Byrom L. Walker - Age 47; Controller effective May 1, 2007. Mr. Walker had been Manager of Financial Reporting since he joined the Company in early 2006. Prior to joining the Company, Mr. Walker was Corporate Controller from 2004 for Teris, L.L.C., a division of Suez S.A.

19

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities |

Common stock of Deltic Timber Corporation is traded on the New York Stock Exchange under the symbol DEL. The following table sets forth the high, low, and closing prices, along with the quarterly dividends declared, for each of the quarters indicated:

| | | | | | | | | |

| | | Sales Prices1 | | Dividend per

Common Share |

| | | High | | Low | | Close2 | |

2008 | | | | | | | | | |

First Quarter | | $ | 56.13 | | 47.54 | | 55.70 | | .075 |

Second Quarter | | $ | 59.46 | | 50.01 | | 53.51 | | .075 |

Third Quarter | | $ | 69.28 | | 52.97 | | 63.64 | | .075 |

Fourth Quarter | | $ | 63.27 | | 40.35 | | 45.75 | | .075 |

| | | | |

2007 | | | | | | | | | |

First Quarter | | $ | 56.60 | | 46.15 | | 47.96 | | .075 |

Second Quarter | | $ | 57.87 | | 47.03 | | 54.82 | | .075 |

Third Quarter | | $ | 62.83 | | 50.91 | | 56.92 | | .075 |

Fourth Quarter | | $ | 59.83 | | 45.46 | | 51.49 | | .075 |

|

Common stock dividends were declared to be paid for each quarter during 2008 and 2007. As of February 13, 2009, there were approximately 1,076 stockholders of record of Deltic’s common stock.

In December 2000, the Company’s Board of Directors authorized a stock repurchase plan of up to $10 million of Deltic common stock. There is no stated expiration date regarding this authorization. There were no repurchases under the program for the first nine months of 2008. Information pertaining to this plan for the fourth quarter of 2008 is presented in the table below. On December 13, 2007, Deltic announced an expansion of its repurchase program by $25 million.

| | | | | | | | | |

Period | | Total

Number

of Shares

Purchased | | Average

Price

Paid

Per

Share | | Total

Number of

Shares

Purchased

as Part

of Publicly

Announced

Plans or

Programs | | Maximum

Approximate

Dollar Value

of Shares that

May Yet Be

Purchased

Under the

Plans or

Programs |

October 1 through October 31, 2008 | | 103,081 | | 48.51 | | 103,081 | | $ | 22,685,314 |

| | | | |

November 1 through November 30, 2008 | | 26,696 | | 43.82 | | 26,696 | | $ | 21,515,453 |

| | | | |

December 1 through December 31, 2008 | | — | | — | | — | | $ | 21,515,453 |

Information regarding securities authorized for issuance under equity compensation plans required by this Item is contained in Item 12 of this Form 10-K and is incorporated herein by reference.

20

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities (cont.) |

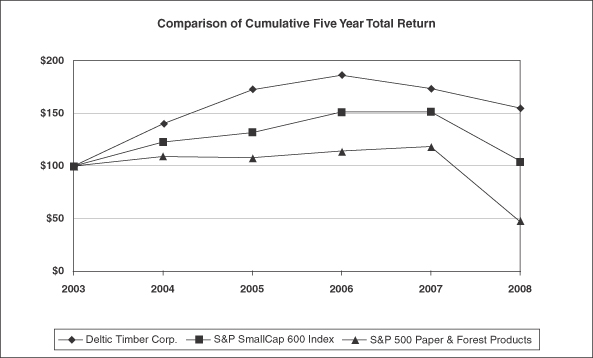

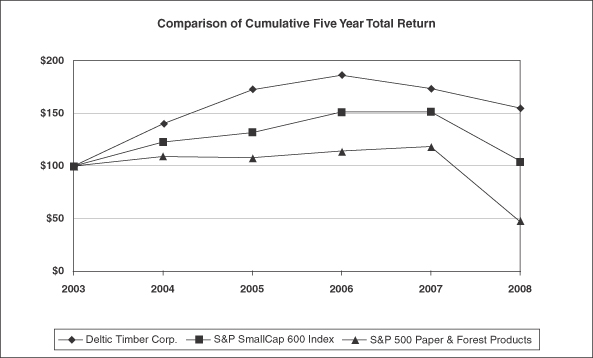

The graphed stock performance represents the cumulative total return for the Company’s common stock compared to issuers with similar capitalization, and to peer industry issuers for the period December 31, 2003, through December 31, 2008. The calculated returns assume an investment of $100 on December 31, 2003, and that all dividends were reinvested.

21

| Item 6. | Selected Financial Data |

The following table presents certain selected consolidated financial data for each of the years in the five-year period ended December 31, 2008:

| | | | | | | | | | | | | | | | |

| (Thousands of dollars, except per share amounts) | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

Results of Operations for the Year | | | | | | | | | | | | | | | | |

| | | | | |

Net sales | | $ | 129,524 | | | 128,255 | | | 153,112 | | | 168,350 | | | 142,017 | |

Operating income | | $ | 7,505 | | | 19,959 | | | 18,721 | | | 26,257 | | | 23,155 | |

Net income | | $ | 4,384 | | | 11,111 | | | 11,323 | | | 14,518 | | | 11,093 | |

Comprehensive income/(loss) | | $ | (915 | ) | | 14,638 | | | 11,621 | | | 14,128 | | | 11,205 | |

Earnings per common share | | | | | | | | | | | | | | | | |

Basic | | $ | .35 | | | .89 | | | .91 | | | 1.18 | | | .92 | |

Assuming dilution | | $ | .35 | | | .89 | | | .89 | | | 1.17 | | | .91 | |

Cash dividends declared per common share | | $ | .30 | | | .30 | | | .30 | | | .275 | | | .25 | |

Net cash provided/ (required) by | | | | | | | | | | | | | | | | |

Operating activities | | $ | 21,683 | | | 28,243 | | | 39,148 | | | 43,125 | | | 42,147 | |

Investing activities | | $ | (30,778 | ) | | (21,023 | ) | | (24,234 | ) | | (29,015 | ) | | (15,723 | ) |

Financing activities | | $ | 835 | | | (7,906 | ) | | (5,192 | ) | | (13,332 | ) | | (27,252 | ) |

Percentage return on | | | | | | | | | | | | | | | | |

Average stockholders’ equity | | | 2.0 | | | 5.1 | | | 5.5 | | | 7.6 | | | 6.3 | |

Average borrowed and invested capital | | | 3.4 | | | 5.7 | | | 5.6 | | | 7.4 | | | 6.2 | |

Average total assets | | | 1.3 | | | 3.3 | | | 3.5 | | | 4.6 | | | 3.6 | |

| | | | | |

Capital Expenditures for the Year | | | | | | | | | | | | | | | | |

| | | | | |

Woodlands | | $ | 11,436 | | | 4,978 | | | 3,333 | | | 7,062 | | | 6,686 | |

Mills | | | 6,874 | | | 5,345 | | | 8,763 | | | 10,732 | | | 4,797 | |

Real Estate | | | 11,222 | | | 10,171 | | | 15,612 | | | 15,379 | | | 12,519 | |

Corporate | | | 122 | | | 74 | | | 59 | | | 74 | | | 165 | |

| | | | | | | | | | | | | | | | |

| | | | | |

| | $ | 29,654 | | | 20,568 | | | 27,767 | | | 33,247 | | | 24,167 | |

| | | | | | | | | | | | | | | | |

| | | | | |

Financial Condition at Year-End | | | | | | | | | | | | | | | | |

| | | | | |

Working capital | | $ | 4,807 | | | 7,285 | | | 12,710 | | | 7,027 | | | 6,481 | |

Current ratio | | | 1.42 to 1 | | | 1.46 to 1 | | | 2.15 to 1 | | | 1.57 to 1 | | | 1.73 to 1 | |

Total assets | | $ | 334,733 | | | 328,744 | | | 324,266 | | | 316,327 | | | 307,580 | |

Long-term debt | | $ | 75,833 | | | 66,667 | | | 70,000 | | | 74,500 | | | 85,724 | |

Stockholders’ equity | | $ | 213,164 | | | 218,086 | | | 207,481 | | | 198,244 | | | 184,091 | |

Long-term debt to stockholders’ equity ratio | | | .356 to 1 | | | .306 to 1 | | | .337 to 1 | | | .376 to 1 | | | .466 to 1 | |

22

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Introduction

Deltic Timber Corporation (“Deltic” or the “Company”) is a natural resources company engaged primarily in the growing and harvesting of timber and the manufacture and marketing of lumber. Deltic owns approximately 438,600 acres of timberland, primarily in Arkansas and north Louisiana. The Company’s sawmill operations are located at Ola in central Arkansas (the “Ola Mill”) and at Waldo in south Arkansas (the “Waldo Mill”). In addition to its timber and lumber operations, the Company is engaged in real estate development in central Arkansas. The Company also holds a 50 percent interest in Del-Tin Fiber L.L.C. (“Del-Tin Fiber”), a joint venture to manufacture and market medium density fiberboard (“MDF”). Deltic is a calendar-year company for both financial and income tax reporting.

The Company is organized into four segments: (1) Woodlands, which manages all aspects of the timberlands including harvesting and sale of timber, timberland sales and acquisitions, oil and gas mineral revenues, and hunting land leases; (2) Mills, which consists of Deltic’s two sawmills that manufacture a variety of softwood lumber products; (3) Real Estate, which includes the Company’s real estate developments and a related country club operation; and (4) Corporate, which consists of executive management, accounting, information systems, human resources, purchasing, treasury, income tax, and legal staff functions that provide support services to the operating business units. (The Company currently does not allocate the cost of maintaining these support functions to its operating units.)