UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the Fiscal Year Ended September 30, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from ____ to ____

Commission File Number: 000-28745

SideChannel, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | | 86-0837077 |

State or other jurisdiction of incorporation or organization) | | I.R.S. Employer Identification No. |

146 Main Street, Suite 405, Worcester, MA 01608

(Address of principal executive offices) (Zip Code)

(508) 925-0114

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| N/A | | N/A | | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Small reporting company | ☒ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

On March 28, 2024, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the common equity held by non-affiliates of the registrant was approximately $16.2 million based upon the closing price of the common stock on that date on the OTCQB Venture Market of approximately $0.07.

As of December 12, 2024, there were 225,975,331 shares of the issuer’s common stock, par value $0.001 per share, outstanding.

Documents Incorporated by Reference: Portions of the Registrant’s Definitive Proxy Statement to be filed for its 2024 Annual Meeting of Stockholders are incorporated by reference into Part II, Item 5 and Part III of this Annual Report on Form 10-K.

SIDECHANNEL, INC.

FORM 10-K ANNUAL REPORT

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2024

TABLE OF CONTENTS

Except as otherwise required by the context, references to “SideChannel,” “SideChannel, Inc.,” the “Company,” “we,” “us” and “our” are to (i) Cipherloc Corporation, a Texas corporation, and its subsidiaries, for all periods prior to September 30, 2021, and to (ii) Cipherloc Corporation, a Delaware corporation, and its subsidiaries, for all periods after September 30, 2021, the date of the completion of the merger of the Texas corporation into the Delaware corporation, and to (iii) SideChannel, Inc., a Delaware corporation and its subsidiaries, for all periods after July 5, 2022, the date of the name change of Cipherloc Corporation’s name to SideChannel, Inc.

Forward-Looking Statements

This Annual Report on Form 10-K, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, contains “forward-looking statements.” These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section entitled “Item 1A. Risk Factors” (“Risk Factors”) and elsewhere in this Annual Report on Form 10-K. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

These forward-looking statements are based on management’s current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties, and other important factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements.

Although we believe that the assumptions underlying our forward-looking statements are reasonable, any of the assumptions could be inaccurate; therefore, we cannot assure you that the forward-looking statements included in this Annual Report on Form 10-K will prove to be accurate. In light of the significant uncertainties inherent in our forward-looking statements, the inclusion of such information should not be regarded as a representation by us or any other person that our objectives and plans will be achieved. Some of these and other risks and uncertainties that could cause actual results to differ materially from such forward-looking statements are more fully described in Risk Factors and elsewhere in this Annual Report on Form 10-K, or those discussed in other documents we filed with the Securities and Exchange Commission (“SEC”). Except as may be required by applicable law, we undertake no obligation to publicly update or advise of any change in any forward-looking statement, whether as a result of new information, future events, or otherwise. In making these statements, we disclaim any obligation to address or update each factor in future filings with the SEC or communications regarding our business or results, and we do not undertake to address how any of these factors may have caused changes to discussions or information contained in previous filings or communications. In addition, any of the matters discussed above may have affected our past results and may affect future results, so that our actual results may differ materially from those expressed in this Annual Report on Form 10-K and in prior or subsequent communications.

This information should be read in conjunction with the audited financial statements and the notes thereto included in this Annual Report on Form 10-K, and “Part II. Other Information - Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations”, contained in this Annual Report on Form 10-K.

We are not aware of any misstatements regarding any third-party information presented in this Annual Report on Form 10-K; however, these estimates, in particular, as they relate to projections, involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors, including those discussed under, and incorporated by reference in, Risk Factors of this Annual Report on Form 10-K. These and other factors could cause our future performance to differ materially from our assumptions and estimates. Some market and other data included herein, as well as the data of competitors as they relate to SideChannel, is also based on our good faith estimates.

PART I

ITEM 1. BUSINESS

Business Overview & Strategy

SideChannel is a cybersecurity advisory services and software company. Our mission is to simplify cybersecurity for mid-market and emerging companies, a market we believe is underserved. Our products and services offer comprehensive cybersecurity and privacy risk management solutions. We anticipate ongoing demand for cost-effective cybersecurity solutions, driven by continued remote and hybrid work environments, increased data breaches, and a heightened focus of Chief Information Officers (CIOs) on information security. To meet these needs, we aim to provide tech-enabled services, including virtual Chief Information Security Officer (vCISO) services, zero trust solutions, third-party risk management, due diligence, privacy, threat intelligence, and managed end-point security solutions.

Market Opportunity

According to the Cantor’s Cybersecurity Q3’24 Market Updater released by Cantor Technology Investment Banking on October 29, 2024 (“Cantor 2024 Q3 Update”), security spending is forecasted to reach $190 billion in calendar year (“CY”) 2024, reflecting significant growth in the cybersecurity market. Information security spending is expected to have grown 12.4% for CY 2023 on a constant currency basis from $141.4 billion in CY 2022 to $158.9 billion in CY 2023. This growth is driven by continued remote and hybrid work, increased incidences of data breaches, and a continued focus of CIOs on information security.

The Cantor 2024 Q3 Update also noted:

| | ● | The number of reported data compromises increased by 78% in 2023, affecting over 350 million victims. |

| | ● | Cybercrime adversaries are utilizing social engineering to circumvent multi-factor authentication (“MFA”), and phishing, stolen or compromised credentials, and cloud misconfiguration were the most frequent attack vectors. |

| | ● | Intrusions through cloud environments have increased by 75% year-over-year from 2022 to 2023. As a result, 51% of organizations are planning to increase security investments following a breach. |

The Cantor 2024 Q3 Update projects that by the end of 2026, the democratization of technology, digitization, and automation of work are expected to increase the total addressable market of fully remote and hybrid workers to 64% of all employees, up from 52% in 2021. This shift increases demand for remote worker technologies such as Identity and Access Management (“IAM”), Endpoint Protection Platforms (“EPP”), and Secure Web Gateways (“SWG”). Organizations are also investing in application and data security to support the rise in volume and velocity of data, with the prevalence of Internet of Things (“IoT”) expanding the attack surface.

Transformational technologies in data security, application security, network security, security operations, and risk management are gaining traction. These include data security posture management (“DSPM”), homomorphic encryption, cyber-physical system (“CPS”) security, generative AI (“GenAI”), and application security posture management (“ASPM”). AI is the top emerging technology to be deployed, with 71% of organizations planning deployment within two to three years, and 34% within the next 12 months, according to the Cantor 2024 Q3 Update.

Our Solutions

Enclave, our proprietary SaaS platform, streamlines critical cybersecurity tasks such as asset inventory and microsegmentation. Enclave integrates access control, microsegmentation, encryption, machine identity management, and secure networking concepts into a unified solution, enabling IT professionals to efficiently segment networks, assign staff, and manage traffic. This aligns with the industry’s shift towards zero trust frameworks, which have been adopted fully or partially by 63% of organizations worldwide, according to the Gartner State of Zero Trust Strategy Adoption Survey dated April 22, 2024 (“Gartner 2024 Zero Trust Report”).

Our efforts are focused on protecting and enabling the critical business functions of our clients and customers through comprehensive cybersecurity programs. This specifically includes:

| ● | Embedding vCISOs as a fractional resource into the leadership teams of our clients. The role of vCISOs is becoming increasingly pivotal, especially among small and cloud-enabled companies. The flexibility and expertise offered by vCISOs make them an attractive option for companies facing budget constraints and needing to establish a robust security posture quickly. |

| ● | Deploying Enclave to simplify the segmentation and security of digital networks, addressing the increased demand for remote worker technologies and zero trust strategies. |

| ● | Assessing, identifying, and mitigating cybersecurity and privacy risks through tech-enabled security engineering processes. We leverage AI-based security operations for post-detection actions, including alert prioritization, augmented threat detection/hunting, playbook creation, and automation of incident response processes. |

| ● | Reselling third-party cybersecurity services and software when appropriate, expanding our offerings to include a full range of cybersecurity products and services delivered through our team of security engineers and a network of third-party service providers and value-added resellers (VARs). |

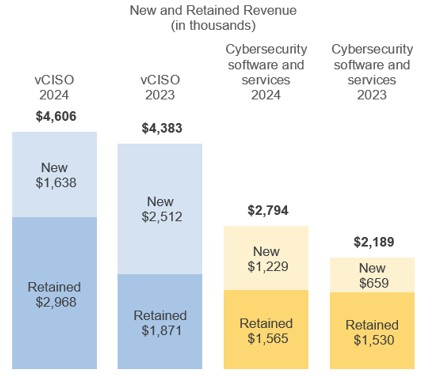

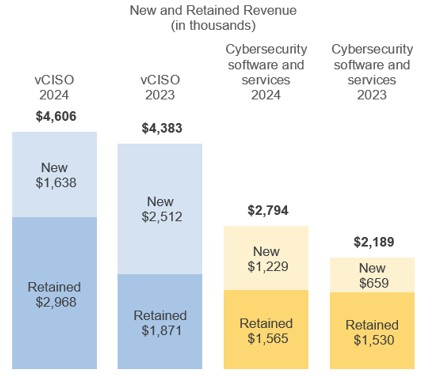

Revenue Categories

We internally report our revenue using two categories:

vCISO Services: This category captures the revenue from the Chief Information Security Officer services that we provide to our clients on a “virtual” or outsourced basis. Services delivered by SideChannel through our team of vCISOs include assessing the cybersecurity risk profile, implementing policies and programs to mitigate risks, and managing the day-to-day tasks to ensure compliance with the adopted cybersecurity framework. Most of our clients use our vCISO services.

vCISO engagements typically include a fixed monthly subscription fee and contract duration typically exceeds 12 months. Hourly rates for vCISO time and material projects range from $350 to $450. Each of our vCISOs is generally embedded into the C-suite executive teams of two to four of our clients.

According to the 2023 vCISO Service Provider Survey by Hitch Partners, the adoption of vCISO services is on the rise, particularly among small and cloud-enabled companies. Key services provided by vCISOs include Governance, Risk, and Compliance (GRC), strategic planning, and mentoring security teams. Many vCISO engagements extend beyond initial expectations, indicating a sustained need for their expertise.

Cybersecurity Software and Services: This category encompasses an array of cybersecurity software and services that our clients deem necessary to protect their digital assets. These augment our vCISO offering and include a full range of other cybersecurity products and services delivered through a team of security engineers along with a network of third-party service providers and VARs. Commercial relationships with third-party service providers and VARs provide SideChannel with additional internal capabilities to mitigate cybersecurity risks. We earn licensing revenue from software contracts and commissions from third-party service provider partnerships which are included in this revenue category.

In response to evolving threats highlighted in the 2024 Data Breach Investigations Report released by Verizon, SideChannel offers solutions designed to address financial and espionage-driven breaches effectively, minimize end-user errors, and ensure rapid incident response. With the increase in data transmission and connected intelligent devices through the prevalence of IoT, the scale of security risks and the attack surface are much larger. Our offerings in data security, application security, network security, security operations, and risk management position us to meet these challenges.

Growth Strategy

Our growth strategy focuses on these three initiatives:

| ● | Securing new vCISO clients: As organizations plan to increase security investments due to breaches and the rising complexity of cyber threats, we aim to expand our client base by offering flexible, expert vCISO services that address budget constraints and the need for rapid security posture establishment. |

| ● | Adding new cybersecurity software and services offerings: We plan to enhance our portfolio by incorporating transformational technologies such as AI-based security operations, data security posture management (DSPM), polymorphic encryption, cyber-physical system (CPS) security, and application security posture management (ASPM). This aligns with industry trends and the anticipated incremental spend on application and data security due to generative AI. |

| ● | Increasing adoption of cybersecurity software, including Enclave, and services offerings at vCISO clients: By promoting Enclave and our other cybersecurity solutions to our existing vCISO clients, we aim to deepen our relationships and provide comprehensive, integrated security solutions. This supports the increased demand for zero trust strategies and remote worker technologies. |

Enclave: A SideChannel Proprietary Software Product

Incorporating insights from the Gartner 2024 Zero Trust Report, implementing a zero-trust strategy has become a priority for a majority of organizations worldwide. The survey revealed that 63% of organizations have fully or partially adopted zero-trust frameworks. For 78% of these organizations, the investment in zero trust constitutes less than 25% of their overall cybersecurity budget. This strategic approach typically covers about half of an organization’s environment, addressing approximately a quarter of overall enterprise risk.

In the Gartner 2024 Zero Trust Report, Gartner emphasized the importance of defining the scope early in the zero-trust strategy. Organizations must identify which domains are in scope and understand the extent of risk mitigation achievable through zero-trust controls. Despite broad adoption, many enterprises struggle with best practices for implementation. Gartner suggests three key practices: establishing a clear scope, communicating success through strategic and operational metrics, and anticipating increases in staffing and costs without delays.

In the context of SideChannel’s offerings, our proprietary software, Enclave, is well-positioned to address these challenges. Enclave simplifies crucial cybersecurity tasks such as asset inventory, vulnerability management, and microsegmentation. By integrating access control, microsegmentation, encryption, machine identity management, and secure networking concepts into a unified solution, Enclave provides a comprehensive solution for managing cybersecurity controls effectively. It allows IT professionals to segment enterprise networks efficiently, allocate the right personnel to those segments, and direct traffic seamlessly. This alignment with zero-trust principles ensures that organizations can enhance their security posture and achieve measurable risk reduction.

By leveraging Enclave, SideChannel not only addresses the immediate cybersecurity needs of our clients but also aligns with industry best practices as highlighted by the Gartner 2024 Zero Trust Report and market trends identified in the Cantor 2024 Q3 Update. With the rise in remote and hybrid work models, and the increased demand for remote worker technologies such as Identity and Access Management, Endpoint Protection Platform, and Secure Web Gateway, Enclave offers a solution that simplifies the segmentation and security of digital networks.

Industry Standards and Compliance

Industry-standard cybersecurity and risk management frameworks, such as the National Institute of Standards and Technology Cybersecurity Framework (NIST CSF) and Center for Internet Security Controls (CIS), prioritize inventory of assets and access control as top requirements for a sustainable and compliant cybersecurity program. CIS version 8 controls call for organizations to:

| ● | Critical Control 1: “Establish and maintain an accurate, detailed, and up-to-date inventory of all enterprise assets with the potential to store or process data.” |

| ● | Critical Control 2: “Actively manage (inventory, track, and correct) all software (operating systems and applications) on the network so that only authorized software is installed and can execute, and that unauthorized and unmanaged software is found and prevented from installation or execution.” |

| ● | Critical Control 3: “Configure data access control lists based on a user’s need to know. Apply data access control lists, also known as access permissions, to local and remote file systems, databases, and applications.” |

We built Enclave to address these extremely critical cybersecurity controls along with many others. Enclave seamlessly combines access control, microsegmentation, encryption, and other secure networking concepts to create a comprehensive solution. Through software, it allows IT professionals to easily segment the enterprise network, place the right staff in those segments, and direct traffic. Unlike open, traditional models, Enclave allows for near-limitless micro-segmented networks to operate insulated from one another.

Further information about Enclave is available on our website.

Summary

By aligning our services and solutions with the key trends and growth projections highlighted in the Cantor 2024 Q3 Update, SideChannel is well-positioned to capitalize on the expanding cybersecurity market. Our focus on providing cost-effective, tech-enabled services addresses the needs of mid-market and emerging companies facing increasing cyber threats. Through our vCISO services, proprietary Enclave platform, and a comprehensive suite of cybersecurity offerings, we aim to drive growth and deliver value to our clients in line with industry expectations.

Company History

The Company was originally incorporated in the State of Texas on June 22, 1953, as American Mortgage Company. During 1996, the Company acquired the operations of Eden Systems, Inc. (“Eden”), which became a wholly owned subsidiary of the Company. Eden was engaged in water treatment and the retailing of cleaning products. Eden’s operations were sold on October 1, 1997. On May 16, 1996, the Company changed its name to National Scientific Corporation. From September 30, 1997, through the year ended September 30, 2001, the company aimed its efforts in the research and development of semiconductor proprietary technology and processes and in raising capital to fund its operations and research. Effective August 27, 2014, the Company changed its name to Cipherloc Corporation (“Cipherloc”) after it began engaging in cybersecurity software development. The Company redomiciled and became a Delaware corporation on September 30, 2021. A reverse merger, completed on July 1, 2022, between SCS, Inc., f.k.a. SideChannel, Inc., a provider of cybersecurity services and technology to middle market companies, was acquired by Cipherloc Corporation. The combined entity changed its name to SideChannel, Inc., on July 5, 2022, and the acquiree is now named SCS, Inc. (“SCS”) and for accounting purposes, is a subsidiary of the Company.

Research and Development

Since Enclave is a proprietary software product, we classify all of our software development activities to be research and development. The success of our software product, Enclave, depends on our ability to provide our customers with reliable, innovative features and benefits that are delivered before, or at least no later than, our competitors. When the demands of product development exceed the capacity or knowledge of our in-house staff, we retain temporary third-party consultants to assist us.

Our research and development expenditures for the fiscal years ended September 30, 2024, and September 30, 2023, were $546 thousand and $669 thousand, respectively. These costs were incurred to develop Enclave.

Selling and Marketing

We use four primary sources to identify prospective clients for our services and products including Enclave.

| | ● | Digital Marketing |

| | ● | Industry Events and Conferences |

| | ● | Direct Outreach |

| | ● | Referral Partners |

We continue enhancing our digital marketing tactics and expanding our online presence. A growing list of referral partners recommend SideChannel to their clients as the primary option to identify, assess, and mitigate cybersecurity risks. Certain referral partners receive a commission upon a referral becoming a SideChannel client.

During fiscal year 2024, we began emphasizing our assessment product when it was premature for the prospective client to engage in a traditional vCISO subscription. Certain clients acquired during 2024 entered into a recurring service or product agreement following the completion of the assessment. We intend to enhance our assessment product to expand the adoption of this offering to prospective clients.

As of September 30, 2024, we had three (3) employees dedicated to selling and marketing activities. Our selling and marketing expenditures for the fiscal years ended September 30, 2024, and September 30, 2023, were $771 thousand and $1.4 million, respectively.

Competition

The cybersecurity software and services market is highly competitive, subject to rapid change, and significantly affected by new product introductions and other activities of market participants.

Some of our competitors have greater financial, technical, sales, marketing, and other resources than we do. Because of these and other factors, competitive conditions in the markets we operate in are likely to continue to intensify in the future, as participants compete for market share. Increased competition could result in price reductions for our products and services, possibly reducing our net revenue and profit margins and resulting in a loss of our market share, any of which would likely harm our business.

We believe that our future results depend largely upon our ability to serve our clients and customers with the products and services described earlier better than our competitors, and by offering new services and product enhancements, whether such product and service offerings are developed internally or through acquisition. We also believe that we must provide product and service offerings that compete favorably against those of our competitors with respect to ease of use, reliability, performance, range of useful features, reputation and price.

We anticipate that we will face increasing pricing pressures from our competitors in the future. Since there are low barriers to entry into the cybersecurity services and software markets, we believe competition in these markets will persist and intensify in the future.

Our chief services competitors include companies such as Optiv, NCC, Coalfire, PwC, EY, Deloitte, and GuidePoint. Our primary software competitors are companies such as Perimeter 81, Zscaler, Palo Alto, and Illumio.

Intellectual Property

Protective Measures

We believe that our intellectual property is an important and vital asset, which enables us to develop, market, and sell our products and services and enhance our competitive position. Our intellectual property includes our proprietary business and technical know-how, inventions, works of authorship, and confidential information. To protect our intellectual property, we rely primarily upon legal rights in trade secrets, patents, copyrights, and trademarks, in addition to our policies and procedures, security practices, contracts, and relevant operational measures.

We protect the confidentiality of our proprietary information by entering into non-disclosure agreements with our employees, contractors, and other entities with which we do business. In addition, our license agreements related to our software and proprietary information include confidentiality terms. These agreements are generally non-transferable. We also employ access controls and associated security measures to protect our facilities, equipment, and networks.

Patents, Copyrights, Trademarks, and Licenses

Our products, particularly our software and related documentation, are protected under domestic and international copyright laws and other laws related to the protection of intellectual property and proprietary rights. Currently, we have six active patents registered with the U.S. Patent and Trademark Office. We employ procedures to label copyrightable works with the appropriate proprietary rights notices, and we actively enforce our rights in the United States and abroad. However, these measures may not provide us with adequate protection from infringement, and our intellectual property rights may be challenged.

Our SideChannel Logo is registered with the U.S. Patent and Trademark Office (“USPTO”). We recently applied for registration of the Enclave Logo in the USPTO and also have common law rights in the Enclave Logo based on our prior use of the Logo in commerce. In the United States, we can maintain our trademark rights and renew trademark registrations for as long as the trademarks are in use.

Government Regulation

Export Control Regulations. We expect that all of our products will be subject to U.S. export control laws and applicable foreign government import, export and/or use requirements. The level of such control generally depends on the nature of the products in question. Often, the level of export control is impacted by the nature of the software and cybersecurity incorporated into our products. In those countries where such controls apply, the export of our products may require an export license or authorization. However, even if a transaction qualifies for a license exception or the equivalent, it may still be subject to corresponding reporting requirements. For the export of some of our products, we may be subject to various post-shipment reporting requirements. Minimal U.S. export restrictions apply to all our products, whether or not they perform cybersecurity functions. If we become a Department of Defense contractor in the future, certain registration requirements may be triggered by our sales. In addition, certain of our products and related services may be subject to the International Traffic in Arms Regulations (ITAR) if our software or services are specifically designed or modified for defense purposes. If we become engaged in manufacturing or exporting ITAR-controlled goods and services (even if we do not export such items), we will be required to register with the U.S. State Department.

To date, Export Control Regulations have had no material impact on our business.

Enhancements to our existing products may be subject to review under the Export Administration Act to determine what export classification they will receive. In addition, any new products that we release in the future will also be subject to such review before we can export them. The U.S. Congress continues to discuss the correct level of export control in possible anti-terrorism legislation. Such export regulations may be modified at any time. Modifications to these export regulations could reduce or eliminate our ability to export some or all of our products from the United States in the future, which could put us at a disadvantage in competing with companies located outside of the U.S. Modifications to U.S. export regulations could restrict us from exporting our existing and future products. Any such modifications to export regulations may put us at a competitive disadvantage with respect to selling our products internationally.

Privacy Laws. We may be subject to various international, federal and state regulations regarding the treatment and protection of personally identifying and other regulated information. Applicable laws may include U.S. federal laws and implementing regulations, such as the GLBA and HIPAA, as well as state and international laws and regulations, including the California Consumer Privacy Act (CCPA) and the European Union General Data Protection Regulation (GDPR). Some of these laws have requirements on the transmittal of data from one jurisdiction to another. In the event our systems are compromised, many of these privacy laws require that we provide notices to our customers whose personally identifiable data may have been compromised. Additionally, if we transfer data in violation of these laws, we could be subjected to substantial fines. To mitigate the risk of having such data compromised, we use cybersecurity, software and other security procedures to protect our databases.

Personnel

As of September 30, 2024, we had 20 full-time employees. We also had approximately 11 independent contractors that provide services to us. We anticipate that we will need to increase our staffing in the foreseeable future.

ITEM 1A. RISK FACTORS

Our business, financial condition and results of operations and the market price for our common stock are subject to numerous risks, many of which are driven by factors that we cannot control or predict. An investment in our common stock involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information contained in this Annual Report on Form 10-K, including the information regarding “Forward-Looking Statements” earlier in this Form 10-K immediately prior to Part I, Item 1 and “Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before investing in our common stock. If any of the events anticipated by the risks described below occur, our results of operations and financial condition could be adversely affected, which could result in a decline in the market price of our common stock, causing you to lose all or part of your investment. Additional risks that we do not yet know of, or that we currently think are immaterial, may also affect our business and results of operations.

Summary of Risk Factors

The following list provides a summary of risk factors discussed in further detail below:

Risks Related to Our Business and Results of Operations

| | ● | Inflation and related geo-political events increase the risk that we are unable to achieve and maintain profitable operations. |

| | ● | We depend significantly upon the continued involvement of our present management and on our ability to attract and retain talented employees. |

| | ● | If we are unable to develop new and enhanced products and services, or if we are unable to continually improve the performance, features, and reliability of our existing products and services, our competitive position would weaken, and our business and operating results could be adversely affected. |

| | ● | Our operating results may vary significantly from period to period and have been unpredictable, which has and might continue to cause the market price of our common stock to be volatile. |

| | ● | Our future revenue and operating results will depend significantly on our ability to retain clients and customers and the ability to add new clients and customers. Any decline in our retention rates or failure to add new clients and customers will harm our business prospects and operating results. |

| | ● | We face intense competition, especially from larger, well-established companies, and we may lack sufficient financial or other resources to maintain or improve our competitive position. |

| | ● | A network or data security incident may allow unauthorized access to our or our end users’ network or data, harm our reputation, create additional liability and adversely impact our financial results. |

| | ● | Our services, products, systems, and website and the data on these sources may be subject to intentional disruption that could materially harm our reputation and future sales. |

| | ● | Our products are complex and operate in a wide variety of environments, systems and configurations, which could result in failures of our products to function as designed and negatively impact our brand recognition and reputation. |

| | ● | If our products and services do not work properly, our business, financial condition and financial results could be negatively affected, and we could experience negative publicity declining sales, and legal liability. |

| | ● | Outages or problems with systems and infrastructure supplied by third-parties could negatively affect our business, financial condition and financial results. |

| | ● | Current global financial conditions have been characterized by increased volatility, which could negatively impact our business, prospects, liquidity and financial condition. |

| | ● | If we experience delays and/or defaults in payments, we could be unable to recover all expenditures. |

| | ● | If we do not effectively manage our growth, our business resources and systems may become strained, and we may be unable to increase revenue growth. |

| | ● | Our growth depends in part on the success of our strategic relationships with third-parties. |

| | ● | Claims, litigation, government investigations, and other proceedings may adversely affect our business and results of operations. |

| | ● | The ability of our executive officers and directors to control our business may limit or eliminate other stockholders’ ability to influence corporate affairs. |

Risks Related to Our Industry

| | ● | We face intense competition. |

| | ● | Delays in product development schedules may adversely affect our revenues. |

| | ● | If we do not accurately predict, prepare for, and respond promptly to rapidly evolving technological and market developments and successfully manage product introductions and transitions to meet changing needs in the cybersecurity technology market, our competitive position, financial results, and prospects will be harmed. |

| | ● | Actual, possible, or perceived defects or vulnerabilities in our products or services, the failure of our products or services to detect or prevent a security breach, or the misuse of our products could harm our reputation and divert resources. |

Risks Related to Our Intellectual Property

| | ● | Our proprietary rights may be difficult to enforce, which could enable others to copy or use aspects of our products without compensating us. |

| | ● | Claims by others that we infringe their proprietary technology or other litigation matters could harm our business. |

| | ● | We rely on the availability of third-party licenses, and our inability to maintain those licenses could harm our business. |

| | ● | Our use of open-source software in our products could negatively affect our ability to sell our products and subject us to possible litigation. |

Risks Related to Cyberattacks

| | ● | Security of our information technology may be threatened. |

| | ● | Security of our products, services, devices, and customers’ data may be breached. |

| | ● | Development and deployment of defensive measures are ongoing. |

| | ● | Disclosure and misuse of personal data could result in liability and harm our reputation. |

| | ● | If our end users experience data losses, our brand, reputation and business could be harmed. |

Risks Related to Regulations and Our Compliance with Such Regulations

| | ● | We previously identified material weaknesses in our disclosure controls and procedures and internal control over financial reporting. If not remediated, our failure to establish and maintain effective disclosure controls and procedures and internal control over financial reporting could result in material misstatements in our financial statements and a failure to meet our reporting and financial obligations, each of which could have a material adverse effect on our financial condition and the trading price of our common stock. |

| | ● | We are subject to changing laws and regulations. |

| | ● | Our failure to comply with laws and regulations applicable to our business could subject us to fines and penalties and could also cause us to lose potential customers, clients, licensees, resellers and/or for licensees and resellers to lose potential customers in the public sector or negatively impact our ability to contract with the public sector. |

| | ● | Governmental restrictions on the sale of our products and services in non-U.S. markets could negatively affect our business, financial condition, and financial results. |

Risks Related to Our Financial Position and Need for Capital

| | ● | We have incurred net losses and may never achieve profitability. |

| | ● | Our ability to continue as a going concern may depend upon our ability to raise additional capital and such capital may not be available on acceptable terms, or at all. |

| | ● | If we can raise additional funding, we may be required to do so on terms that are dilutive to our stockholders. |

| | ● | We will continue to incur increased costs as a result of being a reporting company and, given our limited capital resources, such additional costs may have an adverse impact on our profitability. |

| | ● | We may apply working capital and future funding to uses that ultimately do not improve our operating results or increase the market price of our securities. |

Risks Related to Our Common Stock

| | ● | The market price for our common stock has been volatile, and you may not be able to sell our stock at a favorable price, or at all. |

| | ● | Substantial sales of our common stock, or the perception that such sales might occur, could depress the market price of our common stock. |

| | ● | Holders of our common stock have a risk of potential dilution if we issue additional shares of common stock in the future. |

| | ● | The anti-dilutive rights of certain warrants could result in significant dilution to our existing stockholders and/or require us to issue a substantially greater number of shares, which may adversely affect the market price of our common stock. |

| | ● | Certain warrants issued in 2021 inhibit our access to equity capital, if we should need it, which may limit our ability to grow and maintain our competitiveness. |

| | ● | The purchase agreement related to our 2021 private placement includes covenants that we must comply with, or we may suffer potential monetary and other penalties. |

| | ● | Our common shares are thinly traded, and in the future may continue to be thinly traded, and you may be unable to sell your shares at or near ask prices or at all, if you need to sell your shares to raise money or otherwise desire to liquidate such shares. |

| | ● | A significant number of our shares have been registered for resale, and their sale or potential sale may depress the market price of our common stock. |

| | ● | Future sales and issuances of our securities could result in additional dilution of the percentage ownership of our stockholders and could cause our share price to fall. |

| | ● | Our common stock is subject to restrictions on sales by broker-dealers and penny stock rules, which may be detrimental to investors. |

| | ● | Because our common stock is quoted on the OTCQB instead of a national exchange, our investors may have difficulty selling their stock or may experience negative volatility on the market price of our common stock. |

| | ● | Our charter allows us to issue “blank check” preferred stock and establish its terms, conditions, rights, powers and preferences without stockholder approval. |

| | ● | We have never paid or declared any dividends on our common stock. |

| | ● | If securities or industry analysts do not initiate research coverage on us and, if initiated, fail to publish research or reports, or publish unfavorable research or reports, about our business, our stock price and trading volume may decline. |

| | ● | The sale of shares of our common stock by our directors and officers may adversely affect the market price for our common stock. |

Risks Related to Our Business and Results of Operations

Inflation and related geo-political events increase the risk that we are unable to achieve and maintain profitable operations.

Our business may be affected by general economic, political, and market conditions, including any resulting negative impact on spending by our clients and customers. Some of our clients may view our services as a discretionary purchase and may in the future reduce their spending on our services during an economic downturn, especially in the event of a prolonged recessionary period. Concerns about inflation, rising interest rates, unemployment trends, geopolitical issues, including wars and other armed conflicts, global health epidemics and other highly communicable diseases, bank insolvency and related uncertainty and volatility in the financial services industry, or a widespread economic slowdown or recession (in the United States or internationally) have led to, and could continue to lead to, increased market volatility and economic uncertainty, which could cause current and prospective customers and clients to delay, decrease, or cancel purchases of our services, or delay or default on their payment obligations. As a result, our business, results of operations, and financial condition may be significantly affected by changes in the economy generally.

We depend significantly upon the continued involvement of our present management and on our ability to attract and retain talented employees.

Our success depends significantly upon our present management, most notable our Chief Executive Officer, Brian Haugli, and our Chief Financial Officer, Ryan Polk, who are involved in the development of our products as well as in our strategic planning and operations. All of our officers and key personnel are at-will employees. In addition, many of our key technologies and systems are custom-made for our business by our key personnel. The loss of key personnel, including key members of our management team, as well as certain of our key marketing, sales, product development, or technology personnel, could disrupt our operations and have an adverse effect on our ability to grow our business. Additionally, we will need to adapt and respond to frequently changing circumstances that may impact our workforce, such as natural disasters or pandemics, or our ability to maintain an effective workforce may be impacted.

To execute our business plan, we must attract and retain highly qualified personnel. Competition for these employees is intense, and we may not be successful in attracting and retaining qualified personnel. We have experienced, and we may continue to experience, difficulty in hiring and retaining highly skilled employees with appropriate qualifications.

If we are less successful in our recruiting efforts, or if we are unable to retain key existing employees, our ability to develop and deliver successful products and services will be adversely affected. Effective succession planning is also important to our long-term success. Our failure to ensure effective transfer of knowledge and smooth transitions involving key employees could hinder our strategic planning and execution.

If we are unable to develop new and enhanced products and services, or if we are unable to continually improve the performance, features, and reliability of our existing products and services, our competitive position would weaken, and our business and operating results could be adversely affected.

Our future success depends on our ability to effectively respond to evolving threats to consumers and potential customers, as well as competitive technological developments and industry changes, by developing or introducing new and enhanced products and services on a timely basis. In the past, Cipherloc incurred significant research and development expenses. As a result of the Business Combination, we expect to continue to incur research and development expenses as we strive to remain competitive and as we focus on organic growth through internal innovation. If we are unable to anticipate or react to competitive challenges or if existing or new competitors gain market share in any of our markets, our competitive position would weaken, and we could experience a decline in our revenues and net income, which could adversely affect our business and operating results. Additionally, we must continually address the challenges of dynamic and accelerating market trends, increasingly sophisticated cyber-attacks and intrusions and competitive developments. Customers may require features and capabilities that our current products do not have. Our failure to develop new products and improve our existing products to satisfy customer preferences and needs and effectively compete with other market offerings in a timely and cost-effective manner will harm our ability to retain our customers (if any) and the ability of our licensees or resellers to retain their customers, and to create or increase demand for our products, which may adversely impact our operating results. The development and introduction of our new or enhanced products will involve a significant commitment of time and resources and will be subject to a number of risks and challenges, including but not limited to:

| | ● | Lengthy development cycles; |

| | ● | Evolving industry and regulatory standards and technological developments by our competitors and customers (if any) and the customers of our licensees and resellers; |

| | ● | Rapidly changing customer preferences and needs; |

| | ● | Evolving platforms, operating systems, and hardware products, such as mobile devices, and related product and service interoperability challenges; |

| | ● | Entering new or unproven markets; and |

| | ● | Executing new product and service strategies. |

If we are not successful in managing these risks and challenges, or if our new or improved products and services are not technologically competitive in the market, or do not achieve market acceptance, our business and operating results would be adversely affected, our market share would decline, and our margins would contract.

Our operating results may vary significantly from period to period and have been unpredictable, which has and might continue to cause the market price of our common stock to be volatile.

Our operating results, in particular, our revenues, gross margins, operating margins, and operating expenses, have historically varied significantly from period to period, and we expect such variation to continue as a result of a number of factors, many of which are outside of our control and may be difficult to predict, including:

| | ● | our ability to attract and retain customers (if any) and/or the ability of our licensees and resellers to retain customers or sell products and services; |

| | ● | the budgeting cycles, seasonal buying patterns, and purchasing practices of potential customers and customers of our licensees and resellers; |

| | ● | price competition; |

| | ● | the timing and success of our new product and service introductions by us or our competitors or any other change in the competitive landscape of our industry, including consolidation among our competitors, licensees, resellers, clients, or customers, and strategic relationships entered into by and between our competitors; |

| | ● | changes in the mix of our services, products, and support; |

| | ● | changes in the growth rate of the cybersecurity technology market; |

| | ● | the timing and costs related to the development or acquisition of technologies or businesses or strategic partnerships; |

| | ● | lack of synergy, or the inability to realize expected synergies, resulting from any acquisitions or strategic partnerships; |

| | ● | our inability to execute, complete or integrate efficiently any acquisitions that we have or may hereafter undertake; |

| | ● | increased expenses, unforeseen liabilities, or write-downs and any impact on our operating results from any acquisitions we may consummate; |

| | ● | our ability to create sizeable and productive distribution channels for our proprietary software; |

| | ● | decisions by potential customers, or the customers of our licensees and resellers, to purchase cybersecurity solutions from larger, more established cybersecurity software and service vendors, or from their sales channel partners; |

| | ● | timing of revenue recognition from the delivery of existing and future statements of work; |

| | ● | Insolvency or credit difficulties confronting customers (if any), our licensees and resellers, or the customers of our licensees and resellers, which could adversely affect their ability to purchase or pay for our products and services and offerings; |

| | ● | the cost and potential outcomes of any litigation, which could have a material adverse effect on our business; |

| | ● | seasonality or cyclical fluctuations in our markets due to holiday schedules, industry events, or customer funding policies that may impact our ability to secure new clients or deliver services to existing clients; |

| | ● | future accounting pronouncements or changes in our accounting policies; and |

| | ● | general macroeconomic conditions including interest rates, inflation and increasing labor costs, in some or all regions in which we operate. |

Any one of the factors above, or the cumulative effect of some of the factors referred to above, may result in significant fluctuations in our operating results including our revenue and net income. This variability and unpredictability could result in our failure to meet our revenue, margin, or other operating result expectations, or those of securities analysts or investors for a particular period. If we fail to meet or exceed such expectations for these or any other reasons, the market price of our common stock could decline substantially, and we could face costly lawsuits, including securities class action suits.

Our future revenue and operating results will depend significantly on our ability to retain clients and customers and the ability to add new clients and customers. Any decline in our retention rates or failure to add new clients and customers will harm our business prospects and operating results.

We anticipate that our future revenue and operating results will depend significantly on our ability to retain clients and customers and our ability add new clients and customers. In addition, we may not be able to predict or anticipate accurately future trends in retention or effectively respond to such trends. Our retention rates may decline or fluctuate due to a variety of factors, including the following:

| | ● | our clients’ and customers’ levels of satisfaction or dissatisfaction with our products and services; |

| | ● | the quality, breadth, and prices of our products and services; |

| | ● | our general reputation and events impacting that reputation; |

| | ● | the products and services and related pricing offered by our competitors; |

| | ● | disruption by new services or changes in law or regulations that impact the need for or efficacy of our products and services; |

| | ● | our customer service activities and responsiveness to any customer issues; |

| | ● | customer dissatisfaction if they do not receive the full benefit of our services due to their failure to provide all relevant data; |

| | ● | customer dissatisfaction with the methods or sufficiency of our remediation services; and |

| | ● | changes in target customers’ planned spending levels as a result of general economic conditions or other factors such as inflation. |

If we do not retain our existing clients and customers, or add new clients and customers, we may not generate revenue and/or our revenue may grow more slowly than expected, or decline, and our operating results and gross margins will be negatively impacted. In addition, our business and operating results may be harmed if we are unable to increase our retention rates or if they decline.

We also must continually add new clients and customers, both to replace those who cancel or elect not to renew their agreements with us and to grow our business beyond our current level. If we are unable to attract new clients and customers in numbers greater than the number that cancel or elect not to renew their agreements with us, our client base will decrease, and our business, operating results, and financial condition would be adversely affected.

We face intense competition, especially from larger, well-established companies, and we may lack sufficient financial or other resources to maintain or improve our competitive position.

The market for cybersecurity technologies is intensely competitive, and we expect competition to increase in the future from established competitors and new market entrants. Our main competitors fall into three categories:

| | ● | large companies that incorporate security or encryption features in their services and products, such as Google’s Cloud Platform, Amazon’s AWS services, and Microsoft’s Azure, or those that have acquired, or may acquire, cybersecurity services, products, or technologies and have the technical and financial resources to bring competitive solutions to the market; |

| | ● | independent security vendors, such as Optiv and Coalfire, that offer cybersecurity products; and |

| | ● | small and large companies that offer cybersecurity services and technologies that compete with our services and products. |

Our current and proposed products and services face, and will continue to face, intense competition from larger and smaller companies, as well as from academic and research institutions. We compete in an industry that is characterized by: (i) rapid technological change, (ii) evolving industry standards, (iii) emerging competition, and (iv) new service and product introductions. Our competitors have existing products and technologies that will compete with our products and technologies and may develop and commercialize additional products and technologies that will compete with our products and technologies. Some of these new products and services may have functionality that ours do not have. Because many competing companies and institutions have greater financial resources than us, they may be able to: (i) provide broader services and product lines, and (ii) fully develop and deploy new products faster than we can with their larger and broader resources. Our competitors also generally have greater development capabilities than we do and have greater experience in undertaking testing of products, obtaining regulatory approvals, and manufacturing and marketing their products. They may also have greater name recognition and better access to customers, clients, licensees, and resellers than we do. Our chief services competitors include companies such as Optiv, NCC, Coalfire, PwC, EY, Deloitte, and GuidePoint. Our primary product competitors for Enclave are companies such as Perimeter 81, Zscaler, Palo Alto, and Illumio.

Many of our existing competitors have, and some of our potential competitors may have, substantial competitive advantages such as:

| | ● | greater name recognition and longer operating histories; |

| | ● | larger sales and marketing budgets and resources; |

| | ● | broader distribution and established relationships with distributors and customers (if any), or the customers of our licensees and resellers; |

| | ● | greater customer support resources; |

| | ● | greater resources to make strategic acquisitions or enter strategic partnerships; and |

| | ● | greater financial, technical, and other resources. |

In addition, some of our larger competitors have substantially broader and more diverse product and service offerings, which may make them less susceptible to downturns in a particular market and allow them to leverage their relationships based on other services and products or incorporate functionality into existing services and products to gain business in a manner that discourages users from purchasing our services, products and subscriptions, including through selling at zero or negative margins, offering concessions, product bundling, or closed technology platforms. Many of our smaller competitors that specialize in providing protection from a single type of security threat are often able to deliver these specialized cybersecurity or security products to the market more quickly than we can.

Organizations that use legacy products and services may believe that these products and services are sufficient to meet their security needs, or that our platform only serves the needs of a portion of the cybersecurity technology market. Accordingly, many organizations have invested substantial personnel and financial resources to design and operate their networks and have established deep relationships with other providers of cybersecurity services and products. As a result, these organizations may prefer to purchase from their existing suppliers rather than add or switch to a new supplier such as us, regardless of product performance, features, or greater services offerings, or may be more willing to incrementally add solutions to their cybersecurity infrastructure from existing suppliers than to replace it wholesale with our solutions.

Conditions in our market could change rapidly and significantly because of technological advancements, partnering or acquisitions by our competitors, or continuing market consolidation. New start-up companies that innovate and large competitors that are making significant investments in research and development may invent similar or superior services, products, and technologies that compete with our services and products. Some of our competitors have made or could make acquisitions of businesses that may allow them to offer more directly competitive and comprehensive solutions than they had previously offered and adapt more quickly to innovative technologies and changing needs. Our current and potential competitors may also establish cooperative relationships among themselves or with third-parties that may further enhance their resources and reduce their expenses. These competitive pressures in our market or our failure to compete effectively may result in price reductions, fewer orders, reduced revenue and gross margins, and loss of market share. Any failure to meet and address these factors could materially harm our business and operating results.

A network or data security incident may allow unauthorized access to our or our end users’ network or data, harm our reputation, create additional liability and adversely impact our financial results.

Increasingly, companies are subject to a wide variety of attacks on their networks on an ongoing basis. In addition to traditional computer “hackers” malicious code (such as viruses and worms), phishing attempts, employee theft or misuse, and denial of service attacks, sophisticated nation-state and nation-state supported actors engage in intrusions and attacks (including advanced persistent threat intrusions) and add to the risks to internal networks, cloud deployed enterprise and customer-facing environments and the information they store and process. Despite significant efforts to create security barriers to such threats, it is virtually impossible for us to entirely mitigate these risks. We, and our third-party software and service providers, may face security threats and attacks from a variety of sources. Our data, corporate systems, third-party systems and security measures and/or those of our licensees, resellers, clients, customers, software providers, independent contractors, employees, end users may be breached due to the actions of outside parties, employee error, malfeasance, a combination of these, or otherwise, and, as a result, an unauthorized party may obtain access to our or our customers’ data. Furthermore, as a provider of cybersecurity technologies, we may be a more attractive target for such attacks. A breach in our data security or an attack against our service availability, or that of our third-party service providers, could impact our networks or networks secured by our services, products and subscriptions, creating system disruptions or slowdowns and exploiting security vulnerabilities of our services, products, and the information stored on our networks or those of our third-party service providers could be accessed, publicly disclosed, altered, lost, or stolen, which could subject us to liability and cause us financial harm. Any actual or perceived breach of network security in our systems or networks, or any other actual or perceived data security incident we or our third-party service providers suffer, could result in damage to our reputation, negative publicity, loss of channel partners, licensees, resellers, clients, customers, and sales, loss of competitive advantages over our competitors, increased costs to remedy any problems and otherwise respond to any incident, regulatory investigations and enforcement actions, costly litigation, and other liability. In addition, we may incur significant costs and operational consequences of investigating, remediating, eliminating, and putting in place additional tools and devices designed to prevent actual or perceived security incidents, as well as the costs to comply with any notification obligations resulting from any security incidents. Any of these negative outcomes could adversely impact the market perception of our services, products and customer and investor confidence in our company and, moreover, could seriously harm our business or operating results.

It is essential to our business strategy that our technology and network infrastructure remain secure and are perceived by any clients and customers we have, and others, to be secure. Despite security measures, however, any network infrastructure may be vulnerable to cyber-attacks by hackers and other security threats. We may face cyber-attacks that attempt to penetrate our network security, sabotage or otherwise disable our research, products and services, misappropriate our proprietary information, or that of our licensees and resellers, or their or our customers and partners, which may include personally identifiable information, or cause interruptions of our internal systems and services. Any cyber-attacks could negatively affect our reputation, damage our network infrastructure and our ability to deploy our products and services, harm our business relationships, and expose us to financial liability.

Our services, products, systems, and website and the data on these sources may be subject to intentional disruption that could materially harm our reputation and future sales.

Despite our precautions and ongoing investments to protect against security risks, data protection breaches, cyber-attacks, and other intentional disruptions of our products and services, we expect to be an ongoing target of attacks specifically designed to impede the performance and availability of our offerings and harm our reputation as a company. Similarly, experienced computer programmers or other sophisticated individuals or entities, including malicious hackers, state-sponsored organizations, and insider threats including actions by employees and third-party service providers, may attempt to penetrate our network security or the security of our systems and websites and misappropriate proprietary information or cause interruptions of our services. This risk has increased as more individuals are working from home and utilize home networks for the transmission of sensitive information. Such attempts are increasing in number and in technical sophistication, and if successful could expose us and the affected parties to risk of loss or misuse of proprietary or confidential information or disruptions of our business operations. While we engage in a number of measures aimed to protect against security breaches and to minimize problems if a data breach were to occur, our information technology systems and infrastructure may be vulnerable to damage, compromise, disruption, and shutdown due to attacks or breaches by hackers or due to other circumstances, such as error or malfeasance by employees or third-party service providers or technology malfunction. The occurrence of any of these events, as well as a failure to promptly remedy these events should they occur, could compromise our systems, and the information stored in our systems could be accessed, publicly disclosed, lost, stolen, or damaged. Any such circumstance could adversely affect our ability to attract and maintain licensees and resellers, and/or for us or our licensees and resellers to retain customers, as well as strategic partners, cause us to suffer negative publicity, and subject us to legal claims and liabilities or regulatory penalties. In addition, unauthorized parties might alter information in our databases, which would adversely affect both the reliability of that information and our ability to market and perform our services. Techniques used to obtain unauthorized access or to sabotage systems change frequently, are constantly evolving and generally are difficult to recognize and react to effectively. We may be unable to anticipate these techniques or to implement adequate preventive or reactive measures. Several recent, highly publicized data security breaches at other companies have heightened consumer awareness of this issue and may embolden individuals or groups to target our systems or those of our licensees, resellers, or strategic partners, or our or their customers.

Our products are complex and operate in a wide variety of environments, systems and configurations, which could result in failures of our products to function as designed and negatively impact our brand recognition and reputation.

Because we offer very complex products, errors, defects, disruptions, or other performance problems with our products may and have occurred. For example, we may experience disruptions, outages, and other performance problems due to a variety of factors, including infrastructure changes, human or software errors, capacity constraints due to an overwhelming number of users accessing our websites simultaneously, fraud, or security attacks. In some instances, we may not be able to identify the cause or causes of these performance problems within an acceptable period of time. Interruptions in our products could impact our revenues or cause licensees, resellers, clients, and customers to cease doing business with us. Our operations are dependent upon our ability to protect our technology infrastructure against damage from business continuity events that could have a significant disruptive effect on our operations. We could potentially lose end user/customer data or experience material adverse interruptions to our operations or delivery of products and services to our clients in a disaster recovery scenario. Further, our business would be harmed if any of these types of events caused our licensees, resellers, or customers, or our licensees’ and resellers’ customers or potential customers, to believe that our products are unreliable. We believe that our brand recognition and reputation are critical to retaining existing licensees, resellers, clients and customers, and attracting new licensees, resellers, clients, and customers. Furthermore, negative publicity, whether or not justified, relating to events or activities attributed to us, our employees, our strategic partners, our affiliates, or others associated with any of these parties, may tarnish our reputation and reduce the value of our brands. Damage to our reputation may reduce demand for our products and have an adverse effect on our business, operating results, and financial condition. Moreover, any attempts to rebuild our reputation and restore the value of our brands after such an event may be costly and time-consuming, and such efforts may not ultimately be successful.

If our products and services do not work properly, our business, financial condition and financial results could be negatively affected, and we could experience negative publicity, declining sales, and legal liability.

We produce complex products that incorporate leading-edge technology that must operate in a wide variety of technology environments. Software may contain defects or “bugs” that can interfere with expected operations in these varying technological environments. There can be no assurance that our testing programs will be adequate to detect all defects prior to the product being introduced, which might decrease customer satisfaction with our products and services. The product reengineering cost to remedy a product defect could be material to our operating results. Our inability to cure a product defect could result in the temporary or permanent withdrawal of a product or service, negative publicity, damage to our reputation, failure to achieve market acceptance, lost revenue and increased expense, any of which could have a material adverse effect on our business, financial condition and financial results.

Outages or problems with systems and infrastructure supplied by third-parties could negatively affect our business, financial condition and financial results.

Our business relies on third-party suppliers of the telecommunications infrastructure. We, our clients and customers and our licensees and resellers, and their customers, will use various communications service suppliers and the global internet to provide network access between our data centers and our customers and end-users of our services. If those suppliers do not enable us to provide our clients and customers, or our licensees’ and resellers’ customers with reliable, real-time access to our systems (to the extent required), we may be unable to gain or retain clients, customers, licensees and resellers. These suppliers periodically experience outages or other operational problems as a result of internal system failures or external third-party actions. Supplier outages or other problems could materially adversely affect our business, financial results and financial condition.

Current global financial conditions have been characterized by increased volatility, which could negatively impact our business, prospects, liquidity and financial condition.

Current global financial conditions and recent market events have been characterized by increased volatility, and the resulting tightening of the credit and capital markets has reduced the amount of available liquidity and overall economic activity. We cannot guarantee that debt or equity financing, or the ability to generate cash from operations, will be available or sufficient to meet or satisfy our initiatives, objectives or requirements. Our inability to access sufficient amounts of capital on terms acceptable to us for our operations will negatively impact our business, prospects, liquidity and financial condition.

If we experience delays and/or defaults in payments, we could be unable to recover all expenditures.

Because of the nature of our contracts, at times we will commit resources to projects prior to receiving payments from the counterparty in amounts sufficient to cover our expenditures on projects as they are incurred. Delays in payments may require us to make a working capital investment. Defaults by any of our clients, customers, licensees, and resellers could have a significant adverse effect on our revenues, profitability and cash flow. Our clients, customers, licensees, and resellers may in the future default on their obligations to us or them due to bankruptcy, lack of liquidity, operational failure or other reasons deriving from the current general economic environment. If a client, customer, or licensee defaults on its obligations to us or our licensee, or a licensee or reseller defaults in its payments to us, it could have a material adverse effect on our business, financial condition, results of operations or cash flows.

If we do not effectively manage our growth, our business resources and systems may become strained, and we may be unable to increase revenue growth.

We plan to grow aggressively and, if successful, our future growth may provide challenges to our organization, requiring us to expand our personnel and our operations. Future growth may strain our infrastructure, operations and other managerial and operating resources. If our business resources become strained, our earnings may be adversely affected, and we may be unable to increase revenue growth. Further, we may undertake contractual commitments that exceed our labor resources, which could also adversely affect our earnings and our ability to increase revenue growth.

Our growth depends in part on the success of our strategic relationships with third-parties.